Thursday, September 1, 2005

Headlines--- Welcome New Readers ######## surrounding the article denotes it is a "press release" Michael Brown, head of the Federal Emergency Management Agency, urged people to make cash contributions to organizations. Cash donations "allow volunteer agencies to issue cash vouchers to victims so they can meet their needs. Cash donations also allow agencies to avoid the labor-intensive need to store, sort, pack and distribute donated goods. Donated money prevents, too, the prohibitive cost of air or sea transportation that donated goods require." FEMA listed the following agencies as needing cash to assist hurricane victims: . American Red Cross, 800-HELP NOW (435-7669) English, 800-257-7575 Spanish. Donations can be made online to most of these organizations through Network for Good. The Salvation Army is asking for donations to their Thrift stores, particularly clothing, shoes, baby and children clothing, toys, and anything you would like to donate. For more information about donating directly to the Hurricane recovery efforts: http://www.salvationarmyusa.org/ ---------------------------------------------------------------- Welcome New Readers While most who read Leasing News go to the web site first, many still join our mailing list. Our goal is to print daily from Monday to Friday, but most often it is only three or four times a week, so when you are on the mailing list, you are informed that the new edition is available. We go to "press" when we think there is enough equipment leasing news to do so. Readers on our mailing list also get notices of major events from time to time. We welcome the new readers and hope you enjoy and find informative Leasing News. ---------------------------------------------------------------- Classified Ads---Credit Atlanta, GA. Boston Ma. Corona, CA. Fort Lee NJ Credit: Irvine, CA, I have over 16 years of Credit/Collection experience in the finance industry. Prompt results, extremely effective and knowledgeable, professional, excellent manager and team player. Los Angeles, CA Mill Valley, CA New Jersey, NJ New York, NY. Portland, OR . Orange, CA. Senior Credit Officer For a full listing of all "job wanted" ads, please go to: http://216.66.242.252/AL/LeasingNews/JobPostings.htm To place a free "job wanted" ad, please go to: http://216.66.242.252/AL/LeasingNews/PostingForm.asp --------------------------------------------------------------- R.W. Professional Loses Motion to Suppress Evidence As reported earlier, Barry Drayer, the key executive of R.W. Professional, Incorporated, has pleaded to the court that he has no money to hire an attorney, and the court appointed one, again postponing the case. A ruling in the "Pacer" files that the "Waiver of Speedy Trial" document meant that this trial will be delayed until 10/25/05 for the "interest of justice." Elizabeth E. Macedonio became the attorney for Barry Drayer, and appears to being a public defender, as the court approves "itemized" expenses. Drayer and other major defendants remain under house arrest, meaning wearing ankle bracelets that record their location. To obtain the ability to travel from the house appears to take the permission of the court in writing. A reliable source told Leasing News that Drayer is claiming he has no money to pay for representation, and therefore has received a public defender, and for the defense to be able to represent the defendant, has been granted time to review all matters to date. It appears CIT has also entered the proceedings. CIT did not return telephone or e-mail regarding this subject. American Express has a $20 million case pending, and others, including a group of community banks, have over $10 million in cases pending. "CJA 20 as to BARRY DRAYER: Authorization to Pay $2,970.00 TO Elizabeth Macedonio. (Signed by Judge Arthur D. Spatt on 6/8/05). (Coleman, Laurie) Additional attachment(s) added on 6/15/2005 (Coleman, Laurie)." Here is the ruling from Westlaw regarding the denial to suppress evidence: United States District Court, E.D. New York. UNITED STATES of America, v. RW PROFESSIONAL LEASING SERVICES CORP., also known as "Professional Leasing Services," Rochelle Besser, also known as "Rochelle Drayer," Barry Drayer, Roger Drayer, Adam Drayer, Myrna Katz, Stephen Barker, and Payaddi Shivashankar, Defendants. No. 02CR767(ADS)(MLO). Aug. 30, 2005. Roslynn R. Mauskopf, United States Attorney, Eastern District of New York by Geoffrey R. Kaiser, Assistant U.S. Attorney, Central Islip, NY. Frankel & Abrams by Stuart E. Abrams, Esq., Of Counsel, New York, NY, for Defendant RW Professional Leasing Services Corp. Simon & Partners LLP by Bradley D. Simon, Esq., Kenneth C. Murphy, Esq., of Counsel, New York, NY, for Defendant Rochelle Besser. Elizabeth Macedonia, P.C. by Elizabeth E Macedonio, Esq., Steve Zissou, Esq., of Counsel, New York, NY, for defendant Barry Drayer. James C. Neville, Esq., Port Washington, NY, for Defendant Roger Drayer. Grossman & Rinaldo by Paul Rinaldo, Esq., of Counsel, New York, NY, for Defendant Adam Drayer. Gotlin & Jaffe by Daniel Gotlin, Esq., of Counsel, New York, NY, for Defendant Susan Cottrell. John S. Wallenstein, Esq., Mineola, NY, for Defendant Myrna Katz. Craig M. Lytle, Esq., Redondo Beach, CA, Terrence P. Buckley, Esq ., Islandia, NY, for Defendant Stephen Barker. MEMORANDUM OF DECISION AND ORDER SPATT, District Judge. *1 This case involves charges of conspiracy to commit bank fraud, wire fraud, and money laundering. Presently before the Court are objections by defendant RW Professional Leasing Services, Corp. ("PLS"), to the Report and Recommendation ("Report") dated June 23, 2004, of United States Magistrate Judge Michael L. Orenstein. The Report recommended that the Court deny the defendants' joint pretrial motion to suppress evidence that was allegedly unlawfully seized from PLS offices by Frank Zambaras ("Zambaras"), who was identified as a confidential source in a subsequent application for a search warrant. I. BACKGROUND

The background of this case is incorporated in this Court's three previous memoranda dated May 4, 2004, August 5, 2004, and December 7, 2004. Familiarity with these decisions is assumed. In the May 4, 2004 decision, the defendants' motion to suppress evidence seized by Zambaras was referred to Judge Orenstein to conduct a suppression hearing and report on whether such evidence should be suppressed. On June 22 and 23, 2004, Judge Orenstein conducted a suppression hearing at which Zambaras and Special Agent Rondie Peiscop-Grau of the Federal Bureau of Investigations ("Special Agent Peiscop-Grau") testified. At the conclusion of the hearing, Judge Orenstein issued a Report that recommended denying the Defendants' motion to suppress the documents obtained by Zambaras. PLS timely objected to Judge Orenstein's recommendation and argued that Judge Orenstein applied too narrow a legal standard in denying the motion because the court purportedly did not consider whether the government gave "tacit" approval to Zambaras's unlawful conduct.

Zambaras testified at the hearing that he was an equipment leasing broker who worked as a contractor for PLS from 1992 to 2002. Zambaras admitted that while working for PLS he was directed by defendant Roger Drayer to fraudulently alter checks. In the beginning of June, 2002, Zambaras notified Roger Drayer that he was terminating his contractual relationship with PLS because it was no longer able to fund his leasing deals. Also sometime in early June 2002, Zambaras contacted the FBI and made a complaint about fraudulent activities at PLS. On June 12, 2002, Zambaras met with Special Agent Peiscop-Grau and supplied her with information concerning fraudulent activity at PLS. At the meeting, Zambaras indicated that he had previously removed documents and a CD-ROM from PLS that contained evidence confirming the information about the fraudulent activities. Zambaras testified that Special Agent Peiscop-Grau admonished him for removing property from PLS because he had no authority to take such materials. She further directed him to retain the materials. On June 18, 2002, Zambaras and Special Agent Peiscop-Grau met for a second time. At the meeting Zambaras gave her a box containing the records that were discussed at the previous meeting as well as additional records gathered from PLS after the first meeting. Special Agent Peiscop-Grau again admonished Zambaras for removing property from PLS offices. Although both Zambaras and Special Agent Peiscop-Grau testified that she told Zambaras that he was not a government agent and was not authorized to take documents from PLS, she did not refer to this instruction in her "Form 302," which is the form used to memorialize an agent's meeting with an individual. *2 On June 20, 2002, Special Agent Peiscop-Grau executed an affidavit in support of an application for a warrant to search PLS's offices, which referred to documents that Zambaras had taken from PLS. On June 21, 2002, the FBI executed the search of PLS offices pursuant to the search warrant obtained. Zambaras was asked to assist, and did assist, the government agents in searching the PLS offices pursuant to the warrant. C. Magistrate Judge Orenstein's Report and Recommendation Judge Orenstein found that the taking of the documents and information from PLS after Zambaras met with Special Agent Peiscop-Grau was done while he was acting on his own behalf, and not on behalf of the government. Specifically, Judge Orenstein noted that when Zambaras met with Agent Peiscop-Grau, Zambaras indicated that he had already taken the documents but did not have them with him. Also, during the discussions the agent admonished and warned Zambaras that he was not acting undercover; was not authorized to take documents; and that he did not have any authority to take documents. In response, Zamabaras testified that he knew he had no authority to take documents, but testified that he felt it was critical that he take them so that they would not be destroyed. Judge Orenstein concluded that it was immaterial whether Special Agent Peiscop-Grau had knowledge or believed that Zambaras was going to take additional materials from PLS. Instead, Judge Orenstein emphasized that the issue was whether the Special Agent told "him or [did] anything which either required, asked, recruited, requested, encouraged, [or] importuned Zambaras to obtain the documents." Suppression Hr'g Tr. 306-07, June 23, 2004. Judge Orenstein found that "there has not been one shred or scintilla of evidence that the government tacitly involved itself in Mr. Zambaras' independent act of taking documents after June 12, 2002." Hr'g Tr. 307-08. Further, Judge Orenstein found that it was proper for Special Agent Peiscop-Grau to accept the documents from Zambaras, even though they may have been obtained by theft or burglary. Judge Orenstein noted that as soon as Special Agent Peiscop-Grau received the documents, she sought advice from the Assistant United States Attorney as to whether it was proper to take the documents. II. DISCUSSION A. Standard of Review Pursuant to 28 U.S.C. § 636(b)(1), any party may file written objections to the report and recommendation of a magistrate judge within ten days after being served with a copy. Id.; see also Fed.R.Civ.P. 72(a). Once objections are filed, the district court is required to make a de novo determination as to those portions of the report and recommendation to which objections were made. See 28 U.S.C. § 636(b)(1); Brassia v. Scull, 892 F.2d 16, 19 (2d Cir.1989). The phrase "de novo determination" in section 636(b)(1)--as opposed to "de novo hearing"--was selected by Congress "to permit whatever reliance a district judge, in the exercise of sound judicial discretion, chose to place on a magistrate's proposed findings and recommendations." United States v. Radios, 447 U.S. 667, 676, 100 S.Ct. 2406 (1980). *3 Section 636 does not require the district court "to rehear the contested testimony in order to carry out the required 'determination.' " Id. at 674. Rather, in making such a determination, the district court may, in its discretion, review the record and hear oral argument on the matter. See Pan Am. World Airways, Inc. v. International Brotherhood of Teamsters, 894 F.2d 36, 40 n. 3 (2d Cir.1990). Furthermore, the district judge may also, in his sound discretion, afford a degree of deference to the Magistrate Judge's Report and Recommendations. See U.S. v. Radios, 447 U.S. 667, 676, 100 S.Ct. 2406, 65 L.Ed.2d 424 (1980). B. Surreptitious Search and Seizure by a Private Party It has long been settled that "a wrongful search or seizure conducted by a private party does not violate the Fourth Amendment and that such private wrongdoing does not deprive the government of the right to use evidence that it has acquired lawfully." Walter v. United States, 447 U.S. 649, 656, 100 S.Ct. 2395, 65 L.Ed.2d 410 (1980); see also Burdeau v. McDowell, 256 U.S. 465, 475, 41 S.Ct. 574, 65 L.Ed. 1048 (1921). The Second Circuit has stated that the "surreptitious search of premises by a private party does not violate the Fourth Amendment" unless such individual is acting as an instrument or agent of the government in obtaining evidence. United States v. Bennett, 709 F.2d 803, 805 (2d Cir.1983). If the government "was in it before the object of the search was completely accomplished [by the private party, it] must be deemed to have participated in it." Id. (quoting Lustig v. United States, 338 U.S. 74, 78-79, 93 L.Ed. 1819, 69 S.Ct. 1372 (1949)). It is " 'immaterial' whether the government originated the idea for a search or joined it while it was in progress." United States v. Knoll, 16 F.3d 1313, 1320 (2d Cir.1994) (quoting Lustig, 338 U.S. at 78-79). "Whether a private party should be deemed an agent or instrument of the Government for Fourth Amendment purposes necessarily turns on the degree of the Government's participation in the private party's activities, a question that can only be resolved in light of the circumstances." Skinner v. Rwy. Labor Executives Assoc., 489 U.S. 602, 614, 103 L.Ed.2d 639, 109 S.Ct. 1402 (1989) (citations omitted). The Second Circuit has noted that "[t]he government may become a party to a search through nothing more than tacit approval." Knoll, 16 F.3d at 1320 (citing 1 Wayne R. LaFave, Search & Seizure § 1.8(b), at 180 (2d ed.1987)). In Knoll, the Second Circuit recognized that private individuals may be considered acting as government agents if the government directs their actions or tacitly approves of whatever measures were taken to seize the evidence. Id. Thus, the protections of the Fourth Amendment are invoked if the government directs or tacitly approves of a surreptitious search by private individuals. C. PLS Objections to the Report and Recommendation *4 PLS argues that Judge Orenstein applied too narrow a legal standard in recommending that the defendants' motion to suppress be denied because the Report failed to fully apply the Second Circuit's ruling in Knoll.. The Court disagrees. The Report issued by Judge Orenstein clearly embraces the legal standards enunciated in Knoll. The Report states: [t]he issue before the Court is whether there was tacit approval of Mr. Zambaras's activities on or after June 12.... .... This Court specifically finds that there has not been one shred or scintilla of evidence that the government tacitly involved itself in Mr. Zambaras' independent act of taking documents after June 12, 2002. H'rg Tr. 304, 308. PLS argues that Knoll requires a court to look beyond the formal relationship between the government and private party and to consider the "reality" of the relationship. While the Court agrees that it is essential to perform a critical analysis of the relationship between the private party and the government, the Court cannot disregard the evidence or make assumptions about the "reality" of the relationship that are not supported by the evidence. In Knoll, there was testimony that the government agent encouraged the private party after learning of the surreptitious search by making statements such as "get me more information," "you've got to turn more over," and "[i]f there's stuff out there, you've got to turn it over." Knoll, 16 F.3d at 1320. The Second Circuit reasoned that these statements, made prior to the carrying out the private search, may have tacitly approved such conduct. In this case there was absolutely no evidence that the government directed, encouraged, or tacitly approved of Zambaras' actions. Both Zambaras and Special Agent Peiscop-Grau testified that she told Zambaras that he was not a government agent and was not authorized to take documents from PLS. After their first meeting, Special Agent Peiscop-Grau did not encourage Zambaras to obtain additional documents. Rather, she repeatedly admonished Zambaras for taking the materials. Also, instead of asking Zambaras to seize additional evidence, Special Agent Peiscop-Grau immediately sought advice from an Assistant United States Attorney and a search warrant from the court. In sum, there is absolutely no evidence in the record that the government directed or tacitly approved the search and seizure executed by Zambaras. Therefore, the Court finds that Judge Orenstein correctly determined that Zambaras was not acting as a government agent in any way. After carefully reviewing Judge Orenstein's well-reasoned and thorough Report, the Court concludes that his Report is certainly not clearly erroneous. Judge Orenstein applied the proper standard and reasonably applied the facts obtained from all the testimony given at the suppression hearing to the law. Accordingly, the Court adopts Judge Orenstein's Report and denies the motion to suppress the evidence. III. CONCLUSION *5 For all the foregoing reasons, it is hereby ORDERED, that the Court adopts Judge Orenstein's Report in its entirety; and it is further ORDERED, that the defendants motion to suppress the evidence obtained by Zambaras is denied. SO ORDERED. 2007213959 2007213959 E.D.N.Y.,2005. U.S. v. RW Professional Leasing Services Corp. --- F.Supp.2d ----, 2005 WL 2077125 (E.D.N.Y.) Previous stories about R.W. Financial http://www.leasingnews.org/Conscious-Top%20Stories/RW_stories.htm ---------------------------------------------------------------- "We are coming for the rest of the LC's now!" As predicted that the clause in NorVergence Leasing "Equipment NorVergence lessees are viewing this as a "victory," and "Everything I said would happen in Texas has happened, and we are " Please feel free to publish the attached orders, and let me "We have only now begun to fight!" http://leasingnews.org/PDF/Eastern_District.pdf http://leasingnews.org/PDF/Denying_Pop_Mandamus.pdf http://leasingnews.org/PDF/Studebaker_Order.pdf --------------------------------------------------------------- NJ Judge Orders $15 Million to 600 Pennsylvania lessees By BRIAN SCHROCK Daily American Staff Writer A Somerset County judge has ordered a $15 million judgment against a New Jersey company accused of defrauding more than 600 Pennsylvania consumers, including small businesses, churches, charities, schools and the local chamber of commerce. Sources said it is unlikely that any of the organizations will see a dime. The company, NorVergence of Newark, N.J., sold telecommunication packages in Pennsylvania from April 2003 through June 2004 with the promise of big savings, flat rates and unlimited broadband, land line and cell phone service, according to the Pennsylvania Attorney General's office. The service, the company said, was made possible by installing a "black box," typically called the Matrix or Matrix 850, at the customer's place of business. Court documents show that the company rented the boxes to consumers for between $250 and $5,700 per month - for as long as 60 months - even though the box was nothing more than a standard telephone router. The company purchased the device from a Huntsville, Ala., company, for less than $1,500. Authorities said NorVergence sold the rental agreements to finance companies in return for lump sums of cash. "The commonwealth ... believes that the finance companies paid NorVergence in excess of $100 million in upfront payments for the purchase or assignment of the rental agreements," Senior Deputy Attorney General Barry Creany wrote in the lawsuit, which was filed in December 2004. Authorities said the rental agreements were complex, highly technical documents with a "sea of fine print." The agreements reportedly included provisions that required customers to pay even if NorVergence failed to provide services. The agreements also allowed finance companies to seek collections in any forum they chose, making it difficult for customers to dispute the monthly rental fees, according to the Federal Trade Commission, which filed its own complaint against the company Nov. 4 in U.S. District Court in New Jersey. NorVergence, which in 2003 boasted annual revenues of $143 million, was forced by creditors into Chapter 11 bankruptcy in June 2004. Not long thereafter, the Pennsylvania Attorney General's office was flooded with complaints from consumers who had their telephone and Internet service disconnected. Creany said the company sold telecommunication packages to 645 Pennsylvania consumers, including nine in Somerset County. Those included the Somerset County Chamber of Commerce, which signed two rental agreements in May 2004. Hank Parke, the chamber's former executive director, remembers being attracted to the idea of receiving unlimited phone, broadband, cell phone and toll-free service for a flat monthly fee. As a nonprofit organization with a limited budget, the chamber was always looking for ways to save money, Parke said. "Every business is trying to cut overhead. And when you can cut overhead and get a decent service for a flat fee, it's a wise move," he said. "You just hope the service is actually offered or, in this case, delivered." Parke said the chamber was contacted by a leasing company, but has not, to the best of his knowledge, paid any bills for a service that was never provided. "I just hope this thing gets cleared up and the businesses that are out of money or have an outstanding lease are let off the hook because generally they didn't deliver," he said. Chamber Executive Director Ron Aldom could not immediately be reached for comment Tuesday afternoon. In June, Parke testified on the commonwealth's behalf. The hearing was held, in part, to determine how much money the company would be held responsible for. Court documents indicate that NorVergence assigned 540 of the 645 rental agreements to finance or leasing companies. As of July, the approximate average balance due on those agreements was $26,500. Authorities multiplied the two figures to arrive at the figure cited in Judge Eugene Fike's order- $14,310,000. Fike also assessed the company a $645,000 civil penalty for "willful violations of the Consumer Protection Law." Sources said it is unlikely that Pennsylvania consumers will see any of that money. Michael Holt, the New Jersey-based attorney for bankruptcy trustee Charles M. Forman, said former employees of the company and taxing authorities will be among the first to be paid - if there is, in fact, any money available for that purpose. The two groups have filed claims in excess of $13 million. The Federal Trade Commission has sought a $180 million judgment against the company, which ceased operating in July 2004. Forman, a government appointee, is responsible for liquidating the company's assets and using the money to pay creditors. "In this case, it appears highly unlikely that there will be any money to pay out to unsecured creditors," Holt said. Creany agreed. "I think it's an administrative insolvency," he said "It doesn't look like there will be funds to distribute to creditors, let alone unsecured creditors like these." About 35 leasing or finance companies were involved with rental agreements in Pennsylvania, Creany said. A handful of those have agreed to forego collections or collect only a percentage of the amount due as part of settlements with the state attorney general's office. Others may go to court to try to collect the money, though Creany noted that a consumer's bargaining position has been enhanced by the allegations swirling around NorVergence. "There's good cause to rule that the NorVergence sales program was nothing more than an elaborate type of scheme," Creany said at the court hearing in June. NorVergence officials could not be reached for comment Tuesday. Michael Sirota, an attorney for company President Peter J. Salzano, did not immediately return a telephone call for comment. Telephone numbers to the company's office in New Jersey were either disconnected or were no longer in service. "For all intents and purposes, there really is no NorVergence anymore," Holt said. The judge's order prohibits NorVergence from selling or assigning previously unassigned rental agreements. It also says that the contracts between the company and Pennsylvania consumers are "rescinded and unenforceable" by the company. The order makes no mention of the finance companies. The judge's order does not prohibit the company from conducting business in Pennsylvania, though Creany said it may be a moot point. "If the bankruptcy proceedings don't put an end to NorVergence, we would have the ability to reopen this issue," he said. The judge also issued an order Monday accepting a settlement agreement between Salzano and the attorney general's office. The settlement limits the business practices Salzano can engage in, and requires him to notify officials in writing of any business plans in Pennsylvania. The consent petition carries the threat of a $250,000 civil penalty for violations of the order. Salzano filed for Chapter 11 bankruptcy in January 2005, according to court documents. (Brian Schrock may be contacted at brians@dailyamerican.com .) ----------------------------------------------------------------

---------------------------------------------------------------- Classified Ads---Help Wanted Account Executives

Credit Analyst

Lease Representatives

MIS/Business Analyst

National Account Manager

Vendor Relationship

----------------------------------------------------------------

Netbank Financial joins the "Funder Only" List Funder's Only - Update A -Accepts Broker Business | B -Requires Broker be Licensed | C -Sub-Broker Program

(F) NetBank Business Finance accepts sub-brokered transactions only from a select, pre-approved group of broker/lessors. NBF is a wholly owned subsidiary of NetBank, Inc. and will occasionally accept lease and loan referrals from other NetBank companies. full list located here: http://www.leasingnews.org/Conscious-Top%20Stories/Funders_Only.htm ----------------------------------------------------------------

Owner sells majority of Brookfield leasing company John Engelbrecht, the chairman and chief executive officer of M2 Lease Funds L.L.C., reportedly has sold 80 percent of the membership units in the Brookfield leasing company to a bank holding company in Illinois for $5 million. Engelbrecht, who founded the company more than 30 years ago, holds the remaining 20 percent membership interest, Quad City Bank owner QCR Holdings Inc., Moline, Ill., M2, written as "M squared," is a private investment firm that leases machinery and equipment to commercial and industrial businesses under direct financing lease contracts. As of July 31, 2005, M2 had total assets of approximately $32.4 million, QCR said. QCR Holdings (NASDAQ: QCRH - News) is a multi-bank holding company that serves the Quad City; Cedar Rapids, Iowa; and Rockford, Ill., areas. ----------------------------------------------------------------

Leasing Association Conference Up-Date Time to register for the "early bird" discount, plus Leasing Association Conferences-Fall, 2005 September 14-16 Vancouver, BC

The Canadian Finance and Leasing Association 2005 Conference "Working smarter for tomorrow ~ Mieux travailler pour demain" & 32nd Annual General Meeting ~ September 14 -16, Westin Bayshore Resort & Marina, Vancouver, BC - Join us in Vancouver for the 2005 Conference and discover how businesses are Working smarter for tomorrow within the asset-based financing/leasing industry. Registration, plus agenda, please go here. A list of Conference delegates is available to the Public by Company ------------------------------------------------------------------

Eastern Association of Equipment Lessors Information on the key speakers: For Agenda and Registration, please go here: For Exhibitor Registration This year's " FALL EXPO" is quickly developing into a must attend event for any and all leasing professionals. The EAEL has sponsored the Fall Expo for 22 years and this year is presenting the event in conjunction with the NAELB ; and has adapted the title of " Take The Next Step To Success". Participating exhibitors have already given a vote of confidence to this one day gathering of leasing companies and individuals who are leading the way with their optimism in the future of our industry. The number of exhibitors has outpaced previous years with the addition of new exhibitors every day; and the demand is quickly reaching maximum available space. The Expo currently has 39 Confirmed exhibitors The anticipated crowd is motivating exhibitors and record high numbers of sponsors to secure their place on the " FALL EXPO" roster. The day is highlighted by nine workshops and two speakers the Honorable Bill Bradley and Famed Economist Dr. Irwin Kelly. The most exciting news is that expected attendees will outpace recent years and may even top records posted in the mid nineties . Both the EAEL and NAELB are receiving daily inquiries and commitments from members and non-member who are planning on attending. The date is Monday September 19 th 2005, at the Marriott at Glenpointe Teaneck NJ. For a registration form your readers can visit the EAEL web site at www.eael.org .Scott A Wheeler ------------------------------------------ National Assocation of Equiment Leasing Brokers -----------------------------------------

United Association of Equipment Leasing

The Chairman for the conference is Randy Haugh from Lease Team, Inc. The event will take place at beautiful Lake Tahoe, Nevada. Our theme for this year is Peak Performance: Peers, Processes, Practices and Profitability. We have a great lineup of sessions, roundtables and panel discussions scheduled on interesting and diverse topics. We also have some good opportunities to network; Thursday night, welcome reception will take place on the deck of the Edgewood Country Club and the other of the events will also feature the exclusive buyout of the M.S. Dixie for the Saturday Sunset Dinner/Dance Cruise.

We are very excited about about two of the speakers we have line up this year. Colonel Tom Schaefer was an Iranian hostage for 444 days in 1979-1980. We also have Mr. Joseph Lane, Chairman of the Equipment Leasing and Finance Fundation, addressing our industriy as our keynote speaker.

The view the complete brochure, click here. If you have not booked your room at Caesars Tahoe for the UEAL Fall Conference and Exposition please do so as soon as possible.

Caesars Lake Tahoe offers unparalleled comfort, luxery and gaming excitement with the great outdoors. A 17-story Y shaped hotel tower with 440 guest rooms and 37 suites. Caesars elegant rooms are accentuated by their beautiful surroundings. Please call 1.775.588.3515 to make a reservation and don't forget to mention this is for UAEL block. ----------------------------------------- Equipment Leasing Association A non-member who has not attended the conference before is invited Registration and all information about the Annual Convention are now available on-line at http://www.elaonline.com/events/2005/annconv/ ---------------------------------------

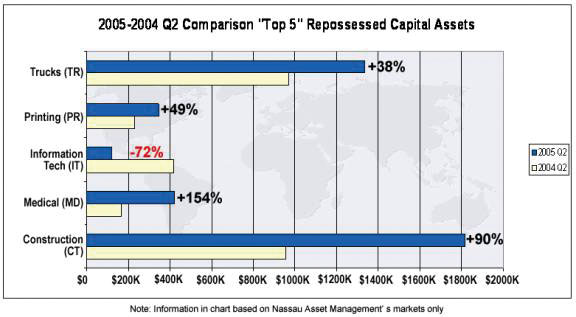

---------------------------------------------------------------- ### Press Release ############################ Nassau Asset Management notes repos rose in several sectors during Q1, Q2 Fuel prices may be driving up some equipment repossessions WESTBURY, NY, -- Fuel costs may be contributing to an increase in equipment repossessions and liquidations nationwide, reports Nassau Asset Management, which tracked a rise in several sectors during the first two quarters of 2005. The company studies equipment trends as part of its equipment recovery, appraisal, collections and remarketing business.

Nassau earlier this year noted that repossessions and liquidations during first quarter (Q1) rose significantly for the first time since 2002. In the company's latest NasTrac Quarterly Index (NQI), repossessions and liquidations during second quarter (Q2) 2005 compared with Q2 2004 increased in four of five categories: trucks/trailers (+38%); printing presses (+49%); medical devices (+154%); and construction equipment (+90%). Only information technology equipment fared better (-72%). An analysis of the many factors contributing to repossessions indicates that fuel prices may be having a greater impact than in the past. "We feel fuel cost is a factor that can push a business already close to failing over the edge," said Edward Castagna, Nassau's president. "For trucking companies, fuel represents 25 percent of operating costs, according to the American Trucking Associations (ATA). The high price of fuel also is affecting more than truckers. It increases the cost of doing business for many companies." Rising fuel prices have spiked even higher in recent days due to shutdowns in national oil production caused by Hurricane Katrina.

About NQI NQI reflects Nassau's internal repossession and orderly liquidation activity in a given quarter compared to the same quarter the previous year. Readers should keep in mind that results must be viewed over several quarters to establish trends. Companies can contract with Nassau to dig deeper into the numbers, helping mitigate risk in portfolios and/or provide useful economic indicators. About Nassau Nassau Asset Management of Westbury, NY, has been providing full-service asset management, including equipment remarketing, fleet and plant liquidations, collections, and appraisals for more than 25 years to the equipment finance industry. For more information, please visit www.nasset.com or call 1-800-4.NASSAU. Contacts Edward Castagna ### Press Release ############################ CHARTER CAPITAL announces partnership with The MED Group Scottsdale, AZ - - Charter Capital is pleased to announce that they have entered into an exclusive agreement with The MED Group of Lubbock, TX to provide The MED Groups 220 Member companies with a wide range of customized equipment leasing and financing products. "The understanding and importance that Charter Capital places on true strategic partnerships with their customers [our members] and their commitment to the highest level of customer satisfaction were factors considered in The MED Group establishing this agreement for leasing services", said Jeff Woodham, Senior Vice President of Operations with The MED Group. "We are delighted at the opportunity to work with The MED Group, a company that has values and a business mission that is similar to ours. We look forward to working and growing our businesses together", said Greg Reeve, General Manager of Charter Capital. About CHARTER CAPITAL: Charter Capital is a leading provider of leasing and financing solutions for equipment acquisitions ranging from $10,000 to $1,000,000. Founded in 1977, Charter is headquartered in Scottsdale, Arizona and its website is www.charteraz.com. About The MED Group: Since January 1968, The MED Group has supported its members with management, educational, marketing, technical, and contract services. There are more than 220 members with approximately 750 locations throughout the United States, the District of Columbia, and Puerto Rico that provide home medical equipment and supplies, rehabilitation technology, respiratory products and services, home infusion therapy, and medical equipment repairs. The MED Group's national headquarters are located in Lubbock, Texas, and its website address is www.medgroup.com. Charter Capital contact: Greg Reeve ### Press Release ############################ ----------------------------------------------------------------

News Briefs---- Airlines May Face Possible Fuel Shortages http://www.nytimes.com/aponline/business/AP-Katrina-Airlines-HK3.html Economic fallout will be massive from Katrina http://www.usatoday.com/money/economy/2005-09-01-katrina-econ-fallout-usat_x.htm ----------------------------------------------------------------

You May Have Missed Come fall, states expand push for sales taxes on Internet purchases http://www.signonsandiego.com/news/business/20050831-1312-internettaxes.html ----------------------------------------------------------------

Baseball Poem

------------------- --- with the permission of the author, from his available from Amazon |

|||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||

|