Connect with Leasing News

Connect with Leasing News ![]()

![]()

![]()

![]()

![]() Add me to mailing list |

Add me to mailing list | ![]() |

| ![]() Search |

Search | ![]() Stress Release

Stress Release

Advertising | All Lists | Archives | Classified Ads | This Day In American History

Independent, unbiased and fair news about the Leasing Industry

kitmenkin@leasingnews.org

![]()

Senior Accountant NYC www.easternfunding.com |

Wednesday, January 4, 2012

Today's Equipment Leasing Headlines

Leasing News Person of the Year 2011

John C. Deane

Classified Ads---Asset Management

PacWest Bancorp Acquires Marquette Equipment Finance

Leasing 102 by Mr. Terry Winders, CLP

"Business Tax Increase for 2012 affects Leasing"

Classified Ads---Help Wanted

Forged Corporate Resolution Stings Creditor

by Tom McCurrin

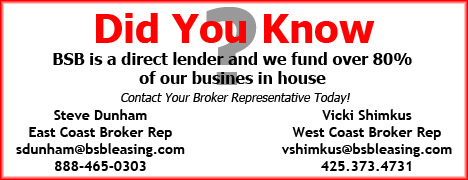

Placard---Don’t Be Left out

One of Most Influential Women in Leasing Says Goodbye

Top Stories December 28

Leasing Notables Who Passed Away 2011

Hugh Swandel NEFA 2012 President

2012 Leasing Conference---Save the Dates

Reno, Nevada Adopt-a-Dog

Broker/Funder/Industry Lists |

Features (collection)

Top Ten Stories Chosen by Readers |

Top Stories last six months

How Sale/Leasebacks Get Respect

You May have Missed---

Personal Motivation Messages

SparkPeople--Live Healthier and Longer

Sports Briefs---

Football Poem

California Nuts Briefs---

"Gimme that Wine"

This Day in American History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

######## surrounding the article denotes it is a “press release” and was not written by Leasing News nor information verified, but from the source noted. When an article is signed by the writer, it is considered a “by line.” It reflects the opinion and research of the writer. It is considered “bias” as it is the writer’s viewpoint.

[headlines]

--------------------------------------------------------------

Leasing News Person of the Year 2011

John C. Deane

CEO

The Alta Group

John Deane's contributions to the leasing industry, both in the United States and internationally, have been great over a long leasing career.

He is recognized for his outstanding leadership as CEO of The Alta Group with many accomplishments, especially this past year, including development of a formal structure binding the geographic units of the organization together, including expansion not only in North America, Central America, the United Kingdom, Europe, the Middle East, Africa, but now South America, China, as well as Asia Pacific; developing strong relationships by attracting very talented and well-known leasing experts to the Alta Group.

He is an ex-banker as wells as CEO of both Great Western Leasing and BancOne Leasing as well as having served as the CFO and president of several major financial corporations, well-known lecturer on economics, as well as his long time association with the Equipment Leasing and Finance Association, serving as its chairman in 1991 of its predecessor---the American Association of Equipment Lessors. Here is a leader in his field, literally now world wide.

His website biography best describes him:

"John Deane thrives on the intellectual challenge of navigating the multi-dimensional complexities of the equipment leasing and finance industry. A founder of The Alta Group, John judges the value of Alta's work not just in the breadth and depth of the information it gathers for its clients but in helping them select and execute strategies that put that industry intelligence to work in an organization."

[headlines]

--------------------------------------------------------------

Classified Ads---Asset Management

| San Francisco, CA Ten years experience setting residuals, negotiating leases and remarketing equipment across a broad spectrum of large ticket asset types including marine, intermodal, mining, energy, manufacturing. geoffwalshe@yahoo.com |

| Located near Dallas Extensive experience in valuation/remarketing of IT and telecom assets. Established network of customers and vendors. Strong leasing background Located near Dallas contact: leasevalue@gmail.com |

Free Posting for those seeking employment in Leasing:

http://www.leasingnews.org/Classified/Jwanted/Jwanted-post.htm

All “free” categories “job wanted” ads:

http://www.leasingnews.org/Classified/Jwanted/Jwanted.htm

[headlines]

--------------------------------------------------------------

PacWest Bancorp Acquires Marquette Equipment Finance

PacWest Bancorp (Nasdaq:PACW) yesterday afternoon announced that on January 3, 2012, its subsidiary, Pacific Western Bank, completed the acquisition of Marquette Equipment Finance, or MEF, a specialty equipment leasing company located in Midvale, Utah. The division has been reportedly available for one year. There are approximately 71 employees and the main thrust is in the $100,000 to $5 million range and higher.

The press release stated Marquette has "$166 million in gross leases outstanding, with no leases on nonaccrual status. It had been a subsidiary of Meridian Bank, also under control of the Marquette family, and now has the opportunity to perhaps double their 2011 numbers.

According to the press release, "leases are spread across 18 industries, with the top three being financial services/insurance, manufacturing, and health care and representing 68% of the lease portfolio balance. The weighted average yield on the lease portfolio at year end was approximately 9% and its weighted average remaining maturity was 34 months. In addition, Pacific Western Bank assumed $154 million in outstanding debt and other liabilities.

FDIC reports Pacific Western Bank had 937 full-time employees with 78 offices in California, primarily Southern California, and one in Scottsdale, Arizona, as of September 30, 2011; net worth $635 million, profit $42.6 million, non-current loans $132.9 million, charge offs $34.2 million ($23.6 nonfarm, nonresidential property, $3.2 million commercial and industrial, $3.998 other loans, $1.39 construction and land development) $1.2 multifamily residential property); Tier 1 risk-based capital ratio 14.63%

FDIC reports Meridian Bank had 259 full time employees at its seven offices in Arizona as of September 30, 2011; with a net worth of $185 million, net income of $12.99 million, non-current loans $19,188 with charge offs of $11.8 million ($6.4 1-4 family residential properties, $4.4 million construction and land development, $47,000 nonfarm-nonresidential, $305,000 commercial and industrial, lease financing receivables, $47,000; Tier 1 risk-based capital ratio 19.90%.

Matt Wagner, Chief Executive Officer of PacWest Bancorp, commented, "Marquette Equipment Finance is a terrific fit for Pacific Western Bank. Its conservative approach to credit and the strength of the management team have made Marquette Equipment Finance into a solid performing equipment leasing company. MEF's leasing platform provides a valuable additional growth channel for us and enhances both the categorical and geographical diversification of our loan portfolio. We look forward to adding their expertise to our organization and giving them the opportunity to grow further."

Vic Santoro, Executive Vice President and Chief Financial Officer of PacWest Bancorp, stated, "The acquisition of MEF augments our commercial loan assets, deploys excess liquidity into higher yielding assets and will have a positive effect on our net interest margin. We expect that we will enhance MEF's overall profitability through the use of our low-cost funding base."

Jim Christensen, President of Marquette Equipment Finance, said, "MEF is thrilled to be part of the PacWest organization. The MEF employees look forward to making a meaningful contribution to the combined organization going forward."

"MEF will continue operating under the name Marquette Equipment Finance as a subsidiary of Pacific Western Bank on a temporary basis. Pacific Western has committed to change MEF's name within one year. MEF will maintain its focus on equipment finance. Pacific Western has retained all 71 MEF employees. MEF's president, Jim Christensen, and its executive vice president and chief financial officer, Christian Emery, will continue in those responsibilities with MEF.

PacWest currently operates two commercial finance companies as a result of the acquisitions of BFI Business Finance, an asset-based lender located in San Jose, CA, in 2007 and First Community Financial Corp., an asset-based lender and factoring company located in Phoenix, Arizona, in 2004.

Dorran Sampson, Vice-President/Broker Relations, told Leasing News "Marquette confirms our commitment to the leasing broker community."

Comprehensive personal property tax outsourcing services |

[headlines]

--------------------------------------------------------------

Leasing Industry Help Wanted

Carlsbad, California email- resumes@ilslease.com |

Interviewing Leasing Professionals With Proven Track Record and Established Book of Business. Envision Capital Group is dedicated to providing the best in class products and service to our employees, customers, vendors and partners in the small and middle ticket commercial finance industry. With over 50 years of combined experience we have the knowledge, skills, abilities and relationships to help you reach your goals. |

National Business Development Manager Western Equipment Finance, a subsidiary of Western State Bank established in 1901, solicits originations throughout the US and provides funding solutions for a wide range of industries |

Senior Accountant NYC www.easternfunding.com |

For information on placing a help wanted ad, please click here:

http://www.leasingnews.org/Classified/Hwanted/Hwanted-post.htm

Please see our Job Wanted section for possible new employees.

Leasing News Help Wanted Ad Pricing

Help Wanted Web Ad New Programs Classified Ad Section 21 days in a row: Design work is free. Logo is free as well as company description not to exceed the number of lines of the ad. Ads are placed in the "Help Wanted' section by category, alphabetical, with the ad with the most lines first in the group. They appear on the web site and in each news edition at the top in a rotation basis per issue. * Help Wanted” ads appear in each issue on a chronological basis above the top headline as a courtesy. This position is not available as a paid position, but is generally on a rotation basis. At the same time, the ad continues in the classified help wanted section in the news edition and web site, so in effect appears twice. Leasing News reserves the right to refuse advertising, particularly to a company that has appeared in the complaint bulletin board |

| John Kenny Receivables Management www.jrkrmdirect.com • End of Lease Negotiations & Enforcement The Solution to Your Credit & Accounts Receivable Needs |

(Leasing News provides this ad as a trade for investigations

and background information provided by John Kenny)

[headlines]

--------------------------------------------------------------

Leasing 102

by Mr. Terry Winders, CLP

“Business Tax Increase for 2012 affects Leasing”

Congress did not extend for 2012 the President Obama stimulus 100% bonus depreciation benefit (1), this then becomes a tax increase, eliminates a stimulus also to acquire equipment, perhaps catches higher taxes in early disposal of equipment as per the IRS guidelines, and definitely affects the equipment leasing and finance industries. It is not helpful to small business in the United States.

Existing short term “true leases” are still available, but those leasing for cash flow with a bargain purchase option, we are back to MACRS depreciation and the percentages of the original fair market value allowed for each year based on the allowed term.

Here is a copy of the IRS’s depreciation schedule that gives you the asset class life and the allowable depreciation percentage for each year based on the class life. (2)

Prior to 2012 the business tax payer could fully deduct the equipments cost in the year it was acquired up to specific dollar amounts, as regulated and defined by IRS guidelines. With less depreciation available in 2012 from assets purchased the last few years, clearly the income tax bill will be higher. In addition if a business decides to replace any asset, the selling price will be fully taxable because the tax basis (undepreciated value) will be “0” because they took 100% of the purchase price off their taxes when they acquired it. So with limited deductions the business tax bill will be much higher.

Some will use the like-kind exchange program (IRC Code section 1031) and acquire like kind replacements so the tax burden is deferred into the future. Kicking the can down the road so to speak. The requirements are to qualify as a Section 1031 exchange; a deferred exchange must be distinguished from the case of a taxpayer simply selling one property and using the proceeds to purchase another property (which is a taxable transaction). Rather, in a deferred exchange, the disposition of the relinquished property and acquisition of the replacement property must be mutually dependent parts of an integrated transaction constituting an exchange of property. Taxpayers engaging in deferred exchanges generally use exchange facilitators under exchange agreements pursuant to rules provided in the Income Tax Regulations.

Real property and personal property can both qualify as exchange properties under Section 1031; but real property can never be like-kind to personal property. In personal property exchanges, the rules pertaining to what qualifies as like-kind are more restrictive than the rules pertaining to real property. As an example, cars are not like-kind to trucks.

An example of a like-kind exchange comes when a company wants to acquire a replacement piece of equipment. Let’s say they have an asset they wish to replace that was 100% depreciated in the year they purchased it. Now it has a sale value of 50% of its original cost. If it was just sold it would be taxable event at a 35% rate. In a like-kind exchange the new equipment purchase value will be 100% minus 50% so it will go on the books as a 50% asset and that amount will be depreciated according to MACRS with no tax effect. Then if the second asset is sold in the future, its lower tax bases may cause a taxable event unless they do an additional like-kind exchange on it.

It is important to know that taking control of cash or other proceeds before the exchange is complete may disqualify the entire transaction from like-kind exchange treatment and make ALL gain immediately taxable. If cash or other proceeds that are not like-kind property are received at the conclusion of the exchange, the transaction will still qualify as a like-kind exchange. Gain may be taxable, but only to the extent of the proceeds that are not like-kind property.

One way to avoid premature receipt of cash or other proceeds is to use a qualified intermediary or other exchange facilitator to hold those proceeds until the exchange is complete. Be careful in your selection of a qualified intermediary as there have been recent incidents of intermediaries declaring bankruptcy or otherwise being unable to meet their contractual obligations to the taxpayer. These situations have resulted in taxpayers not meeting the strict timelines set for a deferred or reverse exchange, thereby disqualifying the transaction from Section 1031 deferral of gain. The gain may be taxable in the current year while any losses the taxpayer suffered would be considered under separate code sections.

When the replacement property is ultimately sold (not as part of another exchange), the original deferred gain, plus any additional gain realized since the purchase of the replacement property, is subject to tax.

Because of the complex nature of like kind exchanges and the outside expense for a qualified intermediary most of these transactions are going to be for higher transactions.

Of course none of this has anything to do with a lease because title must rest with owner each time unless it is a bargain option lease where the lessor is one and the same each time.

A true lease may help a lessee from the heavy tax burden instead of a like-kind exchange when the use of the equipment is much shorter than the asset class life for federal income tax. A true lease will increase the tax write off if the term of the lease is short or a higher/lower rent stream is arranged. This would allow the lessee to expense the rents that should be higher than MACRS depreciation.

If cash flow is a problem because of the higher taxes leasing can offer a low/high rent program to lower payments in the months requiring tax payments. True Leasing is a very flexible product when considering how the payments are expensed for tax purposes. However the new accounting rules will flatten it out for book purposes.

(1) Accounting Web on Business Tax Credit

http://www.accountingweb.com/topic/tax/obama-wants-expand-extend-business-tax-credits

(2) IRS Depreciation Schedule (personal property)

http://leasingnews.org/PDF/IRS_Depreciation_Schedule.pdf

Mr. Terry Winders, CLP, has been a teacher, consultant, expert witness for the leasing industry for thirty-five years and can be reached at leaseconsulting@msn.com or 502-649-0448

He invites your questions and queries.

Previous #102 Columns:

http://www.leasingnews.org/Conscious-Top%20Stories/Leasing_102/Index.htm

|

(This ad is a “trade” for the writing of this column. Opinions

contained in the column are those of Mr. Terry Winders, CLP)

[headlines]

--------------------------------------------------------------

Forged Corporate Resolution Stings Creditor

by Tom McCurrin

I can’t speak for every leasing and banking lawyers, but there isn’t a year that goes by that I’m given a deal to collect upon with screwed up corporate resolutions. Often it’s an LLC without any reference to the membership, other times, the resolution is for a person different than the lease signer.

The recent case of Regions Bank v Bric Construction, 2011 WL 6288033 (Tenn. Ct. App. December 13, 2011), the creditor was faced with a resolution which was admittedly forged, although notarized. The case provides some valuable lessons for leasing underwriters and lawyers to know your customer and to develop policies to insure the authenticity of your customer’s signatures. It is one thing to use signatures by mail and fax for smaller deals, but it transactions over $500,000, specific policies probably need to be developed. This creditor had no such policies and as a result, the case was sent down for a re-trial of the signature issues. The facts follow.

Bric Construction was a Limited Liability Company, and was “member managed.” The sole member was Ms. Patricia McIntosh.

Bric Construction signed a series of lease agreements and equipment financing agreements with Regions Bank, but Ms. McIntosh’s signature on the corporate resolution was not genuine, although it was notarized. It was unknown who actually signed the documents, although there was some evidence that her husband may have signed Ms. McIntosh’s name, and he had his assistant notarize the signature.

However, the creditor was helped by the fact that Bric Construction acknowledged receipt of the monies and equipment, and made payments on the obligations for over a year, before defaulting.

At trial, the lessee claimed two things. First, Bric Constructions claimed that the lease and equipment finance documents were forged and that because the signatures were not genuine. Second, the lessee claimed that the Bank also lost its security interest in the collateral, which included a very expensive Bentley sedan and an excavator which was improperly described in the security agreement.

The trial court saw through the charade and ruled squarely in favor of the lessor, ruling that Ms. McIntosh ratified her signature by knowledge of the event and making payments for a year. However, the creditor’s victory was short lived.

On the first issue, the Court of Appeal ruled that, the bank’s lawyers failed to develop the testimony that Ms. McIntosh was aware of a certain $400,000 disbursement, and why, if she was signing checks, the obligation was paid as agreed for over a year, if she disputed her signature. Therefore, while she may have ratified the signature, there was not enough evidence to support the trial court’s verdict, and the Court of Appeal sent the case back down for re-trial on this issue.

On the second issue, the Court of Appeal ruled the sufficiency of the description of the collateral, was governed by Uniform Commercial Code § 9-108 which sets forth the detail of description required in a security agreement, which must “reasonably identify the collateral.” Although the description could have been better, there was evidence that the parties were not confused about which excavator was purportedly being pledged, notwithstanding the lack of identifying numbers.

The lessons for the leasing underwriter are many here.

First, know your customer and make sure that the right people sign the corporate resolution. To insure the company against identity theft and/or forgery, obtain copies of the driver’s license of the signer. On larger sized transactions, compare the signatures on the lease or loan documents with known signatures, such as a driver’s license.

Second, while notaries provide some minimal level of protection, the notaries connected with the lessee are often dishonest and the limit of liability to the notary might be his or her notary bond, which is between $10 and $20,000 in most states. If the leasing company is involved in a large transaction, it is probably worth having the documents signed in front of the creditor or notarized by an independent notary or signing service which can’t be bribed.

Of course, telephone audits of all signatories would also go a long way to spotting the forgery or proving ratification.

Finally, when putting together the lease schedule, include every possible identifying feature of the collateral, including make, model, serial number and VIN. An onsite equipment verification, like QuikTrak, will go a long way to establishing your collateral, especially when it is tagged and photographed.

I have one real example which parallels this case. About two years ago, he tried a case for a well known national leasing company financing exercise equipment where the principal’s supposed partner’s signature was forged and notarized by that partner’s notary. While such activities make nice police reports, suing the notary for her bond wouldn’t get leasing company its $3 million dollars. What puzzled us was the fact that this was a huge deal for this leasing company, and we couldn’t ever figure out why such a large transaction would not warrant a formal closing, rather than obtaining signatures by mail. The excuse was press of business.

The lessons for leasing lawyers who have to litigate these matters with faulty lease documents are three fold. First, try to establish knowledge of the principal of the lease through telephone audits, witnesses to the signing, or truly independent notaries. Second, if the unauthorized signer approved lease payments, that signer should be vigorously cross-examined so his or her knowledge and ratification becomes an issue of fact for the judge or jury to decide. Character matters, and when reading the decision, I got the impression that the lessees were playing musical chairs with signatures to game the system.

The bottom line to the Regions Bank case is “know your customer” and if the deal is over a threshold, the creditor should have guidelines to insure the signatures on the documents are genuine. It amazes me why the largest of deals are treated with routine signature policies, which should not be the case.

Tom McCurnin

Barton, Klugman & Oetting

350 South Grand Ave.

Suite 2200

Los Angeles, CA 90071

Direct Phone: (213) 617-6129

Cell (213) 268-8291

Fax: (213) 625-1832

Email: tmccurnin@bkolaw.com

Visit our Web Site at: www.bkolaw.com

FDIC Case:

http://leasingnews.org/PDF/FDIC_Case.pdf

Previous Articles by Tom McCurnin:

http://www.leasingnews.org/Conscious-Top%20Stories/leasing_cases.html

[headlines]

--------------------------------------------------------------

[headlines]

--------------------------------------------------------------

One of Most Influential Women in Leasing Says Goodbye

(Photo: www.CLPfoundation.org)

What has been floating around the month of December, 2011, has become official now that the Certified Leasing Professional (CLP) Foundation announces that the Executive Director of the CLP Foundation, Cindy Spurdle, will leave by April. She told Leasing News she has other interests to follow and considers the move "semi-retirement." This is a major event following the death of its president Chris Walker in 2011.

Originally started by the then Western Association of Equipment Leasing, which became the United Association of Equipment Leasing, the CLP program became a foundation and Cindy Spurdle became part-time executive director in 2000.

Leasing News named her one of the Most Influential Women in Leasing (1)

(Photo: Leasing News Archive)

"Cynthia 'Cindy'" Spurdle ---Long time executive director of the Certified Leasing Professional Foundation, who began her career in 1982 Wrigley Group Ltd., a family owned leasing company started by her father. Her late husband and she purchased the business in 1988. 'In 1990 I was working on a transaction with a broker in Albany, NY, Gerry Oestreich, who later became President of the National Association of Equipment Leasing Brokers. He told me about a brand new association called the NAELB just getting underway in Atlanta." She took the position as the first Executive Director of the NAELB in 1998 and took over the management of the entire association, except the books, and all of the conferences and meetings for two years. She then went to the Cindy went to the United Association of Equipment Leasing office, helped with the conferences, but main job was the Certified Financial Professional program, which is now a "foundation" that she is the executive director. She is active at many conferences for all the associations, a hard worked, always in the background, gets the job done, above and beyond what is asked of her.

http://www.leasingnews.org/whateverhappenedto/sprudle.htm" (1)

In a press release, the CLP thanked her for the "countless hours of work, ideas and contributions to the development of the Foundation," which went beyond her paid part-time salary.

According to Leasing News archives there were 223 Certified Lease Professionals in 2004--- The year 2011 ended with 168 members, a slight drop from the previous year of 174 members.

Incoming president Rosanne Wilson, CLP, B.P.B., is planning an aggressive year, especially with the new perquisite of three years:

-

"A minimum three years of verifiable equipment leasing and financing experience.

-

Acceptable character, ability and reputation.

-

Pledge, in writing, to adhere to the CLP Standards of Professional Conduct."

A test is required as well as renewal to remain a member. More information is available here:

http://www.clpfoundation.org/toolbox/application.php

Why I Became a CLP:

http://www.leasingnews.org/CLP/Index.htm

(1) Most Influential Women in Leasing

http://www.leasingnews.org/Pages/influential_women.htm

|

((Please Click on Bulletin Board to learn more information))

(Leasing News provides this ad “gratis” as a means

to help support the growth of Lease Police)

[headlines]

--------------------------------------------------------------

Top Stories December 28

Here are the top ten sorties opened by readers:

(1) Placard---Leasing is Like Living with a Girl

http://leasingnews.org/archives/Dec2011/12_28.htm#placard

(2) Loose Ends:

E.A.R./HL Leasing/NorVergence/Brican America/

Operation Lease Fleece/Allied Health Care Services

http://leasingnews.org/archives/Dec2011/12_28.htm#loose_ends

(3) Salvation Army Kettle Donors

http://leasingnews.org/archives/Dec2011/12_28.htm#donors

(4) Fallout from CMC Continues in Nevada Federal Court

by Tom McCurrin

http://leasingnews.org/archives/Dec2011/12_28.htm#fallout

(5) Leasing 102 by Mr. Terry Winders, CLP

Tax indemnity in “true leases”

http://leasingnews.org/archives/Dec2011/12_28.htm#idemnity

[headlines]

--------------------------------------------------------------

Leasing Notables Who Passed Away 2011

David Fenig

Peter King

Dave Padden

Ted Parker

Jeffrey Taylor

Chris Walker

David H. Fenig, 56, Equipment Leasing and Finance Association Vice-President of Federal Government Relations for the past eight years, passed away in December, 2011. He also served for six years in the U.S. Senate as Tax Counsel and Legislative Director to Sen. Spark Matsunaga (D-HI), a senior member of the Senate Finance Committee.

During his tenure in the Senate, Fenig played a key role in the consideration and enactment of the Tax Reform Act of 1986.

http://leasingnews.org/PDF/David_H_Fenig.pdf

Peter J. King, 83, of North Oaks, Minnesota, passed away peacefully on March 14, 2011, after a courageous battle with cancer. “He built King Capital and Sunrise International Leasing into major equipment leasing businesses by being innovative. Peter was also a person of many interests. In recent years, he has devoted much of his time and wealth to the charitable activities of the foundation he established. He will be missed by the many people whose lives he touched."

Bruce Kropschot, The Alta Group

http://leasingnews.org/archives/Mar2011/3_21.htm#king

David H. Padden, 84, retired President and Founder of Padden and Co. and Padco Lease Corp., Chicago, Illinois, on October 2nd, 2011 passed away. One of the early pioneers, his son Jim followed in his footsteps and runs the company today.

http://leasingnews.org/archives/Oct2011/10_06.htm#padden

Ted Parker, age 75, after several heart operations, and a recent stay in the hospital, Ted's heart gave out. He had moved to Hamilton, Montana about five years ago to pursue his passion for fly fishing. He is survived by his son. He had books on leasing, CD's, a master book of leasing forms with CD; many became the standard of the industry in the 1970’s and 1980’s. A good friend and long time Leasing News advertiser.

Many also may remember he was the 1986 President of the Western Association of Equipment Leasing (WAEL), today the National Equipment Finance Association. In an early biography it said he had been in leasing for 30 years, add another ten and it was 40 years at the time he retired in 1996. He also was one of the first Certified Leasing Professionals.

http://leasingnews.org/archives/Aug2011/8_01.htm#parker

June 19, 2011 Jeffrey Taylor passed away at age 60 fighting cancer. He was a well-known, long time leasing trainer, lecturer, author, CPA, CLP, a recovering alcoholic (wrote a book about it) who retired and moved to Scottsdale Arizona, where he became a real estate agent, then a travel agent, and then was into making films. During his time in leasing, he was the first to have a daily newsletter that reached 16,000 readers throughout the world.

"Jeffrey was an entrepreneur, an entertainer & a friend to those in need. He is survived by his wife of 23 years, Toby Taylor; two daughters, Jordana Hazel & Moira Taylor; two step-children and their spouses, George & Elizabeth Friedman and Carrie & Doug LeBow; and three step-grandchildren." http://www.legacy.com/obituaries/azcentral/obituary.aspx?n=jeffrey-taylor&pid=152190898

Jeff Taylor in the Hospital

http://leasingnews.org/archives/May2011/5_18.htm#taylor_hospital

Jeff Taylor photos

http://www.caringbridge.org/visit/jeffreytaylor2/photos

Chris Walker, 56, Cedar Rapids, Iowa, on November 18, 2011 "...lost his valiant fight with pancreatic cancer last evening. Most of you had the privilege of knowing Chris. He has served in various sales and business development positions in a number of units within GreatAmerica since he joined us in June of 1997. Many of us worked with Chris even before the days of GreatAmerica, at GE Capital (1990 – 1997), and at LeaseAmerica before that (1979-1990). "

Tony Golobic, GreatAmerica Leasing

Chris was president of the Certified Leasing Professional Foundation, a member of the National Equipment Finance Association Board of Directors, an accomplished musician. Survivors include his wife, Jean, a daughter, Madeline; his mother Joann Walker; two sisters, Cindy (Dennis) Nodorft and Patty Walker and a brother Michael.

http://www.leasingnews.org/Pages/walker_passes.html

http://leasingnews.org/archives/Nov2011/11_21.htm#walker

[headlines]

--------------------------------------------------------------

Hugh Swandel NEFA 2012 President

Hugh Swandel, Managing Director of the Alta Group in Canada, is the 2012 President of the National Equipment Finance Association. He is an active, long-time member, recently serving as vice-president.

He serves also on the board of directors of the Canadian Finance and Leasing Association (CFLA). He also is a member of the Equipment Leasing and Finance Association of America (ELFA). He currently serves on the Advisory Board of Leasing News. In 2006 and again in 2010, Hugh received the Canadian leasing industry’s highest honor when he was named “CFLA Member of the Year.”

Prior to founding his firm, Swandel and Associates, in 2001, Hugh served as president and chief operation officer of Electronic Financial Group (EFG). EFG was a Canadian company that launched a multi lending web based credit system. Earlier, Hugh spent 10 years with National Leasing Group in a variety of senior positions. National Leasing Group is a privately held Canadian lessor that has won numerous awards for excellence in management and innovation.

Chris Enbom, CLP, CEO of Allegiant Partners, remains on the

NEFA Executive Committee as Immediate Past President.

The following also serve on the Executive Board, John Rosenlund, CLP, of Portfolio Financial Servicing Company, as Vice President; John Donohue, of Direct Capital Corporation, as Treasurer; and Frank Peretore, of Peretore & Peretore, P.C., as Secretary.

NEFA 2012 Directors include Tara Aasand, Great American Insurance, William Ford, Jr., Ford Financial Services, Kyle Gilliam, CLP, Arvest Equipment Finance, Brad Harmon, CLP, First Star Capital, Terey Jennings, CLP, Financial Pacific Leasing, Jesse Johnson, LeaseTeam, Tim Mathison, P&L Capital Corp, Jim Merrilees, CLP, Inspection

Services Division of RTR Services, David Normandin, CLP, Normandin Consulting, Bruce Smith, CLP, Diversified Capital Credit Corp., Gary Souverein, Pawnee Leasing Corp.

[headlines]

--------------------------------------------------------------

2012 Leasing Conference---Save the Dates

Leasing Association 2012 Conferences

National Equipment Finance Summit

March 22-24, 2012

San Diego, CA

Lynne Wicker, Conference Chairperson

RTR Services, Salem, Oregon

April 17-19

24th Annual National Funding Conference

Fairmont Hotel

Chicago, Illinois

![]()

April 23-25

National Vehicle Leasing Association

Annual Conference

Worthington Renaissance Hotel

200 Main Street

Fort Worth, Texas

April 26-28, 2012

Denver Sheraton Downtown Hotel

Denver, Colorado

AGLF/ELFA Public Sector Finance Forum

May 9 - May 11

Doubletree Magnificent Mile

Chicago, Illinois

September 13—15

Funding Symposium

Rennaisance Washington, DC Dupont Circle Hotel

1143 New Hampshire Avenue, NW

Washington, DC 20037-1522

October 21-23

ELFA 51st Annual Convention

JW Marriott Desert Springs

Palm Desert, California

-------------------------------------------------------------------

To view Leasing Association Events-Meetings Open to All, please click here.

[headlines]

--------------------------------------------------------------

Reno, Nevada -- Adopt-a-Dog

Miles

Breed: Terrier (Unknown Type, Small)/

Terrier (Unknown Type, Medium)

Color: Black

Age: Adult

Size: Small 25 lbs (11 kg)

Sex: Male

I am already neutered, up to date with shots, and good with dogs.

MILES's Story...

"MILES rescued from local county shelter. Has allergies will require quality grain free food. Loving and sweet. $75 adoption fee. Adopted in Reno/Sparks community only. Call in Reno 852-7111 for details and application. For Pets Sake conducts a home visit and fence check prior to adoption. Thank you.

Contact This Rescue Group...

Rescue Group: FOR PETS' SAKE, INC

Pet ID #: MILES

Contact: SARA PETERSEN

Phone:

(775) 852-7111

Let 'em know you saw "MILES" on Adopt-a-Pet.com!

E-mail:

pupylov@sbcglobal.net

Address: 11000 BONDSHIRE DRIVE

RENO, NV 89511

Adopt-a-Pet by Leasing Co. State/City

http://www.leasingnews.org/Conscious-Top%20Stories/Adopt_Pet.htm

Adopt a Pet

http://www.adoptapet.com/

|

--- You May Have Missed

How Sale/Leasebacks Get Respect

http://www.cfo.com/article/2012/1/tax_saleleaseback-owned-

ground-irs-examiner-irs-national-office

----------------------------------------

SparkPeople--Live Healthier and Longer

![]()

Personal Motivation Messages

http://www.sparkpeople.com/mypage_motivate.asp

------------------------------------------

Sports Briefs----

Giving up on Luck costs Stanford dearly

http://rivals.yahoo.com/ncaa/football/news;_ylt=AkkEB5QWLD6lJI.Pwkkij5kcvrYF?slug=pf-forde_stanford_takes_away_luck_fiesta_loss_010312

-----------------------------------------

Football Poems

A champion is one who gets up when he can't.

Jack Dempsey

-------------

Take pride in how far you have come; have faith in how far you can go.

Unknown

-------------

Tough times don't last, tough people do.

Unknown

----------------------------------------

![]()

California Nuts Briefs---

What the bosses make in Silicon Valley

http://www.mercurynews.com/salary-survey/ci_18306160

Three UCs make list of 10 best values in public colleges

http://blog.sfgate.com/pender/2012/01/03/three-ucs-make-list-of-10-best-values-in-public-colleges/?tsp=1

------------------------------------

![]()

“Gimme that Wine”

http://www.youtube.com/watch?v=EJnQoi8DSE8

Top 10 Northwest wine stories of 2011

http://www.thenewstribune.com/2012/01/03/1967368/top-10-northwest-wine-stories.html

Ready or Not, 2008 Médocs

http://www.nytimes.com/2012/01/04/dining/reviews/2008-bordeaux-from-medoc-winereview.html?ref=dining

Champagne sales surged in 2011, booze headed for 2012 boost

http://www.latimes.com/business/money/la-fi-mo-champagne-alcohol-20120101,0,6198400.story

Charlie Trotter’s Closing in Chicago

http://dinersjournal.blogs.nytimes.com/2012/01/01/charlie-trotters-said-to-be-closing-in-chicago/

Free Mobile Wine Program

http://leasingnews.org/archives/Feb2010/2_26.htm#mobile

Wine Prices by vintage

http://www.winezap.com

http://www.wine-searcher.com/

US/International Wine Events

http://www.localwineevents.com/

Winery Atlas

http://www.carterhouse.com/atlas/\

Leasing News Wine & Spirits Page

http://two.leasingnews.org/Recommendations/wnensprts.htm

[headlines]

----------------------------------------------------------------

![]()

This Day in History

1780 - A snowstorm hits Washington's army at Morristown New Jersey.

1838- Charles Sherwood Stratton, known as “ Tom Thumb, “ perhaps the most famous midget in history, was born at Bridgeport, CT. He eventually reached a height of three feet, four inches and a weight of 70 pounds. Discovered by P.T. Barnum in 1842, Stratton, as “General Tom Thumb,” became an internationally known entertainer and performed before Queen Victoria and other heads of state. On Feb 10, 1863, he married another midget, Lavinia Warren. Stratton died at Middleborough, MA, July 15, 1883.

1847 - Samuel Colt rescues the future of his faltering gun company by winning a contract to provide the U.S. government with 1,000 of his .44 caliber revolvers. Before Colt began mass-producing his popular revolvers in 1847, handguns had not played a significant role in the history of either the American West or the nation as a whole. With the help of Eli Whitney and other inventors, Colt developed a system of mass production and interchangeable parts for his pistols that greatly lowered their cost. Though never cheap, by the early 1850s, Colt revolvers were inexpensive enough to be a favorite with Americans headed westward during the California Gold Rush. Between 1850 and 1860, Colt sold 170,000 of his "pocket" revolvers and 98,000 "belt" revolvers, mostly to civilians looking for a powerful and effective means of self-defense in the Wild West.

1856--New post office law made required that all letters shall bear postage stamps.

1863 - Union General Henry Halleck, by direction of President Abraham Lincoln, orders General Ulysses Grant to revoke his infamous General Order No. 11 that expelled Jews from his operational area.

1869- the fist School for blind African-American students was the state School for the Blind and the Deaf, opened in Raleigh, NC, with 26 pupils.

1893- President Benjamin Harrison issued a proclamation granting full amnesty and pardon to all persons who had since November 1, 1890, abstained from unlawful cohabitation of a polygamous marriage. This was intended in the main for a specific group of elderly Mormons who had continued in the practice of contracting serial marriages. Amnesty was based on the condition that those pardoned must obey the law in the future or be " vigorously prosecuted." The practice of polygamy as a factor interfering with attainment of statehood for Utah.

1888 - Sacramento, CA, received 3.5 inches of snow, an all-time record for that location. The heaviest snow in recent history was two inches on February 5th in 1976.

1896 - Six years after Wilford Woodruff, president of the Mormon church, issued his Manifesto reforming political, religious, and economic life in Utah, the territory is admitted into the Union as the 45th state. In 1823, Vermont-born Joseph Smith claimed that an angel named Moroni visited him and told him about an ancient Hebrew text that had lost been lost for 1,500 years. The holy text, supposedly engraved on gold plates by a Native-American historian in the fourth century, related the story of Jewish peoples who had lived in America in ancient times. Over the next six years, Smith dictated an English translation of this text to his wife and other scribes, and in 1830, The Book of Mormon was published. In the same year, Smith founded the Church of Christ, later known as the Church of Jesus Christ of Latter-day Saints, in Fayette, New York. The religion rapidly gained converts and Smith set up Mormon communities in Ohio, Missouri, and Illinois. However, the Christian sect was also heavily criticized for its unorthodox practices and on June 27, 1844, Smith and his brother were murdered in a jail cell by an anti-Mormon mob in Carthage, Illinois. Two years later, Smith's successor, Brigham Young, led an exodus of persecuted Mormons from Nauvoo, Illinois, along the western wagon trails in search of religious and political freedom. In July 1847, the 148 initial Mormon pioneers reached Utah's Valley of the Great Salt Lake. Upon viewing the valley, Young declared: "This is the place," and the pioneers began preparations for the tens of thousands of Mormon migrants who would follow. In 1850, President Millard Fillmore named Young the first governor of the territory of Utah, and the territory enjoyed relative autonomy for several years. Relations became strained, however, when reports reached Washington that Mormon leaders were disregarding federal law and had publicly sanctioned the practice of polygamy. In 1857, President James Buchanan removed Young, a polygamist with over 20 wives, from his position as governor, and sent U.S. army troops to Utah to establish federal authority. Tensions between the territory of Utah and the federal government continued until Wilford Woodruff, the president of the Mormon church, issued his Manifesto in 1890, renouncing the traditional practice of polygamy, and reducing the domination of the church over Utah communities. Six years later, the territory of Utah was granted statehood.

1914- Jane Wyman, American actor won the Academy Award for her work in Johnny Belinda (1948) and was nominated three other times. Ronald Reagan, her divorced second husband, the father of her only daughter Maureen went on to become president of the United States. With a reputation as a goody-goody in films, Wyman shocked everyone in the 1940 film “You're in the Army Now!” with a kiss that lasted 185 seconds, the longest kiss ever filmed.

1915- Moses Alexander of Idaho, a Democrat, became the first governor in the United States who was Jewish. he served from January 4, 1915 to January 6, 1919.

1916- guitarist Sam Gaillard, Detroit, MI.

1922 –Jazz tenor and flute player Frank Wess birthdayhttp://www.npr.org/programs/btaylor/pastprograms/fwess.html

1926- "Billboard" Magazine published the first list of best-selling pop records, covering the week that ending 1935. On the list were recordings by the orchestras of Tommy Dorsey and Ozzie Nelson.

1930- Don Shula pro football Hall of Fame couch and former player born Painesville, Ohio,

1935- heavyweight champion Floyd Patterson born Lincointon, GA.

1936- Billboard magazine published the first list of best-selling pop records, covering the week that ended December 30, 1935. On the list were recordings by the Tommy Dorsey and the Ozzie Nelson Orchestras.

1942- British jazz-rock guitarist John McLaughlin was born. He first gained recognition for his work on Miles Davis's "Bitches' Brew" album, and later formed the Mahavishnu Orchestra. This group did much in the 1970's to promote the idea of fusing jazz and rock music.

1944- San Francisco Giants' Tito Fuentes born Havana, Cuba.

1945--JACHMAN, ISADORE S. Medal of Honor

Rank and organization: Staff Sergeant, U.S. Army, Company B, 513th Parachute Infantry Regiment. Place and date: Flamierge, Belgium, 4 January 1945. Entered service at: Baltimore, Md. Birth: Berlin, Germany. G.O. No.: 25, 9 June 1950. Citation: For conspicuous gallantry and intrepidity above and beyond the call of duty at Flamierge, Belgium, on 4 January 1945, when his company was pinned down by enemy artillery, mortar, and small arms fire, 2 hostile tanks attacked the unit, inflicting heavy. casualties. S/Sgt. Jachman, seeing the desperate plight of his comrades, left his place of cover and with total disregard for his own safety dashed across open ground through a hail of fire and seizing a bazooka from a fallen comrade advanced on the tanks, which concentrated their fire on him. Firing the weapon alone, he damaged one and forced both to retire. S/Sgt. Jachman's heroic action, in which he suffered fatal wounds, disrupted the entire enemy attack, reflecting the highest credit upon himself and the parachute infantry.

1948---Top Hits

Ballerina - Vaughn Monroe

How Soon - Jack Owens

Serenade of the Bells - The Sammy Kaye Orchestra (vocal: Don Cornell)

I’ll Hold You in My Heart (Till I Can Hold You in My Arms - Eddy Arnold

1954-- A young truck driver named Elvis Presley enters the Memphis Recording Service in Memphis, TN, ostensibly to record a song for his mother's birthday (which was, in reality, many months away). He records "Casual Love Affair" and "I’ll Never Stand in Your Way." It was this recording that would lead MRS head Sam Phillips to call Presley back to record for his Sun Records label.

1957-- On NBC's The Steve Allen Show, former heavyweight boxing champ Joe Louis introduces the world to singer Solomon Burke, who performs Louis' song "You Can Run, But You Can't Hide."

1956---Top Hits

Memories are Made of This - Dean Martin

The Great Pretender - The Platters

Band of Gold - Don Cherry

Sixteen Tons - Tennessee Ernie Ford

1957-- Elvis Presley reports for his pre-induction Army physical in Memphis

1959- “ College Bowl” premiered on TV. Originally, a quiz show on CBS. Two colleges sent a team of their best and brightest to the academic competition. “College Bowl” was sponsored by General Electric and hosted by Allen Ludden (1959—62) and Robert Earle (1962—70). More recent incarnations of ”College Bowl” have appeared on NBC and Disney with Pat Sajak and Dick Cavett as hosts.

1960-- Marty Robbins' "El Paso" hits #1

1961--After leaping from #100 to #50 last week, Mark Dinning's "Teen Angel" enters the Top 40 of the Billboard Pop chart. The teenage tragedy song will reach the top less than five weeks later.

1964---Top Hits

There! I’ve Said It Again - Bobby Vinton

Louie Louie - The Kingsmen

Forget Him - Bobby Rydell

Love’s Gonna Live Here - Buck Owen

1964--Bobby Vinton's "There! I've Said It Again" becomes the last US number one record before the so called British Invasion. Between Bill Haley's "Rock Around The Clock" in July, 1955 and Vinton's hit, only five non-American artists could manage a US chart topper. All that was about to change

1965- Leo Fender sells Fender Guitars to CBS for $13 million.

1970- the Minnesota Vikings became the first expansion team to win the NFL title when they defeated the Cleveland Browns 27-7 in Minneapolis. The Vikings went on to lose Super Bowl IV to the Kansas City Chiefs.

1970- the Kansas City Chiefs, aided by four interceptions, defeated the Oakland Raiders 17-7, in the last American Football League Championship game. The Chiefs went on to defeat the Minnesota Vikings in Superbowl IV.

1971- Gerald Garrison Hearst, great 49er, number 20, born Lincolnton, Ga.

1971 - A blizzard raged from Kansas to Wisconsin, claiming 27 lives in Iowa. Winds reached 50 mph, and the storm produced up to 20 inches of snow.

1972---Top Hits

Brand New Key - Melanie

American Pie - Don McLean

An Old Fashioned Love Song - Three Dog Night

Kiss an Angel Good Mornin’ - Charley Pride

1974- in a NHL game between the Boston Bruins and the Minnesota North Stars, Burins winger Dave Forbes punched Henry Boucha, fracturing his cheekbone and opening a cut that required 30 stitches to close Forbes was later indicted for using “ excessive force,” becoming the first professional athlete to be prosecuted for actions taken during a game. his trial that summer ended in a hung jury after which all charges were dropped.

1974 - President Richard Nixon refuses to hand over tape recordings and documents that had been subpoenaed by the Senate Watergate Committee. Marking the beginning of the end of his Presidency, Nixon would resign from office in disgrace eight months later.

1975-- Phoebe Snow's "Poetry Man" enters the pop charts

1975-- Elton John's "Lucy in the Sky with Diamonds" hits #1

1980---Top Hits

Escape (The Pina Colada Song) - Rupert Holmes

Please Don’t Go - K.C. & The Sunshine Band

Send One Your Love - Stevie Wonder

Happy Birthday Darlin’ - Conway Twitty

1982 - Milwaukee, WI, was shut down completely as a storm buried the city under 16 inches of snow in 24 hours. It was the worst storm in thirty-five years.

1984, " Night Court" premiered on television. The original cast included Harry Anderson as Judge Harry T. Stone, John Larroquette as prosecutor Dan Fielding, Richard M0II as court officer Bull Shannon and Selma Diamond as court officer Selma Hacker. Karen Austin as clerk Lana Wagner and Paula Kelly as public defender Liz Williams were gone after one season, Ellen Foley then became PD Billie Young but was replaced by Markie Post in 1985 as PD Christine Sullivan. Charles Robinson joined the cast as clerk Mac Robinson in 1985. Diamond died in 1985 and Florence Halop, who then appeared as court officer Florence Kleiner, died in 1986. Marsha Warfield was then brought aboard as Court Officer Roz Russell. Mel Tormé made a few appearances as himself, Harry’s idol. The last telecast was July 1, 1992.

1974- President Richard Nixon rejected the Senate Watergate Committee’s subpoenas seeking White House tapes and documents.

1984-- the last Van Halen album with David Lee Roth as lead singer, "1984," was released. Sammy Hagar was Roth's replacement.

1985- to honor team president and former coach Arnold “ Red” Auerbach, the Boston Celtics retired uniform number 2 in a ceremony prior to a game against the New York Knicks. Auerbach begin coaching the Celtics in 1950-51 and led them to `6 NBA championships as coach, general manager and president.

1985 — The Cowboys play their record 36th postseason game, but Eric Dickerson steals the show, rushing for a playoff-record 248 yards and two touchdowns to lead the Los Angeles Rams to a 20-0 victory over Dallas.

1987 - A storm moving off the Pacific Ocean spread wintery weather across the southwestern U.S., with heavy snow extending from southern California to western Wyoming. Up to 15 inches of snow blanketed the mountains of southern California, and rainfall totals in California ranged up to 2.20 inches in the Chino area.

1988 - Frigid arctic air invading the central and eastern U.S. left Florida about the only safe refuge from the cold and snow. A storm in the western U.S. soaked Bodega Bay in central California with 3.12 inches of rain.

1988---Top Hits

Faith - George Michael

So Emotional - Whitney Houston

Got My Mind Set on You - George Harrison

Somewhere Tonight - Highway 101

1989 - Up to a foot of snow blanketed the mountains of West Virginia, and strong winds in the northeastern U.S. produced wind chill readings as cold as 60 degrees below zero in Maine. Mount Washington NH reported wind gusts to 136 mph along with a temperature of 30 below zero!

1990 - A winter storm moving out of the southwestern U.S. spread heavy snow across Nebraska and Iowa into Wisconsin. Snowfall totals in Nebraska ranged up to 7 inches at Auburn and Tecumseh. Totals in Iowa ranged up to 11 inches at Carlisle. In Iowa, most of the snow fell between midnight and 4 AM.

1990-- Feminists' long-sought for family leave program became a reality in New Jersey when Governor Jim Florio signed a bill that requires employers to give their employees up to 12 weeks off to care for a newborn or adopted child, or for an ill or injured immediate family member. The leave is unpaid, but health insurance and other benefits stay in effect and the furloughed workers would be guaranteed their old job or its equivalent. President Bill Clinton would get the same basic bill passed by the U.S. Congress three years later. Women who usually act as the family caretakers in time of sickness are the workers with the most need for these laws.

1994 - A major winter storm blanketed much of the northeastern U.S. with heavy snow. More than two feet was reported in northwestern Pennsylvania, with 33 inches at Waynesburg. There were ten heart attacks, and 185 injuries, related to the heavy snow in northwest Pennsylvania. Whiteout conditions were reported in Vermont and northeastern New York State. A wind gusts to 75 mph was clocked at Shaftsbury VT. In the Adirondacks of eastern New York State, the town of Tupper reported five inches of snow between 1 PM and 2 PM

1995 - Rep. Newt Gingrich (R-GA) was formally elected Speaker of the U.S. House of Representatives. He was the first Republican to hold the post in 40 years and the first Georgia Speaker in over 100 years.

1999 - Minnesota inaugurated pro wrestler Jesse Ventura as its 38th governor. The only Reform Party candidate to ever win statewide office, Ventura had shocked the political establishment by defeating Attorney General Hubert H. (Skip) Humphrey III and St. Paul Mayor Norm Coleman in an upset victory.

2000 - The Nasdaq composite index was hit for its worst point loss, falling more than 229 points (5.6 percent) to 3,901. The market appeared to be concerned about future Fed rate hikes. The Dow Jones Industrial Average plunged 359 points (3.2 percent) to 10,997.

-------------------------------------------------------------

SuDoku

The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler?

http://leasingnews.org/Soduku/soduko-main.htm

--------------------------------------------------------------

Daily Puzzle

How to play:

http://www.setgame.com/set/puzzle_frame.htm

Refresh for current date:

http://www.setgame.com/set/puzzle_frame.htm

--------------------------------------------------------------

http://www.gasbuddy.com/

http://www.gasbuddy.com/GB_Map_Gas_Prices.aspx

http://www.gasbuddy.com/GB_Mobile_Instructions.aspx

--------------------------------------------------------------

Weather

See USA map, click to specific area, no commercials

--------------------------------------------------------------

Traffic Live---

Real Time Traffic Information

You can save up to 20 different routes and check them out with one click,

or type in a new route to learn the traffic live

--------------------------------