Information, news, and entertainment for the commercial

alternate financing,

bank, finance and leasing industries

Add me to mailing list

| Search | All Lists | Columnists | Site Map

Advertising| Archives | Classified Ads | This Day In American History

Email the Editor

![]()

Wednesday, December 9, 2020

Today's Leasing News Headlines

Dr. Geller Reports 50% decrease Money Anxiety

Propelled the Market by 50%

October, 2020 - The List

The Good, the Band, and the Ugly

Bad Guys: Companies who utilize Evergreen Clauses

for Extra Lease Payments

Leasing Industry Positions Available

---Now Hiring

Forward with Determination!

Sales Makes it Happen by Scott Wheeler, CLFP

Lessors, Put Your Seatbelts On!

"Final Rules" in Collection Procedures

By: Edward P Kaye, Esq. and Sloan Schickler, Esq.

Four Hour Funding: A Message

From Our President, John Boettigheimer

First Credit Card Debt Reduction in 35 Years

Cities with Least Sustainable Debt

WalletHub Reports

Labrador Retriever

Plano, Texas Adopt a Dog

Ralph Petta, President and CEO

Message to Equipment Leasing & Finance Association Members

News Briefs---

Fauci says Covid-19 could be under control in ‘back half of 2021

’ if enough people are vaccinated

Pfizer’s Vaccine Offers Strong Protection After First Dose

worked well regardless of a volunteer’s race, weight or age

COVID-19 unemployment scam could hit $2 billion,

bank tells California lawmakers

‘The business is going to die.’ Sacramento hair and nail salons

brace for COVID-19 shutdown

COVID-19 Restaurant Impact Survey Oct. 2019/2020

National Restaurant Association, (three pages)

Boeing reports more 737 Max cancellations

as airlines prepare to return the plane to service

10,000 More Restaurants Have Closed in Three Months

The number is now over 100,000, reports National Restaurant Assoc.

You May have Missed---

Elon Musk confirms:

‘Yes, I have moved to Texas’

Broker/Funder/Industry Lists | Features (wrilter's columns)

Top Ten Stories Chosen by Readers | Top Stories last six months

www.leasingcomplaints.com (Be Careful of Doing Business)

www.evergreenleasingnews.org

Leasing News Icon for Android Mobile Device

Sports Brief----

California Nuts Brief---

"Gimme that Wine"

This Day in History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

######## surrounding the article denotes it is a “press release,” it was not written by Leasing News nor has the information been verified. The source noted. When an article is signed by the writer, it is considered a “byline.” It reflects the opinion and research of the writer.

[headlines]

--------------------------------------------------------------

Dr. Geller Reports 50% decrease Money Anxiety

Propelled the Market by 50%

The Theory of Money Anxiety, developed by Dr. Dan Geller, shows that when the level of money anxiety decreases, people increase their spending, which stimulates the economy and fuels the market.

The November Money Anxiety Index decreased to 74.6; a drop of 68.8 index points, or 48%, since its peak of 143.4 in April of this year. During the same time, the Dow Jones Industrial Average increased by 9,695 to 29,688 at the end of November – an increase of 49%.

The link between money anxiety and financial behavior has been established by the Money Anxiety Theory and published in the Journal of Applied Business and Economics.

drgeller@analyticom.com

www.analyticom.com+

[headlines]

--------------------------------------------------------------

October, 2020 - The List

The Good, the Band, and the Ugly

Marlin Reports Third Quarter Net Income $2.7 Million

Origination Volume $68.5 Million, Down 66% from Last Year

http://leasingnews.org/archives/Oct2020/10_30.htm#marlin

Fourth & Reportedly Last Call for Comments on SB 1235

California Commercial Financing Disclosures

Today, October 28, 2020

http://leasingnews.org/archives/Oct2020/10_28.htm#fourth

Computing Interest Rates Programs

For Possible SB 1235 Use in California and Elsewhere

http://leasingnews.org/archives/Oct2020/10_28.htm#computing

Independents 3rd Q Reports to Leasing News Confirm

ELFA MLFI-25 Reporting September up 24%

Over August New Business

http://leasingnews.org/archives/Oct2020/10_26.htm#elfa

One of the Banks Caught in a $2B Check Kiting Scheme,

Almena State Bank of Almena, Kansas is Closed; Equity Bank

of Andover, Kansas Assumes All of the Deposits

http://leasingnews.org/archives/Oct2020/10_26.htm#banks

Colorado Fires, Smoke and Ash

Report from Gary Souverein, President, Pawnee Leasing

http://leasingnews.org/archives/Oct2020/10_23.htm#colorado

First Citizens to Buy CIT Group

in an all-stock deal valued at roughly $2.2 billion

https://www.marketscreener.com/quote/stock/FIRST-CITIZENS-BANCSHARES-9272/news/First-Citizens-to-Buy-CIT-Group-3rd-Update-31555331/.

Partners Capital Group Will Join

Companies who utilize Evergreen Clauses

for Extra Lease Payments

http://leasingnews.org/archives/Oct2020/10_13.htm#partners

North Mill Hits New Record in 2020, 20% Higher than Last Year

Originations just under $50 Million. FICO Average 720

http://leasingnews.org/archives/Oct2020/10_05.htm#north

[headlines]

--------------------------------------------------------------

Bad Guys: Companies who utilize Evergreen Clauses

for Extra Lease Payments

These companies use language in their lease documents regarding purchase options to confuse, perhaps to deceive, resulting in an automatic continuation for an additional twelve months of payments. Often they win transactions with lower monthly payments as the lessee does not carefully read and prepare for the end-of-lease notification requirement (many are on ACH payments).

Several have continuation of payments and the requirement of replacing the equipment for a new lease. Leasing News has had complaints involving companies who invoke the twelve months on a $1.00 purchase option, as well as on an Equipment Finance Agreements.

Several have appeared in Leasing News "Complaints" Bulletin Board:

http://www.leasingnews.org/bulletin_board.htm

Additionally, Tom McCurnin has written often about Evergreen Clause court cases involving these companies.

http://www.leasingnews.org/Conscious-Top%20Stories/leasing_cases.html

Two of the companies on this list do a lot of copier leasing, where it is reported manufacturers are now getting a piece of auto-renewals and as well as insisting that they be in the lease as a condition of the business. Leasing News has heard from a very reliable source that some copier manufacturers also give dealers 4-5 months’ notice of a discontinued model and agree to sell it to the dealer at 40% of list price, on the condition that the captive finance division not receive the business. Also buried in the contract on one is a one month rental return fee including an inspection fee at the location specified by lessor and at lessee’s return expense (often not the local dealer who supplied the copier).

Advice for Broker or Lessor

Dealing with a Company that Uses Evergreen Clauses

http://leasingnews.org/archives/Nov2013/11_18.htm#advice

Complaints on Extra Payments

ACC Capital, Midvale, Utah

De Lage Landen, Wayne, Pennsylvania

IFC Credit, Morton Grove, Illinois

Jules and Associates, Los Angeles, California

LEAF Financial Group, Philadelphia, Pennsylvania

Marlin Business Leasing, Mount Laurel, New Jersey

Marquette Equipment Finance, Midvale, Utah

Mazuma Capital Corporation, Draper, Utah

Onset Financial, South Jordan, Utah

Pacific Western Equipment Finance, Cottonwood Heights, Utah

Partners Capital Group, Santa Ana, California

Republic Bank, Bountiful, Utah

Tetra Financial Group, Salt Lake City, Utah

Winthrop Resources, Minnetonka, Minnesota

ACC Capital, Midvale, Utah---This company is no longer in business, although its portfolio is being wound down, according to its owner Loni Lowder; the receivables are being collected by creditors. Lowder today is an employee, manager, Stalwart Contract Finance, Salt Lake City, Utah. All Evergreen Clause complaints have not been satisfied, but were when the company was active.

De Lage Landen, Wayne, Pennsylvania -- $34,560 in lease payments were collected illegally, although the lease contract had an Evergreen clause that if the lessee did not notify in 90 days before expiration, the payments would continue. It appears this went on for almost three years. The purchase option was 10%.

What makes it even more shameless is a collection agency was involved after payments stopped, but wait, it gets worse: the lessee has settled with the funder and the funder's collection agency, but the lessor, who sold the lease to the funder, De Lage Landen (DLL,) remains in the suit as being party, or “in collusion,” with the Evergreen clause collection matter. The fact is the lessor was not directly involved in the collection of payments or received any remuneration, as well as the suit continues, now solely against the lessor.

http://leasingnews.org/archives/Nov2013/11_18.htm#dll

IFC Credit, Morton Grove, Illinois---This company is in bankruptcy, appeared many times in the Leasing News Bulletin Board prior to filing bankruptcy, but engaged in Evergreen Clauses, and unfortunately a recent example is a complaint to the trustee, stemming from M&T Bank lease assignment expiring and notify the lessee that they did not notify about the residual, which was a $1.00. This has happened many times with other banks who have taken over the IFC Credit Corporation portfolio. This company is no longer in business.

Jules and Associates, Los Angeles, California--- Jules and Associates, Los Angeles, California---A repeat customer, who notified Jules and Associates on a lease, but was not before the 180 day expiration, so Jules and Associates instead of the 1% due for the residual ($2,308.79) charged six more payments or $40,463.94, and if 1% is not paid in this time, they will be subject to another three months.

http://leasingnews.org/archives/Aug2011/8_29.htm#jules

LEAF Financial Group, Philadelphia, Pennsylvania--- There have been complaints about the Evergreen Clause, including one this year for an Equipment Finance Agreement.

People's United Bank, N.A., Bridgeport, Connecticut, purchased LEAF Commercial Credit. Crit DeMent became Chairman and CEO. LEAF Financial Group, Philadelphia, Pennsylvania. https://www.prnewswire.com/news-releases/peoples-united-bank-acquires-leaf-commercial-capital-inc-one-of-the-largest-independent-commercial-equipment-finance-companies-in-the-us-300490921.html

Marlin Business Leasing, Mount Laurel, New Jersey---The actual SEC filings state the profit earned from Evergreen Clause, primarily from copier leases. Bulletin Board Complaints have been received about this practice in addition to the SEC financial statement filings. (9) Marlin Response to posting

Marquette Equipment Finance, Midvale, Utah --- According to Dorran Sampson, Vice-President/Broker Relations: "Marquette Equipment Finance does not offer an Evergreen product. Our master lease provides for extensions but is negotiated at the schedule level. Notice periods are also negotiated at the schedule level and vary depending on the Lessee’s needs."

When the company was bought and became Pacific Western Equipment Finance (a division of Pacific Western Bank) he maintained the same position. It was noted his old company was still on the list, and a request of his "master lease" was made.

"Our docs are the same as when we were with Marquette. Because we’re public now, it is very difficult to get documents released."

I asked him if he could send to a broker wanting to do business with him, "Sorry, can’t forward to you or your brokerage."

A search of PACER, a national index for U.S. district, bankruptcy and appellate courts brought up a number of Marquette cases, and the first one hit pay dirt: Merchants & Farmers Bank, a Mississippi Corporation versus Marquette Equipment Finance and Applied Financial. It was a similar case and while "dismissed with prejudice" (6), it had the arguments regarding the purchase option and a copy of the complete contract with a similar PPR as with Mazuma Capital:

"(g) Lessee's Options at End of Initial Period. At the end of the Initial Period of any Lease, Lessee shall, provided at least one-hundred-eighty (180) days prior written notice is received by Lessor from Lessee via certified mail, do one of the following: (1) purchase the Property for a price to be determined by Lessor and Lessee, (2) extend the Lease for twelve (12) additional months at the rate specified on the respective Schedule, or (3) return the Property to Lessor at Lessee's expense to a destination within the continental United States specified by Lessor and terminate the Schedule; provided, however, that for option (3) to apply, all accrued but unpaid late charges, interest, taxes, penalties, and any and all other sums due and owing under the Schedule must first be paid in full, the provisions of Sections 6(c) and (d) and 7(c) hereof must be specifically complied with, and Lessee must enter into a new Schedule with Lessor to lease Property which replaces the Property listed on the old Schedule. With respect to options (1) and (3), each party shall have the right in its absolute and sole discretion to accept or reject any terms of purchase or of any new Schedule, as applicable. In the event Lessor and Lessee have not agreed to either option (1) or (3) by the end of the Initial Period or if Lessee fails to give written notice of its option via certified mail at least one-hundred-eighty (180) days prior to the termination of the Initial Period, then option (2) shall apply at the end of the Initial Period. At the end of the extension period provided for in option (2) above, the Lease shall continue in effect at the rate specified in the respective Schedule for successive periods of six (6) months each subject to termination at the end of any such successive six-month renewal period by either Lessor or Lessee giving to the other party at least ninety (90) days prior written notice of termination."

The first option is to purchase the equipment for a price to be determined by Lessor and Lessee and requires a certified letter 180 days prior. This sounds like a fair market purchase option, but the “price to be determined” language means that the Lessor can set any price it wants. This option is illusory in my opinion.

The second option is to continue the lease for an additional 12 months, the “Evergreen” period. No notice of this provision is given to the lessee either in advance of signing or prior to exercising this option. Republic Bank purchases these 12 month extensions in advance of their exercise. How would the bank know that the lessee is going to exercise this option, unless everyone knows it is the only practical option for the lessee to exercise? Republic Bank President Boyd Lindquist confirmed in a telephone call that he “buys” these extensions from Mazuma and has for quite some time.

The third option is to return the equipment, but the clause is draped with the condition that the lessee has to re-lease identical equipment for a similar term. It also has 180 day certified letter requirement, and applies to the second option of 12 months, but also has the clause of an automatic six month option. So what is the point of exercising this option? At the end of this re-lease, there would be the same three identical options, so the lessee would be required to re-lease and re-lease. It’s just like Groundhog Day.

Leasing News is working on obtaining information on other companies so named to add to the list, including follow-up on the master lease for Pacific Western Equipment Finance. If you have a copy, please send and will keep your name “off the record.”

((7) See for Copy of Filing, including contract.)

Mazuma Capital Corp, Draper, Utah Several routie "end of lease agreements, as alleged in Unified Container and Anderson Dairy (1) "8. The basic scheme involves the inclusion of a purchase, renewal, return (“PRR”) provision in the lease. The lessor assures the customer they will be able to purchase the equipment at the end of the initial term in the lease for a reasonable or nominal price. Often, the lessor promises the equipment can be purchased at a fixed percentage of the total amount financed. However, at the end of the initial lease term, the lessor refuses to honor the agreed upon purchase price or negotiate in good faith regarding a purchase price, but instead, insists the lease automatically renews for an additional term (usually twelve months).

9. The inclusion of the purchase and return options in the lease are entirely illusory and intended only to give the customer the false impression that it can exercise any of the three options at the end of the initial lease term, when in fact, the lessor will only allow an automatic renewal at the end of the initial lease term.) There are other exhibits. This case was settled "out of court."

(page 3)

H. Jared Belnap, President & CEO, Mazuma Capital Corp., takes exception on beingon the Evergreen list. His full letter and Leasing News Response is at (5).

Mazuma Capital was acquired by Onset Financial, South Jordan, Utah.

Onset Financial, South Jordan, Utah --- Onset contract, which contained:

“(Section 20:

n. Lessee's Options at Maturity of Base Period. At the maturity of the Base Period of any Lease, Lessee shall, provided at least one hundred fifty (150) days prior written notice is received by Lessor from Lessee via certified mail, do one of the following: (1) purchase the Property for a price to be determined by Lessor end Lessee, (2) renew the Lease for twelve (12) additional months at the rate specified on the respective Schedule, or (3) terminate the Schedule and return the Properly to Lessor at Lessee's expense to a destination within the continental United States specified by Lessor; provided, however, that for option (3) to apply, all accrued but unpaid late charges, interest, taxes, penalties, and any and all other sums due and owing under the Schedule must first be paid in full, the provisions of Sections 8f, 8g and 7d hereof must be specifically complied with, and Lessee must enter into a new Schedule with Lessor to lease Property which replaces the Property listed on the old Schedule. With respect to options (1) and (3), each party shall have the right in its absolute and sole discretion to accept or reject any terms of purchase or of any new Schedule, as applicable. In the event Lessor end Lessee have not agreed to either option (1) or (3) by the maturity of the Base Period, or if Lessee fails to give written notice of Its option via certified mail at least one hundred fifty (150) days prior to the maturity of the Base Period, or if an Event of Default has occurred under any Lease, then option (2) shall apply at the maturity of the Base Period. At the maturity of the renewal period provided for In option (2) above, the Lease shall continue in effect at the rate specified in the respective Schedule for successive periods of six (6) months each subject to termination at the maturity of any such successive six-month renewal period by either Lessor or Lessee giving to the other party at best thirty (30) days prior written notice of termination." (3)

((8) See for Copy of Onset Contract with PPR purchase option.

Pacific Western Equipment Finance, Cottonwood Heights, Utah

Dorran Sampson, then Vice-President/Broker Relations, Marquette Equipment Finance, now Vice President Broker Relations Pacific Western Equipment Finance told Leasing News when the company was bought and became Pacific Western Equipment Finance (a division of Pacific Western Bank) they maintained the same position as Marquette.

"Our docs are the same as when we were with Marquette. Because we’re public now, it is very difficult to get documents released."

I asked him if he could send to a broker wanting to do business with him, "Sorry, can’t forward to you or your brokerage.

Leasing News has obtained a copy of a Pacific Western Equipment Finance agreement, and confirms the same procedures as their former company Marquette utilized:

“14. LESSEE’S OPTIONS AT END OF INITIAL PERIOD.

At the end of the Initial Period of any Lease, Lessee shall, provided at least one-hundred-eighty (180) days prior written notice is received by Lessor from Lessee via certified mail, do one of the following: (1) purchase the Property for a price to be determined by Lessor and Lessee, (2) extend the Lease for twelve (12) additional months at the rate specified on the respective Schedule, or (3) return the Property to Lessor at Lessee’s expense to a destination within the continental United States specified by Lessor and terminate the Schedule; provided, however, that for option (3) to apply, all accrued but unpaid late charges, interest, taxes, penalties, and any and all other sums due and owing under the Schedule must first be paid in full, the provisions of Sections 6(c) and (d) and 7(c) hereof must be specifically complied with, and Lessee must enter into a new Schedule with Lessor to lease Property which replaces the Property listed on the old Schedule. With respect to options (1) and (3), each party shall have the right in its absolute and sole discretion to accept or reject any terms of purchase or of any new Schedule, as applicable. IN THE EVENT LESSOR AND LESSEE HAVE NOT AGREED TO EITHER OPTION (1) OR (3) BY THE END OF THE INITIAL PERIOD OR IF LESSEE FAILS TO GIVE WRITTEN NOTICE OF ITS OPTION VIA CERTIFIED MAIL AT LEAST ONE-HUNDRED-EIGHTY (180) DAYS PRIOR TO THE TERMINATION OF THE INITIAL PERIOD, THEN OPTION (2) SHALL APPLY AT THE END OF THE INITIAL PERIOD. At the end of the extension period provided for in option (2) above, the Lease shall continue in effect at the rate specified in the respective Schedule for successive periods of six (6) months each subject to termination at the end of any such successive six (6) month renewal period by either Lessor or Lessee giving to the other party at least thirty (30) days prior written notice of termination” (10) (Also see Marquette listing)

(10) http://leasingnews.org/PDF/PacificWesternEquipmentFinance.pdf

Pacific Western Bank Responds to Evergreen Non-Notification

http://leasingnews.org/archives/Mar2013/3_28.htm#pacwest

Was formerly Marquette Equipment Finance. BofI Acquires Certain Assets of Pacific Western Equipment Finance. “The Bank acquired certain assets and will operate on an ongoing basis the equipment lending operations of EQF as follows: The Bank acquired approximately $140 million of equipment leases diversified across 36 states and Canada and over 50 industries

The Bank will retain approximately 25 existing employees, including EQF’s entire senior management team

The EQF team will become a part of the Bank’s C&I lending group and continue to conduct equipment lending operations at existing loan production and servicing office in Utah

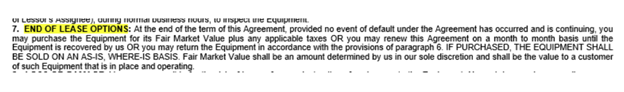

Partners Capital Grouputilizes theWintergreen Clause, an offshoot of the Evergreen Clause. Instead of an automatic 12-month renewal clause, the payments continue until the purchase option is received or release of the contract by the return of the equipment in satisfactory order is confirmed by the lessor.

Pacific Capital Group originally responded:

“Here: is the language in our docs and below that the letter we mail every customer at the end of term. We don't require any notification or any kind nor do we charge any processing fees:”

In reviewing this, Leasing News responded, "It is not mailed 90 days in advance of the termination, as well as it does not state what the "fair market value" is, or how the "fair market value" is obtained. It is basically a “Wintergreen lease termination."

The company response:

- We notify every customer via the letter below prior to the expiration of their lease.

- We always give our customers the option of buying, returning or going month-to-month after their initial lease term has been paid and we start the conversation months before the termination date.

- We do not require any written notice nor do we require “must be given no sooner than 180 days prior to the expiration” or “must be given within 90 days of lease termination” like others in our industry. We are easy. We notify our customers well in advance and they can call, email or communicate with us in any way they want and at any time during or after their initial lease period.

- A good percentage of our customers do not want and do not use the equipment any longer. If our asset dept. deems the equipment has value, we will have it shipped to a remarketer to be sold, and if it has no value, we charge nothing. We do not bill the customer for any payments.

- A good percentage of our leases are originated though vendor programs where we notify the vendor that our mutual customer has equipment on a lease that is maturing. Most of the time the vendor is able to lease the customer a new machine and they take the old machine in as a trade. We are happy to write a new lease as it’s a “win win win” for all of us.

For those customers who do still use the equipment and do not want to trade it in, our asset department will reach out to the original vendor and maybe a few others to get a value on the asset. Customer has the option to purchase the equipment at the “Fair Market Value” or simply return it.

90% of all our business comes from vendors, the remaining 10% is repeat customers. We must do all we can before, during and after every lease and loan to make sure all our customers are happy because if we have just one upset customer for any reason, the vendor is going to hear about it and we do not want to lose a vendor program over a billing issue.

Republic Bank, Bountiful, Utah Purchases and participates in extended Evergreen clause agreements.

They are legal in all states, except four states require advance notification be given to the lessee regarding termination of the lease and its residual (Four states: New York Rhode Island, Texas, Illinois (In Illinois, Consumer law, but may affect commercial, especially a proprietorship, partnership or personal guarantee)"

Tetra Financial Group, Salt Lake City, Utah Several routine "end of lease agreements, as alleged in Unified Container and Anderson Dairy (1)

“22. Mazuma Capital is associated with Republic Bank and obtains financing for its leases containing PRR provisions from Republic Bank.

23. Like what took place at Amplicon, Inc., the PRR scheme utilized by Matrix, Applied Financial, LLC, Mazuma Capital, Tetra Financial Group, LLC and others has begun to be exposed through litigation and negative press. See Deseret News (2) articles attached hereto as Exhibits B (2) and C. (3)”

Here is a case where New York courts threw out the Evergreen Clause as not legal in New York, even though venue appears to be Utah. (4))

(1) 36 main pdf

http://leasingnews.org/PDF/36main.pdf

(2) Deseret News

http://leasingnews.org/PDF/DeseretNewsarticle.pdf

(3) Exhibit C

http://leasingnews.org/PDF/ExhibitCDeseret.pdf

(4) Salon Management case

http://leasingnews.org/PDF/SalonManagement.pdf

(5) Mazuma Takes Exception on Being on Evergreen List

http://leasingnews.org/archives/Jul2012/7_30.htm#mazuma

(6) Order to Dismiss with Prejudice

http://leasingnews.org/PDF/Marquette_order_dismiss.pdf

(7) Copy of filing, including contract

http://leasingnews.org/PDF/Maquette.pdf

(8) Copy of Onset Contract with PPR purchase option

http://leasingnews.org/PDF/OnsetContract.pdf

(9) Marlin Response to posting.

http://leasingnews.org/archives/Jul2012/7_13.htm#response

Companies who notify lessee in advance of lease expiration

http://www.leasingnews.org/Pages/lease_expiration.html

[headlines]

--------------------------------------------------------------

[headlines]

--------------------------------------------------------------

Sales Makes it Happen by Scott Wheeler, CLFP

In business, professionals and organizations are either moving forward or falling behind. There is no status quo. The markets are constantly changing. Top originators are constantly looking forward, building new relationships, and improving their position within the market. Successful originators are willing to put themselves out in front of their competition knowing that success requires hard work and never accepting the status quo - there is always the next level of success.

In recent conversations with top originators, they have expressed optimism about their path forward with the following comments:

- "I had to re-invent myself in 2020; I needed to pivot because of COVID-19. The extra effort has paid off. I have developed new relationships with stronger end-users and my production is rising significantly. I expect 2021 to be one of my strongest production years based upon my current relationships and database of strong prospects. I am having fun re-positioning for future success."

- "The competition has changed significantly in the last six months. Competition is fierce. I have developed a few "key" vendor accounts won from institutional competitors. These vendors fell out of favor with the larger finance companies because of reduced activity. However, their activity was significant for me and my company. I was able to develop programs that satisfied the vendors' needs and created significant flow business for me and my company. I am excited to develop more of these programs for additional vendors in the coming months."

- "My team of originators is working harder and smarter than ever. They have taken our company to a new level. We are winning larger transactions with stronger credits because the team is talking to more of the "right" prospects. The company's tracking system and pre-qualifying tools are allowing our originators to focus on the "right" prospects that need our products. The originators are excited to present our products because success breeds success."

The above comments reflect the results of forward-thinking originators and companies that are moving ahead with determination, purpose, and a plan for success.

Order via Amazon: https://www.createspace.com/5355516

Scott A. Wheeler, CLFP

Wheeler Business Consulting

1314 Marquis Ct.

Fallston, Maryland 21047

Phone: 410 877 0428

Fax: 410 877 8161

Email: scott@wheelerbusinessconsulting.com

Web: www.wheelerbusinessconsulting.com

Sales Makes it Happen articles:

http://www.leasingnews.org/Legacy/index.htm

[headlines]

--------------------------------------------------------------

Lessors, Put Your Seatbelts On!

"Final Rules" in Collection Procedures

By: Edward P Kaye, Esq. and Sloan Schickler, Esq.

The Consumer Financial Protection Bureau (CFPB) recently finalized its much anticipated “Final Rule,” a significant 653-page update to the decades old Federal Debt Collections Practices Act (FDCPA or Act). Most importantly, the rule provides far reaching guidelines on how and when debt collectors can communicate with their consumer debtors and clarifies prohibitions against harassment and abuse, false or misleading representations and unfair practices.

The FDCPA was originally passed by Congress in 1977, long before email, texting, and social media were commonplace. The Act did not contemplate communications with debtors through Gmail, iPhone, Facebook or Twitter, to name a few. As communications technology evolved, debt collectors faced regulatory compliance issues as to what methods of communication are allowed, the time of day they are permissible, and the contents of collection messages allowed without running into the law.

The rule directly impacts third-party debt collectors, currently covered under the FDCPA, and will be a guide for both consumer and commercial lessors that want to establish best practices to collect on their own account. In either case, the rule is a game changer and will likely require any lessor (including LHPH dealers) involved in debt collection to update their collection practices and procedures to stay compliant.

The good news is the rule does not go into effect until November 30, 2021, so there is time to determine the changes to your current collection process and procedures that are necessary.

CFPB Director Kathleen L. Kraninger, commented, “With the vast changes in communications since the FDCPA was passed more than four decades ago, it is important to provide clear rules of the road.”

Lessors, put your seatbelts on!

Below are some highlights of the rule:

- Telephone Call Frequency Limits: No more than seven times within a seven-day period or within seven days after engaging in a telephone conversation with the consumer.

- Voicemail: A voicemail message must only contain a “limited-content message,” meaning the consumer’s name, a request that the consumer reply to the message, the name(s) of natural persons whom the consumer can contact to reply, a telephone number to reply to and if applicable, an opt-out notice. Adding additional information will be a violation of the rule.

- Time and Place Restrictions: Calls and messages between 8:00 a.m. and 9:00 p.m. local time at the consumer’s location is permissible. There is a prohibition against communicating at any time or place the debt collector knows or should know is inconvenient to the consumer which would include at the consumer’s place of work.

- Email: Email can be used if the consumer used the email address to communicate with the creditor, the consumer consented to the use of the email address and has not withdrawn consent. the creditor obtained the email address from the consumer, and the consumer did not ask the creditor to stop using the email address.

- Text Messages: Text messages can be used if the consumer used the phone number to communicate with the debt collector and has not opted out, and within the past 60 days either, sent a text message from that phone number; or the debt collector confirmed, using a complete and accurate database, that the phone number has not been reassigned from the consumer to another user.

- Social Media: Debt collectors are prohibited from communicating through a social media platform if the communication is viewable by the general public or the consumer’s contacts. However, there is no prohibition from sending a message through a social media platform if the message is not viewable by the general public or the person’s social media contacts.

- Opt-out: The rule requires debt collectors who communicate electronically to offer the consumer a reasonable and simple method to opt out of such communications at a specific email address or telephone number. The rule also provides that consumers may, if the debt collector communicates through electronic communications, use that medium to place a cease communication request or notify the debt collector that they refuse to pay the debt.

The final rule contains provisions on disputes, record retention and many other topics and the CFPB intends to issue a second debt collection final rule focused on consumer disclosure in December 2020. Until then, keep your seatbelts on!

The final rule can be found here:

https://files.consumerfinance.gov/f/documents/cfpb_debt-collection_final-rule_2020-10.pdf

Sloan Schickler and Ed Kaye are partners in the vehicle finance law firm, Schickler Kaye LLP (www.skfinancelaw.com). Schickler, a veteran vehicle leasing, finance, and bank attorney, has been the NVLA Legal and Legislative counsel since 2017 and currently sits on the board of directors. Kaye is the former CEO and General Counsel of a prominent independent vehicle leasing company and the immediate past president of the NVLA. He currently sits on the NVLA board of directors. Together, they provide decades of experience representing and protecting lessors and lenders in all facets of the vehicle leasing and financing business. They can be reached at ekaye@skfinancelaw.com, sschickler@skfinancelaw.com or 212-262-6400.

[headlines]

--------------------------------------------------------------

##### Press Release ############################

Four Hour Funding: A Message

From Our President, John Boettigheimer

|

|||||

|

|

||||

* See you Broker Kit for Monthly Bonus program rules.

##### Press Release ############################

[headlines]

--------------------------------------------------------------

##### Press Release ############################

First Credit Card Debt Reduction in 35 Years

Cities with Least Sustainable Debt

WalletHub Reports

Credit Card Debt Study Key Stats

- Consumers repaid more than $119 billion in credit card debt through the first three quarters of 2020 – an all-time record.

- For the first time in 35 years, consumers paid down credit card debt during the third quarter of the year.

- Credit card debt rose by $76.7 billion during 2019, and WalletHub now projects a decrease of $89 billion in 2020.

- Credit card charge-off rates are down 17.3% compared to Q2 2020.

- The best balance transfer credit cards currently offer 0% APRs for the first 12-20 months with no annual fee and balance transfer fees as low as 3%.

Least-Sustainable Credit Card Debt |

Most-Sustainable Credit Card Debt |

Magnolia, TX |

Cupertino, CA |

Park City, UT |

Sunnyvale, CA |

Cumming, GA |

Mountain View, CA |

Dahlonega, GA |

Saratoga, CA |

Jacksonville, NC |

Foster City, CA |

Richmond, TX |

Scarsdale, NY |

Leesville, LA |

Palo Alto, CA |

Cottonwood, AZ |

Los Altos, CA |

Boerne, TX |

Milpitas, CA |

Raeford, NC |

Santa Clara, CA |

Willis, TX |

Chevy Chase, MD |

Wasilla, AK |

Bronxville, NY |

Ooltewah, TN |

Fremont, CA |

Dumfries, VA |

Belmont, CA |

St. Augustine, FL |

Lexington, MA |

Hialeah, FL |

Seal Beach, CA |

Buford, GA |

Redmond, WA |

Hinesville, GA |

Dublin, CA |

Miami, FL |

Falls Church, VA |

Ewa Beach, HI |

Cambridge, MA |

“The more than $119 billion in credit card debt that U.S. consumers have repaid during the first three quarters of 2020 is actually one clear silver lining of the pandemic,” said Jill Gonzalez, WalletHub analyst. “Paying off debt is one of the best ways to pandemic-proof your finances, and too many of us were way far too overextended at this time last year, so it’s great that we’ve collectively cut back.”

How will credit card debt levels look after Q4 data comes in?

“WalletHub is projecting consumers to add about $30 billion in credit card debt during the fourth quarter of 2020, leaving us with a decrease of about $89 billion in credit card debt for the year,” said Jill Gonzalez, WalletHub analyst. “If consumers do end 2020 owing less credit card debt than they started with, it would only be the second time in at least 35 years that’s occurred, with the other time being in 2009.”

WalletHub Analyst Jill Gonzalez

### Press Release ############################

|

[headlines]

--------------------------------------------------------------

Labrador Retriever

Plano, Texas Adopt a Dog

Liv

Female

1.2 Years old

Liv is such a sweetheart! She will be your shadow all day long and loves to snuggle through the night. She is learning to play with toys, but doesn’t destroy anything. She just carries them around gently. Liv is very curious of her surroundings and especially loves to chase squirrels and rabbits! She’s on alert at the window whenever she isn’t snuggling or playing.

Liv has done very well with her potty training. There may still be an occasional accident, but she’s very smart and aims to please. She is also doing very well with Sit, Shake and Down commands and walks very well on a leash.

Liv is currently living with foster dogs and kids and gets along well with them all. She is going to bless someone’s home with so much love and fun! Will it be yours?

The Dallas Fort Worth Labrador Retriever Rescue Club, Inc. (DFWLR-RC)

Dallas Fort Worth Labrador Retriever Rescue Club, Inc.

PMB 352

3100 Independence Parkway, Suite 311

Plano, Texas 75075

469.213.0271

NOTE: We are not located at this address. Info@dfwlabrescue.org

Adoption Procedure:

http://www.dfwlabrescue.org/information.html

[headlines]

--------------------------------------------------------------

Ralph Petta, President and CEO

Message to Equipment Leasing & Finance Association Members

https://elfa-mail.com/u/lp/News/t/c-1x-QIOpsHBtrFicSJ-QK7ilCXQ-QkW8RX/m/e/Page.htm

[headlines]

--------------------------------------------------------------

News Briefs---

Fauci says Covid-19 could be under control in ‘back half of 2021

’ if enough people are vaccinated

https://www.cnbc.com/2020/12/08/covid-vaccines-fauci-says-virus-could-be-under-control-in-back-half-of-2021.html

Pfizer’s Vaccine Offers Strong Protection After First Dose

worked well regardless of a volunteer’s race, weight or age

https://www.nytimes.com/2020/12/08/health/covid-vaccine-pfizer.html

COVID-19 unemployment scam could hit $2 billion,

bank tells California lawmakers

https://www.sacbee.com/news/california/article247676875.html?ac_cid=DM339142&ac_bid=-1219780296

‘The business is going to die.’ Sacramento hair and nail salons

brace for COVID-19 shutdown

https://www.sacbee.com/news/coronavirus/article247598080.html?ac_cid=DM338786&ac_bid=-1223625191

COVID-19 Restaurant Impact Survey Oct. 2019/2020

National Restaurant Association, (three pages)

https://restaurant.org/downloads/pdfs/advocacy/covid-19-restaurant-impact-survey-v-state-results

Boeing reports more 737 Max cancellations

as airlines prepare to return the plane to service

https://www.cnbc.com/2020/12/08/boeing-reports-more-737-max-cancellations-in-november.html

10,000 More Restaurants Have Closed in Three Months

The number is now over 100,000, reports National Restaurant Assoc.

https://www.qsrmagazine.com/finance/10000-more-restaurants-have-closed-three-months

[headlines]

--------------------------------------------------------------

You May Have Missed---

Elon Musk confirms:

‘Yes, I have moved to Texas’

https://www.cnbc.com/2020/12/08/elon-musk-confirms-he-moved-to-texas.html

[headlines]

--------------------------------------------------------------

Sports Briefs---

Alex Smith’s legend grows with bloody leg

https://nypost.com/2020/12/08/alex-smiths-legend-grows-with-bloody-sock/

How NFC East will be won: Tracking paths to victory

for Giants, Cowboys, Eagles and Washington

https://www.usatoday.com/story/sports/nfl/2020/12/08/nfc-east-playoff-paths-giants-cowboys-eagles-washington/6492716002/

Opinion: Jared Goff responds to criticism with

performance that fits Rams' blueprint for success

https://www.usatoday.com/story/sports/nfl/columnist/mike-jones/2020/12/06/jared-goff-los-angeles-rams-quarterback-sean-mcvay/3853902001/

[headlines]

--------------------------------------------------------------

California Nuts Briefs---

$88 Million Multi-State Settlement

with Nationstar Mortgage LLC/54,000 California Borrowers

http://leasingnews.org/PDF/nation_star2020.pdf

[headlines]

--------------------------------------------------------------

![]()

“Gimme that Wine”

http://www.youtube.com/watch?v=EJnQoi8DSE8

California wineries brace for big losses

during holiday season after looming lockdown

https://www.sfchronicle.com/wine/article/California-wineries-brace-for-big-losses-during-15774342.php

The first yield monitor sensor is on its way

https://www.vitisphere.com/news-92990-The-first-yield-monitor-sensor-is-on-its-way.htm

The Problem with Wine Terminology in the Virtual World

https://daily.sevenfifty.com/the-problem-with-wine-terminology-in-the-virtual-world/

Free Wine App

https://www.nataliemaclean.com/mobileapp/

Wine Prices by vintage

http://www.winezap.com

http://www.wine-searcher.com/

[headlines]

----------------------------------------------------------------

![]()

This Day in History

1561 - Birthday of Sir Edwin Sandys (d. 1629) at Worcestershire, England. English statesman and one of the founders of the Virginia Colony (treasurer, the Virginia Company, 1619-20). He later became a member of the Bermuda Company. Sandys Parish in Bermuda named for him. Encouraged many to go to America. He was also in favor of having the colonies become a self-sufficient republic. http://www.famousamericans.net/siredwinsandys/

http://www.bermuda-online.org/seesandy.htm

1640 - Hugh Bewitt was banished from the Massachusetts Bay Colony when he declared himself to be free of original sin.

1775 - British troops lost the Battle of Great Bridge, and left Virginia soon afterward. Tensions heightened in Virginia in April, 1775 at about the same time as the Battles of Lexington and Concord in Massachusetts. Lord Dunmore, the royal governor of Virginia Colony had, on arrival in Norfolk, ordered the fortification of the bridge across the Elizabeth River, about 9 miles south of Norfolk in the village of Great Bridge. In response to Dunmore's proclamation, Virginia's assembly ordered its troops to march on Norfolk. They carefully withheld fire until the grenadiers were within 50 yards and then unleashed a torrent of fire on the British column. The British advance dissolved as the Colonials’ musket fire continued; about half of the British force was killed, and many were injured. They spiked their guns and retreated across the bridge. In some 25 minutes, Dunmore's attempt to stop the Patriot buildup near Norfolk had been emphatically turned back. In the following days, Dunmore and his Tory supporters took refuge on ships of the Royal Navy, and Norfolk was occupied by the victorious Colonials.

1783 - Slavery was made illegal in Massachusetts by a judicial interpretation of the state constitution of 1780, "…in which the text stating that all men were 'born free and equal'…” was construed as legal nullification of slavery. This year also saw the slave trade outlawed in Maryland. The following year, slavery was abolished in Connecticut and Rhode Island.

1786 - A second great snowstorm in just five days brought another 15 inches of snow to Morristown, NJ, on top of the eight inches which fell on the 7th and 8th, and the 18 inches which fell on the 4th and 5th. The total snowfall for the week was thus 41 inches. New Haven, CT received 17 inches of new snow in the storm. Up to four feet of snow covered the ground in eastern Massachusetts following the storms.

1788 - George Washington sold his race horse, Magnolia, to Colonel Henry Lee. Washington reportedly got 5,000 acres of Kentucky farmland. Lee was in Washington's command and also was one of the signers of the Declaration of Independence. He was known as “Light Horse Harry.” He wanted the horse to race as this was the great sport of the time. Upon the death of President George Washington, Harry was asked by Congress to deliver a tribute to his beloved general, describing him for posterity:

“First in war, first in peace and first in the hearts of his countrymen...second to none in the humble and endearing scenes of private life.”

After the death of his idol, Harry's fortunes began to decline rapidly. The support of a family of six, coupled with disastrous land speculation, reduced him to poverty. Then, on January 19, 1807, in the large upstairs room at Stratford where so many Lees had come into the world, Ann gave birth to their fifth son, Robert Edward, named after two of his mother's favorite brothers. As Robert was learning to walk, his father was carried off to debtor's prison in Montross. With characteristic courage, in a 12-by-15 foot prison cell, Harry wrote his “Memoirs of the War in the Southern Department of the United States”, still the standard text on that portion of the Revolutionary War. When the book was finished in 1810, the family moved to Alexandria, where a new life on a modest scale was made possible by a legacy from Ann's father. Harry's eldest son, Henry IV, became master of Stratford. "Light Horse Harry's" last years were marred by sorrow and pain. Internal injuries, received when he was beaten by a mob as he defended a friend and freedom of the press in Baltimore, kept him in constant physical pain. He sought relief in the warm climate of the West Indies. When his health continued to decline, Harry attempted to return home, but died on Cumberland Island, Georgia, in the home of the daughter of his former commander, Nathaniel Greene.

http://www.patriotresource.com/people/lee.html

http://www.stratfordhall.org/lighthorse.htm

1789 – The University of North Carolina was chartered by the North Carolina General Assembly.

1793 - The first daily newspaper in New York City was founded by Noah Webster; “The America Minerva" was published for the first time. How long Webster stayed awake at night to come up with "Minerva" is anyone's guess.

1835 - Inspired by the spirited leadership of Benjamin Rush Milam, the newly created Texas Army takes possession of the city of San Antonio, an important victory for the Republic of Texas in its war for independence from Mexico. After helping the Texas Army capture the city of Goliad, he made an impassioned call for volunteers, asking: "Who will go with old Ben Milam into San Antonio?" Three hundred men did volunteer, and the Texas Army began its attack on San Antonio at dawn on December 5. By December 9, the defending forces of the Mexican army were badly beaten, and the commanding general surrendered the city. Milam, however, was not there to witness the results of his leadership as he was killed instantly by a sniper bullet on December 7. If Milam had survived, he might well have been among the doomed defenders of the Alamo that were wiped out by Santa Ana's troops the following March.

1848 - Birthday of Joe Chandler Harris (d. 1908) at Eatonton, GA. American author, creator of the “Uncle Remus” stories.

1849 - San Francisco's first fire engine arrived from the East. It was known as the Martin Van Buren engine because it has been used to water the lawn of the President's estate in New York. It was not intended for fire use but had been purchased to pump water from mines.

1861 - The Battle of Chusto-Talasah, also known as Bird Creek, Caving Banks, and High Shoal, was fought in what is now Tulsa County, Oklahoma (then Indian Territory). It was the second of three battles in the Trail of Blood on Ice campaign for the control of the territory. Indian Union troops hold off Confederate advance but retreat due to lack of ammunition. Confederates call it a “victory,” and they would win a resounding one later in the month at Chustenahlah when they again pushed back the ill-trained Indian troops.

http://www.pathsofthecivilwar.com/Pastfinder/PCWsummary.asp?l

ocationID=OK002

http://home.earthlink.net/~dawise/CreekReg.htm

http://www.civil-war-and-more.com/1861w.html

http://www2.cr.nps.gov/abpp/battles/ok003.htm

1867 – Colorado Territory moved its capital to Denver from Golden.

1872 - African-American P.B.S. Pinchback was the Acting Lt. Governor and succeeded after the impeachment of Gov. Henry Clay Warmoth. He took the oath of office, starting the first of 35 days as the Governor of Louisiana.

http://www.pbs.org/wnet/aaworld/reference/articles/p_b_s_pinchback.html

http://www.africana.com/Articles/tt_1153.htm

http://www.sec.state.la.us/46.htm

1886 - Birthday of Clarence Birdseye (d. 1956) at Brooklyn, NY. The American industrialist who developed a way of deep-freezing foods, he was marketing frozen fish in 1925 when he founded Birdseye Seafood Company. He renamed that General Seafood and sold it to Goldman Sachs which later renamed it General Food Corporation which formed The Birds Eye Frozen Food Company.

1888 - Twenty-eight-year-old Herman Hollerith installed his punch calculator machine at the War Department in Washington, D.C. Hollerith had developed his tabulating machine, which read and sorted punched cards, in the hopes that it would be used in the 1890 census. Census officials thought Hollerith's machine seemed promising but needed practical experience, so Hollerith volunteered to use the machine to organize health statistics from city health departments in New York and Baltimore. It was so successful that news of the machine soon spread, and the War Department invited Hollerith to install a tabulating machine there to track statistics. Ultimately, the Census Department did use Hollerith's machine in the 1890 census.

1898 - Birthday of Emmett Kelly (d. 1979) at Sedan KS. American circus clown and entertainer, Kelly was best known for “Weary Willie,” a clown dressed in tattered clothes, with a beard and large nose.

1906 - Birthday of Admiral Grace Murray Hopper (d. 1992) at New York, NY. She retired from the Navy at eighty years old, developer of the computer, mother of COBOL, and quite an amazing woman, rising to the highest ranks for a woman at that time, 1983. When she retired from the Navy in 1986, she went to work full time for the Digital Computer Company as a “consultant.” Reportedly, she functioned in much the same capacity she did when she was in the Navy, traveling on lecture tours around the country, speaking at engineering forums, colleges, universities and computer seminars, passing on the message that managers shouldn't be afraid of change. In her opinion, "the most damaging phrase in the language is “We've always done it this way.” While the question on “Who Wants to be a Millionaire” for the top prize was “what insect was the computer bug,” which was the moth. This word was coined by Admiral Hopper and the Navy has a picture of what she discovered. She also is attributed with the phrase, “Computer debugging.” She is said to also have had quite a sense of humor. She was a constant smoker of filter-less Lucky Strike cigarettes. The USS Hopper (DDG 70) is named after her honor. http://www.history.navy.mil/photos/pers-us/uspers-h/g-hoppr.htm

http://www.agnesscott.edu/lriddle/women/hopper.htm

http://www.sdsc.edu/ScienceWomen/hopper.html

http://ei.cs.vt.edu/~history/Hopper.Danis.html

http://www.chips.navy.mil/links/grace_hopper/file2.htm

http://www.chinfo.navy.mil/navpalib/ships/destroyers/hopper/hoprcom.html

1907 – The first Christmas Seals were sold, at the Wilmington, DE Post Office.

1911 – “10 faw, 10 faw.” Actor Broderick Crawford (d. 1986), who starred in the early TV cop series “Highway Patrol,” was born in Philadelphia.

1912 – Former House Speaker Thomas “Tip” O’Neill (d. 1994) was born in Cambridge, MA.

1916 - Trumpet player Bob Scobey (d. 1963) birthday, Tucumcari, NM.

http://artisttv.artistdirect.com/music/artist/bio/0,,490603,00.html?

artist=Bob+Scobey

http://www.stompoff.com/westcoast.html

http://www.musicweb.uk.net/encyclopaedia/s/S38.HTM

http://www.jazzbymail.com/artists/bsfjb.html

http://64.33.34.112/.WWW/turkmurp.jpg

http://www.sftradjazz.org/75.html http://www.trumpetjazz.com/artists.cgi?name=

Bob+Scobey&x=21&y=9

1916 – Actor Kirk Douglas was born Issur Danielovitch (d. 2020) in Amsterdam, NY. As an actor and philanthropist, Douglas has received three Academy Award nominations, an Oscar for Lifetime Achievement, and the Medal of Freedom. As an author, he has written ten novels and memoirs. Currently, he is No. 17 on the American Film Institute's list of the greatest male screen legends of classic Hollywood cinema, and the highest-ranked living person on the list.

1917 - A severe winter storm struck the Ohio Valley and the Great Lakes Region. It produced 25 inches of snow and wind gusts to 78 mph at Buffalo, NY. The storm produced 26 inches of snow at Vevay, IND, with drifts fourteen feet high. By the 16th of the month people could walk across the frozen Ohio River from Vevay into Kentucky.

1918 - Birthday of violinist Joe Thompson (d. 2012), Mebane, NC

1919 - Birthday of Roy deCarava (d. 2009) in Harlem, NYC. He was the first African-American photographer to be awarded a Guggenheim Fellowship.

http://www.frif.com/cat97/a-e/conversa.html

http://www.lib.virginia.edu/speccol/exhibits/rec_acq/history/sweet.html

http://www.masters-of-photography.com/D/decarava/decarava.html

http://artcyclopedia.com/artists/decarava_roy.html

http://www.tfaoi.com/aa/2aa/2aa68.htm

http://www.washingtonpost.com/wp-srv/style/museums/photogallery/decarava/decarava1.htm

1922 - Birthday of Redd Foxx, born John Elroy Sanford (d. 1991) at St. Louis, MO. Redd Foxx plied his comedic trade on vaudeville stages, in nightclubs, on television, in films and on record albums. His talents reached a national audience with the TV sitcom “Sanford and Son.” He died after collapsing during a rehearsal for a new TV sitcom, “The Royal Family”.

http://www.triviatribute.com/reddfoxx.html

http://www.cmgww.com/stars/foxx/biography.html

http://www.tvtome.com/tvtome/servlet/PersonDetail/personid-38305

1923 - Traveling to Chicago for the Major League meetings, Wild Bill Donovan, New Haven Manager, was killed in a train wreck. New Haven president George Weiss had swapped berths with Donovan and escapes with a minor injury. Phil’s owner William F. Baker was also on the train, but he was unhurt.

1925 – 73,000 fans saw Red Grange and the Chicago Bears beat the NY Giants in the first NFL game in NYC.

1926 – 17-year-old Benny Goodman’s first recording session, Chicago, playing clarinet with Ben Pollack and His Californians. Victor Records. He had a 16 bars solo of a song called “He’s the Last Word.” Goodman worked hard to raise his family out of abject poverty in Chicago. Sadly, his father was hit by a car and killed on the same day Goodman recorded the solo. His father never came to one of Goodman's shows because he didn't own a suit.

1927 - Birthday of sax player Bennie Green (d. 1977), Leeds, England.

http://search.centerstage.net/music/whoswho/BennieGreen.html

1927 - Red McKenzie-Eddie Condon stage first Chicago-style session, Chicago, Okeh records.

1931 - Baseball owners, fearful of the effects of the Depression, voted to cut rosters from to 23. Both leagues stopped awarding MVP trophies. The National League continued to prohibit uniform numbers. The NL loaned the Phillies $35,000 and loaned Judge Emil Fuchs, owner of the Boston Braves, $20,000 secured by his stock.

1932 - Birthday of trumpet player Donald Byrd (d. 2013), Detroit, MI.

http://members.tripod.com/~hardbop/byrd.html

http://www.thejazzfiles.com/JazzByrd.htm

http://www.duke.edu/~vks2/biography.html

1932 - Birthday of song writer/singer Jesse Hill (d. 1996), New Orleans, LA.

http://www.offbeat.com/obfebruary2002/feature.html

1934 - Birthday of harmonica player Junior Wells (d. 1998), West Memphis, AR.

http://www.island.net/~blues/junior.html

http://www.juniorwells.com/jwbio.htm

http://www.imdb.com/Name?Wells,+Junior

1934 – Known as The Sneakers game, the NY Giants defeated the Chicago Bears, 30-13 to win the NFL Championship. The defending champion Bears entered the game undefeated at 13–0, with an 18-game winning streak. A freezing rain the night before the game froze the Polo Grounds field. After Ray Flaherty, a Giants end, made a remark to Giants' head coach Steve Owen suggesting that sneakers would provide better footing on the frozen playing surface, Owen sent Abe Cohen to Manhattan College to get some sneakers. There, Brother Jasper, the athletic director emptied the lockers of the school's basketball team. Cohen arrived in the third quarter with nine pairs of basketball sneakers from the college. The Bears led 10–3 at the half when the Giants switched to the sneakers. A Chicago field goal was the only score in the third quarter, extending the lead to ten points. Early in the fourth, Giants QB Ed Danowski threw a touchdown pass to close the score to 13–10. On the next New York drive, RB Ken Strong scored on a 42-yard touchdown run. Later an 11-yard run by Strong was turned into another touchdown for the Giants, and they scored for a final time on Danowski's 9-yard run, a fourth unanswered touchdown. New York outscored the Bears 27–0 in the second half to win.

1935 – The Downtown Athletic Club, in NYC, awarded its trophy, later renamed the Heisman Trophy, for the first time. The winner was halfback Jay Berwanger of the University of Chicago.

1938 – Birthday of David Houston (d. 1993), Bossier City, LA. He was a Grammy Award-winning singer: “Almost Persuaded” [1966]; “Mountain of Love,” “Livin' in a House Full of Love,” “With One Exception,” “You Mean the World to Me,” “Have a Little Faith,” “Already It's Heaven,” “Baby Baby [I Know You're a Lady],” “So Many Ways;” actor: “Carnival Rock,” “Cottonpickin' Chickenpickers.”

1938 – Birthday of David “Deacon” Jones (d. 2013), Eatonville, FL. He spent most of his 14-year career as a defensive end with the Fearsome Foursome of the LA Rams. He coined the term ‘sack' of which he was premier at the time; NFL defensive player of the year [1967, 1968]; NFL Hall of Fame, 1980.

1940 - The Chicago Bears won the NFL championship by defeating the Washington Redskins, 73-0, the most one-sided victory in the league's title game.

1941 - The first American bombing mission took place two days after the Japanese attack on Pearl Harbor, when B-17 airplanes of the 19th Bombardment Group attacked Japanese ships off the east coast of Vigan, Luzon, Philippines.

1941 – The first fighter plane from the United States to destroy a Japanese airplane in World War II was a Grumman F-50 Wildcat fighter of the Marines, which downed a twin-engine bomber off Wake Island.

1941 - Although having a 3-C draft deferment due to being the sole support of his family, Bob Feller, last year's AL’s leading pitcher with 27 victories for the Indians, becomes the first American athlete to enlist after the Japanese attack on Pearl Harbor. The 23-year old Navy recruit has already won 107 Major League games. Feller spent a full four years in the Navy and saw combat as Gun Captain aboard USS Alabama in the Pacific. Historians conservatively estimate that the military service cost him at least 100 wins, yet he still complied a 266-162, 3.25 ERA record.

http://www.bobfellermuseum.org/

1942 – Birthday of Dick Butkus, Chicago. College and Pro Football Hall of Famer who spent his entire career as the Chicago Bears middle linebacker. He was two-time NFL Defensive Player of the Year, 8-time Pro-Bowl selection, and a member of the NFL 75th Anniversary Team. NFL.com rates him #10 on the all-time list.

1942 - VANDEGRIFT, ALEXANDER ARCHER, Medal of Honor

Rank and organization: Major General, U.S. Marine Corps, commanding officer of the 1st Marine Division. Place and date: Solomon Islands, 7 August to 9 December 1942. Entered service at: Virginia. Born: 13 March 1887, Charlottesville, Va. Citation: For outstanding and heroic accomplishment above and beyond the call of duty as commanding officer of the 1st Marine Division in operations against enemy Japanese forces in the Solomon Islands during the period 7 August to 9 December 1942. With the adverse factors of weather, terrain, and disease making his task a difficult and hazardous undertaking, and with his command eventually including sea, land, and air forces of Army, Navy, and Marine Corps, Maj. Gen. Vandegrift achieved marked success in commanding the initial landings of the U.S. forces in the Solomon Islands and in their subsequent occupation. His tenacity, courage, and resourcefulness prevailed against a strong, determined, and experienced enemy, and the gallant fighting spirit of the men under his inspiring leadership enabled them to withstand aerial, land, and sea bombardment, to surmount all obstacles, and leave a disorganized and ravaged enemy. This dangerous but vital mission, accomplished at the constant risk of his life, resulted in securing a valuable base for further operations of our forces against the enemy, and its successful completion reflects great credit upon Maj. Gen. Vandegrift, his command, and the U.S. Naval Service.

1943 - Birthday of trumpet player Jimmy Owens, New York City.

http://www.trumpetjazz.com/artists.cgi?name=Jimmy+Owens&x=15&y=5

1946 - Top Hits

“Ole Buttermilk Sky” - The Kay Kyser Orchestra (vocal: Mike Douglas & The Campus Kids)

“Rumors are Flying” - The Frankie Carle Orchestra (vocal: Marjorie Hughes)

“The Old Lamplighter” - The Sammy Kaye Orchestra (vocal: Billy Williams)

“Divorce Me C.O.D.” - Merle Travis

1946 – The Subsequent Nuremberg Trials began with the "Doctors’ Trials," prosecuting physicians and officers alleged to be involved in Nazi human experimentation and mass murder under the guise of euthanasia.

1949 – The All-American Football Conference folded. Of those teams, the San Francisco 49ers, Cleveland Browns, and Baltimore Colts were merged into the NFL.

1950 – Harry Gold was sentenced to 30 years in jail for helping Klaus Fuchs pass information about the Manhattan Project to the Soviet Union. His testimony was later instrumental in the prosecution of the Rosenbergs.

1953 - Frank Sinatra recorded "Young at Heart." The song was turned down by Nat ‘King' Cole and other artists, believe it or not. It became a top hit in the U.S. in March of 1954.

1953 – General Electric announced that all communist employees will be discharged from the company.

1954 - Top Hits

“Mr. Sandman” - The Chordettes

“Count Your Blessings” - Eddie Fisher

“Dim Dim the Lights (I Want Some Atmosphere)” - Bill Haley & His Comets

“More and More” - Webb Pierce

1956 - The Million Dollar Session was held at Sun Records in Memphis, TN. Elvis Presley, Johnny Cash, Carl Perkins and Jerry Lee Lewis gathered for an impromptu jam session. Six songs by the artists were recorded at this session. None of the songs was released for nearly three decades.

1957 – Singer Donny Osmond was born in Ogden, UT.

1958 - In Indianapolis, retired Boston candy manufacturer Robert H.W. Welch, Jr., establishes the John Birch Society, a right-wing organization dedicated to fighting what it perceives to be the extensive infiltration of communism into American society. Welch named the society in honor of John Birch, considered by many to be the first American casualty in the struggle against communism. In 1945, Birch, a Baptist missionary and U.S. Army intelligence specialist, was killed by Chinese communists in the northern province of Anhwei. The John Birch Society, initially founded with only 11 members had, by the early 1960s, grown to a membership of nearly 100,000 Americans and received annual private contributions of several million dollars. In the early days of formation, Ronald Reagan came to several meetings in the Pacific Palisades (he was never listed as a member). As a teenager, I parked the cars for one of my neighbors who held the meetings. The John Birch Society remains active today, and its members seek "to expose a semi-secret international cabal whose members sit in the highest places of influence and power worldwide."

1960 - Sperry Rand Corporation of St. Paul, MN unveiled a new computer, known as Univac 1107. The electronic wizard employed what was known as thin-film memory. The 1107, without any peripherals, weighed about 5,200 pounds.

1961 - The Tokens' "The Lion Sleeps Tonight" tops the Cashbox Magazine Best Sellers Chart for the first of a four week run.

1961 – Nazi SS Col. Adolph Eichmann was found guilty of war crimes in Israel. After Germany's defeat in 1945, Eichmann fled to Austria. He lived there until 1950, when he moved to Argentina using false papers. Information collected by the Mossad, Israel's intelligence agency, confirmed Eichmann's location in 1960. A team of Mossad and Shin Bet agents captured Eichmann and brought him to Israel to stand trial on 15 criminal charges, including war crimes, crimes against humanity and crimes against the Jewish people. Found guilty on many of these charges, he was sentenced to death by hanging and was executed on 1 June 1962.

1962 - Top Hits

“Big Girls Don't Cry” - The 4 Seasons

“Return to Sender” - Elvis Presley

“Bobby's Girl” - Marcie Blane

“Don't Let Me Cross Over” - Carl Butler & Pearl (Dee Jones)

1962 - Arizona's Petrified Forest National Monument was established as a national park.

http://www.orerockon.com/petrified_forest.htm

http://www.nps.gov/pefo/

http://www.petrifiedforest.org/

1963 - The first Supremes album, "Meet The Supremes," is released by Motown Records. The LP contained their first US Top 40 hit, "When The Lovelight Starts Shining Through His Eyes."

1965 - "A Charlie Brown Christmas" premieres

http://www.ew.com/ew/fab400/tv100/60s_p4.html

http://www.phillyburbs.com/holidays/christmas/tv/cbc.shtml

http://us.imdb.com/Title?0059026

1965 – In one of the most famous trades in Major League history, the Cincinnati Reds traded Frank Robinson to the Baltimore Orioles for pitchers Milt Pappas and Jack Baldschun and OF Dick Simpson. The Reds' GM Bill DeWitt defended the trade by labeling Robinson "an old 30," a concept that Robinson quickly proved wrong. He responded by winning the AL Triple Crown, the AL MVP and World Series MVP, as the O’s swept the Dodgers of Koufax and Drysdale. He spent six years with the Orioles, hitting over .300 four times and continuing to hit home runs. The Orioles, during those six years, finished in first place four times and won the World Series twice. On Mother's Day 1966, Robinson became the only player who ever would hit a ball out of Memorial Stadium. He is the only player to win the MVP in both leagues. When he retired, his 586 career HRs ranked him fourth all-time behind Ruth, Aaron, and Mays. Washed up, indeed!

1965 - While giving a speech in Columbia, MO, Branch Rickey collapsed and died a few days short of his 84th birthday.

1965 - An article in the New York Times asserts that the U.S. bombing campaign has neither destabilized North Vietnam's economy nor appreciably reduced the flow of its forces into South Vietnam. These observations were strikingly similar to an earlier Defense Intelligence Agency analysis, which concluded that "the idea that destroying, or threatening to destroy, North Vietnam's industry would pressure Hanoi into calling it quits seems, in retrospect, a colossal misjudgment." President Johnson called for more ground troops to be deployed to South Vietnam.

1970 - Top Hits

“I Think I Love You” - The Partridge Family

“The Tears of a Clown” - Smokey Robinson & The Miracles

“Gypsy Woman” - Brian Hyland

“Endlessly” - Sonny James

1972 - The Moody Blues hit number one on the US album charts for the first time with "Seventh Sojourn." It will be their last album of new material for more than five years as the group's members split to record and to tour as solo artists.

1972 - Elton John's "Crocodile Rock" is released. It would become his fourth US Top Ten hit and first number one single.

1972 – Apollo 17 becomes the sixth and final Apollo mission to land on the Moon.

1975 - President Gerald Ford signs $2.3 B loan-authorization for New York City. He had originally opposed the aid to the city, but due to the political pressure, agreed for a federal loan to some $2,300,000,000 annually, to help the city avoid bankruptcy. The fiscal crisis had begun when securities markets declined to buy New York City notes.

1978 - Top Hits

“Le Freak” - Chic

“I Just Wanna Stop” - Gino Vanelli

“I Love the Nightlife” (“Disco 'Round”) - Alicia Bridges

“On My Knees” - Charlie Rich with Janie Fricke

1978 - John Belushi and Dan Ackroyd's version of Sam & Dave's "Soul Man" is released under the name, "The Blues Brothers."

1978 - "Le Freak" by Chic topped the charts and stayed there for 6 weeks.

1979 - The eradication of the smallpox virus was certified, making smallpox the first and, to date, only human disease driven to extinction.

1980 - 61ºF in Boston at 1 AM

1984 - Walter Payton of the Chicago Bears got another first as he ran six plays as quarterback. He was intercepted twice but ran the ball himself on four carries. It didn't help. The Green Bay Packers won, 20-14. Payton said after the game, “It was okay, but I wouldn't want to do it for a living.”

http://www.sportingnews.com/archives/payton/

http://www.payton34.com/

1984 - Los Angeles Rams running back Eric Dickerson rushes for 215 yards in a 27-16 victory over Houston to top O.J. Simpson's single-season mark of 2,003 yards rushing. Dickerson finishes the year with 2,105 yards.

1984 - Michael Jackson announces that at the end of the current Jackson's tour, he will launch a solo career and no longer perform with his brothers.

1986 - Top Hits

“The Next Time I Fall” - Peter Cetera with Amy Grant

“Hip to Be Square” - Huey Lewis & The News

“The Way It Is” - Bruce Hornsby & The Range

“It Ain't Cool to Be Crazy About You” - George Strait

1987 - The fifth storm in nine days kept the northwestern U.S. wet and windy. Winds along the coast of Washington gusted to 75 mph at Oceans Shores and at Hoquiam, and the northern and central coastal mountains of Oregon were drenched with three inches of rain in ten hours, flooding some rivers. Snowfall totals in the Cascade Mountains of Washington State ranged up to 36 inches in the Methow Valley. High winds in Oregon blew a tree onto a moving automobile killing three persons and injuring two others at Mill City

1987 - Ron Hextall of the Philadelphia Flyers became the first goalie in NHL history to shoot the puck into the opposition team's net in a 5-2 victory over the Boston Bruins.

1988 - A winter storm blanketed the Southern and Central Appalachians with up to ten inches of snow. Arctic air invaded the north central U.S. bringing subzero cold to Minnesota and North Dakota.

1989 - "We Didn't Start the Fire" by Billy Joel topped the charts and stayed there for 4 weeks.

1995 - The Beatles' "Anthology 1" was #1 in the U.S. The double CD contained 60 Beatles songs and was their sixteenth number-one album. It also set a record for the longest time span for a run of number-one albums: 31 years and 10 months between "Meet the Beatles" and "Anthology 1.”

2000 – In the continuing saga of who won the 2000 Presidential election, the Supreme Court halted the Florida vote recount. Eventually, Republican George W. Bush was declared the winner.

2002 - Pat Boone returned to Billboard's Hot 100 after a 40-year absence. His new song, "Under God," was written in response to a lawsuit filed in San Francisco by an agnostic who claimed his daughter's constitutional rights were violated by having to say the words "under God" when her school recites the Pledge of Allegiance. The record briefly rose to number 25, ahead of songs by the likes of Jennifer Lopez and Jay-Z. Boone's last Top 40 hit was "Speedy Gonzalez," which made it to number 6 in 1962.

2002 - United Airlines filed the then-biggest bankruptcy in aviation history after losing $4 billion in the previous two years.

2008 – Bernie Madoff was arrested and charged with securities fraud in a $50 billion Ponzi scheme.

2014 - The NASA Mars rover Curiosity has returned images from the red planet's Gale Crater showing evidence of sediment deposits, suggesting that lakes and rivers potentially existed across the planet millions of years ago.

2014 - The Senate Intelligence Committee released its report on CIA interrogation methods after 9/11. The report found that the CIA hid many of its actions from Congress and former President George W. Bush and claims that little useful intelligence resulted.

2018 – Green Bay QB Aaron Rodgers broke Tom Brady’s NFL record with his 359th straight pass without an interception during Packers 34-20 win over Atlanta Falcons; finishes game with streak intact at 368. The streak grew to 402 before he threw an interception. In addition to setting the record, Rodgers set NFL records for interception percentage for a season, with only 0.335% of his passes being intercepted, and for the amount of thrown away passes. He was ranked ninth by his fellow players on the NFL Top 100 Players of 2019.

2019 – A Washington Post analysis of the "Afghanistan Papers" revealed that US officials "deliberately misled" the public on progress of the Afghanistan war, hiding that it was a lost cause.

-------------------------------------------------------------

SuDoku

The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler?

http://leasingnews.org/Soduku/soduko-main.htm

--------------------------------------------------------------

Daily Puzzle

How to play:

http://www.setgame.com/set/puzzle_frame.htm

Refresh for current date:

http://www.setgame.com/set/puzzle_frame.htm

--------------------------------------------------------------

http://www.gasbuddy.com/

http://www.gasbuddy.com/GB_Map_Gas_Prices.aspx

http://www.gasbuddy.com/GB_Mobile_Instructions.aspx

--------------------------------------------------------------

Weather

See USA map, click to specific area, no commercials

--------------------------------------------------------------

Traffic Live---

Real Time Traffic Information