![]() Add me to mailing list |

Add me to mailing list | ![]() Change email |

Change email | ![]() |

| ![]() Search

Search

Advertising | All Lists | Archives | Classified Ads | This Day In American History

Leasing News is a web site that posts information, news, and

entertainment for the commercial bank, finance and leasing industry

kitmenkin@leasingnews.org

![]()

Friday, August 29, 2014

Today's Equipment Leasing Headlines

A Key Part of the Economic Recovery Is Finally Happening

Classified Ads---Management

Financial Pacific Completes 1st Year/Subsidiary of Umpqua Bank

Navitas Reaches Three Year Growth 1,124%; Makes Inc. 500

New Hires—Promotions in the Leasing Industry

Leasing Industry Ads---Help Wanted

Sales Makes it Happen by Steve Chriest

All Sales Are Complex

Financial and Sales Training

Update

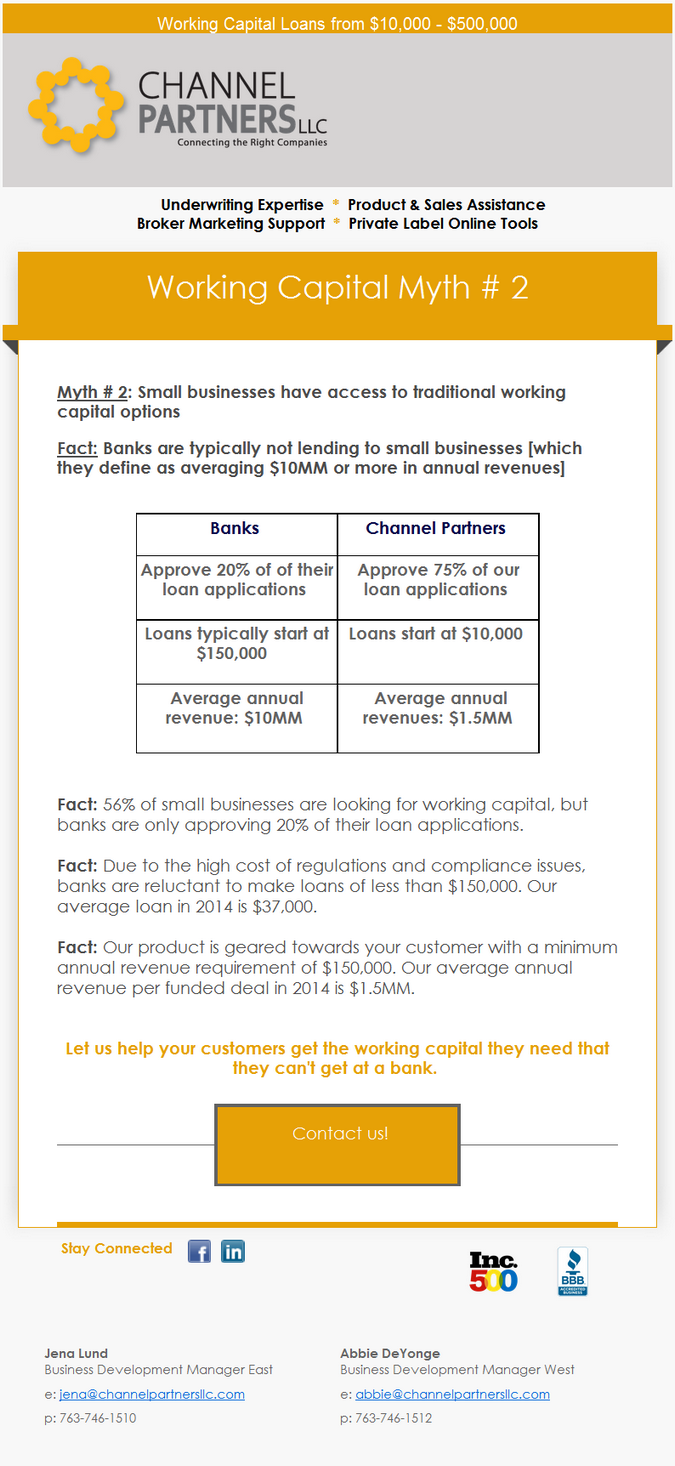

Advertisement---Working Capital Myth 2

Settlement tab for biggest banks surpasses $128B

SNL Feature Article

Douglas Guardian Sings Up Yamaha Motor Canada

as Inventory Inspection Partner

FDIC-Insured Institutions Earned $40.2 Billion 2nd Q, 2014

Up $2 Billion, Quarterly Loan Growth is Largest Since 2007

New York Attorney General Eric Schneiderman: B of A Settlement

The Grapes of Wrath/On the Waterfront/Matewan

Roger & Me/Horrible Bosses

Labor Day Movies by Fernando Croce

Labrador Retriever Mix

Tacoma, Washington Adopt-a-Dog

Leasing Conferences—Updates

Last Day to Register on line for NAELB Conference

News Briefs---

Mortgage rates enjoy a longer summer dip

Pending home sales rebound in July, reaching 11-month high

GDP Expanded at 4.2% Rate in Second Quarter

Why Boeing Is Battling Conservatives, Airlines Over Export-Import Bank

Market Basket Workers Begin Recovery Effort

Arthur T. Addresses Supporters: ‘You Empowered Others to Seek Change’

Free Tablet TV coming to San Francisco, other cities planned

Operators roll out more nutritious breads to appeal to health-conscious

Obama picks prosecutor Sarah Saldaña to lead Immigration

Broker/Funder/Industry Lists | Features (writer's columns)

Top Ten Stories Chosen by Readers | Top Stories last six months

www.leasingcomplaints.com (Be Careful of Doing Business)

www.evergreenleasingnews.org

Leasing News Icon for Android Mobile Device

You May have Missed---

SparkPeople--Live Healthier and Longer

Poem

Sports Briefs---

California Nuts Brief---

"Gimme that Wine"

This Day in American History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

######## surrounding the article denotes it is a “press release” and was not written by Leasing News nor information verified, but from the source noted. When an article is signed by the writer, it is considered a “by line.” It reflects the opinion and research of the writer.

Please send to a colleague and ask them to subscribe to our news

editor or bookmark us (www.leasingnews.org) as each news edition

appears on our web site.

[headlines]

--------------------------------------------------------------

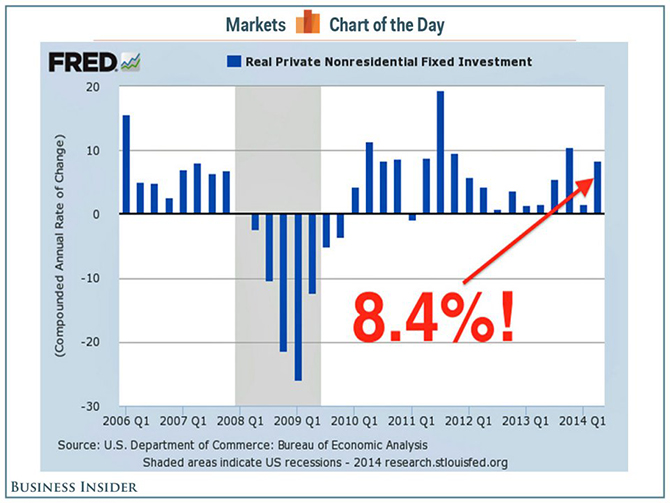

A Key Part of the Economic Recovery Is Finally Happening

By Sam Ro

www.businessinsider.com

GDP grew at a blazing 4.2% rate in Q2.

The most exciting line item of the GDP report is real nonresidential fixed investment, which is a fancy way of saying business investment. In Q2 it jumped a whopping 8.4%, which was much stronger than the initial 5.5% estimate.

"The drivers in this category included impressive gains in structures spending (9.4% from the previously reported 5.3% increase) and business equipment expenditures, 10.7% versus the initial estimate of 7.0%," noted Bloomberg economists Rich Yamarone.

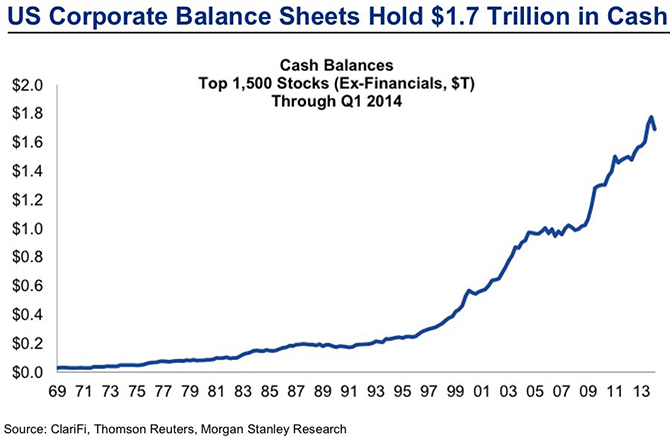

This suggests "that businesses began to put cash to work in Q2 as the US economy rebounded from the early-year growth stumble," said TD Securities' Gennadiy Goldberg.

This Is What We've Been Waiting For

The financial crisis was highlighted by a credit crunch, which left even the most financially healthy corporations strapped for cash. As a result, corporate America had been accumulating and hoarding trillions of dollars of cash on their balance sheets.

And because growth has been slow and the outlook uncertain, corporations have largely returned excess cash flows to investors through share buybacks and dividends.

With the economic recovery and bull market in stocks entering its sixth year, economists and strategists have argued that the next leg of growth would have to be driven at least in part by a boom in business spending.

However, all of the catalysts for a business spending boom appear to finally be coming together.

We know growth is picking up.

Equipment is getting old.

[headlines]

--------------------------------------------------------------

Classified Ads---Management

(These ads are “free” to those seeking employment

or looking to improve their position)

| Boston, Mass. Accomplished Sales & Relationship Management Professional with business development experience in the financial services industry. Recognized by market leaders as industry expert in Professional Practice financing, as well as Residential Mortgage Lending. Keen insight and understanding of transaction process and financial requirements of customer. Proven record of exceeding sales goals. deb.harold@hotmail.com |

| Work Remotely Business Development - Are you looking to enter/increase your Healthcare lending? Let me identify and qualify healthcare (all verticals) vendors, distributors, and end users who utilize leasing/financing as a tool to sell equipment for you. Many years experience - contact Mitchell Utz at mitutz@msn.com or (215) 460-4483. |

Free Posting for those seeking employment in Leasing:

http://www.leasingnews.org/Classified/Jwanted/Jwanted-post.htm

All “free” categories “job wanted” ads:

http://www.leasingnews.org/Classified/Jwanted/Jwanted.htm

|

[headlines]

--------------------------------------------------------------

Financial Pacific Completes First Year as Subsidiary of Umpqua Bank

It was past press time to include Paul Menzel, CLP, President of Financial Pacific, in the reaction to the July Equipment Finance and Leasing Association MFLI-25 article, but since this is an anniversary event, here is Mr. Menzel's celebration:

“We originated $80MM in new volume in the 2nd quarter of 2014, excluding portfolio acquisitions. This represents an increase of 129 percent over the 2nd quarter volume for 2013 of $35MM for the company, which was acquired by Umpqua Bank on July 1, 2013.

“We completed our first year as a subsidiary of Umpqua Bank, and the association has been extremely successful for all concerned, including our associates, clients and Umpqua. With the Umpqua’s capital and lower cost of funds, we are better positioned than at any time in our history to provide critical access to capital for our funding partners. We now offer the industry’s broadest credit window for the small-ticket, vendor and middle-market segments.

“We also welcomed the addition of a team of leasing professionals from Umpqua’s acquisition of Sterling Financial in April of 2014. The team is led by Steve Tidland and serves the lower middle market for equipment finance credits between $100,000 and $500,000 from their offices in Anaheim, CA.

“However, we too saw some summer softness which we consider typical. We are already seeing an uptick in activity now so the summer seems to be coming to an end in terms of business activity.”

The Wednesday article had comments from: John Boettigheimer President, Centra Leasing, Inc.; Christopher A. Enbom, CEO, Allegiant Partners; Allan Levine, President, Madison Capital: David T. Schaefer, CLP, Chief Executive Officer, Orion First Financial, Elaine Temple, President, BancorpSouth Equipment Finance, with a summation from ELFA President and CEO Woody Sutton, CAE.

http://leasingnews.org/archives/Aug2014/8_27.htm#elfa

|

[headlines]

--------------------------------------------------------------

Navitas Reaches Three Year Growth 1,124%; Makes Inc. 500

Gary Shivers’ company, Navitas, Ponte Vedra Beach, Florida, formed in 2008, has reached a three year growth of 1,124%, qualifying the company for Number 421 in the September, 2014 issue of Inc. Magazine’s 500 top US companies.

Gary Shivers,

President, CEO

“This is a great achievement for our company, one that all of our employees, investors, and partners are extremely proud of," he said. "I strongly feel that our dramatic growth is due to our total company focus on helping our customers transform the way they use financing, from simply a procurement method into a new customer acquisition strategy."

Shivers should know, he was Executive Vice-President, Advanta Leasing Corporation (1986-1996), the co-founded Marlin Business Services (1996-2007). On December 20, 2006, Gary R. Shivers resigned as President and as a director of Marlin Business Services Corp. He had a separation agreement for one more year with termination January 31, 2007, followed by an 18 month non-competition agreement. (1)

Rich Pfaltzgraff

Senior VP/Chief Financial Officer

"The exciting news is, we are still a very young company with a lot of new products and services still to come, which keeps me very optimistic about our continued future success," he said.

(1) Shivers Resigns from Marlin

http://www.leasingnews.org/archives/December%202006/12-20-06-flash.htm

[headlines]

--------------------------------------------------------------

New Hires—Promotions in the Leasing Industry

David Atkinson has been appointed Executive Vice President of Business Development, Bluepoint Solutions, Henderson, Nevada. “He will be responsible for the growth of the company by managing and developing the sales organization and existing customer relationships....Atkinson brings more than 25 years of sales management experience to his new role at Bluepoint. He has previously led successful sales teams at Oracle, Basic Four, Trilogy, i2Technologies. His previous accomplishments consist of revamping compensation plans at The Tribune Company, helping start-ups hire quality sales personnel, and designing repeatable, measurable, transferable and manageable sales processes." Bluepoint Solutions provides end-to-end payment processing and content management solutions to community financial institutions.

Daniel Barker was promoted to Broker Channel Manager at TimePayment Corp., Greater Boston, Massachusetts, area. He joined the firm as Credit Administrator, July, 2011, was promoted to Credit Analyst, November, 2011, then Sr. Credit/Broker Services Analyst, January, 2013; promoted then to Broker Team Lead, January, 2014. Before TimePayment, he was Credit Administrator, TimePayment Corp (July, 2011–November, 2011). He joined Arrow Uniform as Billing Clerk, October, 2008; promoted to Credit Memo Analyst, October, 2009, then Accounts Payable Analyst, October, 2010. Prior he was Accounting Temp to Hire, Snelling Staffing Services (August, 2008-December, 2008); Operations, Operations, Trailer Connection LLC (July, 2008–August, 2008); Internship, Beebe & Company, P.C. (April, 2006 – May, 2006); Accounting Assistant, J. Garza CPA PLLC (2005 – 2006); From 2008 to 2011, he was at FBC of Gibraltar Michigan, first as VBS Coordinator, then in 2008, Kids4Truth Director. Volunteer Income Tax Assistance Program Tax Preparer, Baker College (IRS Certified) (2007 – 2008). Education: University of Phoenix, Master of Science (MS), Accountancy (2008 – 2010); Baker College of Allen Park, Bachelor of Business Administration (BBA), Accounting (2006-2008). Baker College of Allen Park, Associate of Business, Accounting (2004–2006).

www.linkedin.com/pub/daniel-barker/76/523/513

Donald Crecca was hired into Syndications at IBM, Armonk, NY. Previously, he was Director, Capital Markets, CIT Group, Inc., Vendor Finance (July, 2007 – August, 2014); Senior Program Manager, Stryker Corporation (July, 2005 – July, 2007). He went to work January,1993, at GE Capital as Remarketing Support Specialist; promoted to Risk Analyst, March, 1994; then Sales Representative/Program Manager, June, 1996; Relationship Manager, January, 1998; Operations Manager, July, 2000; Manager, Inside Sales, January, 2001; National Sales Manager, Healthcare Financial Services, July, 2003. He then started as Senior Program Manager, Stryker Corporation (July, 2005-July, 2007). He began his career as Portfolio Analyst (August, 1991-1993). Education: Gettysburg College, BA, Management (1987–1991).

www.linkedin.com/pub/donald-crecca/13/2b0/2a6

Mark Haley was hired as Vice President of Business Development at North Mill Capital LLC, Greater Boston, Massachusetts Area. Previously he was Business Development Officer, Bibby Financial Services (July, 2013 – July, 2014); Founder/Director of Business Development, Bay Colony Capital (June, 2008 – June, 2013). Education: Union College, BA, Economics. Activities and Societies: Captain, Varsity Ice Hockey; Chi Psi Fraternity

www.linkedin.com/pub/mark-haley/12/658/571

Bryan Murphy, CLP, was promoted to Salesforce Administrator at First American Equipment Finance, Rochester, New York. He joined the firm June, 2008 with this last position as Vice President, Project Manager. Previously, he was Vice Translations Technician, One Communications (August, 2007 – June, 2008); Human Resource Support Specialist, Paychex (September, 2004 – August, 2007). Projects: Implementing Computer Leasing Refresh Plan (Link) (July, 2012 – Present)/ Certifications: Certified Lease Professional, CLP Foundation - http://www.clpfoundation.org (October, 2012 – Present). Education: State University of New York College at Oswego, BS, Business Administration (2000 – 2004). Activities and Societies: Student Advisory Council to the Dean of the School of Business’ Phi Beta Lambda

www.linkedin.com/pub/bryan-murphy-clp/23/152/9a7

Chuck Phillips was announced as Director of Capital Finance at Solect Energy Development, LL; based out of Hopkinton, Massachusetts. Previously, he was Vice President, TD Equipment Finance, TD Bank (May, 2011 – June, 2014); Technology Services Specialist, Hewlett-Packard (May, 2010 – May, 2011); Senior Vice President, Business Development Officer, Bank of America (December, 2005 – February, 2009); Senior Account Executive-New England, ePlus (2004 – 2005); Global Account Manager, Dell Financial Services (2003 – 2004). He joined Hewlett Packard (Formerly Compaq & Digital Equipment) November, 1993 as Senior Sales Services Representative; July, 1995 promoted to North American Engagement Manager; May, 1999 promoted to Finance Area Manager-New England/North East. Education: Saint Bonaventure University, BS, Marketing.

www.linkedin.com/pub/chuck-phillips/0/5aa/304

Reza Saffarian was announced as Vice President of Operations at Pacific Rim Capital, Aliso Viejo, California. He joined the firm May, 2014. Previously, he was Founder, MRST Consultants (December, 2013–May, 2014); Program Manager, PMO, Cisco Systems (November, 2007–December, 2013); Senior Solution Architect, NetSol Technologies Inc. (January 2007–November, 2007); Vice President, Element Financial Corporation (2004–2006); Vice President, De Lage Landen (2002 – 2004); Vice President, Bank of America Leasing (2000 – 2002); Vice President, CitiCapital (1994–2000). Languages: Persian. Education: LaSalle University Master of Science (M.S.), Information Technology, 4.0 (1998–2000) Activities and Societies: Member of Beta Gama Sigma. Pepperdine University, Master of Science (M.S.), Business Administration, Management and Operations (1983–1985). Pepperdine University, Bachelor of Science (B.S.), Business Administration and Management, General (1979–1983). Activities and Societies: Member of the International Student Body

www.linkedin.com/pub/reza-saffarian/26/3b1/1a8

David Silvers joins EverBank Commercial Finance to lead the firm's funeral vehicle financing segment, a new business line within the industrial group. He previously was Assistant Vice President at 1st Source Bank, Cincinnati, Ohio (May, 2006-August, 2014). Education: Miami University.

www.linkedin.com/pub/david-silvers/44/139/a45

Jennifer Whitney was hired as National Business Manager, Eastern Funding, LLC, New York, New York." (She) will be responsible for new loan originations nationwide with a focus in the self-service laundry niche." Previously she was at Alliance Laundry Systems for 14 years, promoted in 2011 to Financial Service Manager. "(She)... received her B.B.A. in Finance and Business Administration from Valparaiso University in Valparaiso, Ind. Prior to joining Alliance, she worked for JP Morgan Chase f/k/a Bank One."

|

((Please Click on Bulletin Board to learn more information))

(Leasing News provides this ad “gratis” as a means

to help support the growth of Lease Police)

[headlines]

--------------------------------------------------------------

Leasing Industry Help Wanted

Collector, Atlanta, GA Sales, Chicago, Atlanta Work out of main office and satellite. Heavy phone sales calling on both independent dealers and end users (cold/warm calling), marketing, weekly reporting to management. Outside territorial salespeople will also be considered. Contact: Michael Testa 312-881-3133 mtesta@secondcityleasing.com www.secondcityleasing.com |

For information on placing a help wanted ad, please click here:

http://www.leasingnews.org/Classified/Hwanted/Hwanted-post.htm

Please see our Job Wanted section for possible new employees.

[headlines]

--------------------------------------------------------------

Sales Makes it Happen by Steve Chriest

All Sales Are Complex

More than a few leasing salespeople and their managers think of the leasing sale as transactional. I want to suggest that the leasing sale, at all levels, is a complex sale. As is true in any complex selling situation, it's what and who you don't know that usually spells disaster for your selling efforts.

The complex sale characteristics of vendor sales are easy to see. Selling to vendors usually involves more than one buying influencer on the vendor side. Not only must the senior managers in a vendor organization approve doing business with you, but the vendor's salespeople and support staff must also stand behind doing business with you and your company. Reluctance on the part of any of these influencers and players can spell big trouble for your sale. In addition, the decision-making process, especially for large vendor accounts, can be involved and can take a good deal of time.

What about a leasing sale to an individual lessee who runs a small business? You're dealing directly with the decision-maker. He or she can make a quick decision and does not need to consult with anyone regarding the decision, right? This sale is simple and transactional, right? Wrong!

What most salespeople and managers miss about these transactional sales is the fact that in many cases, in fact in almost all cases, unseen decision influencers lurk in the background. A sole proprietor who operates a one-man machine shop, for example, may have a spouse who works in the business, but behind the scenes, exerting strong influence over capital expenditures. That same entrepreneur may belong to local trade group that offers free advice on financing alternatives for its members. This small business owner may have a CPA, and perhaps an attorney with whom he consults on all major business decisions.

So, what appears to be a simple, transactional sale is actually a complex sale that may involve multiple decision influencers. The fact that the machine shop owner may also engage outside experts to evaluate financing options also adds to the complexity of the decision-making process. It is best to find out if he will discuss it with his bookkeeper or his certified public accountant, or even his son-in-law, who is an attorney.

Don't be fooled into thinking any sale is as simple as it appears. If you don't know everything there is to know about your customer's buying decision process, or you haven't identified, or aren't aware of all the key decision influencers, both seen and unseen, you may lose your sale without ever knowing why.

About the author: Steve Chriest is the founder of Selling UpTM (www.selling-up.com), a sales consulting firm specializing in sales improvement for organizations of all types and sizes in a variety of industries. He is also the author of Selling The E-Suite, The Proven System for Reaching and Selling Senior Executives and Five Minute Financial Analyst, Basic CREDIT & Analysis Tools for Non-Accountants. He was the CEO of a very successful leasing company and executive at a major company. You can reach Steve atschriest@selling-up.com.

Sales Makes It Happen Articles:

http://www.leasingnews.org/Legacy/index.html

[headlines]

--------------------------------------------------------------

Financial and Sales Training

(For our "Lease School/Franchisors" list, please click here)

These individuals act as a consultant in 75% or more of their main business, actually training staff or individuals of a leasing company. These are not schools or franchisors, which can be viewed

by clicking here.

| Winders Consulting Co., Inc. | |

| Adrian Miller | Wheeler Business Consulting, LLC |

Several hold classes, and most will travel to their client's premise.

To qualify for this page, they must be an active member in an equipment leasing association.

Please fax our request form back to 408-317-2066 or you

may e-mail to: kitmenkin@leasingnews.org.

Second Column: YCS - Year Company Started | YELB - Years in equipment Leasing Business

Name City, State Contact Website Leasing Association |

YCS YELB (see above for meaning) |

Geographic Area |

Specialty |

Institute For Personal Development Vourhees, NJ Linda P. Kester linda@lindakester.com 856.489.6558 www.lindakester.com National Speakers Association |

1996 18 |

United States |

Motivating, Educating and empowering leasing sales reps to top performance. Practical ideas for success using the telephone and internet. |

Adrian Miller Port Washington, NY Adrian Miller amiller@adrianmiller.com 516-767-9288 www.adrianmiller.comwww.adrianmiller.com/blog/ |

1989 |

International |

Highly results-driven, informative and enjoyable sales skills training programs that will leave participants empowered for bottom-line success. AMST guarantees a positive return on training time and investment. |

Selling Up TM |

2000 20 |

International |

By leveraging people, process and technology, Selling Up guides the next step in revenue generation and elevates sales organizations into appreciating corporate assets. |

Teichman Financial Training Sausalito, California Bob Teichman, CLP BoTei@aol.com 415.331.6445 NAELB, NEFA |

1998 51 |

International |

"We specialize in the technical side of leasing, offering comprehensive training in packaging, credit, pricing, structuring, financial analysis and operations. Our clients include lessors, lessees, lenders, associations, and government agencies." |

Wheeler Business Consulting, LLC Fallstow, Maryland Scott Wheeler, CLP Scott@wheelerbusinessconsulting.com 410-877-0428 www.wheelerbusinessconsulting.com NAELB, NEFA |

2008 26 |

USA |

Provide multiple educational products to individuals and companies engaged in the leasing/financing industry. Encourage & facilitate personal and corporate strategy building to promote efficiencies, increase productivity & future success. |

Winders Consulting Co., Inc. Louisville, KY Terry Winders, CLP Leaseconsulting@msn.com 502-649-0448 ELFA, NAELB, NEFA |

1991 35 |

USA |

Lease seminars and training on rules & regulations pricing, documentation, sales. Also procedure audits, and help to establish a leasing activity or company for brokers, bankers, and captives.. Expert witness on legal & tax. |

(A) Selling Up's Sales Management Operating System™ ( SMOS™) provides companies and business units of all sizes with a proven methodology and unique tools offering a comprehensive, flexible, scalable approach to managing all elements of the organizational sales process.

[headlines]

--------------------------------------------------------------

[headlines]

--------------------------------------------------------------

Settlement tab for biggest banks surpasses $128B

SNL Feature Article

By Sam Carr

With the latest settlements from Bank of America Corp. and Goldman Sachs Group Inc., the settlement tab for the largest six bank holding companies by assets climbed above $128 billion for credit crisis and mortgage-related settlements, according to data compiled by SNL Financial.

Bank of America's record $16.65 billion settlement, announced Aug. 21, is a comprehensive agreement covering actual and potential civil claims against the company from the Department of Justice, the SEC, the Federal Housing Administration, Ginnie Mae and several state attorneys general, as well as all pending claims brought by the FDIC.

According to the press release from BofA, the agreement, which primarily relates to conduct at Countrywide and Merrill Lynch prior to BofA's acquisition of those companies, includes $9.65 billion in cash and approximately $7.0 billion worth of consumer relief. The cash portion consists of a $5.02 billion civil monetary penalty and $4.63 billion in compensatory remediation payments.

One day after BofA announced its $16.65 billion settlement, Goldman Sachs announced an agreement with the Federal Housing Finance Agency to settle litigation involving the sale of private label residential mortgage-backed securities to Fannie Mae and Freddie Mac. Goldman Sachs agreed to repurchase the private label RMBS originally sold to the government sponsored enterprises from 2005 to 2007 for a total of $3.15 billion, consisting of approximately $2.15 billion payable to Freddie Mac and approximately $1 billion to Fannie Mae.

With the Goldman Sachs agreement, all of the largest six U.S. bank holding companies have settled claims with the FHFA over private label securities sold to the GSEs. The settlement marks the 16th that the FHFA has reached in the 18 private label RMBS lawsuits it filed in 2011. "Three cases remain outstanding and FHFA is committed to satisfactory resolution of those actions," the agency stated.

When considering the costs of the credit crisis and mortgage-related settlements, analysts also examine the amounts of loans previously sold that have been repurchased, or "putbacks," in addition to the settlements with regulators and investors.

In addition to litigation reserves, as of June 30 the six largest bank holding companies reported a combined $13.72 billion in representation-and-warranty reserves for one- to four-family mortgage loans sold or securitized, down from $15.28 billion in the linked quarter. In the first six months of 2014, the largest six bank holding companies repurchased approximately $1.10 billion in closed-end one- to four-family loans previously sold. This compares to $15.22 billion for full year 2013 and $7.81 billion during 2012.

![]()

John Kenny • Fraud Investigations • Credit Investigations • Asset Searches • Skip-tracing • Third-party Commercial Collections john@jkrmdirect.com | ph 315-866-1167| www.jkrmdirect.com |

(Leasing News provides this ad as a trade for investigations

and background information provided by John Kenny)

[headlines]

--------------------------------------------------------------

[headlines]

--------------------------------------------------------------

[headlines]

--------------------------------------------------------------

Labrador Retriever Mix

Tacoma, Washington Adopt-a-Dog

Cash

ID #A473413

Male

Neutered

Six Years

Black

Location 32

Shelter Staff made the following comments about this animal:

"Hi, my name is CASH and I would love to meet you. I am a Neutered Male Labrador Retriever mix. The shelter staff thinks I am about 6 years old. I have been at the shelter since Aug 22, 2014."

For more information about this animal, call:

Humane Society for Tacoma and Pierce County at (253) 383-2733

Ask for information about animal ID number A473413

Humane Society for Tacoma & Pierce County

2608 Center Street

Tacoma, WA 98409

(253) 383-2733

Adoption Hours

Mon-Tue-Wed: 9:30 am - 5:30 pm

Thursday: 11:00 am - 5:30 pm

Friday: 9:30 am - 5:30 pm

Saturday: 9:00 am - 4:30 pm

Sunday: Closed

Application:

http://www.thehumanesociety.org/wp-content/uploads/2013/04/Dog-Adoption-Application.pdf

Adopt a Pet

http://www.adoptapet.com/

[headlines]

--------------------------------------------------------------

Leasing Conferences—Updates

Last Day to Register on line for NAELB Conference

September 4-6

2014 Eastern Regional Meeting

Lord Baltimore Hotel

Baltimore, MD

All registrations must be received by the office no later

than Friday, August 29, 2014.

After this date, you must register on-site.

Exhibitors to Date

Amerisource Funding

Bankers Capital

Blue Bridge Financial LLC

Business Credit Reports

Bryn Mawr Funding

Channel Partners LLC

CLP Foundation

Financial Pacific Leasing, LLC

First Federal Leasing

Fora Financial

iCapital

instaCOVER

Leasepath

Maxim Commercial Capital LLC

Merchant Cash and Capital, LLC

North Mill Equipment Financing LLC

OnDeck

Pacific Western Equipment Finance

Pawnee Leasing Corporation

Preferred Business Solutions

RLC Funding

TEAM Funding Solutions

Varilease Finance, Inc.

Registration/Schedule Available

September 10-12

Canadian Finance and Leasing Association

The Fairmont Chateau Whistler

Whistler, British Columbia

Registration now Open, Program Available

http://www.cfla-acfl.ca/events/cfla-annual-conference-2014/

September 18-20

Hyatt Regency San Antonio Riverwalk

123 Losoya Street

San Antonio, Texas 78205

United States

The Women in Leasing Group would like to cordially other women in

leasing to our next luncheon at Acenar Restaurant located along the River Walk in San Antonio on Thursday, September 18, 2014 from 1:00pm – 3:00pm. The restaurant is within walking distance of the hotel for the NEFA Funding Symposium. If you would like to attend please RSVP by September 9th to Shari Lipski at 847.897.1711 or via email at SLipski@ECSFinancial.com

170 registered to date. Online registration

available until 9/18/2014. Full Information

here:http://www.nefassociation.org/events/event_details.asp?id=387999

Exhibitors to date

Amerisource Funding

Bank of the West

Blue Chip Leasing Corporation

Boston Financial & Equity Corporation

Business Credit Reports

Bryn Mawr Funding

Channel Partners, LLC

CLP Foundation

Collateral Specialists, Inc.

Conestoga Equipment Finance

Dakota Financial, LLC

Delta Management Group, Inc.

ECS Financial Services, Inc

Financial Pacific Leasing, Inc.

FORA Financial

Funding Circle

Leasepath

LeaseTeam, Inc.

Great American Insurance

LCA Financial, LLC

Maxim Commercial Capital

Monitor Daily

North Mill Equipment Finance

OneWorld Business Finance

Orange Commercial Credit

NCMIC Finance Corporation

Pawnee Leasing Corporation

Quiktrak, Inc.

RLC Funding

RTR Services, Inc.

Winston & Winston, P.C.

September 19 - 20, 2014

Tianjin, China

Sudhir Amembal:

The First Global Leasing Industry Competitiveness Forum

For More Information:

kelly@amembalandassociates.com

Qualified leasing professionals from outside of China will not be charged any registration fees. They are, however, expected to pay for all their travel expenses including accommodations and meals at the venue.

From the Chinese side, the speakers will include prominent leasing company executives and supportive governmental representatives; from the international side, the speakers will be drawn from senior executives from leading leasing companies and others who have played a vital role in leasing's international growth.

Speakers include:

• Sudhir P. Amembal, Chairman & CEO, Amembal & Associates, U.S.A.

• Crit DeMent, Chairman & CEO, LEAF Commercial Capital, Inc., U.S.A.

• Esteban Gaviria, CEO, Leasing Bancolombia, Colombia

• Shawn D. Halladay, Global Leasing Expert, Amembal & Associates and The Alta Group, U.S.A.

• Hugh Lander, Chief Executive Officer, BOQ Finance (BOQF), Australia

• Bob Rinaldi, Chairman-Elect, ELFA, U.S.A.

• Arnaldo Rodriguez, President, CSI International, Spain

• Jukka Salonen, Chairman, Leaseurope, Finland

• Fred Sasser, Chairman, Chicago Freight Car Leasing, U.S.A.

• Judy Tan, Managing Director, Caterpillar (China) Financial Services, China

• Wang Chong,Chairman,CDB(China Development Bank) Leasing,China

• Kong Linshan, Chairman, Minsheng financial leasing co., LTD, China

• Kong Fanxing, Chairman, International Far Eastern Leasing, China

• Cong Lin, President, ICBC Leasing, China

Information on Conference, including biographies:

http://www.leasingnews.org/PDF/2014ChinaForum_7302014.pdf

October 9 -10

Eurostars Grand Marina

Barcelona, Spain

Booking of rooms at the Grand Marina is to be done by filling in a Hotel Reservation Form, which can be downloaded from the Annual Convention website at:

http://www.annual-convention.eu/index.php?page=accommodation

Last year's event was a resounding success with more than 500 participants from across Europe as well from Australia, Canada, China, Morocco, South Korea and the USA.

Registration/Further Information:

http://www.annual-convention.eu/

October 19-21

2014 53rd Annual Convention

Manchester Grand Hyatt

San Diego, CA

Video Preview of ELFA Annual Convention

ELFA President and CEO Woody Sutton

(1:55)

- Friday, September 26, 2014: Last day to receive the special ELFA convention rate for your accommodations at the Manchester Grand Hyatt or the San Diego Marriott Marquis & Marina.

- Tuesday, October 7, 2014: Last day for mail-in and online registrations. After this date registrations can be made on-site. Please note: There are no refunds of registration fees after this date.

Full Information: Speakers, Brochure, Registration:

http://www.elfaonline.org/events/2014/AC/

Cosmopolitan, Las Vegas, Nevada

It will bring together critical decision makers concerning credit and collections

from all facets of financial services.

Agenda

http://www.collectionscreditrisk.com/conferences/fscc/agenda_preview.html

Registration

http://www.collectionscreditrisk.com/conferences/fscc/reginfo.html

November 5, 2014

Latin American Leasing &

Operation Forum

The Alta Group

Intercontinental Hotel Doral

Miami, Florida

Wednesday November 5th the Latin American Legal and Operations Forum will give participants access to the latest advances in the legal and operational practices in the industry. It will be an excellent opportunity to learn about the laws and regulations of leasing in different countries of the Americas.

The event will be simultaneously translated in English and Spanish.

Information:

http://www.thealtaconferencias.com/?task=view_event&event_id=9

November 5-7

34th Annual AGLF Fall Conference

Tucson, Arizona

Hotel Information

http://www.loewshotels.com/en/Ventana-Canyon-Resort

November 6 - 8

2014 Western Regional Meeting

Hyatt Regency Irvine

Irvine, CA

November 7, 2014

XII Latin American Leasing Conference

The Alta Group

Intercontinental Hotel Doral

Miami, Florida

Thursday 6th to Friday 7th the XII Latin American Leasing Conference will be held. This will provide participants insights regarding developments in the professional practice of the leading rental companies in the Americas. The conference will also showcase best practices leasing companies and finance teams are now utilizing in strategic planning and implementation of funding strategies as well as risk and asset management.

The event will be simultaneously translated in English and Spanish.

Information:

http://www.thealtaconferencias.com/index.php/component/

eventbooking/?task=view_category&category_id=1&Itemid=101

November 11-13

The 2014 Middle East Leasing Summit to be held November 11-13 at the JW Marriott Marquis Hotel Dubai is reported to be strongly supported by leading leasing companies and international leasing association.

This summit will gather regional government officials, vendor representatives, national organizations and industry leaders to interpret the air finance from the aspect of market situation, regulatory, growth point and second hand aircraft to better understand Middle East air finance market.

The conference promises "Deep insight into Middle East leasing market climate with introduction of Islamic Finance’s application and banks’ involvement. There is no doubt that this summit will provide a premier platform for its delegates to establish strategic cooperative partnerships, expand business. We firmly believe that your outstanding industrial background and broad knowledge would contribute significantly to the quality and scope of this

summit."

For more information, please visit the official website at

http://www.duxes-events.com/LeaseME/

November 12 - 14

Commercial Finance Association

70th Annual Convention

Washington Marriott Wardman Park

Washington, D.C.

November 16 -17

NJ Expo Regional

Teaneck, New Jersey

(Sunday evening- All Day Monday)

November 18 - 21, 2014

Istanbul, Turkey

The Third Annual Operating Lease Conference

"Three prominent and qualified speakers have been added to the agenda.

They are: Stephan van Beek, Senior Director Sales & Marketing Development - EMEA, Oracle Financing, an expert on software leasing; Arnaldo Rodriguez, President – International Division, CSI Leasing, who is the epitome of having successfully globalized the product; and, Esteban Gaviria, CEO, Leasing Bancolombia, who leads the most successful bank-held operating leasing company in Latin America. I will chair the conference and also teach a two-day seminar preceding the conference."

Sudhir Amembal

For More Information:

kelly@amembalandassociates.com

CFA Related Conferences

http://www.leasingnews.org/PDF/CFAConferences_2014.pdf

CFA Network Calendar

http://www.leasingnews.org/PDF/CFAEventsCalendar_2014.pdf

ELFA ---2014 Schedule of Conferences, Workshops

and e-Learning Opportunities

http://www.leasingnews.org/PDF/ELFA2014ScheduleInfo_1212014.pdf

[headlines]

--------------------------------------------------------------

![]()

News Briefs----

Mortgage rates enjoy a longer summer dip

http://www.bankrate.com/finance/mortgages/mortgage-analysis.aspx?ic_id=Top_Stories_link_1

Pending home sales rebound in July, reaching 11-month high

http://www.latimes.com/business/la-fi-pending-home-sales-20140828-story.html

GDP Expanded at 4.2% Rate in Second Quarter

http://online.wsj.com/articles/gdp-expanded-at-4-2-rate-in-second-quarter-1409229416

Why Boeing Is Battling Conservatives, Airlines Over Export-Import Bank

http://247wallst.com/aerospace-defense/2014/08/27/why-boeing-is-battling-conservatives-airlines-over-export-import-bank/

Market Basket Workers Begin Recovery Effort

http://www.boston.com/business/news/2014/08/28/market-basket-workers-begin-recovery-effort/20giMyHMHQR1Hc9bKntn9H/pictures.html

Arthur T. Addresses Supporters: ‘You Empowered Others to Seek Change’

http://www.boston.com/business/news/2014/08/28/arthur-addresses-supporters-you-empowered-others-see-change/qG0Gc2Zoy4B1URsgw8ZtMN/story.html

Free Tablet TV coming to San Francisco, other cities planned

http://tabtimes.com/news/ittech-accessories/2014/08/25/tablet-tv-coming-san-francisco-other-cities-planned

Operators roll out more nutritious breads to appeal to health-conscious

http://www.qsrmagazine.com/food-beverage/fresh-bread

Obama picks prosecutor Sarah Saldaña to lead Immigration and Customs Enforcement

http://trailblazersblog.dallasnews.com/2014bama-picks-prosecutor-sarah-saldana-to-lead-immigration-and-customs-enforcement.html/

Collector, Atlanta, GA Sales, Chicago, Atlanta Work out of main office and satellite. Heavy phone sales calling on both independent dealers and end users (cold/warm calling), marketing, weekly reporting to management. Outside territorial salespeople will also be considered. Contact: Michael Testa 312-881-3133 mtesta@secondcityleasing.com www.secondcityleasing.com |

[headlines]

--------------------------------------------------------------

--You May Have Missed It

Pennsylvania becomes 27th state to expand Medicaid

http://www.seattlepi.com/news/us/article/US-approves-Pennsylvania-Medicaid-plan-5719087.php

[headlines]

--------------------------------------------------------------

SparkPeople--Live Healthier and Longer

![]()

Sparkpeople Free Mobile Apps

http://www.sparkpeople.com/mobile-apps.asp

[headlines]

--------------------------------------------------------------

Baseball Poem

By Donald Hall

From “Fathers Playing Catch (Essays on Sport-mostly baseball) with Sons”

North Point Press, Farrar, Straus and Giroux, New York

http://www.amazon.com/s/ref=br_ss_hs/002-2141354-2944804?platform=gurupa&url=

index%3Dblended&keywords=Fathers+Playing+Catch+with+their+Sons&Go.x=14&Go.y=11

“Half of my poet-friends think I am insane to waste my time writing about sports and to loiter in the company of professional athletes. The other half would murder to take my place.

“My obsession with sports began a year or two before my obsession with poetry, I suppose in mimicry of my father and in companionship. The first essay in this book talks about those days. Like other boys I wanted desperately to be an athlete, but, although (and probably because) I conceived that my father was prodigiously athletic, I wholly incompetent: I dropped the ball; I struck out; I practiced the airball layup. A few years back trying to write songs for a composer, I made this lamentation:”

In the baseball game of life

It's the bottom of the ninth:

We trail, bases are loaded, and I'm up.

The pitcher throws a sliders

Just where the plate gets wider.

I think, I swing, I foul it off my cup.

Then he brings if Express Freight

Through the fat part of the plate.

I think, I swing, I pop the baseball up.

In the basketball game of life

I am standing in the line:

Time's fine. I've got two shoots to win the game.

In the silent, breathless gym

My first one hits the rim.

I pause, I bounce the ball, I take good aim.

If I make it we will tie

But my shot hits only sky.

We lose. I disappear. I change my name.

In a third stanza, I dropped a game-winning pass at the end of the fourth quarter. I ended:

They can shoot me if they want to. I don't mind.

From “Fathers Playing Catch (Essays on Sport-mostly baseball) with Sons”

By Donald Hall

North Point Press, Farrar, Straus and Giroux, New York

index%3Dblended&keywords=Fathers+Playing+Catch+with+their+Sons&Go.x=14&Go.y=11

[headlines]

--------------------------------------------------------------

Sports Briefs----

Roger Goodell Alters N.F.L. Policy on Domestic Violence

in Wake of Ray Rice Case

http://www.nytimes.com/2014/08/29/sports/football/roger-goodell-admits-he-was-wrong-and-alters-nfl-policy-on-domestic-violence.html?_r=0

Giants pitcher Yusmeiro Petit retires 46 straight for MLB record

http://www.usatoday.com/story/sports/mlb/2014/08/28/yusmeiro-petit-sets-mlb-record-for-consecutive-batters-retired/14752635/

Anthony Brown Quits USC Football Team, Claims Steve Sarkisian Is Racist

http://bleacherreport.com/articles/2179393-anthony-brown-quits-usc-football-team-claims-steve-sarkisian-is-racist

[headlines]

--------------------------------------------------------------

California Nuts Briefs---

More hops to Hawaii from SF Bay Area airports

http://www.contracostatimes.com/spotlight/ci_26388630/more-hops-hawaii

[headlines]

--------------------------------------------------------------

![]()

“Gimme that Wine”

http://www.youtube.com/watch?v=EJnQoi8DSE8

California drought: Livermore winemakers see lighter crop yields, smaller fruit

http://www.contracostatimes.com/contra-costa-times/ci_26424283/california-drought-livermore-winemakers-see-lighter-crop-yields

Napa, Sonoma wineries mop up

http://www.pressdemocrat.com/news/2576090-181/wine-wineries-clean-up-after

Wine Country Weekend celebrates 2 growing regions blessed with fog

http://www.pressdemocrat.com/lifestyle/2525620-181/wine-country-weekend-celebrates-2

Napa vintners say 95 percent of wineries up and running (w/video)

http://www.pressdemocrat.com/business/2606282-181/napa-vintners-say-95-percent

B.R. Cohn Winery Finds Earthquake Losses Less Than Feared

http://www.winebusiness.com/news/?go=getArticle&dataid=137865

Utah Approves Winery in Town With Polygamous Sect

http://abcnews.go.com/US/wireStory/utah-approves-winery-town-polygamous-sect-25154151

Free Mobile Wine Program

http://leasingnews.org/archives/Feb2010/2_26.htm#mobile

Wine Prices by vintage

http://www.winezap.com

http://www.wine-searcher.com/

US/International Wine Events

http://www.localwineevents.com/

Winery Atlas

http://www.carterhouse.com/atlas/\

Leasing News Wine & Spirits Page

http://two.leasingnews.org/Recommendations/wnensprts.htm

[headlines]

----------------------------------------------------------------

![]()

This Day in History

1708 - Haverhill, Mass., was destroyed by French & Indians.

1758 - New Jersey Legislature formed the 1st Indian reservation at, oddly enough, Indian Mills, NJ…that’s right, New Jersey!!

1776 - General George Washington retreated during the night from Long Island to New York City, withdrawing from Manhattan to Westchester.

1786 - Shays’ Rebellion: Daniel Shays, veteran of the battles of Lexington, Bunker Hill, Ticonderoga and Saratoga, was one of the leaders of more than 1,000 rebels who sought redress of grievances during the depression days of 1786—87. He began organizing his followers with speeches this day. They prevented general court sessions and on Sept 26, they prevented Supreme Court sessions at Springfield, MA. On Jan 25, 1787, with 1100 men, they attacked the federal arsenal at Springfield; Feb 2, Shays’ troops were routed and fled. Shays was sentenced to death but pardoned June 13, 1788. The uprising had been caused by the harsh economic conditions faced by Massachusetts farmers, who sought reforms and the issuance of paper money. Shays later he received a small pension for services in the American Revolution.

1809 - Birthday of Oliver Wendell Holmes, physician and author, father of Supreme Court justice Oliver Wendell Holmes, at Cambridge, MA. Died at Boston, MA, Oct. 8, 1894. “A moment’s insight”, he wrote, “is sometimes worth a life’s experience.”

http://www.arlingtoncemetery.com/owholmes.htm

http://www.eldritchpress.org/owh/owhhes.html

1811 – Birthday of Henry Bergh, founder of the ASPCA, in NYC. He was President Lincoln’s ambassador to Russia when the severe climate forced him home. On returning to the United States, Bergh resolved to work on behalf of animal welfare. Alone, in the face of indifference, opposition, and ridicule, he began working as a speaker and lecturer, but most of all in the street and the courtroom, and before the legislature. The legislature passed the laws prepared by him, and on 10 April 1866, the ASPCA was legally organized, with Bergh as president. He died in NYC in 1888.

1815 - Anna Ella Carroll’s birthday, writer and publicist for Union causes during the Civil War. She is best known for her pamphlet which outlined the proposition that the Southern states would resume their original places in the United States once the rebellion of the Civil War was over, precisely the course adopted by Abraham Lincoln in superseding Congress in the conduct of the war. She is credited with the plan to invade the South along the Tennessee River. Her tombstone reads "Maryland's Most Distinguished Lady." However, she died financially poor and anonymous in 1893.

http://www.mdarchives.state.md.us/msa/educ/exhibits/womenshall/html/carroll.html

http://nabbhistory.salisbury.edu/

http://www.amazon.com/exec/obidos/external-search/103-5362656-4423850?tag=fast-b

kasin00-20&keyword=Anna%20Ella%20Carroll&mode=books

1817 - The first “abolition” newspaper was “The Philanthropist”, published and edited by Charles Osborn, which appeared in Mount Pleasant, OH. It published “An Appeal to Philanthropists” by Benjamin Lundy, which is said by some to be the most powerful abolition appeal ever made.

1831 – Michael Faraday discovers electromagnetic induction. Although Faraday received little formal education, he was one of the most influential scientists in history. It was by his research on the magnetic field around a conductor carrying a direct current that Faraday established the basis for the concept of the electromagnetic field in physics. Faraday also established that magnetism could affect rays of light and that there was an underlying relationship between the two phenomena. It was largely due to his efforts that electricity became practical for use in technology. As a chemist, Faraday discovered benzene, investigated chlorine, invented an early form of the Bunsen burner and the system of oxidation numbers, and popularized terminology such as anode, cathode, electrode, and ion.

1839 - In January, 53 Africans were seized near modern-day Sierra Leone, taken to Cuba and sold as slaves. While being transferred to another part of the island on the ship Amistad, led by the African, Cinque, they seized control of the ship, telling the crew to take them back to Africa. However, the crew secretly changed course and the ship landed at Long Island, NY, where it and its ‘cargo’ were seized as salvage this day. The Amistad was towed to New Haven, CT where the Africans were imprisoned and a lengthy legal battle began to determine if they were property to be returned to Cuba or free men. John Quincy Adams took their case all the way to the Supreme Court, where on Mar 9, 1841, it was determined that they were free and could return to Africa.

1852 - The Latter Day Saints first published their doctrine of "celestial marriage," popularly known as polygamy. The Mormon Church maintained this teaching until the Manifest of 1890 (and later Congressional legislation) outlawed the practice.

1861 - The first Confederate forts to surrender in the Civil War were Fort Clark and Fort Hatteras on Hatteras Island, NC, guarding Pamlico Sound. They surrendered to Flag Officer Silas H. Stringham and General Benjamin Franklin Butler, who had captured the garrison with 715 men, 31 heavy guns, and 1,000 stands of arms.

1862 - (29th-30th) At the second Battle of Bull Run, the maneuvers of General Stonewall Jackson and his teamwork with General Robert E. Lee were too much for the 45,000 Union troops under General John Pope, who broke and retreated to Washington, DC. Union losses were 1724 killed, 8372 wounded, 5958 missing. Confederate losses stood at 1481 killed, 7627 wounded, 89 missing. http://www.infoplease.com/ce6/history/A0857066.html

http://www.infoplease.com/ce6/people/A0839705.html

http://www.amazon.com/exec/obidos/ASIN/0252023633/jimbo2/104-1979401-1205565

1869 - The Mount Washington Cog Railway opens in New Hampshire, making it the world's first rack railway. The railway is still in operation, climbing Mt. Washington.

1894 - Birthday of African-American sociologist E. Franklin Fraiser.

1896 - History records chop suey was concocted in New York City by the chef of Chinese Ambassador Li Hung-Chang, who devised the dish to appeal to both American and Asian tastes. Chop suey was unknown in China at the time.

1898 – The Goodyear Tire & Rubber Company was founded.

1904 - Third modern Olympic Games open in St Louis. These Games were originally scheduled for Chicago. However, President Theodore Roosevelt intervened on behalf of St. Louis so that the Games would be in conjunction with the Louisiana Purchase Exhibition. Again the Games were upstaged, this time by the St. Louis World’s Fair, and critics believed this would kill the fourth Olympics from taking place. The marathon included the first two Africans to compete in the Olympics – two Zulu tribesman named Lentauw (real name: Len Taunyane) and Yamasani (real name: Jan Mashiani). They wore bibs 35 and 36, respectively.

The only problem was that these two tribesmen were not in town to compete in the Olympics – they were actually the sideshow! Yes, they were imported by the exposition as part of the Boer War exhibit (both were really students at Orange Free State in South Africa, but no one wanted to believe that these tribesmen could actually be educated – it would have ruined the whole image). Lentauw finished ninth and Yamasani came in twelfth. This was a disappointment, as many observers were sure Lentauw could have done better – that is if he had not been chased nearly a mile off course by a large, aggressive canine!

The marathon was over, but there is still one more little story to go along with this: It seems that two of the patrolling officials driving in a brand-new automobile were forced to swerve to avoid hitting one of the runners – they ended up going down an embankment and were severely injured.

In the end, the St. Louis Olympics (along with the previous Paris games) proved to be such a disaster that the Olympic Committee was forced to hold interim Olympic Games in 1906 at Athens, in an attempt to revive the flagging Olympic movement. These games were not numbered, but were attended by twenty countries and put the Olympics back on a steady course to success. An interesting useless side note: Iced tea made its debut at the 1904 Exposition. It seems that it was so hot during the Expo that the staff at the Far East Tea House couldn’t even give away their product.

1911 – Ishi, considered the last Native American to make contact with European Americans, emerges from the wilderness of northeastern California…and he had no statement on the name of Washington’s NFL team!!

1915 – The US Navy raises F-4, the first U.S. submarine sunk in an accident.

1915 – Birthday of actress Ingrid Bergman at Stockholm, Sweden. She won three Academy Awards, two Emmy Awards, four Golden Globes, and the Tony Award for Best Actress. She is ranked as the fourth greatest female star of American cinema of all time by the American Film Institute. She is best remembered for her roles as Ilsa Lund in “Casablanca” (1942), co-starring Humphrey Bogart, and as Alicia Huberman in “Notorious” (1946), an Alfred Hitchcock thriller co-starring Cary Grant. Bergman died in 1982.

1916 – US passes the Philippine Autonomy Act.

1917 – Weezie’s birthday: Actress Isabel Sanford was born in Harlem, NYC. Lead role in “The Jeffersons”, in 1981, she became the first African-American actress to win a Primetime Emmy Award for Outstanding Lead Actress in a Comedy Series. She died in LA in 2009.

1920 - Birthday of Charlie Parker. Clint Eastwood made a movie about his life. Known as “The Bird,” he and Dizzy Gillespie, trumpet player extraordinaire and great showman, are credited with “inventing” the style “Be-Bop.” Definitely way ahead of his time, and quite melodic (his record albums with strings from 1947 to 1952 produced by Norman Granz are jazz classics). There is controversy on how he got his name. Some say it was from sitting in the backyard of “speakeasies” in Kansas City, Kansas, where he was raised, fingering his alto sax. Others say it was his love of chicken. He was addicted to Heroin, as many of the “Be-Bop” players were. The movie “The Man with the Golden Arm” was a take-off of his life, not Chet Baker, according to the writer of the movie. He was taken to Camarillo for the Insane, where he kicked the habit, for a short time. The club Birdland in Manhattan was named after him. It is told one of his ideas to make the club more profitable was to have a Country and Western band come and play during the breaks. Parker was a profound influence upon Miles Davis, who started playing with his band at the age of 17.

http://www.kcpl.lib.mo.us/sc/bio/parker.htm

http://www.geocities.com/BourbonStreet/5066/

http://www.changingtones.com/trmpt02.html

http://www.bigmagic.com/pages/blackj/column4.html

http://www.downbeat.com/artists/window.asp?action=new&aid=117&aname=Charlie+Parker

http://www.charlieparkerresidence.net/

1921 – Birthday of Wendell Scott, at Danville, VA. Auto racer and the first black stock-car driver. He is the only black driver to win a race in what is now the Sprint Cup Series. NASCAR champion 12-1-63: won race but because of racial tensions did not receive honor until Jan. 1964 when NASCAR officials admitted the flagman’s intentional error. The film “Greased Lightning”, starring Richard Pryor as Scott, was loosely based on Scott's biography. Scott died Dec 22, 1990.

1922—New Orleans Rhythm Kings cut first records for Gennett.

1922 –The first radio advertisement is aired on WEAF-AM in NYC

1924 – Birthday of singer Dinah Washington (Ruth Lee Jones) born Detroit, Michigan. Her hits include: “What A Diff’rence a Day Makes”, “It Could Happen to You”, “Our Love is Here to Stay”, “For All We Know”, “Baby [You’ve Got What It Takes]”, “A Rockin’ Good Way [To Mess Around and Fall in Love]”, “Baby Get Lost”, “This Bitter Earth”; w/Lionel Hampton band [1943-46]. Washington died Dec 14, 1963.

http://www.ddg.com/LIS/InfoDesignF96/Ismael/jazz/1950/Washington.html

http://www.rockhall.com/hof/inductee.asp?id=207

1936 – Incumbent Arizona Senator John McCain was born in the Panama Canal Zone, where his father was stationed. At the time, the Canal was under US control. McCain graduated from the US Naval Academy in 1958 and began his naval career at Pensacola where he began his aviation training. On a mission during the Vietnam War, he was captured on October 26, 1967 when his plane was shot down by a missile over Hanoi. McCain fractured both arms and a leg ejecting from the aircraft, and nearly drowned when he parachuted into a lake. Some North Vietnamese pulled him ashore, then others crushed his shoulder with a rifle butt and bayoneted him. Although McCain was badly wounded, his captors refused to treat his injuries, beating and interrogating him to get information; he was given medical care only when the North Vietnamese discovered that his father was a top admiral. He was released on March 14, 1973. After retiring in 1981, he began his political career by running and winning a seat in Congress from Arizona’s First District. Upon being skewered in the press for being a carpetbagger, McCain responded, “…Listen, pal. I spent 22 years in the Navy. My father was in the Navy. My grandfather was in the Navy. We in the military service tend to move a lot. We have to live in all parts of the country, all parts of the world. I wish I could have had the luxury, like you, of growing up and living and spending my entire life in a nice place like the First District of Arizona, but I was doing other things. As a matter of fact, when I think about it now, the place I lived longest in my life was Hanoi.” His Senate career began in 1987 where he has been a leader and he has run for President twice.

1938 – Elliott Gould’s birthday in Queens, NY. Aside from becoming Barbra Streisand’s first husband, Gould has had a decent career in movies. Among them: “M*A*S*H”, “Bob and Carol and Ted and Alice”, “Oceans 12”, “Oceans 13”.

1939 - A typical day at the Graham dairy farm in Georgetown, North Carolina. http://memory.loc.gov/ammem/today/aug29.html

1940 – Former Reagan Press Secretary James Brady, who just passed last month, was born. Brady was wounded severely in the 1981 assassination attempt on President Reagan in Washington, DC, suffering permanent brain damage. The resulting gun legislation bears his name as the Brady Bill.

1943 – Blood, Sweat, and Tears pianist Dick Halligan born.

1944 - For the sake of diplomacy, Paris was liberated on August 25, when the German commander General Dietrich von Choltiz surrendered to French General Jacques-Phillipe Leclerc. On this day, the 15,000 American troops taking part in the liberation marched down Champs Elysees.

1944 - McVElGH, JOHN J., Medal of Honor.

Rank and organization: Sergeant, U .S. Army, Company H, 23d Infantry, 2d Infantry Division. Place and date: Near Brest, France, 29 August 1944. Entered service at: Philadelphia, Pa. Birth: Philadelphia, Pa. G.O. No.: 24, 6 April 1945. Citation: For conspicuous gallantry and intrepidity at risk of his life above and beyond the call of duty near Brest, France, on 29 August 1944. Shortly after dusk an enemy counterattack of platoon strength was launched against 1 platoon of Company G, 23d Infantry. Since the Company G platoon was not dug in and had just begun to assume defensive positions along a hedge, part of the line sagged momentarily under heavy fire from small arms and 2 flak guns, leaving a section of heavy machineguns holding a wide frontage without rifle protection. The enemy drive moved so swiftly that German riflemen were soon almost on top of 1 machinegun position. Sgt. McVeigh, heedless of a tremendous amount of small arms and flak fire directed toward him, stood up in full view of the enemy and directed the fire of his squad on the attacking Germans until his position was almost overrun. He then drew his trench knife. and single-handed charged several of the enemy. In a savage hand-to-hand struggle, Sgt. McVeigh killed 1 German with the knife, his only weapon, and was advancing on 3 more of the enemy when he was shot down and killed with small arms fire at pointblank range. Sgt. McVeigh's heroic act allowed the 2 remaining men in his squad to concentrate their machinegun fire on the attacking enemy and then turn their weapons on the 3 Germans in the road, killing all 3. Fire from this machinegun and the other gun of the section was almost entirely responsible for stopping this enemy assault, and allowed the rifle platoon to which it was attached time to reorganize, assume positions on and hold the high ground gained during the day.

1945 - Wyomia Tyus’ birthday, Afro-American U.S. sprinter who was the first person to win Olympic gold medals in back-to-back competitions: the 100m dash in 1964 and in 1968, setting a new world's record the second time.

http://search.eb.com/blackhistory/micro/610/19.html

1946 – One of the battleships damaged at Pearl Harbor, USS Nevada, was decommissioned by the US Navy.

1948 - In St. Louis, Jackie Robinson hits for the cycle, drives in two runs, scores three times and steals a base helping the Dodgers to beat the Cardinals, 12-7.

1948 - Carol Bartz’ birthday, American CEO and chair of Autodesk, once one of the world's largest manufacturers of computer-design software. Only 2 percent of technology company chief executives are women. As CEO of Autodesk, Carol Bartz ran the fourth largest PC software company in the world, with 3 million customers in nearly 140 countries. She was also a strong role model for other aspiring women in the software Industry. Bartz led the effort to re-architect Autodesk's flagship product AutoCAD, and led the corporation towards further innovation and diversification of its product line.

http://usa.autodesk.com/adsk/servlet/item?id=348263&siteID=123112

1953 - Birthday of American composer William Copper, Virginia.

1954 - Birthday of Flora “Flo” Hyman, volleyball player, born at Inglewood, CA. Hyman stood 6’5” and was regarded as the best player in the US, starring on the 1984 Olympic team that won the silver medal. She suffered from Morfan’s syndrome, a hidden congenital aorta disorder. Died at Matsue, Japan, Jan 24, 1985.

http://sportsillustrated.cnn.com/siforwomen/top_100/69/

1954 - San Francisco International Airport (SFO) opens. It has been continually “under construction” since this date. San Francisco has had at least three airports within the city limits during the twentieth century. Crissy Field at the Presidio dates from World War I, the Marina Flying Field from 1915, and the late 1930s saw development of the Seaplane Harbor at Treasure Island. Ingleside racetrack was also used for aviation purposes in the early part of the twentieth century. Commercial and general aviation ultimately moved to Mills Field in San Mateo County in the 1930s, which originally was temporary as the originally international airport was to be built on Treasure Island. Crissy Field at the Presidio was the last airport within the city, and ended limited operations in the 1980s.

http://www.sfmuseum.org/hist/airport.html

http://www.sfmuseum.org/hist2/airfield.html

http://www.san-francisco-sfo.com/

http://www.worldairportguide.com/Airports/sfo/sfo.asp

1956 - Top Hits

“My Prayer” - The Platters

“Hound Dog/Don’t Be Cruel” - Elvis Presley

“Allegheny Moon” - Patti Page

“I Walk the Line” - Johnny Cash

1958 - Air Force Academy moved from Denver to its present site in Colorado Springs, Colorado.

1958 – Birthday of singer/dancer Michael (Joe) Jackson (‘King of Pop’), Gary, Indiana. Joined the family act, The Jackson Five, in 1964 and started his solo career in 1971. “I Want You Back,” “ABC,” “The Love You Save,” “ I’ll Be There,” solo: Ben; Grammy Award: Don’t Stop ’Til You Get Enough [1979]; 5 Grammy Awards in 1983: “Thriller,” ”Billie Jean,” “E.T.: The Extra-Terrestrial;” 2 in 1984: ”Beat It”; another in 1985 [w/Lionel Richie]: “We are the World”); 1989 Best Music Video/Short Form Grammy: “Leave Me Alone”; “The Legend,” Award Grammy; “The Girl is Mine”, “Stay, Stay, Stay” [w/Paul McCartney], “I Just Can’t Stop Loving You” [w/Siedah Garrett], Rock with You, Bad, Smooth Criminal, Ease on Down the Road [w/Diana Ross - from Broadway’s The Wiz]; Captain Eo in Epcot Center’s multimedia show; married and divorced Lisa Marie Presley; inducted into Rock and Roll Hall of Fame Mar 19, 2001. Died from an overdose after cardiac arrest in June 25, 2009.

1958 - Alan Freed's "Big Beat Show" opens at the Fox Theatre in Brooklyn. The usual venue, The Paramount, is vacated because management didn't like the fact there was a riot after Freed's Boston concert. The opener in Brooklyn brought in $200,000 and those performing included Frankie Avalon, Jimmy Clanton, Bobby Freeman, the Elegants, Bill Haley & the Comets and Chuck Berry.

1958 - John Lennon and Paul McCartney of a Liverpool band called the Quarrymen, welcome George Harrison to the group.

1959 - Horace Silver Quintet records “Blowin’ the Blues Away.”

1960 - Birthday of American composer William Susman, Chicago, IL.

1962 - Malvin Russell “Mel” Goode of Pittsburgh, PA, became the first African-American to be a television news commentator when he was assigned by WABC-TV to the United Nations staff, New York City.

1962 - Elvis' tenth movie, “Kid Galahad”, opens in US theaters, featuring the King as an amateur boxer. Charles Bronson also stars.

1962 - Hackberry, LA, was deluged with twenty-two inches of rain in 24 hours, establishing a state record.

1964 - Top Hits

“Where Did Our Love Go” - The Supremes

“The House of the Rising Sun” - The Animals

“C’mon and Swim” - Bobby Freeman

“I Guess I’m Crazy” - Jim Reeves

1964 - Walt Disney's supercalifragilisticexpialidocious "Mary Poppins" released. http://us.imdb.com/Details?0058331

1964 - Roy Orbison’s "Oh, Pretty Woman" was released. It hit number one (for 3 weeks) on September 26th and became the biggest of his career. "Oh, Pretty Woman" was Orbison’s second #1 hit. The other was "Running Scared" (6/05/61).

1964 - In a clear case of rock and roll being saved by the British Invasion, Billboard magazine notes that guitar sales are the highest they've been since the advent of Elvis Presley.

1965 – San Francisco Giant Willie Mays breaks former Pirate Ralph Kiner’s record for home runs in the month of August when the 'Say Hey Kid' connects for his 17th round tripper in an 8-3 victory over the Mets.

1965 - Cool wave brought 2.5 inches of snow to Mt. Washington for an August record. It reached 25 in Vermont, the earliest freeze on record in many locations.

1965 - The Gemini V spacecraft returns to Earth.

1966 - The Beatles performed at Candlestick Park in San Francisco, CA. It was the group’s last live appearance before they disbanded in 1970. Also appearing were The Ronettes and the Remains. Ticket purchases by mail were available from KYA, No. 1 Nob Hill Circle, San Francisco

http://www.televideos.com/prod01.htm

1966 - The last episode of ABC-TV's musical variety show “Hullabaloo” airs, featuring guest stars Lesley Gore, Paul Anka, Peter and Gordon, and The Cyrkle.

1967 - Final TV episode of "The Fugitive". The series originally started on September, 1963. Dr. Richard Kimble (David Janssen) was wrongly convicted and sentenced to death for his wife’s murder, but escaped from his captors in a train wreck. This popular program aired for four years detailing Kimble’s search for the one-armed man (Bill Raisch) who had killed his wife, Helen (Diane Brewster). In the meantime, Kimble himself, was being pursued by Lieutenant Phillip Gerard (Barry Morse). The final episode aired this day in 1967 featured Kimble extracting a confession from the one-armed man as they struggled from the heights of a water tower in a deserted amusement park. That single episode was the highest-rated show ever broadcast until 1975. The TV series generated a hit movie in 1993 with Harrison Ford as Kimble and Oscar-winner Tommy Lee Jones as Gerard. (Feb. 28, 1983: “M*A*S*H”, concluding a run of 255 episodes, this 2 ½ hour finale became the most-watched television show at that time---77 percent of the viewing public was tuned in. “Cheers’” last episode on August 19, 1993 did not beat this rating nor did “Seinfield’s” last on May 14, 1998 nor did my most favorite show, “Mad About You.” on May 24, 1999.

http://www.tvtome.com/MadAboutYou/

(Helen Hunt and co-star, Paul Reiser, were both given $1,000,000 per episode salaries for the 1999 TV season of "Mad About You".)

1967 – At a time when they scheduled doubleheaders in Major League Baseball, the Yankees and the Red Sox played the longest in Yankees’ history. Red Sox take the 1st game 2-1 in 9, Yankees win 2nd game in 20 innings, 4-3, taking a total of 8 hours and 19 minutes.

1968 - Democratic Party National Convention: Antiwar protesters clashed with police and national guardsmen in the streets outside, and hundreds of people, including innocent bystanders and members of the press, were brutally beaten by Chicago’s finest.

1968 - Cream and Electric Flag opened at Fillmore West, San Francisco.

1969 - To compete with Johnny Carson (NBC) and Joey Bishop (ABC), CBS-TV presented Merv Griffin on late-night TV. Johnny ruled -- staying on top for almost 23 years to come.

1970 – Chicano Moratorium against the Vietnam War was staged in East Los Angeles. Police riot kills three people, including journalist Ruben Salazar.

.1971 - Hank Aaron became the first baseball player in the National League to drive in 100 or more runs in each of 11 seasons.

1971 - No. 1 Billboard Pop Hit: “Uncle Albert/Admiral Halsey,'' Paul & Linda McCartney. McCartney had a real Uncle Albert, who he said would quote the Bible when he got drunk.

1972 - Top Hits

“Brandy (You’re a Fine Girl)” - Looking Glass

“Alone Again (Naturally)” - Gilbert O’Sullivan

“Long Cool Woman (In a Black Dress)” - The Hollies

“If You Leave Me Tonight I’ll Cry” - Jerry Wallace

1972 - President Richard Nixon announced that a White House investigation of the Watergate break-in, conducted by White House counsel John Dean, revealed that administration officials were not involved in the burglary.

1974 - 600 Catholic nuns adopt a resolution calling for the ordination of women priests in the Roman Catholic Church.

1974 - Moses Malone became the first basketball player to jump from high school to professional basketball, skipping college to sign a contract with the Utah Stars of the ABA.

1977 - Lou Brock stole the 893rd base of his career, surpassing Ty Cobb’s modern record for career stolen bases. Ricky Henderson in 1982 breaks Brock’s for stealing the most bases in one season with 122.

1979 - Sheridan Broadcasting Corp purchases Mutual Black Network, making it the first completely Black-owned radio network in the world.

1980 - Top Hits

“Magic” - Olivia Newton-John

“Sailing” - Christopher Cross

“Take Your Time (Do It Right)” - The S.O.S. Band

“Drivin’ My Life Away” - Eddie Rabbitt

1981 - The Pretenders "II" LP enters the chart.

1981 - The soundtrack to the film, "Heavy Metal" enters the album charts. The LP features tracks by Stevie Nicks, Cheap Trick, Devo and Sammy Hagar.

1982 - No. 1 Billboard Pop Hit: “Abracadabra,'' Steve Miller Band.

1984 - Edwin Moses won the 400-meter hurdles in track competition in Europe. It was the track star’s 108th consecutive victory.

1984 - High temperature at Topeka, KS reaches 110 degrees for the first time since the dust bowl of the 30's.

1986 - The former "American Bandstand" studio, at the original home of WFIL-TV in Philadelphia, PA, was placed on the National Register of Historic Places. The studio is located at 4548 Market Street.

1987 - Los Lobos' remake of Ritchie Valens' 1959 classic, "La Bamba" hits #1 on the pop singles chart and stays there for three weeks.

1987 – Nolan Ryan passes the 200 strikeout mark in a season for a record eleventh time.

1987 - Some of the most powerful thunderstorms in several years developed over the piedmont of North Carolina, and marched across central sections of the state during the late afternoon and evening hours. Baseball size hail was reported around Albemarle, while thunderstorm winds downed giant trees around High Falls.

1988 - Cool air invaded the north central U.S. Ten cities reported record low temperatures for the date, including Bismarck, ND with a reading of 33 degrees. Deerfield, a small town in the Black Hills of South Dakota, reported a low of 23 degrees. The remnants of Tropical Storm Chris drenched eastern Pennsylvania with up to five and a half inches of rain, and produced high winds which gusted to 90 mph, severely damaging a hundred boats in Anne Arundel County, MD.

1988 - Top Hits

“Monkey” - George Michael

“I Don’t Wanna to Go on with You like That” - Elton John

“I Don’t Wanna Live Without Your Love” - Chicago

“The Wanderer” - Eddie Rabbitt

1989 - In a special election, Ileana Rose Lehtinen (R-FL) becomes the first Cuban-American elected to the U.S. Congress.

1990 - Saddam Hussein declares America can't beat Iraq. By the end of 1990, 580,000 Iraqi troops were believed to be in Kuwait or southern Iraq. Facing them were 485,000 troops of 17 allied countries. Earlier, on August 10 at a meeting in Cairo, only 12 of the 21 member nations of the Arab League voted to support American troops.

1991 - The Soviet Communist Party suspended parliament, thus ending a 75-year control of the USSR. Democratic change was sought and the struggle still continues today, perhaps ending the hunt in the United States to “halt” communism. Capitalism won out but we must wait to see what President Putin has in mind for the second coming of the USSR.

1992 – Guns 'n' Roses’ "November Rain" peaks at #3 on the pop singles chart.

1994 - Viacom Inc. announced the purchase of Blockbuster Entertainment Corp., the video rental store giant, for $8 billion.

1998 - Top Hits

“I Don’t Want To Miss A Thing”- Aerosmith

“The First Night”- Monica

“Crush”- Jennifer Paige

“My Way”- Usher

2002 - To show their displeasure about tomorrow's impending strike, fans at Devil Ray-Angel game begin throwing foul balls back onto the field at Edison Field and over 100 people are ejected for throwing trash. New words are added to the traditional seventh-inning rendition of "Take Me Out to the Ballgame" as many of the fans in attendance begin to chant, "Don't strike! Don't strike! Don't strike!"