![]() Add me to mailing list |

Add me to mailing list | ![]() Change email |

Change email | ![]() |

| ![]() Search

Search

Advertising | All Lists | Archives | Classified Ads | This Day In American History

Leasing News is a web site that posts information, news, and

entertainment for the commercial bank, finance and leasing industry

kitmenkin@leasingnews.org

![]()

Senior Credit Analyst Choose Location Financial Pacific Leasing - Commercial

|

Monday, July 6, 2015

US Women Capture World Cup

Today's Equipment Leasing Headlines

Archives: July 6, 2004

NorVergence Files Bankruptcy?

The Volume Produced by Alternate Finance is Astounding

Changing the Way Credit Decision Are Being Made

by Christopher Menkin

California SB 197 Will Change Small Ticket Leasing

in the Golden State/Maybe Elsewhere, too

NAELB Leasing School Says it is Time

Here’s Their Message

Leasing Industry Ads---Help Wanted

Opportunities Available

"How do I handle 'age' in an interview?"

Career Crossroad---By Emily Fitzpatrick/RII

Paul Knowlton – CLFP for 17 Years

Celebrating Long Time Members

Leasing 102 by Mr. Terry Winders, CLFP

Municipal Leases

Iowa Court Allows Lessor to Make Successor

Liability Claim Against Lessee’s Successor

by Tom McCurnin, Leasing News Legal Editor

All Wireless Phones to Have Anti-Theft Devices

Servicers to Have Preloaded or Downloadable Software

Dan Baldwin Forms "Cloud Broker Association"

To Publish Member Directory and Network

Australian Cattle Dog Mix

Chicago/Highland Park, Illinois Adopt-a-Dog

Attorneys Who Specialize in

Banking, Finance, and Leasing

News Briefs---

Eurozone Central Bank Now Controls Destiny

of Greece’s Battered Banks

Wall Street braces for wild ride after Greek vote

"I think the equity market sells off"

Broker/Funder/Industry Lists | Features (writer's columns)

Top Ten Stories Chosen by Readers | Top Stories last six months

www.leasingcomplaints.com (Be Careful of Doing Business)

www.evergreenleasingnews.org

Leasing News Icon for Android Mobile Device

You May have Missed---

SparkPeople--Live Healthier and Longer

Poem

Sports Briefs---

California Nuts Brief---

"Gimme that Wine"

This Day in American History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

######## surrounding the article denotes it is a “press release”

and was not written by Leasing News nor information verified, but from the source noted. When an article is signed by the writer, it is considered a “by line.” It reflects the opinion and research of the writer.

Please send a copy of Leasing News to a colleague and ask them

to subscribe. It’s easy. All they have to do is put “subscribe” in

the subject line and email: kitmenkin@leasingnews.org

[headlines]

--------------------------------------------------------------

Archives: July 6, 2004

NorVergence Files Bankruptcy?

Robert J. Fine

Leasing News has been writing about the troubles and background of NorVergence for two years, quoting Robert J. Fine, who is the NorVergence Bank-Funder contact under the title of Director of Strategic Relations.

As critics have noted to us, he also serves as the popular President of the Eastern Association of Equipment Lessors.

The complaints range from the value of the actual collateral to the service, with many warning that when NorVergence fails, it will erupt into a class action suit similar to the one that cost Microfinancial millions of dollars. The “distance” between financing and approving the seller plus servicer of the equipment may be decided by a court of law or another jurisdiction...

“This magical box is nothing more than an Adtran IAD (Integrated Access Device retailing for about $500). The really sad thing is that if a customer is just getting DSL or Cable High speed internet, the box does absolutely nothing!!!”

TODAY

Robert J. Fine

SVP & Group Director

Signature Bank

https://www.linkedin.com/pub/robert-fine/20/238/61a

http://leasingnews.org/archives/Mar2012/3_28.htm#fine

NorVergence Collection of Articles

http://www.leasingnews.org/Conscious-Top%20Stories/Novergence_main.htm

|

((Please Click on Bulletin Board to learn more information))

(Leasing News provides this ad “gratis” as a means

to help support the growth of Lease Police)

[headlines]

--------------------------------------------------------------

The Volume Produced by Alternate Finance is Astounding

Changing the Way Credit Decision Are Being Made

by Christopher Menkin

| Funder | 2014 |

| SBA-guaranteed 7(a) loans < $150,000 | $1,860,000,000 |

| OnDeck* | $1,200,000,000 |

| CAN Capital | $1,000,000,000 |

| Funding Circle (including UK) | $600,000,000 |

| Kabbage | $400,000,000 |

| Yellowstone Capital | $290,000,000 |

| Strategic Funding Source | $280,000,000 |

| Merchant Cash and Capital | $277,000,000 |

| Square Capital | $100,000,000 |

| Funder | Lifetime |

| CAN Capital | $5,000,000,000 |

| OnDeck | $2,000,000,000 |

| Yellowstone Capital | $1,100,000,000 |

| Funding Circle (including UK) | $1,000,000,000 |

| Merchant Cash and Capital | $1,000,000,000 |

| RapidAdvance | $700,000,000 |

| Kabbage | $500,000,000 |

| PayPal Working Capital | $500,000,000 |

| The Business Backer | $300,000,000 |

| Fora Financial | $300,000,000 |

| Capital For Merchants | $220,000,000 |

| Credibly | $140,000,000 |

*According to a recent Earnings Report, OnDeck had already funded $416 million in Q1 of 2015; Kabbage is at $550 million

The following data was compiled using publicly published figures or confirmed with company representatives. A handful of funders that were large enough to make this list preferred to keep their numbers private and thus were omitted. (Lending Club claims over $7 billion in loans made. Editor)

Source: www.debanked.com

Attendance is growing at Crowdfunding, Alternative Funding, and other such conferences being held around the United States. Their role is to replace normal bank lending, which is also affecting all types of financing from factoring, commercial finance, and leasing, primarily in the small ticket, although reaching middle-ticket transactions.

The first Lendit Conference in New York City started with 300, the next year 500, then 1,000 the following year, and this year, it was reported to be close to 1,800 attendance. From Leasing News readers who attended, very few were from the banking or leasing industry itself. Faces also were changing. They were getting younger: millennials.

Leasing News itself has had five advertisers who fit this category with

one of the first, OnDeck. A few years ago, the OnDeck marketing person sent in an ad and wanted to know the cost. I kept the email as I explained “print is different than HTML on the internet. Look at it this way as a television set. The internet is 300dpi, most TV's are now 480dpi and with digital, 1200dpi. Magazine quality is 3000 dpi.” He telephoned, and I explained the approach. He said they had been going direct and now wanted to go after brokers. He wanted to know how many brokers were in the United States.

My answer was about 5,000. As I told him, many funders had 300 to 500 brokers, some had 800, others lower, and it depended on how many deals they submitted, how many they had signed, and most important, how many were funded. He explained they did all the paperwork, so they didn’t have any of those criteria. They basically collected “requests.” I told him there were professional brokers making six figures, some making seven figures, but most did not in either category.

But I told him he wasn’t looking at this correctly for his product, as there were more than 5,000; to look at it the way Paul Menzel, CLFP, head of FinPac looked at it: “Third Party Originators.” This meant they could be sellers of equipment looking for a commission, bankers who couldn’t satisfy their customer or had a customer’s customer they could not help, or a customer who was at their limit; or a SBA client. It also meant a real estate agent who had a property to sell or lease, with equipment or work out to be completed, or a finance and insurance man at a car dealership who not only had vehicles, but a client who needed working capital or equipment, or even another leasing company or leasing sales person who couldn’t help an existing client or applicant, and I could go on about who was a potential “Third Party Originator.” So there is definitely more than 5,000.

The number is significant as the “third party original” makes a referral and the Alternate Finance operation does everything. It contrasts with a person selling an equipment lease, whether capital or operating, because being a leasing broker, the more you know about your product, the paperwork, the procedure, validating the equipment and the vendor, collecting personal financial statements and tax returns when necessary, signing the lease, perhaps getting insurance verified as well as perhaps needing a landlord waiver, as well as calling for a site inspection, when necessary, and holding it all together; overcoming complaints about rate, “Evergreen clause,” problems with other leasing companies…none of which are requirements for a cash advance or working capital loan. So the idea was to reach “Third Party Originators” and make their work much easier and faster.

The number of referrers can then be considered almost unlimited. Of course, professionals who work at it full time, definitely will have a higher referral and acceptance rate than an amateur.

The marketplace has grown since that telephone conversation three years ago. I had a call from a potential working capital advertiser who said they were relatively new, but had a lot of cash. He told me they specialized in franchises, as if this was a wonderful, new approach, and made them different than anyone else. I listened as he told me they just funded a $400,000 deal they got in the morning, approved it and had it signed electronically the same day, even sent the money by wire, the same day. He said they didn’t even use analytics, but went on Yelp, LinkedIn, had the bank statements and that is all they needed. I asked him if they had workouts, and he said, “Yes.” I told him I was surprised, as I thought they would make progress payments, do site inspections on acceptance of equipment or work. He said they don’t do that in a loan. It was a franchise.

I do know one leasing company that can perform in this manner in four hours up to $50,000 for pre-approved vendors. There are others who do very quick approvals, and there are many who can offer 24 hour turnaround, meaning ACH, even wiring the money; all on Equipment Finance Agreements. It seems we have come a long way from "fax to fund."

And further than Jim Merrilees promoting BLISS, creating a super lessor network, using what is now called analytics, making transactions faster and faster.

Leasing News Associate Editor Ralph Mango remembers, "I was on a team from Newcourt, after we won the bid to start Dell Financial Services in '96, that pioneered the front end credit decision automation for the small ticket segments for which I was VP-GM. It linked to D&B and the credit bureaus for 10 minute decisions.

“I was never in favor of the widespread usage thereof outside small ticket. Our focus was reducing or eliminating manual input to four and low five figure transactions whose inherent gross margins did not support manual effort, theorizing that the higher rates for micro and small ticket can be used to fund larger expected losses.

“For larger amounts, and for working capital, and when the equipment story is unknown, the traditional tax returns/financials, trade payments analysis, principals' character and credit check, etc., remain a singular source of risk mitigation, now more than ever. Given the increasingly difficult legislation against proper aggressive collection efforts, without such scrutiny, the chances of full payout are reduced and I do not think adequate allowances for that are factored into the credit process or the loss expectations analysis.”

Is it getting too fast? I remember in the early 1970's we discounted leases as American Leasing in Santa Clara to the San Jose, California, Wells Fargo Auto Loan Production Group. All car leases and loans went through this group and we were one of the first non-recourse equipment discounters at this center. Monday was the busiest day as car dealers from the weekend would bring in their deals to get approved and funded (“dealers” such as ourselves could write the checks from having the signed documents and money put into our account).

We were in a rush, too, hand delivered the deal, and the group was really very busy. I had done the write-up with the note that the company made $90,000 last year on their tax return, which was included. It was approved by the time I drove back to the office, less than five miles away; we paid the vendor later that afternoon, who came to the office to pick up the check.

Sometime later, a week or two, the package was put together with insurance certificates, documents signed by the bank, for the staff to file. For some reason I was looking at it (maybe I looked at all of them, but I don’t really remember, as I viewed this under “accounting”). In looking at it, I realized it was a $90,000 loss, not a $90,000 profit! I gulped in my throat, plopped down at my desk, and wondered what to do next.

First I called our Wells Fargo contact, and told him what I had found on this non-recourse deal, as I knew we also had "reps and warrants." I was really more worried about our reputation, and this was a mistake, not done on purpose. I explained what I discovered. He laughed. He said he had just glanced at the package, looked quickly at the write-up, and approved it, because he knew us. His final comment, hope it pays out. Lucky me, it did.

The new guys in town believe their rate will cover any losses they have from moving too fast, and maybe they also feel they are very lucky, too. I hope they are.

[headlines]

--------------------------------------------------------------

California SB 197 Will Change Small Ticket Leasing

in the Golden State/Maybe Elsewhere, too

by Christopher Menkin

California SB 197 will allow an unlicensed lender (including capital leases) to do more than five transactions a year. The present law, provided the condition of a referral agreement is met (1), conflicts, meaning all such transactions must meet the requirements of SB 197(Now amended and sent back to committee) (2). The interesting part is the major sponsors of the bill do not come from the banking, finance, or the leasing industry. The major support comes from two groups, noted by the author, State Senator Marty Block.

One is the California Association for Micro Enterprise Opportunity. This groups states 85% of the businesses in the U.S. are micro, generating 25% of all jobs in the US.

"A micro-business is a firm with five or fewer employees, started for $50,000 or less in initial capital and that may not have access to traditional commercial loans."

http://www.microbiz.org/about-micro-business/what-is-micro-enterprise

This page has a map and lists members:

http://www.microbiz.org/cameo-membership/members/

and here is the list in PDF:

http://leasingnews.org/PDF/2015MicromemberDirectory.pdf

Another is American Sustainable Business Council. This

page shows who has contributed, all legitimate, and well-known:

http://asbcouncil.org/membership/member-businesses#.VZb_a0Y2d6I

Members are diverse, too:

http://asbcouncil.org/membership/member-organizations#.VZb_xUY2d6I

One group of readers sees this as allowing all those who are unlicensed to remain unlicensed, and those who are licensed may be able to operate without being licensed.

Another sees this as no "private label" agreements by unlicensed, lenders, all transaction must issue a letter about receiving a commission, and the funder needs to have a letter from the borrower that they have received the receipt of the statement from the referral that the referrer is receiving a commission.

The bill is still open for changes, and when, and if, signed into law, can they be interpreted?

It should be noted that most of the alternative finance lenders, who do cash advance or working capital loans are not licensed, and the manner in which transaction are made do not required to be licensed in California. (3)

(1) Latest Amendment Change now reads:

A licensee that is a finance lender shall provide a prospective borrower who has been referred by an unlicensed person or company the following written statement, in 10-point font or larger, at the time the licensee receives an application for a commercial loan, and shall request the prospective borrower to acknowledge receipt of the statement in writing:

“You have been referred to us by [Name of Unlicensed Person or Company]. If you are approved for the loan, we may pay a fee to [Name of Unlicensed Person or Company] for the successful referral. If you wish to report a complaint about this loan transaction, you may contact the Department of Business Oversight, Division of Corporations at 1-866-ASK-CORP (1-866-275-2677), or file your complaint online at www.dbo.ca.gov.” (6/25 Latest Version)

http://leasingnews.org/archives/Jun2015/6_26.htm#california

(2) Back to Committee

http://leasingnews.org/archives/Jun2015/6_26.htm#california

(3) What Types of Companies Can Pay Referral Fees?

http://leasingnews.org/archives/Apr2015/4_29.htm#law

[headlines]

--------------------------------------------------------------

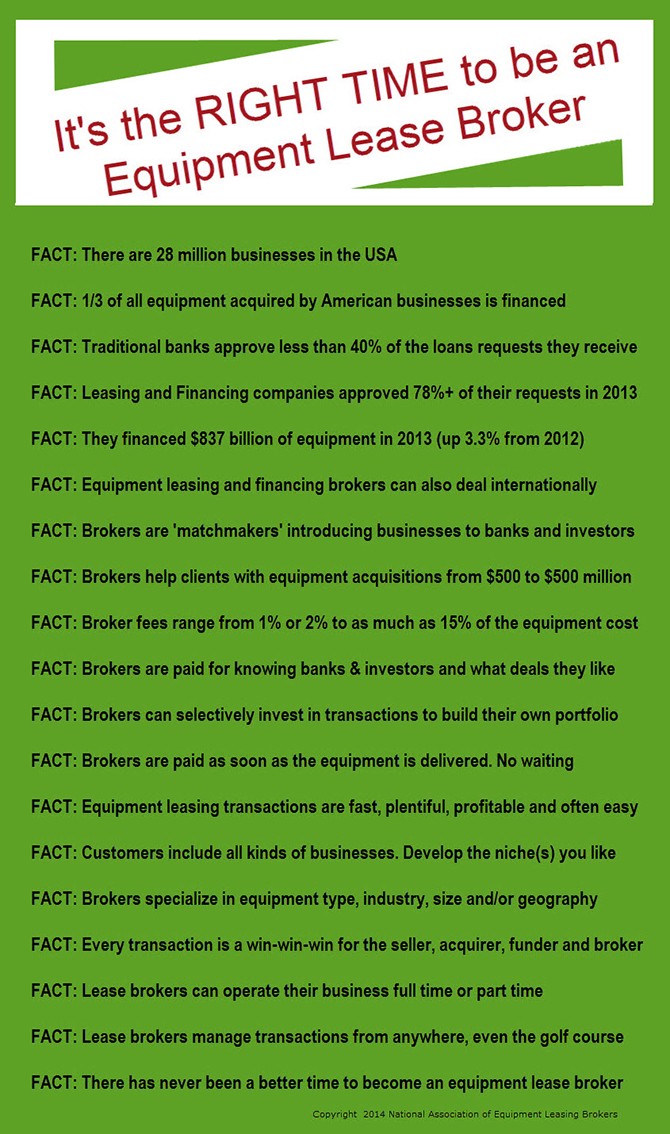

NAELB Leasing School Says it is Time

Here’s Their Message

from

National Association of Equipment Leasing Brokers

More Information:

http://www.naelbschool.com/about/

[headlines]

--------------------------------------------------------------

Leasing Industry Ads---Help Wanted

Opportunities Available

Senior Credit Analyst Choose Location Financial Pacific Leasing - Commercial

|

Finance Officer Click here for more information www.FFResources.com |

[headlines]

--------------------------------------------------------------

"How do I handle 'age' in an interview?"

Career Crossroad---By Emily Fitzpatrick/RII

Question: I am an older candidate in the job market. How do I handle any “age” questions that an employer may ask me?

Answer: It is illegal to discriminate against a job candidate because of age; many questions about age in an interview can be considered illegal. However, that does not stop them being asked – so how do you handle this?

You could actually say “That’s an illegal question and I’m not going to answer it.” HOWEVER, a response like this isn’t going to get you a job offer – which is the goal! I recommend in response to make a positive statement about yourself.

First, if this question is asked, it usually means that the interview is going well: the interviewer is looking at your favorably, probably thinks you can do the job. You could reply “I’m ….. (age)” – okay that doesn’t assist you. The best way would be to reply with a version of the following: “That’s interesting you should ask, I’m …… That gives me …… years in the industry (role, etc...) and …… years doing exactly the job you are trying to fill. The benefit to my experience and energy level is ……” – finish with a benefit statement about what you bring to the position and company. Make it positive, not a negative answer.

If in sales – all you need is a proven track record of success – IDEALLY, business / relationships / deals to bring to the table – express this!

I recommend another option: even if the interviewer doesn’t bring up the topic, broach the topic yourself (as it may be an unspoken question) – take the initiative.

When asked if you have any questions, reply “Mr./Mrs. ……(interviewer) if I were sitting in your chair looking at a seasoned pro, I would be considering issues like energy, manageability and professional currency, let me tell you something about my …..” and add some benefits you would bring to the table / employer.

By doing this, you will prove yourself to be perceptive, to the point and will eliminate any unspoken concerns.

Emily Fitzpatrick

Sr. Recruiter

Recruiters International, Inc.

Phone: 954-885-9241

Cell: 954-612-0567

emily@riirecruit.com

Invite me to Connect on LinkedIn

www.linkedin.com/pub/emily-fitzpatrick/4/671/76

Also follow us on Twitter #RIIINFO

Career Crossroads Previous Columns

http://www.leasingnews.org/Conscious-Top%20Stories/crossroad.html

[headlines]

--------------------------------------------------------------

Paul Knowlton – CLFP for 17 Years

Celebrating Long Time Members

The Certified Leasing and Finance Professional Foundation is celebrating their 30th anniversary of the designation and 15th for the formation of the Foundation. Originally started by the Western Association of Equipment Lessors (WAEL) in 1985, who changed their name to United Association of Equipment Leasing (UAEL), then Merged with the Eastern Association of Equipment Lessors (EAEL), and became the National Equipment Finance Association, (NEFA) later joining support from National Association of Equipment Leasing Brokers (NAELB), this series salutes those who remain active.

Paul Knowlton, CLFP

Vice President, Sales Team Lead

Equipment Finance

Union Bank

(Note: the designation changed at the first of the year from CLP to CLFP. Paul became a Certified Lease Professional in 1998, and the designation has been up-dated to its current standing in this article. Editor.)

I entered the leasing business in the late 80’s from commercial banking. Initially, I was focused on business development with Textron Financial, American National Leasing and LeasePartners. I brought a strong credit background with me from completion of a work/college program with US Bank of Oregon (graduating from University of Oregon, 1984) and an initial job with their credit exam crew. From their I worked at American National Leasing,

then Textron Financial.

In 1994, I joined up with Ken Taylor (today Vice-President at Exchange Bank) and Steve Crane, CLFP (today Vice President and Commercial Division Manager at BSB Leasing, Inc.) as a principal of Taylor Financial, a lease brokerage. That was a great experience as it exposed me to the full range of opportunities and challenges of operating a business in our industry. In 1996, we agreed to an acquisition by Winthrop Resources and became one of the first offices of WINR Business Credit, later TCF Leasing.

In 1998, I was given the opportunity to start up the small-ticket leasing division for Bank of Walnut Creek (BWC). I needed to use all my previous experience in sales, credit and operations. It was also at this time I began studying for my CLFP designation and became active in the United Association of Equipment Lessors, now known as National Equipment Finance Association, eventually serving as President in 2008. Even with my diverse background in leasing, I discovered during my CLFP studies that there was a lot more to learn. The things I learned I was able to put into immediate use at BWC, from documentation, accounting to collections. It was an important reminder that none of us should ever stop trying to learn more and expand our knowledge. The CLFP designation raised my standing within the industry, the bank and with clients.

At BWC Equipment Leasing were able to establish broker relationships because of what I learned and who I met during my CLFP work. The designation also assisted me with the bank management, as I was able to address portfolio matters, policy issues and regulatory requirements. I was also able to explain what these four letters meant to clients and that gave them confidence working with someone with the highest certification in the industry. I am very proud of the co-workers and friends that I’ve helped achieve their CLFP membership: Raquel O’Leary, Lori Littleford, Jim Simpson and Brad Harmon.

Bank of Walnut Creek completed its merger 2006 with First Republic Bank October 16, 2005, and stayed with them until June, 2008, going into Clean Power Finance, renewable energy, then went to Wells Fargo Bank for two and a half years, joining Union Bank on January, 2012. I have been with Union Bank the last 3 years as Program Manager of Equipment Finance to build out this product category. Once again the CLFP designation has allowed me to reconnect with resources within the industry.

Pursuit of a CLFP designation resulted in a wealth of knowledge and a great feeling of accomplishment. But one of the most important benefits of pursuing a CLFP, and getting involved with the Foundation, is the people you meet. Since becoming a CLFP, I have become friends with and relied upon some of the most knowledgeable players in our industry. The CLFP designation is an investment that will pay big rewards in the future as the economy continues to recover and new opportunities develop.

[headlines]

--------------------------------------------------------------

(Terry retired January 1, 2015. To honor him and his many years of writing for readers of Leasing News, is repeating several of his columns that are still meaningful today. Here is August 6, 2012.)

Municipal Leases

Leases to governmental bodies that are political subdivisions and have taxing authority are called Municipal leases and the lessor’s margin is tax free if certain rules are followed. They include, the equipment must be for “essential use“ meaning the equipment is paid for by tax revenues and not by ticket admissions, grants, patient revenues, or other funds not connected to taxes.

The transaction must contain a “Non Appropriation Clause”. This allows the municipality to return the equipment at the end of their fiscal year if no funds have been appropriated for this equipment the next fiscal year. Most municipal leases carry a clause that restricts the return of the equipment if it is replaced by equipment that serves the same purpose. Some lessors have been caught with this clause when the municipality did not replace the equipment but instead hired an outside contractor to perform the service. This caused a change in documentation to also restrict returning the equipment based on the service to the public.

The transaction must show that the municipality will retain ownership at lease termination. This is usually handled by a mandatory low value purchase requirement.

Municipal lease documentation is different and requires the proper authority to approve it and the correct person designated to sign. This requires an incumbency certificate and a lessee’s attorney’s opinion to make sure all the required approvals have been met and the signer has the authority to sign, and the transaction is not subject to public referendum regarding appropriation.

Tax free income is attractive but the rates are very low and only have value to someone that has taxable income from other sources. If a large loss creates negative income for the lessor’s tax year then tax free income is not attractive because income would be higher on a taxable transaction and would be sheltered from taxes by the loss.

On occasion, after a change in political makeup of the represented authority, it is important to note that on occasion they like to get out of the responsibility for the lease and will try and maintain that the previous administration had no authority to lease the equipment. Therefore you must maintain very strong documentation and “dot every i” and make sure all signatures and blanks are properly handled. Make sure the attorney’s option says that all approvals have correctly been made and the authority of the signor is in place.

Do not confuse municipal leasing with federal leasing or “not-for-profit” 501C companies. The normal rule for federal leasing is “don’t do it”…. give it to someone that knows how to handle all the required red tape and hopefully you can get a fee and run the other way just as fast as you can. My advice, leave it to the experts.

Previous #102 Columns:

http://www.leasingnews.org/Conscious-Top%20Stories/Leasing_102/Index.htm

|

[headlines]

--------------------------------------------------------------

Iowa Court Allows Lessor to Make Successor

Liability Claim Against Lessee’s Successor

by Tom McCurnin

Leasing News Legal Editor

Lessee’s Operations Are Assumed by Related Successor, Which Makes Lease Payments. After Default By the Successor, Iowa Court Imposes Liability Upon the Successor for the Full Lease Balance—A Real Pain in the Assets.

“People who think they know everything are a great annoyance to those of us who do.”—Issac Asimov, American science fiction author, 1982

Wells Fargo Financial Leasing, Inc. v. Best Reprographics, 2013 WL 5951211

(Iowa 2013)

Here’s a fun case where the lessee thought it was smarter than the lessor, and got completely busted, by its own stupidity.

Wells Fargo leased graphic arts equipment to Best Reprographics in 2006. The principals were Robert and Daphne Best. In addition, Daphne Best formed MS Dallas Reprographics.

In 2006, Best Reprographics defaulted but MS and Best allegedly entered into an asset purchase agreement where MS would take responsibility for Best's remaining leases, agreements, and debts owed relative to the equipment. While this agreement was never reduced to writing, MS took possession of Best's assets and collected on all outstanding receivable accounts still owed to Best. MS immediately began making payments to Wells Fargo for the leased equipment and used the equipment in its daily operations. Additionally, MS extended offers to all of Best's employees to continue performing the same work for MS. Seven employees accepted offers and began working for MS.

MS defaulted on the lease in 2009, and the Lessor filed a lawsuit claiming that Best and MS were essentially one and the same.

The Trial Court, after hearing evidence of the fact that MS Dallas and Best had similar officers, directors, and stockholders, similar customers, and similar operations found that MS Dallas was liable on the lease as a successor.

The Iowa Court of Appeal affirmed, holding that a successor corporation is held liable for the debts and obligations of its predecessor corporation when: (1) there is an express agreement to assume liability; (2) there is a consolidation or a merger; (3) the purchase corporation is a “mere continuation” of the selling corporation; or (4) the transaction is fraudulent. Here the Court held that MS Dallas was a mere continuation of the same business as Best.

What are the lessons here?

• First, the Lessor did a great job. Successor liability is easy to allege and hard to prove. Here the Lessor’s counsel did a great job at establishing the continuity of the two businesses. While the lease balance was $89,000, I often find that clients don’t want to invest the legal assets to prove these types of cases, which requires documents and depositions to do a good job.

• Second, aas this corp only? I wondered why this was even necessary. If the Lessor had guaranties of the principals, would tying up a successor company really accomplish much?

• Third, debtors need to be Ccareful about de facto mergers. I always advise clients who want to launder old debt with a new corporation not to take the assets of the old corporation. Wind up the old corporation and start up the new corporation with fresh seed money to avoid this type of claim.

The bottom line to this case is that the lessee thought it was smarter that the lessor and tried to form a new corporation with the old corporation’s assets. Sadly for the lessee, this didn’t work and the court saw through the charade.

I love happy endings.

Wells Fargo Financial Leasing Case

http://leasingnews.org/PDF/WellsFargoFinancialLeasing.pdf

Tom McCurnin is a partner at Barton, Klugman & Oetting

in Los Angeles, California.

Tom McCurnin

Barton, Klugman & Oetting

350 South Grand Ave.

Suite 2200

Los Angeles, CA 90071

Direct Phone: (213) 617-6129

Cell (213) 268-8291

Email: tmccurnin@bkolaw.com

Visit our web site at www.bkolaw.com

Previous Tom McCurnin Articles:

http://www.leasingnews.org

Previous Tom McCurnin Articles:

http://www.leasingnews.org/Conscious-Top%20Stories/leasing_cases.html

|

[headlines]

--------------------------------------------------------------

All Wireless Phones to Have Anti-Theft Devices

Servicers to Have Preloaded or Downloadable Software

Wirelessweek.com reports device manufacturers, including Apple, Samsung, LG and HTC, among others, have all agreed to include anti-theft technologies on new model phones, including remote wipe capabilities, as well as the ability for users to render their devices inoperable.

Meanwhile, AT&T, Sprint, T-Mobile, U.S. Cellular, and Verizon have all committed to permit the availability and full usability of a baseline anti-theft tool to be preloaded or downloadable on smartphones as specified in the commitment.

CTIA President and CEO Meredith Attwell Baker said in a statement that the commitment exemplifies the wireless industry's willingness to work with policy makers to ensure consumers are protected.

"As media reports indicated from San Francisco to New York City, these efforts are significantly reducing device thefts across the country," Attwell Baker said. "We will continue to work with all interested parties to continue to deploy new technologies and tools to improve device theft deterrence tools."

(Leasing News provides this ad as a trade for appraisals and equipment valuations provided by Ed Castagna)

[headlines]

--------------------------------------------------------------

Dan Baldwin Forms "Cloud Broker Association"

To Publish Member Directory and Network

Dan Baldwin, Executive Director of Telecommunication Association, announces the formation of network:

"CBA's goal is to help cloud brokers and vendors interrupt the 'race to zero' by advocating for bundled cloud solution pricing over line item pricing by helping cloud brokers develop bundled customer solutions they can directly invoice or invoice with the assistance of supporting cloud vendors."

More information here:

https://docs.google.com/document/d/1sdbinUQGLdZijfc0eB0ZT4obQvtSM-AIenMGhd40UxU/edit?pli=1

|

--------------------------------------------------------------

Australian Cattle Dog Mix

Chicago/Highland Park, Illinois Adopt-a-Dog

Lindsay

Female

Two Years

She is located in the

Training Program

Adoption Inquiries

adoptions@pawschicago.org

Paws Chicago

Lincoln Park Adoption Center

1997 N. Clybourn Ave.

Chicago, IL 60614

Telephone: (773) 935-PAWS

Fax: (773) 549-5760

North Shore Adoption Center

1616 Deerfield Road

Highland Park, IL 60035

Telephone: (224) 707-1190

Adoption Process:

http://www.pawschicago.org/our-work/pet-adoption/adoption-process/adoptions@pawschicago.org

Adopt a Pet

http://www.adoptapet.com/

--------------------------------------------------------------

Attorneys Who Specialize in

Banking, Finance, and Leasing

| Birmingham, Alabama The lawyers of Marks & Associates, P.C. have over 30 years experience in dealing with virtually every type of equipment financing and are recognized throughout the industry for prompt, practical solutions and exemplary service. They offer cost-conscious, effective lease enforcement and good counsel. Email: Barry@leaselawyer.com Website: www.leaselawyers.com |

California, National: city: Riverside Ellen Stern - get results, reasonable pricing; numerous industry contacts, nearly 30 yrs exp.in SoCal, 20 yrs equip.: CFL license specialist, documentation, work-outs, litigated collections, recoveries; deal-maker. Email: leaselaw@msn.com |

||

|

Connecticut, Southern New England: EVANS, FELDMAN & BOYER, LLC Collections, litigation, documentation, portfolio sales and financing, bankruptcy. We represent many of the national and local leasing companies doing business in this state. Past chairman EAEL legal committee. Competitive rates. email: rcfeldman@snet.net |

||

| Los Angeles/Santa Monica Hemar & Associates, Attorneys at Law Specialists in legal assistance, including debt collection, equipment recovery, litigation for 35 years. Fluent in Spanish. Tel: 310-829-1948 email: phemar@hemar.com |

|||

| Los Angeles, Southern CA Seasoned attorney representing secured creditors in auto finance and truck/equipment lease industry. Bankruptcy and State Court litigation. Vincent V. Frounjian (818) 990-0605or email: vvf@pacbell.net. |

Encino, California: Statewide “ELFA” |

||

Los Angeles, Statewide: CA. "ELFA" Aggressive creditors rights law firm specializing in equipment leasing handling collection matters on a contingency, fixed fee or hourly cbasis. email:RGarwacki@prodigy.net |

Los Angeles, Statewide: CA "ELFA" |

||

Los Angeles- Statewide, CA Lawyer specializing in banking and leasing issues statewide. Documents and litigation. Tom McCurnin, Barton, Klugman & Oetting. Voice: (213) 617-6129 Cell:(213) 268-8291 Email: tmccurnin@bkolaw.com |

California & National Paul Bent – More than 35 years experience in all forms of equipment leasing, secured lending, and asset based transactions. Financial analysis, deal structuring, contract negotiations, documentation, private dispute resolution, expert witness services. (562) 426-1000 www.paulbentlaw.com pbent@paulbentlaw.com |

||

Illinois |

Law Firm - Service, Dallas, TX. "ELFA" Mayer regularly practices in leasing, secured financing, project development and finance and corporate finance. email: dmayer@pattonboggs.com Website: www.pattonboggs.com |

||

| Massachusetts (collection/litigation coast to coast) Modern Law Group focuses its practice on collections, lease enforcement and asset recovery. For the past five years, our attorneys have helped clients recover millions of dollars. We are able to cover your needs coast to coast. Email phone 617-855-9085www.modernlawgroup.com |

Michael J. Witt, experienced bank, finance, and leasing attorney, also conducts Portfolio Audits. Previously he was Managing Counsel, Wells Fargo & Co. (May, 2003 – September, 2008); Senior Vice President & General Counsel, Advanta Business Services (May, 1988 – June, 1997) Tel: (515) 223-2352 Cell: (515) 868-1067 |

||

| National: The OMEGA Network Group-nationwide legal representation of small and mid ticket equipment lessors-flat fee bankruptcy & replevin, contingent collection, billable litigation (704-969-3280) tong_92@yahoo.com |

National: Coston & Rademacher: Business attorneys serving the lease-finance industry since 1980. Transactional, documentation, corporate/finance, workouts, litigation, bankruptcy, portfolio management. Chicago-based national practice. Jim Coston, CLP (Members: ELFA, NEFA). |

||

| St. Louis County , MO. - statewide: Schultz & Associates LLP., collections, negotiation, and litigation. Also register and pursue recovery on foreign judgments. Contingency and reasonable hourly rates. Ronald J. Eisenberg, Esq. (636) 537-4645 x108 reisenberg@sl-lawyers.com www.sl-lawyers.com |

NJ,De,Pa: Specializing in leased equipment/secured transactions. Collections, replevins/workouts reasonable rates. Sergio Scuteri/Capehart & Scratchard, PAsscuteri@capehart.com / www.capehart.com | ||

| New York and New Jersey Peretore & Peretore, P.C. documentation, portfolio purchase & sale, replevin, workouts, litigation, collection, bankruptcy. Aggressive. Over 25 years experience.www.peretore.com |

Thousand Oaks, California: |

Receivables Management LLC

• End of Lease Negotiations & Enforcement

John Kenny

• Third-Party Commercial Collections

john@jkrmdirect.com | ph 315-866-1167

www.jkrmdirect.com(Leasing News provides this ad as a trade for investigative

reporting provided by John Kenny)

[headlines]

--------------------------------------------------------------

![]()

News Briefs----

Eurozone Central Bank Now Controls Destiny

of Greece’s Battered Banks

http://www.nytimes.com/2015/07/06/business/international/eurozone-central-bank-now-controls-destiny-of-greeces-battered-banks.html

Wall Street braces for wild ride after Greek vote

"I think the equity market sells off"

http://www.usatoday.com/story/money/2015/07/05/greece-debt-crisis-stocks-money-markets/29631265/

[headlines]

--------------------------------------------------------------

--You May Have Missed It

The Polaroid Swinger:

Changing the Market in an Instant

http://www.nytimes.com/2015/07/05/upshot/the-polaroid-swinger-changing-the-market-in-an-instant.html

[headlines]

--------------------------------------------------------------

SparkPeople--Live Healthier and Longer

![]()

Soda Drinkers Beware!

Nutrition News Flash

http://www.sparkpeople.com/resource/nutrition_articles.asp?id=650

[headlines]

--------------------------------------------------------------

Baseball Poem

ere are three “choice” short poems from Tim Peeler, from his book “Touching All the Bases.” He has given us permission to reproduce them.

Budweiser!

Budweiser! he calls

between innings, between pitches,

between breaths

An Asterisk as Big as a Ball

the ball talked to

three hundred thirty feet of air,

rising into the teeth

of the bat's echo,

crashing into right field bleachers

like any other Yankee missile —

an exiled hero

circled the Ruthian diamond

to footnote glory —

just down the first base line

the magic bat lay,

like a gun that had killed

its owner.

whiskey moon

frank says the full moon

is for whiskey,

spits tobacco to punctuate

his short sentences,

hours sipping, replaying

his career in slow motion,

oiling the first baseman's mitt,

then spreading it carefully

to catch the milky light,

frank says it softens the leather,

I say it embalms the memory.

These come from a soft cover 128 pages

with index published by www.mcfarlandpub.com

( they take two weeks to send, but you are helping

this company stay alive, or you can buy from

Amazon, for the same price, but perhaps faster

delivery. While they are all mostly baseball,

some are not. He is a unique American poet.

He lives in Hickory, North Carolina.

[headlines]

--------------------------------------------------------------

Sports Briefs----

Carli Loyd turns in performance for the ages as US routs Japan for Cup

http://www.si.com/planet-futbol/2015/07/06/carli-lloyd-usa-japan-womens-world-cup-final

Loyd gives USA a new hero

http://espn.go.com/espnw/news-commentary/2015worldcup/article/13204590/with-game-lifetime-carli-lloyd-gives-us-new-hero

Daytona finish feature massive, horrifying wreck (Video)

http://screengrabber.deadspin.com/daytona-finish-features-massive-horrifying-wreck-1715930669

San Diego may do better without the NFL

http://www.sandiegouniontribune.com/news/2015/jul/04/san-diego-may-do-better-without-nfl-chargers/

Final stadium cost could determine if Raiders deal is good for Oakland

http://www.insidebayarea.com/raiders/ci_28430061/final-stadium-cost-could-determine-if-raiders-deal

Grant Cohn: What we’ll miss about Jim Harbaugh

http://www.pressdemocrat.com/sports/4144930-181/grant-cohn-what-well-miss

Candlestick Park Reaches Final State of Demolition - Photos

http://sports.yahoo.com/photos/candlestick-park-reaches-final-stage-of-demolition-slideshow/demolition-san-franciscos-candlestick-park-20150630-220140-246--sector.html

[headlines]

--------------------------------------------------------------

California Nuts Briefs---

California slips back to No. 8 economy in world

http://napavalleyregister.com/ap/state/california-slips-back-to-no-economy-in-world/article_c3bea7f9-aba5-52a5-8e67-f7304a0fde17.html

California cuts water use by 29% in May

http://www.usatoday.com/story/news/nation/2015/07/01/california-water/29577379/?hootPostID=4f6edd14a68ef08f0400aacb4f7f8f6b

[headlines]

--------------------------------------------------------------

![]()

“Gimme that Wine”

http://www.youtube.com/watch?v=EJnQoi8DSE8

Google Street View Goes Inside California Wine Country

http://www.winespectator.com/webfeature/show/id/51775

Jackson Family Wines’ investments in sustainability pay off

http://www.pressdemocrat.com/business/4133637-181/jackson-family-wines-investments-in

A $315 Million Bet on Pinot Noir

http://www.winespectator.com/webfeature/show/id/51784

7 Maps & Charts That Explain The Incredible Rise Of Rosé In America

http://vinepair.com/wine-blog/7-maps-charts-explain-rise-rose-in-america/

The real reasons Trader Joe's wine is so cheap

www.businessinsider.com/why-trader-joes-wine-is-so-cheap-2015-7

Free Mobile Wine Program

http://leasingnews.org/archives/Feb2010/2_26.htm#mobile

Wine Prices by vintage

http://www.winezap.com

http://www.wine-searcher.com/

US/International Wine Events

http://www.localwineevents.com/

Leasing News Wine & Spirits Page

http://two.leasingnews.org/Recommendations/wnensprts.htm

[headlines]

----------------------------------------------------------------

![]()

This Day in American History

1526 - The first European settlement in what is now South Carolina, San Miguel de Guadalupe, was established by Lucas Vazsquez de Ayllon, who led some 500 or 600 settlers from Hispaniola to this coast location. The site of the settlement was thought to be just north of the Peedee River. Many of the settlers died of fever. After Ayllon succumbed himself on October 18, the approximately 150 surviving settlers returned to Hispaniola. The Spanish were the first group interested in this part of the Americas: Juan Ponce de Leon discovering Florida, claiming it for the King of Spain. Members of his expedition reached the Mississippi River, and Juan Rodriquez Cabrillo not only went as far as Mexico, but in 1542, also landed near what is now Ballast Point, San Diego. He then discovered Santa Catalina Island, San Pedro Bay, the Santa Barbara Channel, and other West Coast landmarks, which bear the names he gave them today.

1699 – The pirate, Captain William Kidd, was captured in Boston

1747 - American naval officer, John Paul Jones (1747-92), was born at Kirkcudbrightsire, Scotland. Remembered for his victory in the battle of his ship, the Bonhomme Richard, with the British frigate Serapis, on Sept 23, 1779. When Jones was queried: "Do you ask for quarter?" he made his famous reply: "I have not yet begun to fight!" Jones was victorious, but the Bonhomme Richard, badly damaged, sank two days later.

1757 - Birthday of William McKendree (1757-1835) in King William County, VA. Colonial American church leader. In 1808, he was ordained the first American-born bishop of the Methodist Episcopal Church.

1775 - Congress issued the "Declaration of the Causes & Necessity of Taking up Arms," listing grievances but denying intent to be independent.

1776 - The Pennsylvania Evening Post of Philadelphia was the first newspaper to publish the Declaration of Independence.

1785 - Congress unanimously resolved that US currency be named "dollar" and adopted decimal coinage

1847 - Birthday of Ellen Martin Henrotin - wealthy U.S. widow who used her money to make the 1893 Chicago World's Fair the national focal point for feminist activity. Most importantly, she led a committee that forced the closing of hundreds of brothels in Chicago and brought about the downfall of the flourishing "white slavery" trade in which women were kidnapped into prostitution.

1866 - Birthday of Mina Miller (1866-1947), the seventh of eleven children. She met Thomas Edison at the home of a mutual friend of her father and Edison, the inventor Ezra Gilliland. Her future husband claims he taught her Morse code so that they could converse in secret, even while the family watched. This is how Edison claims he proposed marriage and how she responded "yes." The two married on February 24, 1886. The couple moved into Glenmont, the Edisons' new home, after their honeymoon in Florida. At age twenty, the new Mrs. Edison became a stepmother to first wife?? Mary's three children. It was not an easy task. She was less than ten years older than stepdaughter Marion. Although Mina tried to nurture her new family, Marion later described Mina as "too young to be a mother but too old to be a chum." Her role as Mrs. Thomas Edison was also difficult: Edison frequently stayed late at the laboratory and forgot anniversaries and birthdays. Yet he seemed to love his "Billie." A note found in one of Mina's gardening books reads, "Mina Miller Edison is the sweetest little woman who ever bestowed love on a miserable homely good for nothing male (sic)" As Thomas Edison supervised his "muckers" down the hill (at his laboratory), Mina hired and supervised a staff of maids, a cook, a nanny and a gardening staff. She even called herself the "home executive." After 1891, she, not her husband, owned the house. (This protected the house from being seized to pay Edison's debts if he went bankrupt.).Four years after Edison died, Mina married childhood sweetheart Edward Everett Hughes. The two lived in Glenmont until Hughes died in 1940, when she once again adopted the name of Mrs. Edison.

1858 - Lyman Reed Blake (1835-83) of Abington, MA, obtained patents for the McKay stitching machine, which revolutionized shoe manufacturing, creating a new industry for New England, providing inexpensive and well-made footwear. The upper was lasted upon the insole by means of tacks driven through the insole and clinched against the steel bottom of the last. The outsole was then attached to the insole and upper by the McKay sewing machine, which made a chain stitch through and through to the inside of the shoe. The surface of the insole was then covered by a lining. The machine was first put in use by William Potter and Sons, Lynn, MA, in 1861. It was probably foot powered.

1899 - Birthday of Mignon G. Eberhart (1899-1996) in Lincoln, NE. U.S. mystery writer whose writing career spanned 57 years (1929-1988) and included 59 books. She commonly used brave, plucky women in exotic locations. Many of her books became Hollywood movies.

http://www.mignoneberhart.com/

1871 - The first baseball game between an all-white team and an all-African American team was played in Chicago, IL. The African-American Uniques beat the Alerts by a score of 17-16.

1921 - Birthday of Nancy Davis Reagan, former First Lady, wife of the late Ronald Reagan, 40th president of the US, was born Anne Frances Robbins in New York, NY.

1925 - Birthday of TV host, singer, entertainer, business executive Merv Griffin (1925-2007), was born in San Mateo, Ca. He got his first start here in San Francisco on my old alma mater KRFC on the Old Don Lee Network. As much as perhaps anyone in television history, Merv contributed in a variety of ways. Perhaps the most enduring are his game shows that include “Wheel of Fortune” and “Jeopardy”, both of which are still going strong.

1928 - At Potter, NE, severe thunderstorm drops huge hailstones. One measured 5.5 inches in diameter, with a circumference of 17 inches and weighed 1.5 pounds!

1932 - Cubs shortstop Bill Jurges was shot twice in a Chicago hotel room by a spurned girlfriend, Violet Popovich Valli.

1932 - Singer Della Reese was born Delloreese Patricia Early in Detroit, MI. She started her career in the 1950s as a gospel, pop and jazz singer, scoring a hit with her 1959 single "Don’t You Know". In the late 1960s, she had hosted her own talk show, “Della”, which ran for 197 episodes. Through four decades of acting, she is best known for playing Tess, the lead role on the 1994–2003 television show “Touched By An Angel”. In more recent times, she became an ordained New Thought minister in the Understanding Principles for Better Living Church in Los Angeles, California.

1933 - Major League baseball Holds First All-Star Game: The first midsummer All-Star Game was held at Comiskey Park, Chicago, IL. Babe Ruth led the American League and became the first to hit a home run in an All-Star game. The AL defeated the National League 4-2. Prior to the summer of 1933, All-Star contests consisted of pre-and postseason exhibitions that often found teams made up of a few stars playing beside journeymen and even minor leaguers.

1936 - 114ø F (46ø C), Moorhead, Minnesota (state record)

1936 - 121ø F (49ø C), Steele, North Dakota (state record)

1946 - “43,” George W. Bush, 43rd President, former governor of Texas, was born in New Haven, CT.

1946 - Birthday of Sylvester Stallone, actor, director, in New York, NY.

1947 - Top Hits

“Peg o' My Heart” - The Harmonicats

“I Wonder, I Wonder, I Wonder” - Eddy Howard

“Chi-Baba, Chi-Baba” - Perry Como

“It's a Sin” - Eddy Arnold

1947 - Allen Funt (1914-99) debuted with "The Candid Microphone" on ABC Radio. Later, on August 10, 1948, "Candid Camera" became a smash TV hit and made Funt a star. Funt also produced the film "What Do You Say to a Naked Lady?" using his hidden camera concept.

1949 - The Quiz Kids premiered and my good friend Ken Kelly of Goodwill and the Salvation Army was one of the winners. This show began on radio and continued on TV with the original host, Joe Kelly, and later with Clifton Fadiman. The format was a panel of five child prodigies who answered questions sent in by viewers. Four were regulars, staying for weeks or months, while the fifth was a "guest child." The ages of the panelists varied from 6 to 16.

1953 - “Name That Tune” was a musical identification show that appeared in different formats in the 50's and the 70's. Red Benson was the host for the NBC series and Bill Cullen (and later George DeWitt) was the CBS host. Two contestants listened while an orchestra played a musical selection, and the first contestant who could identify it raced across the stage to ring a bell. The winner of the round then tried to identify a number of tunes within a specific time period. After 11 years, the show was brought back with Richard Hayes as host. In 1974, new network and syndicated versions appeared.

1955 - Top Hits

“Rock Around the Clock” - Bill Haley & His Comets

“Cherry Pink and Apple Blossom White” - Perez Prado

“Learnin' the Blues” - Frank Sinatra

“Live Fast, Love Hard, Die Young” - Faron Young

1955 - Governor William Grant Stratton of Illinois signed into law a state requirement that all automobiles be equipped with frame holes to which seat belts could be fastened, the first state to mandate this requirement. The law also required that no new motor vehicle could be registered unless equipped with seat belt attachments conforming to the specifications of the Society of Automotive Engineers.

1955 - "Baby Let's Play House" becomes Elvis' first single to place on the national charts and hits #10 on the Country & Western charts.

1955 - A landmark in music history is established on July 9th, when Bill Haley's "Rock Around The Clock" reaches number one on the Billboard chart. Many music historians will eventually acknowledge the song as a dividing line, separating Rock and Roll from everything that preceded it.

1957 - Althea Gibson of the US became the first black person to win any Wimbledon title when she beat Darlene Hard, also of the US, 6-3, 6-2 to win the women's singles championship.

http://memory.loc.gov/ammem/today/jul06.html

1957 - Paul McCartney met John Lennon for the first time when Lennon's band, The Quarrymen were playing at a church social. In the church basement between sets, 15 year old McCartney teaches a 16 year old Lennon to play and sing Eddie Cochran's, "Twenty Flight Rock" and Gene Vincent's "Be-Bop-A-Lula". Lennon would later say that he was impressed with McCartney's ability to tune a guitar.

1961 - The Count Basie and Duke Ellington Bands record together for the first time.

http://www.amazon.com/exec/obidos/tg/detail/-/B00000IMYM/104-4730229-5095117?v=glance

1963 - Two weeks after being released, The Surfaris' classic tune "Wipe Out" cracks the Billboard Hot 100 on its way to number two. The song was recorded as a "filler" in just two takes, but would stay in the Top 40 for ten weeks.

1963 - Three members of The United States Marine Corps at Camp LeJeune, North Carolina, who called themselves The Essex, had the number one song on Billboard's chart with "Easier Said Than Done". It was a tune that the group would later confess none of them really liked. In the studio, they rushed through the recording, intending the track to be the "B" side of their first single.

1963 - James Brown went to #2 on the US album chart with "Live at the Apollo". The LP spent a total of 33 weeks on the chart.

1971 - Top Hits

“It's Too Late/I Feel the Earth Move” - Carole King

“Indian Reservation” - Raiders

“Treat Her Like a Lady” - Cornelius Brothers & Sister Rose

“When You're Hot, You're Hot” - Jerry Reed

1961 - Cecil Francis Poole became the first black US state’s attorney when he was sworn in as US attorney for the Northern District of California. He served until his retirement on Feb 3, 1970.

1963 - Top Hits

Sukiyaki - Kyu Sakamoto

Blue on Blue - Bobby Vinton

Easier Said Than Done - The Essex

Act Naturally - Buck Owens

1970 - California became the first state to adopt a “no fault” divorce law. It allowed divorces in cases of incurable insanity and irreconcilable differences. The divorce rate of more than 1 million a year was reached in 1975, when 1,036,000 divorces were granted.

1974 - The Hues Corporation had the top tune in the US with "Rock the Boat".

1977 - Peak of 10 day heat wave with 100 in Washington, D.C.

1979 - Top Hits

“Ring My Bell” - Anita Ward

“Bad Girls” - Donna Summer

“Chuck E.'s in Love” - Rickie Lee Jones

“Amanda” - Waylon Jennings

1981 - The DuPont Company of Wilmington, Delaware announced their intent to purchase Conoco, Inc. (Continental Oil Co.) for seven billion dollars. For that time, the merger was the largest in corporate history. Until a final sum of $7.7 billion closed the deal, the bargaining continued. The result of the merger was the creation of the seventh largest industrial company in the United States.

1986 - Pocatello, ID sets new record with 35, coldest for July

1987 - Top Hits

I Wanna Dance with Somebody (Who Loves Me) - Whitney Houston

Alone - Heart

Shakedown - Bob Seger

That was a Close One - Earl Thomas Conley

1989 - Despite retiring May 29, Phillies’ 3B Mike Schmidt was elected to start the All-Star game.

1990 - After pitching a no-hitter and losing, NY Yankee Andy Hawkins pitched a complete 12 inning game and lost, 2-0.

1994 - Top Hits

“I Swear” - All-4-One

“Regulate (From ‘Above The Rim’)” - Warren G

“Any Time, Any Place/And On And On” - Janet Jackson

“Don t Turn Around” - Ace Of Base

1994 - "Forrest Gump", starring Tom Hanks, Robin Wright, and Gary Sinise, is released

1996 – The Yankees’ closer, John Wetteland, set a record of 20 consecutive saves en route to 24. At season’s end, Wetteland was traded to the Texas Rangers, opening the closer role for Mariano Rivera.

1998 - Korean Se Ri Pak rolled in an 18-foot birdie putt to defeat amateur Jenny Chuasiriporn on the second hole of sudden death and win the 1998 US Women's Open at Blackwolf Run GC in Kholer, WI. The two golfers had finished the regulation 72 holes tied at six-over-par and had battled evenly at two-over— through an 18-hole playoff. Both parred the first extra hole, the first sudden-death hold in the history of the tournament. By winning, Pak became the youngest Open champ in history at 20, and only the second golf on the LPGA tour to win two major championships in her rookie year. Her earlier victory had come in the McDonald's LPGA Classic.

2001 - Playing in the 101st different park since 1876, the Cubs beat the Tigers in Comerica Park, 15-8. The Cubs win for the first time in Detroit in 56 years dating back to Game 3 of the 1945 World Series when Claude Passeau threw a 3-0 shutout in Briggs Stadium.

2002 - Daryle Ward becomes the first player in the brief history of

Pittsburgh's PNC Park to hit the Allegheny River on the fly. His fifth inning towering grand slam, which is estimated to travel 479 feet, help the Astros to rout the Pirates, 10-2.

2013 - 3 people are killed and 181 are injured after a Boeing 777 crash lands at San Francisco Airport.

-------------------------------------------------------------

SuDoku

The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler?

http://leasingnews.org/Soduku/soduko-main.htm

--------------------------------------------------------------

Daily Puzzle

How to play:

http://www.setgame.com/set/puzzle_frame.htm

Refresh for current date:

http://www.setgame.com/set/puzzle_frame.htm

--------------------------------------------------------------

http://www.gasbuddy.com/

http://www.gasbuddy.com/GB_Map_Gas_Prices.aspx

http://www.gasbuddy.com/GB_Mobile_Instructions.aspx

--------------------------------------------------------------

Weather

See USA map, click to specific area, no commercials

--------------------------------------------------------------

Traffic Live---

Real Time Traffic Information

You can save up to 20 different routes and check them out with one click,

or type in a new route to learn the traffic live

--------------------------------