|

Sales Account Executives: Jacksonville, FL/Philadelphia, PA. Navitas Lease Corp is a top leader in the equipment financing industry. We offer solutions to small-to-medium-sized businesses looking to acquire and finance equipment. |

Congratulations Green Bay Packers

and Aaron Rodgers, Super Bowl MVP

Monday, February 7, 2011

Today's Equipment Leasing Headlines

Archive February 7, 2000

The List: 70 Companies

Classified Ads---Asset Management

$87 Million & Criminal Case continued against Schwartz

Leasing 102 by Mr. Terry Winders, CLP

Prefunding Documents

Classified ads---Help Wanted

Bank Beat---Two More Georgia, One Chicago Bank Failure

Saluting Leasing News Advisor Bruce Lurie

Top Stories January 31--February 4

February CLP: Three New Directors plus Chris Walker/Lia Wax

Santa Monica, California Adopt-a-Dog

Classified ads—Web Sites to post Resumes

Broker/Funder/Industry Lists |

Features (collection)

Top Ten Stories Chosen by Readers |

Top Stories last six months

Sports Briefs---

California Nuts Briefs---

"Gimme that Wine"

This Day in American History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

######## surrounding the article denotes it is a “press release” and was not written by Leasing News nor information verified, but from the source noted. When an article is signed by the writer, it is considered a “by line.” It reflects the opinion and research of the writer. It is considered “bias” as it is the writer’s viewpoint.

[headlines]

--------------------------------------------------------------

Archive February 7, 2000

The List: 70 Companies

Chronological Order

PLM International (2/2000) MILPI Acquisition Corp completes cash offer for outstanding stock

Colonial Pacific (2/2001) Colonial Closes former "Tilden Operation" in New York and Anaheim, rumors floating to surface: GE/CPL will leave small ticket broker marketplace ( 5/2000) no more re-brokered applications, except from one or two sources, such as Steve Dunham's

Leasing Associates (11/98) purchased by GE Capital)

Linc Capital (2/2000 creditors file for Chapter 7 (9/2000 out of vendor and broker business, NASDAQ halts stock sales, $13.4 loss last quarter, 10/2000 assets for sale)

Finova (2/2001) downgraded to "C" rating by Fitch "With significant debt maturities due in May 2001 and Leucadia National Corp's $350 million investment withdrawn, Finova's ability to operate as a going concern faces serious challenges."(1/2001) Deal of Leucadia National to Invest $350 Million in Finova falls apart 1/2001 laid off 90 employees, or about 9 percent of its workforce, in an ongoing effort to cut costs. The company continues to employ about 300 people in Phoenix and 940 nationwide. (12/2000) out of market place, many problems, raises $250 MM, but not enough) (11/2000 Announces they will discontinue business, sell units 11/2000 Suspends Dividend 11/2000 Leucadia National to Invest $350 Million in Finova 11/2000 reports $274 million loss) (10/2000 Dow Jones notes stock falling and problems at Finova) (10/2000 Dow Jones headlines "Finova Stock Falls as Buyout Hopes Wane.”

Orix (2/2001) Closes re-discount center, Steve Geller says "goodbye." 11/10 First Six Month Profits up 14% at Orix! ) 11/8 New President at Orix appointed 11/10 First Six Month Profits up 14% at Orix! No negative reports, company appears to be doing very well. 10/2000 "long-term Outlook has been revised from Stable to Negative" Credit Allianchat it has changed its name to ORIX Financial Services, 9/2000 Japanese Bank President Commits Suicide (Orix is a 14.7% shareholder in bank having problems), (8/2000 closes small ticket vendor division in\ Portland, Oregon, "Business as usual (in New Jersey and with brokers)," says Steve Geller)

Affiliated Leasing, Lewistown, Texas (1/2001) Merges with First Commerce Leasing January 26.

Advanta Leasing (1/2001 Advanta ceases leasing business announcement 1/2001 Chris Ciarrocchi says "goodbye" Mortgage Division sold, re-affirms Leasing Division still for sale, former prez now at eOriginals, others let go like Kaye Lee.) (9/2000) for sale.

LeaseExchange.com (2/1 reported on "auto-pilot" ( 1/2001) Closes Irving office, cuts staff Union Bank, San Francisco ( 1/2001 Leasing curtailment/cutback 1/2001 Union Bank, Los Angeles, no more lease purchasing, not confirmed about S.F. yet )

El Camino Leasing, Woodland Hills, California (1/2001) ( 1/2001 reportedly winding down, sold portfolio, selling partner relationships, selling off all assets (10/2000 No longer taking broker business 11/2000 struggling to stay in leasing business, according to insider reports

NationsCredit, Business Leasing Group (1/2001) complaints from brokers regarding getting information for NationsCredit and GrayRock Capital on FMV, payoffs, residuals from Textron who is servicing the portfolio )(1/29/99) sold to Textron *** Textron does "broker business."

eLease (12/2000) purchase by Primestreet (June/July/2000) senior management changes)

Saddleback Financial (1/2001) Prez. Warren Emard announces "... still in business... We are still originating business through vendors and directly to lessees. Does not accept broker business."

First Commercial Capital Corp (/2001 to be acquired by TCF Leasing)

First International Bancorp (1/2001) to be acquired by UPS Capital First State Bancorp, Albuquerque, N.M (3/2000 sold leasing division-$64 million---)

BSB Leasing (1/2001 Don Myerson bought back the company and they are back in business at 303-329-09227. Official announcement to be made soon. They are notifying brokers to start sending them business again. 12/2000 Don Myerson says to be "re-born"11/2000 closed to accepting new business.)

SierraCities (1/2001 VerticalNet Merger falls apart 1/16/01 Sells Off UK Assets, 7/2000 2nd quarter loss, see report)

United Capital, Austin Texas ( 1/2001 ½ employees let go, portion of portfolio sold, discounters not paid, vendors not paid, it is alleged.1/2001, selling off portfolio, problems ahead with vendors not paid, brokers not paid, sinking in quicksand 12/2000 no new deals until after the 1st of year, Steve Dallas trying to hold it together. Dallas says, "We will survive."

Preferred Capital (01/2000 Mark Seif confirms 12/2000 On the block. David Murray left 11/7 "didn't like letting his friends go.”)

Affinity Leasing, Washington (12/2000 to close and concentrate on Financial Pacific biz)

Banc One Leasing (12/2000 Lays Off 60, Closes 5 offices)

Bayview Capital (12/2000 announces $17 million loss/later does not issue dividend)

Bombardier ( 12/2000 reported having leasing problems, not confirmed, company strong in other divisions, but appears backing out of leasing division )

Capital Associates, Denver, Colorado (12/2000 no longer doing business, filing BK?)

Conseco Finance Vendor Service (12/2000 purchased by Wells Fargo Leasing).

DVI Capital (12/2000 out of broker)

Finantra (11/2000 will eliminate its commercial finance operations in order to focus on its two core finance platforms, consumer finance and services and consumer mortgage lending.)

Metwest Leasing, Spokane WA. (11/2000 is pulling the plug, confirmed by five sources. 9/2000 advising brokers that they have run out of funds so they are unable to fund a transaction we have there for funding.)

Newcourt (8/2000 sold off) Old Kent Financial, Grand Rapids, Michigan (11/2000 Fifth Third Bank, Cincinnati, Ohio announces acquirement, to close second quarter 2001. Gateway Leasing sold to Old Kent in 1997, small ticket leasing specialists)

Resource Leasing, Herndon, Virginia (11/2000) MicroFinancial/Leasecomm acquires major portion of the assets.)

Signature Leasing, Dublin, California (11/2000 no longer in small ticket marketplace; appears to have closed down).

Transamerica (11/2000 for sale, but no buyers, so taken off marketplace, no longer for sale)

Varilease (11/2000 closed down)

Copelco (10/2000 ceases broker business, many complaints in manner turning off faucet 5/2000 sold to Citibank 10/2000 stock down rated/)

Matsco Financial (10/2000 purchased by Greater Bay Bank)

T&W, Washington (10/2000 filed Chapter 11. Creditors meeting on 12-4-00 Seattle. Case # 00-10868 US Bankruptcy Court Western District of Wash. 206-553-7545. Debtor Attorney-Marc Barreca 206-623-7580)

Balboa Capital ( 9/2000 Founder Pat Byrne "...office available any time he wants to use it" Reported he is no longer "in control" or working "full time" at Balboa, the company he started with partner Giffin).

Liberty Leasing, Des Moines, Iowa (10/2000 closed, selling portfolio, owned by Commercial Federal Bank, Omaha, Nebraska)

Bay View Commercial Corporation (Bay View Bank) 9/2000 discontinuing all franchise loan and lease production

Charter Financial (purchased by Wells Fargo 9/5/2000)

Manifest Group--( 9/1/2000 purchased by US Bancorp Leasing and Financial, "...a win for all the parties involved," Brian Bjella. 11/2000 DONALD POLFLIET leaves and no one knows where he went. If you know, please tell us. (Today, 2011 at Falcon Leasing).

Onset Capital (9/2000 Irwin buys 87% equity)

Republic Leasing, South Carolina 9/27/2000 (“The expected result will be a sale of Republic Leasing"---Dwight Galloway. He adds, "We have always been for sale for the right price, but in thirteen years we have not sold off any leases or gone direct after broker's business, ever.")

SFC Capital (9/15/2000 purchased by Trinity Capital)

Dana (7/2000 sold off portfolio, active as captive lessor)

Lease Acceptance Corp--- (7/26/2000 ceases broker business)

New England Capital (6/2000 sold to Network Capital Alliance a division of Sovereign Bank. Sovereign did hire two people who will run a sales office in CT, doing basically the same deals with the same people as before. Little will change in that aspect.

Prime Capital, Chicago (6/2000 closed)

Scripp Financial (6/29/2000 (purchased by US Bancorp)

Metrolease--( 5/2000 reports closing operation, John Blazek at Evergreen Leasing, Hathcock losing assets, will not confirm nor deny; many serious rumors of serious fraud floating around the marketplace, including debt to Textron Financial, reported to file bk.)

Phoenix (5/2000 both divisions closed)

FMA Financial, California (4/2000 reportedly closed to brokers)

USA Capital Leasing (5, 2000) creditors force Chapter 7 (4, 2000) file chapter 11 BK

Fidelity (4/2000 acquired by EAB, a wholly owned subsidiary of ABN AMRO Bank N.V., headquartered in the Netherlands, raising funds)

Comstock Leasing (2/2000) purchased by Linc Capital.

NIA National Leasing (3/2000 purchased by Lakeland Bancorp)

Franklin Leasing, Des Moines, Iowa--owned by Liberty Bank-- (2/2000)-no longer writing lease ( limited by regulations and leases are for sale ).

BankVest (1/2000) bankrupt, voluntary (11/99) Orix, smaller banks, creditors file for involuntary bankruptcy against BankVest (10/99) ceases new business (8/99) Fleet pulls their lines.

Commerce Security ( 9/99 closed to leasing broker program )(11/99 last fundings/ 12/2000 Leasing News gives credit to Ron Wagner as the first to see the quality and margins of leasing changing, decides to avoid what was to happen in the year 2000 ).

Franchise Mortgage Acceptance Corporation (FMAC) 11/1999 purchased

Heller Financial's Commercial Services Unit (10/99 purchased by CIT)

Lyon Credit Corporation (9/99 purchased by Hudson United Bancorp)

Japan Leasing Credit claims (JLC --6/99 purchased by Orix)

Liberty Leasing (6/1999 closed, California company)

Golden Gate Funding (2/99) purchased by Westover Financial

Rockford Industries (2/99) sold to American Express

No dates on these changes:

American Business Leasing (gone)

The Bancorp Group, Inc. (Southfield, MI) (Not accepting news business. The BOD of the parent bank is assessing what to do with the leasing subsidiary.....currently servicing portfolio but not originating. No longer in business)

Imperial Credit Industries (ICII) (sold portfolio)

Leasing Solutions, San Jose (bankrupt)

Merit Leasing (gone)

Prime Leasing, Minnesota (no longer doing business)

***Original Purchases by Date by UniCapital

American Capital Resources 2/98

Boulder Capital Group 2/98

Cauff, Lippman Aviation 2/98

Jacom Computer Services 2/98

Matrix Funding 2/98

Merrimac Financial Associates 2/98

Municipal Capital Markets Group 2/98

The NSJ Group 2/98

Portfolio Financial Servicing 2/98 --acquires assets of UniCapital

Vanlease 2/98

The Walden Group 2/98

K.L.C., Inc. dba Keystone Leasing 5/98

Jumbo Jet 7/98

HLC Financial 7/98

Saddleback Financial Corporation 7/98 ---back in business U.S.

Turbine Engine Corp. 7/98

The Myerson Companies dba BSB Leasing 9/98 --- back in business under original owner now: Don Myerson

[headlines]

--------------------------------------------------------------

Classified Ads--- Asset Management

(These ads are “free” to those seeking employment

or looking to improve their position)

Minneapolis, MN |

Experienced Asset Manager of various portfolio's for a bank, broker and leasing company. Utilized specialized remarketing companies to maximize collateral values. Worked remote two years. geoff.taylor@verizon.net | Resume | Reference 1 | Reference 2 |

Free Posting for those seeking employment in Leasing:

http://www.leasingnews.org/Classified/Jwanted/Jwanted-post.htm

All “free” categories “job wanted” ads:

http://www.leasingnews.org/Classified/Jwanted/Jwanted.htm

[headlines]

--------------------------------------------------------------

$87 Million & Criminal Case continued against Charles K. Schwartz

(mug shot: Essex County Corrections Facility)

Of the 31 cases filed in 2010, only five remain including De Lage Landen Financial which involves the dealer of the equipment who appears to have turned states evidence in the US Attorney case against. The bankruptcy proceedings filed by Commonwealth Capital, Key Equipment Finance and Kingsbridge Holdings on September 17, 2010 against Charles K. Schwartz continues with creditors filing their claims regarding his personal guarantee on the many leases and assets of Allied Health Care Services continued to be auctioned off.

There are seventeen pages of creditors to be notified regarding auction of Allied Health Care Services, Inc. building located 89 Main Street, New Jersey (6,170 square feet with un-finished basement on 26,068 square foot lot).

Also to be sold: he following motor vehicles: 2003 GMC Savanna cargo van; 2008 GMC Savanna cargo van; 2009 GMC Savanna cargo van; 2007 GMC Savanna cargo van; 2008 Buick Enclave 4 door SUV; 2006 GMC Savanna cargo van; 2004 GMC Yukon 4 door SUV; 2001 GMC Yukon Denali 4 door SUV; 2007 Pontiac Torrent 4 door SUV; 2007 GMC Savanna cargo van; 2008 Pontiac Torrent 4 door SUV as well as miscellaneous office furniture and equipment, inventory consisting of life care/Respironics ventilators, wheelchairs, and other healthcare equipment supplies (actual list of equipment not noted.

The September 1, 2010 filing against Charles K. Schwartz shows several appeals regarding bail showing he was denied a change in the original order and has the right to apply again following the oral hearing on January 28, 2011 as it appears he does not have the ability to put up the collateral. There have been rumors that money was deposited out the United States, but that has never been proven nor does it appear available to get Schwartz out of Essex County Jail as the case and two bankruptcies proceed.

List of Creditors:

http://www.leasingnews.org/PDF/MainStreetBldg_creditors.pdf

Schwartz Denied Change in Bail:

http://www.leasingnews.org/PDF/SchwartzBailDenied.pdf

Allied Health Care Services stories:

http://www.leasingnews.org/Conscious-Top%20Stories/allied_health.html

Gary DiLillo, President

216-658-5618 or gary@avptc.com |

[headlines]

--------------------------------------------------------------

Leasing 102

by Mr. Terry Winders, CLP

Prefunding Documents

I have been opposed to vendors that need to be paid prior to a lessee’s placing in the hand of a lessor a signed acceptance after delivery and inspection. In this economy and with many lessors approving transactions before having a take out resulting in the delay of payments, the trend toward pre-payment, and especially a lessor “down payment” is becoming a more common demand.

Many funders have put in place “interim rent” programs, but have not fully covered all the legal problems from testing and acceptance of the equipment in satisfactory working condition to other documentation that is also necessary. So I asked Mr. Barry Marks Esq. of Birmingham, Alabama to create a Prefunding Acceptance Certificate that attempts to solve some of the problems.

Caution should be taken that this is an attempt to document the event and is not a fool proof solution. Here is the language:

| As the Lessee we request you to make arrangements to pay for the vehicle or other equipment (“vehicle”) before it is delivered to and inspected by us. The Lessor is only willing to do this at lessee’s sole risk. Accordingly, notwithstanding any contrary language in the lease, the term of the lease and all of Lessee’s obligations, thereunder, including the lessee’s obligation to pay lease payments, will begin on the above date, whether or not lessee has received and accepted the vehicle or any portion of it or any related equipment. As of that date, lessee’s obligations are absolute, unconditional, and cannot be cancelled.

Lessee hereby waives any right to inspect the vehicle, including all rights under the Uniform Commercial Code and LESSEE UNCONDITIONALY ACCEPT THE EQUIPMENT AS-IS WHERE-IS AS OF THE DATE OF LEASE COMMENCEMENT SHOWN ABOVE WHETHER OR NOT IT HAS BEEN DELIVERED (IN WHICH CASE LEASE WILL IMMEDIATELT TERMINATE ON NOTICE FROM LESSOR. LESSEE ACKNOWLEDGES THAT LESSOR MAKES NO REPRESNTATIONS OR WARRANTY AS TO THE VEHICLE AND DISCLAIM ANY IMPLIED WARRANTY OR MERCHANTABILITY OR FITNESS FOR USE OR PURPOSE. NOTICE TO SIGNER: BY EXECUTION BELOW YOU ARE WAIVING VALUABLE LEGAL RIGHTS |

As you can see by the language it is a precarious situation for the lessee but if the vendor and the lessor can get the lessee to sign it, at least there is some hope that everything will go smoothly. I would not use this approach unless the equipment does not require assembly and is intact and ready to use upon delivery. Also the equipment should not have a history of any problems of performance at delivery. However, anytime you allow the lessee opportunities to reject the lease under the condition if it did not function properly upon possession, you will have an expensive legal bill.

One additional problem is that if the papers are signed in advance of the lessee taking possession then the Filing of a lien for UCC purposes could be in question. If it’s a vehicle the title work will solve the problem. If it is personal property, the usual delivery certificate has been signed early so the clock for the 20 days may apply to have preference over a blanket lien holder. This would require that you obtain a bill of laden to prove possession date or file a UCC- 1 with the best description available, when the papers are signed. Often overlooked, there should be a follow up with a UCC-3 to Correct, or add to, the description when the complete information becomes available, which also strengthens your security position.

I highly recommend the delivery and acceptance certificate be signed and dated upon actual delivery to give the lessee to inspect and agree that the equipment is in working order. Prefunding documents work in some legal courts and not in others. I also recommend only do prefunding when forced to do so and with an exceptional credit.

Mr. Terry Winders, CLP, has been a teacher, consultant, expert witness for the leasing industry for thirty-five years and can be reached at leaseconsulting@msn.com or 502-649-0448

He invites your questions and queries.

Previous #102 Columns:

http://www.leasingnews.org/Conscious-Top%20Stories/Leasing_102/Index.htm

|

(This ad is a “trade” for the writing of this column. Opinions

contained in the column are those of Mr. Terry Winders, CLP)

[headlines]

--------------------------------------------------------------

Leasing Industry Help Wanted

Vehicle Lenders Group, LLC is looking for dynamic sales associate. Either work out of one of our offices in Calif. , Dayton, or Oyster Bay, NY or your own office. |

Sales Account Executives: Jacksonville, FL/Philadelphia, PA. Navitas Lease Corp is a top leader in the equipment financing industry. We offer solutions to small-to-medium-sized businesses looking to acquire and finance equipment. |

Please see our Job Wanted section for possible new employees.

Leasing News Help Wanted Ad Pricing

Help Wanted Web Ad New Programs Classified Ad Section Design work is free. Logo is free as well as company description not to exceed the number of lines of the ad. 15 days in a row: 30 days in a row: Ads are placed in the "Help Wanted' section by category, alphabetical, with the ad with the most lines first in the group. They appear on the web site and in each news edition at the top in a rotation basis per issue. * Help Wanted” ads appear in each issue on a chronological basis above the top headline as a courtesy. This position is not available as a paid position, but is generally on a rotation basis. At the same time, the ad continues in the classified help wanted section in the news edition and web site, so in effect appears twice. Leasing News reserves the right to refuse advertising, particularly to a company that has appeared in the complaint bulletin board |

[headlines]

--------------------------------------------------------------

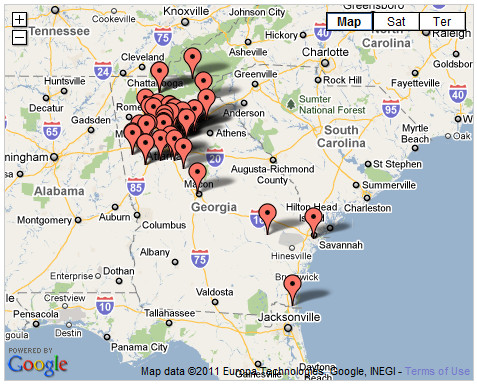

Bank Beat---Two More Georgia, One Chicago Bank Failure

The two branches of North Georgia Bank, Watkinsville, Georgia were closed with BankSouth, Greensboro, Georgia, to assume all of the deposits of North Georgia Bank, except certain brokered and Internet deposits.

44 banks have failed in Georgia over the past two years

http://projects.ajc.com/maps/business/failed-georgia-banks/

Watkinsville, a town of 2,097 is less than ten miles south of Athens with a population of over 100,000, known perhaps as the home of the University of Georgia and one of the 28 governments where it is both city-county government combined, such as San Francisco, California.

Most of the bank failures have dealt with the land and construction loan defaults, many by small community banks who wanted to get in on a the expansion bubble and did not have the capital o survive the downturn.

As of December 31, 2010, North Georgia Bank had approximately $153.2 million in total assets and $139.7 million in total deposits. BankSouth agreed to purchase approximately $123.9 million of the failed bank's assets, including all of the loans. The FDIC will retain the remaining assets for later disposition.

Formed April 17, 2000, the bank had 27 full time employees with a branch in Athens and one in Watkinsville. 008 the net equity was $13.3 million, 2009 $8.2 million, and September 30, 2010, $3.8 million. Non-current loans in the same periods were $14.7 million, $25.7 million and $33.2 million. The bank lost $1.8 million year-end 2008 and $5 million year-end 2009 with charge offs of $2.5 million in construction and land development, $382,000 in nonfarm nonresidential properties, and $431 1-4 family residential properties, $122,000 in farmland. September 30, 2009 the loss was $4.8 million after charge offs of $2.7 million n construction and land development, $972,000 in 1-4 family residential properties, $79, --- secured by nonfarm nonresidential properties, and $380,000 in commercial and industrial loans. Tier 1 risk-based capital ratio 3.23%.

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $35.2 million.

http://www.fdic.gov/news/news/press/2011/pr11024.html

The three branches of American Trust Bank, Roswell, Georgia were closed with Renasant Bank, Tupelo, Mississippi, to assume all of the deposits. Formed August 11, 2002 to service Atlanta, Sandy Springs, and Marietta there were branches in Alpharetta, Cumming, and Roswell.

Renasant Bank has been expanding its branch network to 14 full-service locations in North Georgia providing entry into the Roswell market while at the same time adding additional branches in the Alpharetta and Cumming markets.

"We are pleased to announce our second FDIC-assisted acquisition in the past eight months. The chance to acquire American Trust was a tremendous opportunity to expand Renasant Bank's presence in North Georgia," said Renasant Chairman and CEO, E. Robinson McGraw. "Our entrance into North Georgia in July, 2010 following our acquisition of Crescent Bank & Trust in July, 2010 has been a great addition for Renasant as it provides access to new markets with attractive, long-term growth opportunities. Going forward, our excess liquidity and strong capital ratios have us well positioned to consider opportunities to expand our footprint in desirable markets and continue to enhance long term shareholder value in Renasant."

The FDIC and Renasant Bank entered into a loss-share transaction on $94.3 million of American Trust Bank's assets.

The bank had 43 full time employees December 31, 2008 but was down to 29 full time employees in September 30, 2010. Net equity year-end 2008 was $24.3 million, $10.2 million year-end 2009 and $5.8 million, September 30, 2010. Non-current loans in the same period were $8.1 million. $34.9 million and $41.1 million.

The bank had lost $2 million year-end 2008 and $14.1 million year-end 2009 following $$4.9 million n charge offs for construction and land development, $1.4 million in nonfarm nonresidential properties, $483,000 in commercial and industrial loans, and $206,000 1-4 family residential properties.

Year-end 2010 numbers were not available, but September 30, 2010 showed a $4.8 million loss to the bank fatter charge offs of $2.3 million in construction and land development, $392,000 nonfarm nonresidential properties, $175,0000 in commercial and industrial loans. Tier 1 risk-based capital ratio: 2.93%.

As of December 31, 2010, American Trust Bank had approximately $238.2 million in total assets and $222.2 million in total deposits. In addition to assuming all of the deposits of the failed bank, Renasant Bank agreed to purchase approximately $147.4 million of the failed bank's assets. The FDIC will retain the remaining assets for later disposition.

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $71.5 million.

http://www.fdic.gov/news/news/press/2011/pr11023.html

![]()

Community First Bank – Chicago, Chicago, Illinois, was closed with Northbrook Bank and Trust Company, Northbrook, Illinois, to assume all of the deposits. Formed November 1, 2005, the bank had 13 full time employees.

January 30 and August 3 of last year the FDIC issued corrective action notices about the operation of the small bank.

Net Equity had gone from $7.2 million year-end 2008 to $3 million year-end 2009, it a $1.3 million loss 2008 and $4.2 million loss 2009 with charge offs of $902,000 in construction and land development loans, $148,000 in "other loans" as well as $4.7 million in non-current loans.

September 30, 2010 net equity had dropped to $1.6 million with a loss of $1.3 million. Non-current loans were $2 million and charge offs $336,000, but net operating income was $1.49 million. Tier 1 risk-based capital ratio: 3.49%.

As of December 31, 2010, Community First Bank – Chicago had approximately $51.1 million in total assets and $49.5 million in total deposits. Northbrook Bank and Trust Company will pay the FDIC a premium of 0.50 percent to assume all of the deposits of Community First Bank – Chicago. In addition to assuming all of the deposits of the failed bank, Northbrook Bank and Trust Company agreed to purchase essentially all of the assets.

The FDIC and Northbrook Bank and Trust Company entered into a loss-share transaction on $42.8 million of Community First Bank – Chicago's assets.

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $11.7 million.

http://www.fdic.gov/news/news/press/2011/pr11025.html

Tracking Bank Failures Map:

http://graphicsweb.wsj.com/documents/Failed-US-Banks.html

List of Bank Failures:

http://www.fdic.gov/bank/individual/failed/banklist.html

Bank Beat:

http://www.leasingnews.org/Conscious-Top%20Stories/Bank_Beat.htm

[headlines]

--------------------------------------------------------------

Saluting Leasing News Advisor Bruce Lurie

![]()

The Leasing News Advisory Board does not participate in editorial decisions, meaning reviewing or choosing stories or subjects. Their role is to participate with policy and business advice as well as contribute in discussions on matters brought up by the publisher in a private internal blog.

Bruce Lurie joined the Leasing News Advisory board September 12, 2007 and has been an active participant.

Bruce Lurie, President, Douglas-Guardian Services Corporation, Houston, Texas, an equipment inspection and collateral management firm established in 1932.

Douglas-Guardian Services Corporation

14800 St. Mary's Lane, Suite 200

Houston, Texas 77079

Telephone: 800-255-0552

Fax 800-529-7530

blurie@douglasguardian.com

www.douglasguardian.com

Since July 1995, Bruce Lurie has been president of Douglas-Guardian Services Corporation, the original equipment inspection and collateral management firm established in 1932.

When not chasing down collateral to inspect throughout the US or Canada, Bruce enjoys spending time with his wife Martha and learning new and exciting things from his ten year old daughter Danielle. Bruce is an avid jogger and former triathlon fanatic.

Prior to Douglas Guardian, his experience includes fifteen years with Brown and Root, Inc., a multi-billion dollar engineering and construction company. Primary areas of responsibility have included project development, project finance, sales, marketing, strategic planning and executive management. Extensive training in quality deployment and team building techniques. BS, Civil Engineering, BS Engineering Management, and MBA from Tulane University, New Orleans, LA.

--------------------------------------------------------------

Top Stories January 31--February 4

Here are the top ten stories opened by readers:

(1) Brad Peterson on "Real U.S. Bank Equipment Finance" letter

http://leasingnews.org/archives/Feb2011/2_02.htm#peterson

(2) "The real U.S. Bank Equipment Finance story"

by Christopher Menkin

http://leasingnews.org/archives/Jan2011/1_31.htm#real_story

(3) Lease Police Alert---Tiger Capital Management

http://leasingnews.org/archives/Feb2011/2_04.htm#alert_tiger

(4) Latitude Equipment Leasing Closed?

http://leasingnews.org/archives/Feb2011/2_04.htm#latitude

(Tie) (5) Do you want to become extinct?

http://leasingnews.org/archives/Jan2011/1_31.htm#extinct

(Tie)(5) Equipment Not Repossessed, Lessee use as they Sue Lessor

http://leasingnews.org/archives/Feb2011/2_02.htm#repossessed

(Tie)(6) Snow and Ice Bring Leasing to a Stand Still

http://leasingnews.org/archives/Feb2011/2_02.htm#snow

(Tie)

(6) U.S. Senate votes repeal “1099” Law for 2012

http://leasingnews.org/archives/Feb2011/2_04.htm#repeal

(7) Bank Beat---US Bank Acquires 38 Branches in New Mexico

Bank Prez down with his bank plus two more banks closed

http://leasingnews.org/archives/Jan2011/1_31.htm#bank_beat

(8) The facts behind the $96 Million LEAF Securization

by Christopher Menkin

http://leasingnews.org/archives/Feb2011/2_04.htm#leaf_facts

(9) Tiger's $1B Dubai golf resort was a mirage

http://www.nypost.com/p/news/business/tiger_dubai_g

olf_resort_was_mirage_zTRYNbuL2oThKn1zsLrMvM

(10) Leasing 102 by Mr. Terry Winders, CLP

Vendor Support Agreements

http://leasingnews.org/archives/Jan2011/1_31.htm#vendor

John Kenny Receivables Management • Credit Investigations • Asset Searches • Skip-tracing • Third-party Commercial Collections john@jkrmdirect.com | ph 315-866-1167| www.jkrmdirect.com |

(Leasing News provides this ad as a trade for investigations

and background information provided by John Kenny)

--------------------------------------------------------------

February CLP: Three New Directors plus Chris Walker/Lia Wax

Three new directors for the Certified Leasing Professional Foundation:

|

|

|

| Jeffry D. Elliott, CLP | David A. Normandin, CLP | CLP Kyra Siverly, CLP |

2011 CLP Foundation Board or Directors:

• Joseph G Bonanno, Esq., CLP - Law Office of Joseph Bonanno

• Jeffry D. Elliot, CLP - Huntington Equipment Finance

• Jack Harvey, CLP - Enterprise Financial Solutions, Inc

• D. Paul Nibarger, CLP - Nibarger Associates

• David A Normandin, CLP - ENvision Capital Group LLC

• John Rosenlund, CLP - Portfolio Servicing Company

• Vicki Shimkus, CLP - BSB Leasing

• Kyra Siverly, CLP - Chase Industries, Inc.

• Chris Walker, CLP - GreatAmerica Leasing

• Donna Wesemann, CLP - Susquehanna Commercial Finance, Inc.

• Rosanne Wilson, CLP - 1st Independent Leasing, Inc.

Spotlight Two CLP Members

An Interview with Chris Walker, CLP

Chris Walker, CLP

GreatAmerican Leasing Corp.

CLP Foundation President

What do you enjoy most about the leasing industry?

My Favorite aspect of the equipment finance industry is that no day is the same. My focus has always been on the vendor originated side of our business and I enjoy calling on vendors, uncovering new opportunities and helping vendors use equipment financing effectively.

Can you tell us about your background in the industry?

I got my start in this business in 1979 with a company in Cedar Rapids called LeaseAmerica. We were a general equipment lessor originating business direct from lessees along with a few vendor referrals. We had six field offices scattered around the Midwest supported by 34 home office employees. My training included being a collector, credit analyst, accounting clerk and later filling in for field sales reps that might be away from their office for a week or two. I loved being sent off to an office, answering the phone and doing whatever I could to help the customers. Our training program was more baptism by fire than formal training but it seemed to work well for me.

My first opportunity in sales came when our sales rep in Milwaukee decided to pursue a new opportunity. It started with a temporary assignment and ended with me being able to assume responsibility for the office. I worked hard and Milwaukee was good to me. While I was in Milwaukee I landed a large national program that consumed the majority of my time and while it was successful I had all my eggs in one basket and I needed to diversify.

I wrote a business plan to create a national accounts support team in our Cedar Rapids home office that could service national and regional programs thereby freeing up our sales team to originate more business. Management liked my idea and they asked me to return to Cedar Rapids and implement the program. While I have always traveled, Cedar Rapids has been my home for the past 25 years.

If you could transport yourself instantly, where would you go?

If I could be transported somewhere in history instantly it would be to the Beatles recording sessions for their Sergeant Pepper's Lonely Hearts Club Band album. It would be 1966 and I would be watching creative genius unfold in the collaboration of musicians and technicians directed by George Martin. This album was voted Rolling Stone magazines number one selection in their top 500 rock albums of all time for its musical composition and the innovative methods that were required to record and produce this masterpiece. I remember hearing it for the first time on my parent's hi-fi and I still enjoy listening to it on my iPod at 35,000 feet (that's in an airplane but with a nod to the psychedelic era that produced Sgt. Peppers).

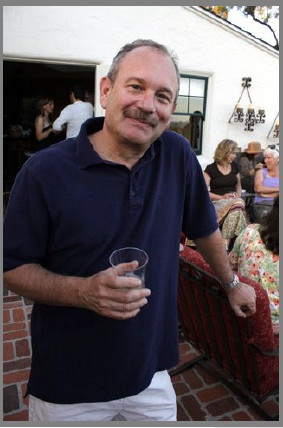

Chris enjoying some downtime at his sister’s house in

Santa Barbara, California overlooking the Pacific.

If you won 50 million dollars in the lottery what would you do with the money?

What would I do if I won $50,000,000? After taking care of my family and local charities, we would embark on an extended tour of concert venues where my friends and I would enjoy our favorite live musical experiences. I can imagine seeing The Rolling Stones in Paris, Boz Skaggs at a small club in San Francisco, Steely Dan at the Hollywood Bowl and Eric Clapton in London. The seats would be front and center, accommodations first class, and travel by private jet. I can dream can't I?

An Interview with Lia Wax, CLP

Lia Wax, CLP

Financial Pacific Leasing, L.L.C

How did you get your start in the business of leasing?

I moved to the Pacific Northwest in 1999, shortly after completing graduate school in Tennessee. I knew I needed a job as quickly as possible and answered an ad for a collections position at a local leasing company. I had no previous leasing experience, but it sounded like an interesting position with a good company. Within a couple days, I got a call from Financial Pacific Leasing letting me know that the collection position had been filled, but that they had another position available that they thought would be a good fit. I was hired in August of that year as a File Coordinator responsible for preparing files for the company's commercial paper conduit. By early 2000, I was a Customer Service Representative, and by the middle of 2001, I was promoted to Supervisor. A position I have retained since that time, while adding the Titling department in 2006. I have been with Financial Pacific for over 11 years now.

In 2004, shortly after reaching the required five years of experience, I asked to have the opportunity to study for the CLP. Being in Customer Service at Financial Pacific, you are required to know a little about all the areas, from Credit through to Collections, to do your job effectively. Being a firm believer that knowledge is power, I felt that if I was going to make leasing my career, I owed it to myself and my employer to learn more than just what was required of me to fulfill my basic job description. I needed to learn everything I could about the industry and our place in it.

I will not sugar coat it, it was a grueling experience, but the sense of pride and accomplishment I have for achieving the designation is tremendous - not to mention the benefits of the knowledge gained through the study and preparation process. I particularly enjoy the camaraderie I experience when meeting other CLPs, or when talking to people preparing to take the exam. I just say, "I've been there, I know how you feel. Yes it's hard, but it's worth it!"

What do you enjoy most about your day?

There are two things I enjoy most about my day. Firstly, it's the people I work with. There's a lot of longevity at Fin Pac and I've built some great relationships. It makes for a very comfortable work environment — it's like a family. I've had the same Manager for 11 years and we work amazingly well together. I understand what a rarity that is in the modern workplace and appreciate it on a daily basis. Secondly, it's that I get to learn something new every day. I have a thirst for knowledge and love problem solving. I enjoy resolving complicated situations and scenarios successfully, to everyone's benefit, while learning something new in the process.

Interesting hobby or accomplishment?

I have a Bachelor of Music degree from the University of North Texas, and a Master of Music degree from the University of Tennessee, Knoxville — both in Flute Performance. I've been a flutist since the age of ten. Although I tried my hand at piano as well as bassoon, flute is the one that stuck. I also enjoy singing on occasion. My preferred performance genres are opera, symphonic works, and classical solo works. That being said, my listening preferences are quite eclectic, with alternative rock being my favorite, though I will listen to just about everything in between. My job feeds my brain, music feeds my soul.

If you could be a super hero, what would be your super power and why?

I'm not sure if it would constitute a super hero trait, but if I could have a "super" power, it would be the ability to cure any disease. I've seen so many lives, both within my family and without, touched and even devastated by disease. To be able to save a child with leukemia, cure a mother with breast cancer, turn back the clock for a brother, sister, friend with a terminal illness - to me, that would be the ultimate super power.

February CLP Circular:

http://www.leasingnews.org/PDF/CLPFebruaryCircular.pdf

[headlines]

--------------------------------------------------------------

Santa Monica, California -- Adopt-a-Dog

Pony Boy

Breed: Boxer

Location: Santa Monica, CA

Size: Med. 26-60 lbs (12-27 kg)

Color: Tricolor (Tan/Brown & Black & White)

Sex: Male

Age: Young

Pony Boy Curtis is:

already neutered

purebred

good with kids

good with dogs

not good with cats

up to date with shots

"Pony Boy Curtis was found roaming the streets of Downey and was picked up by Animal Control and brought to the shelter. He was emaciated and sick and had given up on life. When our volunteers met him, he leaned into them and wanted nothing more than to get out of the shelter. We were so happy to save him!

Pony Boy is gentle and kind. He gets so happy when he sees other dogs. We aren’t sure yet how he is with cats. He loves people of all ages and sizes and walks so nicely on leash. He is so mellow and polite and does not jump on people when he greets them. We think Pony Boy is about four years old. He is a stunning Boxer with the most beautiful red coat and big German Boxer head. He is a big boy, weighing in at about 60 pounds. We know sweet Pony Boy will make a great addition into any family big or small."

Contact this rescue group to adopt Pony Boy Curtis...

Rescue Group: Take Me Home Rescue

Contact: Haze Lynn

Phone: (310) 967-4637

- Let 'em know you saw "Pony Boy Curtis" on Adopt-a-Pet.com!

E-mail: tmhrescue@gmail.com

Fax: (310) 396-3349

Website: http://takemehome.tv

Address: 2633 Lincoln Blvd #207

Santa Monica, CA

90405

Adopt-a-Pet by Leasing Co. State/City

http://www.leasingnews.org/Conscious-Top%20Stories/Adopt_Pet.htm

Adopt a Pet

http://www.adoptapet.com/\

Classified ads—Web Sites to post Resumes

www.adams-inc.com

www.affinitysearch.com

www.bajobs.com

www.careerbank.com

www.careerbuilder.com

www.careerpath.com

www.careerjet.com

www.craigslist.org

ELFA Career Center

www.FinanceLadder.com

http://www.findhow.com/

www.hotjobs.com

www.indeed.com

www.jobs.net

www.jobs-applications.com

www.jobssearchengine.net

www.jobsearchusa.org

www.JobSpin.com

www.jobsinthemoney.com

www.ladders.com

www.leasingworld.co.uk

www.lessors.com

www.MarketingJobs.com

www.monitordaily.com

www.monster.com

www.monstertrak.monster.com/

www.Postonce.com

www.RecruiterConnection.com

www.resumeblaster.com

www.vault.com

www.vetjobs.com

www.worktree.com

www.worldleasingnews.com

All "Outsourcing" Classified ads (advertisers are both requested and responsible to keep their free ads up to date:

http://www.leasingnews.org/Classified/Outsourcing/Outsourcing.htm

How to Post a free "Outsourcing" classified ad:

http://www.leasingnews.org/Classified/Outsourcing/Outsourcing-post.htm

Sports Briefs----

Green Bay Packers take down Steelers, 31-25

More than 1,000 fans displaced as temporary seats not ready; NFL offers triple refunds

Fans chant against Jerry Jones over seat fiasco

Attendance at Cowboys Stadium just short of Super Bowl record

It was dogs' night out — make that dogs' night in — for Super Bowl advertisers

Upcoming Super Bowls:

2012: Super Bowl XLVI, Indianapolis Lucas Oil Stadium

2013: Super Bowl XLVII, New Orleans Superdome

2014: Super Bowl XLVIII, New Meadowlands Stadium, N.J.

2015: Super Bowl XLIX, to be announced

2016: Super Bowl L, to be announced

(Leasing News provides this ad “gratis” as a means

to help support the growth of Lease Police)

![]()

California Nuts Briefs---

Chico, Hometown of Green Bay Packers Quarterback celebrates

http://www.sacbee.com/2011/02/06/3382350/hometown-of-green-bay-packers.html

![]()

“Gimme that Wine”

Lion Nathan USA Acquires Macrostie Winery and Vineyards

http://www.winebusiness.com/news/?go=getArticle&dataid=83702

Tennessee: Allowing Wine in Grocery stores could bring 3,000 jobs

http://www.bizjournals.com/nashville/morning_call/2011/02/group-wine-in-groceries-could-bring.html

Champagne brings back bling

http://www.thedrinksbusiness.com/index.php?option=com_content&task=view&id=12292&Itemid=66

Domaine de la Romanée-Conti’s production down 40%

http://www.thedrinksbusiness.com/index.php?option=com_content&task=view&id=12289&Itemid=66

Free Mobile Wine Program

http://leasingnews.org/archives/Feb2010/2_26.htm#mobile

Wine Prices by vintage

http://www.winezap.com

US/International Wine Events

http://www.localwineevents.com/

Winery Atlas

http://www.carterhouse.com/atlas/\

Leasing News Wine & Spirits Page

http://two.leasingnews.org/Recommendations/wnensprts.htm

[headlines]

----------------------------------------------------------------

![]()

This Day in American History

1820- the first American to set foot on Antarctica was John Davis, a seal hunter, who went ashore at Hughes Bay. Antarctica had already been seen from a distance by the English explorer James Cook and the crew of his ship, the Endeavor, which circumnavigated the continent between 1773 and 1775.

1827- ballet was introduced to the United States by renowned French danseuse Mme Francisquy Hutin with a performance of The Deserter, staged at the Bowery Theater, New York, NY. A minor scandal erupted when the ladies in the lower boxes left the theater upon viewing the light and scanty attire of Mme Hutin and her troupe.

1861- a dramatic drop in temperature took place. The temperature at Gouverneur, New York plunged 70 degrees in one day, from 30 degrees above zero to 40 degrees below zero. Hanover, New Hampshire plummeted 69 degrees in 18 hours, from 37 degrees at 1 PM on the 7th to 32 degrees below zero at 7 am on the 8th. West Cummingham, Massachusetts dropped 80 degrees, from 48 degrees to 32 degrees below zero, and Boston, Massachusetts plunged 60 degrees, from 46 degrees to 14 degrees below zero.

1867- birthday of author Laura Elizabeth Ingalls, Dakota Territory, now Wisconsin. http://memory.loc.gov/ammem/today/feb07.html

1882-John L. Sullivan won the bare-knuckle heavyweight championship of the world by defeating Paddy Ryan in a nine-round fight in Mississippi City, MS. Sullivan was the last bare-knuckles champion. He held the title until 1892 when he lost to James J. Corbett in a fight conducted under the Marquees of Queensbury Rules.

1883--- Song writer/composer/pianist/organist Eubie Blake birthday

http://www.jass.com/sissle.html

http://chnm.gmu.edu/courses/magic/saloon/blake.html

1885-Birthday of Sinclair Lewis, American novelist and social critic. Recipient of Nobel Prize for Literature (1930). Among his novels: Main Street, Babbitt and It Can't Happen Here. Born Harry Sinclair Lewis at Sauk Center, MN. Died at Rome, Italy, Jan 10, 1951.

1893 - Elisha Gray, of Highland Park, Illinois, patented the telautograph which automatically signed autographs on documents, freeing up the autographer to do other things.

1904 - The biggest fire in the United States since the great Chicago blaze of 1871 broke out in Baltimore, destroying more than 2,600 buildings.

1920 - a great 4 day snow and sleet storm came to an end over New England and southeastern New York. Accumulations of 15 to 20 inches of ice, sleet, and snow were common, stalling traffic for weeks.

1922 - For the first time, DeWitt and Lila Acheson Wallace offered 5,000 copies of their magazine for sale. Today, "Reader’s Digest" continues to be widely read all over the world. In fact, it is the most-read periodical in history with an over 16 million circulation.

1926 -- Negro History Week, originated by Carter G. Woodson, is observed for the first time.

1931 - In New York City, the American opera, "Peter Ibbetson", by Deems Taylor premiered at the Metropolitan Opera House.

1934 - A deep freeze made it possible to drive from Bay Shore to Fire Island NY.

1936 - An executive order established the United States Vice President’s flag.

1940 - Walt Disney's animation, "Pinocchio", premiered at the Center Theatre in Manhattan, New York. The showing was the second feature-length film for Disney, following "Snow White and the Seven Dwarfs". One critic called the show, "The happiest event since the war."

1941 - UCLA forward, Jackie Robinson, scored 20 points in a losing cause, as the USC Trojans beat the Bruins 43-41, marking the 34th straight loss UCLA had suffered to USC since 1932. In the 1970s, the Bruins made up for those losses when coach John Wooden arrived.

1941 - On Victor Records, the Tommy Dorsey Orchestra and Frank Sinatra teamed up to record "Everything Happens to Me". The session was held in the New York City studios of Victor.

1944-- The Nazi's launch a second attack against the Allied beachead at Anzio, Italy. They hoped to push the Allies back into the sea.

1949 - The New York Yankees rewarded Joe DiMaggio by making him the first baseball player to earn $100,000 a year.

1949 - No. 1 Billboard Pop Hit: ``A Little Bird Told Me,'' Evelyn Knight & the Stardusters.

1950 --The United States recognizes Vietnam under the leadership of Emperor Bao Dai, not Ho Chi Minh who is recognized by the Soviets.

1950—Top Hits

Dear Hearts and Gentle People - Dinah Shore

A Dreamer’s Holiday - Perry Como

The Old Master Painter - Snooky Lanson

Chatanoogie Shoe Shine Boy - Red Foley

1951-MILLETT, LEWIS L. Medal of Honor

Rank and organization: Captain, U.S. Army, Company E, 27th Infantry Regiment. Place and date: Vicinity of Soam-Ni, Korea, 7 February 1951. Entered service at: Mechanic Falls, Maine. Born: 15 December 1920, Mechanic Falls, Maine. G.O. No.: 69, 2 August 1951. Citation: Capt. Millett, Company E, distinguished himself by conspicuous gallantry and intrepidity above and beyond the call of duty in action. While personally leading his company in an attack against a strongly held position he noted that the 1st Platoon was pinned down by small-arms, automatic, and antitank fire. Capt. Millett ordered the 3d Platoon forward, placed himself at the head of the 2 platoons, and, with fixed bayonet, led the assault up the fire-swept hill. In the fierce charge Capt. Millett bayoneted 2 enemy soldiers and boldly continued on, throwing grenades, clubbing and bayoneting the enemy, while urging his men forward by shouting encouragement. Despite vicious opposing fire, the whirlwind hand-to-hand assault carried to the crest of the hill. His dauntless leadership and personal courage so inspired his men that they stormed into the hostile position and used their bayonets with such lethal effect that the enemy fled in wild disorder. During this fierce onslaught Capt. Millett was wounded by grenade fragments but refused evacuation until the objective was taken and firmly secured. The superb leadership, conspicuous courage, and consummate devotion to duty demonstrated by Capt. Millett were directly responsible for the successful accomplishment of a hazardous mission and reflect the highest credit on himself and the heroic traditions of the military service.

1956-- Ella Fitzgerald cuts first session of “Cole Porter Songbook.”

1956--McGAHA, CHARLES L. Medal of Honor

Rank and organization: Master Sergeant, U.S. Army, Company G, 35th Infantry, 25th Infantry Division. Place and date: Near Lupao, Luzon, Philippine Islands, 7 February 1945. Entered service at: Crosby, Tenn. Birth: Crosby, Tenn. G.O. No.: 30, 2 April 1946. Citation: He displayed conspicuous gallantry and intrepidity. His platoon and 1 other from Company G were pinned down in a roadside ditch by heavy fire from 5 Japanese tanks supported by 10 machineguns and a platoon of riflemen. When 1 of his men fell wounded 40 yards away, he unhesitatingly crossed the road under a hail of bullets and moved the man 75 yards to safety. Although he had suffered a deep arm wound, he returned to his post. Finding the platoon leader seriously wounded, he assumed command and rallied his men. Once more he braved the enemy fire to go to the aid of a litter party removing another wounded soldier. A shell exploded in their midst, wounding him in the shoulder and killing 2 of the party. He picked up the remaining man, carried him to cover, and then moved out in front deliberately to draw the enemy fire while the American forces, thus protected, withdrew to safety. When the last man had gained the new position, he rejoined his command and there collapsed from loss of blood and exhaustion. M/Sgt. McGaha set an example of courage and leadership in keeping with the highest traditions of the service.

1958—Top Hits

Don’t/I Beg of You - Elvis Presley

Get a Job - The Silhouettes

Sail Along Silvery Moon - Billy Vaughn

Ballad of a Teenage Queen - Johnny Cash

1960-Barrett Strong's "Money" enters the pop chart where it tops out at #23. On the R&B chart it climbs to #2. The song will be covered by the likes of the Beatles, Kingsmen, Flying Lizards and Jr. Walker and the All Stars.

1962 -- Vietnam: First U.S. Army support companies arrive in Saigon. Weapons

were still M-1's and BAR's; no preparation for jungle war fare. The

military has not changed in all these years, still: SNAFU. Ask

any vet who was there.

1962-Birthday of singer Garth Brooks; the biggest star to emerge from the "new country" movement of the 1990s, was born in Yukon, Oklahoma. He blended rock and country influences and his highly theatrical stage shows stemmed from his admiration for such groups as Queen and Kiss. Since his self-titled debut in 1989, sales of Brooks's albums have surpassed 50 million. His 1991 release "Ropin' the Wind" was the first album ever to debut at number one on both Billboard's pop and country album charts, a feat repeated by his 1993 album "In Pieces."

1964 -- Cassius Clay becomes a Black Muslim.

1964-The Beatles arrive at New York's Kennedy Airport for their first appearance on "The Ed Sullivan Show." They are greeted by thousands of screaming fans in what is the first demonstration of Beatlemania in America. It was also the day that Baskin-Robbins introduced "Beatle-Nut" ice-cream.

1965 -- Vietnam: US Air force begins systematic saturation bombing & strafing of North Vietnam — as opposed to their special "festive" bombing & strafing — coinciding with Kosygin’s visit to Hanoi.

1966-The Beatles' "Nowhere Man" is released.

1966—Top Hits

My Love - Petula Clark

Barbara Ann - The Beach Boys

No Matter What Shape (Your Stomach’s In) - The T-Bones

Giddyup Go - Red Sovine

1966-The Beach Boys album, "Summer Days" goes gold, it's their sixth album to do so.

1967--SISLER, GEORGE K. Medal of Honor

Rank and organization: First Lieutenant, U.S. Army, Headquarters and Headquarters Company, 5th Special Forces Group (Airborne), 1st Special Forces. Place and date: Republic of Vietnam. 7 February 1967. Entered service at: Dexter, Mo. Born: 19 September 1937, Dexter, Mo. Citation: For conspicuous gallantry and intrepidity at the risk of his life and above and beyond the call of duty. 1st Lt. Sisler was the platoon leader/adviser to a Special United States/Vietnam exploitation force. While on patrol deep within enemy dominated territory, 1st Lt. Sisler's platoon was attacked from 3 sides by a company sized enemy force. 1st Lt. Sisler quickly rallied his men, deployed them to a better defensive position, called for air strikes, and moved among his men to encourage and direct their efforts. Learning that 2 men had been wounded and were unable to pull back to the perimeter, 1st Lt. Sisler charged from the position through intense enemy fire to assist them. He reached the men and began carrying 1 of them back to the perimeter, when he was taken under more intensive weapons fire by the enemy. Laying down his wounded comrade, he killed 3 onrushing enemy soldiers by firing his rifle and silenced the enemy machinegun with a grenade. As he returned the wounded man to the perimeter, the left flank of the position came under extremely heavy attack by the superior enemy force and several additional men of his platoon were quickly wounded. Realizing the need for instant action to prevent his position from being overrun, 1st Lt. Sisler picked up some grenades and charged single-handedly into the enemy onslaught, firing his weapon and throwing grenades. This singularly heroic action broke up the vicious assault and forced the enemy to begin withdrawing. Despite the continuing enemy fire, 1st Lt. Sisler was moving about the battlefield directing force and several additional men of his platoon were quickly wounded. His extraordinary leadership, infinite courage, and selfless concern for his men saved the lives of a number of his comrades. His actions reflect great credit upon himself and uphold the highest traditions of the military service.

1968 -- After American & South Vietnamese air & artillery strikes level the city of Bentre, South Vietnam (pop. 50,000), a US Army major explains that

"it became necessary to destroy the town to save it."

http://www.namebase.org/nerve.html

1969-- Diane Crump became the first woman jockey to ride in a pari-mutuel race at a US Track. Crump finished tenth in a field of 12 at Hialeah.

1969 - The weekly TV music variety show ``This Is Tom Jones'' premieres on ABC-TV.

1970-Johnny Cash's album, "Hello, I'm Johnny Cash" goes gold. His label, Columbia, report his LPs "At Folsom Prison" and "At San Quinten" have sold over 2 million copies each and his "Greatest Hits" album has sold over a million copies.

1970-Joe Cocker's version of the Beatles classic "She Came In Through The Bathroom Window" peaks at #30 on the pop chart.

1974-Soul artist Barry White receives four gold records on this date: for the singles "Never, Never Gonna Give Ya Up" (#7), "Love's Theme" (Number One by the Love Unlimited Orchestra, conducted by White), and the album's "Under the Influence of Love Unlimited" (#3) and "Sonte Gon'" (#20).

1974—Top Hits

The Way We Were - Barbra Streisand

Love’s Theme - Love Unlimited Orchestra

Americans - Byron MacGregor

Jolene - Dolly Parton

1974-- Mel Brooks' "Blazing Saddles" opens in movie theaters.

http://www.filmsite.org/blaz.html

http://en.wikipedia.org/wiki/Blazing_Saddles

1976-Paul Simon's "50 Ways To Leave Your Lover" peaks at #1 on the chart.

1978 - The worst winter storm of record struck coastal New England. The storm produced 27.5 inches of snow at Boston, and nearly 50 inches in northeastern Rhode Island. The fourteen foot tide at Portland ME was probably the highest of the century. Winds gusted to 79 mph at Boston, and reached 92 mph at Chatham MA. A hurricane size surf caused 75 deaths and 500 million dollars damage.

1979-- the Toronto Maple Leafs’ Darryl Sittler set an NHL record for most points in a game when he scored six goals and earned four assists in an 11-4 victory over the Boston Bruins. 1982, outfielder George Foster became baseball’s highest-paid player and the first $2 million man when he signed a five-year contract worth $10 million with the New York Mets. Free agent Foster left the Cincinnati Reds’ fabled “Big Red Machine,” but his offensive production with the Mets never reached expectations. New York released him before the last year of his contract expired.

1979 - No. 1 Billboard Pop Hit: ``Da Ya Think I'm Sexy?'' Rod Stewart. The song is an international success, reaching No. 1 in 11 countries.

1980 -- Pink Floyd begins one of the more unusual coast-to-coast tours in rock history, playing the first of only 14 shows in Los Angeles. The only other city they played was New York. The stage, to promote the band's latest album "The Wall," features a 120 by 60 foot wall made of Styrofoam blocks, which gradually envelops the group as the show goes on.

1982—Top Hits

Centerfold - The J. Geils Band

Harden My Heart - Quarterflash

Turn Your Love Around - George Benson

Lonely Nights - Mickey Gilley

1984---Navy Captain Bruce McCandless was the first and Army Lieutenant Colonel Robert Stewart were the second astronaut to fly free in space. While in orbit over the earth, McCandless exited Space Shuttle Challenger and maneuvered freely, without a tether, using a rocket pack on his own design. Stewart also sued the rocket pack to fly untethered later that day.

1985 - "Sports Illustrated" released its annual swimsuit edition. This issue was the biggest regular edition in the magazine’s history, with 218 pages. On the cover, Paulina Porizkova joined Cheryl Tiegs and Christie Brinkley as the only models to make the cover more than once.

1985 - "New York, New York" became the Big Apple's official anthem. Mayor Ed Koch made the announcement.

1986 -- Haiti: After huge popular protests, dictator "Baby Doc" Duvalier (President-for-Life) flees the country, ending 35 years of this U.S.-sponsored terrorist dictatorship

1987 - Madonna’s "Open Your Heart" hit #1 in the U.S. It was the third straight number-one single from her "True Blue" album.

1988 - Twenty-two cities in the eastern U.S. reported record low temperatures for the date, including Binghamton NY with a reading of 5 degrees below zero. Snow blanketed southern Louisiana, with three inches reported at Cameron.

1989 - Twenty-five cities in the western U.S. reported record low temperatures for the date. Lows of 16 at Las Vegas NV, 26 at Bakersfield CA, -29 degrees at Milford UT, and -16 degrees at Reno NV were February records. The low of 43 degrees below zero at Boca CA was a state record for the month of February. In Utah, lows of -32 degrees at Bryce Canyon, -27 degrees at Delta, -29 degrees at Dugway, and -38 degrees at Vernal were all-time records for those locations.

1989 - No. 1 Billboard Pop Hit: ``Straight Up,'' Paula Abdul.

1990- Lisa Leslie of Morningside HS, Inglewood, CA, scored 101 points in the first half of a game against South Torrance HS. the game ended at the half with the score at 1023-24 as the South Torrance coach refused to let his team finish the game.

1990

How Am I Supposed to Live Without You - Michael Bolton

Opposites Attract - Paula Abdul with The Wild Pair

Downtown Train - Rod Stewart

Nobody’s Home - Clint Black

1994- Whitney Houston dominated the 21st annual American Music Awards, winning seven honors on the strength of "The Bodyguard" soundtrack and her version of Dolly Parton's "I Will Always Love You." During the taping of the show in Los Angeles, Blind Melon lead singer Richard Shannon Hoon began mouthing off, then struck a security guard in the face. He was arrested and put in a police car, where he tried to kick out the partition between the front and back seats. After a further altercation at the police station, Hoon was charged with assault and battery. Blind Melon was a nominee for best new artist but lost to Stone Temple Pilots.

1994-, Paul Anka was honored at the French music industry's annual awards in Paris for his song "My Way." It was in 1968 that Anka wrote new lyrics to the melody of a French pop hit "Comme d'habitude," which means "As Usual." Anka called his version "My Way," and it became Frank Sinatra's signature song.

1998 - The XVIIIth Winter Olympic games opened at Nagano, Japan. Wind, rain, fog and lightning, with a mild earthquake thrown in, played havoc with Alpine skiing during the first five days. Then, good weather moved in and, when the games ended, the Japanese were hailed for their excellent show.

1998-- NHL's Dallas Stars retire Neal Broten's #7

--------------------------------------------------------------

SuDoku

The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler?

http://leasingnews.org/Soduku/soduko-main.htm

--------------------------------------------------------------

Daily Puzzle

How to play:

http://www.setgame.com/set/puzzle_frame.htm

Refresh for current date:

http://www.setgame.com/set/puzzle_frame.htm

--------------------------------------------------------------

http://www.gasbuddy.com/

http://www.gasbuddy.com/GB_Map_Gas_Prices.aspx

http://www.gasbuddy.com/GB_Mobile_Instructions.aspx

--------------------------------------------------------------

Weather

See USA map, click to specific area, no commercials

--------------------------------------------------------------

Traffic Live---

Real Time Traffic Information

You can save up to 20 different routes and check them out with one click,

or type in a new route to learn the traffic live

--------------------------------