|

Thursday, August 30, 2012

Today's Equipment Leasing Headlines

Archives---August 30, 2000

---Manifest is Sold

Classified Ads---Senior Management

Banks/Savings Institutions Earn $34.5 Billion Second Quarter

Mergers and Purchase of Bank/Thrift Branches Continues

Bank Accounts Keep on Growing Despite Record Low Rates

Classified Ads---Help Wanted

New Hires---Promotions

Why I Became a CLP

---David Normandin, CLP, Sr. VP, PacTrust Bank

Speedy Repossession/Resale Cost Bank $1 Million Deficiency

by Tom McCurnin, Esq.

Beige Report--August 29, 2012

English Toy Spaniel/Chihuahua Mix

Irvine, California Adopt-a-Dog

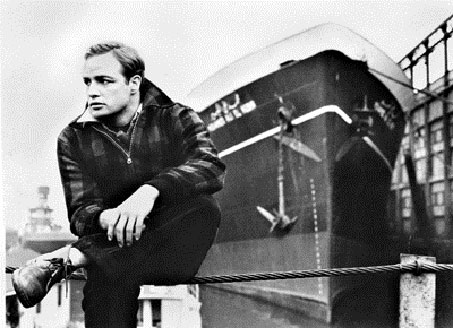

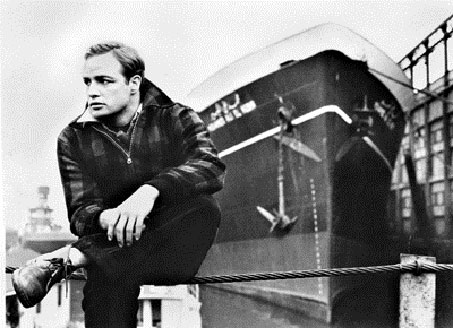

Modern Times/One the Waterfront/Blue Collar

Norma Rae/Office Space

---Labor Day DVD’s Suggestions by Fernando Croce

Open Positions at Leasing Funders/Various Locations

News Briefs

Scotiabank to buy ING Bank of Canada for $3.13 billion

Despite economy, Americans still optimistic

Pending home sales up modestly in June

Broker/Funder/Industry Lists |

Features (collection)

Top Ten Stories Chosen by Readers |

Top Stories last six months

You May have Missed---

SparkPeople--Live Healthier and Longer

Sports Briefs---

Baseball Poem

California Nuts Brief---

"Gimme that Wine"

This Day in American History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

######## surrounding the article denotes it is a “press release”

and was not written by Leasing News nor information verified, but from the source noted. When an article is signed by the writer, it is considered a “by line.” It reflects the opinion and research of the writer. It is considered “bias” as it is the writer’s viewpoint.

[headlines]

--------------------------------------------------------------

Archives- August 30, 2000

---Manifest is Sold

(Appearing in the August 31, 2000 edition, please note the three who signed the “memo” are no longer with US Bancorp/Manifest. editor:)

Rumored for over a month, and confirmed with Manifest Group Spokesman, fax is true:

" It will be business as usual...same place, same staff, same portfolio, but more money than Schwan could commit to our growth---expect better things from us now as we grow in this exciting new leasing world."

Dear Valued Customer,

It is with great excitement that we announce U.S. Bancorp Leasing and Financial has acquired Lyon Financial Services (LFS) and all of its business units, including The Manifest Group, from Schwan's Sales Enterprises. The anticipated close date is September 28, 2000.

U.S. Bancorp, headquartered in Minneapolis, MN, is the 10th largest bank holding company in the United States with $86 billion in assets. U.S. Bancorp along with U.S. Bank and other subsidiaries is a world class financial institution serving millions of customers throughout the West and Midwest. Lyon Financial Services will merge with their already existing U.S. Bancorp Leasing & Financial; the 5th largest bank affiliated leasing company in the United States.

Schwan's Sales Enterprises has had a strong commitment to Lyon Financial, The Manifest Group and the entire leasing industry for the past 20 plus years. They have helped us build a very stable, financially strong, and rapidly growing company. Lyon Financial strives to continue strong growth and this takes a tremendous amount of capital and resources. Schwan's is a multi billion-dollar food company with strong ambitions to focus more resources to allow them to gain a worldwide dominance in the frozen food industry. Bancorp Leasing & Financial strives to diversify product offerings and gain more share of the small ticket leasing industry. This partnership allows us all to meet our strategic goals.

The synergies between Lyon Financial and U.S. Bancorp make this a very exciting venture for all of us. The Manifest Group will remain in Marshall, Minnesota with the same employees and management. We will continue to focus on helping you grow your business and adhere to our confidentiality of your customer base. In addition, Bancorp has a strong line of products. services, and resources that we will leverage and provide you additional opportunities to grow.

Those air exciting times for all of us and we appreciate your support during the transition. We thank Schwan's Sales Enterprises for their years of support and for partnering us with a world class organization, U.S. Bancorp. As always, The Manifest Group is "Focused on Your Success

Please feel free to call with any questions, 800-325-2236. Thank you.

Troy Molitor, Brian Bjella, Brad Peterson

General Manager Extension 2002

Director of Sales - East Extension 2914

Director of Sales - West Extension 2911

[headlines]

--------------------------------------------------------------

Classified Ads---Senior Management

(These ads are “free” to those seeking employment or looking

to improve their position)

Philadelphia, PA

27 yrs. exp. sales, ops., credit, strategy, P&L mngmet. Most recently created & executed the biz plans for 2 highly successful Bank-owned small ticket leasing subsidiaries.

email: mccarthy2020@comcast.net |

Southern CA

20 years exp. as hands-on leasing CFO, managing accounting, treasury, FP&A, including securitizations, Great Plains/FRx, budgets, risk management. MBA. Also available as interim Controller/CFO, consultant.

Email: leasecfo@gmail.com

|

Free Posting for those seeking employment in Leasing:

http://www.leasingnews.org/Classified/Jwanted/Jwanted-post.htm

All “free” categories “job wanted” ads:http://www.leasingnews.org/Classified/Jwanted/Jwanted.htm

|

Gary DiLillo, President

440.871.0555 or gary@avptc.com

Comprehensive personal property tax outsourcing services.

Click here to see what our clients say about us. |

[headlines]

--------------------------------------------------------------

Banks/Savings Institutions Earn $34.5 Billion Second Quarter

The Federal Deposit Insurance Corporation (FDIC) reports that commercial banks and savings institutions reported aggregate net income of $34.5 billion in the second quarter of 2012, a $5.9 billion improvement from the $28.5 billion in profits the industry reported in the second quarter of 2011. This is the 12th consecutive quarter that earnings have registered a year-over-year increase. Lower provisions for loan losses and higher gains on sales of loans and other assets accounted for most of the year-over-year improvement in earnings. Also noteworthy was an increase in loan balances for the fourth time in the last five quarters.

Almost two-thirds of all institutions (62.7 percent) reported improvements in their quarterly net income from a year ago. Also, the share of institutions reporting net losses for the quarter fell to 10.9 percent from 15.7 percent a year earlier. The average return on assets (ROA), a basic yardstick of profitability, rose to 0.99 percent from 0.85 percenta year ago.

Total loan balances increased. Loan balances posted their fourth quarterly increase in the last five quarters, rising by $102 billion (1.4 percent). Loans to commercial and industrial borrowers increased by $48.9 billion (3.6 percent), while residential mortgages rose by $16.6 billion (0.9 percent) and credit card balances grew by $14.7 billion (2.3 percent). However, balances of real estate construction and development loans fell by $10.9 billion (4.8 percent), and home equity lines of credit declined by $10.2 billion (1.7 percent)

The Deposit Insurance Fund (DIF) balance continued to increase. The unaudited DIF balance — the net worth of the fund — rose to $22.7 billion at June 30 from $15.3 billion at the end of March. The increase included $4.0 billion previously set aside for debt guarantees under the FDIC's Temporary Liquidity Guarantee Program. Assessment revenue and fewer expected bank failures also continued to drive growth in the fund balance. The contingent loss reserve, which covers the costs of expected failures, fell from $5.3 billion to $4.0 billion during the quarter. Estimated insured deposits grew 0.7 percent in the second quarter.

The complete Quarterly Banking Profile is available at http://www2.fdic.gov/qbp

[headlines]

--------------------------------------------------------------

Mergers and Purchase of Bank/Thrift Branches Continues

Hudson City and Buffalo, N.Y.-based M&T announced an approximately $3.7 billion deal that will result in a combined network of 870 branches stretching from Connecticut to Virginia. Hudson City was primarily a mortgage lender, analyst Marty Mosby of Guggenheim Securities told SNL Financial. They needed to add commercial offerings as C&I portfolios are now growing for banks around the country.

In terms of assets, the deal would make M&T the 17th-largest bank in the country, according to SNL data. In terms of deposits, M&T before the deal is No. 21, and after the deal would be the 16th-largest in the country.

[headlines]

--------------------------------------------------------------

Bank Accounts Keep on Growing Despite Record Low Rates

The amount of money deposited in bank accounts reached a new high of $10.3 trillion on June 30 - an increase of $139 billion in the first six months of this year despite decreasing interest rates, Dan Geller, PH.D., executive vice President of Market Rates Insight reports.

Dan Geller, PhD

“In the current economic environment, the greater the amount of money deposited in banks, the lower interest rates will go.” said Dan Geller, Ph.D. Executive Vice President at Market Rates Insight, “as long as lending is soft, deposited money is becoming more and more expensive to banks since they have to pay interest on the increased amount of deposits, as well as deposit insurance to the FDIC.”

The highest increase in account balance occurred in regular savings accounts, which increased by $192 billion to a new record amount of $1.7 trillion. Money Market accounts showed a modest increase of $16 billion to a new record of $4.0 trillion. The increase in deposit balances occurred even though interest rate currently paid on Savings accounts is only 0.13 percent; and on money market accounts only 0.12 percent.

All other major account types experienced a decline in balances during the first six months of this year. The largest drop occurred in checking accounts, which decreased by $34 billion to a balance of $1.4 trillion. Certificate of deposits balance decreased by $16 billion to a total balance of $1.8 trillion. Interest rate currently paid on checking accounts is less than one-tenth of one percent (0.09%), and the average interest rate on all CD terms, from three months to five years, is 0.46 percent.

Despite these low interest rates, banks are making record profits from other products that they offer, as noted in the article above.

According to SNL Financial, the Federal Reserve are increasingly looking at cutting the rate the bank pays on reserves banks hold at the central bank. SNL examined which depositories are keeping the highest percentage of their tangible assets at the bank.

[headlines]

--------------------------------------------------------------

Leasing Industry Help Wanted

General Legal Counsel

National Bank Holding Company in Southern California

10+ yrs exp. commercial finance/leasing industry.

Background in employment law, contract origination,bankruptcy litigation/

must possess

an immense veracity, extensive understanding on

wide range of legal issues and business experience.

Salary requirements + resume: rose.jones98@yahoo.com

|

For information on placing a help wanted ad, please click here:

http://www.leasingnews.org/Classified/Hwanted/Hwanted-post.htm

Please see our Job Wanted section for possible new employees.

[headlines]

--------------------------------------------------------------

New Hires---Promotions

Cynthia (Lecocq) Caine named Access GE Leader, GE Capital Americas at GE Capital, Greater Philadelphia Area. Prior she was GE Healthcare Financial services as northeast zone commercial leader (December, 2010-August, 2012), joining GE Healthcare Financial services in March, 2005 becoming VP sales. Previously she was vice president, Wells Fargo Financial (2001--2005), VP of sales, Heartland Business Credit (1999-2001), vice-president, GE (1991-1999). University of Iowa BA, International Business.

www.linkedin.com/pub/cynthia-caine/11/17/962

Carla Freberg, Sales Manager-Vendor Services Group at Balboa Capital, Irvine, California, announces Balboa has added 33 new employees. “We are seeing an upward trend in capital investing, and we felt it necessary to increase our staff so we can continue delivering high-quality equipment financing products and services to our customers. We are excited to welcome these talented new members to our various financing divisions. Their knowledge, experience and professionalism will represent Balboa Capital well,” Mrs. Freberg added.

None of the employees were named, but in a company press release, it was noted: "The company is experiencing rapid growth and reinvesting in its operations to meet the needs of its customers in the small ticket, middle market and vendor financing channels...Balboa Capital is gearing up for the busy final months of 2012, particularly with the current Section 179 Tax Provision expiring on December 31.'“Under Section 179, businesses can deduct up to $125,000 of the full purchase price of new and used capital equipment, but this deduction amount is expected to decrease to $25,000 in 2013' said Mrs. Freberg"

http://leasingnews.org/PDF/Balboa_new_staff.pdf

Mrs. Freberg joined Balboa Capital August, 2007 as a team leader-vendor services group. Prior she was account executive-technology, Key Equipment Finance (December, 2002-November, 2006).Louisiana State University and Agricultural and Mechanical College Bachelor's degree, International Business (1998 – 2001. Istur- Arts and Business School of Florence, Italy Associate's degree, International Marketing (1996 – 1998).

www.linkedin.com/in/carlafreberg

John D. Gay hired as an Independent Contractor at First Financial Merchant Services, Cumberland, Maryland area. Previously he was president, Competitive Equipment Leasing LLC (December, 2009-July, 2012), regional leasing manager, Cisco Systems (October, 2006-November, 2009), regional leasing manager-project finance, Siemens Financial Services, Inc. (January, 2004-October, 2006), regional sales manager, Academic Capital Group (January, 2000-January, 2004), senior finance manager, PeopleSoft USA (January,1998-January, 2000), equipment leasing as well as multiple financial and accounting positions, various companies (January, 1978-January, 1998), director of syndications Unisys Finance, Unisys (1987-1993). California State University-Los Angeles Master of Business Administration, Finance (1978 – 1980), San Diego State University-California State University BS, Finance (1968 – 1972).

www.linkedin.com/in/financejohngay

Robert "Bob" Leonard named Executive Vice President at Bank of Birmingham to expand its business services to include equipment lease financing. He joined the bank in 2012, to be responsible "for our residential and commercial real estate services operations." Prior his was vice president/managing director Right Management (2009-June, 2012), senior director, Q10/iCap Michigan (one of the largest commercial real estate financing companies with 30 offices national) (August, 2004-2009), senior director, iCap Realty Advisors-Florida (2006-2008), principal, Harrison Capital Corporation (1998-2005), director, private banking and personal trust, Michigan National Bank (now Bank of America) (1994-1998), first vice-president, Michigan National Bank (1989-1994), investment officer, Ford Motor Credit Company (1986-1988), assistant vice president, Comerica (1981-1986).University of Michigan - Stephen M. Ross School of Business MBA (1982 – 1986), Michigan State University BBA, Finance (1977 – 1981).

www.linkedin.com/pub/bob-leonard/10/b1b/4b1

Jeffrey Piccinelli named Senior Vice President at GE Capital, Corporate Finance, Scottsdale, Arizona, with territory Arizona and Nevada. He joined the company December, 2011. Previously he was director of acquisitions, Cole Capital (May, 2010-December, 2011), vice-president of sales-originations & acquisitions, GE Capital, Franchise Finance (April, 2001-February, 2009), senior risk analyst, GE Capital, Franchise Finance (August, 1997-April, 2001), MBA intern, NISA investment Advisors (May, 1996-June, 1997), bank auditor, Wells Fargo, August, 1993-August, 1995), Washington University in St. Louis MBA, Concentration Finance (1995 – 1996), Arizona State University BS, Finance (1989 – 1993).

www.linkedin.com/pub/jeff-piccinelli/7/35/197

Christopher Smith named Senior Vice President at GE Capital, Corporate Finance, Denver, Colorado. "He will work with middle-market companies in Colorado and New Mexico to provide equipment financing solutions." Previously he was senior director, Oxford Finance (April, 2010-September, 2011), vice president, healthcare corporate finance, Siemens Financial services (January, 2007-May, 2010), vice president, corporate finance, GE Capital (January, 2005-July, 2006), director, Stanford Keene, LLC (April, 1999-December. 2004), vice-president, First union Securities (1997-1999). University of Michigan, MBA, Business (2006 – 2008). East Carolina University, Master of Finance, Finance (1994 – 1995), University of North Carolina at Chapel Hill B.A., Economics (1986 – 1990) TW Andrews High.

www.linkedin.com/pub/christopher-smith/4/642/941

Jason Stall named Senior Vice President at GE Capital, Corporate Finance, Denver, Colorado, responsible for the territories of Colorado and Wyoming. He joined GE Capital, November, 2011. Previously he was managing partner/funder, Semi-Rebellious Film & Records (January, 2009-October, 2011), finance director, Franchise Capital Advisors (June, 2008-October, 2011), producer/founder, Dreamy Draw Music & Production (2008-2009), vice-president, Auto Star (iStar Financial) (June, 2006-June, 2008), vice president, GE Commercial Finance (2000-2006). University of Arizona BS, Finance (1992 – 1996), Chaparral (1988 – 1992).

www.linkedin.com/pub/jason-stall/4/839/b01

[headlines]

--------------------------------------------------------------

Why I Became a CLP

David Normandin, CLP,

Senior Vice-President, PacTrust Bank

In a world full of “me too”, it can be difficult to stand out from the crowd. Everyone says that they have the best service or price, but both of those are very different from value. Given we are in a line of business that sells money, there will always be someone who will sell it for less or claim to have better service. It is far more rare to find a competitor that can match the value delivered if you execute with a higher level of knowledge.

I believe that value is delivered when knowledge is leveraged in the context of understanding our customers’ core needs. People in our world are willing to pay for value and it never goes out of style.

After more than a decade in the commercial leasing business I decided to become a Certified Leasing Professional because I wanted to stand out from the crowd as having the knowledge, skills and abilities to deliver value to those around me. I had invested heavily in knowledge over my time in the industry, but becoming a CLP was a public way to illustrate my knowledge and commitment to excellence.

Ironically, earning a CLP had been on my radar for many years and there just never seemed to be the right time to study and take the exam. In 2008, Chris Walker, CLP, late of GreatAmerica Leasing, approached me with his famous smile and asked me why I wasn’t a CLP. I explained to him that it was on my radar and that I had not gotten around to it. For those who knew Chris, that was all it took for him to give me a regularly scheduled elbow to the ribs that caused me to invest in the CLP Handbook. My ribs became sore in 2009 so I quickly read through the handbook and scheduled to take the review and sit for the exam at the upcoming Conference in Monterey. I must admit that missing golf that Thursday to spend the day taking the review class was a good decision. I felt prepared to take the exam that Sunday and walked in with confidence. I passed the exam and I am very thankful for Chris’ elbows that kept me focused on a worthwhile goal. Chris had that same smile at the following Conference when he presented to me the CLP Certification that I had earned.

Today I serve on the CLP board and marketing committee as I am a firm believer in the value of the foundation and the real impact it has on the future of our business.

In a parting note, many people tell the stories of how tough this exam is and it is long, but I think that anyone with some level of experience, desire and discipline would do well on this exam by reading the handbook and taking the review prior to the exam. Please accept this as my elbow to encourage you to stand out in the crowd by committing to become a Certified Leasing Professional by the end of this year. To get started, please contact Reid at the CLP Foundation at 206.535.6281 or email her at reid@clpfoundation.org.

Why I Became a CLP/Collection

http://www.leasingnews.org/CLP/Index.htm

[headlines]

--------------------------------------------------------------

Speedy Repossession/Resale Cost Bank $1 Million Deficiency

by Tom McCurnin, Esq.

Barton, Klugman & Oetting

Los Angeles, California

It is the common perception among those involved in collections that speed is everything. Declare a default now, repossess now, resell now, and sue for deficiency now. Collectors are reviewed for speed. Collection managers are gauged only by the last quarter. Attorney’s market themselves as aggressive and fast. Indeed, one of my hero’s, General George S. Patton, Jr. once stated, “A good plan executed today is better than a perfect plan executed tomorrow.”

Well war is not law, and sometimes in law and collections, it’s better to slow down and think things through before acting precipitously. The case on point is United Cent. Bank v. Siddiqui, 276 P.3d 838 (Kan. Ct. App. 2012). There, the creditor financed machine tools, a large steel blanker, worth $1 million dollars. The borrower was located in Illinois and his brother (a neurologist) and guarantor was located in Kansas.

The borrower got in a dispute with the manufacturer of the unit, as it was not producing in the quantity it should have. The borrower went in and out of default, and finally, a default was declared in February, 2009. Reading between the lines, this was a single asset company, and the building facility was abandoned by the borrower after the default. The equipment was too big to disassemble and move. The Bank had to be sold in place.

The Bank quickly made amends to the landlord to sell the equipment in place. Anyone who has been in this position knows the dynamics. The landlord wants the entire amount of the rent paid, including past due rent, even though the creditor’s machine is occupying a small portion of the facility. The creditor may not have a landlord’s waiver, so the creditor is at the mercy of the landlord. The rent could be $20-30,000 per month. It might take 6-9 months to properly sell the collateral in place. Business pressures force everyone to act with all deliberate speed.

In this case, the Bank was facing a huge deficiency, well over a million dollars and the equipment could not be broken down and re-sold in an efficient manner. The Bank did not have a landlord’s waiver, and the FDIC was on the heels of the Bank, threatening to close it down. The landlord was not cooperative.

The Bank quickly hired a Chicago law firm to coordinate the repossession and sale. The firm scheduled a public auction less than 10 days after noticing the borrower and guarantor. The sale was only advertised on Craig’s List and that ad contained typographical errors. Only two people showed up to bid, and the blanking machine was sold for $300,000.

Rather than sue in Illinois, the Bank elected to go to Kansas and sue the guarantor. I am guessing they wanted to avoid the time requirements for two suits, one in Illinois and a subsequent suit in Kansas. The sole evidence in this Kansas suit as to the commercially reasonableness of the sale was a Chicago lawyer who had conducted 11 prior sales, none of the type of this equipment, who concluded that the sale was commercially reasonable. Not surprisingly, the Court found that this evidence was insufficient. The Court noted the following problems with the Bank’s case:

-

No Advertising Was Done to Trade Journals. Machine tools are a known commodity, and while a steel blanker might have been a specialty tool, the Court questioned why the Bank did not advertise in trade journals.

There Was No Explanation for the Diminution in Value of the Equipment. Experts opined that the machine should have yielded around $800,000 and the Bank offered no explanation why the equipment sold for substantially less. Of course they were without an appraisal.

The Court gave the lawyers a slap in the face when the Court stated:

“[The Bank] should have been aware that the evidence of the blanking machine's value—independent of the $300,000 price it received at the sale—was essential to establishing the sale's commercial reasonableness at the bench trial. To that end, we agree [The Bank] could have, and should have, presented this type of evidence to the district court in litigating the issue of commercial reasonableness in the first instance”:

Ouch. That sound you just heard was the Kansas Court of Appeal bitch-slapping the Bank’s lawyer.

As you might expect, the Court held that the sale of the equipment was commercially unreasonable. The deficiency against the guarantor was denied. The guarantor was awarded his attorney fees for the trial and the appeal. Given the fact that he was Doctor, and probably collectable, this compounds the error by the Bank and its lawyers. What is tragic is that the FDIC took over the Bank shortly after this whole affair, so all the efforts for the sale, the litigation, and the appeal were for naught—a complete waste.

The lessons for the leasing professional are obvious here.

First, slow down and trust your instincts. If the collateral is a machine tool, then place the collateral in the hands of an experienced machine tool auction house.

Second, appraise and photograph the equipment. If you have to defend a low price sale, a liquidation appraisal with photographs of every wart on the equipment will go a long way to prove a proper sale price.

Third, advertise the sale, not on eBay or Craigslist, but spend the money for a trade journal. If time is a factor, most auction houses have an on-line inventory catalog.

Fourth, consider filing suit and obtaining a court order for the sale. A court supervised sale is generally considered to be commercially reasonable.

Finally, negotiate a landlord waiver in advance of loaning the money. If the facility is a single use facility as was the case here, and the Bank is supplying the only equipment, the Bank can pretty much call the shots on its rights after default. Many creditors look for two or three months free after default and after that a percentage of the rent.

The bottom line is that perhaps the Bank was in too big a hurry to sell the equipment. Given the fact that the manufacturing facility was certainly expensive to rent for multiple months, the necessity for speed is understandable.

Rather than listen to Gen. George Patton, perhaps the Bank should have consulted Ovid, the Roman poet, who once said, “Take a rest. A field that has rested gives a bountiful crop.”

Tom McCurnin

Barton, Klugman & Oetting

Los Angeles, California

email: tmccurnin@bkolaw.com

Voice: (213) 621-4000

Fax (213) 625-1832

Visit our Web Site at www.bkolaw.com

Court Case:

http://leasingnews.org/PDF/SpeedinCollectionCase.pdf

Previous Tom McCurnin Articles:

http://www.leasingnews.org/Conscious-Top%20Stories/leasing_cases.html

• Contract Negotiations

• Fraud Investigations

• Credit Investigations

• Skip-tracing

• Third-party Commercial Collections

John Kenny

Receivables Management

For flat fee or commissions basis

john@jkrmdirect.com | ph 315-866-1167| www.jkrmdirect.com |

(Leasing News provides this ad as a trade for investigations

and background information provided by John Kenny)

[headlines]

--------------------------------------------------------------

Beige Report--August 29, 2012

"The direction and magnitude of changes in loan demand varied among the Districts and also with respect to type of loan. The Richmond and Atlanta Districts reported generally low demand for loans, but some pockets of growth. The Chicago District noted that growth in business loan demand was generated mostly from small and mid-size firms and for the purpose of refinancing rather than financing capital expenditures. Cleveland, St. Louis, and San Francisco mentioned small positive or negative changes in business credit demand, and relatively strong demand for consumer credit. The Kansas City District reported stable demand for commercial and industrial loans and commercial real estate loans, while Dallas noted softer demand for loans overall; however, both Districts cited increases in demand for residential real estate loans. The New York and Philadelphia Districts observed growth in most lending categories.

“Credit conditions have improved over the reporting period according to District reports. Credit spreads were lower and competition for high-quality borrowers among lending institutions has increased. The New York District noted that shrinking spreads were observed particularly in commercial and industrial loans as well as in commercial mortgages. Some bankers in the Cleveland District mentioned a moderate loosening of lending guidelines. The New York, St. Louis, and Kansas City Districts reported unchanged credit standards; New York and Cleveland cited declining delinquency rates.”

Boston

www.federalreserve.gov/monetarypolicy/beigebook/beigebook201208.htm?boston

New York

www.federalreserve.gov/monetarypolicy/beigebook/beigebook201208.htm?new_york

Philadelphia

www.federalreserve.gov/monetarypolicy/beigebook/beigebook201208.htm?philadelphia

Cleveland

www.federalreserve.gov/monetarypolicy/beigebook/beigebook201208.htm?cleveland

Richmond

www.federalreserve.gov/monetarypolicy/beigebook/beigebook201208.htm?richmond

Atlanta

www.federalreserve.gov/monetarypolicy/beigebook/beigebook201208.htm?atlanta

Chicago

www.federalreserve.gov/monetarypolicy/beigebook/beigebook201208.htm?chicago

St. Louis

www.federalreserve.gov/monetarypolicy/beigebook/beigebook201208.htm?st_louis

Minneapolis

www.federalreserve.gov/monetarypolicy/beigebook/beigebook201208.htm?minneapolis

Kansas City

www.federalreserve.gov/monetarypolicy/beigebook/beigebook201208.htm?kansas_city

Dallas

www.federalreserve.gov/monetarypolicy/beigebook/beigebook201208.htm?Dallas

San Francisco

www.federalreserve.gov/monetarypolicy/beigebook/beigebook201208.htm?san_francisco

Full Report

www.federalreserve.gov/monetarypolicy/beigebook/beigebook201208.htm?full_report

Send Leasing News to a Colleague. We are free!!!

[headlines]

--------------------------------------------------------------

English Toy Spaniel/Chihuahua Mix

Irvine, California Adopt-a-Dog

ID#: 4732157-A080412

Lindsay

Female

English Toy Spaniel/Chihuahua Mix

Size: Small 25 lbs (11 kg) or less

Age: Senior

"Hi! I’m Lindsay and I was transferred to the Irvine Animal Care Center through the Third Chance for Pets program. I arrived with her friend Connor and would love to be adopted with him. I am a happy little dog, constantly smiling and wagging my tail. I love to go on walks and play with Connor. I walk well on leash and am learning to sit. Come visit me today!"

Shelter: Irvine Animal Care Center

Pet ID #: 4732157-A080412

Phone: (949) 724-7740

Let 'em know you saw "*LINDSAY" on Adopt-a-Pet.com!

E-mail: info@irvineshelter.org

Let 'em know you saw "*LINDSAY" on Adopt-a-Pet.com!

Website: http://www.irvineshelter.org

Address: 6443 Oak Canyon

Irvine, CA 92618

Adopt-a-Pet by Leasing Co. State/City

http://www.leasingnews.org/Conscious-Top%20Stories/Adopt_Pet.htm

Adopt a Pet

http://www.adoptapet.com/

[headlines]

--------------------------------------------------------------

Leasing News: Labor Day Special

By Fernando F. Croce

With Labor Day coming up this weekend, we at Leasing News offer a cinematic salute to every man and woman who ever had a particularly harrowing day at the office. Check out these vintage and modern classics at Netflix.

Modern Times (Charles Chaplin, 1936): What better figure to celebrate work than Chaplin’s legendary Little Tramp? In the comic genius’ last silent film, Chaplin’s unforgettable character is a harried factory worker who’s driven crazy by the many machines controlling his life. A magnet for trouble, the Little Tramp goes from one scrape to another as he’s mistaken for a street agitator, foils a jail break, goes through a variety of jobs, and falls for a poor, orphaned girl (Paulette Goddard). Defying contemporary Hollywood’s conventions, Chaplin uses sound effects instead of voices to create a remarkable fusion of balletic humor and Depression-era desperation. The scene in which the Little Tramp plays guinea pig for a berserk feeding machine is just one of the film’s classic comic highlights.

On the Waterfront (Elia Kazan, 1954): Arguably the most respected picture in director Elia Kazan’s long and controversial career, this Best Picture Oscar winner also gave Marlon Brando one of his most unforgettable roles. Brando stars as Terry Malloy, a former boxer now eking out a living as a longshoreman, taking orders from thuggish union boss (Lee J. Cobb). In the face of rampant brutality, and after persuasion from a crusading priest (Karl Malden) and a murdered worker’s sister (Eva Marie Saint), however, Terry’s impassivity leads to a decision that will change his life forever. Stocked with gritty detail and brilliant scenes (including Brando’s legendary I-could-have-been-a-contender speech with Rod Steiger), Kazan’s explosive account of corruption, violence and redemption is served up with a visual and emotional intensity that continues to endure.

Blue Collar (Paul Schrader, 1978): Though responsible for writing the screenplays for many of Martin Scorsese’s greatest movies (“Taxi Driver,” “Raging Bull”), Paul Schrader also has a respectable career as a director of risky films. This, his first, may also be his strongest, a stirring and powerful look at the struggles of a trio of employees at a Detroit auto factory. Jerry (Harvey Keitel), Zeke (legendary comedian Richard Pryor, in a knockout serious performance) and Smokey (Yaphet Kotto) are friends whose indignation at the corrupt bosses and work conditions of their car plant leads them to a crime that grows even more complicated once the local union gets involved. An entertaining drama that still manages to ask hard-hitting questions, this is a tough, underrated slice of working-class life.

Norma Rae (Martin Ritt, 1979): Sally Field won her first Oscar for her strong performance in this acclaimed tale of underdog grit. Field plays Norma Rae, a tough Alabama woman who works under harsh conditions at a local textile mill. The pay is low, the shifts are long, and the machines are dangerous, yet she works diligently and without question. It’s only when she meets a union leader from New York (Ron Lieberman) that she starts to demand better conditions for her and her fellow workers. Unfortunately, her struggle also brings her trouble with her friends and family, including her husband (Beau Bridges). Director Martin Ritt, a veteran of social-conscience pictures like “Hud,” brings a vividly detailed sense of people and environment, along with excellent performances, to this inspiring drama.

Office Space (Mike Judge, 1999): The workplace has often been subject to satire, though rarely with as much hilarious venom as in this wicked tale of cubicle stress and liberation. Peter (Ron Livingston) is a low-wattage software engineer whose job includes endless commutes, dreary co-workers, and arrogant bosses. His life takes a sudden turn when, as the result of a visit to a hypnotherapist, Peter enters a state of serene mischief that allows him to embrace his inner rebel. Asking himself “why not,” he starts arriving late at work, paying less attention to his projects, and leaving early to visit his girlfriend (Jennifer Aniston). That his new attitude somehow makes him more valuable to the company is one of the many unpredictable touches in director Mike Judge’s sharp cult comedy.

[headlines]

--------------------------------------------------------------

Open Positions at Leasing Funders/Various Locations

(Most of the listing have "open positions." While you may find ones that do not, check back later, as they may have added an opening.)

Advantage Funding

http://www.advantagefund.com/employment.htm

AIG

http://www.aigcorporate.com/addresources/globalcareers.html

Altec

https://careers.altec.com/

Alter Moneta

http://www.altermoneta.com/careers/opportunities.html

Atlas Copco

http://www.atlascopco.com/us/careers/openjobs/

Balboa Capital

http://www.balboacapital.com/about_us/careers.aspx

Bank of America

http://careers.bankofamerica.com/overview/overview.asp

Bank of Ozarks

https://bankozarks.applicantharbor.com/jobmainlist.php?a=m

Bank of the West

https://www.bankofthewest.com/about-us/careers/job-search.html

(type in state, and keyword leasing or category)

CIT Job Openings

http://sj.tbe.taleo.net/SJ1/ats/careers/jobSearch.jsp?org=CIT&cws=1

CSI Leasing

http://www.csileasing.com/ViewJobPostings.aspx

Data Sales

http://www.datasales.com/open_jobs.html

De Lage Landen Financial

https://tbe.taleo.net/NA4/ats/careers/jobSearch.jsp?org=DELAGELANDEN&cws=1

Direct Capital

http://tbe.taleo.net/NA2/ats/careers/jobSearch.jsp?org=DIRECTCAPITAL&cws=1

Farm Credit

http://www.farmcreditnetwork.com/careers/opportunities

Financial Pacific

http://www.finpac.com/careers.aspx

Fifth-Third Bank

https://cvg53.cvgs.net/Main/careerportal/JobAgent.cfm

GE Capital

www.ge.com/careers

GreatAmerica Leasing

http://jobs.greatamerica.com/

Hillcrest Bank

https://www.hillcrestbank.com/Careers.aspx

Home Savings Bank

http://www.home-savings-bank.com/careers.php

Huntington Bank

https://www.huntington.com/us/HNB3400.htm

Key Bank

Click here

Marlin Business Services

Key (not available at this time)

https://www.marlinleasing.com/Careers/joblisting.html?location=all

Madi$on Capital

http://www.madisoncapital.com/employment.php?expandable=3&subexpandable=5

Meridian Bank

https://www.meridianbank.com/careers.html

Microfinancial/Timepayment

http://www.hirebridge.com/jobseeker2/Searchjobresults.asp?cid=5224

Northern California Farm Credit (office listings)

http://www.norcalfc.com/locations.html

People's United Bank

https://www3.ultirecruit.com/PEO1003/JobBoard/ListJobs.aspx

PL Capital

http://www.plcapital.com/careers.asp

Prime Alliance Bank

http://www.primealliancebank.com/home/careers

Regions Bank

https://regions.taleo.net/careersection/2/jobsearch.ftl

Republic Financial

http://tbe.taleo.net/NA8/ats/careers/jobSearch.jsp?org=REPUBLICFINANCIAL&cws=1

Sterling Bank

https://www.synovus.apply2jobs.com/ProfExt/index.cfm?fuseaction=m

External.showSearchInterface

TCF Bank

https://tcfbank.taleo.net/careersection/corporate/jobsearch.ftl?lang=en

TD Bank

https://tderec.ijob.com/recruit/servlet/com.lawson.ijob.util.Login

US Bank

(type position in blank space and/or state)

http://www.usbank.com/cgi_w/cfm/careers/careers.cfm

Wells Fargo

https://employment.wellsfargo.com/psp/PSEA/APPLICANT_NW/HRMS/c/HRS_HRAM.HRS_CE.GBL

Zions Bank

https://zionsbancorp.taleo.net/careersection/zfnbexternal/jobsearch.ftl?lang=en

Leasing News invites other employers to list their "open positions." The listing is free.

Mr. Terry Winders available as a consultant regarding assisting attorneys in resolving disputes or explaining procedures or reviewing documents as utilized in the finance and leasing industry.

He is the author of several books, including DVD's, as well as weekly columnist to Leasing News. He also performs audits of leasing companies as an expert on documentation, and has acted as an expert witness on leasing for litigation in legal and tax disputes, including before the IRS. He also has taught the senior bank examiners, how to review a bank leasing department, for the Federal Reserve in Washington D.C. and has trained the examiners for the FDIC on how to prepare a lease portfolio for sale.

502.649.0488/Leaseconsulting@msn.com

|

(This ad is a “trade” for the writing of this column. Opinions

contained in the column are those of Mr. Terry Winders, CLP)

News Briefs----

Scotiabank to buy ING Bank of Canada for $3.13 billion

http://www.thestar.com/business/article/1248834--scotiabank-to-buy-ing-bank-of-canada-for-3-13-billion

Despite economy, Americans still optimistic

http://www.upi.com/Business_News/Consumer-Corner/2012/08/26/Consumer-Corner-Despite-economy-Americans-still-optimistic/UPI-61341345975200/

Pending home sales up modestly in June

http://www.upi.com/Business_News/2012/08/29/Pending-home-sales-up-modestly-in-June/UPI-72581346252098/

[headlines]

--------------------------------------------------------------

You May Have Missed---

Apps now key to small-business savings

http://www.usatoday.com/money/smallbusiness/story/2012-08-19/efficient-small-business-apps/57121726/1?csp=ip

[headlines]

--------------------------------------------------------------

SparkPeople--Live Healthier and Longer

SparkPeople--Live Healthier and Longer

Wild or Farmed Fish: What's Better?

http://www.sparkpeople.com/resource/nutrition_articles.asp?id=1282

[headlines]

--------------------------------------------------------------

Sports Briefs----

Madden 13 says 49ers will rule NFC West again

http://www.mercurynews.com/49ers/ci_21426959/madden-13-says-49ers-will-rule-nfc-west?nstrack=sid:14028700|met:300|cat:0|order:6

NFL tells teams to expect replacement refs in Week 1

http://www.nfl.com/news/story/0ap1000000056100/article/nfl-tells-teams-to-expect-replacement-refs-week-1

Former Fortune 500 CEO Joe Moglia has never led a major football program — so why is Coastal Carolina finally giving him a chance?

http://www.grantland.com/story/_/id/8308203/former-fortune-500-ceo-joe-moglia-gets-chance-leading-coastal-carolina-fcs-football-program

((Please Click on Bulletin Board to learn more information))

(Leasing News provides this ad “gratis” as a means

to help support the growth of Lease Police)

[headlines]

--------------------------------------------------------------

Baseball Poem

Larry Zirlin

Last Baseball Dream of the Season

Although I have no memory

of my career in the majors

my name appears

in the Baseball Encyclopedia

Lifetime average: 241

Now that you know this dream

you know everything about me.

From "Line Drives," 100 Contemporary Baseball Poems,edited by Brooke Horvath

and Tim Wiles, Southern Illinois University Press

[headlines]

--------------------------------------------------------------

California Nuts Briefs---

California public pension reform savings could reach $60 billion

http://blogs.sacbee.com/the_state_worker/2012/08/calpers-pegs-california-public-pension-reform-savings-at-up-to-60-billion.html

Number of temp workers in California on the rise

http://www.mercurynews.com/business/ci_21420677/number-temp-workers-california-rise

[headlines]

--------------------------------------------------------------

“Gimme that Wine”

http://www.youtube.com/watch?v=EJnQoi8DSE8

Forget Coffee, I’ll Have This Brew

http://www.nytimes.com/2012/08/29/dining/reviews/hefeweizen-goes-with-second-breakfast-beers-of-the-times.html?_r=1&ref=dining&gwh=BF8A94096ADD1F0DD840190FC281E322

Santa Clara County .County moves forward with new winery regulations

http://www.gilroydispatch.com/news/community/county-moves-forward-with-new-winery-regulations/article_1ce0f392-f143-11e1-beb1-0019bb30f31a.html

Sonoma County’s Finest Wine Weekend Gets Even Better

http://healdsburg.patch.com/blog_posts/sonoma-countys-finest-wine-weekend-gets-even-better

Top 10 totally pointless wine accessories

http://www.thedrinksbusiness.com/2012/08/top-10-totally-pointless-wine-accessories/

Free Mobile Wine Program

http://leasingnews.org/archives/Feb2010/2_26.htm#mobile

Wine Prices by vintage

http://www.winezap.com

http://www.wine-searcher.com/

US/International Wine Events

http://www.localwineevents.com/

Winery Atlas

http://www.carterhouse.com/atlas/\

Leasing News Wine & Spirits Page

http://two.leasingnews.org/Recommendations/wnensprts.htm

[headlines]

----------------------------------------------------------------

This Day in History

1637- The first Synod was held at Mr. Shepard's church, Cambridge ( then Newtowne), Massachusetts to condemn the preaching of Anne Hutchinson, the first female religious leader in the American colonies. Eight-two errors in her teachings were enumerated and condemned. The synod adjourned on September 22, 1637. Hutchinson was bought to trail on the strength of this condemnation and was exiled from the Massachusetts Bay Colony. Moving the following year to Rhode Island, then to New York, Anne and her family were killed by Indians in 1643.

1645 - Dutch & Indians signed peace treaty in New Amsterdam (NY).

1770- Anglican clergyman and hymn writer John Newton wrote in a letter: 'The exercised and experienced Christian, by the knowledge he has gained of his own heart and the many difficulties he has had to struggle with, acquires a skill and compassion in dealing with others.

1776- A few days before, in the Battle of Long Island, N.Y., American forces commandeered by Gen. Israel Putnam and Gen. John Sullivan were defeated by the British under Gen. Sir William Howe and Gen. Sir Henry Clinton. Howe took Gen. Sullivan ***prisoner. On Aug 30, the Americans evacuated Long Island and crossed to Massachusetts. General Washington took advantage of a heavy fog to evacuate Long Island after a defeat. Adverse winds kept the British fleet from intervening

1778- American forces withdrew from Rhode Island after an unsuccessful attempt, led by John Sullivan, to recapture Newport from the British ***

1780 - General Benedict Arnold betrayed the US when he promised secretly to surrender the fort at West Point to the British army. Arnold whose name has become synonymous with traitor fled to England after the botched conspiracy. His co-conspirator, British spy Major John Andre, was hanged.

1781 - The French fleet of 24 ships under Comte de Grasse arrived in the Chesapeake Bay to aid the American Revolution. The fleet defeated British under Admiral Graves at battle of Chesapeake Capes.

1800-African-American Gabriel Prosser's major slave revolt is disclosed by Mosby Sheppard two slaves Tom and Pharoah, who told him of the plot. during the afternoon of this day, Saturday, August 30, set for the rebellion and was made by Mr. Mosby Sheppard, whose slaves, Tom and Pharoah, had told him of the plot. Virginia Governor Monroe, who had heard earlier plans of slaves making swords, bullets, and organizing for an attack on Richmond, realizing secrecy was now impossible and worried others would join Prosser, acted quickly and openly. He appointed three aides for himself, asked for and received the use of the federal armory at Manchester, posted cannon at the capitol, called into service well over six hundred and fifty men, and gave notice of the plot to every militia commander in the State” But," as a contemporary declared, upon that every evening just about Sunset, there came on the most terrible thunder accompanied with an enormous rain, that I ever witnessed in this State. Between Prosser's and Richmond, there is a place called Brook Swamp which runs across the high road, and over which there was a [MS torn] bridge. By this, the Africans were of necessity to pass, and the rain had made the passage impracticable.

Nevertheless about one thousand slaves, some mounted, armed with clubs, scythes, home-made bayonets, and a few guns, did appear at an agreed-upon rendezvous six miles outside the City, but, as already noted, attack was not possible, and /222/ the slaves disbanded. As a matter of fact even defensive measures, though attempted, could not be executed.

The next few days the mobilized might of an aroused slave State went into action and scores of Negroes were arrested. Gabriel had attempted to escape via a schooner, Mary, but when in Norfolk on September 25, he was recognized and betrayed by two Negroes, captured, and brought back, in chains, to Richmond. He was quickly convicted and sentenced to hang, but the execution was postponed until October 7, in the hope that he would talk. James Monroe personally interviewed him, but reported, "From what he said to me, he seemed to have made up his mind to die, and to have resolved to say but little on the subject of the conspiracy." Along with Gabriel fifteen other rebels were hanged on the seventh of October. Twenty-one were reported to have been executed prior to this, and four more were scheduled to die after October 7. A precise number of those executed cannot be given with certainty, but it appears likely that at least thirty-five Negroes were hanged, four condemned slaves escaped from prison (and no reference to their recapture has been seen), while one committed suicide in prison The chasm between slave owners and their “property” widen with both becoming extremely “fearful” of each other. As Dr. Martin Luther King, Jr. was to point out in the next century, “violence begets violence.”

http://www.blackhistory.eb.com/micro/223/96.html

http://www.co.henrico.va.us/rec/gabriel.htm

1813 - Creek Indians massacred over 500 whites at Fort Mims Alabama.

1820- Birthday of George F. Root, American sacred music editor and composer. Root helped edit 75 musical collections, as well as composing several hundred original sacred melodies. One of these, JEWELS, is the tune to which is commonly sung the hymn, "When He Cometh."

1838 -- The first African-American magazine Mirror of Freedom, begins publication in New York City.

1839 - A hurricane moved from Cape Hatteras NC to offshore New England. An unusual feature of the hurricane was the snow it helped produce, which whitened the Catskill Mountains of New York State. Considerable snow was also reported at Salem NY.

1856-Wilberforce University was established in Xenia, Ohio under auspices of the Methodist Episcopal Church. In 1863, the university was transferred to the African Methodist Episcopal (AME) Church.

1862-The battle actually started yesterday, but today at the second Battle of Bull Run, the maneuvers of Gen. Stonewall Jackson and his teamwork with Gen. Lee were too much for the 45,000 Union troops under Gen. John Pope, who broke and retreated to Washington, D.C. this day. Union losses were 1724 killed, 8372 wounded, 5958 missing. Confederate losses stood at 1481 killed, 7627 wounded, 89 missing. It is believed the almost 6,000 soldiers missing deserted and fled from the army. We highlighted it yesterday, and “Today in History” highlights its end.

http://memory.loc.gov/ammem/today/aug30.html

((http://lcweb2.loc.gov/cgi-bin/query/r?ammem/cwar:@field

(NUMBER+@band(cwp+4a40399 ))

http://memory.loc.gov/ammem/today/jan21.html

1890- Congress approved the inspection of meat. It provided for the inspection of salted pork, and bacon intended for export, as well as the inspection of export swine, cattle, sheep, and other ruminants, due primarily to complaints of foreign buyers. It did not apply to meat in the United States. Importers of American Leasing meat were objecting to not only the quality, but to the “disease” brought by American meat products. Upton Sinclair's book, “The Jungle,” 1905, exposed the horror of meat packing in Chicago, which led the Pure Food and Drug Act and inspection of meat facilities and quality standards.

1893- Frances Folsom Cleveland ( Mrs. Grover Cleveland) was the first presidential wife to have a baby at the White House when she gave birth to a baby girl ( Esther) The first child ever born in the White House was a granddaughter to Thomas Jefferson in 1806.

1894 -Independent Christian evangelist and educator Bob Jones, Sr. was converted at age 11 to a vital Christian faith. Licensed to preach by the Methodists at 15, Jones maintained a lifelong fundamentalist view of the Bible. In 1926, at age 32, he founded Bob Jones University.

1901- birthday of Roy Wilkins, grandson of a Mississippi slave, civil rights leader, active in the National Association for the Advancement of Colored People ( NAACP), retired as its executive director in 1977. Born at St. Louis, MO. Died at New York, NY, Sept 8, 1981

http://www.tccom.com/wilkins/

1907-birthday of actress Shirley Booth. She won the 1950 Tony award for her work in Come Back Little Sheba and the 1953 Tony for Time of the Cuckoo. Her later years were spent as Hazel on the TV sitcom of the same name.

1908-Birthday of singer-leader Willie Bryant, born New Orleans, LA. Once employed Ben Webster, Benny Carter, Teddy Wilson, and many others.

1918-Birthday of Baseball Hall of Fame outfielder, Theodore Samuel(Ted) Williams, San Diego, CA.

1924- Trumpet play Kenny Dorham Birthday

http://www.jazztranscriptions.com/dorhambio.html

http://members.tripod.com/~hardbop/dorham_discography.html

1935 – Birthday of singer John Phillips (: The Mamas & The Papas: Monday Monday, California Dreamin', Creeque Alley; songwriter: California Dreamin', San Francisco [Be Sure to Wear Flowers in Your Hair]; actress MacKenzie Phillips' father; died Mar 18, 2001)

1943-WALSH, KENNETH AMBROSE Medal of Honor

Rank and organization: First Lieutenant, pilot in Marine Fighting Squadron 124, U.S. Marine Corps. Place and date: Solomon Islands area, 15 and 30 August 1943. Entered service at: New York. Born: 24 November 1916, Brooklyn, N.Y. Other Navy awards: Distinguished Flying Cross with 5 Gold Stars. Citation: For extraordinary heroism and intrepidity above and beyond the call of duty as a pilot in Marine Fighting Squadron 124 in aerial combat against enemy Japanese forces in the Solomon Islands area. Determined to thwart the enemy's attempt to bomb Allied ground forces and shipping at Vella Lavella on 15 August 1943, 1st Lt. Walsh repeatedly dived his plane into an enemy formation outnumbering his own division 6 to 1 and, although his plane was hit numerous times, shot down 2 Japanese dive bombers and 1 fighter. After developing engine trouble on 30 August during a vital escort mission, 1st Lt. Walsh landed his mechanically disabled plane at Munda, quickly replaced it with another, and proceeded to rejoin his flight over Kahili. Separated from his escort group when he encountered approximately 50 Japanese Zeros, he unhesitatingly attacked, striking with relentless fury in his lone battle against a powerful force. He destroyed 4 hostile fighters before cannon shellfire forced him to make a dead-stick landing off Vella Lavella where he was later picked up. His valiant leadership and his daring skill as a flier served as a source of confidence and inspiration to his fellow pilots and reflect the highest credit upon the U.S. Naval Service.

1949—Top Hits

You're Breaking My Heart - Vic Damone

Room Full of Roses - The Sammy Kaye Orchestra (vocal: Don Cornell)

Some Enchanted Evening - Perry Como

I'm Throwing Rice (At the Girl that I Love) - Eddy Arnold

1952 - Captain Leonard W. Lilley of the 4th Fighter Interceptor Wing scored his first aerial victory. He went on to become an F-86 Sabre ace.

1956- White mob prevents enrollment of blacks at Mansfield High School, Texas, as school busing and desegregation comes to major conflicts across the nation..

http://www.tsha.utexas.edu/handbook/online/articles/view/MM/jcm2.html

1957—Top Hits

Love Letters in the Sand - Pat Boone

Tammy - Debbie Reynolds

Whole Lot of Shakin' Going On - Jerry Lee Lewis

(Let Me Be Your) Teddy Bear - Elvis Presley

1959- Bobby Darin's "Mack the Knife" debuts on the pop charts. The song from the "Three Penny Opera" will be Darin's biggest hit.

1961 - No. 1 Billboard Pop Hit: "Michael," the Highwaymen. The five members were all freshmen from the same fraternity at Wesleyan University at Middletown, Conn. The song debuts at No. 100 on the Hot 100.

1961-24 year old Gene Chandler records "Duke of Earl" for Vee Jay Records. It will become the label's first number one and first million seller next February.

1962-A presidential hot line was installed between the White House, Washington, DC, and the Kremlin, Moscow, during the administration of President John F. Kennedy.

1963 - Two months after signing an agreement to establish a 24-hour-a-day "hot line" between Moscow and Washington, the system goes into effect. The agreement came just months after the October 1962 Cuban missile crisis, in which the United States and Soviet Union came to the brink of nuclear conflict.

1963 - ABC-TV's American Bandstand airs its final weekday show, becoming a weekly, rather than daily, show and moving to Saturdays for the rest of its run.

1965 - No. 1 Billboard Pop Hit: "Help!" The Beatles. The song is released in the U.S. two weeks before the film "Help!" opens in New York.

1965-- The Beatles perform at their second Hollywood Bowl show of 1965, seven songs of which will make it to the eventual Beatles at the Hollywood Bowl LP released in 1977.

1965—Top Hits

I Got You Babe - Sonny & Cher

Help! - The Beatles

California Girls - The Beach Boys

Yes, Mr. Peters - Roy Drusky & Priscilla Mitchell

1968- The Beatles' "Hey Jude" is released.

1968 - The Beatles record "Dear Prudence"

1968 --The Democratic Convention comes to and end Reportedly Chicago's finest invade McCarthy's headquarters, dragging staffers from their beds and beating the beejezus out of them. CBS TV-anchor Walter Cronkite tells prime-time television viewers :"I want to pack my bags & get out of this city." On August 29, vice president Hubert H. Humphrey was nominated for president and Senator Edmund S. Muskie of Main was named the vice presidential candidate. The convention, which began August 26, was the most violent in U.S. history. Antiwar protestors clashed with police and national guardsmen. Hundreds of people, including bystanders and members of the press, were beaten by police, some in full view of television cameras. George Wallace and Gen. Curtis E. LeMay would become third party candidates. On November 5, Richard M. Nixon would be elected president along with Spiro T. Agnew as vice president. The popular vote was Nixon 31,785,480; Humphrey, 31,275,166; Wallace 8,906,473. The actual decision was by the electoral vote with Nixon 302; Humphrey, 191 and George Wallace, 45. The Republicans gained four seats in the House, five in the Senate, although Democrats still held majorities of 58-42 in the Senate and 2453-192 in the House. The Republicans gained five governorships in the election.

1969-- The second annual Isle of Wight Festival takes place in England just two weeks after the triumphant Woodstock concert, featuring Bob Dylan, The Who, The Band, Joe Cocker, Free, Richie Havens, The Moody Blues, The Nice, Tom Paxton, Pentangle and The Pretty Things.

1972-John Lennon and Yoko Ono were joined by Stevie Wonder, Roberta Flack and Sha Na Na at a fund raising concert for the One To One charity at New York's Madison Square Gardens. Several of the performances were later included on Lennon's, "Live in New York City" album.

1973—Top Hits

Brother Louie - Stories

Live and Let Die - Wings

Let's Get It On - Marvin Gaye

Everybody's Had the Blues - Merle Haggard

1974-The last episode of the regular TV series “The Brady Bunch.” The first show was aired September 26, 1969, starring Robert Treed as widower Mike Brady who has three sons and is married to Carol _(played by Florence Henderson), who has three daughters, Housekeeper Alice was played by Ann B. Davis, Sons Greg ( Barry Williams), Peter ( Christopher Knight) and Bobby ( Mike Lookinland) and daughters Marcia ( Maureen McCormick), Jan ( Eve Plumb) and Cindy ( Susan Olsen) experienced the typical crises of youth. The programs steered clear of social issues and portrayed childhood as a time of innocence. The program continues to be very popular in reruns in after-school time slots. There were also many spin-offs. “ The Brady Kids,” ( 1972-74), a Saturday morning cartoon,” The Brady Bunch Hour)” 1976-88), a variety series, “ The Brady Brides, 1981), a sitcom about the two older daughters adjusting to marriages and the “Bradys'(19090), a short-lived dramatic series. “A Very Brady Christmas(1988) was CBS's highest rated special for the season. In 1995, “ The Brady Bunch Movie” appealed to fans who had watched the program 25 years before.

1975- James Taylor's "How Sweet It Is (To Be Loved By You)" peaks at #5 on the pop singles chart.

1975-KC and the Sunshine Band's "Get Down Tonight" tops the Billboard chart.

1975-Orleans enters the Billboard Hot 100 for the first time with "Dance with Me", which would climb to #6. They would return a year later with "Still the One" (#5) and again in 1979 with "Love Takes Time" (#11).

1980- Pat Benatar's "You Better Run" peaks at #42 on the pop singles chart.

1980-"Sailing" by Christopher Cross was Billboard's top single. The record would sweep the Grammy Awards the next spring when it won for Song of the Year and Record of the Year.

1981—Top Hits

Endless Love - Diana Ross & Lionel Richie

Slow Hand - Pointer Sisters

Stop Draggin' My Heart Around - Stevie Nicks with Tom Petty & The Heartbreakers

(There's) No Gettin' Over Me - Ronnie Milsap

1981-Jockey Bill Shoemaker rode John Henry to a nose victory to win the inaugural running of the Arlington Million, the first $1 million horse race, at Arlington Park in Illinois.

1982 - A tropical depression brought torrential rains to portions of southern Texas. Up to twelve inches fell south of Houston, and as much as eighteen inches fell southeast of Austin. The tropical depression spawned fourteen tornadoes in three days. (David Ludlum) Record cold gripped the northeastern U.S. Thirty-one cities in New England reported record lows, and areas of Vermont received up to three inches of snow

1983- Colonel Guion Bluford, mission specialist on the third flight of the Space Shuttle Challenger, became the first African-American astronaut to fly in outer space.

1986- Steve Winwood's "Higher Love" hits #1 on the singles chart; Mick Jagger's "Ruthless People" peaks at #51 and David Lee Roth's "Yankee Rose" peaks at #16.

1987 - Eight cities in California and Oregon reported record high temperatures for the date, including Redding CA and Sacramento CA where the mercury hit 100 degrees.

1988 - Thunderstorms drenched Georgia and the Carolinas with heavy rain, soaking Columbia, SC, with 4.10 inches in three hours. Fresno CA was the hot spot in the nation with a record high of 109 degrees. Duluth MN tied their record for the month of August with a morning low of 39 degrees

1989 - Billy Joel fires Frank Weber as his manager after discovering an alleged $90 million Weber had embezzled from his savings. Weber was the brother of Joel's ex-wife and former business manager Elizabeth Weber Small.

1989—Top Hits

Right Here Waiting - Richard Marx

Cold Hearted - Paula Abdul

Hangin' Tough - New Kids on the Block

Are You Ever Gonna Love Me - Holly Dunn

1990-Paul Anka, who was born in Ottawa, Canada, is naturalized as an American citizen in Las Vegas. During the ceremony, his illegally parked car was towed away.

1990- Seattle Mariners become 1st team to have father-son teammates, signing Ken Griffey to play with son Ken Griffey Jr .

http://bigleaguers.yahoo.com/mlb/players/4/4305/

http://www.griffeyjr.com/

http://griffeyjr.com/biography

1993 - "Late Show with David Letterman" debuted on CBS-TV. CBS remodeled the Ed Sullivan Theater (on 54th Street in New York City) for Letterman, who had just spent over a decade on NBC ("Late Night with David Letterman"). The first musical guest to appear on the new show was Billy Joel. The show first started February 1, 1982 with the top ten lists, mail bag, stupid pet tricks, participation by the TV crew, neighbors, and on the new show, this was carried forward along with surprise people in the audience such as Paul Newman with his tow gun salute, Martha Stewart. The show also featured his Canadian side-kick and very popular “hip” musician Paul Shaffer.

1994-—Top Hits

I ll Make Love To You- Boyz II Men

Stay (I Missed You) (From "Reality Bites")- Lisa Loeb

Wild Night- John Mellencamp With Me Shell Ndegeocello

Fantastic Voyage- Coolio

1997-The Houston Comets defeated the New York Liberty, 65-51, to win the first WNBA title. Houston was led by the new league's Most Valuable Player, Cynthia Cooper, who scored 25 points.

1998 -Toms River becomes the first American team since 1993 to win the Little League World Series as Chris Cardone hits home runs in consecutive at-bats, including a game- deciding two-run shot beating Kashima, Japan,12-9.

1999-—Top Hits

Bailamos- Enrique Iglesias

Genie In A Bottle- Christina Aguilera

Summer Girls- LFO

Unpretty- TLC

2000- As Braves come to bat in the bottom of the ninth inning trailing the Reds, 4-2, a power spike causes most of the lights to go out at Turner Field causing a 12-minute delay. As the Atlanta crowd waits for play to resume it is treated to a rendition of the song, "The Night the Lights Went Out in Georgia"

2002- After marathon negotiation sessions to avoid a players' strike just hours away, Bud Selig announces the players union and owners have reached a settlement on a new four-year CBA without the need of a work stoppage. The new agreement, called 'historic' by the commissioner, gives the owners the economic restraints they wanted as the players are assured no teams will be contracted until 2007 season with a revenue sharing plan will gradually be implemented during the span of the contract.

2002 - Bruce Springsteen fans flock to stores for the release of "The Rising," the Boss' first album with the E Street Band since 1987.

2003-—Top Hits

Shake Ya Tailfeather- Nelly, P. Diddy & Murphy Lee

Crazy In Love- Beyonce Featuring Jay-Z

Right Thurr- Chingy

P.I.M.P.- 50 Cent

2005-- In the long tradition of Bronx Bombers, Alex Rodriguez becomes only the second right-handed batter in Yankees history to hit 40 homers in a season. The Yankee's third baseman joins Joe DiMaggio, who hit 46 homers in 1937, making it the only time ‘Joltin' Joe' reached the 40 mark.

****In New Hampshire, a band of four hundred men, suddenly assembling in arms, and conducted by John Sullivan, an eminent lawyer and a man of great ambition and intrepidity, gained possession by surprise of the castle of Portsmouth, and confined the royal garrison till the powder-magazine was ransacked and its contents carried away.

Extremely controversial in his day, Somersworth's John Sullivan became the first "president" of New Hampshire. He served three terms in the role we now call governor. Sullivan cut his teeth as a young lawyer in Portsmouth, NH and became the first attorney in Durham. His goal in life was to be wealthy and his litigious pursuit of debtors in his hometown led to angry mobs surrounding his house. He served courageously, some say brazenly, in Revolutionary War battles, though he had been a friend of exiled British NH governor John Wentworth, whom he later replaced. Captured by the British, Sullivan became a courier between the two sides for which he was severely criticized. Sullivan joined the Seacoast NH uprising at Fort William and Mary in 1774, then served in a number of failed battles. George Washington was not fond of Sullivan, but called on him often. Major General Sullivan was among the troops at Quebec, and a leader at Trenton, Brandywine and Germantown. Washington called on him again in 1779 to literally wipe out all Native American settlements that threatened colonists in New York and Pennsylvania. Sullivan's March, as it was called, devastated Indian populations there as his troops destroyed all native housing and crops. He served in both the first and second Continental Congress. After the war he returned to his law practice and was made a federal judge, though he was often too ill, often from alcohol, to serve. The NH town and county of Sullivan are among the many places dedicated in his name.

[headlines]

-------------------------------------------------------------

SuDoku

The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler?

http://leasingnews.org/Soduku/soduko-main.htm

[headlines]

--------------------------------------------------------------

Daily Puzzle

How to play:

http://www.setgame.com/set/puzzle_frame.htm

Refresh for current date:

http://www.setgame.com/set/puzzle_frame.htm

[headlines]

--------------------------------------------------------------

http://www.gasbuddy.com/

http://www.gasbuddy.com/GB_Map_Gas_Prices.aspx

http://www.gasbuddy.com/GB_Mobile_Instructions.aspx

[headlines]

--------------------------------------------------------------

Weather

See USA map, click to specific area, no commercials

http://www.weather.gov/

[headlines]

--------------------------------------------------------------

Traffic Live---

Real Time Traffic Information

You can save up to 20 different routes and check them out with one click,

or type in a new route to learn the traffic live

--------------------------------

[headlines] |

Connect with Leasing News

Connect with Leasing News ![]()

![]()

![]()

![]()

![]() Add me to mailing list |

Add me to mailing list | ![]() |

| ![]() Search |

Search | ![]() Stress Release

Stress Release![]()

![]()

![]()

![]()

![]()

![]()

![]()