Vehicle Lenders Group, LLC is looking for dynamic sales associate. Either work out of one of our offices in Calif. , Dayton, or Oyster Bay, NY or your own office. |

Wednesday, February 9, 2011

Today's Equipment Leasing Headlines

Placard---No Problem

Classified Ads---Collections/Controller

American Screw…and they really did!

Alphabetical Up-date---the Bad Boys

Charles K. Schwartz, Sheldon Player, Rudy Trebels, Et. Al

Leasing Brings Resource America to a serious loss

by Christopher Menkin

Sales Makes it Happen---by Steve Chriest

Rethinking Customer Loyalty

Classified Ads---Help Wanted

Saluting Leasing News Advisor Shawn Halladay

Tax Preparer Sentenced to 5 1/2 years in Federal Prison

California Bank & Trust Philanthropic Performance

FDIC to Help Main Street Community Banks Insurance

Anderson, South Carolina Adopt-a-Dog

Classified ads—Asset Management

News Briefs---

Bank of the West sees dramatic rebound continue

Law firm liable in bank failure, feds say

BofA to drop reverse mortgages

Third of homes in Seattle metro area worth less than mortgage

Broker/Funder/Industry Lists |

Features (collection)

Top Ten Stories Chosen by Readers |

Top Stories last six months

Sports Briefs---

California Nuts Briefs---

"Gimme that Wine"

This Day in American History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

######## surrounding the article denotes it is a “press release” and was not written by Leasing News nor information verified, but from the source noted. When an article is signed by the writer, it is considered a “by line.” It reflects the opinion and research of the writer. It is considered “bias” as it is the writer’s viewpoint.

[headlines]

--------------------------------------------------------------

[headlines]

--------------------------------------------------------------

Classified Ads--- Collections/Controller

(These ads are “free” to those seeking employment

or looking to improve their position)

Seattle, WA |

| Chicago, IL experienced in lease accounting, operations, management, and Sarbanes-Oxley. Seeking position with equipment lessor. Would consider contract assignments or relocating. Email: leasecontroller@comcast.net |

|

Southeastern, MI Controller & Management experience w/ equip lessors &broker. MBA, CPA w/ extensive accounting, management, securitization experience with public and private companies. Willing to relocate. Email: Leasebusiness@aol.com |

| Acton, MA Strong experience in lease accounting, operations, & systems. Implemented lease plus, Great Plains, networks. Excellent financial reporting and analysis skills. Looking for new opportunity. alexanderzlenz@gmail.com| Resume |

Southern CA |

Free Posting for those seeking employment in Leasing:

http://www.leasingnews.org/Classified/Jwanted/Jwanted-post.htm

All “free” categories “job wanted” ads:

http://www.leasingnews.org/Classified/Jwanted/Jwanted.htm

[headlines]

--------------------------------------------------------------

American Screw…and they really did!

In the recent failures with the fraudulent vendor invoices one of the most obvious was the literally hundreds of UCC filings as reported by Leasing News in the cases of Allied Health Care Services--$87 million, CyberNet-- $114 Million, Equipment Acquisition Resources-- $175 million, and Wildwood Industries--- $220 million.

Dun & Bradstreet has 343 UCC’s (South Carolina records 146, the following email says over 160) on American Screw & Rivet Corp., Anderson, South Carolina. According to www.independentmail.com, the company is closed with all property to be auctioned. There were an estimated 15 employees. The total debt owed has not been completed as all creditors have not filed to date, but by the list of creditors, it will be high.

"American Screw & Rivet Corporation engages in the production and supply of rivets in the United States and internationally. The company was founded in 1964 and is based in Anderson, South Carolina. As on November 8, 2010, an involuntary petition for liquidation under chapter 7 was filed against American Screw & Rivet Corporation. On December 28, 2010 the involuntary petition was approved by the Court."

http://investing.businessweek.com/research/stocks/private/snapshot.asp?privcapId=115791505

This was brought to Leasing News attention by a reader as another example of the lack of due diligence, particularly regarding UCC filings as an indication of much debt:

"I was first introduced to a company in South Carolina nearly 10 years ago, and called them periodically seeking equipment financing opportunities. The owner, Nancy Stein, would send financial statements from time to time and this company was on my radar as a very decent middle market credit.

"I was approached by Nancy in late 2009 for about $350,000 of new equipment financing, but with the stipulation that we had to agree that we wouldn't sell our paper in the secondary market. This seemed like a strange request, but I pursued the deal and asked for updated financial statements. Nancy sent me the statements, along with a four page explanation. Once I saw the length of her explanation, I thought to myself, ‘The financials must have gone downhill’. You can imagine my surprise when in fact the financials looked pretty good. Of course, this combination sent my radar buzzing, and I re-read her 4 page explanation to try to ascertain why a "decent" middle market borrower would go to the effort to provide such a detailed explanation when none was necessary. I started looking for trouble, and it didn't take long to find it.

"In about one minute, we found that South Carolina has a free search engine that lists UCC-1's against specific debtors. We quickly learned there were over 160 UCC-1's filed (we couldn't see the actual filings without running a full search, and I didn't feel like paying for one). I noticed the names of MANY known equipment lenders, as well as a number of local banks in the Carolinas. I called a few of the lenders I knew on the list, and quickly ascertained that the company had millions of dollars outstanding with just these lenders. The financial statements indicated the company had only $1 million in debt, and possible another $1 million could be accounted for if I guessed at the original value of off balance sheet leases. But I knew immediately that we couldn't account for the millions I had personally uncovered, and there were probably 40+ more lenders to call if I had wanted to know more.

"Once I confirmed a problem, I told the lenders (that were involved with this credit that I knew personally) of a possible fraud going on. All lenders told me the account always performed well. In some instances, I felt like I was being told to keep my nose out of this situation. So much for trying to be helpful.

"I couldn't understand why other creditors hadn't run a lien search and tried to tie back the UCC-1's against company financial statements. Any lender that had taken this simple step could have uncovered a major problem. When I approached Nancy with my findings, she had a number of ‘excuses’, and while at the time I couldn't prove the fraud I knew in my heart that this situation wouldn't end well."

Forced into Bankruptcy

Aquesta Bank, Cornelius, North Carolina, U.S. Bancorp Equipment Finance, Inc., Portland, Oregon, American Bank, Bethesda, Maryland, U.S. Bank, Portland, Oregon, Palmetto Bank, Laurens, South Carolina, and the Huntington National Bank, Cannonsburg, Pennsylvania on November 8, 2010 filed a Bankruptcy Petition for Chapter 7 against the appropriately named company “American Screw & Rivet Corporation,” Anderson, South Carolina claiming a debt of $4.9 million. None of them are subscribers to Lease Police, nor did it seem did they pay attention to the number of UCC filings recorded by Dun & Bradstreet or by a search on South Carolina UCC filings for American Screw & Rivet. Were they dumb? You betcha’.

Other creditors include All Points Capital, Alter Moneta Corp., Bank of Anderson, Bank of Ozark, Carolina First bank, Capital Bank, Central Carolina Bank, CIT Group/Equipment Financing, Community First Bank (closed last week), First Reliance Bank, JP Morgan Chase, OFC Capital, Omni National Bank Regions Bank, UPS Capital Business Credit to name a few. All stupid! Again, none subscribe to Lease Police.

The latest in the Chapter 7 filing is an examination of Nancy M. Stein, who the web site states is the treasurer of the company "since 1981," to be held Wednesday, February 23, 2011.

U.S. Bank, successor to Park National Bank, sued the company November 20, 2009 naming the corporation along with William L. Stein and Nancy M. Stein with a summary judgment made on August 19, 2010 by Matthew F. Kennelly, United States District Judge, regarding $867,400 plus interest. There were many other default judgments in the $500,000 range, most of them equipment finance agreements or capital leases with $1.00. The exhibits on file did not show invoices nor mention the seller of the equipment. Several law suits also names William L. Stein, Jr. None of the parties seem to have filed personal bankruptcy at this time.

The website shows Nancy M. Stein as Treasurer.

http://americanscrewandrivet.com/team.html

The company is on Facebook.com with such announcements as producing 100,000 cots for Haiti and shows many products it produces besides rivets. (A litigation filing with Bank of America over loan defaults and lease agreements states they were suppliers of “several bed-frame manufacturers and La-Z-Boy.”

http://www.facebook.com/album.php?aid=153002&id=338663513330

Leasing News received the same reaction as the party who sent the email, especially on the Allied Health Care Services as to how could we question such a fine company and client, and almost for three years Leasing News was alerting readers about Sheldon Player and his past, and let's mention IFC Credit where Rudy Trebels had the presentation of the Leasing News Person of the Year Award to Randy Brook cancelled due to his influence as a National Equipment Finance Association sponsor (not to mention the Leasing News Bulletin Board Complaints) and there are others.

[headlines]

--------------------------------------------------------------

Alphabetical Update---the Bad Boys

Charles K. Schwartz, Sheldon Player, Rudy Trebels, Et. Al.

by Kit Menkin

Perhaps this should be added to the "Bad Boys" group in Leasing News.

ALPHABETICAL

(mug shot: Essex County Corrections Facility)

The up-date on Charles K. Schwartz and Allied Health Service Center brought many emails about other cases: asking what was happening? In the Allied case, the trustee is in the process of deposing the assets and the up-date showed which ones, as well as Schwartz attempt to get out of jail on bail before his trial starts. It appears he doesn't have the assets to do so. Many have called saying they have heard from attorneys Schwartz has money hidden overseas, but that is just "talk" or perhaps a wish from creditors who most likely will not only wind up with a loss from the transaction, but attorney and court fees, plus a lot of time wasted by they and their staff. Many of the loans were made after both Lease Police and Leasing News made alerts about the company.

(This was on his web site selling his new bottled water

from Wyoming; don’t know if Schwartz, some say it is not,

although site claims it is. editor)

Perhaps the most emails and telephone calls are about Sheldon Player of Equipment Acquisition Resources: why isn't he in jail. Yes, he is an ex-convict, who has had parole problems, according the court records. And you have to understand because he has been through this; he knows how to play the game. Speaking of that, it is amazing how the three officers spent so much time and lost so much money at the casinos. Perhaps they did win from time to time, but then why did they need so much money wired from E.A.R. to the various casino's the bankruptcy trustee is trying to get the money back (he is claiming it was company money as from E.A.R. and not from their personal bank accounts; meaning, if the money went to their personal accounts and then from there to the casino, it would be personal money and he could not claim the money back.) We're talking about more than $5 million so far, too.

Those that saw the assets say they were a warehouse full of junk piled on each other, and eventually all sold, as well as other equipment from another warehouse. Much of the transactions then were “ghost.” It is complicated as there is a vendor involved, several leasing companies who also sold equipment as if it was there's to sell and then have leased to E.A.R. And no one has told tales. There are about seven active brokers who sold the deals, all orchestrated primarily by one independent who was also on E.A.R. payroll. She got two to three points from E.A.R. and whatever she could from the leasing company or broker. Talk about the Russians and Afghanistan’s and the way business is done overseas, we had the collusion right here in the River City with everyone getting a piece except for the funder (he got the shaft.)

This one is similar to Allied, but two years earlier when we informed Leasing News readers in an alert to watch out about Player, even quoting him from an interview about his past going to jail for exactly what it appears he did again. Paul Weiss had left Icon Capital, and if he had stayed, I know he was reading Leasing News and would have saved his company $30 million. Paul is out of leasing in the United States now, heavily involved in Japan and China. The man has a touch of gold.

One reader told me Paul was planning a leasing venture in the large ticket and middle market arena in the United States with substantial backing from unknown sources. I tried to reach him, and had to leave a message on his cell phone as the time zone indicated he may be out of the country.

The latest at Allied finds the settlement with the IRS as he paid $4.7 million in federal taxes on ghost income to fool the creditors with his tax returns. All the parties had to agree, and the trustee did the best he could with the IRS (they kept a good portion.) It was a lot of paperwork, according to the court action records. Once all the income is brought in, then expenses settled, what's left goes to the creditors (not that easy as they have to all basically agree). As long as this is going on, looks like they want to keep Player cooperating, so as stated earlier, he knows how to play the game to stay out as long as he can, plus work the system to his best advantage. Also, look at the positive side, he's keeping the economy going by getting so much work for attorneys and their staff.

The saga of John Otto and HL Leasing has been going on since his suicide May 12, 2009. Supposedly the FBI began its investigation before his untimely death. Alleged claims of $132 million in leases to investors, primarily reported to be American Express Leases purchased from Key Corp., who took over the business leasing division.

At one time the HL Leasing blog was very active with many testimonies of suffering and complaints. It has become very quiet with not much activity, which seems to reflect the FBI office in Fresno and Palm Springs, California. The wife and president of the company are still alive, but no one has turned states evidence and certainly by the time the FBI should have realized there were no leases and thus no UCC filed and it was a Ponzi scheme. Right now it is still alleged. Calls to the FBI office about what the status is have gone unanswered. It seems no one cares.

(Rudolph Trebels, people who have seen him say

he has shaved off his mustache.)

IFC Credit is perhaps the most involved and most complex as part of it involves a bankruptcy suit of 72 Injunctive relief and 91 Declaratory judgments. It also involves Len Ludwig with First Portland and that portfolio he is also trying to get off the ground as well as many of the creditors taking over existing accounts with incorrect payments made, wrong purchase options, what happened to the security deposits, and a couple of cases against the individuals behind the company with a “Status hearing to be held on 2/24/2011 at 10:30 AM at 219 South Dearborn, Courtroom 619, Chicago, Illinois 60604."

There is another case with the latest on February 7, 2011 "Application for Compensation with Coversheet for James E. Coston, Special Counsel, Fee: $164,692.50, Expenses: $1,026.07, for Coston & Rademacher, P.C., Special Counsel, Fee: $164,692.50, Expenses: $1,026.07. Filed by Karen Newbury."

Coston is only one of the attorneys. This doesn't mention the other costs, as well as the various suits against IFC Credit that involve Rudolph Trebles, who is back in the leasing business, made a member in good standing by the Equipment Leasing and Finance Association. Suits by the bankruptcy proceedings as well as by CoActive Capital Partners. It is one BIG mess! If you have a son or daughter who wants to go to college, tell them to study to become a leasing attorney. It’s where the big money is.

Operation Lease Fleece. It is funny there has been no mention of Jay Callaghan, who was the insider from Citicapital, according to Adam Zuckerman, one of the key players awaiting sentence. He has evidently “walked.” It was a Citicapital audit that caught the scheme and brought it to the attention of the FBI. This has been going on for almost three and a half years. There have been a few more indictments, and certainly both the FBI and US Attorney's office are getting tired of the case, but the fact remains the same people, the same judge, have been following this and it appears the postponements, in my opinion, no one has told me this, is because they want to get the Vartanian Brothers, vendors still in business, who's trial has been postponed as they continue to want to make a plea deal as the rest. The hold-up to the other sentencing is once brought before the judge, the sealed records are open, at least to other attorneys and to the media as public information, and obviously the prosecutors don't want the other side to know what they told the FBI. Unless the FBI brings them to the Vartanian trial, the records stay sealed and any plea dealings are also kept private. They certainly want the Vartanians! By the way, they are reportedly very good friends of Brian Acosta, top salesman for CapitalWerks for over five years.

So the whole case drags on, although some have been sentenced. In reality, those named are no longer in the leasing or finance business, so they have been punished, perhaps not enough, but that is up to the courts to decide.

The Vartanian Brothers Trial was continued to April 5, 2011 at 09:00 AM before Judge Cormac J. Carney

Leasing News Bad Boys:

http://www.leasingnews.org/Conscious-Top%20Stories/bad_boys.htm

$87 Million & Criminal Case continued against Schwartz

http://leasingnews.org/archives/Feb2011/2_07.htm#continued

E.A.R.---Sheldon Player stories:

http://www.leasingnews.org/Conscious-Top%20Stories/Sheldon_Player.htm

HL Leasing Stories

http://www.leasingnews.org/Conscious-Top%20Stories/heritage_leasing.htm

IFC Credit Stories

http://www.leasingnews.org/Conscious-Top%20Stories/IFC_stories.htm

Previous Stories:

Operation Lease Fleece---2011 Update

http://www.leasingnews.org/Conscious-Top%20Stories/Lease_Fleece.htm

Gary DiLillo, President

216-658-5618 or gary@avptc.com |

|

[headlines]

--------------------------------------------------------------

Leasing Brings Resource American to a serious loss

by Christopher Menkin

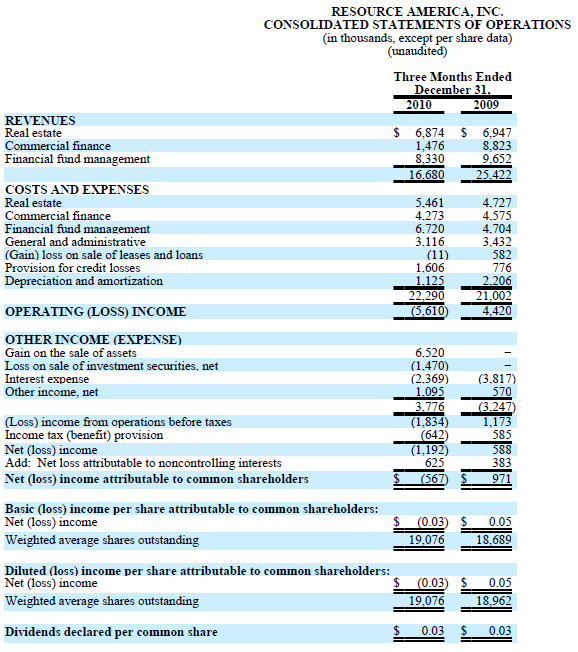

Resource America (NASDAQ-Rex) reported a loss of $567,000 for their first fiscal quarter ending December 31, 2010, but that was after the gain of $6.5 million in the sale of assets, according to their "Consolidated Statement of Operations."

It may be a little more involved, but going back to the numbers as you see above, the revenues of the same period in 2009 were $25.4 million compared to $16.7 million, primarily because of the loss of "commercial finance" going from $8.8 million to $1.5 million. Expenses were similar for both years. The bottom line is an operating loss of $5.6 million."

RESOURCE AMERICA, INC. CONSOLIDATED STATEMENTS OF OPERATIONS

(Please note commercial finance numbers, look at commercial finance expenses, see “operating loss,” then gain of sale and the rest are numbers which Resource America takes advantage of, so you really don’t know what is happening. This is like the old joke of hiring an accountant and asking him how good is he, and he answers I can make it look as good as you want.)

The Resource American Press Release states, "The GAAP net loss attributable to common shareholders for the first fiscal quarter ended December 31, 2010 was primarily the result of losses generated from LEAF Financial Corporation ("LEAF"), the Company's commercial finance operating segment, and deferred tax asset adjustments. Schedule I reflects the removal of these items to derive adjusted net income attributable to common shareholders."

Jonathan Cohen, CEO and President, is quoted as making "substantial growth in management fees generated from real estate products...During the quarter, we re-capitalized LEAF and are no starting to grow the business..." (with Guggenheim investment money. Cmenkin.) As PT Barnum said, “There’s a sucker born every minute."

What was sold to change the loss line, the operating statement states: "The aggregate purchase price of the assets sold by REM and RFFM was approximately $11.1 million, net of transaction costs, and as a result of this transaction, the Company recorded a net gain of $5.1 million."

Looks to me like LEAF is bleeding $$ badly. Revenue is way down. Since we know Leaf has no equity, as a standalone company it would seem that they are now upside down.

Note, this is the Press Release filing with SEC (the actual filing will have more “factual information”):

http://www.leasingnews.org/PDF/ResourceAmerica_8K_Dec2010.pdf

|

(This ad is a “trade” for the writing of this column. Opinions

contained in the column are those of Mr. Terry Winders, CLP)

--------------------------------------------------------------

Sales Makes it Happen---by Steve Chriest

Rethinking Customer Loyalty

Customer loyalty is a major concern for everyone in business today, perhaps because there appears to be so little loyalty among so many customers. At best, loyalty is fleeting among many customers, and at worst, it simply isn’t part of their thinking.

I am always amazed at how many books are written each year on the subject of customer loyalty. These books are written and read, I think, because we don’t want to face the reality of pervasive disloyalty in the business world. We do a good job for our customers, we treat them fairly, our pricing is competitive and we remain loyal to our customers. So why aren’t they more loyal to us?

At the risk of sounding cynical, customer loyalty really is a simple concept, and for me can be boiled down into the following statement: Customers are loyal so long as the rewards of loyalty outweigh the rewards of disloyalty! Approached from this understanding, the challenge of gaining customer loyalty may not become easier, but surely comes into clearer focus.

To make matters more challenging, providing good service to customers today will not guarantee continued loyalty. I was shocked to discover that 80% of customers who switch vendors rate the service of their previous vendors as “satisfactory to good.” Good service is no longer good enough to guarantee customer loyalty!

Keeping customers loyal continues to be more challenging than ever for most businesspeople. Next week we will explore some ways to promote customer loyalty in highly competitive industries, like equipment financing.

About the author: Steve Chriest is the founder of Selling UpTM (www.selling-up.com), a sales consulting firm specializing in sales improvement for organizations of all types and sizes in a variety of industries. He is also the author of Selling The E-Suite, The Proven System For Reaching and Selling Senior Executives and Five Minute Financial Analyst, Basic CREDIT & Analysis Tools for Non-Accountants. He was the CEO of a very successful leasing company and executive at a major company. You can reach Steve at schriest@selling-up.com.

Sales Makes it Happen articles:

http://www.leasingnews.org/Legacy/index.html

[headlines]

--------------------------------------------------------------

Leasing Industry Help Wanted

Vehicle Lenders Group, LLC is looking for dynamic sales associate. Either work out of one of our offices in Calif. , Dayton, or Oyster Bay, NY or your own office. |

Sales Account Executives: Jacksonville, FL/Philadelphia, PA. Navitas Lease Corp is a top leader in the equipment financing industry. We offer solutions to small-to-medium-sized businesses looking to acquire and finance equipment. |

Please see our Job Wanted section for possible new employees.

[headlines]

--------------------------------------------------------------

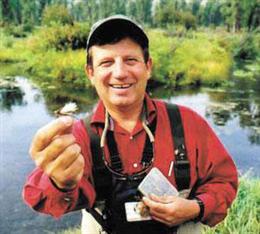

Saluting Leasing News Advisor Shawn Halladay

The Leasing News Advisory Board does not participate in editorial decisions, meaning reviewing or choosing stories or subjects. Their role is to participate with policy and business advice as well as contribute in discussions on matters brought up by the publisher in a private internal blog.

Shawn Halladay has been a frequent contributor of articles, particularly regarding accounting, changes to FASB rules, tax ruling, as well as covering several of the Equipment Leasing and Finance Association events and conferences. He joined the Leasing News Advisory Board on April 17, 2006.

Shawn D. Halladay

124 South 400 East, Suite 310

Salt Lake City, UT 84111

801/322-4499

801/322-5454 fax

shalladay@thealtagroup.com

www.thealtagroup.com

Shawn is Managing Director of The Alta Group's Professional Development practice area and has authored or co-authored eight books on equipment leasing, including "A Guide to Equipment Leasing," “A Guide to Accounting for Leases" and "The Handbook of Equipment Leasing."

His professional expertise stretches across all leasing sectors and around the globe. Based in Salt Lake City, Utah, he has served lessors throughout North and South America, Asia, and Europe, providing training in all aspects of equipment leasing and consulting services supporting best practices and benchmarking studies, strategic planning, litigation support, accounting, and quantitative analyses.

He likes to travel as an excuse to attend soccer games, one of his passions.

|

[headlines]

--------------------------------------------------------------

#### Press Release #############################

Inland Return Preparer Sentenced to Serve

5 ½ Years in Federal Prison

Tax Returns Claimed More Than $3.6 Million in Fraudulent Refunds

Riverside – A tax return preparer who operated a return preparation business in Apple Valley, California was sentenced in United States District Court to spend 66 months in federal prison after pleading guilty to charges that he conspired to defraud the United States and that he aided and assisted in the preparation of false tax returns.

Robert Dean Larsen, of Riverside, was also ordered by United States District Judge Virginia A. Phillips to spend three years on supervised release and pay to the Internal Revenue Service restitution in the amount of $204,099.93.

On August 26, 2010, Larsen pleaded guilty to conspiring to defraud the IRS and two counts of aiding and abetting in the preparation of a false tax return. Larsen, who operated Larsen’s Tax Pros at various locations in San Bernardino County and operated Laza’s Tax Service in Apple Valley, admitted in his plea agreement that, from 2002 to 2006, tax return preparers at his businesses filed at least 1,162 tax returns with the Internal Revenue Service that were false and that the tax loss based upon the false returns was more than $3.6 million.

According to his plea agreement, Larsen admitted that he operated Larsen’s Tax Pros from 2002 through 2004. In 2003, Larsen hired Christopher Daniel Laza to assist him in the preparation of tax returns. In 2004, Larsen and Laza began to operate their tax preparation business through a partnership, Laza’s Tax Service.

As a part of their scheme to defraud the IRS, Larsen admitted that he and Laza prepared income tax returns for clients that contained one or more false statements. The items on the returns that Larsen and Laza prepared for clients that contained false statements included taxes paid, mortgage interest paid, charitable contributions, unreimbursed employee business expenses, business losses, and investment losses, among others.

The falsified or inflated items listed on the tax returns prepared by Larsen and Laza were not provided to them by their clients during the preparation of the clients’ tax returns. When a client asked either Larsen of Laza about the falsified items listed on their tax returns, the client was sometimes told that Larsen possessed specialized knowledge in tax preparation with regard to deductions or that receipts could be obtained to justify the expense in question.

Additionally, Larsen admitted in his plea agreement that he willfully aided and assisted in the preparation of two materially false and fraudulent tax returns for his clients for tax years 2002. Specifically, Larsen admitted that he knew that deductions he claimed on client’s returns for real estate taxes, mortgage interest, charitable contributions, employee business expenses, and miscellaneous deductions were false.

At the conclusion of today’s sentencing hearing, Judge Phillips ordered Larsen to begin serving his sentence on April 4, 2011.

Larsen’s co-defendant, Christopher Laza, is scheduled to be sentenced before Judge Phillips on May 31, 2011.

The investigation of both Larsen and Laza was conducted by IRS-Criminal Investigation’s Los Angeles Field Office in conjunction with the United States Attorney’s Office for the Central Judicial District of California.

[headlines]

--------------------------------------------------------------

#### Press Release ##############################

California Bank & Trust Announces Philanthropic Performance for 2010

SAN DIEGO, CA –--California Bank & Trust (CB&T) (www.calbanktrust.com) is pleased to announce its philanthropic performance and charitable activities in California for calendar year 2010. The bank contributed monetary and in-kind support of more than $800,000 to hundreds of charities that reside in the California communities where CB&T has branches. Of that total, $272,975 was allotted to community development, including affordable housing projects, community facilities and neighborhood projects throughout California.

“We are very proud of CB&T’s tremendous spirit of generosity,” said Steven Herman, Vice President and Manager of California Bank & Trust’s Community Reinvestment Department. “CB&T’s culture of giving encourages our associates as well,” he added. “Last year, our associates stepped up to donate more than 6,528 volunteer hours to numerous non-profit organizations and also contribute an excess of $200,000 in support specifically for the United Way.”

“Many people are facing difficulties in this economic slow-down and so many families are desperately in need,” Herman continued. “As a community bank, CB&T and its associates have a strong connection to our local residents and we’re honored to support the organizations who serve them.”

About California Bank & Trust

California Bank & Trust, a subsidiary of Zions Bancorporation (NASDAQ: ZION), is one of the largest banks headquartered in California with over $10 billion in assets and more than 100 branches statewide. CB&T provides a full array of financial solutions for businesses and individuals, including commercial and small business lending, cash management, international banking and wealth management. The professional bankers at CB&T are backed by major resources, yet maintain local decision-making authority and regional market and industry expertise. They are committed to providing clients with valuable business and economic insights and to connecting them with the beneficial business relationships they need to succeed. To learn more, visit www.calbanktrust.com.

[headlines]

--------------------------------------------------------------

#### Press Release ##############################

ICBA Victory: Final FDIC Rule Establishes Parity

for Main Street Community Banks

Assessment Base Change Keeps Money Where It Belongs

—In the Community

Washington, D.C. The Independent Community Bankers of America (ICBA) lauded the Federal Deposit Insurance Corporation (FDIC) board of governor’s decision today to approve a final plan that imposes parity between small and large banks within the deposit-insurance system by basing the assessment base on average consolidated total assets minus average tangible capital instead of domestic deposits. ICBA has long advocated for the change, which was one of the association’s key priorities in the Wall Street Reform Act.

“ICBA led the charge throughout the Wall Street reform debate to create fairness within the deposit insurance system so that Main Street community banks, which are the lifeblood that drive economic stability and prosperity in thousands of communities across the nation, can continue to serve their customers and keep money where it belongs—in the community,” said James MacPhee, ICBA chairman and CEO of Kalamazoo County State Bank, Kalamazoo, Mich. “ICBA thanks the FDIC for approving this pivotal final rule, which will ultimately benefit the communities we serve.”

Under the current system, banks with less than $10 billion in assets pay approximately 30 percent of total FDIC premiums, even though they only hold 20 percent of total bank assets. Updating the system will lower assessments for 98 percent of these banks, saving community banks roughly $4.5 billion over the next three years, allowing them to reinvest those savings in their communities.

To learn more about this ICBA victory or to speak with an ICBA staff expert, please contact Aleis Stokes at 202-821-4457. For more information, visit www.icba.org.

About ICBA

The Independent Community Bankers of America, the nation’s voice for community banks, represents nearly 5,000 community banks of all sizes and charter types throughout the United States and is dedicated exclusively to representing the interests of the community banking industry and the communities and customers we serve. For more information, visit www.icba.org.

#### Press Release ############################

|

[headlines]

--------------------------------------------------------------

Anderson, South Carolina -- Adopt-a-Dog

1006042

Corgi/Beagle Mix

Medium • Adult • Female

"She is about 1 year old. She was kept outside in a fenced yard. She is friendly with kids. She will chase cats and livestock. Very friendly and outgoing girl.”

Anderson County Animal Shelter

Anderson, SC

864-260-4151

http://www.petfinder.com/shelters/SC57.html

Adoption Fee is $65.00 (cash or check) and includes spay/neuter surgery, 1st set of vaccines, 1 dose of de-wormer, Heartworm test (if old enough) and a Rabies Vaccine.

Adopt-a-Pet by Leasing Co. State/City

http://www.leasingnews.org/Conscious-Top%20Stories/Adopt_Pet.htm

Adopt a Pet

http://www.adoptapet.com/\

John Kenny Receivables Management • Credit Investigations • Asset Searches • Skip-tracing • Third-party Commercial Collections john@jkrmdirect.com | ph 315-866-1167| www.jkrmdirect.com |

(Leasing News provides this ad as a trade for investigations

and background information provided by John Kenny)

Classified ads—Asset Management

Asset Management: Atlanta, GA |

Asset Management: Boston, MA Nationwide appraisals, remarketing, audits, inspections and more! Over 15-years industry experience and dedicated to deliver personal, prompt, professional services. Call Chris @ 508-785-1277. Email:chris@dovermanagementgroup.com |

Asset Management: Minneapolis, MN |

Asset Management: Monroe, NC Recover a greater return on your investment. We specialize in the woodworking, pallet, sawmill and forestry industries. Carolinamachinerysales.com/ Melinda Meier (704)288-1904 x103 |

| Asset Management: Nationwide BUYER/LENDER BEWARE. Don't sign anything until Collateral Verifications Inc. goes onsite, knocks on the door and gets the facts. http://www.i-collateral.com Email: mark@i-collateral.com |

Nationwide |

Asset Management: NorthWest Sequent provides collateral recovery, remarketing, and storage services to lenders with assets located in the greater Pacific Northwest. Professional services at reasonable pricing. Contact rossr@sequentam.com |

Asset Management: Orange City, FL We help Lessors Liquidate un-wanted Assets valued at $750,000+. It's an effective method of Liquidating Assets such as Jets, Planes, Helicopters, Freighters, etc. Eric R. Sanders Tel 386-789-9441 www.ValuedAssetSales.com www.The-RandolphCapital.com EQPMNTLEASING@aol.com |

| Asset Storage/Re-Marketing: Ohio & surrounding states. Providing no cost warehousing, condition reports, digital photos and remarketing of off-lease forklifts & industrial equipment. NAFTA wide dealer network. Email to GCochran@OhioLift.com | |

| Asset Management: South East US- AllState Asset Management Recovery, remarketing, inspections. 25 years experience, dedicated to deliver, prompt, professional services. Call Brian @ 704-671-2376. brian.buchanan@allstateassetmgmt.com |

Asset Management: Global Specializing in Semiconductor and Electronic Test Equipment collateral. Lender services include Consignment Sales, Remarketing, Portfolio Purchases, Inspections, De-installation, Repairs and Warehousing. www.testequipmentconnection.com mnovello@testequipmentconnection.com |

| Bulldog Asset Management provides recovery and remarketing services with a difference. Contingent repos, free storage and industry experts to remarket. Email: jeff@buybulldog.com www.buybulldog.com |

All "Outsourcing" Classified ads (advertisers are both requested and responsible to keep their free ads up to date:

http://www.leasingnews.org/Classified/Outsourcing/Outsourcing.htm

How to Post a free "Outsourcing" classified ad:

http://www.leasingnews.org/Classified/Outsourcing/Outsourcing-post.htm

![]()

News Briefs----

Bank of the West sees dramatic rebound continue

Law firm liable in bank failure, feds say

BofA to drop reverse mortgages

Third of homes in Seattle metro area worth less than mortgage

Sports Briefs----

North Texas widely panned as Super Bowl host

Packers celebrate Super Bowl win with 56,000 fans at Lambeau Field

Dallas Mayor Disavows ‘Key’ Presentation to Michael Vick

NFL, union need to get to work to get to work

|

![]()

California Nuts Briefs---

Hero pilot Chesley 'Sully' Sullenberger suing Sonoma bank

http://www.pressdemocrat.com/article/20110208/ARTICLES/110209508/1350?Title=Hero-pilot-suing-Sonoma-bank

![]()

“Gimme that Wine”

Washington enjoys record wine grape harvest

http://www.tri-cityherald.com/2011/02/06/1356752/state-enjoys-record-wine-grape.html

A Year of Highs and Lows in Oregon

http://oregonwinepress.com/article?articleTitle=a+year+of+highs+and+lows--1293650440--610--wine_news

In Teroldegos, the Thrill of the Obscure

http://www.nytimes.com/2011/02/09/dining/09pour.html?_r=1&ref=dining

Restaurant Industry in sync with new USDA guidelines

http://nrn.com/article/industry-sync-new-usda-guidelines

Free Mobile Wine Program

http://leasingnews.org/archives/Feb2010/2_26.htm#mobile

Wine Prices by vintage

http://www.winezap.com

US/International Wine Events

http://www.localwineevents.com/

Winery Atlas

http://www.carterhouse.com/atlas/\

Leasing News Wine & Spirits Page

http://two.leasingnews.org/Recommendations/wnensprts.htm

[headlines]

----------------------------------------------------------------

![]()

This Day in American History

1773—Birthday of William Henry Harrison, the 9th president of the United States ( March 4-April 4, 1841). His term of office was the shortest in our nation's history-32 days. He was the first president to die in office (of pneumonia contracted during inaugural ceremonies). John Tyler assumed the presidency and historians state his administration was characterized by bickering and frustration, primarily caused by Henry Clay and Daniel Webster over political issues in their own "Whig" party.

1775 ---English Parliament declares Massachusetts colony is in rebellion.

1794- The first warship to capture an enemy shop after the Revolution was the U.S.S. Constellation, a 36-gun frigate of 1,265 tons. Off the island of Nevis, West Indies, the 36-gun Constellation, under the command of Commodore Thomas Truston, met and captured the 40-gun French frigate Insurgente, inflicting 70 casualties at the cost of only 4 American casualties. (not to be confused with the U.S.S.) Truxtun was headed for the island of Nevis when he caught sight of the French frigate L'Insurgente . After pursuing the Frenchman, Truxtun prepared for action. However, as the two ships were on the verge of engaging one another, a squall engulfed them, snapping the main topmast of the French frigate. The loss of mobility, coupled with the French tendency to fire high into the opponent's rigging, gave Truxtun a deadly advantage. Unable to maneuver and suffering from heavy damage to her hull by American gunnery, the 40-gun L'Insurgente was defeated by the 38-gun Constellation . The battle had lasted only seventy-five minutes. The Constellation suffered three casualties, compared to seventy sustained by L'Insurgente . "A very fine frigate [is] being added to our infant Navy" was the report sent to Stoddert.

http://www.navysna.org/awards/Hall%20of%20Fame%20Write%

20Ups/Truxton.htm

Constellation which was President Lincoln's flagship or the Federal of Planets Space Ship.)

http://maritimeone.com/id61.htm

http://www.geocities.com/TheTropics/Shores/1258/shipsv.html

http://www.congressionalgoldmedal.com/ThomasTruxton

http://maritimeone.com/id61.htm.htm

http://antiqbook.com/boox/spo/1110.shtml

1812-- Pioneer missionary Samuel Newell married fellow Congregationalist Harriet Atwood. They afterward sailed for India with Adoniram and Ann Hasseltine Judson. (Harriet Newell and Ann Judson thereby became the first American women commissioned for missionary work abroad.)

1819--Birthday of Lydia E. Pinkham developed a home tonic of herbs and 19% alcohol that she gave her children. As the tonic grew famous in her neighborhood she made her first sales in 1875 to earn money since she was married to a dreamer whose ship never came in. Later, her son marketed the home remedy under her direction.

1825- John Quincy Adams was elected president of the United States by the House of Representatives, into which the election had been thrown by the failure of any of the four candidates to win a majority in the electoral college. Henry Clay, one of the candidates assisted Adams cause in the House. In the four way race of Adams, Andrew Jackson, Henry Clay, and William Crawford Jackson had received more electoral votes than Adams, but no majority.

1849--Laura Clay at the 1920 convention became the first woman to receive a vote for the presidential nominee of the Democratic Party. She was a noted suffrager and first president of the Kentucky Equal Rights Association.

1859—Birthday of Carrie Chapman Catt. Very young, Carrie Lane noticed that her mother did not go to vote when her father did and she developed a lifelong devotion to the cause of women's suffrage. She became high school principal at Mason City, Iowa, in 1881. Within a few years she was elected superintendent of schools - one of the first women to fill such an office in the United States. After one year of marriage to Leo Chapman, editor and owner of the Mason City Republican, he died of typhoid fever in 1886. It was then that CCC began speaking and organizing activists for the Iowa Woman Suffrage Association and broke onto the national scene like a rocket. She died in New Rochelle, N.Y., on March 9, 1947. Catt is buried in New York City alongside Mary Garrett Hay with whom she lived from 1905 until Hay's death in 1928. They share a single headstone which reads: "Here lie two, united in friendship for 38 years through constant service to a great cause."

1861-- Tennessee votes against secession. On June 8, pro-slavery advocates stop anti-slavery voters at the polls, whereupon Tennessee secedes from the Union.

1886- President Cleveland declares a state of emergency in Seattle because of anti-Chinese violence. These protests were also seen in other Northwest cities due to the influx of “cheap” Chinese labor.

http://immigrants.harpweek.com/ChineseAmericans/Items/Item095L.htm

1873- In the foremost scandal of the day, Victoria Woodhull, publisher, was arrested for writing that renowned preacher Henry Ward Beecher had committed adultery. The postal authorities charged her with sending obscene literature through the mail. She was acquitted of the charge. What made the event more newsworthy is that Beecher was subsequently sued for alienation of affections by Theodore Tilton. The jury and the public found Dr. Beecher innocent but found Mrs. Tilton guilty.

1874—Birthday of American poet Amy Lowell, born at Brookline, MA. Her eccentricities inspire more discussion then her poetry. A lesbian and a very fat woman, she wore frilly clothes, smoked cigars, slept during the day, wrote poetry at night and kept all the mirrors in her house covered.

In 1915, anticipating a wartime shortage, Lowell, like George Sand a woman partial to cigars, ordered 10,000 Manilas. Ezra Pound, trying to help place her poetry, made up the "Imagist" movement.

Died Brookline, Ma., May 12, 1925.

http://www.sappho.com/poetry/a_lowell.html

1900-The great Count Basie bassist Walter Page birthday.

1904- a tremendous fire that started on February 7 was put out in Baltimore, Maryland, after destroying 2600 buildings in an 80-block area of the business district. It was the biggest fire since the great Chicago fire of 1871. Over $80 million (that day's dollar amount ) in buildings were destroyed.

1909—Birthday of Carmen Miranda, born Maria do Carmo Miranda da Cunha in Marco de Canavezes, Portugal. Her family moved to Rio de Janeiro when she was about two years old. Her career took off in the carnival of 1930 with the spectacular success of the marchinha "Taí" A popular movie star and singer in her day, she Carmen of a heart attack on August 5, 1955, at home in Beverly Hills, California.

http://www.maria-brazil.org/carmen.htm

http://www.humnet.ucla.edu/echo/Volume2-Issue1/wells-media/

Carmen-Miranda.jpg

1912—The United States Lawn Tennis Association amended the playing rules for its men's single's championship. The defending champion lost his by directly into the final and was required to play through the tournament.

1914—Birthday of country and western singer, born at Crip, Texas. Ernest Tubb was the sixth member to be elected to the Country Music Hall of Fame and the headliner on the first country music show ever to be presented at Carnegie Hall. His first major hit, “ Walking the Floor Over You,“ gained him his first appearance at the Grand ole Opry in 1942, and he attained regular membership in 1943. He died September 6,1984, at Nashville, Texas.

1914—Birthday of Bill Veek, baseball's premiere promoter and showman as an owner of several teams. He integrated the American League, sent a midget to the plate to start a game and, in general, sought to provide fans with entertainment in addition to baseball. Inducted into the Hall of Fame in 1991. Died at Chicago, Il, Jan. 2, 1986.

1914-Birthday of ecdysiast Gypsy Rose Lee, real name Rose Louise Hovick, born Seattle, Was. died 1970.

http://us.imdb.com/name/nm0497346/

http://www.thrillingdetective.com/eyes/gypsy_rose_lee.html

1917 -- US: American labor agitator Tom Mooney falsely convicted of fatal bombing. He is Pardoned and released 22 1/2 years from now.

http://www.shapingsf.org/ezine/labor/mooney/

http://www.dartmouth.edu/~library/Library_Bulletin/Nov1989/

LB-N89-VClose2.html

1933 - The temperature at Moran, WY, located next to Teton National Park, plunged to 63 degrees below zero to establish a state record. The temperature at the Riverside Ranger Station in Montana dipped to 66 below zero to establish a record for the state, and a record for the nation which stood until 1954.

1934 - The mercury dipped to 51 degrees below zero at Vanderbilt to establish a record for the state of Michigan. The temperature at Stillwater plunged to 52 degrees below zero to establish a record for the state of New York.

1941--Birthday of Carole King, singer, songwriter. Her soft rock Tapestry album sold more than 13 million copies and in 1971 she won four Grammy awards. "Will You Love Me Tomorrow" in 1960-61 was her first hit to top the charts. After her divorce in 1969 she changed her style and performed solo. "You've got a Friend" was the 1971 Grammy best song and "It's Too Late" the best record.

1942- singer-songwriter Carole King was born in Brooklyn, New York. Along with her then-husband Gerry Goffin, King wrote some of the most successful pop tunes of the 1960's. Among them were "Will You Love Me Tomorrow" for the Shirelles, "Up on the Roof" for the Drifters and "The Loco- Motion" for Little Eva. In the '70s, King started concentrating on her singing. Her 1971 album "Tapestry" became the biggest- selling album of all time, although its sales have since been topped by at least two other albums.

1943- in a major strategic victory, the American 161st and 132nd Regiments retook Guadalcanal in the Solomon Islands on this date after a six-month-long battle. More than 9,000 Japanese and 2,000 Americans were killed. The fierce resistance by the Japanese was an indication to the Allies of things to come. Guadalcanal put the Allies within striking distance of Rabaul, the major Japanese base in the area (as featured in "Victory at Sea".)

1944-Jimmy Page, guitarist with Led Zeppelin, is born.

1944--Birthday of 1944 Alice Walker, Black American essayist, poet, novelist, and womanist. Won 1983 Pulitzer Prize for her novel The Color Purple (1982). Her Warrior Marks and Possessing the Secret of Joy take up the horrendous practice of female genital mutilation in some African locations.

1945--*CICCHETTI, JOSEPH J. Medal of Honor

Rank and organization: Private First Class, U.S. Army, Company A, 148th Infantry, 37th Infantry Division. Place and date: South Manila, Luzon, Philippine Islands, 9 February 1945. Entered service at: Waynesburg, Ohio. Birth: Waynesburg, Ohio. G.O. No.: 115, 8 December 1945. Citation: He was with troops assaulting the first important line of enemy defenses. The Japanese had converted the partially destroyed Manila Gas Works and adjacent buildings into a formidable system of mutually supporting strongpoints from which they were concentrating machinegun, mortar, and heavy artillery fire on the American forces. Casualties rapidly mounted, and the medical aid men, finding it increasingly difficult to evacuate the wounded, called for volunteer litter bearers. Pfc. Cicchetti immediately responded, organized a litter team and skillfully led it for more than 4 hours in rescuing 14 wounded men, constantly passing back and forth over a 400-yard route which was the impact area for a tremendous volume of the most intense enemy fire. On 1 return trip the path was blocked by machinegun fire, but Pfc. Cicchetti deliberately exposed himself to draw the automatic fire which he neutralized with his own rifle while ordering the rest of the team to rush past to safety with the wounded. While gallantly continuing his work, he noticed a group of wounded and helpless soldiers some distance away and ran to their rescue although the enemy fire had increased to new fury. As he approached the casualties, he was struck in the head by a shell fragment, but with complete disregard for his gaping wound he continued to his comrades, lifted 1 and carried him on his shoulders 50 yards to safety. He then collapsed and died. By his skilled leadership, indomitable will, and dauntless courage, Pfc. Cicchetti saved the lives of many of his fellow soldiers at the cost of his own.

1950 - During a speech in Wheeling, West Virginia, Senator Joseph McCarthy (Republican-Wisconsin) claims that he has a list with the names of over 200 members of the Department of State that are "known communists." The speech vaulted McCarthy to national prominence and sparked a nationwide hysteria about subversives in the American government. He did untold damage to many people's lives and careers, had a muzzling effect on domestic debate on Cold War issues, and managed to scare millions of Americans. McCarthy, however, located no communists and his personal power collapsed in 1954 when he accused the Army of coddling known communists. Televised hearings of his investigation into the U.S. Army let the American people see his bullying tactics and lack of credibility in full view for the first time, and he quickly lost support. The U.S. Senate censured him shortly thereafter and he died in 1957.

1952---Top Hits

Slowpoke - Pee Wee King

Cry - Johnnie Ray

Anytime - Eddie Fisher

Give Me More, More, More (Of Your Kisses) – Lefty Frizzell

1957-After nine weeks, Guy Mitchell's "Singing the Blues" is pushed out of Billboard's top spot by Elvis Presley's "Too Much".

1958-A report by the American Research Bureau cites Dick Clark's American Bandstand as the top-ranked daytime television program, drawing an average of 8,400,000 viewers per day.

1959-Lloyd Price reached number one on the Billboard Pop chart with "Stagger Lee", an up-dated version of an old Folk song called "Stack-O-Lee". Wilson Pickett would take the song to number 22 in 1967.

1960---Top Hits

Teen Angel - Mark Dinning

Where or When - Dion & The Belmonts

Handy Man - Jimmy Jones

He'll Have to Go - Jim Reeves

1962-Neil Sedaka records "Breaking up Is Hard to Do"

1962-Neil Sedaka records "Breaking Up Is Hard To Do", which will become his 5th US Top Ten hit and first number one by the following August. Neil's ballad version of the song would peak at number eight in February 1976.

1963-Ray Hildebrand and Jill Jackson, who were billed as Paul and Paula, had the top tune in the US with "Hey Paula".

1963-Ray Hildebrand and Jill Jackson, who were billed as Paul and Paula, had the top tune in the US with "Hey Paula".

1963- Ruby and the Romantics' "Our Day Will Come" enters the pop charts

1963-Birthday of country singer Travis Tritt.

1963 - The first Boeing 727 took off, becoming the world's most popular way to fly. Before production was stopped in 1984, 1,832 of the aircraft were built.

1964 -- Arthur Ashe, Jr., becomes first African American on US Davis Cup Team.

1964- the Beatles made their live US television debut on "The Ed Sullivan Show." "I Want to Hold Your Hand" could barely be heard over the screams from the audience, who were also treated to "All My Loving," "Till There Was You," "She Loves You" and "I Saw Her Standing There." There were 50,000 requests for the 725 available seats. The Beatles appeared on the show again a week later. Each program was watched by an estimated 70-million people, the highest rating at the time.

1968---Top Hits

Green Tambourine - The Lemon Pipers

Spooky - Classics IV

Love is Blue - Paul Mauriat

Skip a Rope - Henson Cargill

1969 - The Boeing 747 took its first flight, ushering flew in the age of the jumbo jet. As manager of the Chamber of Commerce of San Bruno, “The Airport City,” we issued gold, silver, and copper coins to celebrate the event. They are considered collected items today.

1969 - Roslyn Kind quietly made her television debut on "The Ed Sullivan Show". Ed said she was "...America's teenager who wasn't protesting or playing a guitar." Although she only appeared once, her sister appeared many times. Roslyn Kind is Barbra Streisand's sister.

1969--*PROM, WILLIAM R. Medal of Honor

Rank and organization: Lance Corporal, U.S. Marine Corps, Company 1, 3d Battalion, 3d Marines, 3d Marine Division (Rein), FMF. Place and date: Near An Hoa, Republic of Vietnam. 9 February 1969. Entered service at: Pittsburgh, Pa. Born: 17 November 1948, Pittsburgh, Pa. Citation: For conspicuous gallantry and intrepidity at the risk of his life above and beyond the call of duty while serving as a machinegun squad leader with Company 1, in action against the enemy. While returning from a reconnaissance operation during Operation TAYLOR COMMON, 2 platoons of Company 1 came under an intense automatic weapons fire and grenade attack from a well concealed North Vietnamese Army force in fortified positions. The leading. element of the platoon was isolated and several marines were wounded. L/Cpl. Prom immediately assumed control of 1 of his machineguns and began to deliver return fire. Disregarding his safety he advanced to a position from which he could more effectively deliver covering fire while first aid was administered to the wounded men. Realizing that the enemy would have to be destroyed before the injured marines could be evacuated, L/Cpl. Prom again moved forward and delivered a heavy volume of fire with such accuracy that he was instrumental in routing the enemy, thus permitting his men to regroup and resume their march. Shortly thereafter, the platoon again came under heavy fire in which 1 man was critically wounded. Reacting instantly, L/Cpl. Prom moved forward to protect his injured comrade. Unable to continue his fire because of his severe wounds, he continued to advance to within a few yards to the enemy positions. There, standing in full view of the enemy, he accurately directed the fire of his support elements until he was mortally wounded. Inspired by his heroic actions, the marines launched an assault that destroyed the enemy. L/Cpl. Prom's indomitable courage, inspiring initiative and selfless devotion to duty upheld the highest traditions of the Marine Corps and the U.S. Naval Service. He gallantly gave his life for his country.

1970 - Sly and The Family Stone were awarded a gold record for the single, "Thank You (Falettinme Be Mice Elf Agin)". At the time Sly (Sylvester) Stewart was a disc jockey in Oakland, California.

1971 - An earthquake measuring 6.6 struck the San Fernando Valley in California, killing 58 people. Property damage reached $900 million.

1971 -- Satchel Paige becomes first Negro-league player elected to baseball Hall of Fame.

Sometimes I feel like I will never stop

Just go forever

Till one fine morning

I'll reach up and grab me a handful of stars

and swing out my long lean leg

and whip three hot strikes burning down the heavens

and look over at God and say

How about that!

— Samuel Allen, "To Satch"

http://www.negroleaguebaseball.com/history101.html

1975-- Cher's solo TV show premiered. Among the guests were Elton John, Bette Middler and Flip Wilson.

1976---Top Hits

50 Ways to Leave Your Lover - Paul Simon

Love to Love You Baby - Donna Summer

You Sexy Thing - Hot Chocolate

Sometimes - Bill Anderson & Mary Lou Turner

1984---Top Hits

Karma Chameleon - Culture Club

Joanna - Kool & The Gang

Running with the Night - Lionel Richie

Show Her - Ronnie Milsap

1987 - Just twenty years after the first woman was admitted to the New York Stock Exchange, the Exchange Luncheon Club decided to put in a women's rest room. Prior to this gracious offer, the women had to walk down a flight of stairs.

1987 - A storm off the Atlantic coast produced high winds and heavy snow in the northeastern U.S., with blizzard conditions in eastern Massachusetts. Wind gusted to 80 mph and 23.4 inches of snow produced drifts eight feet high at Cape Cod MA. It was the worst blizzard in thirty years for the Cape Cod area. Winds in some of the mountains and ridges of the Appalachian Region gusted to 100 mph

1989 - A winter storm continued to bring rain and snow to southern California. Snowfall totals ranged up to 18 inches at Olancha, with three inches at Palmdale.

1990 - Thunderstorms developing ahead of a cold front erupted over eastern Texas late in the morning, and produced severe weather as they swept across the southeastern states. Early evening thunderstorms spawned a tornado which injured one person at Nat TX, and produced tennis balls size hail which caused more than half a million dollars damage around Shreveport, LA.

1992-Three months after announcing his retirement ( On November 7,1991) from the NBA because he had been infected with HIV, Magic Johnson led the West to a 153-113 victory over the East in the 42 nd NBA All-Star Game. Magic was named All-Star Game MVP for the second time.

1997 - "The Simpsons" became the longest-running prime-time animated series. The record was previously held by "The Flintstones".

2010-Former Beatles drummer Ringo Starr became the 2,401st person to be added to the Hollywood Walk of Fame during a ceremony that marked the 50th anniversary of the attraction's groundbreaking. The Beatles as a group were given a star in 1998.

--------------------------------------------------------------

SuDoku

The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler?

http://leasingnews.org/Soduku/soduko-main.htm

--------------------------------------------------------------

Daily Puzzle

How to play:

http://www.setgame.com/set/puzzle_frame.htm

Refresh for current date:

http://www.setgame.com/set/puzzle_frame.htm

--------------------------------------------------------------

http://www.gasbuddy.com/

http://www.gasbuddy.com/GB_Map_Gas_Prices.aspx

http://www.gasbuddy.com/GB_Mobile_Instructions.aspx

--------------------------------------------------------------

Weather

See USA map, click to specific area, no commercials

--------------------------------------------------------------

Traffic Live---

Real Time Traffic Information

You can save up to 20 different routes and check them out with one click,

or type in a new route to learn the traffic live

--------------------------------