Information, news, and entertainment for the commercial

alternate financing,

bank, finance and leasing industries

Add me to mailing list

| Search | All Lists | Columnists | Site Map

Advertising| Archives | Classified Ads | This Day In American History

Email the Editor

![]()

Wednesday, September 22, 2021

Today's Leasing News Headlines

Fed: Industrial Production Now Beats Pre-Pandemic Levels

Industry Week.com

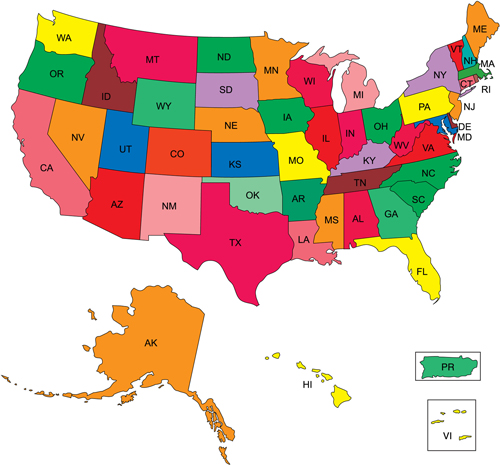

License and Registration United States

By Kenneth C. Greene, Attorney

New Disclosure Laws, Pt. 1 (Revised)

Leasing Industry Ads

Equipment Vendor Sales Managers/Rainmakers Wanted

Why I Became a CLFP

Terey Jennings, CLFP, Financial Pacific

Credit Managers

A Time for Planning Ahead

Remote Work Already Changing Seattle Permanently,

Tech Worker Survey Indicates

By Mike Lewis, Geekwire.com

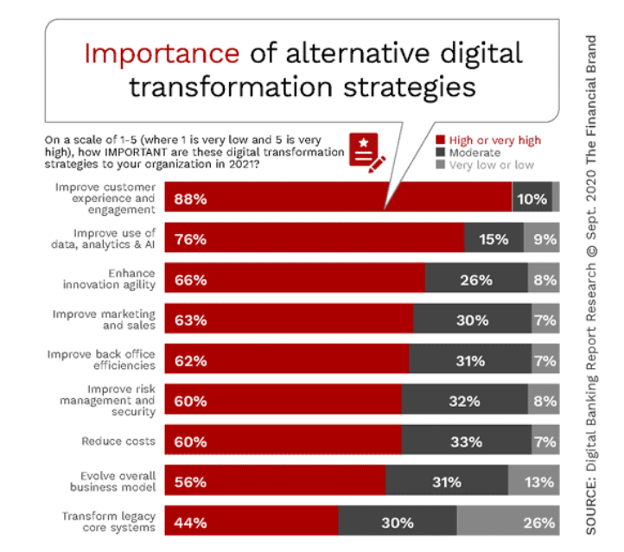

Banks Say Innovation Now More

Important Than Ever

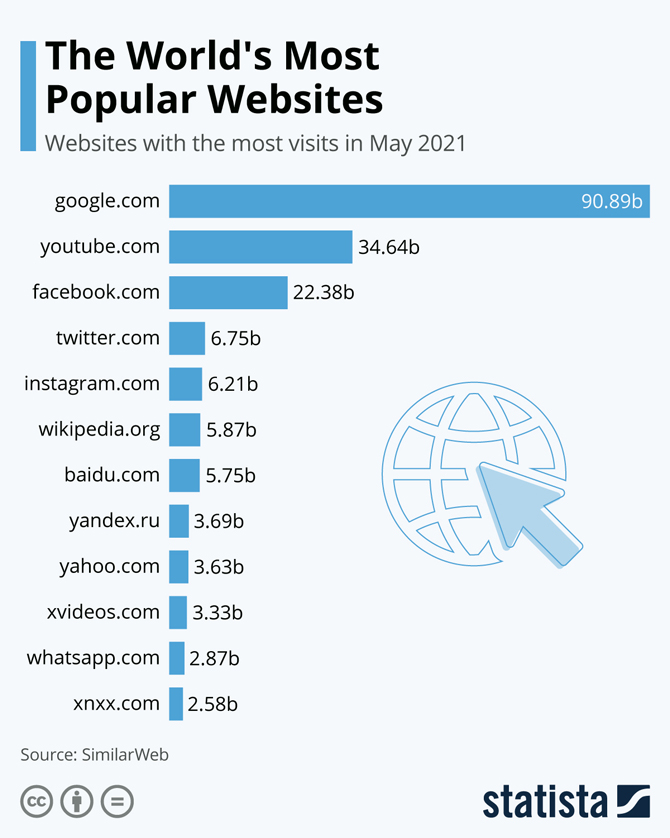

The World's Most Popular Websites

Websites with the Most Visits

The Future of Fleet Payments: Expect the Unexpected

By Amanda Huggett, Automotive Fleet

Grand Opening of its Amur New Headquarter,

Celebrating 25th Anniversary of Company Found

Davidson Kempner Launches New

Commercial Aviation Financing Platform

ELFA Announces Thomas Ware Will Receive

2021 Distinguished Service Award

Saint Bernard Mix

Grand Island, Nebraska Adopt-a-Dog

Largest Association Conference This Year

ELFA 60th Annual Convention

764 Registered to Date, Including 40 Virtual Attendees

News Briefs---

U.S. Bank buys MUFG Union Bank,

a big presence on the West Coast, for $8 billion

Google to Buy New York City Office Building for $2.1 Billion

Manhattan deal is priciest sale of a U.S. office building

Ex-Controller Testifies in Trial of Theranos CEO

revenue projections that did not match the reality of its finances

Historic Lows in Net Interest Margins Bedevil U.S. Banks

Lower demand for credit and tighter net interest margins

You May have Missed---

Report: Over a Third of Gen-Z and Millennial Workers

are Looking for a New Job

Broker/Funder/Industry Lists | Features (wrilter's columns)

Top Ten Stories Chosen by Readers | Top Stories last six months

www.leasingcomplaints.com (Be Careful of Doing Business)

www.evergreenleasingnews.org

Leasing News Icon for Android Mobile Device

Sports Brief----

California Nuts Brief---

"Gimme that Wine"

This Day in History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

######## surrounding the article denotes it is a “press release,” it was not written by Leasing News nor has the information been verified. The source noted. When an article is signed by the writer, it is considered a “byline.” It reflects the opinion and research of the writer.

[headlines]

--------------------------------------------------------------

Fed: Industrial Production Now Beats Pre-Pandemic Levels

Industry Week.com

Growth would have been stronger, the Fed said, had it not been for Hurricane Ida and sustained supply challenges

U.S. industrial production surpassed pre-pandemic levels last month according to data released y from the Federal Reserve.

The Fed’s latest report shows industrial production in August hit 101.6% of average monthly production in 2017. The latest figure is 5.9 percentage points better than 12 months ago and 0.3 points better than February 2020, the last month unaffected by COVID-19.

Industrial production is calculated based on the productivity of three related sectors: manufacturing, mining, and utilities.

Manufacturing production rose by 0.2 points, 5.9 points better than 12 months ago and 1.0 point above its February 2020 level.

Production of motor vehicles increased in August as the seasonally adjusted annual rate rose to 9.53 million units, up from July’s annualized rate of 9.31 million trucks and automobiles and the 2020 average of 8.82 million.

Mining production slipped 0.6 points as oil and gas extraction in the Gulf of Mexico was hammered late in the month by Hurricane Ida but remained 10.3 points higher than it was in August 2020. And the utilities sector saw the highest percentage-point growth in August as demand for air-conditioning in the atypically warm month drove a 3.3 increase.

Despite the positive comparison to pre-pandemic times, the figures indicate something of a productivity slowdown compared to July. Industrial production rose 0.4 points in August, just half of the 0.8 points’ growth seen the month before.

According to the Federal Reserve, the slowdown—like the productivity dip in mining production—is due to Hurricane Ida. The category-5 hurricane that landed in Louisiana late last month caused blackouts for significant portions of Southeast Louisiana and forced petroleum, chemical, and plant factories to close.

Without the storm, the Fed estimates manufacturing production and overall industrial production would have grown by 0.4 and 0.7 points, respectively.

[headlines]

--------------------------------------------------------------

License and Registration United States

By Kenneth C. Greene, Attorney

New Disclosure Laws Pt. 1 (Revised)

This series will examine the new commercial financing disclosure laws. Rather than address the laws state by state, as I did in the last series which discussed licensing and registration, I will adopt a more pragmatic approach, one that attempts to coordinate the disclosure requirements of each state by the type of transaction. The idea is to make it possible to utilize as few sets of documents as possible and still remain compliant with each state’s different laws. Otherwise, you might need a separate group of documents for every state that has disclosure laws, so that you end up with a template library of hundreds of documents which, at best, is cumbersome, and, more accurately, a ridiculously inefficient way to conduct business. These articles are intended to save you time and money by adopting a global approach to the disclosure documentation. This will also require updating as all of the laws appear to be in a state of flux at the moment.

I for one am an advocate of a Federal system of disclosure laws, or at least uniform laws adopted by the states, akin to the Uniform Commercial Code, one of the most logical and consistent bodies of American law. Although the Commercial Codes of many states vary a bit, they are similar enough that you can assume a certain amount of harmony between them. But that might be a pipe dream. For now, hopefully these articles will help everyone navigate this maze.

The states that require attention are California, New York, New Jersey and Connecticut. First, we will look at the present status of the disclosure legislation in those states. Starting next segment, I will take different financing products and attempt to create a compilation that includes all disclosures each type of transaction requires, regardless of the state law that governs them.

California: California, always a “leader” when it comes to business oversight, passed Senate Bill 1235 in 2018. To date, however, it has not yet taken effect. The law requires the newly named Department of Financial Protection and Innovation (DFPI), formerly known as the Department of Business Oversight (DBO), to promulgate rules and regulations that businesses can use to effect compliance with the new law. There have been six rounds of commentary from the public, the last ending a few weeks ago. It is my expectation that the rules will become final in short order and that the law will actually take effect in the beginning of 2022. Curiously, and perhaps disturbingly, although the law is only about four pages long, the most recent version, including commentary and revisions, is 53 pages!

Here is the body of that text, including the most recent modifications: https://dfpi.ca.gov/wp-content/uploads/sites/337/2021/08/2021-08-09-Commercial-Financing-Disclosures-Second-Modified-Text.pdf (2021)

New York: At the end of 2020, New York enacted Senate Bill 5470-B, imposing federal Truth-in-Lending (TIL) type disclosure obligations on lenders and brokers making certain commercial loans of $500,000 or less. Shortly thereafter, former Governor Andrew Cuomo modified what is now known as the New York “Commercial Loan Disclosure Law”. That law became operative on June 21, 2021. Here is a link to the original statute:

https://legislation.nysenate.gov/pdf/bills/2019/s5470b (2020)

It appears the commercial financial disclosure law is going forward for a January 1, 2022 deadline.

Acting Superintendent Adrienne A. Harris released a copy of the proposed regulations to receive comment within 60 days.

Among its provisions, the regulation:

- Provides detailed definitions for terms used in the CFDL, and in the regulation itself;

- Explains how providers should calculate the finance charge and annual percentage rate;

- Sets forth formatting requirements for disclosures required by the CFDL, both generally and specifically for the following types of financing:

- Sales-based financing;

- Closed-end financing;

- Open-end financing;

- Factoring transaction financing;

- Lease financing; and

- General asset-based financing;

- Describes how the CFDL’s disclosure threshold of $2,500,000 is calculated;

- Details certain duties of financers and brokers involved in commercial financing; and

- Prescribes a process under which certain providers calculating estimated annual percentage rates will report data to the Superintendent relating to the actual retrospective annual percentage rates of completed transactions, in order to facilitate accurate estimates for future transactions.

Proposed Regulations (45 pages):

https://www.dfs.ny.gov/system/files/documents/2021/09/pre_proposed_fs_sect600.pdf

Anyone wishing to provide commentary about the modifications is invited to send their comments to:

George Bogdan

Senior Attorney

Department of Financial Services

One State Street

New York, New York 10004-1417

FAX: (212) 709-1655

(212) 480-4758

george.bogdan@dfs.ny.gov

Connecticut: Their new Truth-in-Lending Act also mimics the Federal TILA. Committee Bill No. 745 was referred to the Committee on Banking in January 2021. If the bill passes, it will go into effect in October of this year.

ttps://www.cga.ct.gov/2021/TOB/S/PDF/2021SB-00745-R01-SB.PDF (2021)

New Jersey: A small business finance disclosure bill has languished there for a few years now, but there appears to be a renewed interest in enacting it into law. It is similar in scope to the law recently passed in New York.

Here is the link to the most recent iteration of that bill: https://www.njleg.state.nj.us/2020/Bills/S0500/233_I1.HTM (2020)

You are more than welcome to read these statutes, but my intent is to summarize them in a way that will make them easier to understand and apply to your document portfolio.

For the next article, I will address the disclosure requirements for standard commercial loans in all four of these states I will then tackle the other financial products, one by one, and hope this all begins to look less troublesome than it may appear at first glance.

Ken Greene

Law Office of Kenneth Charles Greene

5743 Corsa Avenue Suite 208

Westlake Village, California 91362

Tel: 818.575.9095

Fax: 805.435.7464

ken@kengreenelaw.com

Alternate: kengreenelaw@outlook.com

https://leasingnews.org/Advisory%20Board/Greene_Law.htm

This article is presented by the Law Office of Kenneth Charles Greene. All copyrightable text, the selection, arrangement, and presentation of all materials (including information in the public domain), and the overall design of this presentation are the property of the Law Office of Kenneth Charles Greene. All rights reserved. Permission is granted to download and reprint materials from this article for the purpose of viewing, reading, and retaining for reference. Any other copying, distribution, retransmission, or modification of information or materials from this article, whether in electronic or hard copy form, without the express prior written permission of Kenneth C. Greene, is strictly prohibited. The materials available from this article are for informational purposes only and not for the purpose of providing legal advice. You should contact your attorney to obtain advice with respect to any particular issue or problem. Use of and access to these materials does not create an attorney-client relationship between the Law Office of Kenneth Charles Greene and the user or viewer. The opinions expressed herein are the opinions of the individual author

[headlines]

--------------------------------------------------------------

Help Wanted Ads

[headlines]

--------------------------------------------------------------

Why I Became a CLFP

Terey Jennings, CLFP

President

Financial Pacific Leasing, Inc.

a subsidiary of Umpqua Bank

Terey joined Financial Pacific Leasing 36 years ago, in 1986, and has held various positions within the sales and marketing area, before being appointed Executive Vice President. He is active in a number of equipment leasing associations and is a past President of the United Association of Equipment Leasing, now National Equipment Finance Association (NEFA). He has been active in his community for many years. He earned a degree in Business Administration from Pacific Lutheran University.

He was one of the first two employees at Financial Pacific to receive a CLFP designation of which there are now 30 CLPFs in good-standing there. The following is an excerpt of an interview regarding his experience with the CFLP program, and background on why Financial Pacific so strongly supports the designation.

“Financial Pacific has sponsored 30 employees who have obtained their CLP designation," he said. "This is a very proud accomplishment for us. As a company, we include the CLP program in our training strategies and employees who meet the minimum requirements for the CLP designation strive for this goal. When they see their peers successfully navigate through the process, it takes away some of the fear associated with the exam, and provides a comfort level as being an achievable goal. We also have mentors available to provide support. We’ve been fortunate to have UAEL now NEFA provide 'Institute for Leasing Professionals' annually in our area and are thankful for that convenience.

“I’ve always felt that the process I went through to prepare for the exam has benefited me over the years in many ways. Because it was such a wide range of relevant information, I not only learned some new and interesting things but it also reinforced things I already knew. I’ve had many opportunities to refer back to the material over the years, and it’s been a rewarding experience to teach classes for new CLFP candidates.”

“I’ve always believed the process of studying and preparing for this is exam is valuable to anyone in our industry. It doesn’t matter what anyone’s job responsibilities are - the information is so broad. I sometimes think, 'If everyone in our company went through the process, would it make us a better company?' The answer is always 'yes'.”

[headlines]

--------------------------------------------------------------

Credit Managers

A Time for Planning Ahead

Credit Today

www.creditToday.net

It is hard to believe but we are entering the fourth quarter of 2021. It is time to begin 2022 planning for your department. What will the targets be, are there staffing changes needed, any systems upgrades in the coming year, can you improve how the department is organized, what changes will my company be making?

Credit Managers do not have the luxury of keeping things as they are in the fast-paced change environment in which we all find ourselves in. It is time to reassess and plan for how the Credit Department can deliver the most value to the company in the coming year.

So, what is in the way? Here are some typical responses:

I just don't know where to start and I don't have enough time to set aside for planning. Developing a plan for your department does not have to be done in one block of time. Set a realistic schedule to complete a 2022 plan. Set milestones, build the plan by breaking it into manageable milestones, with set dates for completion. For example:

- Meet with Sales to understand the new product or market strategies or competitive threats needing credit support.

- Meet with senior management to understand the cash forecast, performance expectations, and organization, or technology initiatives impacting the department.

- Meet with the credit team on a weekly basis to outline plan elements and draft the plan.

- Set a time for review of the draft plan by the management team.

- Complete the plan for rollout in 2022.

- I first have to get management buy-in. Gain cooperation and interest by asking for input from senior management and other stakeholders. Planning is a team sport. By seeking their input, it will show them you are working to support their objectives.

- My company culture is risk-averse and resistant to change. “We are doing fine with the way we have always done things.” You can overcome this resistance by focusing on the return to the company, yourself, and your staff from the time and resource investment.

Be prepared to explain the expected results. These will be different for each company but here are a few to consider:

- Improved cross-functional coordination and communication.

- Ability to adapt to anticipated changes in the organization, market, or technology that could threaten performance or additional opportunities for improvement.

- Provide faster credit decision turnaround

- Deliver improvements in cash flow

- Reductions in, and faster resolution of deductions

- Reduction in overhead expenses

- Added efficiency and performance transparency

- Help to facilitate increased revenue opportunities for new product lines, customers, or markets.

- Ensure accountability for those involved in implementing changes.

Conclusion:

We are in a period of rapid change in the business environment. It is up to you to ensure the Credit Department anticipates what needs to be done to support the company in the coming year. As the saying goes, “If you don't know where you are going, you can take any road to get there.” It may be time-consuming and distract you from other daily activities, but planning is worth the effort. Now is the time to focus on planning for 2022.

Source: credittoday.net

[headlines]

--------------------------------------------------------------

Remote Work Already Changing Seattle Permanently,

Tech Worker Survey Indicates

By Mike Lewis, Geekwire.com

The majority of Seattle tech workers don’t expect to ever return to their offices full time and the effects of that transition could alter everything from commercial real estate, to what social issues tech workers spend their time and money on, to downtown’s status as a business district.

Sea. Citi survey show that the population of workers who once filled downtown Belltown and South Lake Union offices, bars and restaurants and apartments are now looking increasingly to the suburbs after nearly two years of remote work amid the pandemic.

Nicholas Merriam, CEO and Co-Founder of Sea.Citi, a tech industry civic issue engagement nonprofit group, said, “Remote work is here to stay…And the data reveals a fundamental shift in how tech workers engage in their environment.”

The detailed survey of 467 tech workers between June and August also showed that while more than 50% of workers would consider moving away from Seattle — although not all specifically spurred by remote work options — these same workers remain deeply interested and engaged in the prevailing social concerns of the city, affordable housing and homelessness, racial equity and climate change.

Related: Are tech employees coming back to downtown Seattle? Here’s what companies are planning for Merriam speculated that working from home not only solved some of the traffic problems temporarily, it also made people less focused on them. “If you are not out there battling it every day on your car or bicycle, you think about it less,” he said.

But the longer-term attitude shift appears to be where people see themselves living and that, in turn, could change which issues matter, and where people donate and volunteer. The vast majority of tech workers surveyed — a whopping 84 percent — say they will either be working remotely part time (56 percent) or full time (28 percent). Additionally, 53 percent are open to moving or have already moved.

The two top reasons for moving? Housing affordability and the lure of remote work.

“There will be less people coming downtown, period,” Merriam said. “This will change what we use downtown for.”

Downtown Seattle had been one of the city’s fastest-growing neighborhoods, adding 48,000 people since 2010 for a population of 82,000. But the changes to the area are unlikely to be limited to people moving. When people relocate, it alters where they shop, dine and volunteer, Merriam said. The survey seems to indicate this point exactly.

Asked specifically if, “the ability to work remotely means (workers) will become more connected to and invested in their neighborhood or town, and less in the downtowns where their offices used to be,” the answer was a resounding yes.

Among people who have moved or have considered moving, 70% said they would end up more connected to their new neighborhood or town and less connected to downtown Seattle. While this could be bad news for downtown Seattle nonprofits that pull donations and volunteers from tech workers there, it could conversely be good news for suburban or neighborhood-based charities.

“This is significant,” Merriam said. “When people move, they still seek that connection. But they seek it in a new place. What is not as good for downtown might be good for the suburbs or neighborhoods.”

[headlines]--------------------------------------------------------------

Banks Say Innovation Now More

Important Than Ever

By Jim Marous, Co-Publisher of The Financial Brand, CEO of the

Digital Banking Report and host of the Banking Transformed podcast.

To remain competitive and to differentiate from competition, financial institutions must use innovation as a foundation for updated business models. Without an ongoing ability to embrace change and create updated solutions, banks and credit unions will fall further behind industry leaders, negatively impacting customer satisfaction, operational efficiency, and revenue growth.

During the pandemic in 2020 and early in 2021, financial services firms innovated at a pace much faster than in the past. Banks and credit unions found new ways to connect with prospects, open new accounts, support and service existing relationships, and rethink back office operations. The question is whether legacy banking organizations can sustain this heightened spirit of innovation in a post-pandemic environment?

The challenge is that many of the components that necessitated innovation over the past 18 months are not as apparent as they were. For instance, many organizations may believe that the response to the urgent need to provide digital access for consumers has been resolved. In some organizations, there may not be the belief that innovation needs to be a top priority as it was during the early stages of the pandemic. Finally, leaders may not be accustomed to converting longer-term innovation outcomes into a series of shorter-term sprints that are both manageable and sustainable.

The vast majority of financial institutions place innovation close to the top of their digital transformation priorities, right below improving customer experiences and improving the use of data and advanced analytics. Banks and credit unions also see innovation as one of the keys to ongoing success. Despite understanding the importance of innovation, however, the Digital Banking Report found that only 9% of banking organizations ranked themselves as being “‘innovation pioneers” (with 32% saying they were “fast followers”). Interestingly, both rankings were lower than in the previous year.

An innovation strategy and culture is needed now more than ever to change the way organizations deliver financial services and the way modern technology can support new banking operating models. Often, innovation is required to catch up with both financial and non-financial leaders that have disrupted the banking ecosystem and altered consumer and business expectations.

Santa Rao, Chief Business Officer and Global Head of Infosys Finacle, said, “The floodgates of innovation in financial services have opened as a result of Covid-19, but the real innovation is down the line, with innovation continuing to accelerate.”

An innovation strategy and culture is needed now more than ever to change the way organizations deliver financial services and the way modern technology can support new banking operating models. Often, innovation is required to catch up with both financial and non-financial leaders that have disrupted the banking ecosystem and altered consumer and business expectations.

Source: The Financial Brand.com

[headlines]

--------------------------------------------------------------

According to SimilarWeb, in seventh place is the Chinese search engine baidu.com, which received almost 6 billion visitors in May. You don't have to go too far before you find porn, of course, with xvideos.com in tenth place and 3.3 billion visits over the month - one of two adult content sites in the top twelve

By Martin Armstrong, Statista

[headlines]

--------------------------------------------------------------

The Future of Fleet Payments: Expect the Unexpected

By Amanda Huggett, Automotive Fleet

Weather events are a primary reason for fleets to be ready to adapt at any time — not to mention supply chain constraints and ever-evolving technologies.

When it comes to how fleets pay for fuel and other expenses on the road, technology continues to bring new features and even more benefits for your business. To find out the latest innovations and trends in fleet payment solutions, we talked with Michelle Erickson, Senior Product Manager for US Bank/Voyager Fleet.

The Connected Vehicle

With the ability to derive data directly from the vehicle on the rise, Erickson new enhancements in fleet payments will follow, including:

- Increased security in encrypted technology to tokenize and allow payments.

- Program optimization. Fleet managers could eventually eliminate physical card distribution and management.

- Driver experience. When driver data is captured by technology, it streamlines the user experience. No more entering data at the pump, and no more receipts to be captured and provided to fleet managers.

- A few years ago, Voyager Fleet and Mastercard completed a connected car pilot to better understand the complexities and possibilities that the technology could bring to their fleet customers. “At the time it was limited to telematics data, but today it has grown to include such things as internet access and mobile commerce capabilities,” Erickson explains.

Unexpected Events for Fleets

With the challenges of the last year, Voyager saw a noticeable dip in transaction volumes at the end of Q1 into Q2 of 2020, with a view toward recovery starting at the end of Q2.

Michelle Erickson,, Senior Product Manager for US Bank/Voyager Fleet, said, “We saw a consistent increase quarter over quarter in transaction volumes with what we consider a ‘return to normal’ volume in Q1 of this year,” Erickson says. “I believe what this shows us is that even through pandemic situations, our fleets were still out there running and providing goods and services.”

Add in recent events like floods in Florida, a cold snap in Texas, fires in California, hurricanes on the East Coast, and pipeline hacks, and fleets now must also learn to expect the unexpected. “From a payment solutions perspective, we need to be able to support our customers in this reaction,” Erickson comments, “and we need to do it in a near-real time fashion — just like they are.”

As if that aren’t enough, we’re all familiar with the supply chain and chip shortage issues too. Erickson understands some fleets will extend vehicle replacement, which in turn may require more spend on maintenance.

Many fleets are considering taking the first steps to shift toward EVs. Of course, that also means a need for home charging or paying for public charging, and requires fleets to manage payment options, spend, and vehicle utilization.

Contactless, Cardless, and Virtual

Payment solutions are also seeing a large pivot to contactless, cardless, and virtual transactions.

New tech also brings with it more data and the ability to mine that data and make it useful. Barely a decade ago, using data meant pulling out a spreadsheet with one source of data (say, transactions), and now, we have access to multiple sources of data from disparate sources such as the vehicle itself, telematics/GPS, fuel, and maintenance purchases.

“All of these points can provide a fleet manager a more holistic view into fleet management,” Erickson says. “But to use that, we must provide our fleet managers with a way to digest and visually represent that information.”

For Voyager, data analytics dashboards provide the means to do that.

Expecting the Unexpected

Erickson says that US Bank’s new Voyager Mastercard is the first fleet card to use chip technology to support two network rails — Voyager and Mastercard. This means that a customer with a traditional fuel card could now meet their other fleet transaction needs such as paying tolls or an unexpected hotel stay because of unprecedented storms, or simply a detour that takes the driver into a rural area where there isn’t a Voyager location accessible.

The Voyager Mastercard also allows for over-the-road truck drivers that stop at a Canadian or Mexican station to fuel without managing another card or cash. And it can be managed on a single platform, whereby fleet managers can set up and maintain cards, change card controls and limits, and do their reporting and billing in one system.

These features help fleets to better manage these unexpected events. “Ultimately, Voyager wants to meet the needs of our fleets and our ever-changing environment,” Erickson says.

[headlines]

--------------------------------------------------------------

##### Press Release ############################

Grand Opening of its Amur New Headquarter,

Celebrating 25th Anniversary of Company Found

At the Podium: Todd Wainwright, Amur SVP Head of Commerce & Strategic Partnerships; In the Background: Mayor Roger Steele of Grand Island, Cindy Johnson, President of the Grand Island Chamber of Commerce.

GRAND ISLAND, Nebraska – Amur officially celebrated the grand opening of the company’s newly renovated and expanded headquarters in the heart of the Railside Business Improvement District in Grand Island, Nebraska. It also celebrated the 25th anniversary of the company’s founding. In connection with this momentous milestone, Amur also solidified its commitment to serve small businesses in the US, debuting an entirely new digital presence in which every aspect has been determined by the customer. Through detailed customer research and data analysis, every touch point of the digital experience has now been designed to cater to the small business owner and their rapidly evolving needs. The new website can be viewed at www.GoAmur.com.

Jacklynn Manning, CLFP, Amur Vice President of Marketing, said, “The past few years have exposed a gap between the financial needs and the offerings in the marketplace for small businesses.

“By digging deep into the needs of the small business community we are introducing a brand and digital transformation which is customized and personalized to the unique small business owner and their needs in an effort to prove to our customers that We’re Big on Small.”

As part of a brand and digital transformation, Amur Equipment Finance will now be known simply as Amur.

Todd Wainwright, Amur Senior Vice President, Head of Commerce and Strategic Partnerships, said, For well over a year we have positioned Amur to champion small businesses and have listened to our small business partners along the way.

“Everything Amur does moving forward will be centered on fulfilling the needs of small businesses and providing them with the financial tools they need to grow and succeed.”

A celebration worthy of a new headquarters, a new vision for the future and a brand evolution incorporating a complete digital transformation, Amur welcomed thousands from the Grand Island community for live entertainment and free food trucks over the course of the weekend. Also speaking at the event were Grand Island Mayor Roger Steele and Cindy Johnson, President of the Grand Island Chamber of Commerce.

About Amur

We’re Big on Small. As a Top Five nationally ranked independent commercial equipment finance provider, and a certified Great Place to Work®, Amur is dedicated to ensuring that its small business customers and its employees are equipped to grow and succeed. Amur has 9 offices and over 300 team members across the nation dedicated to championing the financial needs of small businesses every day. We have served over 500,000 small businesses and helped them thrive in the world’s most essential industries – from transportation and technology to manufacturing and medicine.

See for yourself how We’re Big on Small at www.GoAmur.com

##### Press Release ############################

[headlines]

--------------------------------------------------------------

##### Press Release ############################

Davidson Kempner Launches New

Commercial Aviation Financing Platform

NEW YORK, -- Davidson Kempner Capital Management LP ("Davidson Kempner"), an institutional investment management firm, announcesd the launch LLC ("Ashland Place"). Ashland Place is an institutional financing platform offering innovative capital solutions to the global commercial aerospace industry. The business will be led by Jennifer Villa Tennity, a veteran aircraft leasing and banking executive.

Ashland Place will be a wholly-owned subsidiary of Davidson Kempner formed to provide sourcing and loan arrangements in the aviation space. Davidson Kempner has significant experience in commercial aviation industry investments and its new platform expands the firm's capabilities in the sector.

Ms. Villa Tennity said," With the support of Davidson Kempner, will be an important capital solution provider to airlines and aircraft investors alike."

Ms. Villa Tennity brings nearly 25 years of professional experience in the aviation leasing and lending space to Ashland Place. She most recently served as President of CIT's Aviation Lending business, providing aircraft-backed loans to the commercial aviation industry. Prior to serving as President of CIT's Aviation Lending business, Ms. Villa Tennity served as the Chief Risk Officer of its $22 billion Commercial Aerospace division until the business was sold to Avolon.

Additional information about Ashland Place can be found at: www.ashlandplace.com.

About Davidson Kempner Capital Management

Davidson Kempner Capital Management LP is a U.S.-registered global institutional investment management firm with more than 38 years of experience and a focus on fundamental investing with a multi-strategy approach. Davidson Kempner has more than $37 billion in assets under management with over 400 professionals in six offices, including New York, Philadelphia, London, Dublin, Hong Kong and Shenzhen.

### Press Release ############################

[headlines]

--------------------------------------------------------------

### Press Release ############################

ELFA Announces Thomas Ware Will Receive

2021 Distinguished Service Award

Thomas Ware, President of Tom Ware Advisory Services, LLC

WASHINGTON, D.C. – The Equipment Leasing and Finance Association (ELFA) has selected Thomas Ware to receive its 2021 Michael J. Fleming Distinguished Service Award. The award honors individuals who have made significant contributions to the association and the equipment finance industry. Ware, who is President of Tom Ware Advisory Services, LLC, will be formally recognized during a ceremony at the 60th ELFA Annual Convention in San Antonio, Texas, in October.

ELFA President and CEO Ralph Petta, said, “Over the past two decades, Tom has helped ELFA deliver market data and insights to our membership and highlight the value of the $900 billion equipment finance industry to the U.S. economy. Sa

“It is an honor to present him with the Distinguished Service Award in recognition of his outstanding contributions to ELFA, the Equipment Leasing & Finance Foundation and the equipment finance industry.”

Thomas Ware replied, “I’m thrilled to be receiving this award from ELFA "Throughout my career, first as a lender and chief credit officer, and later as a service provider, I’ve strived to find new and better ways of doing business, particularly by leveraging the power of data, analytics, systems and credit scoring. Doing this well requires real-world collaboration, and ELFA and the Foundation have been absolutely essential in providing the environment necessary and conducive for such collaboration. Thank you to ELFA for making this possible.”

Ware has been an active member of ELFA for many years, contributing to the mission of the association in a number of key areas. As an expert on small business credit and leveraging data and analytics for the commercial finance industry, he is a long-time member of the Credit & Collections Committee and a past member of the Small Ticket Business Council Steering Committee.

Ware has been a champion of the association’s business and professional development programs. As an industry thought leader, he has served as a frequent speaker and facilitator at numerous ELFA events, including the Credit & Collections Conference, Annual Convention, Funding Conference and Operations & Technology Conference. He also has contributed to the association’s Executive, CFO, Bank and Captive & Vendor Finance Roundtables. During the COVID pandemic, he has participated as a speaker in ELFA’s popular Wednesday Webinars series. He also is a regular contributor to the association’s publications, including Equipment Leasing & Finance magazine.

In addition to his work with ELFA, Ware is active with the Equipment Leasing & Finance Foundation. He currently serves as a member of the Foundation’s Board of Trustees and Executive Committee and is Chair of the Foundation’s Research Committee. In this role, he leads development of the organization’s studies and research resources. Over the years, Ware has participated in the Industry Future Council and lent his insights to essential Foundation reports, including those on FinTech, Securitization, Alternative Financing, Predictive Analytics and Credit Scoring. Most recently, he spearheaded the design and analysis of the Foundation’s COVID Impact and Recovery Survey.

As President of Tom Ware Advisory Services, LLC, Ware is an independent analytics, risk and credit scoring consultant. Prior to his current position, he served for 18 years as Senior Vice President of Analytics & Product Development at PayNet, which was acquired by Equifax in 2019. In that role he was responsible for the development of PayNet’s MasterScore and probability of default models, which have been used by hundreds of lenders to help decision millions of commercial loan and lease applications worth over $300 billion. Ware was also responsible for creating loss forecasting models, peer lender performance benchmarking and Strategic Business Reviews, and for developing a wide variety of research about commercial lending that appeared regularly at ELFA conferences as well as in leading print and television media outlets. Prior to PayNet, Ware had 17 years’ experience as a lender with banks and finance companies, including as Chief Credit Officer & Senior Vice President, Operations at American Express Equipment Finance, and as General Manager of a division of J.I. Case/CNH Capital. He began his career with a Boston management consulting firm that became the New England office of Oliver Wyman.

In addition to ELFA, Ware has contributed to a variety of organizations. He served on the Board of Governors of the Risk Management Association’s Washington, D.C. and Maryland chapter. He has spoken at events organized by the Canadian Finance & Leasing Association, the National Equipment Finance Association and the Credit Card Roundtable. He wrote “The 12 Secrets of Commercial Credit Scoring,” a three-part series of articles published in the Monitor magazine. He graduated with Distinction in Mathematical Economics from Dartmouth College and holds an MBA from Harvard Business School.

About ELFA

The Equipment Leasing and Finance Association (ELFA) is the trade association that represents companies in the nearly $1 trillion equipment finance sector, which includes financial services companies and manufacturers engaged in financing capital goods. ELFA members are the driving force behind the growth in the commercial equipment finance market and contribute to capital formation in the U.S. and abroad. Its 575 members include independent and captive leasing and finance companies, banks, financial services corporations, broker/packagers and investment banks, as well as manufacturers and service providers. In 2021, ELFA is celebrating 60 years of equipping

###business for success. For more information, please visit www.elfaonline.org.

#### Press Release #############################

[headlines]

--------------------------------------------------------------

Saint Bernard Mix

Grand Island, Nebraska Adopt-a-Dog

Hugo

ID 48410833

Male

Age: 3 years, 28 days

Neutered

Adoption Cost: $275.00

Each adoption includes the following:

Spaying (females) or neutering (males)

First Treatment for Worms

Flea and Tick Treatment

Temporary Vaccinations

Rabies Vaccination

Microchipping (dogs only)

Behavior and Training advice

Adoption Application:

https://centralnebraskahumanesociety.com/adoption-application/

Central Nebraska Humane Society

1312 Sky Park Road

Grand Island, NE 68801

https://centralnebraskahumanesociety.com/

(308) 385-5305

Contact by email:

https://centralnebraskahumanesociety.com/contact-us/

Hours:

M-F: 8-5:30

SAT: 8-4:30

SUN: 1-4

[headlines]

--------------------------------------------------------------

Largest Association Conference This Year

ELFA 60th Annual Convention

764 Registered to Date, Including 40 Virtual Attendees

Lite Participant List

By Participant Last Name

By Company Name

Only Registered attendees can see the Full Participant Listings

List here:

https://apps.elfaonline.org/events/2021/ac/attend.cfm

Full Brochure (12 pages)

https://cvdata.elfaonline.org/cvweb/cgi-bin/documentdll.dll/view?DOCUMENTNUM=3073

[headlines]

--------------------------------------------------------------

News Briefs---

U.S. Bank buys MUFG Union Bank,

a big presence on the West Coast, for $8 billion

https://www.startribune.com/u-s-bank-buys-mufg-union-bank-a-big-presence-on-the-west-coast-for-8-billion/600099282/

Google to Buy New York City Office Building for $2.1 Billion

Manhattan deal is priciest sale of a U.S. office building

https://www.wsj.com/articles/google-to-buy-new-york-city-office-building-for-2-1-billion

Ex-Controller Testifies in Trial of Theranos CEO

revenue projections that did not match the reality of its finances.

https://www.cfo.com/fraud/2021/09/ex-controller-testifies-in-trial-of-theranos-ceo/

Historic Lows in Net Interest Margins Bedevil U.S. Banks

Lower demand for credit and tighter net interest margins

https://www.cfo.com/credit/2021/09/historic-lows-in-net-interest-margins-bedevil-u-s-banks/

[headlines]

--------------------------------------------------------------

You May Have Missed---

Report: Over a Third of Gen-Z and Millennial Workers

are Looking for a New Job

https://www.prnewswire.com/news-releases/report-over-a-third-of-gen-z-and-millennial-workers-are-looking-for-a-new-job-301381889.html

[headlines]

--------------------------------------------------------------

Sports Briefs---

Complete position-by-position grades

for the 49ers victory over the Eagles

https://www.ninersnation.com/2021/9/20/22682771/49ers-eagles-grades-bosa-garoppolo-kittle

Winners and losers from NFL Week 2, plus an ugly week

for QB injuries and picking Lions-Packers winner

https://www.cbssports.com/nfl/news/winners-and-losers-from-nfl-week-2-plus-an-ugly-week-for-qb-injuries-and-picking-lions-packers-winner/

Tom Brady and the Buccaneers just broke an NFL record

that the QB originally helped the Patriots set in 2007

https://www.cbssports.com/nfl/news/tom-brady-and-the-buccaneers-just-broke-an-nfl-record-that-the-qb-originally-helped-the-patriots-set-in-2007/

Upstart Raiders Are More Than Just

MVP Dark-Horse Derek Carr

https://bleacherreport.com/articles/2948565-upstart-raiders-are-more-than-just-mvp-dark-horse-derek-carr

Jerry Jones says Cowboys have an ‘outstanding situation’

at RB with Ezekiel Elliott, Tony Pollard

https://www.dallasnews.com/sports/cowboys/2021/09/21/jerry-jones-says-cowboys-have-an-outstanding-situation-at-rb-with-ezekiel-elliott-tony-pollard/

Aaron Rodgers rebukes those who are critical

of his work ethic: 'Absolute (expletive)'

https://www.usatoday.com/story/sports/nfl/packers/2021/09/21/aaron-rodgers-packers-pat-mcafee-show-critical-work-ethic/5802211001/

[headlines]

--------------------------------------------------------------

California Nuts Briefs---

California has the lowest coronavirus rate

in the nation. Here’s what we know

https://www.eastbaytimes.com/2021/09/20/california-has-the-lowest-coronavirus-rate-in-the-nation-heres-what-we-know/

Californians falling far short on water conservation

as drought worsens

https://www.eastbaytimes.com/2021/09/21/californians-falling-far-short-on-water-conservation-as-drought-worsens/

Drought: Which cities in California are saving

the most and least water

https://www.eastbaytimes.com/2021/09/21/drought-which-cities-in-california-are-saving-the-most-and-least-water/

California halts insurance cancellations

in major wildfire areas across 22 counties

https://www.northbaybusinessjournal.com/article/industrynews/california-halts-insurance-cancellations-in-major-wildfire-areas-across-22/

San Francisco airport becomes first in U.S.

to require COVID-19 vaccinations for workers

https://www.sandiegouniontribune.com/news/california/story/2021-09-21/san-francisco-airport-to-require-covid-vaccinations-for-workers

[headlines]

--------------------------------------------------------------

![]()

“Gimme that Wine”

http://www.youtube.com/watch?v=EJnQoi8DSE8

Trader Joe's Platinum Reserve, Cabernet Sauvignon Napa

Another Outstanding Buy

A reader writes, "That 'mystery' private label wine from Trader Joe’s was outstanding. Since it is so young, I opened the bottle about 4 hours before dinner. I am going to save the remaining bottles for the future, as the wine will only get better.

"This wine was bottled four weeks ago. I bought a case.

"My subjective tasting notes:

"It is a medium-body cab (just below the full-body category in my humble opinion) with nice complexity and a super finish. Wine clings to the glass and is semi-inky. Not sure about any specific flavors that stand out – it’s just a really nice cab with just enough fruit and it’s very smooth and velvety."

Cannabis wines use dealcoholization, emulsion technology

to transform Napa’s signature beverage

https://napavalleyregister.com/news/local/cannabis-wines-use-dealcoholization-emulsion-technology-to-transform-napa-s-signature-beverage/article_72a4b2bd-c53a-52ec-9bd3-eea4cb16af86.html

‘Super resilient and super creative’:

How local wineries survived the pandemic

https://www.pressdemocrat.com/article/news/super-resilient-and-super-creative-how-local-wineries-survived-the-pande/

Free Wine App

https://www.nataliemaclean.com/mobileapp/

Wine Prices by vintage

http://www.winezap.com

http://www.wine-searcher.com/

[headlines]

----------------------------------------------------------------

![]()

This Day in History

1656 – The General Provincial Court at Patuxent, Maryland empaneled the first all-woman jury in the colonies to hear the case of Judith Catchpole, accused of murdering her child. The defendant claimed she had never even been pregnant and, after all the evidence was heard, the jury acquitted her.

1692 – The last person hanged for witchcraft in U.S. was executed in Salem, MA.

1711 - The Tuscarora Indian War began with a massacre of settlers in North Carolina, following white encroachment that included the enslaving of Indian children. Fought until February 11, 1715 between the British, Dutch and German settlers, and the Tuscarora Native Americans, the Europeans enlisted the Yamasee and Cherokee as Indian allies against the Tuscarora, who had amassed several allies themselves. This was considered the bloodiest colonial war in North Carolina. Defeated, the Tuscarora signed a treaty with colonial officials in 1718 and settled on a reserved tract of land in what became Bertie County.

1734 - The Moravian settlement in America began with the arrival of George Boehnischt in Pennsylvania. The following year, a group of Moravians led by Augustus Gottlieb Spangenberg came to Georgia to convert Native Americans. Their first church was built in 1735 in Savannah, GA, where General James Edward Oglethorpe had given 600 acres of land for a colony. Bishop David Nitschmann arrived from Germany in 1736 and ordained Anton Sieffert as pastor, the first ordination by a Protestant bishop in America. The group soon relocated to Pennsylvania and built a settlement in Bethlehem in 1741. Spangenberg became the Moravians' first American bishop in 1744. Moravians are followers of Jan Hus, the 15th century Bohemian religious reformer, and call themselves, the Church of the Bretheren, or Unitas Fratrum.

http://www.moravianjamaica.org/about_us.htm

http://www.everydaycounselor.com/archives/sh/shistory.htm

http://www.redeemermoravian.org/vision.htm

1776 – Captain Nathan Hale of Connecticut was executed by the British in New York City for spying. Before he was hanged he said, “I only regret that I have but one life to lose for my country.”

http://memory.loc.gov/ammem/today/sep22.html

1777 - Tacy Richardson's Ride: Courageous 23-year-old Tacy Richardson (1754-1807) rode her favorite horse, "Fearnaught," several perilous miles from the family farm at Montgomery County, PA to the James Vaux mansion to warn General George Washington of the approach of British troops led by General William Howe. As it turned out, the British crossing of the Schuylkill at Gordon's Ford was a feint to deceive Washington who indeed hastily withdrew to Pottstown, clearing the way for General Howe to spend that night in the quarters Washington had occupied only a few hours earlier.

1789 - The U.S. created the Office of Postmaster General under the Treasury Department, following the Departments of State, War and Treasury.

1823 – Mormon leader Joseph Smith states he found the Golden plates after being directed by God through the Angel Moroni to the place where they were buried.

1862 – Abraham Lincoln delivers the Emancipation Proclamation, one of the most important presidential proclamations of American history. President Lincoln, by executive proclamation, freed the slaves in the rebelling states: "That on . . . [Jan 1, 1863] . . . all persons held as slaves within any state or designated part of a state, the people whereof shall then be in rebellion against the United States, shall be then, thenceforward, and forever, free..." The 13th Amendment to the US Constitution officially declared the abolition of slavery in all states.

(Lower half of: http://memory.loc.gov/ammem/today/sep22.html )

1888 – The first issue of National Geographic Magazine is published.

1893 – The first automobile in U.S. (by Duryea brothers) runs in Springfield, MA. The Duryea's "motor wagon" was a used horse drawn buggy that the brothers had purchased for $70 and into which they had installed a 4 HP, single cylinder gasoline engine.

1903 - Italo Marchiony applied for his patent for his new mold which was filled with Ice Cream and is credited with inventing the Ice Cream Cone. He emigrated from Italy in the late 1800's and went into business in New York City with a pushcart dispensing lemon ice. Success soon led to a small fleet of pushcarts, and the inventive Marchiony was inspired to develop a cone, first made of paper, later of pastry, to hold the ices and then vanilla and chocolate ice cream.

1902 – American actor and producer John Houseman was born Jacques Haussmann (d. 1998) at Bucharest. He is best known for his collaboration with Orson Wells on the 1938 radio production of “War of the Worlds” and his role as Professor Kingsfield in the film and television version of “The Paper Chase.” He won an Oscar for that film role in 1974 and helped establish the Julliard drama school and the Acting Company repertory group.

1911 - Cy Young beats Pittsburgh 1-0 for his 511th and final career victory. With Joe DiMaggio’s 56-game hitting streak, many believe this to be baseball’s most unbreakable record. The annual award for the top pitcher in each league is named the Cy Young Award.

1912 - At Sportsmen’s Park in St. Louis, Eddie Collins became the only player in Major League history to steal six bases in one game for a second time. The Philadelphia Athletics’ 2B's feat of thievery has yet to be surpassed. It will be 79 years until another major leaguer, Otis Nixon, even ties Collins' mark.

1915 – Xavier University, the first Black Catholic college in the US, opens in New Orleans. This is not to be confused with Xavier University in Ohio.

1919 – A strike led by the Amalgamated Association of Iron and Steel Workers, begins in Pennsylvania before spreading across the United States.

1920 – A Chicago grand jury convenes to investigate charges that 8 White Sox players conspired to fix the 1919 World Series. They would find all eight to be not guilty, a verdict that did not deter new Major League Baseball Commissioner Kennesaw Mountain Landis from banning them for life for conduct detrimental to the game.

1922 - With the passage of the Cable Act, women who married foreign citizens kept their US citizenship. Up to that point, American-born women automatically lost their US citizenship if they married a foreign man. At no time in the history of the United State could men have lost their citizenship.

1925 - New York Yankee Ben Paschal hits two inside-the-park HRs.

1927 - Still talked about today as the “long count,” the world championship boxing match between Jack Dempsey and Gene Tunney at Soldier Field, Chicago, IL was fought. It was the largest fight purse in the history of boxing at the time, nearly $1 million. Nearly half the population of the US is believed to have listened to the radio broadcast of this fight. In the seventh round of the 10-round fight, Tunney was knocked down. Following the rules, Referee Dave Barry interrupted the count when Dempsey failed to go to the farthest corner. The count was resumed and Tunney got to his feet at the count of nine. Stopwatch records of those present claimed the total elapsed time from the beginning of the count until Tunney got to his feet at 12-15 seconds. Tunney, awarded seven of the 10 rounds, won the fifth and claimed the world championship. Dempsey's appeal was denied and he never fought again. Tunney retired the following year after one more (successful) fight.

1927 – Birthday of “I bleed Dodger blue”, Tommy LaSorda (d. 2021) in Norristown, PA. Originally signed by the nearby Phillies in 1945, the Dodgers drafted him off their minor league roster in 1948 and he has been a Dodger since. His career MLB record is 0-4 and, other than his fame as a Dodger manager, he contributed mightily to the Dodgers in 1954. LaSorda had to be sent to the minors to make room for rookie Sandy Koufax. LaSorda’s managerial record is 1,599–1,439 and it includes World Series championships in 1981 and 1988. He was elected to Baseball’s Hall of Fame in 1997.

1937 - On the Brunswick label, Red Norvo and his orchestra recorded the "Russian Lullaby." Later Norvo would do a more famous work with a recording including singer Dinah Shore.

1938 - A great hurricane smashed into Long Island and bisected New England, causing a massive forest blowdown and widespread flooding. Winds gusted to 186 mph at Blue Hill, MA, and a storm surge of nearly thirty feet caused extensive flooding along the coast of Rhode Island. The hurricane killed 600 persons and caused $500 million damage. The hurricane, which lasted twelve days, destroyed 275 million trees. Hardest hit were Massachusetts, Connecticut, Rhode Island and Long Island, NY. The "Long Island Express" produced gargantuan waves with its 150 mph winds, waves which smashed against the New England shore with such force that earthquake recording machines on the Pacific coast clearly showed the shock of each wave.

1941 – Birthday of Pastor Jeremiah Wright in Philadelphia. Pastor Emeritus and former Pastor of the Trinity United Church of Christ in Chicago. He is the former pastor and ‘spiritual advisor’ of President Obama, known for his politically charged, controversial comments denouncing the United States.

1945 - Stan Musial of the St. Louis Cardinals gets 5 hits off 5 pitchers on 5 consecutive pitches.

1946 – Birthday of longtime California Congressman Dan Lungren.

1950 - Omar N. Bradley promoted to rank of 5-star general

1954 - The temperature at Deeth, NV, soared from a morning low of 12 degrees to a high of 87 degrees, a record daily warm-up for the state.

1954 – Brooklyn Dodger Karl Spooner, in his Major League debut, strikes out 15 New York Giants. Consistent arm injuries forced him out of the game, his last being in the 1955 World Series.

1955 - The film, “To Hell and Back,” starring World War II hero Audie Murphy, premiered in New York on this date.

http://www.rottentomatoes.com/m/to_hell_and_back/cast_crew.php

1955 – Champ Rocky Marciano knocks out Archie Moore in nine rounds. Marciano retired undefeated.

1956 - Top Hits

“Canadian Sunset” - Hugo Winterhalter & Eddie Heywood

“Whatever Will Be Will Be” (Que Sera Sera) - Doris Day

“Be-Bop-a-Lula” - Gene Vincent & His Blue Caps

“Don't Be Cruel/Hound Dog” - Elvis Presley

1957 – Brooklyn Dodger Duke Snider, in his final season in Brooklyn before the Dodgers’ move to LA, hits his 40th home run, tying him with Ralph Kiner for having five consecutive 40+ homer seasons in the National League.

http://www.baseballhalloffame.org/hofers_and_honorees/hofer_bios/snider_duke.htm

http://www.thebaseballpage.com/past/pp/sniderduke/

1957 - “Maverick” premiered on television. (Yes, my father Lawrence Menkin, wrote several of these episodes as well as other Western television shows). This popular western, which has since been remade into a popular movie, starred James Garner as Bret Maverick, a clever man who preferred card playing to fighting. A second Maverick was introduced when production was behind schedule--Jack Kelly played his brother Bart. Garner and Kelly played most episodes separately, and when Garner left in 1961, Kelly was in almost all the episodes. Other performers included Roger Moore, Robert Colbert and Diane Brewster. This western distinguished itself by its light touch and parody of other westerns and was must-see TV on Sunday nights if you weren’t watching The Ed Sullivan Show.

http://www.tvtome.com/tvtome/servlet/ShowMainServlet/showid-1020

http://www.amazon.com/exec/obidos/tg/browse/-/871682/103-0205572-2897419

1958 – TV financial host Neil Cavuto was born, Westbury, NY.

1960 - Joan Jett is born in Philadelphia. Her first solo hit, "I Love Rock 'N Roll" sells more than one million records and stays at No. 1 on Billboard's Hot 100 singles chart for seven weeks.

1961 - The first African-American judge of a federal district court was Judge James Benton Parsons, who was sworn in at Chicago, IL, as U. S. district judge for the Northern District of Illinois.

1961 - Hurricane Esther performed a 350 mile complete circle south of Cape Cod, MA from the 21st to the 25th, then passed over Cape Cod and Maine. Its energy was spent mainly over the cool Atlantic but heavy rains resulted in widespread local flooding in Maine.

1961 - In response to the ever-expanding "twist" craze, Chubby Checker performs his original hit from a year ago, "The Twist," along with the follow-up smash "Let's Twist Again," in a medley on CBS-TV's Ed

Sullivan Show. The resultant attention boosted both singles back into the Hot 100 and shot "The Twist" back to #1 in early 1962, marking the only time the same single has hit the top spot in two separate years

1962 – Bob Dylan plays Carnegie Hall in NYC.

1964 - Robert Vaughn starred as Napoleon Solo when "The Man from U.N.C.L.E." debuted on NBC-TV this night. Solo's trusty sidekick in this James Bond spoof was Illya Kuryakin, played by David McCallum. The show was a hit for 3½ seasons.

http://www.manfromuncle.org/

http://www.tvtome.com/tvtome/servlet/ShowMainServlet/

showid-3323/The_Man_From_UNCLE/

1964 - Top Hits

“The House of the Rising Sun” - The Animals

“Bread and Butter” - The Newbeats

“Oh, Pretty Woman” - Roy Orbison

“I Guess I'm Crazy” - Jim Reeves

1964 - "Fiddler on the Roof" opened on Broadway at the Imperial Theater. The lights lowered, the curtain rose and Zero Mostel stepped into the spotlight as the fiddler played. “Tra-a--a-dition,” he sang, as he began the first of 3,242 performances. It became the first musical to run for more than 3,000 performances and is based on stories by the Yiddish writer Sholem Aleichem (pen name of Sholem Yakov Rabinowitz). Zero Mostel took the part of Tevye. It was presented by Harold Prince, with choreography of Jerome Robbins, music by Jerry Bock, lyrics by Sheldon Hamick and book by Joseph Stein.

1965 - San Francisco rock group, “The Great Society” with singer Grace Slick, makes its stage debut at the Coffee Gallery in North Beach, California.

1965 - The Supremes make studio recording of "I Hear a Symphony." The song tops Billboard's Hot 100 for two weeks in November.

1966 - Surveyor 2 crashes on Moon

1966 – The Baltimore Orioles beat the Kansas City A's 6-1 to clinch their first AL pennant since moving from St. Louis to start the 1954 season.

1966 – Paid attendance at Yankee Stadium – 413.

1966 – Willie Mays hit the 600th home run of his career, off Mike Corkins of the Padres in San Diego. Mays finished his career with 660, at the time of his retirement, the third highest behind Ruth and Aaron.

1967 - The Beatles appear on the cover of Time Magazine.

1967 - No. 1 Billboard Pop Hit: "The Letter," The Box Tops. The Arbors took the song to No. 20 in 1969 and Joe Cocker hit No. 7 with it in 1970.

1968 - The Twins' Cesar Tovar is the second Major Leaguer to play one inning at each position. In 1965, A's Bert Campaneris became the first.

1971 - Captain Ernest Medina is acquitted of all charges relating to the My Lai massacre of March 1968. His unit, Charlie Company, 1st Battalion, 20th Infantry, 11th Infantry Brigade (Light) of the 23rd (Americal) Division, was charged with the murder of over 200 Vietnamese civilians, including women and children, at My Lai 4, a cluster of hamlets that made up Son My village in Son Tinh District in Quang Ngai Province in the coastal lowlands of I Corps Tactical Zone. Medina had been charged with murder, manslaughter, and assault. All charges were dropped when the military judge at the Medina's court martial made an error in instructing the jury. After the charges were dropped, Medina subsequently resigned from the service. There were 13 others charged with various crimes in conjunction with the My Lai massacre, but only one, Lt. William Calley, was found guilty. Calley was sentenced to life imprisonment for the murder of 22 civilians, but his sentence was reduced first to 20 years, then 10 years, and he was ultimately paroled by President Nixon in November 1974, after having served about one-third of his sentence.

1972 - Top Hits

“Black & White” - Three Dog Night

“Baby Don't Get Hooked on Me” - Mac Davis

“Saturday in the Park” - Chicago

“When the Snow is on the Roses” - Sonny James

1973 - Henry Kissinger took the oath as U.S. Secretary of State. This was the first time a naturalized citizen had held this office. Only in America...

1975 - No. 1 Billboard Pop Hit: "I'm Sorry," John Denver.

1975 - Sara Jane Moore failed in an attempt to shoot President Gerald R. Ford outside a San Francisco hotel.

1976 - “Charlie's Angels” Premiere. This extremely popular show of the '70s featured three attractive women, usually scantily-dressed, solving crimes. Sabrina Duncan (Kate Jackson), Jill Munroe (Farrah Fawcett-Majors) and Kelly Garrett (Jaclyn Smith) signed on with detective agency Charles Townsend Associates. Their boss was never seen, only heard (the voice of John Forsythe); messages were communicated to the women by his associate John Bosley (David Doyle). During the course of the series, Cheryl Ladd replaced Fawcett, Shelley Hack and Tanya Roberts succeeded Kate Jackson.

http://www.tvtome.com/CharliesAngels/

http://www.charliesangels.com/

1980 - Top Hits

“Upside Down” - Diana Ross

“All Out of Love” - Air Supply

“Another One Bites the Dust” - Queen

“Lookin' for Love” - Johnny Lee

1982 - “Family Ties” premiers on TV. This popular 80s sitcom was set at Columbus, OH and focused on the Keaton family: Ex-hippies Elyse (Meredith Baxter-Birney), an architect, and Steven (Michael Gross), a station manager of the local public TV station; Alex (Michael J. Fox), their smart, conservative and financially-driven son; Mallory (Justine Bateman), their materialistic, ditzy daughter, and Jennifer (Tina Yothers), their tomboy youngest daughter. Later in the series, Elyse gave birth to Andrew. Marc Price played Irwin "Skippy" Handleman, the nerdy next-door neighbor who adored the Keatons, and Mallory in particular.

http://www.valdefierro.com/ties2.jpg

http://www.tvtome.com/FamilyTies/

http://www.familyties-tv.com/bios.htm

http://www.twiztv.com/scripts/pilots/familytiespilot.htm

1982 – The cable cars in San Francisco made a final run before a 20-month shut down for a complete rehabilitation of the system. They still run half-way to the stars.

1983 - Forty-one cities reported record cold temperatures during the morning. Houston, TX, hit 50 degrees, and Williston, ND plunged to 19 degrees.

1983 – The Everly Brothers reunite after 10 years at Royal Albert Hall in London.

1985 - The poor of America's Heartland ... the financially troubled farmers of Middle America ... got help from their friends in the music biz. Singing stars Willie Nelson, Neil Young and John Cougar Mellencamp held a benefit concert to raise funds. The stars came out and so did the money. The "Farm Aid" concert raised ten million dollars.

1986 - Los Angeles Dodgers’ Fernando Valenzuela becomes the first Mexican to win 20 games in the Majors.

1987 - Tropical Storm Emily, which formed in the Caribbean the previous afternoon, caused considerable damage to the banana industry of Saint Vincent in the Windward Islands. Unseasonably hot weather continued in Florida and the western U.S. Redding, CA and Red Bluff, CA, with record highs of 108 degrees, tied for honors as the hot spot in the nation.

1988 - Top Hits

“Sweet Child o' Mine” - Guns N' Roses

“Simply Irresistible” - Robert Palmer

“Don't Worry Be Happy” - Bobby McFerrin

“Joe Knows How to Live” - Eddy Raven

1989 - Called by some critics "Body Watch," the California-beach-based lifeguard show “Baywatch” debuted on NBC. It first appeared on April 23 as a two-hour movie. Although the series had a healthy viewership, the network canceled the show after one season. Baywatch star, David Hasselhoff, took an unusual step, and investing a great deal of his own money, revived the show and offered it for syndication. He had researched the audience and believed there was a loyal enough following to make his investment pay off. Hasselhoff proved to be right, and within a few years, “Baywatch” became the most-watched television show in the world, with huge audiences in England and China. It was estimated to have a collective viewership of 1 billion.

http://www.baywatch.com/

http://www.iol.ie/~wayneh/baywatch/history/index.htm

1989 - Hurricane Hugo quickly lost strength over South Carolina, but still was a tropical storm as it crossed into North Carolina, just west of Charlotte, at about 7 AM. Winds around Charlotte reached 69 mph, with gusts to 99 mph. Eighty percent of the power was knocked out to Charlotte and Mecklenburg County. Property damage in North Carolina was 210 million dollars, and damage to crops was 97 million dollars. The strongest storm surge occurred along the southern coast shortly after midnight, reaching nine feet above sea level at ocean Isle and Sunset Beach. Hugo killed one person and injured fifteen others in North Carolina. Strong northwesterly winds ushered unseasonably cold air into the north central U.S., in time for the official start of autumn, at 8:20 PM (CDT). Squalls produced light snow in northern Wisconsin. Winds in Wisconsin gusted to 52 mph at Rhinelander.

1990 - Andre Dawson of the Montreal Expos steals his 300th base and becomes the only player other than Willie Mays to have 300 home runs, 300 steals and 2,000 hits.

1991 – Miami Dolphins Coach Don Shula records his 300th career NFL victory

1992 - Bruce Springsteen breaks the rules and plays an electric set for MTV's "Unplugged" show. The episode is renamed, "MTV Plugged."

1993 - The Rockies complete their inaugural season with a Major League home attendance record of 4,483,350 fans.

1993 – Nolan Ryan’s last game in the Majors. Ryan finished with 324 wins, 5,714 strikeouts and seven no-hitters; the last two are Major League records.

1993 - A barge strikes a railroad bridge near Mobile, AL, causing the deadliest train wreck in Amtrak history. 47 passengers are killed.

1994 - “Friends” premiered. This NBC comedy brought together six single friends and the issues in their personal lives, ranging from their jobs to their love lives. Cast included Courtenay Cox Arquette, Lisa Kudrow, Jennifer Aniston, Mathew Perry, David Schwimmer and Matt Le Blanc.

http://www.nbc.com/Friends/index.html

http://www2.warnerbros.com/friendstv/index.html

1995 - Time Warner and Turner Broadcasting System agree to a $7.5 million merger.

1997 - The Atlanta Braves won an unprecedented sixth straight division title. The record eclipsed the old mark of five straight set by the New York Yankees (1949-1953) and the Oakland A's (1971-1975). The Braves failed to reach the World Series, however, for the first time since 1993.

1998 - The Blue Jays' Jose Canseco hits his 45th and 46th home runs setting a new career high.

1998 - With AL-leading HR #s 54 and 55, Mariner Ken Griffey Jr. joins Babe Ruth and Lou Gehrig as the only players to drive in 140 or more runs in three consecutive seasons.

2002 - In last game ever played at Cinergy Field, the Phillies complete a three-game sweep defeating the Reds, 4-3, in front of many of the team's former superstars except for the banished Pete Rose. The all-time hit leader, however, is not forgotten as Tom Browning, paints Rose's uniform number 14 on the pitcher's mound after the game with red spray paint and, as home plate is dug up and to be delivered next door to Great American Ball Park, the crowd begins to chant, "Pete, Pete."

2002 - Sting receives an Emmy for the A&E documentary, "Sting in Tuscany: All This Time." He dedicates his award to his "dear late friend Timothy White."

2003 - For only the third time in Major League history, a Korean pitcher and a Japanese pitcher oppose one another as Expos' hurler Tomo Ohka faces Jae Weong Seo of the Mets as starters at Shea Stadium. Both Pacific Rim right-handers throw well but neither gets the decision as Montreal beats the Mets on misplayed fly balls in the ninth, 4-2.

2003 - With Atlanta beating the Marlins, 8-0, Greg Maddux becomes the first pitcher ever to have won at least 15 games in 16 consecutive seasons. The Braves' righty had shared the accomplishment with Cy Young.

2004 - "Lost" premiered on ABC.

2005 - An American Society of Microbiology's study of the number people of who wash their hands after using a public rest room reports 83 percent of patrons take advantage of the available soap and water. Of the 6,300 bathroom users monitored, the worst hygiene was found at Turner Field where only 37 percent of men left the bathroom without washing, and 16 percent of the woman did during an Atlanta Braves game.

2005 - John Roberts' nomination as Chief Justice of the Supreme Court cleared the Senate Judiciary Committee on a 13-5 vote.

2005 - For the first time in the historical record, two hurricanes reached category-5 intensity in the Gulf of Mexico in a single season as Hurricane Rita intensified before making landfall (Katrina and Rita).

2008 - The U.S. Mint unveiled the first changes to the penny in 50 years, with Abraham Lincoln's portrait still on the front, but new designs replacing the Lincoln Memorial on the back.

2014 - The U.S. Treasury issued rules to hinder companies from moving their headquarters outside the country to save on taxes. The rules may impact pending deals, such as Burger King's plan to move to Canada after merging with Tim Horton's.

2019 – President Trump admitted he spoke with Ukraine president about Joe Biden’s son. A US intelligence officer made an official complaint about the call.

-------------------------------------------------------------

SuDoku

The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler?

http://leasingnews.org/Soduku/soduko-main.htm

--------------------------------------------------------------

Daily Puzzle

How to play:

http://www.setgame.com/set/puzzle_frame.htm

Refresh for current date:

http://www.setgame.com/set/puzzle_frame.htm

--------------------------------------------------------------

http://www.gasbuddy.com/

http://www.gasbuddy.com/GB_Map_Gas_Prices.aspx

http://www.gasbuddy.com/GB_Mobile_Instructions.aspx

--------------------------------------------------------------

Weather

See USA map, click to specific area, no commercials

--------------------------------------------------------------

Traffic Live---

Real Time Traffic Information

You can save up to 20 different routes and check them out with one click,

or type in a new route to learn the traffic live

--------------------------------

![]()