![]() Add me to mailing list |

Add me to mailing list | ![]() Change email |

Change email | ![]() |

| ![]() Search

Search

Advertising | All Lists | Archives | Classified Ads | This Day In American History

Leasing News is a web site that posts information, news, and

entertainment for the commercial bank, finance and leasing industry

kitmenkin@leasingnews.org

![]()

National Sales Representatives

axiscapitalinc.com |

Wednesday, May 14, 2014

Today's Equipment Leasing Headlines

Classified Ads---Credit

Northern Leasing Brings up $2 Million Bond re:

Ascentium New York Court of Appeals Case

By Tom McCurnin, Leasing News Legal Editor

Element Tops $1 billion in Q1 Originations

to Deliver $0.10 Adjusted Operating EPS

Financial Pacific Leasing Updates

Funder/Looking for Brokers/Story Credits

Classified Ads---Help Wanted

NAELB Leasing School Joins

Leasing Schools/Franchisors List

Sales Make it Happen – by Scott Wheeler

Building an Effective Sales Team

Big banks struggled to grow loans in Q1,

but reasons for optimism

Earnings Scorecard for Top 25 US Bank/Thrifts

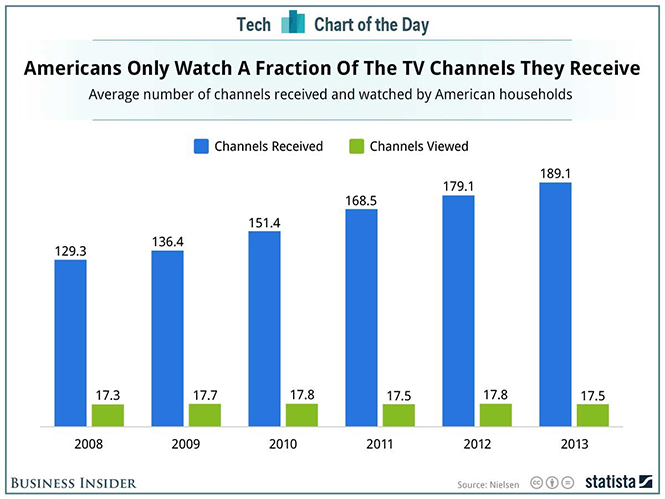

Chart -We Only Watch Fraction of TV Channels

FDIC $96.6 Million Sallie Mae Settlement

Labrador Retriever Mix

Murray, Utah Adopt-a-Dog

News Briefs---

Is IT Being Shut Out of Key Tech Decisions?

A Changing Shape in America’s Age Distribution

Broker/Funder/Industry Lists | Features (collection)

Top Ten Stories Chosen by Readers | Top Stories last six months

www.leasingcomplaints.com (Be Careful of Doing Business)

www.evergreenleasingnews.org

You May have Missed---

SparkPeople--Live Healthier and Longer

Poem

Sports Briefs---

California Nuts Brief---

"Gimme that Wine"

This Day in American History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

######## surrounding the article denotes it is a “press release”

and was not written by Leasing News nor information verified, but from the source noted. When an article is signed by the writer, it is considered a “by line.” It reflects the opinion and research of the writer.

Please send to a colleague and ask them to subscribe.

We are free.

[headlines]

--------------------------------------------------------------

Northern Leasing Brings up $2 Million Bond re:

Ascentium New York Court of Appeals Case

By Tom McCurnin

Leasing News Legal News Editor

(Leasing News received a telephone call from Northern Leasing Systems Corporate office, the large P.O.S. lessor, complaining about Mr. McCurnin’s original column, then Mr. McCurnin received a call from Northern’s attorney, who wanted the story “set straight.” Ascentium Capital was asked for a comment, but did not want to make any, until “after the case was closed.”

(The case involved two leasing pools, as well as the reporting on leases that were being paid on time. As Mr. McCurnin wrote in the original article, “Northern Leasing failed to pay the shortfall from the pools, failed to repurchase the pools, and also failed to provide servicer reports. On November 21, 2013, judgment was entered against Northern Leasing for $1.7 million dollars. Ascentium moved the Court for an injunction preventing Northern from diverting funds from another pool which Ascentium claimed cross-collateralized the two pool agreements at issue.”

(At this time, there also is a case in the Supreme Court of the State of New York underway, basically a class action suit continuing since June 30, 2009 versus Northern Leasing Systems, Inc., Jay Cohen, Steve Bernardone, Rich Hahn, and Sara Krieger, which Leasing News is following (1). Ironically one of the legal expert witnesses for the plaintiff is Randy Brooks, retired FTC Lawyer, 2007 Leasing Person of the Year. (2) (Editor)

Northern Leasing Defaulted on Its Securitization Pool Agreement and

Judgment Was Entered Against It. However, Northern Leasing Posted

a $2 Million Dollar Bond, So In Theory, Enforcement Procedures Should

Be Stayed on One Pool. The Case Continues.

Ascentium v Northern Leasing Court of Appeals No. 650481/20012

Monday, May 12, 2014: Leasing News reported the odd story of Northern Leasing Systems, Inc., New York City, which securitized a number of leasing pools with Ascentium Capital, Kingwood, Texas.(3) The leasing revenue did not meet projections, and there existed a shortfall. Ascentium claimed that Northern didn’t pay the shortfall, and Northern apparently claimed that it didn’t have to pay it. Ascentium sued. Northern still refused to pay. Ascentium took the matter to Summary Judgment. A Judgment was entered against Northern Leasing. Northern Leasing still refused to pay, and appealed the Judgment to the New York Court of Appeals, filing a $2 million dollar appeal bond in the process. The service agreement between the parties, part of the basis for the complaint, was also in contention.

Ascentium turned up the heat, and claimed that the particular lease pool was cross-collateralized. Ascentium was entitled to the monies which were being diverted from that pool. In addition, Ascentium claimed that Northern Leasing was not providing servicer reports. A New York Judge ruled against Northern Leasing, issuing a Preliminary Injunction requiring Northern Leasing to pay the diverted funds---and to further provide servicing reports.

The point of the article was two-fold. First, I questioned why the borrower, Northern was appointed servicer. Typically, I like see a neutral party, like US Bank, appointed servicer for the pool, with the borrower appointed sub-servicer. This way, the whole injunction thing could have been avoided. Second, I questioned the appropriateness of a borrower biting the hand that feeds it. Pool money is still tight, and to require a funder to sue to get its money is simply not going to enhance the reputation of any leasing company.

Late last week, the New York Court of Appeals entered the fray, staying (freezing) the injunction the trial court previously issued, which required Northern to pay diverted funds and to account for the receipts of the lease pool. The reason, although unstated by the Court of Appeals, certainly has to do with the filing of the appellate bond.

In most states, the filing of an appellate bond stays, or freezes, all collection activity on the judgment. So, at least on that score, the trial judge may have overstepped his authority in granting that injunction, hence the interim correction by the New York Court of Appeals. There also may be items about the second pool or other pools, although not covered in the Summary. (4)

In reading the papers, the other question I had, relative to the injunction, was the appropriateness of it from the start. Typically, injunctions are rare, often disfavored extreme remedies where money damages are insufficient to compensate the plaintiff. But in this case, Northern posted a $2 million dollar bond, so there is an assured pot of gold at the end of the rainbow. So why did Ascentium file for the injunction in the first place?

None of the players or their lawyers would comment, but the tone of the Court’s decision reflects an angry judge. Northern must have done something to tick off that trial judge. In addition, the fact that Northern is giving Ascentium the “middle finger salute” on the Pooling Agreement obligation certainly angered Ascentium, which might explain why Ascentium sought the injunction.

Lingering questions remain about this case:

First, and I want to emphasize this: never, ever, have the borrower be its own servicer. The lender should appoint a servicer, and have the borrower be a sub-servicer. Better yet, have the Lease Pool placed into a Bankruptcy Remote Entity, so that the borrower loses control over the Pool in the event of a default.

Second, the trial judge may have made a mistake on the injunction, perhaps goaded by parties or their counsel. The tone of the decision reflects a judge who is noticeably angry at Northern Leasing. This was not explained, but was quite evident by his tone and judgment.

Third, why bite the hand that feeds you? Securitization money is tight now, although it has loosened up considerably from 2008. So why would Northern enter into a series of securitization pools, default, and force the lender to sue, and now fight it out in the very public arena of the appellate courts? I just don’t understand why a leasing company would want to play out this game in an open court for all other lenders to know about. It’s a small world.

- New York Class Action Case

http://www.leasingnews.org/PDF/Firstfiling52014.pdf - Leasing Person of the Year for 2007 Randall H. Brook

http://www.leasingnews.org/archives/January%202008/01-07-08.htm#lpy - Northern Leasing Found to Have Diverted Proceeds from Lease Servicing Pool By Tom McCurnin

http://leasingnews.org/archives/May2014/5_12.htm#northern - Summary Statementhttp://www.leasingnews.org/PDF/AscentiumCapitalOrder52014.pdf

Tom McCurnin is a partner at Barton, Klugman & Oetting in Los Angeles, California.

Tom McCurnin

Barton, Klugman & Oetting

350 South Grand Ave.

Suite 2200

Los Angeles, CA 90071

Direct Phone: (213) 617-6129

Cell (213) 268-8291

Email: tmccurnin@bkolaw.com

Visit our web site at www.bkolaw.com

Previous Tom McCurnin Articles:

http://www.leasingnews.org/Conscious-Top%20Stories/leasing_cases.html

|

[headlines]

--------------------------------------------------------------

Classified Ads---Credit

(These ads are “free” to those seeking employment or looking

to improve their position)

Credit, syndication, workout experience |

| Orlando, Florida As a Commercial Credit Analyst/Underwriter, I have evaluated transactions from sole proprietorships to listed companies, across a broad spectrum of industries, embracing a multitude of asset types. Sound understanding of balance sheet, income statement and cash flow dynamics which impact credit decisions. Strong appreciation for credit/asset risk. rpsteiner21@aol.com 407 430-3917 |

Free Posting for those seeking employment in Leasing:

http://www.leasingnews.org/Classified/Jwanted/Jwanted-post.htm

All “free” categories “job wanted” ads:

http://www.leasingnews.org/Classified/Jwanted/Jwanted.htm

[headlines]

--------------------------------------------------------------

####Press Release ###############################

Element Tops $1 billion in Q1 Originations

to Deliver $0.10 Adjusted Operating EPS

Strategic acquisitions and strong US demand deliver more than $2 billion of new business in the last two quarters

Free operating cash flow increased to $0.14 per share from $0.12 per share in the previous period

Aviation pipeline rebuilds to $2.4 billion from $1.5 billion at the end of 2013

Adjusted OPEX continues to decline to 2.22% from 2.26% in Q4

TORONTO, Ontario, - Element Financial Corporation (TSX:EFN) (“Element” or the “Company”), one of North America’s leading equipment finance companies, reported financial results for the three-month period ending March 31, 2014 with record originations of $1.1 billion contributing to a 27 percent increase in the Company’s total earning assets to $3.8 billion as at March 31, 2014 versus $3.0 billion as at December 31, 2013. After tax adjusted operating income increased by 37 percent to $20.7 million in the three-month period ending March 31, 2014 versus $15.0 million in the preceding period producing $0.10 of after tax adjusted operating earnings per share for the period in line with the consensus of analysts’ estimates.

For more information, please see attached or visit us at www.elementfinancial.ca.

##### Press Release ############################

Bookmark us

[headlines]

--------------------------------------------------------------

![]()

Updates

Funders List “A”

Funders Looking for Broker Business

Store Credits

“Financial Pacific Leasing is a subsidiary of Umpqua Bank. FinPac has been in business since 1975, and supports a nationwide network of Third Party Originators. Our small ticket group funds transactions ($5,000 - $100,000) "A" to "C" credits. Our commercial group funds transactions ($100,000 - $500,000) for “A” credits. We are a strong and stable company committed to the Third Party channel. A relationship with Financial Pacific can enhance your vendor/origination relationships by broadening your credit window. To Qualify - Please Call or see "Prospective Third Party Originators" section on www.finpac.com.”

Financial Pacific Leasing |

140 |

USA and Canada |

$5,000-$500,000 |

Y |

Y |

Y |

Y |

Y |

A -Accepts Broker Business | B -Requires Broker be Licensed | C -Sub-Broker Program | D -"Private label Program" | E - Also "in house" salesmen

Funder List "A"

http://www.leasingnews.org/Funders_Only/Funders.htm

Funders Looking for New Broker Business

http://www.leasingnews.org/Funders_Only/New_Broker.htm

Story Credit Lessor

http://www.leasingnews.org/Funders_Only/New_Broker.htm

[headlines]

--------------------------------------------------------------

Leasing Industry Help Wanted

We are looking to grow our sales team! CalFirst is seeking seasoned sales professionals to join our sales team in Irvine, CA. Our sales professionals are responsible for originating equipment leasing and |

National Sales Representatives

axiscapitalinc.com |

For information on placing a help wanted ad, please click here:

http://www.leasingnews.org/Classified/Hwanted/Hwanted-post.htm

Please see our Job Wanted section for possible new employees.

[headlines]

--------------------------------------------------------------

NAELB Leasing School Joins

Leasing Schools/Franchisors List

Leasing Schools/Franchisors

(For our "Financial and Sales Training" list, please click here)

| Global Leasing |

| Lease One |

| NAELB |

| Wheeler Leasing School |

(does not include those specifically employed in training or education, but who have a similar program as the following entities:)

------------------------------------------------------------------

Global Financial Training Program

Over 35 Years of Experience Financing Businesses

Program Cost: $19,950.00

Phil Dushey

President & CEO

In 2001, Global Leasing founder Phil Dushey created a new company to train independent entrepreneurs who want to enter the lucrative field of business financing. Global Financial Training Program teaches all aspects of finance including Equipment Leasing, Accounts Receivable Financing, Cash Advance, Commercial Real Estate, SBA Loans and much more. Phil’s students have found great success with his program.

Mr. Dushey is a founding member of the National Association of Equipment Leasing Brokers. He has been a member and speaker at many leasing organizations for several years. He is also a founding member of the leasing news advisory board.

Global Financial Training Program provides students with everything they need to start making money immediately after four days of training. As a full-service finance company you will provide a valuable service for business owners that have difficulty getting financing from their local banks. The banks are turning down over 90% of business loan applications and you can approve at least 50% of the turndowns. After the training at their offices in New York City trainees are instantly approved with over 25 lenders, get a custom designed website, stationery package, 1000 leads and enough marketing to have their phones ringing the first week after the training and much more... It's easier than you think to fulfill your dreams of independence, living the life you deserve and enjoying the prestige of owning your own company.

You don't need prior experience. All you need is the desire to be your own boss, the ability to learn, good people skills, and a passion to succeed and make a lot of money.

How much, is up to you...

Philip Dushey

President & CEO

Global Financial Services

1 State Street, 21st Floor

New York NY 10004

Email phil@gbtsinc.com

www.globalfinancialtrainingprogram.com

Phone: 212-480-4900

The Global Group of independently owned companies are:

Global Financial Services | www.globaleasing.com

We have been actively providing financial services for 35 years

Global Church Financing | www.globalchurchfinancing.com

One of the largest independent companies financing equipment for churches nationwide

Global Financial Training Program | www.globalfinancialtrainingprogram.com

The oldest and most comprehensive training program for people who want to own their own finance company

Mr. Dushay is also on the Leasing News Advisory Board

http://www.leasingnews.org/Advisory%20Board/Dushay_Phil.htm

Moving America Forward is a business television show hosted by William Shatner, anchored by Doug Llewellyn. On this episode we talk to Phil Dushey about his business opportunity and Global.

----------------------------------------------------------------------------------------------------------

Lease One, Lynnfield, Massachusetts

Program Cost: $19,900.00

Since 1989 Lease One has been providing superior training along with unprecedented ongoing support to our broker network. With offices from coast to coast we proudly exhibit the foremost training experience available. Our one time initial investment will provide you with the training and support for the lifetime of your venture with no on-going fees (Hotel/Airfare/Materials/Leads are all included in this price).

“The Lease One Opportunity is the only turn key business opportunity that allows you to devote the time necessary to building a business, no need to worry about processing or underwriting your deals; we do it for you, forever! Our unique program is the only one that offers free marketing assistance along with a devoted graphics design department to enable you to creatively attract new customers to your business. Call us today or visit our website (www.leaseoneopportunity.com ) to learn more about this exciting opportunity. We are Lease One; It's the Lease we can do!”

Joseph L. Angelo Jr.

Lease One Corp.

220 Broadway, Suite 102

Lynnfield , MA 01940

www.leaseoneopportunity.com

----------------------------------------------------------------

NAELB Leasing School

Program Cost: $16,950

(Faculty and Staff include Charles “Bud” Callahan, CLP, School

Director, with Linda Kester, Marketing Director,

and Joseph G. Boannano, Esq., CLP, attorney)

http://www.naelbschool.com/bio/

NAELB Leasing School teaches entrepreneurs how to own, operate

and succeed in their own equipment leasing and finance brokerage business.

The National Association of Equipment Leasing Brokers is the only major leasing association to offer an equipment leasing program to become a leasing broker.

The National Association of Equipment Leasing Brokers offers the most comprehensive specialty financial educational symposium in the industry, providing:

• A week long intensive hands-on learning experience with after-hours discussions of real-world leasing situations and valuable course materials including handbooks, industry software and more

• Real-world training by experts in the field (our instructors have been active in the industry for at least 25 years each)

• Training week concludes with FREE admission to the following NAELB Conference, offering the perfect opportunity to expand your networking with lenders, industry service providers and fellow brokers who are eager to provide support as you develop your business

• One full year of mentoring from experienced NAELB brokers who help you navigate the pitfalls and point you toward business solutions

• One full year of membership in the NAELB, the nation’s largest leasing broker association formed by brokers for brokers, and use of all member benefit programs

• Graduates are able to deal directly with multiple quality funding sources -‐ no obligation to split fees with the school or school mentors

Our price is $16,950 (but call 855-‐411-‐ELBS to find out if you qualify for one of our available discounts). Hotel, airfare allowance, meals, NAELB membership, COURSE MATERIALS, INDUSTRY TOOL KITS, and mentorship, are all included at this price.

For more information, please visit www.NAELBSchool.com or call 855-‐411-‐Equipment Leasing Broker School (3527)

---------------------------------------------------------------

Program Cost: $18,500

Overview

Wheeler Business Consulting L.L.C. provides training and continuous support to individuals seeking to enter the leasing/financing industry. The leasing/financing industry provides much needed funds to businesses looking to acquire essential equipment. Entrepreneurs nationwide are originating equipment financing and leasing transactions assisting small, medium and large companies. It is estimated that 80% of all businesses have leased equipment and that nearly one-third of all equipment purchased by corporations is funded by independent finance and leasing agreements.

There are tremendous opportunities to enter the leasing/financing industry. There are few barriers to entry. Individuals who are properly trained, who are networked with local, regional and national funding sources can arrange transactions for their corporate clients in the range of a few thousand dollars to multi-million dollars.

As with most businesses, the establishment of a lease brokering operation is a long term proposition. However, with the proper training, support and encouragement, an individual can start making above average incomes relatively quickly. Within two to five years an individual should expect to generate an income which is well in the six figure range.

With quality training, individuals will be able to offer consistent, high spirited customer service to their commercial clients. Successful lease brokers can build a business from a small home based operation to a full service office in a relatively short period of time.

My goal is to share my thirty plus years of industry experience with others who are serious about learning and succeeding in the leasing/financing industry.

Contact Information:

Wheeler Business Consulting LLC 1314 Marquis Ct.

Fallston, Maryland 21047

Phone: 410-877-0428

Fax: 410-877-8161

email: scott@wheelerbusinessconsulting.com

Website: www.wheelerbusinessconsulting.com

[headlines]

--------------------------------------------------------------

Sales Make it Happen

by Scott Wheeler

With over thirty plus years of leasing experience and an Executive Masters in Business Administration, Scott is an accomplished senior leasing executive with leadership qualities in marketing and operations. His extensive experience will benefit organizations looking to reach a higher level of profitability and corporate development.

Building an Effective Sales Team

The commercial equipment leasing and finance industry is steadily improving. Portfolios are performing historically well with delinquencies at an all-time low, and sales volumes are increasing for individual originators and organizations that are well positioned in the market. Every organization, no matter the size, is working to build a marketing engine that can sufficiently produce more assets at the lowest possible cost. Organizations cannot afford to have 20% of their sales force producing 80% of the volume. Lessors, banks and finance companies must have a greater percentage of their staff producing at the highest levels. Therefore, the commercial equipment leasing/finance industry is faced with a growing demand for top producing originators. Organizations with strong marketing teams will consistently outperform the competition; and will create the greatest market value.

Organizations throughout the industry are expanding their direct sales forces to gain market penetration, increasing their indirect channel partners to grow assets, pursuing portfolio and organizational acquisitions, and are taking an “all of the above” approach in order to increase quality equipment portfolios. All of these assets are ultimately produced by the individual originator in the field, doing what he or she does best – building relationships with the “right” vendors and end-users.

Owners, managers, and team leaders are looking to hire and retain strong originators who can quickly generate more assets. The search is not always easy and having the wrong staff members can be devastating in respect to financial cost and the misallocation of internal resources.

Building a cohesive marketing team requires tenacity, leadership, and determination on the part of management. Non-producers have always been a liability. Today, even average producers can become a drain on an organization. Access to capital is not today’s challenge; the primary challenge for financing and leasing organizations is human capital – having an effective marketing team that can consistently originate the types of assets being sought after by banks, parent companies, investors and funding partners. Top producing originators are a hot commodity.

Experience matters. Industry knowledge and efficiency are required, but consistent results are paramount. Originators with extensive experience and expertise have been able to translate their past success into the new economy; they have embraced new technologies and marketing efficiencies and are outperforming their competition by looking forward, rather than constantly seeking to emulate the past.

Sales managers, owners and team leaders are carefully dissecting their existing sales staff to determine the characteristics that encourage success. They are recruiting, training and coaching their staffs based upon proven selling characteristics and current capabilities. Most importantly, they are leading their teams toward common goals.

Aggressive sales leadership is a hands-on proposition, with the ability to think long term while being committed to participating in the daily process of working new transactions and relationships. Successful managers are the linchpin that allows sales teams to execute the company’s vision.

The strongest sales managers, owners and team leaders are able to attract and retain the talent that complements and aligns with their company’s value proposition. The markets are changing and sales leaders know that the relationships built today will ensure future stability and growth; therefore, building a world class sales team is essential for success.

Wheeler Business Consulting will be facilitating a workshop

“Building an Effective Sales Team,” for sales managers, owners and team leaders on June 4, 2014 in Baltimore Maryland –

In conjunction with the annual NEFA Crab Feast.

For more info link to: http://wheelerbusinessconsulting.com/workshopeffectivesalesteam.html

Scott A. Wheeler

Wheeler Business Consulting

1314 Marquis Ct.

Fallston, Maryland 21047

Phone: 410 877 0428

Fax: 410 877 8161

Web: www.wheelerbusinessconsulting.com

Sales Makes it Happen articles:

http://www.leasingnews.org/Legacy/index.html

|

[headlines]

--------------------------------------------------------------

Big banks struggled to grow loans in Q1,

but reasons for optimism

By Kevin Dobbs and Robin Majumdar

SNL information

After a challenging final quarter of 2013, meaningful loan growth remained difficult for large banks to generate during the first quarter, as a brutal winter crimped economic activity and minimized demand for credit.

Lending declined during the first quarter at four of 10 major banks analyzed by SNL Financial. Among the remaining six, all grew lending less than 2% during the first three months of the year.

U.S. GDP came to a near standstill during the first quarter. The U.S. Department of Commerce, in an initial estimate, pegged growth at just 0.1%.

But as winter thawed and activity resumed in March, bankers reported during earnings season, the economy appeared to bounce back and provide reason to believe loan demand will pick up along with it.

"While economic growth during the first quarter was uneven, economic activity improved later in the quarter, including national auto sales, which reached a seven-year high in March," Wells Fargo & Co. Chairman, President and CEO John Stumpf told analysts after posting a first-quarter profit in April. Wells reported single-digit loan growth during the quarter. "Employment also increased in March for the 42nd consecutive month, one of the longest periods of sustained growth ever, and consumer confidence hit a six-year high."

Sales of new U.S. autos slowed early in 2014 amid the winter-induced crawl, but they did in fact spring back in March and then increased more than 8% in April when compared with a year earlier, according to Autodata Corp. Sales ran at an annual rate of more than 16 million in April, well ahead of actual sales of 15.6 million in 2013.

The American job market bounced back in the spring, too, with nonfarm employment in April growing by a seasonally adjusted 288,000 jobs, the largest monthly gain in more than two years, according to the U.S. Department of Labor. Officials also estimated job growth topped 200,000 in February and March, following much weaker advances in January and in December 2013.

"You do see some growth coming back," Jefferson Harralson, a bank analyst at Keefe Bruyette & Woods Inc., told SNL. "I do think the slowdown we saw was seasonal — because of the weather."

Wells' Stumpf also noted what he views as strong economic underpinnings that could help propel growth as momentum builds — notably including lower debt levels that provide Americans with plenty of room to borrow and invest.

"I'm optimistic about future economic growth, because consumers and businesses have continued to improve their financial conditions," he said. "Households have reduced their leverage to the lowest level since 2001, and the burden of their financial obligations is lower than at any time since the mid-1980s. Also, businesses are well-positioned to hire and invest with ample supplies of cash."

U.S. Bancorp Chairman, President and CEO Richard Davis also was generally upbeat during earnings season. After reporting in April a first-quarter profit, he told analysts that, while the company's overall loan growth hovered in the low single digits during the first three months of 2014, credit demand was notable across several business lines.

He cited particular strength in autos and credit cards on the consumer side, and he noted advances across a range of commercial segments, including small-business lending.

"This quarter, we had strong loan production in small businesses, up almost 30% over last year's first quarter," Davis said. "That's all types of small business, particularly for those under $250,000."

The Federal Reserve said its latest survey of senior loan officers showed that banks overall "eased their lending policies" for commercial-and-industrial and commercial real estate loans amid "stronger demand" for both types of loans in the first quarter. The Fed also said banks relaxed standards on credit card and auto loans.

Analysts said the data suggests banks are eager to grow their loan books. Evercore analysts said in a note that the survey results were "consistent" with recent commentary from bank executives who have noted increased loan demand but also "tighter spreads."

That latter part is of some concern, analysts say.

With short-term interest rates still low, and competition for loans heated, banks that are responding to more demand find themselves vying for customers amid an increasingly crowded field of lenders, analysts say. As such, even as loan books expand, interest income could continue to be difficult to propel, as banks are often competing by lowering prices, and this impacts the spread between the interest banks earn on loans and what they pay out on deposits.

Harralson said there has indeed been "greater intensity" in pricing competition over the past year. He said it likely will "take higher rates, really, to ease the competition."

Either that, or more banks "will pull away" and "say loan growth is just too expensive to get right now," he said. "I think this makes each bank step back and decide just how aggressively they want to participate."

This decision-making, he said, could play out over the course of 2014, as the Fed has indicated it is not likely to boost rates until next year.

And a Fed move in 2015 is dependent upon an increasingly strong economy this year, with ongoing improvement in the job market a key factor.

While the employment picture brightened significantly in April, the job market is not yet robust, economists say.

As Raymond James Chief Economist Scott Brown noted to SNL after the April jobs report was released, unemployment remains high and labor force participation is weak.

The jobless rate in April fell to 6.3% from 6.7% the previous month, but it was still well above the 4% to 5% level of the early 2000s. And the rate dropped last month in large part because the labor force participation rate declined from 63.2% to 62.8%, around a three-decade low.

"So that means a lot of people have given up on looking for work, and so they are not counted in the unemployment rate," Brown said. "That suggests we still have quite a ways to go. … But having said that, I do think things are on the right track now, with the weather improved, and I think we can continue to grow."

![]()

[headlines]

--------------------------------------------------------------

Earnings Scorecard for Top 25 US Bank/Thrifts

SNL Financial

The top 25 publicly traded banks and thrifts reported mixed earnings growth trends in the first quarter.

Eleven of the 25 biggest public banks and thrifts in the U.S. reported that earnings per share improved in the first quarter from year-ago levels. Another 11 institutions reported lower EPS figures, while the remainder saw no change.

Earnings growth trends were even more favorable across a broader group of publicly traded banks and thrifts. SNL analyzed 403 out of 440 major-exchange-traded U.S. banks and thrifts that had reported first-quarter earnings as of May 7. Of that number, 57.82% saw year-over-year EPS growth, 5.21% saw no change and 36.97% reported a decline in EPS from the prior year.

Among the top 25 banks and thrifts, six showed linked-quarter and year-over-year EPS improvement: Wells Fargo & Co., Bank of New York Mellon Corp., Capital One Financial Corp., Northern Trust Corp., KeyCorp and Comerica Inc.

On the other hand, seven of the top 25 showed declines from the prior quarter and year-ago period: JPMorgan Chase & Co., Bank of America Corp., State Street Corp., Fifth Third Bancorp, New York Community Bancorp Inc., First Republic Bank and First Niagara Financial Group Inc.

Bank of America was the only bank among the top 25 to report a net loss in the first quarter, largely due to $6.0 billion in litigation expenses. The company took analysts aback by posting a loss of 5 cents per share, 10 cents lower than consensus estimates.

Meanwhile, results from Citigroup Inc. topped analyst estimates for the first quarter. Citi, which disappointed in the fourth quarter of 2013 when its EPS came in 10 cents below analysts' expectations, rebounded to net income of $1.23 per share, compared to the FactSet mean estimate of $1.14 per share. Citi had other issues to grapple with during the first quarter, including an objection to its Comprehensive Capital Analysis and Review submission and the discovery of fraud at its Banamex unit.

The banking industry as a whole continues to battle pressure on net interest margins. The median NIM of the 403 companies covered in the review fell 8 basis points quarter over quarter and 3 basis points year over year. Every bank in the top 25 saw NIM compress from the linked quarter except for First Republic. Margins fell year over year for all banks in the top 25 save for Citi, Regions Financial Corp. and Popular Inc.

Several companies touted improvements in credit quality and declines in nonperforming assets. Among the 403 companies in SNL's analysis, the median loan loss provision decreased to $300,000 from $460,000 in the fourth quarter of 2013 and from $498,000 in the year-ago quarter. However, several banks among the top 25 saw loan loss provisions increase quarter over quarter: SunTrust Banks Inc., U.S. Bancorp, Comerica, Popular, Fifth Third, BofA and JPMorgan. Zions saw a recovery for loan losses, albeit a lower one than in the previous quarter. Hudson City Bancorp Inc. recorded no provision for loan losses.

Keep reading the full report and analysis here: http://www.snl.com/InteractiveX/Article.aspx?cdid=A-28009729-12840

[headlines]

--------------------------------------------------------------

John Kenny • Fraud Investigations • Credit Investigations • Asset Searches • Skip-tracing • Third-party Commercial Collections john@jkrmdirect.com | ph 315-866-1167| www.jkrmdirect.com |

(Leasing News provides this ad as a trade for investigations

and background information provided by John Kenny)

[headlines]

--------------------------------------------------------------

##### Press Release ############################

FDIC $96.6 Million Sallie Mae Settlement

The Federal Deposit Insurance Corporation (FDIC) announced a settlement with Sallie Mae Bank, Salt Lake City, Utah, and Navient Solutions, Inc. (formerly known as Sallie Mae, Inc.), subsidiaries of SLM Corporation and Navient Corporation, respectively, and herein collectively referred to as Sallie Mae, for unfair and deceptive practices related to student loans in violation of Section 5 of the Federal Trade Commission Act (Section 5) and for violations of the Service members Civil Relief Act (SCRA).

This action results from an examination of Sallie Mae by the FDIC regarding Sallie Mae's compliance with federal consumer protection statutes, including Section 5 and SCRA, and a companion investigation by the Department of Justice (DOJ) related to the treatment of service members. As part of the settlement, Sallie Mae stipulated to the issuance of Consent Orders, Orders for Restitution, and Orders to Pay Civil Money Penalty (collectively, FDIC orders). The FDIC orders require these entities to pay civil money penalties totaling $6.6 million, to pay restitution of approximately $30 million to harmed borrowers and to fund a $60 million settlement fund with the DOJ to provide remediation to service members. The DOJ has also taken separate action against the entities with regard to violations of the SCRA.

The FDIC determined that Sallie Mae violated federal law prohibiting unfair and deceptive practices in regards to student loan borrowers through the following actions:

-

Inadequately disclosing its payment allocation methodologies to borrowers while allocating borrowers' payments across multiple loans in a manner that maximizes late fees; and

-

Misrepresenting and inadequately disclosing in its billing statements how borrowers could avoid late fees.

The FDIC determined that Sallie Mae violated federal laws regarding the treatment of service members (SCRA and Section 5) through the following actions:

-

Unfairly conditioning receipt of benefits under the SCRA upon requirements not found in the Act;

-

Improperly advising service members that they must be deployed to receive benefits under the SCRA;

-

Failing to provide complete SCRA relief to service members after having been put on notice of these borrowers' active duty status.

In addition to the payment of restitution to harmed borrowers and a civil money penalty, the FDIC orders require Sallie Mae to take affirmative steps to ensure that disclosures regarding payment allocation and late fee avoidance are clear and conspicuous, that service members are properly treated under the SCRA, and that all residual violations be remedied to ensure compliance with applicable laws.

### Press Release ############################

|

((Please Click on Bulletin Board to learn more information))

(Leasing News provides this ad “gratis” as a means

to help support the growth of Lease Police)

[headlines]

--------------------------------------------------------------

Labrador Retriever Mix

Murray, Utah Adopt-a-Dog

PARIS - ID#A075556

"I am a spayed female, black Labrador Retriever mix.

"The shelter staff thinks I am about 8 years old.

"I have been at the shelter since Apr 22, 2014."

Shelter Staff made the following comments about this animal:

"I'M NEW TO THE AREA, I CAME FROM ANOTHER SHELTER & HAVE BEEN GIVEN A CHANCE FOR A NEW LIFE! ALTHOUGH MY HISTORY IS UNKNOWN I HAVE DONE WELL WITH MANY DOGS HERE. I WOULD BENEFIT FROM REGULAR MENTAL & PHYSICAL EXERCISE TO KEEP ME AT MY BEST. A SOLID ROUTINE & PROPER CRATE TRAINING WILL ENSURE HOUSE TRAINING. IF YOU'RE INTERESTED PLEASE BRING YOUR CURRENT CANINE COMPANION & ENTIRE FAMILY TO THE HUMANE SOCIETY OF UTAH TO MEET ME TODAY!"

LOCATED AT:

4242 SOUTH 300 WEST

MURRAY, UTAH 84107

(801) 261-2919

UTAHHUMANE.ORG

Adoption Hours

Monday - Saturday: 10:00 AM - 7:00 PM

Sunday: 12 Noon - 5:00 PM

Adopt a Pet

http://www.adoptapet.com/

[headlines]

--------------------------------------------------------------

![]()

News Briefs----

Is IT Being Shut Out of Key Tech Decisions?

http://www.baselinemag.com/it-management/slideshows/is-it-being-shut-out-of-key-tech-decisions.html

A Changing Shape in America’s Age Distribution

http://www.nytimes.com/2014/05/13/upshot/a-changing-shape-in-americas-age-distribution.html

[headlines]

--------------------------------------------------------------

--You May Have Missed It

Mark Zuckerberg’s Newark schools cash drop:

“Everybody got paid but Raheem still can’t read”

http://www.salon.com/2014/05/12/mark_zuckerbergs

[headlines]

--------------------------------------------------------------

SparkPeople--Live Healthier and Longer

![]()

Are You a Smart Snacker?

http://www.sparkpeople.com/resource/assessment_questions.asp?quizid=70

[headlines]

--------------------------------------------------------------

Basketball Poem

March Madness II

There is another March Madness

and it also happens every year,

there are shouts, cheers, and tears...

I wonder if you can make a guess?

The fans - they dress in all sorts of wild gear,

and there are office bets placed all around;

the brackets are made and are NCAA bound

and no Madness is the same from year to year.

Can you guess what this thing I rhyme is all about,

or are you like some that really don't care?

But watch and you'll see some amazing air

for basketball fans - March Madness carries real clout.

Now I know this isn't about the blues,

but I wasn't in the mood to make you sad,

so I wrote this piece, I hope your glad...

the March Madness cure - Basketball shoes!

Poet Unknown---

[headlines]

--------------------------------------------------------------

Sports Briefs----

USF strength coach resigns after questioning 49ers' selection of Aaron Lynch

http://www.tampabay.com/blogs/bulls/report-usf-strength-coach-straub-suspended/2179522

Trade win: 49ers beat out Bills for RB Hyde

http://blog.sfgate.com/49ers/2014/05/13/trade-win-49ers-beat-out-buffalo-for-rb-hyde/

Clippers blow lead late to OKC

http://www.latimes.com/sports/sportsnow/la-sp-sn-clippers-thunder-live-game-5-20140513-htmlstory.html

[headlines]

--------------------------------------------------------------

California Nuts Briefs---

California governor releases $108 billion budget

http://www.utsandiego.com/news/2014/may/12/governor-to-release-update-to-record-spending-plan/

Martins Beach billionaire evades questions on stand

http://www.sfgate.com/science/article/Martins-Beach-billionaire-evades-questions-on-5472928.php?cmpid=hp-hc-bayarea

[headlines]

--------------------------------------------------------------

![]()

“Gimme that Wine”

http://www.youtube.com/watch?v=EJnQoi8DSE8

This week "Malibu Coast" becomes an AVA

http://www.winebusiness.com/news/?go=getArticle&dataid=132614

Pelosi family wins delay of winery project

http://napavalleyregister.com/news/local/pelosi-family-wins-delay-of-winery-project/article_b3f7252e-d68e-55cd-85ef-40ae556ea9ba.html

Amazon's top-selling wines: They're not all Chardonnay

http://www.latimes.com/food/dailydish/la-dd-amazons-top-selling-wines-20140404-story.html

Guglielmo Wines Served Exclusively At DNC Fundraising Dinner For President Obama At Fairmont Hotel in San Jose

http://www.winebusiness.com/news/?go=getArticle&dataid=132519

Free Mobile Wine Program

http://leasingnews.org/archives/Feb2010/2_26.htm#mobile

Wine Prices by vintage

http://www.winezap.com

http://www.wine-searcher.com/

US/International Wine Events

http://www.localwineevents.com/

Winery Atlas

http://www.carterhouse.com/atlas/\

Leasing News Wine & Spirits Page

http://two.leasingnews.org/Recommendations/wnensprts.htm

[headlines]

----------------------------------------------------------------

![]()

This Day in History

http://memory.loc.gov/ammem/today/may14.html

1787 - Delegates began gathering in Philadelphia for a convention to draw up the U.S. Constitution. The only colony that did not send delegates was Rhode Island which was strongly against a federal government. On this day the only colonies that sent delegates were Virginia and Pennsylvania, as the others arrived over ensuing months. Among those NOT in attendance: Thomas Jefferson, John Adams, John Hancock, and Patrick Henry.

1771-Robert Owen, English progressive owner of spinning works, philanthropist, Utopian socialist, and founder of New Harmony, IN, born at Newtown, Wales. Died there Nov 17, 1858.

http://robert-owen.midwales.com/

1796-In the 18th century, smallpox was a widespread and often fatal disease. Edward Jenner, a physician in rural England, heard reports of dairy farmers who apparently became immune to smallpox as a result of exposure to cowpox, a related but milder disease. After two decades of studying the phenomenon, Jenner injected cowpox into a healthy eight-year-old boy, who subsequently developed cowpox. Six weeks later, Jenner inoculated the boy with smallpox. He remained healthy. Jenner called this new procedure vaccination, from vaccinia, another term for cowpox. Within 18 months, 12,000 people in England had been vaccinated and the number of smallpox deaths dropped by two-thirds. . Inoculations were begun in the United States where the spread of smallpox had wiped out entire communities, particularly Indian tribes.

1801 - Tripoli declares war against the United States

1804 - Charged by President Thomas Jefferson with finding a route to the Pacific and to explore the newly acquired Louisiana Territory, Meriwether Lewis and Captain William Clark left St. Louis. They arrived at the Pacific coast of Oregon in November, 1805 and returned to St. Louis, September 23, 1806.

http://www.pbs.org/lewisandclark/

1834 - The greatest snowstorm ever to occur in May hit the Northern Atlantic coastal states. The hills around Newbury, Vermont were covered with up to 24 inches of snow and the higher elevations around Haverhill, Massachusetts received up to three feet.

1845 - First U.S. warship visits Vietnam. While anchored in Danang for reprovisioning, Capt. John Percival, commanding USS Constitution, conducts a show of force against Vietnamese authorities in an effort to obtain the release of a French priest held prisoner by Emperor of Annam at Hue.

1851--Birthday of Anna Caroline Maxwell , U.S. nurse who established numerous nurse training schools, worked with Red Cross that adopted many of her innovations, and campaigned to get military rank for nurses of the Army Nurse Corps. She authored the standard text, “Practical Nursing”.

1856-Liutenant David Dixon Porter of Chester, PA, arrived at Indianola, Texas with camels imported for military purposes from Ismir, Turkey on the ship “Supply,” a Navy store ship. The shipment consisted of 34 camels---one more than left Smyma. On March 3, 1855, Congress had appropriated $30,000 to the War Department for the purchase and importation of camels and dromedaries to be employed for military purposes.

http://www.tulane.edu/~latner/Porter.html

http://www.arlingtoncemetery.com/ddporter.htm

http://www.civilwar.si.edu/navies_porter.html

1856-The editor of the San Francisco Daily Evening Bulletin was assassinated by a rival newspaper owner. A vigilante group seized the assassin from the sheriff, then tried, convicted, and executed him.

1863- Setting aside their own cry for equality, Susan B. Anthony and Elizabeth Cady Stanton called a meeting of the Women's National Loyal League that would gather hundreds of thousands of petitions calling for a Constitutional amendment to abolish slavery.

1874-This one event created a lot of “firsts”, starting with the first football goalpost, when McGill University and Harvard University squared off at Jarvis Field, Cambridge, MA. The teams played rugby football under Harvard’s rules, which stated that every goal constituted a game. McGill arrived with 11 men and Harvard with 15, four of whom were dropped to equalize the teams. Harvard won three games, the first two lasting about five minutes and the third about 12 minutes. As McGill is located in Montreal, Canada, this was also the first international rugby football contest to be played, as well as the first instance in which an admission fee was charged at a collegiate sporting event. The proceeds were used for “lavishly” entertaining the McGill team. A second match was played the following day, and a third match was played in the fall in Montreal.

1878 – Vaseline was registered as a trade mark by Robert Chesebrough.

1887- Under the Employers Liability Act, passed this day, Massachusetts required all employers to report accidents involving personal injuries suffered by employees in their services.

1893—Birthday of guitarist Pop Stoneman, Galaxy, VA

1896 - The mercury plunged to 10 degrees below zero at Climax, CO. It was the lowest reading of record for the U.S. during the month of May.

1897 – Birthday of Sidney Bechet, jazz clarinetist and soprano saxophone player of renown.

http://en.wikipedia.org/wiki/Sidney_Bechet; http://www.sidneybechet.org/

1897- The unveiling of a statue of George Washington at Philadelphia, PA, and President William McKinley was present. John Phillip Sousa wrote a march for the event, which is perhaps his most widely known,” The Stars and Stripes Forever,” and this event was the first public performance of this stirring composition that is now a staple at nearly every Memorial day and Independence Day celebration. He was in the U.S. Navy, stationed in Great Lakes, Illinois

1898 - Drummer Zutty Singleton born Bunkie, LA.

http://www.dws.org/sousa/

1902- (Helen) Flanders Dunbar birthday - U.S. psychiatrist. She earned four advanced degrees in seven years including a Ph.D. in philosophy, a B.D, and then added a medical degree in 1930. Dunbar integrated religion, science, medicine and psychiatry to head the Council for the Clinical Training of Theological Students. Her chief legacy regards psychosomatic approach to illnesses - a study that showed distinctive personality profiles for each disease. She also uncovered the emotional disturbance of accident prone people. Her “Mind and Body “(1947) is a summation of her findings and considered a classic in modern psychiatry.

1904-The first Olympic Games held in the United States was the Third Olympiad, held in St. Louis, MO, from this day to August 1, 1904. The games were first awarded to Chicago, IL., but were later given to St. Louis to be staged in connection with the World’s Fair. There were few entrants other than Americans in the 14 events. In the field competitions, the American athletes made a clean sweep of all the events with the exception of lifting the bar and throwing the 56-ound weight.

1905--The Asiatic Exclusion League is formed in San Francisco, marking the official beginning of the anti-Japanese movement in America. Among those attending the first meetings are labor leaders and European immigrants Patrick Henry McCarthy and Olaf Tveitmoe of the Building Trades Council of San Francisco, and Andrew Fufuseth and Walter McCarthy of the Sailor's Union. Tveitmoe is named the first president of the organization. Source: www.sfmuseum.org/war/evactxt.html

1913 - John D. Rockefeller made the largest gift of money (to that time) by establishing the Rockefeller Foundation for $100,000,000. The foundation promotes “the well-being of mankind throughout the world.”

1914 – Washington Senators’ pitcher, Walter “Big Train” Johnson, one of Major League Baseball’s greatest pitchers and a charter member of the National Baseball Hall of Fame, threw his 54th consecutive scoreless inning, breaking the record of Jack Coombs, set in 1910.

1917-Birthdayof American Composer Lou Harrison, Portland, Oregon. Died Feb. 2, 2003 in Lafayette, IN. Lou Harrison was in a way in the family of Cowell, Cage and McPhee. He favored Balines music like Mcphee, but used more of Cage and Cowell’s Inspiration. He is very interested in percussion instruments especially from the Far East. He wrote several concerts for percussion instruments so as the concerts for flute and percussion. His Piano Concerto was premiered by JazzMan Keith Jarret.

http://www.classical-composers.org/comp/harrison

1920-Pitcher Walter Johnson of the Washington Senators considered, by some to be the greatest pitcher of all time and the fastest, won the 300th game of his career, beating the Detroit Tigers, 9-8. Johnson played in the major leagues from 1907 through 1927. He compiled a record of 417 wins against 279 losses with an earned run average of 2.17. His win total is second most in MLB history, to Cy Young’s 511.

1930-Located in southwestern New Mexico, Carlsbad Caverns was proclaimed a national monument. It opened on October 25, 1923, and later was established as national park and preserve.

http://www.carlsbad.caverns.national-park.com/

1936-Singer Bobby Darin, whose real name was Walden Robert Cassotto, was born in The Bronx, New York City. A writer for singer Connie Francis, his big break came in 1958 when he wrote and recorded "Splish Splash," which reached number three on the US charts and sold a million copies. His other hits included "Queen of the Hop" and "Mack the Knife." In the late 1960s, he made the transition from teen idol to a more mature star who performed in Vegas nightclubs. Bobby Darin died on December 20th, 1973 after heart surgery to correct lingering effects of childhood rheumatic fever.

http://www.bobbydarin.net/

1937 - Duke Ellington and his band recorded the classic, "Caravan", for Brunswick Records.

1942 – Birthday of baseball Hall of Famer Tony Perez who spent most of his career with the ‘Big Red Machine’ Cincinnati Reds.

1943-- Jack Bruce, one of the most influential bass guitarists in rock, was born in Lanarkshire, Scotland. Bruce's bass playing and tenor vocals with the group Cream in the 1960's were a great influence on the heavy metal groups that followed. He began developing his style with the British rhythm-and-blues pioneers Graham Bond and Alexis Korner. Bruce later played with John Mayall's Bluesbreakers and Manfred Mann before forming Cream with Eric Clapton and Ginger Baker in 1966. The three virtually invented the hard-rock trio style, before breaking up in 1968. Bruce later played in a variety of styles, including hard rock and fusion, with several groups, such as West, Bruce and Laing, Jack Bruce and Friends, and BLT.

1944--*WAUGH, ROBERT T. Medal of Honor

Rank and organization: First Lieutenant, U.S. Army, 339th Infantry, 85th Infantry Division. Place and date: Near Tremensucli, Italy, 11-14 May 1944. Entered service at: Augusta, Maine. Birth: Ashton, R.I. G.O. No.: 79, 4 October 1944. Citation: For conspicuous gallantry and intrepidity at risk of life above and beyond the call of duty in action with the enemy. In the course of an attack upon an enemy-held hill on 11 May, 1st Lt. Waugh personally reconnoitered a heavily mined area before entering it with his platoon. Directing his men to deliver fire on 6 bunkers guarding this hill, 1st Lt. Waugh advanced alone against them, reached the first bunker, threw phosphorus grenades into it and as the defenders emerged, killed them with a burst from his tommy gun. He repeated this process on the 5 remaining bunkers, killing or capturing the occupants. On the morning of 14 May, 1st Lt. Waugh ordered his platoon to lay a base of fire on 2 enemy pillboxes located on a knoll which commanded the only trail up the hill. He then ran to the first pillbox, threw several grenades into it, drove the defenders into the open, and killed them. The second pillbox was next taken by this intrepid officer by similar methods. The fearless actions of 1st Lt. Waugh broke the Gustav Line at that point, neutralizing 6 bunkers and 2 pillboxes and he was personally responsible for the death of 30 of the enemy and the capture of 25 others. He was later killed in action in Itri, Italy, while leading his platoon in an attack.

1944 --Birthday of George Lucas, film director and producer (Star Wars, Indiana Jones). http://en.wikipedia.org/wiki/George_Lucas

1945--DIAMOND, JAMES H. Medal of Honor

Rank and organization: Private First Class, U.S. Army, Company D, 21st Infantry, 24th Infantry Division. Place and date: Mintal, Mindanao, Philippine Islands, 8-14 May 1945. Entered service at: Gulfport, Miss. Birth: New Orleans, La. G.O. No.: 23, 6 March 1946. Citation: As a member of the machinegun section, he displayed extreme gallantry and intrepidity above and beyond the call of duty. When a Japanese sniper rose from his foxhole to throw a grenade into their midst, this valiant soldier charged and killed the enemy with a burst from his submachine gun; then, by delivering sustained fire from his personal arm and simultaneously directing the fire of 105mm. and .50 caliber weapons upon the enemy pillboxes immobilizing this and another machinegun section, he enabled them to put their guns into action. When 2 infantry companies established a bridgehead, he voluntarily assisted in evacuating the wounded under heavy fire; and then, securing an abandoned vehicle, transported casualties to the rear through mortar and artillery fire so intense as to render the vehicle inoperative and despite the fact he was suffering from a painful wound. The following day he again volunteered, this time for the hazardous job of repairing a bridge under heavy enemy fire. On 14 May 1945, when leading a patrol to evacuate casualties from his battalion, which was cut off, he ran through a virtual hail of Japanese fire to secure an abandoned machine gun. Though mortally wounded as he reached the gun, he succeeded in drawing sufficient fire upon himself so that the remaining members of the patrol could reach safety. Pfc. Diamond's indomitable spirit, constant disregard of danger, and eagerness to assist his comrades, will ever remain a symbol of selflessness and heroic sacrifice to those for whom he gave his life.

1945-Gene Cornish, guitarist with the blue-eyed soul group, the Rascals, was born in Ottawa. The group began as the Young Rascals by playing dance clubs in Long Island, New York in the mid-1960's. Their hits included "Good Lovin' " and "Groovin'." After changing their name to the Rascals, the group mellowed, going for more jazz-influenced, stretched-out arrangements. The Rascals broke up in the early '70s.

1950----Top Hits

My Foolish Heart - The Gordon Jenkins Orchestra (vocal: Eileen Wilson)

It Isn’t Fair - The Sammy Kaye Orchestra (vocal: Don Cornell)

The Third Man Theme - Alton Karas

Long Gone Lonesome Blues - Hank Williams

1951—Comedian Ernie Kovacs first hosted "It's a Time for Ernie", a 15-minute afternoon program on NBC in May of 1951 before replacing the "Kukla, Fran and Ollie Show" with "Ernie in Kovacsland." Kovacs also appeared on a variety of daytime and prime-time series and was a fill-in for Steve Allen on the "Tonight!" Show. One of his most famous skits was The Nairobi Trio! His early shows featured his wife, Edie Adams, who smoked a cigar later in White Owl commercials, in a seductive manner, saying she liked men who smoked cigars. I will never forget Ernie Kovacs, reduced very small and superimposed over his wife, looking down her low cut dress. He died in a freakish accident in Beverly Hills, not driving fast, but on a rainy road, ramming into a telephone poll where the climbing rung was left and it pierced the driver's door, killing the great comedian.

1951- Saxophonist Jay Beckenstein born Brooklyn, NY, leader of the jazz-pop band Spyro Gyra.

1955-Bo Diddley's "Bo Diddley" backed with "I'm a Man" debuts on the R&B chart. It will go to #2 making it his most successful record. The A side introduces what will be known as the Bo Diddley beat.

1955--- Les Baxter's "Unchained Melody" hits #1

1955--- Bill Haley and his Comets' "Rock Around The Clock" enters the charts

1956- Mercury Records released the first LP by the Platters, "The Platters,". Although in the next several years it will sell over 50,000 copies, it contains none of their recent hits. They had just scored on the charts with "Only You" and "The Great Pretender." I bought it, and still have it to this day.

http://www.rockhall.com/hof/inductee.asp?id=169

http://www.celebritydirect.org/platters/disco.htm

1957 - The musical, "New Girl in Town", opened at the 46th Street Theatre in New York City. Thelma Ritter and Gwen Verdon starred in the Broadway adaptation of Eugene O’Neill’s "Anna Christie". "New Girl in Town" had a run of 431 performances.

1958----Top Hits

All I Have to Do is Dream - The Everly Brothers

Wear My Ring Around Your Neck - Elvis Presley

Return to Me - Dean Martin

Oh Lonesome Me - Don Gibson

1959-In a melding of classical ballet and modern dance, George Balanchine’s and Martha Graham’s “Episodes” premiered. A new experience for ballet enthusiast, half of the program was choreographed by Balanchine and the other half by Graham.

1961 -- On Mother's Day, a Greyhound bus carrying black and white civil rights activists is bombed and burned in Alabama. The 13 activists thereby launched the “Freedom Rides” throughout the South as a continuing protest of racial segregation. http://www.smithsonianmag.com/history-archaeology/The-Freedom-Riders.html

1963 - No. 1 Billboard Pop Hit: "If You Wanna Be Happy," Jimmy Soul.

1965- "Boss of the Bay," radio station KYA presents the Rolling Stones, the Byrds, Beau Brummels, Paul Revere & the Raiders, & the Vejtables, at Civic Auditorium, in San Francisco.

http://www.sfmuseum.org/hist1/rock.html

1966 - Top Hits

Monday Monday - The Mamas & The Papas

Rainy Day Women #12 & 35 - Bob Dylan

Kicks - Paul Revere & The Raiders

I Want to Go with You - Eddy Arnold

1966-- The Kingsmen's "Louie Louie" on pop charts since '63, enters the Hot 100 for the ninth & last time with a re-released version. Incites controversy over its unintelligible, but assumed obscene lyrics: "Smash your left hand down about right here three times, then twice up in this area, then three times right about here . . . that's "Louie Louie."

http://www.louielouie.org/

http://www2.sunysuffolk.edu/mccoykj/louie/

http://www.thesmokinggun.com/louie/louiereal1.shtml

1968--FOUS, JAMES W. Medal of Honor

Rank and organization: Private First Class, U.S. Army, Company E, 4th Battalion, 47th Infantry, 9th Infantry Division. Place and date: Kien Hoa Province, Republic of Vietnam, 14 May 1968. Entered service at: Omaha, Nebr. Born: 14 October 1946, Omaha, Nebr. Citation: For conspicuous gallantry and intrepidity in action at the risk of his life above and beyond the call of duty. Pfc. Fous distinguished himself at the risk of his life while serving as a rifleman with Company E. Pfc. Fous was participating in a reconnaissance-in-force mission when his unit formed its perimeter defense for the night. Pfc. Fous, together with 3 other American soldiers, occupied a position in a thickly vegetated area facing a wood line. Pfc. Fous detected 3 Viet Cong maneuvering toward his position and, after alerting the other men, directed accurate fire upon the enemy soldiers, silencing 2 of them. The third Viet Cong soldier managed to escape in the thick vegetation after throwing a hand grenade into Pfc. Fous' position. Without hesitation, Pfc. Fous shouted a warning to his comrades and leaped upon the lethal explosive, absorbing the blast with his body to save the lives of the 3 men in the area at the sacrifice of his life. Pfc. Fous' extraordinary heroism at the cost of his life were in keeping with the highest traditions of the military service and reflect great credit upon himself, his unit, and the U.S. Army.

1968--McCLEERY, FINNIS D. Medal of Honor

Rank and organization: platoon Sergeant, U.S. Army, Company A, 1st Battalion, 6th U.S. Infantry. place and date: Quang Tin province, Republic of Vietnam, 14 May 1968. Entered service at: San Angelo, Tex. Born: 25 December 1927, Stephenville, Tex. Citation: For conspicuous gallantry and intrepidity in action at the risk of his life above and beyond the call of duty. P/Sgt. McCleery, U.S. Army, distinguished himself while serving as platoon leader of the 1st platoon of Company A. A combined force was assigned the mission of assaulting a reinforced company of North Vietnamese Army regulars, well entrenched on Hill 352, 17 miles west of Tam Ky. As P/Sgt. McCleery led his men up the hill and across an open area to close with the enemy, his platoon and other friendly elements were pinned down by tremendously heavy fire coming from the fortified enemy positions. Realizing the severe damage that the enemy could inflict on the combined force in the event that their attack was completely halted, P/Sgt. McCleery rose from his sheltered position and began a 1-man assault on the bunker complex. With extraordinary courage, he moved across 60 meters of open ground as bullets struck all around him and rockets and grenades literally exploded at his feet. As he came within 30 meters of the key enemy bunker, P/Sgt. McCleery began firing furiously from the hip and throwing hand grenades. At this point in his assault, he was painfully wounded by shrapnel, but, with complete disregard for his wound, he continued his advance on the key bunker and killed all of its occupants. Having successfully and single-handedly breached the enemy perimeter, he climbed to the top of the bunker he had just captured and, in full view of the enemy, shouted encouragement to his men to follow his assault. As the friendly forces moved forward, P/Sgt. McCleery began a lateral assault on the enemy bunker line. He continued to expose himself to the intense enemy fire as he moved from bunker to bunker, destroying each in turn. He was wounded a second time by shrapnel as he destroyed and routed the enemy from the hill. P/Sgt. McCleery is personally credited with eliminating several key enemy positions and inspiring the assault that resulted in gaining control of Hill 352. His extraordinary heroism at the risk of his life, above and beyond the call of duty, was in keeping with the highest standards of the military service, and reflects great credit on him, the American Division, and the U.S. Army.

1968--- Elvis Presley meets with NBC-TV producer Bob Finkel, helming his upcoming Christmas special with him, and tells him he wants to use this event to reintroduce and prove himself once again to the rock audience.

1969--*SHEA, DANIEL JOHN Medal of Honor

Rank and organization: Private First Class, U.S. Army, Headquarters Company, 3d Battalion, 21st Infantry, 196th Infantry Brigade, American Division. Place and date: Quang Tri Province, Republic of Vietnam, 14 May 1969. Entered service at: New Haven, Conn. Born: 29 January 1947, Norwalk, Conn. Citation: For conspicuous gallantry and intrepidity in action at the risk of his life above and beyond the call of duty. Pfc. Shea, Headquarters and Headquarters Company, 3d Battalion, distinguished himself while serving as a medical aid man with Company C, 3d Battalion, during a combat patrol mission. As the lead platoon of the company was crossing a rice paddy, a large enemy force in ambush positions opened fire with mortars, grenades and automatic weapons. Under heavy crossfire from 3 sides, the platoon withdrew to a small island in the paddy to establish a defensive perimeter. Pfc. Shea, seeing that a number of his comrades had fallen in the initial hail of fire, dashed from the defensive position to assist the wounded. With complete disregard for his safety and braving the intense hostile fire sweeping the open rice paddy, Pfc. Shea made 4 trips to tend wounded soldiers and to carry them to the safety of the platoon position. Seeing a fifth wounded comrade directly in front of one of the enemy strong points, Pfc. Shea ran to his assistance. As he reached the wounded man, Pfc. Shea was grievously wounded. Disregarding his welfare, Pfc. Shea tended his wounded comrade and began to move him back to the safety of the defensive perimeter. As he neared the platoon position, Pfc. Shea was mortally wounded by a burst of enemy fire. By his heroic actions Pfc. Shea saved the lives of several of his fellow soldiers. Pfc. Shea's gallantry in action at the cost of his life were in keeping with the highest traditions of the military service and reflect great credit upon himself, his unit, and the U.S. Army.

1970- Crosby, Stills, Nash and Young announced their breakup before a performance in Chicago. The band - minus Neil Young - would regroup several times during the next dozen years. And all four would get together again in 1988 for the hit single and album "American Dream."

1972-- After 21 seasons with Giants in New York and San Francisco, 41-year old Willie Mays makes a dramatic debut for his new team as he hits a game winning home run off his former team giving the Mets a 5-4 victory. The 'Say Hey Kid's' 647th career homer in the fifth breaks a 4-4 deadlock.

1973-The House of Representatives received formal approval of the appointment of female pages in 1972. Today the 934d Congress, appointed Felda Looper as the successor to Gene Cox, who, for three hours, had served as the first female page 34 years earlier.

1973 - No. 1 Billboard Pop Hit: "You Are the Sunshine of My Life," Stevie Wonder. It is his third chart-topping hit.

1973-Kenny Loggins and Jim Messina's first LP, "Sittin' In," goes gold. The two actually got together by accident. Messina was going to produce a solo effort for Loggins, but the two had such a rapport that Messina was persuaded to perform.

1973 – Skylab, the first US space station was launched.

1974-Three Dog Night's "The Show Must Go On" turns out to be group's last gold record. The song reaches #4 on the pop chart is also the band's last Top Twenty single. The group had eleven gold records, three of which -- "Joy to the World," "Mama Told Me Not to Come" and "Black and White"-- hit Number One.

1974----Top Hits

The Loco-Motion - Grand Funk

The Streak - Ray Stevens

Dancing Machine - The Jackson 5

Is It Wrong (For Loving You) - Sonny James

1977-- Leo Sayer's "When I Need You" hits #1

1981- Birthday of American composer Aaron Alon, Florida

1981 - No. 1 Billboard Pop Hit: "Bette Davis Eyes," Kim Carnes. Bette Davis responds by sending roses to Carnes when the song wins a Grammy. The song is first recorded by Jackie DeShannon.

1982----Top Hits

Chariots of Fire - Titles - Vangelis

Ebony and Ivory - Paul McCartney with Stevie Wonder

Don’t Talk to Strangers - Rick Springfield

Always on My Mind - Willie Nelson

1983 – Birthday of San Francisco 49ers great running back, Frank Gore.

1984—Mark Zuckerberg, Founder of Facebook, born White Plains, NY.

http://en.wikipedia.org/wiki/Mark_Zuckerberg

1985 - The first McDonald’s restaurant -- in Des Plaines, IL -- became the first museum of the fast-food business. McMannequins, McPosters and loads of McPhotos display years of hamburger McProgress

http://www.mcdonalds.com/corp/about/museum_info.html

1987 - The temperature at Sacramento, California soared to 103 Degrees to establish a May record of 7 Days with high temperatures of 100 Degrees or above. It also marked the 9th record high of the month. Ironically, it is expected to be 100 degrees today, and 101 tomorrow (2014).

1988--- Atlantic Records celebrated its 40th anniversary with an 11-hour concert at Madison Square Garden in New York. Many of the acts that recorded for the label since its founding in 1947 appeared - among them, a reunited Led Zeppelin, Wilson Pickett, the Bee Gees, Booker T. and the MG's, Phil Collins and Ruth Brown, one of Atlantic's first big stars. The only sour note was the failure of David Crosby to show up for a reunion with Stephen Stills and Graham Nash.

1990----Top Hits

Nothing Compares 2 U - Sinead O’Connor

Vogue - Madonna

All I Wanna Do is Make Love to You - Heart

Help Me Hold On - Travis Tritt

1990 - Thunderstorms developing ahead of a cold front produced severe weather from northwest Texas to western Missouri. Severe thunderstorms spawned seventeen tornadoes, including nine in Texas. Four tornadoes in Texas injured a total of nine persons. Thunderstorms in Texas also produced hail four inches in diameter at Shamrock, and hail four and a half inches in diameter near Guthrie. Thunderstorms over northeastern Kansas produced more than seven inches of rain in Chautauqua County between 9 PM and midnight.

1991-- President Bush announced his selection of Robert M. Gates to head the Central Intelligence Agency.

1993- Softkey Software and WordStar International announced a merger on this day in 1993: The companies hoped that joining forces would help them hold their ground against larger software companies. The WordStar word processor, released in 1979, was one of the first word processors available for the personal computer, and the product became an immediate hit, selling nearly a million copies within five years. Unfortunately, WordStar was slow to convert to the PC-DOS operating system, introduced by IBM in 1981. As a result, the product lost its dominant position in the word processor market. In 1994, WordStar and Softkey merged with Spinnaker Software.

1996-Basketball player Earvin “Magic” Johnson announced his retirement for the second time form the Los Angeles Lakers. Johnson had first retired before the start of the 1991-92 NBA season when he learned he was HIV-positive. Other players rebuffed his attempts to come back for the 1992-93 season, but he did play 32 games in 1995-96.

1998- While we “celebrate “birthdays, today is an exception, Frank Sinatra, 82, dies in Los Angeles, 1998. The Chairman of the Board has left the room. Perhaps a most revealing book: “Mr. S: My Life with Frank Sinatra” by George Jacobs (Author), William Stadiem (Author)

http://www.amazon.com/gp/product/0060596740/ref=oh_details_o

2000---Tom Jones' album "Reload" was at the top of the UK album chart, making him the oldest artist (60) to ever score a UK #1 album with new material

NBA Finals Champions This Date

1981 Boston Celtics

-------------------------------------------------------------

SuDoku

The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler?

http://leasingnews.org/Soduku/soduko-main.htm

--------------------------------------------------------------

Daily Puzzle

How to play:

http://www.setgame.com/set/puzzle_frame.htm

Refresh for current date:

http://www.setgame.com/set/puzzle_frame.htm

--------------------------------------------------------------

http://www.gasbuddy.com/

http://www.gasbuddy.com/GB_Map_Gas_Prices.aspx

http://www.gasbuddy.com/GB_Mobile_Instructions.aspx

--------------------------------------------------------------

Weather

See USA map, click to specific area, no commercials

--------------------------------------------------------------

Traffic Live---

Real Time Traffic Information

You can save up to 20 different routes and check them out with one click,

or type in a new route to learn the traffic live

--------------------------------