Connect with Leasing News ![]()

![]()

![]()

![]()

![]() Add me to mailing list |

Add me to mailing list | ![]() |

| ![]() Search |

Search | ![]() Stress Release

Stress Release

Advertising | All Lists | Archives | Classified Ads | This Day In American History

Leasing News is a web site that posts information, news, and

entertainment for the commercial bank, finance and leasing industry

kitmenkin@leasingnews.org

![]()

Monday, November 5, 2012

Today's Equipment Leasing Headlines

Pictures from the Past

---1989-A&T Credit Operation

Classified Ads---Senior Management

Salvation Army Plea

MidAmerican Warns of Scam

Unauthorized company is targeting customers

with $100,000 lease credit line offer

What You Missed in Marlin Leasing’s Last Press Release

Leasing 102 by Mr. Terry Winders, CLP

“Lessors Margin”

Another Florida and another Illinois Bank Fail

Bank Beat by Christopher Menkin

Classified Ads---Help Wanted

Career Crossroad---By Emily Fitzpatrick/RII

“Immediate Steps to Take if you are Let Go”

CLP Foundation Announces New CLP---Louis Narrow

Indiana Court Ruling Makes True Lease “Murky”

Lawsuit by Secured Creditor of Lessee Claims Lease was Loan

and Key Equipment Finance Was Unsecured is Allowed to Proceed

By Tom McCurnin

Alexa Rates Web News Standings

(You should be advertising in Leasing News)

Top Stories October 29--November 2

The Best Site to Find a Job

Leasing News Sites Employment Sites

Beagle

Manhattan, New York Adopt-a-Dog

Arizona Equipment Leasing Association Meeting

News Briefs---

Sandy-battered East Coast braces for cold, new storm

Photo collage of Hurrincane Sandy destruction

Banks extend fee waivers for storm-hit customers

Farming equipment – lease or purchase

Broker/Funder/Industry Lists |

Features (collecti)

Top Ten Stories Chosen by Readers |

Top Stories last six months

You May have Missed---

SparkPeople--Live Healthier and Longer

Sports Briefs---

Baseball Poem

California Nuts Brief---

"Gimme that Wine"

This Day in American History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

######## surrounding the article denotes it is a “press release”

and was not written by Leasing News nor information verified, but from the source noted. When an article is signed by the writer, it is considered a “by line.” It reflects the opinion and research of the writer.

Leasing News Help Wanted Classified Ad

(Appears on top of News Headlines

in a rotation basis with other Help Wanted as)

Please see our Job Wanted section for possible new employees.

Please send Leasing News to a colleague and ask them to subscribe.

We are free!

[headlines]

--------------------------------------------------------------

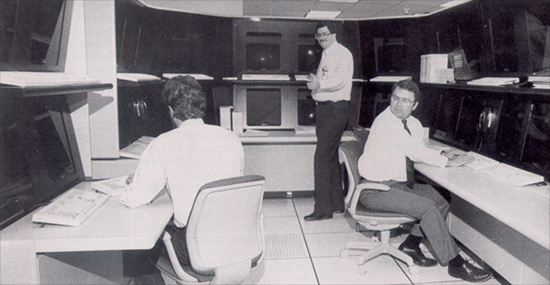

Pictures from the Past

---1989 AT&T Credit Operation

“AT&T CreditCorp., for example, is able to process more than 700 small business credit applications in a day through the use of advanced hardware, software and networking systems.”

- November/December, 1989, Equipment Leasing Today

[headlines]

--------------------------------------------------------------

Classified Ads---Senior Management

(These ads are “free” to those seeking employment or looking

to improve their position)

| Philadelphia, PA 27 yrs. exp. sales, ops., credit, strategy, P&L mngmet. Most recently created & executed the biz plans for 2 highly successful Bank-owned small ticket leasing subsidiaries. email: mccarthy2020@comcast.net |

Free Posting for those seeking employment in Leasing:

http://www.leasingnews.org/Classified/Jwanted/Jwanted-post.htm

All “free” categories “job wanted” ads:

http://www.leasingnews.org/Classified/Jwanted/Jwanted.htm

Comprehensive personal property tax outsourcing services |

[headlines]

--------------------------------------------------------------

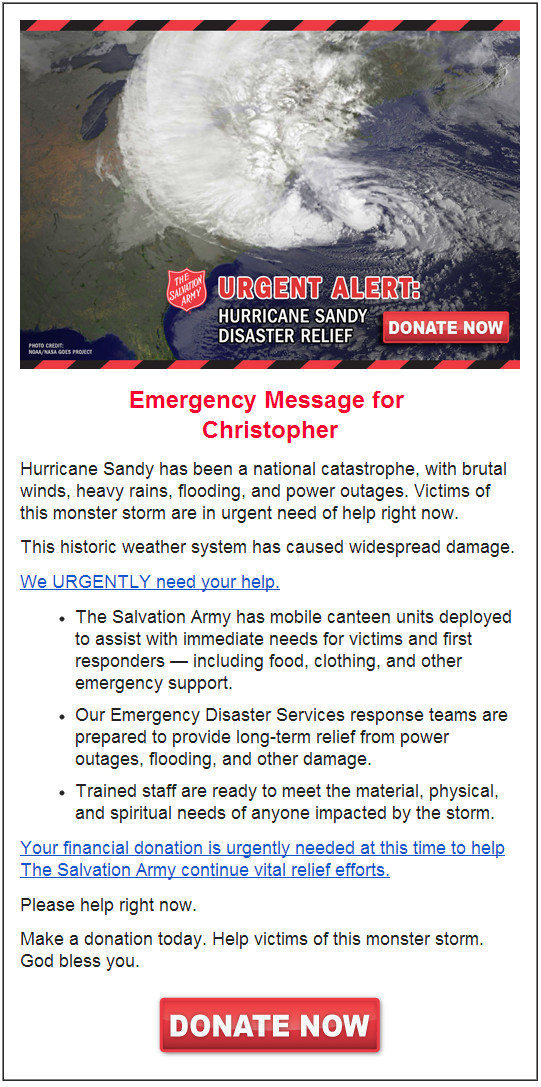

Salvation Army Plea

Be very careful of those who are on the internet or advertising elsewhere for donations to help those suffering due to Hurricane Sandy. Many organizations earn high percentages for their executives and fund raising activities. The Salvation Army has the highest dollar amount that goes to those who need it, spending very little for administration as those who belong are full time dedicated to their crusade to help others.

Christopher Menkin

(40 year plus volunteer for the Salvation Army)

[headlines]

--------------------------------------------------------------

****Alert************************************************

MidAmerican Warns of Scam

Unauthorized company is targeting customers

with $100,000 lease credit line offer

![]()

MidAmerican Energy Co. is warning the public about an unsolicited credit line offer that may target employees or customers of the company.

An individual affiliated with MidAmerican Energy recently received a mailing from Five Point Capital advising the recipient to call an 800 number to confirm receipt of a lease card and activate an account. The mailing included an FPT Platinum Equipment Lease Card with the person's name and MidAmerican Energy Co. printed on the card. The mailing stated that the person had been prequalified for a lease line of credit up to $100,000, and once the card was activated, the card could be used to finance new or used equipment from a vendor of the person's choice.

MidAmerican Energy employees and customers are advised that the mailing has no connection to MidAmerican Energy. Customers are advised to become fully informed in relation to unsolicited offers and to not provide personal information or respond to the sender without performing research on their own.

If a customer receives a suspicious call, mailing, email or other type of unusual contact or offer from a person or company claiming to be from or working on behalf of MidAmerican Energy, the customer should contact local law enforcement authorities immediately. Customers also should call MidAmerican Energy at (888) 427-5632 to report the incident and seek assistance.

MidAmerican Energy Co., Iowa's largest energy company, provides electric service to 732,000 customers and natural gas service to 714,000 customers in Iowa, Illinois, Nebraska and South Dakota. It is headquartered in Des Moines.

Issued by www.messengernews.net

****Alert************************************************

[headlines]

--------------------------------------------------------------

What You Missed in Marlin Leasing’s Last Press Release

Leasing News printed the url to the press release of September 30, 2012, and footnotes it below, as it is a fairly good summation (would have been better if they brought forward their profits from Evergreen Clauses, primarily on copier leases) ---press release at (1).

On November 2, 2012, Marlin released its SEC filing and yes, the Evergreen clauses are still providing profit (see Residual Performance in details that follow).

For those interested in why Marlin is successful, it is outlined in their SEC filings, which obviously a lot of work went into to produce and meet all the legal requirements. It is a masterwork, in my opinion.

Here are some “detail” highlights from the 56 page report.

(Note: if you don’t have time today, come back when you do, as there is a lot to be learned in this SEC report, especially if you make your living in banking and finance.)

Kit Menkin. Editor.

“Return on average assets was 2.50% for the three-month period ended September 30, 2012, compared to 1.56% for the three-month period ended September 30, 2011. Return on average equity was 8.08% for the three-month period ended September 30, 2012, compared to 4.53% for the three-month period ended September 30, 2011.

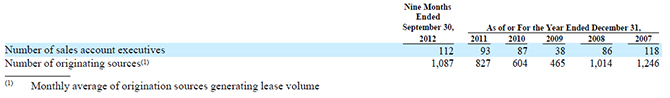

“Overall, our average net investment in total finance receivables for the three-month period ended September 30, 2012 increased 24.8% to $448.7 million, compared to $359.5 million for the three-month period ended September 30, 2011. This change was primarily a result of an increase in the number of sales account executives and higher application approval rates, combined with the continued seasoning and development of our sales account executives.

“During the three months ended September 30, 2012, we generated 6,227 new leases with a cost of $81.6 million, compared to 4,580 new leases with a cost of $59.7 million generated for the three months ended September 30, 2011. Sales staffing levels increased from 95 sales account executives at September 30, 2011 to 112 sales account executives at September 30, 2012. Approval rates also rose from 60% for the quarter ended September 30, 2011 to 67% for the quarter ended September 30, 2012 due to the improved credit quality of the applications received and adjustments made to credit policy in light of the improved performance of recent years’ lease originations.

“For the three-month period ended September 30, 2012 compared to the three-month period ended September 30, 2011, net interest and fee income increased $3.7 million, or 32.2%, primarily due to the impact of the 24.8% million increase in average total finance receivables, combined with a lower cost of funds on liabilities. The provision for credit losses increased $0.6 million, or 75.0%, to $1.4 million for the three-month period ended September 30, 2012 from $0.8 million for the same period in 2011, primarily due to portfolio growth, partially offset by lower charge-offs and improved delinquencies. Other expenses increased $0.6 million, or 6.7%, for the three-month period ended September 30, 2012 compared to the three-month period ended September 30, 2011, primarily due to increased lease origination volume and increased sales compensation expense.

(Marlin page 30)

“During the nine months ended September 30, 2012, we generated 18,057 new leases with a cost of $234.4 million, compared to 13,086 new leases with a cost of $160.6 million generated for the nine months ended September 30, 2011. Sales staffing levels increased to 112 sales account executives at September 30, 2012 from 95 sales account executives at September 30, 2011. Approval rates also rose from 59% for the nine-month period ended September 30, 2011 to 67% for the nine-month period ended September 30, 2012 due to the improved credit quality of the applications received and adjustments made to credit policy in light of the improved performance of recent years’ lease originations

“For the nine-month period ended September 30, 2012 compared to the nine-month period ended September 30, 2011, net interest and fee income increased $9.1 million, or 27.7%, primarily due to a 18.6% increase in average total finance receivables, combined with a lower cost of funds on liabilities. The provision for credit losses increased $0.6 million, or 20.7%, to $3.5 million for the nine-month period ended September 30, 2012 from $2.9 million for the same period in 2011. The impact of portfolio growth was partially offset by lower charge-offs and improved delinquencies. Other expenses increased $2.3 million, or 8.5%, for the nine-month period ended September 30, 2012, compared to the nine-month period ended September 30, 2011, primarily due to increased lease origination volume, increased sales compensation expense and additional compensation related to the achievement of certain performance criteria determined annually.

(Marlin page 35)

“Insurance income. Insurance income increased $0.4 million to $3.1 million for the nine-month period ended September 30, 2012 from $2.7 million for the nine-month period ended September 30, 2011, primarily due to higher billings and lower claims.

“Other income. Other income decreased to $1.1 million for the nine-month period ended September 30, 2012 from $1.3 million for the nine-month period ended September 30, 2011. Other income includes various administrative transaction fees and fees received from lease syndications.

“Salaries and benefits expense. Salaries and benefits expense increased $1.8 million, or 10.7%, to $18.7 million for the nine months ended September 30, 2012 from $16.9 million for the same period in 2011. The increase was primarily due to increased sales compensation and additional compensation related to the achievement of certain performance criteria determined annually. Salaries and benefits expense, as an annualized percentage of average total finance receivables, was 5.94% for the nine-month period ended September 30, 2012 compared with 6.37% for the same period in 2011. Total personnel increased to 258 at September 30, 2012 from 247 at September 30, 2011, primarily due to increased sales staffing levels, which were 112 sales account executives at September 30, 2012, compared to 95 sales account executives at September 30, 2011.

In the first nine months of 2012, we increased the number of our sales account executives by 19, from 93 sales account executives at December 31, 2011 to 112 at September 30, 2012. This action continued our plan to rebuild the sales organization to increase originations and match the level of originations to our current funding capacity.

“General and administrative expense. General and administrative expense increased $0.4 million, or 4.1%, to $10.2 million for the nine months ended September 30, 2012 from $9.8 million for the same period in 2011. General and administrative expense as an annualized percentage of average total finance receivables was 3.24% for the nine-month period ended September 30, 2012, compared to 3.71% for the nine-month period ended September 30, 2011. Selected major components of general and administrative expense for the nine-month period ended September 30, 2012 included $2.0 million of premises and occupancy expense, $1.0 million of audit and tax expense and $0.9 million of data processing expense. In comparison, selected major components of general and administrative expense for the nine-month period ended September 30, 2011 included $2.1 million of premises and occupancy expense, $1.3 million of audit and tax expense and $0.7 million of data processing expense."

(Marlin page 39)

RESIDUAL PERFORMANCE

“Our leases offer our end user customers the option to own the equipment at lease expiration. As of September 30, 2012, approximately 67% of our leases were one dollar purchase option leases, 31% were fair market value leases and 2% were fixed purchase option leases, the latter of which typically contain an end-of-term purchase option equal to 10% of the original equipment cost. As of September 30, 2012, there were $30.5 million of residual assets retained on our Condensed Consolidated Balance Sheet, of which $24.4 million, or 80.0%, were related to copiers. As of December31, 2011, there were $32.7 million of residual assets retained on our Condensed Consolidated Balance Sheet, of which $26.5 million, or 80.9%, were related to copiers. No other group of equipment represented more than 10% of equipment residuals as of September 30, 2012 and December 31, 2011, respectively. Improvements in technology and other market changes, particularly in copiers, could adversely impact our ability to realize the recorded residual values of this equipment.

“Fee income included approximately $0.8 million and $1.2 million of net residual income for the three-month periods ended September 30, 2012 and September 30, 2011, respectively. Fee income included approximately $2.7 million and $3.5 million of net residual income for the nine-month periods ended September 30, 2012 and September 30, 2011, respectively. Net residual income includes income from lease renewals and gains and losses on the realization of residual values of leased equipment disposed at the end of term as further described below.

“Our leases generally include renewal provisions and many leases continue beyond their initial contractual term. Based on the Company’s experience, the amount of ultimate realization of the residual value tends to relate more to the customer’s election at the end of the lease term to enter into a renewal period, purchase the leased equipment or return the leased equipment than it does to the equipment type. We consider renewal income a component of residual performance. Renewal income net of depreciation totaled approximately $1.6 million and $1.9 million for the three-month periods ended September 30, 2012 and September 30, 2011, respectively. Renewal income net of depreciation totaled approximately $5.2 million and $5.7 million for the nine-month periods ended September 30, 2012 and September 30, 2011, respectively. The decline in renewal income was primarily due to fewer leases reaching the end of their original contractual terms during 2012, as a result of the lower originations during the 2008 to 2010 timeframe.”

(Marlin page 42)

-

Marlin Leasing Reports $3.4 Million Net Income 3rd Q

http://www.snl.com/Cache/c14959524.html

Marlin 10Q September 30, 2012---56 pages:

http://www.leasingnews.org/PDF/Marlin10QSeptember3012.pdf

[headlines]

--------------------------------------------------------------

Leasing 102

by Mr. Terry Winders, CLP

“Lessors Margin”

The actual margin most lessors obtain from their funding sources is a direct result of the structure of the lease and the way the transaction is passed on. Usually it is a discount of the payment stream at a rate that is cheaper than the lease rate. The payment stream is present valued and the difference between that and the equipment cost is the lessor’s margin. The margin is usually paid up front. The real question is how to maximize the lessor’s income from structuring the deal.

The structure will affect the margin because the net present value of the rent stream is a function of how fast the principal is returned. Lower payments in the beginning and higher payments in the end will increase the earned income and therefore the lessors fee. In addition, a residual will increase income because they slow down the recovery of the investment while lowering the payment for the lessee.

Retaining the right to negotiate the sale or return of the equipment at termination also increases the opportunity to make additional money. I know most of you know this however I think the art of “equipment leasing” instead of equipment finance scares some people and lessors.

I am constantly talking to bankers and other lessors who think residuals are a risk that is too large to assume. Actually properly investigated equipment, after knowing how it is going to be used, can make the properly assumed residual a better risk than the credit risk. Also, the larger the residual, the larger the income, as I mentioned, because it slows down the return of the equipment cost. Most lessors assume a residual that is no more than 50% of the anticipated wholesale value at termination. This makes an opportunity for additional income at termination if purchase options are 20% above the residual assumption.

Some nay Sayers mention that an increased residual means an increased loss if a default occurs. I respond that most lessors only have a .5% loss ratio so 99.5% of the time they make more money. But once again an opportunity to increase income is an important factor to leasing and usually does not occur in equipment finance.

Residuals do require some changes in the lease agreement. There must be a large paragraph on equipment maintenance, equipment return, and requirements for lease payment changes if the use changes over the term. It also gives value to all the other requirements in the lease. The use requires an additional paragraph on the proper and maximum use for the equipment with adjustments in the rent for over use to protect the residual.

Leases are structured agreements that create payment streams that are adjusted to the equipment use and the cash flow needs of the lessee. Equipment finance usually has level payments over even years whereas properly structured leases have irregular terms and irregular payments.

Leases can be more effective to make a larger income if all of the benefits are used to create a transaction that is a lease instead of a disguised loan. This takes a lease salesperson instead of a loan salesperson. Perhaps you should learn more about what a lease is and how it works. I would recommend the CLP handbook.

(To learn more about the CLP Handbook)

http://www.clpfoundation.org/toolbox/clp_handbook.php

Mr. Terry Winders, CLP, has been a teacher, consultant, expert witness for the leasing industry for thirty-five years and can be reached at leaseconsulting@msn.com or 502-649-0448

He invites your questions and queries.

Previous #102 Columns:

http://www.leasingnews.org/Conscious-Top%20Stories/Leasing_102/Index.htm

Mr. Terry Winders available as Expert Witness. 35 years as a professional instructor to the top equipment leasing and finance companies in the United States, author of several books, including DVD's, as well as weekly columnist to Leasing News. He also performs audits of leasing companies as an expert on documentation, and has acted as an expert witness on leasing for litigation in legal and tax disputes, including before the IRS. He also has taught the senior bank examiners, how to review a bank leasing department, for the Federal Reserve in Washington D.C. and has trained the examiners for the FDIC on how to prepare a lease portfolio for sale.

Mr. Winders received his Master of Business Administration and his Bachelor of Science degrees from the College of Notre Dame. 502.649.0448/Leaseconsulting@msn.com |

(This ad is a “trade” for the writing of this column. Opinions

contained in the column are those of Mr. Terry Winders, CLP)

[headlines]

--------------------------------------------------------------

Another Florida and Another Illinois Bank Fail

Bank Beat by Christopher Menkin

The three branches of Heritage Bank of Florida, Lutz, Florida, were closed with Centennial Bank, Conway, Arkansas, to assume all of the deposits. Founded August 3, 1999, the bank had 38 full time employees as of June 30, 2012 at their two offices in Wesly Chapel and one office in Lutz and Tampa.

Tier 1 Risk Capital: .728% (Yes, that is correct. editor)

Clark G. Hobby, son, H. Clyde Hobby, father

http://hobbylaw.com/

H. Clyde Hobby, P.A., was chairman of the bank and also president of Florida Governmental Consultants and partner in law firm Hobby and Hobby PA, New Port Richey, Florida.

"Mr. Hobby has served on several boards of directors for Florida banking corporations and as their general counsel. In connection with these projects and clients, he is experienced in Florida and Federal banking law and regulation, reviewing and advising clients regarding various types of instruments and loan documents..."

http://hobbylaw.com/bios.html

What is known as the TFR Report, which is the consolidated reports of Condition and Income FFIEC 041 are most revealing. They are the information before the final report. The Heritage Bank of Florida September 30 shows the high 1-4 family loan losses are more in "junior liens" than "1st" ($606,000 to $1.0) as well as the nonfarm/nonresidential loan losses are more in non-owner occupied properties ($172,000 to $756,000), as well as most individual loans are automobile losses followed by credit cards (here it is all automobile loans)

It is obvious that residential mortgages took this bank down with the highest write-offs, more than construction/land, as well as commercial/industrial and nonfarm nonresidential (basically again real estate rentals) were significant to bring a bank from a $24.6 million equity in 2009 to $1.2million the end of this September.

As significant the Non-Current Loans were very high, resulting in further loss in profit.

(in millions, unless otherwise)

Net Equity

2006 $20.0

2007 $22.2

2008 $23.5

2009 $24.6

2010 $17.1

2011 $8.7

9/30 $1.2

Profit

2006 $2.6

2007 $2.5

2008 $2.1

2009 $713,000

2010 -$7.4

2011 -$4.7

9/30 -$7.5

Non-Current Loans

2006 $25,000

2007 $318,000

2008 $3.6

2009 $4.7

2010 $15.7

2011 $13.5

6/30 $7.7

Charge Offs

2006 $16,000 ( $16,000 loans to individuals)

2007 $298,000 ($232,000 commercial/industrial, $36,000 individuals, $30,000 1-4 family)

2008 $581,000 ($266,000 1-4 family, $192, construction/land, $97,000 commercial, $26,000 indiv.)

2009 $1.4 ($651,000 1-4 family, $561,000 commercial/Ind., $178,000 nonfarm/nonres., $12,000 indiv.)

2010 $8.8 ($5.1 1-4 family, $1.9 commercial/ind.,$1.5 nonfarm/nonres.,$30,000 indiv.)

2011 $6.1 ($2.8 1-4 family, $2.2 nonfarm/nonres.,$840,000 commercial/res, $144,000 indiv.,$111,000 construction/land)

9/30 $7.0 ($4.4 commercial/industrial, $1.6 1-4 family, $982,000 nonfarm/nonres., $47,000)

Construction and Land, 1-4 family multiple residential, Multiple Family Residential, Non-Farm Non-Residential loans.

As of September 30, 2012, Heritage Bank of Florida had approximately $225.5 million in total assets and $223.3 million in total deposits. In addition to assuming all of the deposits of the failed bank, Centennial Bank agreed to purchase approximately $193.7 million of the failed bank's assets. The FDIC will retain the remaining assets for later disposition.

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $65.5 million.

8th bank in Florida to fail this year.

http://www.fdic.gov/news/news/press/2012/pr12127.html

The 20 offices of Citizens First National Bank, Princeton, Illinois, were closed with Heartland Bank and Trust Company, Bloomington, Illinois, to assume all of the deposits. The bank was established January 1, 1865 and made it through three depressions and several recessions. As of June 30, 2012 they had 284 full-time employees at their three offices in Princeton, two in Sandwich, and offices in Aurora, Depue, Geonoa, Hampshire, Henry, Hungly, Millbrook, Minooka, Newark, Oglesby, Peru, Plainfield, Plano, Somonauk, and Spring Valley.

Note: for the last few years over 300 full time employees with a high of 326 year-end December 31, 2009).

Tier 1 risk-based capital ratio 3.1%

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $45.2 million.

Mr. Thomas D. Ogaard

Chief Executive Officer

"The year 2000 marked the most profitable year in the history of the bank. Assets reached $515,180,000 and a record net income of $8,186,000 was achieved. Total deposits increased in 2001 by $56.4 million. Thomas R. Lasier retired from the board in 2001. Craig O. Wesner was appointed chairman of the board.

“In 2003, Princeton National Bancorp purchased land in Elburn and Aurora. Construction began on the Aurora facility in 2005.

Total deposits reached a record high of $537,800,000 in 2003, as did loans with a record high of $383,100,000.

“In 2005, the company acquired Somonauk FSB Bancorp, which caused the Citizens banking family to grow in the towns of Somonauk, Sandwich, Millbrook, Newark and Plano. Assets at the end of 2005 were nearing a billion dollars. On Oct. 11, 2006, the total assets of Princeton National Bancorp surpassed that $1 billion mark.

In 2007, the bank grew again with a location in Plainfield.

Tony J. Sorcic retired from Princeton National Bancorp and Citizens First National Bank on Feb. 1, 2010. Thomas D. Ogaard was appointed president/CEO on Feb. 2, 2010.

“In the late 2000s, the bank’s loan portfolio began suffering major losses, which stressed the bank’s capital to critical levels. The loan losses were deep enough to create a severe shortage of capital and resulted in regulatory intervention. The Office of the Comptroller of the Currency filed a formal agreement with the company, demanding it raise its capital to comply with regulatory guidelines.

“According to the 8-K filing, Princeton National Bancorp, Inc. reported its tangible equity to total assets ratio at the end of its second quarter (ending June 30, 2012) was 1.92 percent. Because of that percentage, the bank became “critically undercapitalized” within the meaning of the bank’s ongoing Prompt Corrective Action (PCA) provisions of the Federal Deposit Insurance Act and the regulations of the OCC. At that time, the company was given 90 days to turn its situation around by raising additional capital or merging with another financial institution.

(Todd D. Fanning, Executive Vice President, Chief Operating Officer, Chief Financial Officer and Director, resigned effective June 15, 2012).

“In June 20, 2012, Princeton National Bancorp was delisted from the NASDAQ Global Market for not meeting the requirements of the exchange. On June 29, 2012, the stock began trading on the OTCQB Marketplace.

“Late in the afternoon on Nov. 2, 2012, the Office of the Comptroller of the Currency closed Citizens First National Bank and appointed the Federal Deposit Insurance Corporation (FDIC) as receiver."

http://www.bcrnews.com/2012/11/02/the-history-of-citizens-first-national-bank/aft5541/?page=1

(in millions, unless otherwise)

Net Equity

2006 $96.7

2007 $106.1

2008 $112.1

2009 $97.4

2010 $80.1

2011 $30.2

9/30 $18.4

Profit

2006 $7.7

2007 $8.3

2008 $8.7

2009 -$19.9

2010 -$16.1

2011 -$52.3

9/30 -$4/7

Non-Current Loans

2006 $3.9

2007 $7.4

2008 $33.0

2009 $53.5

2010 $82.9

2011 $96.9

6/30 $64.9

Charge Offs

2006 $426,000 ( $225,000 commercial/industrial, $162,000 farmland, $16,000 1-4 family), $26,000 indivi.)

2007 $445,000 ($344,000 commercial/industrial, $97,000 individual, -$15,000 credit cards, -$1,000 farmland)

2008 $1.1 ($760,000 commercial/ind.,$308,000 individuals, $91,000 1-4 family)

2009 $4.0 ( $2.5 commercial/ind.,$1.0 individuals, $273,000 1-4 family, $238 nonfarm/nonres.)

2010 $22.9 ($13.0 construction/land, $4.0 1-4 family, $1.5 commercial,$1.4 nonfarm/nonres., $117,000indiv., $68,000 farmland)

2011 $51.1 ($21.3 construction/land, $18.2 nonfarm/nonres., $4.9 1-4 family, $3.9 commercial/industrial, $2.2 farmland,$430,000 multifamily, $

9/30 $23.7 ($15.0 construction/land. $2.6 1-4 family, $2.6 commercial/industrial,$2.4 nonfarm/nonres., $133,000 individual)

Construction and Land, 1-4 family multiple residential, Multiple Family Residential, Non-Farm Non-Residential loans

As of September 30, 2012, Citizens First National Bank had approximately $924.0 million in total assets and $869.4 million in total deposits. In addition to assuming all of the deposits of the failed bank, Heartland Bank and Trust Company agreed to purchase essentially all of the assets.

Heartland Bank and Trust has now acquired a total of 4 failed banks in the last two years; previous three are Western Springs National Bank and Trust, Western Springs, Illinois (April,2011), Bank of Shorewood, Shorewood, Illinois, August, 2012 Bank of Illinois, Normal, Illinois (March, 2010),

"We're a locally owned community bank whose roots are right here in the heartland. The Drake family, who came to Central Illinois in 1852, has been in banking for over 80 years. With the third generation of the family taking an active role in the banking business, we continue this tradition.”

About Heartland Bank:

http://www.citizens1st.com/index.asp?page=1169

http://www.fdic.gov/news/news/press/2012/pr12128.html

List of Bank Failures:

http://www.fdic.gov/bank/individual/failed/banklist.html

Bank Beat:

http://www.leasingnews.org/Conscious-Top%20Stories/Bank_Beat.htm

[headlines]

--------------------------------------------------------------

Leasing News Help Wanted Classified Ad

(Appears on top of News Headlines

in a rotation basis with other Help Wanted as)

Please see our Job Wanted section for possible new employees.

[headlines]

--------------------------------------------------------------

Career Crossroad---By Emily Fitzpatrick/RII

“Immediate Steps to Take if you are Let Go”

Question: I was just let go, and it really came as a surprise, what are the steps I should take – I can’t afford to be out of work?!

Answer: I am sorry to hear of your situation …

CANDIDATES always be prepared for this scenario – EVEN if you don’t see the writing on the wall … this reduces the stress level of being let go and gives you some control:

-

Have your resume done professionally and --- review every six months to make sure updated

-

If in sales, make sure you keep copies of your pipeline – always on hand and ready

-

Ask for references / reference letters from clients, colleagues as you see fit

-

Make sure you have interview “attire” ready

Even if you think this won’t happen to YOU – you just never know – best course is to always be prepared

– Be Proactive instead of Reactive!

If you have NOT prepared yourself for this life-altering situation:

-

First, reach out to industry recruiters

-

Second, make sure your resume is marketable, and that it will “entice” a hiring manager / decision maker to take a “closer” look at your background

-

Third, start getting reference letters from colleagues, previous employers and/or clients

-

Fourth, start preparing for interviews

If you need further assistance, we are always here for you!

Emily Fitzpatrick

Sr. Recruiter

Recruiters International, Inc.

Phone: 954-885-9241

Cell: 954-612-0567

emily@riirecruit.com

Invite me to Connect on LinkedIn

www.linkedin.com/pub/emily-fitzpatrick/4/671/76

Also follow us on Twitter #RIIINFO

Career Crossroads Previous Columns

http://www.leasingnews.org/Conscious-Top%20Stories/crossroad.html

|

[headlines]

--------------------------------------------------------------

**** Announcement *************************************

CLP Foundation Announces New CLP---Louis Narrow

The Board of Directors of the Certified Lease Professional (CLP) Foundation is proud to announce that Louis (Lou) Narrow has passed the CLP Exam and earned the coveted CLP designation.

Mr. Narrow is a Vice President with Credential Leasing Corporation, a national lessor based out of Harrisburg, PA, and has been with the company 19 years.

The CLP designation identifies you as a knowlegeable professional to employers, clients, customers, and peers in the leasing industry. There are currently 171 Certified Lease Professionals throughout the world. For more information, call Reid Raykovich at (206) 535-6281 or visit www.clpfoundation.org

****Announcement*************************************

[headlines]

--------------------------------------------------------------

Indiana Court Ruling Makes True Lease “Murky”

Lawsuit by Secured Creditor of Lessee Claims Lease was Loan

and Key Equipment Finance Was Unsecured is Allowed to Proceed

By Tom McCurnin

Barton, Klugman & Oetting

Gibraltar Financial Corp. v. Prestige Equipment Corp., 949 N.E.2d 314 (Ind. 2011)

I’ve always thought that the Uniform Commercial Code’s “bright line” test of 1-203, which codified the nominal consideration test, was supposed to be a bright line test. But I also find that Judges, being Judges, are eager to weigh in on subjective standards like “reasonable.”

And today’s case demonstrates the irresistible impulse of some judges who want to depart from the statutory language to construe a lease as a loan instead of the true lease that was intended by the parties. Here, Key Equipment Finance had a fair market value purchase option, and at least in my judgment, that ought to be end of the analysis. The Indiana Supreme Court thought different. The facts follow:

Vitco, an Indiana manufacturer bought a punch press for $243,000, and did a sale leaseback with Key Equipment Finance. Key did not file a UCC-1 Financing Statement. After the lessee defaulted, Key Equipment Finance repossessed and sold the collateral. However, another secured creditor sued Key, claiming the lease was a security agreement, and since Key Equipment Finance didn’t file a UCC-1, the press was their collateral.

Key’s lease had two buyout opportunities, a “Early Buyout” provision for $78,000 and a an “End of Term Option.” The End of Term Option, had four different scenarios,

(1) Buy the press for fair market value; or

(2) Renew the Lease for the fair market renewal rental value; or

(3) Continue the Lease month-to-month at the current monthly rental rate; or

(4) Return the press to Key Equipment Finance.

Stop right there—the lessee had the chance to either return the press, buy it at FMV, renew the lease for another term, or pay month to month. Why isn’t this a true lease? The trial court and the Indiana Court of Appeals thought so.

The Indiana Supreme Court analyzed the four part bright line tests concerning the residual values and “concluded that the Lease did not create a security interest.”

OK. If the Indiana Supreme Court just said, what I thought they said, why isn’t this opinion over?

The Indiana Supreme Court then stated, “If a court finds that a transaction did not create a security interest per se, it must then consider the economic reality of the transaction in order to determine whether the transaction is more fairly characterized as a lease or a secured financing arrangement.” Oh, so it’s a true lease under the statute, but the lessee, and in this case the junior secured creditor, gets a second bite at the apple based on the murky “economic realities” of the transaction? Yep.

The economic realities test is a subterfuge of UCC 1-203 invented by an Illinois bankruptcy Court in 1995, long before UCC §1-203 was created. In re Meeks, 210 B.R. 1007, (Bkrtcy.S.D. Ill. 1995) that Court held that in order to be a true lease, the lessor must have a meaningful economic interest in the lease goods at the end of the lease. You will note that nowhere in the UCC does that language exist Another way of saying that the lease is really a security agreement is that the economic realities of the deal essentially force the lessee into exercising the purchase option, because the lessee has equity in the equipment.

Here, the Indiana Supreme Court analyzed the lease terms relative to its cost, $243,000, the aggregate payment stream, and the early buyout provision of $78,000. The Indiana Supreme Court then pointed out the obvious that “paying the $78,000 was the only economically sensible course for Vitco to take” given the fact that the equipment was a leaseback. Thus, the Indiana Supreme Court then sent the case back to the trial court for a determination of the “economic realities” of the lease.

I don’t often find fault with appellate judges, and maybe I’m too tied to the leasing industry to be objective, but the Indiana Supreme Court just created mud out of what was supposed to be a bright line test under the Uniform Commercial Code. The lessons for the equipment lessor, besides avoiding the State of Indiana, are:

First, file a UCC-1 Financing Statement, regardless of whether the lease is a security agreement or a true lease. There is plenty of case law which supports the proposition that UCC filing does not make the lease a loan. Here, the dispute was between a secured creditor and the lessor as to the collateral. Had Key Equipment Finance filed an informational UCC filing, this would have been a no harm, no foul, case.

Second, perhaps leasebacks are per se loans, and simply cannot be a true lease. There is some authority for that proposition, mostly in California and Texas, but I’ve never seen an appellate court wrap itself around the pole so tightly without simply coming out and stating that proposition. So if the reader is doing leasebacks, the reader might want to price the lease and take other collateral to compensate the lessor for the risk from an Indiana bankruptcy trustee.

The bottom line to this case is that I think the lessor got it right, save and except not filing a UCC-1, and basically got hosed by the Indiana Supreme Court.

Tom McCurnin is a partner at Barton, Klugman & Oetting in Los Angeles, California.

Barton, Klugman & Oetting

350 South Grand Ave.

Suite 2200

Los Angeles, CA 90071

Tom McCurnin

Direct Phone: (213) 617-6129

Cell (213) 268-8291

Fax: (213) 625-1832

Email: tmccurnin@bkolaw.com

Visit our web site at www.bkolaw.com

Gibraltar Financial Case:

http://www.leasingnews.org/PDF/GibralterCase.pdf

Previous Tom McCurnin Articles:

http://www.leasingnews.org/Conscious-Top%20Stories/leasing_cases.html

|

[headlines]

--------------------------------------------------------------

Alexa Rates Web News Standings

(You should be advertising in Leasing News)

The lower number indicates standing in number of web sites visited on the World Wide Web; divided here by visits from the United States and the Wide World.

Alexa for ten years has ranked Leasing News first among internet readers for news in the leasing industry in the United States as well as the most read from the United states in other countries.

The numbers are more impressive in considering the other media are five times a week where Leasing News is usually Monday-Wednesday-Friday---three times a week. In addition, no Google analytics, SEO, or other mechanics to increase readership are utilized by Leasing News.

US |

WW |

Links |

Web Site |

|

| 1 | 30,772 |

189,363 |

243 |

LeasingNews.com |

| 2 | 133,684 |

416,721 |

158 |

Lessors.com |

| 3 | 194,359 |

729,788 |

174 |

Monitor Daily |

| 4 | 230,220 |

1,496,611 |

78 |

NEFAssociation.org |

| 5 | 240,997 |

842,738 |

333 |

ELFAonline.org |

| 6 | 283,180 |

2,404,594 |

173 |

CLPFoundation.org |

| 7 | 283,266 |

1,420,805 |

60 |

Equipment Finance Advisor |

| 8 | 324,864 |

1,604,325 |

173 |

Commercial Finance Association |

| 9 | 476,945 |

1,816,053 |

139 |

NAELB.org |

| 10 | 539,523 |

2,167,027 |

142 |

WorldLeasingNews.org |

| 11 | No Data |

2,812,638 |

142 |

Equip. Leasing Finance Foundation |

| 12 | No Data |

10,148,931 |

23 |

Assoc. Gov. Leasing/Finance |

(11/4/2012)

The Alexa tool bar works on most browsers, owned by Amazon. They are partnered with Google. www.alexa.com

((Please click on ad to learn more))

(Leasing News provides this ad “gratis” as a means

to help support the growth of Lease Police)

[headlines]

--------------------------------------------------------------

Top Stories October 29--November 2

Here are the top ten stories opened by readers:

(1) Radiance Capital, Tacoma, Washington

Bulletin Board Complaint

http://leasingnews.org/archives/Oct2012/10_31.htm#bbc

(2) Confirmation---Evergreen Leasing is Closed

http://leasingnews.org/archives/Oct2012/10_29.htm#closed

(3) Wells Fargo Equip. Finance Stripped of Its Perfected Lien

By Tom McCurnin

http://leasingnews.org/archives/Oct2012/10_29.htm#wf

(4) East West Bank to cut back Healthcare Leases/Loans?

by Christopher Menkin

http://leasingnews.org/archives/Oct2012/10_29.htm#eastwest

(5) Martin Shames Passes Away

http://leasingnews.org/archives/Nov2012/11_02.htm#shames

(Tie)(6) Many East Coast Leasing Companies Back in Operation

http://leasingnews.org/archives/Oct2012/10_31.htm#back

(Tie)(6) Hurricane Sandy

—and responses to Phil Dushey email

http://leasingnews.org/archives/Nov2012/11_02.htm#sandy

(7) OneWorld Business Finance Up-Dates “Broker-Lessor List”

http://leasingnews.org/archives/Oct2012/10_31.htm#oneworld

(8) Bob Robichaud, CLP, Retires,

VP, Equipment Finance Department, Commerce Nat. Bank

http://leasingnews.org/archives/Nov2012/11_02.htm#retires

(9) Sandy's destruction from the air--56 photos

http://www.sfgate.com/news/slideshow/Sandy-s-destruction-from-the-air-51675.php

(Tie) (10) CLP Spotlight—Frank Vitalie, CLP

Financial Pacific Leasing

http://leasingnews.org/archives/Nov2012/11_02.htm#clp

(Tie) (10) FEMA to Banks and Lenders Re:

Financial Institutions and Borrowers Affected by Hurricane Sandy

http://leasingnews.org/archives/Oct2012/10_31.htm#fema

Not Counted Due to Technical Reasons:

Extra: East Coast Leasing Company Hurricane Update

John Kenny Receivables Management • Credit Investigations • Asset Searches • Skip-tracing • Third-party Commercial Collections john@jkrmdirect.com | ph 315-866-1167| www.jkrmdirect.com |

(Leasing News provides this ad as a trade for investigations

and background information provided by John Kenny)

[headlines]

--------------------------------------------------------------

--- Search by Country

--- Search by State

--- Search by City, State

Categories you can filter include "freelance," "full time", "part time," "Temporary" and "Internship."

While "leasing" brings up many rental property jobs, it also brings up equipment industry jobs, many of them in the private section, meaning captive lessors: those who offer financing to their end users, dealers, and distributors. This continues to be a growing field.

"Finance" tightens the list and specific jobs also work.

You can adjust the radius search from 1 to 5,000 miles. (Don't laugh, one of Leasing News classified helped a person seeking a specific job, who wanted to move back to the mainland from Hawaii: to the East Coast, about 4,000 miles)

More information (and view of job) available at:

http://thejobfind.info/blog/

You will need to create an account to gain full access.

It is free: http://thejobfind.info/submit/

[headlines]

--------------------------------------------------------------

Leasing News Sites Employment Sites

Open Positions at Leasing Funders/Various Locations

http://www.leasingnews.org/Classified/open_funder.html

Classified Ads---Employment Web Sites

http://www.leasingnews.org/Classified/Posting_sites.htm

|

Send Leasing News to a Colleague. We are free!!!

[headlines]

--------------------------------------------------------------

Beagle

Manhattan, New York Adopt-a-Dog

Daisy

Female

Brown/Black/White

Age: 3 years

How to Adopt (includes directions and hours)

http://www.aspca.org/Aspca-nyc/adoption-center/adoption-steps

Adopt-a-Pet by Leasing Co. State/City

http://www.leasingnews.org/Conscious-Top%20Stories/Adopt_Pet.htm

Adopt a Pet

http://www.adoptapet

[headlines]

--------------------------------------------------------------

Arizona Equipment Leasing Association Meeting

“On Tuesday, October 30 the Arizona Equipment Leasing Association had a breakfast meeting at CoCo’s Bakery and Restaurant in Phoenix with nine members in attendance. The meeting started with networking and an introduction to our three new board members: Bill Matetich of Metropolitan Leasing, Pam McConlogue of Bibby Financial and Wade Rasmussen of Amerifund.

“ The continental breakfast was followed by an invigorating presentation, by Dave Barnhart, President of Business Blogging Pros who showed us how to use social media to map your Buyer Highway. There was discussion about utilizing LinkedIn, Facebook, and blogs with our webpage to attract strangers that are the right prospects that will turn into customers. He stressed the importance of knowing what motivates the customer and how they search for a solution.”

(Ask a colleague to join the Leasing News mailing list. We are free.)

[headlines]

--------------------------------------------------------------

![]()

News Briefs----

Sandy-battered East Coast braces for cold, new storm

http://usnews.nbcnews.com/_news/2012/11/04/14920100-sandy-battered-east-coast-braces-for-cold-new-storm?lite

Photo collage of Sandy damage

Link (large file) AFTER LOADING, CLICK IMAGE TO MAKE LARGER

Banks extend fee waivers for storm-hit customers

http://www.usnews.com/news/business/articles/2012/11/04/banks-extend-fee-waivers-for-storm-hit-customers

Farming equipment – lease or purchase

http://www.theclevelandcurrent.com/index.php/component/

content/article/407-farming-equipment--lease-or-purchase.html

[headlines]

--------------------------------------------------------------

You May Have Missed---

Milestones in AT&T History

http://www.corp.att.com/history/milestones.html

[headlines]

--------------------------------------------------------------

SparkPeople--Live Healthier and Longer

![]()

SparkPeople--Live Healthier and Longer

The Symptoms of Seasonal Affective Disorder

http://www.sparkpeople.com/resource/wellness_articles.asp?id=131

[headlines]

--------------------------------------------------------------

Sports Briefs----

Tampa Bay Buccaneers defeat Oakland Raiders as Doug Martin sets team/NFL records

http://www.tampabay.com/sports/football/bucs/article1259975.ece

http://www.contracostatimes.com/raiders/ci_21928401/oakland-raiders-big-plays-cost-raiders-42-32

Falcons pull out 19-13 victory to remain undefeated

http://www.ajc.com/news/sports/football/falcons-pull-out-19-13-victory-to-remain-undefeate/nSxP8/

Bears. Tillman deliver knockout

http://www.chicagotribune.com/sports/football/bears/ct-spt-1105-bears-titans-chicago--20121104,0,1356474.story

Cowboys’ playoff hopes likely gone after losing in Atlanta

http://www.dallasnews.com/sports/dallas-cowboys/headlines/20121104-analysis-cowboys-playoff-hopes-likely-gone-after-losing-in-atlanta.ece

Oregon positioned for title run

http://www.tampabay.com/sports/oregon-positioned-for-title-run/1260006

[headlines]

--------------------------------------------------------------

American Football Poem

LEIF ERICSON

Leif the Viking bent his knees

And prayed to God in ten-o-three

"With your help I’ll set the sail

With your wisdom we’ll prevail."

Across the sea to a far off land

The Vikings sailed under Leif’s command

In winds and waves the ship was tossed,

But through it all the bark did cross.

A new world waited for Leif to view

Adventure, wonder, farmland too

Clear waters, fish and hunting grounds

A finer land could not be found

A man of courage, faith, and prayer

Leif the Norseman did his share

To open the worlds beyond the sea

A noble Viking, great was he!

Written by Carol Naevestad-Billings of Oxford, CT

[headlines]

--------------------------------------------------------------

![]()

California Nuts Briefs---

Raley's, Nob Hill grocery workers go out on strike

http://www.sacbee.com/2012/11/04/4960104/raleys-workers-go-out-on-strike.html

[headlines]

--------------------------------------------------------------

![]()

“Gimme that Wine”

http://www.youtube.com/watch?v=EJnQoi8DSE8

One Person Stands Between You and a Fine Wine

http://www.nytimes.com/2012/11/07/dining/one-person-stands-between-you-and-a-fine-wine-the-sommelier.html?ref=dining&_r=0

Napa Valley mostly finished with 2012 harvest

http://napavalleyregister.com/star/lifestyles/harvest-report-napa-valley-mostly-finished-with-harvest/article_6a70b156-23bb-11e2-8d4f-001a4bcf887a.html

Chenin Blanc "Harvest of this Century" Reports Clarksburg's John Beckman

http://www.sfgate.com/default/article/Chenin-Blanc-Harvest-of-this-Century-Reports-4000674.php

Grgich’s contributions documented in film at festival next week

http://napavalleyregister.com/lifestyles/food-and-cooking/wine/grgich-s-contributions-documented-in-film-at-festival-next-week/article_94886ddc-2495-11e2-a15e-0019bb2963f4.html

Free Mobile Wine Program

http://leasingnews.org/archives/Feb2010/2_26.htm#mobile

Wine Prices by vintage

http://www.winezap.com

http://www.wine-searcher.com/

US/International Wine Events

http://www.localwineevents.com/

Winery Atlas

http://www.carterhouse.com/atlas/\

Leasing News Wine & Spirits Page

http://two.leasingnews.org/Recommendations/wnensprts.htm

[headlines]

----------------------------------------------------------------

![]()

This Day in History

1639 - 1st post office in the colonies opened in Massachusetts.

1653 - The Iroquois League signed a peace treaty with the French, vowing not to wage war with other tribes under French protection.

1733- John Peter Zenger, colonial American printer and journalist, published the first issue of the New York Weekly Journal newspaper. He began his first issue, exposing Governor William Cosby's corruption. Zenger was arrested on November 17,1734, and charged with seditious libel. Zenger had reported that Governor William Cosby of New York had attempted to rig an election in Eastchester, PA, in 1733. Zenger was defended by lawyer Andrew Hamilton of Philadelphia, who convinced the jury that printing the truth does not constitute libel. His acquittal was seen as a vindication of the right of free speech and served as a precedent for freedom of the press.

1768 - William Johnson, the northern Indian Commissioner, signed a treaty with the Iroquois Indians to acquire much of the land between the Tennessee and Ohio rivers for future settlement.

1781- John Hanson elected first "President of the US in Congress assembled"

(Yes, John Hanson was the first president of the United States, not George Washington—who was the first president under the adopted constitution. Technically Hanson was the first president.)

http://www.johnhanson.net/

http://www.marshallhall.org/hanson.html

1807- Eliza Emily Chappell Porter birthday, spent a lifetime organizing schools in several states. During the Civil War gathered and distributed supplies to Union soldiers and hospitals. She joined with Mary Ann Bickerdyke in nursing soldiers in Gen. Sherman's march through Georgia.

1850- Ella Wheeler Wilcox birthday, highly successful writer of popular novels and poetry who became the center of literary life in New York in the pre-World War I years. Her reputation was made by her Poems of Passion (1883) ?She wrote two autobiographies: The Story of a Literary Career (1905) and The Worlds and I (1918).

http://www.ellawheelerwilcox.org/

http://website.lineone.net/~cornerstone/wilcox.htm

1857- Ida Minerva Tarbell birthday, recognized as one of the major journalists of her day, exposed the Standard Oil trust in History of Standard Oil Company, renowned biographer, especially of Lincoln. Her "History of the Standard Oil," which first appeared in McClure's Magazine in nineteen installments, in 1904, was published in two volumes and drew immediate attention to the author. Her early reputation as a "trust buster" did not last, for she had in a high degree developed a sense of fairness, and this was particularly reflected in her "Life of Judge Gary," in which--contrary to all expectations--she had nothing but praise for Judge Gary. ? She was a renowned biographer, especially of Lincoln. ?She wrote "The Early Life of Abraham Lincoln" in collaboration with W. J. McCan Davis. In 1900 her "Life of Abraham Lincoln" appeared in two volumes, and is today a standard work. Other volumes on Lincoln by Miss Tarbell were "He Knew Lincoln," "Father Abraham," "In Lincoln's Chair," "Boy Scouts' Life of Lincoln," "He Knew Lincoln and Other Billy Brown Stories," "In the Footsteps of Lincoln" and "A Reporter for Lincoln.” President Theodore Roosevelt characterized her as a muckraker, a compliment in those days. Tarbell was a lesbian and in her later life became intimate friends with Anne Morgan, the daughter of J. P. Morgan who was also a liberal Republican, feminist, and supporter of working women.

http://tarbell.alleg.edu/index.html

http://www.thoemmes.com/404.asp?404;

http://www.thoemmes.com/encyclopedia/tarbell.htm

http://www.phmc.state.pa.us/ppet/tarbell/page1.asp?secid=31

1862 - In Minnesota, more than 300 Santee Sioux are found guilty of raping and murdering Anglo settlers and are sentenced to hang. A month later, President Abraham Lincoln commuted all but 39 of the death sentences. One of the Indians was granted a last-minute reprieve, but the other 38 were hanged simultaneously on December 26 in a bizarre mass execution witnessed by a large crowd of approving Minnesotans. The Santee Sioux were found guilty of joining in the so-called "Minnesota Uprising," which was actually part of the wider Indian wars that plagued the West during the second half of the nineteenth century. For nearly half a century, Anglo settlers invaded the Santee Sioux territory in the beautiful Minnesota Valley, and government pressure gradually forced the Indians to relocate to smaller reservations along the Minnesota River. At the reservations, the Santee were badly mistreated by corrupt federal Indian agents and contractors; during July 1862, the agents pushed the Indians to the brink of starvation by refusing to distribute stores of food because they had not yet received their customary kickback payments. The contractors callously ignored the Santee's pleas for help. Outraged and at the limits of their endurance, the Santee finally struck back, killing Anglo settlers and taking women as hostages. The initial efforts of the U.S. Army to stop the Santee warriors failed, and in a battle at Birch Coulee, Santee Sioux killed 13 American soldiers and wounded another 47 soldiers. However, on September 23, a force under the leadership of General Henry H. Sibley finally defeated the main body of Santee warriors at Wood Lake, recovering many of the hostages and forcing most of the Indians to surrender. The subsequent trials of the prisoners gave little attention to the injustices the Indians had suffered on the reservations and largely catered to the popular desire for revenge. However, President Lincoln's commutation of the majority of the death sentences clearly reflected his understanding that the Minnesota Uprising had been rooted in a long history of Anglo abuse of the Santee Sioux.

1870 -- One of the nation's first train robberies. Six men, led by Big Jack Davis, hopped aboard the eastbound express for Reno, forced the train to a stop, & rode off to Virginia City with $40,000 in minted coin. 10 hours later, as the delayed engine chugged into Independence, six army deserters jumped aboard to take $4m490 that the Davis gang had overlooked. Within days, authorities captured all 13 bandits, who were sentenced variously from 10 to 15 years in prison.

1872 - Ulysses S. Grant was re-elected US president. Incumbent President Ulysses S. Grant was easily elected to a second term in office despite a split within the Republican Party that resulted in a defection of many key Republicans to opponent Horace Greeley. On November 29, 1872, after the popular vote but before the Electoral College was convened, Greeley died. As a result, electors previously committed to Greeley voted for four different candidates for President, and eight different candidates for Vice President. Despite the absence of life, Greeley himself still received three electoral votes, but these votes were disallowed by Congress. Henry Wilson, who was chosen by the Republicans to succeed Schuyler Colfax as Vice President, died on November 22, 1875.

1885- Birthday of Will Durant, American author and popularizer of history and philosophy. Among his books: The Story of Philosophy and The Story of Civilization (a 10-volume series of which the last four were co-authored by his wife, Ariel). Born at North Adams, MA, and died Nov 7, 1981, at

Los Angeles, CA.

1893- birthday of Raymond Fernand Loewy, the “father of streamlining,” an inventor, engineer and industrial designer whose ideas changed the look of 20th-century life, was born at Paris, France. His designs are evident in almost every area of modern life—the US Postal Service logo, the president's airplane, Air Force One, in streamlined automobiles, trains, refrigerators and pens. “Between two products equal in price, function and quality,” he said, “the better looking will outsell the other.” Loewy died at Monte Carlo, July 14,1986.

1894 -the famous Election Day snowstorm hit southern New England, dumping up 10-12 inches of snow across Connecticut causing much damage to trees and wires. Winds at Block Island, RI gusted to 60 mph

1895,-attorney George Baldwin Selden of Rochester, NY, was granted the first patent for a car. He was the first to have an original application for the internal combustion hydrocarbon motor to a road vehicle. His design resembled a horse-drawn carriage, with high wheels and a buckboard.

1895 -- Charles MacArthur, American journalist, dramatist, screenwriter, born Scranton, Pennsylvania. Much of his work was written with Ben Hecht, including The Front Page (1928), a farce about a star reporter drawn into his own story, & Twentieth Century (1932), a lively satire of the entertainment industry.

1907-Pianist Joe Sullivan Birthday

http://www.redhotjazz.com/sullivan.html

1912 – Democrat Woodrow Wilson won the United States presidential election in a landslide, becoming the only president to defeat two former presidents in one election. Thomas R. Marshall was elected vice president. The electoral vote was Wilson, 435: Theodore Roosevelt, Progressive Party, 88: William Howard Taft, Republican, 8.The popular vote was Wilson 6,293,454: Roosevelt, 4,119,538: Taft, 3,484,980: Eugene V. Debs, Socialist candidate, 900,672, Eugene W. Chafin, Prohibitionist candidate, 206,275. In congressional elections the Democrats took a 51-44 majority in the Senate, with one minor party seat, and 291-127 majority in the House, with 17 seats going to minor parties.

1912- Roy Rogers birthday. Known as the “King of the Cowboys,” Rogers was born Leonard Slye at Cincinnati, OH. His many songs included “Don't Fence Me In” and “Happy Trails to You.” He made his acting debut in Under Western Stars in 1935 and later hosted his own show, “The Roy Rogers Show,” in 1951. Rogers died at Apple Valley, CA, July 6,1998.

1913 -- Los Angeles receives its first piped-in water from Owens Valley, 200 miles northeast of the city. As part of Bureau of Land Reclamation efforts to irrigate the valley for small farmers & homesteaders, J.B. Lippincott began surveying in 1903. He convinced local farmers to relinquish their water rights to him, casting an impression that he would use the water to improve the valley. He & powerful Los Angeles friends, meanwhile, quietly planned to export it through a 200-mile aqueduct. The syndicate, which included Harry Chandler of the "LA Times", began buying huge amounts of San Fernando Valley land. On Lippincott's recommendation, the California reclamation chief dropped the Owens redevelopment plan & yielded the water to the city. Now that the water is flowing, the value of Chandler's land has multiplied to $120 million, 40 times more than what he paid. When he dies as the largest land baron in Southern California, Chandler's estate was worth half a billion dollars.

1915 - Marines under Major Smedley D. Butler captured the stronghold at Fort Capois, Haiti. Butler led a reconnaissance force of twenty-six volunteers in pursuit of a Caco force that had killed ten Marines. Like the Cacos in the mountains, he and his men lived for days off the orange groves. For over a hundred miles they followed a trail of peels, estimating how long before the Cacos had passed by the dryness of the peels. A native guide they picked up helped them locate the Cacos' headquarters, a secret fort called Capois, deep in the mountain range. Studying the mountaintop fort through field glasses, Butler made out thick stone walls, with enough activity to suggest they were defended by at least a regiment. He decided to return to Cape Haitien for reinforcements and capture it. On the way back they were ambushed by a force of Cacos that outnumbered them twenty to one. Fortunately it was a pitch-black night, and Butler was able to save his men by splitting them up to crawl past the Cacos' lines through high grass. Just before dawn he reorganized them into three squads of nine men each. Charging from three directions as they yelled wildly and fired from the hip, they created such a fearful din that the Cacos panicked and fled, leaving seventy-five killed. The only Marine casualty was one man wounded. When he was able to return with reinforcements, spies had alerted the Cacos, and Butler took a deserted Fort Capois without firing a shot.

1918--ALLWORTH, EDWARD C. Medal of Honor

Rank and organization: Captain, U.S. Army, 60th Infantry, 5th Division. Place and date: At Clery-le-Petit, France, 5 November 1918. Entered service at: Corvallis, Oregon. Born: 6 July 1887, Crawford, Wash. G.O. No.: 16, W.D., 1919. Citation: While his company was crossing the Meuse River and canal at a bridgehead opposite Clery-le-Petit, the bridge over the canal was destroyed by shell fire and Capt. Allworth's command became separated, part of it being on the east bank of the canal and the remainder on the west bank. Seeing his advance units making slow headway up the steep slope ahead, this officer mounted the canal bank and called for his men to follow. Plunging in he swam across the canal under fire from the enemy, followed by his men. Inspiring his men by his example of gallantry, he led them up the slope, joining his hard-pressed platoons in front. By his personal leadership he forced the enemy back for more than a kilometer, overcoming machinegun nests and capturing 100 prisoners, whose number exceeded that of the men in his command. The exceptional courage and leadership displayed by Capt. Allworth made possible the re-establishment of a bridgehead over the canal and the successful advance of other troops.

1946- Chuck Connors of the Boston Celtics became the first NBA player to shatter a backboard, doing so during the pre game warm-up in “Boston Garden. Connors also played major league baseball with the Brooklyn Dodgers and the Chicago Cubs and gained fame as star of the television series, “ The Rifleman.” My father Lawrence Menkin wrote many of the episodes.

1935 - The game "Monopoly" was introduced by the Parker Brothers Company.

http://www.adena.com/adena/mo/index.htm

http://www.hasbro.com/monopoly/?CFID=

21692834&CFTOKEN=82601711

1940 - President Roosevelt won an unprecedented third term in office, beating Republican challenger Wendell L. Willkie. Henry A. Wallace was elected vice president. The electoral vote was Roosevelt, 449, Wendell L. Willike, Republican of Indiana, 82. The popular vote was Roosevelt 27,244,160: Willike, 22,305,198: Norman Thomas, Socialist candidate, 100,264: Roger W. Babson, Prohibition candidate, 57,812: Earl Browder, Communist, 48,579: John W. Aiken, Socialist Labor candidate, 14,861. In congressional elections the Democrats lost three Senate seats but kept a 66-28 majority, with two seats going to minor parties. In the House, the Democrats gained seven seats for a 268-162 lead, with five seats going to minor parties.

1944---Top Hits

I'll Walk Alone - Dinah Shore

Dance with the Dolly - The Russ Morgan Orchestra (vocal: Al Jennings)

How Many Hearts Have You Broken - The Three Suns

Smoke on the Water - Red Foley

1946 - 29-year old John F. Kennedy started his political career when today he was elected to the United States House of Representatives as a Congressman from Massachusetts

1947- Frank Sinatra cuts “ I've Got a Crush on You” with Bobby Hackett on trumpet, NYC.

1950- Billy Graham's "Hour of Decision" program was first broadcast over television.

1951---RED CLOUD, MITCHELL, JR. Medal of Honor

Rank and organization: Corporal, U S. Army, Company E, 19th Infantry Regiment, 24th Infantry Division. Place and date: Near Chonghyon, Korea, 5 November 1950. Entered service at: Merrilan Wis. Born: 2 July 1924, Hatfield, Wis. G.O. No.: 26, 25 April 1951. Citation: Cpl. Red Cloud, Company E, distinguished himself by conspicuous gallantry and intrepidity above and beyond the call of duty in action against the enemy. From his position on the point of a ridge immediately in front of the company command post he was the first to detect the approach of the Chinese Communist forces and give the alarm as the enemy charged from a brush-covered area less than 100 feet from him. Springing up he delivered devastating pointblank automatic rifle fire into the advancing enemy. His accurate and intense fire checked this assault and gained time for the company to consolidate its defense. With utter fearlessness he maintained his firing position until severely wounded by enemy fire. Refusing assistance he pulled himself to his feet and wrapping his arm around a tree continued his deadly fire again, until he was fatally wounded. This heroic act stopped the enemy from overrunning his company's position and gained time for reorganization and evacuation of the wounded. Cpl. Red Cloud's dauntless courage and gallant self-sacrifice reflects the highest credit upon himself and upholds the esteemed traditions of the U.S. Army.

1952---Top Hits

You Belong to Me - Jo Stafford

Wish You Were Here - Eddie Fisher

Half as Much - Rosemary Clooney

Jambalaya (On the Bayou) - Hank Williams

1956- “The Nat King Cole Show” premiered on television. Very popular African American pianist, jazz musician turned singer, Cole hosted his own variety show for NBC. The Nelson Riddle Orchestra and the Randy Van Home Singers also appeared as regulars on the show. It began as a 15-minute show which was expanded to half an hour. The show was dropped as a result of lack of sponsorship and because many affiliates declined to carry it.

1960---Top Hits

Save the Last Dance for Me - The Drifters

My Heart Has a Mind of Its Own - Connie Francis

You Talk Too Much - Joe Jones

Wings of a Dove - Ferlin Husky

1960-- Johnny Horton, who had a Number One smash "Battle of New Orleans," is killed in an auto accident in Texas. Ironically, he had just played his last show, at the Skyline in Austin, Texas-where Hank Williams had played his last show as well. Horton's widow, Billy Joe, was also Hanks Williams' widow. Johnny Horton was 33.

1961 - Strong Santa Ana winds fanned the flames of the Bel Air and Brentwood fires in southern California destroying many homes. At 10 PM the Los Angeles Civic Center reported a temperature of 74 degrees along with a dew point of 5 degrees. On the 6th, Burbank reported a relative humidity of three percent.

1964 -- Free Speech Movement (FSM) coalesces as thousands of University of California-Berkeley students rally & occupy Sproul Hall. As a reporter I covered this for KFRC, UPI, and free lanced to other media.

http://www.berkeley.edu/news/berkeleyan/2002/08/28_fsm.html

http://www.fsm-a.org/stacks/covers/narratives_cvr.html

1966 - The Motown hit, You Keep Me Hangin' On, recorded by The Supremes, debuted on Billboard's pop charts, and was Number 1 for 2 weeks. It was on the charts for a total of 10 weeks. The song was The Supremes' eighth Number 1 record.

1966--BAKER, JOHN F., JR. Medal of Honor

Rank and organization: Sergeant (then Pfc.), U.S. Army, Company A, 2d Battalion, 27th Infantry, 25th Infantry Division. Place and date: Republic of Vietnam, 5 November 1966. Entered service at: Moline, Ill. Born: 30 October 1945, Davenport, Iowa. Citation: For conspicuous gallantry and intrepidity in action at the risk of his life above and beyond the call of duty. En route to assist another unit that was engaged with the enemy, Company A came under intense enemy fire and the lead man was killed instantly. Sgt. Baker immediately moved to the head of the column and together with another soldier knocked out 2 enemy bunkers. When his comrade was mortally wounded, Sgt. Baker, spotting 4 Viet Cong snipers, killed all of them, evacuated the fallen soldier and returned to lead repeated assaults against the enemy positions, killing several more Viet Cong. Moving to attack 2 additional enemy bunkers, he and another soldier drew intense enemy fire and Sgt. Baker was blown from his feet by an enemy grenade. He quickly recovered and single-handedly destroyed 1 bunker before the other soldier was wounded. Seizing his fallen comrade's machine gun, Sgt. Baker charged through the deadly fusillade to silence the other bunker. He evacuated his comrade, replenished his ammunition and returned to the forefront to brave the enemy fire and continue the fight. When the forward element was ordered to withdraw, he carried 1 wounded man to the rear. As he returned to evacuate another soldier, he was taken under fire by snipers, but raced beyond the friendly troops to attack and kill the snipers. After evacuating the wounded man, he returned to cover the deployment of the unit. His ammunition now exhausted, he dragged 2 more of his fallen comrades to the rear. Sgt. Baker's selfless heroism, indomitable fighting spirit, and extraordinary gallantry were directly responsible for saving the lives of several of his comrades, and inflicting serious damage on the enemy. His acts were in keeping with the highest traditions of the U.S. Army and reflect great credit upon himself and the Armed Forces of his country.

1966--FOLEY, ROBERT F. Medal of Honor

Rank and organization: Captain, U.S. Army, Company A, 2d Battalion, 27th Infantry, 25th Infantry Division. Place and date: Near Quan Dau Tieng, Republic of Vietnam, 5 November 1966. Entered service at: Newton, Mass. Born: 30 May 1941, Newton, Mass. Citation: For conspicuous gallantry and intrepidity in action at the risk of his life above and beyond the call of duty. Capt. Foley's company was ordered to extricate another company of the battalion. Moving through the dense jungle to aid the besieged unit, Company A encountered a strong enemy force occupying well concealed, defensive positions, and the company's leading element quickly sustained several casualties. Capt. Foley immediately ran forward to the scene of the most intense action to direct the company's efforts. Deploying 1 platoon on the flank, he led the other 2 platoons in an attack on the enemy in the face of intense fire. During this action both radio operators accompanying him were wounded. At grave risk to himself he defied the enemy's murderous fire, and helped the wounded operators to a position where they could receive medical care. As he moved forward again 1 of his machine gun crews was wounded. Seizing the weapon, he charged forward firing the machine gun, shouting orders and rallying his men, thus maintaining the momentum of the attack. Under increasingly heavy enemy fire he ordered his assistant to take cover and, alone, Capt. Foley continued to advance firing the machine gun until the wounded had been evacuated and the attack in this area could be resumed. When movement on the other flank was halted by the enemy's fanatical defense, Capt. Foley moved to personally direct this critical phase of the battle. Leading the renewed effort he was blown off his feet and wounded by an enemy grenade. Despite his painful wounds he refused medical aid and persevered in the forefront of the attack on the enemy redoubt. He led the assault on several enemy gun emplacements and, single-handedly, destroyed 3 such positions. His outstanding personal leadership under intense enemy fire during the fierce battle which lasted for several hours, inspired his men to heroic efforts and was instrumental in the ultimate success of the operation. Capt. Foley's magnificent courage, selfless concern for his men and professional skill reflect the utmost credit upon himself and the U.S. Army.

1966-- The Monkees' "Last Train To Clarksville" hits #1

1967-- Kenny Rogers and his group The First Edition make their television debut on CBS' Smothers Brothers Comedy Hour.

1968---Top Hits

Hey Jude - The Beatles

Those Were the Days - Mary Hopkin

Midnight Confessions - The Grass Roots

Next in Line - Conway Twitty

1968 - Republican Richard M. Nixon won the presidency, defeating Vice President Hubert H. Humphrey and third-party candidate George C. Wallace. Spiro T. Agnew, Republican of Maryland was elected vice-president. The electoral vote was Nixon, 302: Humphrey, 191: George C. Wallace, third-party candidate, 45. One Nixon elector later cast his vote for Wallace. The popular vote was Nixon, 31,785,473: Humprhey,31,275,166: Wallace,9,906,473. The Republicans gained four seats in the House and five in the Senate but the Democrats still held majorities of 58-42 in the senate and 243-192 in the House. The Republicans gained five governorships in the election.

1968- Shirley Anita St. Hill Chisholm, a Democrat, was elected this day and became the first African-American woman elected to Congress. She served the Bedfor-Stuyvessant section of Brooklyn for seven terms.

1970--Midway through a Beach Boys show at L.A.'s Whiskey-a-Go-Go, Brian Wilson, making one of rare stage appearances, loses his balance several times and has to be helped backstage. His right ear, the better of the two, sustains "severe damage" because of the volume level on-stage

1971 - The Los Angeles Lakers began professional sport's longest winning streak in the history by winning the first of 33 consecutive basketball games.

1971--- Two firsts at tonight's Elvis Presley show at the Metropolitan Sports Center in Minneapolis, MI: comic Jackie Kahane begins his lifelong stint as opening act, and Elvis ends the show with cape outstretched in a bizarrely Christ like pose -- another gimmick that will become a staple of Elvis' live act.

1972-- The Jackson 5 Show, the group's second television special, airs on CBS.