Flash#####Flash########Flash##################

(Regular Edition Follows)

AdvanceMe to Settle $23.4 MM—Not Licensed In California

A tentative order with final approval for May 9, 2011 was filed today, March 28, 2011 in US Central District Court of California regarding a class action suit against AdvanceMe, Inc. with a settlement of $23.4 million. It appears AdvanceMe, Inc. was not a licensed California Finance Lender.

“Defendant AdvanceMe, Inc. (“AMI”) offers to merchants a financial product known as Merchant Cash Advance (“MCA”). Class Plaintiffs filed this action on May 29, 2008, alleging that MCAs are not purchases of future credit card receivables, as claimed by Defendant, but rather disguised loans with interest rates that violate California’s usury laws (dkt. #1). The operative Second Amended Complaint asserts claims for violation of California’s usury laws and California Business & Professions Code Section 17200, et seq., on behalf of a putative class of persons owning or operating retail establishments in California who entered into MCAs with Defendant or executed personal guarantees relating to such MCAs (dkt. #99).”

page 2

“The Settlement Agreement provides for a total of approximately $23.4 million in monetary consideration to the Settlement Class to settle the claims in this action. See Settlement Agreement at 12 (dkt. #253-1). Of that total, $11.5 million will be paid in cash; after a deduction for settlement costs (any attorneys’ fees, costs or incentive awards awarded by the Court) and an initial cy pres donation of $500,000 to a non-profit organization for the benefit of Settlement Class members, the $11.5 million will be distributed to qualifying Settlement Class members on a pro rata basis pursuant to the Settlement Agreement. Id. at 12-13. The settlement also includes terms that require Defendant AMI to deem all outstanding balances on MCAs that have been nonperforming for at least 24 months to be fully satisfied and performed. Id. at 11-12. “

page 3

“The negotiations were conducted over the course of many months, and included conference calls, written correspondence and face-to-face discussions. Id. ¶ 6.

3. Strength of Plaintiffs’ Case and Risks of Further Litigation. The contested issues in this case caused the parties to have different views of the settlement value. These issues included: (1) whether California law or New York law governs plaintiffs’ usury claims; (2) whether AMI’s MCAs are functionally equivalent to loans; (3) if AMI’s MCAs are found to be loans, how to calculate the interest rate on these loans for the purpose of determining whether they comply with applicable usury laws...”

page 4

“Considering only the cash consideration, the proposed settlement represents 12.6% of the total aggregate damages of approximately $91,105,709.”

“Attorneys’ fees. Plaintiffs request that the Court award attorneys’ fees in the amount of $4 million, plus interest, which is 17.1% of the $23.4 million settlement consideration ($11.5 million in cash, and approximately $11.9 million in outstanding account balances that Defendant AMI will deem satisfied).”

page 6

It appears AdvanceMe, Inc. does not hold a California Lender's License nor its parent.

March 28 filing on Tentative Settlement (8 pages): PDF

Information about Class Action Suit: http://www.amisettlement.com/

Monday, March 27, 2011

Share Leasing News

Today's Equipment Leasing Headlines

AdvanceMe not a Leasing Funder

Archive--March 28, 2007

The Story behind Capital Access Network---AdvanceMe

by Christopher Menkin

Classified Ads---Sales Manager

Steve Geller Not Held Hostage in London

Player has his Mercedes repossessed, Schwartz gets 3 more

months for plea negotiation, IFC Credit partial settlement?

Classified Ads---Help Wanted

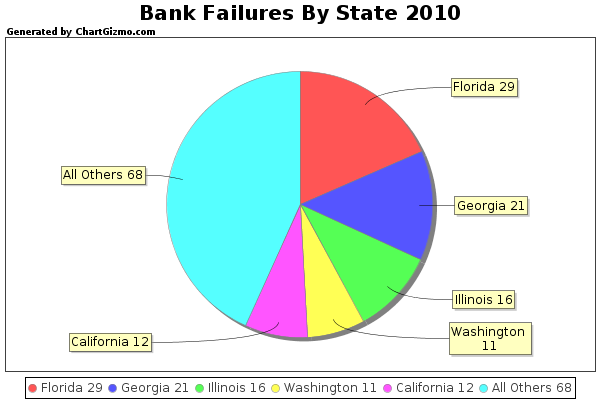

Bank Beat ---Has the Closing of Banks Slowed Down?

--Wintrust Gets Branch #80 ”across Chicagoland"

Top Stories March 21---March 30

Free Subscription/No Forms to fill out/we don's sell email addresses

Charlie Chan “Saying”

Leasing 102 by Mr. Terry Winders, CLP

Residual Assumptions

Northbrook, Illinois Adopt-a-Dog

News Briefs----

Maryland Bank Executive Settles Case

FDIC slaps ban on ex-Georgia bank executive

N.Y. Budget Deal Cuts Aid to Schools and Health Care

Nevada's boom and bust leaves 167,000 empty houses

Broker/Funder/Industry Lists |

Features (collection)

Top Ten Stories Chosen by Readers |

Top Stories last six months

You May have Missed---

Sports Briefs---

California Nuts Brief---

"Gimme that Wine"

This Day in American History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

How to Post a free "Outsourcing" classified ad:

http://www.leasingnews.org/Classified/Outsourcing/Outsourcing-post.htm

######## surrounding the article denotes it is a “press release”

and was not written by Leasing News nor information verified, but from the source noted. When an article is signed by the writer, it is considered a “by line.” It reflects the opinion and research of the writer. It is considered “bias” as it is the writer’s viewpoint.

[headlines]

--------------------------------------------------------------

AdvanceMe not a Leasing Funder

Archive--March 28, 2007

by Christopher Menkin

The headline in the leasing trade publications, and leasing association websites on February 28th:

"UAEL Recognizes AdvanceMe As Cash Advance Funding Source."

Even the Equipment Leasing and Finance Association "ELTnews" ran the same story on March 12, 2007 with the United Association of Equipment Leasing Association “recognize” declaration.

During this time Leasing News learned that "recognize" meant that the leasing associations accepted their membership as a "funder," rather than a "broker/lessor" or "service provider," or other category. Spokesmen for three leasing association said their organization does not "endorse" or "promote one member over another." Nor do they “certify” or “approve” a company as a “funder.” The fact that a funder pays a higher membership fee appeared to be the deciding factor.

None of the three wanted to go on the record.

In attempting for an interview with Mr. Thomas Burnside, CEO of Advance Me, Lauren Shankman, their public relations representative, told Leasing News that the company does not do any equipment leasing at all, nor are they contemplating that. Through a "loan," they basically advance on credit card charges and pay a referral fee to those who provide customers. It is also similar to factoring as they do not run credit on the party receiving the money, nor require a company or personal guarantee. It is based solely on the credit card receipt history of the company.

Their Better Business Bureau report was clean, stating they have 125 employees. Their web site "www.advanceme.com" has a list of testimonials. Leasing News contacted them and found they were not only very pleased with the service, but were happy to recommend them. Mark Gailey purchased KC Computers in the small Northern California gold country town Sutter Creek and was responsible for paying off the remaining payments of the loan, he thought was 21% of the money advanced from the credit cards. He thought if sales went down one month, or he needed to purchase items, the convenience and the experience he had with AdvanceMe, he would utilize their service, and recommends them highly to others.

The web site states: “AdvanceMe, Inc. is a wholly owned subsidiary of Capital Access Network, Inc., a merchant cash advance funder.

“Turn future credit card sales into CASH, today!"

“AdvanceMe, Inc. (AMI) gives you access to working capital without the headaches of a bank loan. Our application is easy to complete and we have the strength to make decisions quickly.

“Since 1998, AMI has provided almost $750 million to more than 15,000 businesses in all 50 states.

“They give an advance on credit card purchases as a form of a loan with a minimum of credit card volume of $1,700.00 per month, although their web site states $6,000 a month will get a loan:

Here is a list of their other services:

http://www.leasingnews.org/Pages/AIM-list.htm

March 28, 2007 Archive Story:

http://www.leasingnews.org/archives/March%202007/03-28-07.htm#ami

[headlines]

--------------------------------------------------------------

The Story behind Capital Access Network---AdvanceMe

by Christopher Menkin

Capital Access Network is an advertiser in Leasing News. The story above was not written because they are an advertiser, nor was the company contacted. The article is from the March 28, 2007 archive.

There has definitely been a trend toward "working capital loans," "credit card advance loans," and growth in small company "factoring," perhaps due to the tightness of many bank and financial institutions, as well as the exiting of the "smaller finance" market place such as "small ticket leases" and "small ticket loans."

Many leasing brokers and companies now outwardly market these transactions, and the companies advertise in Leasing News as there business continues to grow as the need exists and these transactions are becoming not only more accessible, but more attractive.

Leasing News started to write about this product in 2007 and in the March 28 edition featured the story above.

At one time Advance Me was funding over $10 million a month, and may be doing more than that now.

The business model seems to produce way more profit as compared to a leasing company and at substantially less risk. Interestingly, a little known fact is that the business of credit card factoring was actually started by Barbara Johnson, a Gymboree franchisee, who knew nothing about finance. She had a small business and couldn’t figure out why her bank wouldn’t lend her money against her future credit card receipts as collateral. Anyway, to her credit she took it upon herself to figure out a system and patented the method. She later sold that method and related patent to AdvanceMe. AdvanceMe was the first and is still the dominant player in the business.

When others were moving in on the action, AdvanceMe sued them under patent infringement. That caused the others to counter sue and eventually AdvanceMe lost and the patent was ruled invalid because it contained mostly prior art knowledge that Barbara Johnson had utilized.

There are many companies now in this business, including banks, as well as "financial consultants" who refer business to these companies.

August, 2007 Law Suit (54 pages-20mb):

http://www.leasingnews.org/PDF/August07ruling.pdf

Johnson Patent:

http://www.leasingnews.org/PDF/JohnsonPatent.pdf

[headlines]

--------------------------------------------------------------

Classified Ads---Sales Manager

(These ads are “free” to those seeking employment

or looking to improve their position)

|

Bayville, NJ

Dedicated individual seeking a account management position, 3 years leasing experience and 15+ years sales experience. Resume furnished upon request,

email Frank at weag4th@gmail.com . |

Fort Myers, Florida

Very experienced and strong skills with both Captive and Specialty Sales Management. Over 25 years , will relocate and travel---successful and team player.

e-mail: tlinspections@gmail.com

|

Free Posting for those seeking employment in Leasing:

http://www.leasingnews.org/Classified/Jwanted/Jwanted-post.htm

All “free” categories “job wanted” ads:

http://www.leasingnews.org/Classified/Jwanted/Jwanted.htm

John Kenny Receivables Management

www.jrkrmdirect.com

• End of Lease Negotiations & Enforcement

• Fraud Investigation

• Credit Investigations

• Asset Searches

• Skip-tracing

• Third-party Commercial Collections

The Solution to Your Credit & Accounts Receivable Needs

John Kenny

315-866-1167 | John@jkrmdirect.com

|

(Leasing News provides this ad as a trade for investigations

and background information provided by John Kenny)

[headlines]

--------------------------------------------------------------

Steve Geller Not Held Hostage in London

Steve Geller, CLP

Leasing Solutions LLC

Steve Geller is a long time leasing person, belonging to all leasing associations, and very active in the industry at Leasing Solutions, LLC---putting professionals together with funding sources as well as placing leases. He is well-known to many from his earlier days at Tilden and Orix. The first email received at Leasing News was from attorney Barry Marks, who said this was a fraud and Steve's friends should be warned. He included the email he received:

"From: stevegeller44@gmail.com

Subject: Urgent Help

"How you doing? Am stuck in London with my family, We were mugged at gun point...All cash, credit cards and cell phone were stolen off us, Thank God we have our life and passport saved, I have been to the police and the Embassy they are not 100% helping I was told to wait for 3weeks which I can't wait till then, We are having little problem in settling the hotel bills I need your help...Please, Let me know if you can help us out?

“Am freaked out at the moment!!"

"Steve"

Around the same time, Steve Geller also sent us an email, saying he had alerted National Association of Equipment Leasing Brokers on the forum, and asked us to alert Leasing News Readers:

"You may have seen the email about me being held hostage in London and to send money. Of course, it is untrue. Could you post for me ASAP a request that any email to me should only be sent to sgeller@leasingsolutionsllc.com. Thanks - Steve

Steve Geller, CLP

755 Route 340, Palisades, New York 10964

tel: 845-362-6106 fax: 815-642-0837

cell: 914-552-0842

www.leasingsolutionsllc.com

Leasing News hesitated until starting to receive emails from readers asking if it was true that Steve was kidnapped. Constant Contact was then sent to readers and it was posted on the web site, as 2/3rds of our readers read us on line. The message: “Steve not in London or being held a hostage.”

Responses were many:

“Too bad….I was hoping we got rid of that guy once and for all."

Rick Wilbur

Charter Capital

---

"Oh NO, I have already sent my money."

Bo Bohannon

---

"So how do I get my money back?"

Brian Huey

--

"What if I already sent the money? Who’s doing the refunds?"

Bill Richardson

Americus Credit Group

--

"LOL! Send all monies to Steve Geller directly instead then huh?"

Respectfully,

Phillip L. Stuart

Simplified Leasing

---

"So we should send our ransom contribution to his email address instead? Just kidding. Thanks for the heads up."

Paul J. Menzel, CLP

President & CEO

Financial Pacific

---

“I got the e-mail and called Steve Geller. I talked to him on Tuesday and he did not mention a trip to London! "

Joe Leslie

FCI Financial Services, Inc.

---

"Some people will do anything to get invited to the Royal Wedding."

Hugh Swandel

The Alta Group

---

"We should all send out emails like that.....that we are being held hostage. Just to see how much and who would contribute! Maybe that is the true test of one’s worth! I may not receive enough to buy a beer!

"Take care,"

Dave Bril

Trimarc

---

"It was something about their CC's being stolen and having to pay the hotel bill... I called the number originally given...played along with him, and then lit him up...LOL

"Seriously, I got the same email about 2 mos ago from an old Iowa Fiji brother... he lives in Newport, and I called him to verify...its complete fraud."

John Snyder

---

"The same thing happened to me!”

elegantelease@aol.com <elegantelease@aol.com>

---

"I didn't receive that particular bogus email but I've had several like it in the last year."

Terry Waggoner

---

"Which venue would you like me to post in?

CLP site or CLP Group on Linked In, etc…

I did receive Steve’s email from his Gmail account. LOL (literally)

Of course I knew it was spam, same thing happened to a dentist friend of mine last summer.

"He was also stranded in England.

"Crack me up, but what a drag for Steve,"

Tree

Theresa Kabot, CLP

K2 Funding

Kabot Commercial Leasing LLC

---

"The same thing happened to me in January and I found out my email address had been hacked by someone on Facebook who was also a yahoo customer. Steve needs to contact his email service, yahoo, Gmail, AOL, or whoever it is and get his password changed immediately.

"It’s apparently a pretty common scam. The reason a lot of people thought it might be legit is because whoever hacked my email and sent that out to everyone, sent it with my email signature ( I have a personalized signature on my personal yahoo email) so it definitely appeared to be from me. They also deleted all my contacts, and emails I had stored in my Pics. That’s why I said he needs to act fast. I got my pics restored but yahoo was unable to restore my contacts. These hackers can scrub your entire email account and wipe everything out."

Patti Bost, Equipment Financing Consultant

American Leasing and Financial

---

(Steve will be along with Linda Kester at a luncheon open to those in leasing on Wednesday, March 30, Noon to 3:00pm

The Frog and The Peach Restaurant

29 Dennis Street at Hiram Square

New Brunswick, N.J. 08901

Further Information:

Steve Geller, CLP

sgeller@leasingsolutionsllc.com

(845)362-6101

CLP Spotlight on Steve Geller, CLP

http://leasingnews.org/archives/Mar2011/3_04.htm#clp_march

[headlines]

--------------------------------------------------------------

Player has his Mercedes repossessed, Schwartz gets 3 more

months for plea negotiation, IFC Credit partial settlement?

Charles K. Schwartz, President of Allied Health Care Services, remains in Essex County jail, while his business and personal assets are being sold off to pay debts. The latest in the criminal case brought the US Attorney General is a fifth continuance until May 21, 2011 will a plea negotiation is being worked out between both parties.

Equipment Acquisition Resources bankruptcy continues, and it appears Sheldon Player remains free, although he may have lost the use of a 2008 Mercedes-Benz C200W4 as claimed by the the leasing company who is owed payments.

IFC Credit Corporation Bankrutpcy: While the many banks have taken over lease payments and other debts, including residuals, reportedly with many discrepancies on payments and residuals, also to security deposits, a settlement regarding Arthur Levinson, Leonard Ludwig, Thomas Laury, FP Holdings, Inc., First Portland Corp., FPC Funding II, LLC, First Portland Management Corp. II and Pioneer Capital Corporation of Texas has the only objection from U.S. Bank National, and it regards Pioneer Capital Credit. It appears all others are in agreement including Autobahn Funding and DZ Bank. It should also be noted that U.S. Bank is the successor to PFF Bank & Trust ( PFF Bank.)

U.S. states it “is a secured lender to the Debtor pursuant to certain prepetition loan documents and is owed not less than $1,440,549.90 calculated as of March 23, 2011, 4 not including all accrued interest, charges and other recoverable costs. U.S. Bank holds a blanket security interest in all of the Debtor s prepetition assets, a post petition lien in accordance with the Cash Collateral Orders, and a super priority administrative expense claim under 11 U.S.C. § 507(b)."

The latest motion:

“6. By the FPC Settlement Motion, the Trustee seeks approval of its proposed settlement with the Levinson/Ludwig Parties (as defined in the Motion), which provides for, among the following: (a) that the Levinson/Ludwig Parties would receive the sum of $176,000 (over eighteen (18) months) and certain amounts derived from lease collections; (b) a determination that the estate owns the Pioneer Leases and Other Assets, and that FPC Funding owns FPC Funding Leases; and (c) that the Trustee will negotiate promptly, diligently, and in good faith with US Bank to cause the Pioneer Leases to be free and clear of any secured claims of US Bank.

“7. By the DZ Bank Settlement Motion, the Trustee seeks approval of its proposed settlement with DZ Bank and Autobahn Funding Co., LLC (collectively, the DZ Parties ), which provides for, among the following: (a) that the DZ Parties would pay the estate the sum of $364,259 as settlement of the Trustee s avoidance claims against them; (b) the DZ Parties would receive $503,000 derived from certain lease collections; and (c) a determination that the Debtor sold the FPC Funding Leases to FPC Funding and, thus, FPC Funding and not the estate owns the FPC Funding Leases.

“STATEMENT OF POSITION

8 U.S. Bank does not consent to the Trustee s use of cash collateral to pay the settlement amounts as contemplated by the Pending Settlements. The February 24, 2011 Cash Collateral Order does not authorize the use of cash collateral for such purpose. More particularly, the Cash Collateral Orders specifically prohibit the Trustee from using the Protected Cash Collateral for any purpose.

“9. U.S. Bank understands that the Pending Settlement with the Levinson/Ludwig Parties requires the Trustee to negotiate with U.S. Bank to cause the release of its security interests in the Pioneer Leases. U.S. Bank, however, has not consented to the release of its security interests given that, to date, it has received only the Adequate Protection Payments and is owed substantial amounts. Accordingly, U.S. Bank further reserves all rights in connection with its claims against the estate notwithstanding the Pending Settlements

“10. Lastly, the Settlement Motions do not address and no evidence has been offered regarding whether U.S. Bank has interests in the FPC Funding Leases, which will be deemed owned by FPC Funding and not the estate pursuant to the Pending Settlements. To the extent U.S. Bank has interests in such leases, U.S. Bank submits that the Trustee must provide further adequate protection to U.S. Bank before the Pending Settlements can be approved.”

This is only one aspect of the IFC Credit Bankruptcy as the many creditors are attempting to resolve the matrix. Cases against the officers as individuals continue.

Schwartz BK plea negotiation extension:

http://www.leasingnews.org/PDF/SchwartzBKPlea.pdf

EAR BK (Mercedes):

http://www.leasingnews.org/PDF/EARBK_mercedes.pdf

IFC Settlement Positions:

http://www.leasingnews.org/PDF/IFC_settlement.pdf

[headlines]

--------------------------------------------------------------

Leasing Industry Help Wanted

Marketing Genius

Riverside, California

Create, Design, Coordinate convention/trade shows

marketing calls, remarketing assets/website

Send resume: Dreynolds@a-zresources.com

www.a-zresources.com

A-Z Resources captive affiliate to a major business distributor founded in 1975,

join our staff, generating over $120 million in combined sales.

|

Documentation Administrator

Los Angeles, CA

Mininum two years experience, competitive salary,

plus benefits, click here for more information

www.julesandassociates.com

Jules and Associates, Inc. has been

in

business for over 20 years.

|

Please see our Job Wanted section for possible new employees.

[headlines]

--------------------------------------------------------------

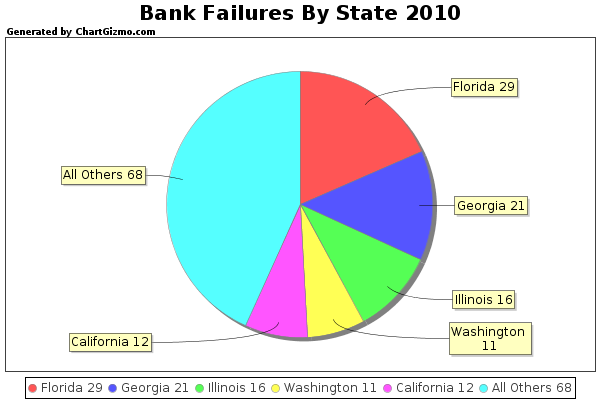

Bank Beat ---Has the Closing of Banks Slowed Down?

--Wintrust Gets Branch #80 ”across Chicagoland"

by Christopher Menkin

(graph by problembanklist.com)

It is Friday that most banks are closed down by the FDIC, and it appears the start of the year to see more banks fail was rising, but there were none closed on March 4, March 18, and only one on March 25th. In 2009 140 failed; 2010, 157 failed; to date it is “only” 26 that have failed, so readers may conclude it has slowed down.

It may also be the regulators have their hands full with too many continuing bank problems. No one seems to like the auditors or regulatory authorities, but they are there to protect depositors, not the investors or bank board of directors. Perhaps the reason for the “slow down” comes from The FDIC on February 23rd reporting their "problem list" has grown from 884 to 860. The number is more dramatic if you consider almost 300 banks have failed in the last two years and are no longer on the list.

From the recent filings, most of the banks that have failed have not had a profit in two years, have large noncurrent loans, and their major causes of grief continue to be "construction and land development loan." The real estate market has not turned around, causing both a lot of collateral, defaults, and losses.

Many of the banks that have failed have board of directors with little professional bank experience, and while they may have their community in mind, were more entrepreneurs than “minders” of the risks involved with other people's money, let alone considering their original investment or investment from friends and relatives, let alone their personal reputation. It is a tremendous responsibility and many were seemingly too cavalier about it

Most of the FDIC "Cease and Desist" orders have been to make changes, but keep the same management ( not all, but many) and call for an infusion of capital. The problem is new investors are afraid to put in "good money after bad" as they have no protection, meaning when the bank fails and is taken over by another bank, they lose their original investment in the bank.

The Bank of Commerce, Wood Dale, Illinois was closed and will become a branch of AdvantageNational Bank Group, ELk Grove Village, Illinois who assumed all the deposits. Established April 21, 1997 the bank had 15 full time employees.

Advantage is part of the Wintrust Community Bank Group includes 15 banks and thrift subsidiaries in Illinois with Advantage being their fourth largest with $405 million in deposits. The largest is Lake Forest Bank & Trust with $1.4 billion, followed by North Shore Community, $1.2 billion, Hinsdale Bank, $1.4 and NorthBrook $1 billion, according to FDIC records, with combined deposits of $10.9 billion and total assets of $14 billion, as of December 31, 2010. Their web site states "79 branches across Chicagoland." With The Bank of Commerce, it is now 80.

http://why.wintrust.com/

According to chicagobreakingbusiness.com, "“As the population of banks has gone down in Chicago, the Wintrust brand actually means something now,” Edward Wehmer, chief executive of Lake Forest-based bank holding company, said Monday at the Raymond James & Associates 32nd Annual Institutional Investors Conference in Orlando.

“The banks will soon be branded ‘Wintrust Community’ banks."

He reportedly predicted 20 banks will fail in Chicago this year. The Bank of Commerce is third in Illinois, so 17 more?

http://chicagobreakingbusiness.com/2011/03/wintrust-to-build-community-network-banks.html

In this town of approximately 14,000. It is not far from Hoffman Estates or Northbrook, or Chicago. The Chicago Sun Times recently ranked it as the fourth best of Chicago’s 150 suburban areas. The area now known as Wood Dale was first inhabited by the Winnebago tribe, part of the Sioux nation, and used as hunting grounds. The land was awarded to them for fighting the French. The Winnebago gave up the grounds after Illinois became a state in 1818, and later they moved to Wisconsin then Iowa. The town's growth came after the 1960's, according to the City of Wood Dale, Illinois web site (www.wooddale.com).

In addition to "construction and land development loans," the residential real estate market added to the The Bank of Commerce Woes as equity dropped from $9 million year-end 2009 to $695,000 year-end 2010 with $38.1 million in non-current loans. The bank had lost $11.3 million the previous year and $8.3 million year-end 2010 with charge offs of $1.8 million in construction and land development, $1.4 million in loans secured by nonfarm nonresidential properties, $1.4 million in loans secured by 1-4 family non residential properties, as well as $234,000 in commercial and industrial loans. Tier 1 risk-based capital ratio 0.51%.

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $41.9 million.

As of December 31, 2010, The Bank of Commerce had approximately $163.1 million in total assets and $161.4 million in total deposits. In addition to paying a premium of 0.10% to assume all of the deposits of the failed bank, Advantage National Bank Group agreed to purchase essentially all of the failed bank's assets.

Tracking Bank Failures Map:

http://graphicsweb.wsj.com/documents/Failed-US-Banks.html

List of Bank Failures:

http://www.fdic.gov/bank/individual/failed/banklist.html

Bank Beat:

http://www.leasingnews.org/Conscious-Top%20Stories/Bank_Beat.htm

http://leasingnews.org/Ads/Completed/channel_partnersMar11_3.html

[headlines]

--------------------------------------------------------------

[headlines]

--------------------------------------------------------------

Leasing 102

by Mr. Terry Winders, CLP

Residual Assumptions

I have written a lot about how important taking proper residual values for leases where the lessor has a purchase option. Even with any residuals, 5% or 10% or “Fair Market Value,” you should not be casual about it.

The salesman or the final acceptance telephone call should have a questionnaire that is kept in the file on how the lessee says they intend to use the equipment. In leases where the residual is over $5,000 expected, it is smart to have a call or calls to the manufacturer to secondary markets and guide books to determine the estimated wholesale value at lease termination. This many be a mandatory procedure with the new FASB accounting rules, so if you are not doing it now, it is a good time to start, not just for better control, but for accounting purposes.

In addition, you look like a Lessor and not a lender, if you are concerned how “your” equipment is being used and if the use exceeds the stated use then the additional rent helps control the residual risk. More and more lessor’s are adding additional rent clauses.

An increase in term can lower rent requirements but it increases the risk. Try and see if the vendor or someone in the secondary market, with good financials, will guarantee your residual for a fee. This fee can be passed on to the lessee as part of the documentation fee.

Occasionally when dealing with non-for-profits creating a Purchase Upon Term (PUT) helps the rental stream while the PUT covers the residual risk. This lease fails the tax and legal test but it does get the payments that fit into the budget of the non-for-profit.

Remember that any fixed price purchase option must be for at least 20% higher than your residual or you may fall into the trap of losing your income tax capital recovery benefits. The federal income tax rules state that “if the rent and the purchase option equal what a lessee could have obtained a loan with a balloon payment then because it has the economics of a loan it is considered a loan”, and not a lease.

You must also remember that any residual lowers the payment which in turn lowers the speed of the return of the investment and increases the lease margin. I have reported before that residuals make you more money, as an example, if you add up the income from a $100,000 fully amortized loan @10% over 60 months with payments in arrears the total income would be $27,482.27. Income on a lease over the same arrangements with a 10% residual provides $29,734.04. The difference of $2,251.77 or 8.19% higher comes from the higher outstanding balance during the repayment period. The additional income from a 15% residual is $3,378.66. The additional income can be realized from a PUT also, but a true lease offers additional income if the lessee selects and pays the purchase option or extends the lease payments.

Residuals have not been used as much today as they have in the past because many new lessors have been afraid to place what they think is a large risk in returning assets. However if the skills learned to study credit are used to evaluate equipment values then the residual risk is less likely to provide a problem than the credit risk. In addition a gain or loss on a residual at termination is charged to a “gain or loss on a capital asset” and as long as there is a positive balance in this account at the end of the year some losses are sheltered by the gains and they never show up. Therefore if the residual is no larger than 50% to 75% of the estimated future wholesale and any small losses are covered by the gains and more money is earned over the term then residual assumptions are a smart investment!

Mr. Terry Winders, CLP, has been a teacher, consultant, expert witness for the leasing industry for thirty-five years and can be reached at leaseconsulting@msn.com or 502-649-0448

He invites your questions and queries.

Previous #102 Columns:

http://www.leasingnews.org/Conscious-Top%20Stories/Leasing_102/Index.htm

(This ad is a “trade” for the writing of this column. Opinions

contained in the column are those of Mr. Terry Winders, CLP)

[headlines]

--------------------------------------------------------------

Northbrook, Illinois-- Adopt-a-Dog

Reed

Animal ID 11709013

Retriever, Labrador/Mix

1 year 5 months

Male

Size Medium

Color Black

Spayed/Neutered

Declawed No

Housetrained Yes

No Cats

Intake Date 11/30/2010

Adoption Price $225.00

" The first thing you will notice about Reed is his eyes. He has the most amazingly beautiful eyes! Reed's owner was heartbroken to have to surrender Reed to Heartland due to allergies in the household, but we know Reed will find a happy home.

“He is an energetic and playful 1 year old Labrador Retriever/Spaniel mix who likes to cuddle after playtime. He really loves to see the other dogs at the shelter. Reed loves play with toys and playing fetch with his friends. He also loves running up and down the agility ladder out in the play yard.

Reed attended a month long training boot camp as a puppy and is very well-behaved. He has lifetime agility, training, obedience classes at K9 University in Chicago where he had his puppy boot camp.”

How to adopt:

http://www.heartlandanimalshelter.net/How2Adopt.html

Location:

Heartland Animal Shelter is located at

2975 Milwaukee Ave. Northbrook, IL. 60062

Phone: 847-296-6400

Fax: 847-296-4198

Hours:

Mon: CLOSED

Tues: 4-7pm

Wed: CLOSED

Thur: 4-7pm

Fri: 4-7pm

Sat: 12pm-4pm

Sun: 12pm-4pm

Email Us!: heartlandanimals@yahoo.com

Adopt-a-Pet by Leasing Co. State/City

http://www.leasingnews.org/Conscious-Top%20Stories/Adopt_Pet.htm

Adopt a Pet

http://www.adoptapet.com/

[headlines]

----------------------------------------------------------------

This Day in American History

1776 - Juan Bautista de Anza, one of the great western pathfinders of the 18th century, arrives at the future site of San Francisco with 247 colonists. Anza established a presidio, or military fort, on the tip of the San Francisco peninsula. Six months later, a Spanish Franciscan priest founded a mission near the presidio that he named in honor of St. Francis of Assisi-in Spanish, San Francisco de Asiacutes. The most northerly outpost of the Spanish Empire in America, San Francisco remained an isolated and quiet settlement for more than half a century after Anza founded the first settlement. It was not until the 1830s that an expansionist United States began to realize the commercial potential of the magnificent natural harbor. In the wake of the Mexican War, the U.S. took possession of California in 1848, though San Francisco was still only a small town of 900 at that time. With the discovery of gold that year at Sutter's Fort, however, San Francisco boomed. By 1852, San Francisco was home to more than 36,000 people. The founder of San Francisco did not live to see it flourish. After establishing the San Francisco presidio, Anza returned to Mexico. In 1777, he was appointed governor of New Mexico

1788-- Maryland becomes the seventh state in what will become the United States of America. It is named in honor of Queen Henrietta Maria, wife of King Charles I of England.

1799-New York State abolished slavery

1811-Saint John Nepomucene Neuman, first male saint of the US. Born at Prachatice, Bohemia, came to the US in 1836. As Bishop of Philadelphia, he was affectionately known as the "Little Bishop." Died at Philadelphia, PA, Jan 5, 1860. Beatified Oct 13, 1963. Canonized June 19, 1977

1834- The Senate passed a resolution sponsored by Senator Henry Clay of Kentucky to censure President Andrew Jackson for his handling of the Bank of the United States, "...assumed upon himself authority and power not conferred by the constitution and laws..." President Jackson on April 1 signed a president resolution against the Senate for censuring him. He succeeded in having them removed from the Senate journal in the following year.

1848- Ohio became the first state to regulate working hours, fixing the maximum of ten hours per day for women and children under 18 years of age. New Hampshire had set a similar provision in 1847, but had a provision that both parties had to agree, as a result the law was ineffective.

1862- at Pigeon's Ranch, a stagecoach stop on the Santa Fe Trail (about 19 miles southeast of Santa Fe, NM), Confederate forces briefly prevailed over Union troops in what some have called the most important battle of the Civil War in the Southwest. It was feared that if Union troops failed to hold here, the confederate forces would proceed to Fort Union and on to control of the rich gold fields of Colorado and California.

1881-P .T. Barnum and James A. Bailey merged their circuses to form the "Greatest Show on Earth."

1882--Birthday of Frances Elliott Davis - U.S. nurse and community leader; broke the color line of the American National Red Cross nursing staff and administration.

1884 -- Cincinnati townspeople, unhappy authorities had not handed out a severe enough punishment to confessed murderer William Berner, show their displeasure by burning down the local courthouse. The State Militia is called out to restore order; in the ensuing battle, 42 were killed & 128 injured.

1890-bandleader Paul Whiteman born Denver, Colorado

http://www.redhotjazz.com/pwo.html

1899-August Adolphus “ Gussie” Busch, Jr., baseball executive born at St. Louis, MO. Busch bought the St. Louis Cardinals in 1953 and became one of the most influential team owners. He tied the success of the sport to the growth of his brewery’s sales and took great pleasure in both. Died at St. Louis, September 29, 1989. http://memory.loc.gov/ammem/today/mar28.html

1909 -- Novelist Nelson Algren (A Walk on the Wild Side) born (1909-1981), Detroit, Michigan. Grew up in Chicago in a poor Polish neighborhood, served a four-month jail term for stealing a typewriter. Algren joined John Reed Club & was editor of the New Anvil, an experimental magazine. Heavy drinker and gambler, involved with Simone de Beauvoir. “Never play cards with a man called Doc. Never eat at a place called Moms. Never sleep with a woman whose troubles are worse than your own.”

http://www.kirjasto.sci.fi/nalgren.htm

1917 - Thane Creek, AK, reported a snow cover of 190 inches.

1920 - The worst tornado disaster of record occurred in Chicago IL as a tornado killed 28 persons and caused three million dollars damage.

1921- President Warren Harding names former US President William Howard Taft as chief justice of the United States.

1922-the microfilm reading device was invented by Bradley Allen Fiske of Washington, DC, who received a patent on a “reading machine.” It was known as a Fiskeoscope and could be carried in the pocket. A 2.5-inch newspaper column was reduced to .025 inches and 100,000 words were contained on a 40-inche tape.

1923—Trumpet player Thad Jones Birthday

http://musichistory.crosswinds.net/jazz/tjones.html

1926---Birthday of Blossom Dearie, famous jazz supper club style singer, pianist, and recording artist. Her mother, a Norwegian immigrant, also played the piano.

1926--Birthday of Harper Lee, perhaps best known recently as a close friend of Truman Capote. She wrote only one novel, To Kill A Mockingbird which won the 1961 Pulitzer Prize for Fiction and a cash prize of $500.

It was made into a successful Hollywood movie which won Gregory Peck an Oscar and Best Picture of the Year.

1934--Birthday of Lopis Duncan - U.S. author, primarily of children's books.

1941--Birthday of Ann-Margaret (Olsson) - Swedish-born American actor and singer. She received a 1971 Academy Award nomination for her work in the cult film Carnal Knowledge. Perhaps best known for accompanying Bob Hope and his troupe to military bases during Viet Nam, very popular with the soldiers not just for her looks but for her attention and recognition to them after the war. The story circulating the internet that At a book signing, actress Ann-Margaret autographed a tattered photo presented to her by an ex-G.I. and thanked him for serving his country is true.

http://www.snopes.com/politics/military/margret.asp

1944-“Rick” Barry III, broadcaster and Basketball Hall of Fame forward, born Elizabeth, NJ.

1945- A record heat wave hit the northeast, bringing temperatures of 90 degrees in Rhode Island and 91 degrees in New York, Pennsylvania and Maryland.

1950-The City College of New York (CFCNY) defeated Bradley, 71-68, in the title game of the NCAA basketball tournament, thereby becoming the only team to win both that championship and the NIT title in the same year. Ten days before, CCNY had beaten Bradely, 69-61 to win the NIT.

1951 - No. 1 Billboard Pop Hit: ``If,'' Perry Como.

1951---Top Hits

If - Perry Como

Be My Love - Mario Lanza

Mockingbird Hill -Patti Page

The Rhumba Boogie - Hank Snow

1957, the first National curling championship competition was held on March 28-30 at the Stadium Club in Chicago, IL, with 10 teams competing. The winner was the Hibbin Curling Club fro Hibbing, MN, which won eight games and lost one.

1952--MATTHEWS, DANIEL P. Medal of Honor

Rank and organization: Sergeant, U.S. Marine Corps, Company F, 2d Battalion, 7th Marines, 1st Marine Division (Rein.). Place and date: Vegas Hill, Korea, 28 March 1953. Entered service at. Van Nuys, Calif. Born: 31 December 1931, Van Nuys, Calif. Award presented: 29 March 19S4. Citation: For conspicuous gallantry and intrepidity at the risk of his life above and beyond the call of duty while serving as a squad leader of Company F, in action against enemy aggressor forces. Participating in a counterattack against a firmly entrenched and well-concealed hostile force which had repelled 6 previous assaults on a vital enemy-held outpost far forward of the main line of resistance Sgt. Matthews fearlessly advanced in the attack until his squad was pinned down by a murderous sweep of fire from an enemy machine gun located on the peak of the outpost. Observing that the deadly fire prevented a corpsman from removing a wounded man lying in an open area fully exposed to the brunt of the devastating gunfire, he worked his way to the base of the hostile machine gun emplacement, leaped onto the rock fortification surrounding the gun and, taking the enemy by complete surprise, single-handedly charged the hostile emplacement with his rifle. Although severely wounded when the enemy brought a withering hail of fire to bear upon him, he gallantly continued his valiant l-man assault and, firing his rifle with deadly effectiveness, succeeded in killing 2 of the enemy, routing a third, and completely silencing the enemy weapon, thereby enabling his comrades to evacuate the stricken marine to a safe position. Succumbing to his wounds before aid could reach him, Sgt. Matthews, by his indomitable fighting spirit, courageous initiative, and resolute determination in the face of almost certain death, served to inspire all who observed him and was directly instrumental in saving the life of his wounded comrade. His great personal valor reflects the highest credit upon himself and enhances the finest traditions of the U.S. Naval Service. He gallantly gave his life for his country.

1958- Eddie Cochran records "Summertime Blues."

1958- Alan Freed's Big Beat Show tour kicks off the first of its 43 shows at the Brooklyn Paramount Theater with Buddy Holly, Jerry Lee Lewis, Chuck Berry, Danny and the Juniors, Frankie Lymon and the Teenagers, The Chantels, The Diamonds, Screaming Jay Hawkins, and more.

1959---Top Hits

Venus - Frankie Avalon

Tragedy - Thomas Wayne

Come Softly to Me - The Fleetwoods

Don’t Take Your Guns to Town - Johnny Cash

1964-Madame Tussaud's Wax Museum in London announces the Beatles will be cast in wax, the first pop album stars to be honored.

1965 -- Martin Luther King, Jr., on TV calls for boycott buses and trains (I believe) in Alabama. March 21 he and John Lewis of the Student Nonviolent Coordinating Committee (SNCC-we pronounced “snick”- started a five-day civil rights march from Selma to Montgomery, Alabama, with 3,200 marches. Part of this I covered by radio from San Francisco, actually speaking with small town police dispatchers who were surprised that a radio station in San Francisco was interested in the "demonstration," one of the words used. At the end, 25,000 gathered in demonstrations at the front of the state capitol in Montgomery. The police and sheriff, and apparently the majority of the citizens were against Dr. King, Jr. and his followers. There was a San Francisco group from SNCC who also would call from telephone booths at the end of the day. The day before Dr. King, Jr. appeal on television ( not the media it is today primarily due to the technocracy of the day), Viola Greeg Liuzzo, a civil rights worker from Detroit,

Michigan was shot and killed in Selma, Alabama.

http://www.thatsalabama.com/civilwrongs/violaliuzzo/

1965- President Lyndon Johnson appeared on television, flanked by FBI Director J. Edgar Hoover and Attorney General Nicholas Katzenbach, and announced the arrests of four Klansmen in connection with the Liuzzo murder. President Johnson stated:

Due to the very fast and the always efficient work of the special agents of the FBI who worked all night long immediately after the tragic death of Mrs. Viola Liuzzo on a lonely road between Selma and Montgomery, Alabama, arrests were made a few minutes ago of four Ku Klux Klan members . . . charging them with conspiring to violate the civil rights of the murdered woman. After naming the arrested Klansmen, the President continued: I cannot express myself too strongly in praising Mr. Hoover and the men of the FBI for their prompt and expeditious and very excellent performance in handling this investigation. It is in keeping with the dedicated approach that this organization has shown throughout the turbulent era of civil rights controversies.

New York Times, March 27, 1965.

One of the arrested Klansmen, Gary Rowe, later surfaced as an undercover FBI informant. Rumors that one of the Klansmen was an informant began to circulate when a federal grand jury indicted only three of the Klansmen, and were confirmed when the informant testified, under heavy guard, before the Alabama grand jury. On Rowe's testimony, the state grand jury returned murder indictments against the three other men who were in the car.

Three criminal trials resulted from the Liuzzo murder: two murder trials in the state courts and one federal conspiracy trial. Only one of the three indicted Klansmen was tried on the murder charge, Collie LeRoy Wilkins. His first trial resulted in a hung jury, and the second in an acquittal. All three Klansmen were successfully prosecuted on the federal charge of conspiring to violate Mrs. Liuzzo's civil rights, and, on verdicts of guilty, each received the maximum sentence.

Gary Rowe testified at all three trials, and related both the background of his involvement with the Ku Klux Klan and the FBI, and his version of the events which took place on March 25. Rowe testified that he was approached by an FBI agent in 1960 or 1961 and was asked to infiltrate the Klan. His duties, he stated, were to "keep up with" any violent actions, and to report to the FBI on the men whom he met in his undercover work.

http://www.icdc.com/~paulwolf/cointelpro/law/liuzzovus485FSupp1274.htm

Note: A book is available on this: The Informant: The FBI, the Ku Klux Klan, and the Murder of Viola Liuzzo

http://www.amazon.com/gp/product/0300106351/ref=cap_pdp_dp_0/

104-8250829-9266338

1966--INGRAM, ROBERT R. Medal of Honor

For conspicuous gallantry and intrepidity at the risk of his life above and beyond the call of duty while serving as Corpsman with Company C, First Battalion, Seventh Marines against elements of a North Vietnam Aggressor (NVA) battalion in Quang Ngai Province Republic of Vietnam on 28 March 1966. Petty Officer Ingram accompanied the point platoon as it aggressively dispatched an outpost of an NVA battalion. The momentum of the attack rolled off a ridge line down a tree covered slope to a small paddy and a village beyond. Suddenly, the village tree line exploded with an intense hail of automatic rifle fire from approximately 100 North Vietnamese regulars. In mere moments, the platoon ranks were decimated. Oblivious to the danger, Petty Officer Ingram crawled across the bullet spattered terrain to reach a downed Marine. As he administered aid, a bullet went through the palm of his hand. Calls for "CORPSMAN" echoed across the ridge. Bleeding, he edged across the fire swept landscape, collecting ammunition from the dead and administering aid to the wounded. Receiving two more wounds before realizing the third wound was life-threatening, he looked for a way off the face of the ridge, but again he heard the call for corpsman and again, he resolutely answered. Though severely wounded three times, he rendered aid to those incapable until he finally reached the right flank of the platoon. While dressing the head wound of another corpsman, he sustained his fourth bullet wound. From sixteen hundred hours until just prior to sunset, Petty Officer Ingram pushed, pulled, cajoled, and doctored his Marines. Enduring the pain from his many wounds and disregarding the probability of his demise, Petty Officer Ingram's intrepid actions saved many lives that day. By his indomitable fighting spirit, daring initiative, and unfaltering dedications to duty, Petty Officer Ingram reflected great credit upon himself and upheld the highest traditions of the United States Naval Service.

1967 – “Raymond Burr starred in a TV movie titled "Ironside". The show, about a wheelchair-bound detective, became very popular as a weekly series in the spring of 1967. Burr, known to millions as determined lawyer, "Perry Mason" (a past TV hit), played the part of Robert Ironside in the new show. He was joined by characters, Detective Sgt. Ed Brown (Don Galloway), Eve Whitfield (Barbara Anderson), Mark Sanger (Don Mitchell) and Commissioner Dennis Randall (Gene Lyons).

http://timstvshowcase.com/ironside.html

1967---Top Hits

Happy Together - The Turtles

Dedicated to the One I Love - The Mamas & The Papas

There’s a Kind of Hush - Herman’s Hermits

I Won’t Come in While He’s There - Jim Reeves

1968-the controversial rock musical Hair, produced by Michael Butler. opened at the Biltmore Theatre at New York City , after playing off-Broadway. For those who opposed the Vietnam War and the "Establishment," this was a defining piece of work-as evidenced by some of its songs, such as "Aquarius," "Flair" and "Let the Sunshine In."

1968 - No. 1 Billboard Pop Hit: ``(Sittin' on) The Dock of the Bay,'' Otis Redding. The song reaches No. 1 three months after Redding is killed in a plane crash near Madison, Wis.

1969 - Joe Cocker played his first American concert. He entertained fans at Billy Graham’s Fillmore East

in New York City

1970-Crosby, Stills, Nash and Young's "Woodstock" is released.

1970-Vietname Moratorium Concert: a seven-hour concert at Madison Square Garden at New York City featured many stars who donated their services for the antiwar cause. Among them were Jimi Hendrix; Dave Brubeck; Harry Belafonte; Peter, Paul and Mary; Judy Collins; the Rascals; Blood, Sweat and Tears and the Broadway cast of Hair.

1971 - No. 1 Billboard Pop Hit: ``Just My Imagination (Running Away with Me),'' The Temptations.

1973-Wilt Chamberlain retired from the NBA after playing in 1,045 games. During his entire 14-season career, Chamberlain never fouled out.

1974 - A streaker (i.e.: someone running around naked), ran onto the set of "The Tonight Show starring Johnny Carson". The clever NBC censors decided to blackout the lower half of the TV screen on the videotape to prevent an ‘X’ rating. The streaker was arrested, but released, for "lack of evidence," said Johnny.

1974- "Hooked on a Feeling" by Blue Swede turns gold. The band's novel version of the BJ Thomas' 1968 song hits Number One next month.

1974 - The Raspberries split up. The group's biggest hit is ``Go All the Way,'' which went all the way to No. 5 on Billboard's Hot 100 in 1972.

1975-- Barbra Streisand attends tonight's Elvis Presley show in Vegas and meets the King backstage to discuss offering him the lead role in her latest film project: a remake of the classic A Star Is Born. Despite the fact that Streisand's boyfriend, stylist Jon Peters, is slated to produce and direct, Presley is said to be ecstatic about the project.

1975---Top Hits

My Eyes Adored You - Frankie Valli

Lady Marmalade - LaBelle

Lovin’ You - Minnie Riperton

Before the Next Teardrop Falls - Freddy Fender

1977 – 49th Annual Academy Awards presentation at Dorothy Chandler Pavilion in Los Angeles, hosted by a cast of four (Warren Beatty, Ellen Burstyn, Jane Fonda, and Richard Pryor), "Rocky" collected Oscars for Best Picture (Irwin Winkler, Robert Chartoff, producers); Best Director (John G. Avildsen); and Film Editing (Scott Conrad, Richard Halsey). "Network" hauled in the gold for Best Actor (Peter Finch); Actress (Faye Dunaway); Supporting Actress (Beatrice Straight); and Writing (Paddy Chayefsky). "All the President’s Men" was given awards for Best Supporting Actor (Jason Robards); Art Direction (George Jenkins); Set Direction (George Gaines); Sound (Dick Alexander, Les Fresholtz, Arthur Piantadosi, Jim Webb); and Writing (William Goldman). The Best Music/Song Oscar-winner titles are memorable too: Barbra Streisand (music) and Paul Williams (lyrics) for "Evergreen (Love Theme from A Star Is Born)" from

"A Star is Born".

http://www.infoplease.com/ipa/A0149362.html

1979-Three Mile Island nuclear reactor complex near Middletown, PA sustained a major accident, the first of its kind. Homes in nearby neighborhoods were evacuated after the reactor suffered a loss of coolant and a partial core meltdown caused by a series of equipment failures and human errors.

1980-although springtime was starting in the Rocky Mountains, the snow just kept on coming! One foot or more of snow fell over portions of eastern Colorado, southwest Nebraska, northwest Kansas and southeastern Wyoming. Winds reached 40 mph and Valentine, Nebraska received 13 inches of snow. North Platte, Nebraska checked in with 15 inches.

1983---Top Hits

Billy Jean - Michael Jackson

Do You Really Want to Hurt Me - Culture Club

Hungry like the Wolf - Duran Duran

Swingin’ - John Anderson

1984-With little or no warning, the Baltimore Colts loaded moving vans in the dead of night and left for Indianapolis. Baltimore was left without an NFL team until 1996 when the Cleveland Browns moved there and were renamed the Ravens.

1984-- Mick Fleetwood, whose band, Fleetwood Mac, had the biggest-selling album of all time just seven years earlier, files for bankruptcy.

1985-- At 10:15 am EST, 6,000 North American radio stations begin playing the all-star benefit single, "We Are The World," written by Michael Jackson and Lionel Richie and performed by a cast of 45 of music's biggest stars, including Ray Charles, Bob Dylan, Bruce Springsteen, Stevie Wonder, Paul Simon, Diana Ross, Billy Joel, Tina Turner, Dionne Warwick, Willie Nelson, and Daryl Hall. Proceeds from the sale of the single and related items -- some $38 million -- go to benefit victims of the recent Ethiopian famine.

1985 - Bill Cosby broke more records with "The Cosby Show" on NBC-TV. The program was the highest-rated program of any network series since 1983. "The Cosby Show" became the highest-rated series since 1978 when "Mork and Mindy", starring Robin Williams and Pam Dawber, premiered on ABC.

http://freespace.virgin.net/lol.marcus/cosby.htm

http://timstvshowcase.com/billcosby.html

1984 -severe thunderstorms in the southeastern US spawned 36 tornadoes which tore paths of devastation across the Carolinas during the afternoon and evening hours killing 59 people and injuring 1248 others. One tornado near Tatum, South Carolina, an F4 on the Fujita scale, was 2.5 miles wide at one point. This outbreak was the worst in the area in 60 years.

1986 - No. 1 Billboard Pop Hit: ``Rock Me Amadeus,'' Falco. The Austrian singer says he was inspired to write the song about Wolfgang Amadeus Mozart after seeing the movie ``Amadeus.''

1987 - The second blizzard in less than a week was in progress across the central plains. 16 inches of snow was recorded at Blue Hill, Nebraska and 14 inches piled up at Omaha, Nebraska. 12 to 18 inches of snow was common across northwestern Kansas. Winds gusting up to 70 mph whipped drifts 20 to 30 feet high in some places. The storm took a great toll on cattle as well.

1989-softball pitchers Cathy McAllister and Stefni Whitton of Southwestern Louisiana performed a feat unprecedented in NCAA history by throwing back-to-back perfect games against Southeaster Louisiana. McAllister won, 5-0, and Whitten struck out 14 to winning 7-0.

1990 –62nd Annual Academy Awards, staged at the Dorothy Chandler Pavilion, Los Angeles, with Billy Crystal as host. Academy of Motion Picture Arts and Sciences (AMPAS) members voted "Driving Miss Daisy" the Best Picture of 1989 (Richard D. Zanuck, Lili Fini Zanuck, producers). The Best Director Oscar was won by Oliver Stone for "Born on the Fourth of July". Best Actor was Daniel Day-Lewis for "My Left Foot" and Best Actress was Jessica Tandy in "Driving Miss Daisy" (the 80-year-old actress was a favorite to win). Oscars for Actor and Actress in a Supporting Role went to Denzel Washington ("Glory") and Brenda Fricker ("My Left Foot"), respectively. Best Music/Song winners were Alan Menken (music), Howard Ashman (lyrics) for "Under the Sea" from "The Little Mermaid". You’re probably still humming this tune from that full-length animated film from Walt Disney Studios. Other popular 1989 films that were honored as nominees or winners include: "Field of Dreams"; "Indiana Jones and the Last Crusade"; "Back to the Future Part II"; "Lethal Weapon II"; "Batman"; "Dead Poets Society"; "When Harry Met Sally"; and "Sex, Lies, and Videotape".

http://www.infoplease.com/ipa/A0149769.html

1991---Top Hits

One More Try - Timmy -T-

Coming Out of the Dark - Gloria Estafan

This House - Tracie Spencer

Loving Blind - Clint Black

1992- 1.6 inches of snow fell on this date at Syracuse, New York. This brought the seasonal snowfall total to 162.8 inches which set a new all-time seasonal snowfall record for the location. The old seasonal record was 162.0 inches set back in the winter of 1989-90.

1996- Williamsport, Pennsylvania recorded .8 inches of snow on this day to bring its seasonal snowfall total to 83.9 inches -- the city's snowiest winter ever.

1996-- Twenty years to the day after first appearing with them on stage as their new lead singer, Genesis front man Phil Collins announces he is leaving the group.

NCAA Basketball Champions This Date

1942 Stanford

1944 Utah

1950 CCNY

1977 Marquette

[headlines]

-------------------------------------------------------------

SuDoku

The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler?

http://leasingnews.org/Soduku/soduko-main.htm

[headlines]

--------------------------------------------------------------

Daily Puzzle

How to play:

http://www.setgame.com/set/puzzle_frame.htm

Refresh for current date:

http://www.setgame.com/set/puzzle_frame.htm

[headlines]

--------------------------------------------------------------

http://www.gasbuddy.com/

http://www.gasbuddy.com/GB_Map_Gas_Prices.aspx

http://www.gasbuddy.com/GB_Mobile_Instructions.aspx

[headlines]

--------------------------------------------------------------

Weather

See USA map, click to specific area, no commercials

http://www.weather.gov/

[headlines]

--------------------------------------------------------------

Traffic Live---

Real Time Traffic Information

You can save up to 20 different routes and check them out with one click,

or type in a new route to learn the traffic live

--------------------------------

[headlines] |

![]()

![]()

![]()

![]()

![]() Add me to mailing list |

Add me to mailing list | ![]() |

| ![]() Search |

Search | ![]() Stress Release

Stress Release![]()

![]()