![]() Add me to mailing list |

Add me to mailing list | ![]() Change email |

Change email | ![]() |

| ![]() Search

Search

Advertising | All Lists | Archives | Classified Ads | This Day In American History

Leasing News is a web site that posts information, news, and

entertainment for the commercial bank, finance and leasing industry

kitmenkin@leasingnews.org

![]()

Friday, July 24, 2015

Today's Equipment Leasing Headlines

SBA Hits Its 7(a) Loan Agreement Cap

unless Congress raises lending cap, not likely

Position Wanted –Credit

Work Remotely or Relocate for Right Opportunity

New Hires---Promotions in the Leasing Business

and Related Industries

Ascentium/NEC Equipment Finance/Umpqua Bank

Leasing Industry Ads---Help Wanted

Two New Certified Leasing and Finance Professionals

Kristen Edwards, Ann Holder

Mark Stout, Texas added: Top 25 Most Influential List

of Attorneys in Equipment Finance and Leasing

The List---May, 2015

-- Mergers, Acquisitions & Changes

Advance Funds Network Accused of Faxing

Unwanted Fax Messages

Citigroup Subsidiary Banamex USA to pay $40 Million

Largest Ever Assessed by DBO Against Bank

SNL Survey Finds Soaring Compliance Costs

Weigh Heavily on Small Banks

Credit unions worse for wear after 5 years

of Dodd-Frank

Element Financial and Quick Bridge Funding to Receive

ELFA’s 2015 Operations & Technology Excellence Award

Staff Terrier

Chicago Ridge, Illinois - Adopt-a-Dog

Leasing Conferences---This Fall

Updated Information

News Briefs---

Wells Fargo now most valuable bank in the world

Beats Out China bank $298.4 Billion to $219 Billion

GATX Second Quarter $24.4 MM Net Income

Net Income Six Months $107.6 MM -$95.2 MM 2014

Qualcomm to cut nearly 5,000 jobs

15% of its Headcount

Apple Pay to Hit 1.5 Million Locations by Yearend

In the United States

Small Exporters Back Obama on Export-Import Bank

Export-Import makes money for U.S. Government

Dutch Car leasing company LeasePlan sold for €3.7 billion

Seller is Volkswaken and banker Friedrich von Metzler

The fleet car leasing market in the US to grow

at a CAGR of 4.16% over the period 2014-2019

Amazon Reports Unexpected Profit, and Stock Soars

"Holy cow, what a quarter!"

Starbucks Profit Jumps 22%;

Chief Cites Increase in Customer Traffic

Thomas Keller’s Per Se Agrees to Pay $500,000

After Withholding Servers’ Tips

False Advertising Lawsuit Claims This Almond Milk

Brand Doesn’t Have Enough Almonds - Only 2%

Broker/Funder/Industry Lists | Features (writer's columns)

Top Ten Stories Chosen by Readers | Top Stories last six months

www.leasingcomplaints.com (Be Careful of Doing Business)

www.evergreenleasingnews.org

Leasing News Icon for Android Mobile Device

You May have Missed---

SparkPeople--Live Healthier and Longer

Poem

Sports Briefs---

California Nuts Brief---

"Gimme that Wine"

This Day in American History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

######## surrounding the article denotes it is a “press release”

and was not written by Leasing News nor information verified, but from the source noted. When an article is signed by the writer, it is considered a “by line.” It reflects the opinion and research of the writer.

Please send a copy of Leasing News to a colleague and ask them

to subscribe. It’s easy. All they have to do is put “subscribe” in

the subject line and email: kitmenkin@leasingnews.org

[headlines]

--------------------------------------------------------------

SBA Hits Its 7(a) Loan Agreement Cap

unless Congress raises lending cap, not likely

Thursday, the Small Business Loan Office, Los Angeles, California Office issued a notice that said effective July 23, 2015, “…the 7(a) program has reached its FY 2015 loan guaranty program limit of $18.75 billion. As a result, SBA is forced to suspend its 7(a) small business lending until the start of the new fiscal year on October 1, 2015, or until such time as the 7(a) loan authority is increased by Congress.

The 7(a) is the most popular SBA Agreement. It includes financial help for businesses with special requirements. (1) The ceasing of this loan product will create a mad dash to alternate financing, those who lend on collateral or have other criteria. It may even spurt equipment leasing.

The notice stated, “All loan applications submitted through delegated or non-delegated authority as of noon (EDT) today will be processed as usual. SBA continues to work closely with our partners in the House of Representatives and Senate to address this challenge. While a solution is not yet finalized, we are hopeful that Congress will soon increase the 7(a) program’s lending authority, ensuring that entrepreneurs and businesses can continue to rely on the program to secure the credit necessary to start or expand their business.

“As announced in SBA Information Notice #5000-1344, dated 7-22-2015, applications are being processed up to the point of approval and placed into a queue awaiting the availability of program authority (the “Queue”). As additional program authority becomes available due to Congressional action or as a result of cancellations of loans previously approved this fiscal year, applications in the Queue will be funded in the order they were approved by SBA. “

Congress is going on its recess in August, and it does not appear the issue will be decided before that. The situation may last until October 1, 2015, the SBA’s new fiscal year. It will hit many small businesses who will be gearing up for the holiday season by placing larger orders and hiring more workers.

[headlines]

--------------------------------------------------------------

Position Wanted – Credit

Work Remotely or Relocate for Right Opportunity

Each Week Leasing News is pleased, as a service to its readership, to offer completely free ads placed by candidates for jobs in the industry. These ads also can be accessed directly on the website at:

www.leasingnews.org/Classified/Jwanted/Jwanted.htm

Each ad is limited to (100) words and ads repeat for up to 6 months unless the candidate tells us to stop. Your submissions should be received here by the end of each week.

Please encourage friends and colleagues to take advantage of this service, including recent graduates and others interested in leasing and related careers.

Will relocate for the right opportunity and can work remotely. I have (25+) years in making credit decisions, as well as helping sales team and third party originators close more transactions via understanding their applicant's financial abilities. I can create alternative or additional opportunities (and income) by knowing which type of loan is best for the borrower aaacorrespondent@gmail.com |

Orlando, Florida |

Receivables Management LLC • Third-Party Commercial Collections john@jkrmdirect.com | ph 315-866-1167 |

(Leasing News provides this ad as a trade for investigative

reporting provided by John Kenny)

[headlines]

--------------------------------------------------------------

New Hires---Promotions in the Leasing Business

and Related Industries

Jeffrey Barry was hired as Senior Vice President of Lease Originations for ATEL Leasing, San Francisco, California; he is based in Chicago, Illinois. Previously, he was Vice President - Equipment Finance, BBVA Compass (April 2013–July 2015); Owner, Ravioli Oil (March 2012–April 2013); Vice President, Large Corporate Finance, PNC Equipment Finance (April 2005–March 2012); District Marketing Manager, ICX Corporation (October 1998–April 2005); Account Executive, MetLife Capital Corp. (1995-1998).

https://www.linkedin.com/pub/jeff-barry/13/618/b8b

Raymond Buckley was hired as Senior Vice President, Lease Originations, Western Region, at ATEL Capital Group, San Francisco, California. Previously, he was Director, Equipment Finance Originations, NXT Capital (April 2013-May 2015); Senior Vice President, GE Capital (June 2006-April 2013), Northwest Branch Manager & SVP, Balboa Capital (May 1995-May 2006). Babson College, Bachelor of Science, Entrepreneurial Studies/Marketing (1990 – 1994) Activities and Societies: Tau Kappa Epsilon Foothill High School - Pleasanton, CA (1986-1990). Member: Commercial Finance Association's Northern California Chapter

www.linkedin.com/in/raymondbuckley

John Crockett hired as Managing Director, Credit and Underwriting, for TIP Capital, a Crestmark Bank Company, Bloomfield Hills, Michigan. Previously he was at Macquarie Equipment Finance, joining the firm 2009 as Collection Manager; promoted in 2012 to Head of North American Operations. Previously, he was at CIT Systems Leasing as Credit Analyst (2000-2004); promoted to Credit Manager (2004-2009). Prior, Credit Manager, Middle Ticket Credit, Heller Financial, Dana Commercial Credit (1984 – 2000). Education: Central Michigan University, Bachelor of Science (B.S.), Business Administration, 3.50 GPA. Walsh College of Accountancy and Business Administration, Master of Science (M.S.), Management, 3.98 GPA

https://www.linkedin.com/in/johncrockett2

Aaron Gehlken was hired as Vice President of Sales at Nations Equipment Finance, Norwalk, Connecticut; he is based in Orange County, California. Previously, he was Private Equity Regional Manager, First National Capital Corporation (2013 – 2015); President and CEO, Factor Security & Continuity, LLC. (2006 – 2013) Corporate Security Program Manager, Idaho Power Company (2005 – 2006); Military Intelligence Officer, USAF (US Air Force)

(1993 – 2005). Languages: English, Persian, Spanish. Education:

University of Maryland University College, BS, Government, Mid East Area Studies, GPA 4.0. Activities and Societies: AFROTC, USAF Intelligence Officer School, Military Intelligence and Analysis. Defense Language Institute, Persian-Farsi. Activities and Societies: L3/R3 DLPT, NSA Professionalized Graphic Linguist, 1996 World Wide Olympics Silver Medalist. Great Plains Baptist Seminary, MDiv, Theology. Treasure Valley Bible Institute, BDiv, Theology

https://www.linkedin.com/in/gehlken

Carl Meinhardt was hired as Vice President, Equipment Finance Officer, Medical, at Key Equipment Finance, Superior, Colorado; based in Kingwood, Texas. Previously, he was Business Development Manager, Engs Commercial Finance Co. (February 2015–June 2015); Regional Finance Manager, Philips Medical Capital (September 2011-December 2014); Area Finance Manager, EMC (October 2010–September 2011); Regional Finance Manager, Siemens Healthcare (February 2003–October 2009); Account Executive, Dell Financial Services (October 1998–October 2001); District Leasing Manager, Eastman Kodak (September 1988–August 1999) Education: The University of Texas at Austin, Bachelor of Arts (B.A.), Economics. Activities and Societies: Beta Theta Pi fraternity; Student Union Special Events Committee; Intramural Sports

https://www.linkedin.com/pub/carl-meinhardt/16/9b8/b22

Christa Millard promoted to Funding Coordinator, Operations Specialist, IMCA Capital, Los Angeles, California. She joined the firm July, 2014. Previously, she was Human Resources Intern, Relief International (March, 2014 – June, 2014); Writing Tutor, Peer Learning Facilitator, UCLA Undergraduate Writing Center (August, 2013 – June, 2014); Customer Relationship Representative, Omega Events, Inc. (June, 2013 – August, 2013). Languages: English, Spanish, Arabic. Education: University of California, Los Angeles, Bachelor of Arts (B.A.), Political Science (International Relations), Arabic (2010 – 2014). Member of Gamma Phi Beta sorority: Greek Relations Chair (1 year). Volunteer for the Law School Witness Program (3 years). Global Siblings Coordinator for the Dashew Center for International Students and Scholars (1 year). Research Assistant for Political Science Department (1 quarter). Honors & Awards: Dean's List; Sharpe Fellow, UCLA Honors College; Phi Beta Kappa. Activities and Societies: Gamma Phi Beta, Volunteer Witness Program, Dashew Center for International Students and Scholars. University of St. Andrews, Education Abroad, Arabic and International Relations. Rower for the St Andrews Boat Club, featured writer for The Saint and amateur blogger. Teaching Assistant for Bell Baxter High School Civic Engagement course.

https://www.linkedin.com/in/christamillard

Bruce W. Robertson was hired as Director of Business Development at eOriginal, Inc., Baltimore, Maryland. Previously, he was Director of Sales/Business Development, Agora Financial LLC (2005–2014); Regional Sales and Marketing Representative, Galil Medical USA (2002–2002); Regional Sales Representative, Cryogen Inc. (2001–2002); Director of New Business Development, Baker APS (a subsidiary of McKesson Corp) (1998–2001); Owner/Independent Sales Rep, Rocky Mountain Cycling Sales (1994–1998); Retail Territory Manager, Colorado, Major Pharmaceuticals Inc. (division of The Harvard Drug Group)(1992–1994); Senior Sales Representative, Southern Colorado, The Sanford Company (1991–1992). Education: University of Colorado Denver, Master of Business Administration (M.B.A.), Business, Management, Marketing, and Related Support Services (2003 – 2004). Western State Colorado University, Bachelor of Arts (B.A.), Business Administration and Management, General (1988–1991); Activities and Societies: Rugby, Skiing, Mountain biking, Fly Fishing. Georgia State University (1986–1987).

https://www.linkedin.com/pub/bruce-robertson/7/483/493

[headlines]

--------------------------------------------------------------

Leasing Industry Ads---Help Wanted

Ascentium Capital/NEC Equipment Finance/Umpqua Bank

Senior Credit Analyst Choose Location Financial Pacific Leasing - Commercial

|

|

Experienced Sales Manager

www.necam.com |

For information on placing a help wanted ad, please click here:

http://www.leasingnews.org/Classified/Hwanted/Hwanted-post.htm

Please see our Job Wanted section for possible new employees.

[headlines]

--------------------------------------------------------------

Two New Certified Leasing and Finance Professionals

Kristen Edwards, Ann Holder

The Certified Lease & Finance Professional (CLFP) Foundation announces two individuals who recently sat for the eight-hour exam successfully passed. They

are:

Kristen Edwards

Assistant Vice President, Credit

Ascentium Capital

Ann Holder

Vice President, Leasing

Bank of Ozarks

"After two decades in the leasing business I decided it was time to earn the Certified Lease & Finance Professional designation," Ann Holder said. “I wanted to stand out for having the knowledge and skills to deliver value to my customers. Earning the CLFP was an additional step in my continuous career development.”

The next two day Academy, followed by a third day for the test offered, but not mandatory, is August 13th -15th at First American Equipment Finance, August 13th -15th. For more information:

http://leasingnews.org/archives/Jul2015/7_08.htm#clfp

The CLFP designation identifies an individual as a knowledgeable professional to employers, clients, customers, and peers in the equipment finance industry.

Companies with two or more foundation members

(# of CLFPs)

First American Equipment Finance 41

Financial Pacific Leasing 21

Ascentium Capital 14

Allegiant Partners 13

Orion First Financial 8

Arvest Equipment Finance 8

ECS Financial Services 7

Banc of California 5

Great American Insurance 5

Bank of the West 4

Maxim Commercial Capital LLC 4

Northland Capital 4

FSG Leasing 3

Huntington Equipment Finance 3

Innovative Lease Services 3

LeaseTeam Inc. 3

Pacifica Capital 3

Alliance Funding Group 2

BSB Leasing 2

Canon Financial Services 2

CBI Equipment Finance 2

Finance Capital 2

GO Capital 2

GreatAmerica Financial Services 2

Padco Financial Services 2

Pinnacle Business Finance 2

Portfolio Financial Servicing Company 2

Providence Capital Funding, Inc. 2

TEQlease 2

There are currently 271 Certified Lease & Finance Professionals and Associates throughout the world. For more information, call Executive Director Reid Raykovich, CLFP at (206) 535-6281 or visit www.CLFPfoundation.org.

[headlines]

--------------------------------------------------------------

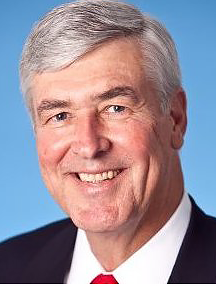

Mark Stout, Texas added: Top 25 Most Influential List

of Attorneys in Equipment Finance and Leasing

![]()

"Mark Stout helped me to locate, obtain and return a stolen truck to one of my lessees after the truck had been driven across the state of Texas – in just 3 days – by utilizing his expertise and relationships 6 counties away. This could have been a disaster for my lessee. I called Stout – Stout called whoever it was he called and the truck was returned. Easy – and that’s what I like."

Mr. Stout represents in excess of thirty financial institutions and leasing companies.

Within the last four years, Mr. Stout has represented commercial lenders in excess of 150 state court proceedings. Mr. Stout handles an extensive trial docket that generally entails at least three court appearances each week in various courts in Texas. In conjunction with his state court proceedings, Mr. Stout frequently utilizes sequestration/replevin proceedings to quickly recover his client’s collateral. Mr. Stout has filed approximately 200 sequestration/replevin actions in Texas. Mr. Stout represents in excess of thirty financial institutions and leasing companies. Within the last four years, Mr. Stout has represented commercial lenders in excess of 150 state court proceedings. Mr. Stout handles an extensive trial docket that generally entails at least three court appearances each week in various courts in Texas. In conjunction with his state court proceedings, Mr. Stout frequently utilizes sequestration/replevin proceedings to quickly recover his client’s collateral. Mr. Stout has filed approximately 200 sequestration/replevin actions in Texas.

Most Influential Lawyers

in Equipment Finance and Leasing

Stewart Abramson

Andrew Alper

Thomas V. Askounis

Joe Bonanno, CLFP

James Coston, CLFP

Jonathan Fleisher

Kenneth Charles Greene, Esq.

Michael A. Leichtling

Malcolm C. Lindquist

Barry Marks, Esq. CLFP

David G. Mayer

Frank Peretore

John G. Sinodis

Ellen Michelle Stern

Kevin Trabaris

Michael J. Witt

Irwin Wittlin

Biographies of Past Nominees

http://www.leasingnews.org/Pages/top_lawyers.html

"Influential" as "a person whose actions and opinions strongly influence the course of events." "Preeminent" is "eminent above or before others; superior; surpassing:" {Online Dictionary}

When the list exceeds 25, there will be a point when the top 25 on the list will be finalized. Nominations will appear in two parts: New Nominations/The Top List to Date (alphabetical) Again, this is not a popularity contest and those making the nomination will not be named.

email: kitmenkin@leasingnews.org

|

[headlines]

--------------------------------------------------------------

The List---May, 2015

-- Mergers, Acquisitions & Changes

"The Good, the Bad and the Ugly"--

Warren Capital, Novato, CA (05/15) Warren Capital Ponzi Scheme Started 1987 Attorney/Receivership Fees Now Over $1.15 million

http://leasingnews.org/archives/May2015/5_26.htm#warren

LeaseOne, Lynnfield, Massachusetts (05/15) Lease One Tagged for Fraud in Lease Commitment

http://leasingnews.org/archives/May2015/5_20.htm#tagged

US Business Funding, Newport Beach (05/15)

Three more complaints http://leasingnews.org/archives/May2015/5_20.htm#tagged

Advantage Funding, Lake Success, New York (05/15)

Acquired by Macquarie Group

http://leasingnews.org/archives/May2015/5_15.htm#macquire

Financial Pacific, Federal Way, WA (05/15) Wins Umpqua Bank 2014 Department of the Year Award

http://leasingnews.org/archives/May2015/5_06.htm#finpac

First American Equipment Finance, Fairport, NY (05/15)

Co-Founder/CEO William Verhelle Retires

http://leasingnews.org/archives/May2015/5_04.htm#retires

Alphabetical

http://www.leasingnews.org/list_alpha_new.htm

Chronological

http://www.leasingnews.org/list_chron_new.htm

[headlines]

--------------------------------------------------------------

Advance Funds Network Accused of Faxing

Unwanted Fax Messages

Advance Funds Network, who offers business loans for businesses

who accept cash or credit cards is the subject of a class action lawsuit

that claims the business illegally sent unwanted fax messages soliciting its services, according to legalnewsline.com. The company

claims funding $252, 000 with a two hour average approval time,

funding 360 clients a month with 110% customer stratification (1)

The suit also states the message was sent by Advance Funds Network to at least 40 others, and the message didn't contain anopt out notice, which is required by federal law.

Garrett is seeking class status for those who received the unwanted fax messages, and is also seeking an unspecified amount in damages plus court costs.

Garrett is represented by Daniel A. Edelman, Cathleen M. Combs, James O. Latturner and Dulijaza Clark of Edelman, Combs, Latturner & Goodwin LLC in Chicago.

Advance Funds Network did not respond for a comment on the case.

United States District Court for the Northern District of Illinois Eastern Division case number 1:15-cv-05616.

[headlines]

--------------------------------------------------------------

Citigroup Subsidiary Banamex USA to pay $40 Million

Largest Ever Assessed by DBO Against Bank

The Department of Business Oversight (DBO) has announced Citigroup subsidiary Banamex USA will pay the State $40 million in civil penalties to resolve allegations Banamex USA violated federal laws that require banks to maintain adequate anti-money laundering programs.

The $40 million penalty is the largest ever assessed by the DBO against a bank.

Jan Lynn Owen

DBO Commissioner

“Banamex agreed three years ago to correct numerous weaknesses in its anti-money laundering program. It has failed to do so,” said DBO Commissioner Jan Lynn Owen. “This new agreement holds Banamex appropriately accountable for its continued violations.”

The DBO pursued the enforcement action jointly with the Federal Deposit Insurance Corporation (FDIC). The FDIC earlier announced the assessment of a $140 million penalty against Banamex, which will be satisfied in part by the DBO’s penalty. The FDIC penalty will be paid to the U.S. Department of the Treasury.

Citigroup announced that it will close Banamex USA, a three branch

unit, Los Angeles, San Antonio, Texas, and Houston, Texas, that did business across the U.S.-Mexico border. They were cited in 2012 to correct their procedures, telling it basically to beef up staff and systems to detect dirty money.

Banamex on Aug. 2, 2012 entered a consent order with the DBO and FDIC. The order required Banamex to take actions in more than 20 separate areas to correct alleged violations of the federal Bank Secrecy Act, rules governing anti-money laundering and compliance programs, and requirements to report suspicious activity by customers.

Subsequent to the 2012 consent order, the DBO and FDIC found new, substantial violations of the BSA and anti-money laundering mandates over an extended period of time. The “joint stipulation” that lays out the settlement terms states the DBO and FDIC “have reason to believe” Banamex committed numerous violations of federal laws and the 2012 consent order.

Citigroup’s decision to shut down Banamex USA was its own, it said,

and not something that the regulators had imposed. In the meantime,

the Justice Department is reportedly examining whether Banamex USA failed to alert the government about suspicious banking that in some cases involved suspected drug-cartel members.

(Leasing News provides this ad as a trade for appraisals

and equipment valuations provided by Ed Castagna)

[headlines]

--------------------------------------------------------------

SNL Survey Finds Soaring Compliance Costs

Weigh Heavily on Small Banks

SNL Financial Special Report

by Kevin Dobbs

Barney Frank and Chris Dodd, co-sponsors of the Dodd-Frank Act

Compliance costs have surged for many banks in the wake of the 2010 Dodd-Frank Act, and relations with regulators have deteriorated in many cases, an SNL Financial survey of bankers and other industry professionals found.

At its inception, lawmakers billed Dodd-Frank as a way to curb excessive risk-taking on Wall Street. But as the law hits its fifth anniversary July 21, smaller community banks in particular say the law has instead become a burden on Main Street lenders, with mounds of new regulatory requirements driving up costs and making it increasingly difficult to focus precious resources on bread-and-butter lending and deposit gathering.

In SNL's online survey of 616 readers — conducted between July 2 and July 17 — 35% of respondents said compliance costs have increased 30% or more over the past five years. Another 27% said such costs have climbed 20% to 30%.

An employee at a $500 million bank wrote in response to the survey that, seven years ago, the bank had one full-time staffer handling compliance work. Today, it has a department with six full-time employees "who work tirelessly to ensure compliance with all rules and guidelines," the respondent said, later adding that, "Smaller banks simply do not have the resources to ensure compliance," and that Dodd-Frank "is killing community banks."

One executive at a bank with less than $1 billion in assets who responded to the survey recently got back into traditional banking after a decade long hiatus from 2002 to 2012. "Clearly the cost in dollars, resources and time of regulatory compliance has been the greatest change in banking in that time," the executive wrote in response to the survey. "I have taken more courses, endured more paperwork and spent more meeting time related to new regulations and greater scrutiny than I even imagined."

Respondents were allowed to share their opinions anonymously so that they could address regulatory issues candidly. Some 43% of the responses to the survey came from bank executives; another 40% were from bank employees. About 6% came from regulators, with the remainder coming from others in the industry, including analysts and consultants.

Among responses from bankers, 39% said they worked at a bank with fewer than $1 billion in assets; another 20% came from banks with between $1 billion and $5 billion. Roughly 6% came from banks between $5 billion and $10 billion, 7% from banks $10 billion to $50 billion, and nearly 14% from banks with $50 billion or more. The remainder came from respondents who were not working at banks or who did not indicate their asset size. Responses came from every region of the country.

Against the backdrop of elevated compliance challenges, some 40% of survey respondents said banks' relations with regulators have deteriorated since the Dodd-Frank Act became law, while only 13% said they had improved and 47% said they had remained steady.

"On the part of the field examining staff the attitude has become belligerent, accusatory and negative. And the administration level is worse," one executive at a bank with less than $1 billion in assets said in response to the survey. "There is no understanding or cooperation whatsoever."

Said a regulator who took the survey: "Bankers are now more agitated with regulators and much more combative than what I remember in my 15 years as a regulator."

Many of those surveyed said that, while relations had worsened following the financial crisis and the ensuing Dodd-Frank Act, interactions have in recent years started to level off. "Relations with regulators, after initially deteriorating substantially, are beginning to normalize again," said an employee at a bank with between $5 billion and $10 billion in assets.

The survey found that 33% think the creation of the Consumer Financial Protection Bureau — an addition of a new regulator to the compliance framework — was the biggest change since Dodd-Frank became law. Another 30% said increased focus on compliance, generally, marked the most notable change.

In response to the survey, one executive at a bank with less than $1 billion in assets called Dodd-Frank "bloated." This banker said the law "amounts to nothing less than a government takeover of consumer lending while passing exorbitant costs along to the banks which in turn pass the costs along to clients. Nothing has been protected, and much has been destroyed. It is purely an example of egregious government overreach."

Bankers were not alone in their criticism of the law. One regulator said Dodd-Frank did not end too big to fail and did not punish those who caused the financial crisis. "Case in point, many of those prominent executives are back/or are getting back into the game again building for the next mortgage boom," the respondent wrote. Another regulator noted that giving banks feedback on Dodd-Frank Act stress tests "has been difficult as there are no 'hard and fast' rules completely established."

A majority of those surveyed — 52% — believe that banks under $1 billion in assets were most negatively impacted by the Dodd-Frank Act.

Respondents noted that while size is generally important, as it is easier to spread out compliance costs over larger asset bases, some banks in notably strong markets or companies with uniquely successful niches can generate robust results. But a majority thinks the smallest banks will continue to struggle with regulatory hardship.

"Most banks can survive, but not necessarily thrive," an executive at a bank with fewer than $1 billion in assets wrote in response to the survey. "The cost of compliance for small community banks under $500 million is horrendous!"

Another executive at a sub-$1 billion bank wrote that banks may need to be larger than $10 billion in assets. "As if economies of scale were not already in favor of the mega-banks, Dodd-Frank essentially sealed that paradigm, despite the fact that the problems that Dodd-Frank was attempting to address were caused primarily by the mega-banks," this executive concluded.

[headlines]

--------------------------------------------------------------

Credit unions worse for wear after 5 years

of Dodd-Frank

SNL Financial Special Report

by Kiah Lau Haslett

Credit unions and community banks may spar over potential customers and the always-contentious member business lending debate, but the institutions do have at least one thing in common: mutual dislike of the Dodd-Frank Act, one of the most significant financial and regulatory reform measures since the Great Depression.

SNL surveyed 180 credit union executives, employees and other industry professionals on the impact Dodd-Frank has had on their institutions in the five years since its passage. The online survey ran from July 2 to July 17. Respondents were allowed to share their opinions anonymously so that they could address regulatory issues candidly. The overall message was overwhelmingly clear: Dodd-Frank has increased compliance costs and regulatory red tape at credit unions, oftentimes making it more difficult to serve members. Nearly 58% of respondents said that Dodd-Frank has had a negative impact on the overall health of the credit union industry.

Half of the respondents identified themselves as credit union executives. About 43% of all respondents came from credit unions with less than $500 million in assets, about 17% came from credit unions of $500 million to $1 billion in assets, and about a quarter came from institutions that had between $1 billion and $5 billion in assets.

Respondents were split in their opinions about how large a credit union must be to survive and thrive under the Dodd-Frank regulatory regime. About 22% believe a credit union needs more than $100 million in assets, another 23% believe a credit union needs more than $500 million in assets, and 17% believe $1 billion is the threshold. More than 75% of all currently operating credit unions in the U.S. have less than $100 million in assets, according to SNL data; almost 17% have assets between $100 million and $500 million.

"I don't see how smaller credit unions can survive and keep up with the regulatory requirements. Members hate the new processes created in the name of protecting them," wrote one respondent who said that credit unions need to have more than $500 million in assets to flourish in a Dodd-Frank world.

But there was a segment of optimism among those polled, with about 29% of respondents saying that all credit unions can survive and thrive in the Dodd-Frank world, regardless of their size. One executive at a credit union in the Northeast with between $500 million and $1 billion in assets wrote that the impact "has not been significant" on that institution. "We have been able to absorb the costs into our operations," the respondent wrote.

Compliance costs have skyrocketed in the five years since the passage of the bill, respondents said. Nearly a quarter said costs increased 20% to 30%; almost 29% said costs grew more than 30%. One respondent reported that employee focus has shifted from operations to compliance and another said that staffing in compliance had doubled.

One executive of an Ohio credit union with less than $500 million in assets reported that compliance costs had "drastically" increased because of "the time it takes to review new regulations and put the required changes in place," including "staff training and retraining, constant reading and comprehending of new requirements, cost of changing forms and adding new forms then changing the same forms again to meet new requirements."

Another executive from a credit union in Massachusetts wrote of the drain Dodd-Frank has caused, despite its good intentions. "It is a very complex and far reaching document that was crafted at a unique time in our industry's history," the respondent said. "It was meant to resolve a number of long-term issues and while at the time the best intentions were meant with the DFA, the ripple [effects of] this many years later are still prevalent and exhausting to comprehend on a day to day basis."

The Consumer Financial Protection Bureau remains a thorn in the side of many credit unions, respondents said. More than 46% said its creation was the biggest change to come from the Dodd-Frank Act. One employee at a Michigan credit union with between $500 million and $1 billion in assets said that the CFPB is "out of touch" with the negative impact of its blanket rules, and needs to use more discretion and due diligence when implementing regulations. The employee said Wall Street banks that created the financial crisis "earned" the CFPB as a regulator, but credit unions had not, and added that the bureau's rules have contributed to a number of mergers in the industry, as small- and medium-sized credit unions and community banks are merged into larger institutions.

But the view was not universally shared among respondents, including a more moderate approach from an executive at a credit union in the Southwest with between $500 million and $1 billion in assets.

"[The] CFPB are not the bad guys. They have a legal mandate to protect consumers and are working hard to do just that," the executive wrote. "[Credit unions] should align with CFPB's mission."

This executive said Dodd-Frank has had a positive impact on the health of the credit union industry, but that relationships between trade associations, like the National Association of Federal Credit Unions and Credit Union National Association, and regulators, like the National Credit Union Administration and CFPB, have deteriorated.

One respondent pointed out that auditors have been "more accommodating" to help credit unions transition. Another noted that regulators "are just attempting to do their job."

"We try and keep a good working relationship with our regulators," the respondent wrote.

And then there is the effectiveness of the law. Credit unions pride themselves on customer service and fairness for their members, and some survey respondents believe the consumer protections and the CFPB are redundant and unnecessary for institutions like theirs.

"Credit [unions] were already looking out for our members with clear and conspicuous advertising and disclosures, so we were pretty much in compliance with Dodd-Frank other than the costs of all the monthly statements (instead of loan coupons) and newly required notices," wrote one respondent. An executive from a sub-$500 million credit union in Colorado said Dodd-Frank is harming consumers. "The consumer ultimately pays the price, not only in terms of additional fees [and] costs but also in limited access to products and services," the executive wrote.

Another respondent wondered if consumers are even aware of how the law protects them.

"I think it would be interesting to give a clear picture of what the Dodd-Frank Act was supposed to do for consumers and if it actually did help them," wrote an employee at a Nevada credit union. "Being on the credit union side of things, we see all the things we need to do to meet its requirements, but do consumers even know or care about this act?"

Brad Bracey contributed to this article.

|

[headlines]

--------------------------------------------------------------

##### Press Release ############################

Element Financial and Quick Bridge Funding to Receive

ELFA’s 2015 Operations & Technology Excellence Award

Washington, D.C. — The Equipment Leasing and Finance Association (ELFA) announces that its 2015 Operations and Technology Excellence Award will go to two companies: Element Financial Corporation and Quick Bridge Funding, LLC. The winners were selected by a subcommittee of ELFA members and will be showcased during ELFA’s Operations and Technology Conference, Sept. 16-18 at the Hilton Philadelphia at Penn’s Landing in Philadelphia, PA.

Hal Hitch

Director of Operations

CIT Equipment Finance

“ELFA’s Operations & Technology Excellence Award was established to recognize innovation, creativity and the employment of newer technologies and operational process improvements,” said Hal Hitch, Director of Operations for CIT Equipment Finance, US and Subcommittee Chair for the award. “The 2015 award applications demonstrated a greater focus on improving the customer experience through the use of cutting-edge technology, and a marked increase in capital spending over prior years, based on the size and scope of the projects submitted. Both winners are inspiring examples of that spirit. We look forward to hearing the sharing of best practices from both winners at the ELFA Operations & Technology Conference in September.”

William G. Sutton, CAE

ELFA President/CEO

“ELFA is pleased to showcase innovative uses of technology in the equipment finance industry,” said William G. Sutton, CAE, ELFA President and CEO. “The operational improvements demonstrated by Element Financial and Quick Bridge Funding serve as models on the effective use of technology in our industry, and further demonstrate how ELFA members are ‘Equipping Business for Success.’”

Element Financial Corporation is recognized for engineering an innovative process to dramatically improve title and registration services across 2,700 unique jurisdictions for their fleet management customers. Element’s approach and the resulting suite of tools significantly improved customers’ experience by enhancing service quality and expediting service delivery. Their efforts also improved internal processes, leading to increased employee productivity and reduced operating expenses. Moving forward, Element will be able to leverage this creative approach across other departments, relying on IT and business collaboration and ongoing data evaluation to produce improved results both internally and for customers.

Quick Bridge Funding, LLC is recognized for building an innovative, scalable, state-of-the-art enterprise financial platform to manage its entire business. The financial platform is a real-time, web-based work-flow software system with integrated reporting, an innovative Big Data aggregation and decision/intelligence engine with robust third-party integration. The project demonstrated positive impacts through a significant reduction in application cycle time, conversion to a single repository for customer information, API integration with partners, centralized reporting and significant reductions in scoring model validation time. The project team established key values that allowed the project to stay on target and reach its goals; namely, the ability to inspect and adapt throughout, ensure involvement of all impacted functions, and adoption of a clean-slate mentality. As an important barometer of the innovation and cutting-edge technology, a number of potential patents were identified.

The Operations and Technology Excellence Award identifies and recognizes equipment finance organizations that have demonstrated best practices in developing and implementing innovative uses of technology or creative business processes to improve operations, enhance customer interactions, enter new markets and build overall ROI. The program brings the backroom to the foreground, spotlighting the best in the industry as an example for others.

Previous Operations and Technology Excellence Award winners include:

2014: BB&T Equipment Finance Corporation and Wells Fargo Equipment Finance

2013: TCF Equipment Finance, Inc. and SunPower Corporation.

2012: LEAF Commercial Capital, Inc. and AIG Commercial Asset Finance

2011: First American Equipment Finance and ICON Capital Corporation

2010: Winthrop Resources Corporation

2009: Key Equipment Finance, PHH Arval

2008: Orion First Financial LLC, Trinity Industries Leasing Co.

2007: TCF Equipment Finance, California First National Bancorp, and Xerox Capital Services

2006: Farm Credit Leasing

2005: Styx Capital, Relational LLC

2004: Cisco Systems Capital Corporation

2003: AgStar Financial Services, National Leasing Group

2002: ABB Financial Services, IBM Global Financing, Caterpillar Financial Services Corporation

For information about the 2015 ELFA Operations and Technology Conference, Sept. 16-18 at the Hilton Philadelphia at Penn’s Landing in Philadelphia, PA, go to http://www.elfaonline.org/events/2015/OTC/.

About ELFA

The Equipment Leasing and Finance Association (ELFA) is the trade association that represents companies in the $903 billion equipment finance sector, which includes financial services companies and manufacturers engaged in financing capital goods. ELFA members are the driving force behind the growth in the commercial equipment finance market and contribute to capital formation in the U.S. and abroad. Its 580 members include independent and captive leasing and finance companies, banks, financial services corporations, broker/packagers and investment banks, as well as manufacturers and service providers. For more information, please visit www.elfaonline.org.

#### Press Release ##############################

|

--------------------------------------------------------------

Staff Terrier

Chicago Ridge, Illinois - Adopt-a-Dog

Molly

ID #A144056

Spayed

Age: 2 years, 9 months

At Shelter since May 15, 2015

Kennel #A-08

For more information about this animal, call:

Animal Welfare League of Illinois - Chicago Ridge at (708) 636-8586

Ask for information about animal ID number A144056

Animal Welfare League

10305 Southwest Highway

Chicago Ridge, Illinois

Adoption and Viewing Hours:

Monday – Friday 12pm – 9pm

Saturday 11am – 7pm

Sundays 11am – 6pm

Application:

http://www.animalwelfareleague.com/adoptions/application/

Dog adoption fees are $135.00 and include:

• One Canine Distemper (yearly) Vaccination

• Parasite Treatment if needed

• One Year Rabies Vaccination

• Collar/Leash/Tag

• AVID Identification Microchip

• 10 Day Health Guarantee on kennel related illnesses

Adopt a Pet

http://www.adoptapet.com/

--------------------------------------------------------------

Leasing Conferences 2015

Save the Date

2015 Eastern Regional Meeting

September 11-12, 2015

Atlanta Marriott Marquis

Atlanta, GA

"Registration is now open to join your fellow leasing professionals for the NAELB 2015 Eastern Regional Meeting to be held September 11th and 12th in Atlanta, Georgia. With one and a half days of educational sessions, exhibits and networking, the Eastern Regional Meeting is a wonderful opportunity to connect with your peers and learn new and innovative ways to grow your business."

The 2015 Eastern Regional Meeting will

include sessions on the following topics:

1. Building a Stronger Broker Community

2. Marketing Tactics

3. Alternative Revenue Solutions

4. Packaging Deals

5. Analyzing Financial Statements

Registration/Agenda/Showcase/Exhibits

Partial Agenda:

THE NAELB VALUE PROPOSITION

Sheri Bancroft, Mike Parker and Pete Sawyer, NAELB Board Members

BUILDING A STRONGER BROKER COMMUNITY

Scott Wheeler, Wheeler Business Consulting

Author of “Call to Action”

His new book will be available to purchase

MARKETING TACTICS

Jacklynn Manning, Fora Financial

EXPLORING ALTERNATIVE REVENUE SOLUTIONS

Panel will include: Chuck Brazier, TradeRiver USA (Supply Chain Finance), Beth Malin, Pinnacle Specialty Capital (Factoring and Purchase Order Finance), Jeff Schubert, RapidAdvance (Working Capital Loans) and TBD (Asset Based Lending)

2015 Funding Symposium

10/7/2015 to 10/9/2015

Wed through Friday

J W Marriott Atlanta Buckhead Hotel

3300 Lenox Road Northeast

Atlanta, Georgia 30326

United States

Contact: Kim King

KKing@NEFAssociation.org

Phone: 847-380-5053

Super Saver registration to Expire 7/31/15

Full Information including pricing, schedule, and reservation:

http://nefassociation.site-ym.com/events/event_details.asp?id=594672&group=#

2015 54th Annual Convention

10/25/2015 - 10/27/2015

JW Marriott Hill Country

San Antonio, TX

Early Bird Registration

Register by Monday, August 3, 2015

http://www.elfaonline.org/events/2015/AC/

Brochure with Schedule of Events

http://www.elfaonline.org/cvweb_elfa/cgi-bin/documentdll.dll/view?DOCUMENTNUM=1147

Keynote Speakers

http://www.elfaonline.org/events/2015/AC/spkrs.cfm

ELFA President and CEO Woody Sutton invites you

to connect, engage and grow in San Antonio! (1:43)

The 2015 Fall Conference will be held at the Loews Don CeSar Hotel in St. Pete Beach, FL on November 4 through November 6, 2015.

2015 Western Regional Meeting

November 13-14, 2015

Doubletree by Hilton Anaheim - Orange County

Anaheim, CA

CFA

71st Annual Convention

November 11 - 13, 2015

JW Marriott Austin

Austin, TX

More Information

http://cfa.connectedcommunity.org/convention/home

EXPO NJ Super Regional

11/15/2015 to 11/16/2015

Sunday/Monday

Teaneck Marriott at Glenpointe

100 Frank Burr Blvd

Teaneck, New Jersey 07666

United States

Contact:

Kim King, NEFA Sr. Association Coordinator

KKing@NEFAssociation.org

Phone: (847) 380-5053

[headlines]

--------------------------------------------------------------

![]()

News Briefs----

Wells Fargo now most valuable bank in the world

Beats Out China bank $298.4 Billion to $219 Billion

http://www.charlotteobserver.com/news/business/banking/bank-watch-blog/article28295164.html

GATX Second Quarter $24.4 MM Net Income

Net Income Six Months $107.6 MM -$95.2 MM 2014

http://www.businesswire.com/news/home/20150723005314/en/GATX-Corporation-Reports-2015-Second-Quarter-Results#.VbFJDfk2d6I

Qualcomm to cut nearly 5,000 jobs

http://www.sandiegouniontribune.com/news/2015/jul/22/Qualcomm-jana-layoffs-smartphones-samsung/

Apple Pay to Hit 1.5 Million Locations by Year-end

http://bankinnovation.net/2015/07/apple-pay-to-hit-1-5-million-locations-by-yearend-cook-says/

Small Exporters Back Obama on Export-Import Bank

http://www.nytimes.com/2015/07/23/business/small-exporters-back-obama-on-ex-im-bank.html?ref=politics

Dutch Car leasing company LeasePlan sold for €3.7 billion

http://www.nltimes.nl/2015/07/23/car-leasing-company-leaseplan-sold-for-e3-7-billion/

The fleet car leasing market in the US to grow at a CAGR of 4.16% over the period 2014-2019

http://www.whatech.com/market-research/transport/77792-the-fleet-car-leasing-market-in-the-us-to-grow-at-a-cagr-of-4-16-over-the-period-2014-2019

Amazon Reports Unexpected Profit, and Stock Soars

http://www.nytimes.com/2015/07/24/technology/amazon-earnings-q2.html?ref=business&_r=0

Starbucks Profit Jumps 22%

http://www.nytimes.com/2015/07/24/business/starbucks-profit-jumps-22-chief-cites-increase-in-customer-traffic.html?ref=business

Thomas Keller’s Per Se Agrees to Pay $500,000

After Withholding Servers’ Tips

http://www.grubstreet.com/2015/07/per-se-service-fee-agreement.html

Lawsuit Claims This Almond Milk Brand Doesn’t Have Enough Almonds - Only 2%

http://time.com/3967752/almond-milk-lawsuit/

|

Experienced Sales Manager

www.necam.com |

[headlines]

--------------------------------------------------------------

--You May Have Missed It

How Do Mobile Payments Impact Tips?

http://www.fsrmagazine.com/kitchen-sink/how-do-mobile-payments-impact-tips

[headlines]

--------------------------------------------------------------

SparkPeople--Live Healthier and Longer

![]()

How a Good Gut Keeps You Healthy

Want a Healthy Body? Cultivate a Healthy Gut

http://www.sparkpeople.com/resource/wellness_articles.asp?id=1975

[headlines]

--------------------------------------------------------------

Baseball Poem

Catcher Sings the Blues |

From the book |

That Sweet Diamond |

by Paul B. Janeczko, Carole Katchen (Illustrator) |

Crouching low, I sing the blues

The aches are now a part of me

Blocking home, I sing the blues

0, the aches are now a part of me

Bruises, bumps, and scrapes

Have worn me down, can't you see?

My knees sing the blues

They sing 'em when I stoop and bend

My knees sing the blues

0, they sing 'em when I stoop and bend

They crunch, crackle, pop

The hurtful noises never end.

My fingers sing the blues

When I grip a ball or make a fist

0, my fingers sing the blues

When I grip a ball or make a fist

The knuckles moan and cry

By fire every one is kissed

Crouching low, I sing the blues

The aches are now a part of me

Blocking home, I sing the blues

0, these aches are now a part of me

Too many bruises, bumps, and scrapes

I'm nothing like I used to be.

No, nothing like I used to be

[headlines]

--------------------------------------------------------------

Sports Briefs----

As Hall Induction Nears, Pedro Martinez

Looks Back on Best Pitching Season Ever

http://bleacherreport.com/articles/2528821-as-hall-induction-nears-pedro-martinez-looks-back-on-best-pitching-season-ever

Is there a deal to be made on Deflategate?

http://www.bostonglobe.com/sports/2015/07/23/there-deal-made-deflategate/TWY9uaDKWQgvVQC9DHnDmM/story.html#

Report: Considerable support for Brady's ban

http://www.theredzone.org/BlogDescription/tabid/61/EntryId/50787/Report--Considerable-support-for-Brady-s-ban/Default.aspx

Hall of Fame wait over for Tim Brown

http://www.insidebayarea.com/raiders/ci_28529160/hall-fame-wait-over-tim-brown

49ers turn to virtual reality for practice edge

http://www.sacbee.com/sports/nfl/san-francisco-49ers/article28448776.html

Five Things to Know about the 49ers Before Camp Opens

www.pressdemocrat.com/sports/4241600-181/grant-cohn-5-things-to

Peyton Manning creates fund to help families

of Chattanooga shooting victims

http://ftw.usatoday.com/2015/07/peyton-manning-chattanooga-shooting-heroes-fund-tennessee

(Leasing News provides this ad “gratis” as a means

to help support the growth of Lease Police)

[headlines]

--------------------------------------------------------------

California Nuts Briefs---

Apple signs two big Santa Clara leases in fresh expansion

http://www.mercurynews.com/business/ci_28529663/apple-signs-two-big-santa-clara-leases-fresh

California drought: Santa Clara County residents cut water

use 35 percent in June, beating conservation goal

http://www.mercurynews.com/drought/ci_28529419/california-drought-santa-clara-county-residents-cut-water

[headlines]

--------------------------------------------------------------

![]()

“Gimme that Wine”

http://www.youtube.com/watch?v=EJnQoi8DSE8

BR Cohn sold to Vintage Wine Estates

http://www.sonomanews.com/home/4241706-181/br-cohn-sold-to-vintage#page=0#ktUS8uDiHExE5WUa.97

Randall Grahm's Estate Vineyard project at Popelouchum

to Discover a New World Grand Cru

http://www.winebusiness.com/news/?go=getNewsIssue&issueId=7787

How Greece's Debt Crisis Is Impacting Its Wine Industry

http://www.eater.com/2015/7/21/9002767/greek-debt-crisis-impact-wine-greece

Arcane laws still plague wine shipment

http://www.pressdemocrat.com/lifestyle/4215578-181/berger-arcane-laws-still-plague

I tried the fruits of New Holland’s self-propelled harvesters

http://journaltimes.com/news/local/i-tried-the-fruits-of-new-holland-s-self-propelled/article_ac5105c2-aacb-5802-9930-47ea094f0277.html

Free Mobile Wine Program

http://leasingnews.org/archives/Feb2010/2_26.htm#mobile

Wine Prices by vintage

http://www.winezap.com

http://www.wine-searcher.com/

US/International Wine Events

http://www.localwineevents.com/

Leasing News Wine & Spirits Page

http://two.leasingnews.org/Recommendations/wnensprts.htm

[headlines]

----------------------------------------------------------------

![]()

This Day in American History

1651 - African Anthony Johnson (1600-70) was granted 250 acres of farmland in Northampton County, Virginia. He was one of the first 20 Africans to arrive in Jamestown in 1619. Anthony nearly lost his life in the spring of 1622. Virginia's Powhatan Indians, threatened by the encroachments of tobacco planters, staged a carefully-planned attack that took place on Good Friday. By the middle of the day, over three hundred and fifty colonists were dead. On the plantation where Anthony worked, fifty-two were killed. Only Anthony and four other men survived. In some ways he was a lucky man. To be sure, finding yourself in bondage on a Virginia tobacco plantation was not the result of good luck, but Anthony Johnson would rise above his low status and undoubtedly become the envy of many colonists. Referred to as "Antonio a Negro" in early records, it's not clear whether he was an indentured servant (a servant contracted to work for a set amount of time) or a slave. Several years later, "Mary a Negro" was brought in to work on the plantation -- she was the only woman on the plantation. At the time, Virginia was populated almost exclusively by men. Still, Anthony and Mary became husband and wife, and they had four children. In 1665, Anthony and his family sold their 250 acres and moved to Maryland where they leased a 300-arce tract of land. Anthony died five years later, in the spring of 1670; Mary renegotiated the lease for another 99 years. That same year, a court back in Virginia ruled that, because "he was a Negro and by consequence an alien," the land (in Virginia) owned by Johnson rightfully belonged to the Crown.

http://www.arlington.k12.va.us/schools/randolph/students/Jamestown.html

http://www.historydetroit.com/part_1.asp

1683 - The 1st settlers from Germany to US left aboard the ship Concord.

1701 - Anniversary of the landing at the site of Detroit by Antoine de la Mothe Cadilac in the service of Louis XIV of France. Fort Ponchartrain due Detroit was first settlement on site.

http://www.historydetroit.com/places/fort_ponchartrain.asp

http://www.michmarkers.com/Pages/S0027.htm

http://www.pbs.org/wgbh/aia/part1/1p265.html

http://www.geo.msu.edu/geo333/tourism/det.htm

1758 – George Washington was admitted to the Virginia House of Burgesses.

1807 - Birthday of Ira Aldridge (1807-67) in NYC. He was a great 19th century Black actor, famous throughout the world.

http://www.famousamericans.net/iraaldridge/

http://www.netc.net.au/locallit/ira/

http://www.npg.org.uk/live/search/person.asp?LinkID=mp52896

http://www.howard.edu/CollegeFineArts/Theatre/General/Aldridge.html

1842 - Birthday of writer Ambrose Bierce (1842-1914) in Meigs County, OH. In 1913, Bierce traveled to Mexico to gain first-hand experience of the Mexican Revolution. He was rumored to be traveling with rebel troops, but was not seen again.

http://www.creative.net/~alang/lit/horror/abierce.sht

http://www.selfknowledge.com/35au.htm

1847 - The Mormons settled in Utah's Great Salt Lake Valley. The land at the time was Mexican territory. After 17 months of travel, Brigham Young led 148 Mormon pioneers, resulting in the establishment of Salt Lake City. Celebrations of this event include the Pioneer Day state holiday and the Days of ’47 parade.

1856 - Dr. Andrew Randall, chairman of the Academy of Sciences, was shot and killed by the gambler Joseph Hetherington. Dr. Randall came to California with Montgomery on the "U.S.S. Portsmouth" and lived at the Niantic Hotel. His office was at 134 Clay St.

1866 - Tennessee was the first state readmitted to the Union after the Civil War.

1897 - Birthday of Amelia Earhart (1897-1937) at Atchison, KS. American aviatrix lost on flight from New Guinea to Howland Island in the Pacific Ocean on July 2, 1937. She was the first woman to cross the Atlantic solo and fly solo across the Pacific from Hawaii to California.

1900 - Birthday of Zelda Fitzgerald (1900-48) in Montgomery, AL. She was the first wife of novelist F. Scott Fitzgerald.

1906 - Birthday of alto sax player Johnny Hodges (1906-70), Cambridge, MA.

http://www.alphalink.com.au/~michaelp/biography.html

http://www.alphalink.com.au/~michaelp/

http://www.thrill.to/Hodges/

http://search.eb.com/blackhistory/micro/273/36.html http://entertainment.msn.com/Artist/Default.aspx?artist=123538

1908 - Charles “Cootie” Williams (1908-85) Birthday in Mobile, AL.

http://search.eb.com/blackhistory/micro/727/46.html

http://www.pitt.edu/~atteberr/jazz/artists/ellington/people/cootie.html

http://hubcap.clemson.edu/~campber/johnson.html

1909 - Birthday of Swing trumpeter Joe Thomas, Groves, MO.

http://www.harlem.org/people/thomas.html

1911 – At Cleveland's League Park, the first unofficial Major League All Star game, a benefit game for Addie Joss’ family, saw the Naps lose to the All-Stars, 5-3.

1916 - Birthday of great detective writer John D MacDonald (1916-68) “Deep Blue Goodbye”. Travis McGee series (have read them all, he is one of my favorite authors).

http://www.kirjasto.sci.fi/jdmacd.htm

http://www.rexswain.com/travis.html

http://www.fantasticfiction.co.uk/authors/John_D_MacDonald.htm

1919 - Race riot in Washington DC (6 killed, 100 wounded) http://www.washingtonpost.com/wp-srv/local/2000/raceriot0301.htm

1921 - Birthday of pianist Billy Taylor (1921-2010), Greenville, NC

http://rollingstone.com/artists/bio.asp?oid=5977&cf=5977

http://www.billytaylorjazz.com/

http://www.bigeastern.com/dr_t/

1924 - Birthday of African-American Townsend “Sonny” Brewster, playwright and activist.

1936 - Birthday of James Lee (Jim) Brock (1936-94), college baseball coach born at Phoenix, AZ. Brock was an outstanding coach at Arizona State University. His Sun Devils won the College World Series in 1977 and 1981, and his teams compiled a record of 977 wins and only 378 losses.

1936 - 118ø F (48ø C), Minden, Nebraska (state record)

1936 - 121ø F (49ø C), near Alton, Kansas (state record)

1937 - Alabama drops charges against five blacks accused of rape in Scottsboro

http://www.pbs.org/wgbh/amex/scottsboro/timeline/index.html

http://www.pbs.org/wgbh/amex/scottsboro/sfeature/sf_women.html

http://www.english.upenn.edu/~afilreis/88/scottsboro.html

1937 - The Farm Security administration (FSA) was established through passage of the Bankhead-Jones Act. The FSA was empowered to make four-year on at 3% interest to aid farm tenants, sharecroppers, and laborers.

1938 - Birthday of Mike Mainieri, vibes, in The Bronx. http://orbita.starmedia.com/~tito-mk/discogr/log.htm http://www.charlesmcpherson.com/

1938 - Artie Shaw records “Begin the Beguine”. (Bluebird 7746) http://www.fortunecity.com/tinpan/newbonham/6/beguine.htm

1939 - Birthday of saxophonist Charles McPherson, Joplin, MO.

1940 - Cynthia Moss birthday in Ossining, NY. U.S. wildlife biologist. Primarily an elephant researcher, she proved that elephants are led by the oldest and the wisest cow and that the males are inveterate bachelors. She was senior associate of the African Wildlife Foundation. Partly because of Moss's research, other women researchers have shown that most herd animals are led by the oldest and wisest female, not the male who is generally used for defense. Even the old idea that the dominant male was the primary breeder has been disproved.

http://hallkidsanimals.com/elephants/107.shtml

http://www.elephanttrust.org/cynthia_moss.htm

http://www.pbs.org/wnet/nature/echo/html/body_intro.html

http://www.amazon.com/exec/obidos/ASIN/0689801424/inktomi-bkasin-20/103-5362656-4423850

1944 - During World War II, the US Army ordered desegregation of its training camp facilities. Later the same year, black platoons were assigned to white companies in a tentative step toward integration of the battlefield. However it was not until after the War—July 26, 1948—that President Harry Truman signed an order officially integrating the armed forces.

1945 - As the Potsdam Conference came to a close in Germany, Churchill, Truman and China's representatives fashioned a communique to Japan offering it an opportunity to end the war. It demanded that Japan completely disarm, allowed them sovereignty to the four main islands and to minor islands to be determined by the Allies, and insisted that all Japanese citizens be given immediate and complete freedom of speech, religion and thought. The Japanese would be allowed to continue enough industry to maintain their economy. The communique concluded with a demand for unconditional surrender. Unaware these demands were backed up by an atomic bomb, on July 26, Japanese Prime Minister Admiral Kantaro Suzuki rejected the Potsdam Declaration.

1949 - Top Hits

“Some Enchanted Evening” - Perry Como

“Bali Ha'I” - Perry Como

“Again” - Gordon Jenkins

“One Kiss Too Many” - Eddy Arnold

1952 - 112ø F (44ø C), Louisville, Georgia (state record).

1953 - Birthday of trumpet player Jon Faddis, Oakland, CA http://www.pitt.edu/~pittjazz/individual_htmls/jon_faddis.html

1956 – It was “yesterday” in 1946 that they first appeared. After a decade together as the country's most popular comedy team, Dean Martin and Jerry Lewis called it quits this night. They did their last show at the Copacabana nightclub in New York City. The duo ended their relationship exactly 10 years after they had started it in Atlantic City. The two men reconciled privately in the later years of Martin's life. In 1976, Martin made a surprise appearance on Lewis's annual Labor Day telethon for the Muscular Dystrophy Association, orchestrated by Frank Sinatra. According to Lewis, the two spoke "every day after that". Another source] claims that contrary to belief, the 1976 MDA telethon was not the first reconciliation of the legendary comedy team. In 1960, four years after they split, Martin and Lewis briefly reunited. Both were performing their own separate acts at the Sands Hotel in Las Vegas, a club they frequently played while they were together. Lewis caught Martin's closing act and Martin introduced his former partner to the audience, bringing him on stage. http://www.deanmartinfancenter.com/index/rightframe/07mandl/07mandl.html

1957 - Top Hits

“Teddy Bear” - Elvis Presley

“Love Letters in the Sand” - Pat Boone

“It's Not for Me to Say” - Johnny Mathis

“Bye Bye Love” - The Everly Brothers

1959 - Vice-President Richard Nixon argued with Khrushchev, known as "Kitchen Debate" He had arrived in Moscow , beginning a two-week tour of the U.S.S.R. and Poland. The next day, he held a highly publicized kitchen debate, a discussion with Soviet Premier Nikita S. Khrushchev while standing before a kitchen exhibit in the U.S. exhibition in Moscow. After the impromptu, so-called kitchen debate, Nixon formally opened the exhibition

1961 - A U.S. passenger jet was hijacked. An armed passenger forced the pilot of an Eastern Airlines Electra en route to Tampa from Miami to divert to Havana, Cuba. This began a trend of hijacking planes to Cuba.

1964 - Birthday of baseball player Barry Bonds, six-time All-Star, three-time National League MVP, born Riverside , CA. http://www.everwonder.com/david/bonds/

1964 - The Beach Boys' "California Girls" is released in the US, where it will reach #3 in September.

1964 - The trio of Dino, Desi and Billy achieve their first US chart entry with "I'm A Fool", which will rise to #17. Dino, the son of Dean Martin, Desi, the son of Lucille Ball and Desi Arnaz, along with Billy Hinsche, would also crack the Top 40 with "Not The Lovin' Kind" later in the year.

1965 - Top Hits

“(I Can't Get No) Satisfaction” - The Rolling Stones

“I'm Henry VIII, I Am” - Herman's Hermits

“What's New Pussycat?” - Tom Jones

“Before You Go” - Buck Owens

1966 - PITTMAN, RICHARD A., Medal of Honor

Rank and organization: Sergeant (then L/Cpl.), U.S. Marine Corps, Company 1, 3d Battalion, 5th Marines, 1st Marine Division (Rein) FMF. Place and date: near the Demilitarized Zone, Republic of Vietnam, 24 July 1966. Entered service at: Stockton, Calif. Born: 26 May 1945, French Camp, San Joaquin, Calif. Citation: For conspicuous gallantry and intrepidity at the risk of his life above and beyond the call of duty. While Company 1 was conducting an operation along the axis of a narrow jungle trail, the leading company elements suffered numerous casualties when they suddenly came under heavy fire from a well concealed and numerically superior enemy force. Hearing the engaged marines' calls for more firepower, Sgt. Pittman quickly exchanged his rifle for a machinegun and several belts of ammunition, left the relative safety of his platoon, and unhesitatingly rushed forward to aid his comrades. Taken under intense enemy small-arms fire at point blank range during his advance, he returned the fire, silencing the enemy position. As Sgt. Pittman continued to forge forward to aid members of the leading platoon, he again came under heavy fire from 2 automatic weapons which he promptly destroyed. Learning that there were additional wounded marines 50 yards further along the trail, he braved a withering hail of enemy mortar and small-arms fire to continue onward. As he reached the position where the leading marines had fallen, he was suddenly confronted with a bold frontal attack by 30 to 40 enemies. Totally disregarding his safety, he calmly established a position in the middle of the trail and raked the advancing enemy with devastating machinegun fire. His weapon rendered ineffective, he picked up an enemy submachinegun and, together with a pistol seized from a fallen comrade, continued his lethal fire until the enemy force had withdrawn. Having exhausted his ammunition except for a grenade which he hurled at the enemy, he then rejoined his platoon. Sgt. Pittman's daring initiative, bold fighting spirit and selfless devotion to duty inflicted many enemy casualties, disrupted the enemy attack and saved the lives of many of his wounded comrades. His personal valor at grave risk to himself reflects the highest credit upon himself, the Marine Corps, and the U.S. Naval Service.

1967 - Jefferson Airplane's second album "Surrealistic Pillow" is certified Gold on the strength of the Top Ten hits, "Somebody to Love" and "White Rabbit".

1969 - Hoyt Wilhelm, pitching for the Chicago White Sox, set a major-league baseball record by pitching in game number 907 of his career. Wilhelm went on to lead all major-league hurlers (number of games pitched) with 1,070 in his career (1952-1972).

1971 - Apollo 15 launched. Astronauts David R. Scott and James B. Irwin landed on moon (lunar module Falcon) while Alfred M. Worden piloted command module Endeavor. Rover 1, a four-wheel vehicle, was used for further exploration. Departed moon Aug 2, after nearly three days. Pacific landing Aug 7.

1973 - Top Hits

“Bad, Bad Leroy Brown” - Jim Croce

“Yesterday Once More” - Carpenters

“Shambala” - Three Dog Night

“Love is the Foundation” - Loretta Lynn

1974 - In a decision on the White House tapes, the Supreme Court ordered that special prosecutor Leon Jaworski's subpoena of tapes and documents be honored by the White House. It ruled that presidential privilege did not apply to evidence required in prosecuting Watergate-related crimes. President Nixon turned over the materials on July 30 and August 5.

1978 - Billy Martin was fired. He was replaced this time by Bob Lemon. It was the first of three times the manager of the New York Yankees baseball team would get the boot. Martin would be canned again in 1979 and in 1983, each time by Yankees owner George Steinbrenner... "the one is a born liar the other a convicted one" comment about Steinbrenner and Jackson

1979 - At Fenway Park off A's hurler Mike Morgan, Red Sox first baseman Carl Yastrzemski becomes the 18th major leaguer and seventh in the American League to hit 400 home runs. 'Captain Carl' will end his 23-year career with 452 homers.

1981 - Top Hits

“Bette Davis Eyes” - Kim Carnes

“All Those Years Ago” - George Harrison

“The One that You Love” - Air Supply

“Feels So Right” - Alabama

1983 - Kansas City Royals slugger George Brett slammed a two-run homer with two outs in the ninth inning to give the Royals a 5-4 lead over New York . Or did he? Seconds after Brett crossed home plate, New York Yankees Manager Billy Martin came out of the dugout to protest that the pine tar on Brett's bat was more than 18 inches up the bat handle. The umpires measured Brett's bat, using home plate as a measuring rod, and came to the conclusion that Martin was correct and called Brett out, erasing the Royals lead. Or did they? The president of the American League, Lee McPhail, later reversed the umpires' decision on the pine tar and ruled that the game was suspended -- with the Royals leading, 5-4. The game was completed 3 1/2 weeks later, on August 18, 1983, in Yankee Stadium. The outcome of the game? It only took 12 minutes to play the remainder of the contest with the Royals tarring the Yankees 5-4.

1984 - After 14 years and four Super Bowl championships with the Pittsburgh Steelers, Terry Bradshaw retired from the National Football League. Bradshaw, age 35, was forced to the sidelines by an elbow injury. Following a divorce from ice skater Jo Jo Starbuck, Bradshaw joined CBS as a football analyst. http://www.mcmillenandwife.com/bradshaw.html

1989 - Top Hits

“Toy Soldiers” - Martika

“Express Yourself” - Madonna

“Batdance” - Prince

“What's Going on in Your World” - George Strait

1998 - “In the last great invasion of the last great war, the greatest danger for eight men ... was saving one.” That one was one Private James Ryan and the story of the search for him, "Saving Private Ryan", opened in U.S. theatres this day. Produced and directed by one Steven Spielberg, the movie earned $30.58 million the first weekend.

1998 – Russell Weston, Jr burst into the Capitol and opens fire, killing two police officers. He is later ruled to be incompetent to stand trial.

2002 – Democrat James Traficant was expelled from the House on a vote of 420 to 1. He represented the 17th Congressional District, which centered on his hometown of Youngstown and included parts of three counties in northeast Ohio's Mahoning Valley. After being convicted of taking bribes, filing false tax returns, racketeering and forcing his aides to perform chores at his farm in Ohio and houseboat in Washington, DC, he was sentenced to prison and released on September 2, 2009, after serving a seven-year sentence.

2005 – Lance Armstrong retired after winning a record seventh consecutive Tour de France victory. Those titles were stripped for doping in 2012.

-------------------------------------------------------------

SuDoku

The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler?

http://leasingnews.org/Soduku/soduko-main.htm

--------------------------------------------------------------

Daily Puzzle

How to play:

http://www.setgame.com/set/puzzle_frame.htm

Refresh for current date:

http://www.setgame.com/set/puzzle_frame.htm

--------------------------------------------------------------

http://www.gasbuddy.com/

http://www.gasbuddy.com/GB_Map_Gas_Prices.aspx

http://www.gasbuddy.com/GB_Mobile_Instructions.aspx

--------------------------------------------------------------

Weather

See USA map, click to specific area, no commercials

--------------------------------------------------------------

Traffic Live---

Real Time Traffic Information

You can save up to 20 different routes and check them out with one click,

or type in a new route to learn the traffic live

--------------------------------