Sales Account Executives: Jacksonville, FL/Philadelphia, PA. Navitas Lease Corp is a top leader in the equipment financing industry. We offer solutions to small-to-medium-sized businesses looking to acquire and finance equipment. |

Monday, January 31, 2011

Today's Equipment Leasing Headlines

Do you want to become extinct?

Classified Ads---Sales Manager

"The real U.S. Bank Equipment Finance story"

by Christopher Menkin

Bank Beat---US Bank Acquires 38 Branches in New Mexico

Bank Prez down with his bank plus two more banks closed

Classified Ads---Help Wanted

Top Stories---January 24--January 28

Leasing 102 by Mr. Terry Winders, CLP

Vendor Support Agreements

Saluting Leasing News Advisor Board Chairman Robert Teichman, CLP

Taos, New Mexico Adopt-a-Dog

Classified ads—Signing Service/Site Inspection

News Briefs---

Banks to Get $30 Billion for Small Business Loans

Flight Lessor recovery set to strengthen in 2011

Credit card rates at record highs near 15%

Taco Bell stands behind its beef

Broker/Funder/Industry Lists |

Features (collection)

Top Ten Stories Chosen by Readers |

Top Stories last six months

Changes that are coming

You May Have Missed---

Sports Briefs---

California Nuts Briefs---

"Gimme that Wine"

This Day in American History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

######## surrounding the article denotes it is a “press release”

and was not written by Leasing News nor information verified, but from the source noted. When an article is signed by the writer, it is considered a “by line.” It reflects the opinion and research of the writer. It is considered “bias” as it is the writer’s viewpoint.

[headlines]

--------------------------------------------------------------

Do you want to become extinct?

[headlines]

--------------------------------------------------------------

Classified Ads---Sale Manager

(These ads are “free” to those seeking employment

or looking to improve their position)

|

Bayville, NJ |

|

Fort Myers, Florida Very experienced and strong skills with both Captive and Specialty Sales Management. Over 25 years , will relocate and travel---successful and team player. e-mail: tlinspections@gmail.com |

Free Posting for those seeking employment in Leasing:

http://www.leasingnews.org/Classified/Jwanted/Jwanted-post.htm

All “free” categories “job wanted” ads:

http://www.leasingnews.org/Classified/Jwanted/Jwanted.htm

|

[headlines]

--------------------------------------------------------------

"The real U.S. Bank Equipment Finance story"

by Christopher Menkin

(The title comes from an unsigned letter sent by US Mail to Leasing News without

a return address from Minneapolis, Minnesota.)

Unedited

The real U.S. Bank Equipment Finance story

A few of us at US Bank Equipment Finance would like to give you the 'real' story related to layoffs, departing senior leaders and 'who' is ultimately responsible for the remaining $9B in assets.

Sal Maglietta continues to lead the integration of both the Portland Equipment Finance Group (middle market transactions over $250,000 and approximately $4B in assets) and the Business Equipment Finance Group (comprised of 4 separate small ticket divisions and approximately $4.4B in assets).

The integration continues to go very well under Sal's direction and leadership. US Bancorp will emerge as a premier funding source, supporting various market niches, customer and products. You won't find a lessor more committed to the overall leasing and finance market space than US Bank.

Please realize Manifest Funding has been and is only a small portion of the US Bank Equipment Finance total assets, approximately 15% and shrinking for good reason. Manifest was 1 of 5 operating divisions in with BEFG (Manifest, Office Equipment, Healthcare, Vendor, Bank Services and Portfolio Services). Each group was run by a General Manager responsible for all sales, marketing, collections, credit decisions, etc.

During 2008-2009, Manifest Funding Services was the majority (over 70%) of Business Equipment Finance Groups charge off's due to poor credit decisions and "stressed" niche markets served.

Manifest was lead by Curt Kovash from 2006-2010 until he assigned to other responsibilities in the summer of 2010. Kovash now reports to Tom Ellis in the Vendor Group having been removed from Manifest.

Manifest, under Kovash's direction was 100% responsible for all operational and sales components outside of shared services (tax/legal/finance) including ALL credit decisions, all portfolio collection, sales and marketing, etc...

Manifest Brokers DID NOT cause these issues, it was the leadership and decisions made by Kovash and staff at Manifest that allowed this to happen and cause the pain to the broker lessor space. They did not react to changing market conditions soon enough. Had managerial control been moved away from Manifest Leadership sooner, the Manifest Group's outcome would have been very different.

The now departed Adrian Hebig (COO), Dave Verkinderen (current GM of BEFG Office Equipment and Machine Tool Finance), Tom Landmark (BEFG Portfolio Analytics), were all instrumental in the 'clean' up of Manifest and the problems incurred.

Hebig left the organization on great terms with US Bank and Maglietta. His departure was not the result of the problems at Manifest or within BEFG, it was his choice to move on to the next opportunity.

Joe Andries was pushed out of the organization due to lack of operational control, risk to US Bank and sheer leadership challenges.

Landmark remains with the organization in a portfolio analytics position to insure what happened at Manifest does not happen again. He has a focused role within the small ticket groups.

Verkinderen continues to lead the Office Equipment Group and the Portland Machine Tool Group as part of the reorganization. He reports to Tony Cracchiolo. Verkinderen is the Sr. onsite manger for the Marshall, MN office. Most if not all of us, are excited about the future at US Bank. We have had our challenges, but we have survived the storm 10X better than our competition.

US Bank is capital rich and very interested in growing profitable assets on a consistent and repeatable basis. We hope this clarifies and provides a clearer picture of the NEW U.S. Bank Equipment Finance Group.

The letter above makes public what Leasing News has been reporting with a view to me that does not understand what has been happening in the finance and leasing industry.

To lay the entire blame on one person is not fair as it takes a team, everyone doing their best, to make a success. When the market changes, you change with it or become extinct just as Darwin’s “Survival of the Fittest."

Curt Kovash was contacted by email for a comment, but none received.

Let me be Mr. Kovash’s advocate.

The National Association of Equipment Leasing Brokers for two years in a row voted US Bank Manifest and Curt Kovash in the Monitor Online award as the best company to do business with. Kovash also served on the National Equipment Finance Association Board of Directors and was very active in the industry.

He arrived at his position August, 2005, not 2006 as the letter states, following:

"(8/05) President and Chief Executive Officer of U.S. Bancorp Equipment Finance William Purcell leaves to become Chief Operating Officer at Aequitas Capital Management

(8/05) Curt P. Kovash named new Senior Vice President and General Manager (8/05) Brad Peterson Joins Pentech Financial Services, Inc. Vice President – Navigator Business Programs. The former General Manager - US Bancorp Manifest Funding Services, Peterson brings over 15 years of experience in lease sales and management to this strategic position. (3/2004) Brad Peterson New US Bancorp Manifest Sr. V-P & Gen. Mgr. (3/04) Brian Bjella as Senior Vice President and General Manager, resigns to form a Company with Ken Noyes: Grandview Financial, which consists of Quest Resources, headquartered in New Jersey. Bjella will remain in Marshall, Minnesota, where the company will grow, keeping the current staff and operations in New Jersey. This is a 50-50 partnership, according to Brian Bjella, who said, “It has always been a dream of mine, but I never actively pursued anything because I love working for Manifest. The right opportunity never came around until now, and it is one that I need to follow. “I am excited to have the opportunity to grow my own company, “he added, “but it is very difficult for me to leave Manifest - it is a great organization with great people.” (4/2002)Troy Molitor resigns as General Manager. He follows Don Polfiet...Chris Canavati. Good men that Manifest does miss. (3/2001) changes name to U.S. Bancorp - Manifest Funding Services. Manifest Group- (9/1/2000) purchased by US Bancorp Leasing and Financial, "...a win for all the parties involved," Brian Bjella. (11/2000) Donald Polfiet leaves and no one knows where he went. If you know, please tell us." (Last we heard, he was CEO of Falcon Leasing, Foley, MN. Editor)

http://www.leasingnews.org/List_Chron/2005.htm

If anything the above changes in management of Manifest perhaps go back to Mary Jane Lindholm, when Lyon Financial was sold to US Bank. Executives grew up from the ranks. There was a comraderie, a team effort. New brokers visited Marshall to get acquainted. Reps visited brokers all over the county, inviting new brokers and working on programs. It was personal relationships. The unsigned letter above gives more credence that that is lost.

Certainly, the market has changed. Let’s go back to when the first signed occurred, and Leasing News wrote about it, earlier than 2008 in the monthly Al Schuler housing reports that readers often asked why do we have these as what does it have to do with leasing? Former leasing executive Steve Chriest wrote February 3, 2006: “Bad Moon on the Rise.”

“"In our current situation, the housing industry has generally been credited with propping up an otherwise wobbly economy for the past several years. With the large number of interest only, adjustable rate, no money down, no income verification, and no credit required loans written over the past few years, and the reality of stagnant or declining house values, it seems inevitable that the housing industry will contribute mightily to the bad moon rising."

http://www.leasingnews.org/archives/February%202006/02-03-06.htm#moon

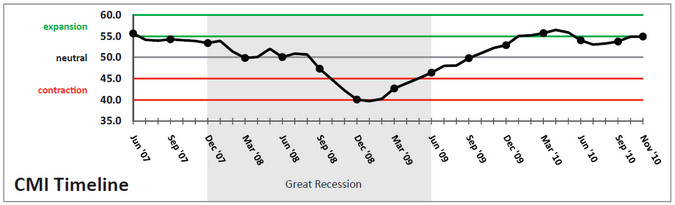

Look at the date the college and university financial officials would declare historically as the start of the slide to the bottom of the recession.

(Compiled from National Association of Credit Managers reports)

It should be noted this also was a time that leasing companies began shutting down broker business with the first being GE Capital.

http://www.leasingnews.org/archives/September%202008/09-25-08.htm#ge

And the housing market decline was serious, too.

http://www.leasingnews.org/archives/September%202008/09-29-08.htm#recover

It was also the time of the rash of "Trigger Leads," leasing companies buying leads of credit run by leasing companies and calling the customer with a lower rate. The internet had changed that from fax to fund to internet with documents and funding and 15 minute approvals (that’s what Great America does.)

While mass software leads and telephone marketing grew, their customers started closing, laying people off, and both the construction and land development was to affect not only banks but Wall Street itself, from restaurants and it seemed only franchises were bulletproof, so everyone went after them.

NorVergence changed leasing, which Leasing News warned about as court decision became more consumer oriented than business; “Hell and high water contracts” were becoming a thing of the past.

The last time I spoke with Kurt it concerned:

"March, 2009 Lyon Financial dba U.S. Bancorp Manifest Financial Services, a wholly owned subsidiary of U.S. Bank, lost a case to Christopher Rural Health Planning with the jury in Franklin County, Benton, Illinois awarding the plaintiff $59 million. The suit goes back to 2005 regarding software leases. When the vendor went out of business, the lessee could get no service on the software, so stopped the lease payments. The case was tried in a very small community in Franklin County where a jury found in favor of the lessees that Manifest was responsible for the software not being up-dated and maintained."

http://www.leasingnews.org/archives/March%202009/03-13-09.htm#kovash

The March 2009 date is significant as it coincided with a series of major changes in the leasing industry, such as the announcement of Paul A. Larkins resigning as CEO of Key National Finance and Key Equipment Finance, Superior, Colorado (FDIC shows $106.5 million charge off year-end 2009 lease financing receivables). (http://www.leasingnews.org/archives/March%202009/03-18-09.htm#resign) as well as Pentech Financial basically out of funds to lease with Navigator Financial lead by Ron Wagner, CLP, closing down (supported by US Bank Manifest turn-downs.) Many banks got out of leasing altogether, others cut off brokers, and even leasing entities ended broker programs.

Smaller companies such as Balboa stopped broker business and LEAF, among others, was headed down the road of extinction.

At the same time Leasing News announced changes at US Bank:

"Michael J. Rizzo, President & CEO, Business Equipment Finance Group, executive vice president at U.S. Bank, formerly President and CEO of Lyon Financial Services (now known as U.S. Bancorp Business Equipment Finance Group), is no longer focusing on the leasing division. Dave Verkinderen is the General Manager of that division. Adrian Hebig is the Chief Operations Officer. Both are considered peers."

http://www.leasingnews.org/archives/March%202009/03-20-09.htm#usbank

It appears the major changes happened July, 2010 as Leasing News reported U.S. Bancorp Oliver-Allen group, Larkspur, California operation office moving to Portland, Oregon, affecting 60 employees, reports of auditing problems, sales administrative problems, lawsuits by ex-salesmen, one sales lady claim costing US Bank $1.2 million over $27,000 commission not paid; several executive problems, too,

Then the reporting on changes at US Bank Manifest, letting people go, as the letter above addresses, as well as cutting brokers who were not sending in a million a year in business or had more write-offs than others. The move was finally made official with this copy of an email to a broker, it was official. July, 2010 cutting back brokers (http://leasingnews.org/archives/July2010/7_02.htm#manifest)

US Bank Portfolio Services has also been stripped.

The latest is cutting back of SIC industries, such as physical fitness and other types of business, as well as franchises due to large loses, it is reported. Much of this comes from brokers who email Leasing News, "Where do I go now?" with LEAF, Marlin, and now Manifest gone with the good rates and liberal approvals.

The letter does not blame the brokers, but the reality is they are the ones taking the hit by US Bank Manifest. The credit model of US Bank Manifest is the culprit. It did not keep up with the marketplace. The company appears headed toward extinction.

Christopher “Kit” Menkin, Editor

Mary Jane Lindholm Found

http://www.leasingnews.org/archives/May%202007/05-16-07.htm#found

[headlines]

--------------------------------------------------------------

Bank Beat---US Bank Acquires 38 Branches in New Mexico

Bank Prez down with his bank plus two more banks closed

The 38 branches of First Community Bank, Taos, New Mexico, were closed with U.S. Bank, (NYSE:USB) Minneapolis, Minnesota, to assume all of the deposits.

“This acquisition is an extension of U.S. Bank's banking franchise into its 25th contiguous state, and it immediately establishes us as one of the top three banks in terms of market share in the attractive New Mexico market. It is a great fit for both companies since First Community Bank and U.S. Bank share a similar community banking model which will help to ensure a smooth transition for customers and employees,” noted John Elmore, executive vice president of community banking at U.S. Bank.

He told the Santafenewmexican.com in a telephone interview late Friday why First Community Bank had failed: "You can look at their financial statements and see that they had very heavy commercial investments in commercial real estate with a lot of it being outside of the New Mexico market."

"New Mexico is a state we have always looked at and been desirous of trying to find the opportunity to become a major player in the state," he said. "... Because of the problems they had, they were not able to invest and do some things maybe in some of the markets that they would have liked ... so we will be looking at additional investments."

First Community Bank was first founded in 1922 in Taos under the name First State Bank. It was acquired by First Community Bank in 1988 and at its height, it included 62 branches in four states.

December 31, 2008 the bank had 813 full time employees, but by September 30, 2010 it was down to

494 full time employees, according to FDIC records. Founded January 1, 1922, there were 12 in Albuquerque, five offices in Santa Fee, two each in Belen, Clovis, Las Cruces, Rio Rancho, Taos, Arizona, and two in Phoenix Arizona, plus one in Sun City, Arizona. They also had a branch in Bernalilo, El Prado, Gallup, Grants, Los Lunas, Moriarty, Placitas, and Portales.

Bank equity 2008 was $254.7 million, 2009 $146.5 million following losses of $149.2 million year-end 2008 and $107.98 million 2009 after charge offs of $80 million in construction and land development, $14.2 million secured by nonfarm nonresidential properties., $8.9 million 1-4 family residential properties, $7.4 million commercial and industrial loans, a total of $113 million in charges offs as well as $247.7 million in non-current loans.

September 30, 2010 found the bank equity down to $52 million from $254.7 the previous quarter in 2009. The bank had also lost $98.1 million September 30, 2010 with $259.3 million in non-current loans after charging off $102.5 million ($65 million in construction and land development, $23.9 secured by nonfarm nonresidential properties, $6.3 million in commercial and industrial loans, $5 million secured by 1-4 family residential properties, $886,000 to loans to individuals, $$534,000 secured by multifamily residential properties, and $729,000 secured by farmland. Tier 1 risk-based capital ratio: 2.68%.

As of September 30, 2010, First Community Bank had approximately $2.31 billion in total assets and $1.94 billion in total deposits. In addition to assuming all of the deposits of the failed bank, U.S. Bank, National Association agreed to purchase essentially all of the assets.

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $260.0 million.

http://www.fdic.gov/news/news/press/2011/pr11018.html

Bank President goes down with his own bank.

The four branches of Evergreen State Bank, Stoughton, Wisconsin with McFarland State Bank, McFarland, Wisconsin, to assume all of the deposits. The bank was formed October 1, 1899 and had 53 full-time employees with three branches in Stoughton, one in Janesville and one in Sun Prairie.

Among the 100 shareholders who lost money was the bank President and CEO Jim Farrell, who according to the Wisconsin State Journal, filed for Chapter 7 less than a month ago, December, 2010. He reportedly had purchased a large amount of stock in the bank, borrowing heavily from two local banks to make the purchase.

He reportedly borrowed more than $2 million in his effort to capitalize the bank and keep it in business.

Equity year-end 2008 was $27 million, $22.3 million year-end 2009, and $3.2 million September 30, 2010. The bank had lost $2.35 million year-end 2008, and $3.5 million year-end 2009 with $12.3 million noncurrent loans.

September 30, 2010, Non-current loans had risen to $17.3 million and the bank was showing a $21.1 million loss September 30, 2010 after $6.2 million in real estate charge offs ($2 million in nonfarm nonresidential property, $1.7 million in multi-family residential property, $1.46 million in 1-4 family residential property, $1 million in construction and land development, but the largest, $4.6 million in commercial and industrial loans.

Tier 1 risk-based capital ratio: 1.26%

As of September 30, 2010, Evergreen State Bank had approximately $246.5 million in total assets and $195.2 million in total deposits. In addition to assuming all of the deposits of the failed bank, McFarland State Bank agreed to purchase essentially all of the assets.

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $22.8 million.

http://www.fdic.gov/news/news/press/2011/pr11016.html

Closed but no bank taking over

FirsTier Bank, Louisville, Colorado, was closed Friday by the Colorado Division of Banking and became the second bank this year not to be taken over by another bank. The office will remain open until February 28, 2011, to allow depositors access to their insured deposits and time to open accounts at other insured institutions.

This is the second bank to fail in Colorado this year. Last week saw the eight branches of United Western Bank close, the first billion dollar plus banking failure of 2011.

The bank was formed June 30, 2009 and had 9 offices, one in Boulder, Broomfield, Denver, Greenwood Village, Louisville, Loveland, Parker, Westminster, Adams County, and Westminster, Jefferson County. There were 102 full time employees.

Gerald Billings, a senior ombudsman specialist for the FDIC, told Fox 31 (KDVR.com), "The bank failed primarily because of the real estate development loans that they made not being able to repay the bank, "Bank equity had dropped from $62.5 million year-end 2008 to $25.7 million year-end 2009 with $160.1 million in noncurrent loans. The bank had lost $36.25 million year-end 2009 after $6.4 million charge off in commercial and industrial loans, $1.6 million in construction and land development, $978,000 in 1-4 family residential properties, and $776,000 in nonfarm nonresidential properties.

September 30, 2010 noncurrent loans were $145.7 million with net equity down to $1.6 million (2008 was $62.5 million) and a loss of $16 million following charge offs of $11.9 million in construction and land development, $1.66 million in nonfarm nonresidential properties, $198,000 farm land, $335,000 in 1-4 family residential properties and $1.9 million in commercial and industrial loans. Tier 1 risk-based capital ratio: 1.59%.

Note: Year-end FDIC numbers were not available, and assuming from other reports, there is more losses, as Coloradodaily.com reported: "Earlier this month, FirsTier bought back Calmante Rock Creek, a benighted luxury townhome development in Superior, in a foreclosure auction. FirsTier had financed Calmante with $10 million in loans." It certainly would have given the bank a negative net equity and the high noncurrent loans show there would be more defaults coming.

Beginning today, Monday, depositors of FirsTier Bank with more than $250,000 at the bank may visit the FDIC’s Web page "Is My Account Fully Insured?" at http://www2.fdic.gov/dip/Index.asp to determine their insurance coverage.

As of September 30, 2010, FirsTier Bank had $781.5 million in total assets and $722.8 million in total deposits.

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $242.6 million.

http://www.fdic.gov/news/news/press/2011/pr11017.html

Should not have been closed?

Here is one that does not appear on the surface it should have been closed; however, The First State Bank, Camargo, Oklahoma, was closed with Bank 7, Oklahoma City, Oklahoma, to assume all of the deposits.

Established September 29, 1911, the bank had 8 full time employees with agricultural specialization. The bank looks like it is the middle of no where, survived the depression, the great dust storm of Oklahoma, and from its financial statement to the FDIC seems to be healthy. Perhaps its only negative is its location.

"Population 115...The median income for a household in the town was $23,750, and the median income for a family was $36,875. Males had a median income of $32,083 versus $28,125 for females. The per capita income for the town was $20,417. There were 20.6% of families and 24.3% of the population living below the poverty line, including 20.0% of under eighteens and 46.7% of those over 64."http://en.wikipedia.org/wiki/Camargo,_Oklahoma

Bank net equity had risen from $2.3 million 2008, $2.96 million 2009, and $3.2 million September 30, 2010. The bank made $32,000 year-end 2008, $757,000 year-end 2009 with noncurrent loans of $95,000, after charging off $296,000 to individuals and $68,000 commercial and industrial loans. September 30, 2010 net profit was $666,000 after charges offs of $380,000 in loans to individual and $66,000 in commercial and industrial loans with noncurrent loans $147,000. The financial numbers look healthy and the Tier 1 risk-based capital ratio 8.79%. There is perhaps more to the story, but not found on line.

As of September 30, 2010, The First State Bank had approximately $43.5 million in total assets and $40.3 million in total deposits. In addition to assuming all of the deposits of the failed bank, Bank 7 agreed to purchase essentially all of the assets.

Tier 1 risk-based capital ratio 8.79%

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $20.1 million.

http://www.fdic.gov/news/news/press/2011/pr11015.html

Tracking Bank Failures Map:

http://graphicsweb.wsj.com/documents/Failed-US-Banks.html

List of Bank Failures:

http://www.fdic.gov/bank/individual/failed/banklist.html

Bank Beat:

http://www.leasingnews.org/Conscious-Top%20Stories/Bank_Beat.htm

Why Choose Advanced Property Tax Compliance? |

|

Dedicated to the leasing industry |

[headlines]

--------------------------------------------------------------

Leasing Industry Help Wanted

Sales Manager – Houston Office FIRST NATIONAL CAPITAL CORPORATION Is the 5th Largest Privately Held Equipment Finance Company In the United States |

Vehicle Lenders Group, LLC is looking for dynamic sales associate. Either work out of one of our offices in Calif. , Dayton, or Oyster Bay, NY or your own office. |

Sales Account Executives: Jacksonville, FL/Philadelphia, PA. Navitas Lease Corp is a top leader in the equipment financing industry. We offer solutions to small-to-medium-sized businesses looking to acquire and finance equipment. |

San Francisco www.bankofthewest.com |

Please see our Job Wanted section for possible new employees.

[headlines]

--------------------------------------------------------------

Top Stories---January 24--January 28

Here are the top ten stories opened by readers:

(1) LEAF Commercial Credit under Way

http://leasingnews.org/archives/Jan2011/1_24.htm#leaf_cc

(2) Archives January 24, 2003—25 year Anniversary

ACC Capital, Loni Lowder, President-CEO

http://leasingnews.org/archives/Jan2011/1_24.htm#archives

(3) Fifth-Third Bank Leasing Charge Offs

http://leasingnews.org/archives/Jan2011/1_24.htm#fifth_third

(Tie) (4) Bank Beat---First Billion Dollar plus Banking Failure 2011

http://leasingnews.org/archives/Jan2011/1_24.htm#bank_beat

(Tie)

(4) New Trends in Leasing

http://leasingnews.org/archives/Jan2011/1_24.htm#trends

(5) Leasing Business Leaders are Positive about 2011

http://leasingnews.org/archives/Jan2011/1_28.htm#positive

(6) WikiLeak? Market Trends Small Ticket Leasing

http://leasingnews.org/archives/Jan2011/1_28.htm#trends

(Tie) (7) Leasing 102 by Mr. Terry Winders, CLP

Tools for Commercial Leasing

http://leasingnews.org/archives/Jan2011/1_24.htm#tools

(Tie) (7) New Hires---Promotions

http://leasingnews.org/archives/Jan2011/1_28.htm#hires

(8) John Roscoe Pleads Guilty in "Cigarettes Cheaper" fraud

http://leasingnews.org/archives/Jan2011/1_26.htm#roscoe_guilty

(9) Two More: Evergreen---ELFA Small Ticket Council

http://leasingnews.org/archives/Jan2011/1_26.htm#two_more

(10) Dog Walks Kit on a Beautiful Day in California

(Eat your heart out those living on the East Coast)

http://leasingnews.org/archives/Jan2011/1_26.htm#dog_walk

[headlines]

--------------------------------------------------------------

Leasing 102

by Mr. Terry Winders, CLP

Vendor Support Agreements

Usually when a vendor has a high margin and fells strongly about a poor credit risk they will offer recourse to encourage the lessor to fund the transaction. Recourse is a very complex issue and therefore requires proper documentation. There are many types of recourse such as; full recourse, limited recourse, dealer participating non recourse, and rent to lease/own programs, and remarketing agreements.

Full recourse is a term that means the seller of the equipment guarantees the performance of the lessee, and if the lessee defaults, is prepared to cover the loss of the funding source. Full recourse allows some transactions that would normally be turned down to be acceptable, but the recourse document needs to be carefully drafted. The agreement must cover many points to establish where, and when, the responsibilities of both parties are effective. For instance, when does the vendor cover the loss, and most important how much? Is the recourse to cover all recovery costs or just the net present value of the unpaid lease payments? If late charges are unpaid are they included in the payoff? Who pays for the recovery costs and if a replevin action is necessary who pays the attorney and court costs. Plus who makes the decision on when to pull the plug? In addition, once the equipment is in the possession of the vendor, and it takes some time to remarket, is the balance paid to the lessor upon re-possession or after it is remarketed. If after remarketing, how long is the remarketing going to take and should a time frame be attached?

Good communication about the scope of the recourse is necessary to make sure both parties to the agreement are fully aware of what part each plays, and who has the power to make decisions.

The days of self-help repossession are long gone and it takes a replevin action to get the legal right to go after the equipment. Some States still allow self help repossession but the risk it represents, if not done correctly, make it a very poor approach. If a Lessee voluntarily surrenders the equipment even then a legal statement, defining the lessee's request you take the equipment with acceptance of continuing responsibilities, needs to be signed to have the right to obtain recover a loss.

Collection costs have raised the bar on the value of recourse today, because if the lessee defaults, the expense of repossession and remarketing add so much to the balance that if it is done correctly, and explained completely, most vendors shy away from it. The equipment must carry a high resale value to make recourse work and a tight reign on delinquency is necessary to avoid letting time slip away. Done with poor documentation a disagreement will always arise with the vendor and it will destroy a good vendor relationship.

Recourse can work if the transaction is a direct finance lease for the lessor so the only consideration is the unpaid balance and the recover costs. If the transaction is a true lease with tax lease considerations then the pay off is larger and makes it almost impossible to come out clean if a default occurs. The best way to reduce the risk is with a security deposit or increased payments in the early years to reduce the balance as soon as possible.

Once in a while the vendor will offer “Limited Recourse” to cover the first two years, or one third of the lease term, to help the lessee prove his ability to pay the lease payments. This is a lessor decision but it still required that you properly document the agreement so if a default occurs, both parties understand their responsibility

A popular recourse arrangement is one were the vendor receives a commission on each transaction but it is held in reserve against any losses. It is called a dealer participating non- recourse arrangement. A dollar amount, or a percentage of the outstanding portfolio, is assigned so that at the end of each year any funds in the account over the selected amount can be paid out to the vendor. The incentive to the vendor is that with few or no losses he gets the full commission. This puts the vendor in the decision tract on what limited credits are acceptable. If the losses are small then the reserve handles the loss and both the lessor and the vendor are covered. However, a proper document is required just like a full recourse agreement to establish timing and cost allocations.

Rent to lease/own programs place the vendors recourse on a short time frame and the lessee's payment on an elevated payment schedule to cover the risk. These are not done for poor credits but for start ups and lessees with short histories. An example is to subtract the wholesale value of the equipment after six months of use from the selling cost. Then create a rent period for six months at a lease payment that will reduce the balance to the wholesale value. The vendor is on full recourse for the six months and then a non-recourse finance or lease program for a longer period of time is offered at a much lower payment amount. The theory is that if the lessee could make the higher payments for six months then the lower payments should be OK and by that time a good equity has been placed into the equipment lowering the risk to the lessor.

The last effort for support is to ask the vendor for remarketing. If they agree an agreement should be drafted to spell out all of the issues such as: commissions paid for the remarketing effort, time in inventory, get ready charges, insurance, advertising costs, and storage. If the commission is not at an equal par with those paid for normal inventory you can expect your equipment to be stored and probably take a very long term to sell.

Vendor support is a good program under the correct set of circumstances but should not be thought of as a way of shifting the burden of risk. Lessor's are better equipped to make credit and equipment judgments and some times good intentions can lead to loss business because usually bad credits will mean a high degree of loss for someone and as my mentor in the business said; Life is to short to do business with companies of low character.

Mr. Terry Winders, CLP, has been a teacher, consultant, expert witness for the leasing industry for thirty-five years and can be reached at leaseconsulting@msn.com or 502-649-0448

He invites your questions and queries.

Previous #102 Columns:

http://www.leasingnews.org/Conscious-Top%20Stories/Leasing_102/Index.htm

|

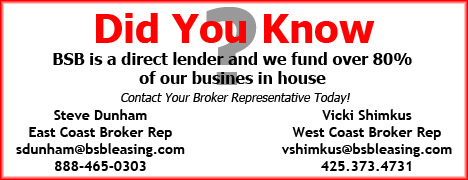

(This ad is a “trade” for the writing of this column. Opinions

contained in the column are those of Mr. Terry Winders, CLP)

[headlines]

--------------------------------------------------------------

Saluting Leasing News Advisor Board Chairman Robert Teichman, CLP

The Leasing News Advisory Board does not participate in editorial decisions, meaning reviewing or choosing stories or subjects. Their role is to participate with policy and business advice as well as contribute in discussions on matters brought up by the publisher in a private internal blog.

Bob was appointed by Kit Menkin as chairman May 8, 2005, primarily to recognize him as our number one good will ambassador. Kit has known him for thirty-eight years since the early 1970's when he was President of Dividend Leasing, Santa Clara, and Bob was the champion salesman, just out of Crocker Bank Leasing. Later roles were reversed when Kit sold him deals at various funding companies he represented. He also tutored him to pass the Certified Leasing Professional test, but could never get Kit to run the HP calculator correctly.

Bob joined the Leasing News Advisory Board July 7, 2000. He was actually involved in the "perception" of the newsletter before this date, making many contributions before we went “on line.”

He is the one readers call with the most complaints, or wanting the editor to print a press release or explain what was written. Perhaps he started to get the calls as at one time he wrote about all the leasing conferences for Leasing News, wrote many articles, "pal'd around" with Kit at conferences, where many learned he was a very close friend.

Many don't know Bob is quite a musician, a dancer, and choral singer.

Robert Teichman, CLP

Teichman Financial Training

3030 Bridgeway, Suite 213

Sausalito, CA 94965

Tel: 415 331-6445

Fax: 415 331-6451

e-mail: BoTei@aol.com

Bob Teichman, CLP, was born in New York City. After attending the High School of Music & Art and the New York College of Music, he received his undergraduate degree from Columbia College.

“I studied music for a lot of years. I even played piano professionally while in college (local 802, American Federation of Musicians, James C. Petrillo presiding!), “he added. “I have kept up my interest in music by singing in a local chorus for the past 27 years. There are about 100 of us and we give concerts several times a year, mostly pre-20th century composers like Bach, Haydn, Mozart, Beethoven. But we do get away from the 18th and 19th centuries. At a recent concert we performed 15th and 20th century music.” He pursued his graduate studies in Geneva, Switzerland.

"55 years ago, when I was a graduate student in Geneva, I met my wife Patricia," he wrote. "She was working at the UN and she and I were members of a group of expatriates- Americans, British, Russians, Swedes, mid-Easterners- who all hung around the same cafes"

"It was the late 1950's and Switzerland was affordable for students like me. The ski slopes were close and most of the rest of Europe was less than a day’s drive away.

"But sooner or later reality sets in. Fifty years ago we married in New York and came to California; driving cross-country in a 1957 Bristol sedan my father had picked up on one of his many trips. The car had right-hand drive, so it was a real challenge maneuvering on the two-lane roads (yeah, they were paved; it was the middle of the 20th, not the 19th, century.) Still, it was an adventure when we had car trouble on a couple of occasions.

"Patty is an avid gardener and an excellent watercolorist. The two interests coincide in her botanical paintings. Here is an example of her painting of a flower from our garden:

"We spend our vacations at a small and very primitive cabin in the Sierra backcountry. Summers only; the roads aren't plowed in the winter. Nice country in summer, though. Pines, firs, granite outcrops, streams, meadows. Also coyotes, bears and deer. We don't bother them, they don't bother us. A bear did chew on my neighbor's cabin. Probably liked the taste of the wood stain.

"Thanks for your friendship over all these years. After having been in the leasing business for almost 48 years, I really appreciate all the wonderful people I have met, and the lasting friendships I have formed. I still enjoy the business immensely. There is always something new around the corner."

Bob started in automotive leasing in 1963 in sales, then moved into equipment leasing in the late 1960's. For over 20 years he provided funding for leasing companies as an officer of both bank and non-bank lenders. Along the way, he started several successful leasing companies. His company, Teichman Financial Training, located in Sausalito, California, was founded in 1998 and provides lease education and consulting services to lessors, funders, brokers, government and international agencies, and other members of the financial community.

He is active in leasing associations, having served on the Board of Directors of the United Association of Equipment Leasing (UAEL) for four years. For three years he was the Chairman of their Education Committee with responsibility for the Certification Program and Educational Programs. He was also a member of other committees including the Standards Committee.

Bob is a frequent speaker at leasing industry events, and has written articles for UAEL's Newsline and other industry publications. He is a co-author of the Certified Leasing Professional's Handbook.

He served two years as President of the Certified Leasing Professional Foundation Board, and served as Chairman of the Education Committee. He is also a member of the National Association of Equipment Leasing Brokers and the National Equipment Finance Association.

[headlines]

--------------------------------------------------------------

Taos, New Mexico -- Adopt-a-Dog

Camron

Animal ID: 11957819

Breed : Shepherd/Retriever, Labrador

Age: 5 months

Sex: Male

Size: Small

Color: Black

Intake Date: 11/29/2010

Adoption Process:

http://www.strayhearts.org/adoption_process.php

Stray Hearts Animal Shelter

1200 Saint Francis Lane

PO BOX 622

Taos, NM 87571

(575) 758-2981

strayhearts@taosnet.com

http://www.strayhearts.org

Adopt-a-Pet by Leasing Co. State/City

http://www.leasingnews.org/Conscious-Top%20Stories/Adopt_Pet.htm

Adopt a Pet

http://www.adoptapet.com/\

Classified ads—Signing Service/Site Inspection

Leasing Industry Outsourcing

(Providing Services and Products)

|

Signing Service: New Jersey Mobile NJ Lease Signing Service We are New Jersey mobile lease signers and Notaries.We bring lease to clients, expedite signing and return docs. Same day. Jim Lissemore, Pres www.Flexo-Notaries.com |

Site Inspection: Placentia, CA On site verifications, document signing or collections. Quick, accurate and professional. Reports with photographs e-mailed direct. Agents throughout US. Contact for coverage and rates. E-mail:pwright@yk2bizsolutions.com |

Site Inspection: US & Canada Quiktrak performs equipment inspections within 24 hours of your job placement anywhere in the US. Order, check status & receive reports & photos online. E-mail:sdresser@quiktrak.com |

Site Inspection: National Property Tax Compliance Services to the leasing industry. Over 60-years experience and fifty Lessors as clients. References and free quotes available, (216) 658-5618, |

| Inspection: Tampa /St. Pete, FL Contact Dick Mitchell @ Randolph Lynn Associates for prompt professional pre-funding equipment inspections, collateral "visits", and related lessee/vendor contacts. (Florida locations) 727-302-9144 E-mail:dmrla@gte.net |

Site Inspection plus: Greater Baltimore area C. and A. Courier Services™, TA / Andreas Klepp-Egge Jr., Baltimore MD 21229.Field Appraisal Inspection Service, 410-746-6355, candacourier22@aol.com. |

| Asset Inspections / Lender Services: Serving Michigan, N.Ohio, N.Indiana – Lender services including asset inspection, business/vendor verification, collections, and lease/loan signings. 25 years experience leasing/financial. www.michiganclosingsandmore.com sheri@michiganclosingsandmore.com |

All "Outsourcing" Classified ads (advertisers are both requested and responsible to keep their free ads up to date:

http://www.leasingnews.org/Classified/Outsourcing/Outsourcing.htm

How to Post a free "Outsourcing" classified ad:

http://www.leasingnews.org/Classified/Outsourcing/Outsourcing-post.htm

![]()

News Briefs----

Banks to Get $30 Billion for Small Business Loans

Flight Lessor recovery set to strengthen in 2011

Credit card rates at record highs near 15%

Taco Bell stands behind its beef

John Kenny Receivables Management • Fraud Investigations • Credit Investigations • Asset Searches • Skip-tracing • Third-party Commercial Collections john@jkrmdirect.com | ph 315-866-1167| www.jkrmdirect.com |

(Leasing News provides this ad as a trade for investigations

and background information provided by John Kenny)

You May have Missed---

Changes that are coming

http://leasingnews.org/PDF/CHANGES_ARE_COMING.pdf

Sports Briefs----

Dallas fans endorse Jerry Jones as Cowboys owner

http://www.dallasnews.com/sports/super-bowl/local/20110129-dmn-poll-dallas-fans-endorse-jerry-jones-as-cowboys-owner.ece

NFL Players Association Creates New Ad Campaign to Spread Awareness of Potential Lockout

http://multivu.prnewswire.com/mnr/nflplayers/48366/

![]()

California Nuts Briefs---

Cell Phones, State Cars, Now Juvenile Offenders

http://www.sacbee.com/2011/01/30/3362700/brown-wants-all-juvenile-offenders.html

Squaw Valley's new CEO is talking about a snow train

http://www.sacbee.com/2011/01/30/3362892/squaw-valleys-new-ceo-is-talking.html

"Death by GPS" in desert

http://www.sacbee.com/2011/01/30/3362727/death-by-gps-in-desert.html

|

![]()

“Gimme that Wine”

Jess Jackson and Barbara Banke Announce Multi- Million Dollar Gift to Build the Jess S. Jackson Sustainable Winery Building at UC Davis

http://www.winebusiness.com/news/?go=getArticle&dataid=83366

Napa winery defaults on $3.3 million loan

http://napavalleyregister.com/news/local/article_5aab4cb8-2aac-11e0-8079-001cc4c03286.html

Lawsuit Roils Nickel & Nickel and Far Niente

http://www.winespectator.com/webfeature/show/id/44386

Free Mobile Wine Program

http://leasingnews.org/archives/Feb2010/2_26.htm#mobile

Wine Prices by vintage

http://www.winezap.com

US/International Wine Events

http://www.localwineevents.com/

Winery Atlas

http://www.carterhouse.com/atlas/\

Leasing News Wine & Spirits Page

http://two.leasingnews.org/Recommendations/wnensprts.htm

[headlines]

----------------------------------------------------------------

![]()

This Day in American History

1734- Birthday of Robert Morris, Signer of the Declaration of Independence, the Articles of Confederation and the Constitution. He was only one of two men who signed all three documents. He was the country’s first “Superintendent of Finance. The Robert Morris Association, formed by the Bankers Association, honors him. He was born at Liverpool, England, and died May 7, 1806, at Philadelphia, PA.

http://www.robert-morris.com/

1752 -The profession ceremony for Sister St. Martha Turpin was held at Ursuline Convent in New Orleans, LA. She was the first American-born woman to become a nun in the Catholic Church. She was born in Illinois, and entered the Uruline Convent in 1748. She began her novitiate on July 2,1749, and made her profession of faith this day in 1752. She died on November 20, 1761, at the age of 30.

http://www.ursulineneworleans.org/history.htm

http://www.accesscom.net/ursuline/

http://new-orleans.travelape.com/attractions/old-ursuline-convent/index.html

1795-Wounded by the sharp criticism of his colleagues, Alexander Hamilton resigned his post as the Secretary of the Treasury. During his run as the first U.S. Treasury Secretary, Hamilton put his conservative stamp on the young nation’s finances, establishing a national bank and a tax-based system to fuel the repayment of national and foreign debts. Hamilton also pushed for the Federal government to assume full responsibility for debts incurred by the states during the Revolutionary War. However, Hamilton’s Federalist ardor was a frequent target for controversy. He also saw the brewing of the wars in Europe and growing interest in European powers interest in the America’s, which was not a popular view with a country that wanted to remain isolationist.

1848-John C. Fremont is court-martialed. An outstanding military leader and abolitionist, known for being ahead of his time, he sided with the wrong political group. He was later pardoned by President Polk, but he resigned his commission. The Gold Rush made him a multimillionaire, where he moved to New York, became actively involved in politics and ran for president to be defeated by Democrat James Buchanan because of his anti-slavery views. He was appointed a general by President Lincoln, but got into political trouble again by proclaiming freedom for all slaves in military

campaigns he was winning ( it was before the emancipation doctrine ).In 1864, he was again considered for the Republican presidential nomination. Popular but controversial, Frémont decided that his bid for the office would cause division within the party. He retired from public life and returned to the West. From 1878 to 1883, Frémont held public office again as appointed governor of the territory of Arizona. Just months before his death on July 13, 1890, Congress granted him a pension, acknowledging the importance of Frémont's early explorations of the West.

http://memory.loc.gov/ammem/today/jan31.html

1851-San Francisco Orphan's Asylum, first in California founded.

1863- The first Union regiment in the Civil War made up of African-American soldiers was the 1st Regiment, South Carolina Volunteers, organized in the summer of 1862 by Major General David Hunter. Since there was no authority at that time for its muster into federal service, it was disbanded then reorganized in October 1862 and mustered into federal service at Buford, SC, on January 31, 1863. Its designation was changed on February 8, 1864, to the 33rd U.S. Colored Infantry.

1865-The controversy of free slaves continued and it was not until this day the U.S. House of Representatives passes the 13th Amendment to the Constitution, abolishing slavery in the United States. It read, "Neither slavery nor involuntary servitude...shall exist within the United States, or any place subject to their jurisdiction.” When the Civil War began, President Lincoln's professed goal was the restoration of the Union. But early in the war, the Union began keeping escaped slaves rather than returning them to their owners, so slavery essentially ended wherever the Union army was victorious. In September 1862, Lincoln issued the Emancipation Proclamation, freeing all slaves in areas that were still in rebellion against the Union. This measure opened the issue of what to do about slavery in border states that had not seceded or in areas that had been captured by the Union before the proclamation. In 1864, an amendment abolishing slavery passed the Senate but died in the House as Democrats rallied in the name of states' rights. The election of 1864 brought Lincoln back to the White House and significant Republican majorities in both houses, so it appeared the amendment was headed for passage when the new Congress convened in March 1865. Lincoln preferred that the amendment receive bipartisan support--some Democrats indicated support for the measure, but many still resisted. The amendment passed 119 to 56, seven votes above the necessary two-thirds majority. Several Democrats abstained, but the 13th Amendment was sent to the states for ratification, which came in December 1865. With the passage of the amendment, the institution that had indelibly shaped American history and had started the Civil War was eradicated.

1871- Birds fly over the western part of San Francisco in such large numbers that they actually darken the sky.

1874 -Jesse James gang robs train at Gads Hill MO.

http://www.rosecity.net/trains/picture4.html

1892 – Birthday of Eddie Cantor (Edward Israel Iskowitz) (‘banjo eyes’: actor, singer: If You Knew Susie like I Know Susie, Alabamy Bound, Dinah, Ida, Makin’ Whoopee, Ma He’s Makin’ Eyes at Me; died Oct 10, 1964)

http://www.eddiecantor.com/

1872- Zane Grey (original name Pearl Grey), American dentist and prolific author of tales of the Old West, was born at Zanesville, OH. Grey eventually wrote more than 80 books that were translated into many languages and sold more than 10 million copies. The novel Riders of the Purple Sage (1912) was the most popular. In 1886, he graduated with a degree in dentistry and moved to New York to begin his practice. Grey's interest in dentistry was half-hearted at best, and he did not relish the idea of replicating his father's safe but unexciting career path. Searching for an alternative, Grey decided to try his hand at writing; his first attempt was an uninspiring historical novel about a family ancestress. At that point, Grey might well have been doomed to a life of dentistry, had he not met Colonel C. J. "Buffalo" Jones in 1908, who convinced Grey to write Jones' biography. More importantly, Jones took him out West to gather material for the book, and Grey became deeply fascinated with the people and landscape of the region. Grey's biography of Jones debuted in 1908 as The Last of the Plainsmen to little attention, but he was inspired to concentrate his efforts on writing historical romances of the West. In 1912, he published the novel that earned him lasting fame, Riders of the Purple Sage. Like the equally popular Owen Wister novel, The Virginian (1902), the basic theme of Riders revolves around the transformation of a weak and effeminate easterner into a man of character and strength through his exposure to the culture and land of the American West. Grey's protagonist, the Ohio-born Bern Venters, spends several weeks being tested by the rugged canyon country of southern Utah before finding his way back to civilization. Venters, Grey writes, "had gone away a boy-he had returned a man." Though Riders of the Purple Sage was Grey's most popular novel, he wrote 78 other books during his prolific career, most of them Westerns. He died in 1939, but Grey's work continued to be extraordinarily popular for decades to come, and by 1955, his books had sold more than 31 millions copies around the world. With the possible exception of Riders, today Grey's books are little read, and most modern readers find them insufferably pompous, moralizing, and sentimental. Grey died Oct 23, 1939, at Altadena, CA.

1907-Birthday of trombonist Benny Morton, born New York City, New York.

http://www.centrohd.com/biogra/m1/benny_morton_b.htm

http://www.jazzprofessional.com/interviews/Benny%20Morton_1.htm

1905 -- American novelist/short story writer John O'Hara born, Pottsville, Pennsylvania.

http://www.ncteamericancollection.org/litmap/ohara_john_pa.htm

http://oharas.com/directory/johnohara.html

1911 - Tamarack, CA, was without snow the first eight days of the month, but by the end of January had been buried under 390 inches of snow, a record monthly total for the U.S.

1914- Jersey Joe Walcott, boxer born Arnold Raymond Cream at Merchantville, NJ. Walcott lost a heavyweight title fight to Joe Louis in 1947 but then defeated Ezzard Charles to win the title in 1951 after losing to him twice before. At 37 years of age, he was the oldest man to win the heavyweight crown. Died at Camden, NJ., Feb 27,1994.

1915—Trumpet player Bobby Hackett birthday, perhaps best known for his solo in

“String of Peals” with Glenn Miller. He later became much more known as a Dixieland

coronet player in the Dixieland revival of the 1950’s. He died in 1976.

http://www.libertyhall.com/bobby.html

http://spaceagepop.com/hackett.htm

1915-American television host Garry Moore was born Thomas Garrison Morfit at Baltimore, MD. His best-known shows were "I've Got a Secret" (1952-67) and "To Tell the Truth" (1969-76). He gave Carol Burnett her break on TV when he made her a regular on "The Garry Moore Show." He died Nov 28, 1993, at Hilton Head Island, SC.

http://www.museum.tv/archives/etv/M/htmlM/mooregarry/mooregarry.htm

1919- Jackie Roosevelt Robinson, Baseball Hall of Fame infielder born at Cairo, GA. Robinson was a star athlete at UCLA and an officer in the US Army during World War II. In Oct, 1945, Branch Rickey of the Brooklyn Dodgers signed Robinson to a contract to play professional baseball, thereby breaking the sport’s unofficial, but firm, color line. Robinson proved to be an outstanding player who endured unimaginable racial taunts and still excelled. He won Rookie of the Year honors in 1947 and was the National League’s Most Valuable Player in 1949. He led the Dodgers to six pennants and a World Series championship in 1955. Inducted into the Hall of Fame in 1962. Died at Stamford, CT, Oct 24, 1972.

1921-Birthday of tenor Mario Lanza, billed as the successor to Enrico Caruso, born in Philadelphia, PA. There were predictions that he would become the greatest tenor of his time, perhaps even of the century. But his unreliability, destructive temper tantrums and a penchant for overeating, then going on frantic diets destroyed his career. Lanza died of a heart embolism in 1959 at age 38. Mario Lanza's 1951 film "The Great Caruso" is reported to have grossed more than five-million dollars. And two of his '50s recordings, "Be My Love" and "The Loveliest Night of the Year," sold more than a million copies each.

http://www.rense.com/excursions/lanza/

1923 – Birthday of Norman Mailer (Pulitzer Prize-winning novelist: The Armies of the Night; Miami and the Siege of Chicago, The Executioner’s Song, The Naked and the Dead, An American Dream) Born Long Branch, New Jersey

http://www.iol.ie/~kic/

http://www.americanlegends.com/authors/norman_mailer.html

http://www.wiredforbooks.org/normanmailer/

1923- Carol Channing, Tony award winner. Best known for her portrayal of Lorelei Lee in Diamonds Are a Girl's Best Friend, and Dolly Gallaher Levi in Hello Dolly. She is the darling of San Francisco.

1928- Scotch tape was developed by Richard Drew of the 3M Company.

1931 – Birthday of Ernie (Ernest) Banks (Baseball Hall of Famer: Chicago Cubs [all-star: 1955-1962, 1965, 1967, 1969/NL Baseball Writer’s Award: 1958, 1959]; 512 home runs; over 40 in a single season five times; record five grand slams [1955], 47 home runs [1958] most ever hit by a shortstop)

http://www.baseballhalloffame.org/hofers_and_honorees/hofer_bios/banks_ernie.htm

1936 - The radio show, "The Green Hornet" was introduced by its theme song, "The Flight of the Bumble Bee". The show was first heard on Detroit, Michigan's WXYZ radio, lasting for 16 years. "The Green Hornet" originated from the same station the "The Lone Ranger" was performed on. The title character in "The Green Hornet" was really named Britt Reid, who was supposed to be the great nephew of John Reid, the Lone Ranger. Both series were created by George Trendle and Fran Striker.

http://members.aol.com/meow103476/greenhornet.html

1936-Birthday of singer Marvin Junior (The Dells), Harrell, AR

http://www.themightydells.com/

http://www.fantasyjazz.com/html/dells_bio.html

http://www.epinions.com/content_59435355780

1936-Birthday of trombonist Garnett Brown, Memphis, TN

Composer, arranger, and trombonist, Garnett earned his B.S. in music at the University of Arkansas at Pine Bluff, and went on to study film scoring and electronic music at UCLA. His numerous performances and recordings include those with Herbie Hancock, Lionel Hampton, Manhattan Transfer, Quincy Jones, Billy Taylor, Chick Corea, Freddie Hubbard, and Dizzy Gillespie. He has co-ordinated, conducted, arranged, composed, and performed music for numerous feature films and television programs, including Roots: Second Generation, A Soldier's Story, and Fat Man and Little Boy. He has received numerous awards, including the first place trombone prize in the Downbeat Reader's Poll in 1967 and 1974. BMI has honored him twice, with the Jazz Pioneers Award in 1984 and the Contribution to American Music Recognition Award in 1990. In 1988 he played with the Dizzy Gillespie Orchestra in an East Coast and European tour. Recently Brown was the orchestrator, arranger, and conductor of the score for the film Harlem Nights; he also worked as music co-ordinator on a feature film with Michel Legrand, and participated in a lecture / demonstration and concert with Billy Taylor for the Washington, D.C. National Association of Jazz Educators. He presently teaches at UCLA in the Music Department, plus is a well-known studio musician.

1937-Birthday of American composer Philip Glass, Baltimore, MD.

http://www.philipglass.com/

1940- The first Social Security check was issued. Ida May Fuller of Ludlow, VT, received the first monthly retirement check in the amount of $22.54. Ms Fuller had worked for three years under the Social Security program (which had been established by legislation in 1935). The accumulated taxes on her salary over those three years were $24.75. She lived to be 100 years and collecting $22,888 in Social Security benefits.

1944-Birthday of blues harmonica player Charlie Musselwhite, born Kosciusko, Mississippi

http://www.charlie-musselwhite.com/memphis.htm

http://www.rosebudus.com/musselwhite/

1944--OLSON, TRUMAN O. Medal of Honor

Rank and organization: Sergeant, U.S. Army, Company B, 7th Infantry, 3d Infantry Division. Place and date: Near Cisterna di Littoria, Italy, 30-31 January 1944. Entered service at: Cambridge, Wis. Birth: Christiana, Wis. G.O. No.: 6, 24 January 1945. Citation: For conspicuous gallantry and intrepidity above and beyond the call of duty. Sgt. Olson, a light machine gunner, elected to sacrifice his life to save his company from annihilation. On the night of 30 January 1944, after a 16-hour assault on entrenched enemy positions in the course of which over one-third of Company B became casualties, the survivors dug in behind a horseshoe elevation, placing Sgt. Olson and his crew, with the 1 available machinegun, forward of their lines and in an exposed position to bear the brunt of the expected German counterattack. Although he had been fighting without respite, Sgt. Olson stuck grimly to his post all night while his gun crew was cut down, 1 by 1, by accurate and overwhelming enemy fire. Weary from over 24 hours of continuous battle and suffering from an arm wound, received during the night engagement, Sgt. Olson manned his gun alone, meeting the full force of an all-out enemy assault by approximately 200 men supported by mortar and machinegun fire which the Germans launched at daybreak on the morning of 31 January. After 30 minutes of fighting, Sgt. Olson was mortally wounded, yet, knowing that only his weapons stood between his company and complete destruction, he refused evacuation. For an hour and a half after receiving his second and fatal wound he continued to fire his machinegun, killing at least 20 of the enemy, wounding many more, and forcing the assaulting German elements to withdraw.

1945 -- US: Army Private Eddie Slovik shot for desertion, the first

since the civil war. Gen. Dwight D. Eisenhower, supreme allied commander, personally ordered the execution during the closing days of World War II to deter other potential deserters. The story of his execution was made into a motion picture with actor Martin Sheen in the role of Private Slovik.

http://www.jewishvirtuallibrary.org/jsource/biography/Slovik.html

http://www.amazon.com/exec/obidos/tg/detail/-/6302161401/103-0205572-2897419

?v=glance#product-details

1947 –Birthday of (Lynn) Nolan Ryan (baseball: pitcher: NY Mets [World Series: 1969], California Angels [all-star: 1972, 1973, 1975,

http://www.charlie-musselwhite.com/memphis.htm

1977, 1979], Houston Astros [all-star: 1981, 1985], Texas Rangers [all-star: 1989]; record for career strike outs [5,714] and no-hitters [7])

1948 -- J. D. Salinger's short story "A Perfect Day for Banana Fish" appears in The New Yorker. The earliest mention of the “Glass” family.

http://www.biblion.com/litweb/biogs/salinger_j_d.html

http://members.aol.com/jdsletters/index.html

1949- the first “Soap Opera” on daytime television was “These Are My Children,” by Irna Phillips, which was aired between 5 and 5:15pm every weekday from January 21 to February 25, 1949, by NBC from Chicago, IL.

1949 - The temperature at San Antonio, TX, plunged to a record low of one degree below zero. Helena MT reached 42 degrees below zero.

1950- George Mikan, center for the Minneapolis Lakers, was chosen the greatest basketball player of the half-century by a national poll of sportswriters.

1951--DODD, CARL H. Medal of Honor

Rank and organization: First Lieutenant (then 2d Lt.), U.S. Army, Company E, 5th Infantry Regiment, 24th Infantry Division. Place and date: Near Subuk, Korea, 30 and 31 January 1951. Entered service at: Kenvir, Ky. Born: 21 April 1925, Evarts, Ky. G.O. No.: 37, 4 June 1951. Citation: 1st Lt. Dodd, Company E, distinguished himself by conspicuous gallantry and intrepidity above and beyond the call of duty in action against the enemy. First Lt. Dodd, given the responsibility of spearheading an attack to capture Hill 256, a key terrain feature defended by a well-armed, crafty foe who had withstood several previous assaults, led his platoon forward over hazardous terrain under hostile small-arms, mortar, and artillery fire from well-camouflaged enemy emplacements which reached such intensity that his men faltered. With utter disregard for his safety, 1st Lt. Dodd moved among his men, reorganized and encouraged them, and then single-handedly charged the first hostile machine gun nest, killing or wounding all its occupants. Inspired by his incredible courage, his platoon responded magnificently and, fixing bayonets and throwing grenades, closed on the enemy and wiped out every hostile position as it moved relentlessly onward to its initial objective. Securing the first series of enemy positions, 1st Lt. Dodd again reorganized his platoon and led them across a narrow ridge and onto Hill 256. Firing his rifle and throwing grenades, he advanced at the head of his platoon despite the intense concentrated hostile fire which was brought to bear on their narrow avenue of approach. When his platoon was still 200 yards from the objective he moved ahead and with his last grenade destroyed an enemy mortar killing the crew. Darkness then halted the advance but at daybreak 1st Lt. Dodd, again boldly advancing ahead of his unit, led the platoon through a dense fog against the remaining hostile positions. With bayonet and grenades he continued to set pace without regard for the danger to his life, until he and his troops had eliminated the last of the defenders and had secured the final objective. First Lt. Dodd's superb leadership and extraordinary heroism inspired his men to overcome this strong enemy defense reflecting the highest credit upon himself and upholding the esteemed traditions of the military service.

1951—Top Hits

My Heart Cries for You - Guy Mitchell

Tennessee Waltz - Patti Page

A Bushell and a Peck - Perry Como & Betty Hutton

The Shot Gun Boogie - Tennessee Ernie Ford

1951- Rock vocalist Phil Collins was born in London. He joined the art-rock group Genesis in 1970 as drummer, replacing John Mayhew. Collins became the lead vocalist for Genesis after the group's front man, Peter Gabriel, left in 1974. With Collins fronting the band, Genesis began to score hit singles, starting with "Follow You, Follow Me" in 1978. Collins, while remaining with Genesis, started a solo career in 1982. His first album, "Face Value," sold two-million copies. He's had numerous single hits as well, including such chart- toppers as "Against All Odds," "One More Night," "Sussudio" and "Separate Lives," a 1986 duet with Marilyn Martin.

1951 – Birthday of Harry Wayne Casey (musician: keyboard, singer: group: KC and the Sunshine Band: Do It Good, Queen of Hearts, Rock Your Baby, Get Down Tonight, That’s the Way [I Like It], [Shake, Shake, Shake] Shake Your Booty, I’m Your Boogie Man, Keep It Comin’ Love, Please Don’t Go) Born

Hialeah, Florida

http://discomuseum.com/KCSunshineBand.html

http://www.harrywaynecasey.com/

1952-Birthday of harmonica player Paul deLay, Portland, Oregon

http://www.cascadeblues.org/NWBlues/PauldeLay/PauldeLay.htm

http://www.pauldelay.com/about.ihtml

http://www.mnblues.com/review/delaylive.html

http://home.europa.com/~damray/welcome.html

1956- Elvis Presley signs with the William Morris Agency in order to make himself available to film studios.

1958 -"Jackpot Bowling" premieres on NBC with Leo Durocher as host

1958- The first successful US satellite. Although launched four months later than the Soviet Union's Sputnik, Explorer reached a higher altitude and detected a zone of intense radiation inside Earth's magnetic field. This was later named the Van Allen radiation belts. More than 65 subsequent Explorer satellites were launched through 1984.

1959-- Just three days before their death in a plane crash, Buddy Holly, Ritchie Valens and the Big Bopper play the Armory in Duluth, MN. In attendance: a seventeen-year-old Robert Zimmerman, who would be inspired to become a musician by this performance. We now know him as Bob Dylan.

1959—Top Hits

Smoke Gets in Your Eyes - The Platters

Donna - Ritchie Valens

The All American Boy - Bill Parsons

Billy Bayou - Jim Reeves

1960-Jimmy Jones' "Handy Man" enters the R&B chart, soon to be #3. The song is written and produced by Otis Blackwell. James Taylor will make it a #4 pop hit in 1977.

Jimmy Jones' "Handy Man" enters the R&B chart, soon to be #3. The song is written and produced by Otis Blackwell. James Taylor will make it a #4 pop hit in 1977.

1961- a test of Project Mercury spacecraft accomplished the first US recovery of a large animal from space. Ham, the chimpanzee, successfully performed simple tasks in space.

1961- the first Commander of a combat ship who was African-American was Lieutenant Commander Samuel Lee Gravely, Jr., of Richmond, VA, who on January 31, 1961, assumed command of the destroyer escort U.S.S. Falgout, one of the vessels of Escort Squadron 5 on duty with the barrier Pacific force. The ship had a crew o f150 and 13 officers.

1961- NBC airs the Bobby Darin and Friends television special, originally meant as a pilot for a weekly variety series.

1962-U.S. Admiral Samuel L. Gravely becomes the first Black person to achieve flag rank, rear admiral. In September 1976, Vice Admiral Gravely assumed command of the Third Fleet. During 1978-80, he was Director of the Defense Communications Agency. Vice Admiral Samuel L. Gravely, Jr., retired from the Navy on 1 August 1980.

http://www.raaheroes.com/military/navy/gravely.htm

http://www.history.navy.mil/photos/pers-us/uspers-g/s-gravly.htm

http://www.aaregistry.com/detail.php3?id=1250

1963 -- Secretary of Defense Robert McNamara declares:

"The war in Vietnam is going well and will succeed."

1963- A seventeen-year-old Neil Young makes his stage debut at a country club in Winnipeg, Manitoba, Canada.

1965 - No. 1 Billboard Pop Hit: ``You've Lost That Lovin' Feelin','' The Righteous Brothers. The song is the first No. 1 song for the duo of Bill Medley and Bobby Hatfield.

1966 - A blizzard struck the northeastern U.S. When the storm came to an end, twenty inches of snow covered the ground at Washington D.C.

1967- While in Sevenoaks, Kent, England, John Lennon visits an antique shop and purchases a circus poster from 1843. It is this poster which inspires most of the lyrics to the Beatles' "Being For The Benefit of Mr. Kite."

1967—Top Hits

I’m a Believer - The Monkees

Tell It Like It Is - Aaron Neville

Georgy Girl - The Seekers

There Goes My Everything - Jack Greene

1968-As part of the Tet Offensive, Viet Cong soldiers attack the U.S. Embassy in Saigon. A 19-man suicide squad seized the U.S. Embassy and held it for six hours until an assault force of U.S. paratroopers landed by helicopter on the building's roof and routed them. The offensive was launched on January 30, when communist forces attacked Saigon, Hue, five of six autonomous cities, 36 of 44 provincial capitals, and 64 of 245 district capitals. The timing and magnitude of the attacks caught the South Vietnamese and American forces off guard, but eventually the Allied forces turned the tide. Militarily, the Tet Offensive was a disaster for the communists. By the end of March 1968, they had not achieved any of their objectives and had lost 32,000 soldiers and had 5,800 captured. U.S. forces suffered 3,895 dead; South Vietnamese losses were 4,954; non-U.S. allies lost 214. More than 14,300 South Vietnamese civilians died. While the offensive was a crushing military defeat for the Viet Cong and the North Vietnamese, the early reporting of a smashing communist victory went largely uncorrected in the media and this led to a great psychological victory for the communists. The heavy U.S. casualties incurred during the offensive coupled with the disillusionment over the earlier overly optimistic reports of progress in the war accelerated the growing disenchantment with President Johnson's conduct of the war. Johnson, frustrated with his inability to reach a solution in Vietnam announced on March 31, 1968, that he would neither seek nor accept the nomination of his party for re-election. As reported earlier, after leaving office he retired to his ranch in Texas and shortly died a broken man as his political influence and popularity was nil.

1968-John Fred and his Playboy Band's "Judy in Disguise" and the American Breed's "Bend Me, Shape Me" are certified gold. Neither group came even close to selling that many records with any other release

1968 -- A Seattle (Washington) City Council hearing concludes that there are no legal means to curb hippies in the U-District.

1970--CLAUSEN, RAYMOND M. Medal of Honor

Rank and organization: Private First Class, U.S. Marine Corps, Marine Medium Helicopter Squadron 263, Marine Aircraft Croup 16, 1st Marine Aircraft Wing. Place and date: Republic of Vietnam, 31 January 1970. Entered service at: New Orleans, La. Born: 14 October 1947, New Orleans, La. Citation: For conspicuous gallantry and intrepidity at the risk of his life above and beyond the call of duty while serving with Marine Medium Helicopter Squadron 263 during operations against enemy forces. Participating in a helicopter rescue mission to extract elements of a platoon which had inadvertently entered a minefield while attacking enemy positions, Pfc. Clausen skillfully guided the helicopter pilot to a landing in an area cleared by 1 of several mine explosions. With 11 marines wounded, 1 dead, and the remaining 8 marines holding their positions for fear of detonating other mines, Pfc. Clausen quickly leaped from the helicopter and, in the face of enemy fire, moved across the extremely hazardous mine laden area to assist in carrying casualties to the waiting helicopter and in placing them aboard. Despite the ever-present threat of further mine explosions, he continued his valiant efforts, leaving the comparatively safe area of the helicopter on 6 separate occasions to carry out his rescue efforts. On 1 occasion while he was carrying 1 of the wounded, another mine detonated, killing a corpsman and wounding 3 other men. Only when he was certain that all marines were safely aboard did he signal the pilot to lift the helicopter. By the courageous, determined and inspiring efforts in the face of the utmost danger, Pfc. Clausen upheld the highest traditions of the Marine Corps and of the U.S. Naval Service.

1970--Medal of Honor PENRY, RICHARD A.