![]() Add me to mailing list |

Add me to mailing list | ![]() Change email |

Change email | ![]() |

| ![]() Search

Search

Advertising | All Lists | Archives | Classified Ads | This Day In American History

Leasing News is a web site that posts information, news, and

entertainment for the commercial bank, finance and leasing industry

kitmenkin@leasingnews.org

![]()

Wednesday, February 4, 2015

Today's Equipment Leasing Headlines

Comments on ELFA President/CEO Retiring

Chief Operating Officer Elected to Office in 2016

Classified Ads---Legal

Loan/Lease Regulations --- Update-New States

“Don’t Have a License? Not Caught, You’re Lucky, so Far”

Leasing News Advisor

Shawn Halladay

Sales Make It Happen – By Steve Chriest

Hidden Issues

Longest Active Certified Leasing Professional

Since 1985 W. Russell (Russ) Runnalls

Letters?---We get eMail!

(News and Reactions to News)

Ninth Circuit Allows Bank to Freeze Chapter 7 Account

---But New York Court Sanctions Bank for Same Conduct

By Tom McCurnin, Leasing News Legal Editor

Tick of the Clock Grows Louder for

Small Business Lending Fund Repayments

Niche PR Firm Launches New Marketing Campaign Platform

Susan Carol Associations

St. Bernard (Mix)

Columbus, Ohio Adopt-a-Dog

Attorneys Who Specialize in

Banking, Finance, and Leasing

News Briefs---

$1.4 Billion Recovered as Result of Sigtarp Investigations

Central Banks in India and Australia Take Steps to Lift Growth

King of ‘Hamptons Versailles’ in court over $250M palace

10 years later, Amazon celebrates Prime’s growth

Broker/Funder/Industry Lists | Features (writer's columns)

Top Ten Stories Chosen by Readers | Top Stories last six months

www.leasingcomplaints.com (Be Careful of Doing Business)

www.evergreenleasingnews.org

Leasing News Icon for Android Mobile Device

You May have Missed---

SparkPeople--Live Healthier and Longer

Poem

Sports Briefs---

California Nuts Brief---

"Gimme that Wine"

This Day in American History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

######## surrounding the article denotes it is a “press release”

and was not written by Leasing News nor information verified, but from the source noted. When an article is signed by the writer, it is considered a “by line.” It reflects the opinion and research of the writer.

Please send Leasing News to a colleague and ask them to join

our mailing list. You may also visit each news edition at www.leasingnews.org or view our previous editions at: www.leasingnews.org/archives.htm

[headlines]

--------------------------------------------------------------

Comments on ELFA President/CEO Retiring

Chief Operating Officer Elected to Office in 2016

Rick Remiker

Former ELFA Chairman

Sr. Executive Vice President, Commercial Banking

Huntington National Bank

"Woody Sutton has done a tremendous job leading the Equipment Leasing and Finance Association, Equipment Leasing and Finance Foundation, and PAC over the last 4+ years. Under Woody's strong leadership the ELFA has experienced improved member retention, expanded programming, strong advocacy on key issues (notably Lease accounting), along with a growth in conference and convention attendance. Woody was also instrumental in hiring a number of exceptional ELFA colleagues who will play a vital role in shaping the future of our industry. While I am disappointed Woody will be leaving at the end of 2015, I am honored to have worked alongside him during his ELFA tenure.

"I am also proud to see Ralph Petta step into the President and CEO role next January. I have worked hand in glove with Ralph over much of the past 20 years on key Association committees, projects, and boards. Ralph's deep knowledge of the industry, key players, and critical issues will serve him well in expanded duties starting in 2016. I am confident Ralph will lead the ELFA to even greater heights."

Adam Warner

Past ELFA Chairman

President

Key Equipment Finance

“I was proud to serve on the Succession & Transition Committee that recruited and on-boarded Woody to the EFLA. I consider it one of my greatest accomplishments in service to our industry. Additionally, I am honored to be asked to Chair the new Transition Committee to oversee a successful changeover to Ralph Petta as President and CEO. I have worked directly with Ralph over the past decade and feel assured that our association will fair extremely well under his leadership.”

[headlines]

--------------------------------------------------------------

Classified Ads---Legal

(These ads are “free” to those seeking employment

or looking to improve their position)

San Diego , CA |

Free Posting for those seeking employment in Leasing:

http://www.leasingnews.org/Classified/Jwanted/Jwanted-post.htm

All “free” categories “job wanted” ads:

http://www.leasingnews.org/Classified/Jwanted/Jwanted.htm

[headlines]

--------------------------------------------------------------

Loan/Lease Regulations --- Updated

“Don’t Have a License? Not Caught, You’re Lucky, so Far”

In most states, banks are not required to have a leasing license as well as manufacturers. Banks are generally exempt because they are regulated by the FDIC.

The common thread among licensing statutes is that if the entity which should otherwise have a license, is licensed by another government agency (real estate brokers is one example), then no license is required.

An expert on this who has won cases against company’s not licensed in California, notably CMC Commercial Credit, Tom McCurnin, Barton, Klugman & Oetting, Los Angeles, California told Leasing News: “A property owner can sell his property on credit without a license or without usury issues. Its called the Time Price Doctrine or Time Price Differential.

“CIT on the other hand doesn't own the stuff and is therefore making a loan and is required to have a license.

“A gray area might be for the leasing company to buy the stuff and have it shipped to them, and they, in turn re-ships to the customer. May not be required to have a license. Simple invoices and drop shipping probably would not pass muster.”

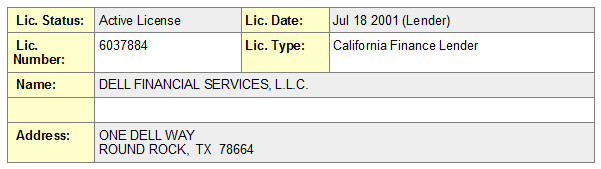

Captive Lessors are required to have a license, and all those that I checked do, such as Dell, who also sells other products than the ones they manufacture.

And while there are financial institutions that also have a bank, such as CIT, they hold a license.

In California, those engaged in true leases, such as Mar Vista, address, do not need to be licensed, but everyone who is involved in “capital leases” with a bargain purchase option, particularly a dollar, are required to be licensed. Without it, they may not accept a commission, engage with a licensed financial institution, and may find their leases in court dismissed for lack of a license. While the fines are not very much, the clout comes in immediate suspension from doing business in California, and while a hearing may be required or filed by an attorney, they may not engage in business during this time.

“NO BROKERAGE COMMISSIONS TO UNLICENSED BROKERS. California Administrative Code Title 10 §1451.”

Commissions may not be paid to unlicensed brokers. There are companies who use other companies’ documents and therefore believe they do not need to be licensed. This may be accurate in dealing with a bank, but not with another licensed financial institution or financial institution out of state that is not licensed in California.

If you are registered by license as a broker, lender, lessor in states that require it, you do not need a city business license (in most states). Cities that require a business license, also require a business license if you work out of your residence. Many cities now are using Schedule C from tax returns, such as in San Jose, California, to catch those without a city license, and they will go back several years as well as a fine, so best to get a license now in case they check your city.

While not all states require a lender's license, many require a license to accept a deposit or advance rental. And remember, a capital lease may be considered a loan as it is with the IRS in many states. If the state requires a license, and your company is not licensed, the transaction may be subject to usury laws.

46 states do not require the lessor to notify the lessee regarding the end of the original term of the lease and can invoke an Evergreen clause, except in these states that do require notification and if not, can void the residual as well as bring on a fine or worse, depending on the number of such transactions and complaints received.

States who require notification:

New York

Rhode Island

Texas

Wisconsin

Illinois

(In Illinois, Consumer law, but may affect commercial, especially a proprietorship, partnership or personal guarantee)

--Christopher Menkin

---Current Regulations

(Any up-dates or additions, please send

to kitmenkin@leasingnews.org)

Alaska: Money Service License. License required to have exemption from usury rates for loans of $10,000 to $25,000, and 24% rate for $850 to $10,000

http://commerce.state.ak.us/dnn/Portals/3/pub/MoneyservicesStatutes.pdf

Arizona: All "advance fee loan brokers" must register annually with the state. Includes "commitment fees." Stiff penalty and on line form for a complaint for the state to investigate. Arizona Revised Statutes, sec. 06-1303-1310 (1996)

Registration process: http://www.azdfi.gov/Licensing/Licensing-FinServ/ALB/ALB.html

Arkansas: All brokers of "a loan of money, a credit card or a line of credit" may not assess or collect an advance fee. In addition, all brokers must register with the Securities Commissioner, post a surety bond of $25.000 and have a net worth of $25,000.

Arkansas Code Annotate sec. 23-39-401 (1995)

California:On September 22, 2016, California Governor Jerry Brown signed SB 777 into law, a bill that restores a de minimus exemption to the California Finance Lenders Law (CFLL) to allow a person or entity that makes one commercial loan per year to be exempt from the CFLL's licensing requirement, regardless of whether the loan is "incidental" to the business of the person relying on the exemption.

"In addition to the lending authority provided by the law, the California Finance Lenders Law provides limited brokering authority. A "broker" is defined in the law as "any person engaged in the business of negotiating or performing any act as broker in connection with loans*made by a finance lender." Brokers licensed under this law may only broker loans to lenders that hold a California Finance Lenders license."

http://leasingnews.org/archives/May2016/05_02.htm#dob

(*any transaction that is not a true rent or meets the accounting and tax rules or is re-sold as a loan or discount or has a nominal purchase option is considered under this nomenclature. ) (2)

Delaware : License required for More Than 5 Loans Per Year.

http://banking.delaware.gov/services/applicense/llintro.shtml

Florida: Brokers of a "loan of money, a credit card, line of credit or related guarantee, enhancement or collateral of any nature" may not assess or collect an advance fee.

Florida Statues, Chapter 687.14 (1992)

Georgia: A broker of "loans of money, a credit card, a line of credit or related guarantee, enhancement or collateral of any kind or nature" may not assess or collect an advance fee unless such fee is for "actual services necessary to apply for the loan." Official Code of Georgia Annotated, sec. 7- 7-1 (1992)

Idaho: No fee may be collected unless a loan is actually made.

Idaho Code, sec. 26-2501 (1992)

Illinois: Code, 815 ILCS 175/15-5.03 Under the Act, a" loan broker" means any person who, in return for a fee from any person, promises to procure a loan for any person or assist any person in procuring a loan from any third party, or who promises to consider whether or not to make a loan to any person. 815ILCS 175/15-5- 15(a) specifically excluded from the application of the Act, however, are (1) any bank …regulated by any service loans for the Federal National Mortgage Association… (3) any insurance producer or company authorized to do business in [Illinois], (4) any person arranging financing for the sale of the person's product, (note that this exception does not apply to any person selling someone else's product and only applies to "the" person's product, implying the exception is for the owner of the product arranging for financing), (5) any person authorized to conduct business under the Residential Mortgage License Act of 1987 and (6) any person authorized to do business in [Illinois] and regulated by the Department of Financial Institutions or the Office of Banks and Real Estate. "In the event that the Act is violated by the broker, the Secretary of State is empowered by the statute to make investigations and examinations, suspend or revoke the broker's approval, subpoena witnesses, compel the production of books and records, order depositions and obtain temporary restraining orders and injunctions against the broker. In the vent that a violate is found, the Secretary of State may impose a fine in the amount of $10,000 for each violation and the broker shall be liable to any person damaged in the amount of tactual damages plus attorneys’ fees." This appears as standard language on most states.

Iowa: A broker of loans of "money or property" may not assess or collect an advance fee except for a "bona fide third-party fee" and a broker must obtain a bond or establish a trust account and file required documents with the Commissioner or Insurance.

Iowa Code, sec. 535C (19920)

Kansas : Broker is not exempt. Discounter or Lessor is exempt: " 'Creditor' means any person to whom a loan is initially payable on the face of the note or contract evidencing the loan" is exempt. Anyone who earns a fee or accept a deposit, except a bank, financial institution, discounter or lessor, must be registered.

http://www.securities.state.ks.us/rules/loan.rtf

Kentucky: Brokers of "a loan of money, a credit card, a line of credit or related guarantee, enhancement or collateral of any kind or nature" may not assess or collect an advance fee.

Kentucky Revised Statutes Annotated, sec. 367.380 (1992)

Louisiana: A broker of loans of "money or property…whether such agreement is styled as a loan, a lease or otherwise" must obtain a surety bond or establish a trust account in the amount of $25,000. A broker may not collect an advance fee but may collect an "advance expense deposit for commercial loans" only for actual expenses incurred in obtaining the loan. Louisiana Revised Statutes Annotated, sec. 9:3574 (1993); Louisiana Revised Statutes Annotated, Sec. 51:1910 (1992)

Non-Louisiana leasing companies, with or without offices in the state, must qualify to do business in Louisiana, and are subject to payment of state and local occupational license fees. See: Collector of Revenues v Wells Fargo Leasing Corp., 393 So.2d 1255 (La. App. 1981). Common misunderstanding of Louisiana law. Motor vehicle lessors, with or without offices in Louisiana, additionally are required to be licensed by the Louisiana Motor Vehicle Commission in order to lease a motor vehicle in the state. (La. R.S. 32:1254(N)) Common misunderstanding of Louisiana law.

Maine: No license required: "the regulation of commercial loan brokers does not fall under the jurisdiction of the Maine Bureau of Consumer Credit Protection. Transactions involving two businesses are legal/contractual in nature. Therefore, disputes involving a commercial loan between a business and commercial loan provider or broker must be settled in the court system."

http://www.maine.gov/pfr/consumercredit/faqs/loan_broker_faq.htm#j

Maryland: Lending threshold is $6,000 or less, so now need for license if over

this dollar amount

Massachusetts: Lending threshold is $6,000 or less, so now need for license if over this dollar amount.

Minnesota: License required for loans of $100,000 or less

Money Transfer License

http://mortgage.nationwidelicensingsystem.org/slr/PublishedState

Documents/MN-Money-Transmitter-Company-Description.pdf

Mississippi: A broker or loans of money may not assess or collect an advance fee and can be fined up to $5,000 for each violation. Mississippi Code Annotated, sec. 81-19-17 (1997)

Missouri: A broker of loans of "money or property" may not assess or collect an advance fee. Missouri Revised Statues, sec. 367 300 (19920

Nebraska: A broker of loans of money may not assess or collect an advance fee. Nebraska Revised Statutes, sec. 45-189 (1993)

Nevada: Foreign Corporations Foreign corporations engaged in activities in Nevada are subject to the provisions of Chapter 80 of the Nevada Revised Statutes. Specifically, NRS 80.010 through 80.055 set forth the requirements for a foreign corporation to qualify to do business in Nevada. Of primary importance are the statutes that establish (a) the filing requirements to qualify to do business (NRS 80.010); (b) the activities in which a foreign corporation may engage that do not constitute “doing business” so as to require qualification (NRS 80.015); and (c) the penalties to which a foreign corporation will be subject for failing to comply with the qualification provisions (NRS 80.055). The penalties for failure to comply with the qualification statutes include a fine (capped at $10,000) and/or denial of the right to maintain a court action. However, failure to comply will not impair the validity of contracts entered into by a foreign corporation nor prevent such corporation from defending itself in court. Foreign LLCs Foreign LLCs engaged in activities in Nevada are subject to the provisions of Chapter 86 of the Nevada Revised Statutes, specifically NRS 86.543 through 86.549. Foreign LLCs seeking to operate in Nevada must comply with the initial filing and registration requirements in NRS 86.544, and annual filing requirements of NRS 86.5461. The LLC must also maintain certain records, such as a list of current members and managers, in accordance with NRS 86.54615. Additionally, NRS 86.5483 lists the activities which do not constitute “doing business” in Nevada for purposes of the Chapter. Foreign LLCs that fail to comply with the Chapter risk penalties similar to those facing a non-compliant foreign corporation. Those penalties are outlined in NRS 86.548.

Nevada has no usury statue.

New Hampshire

Any person making small loans, title loans, or payday loans in New Hampshire must obtain a license from the bank commissioner. N.H. Rev. State. Ann. § 399-A:2. This law does not apply to banks, trust companies, insurance companies, savings or building and loan associations, or credit unions. Id. Any person who violates any provision of this chapter shall be guilty of a misdemeanor if a natural person, or a felony if any other person. N.H. Rev. Stat. Ann § 399-A:18.

New Jersey: Brokers of "loans of money" may not assess or collect an advance fee.

New Jersey Rev. Statutes, sec. 17:10B (1992)

Although New Jersey does not require a lessor to obtain a license to conduct a leasing business in the state, the New Jersey Corporation Business Activities Report Act requires foreign corporations to register with the state. See N.J. STAT. ANN. 14A:13-14. In particular, foreign corporations must file a Notice of Business Activities Report with New Jersey's Department of Taxation. Activities that trigger the requirement of a report include: (a) maintaining an office or other place of business in New Jersey; (b) maintaining personnel in New Jersey, even if the personnel is not regularly stationed in the state; (c) owing or maintaining real or tangible personal property directly used by the corporation in New Jersey; (d) owning or maintaining tangible and/or property in New Jersey used by others; (e) receiving payments from residents in New Jersey, or businesses located in New Jersey, that are greater than $25,000.00; (f) deriving any income from any source or sources within New Jersey; or (g) conducting or engaging in any other activity, property or interrelationships with New Jersey as may be designated by the Director of the Division of Taxation. See N.J.S.A. 14A:13-15. Corporations not required to file a report are those which either received a certificate of authority to do business, or filed a timely tax return under the Corporation Business Tax Act, or Corporation Income Tax Act. See N.J. STAT. ANN. 14A:13-16. Reports must be filed annually by April 15th.

New Mexico: New Mexico currently requires Brokers/Lessors to register for Licensing under the NM Mortgage loan Company or Loan Broker Act with the Financial Institutions Division of the State of New Mexico. Banks with Brick and Mortar within the State of New Mexico are exempt. Prior to licensing applicants must submit the Following:

Articles of Incorporation

Listing of all principals (including management)

A full financial Package (to meet their minimum requirements of liquidity)

Personal financial statements on all principals

Disclosure of all current or past suits (civil or criminal)

Attach a corporate surety bond

Include a $400.00 registration fee renewable yearly

North Carolina: A broker of "loans of money or property…whether such agreement is styled as a loan, a lease or otherwise" must obtain a surety bond or establish a trust account in the amount of $25,000 and obtain a license. North Carolina General Statutes, sec. 66-106 (1992)

North Dakota:License Required “Money Broker’s License”. N.D. Cent. Code Ann. § § 13-04.1-02.1 and 13-04.1-01.1 http://www.nd.gov/dfi/regulate/index.html

Brokers may not accept an advance fee unless the broker is licensed. North Dakota Century Code, 13-04. 1-09.1 (1993) Ohio: Department of Commerce, Division of Financial Institutions

(Certificate to engage in the business of a credit services organization in accordance with the provisions of Sections 4712.01 to 4712.14 of the revised code of Ohio, subject to all the provisions thereof and to the regulations of the division.) Ohio Department of Taxation requires a "Vendor's License" under provision 5739.17 of the Revised Code (...is hereby authorized to sell tangible personal property and selected services at the retail location specified below.) This also makes the lessor responsible for all taxes with penalties for not doing so.

Ohio: Ohio law provides that no person may engage in the business of lending money, credit, or choses in action in amounts of $5,000 or less, or exact, contract for, or receive, directly or indirectly, on or in connection with any such loan, any interest and charges that in the aggregate are greater than the interest and charges that the lender would be permitted to charge for a loan of money if the lender were not a licensee, without first having obtained a license from the Division of Financial Institutions. O.R.C. 1321.02. This rule is applied to any person, who by any device, subterfuge, or pretense, charges, contracts for, or receives greater interest, consideration, or charges than that authorized by such provision for any such loan or use of money or for any such loan, use, or sale of credit, or who for a fee or any manner of compensation arranges or offers to find or arrange for another person to make any such loan, use, or sale of credit. O.R.C. 1321.02.

Rhode Island: Any person who acts as a lender, loan broker, mortgage loan originator, or provides debt-management services must be licensed. R.I. Gen Laws § 19-14-2(a). The licensing requirement applies to each employee of a lender or loan broker. R.I. Gen Laws § 19-14-2(b). No lender or loan broker may permit an employee to act as a mortgage loan originator if that employee is not licensed. R.I. Gen Laws § 19-14-2(b) R.I. Gen. Laws § 19-14-2 (2012) No person engaged in the business of making or brokering loans shall accept applications from any lender, loan broker, or mortgage loan originator who is required to be licensed but is not licensed. R.I. Gen Laws § 19-14-2(d). There is an exemption from the licensing requirement for a person who makes not more than 6 loans in the state within a 12-month period. R.I. Gen Laws § 19-14.1-10. Persons lending money without a license are guilty of a misdemeanor and can be fined not more than $1,000, or imprisoned for not more than 1 year, or both; each violation constitutes a separate offense. R.I. Gen Laws § 19-14-26.

South Carolina: A broker of "a loan of money, a credit card, a line of credit or related guarantee, enhancement or collateral of any kind or nature" may not assess or collect an advance fee. South Carolina Code Annotated, sec. 34-36-10 91992)

South Dakota: Money Lending License

Required for individuals or corporations to engage in the business of lending money, including creating and holding or purchasing and acquiring any installment loan ("Capital Lease" or EFA), single pay loan, or open-end loan which may be unsecured or secured by personal property. Requires filing a surety bond application. State and national banks, bank holding companies, other federally insured financial institutions, and the subsidiaries of those institutions are exempt from licensure. In addition, SD chartered trust companies are exempt from licensure. Any individual or corporation holding this license is required to pay the bank franchise tax.

Duration: 1 year

Cost: Application: $600

South Dakota has no usury status

Vermont: Commercial Loans

Commercial loan license would apply to EFA and "Capital Leases." Exemptions include transactions over $1 million, and brokers who do not engage in transactions more than $50,000 in one year at rates not exceeding 12 percent per annum.

Ontario, Canada: General Requirements: 1. Branch Operation If a foreign corporation wants to carry on business via a branch operation, without a Canadian corporate entity, it may have to obtain a provincial license in each province in which it intends to carry on business. Pursuant to the Ontario Extra-Provincial Corporations Act R.S.O. 1990 c. E.27 ("EPCA"), a class 3 extra-provincial corporation (a corporation that has been incorporated or continued under the laws of a jurisdiction outside Canada) is prohibited from carrying on business in Ontario without a license under the Act [s. 4(2)]. Failure to comply with this licensing requirement can lead to a maximum fine of $2,000 for a person and $25,000 for a corporation [s. 20(1)]. Directors, officers and any person acting as a representative of the corporation can be fined up to $2,000 for authorizing, permitting or acquiescing to an offence by the corporation [s. 20(2)]. For the purposes of the EPCA, an extra-provincial business is considered to be "carrying on business in Ontario" if: a. It has a resident agent, representative, warehouse, office or place where it carries on its business in Ontario; b. It holds an interest, otherwise than by way of security in real property situate in Ontario; or c. It otherwise carries on business in Ontario [s. 1(2)]. This last category is a catchall. Recent case law in the area stresses that it is very much a fact-specific analysis hinging on the extent to which business is actually conducted in Ontario. 2. Incorporation: a foreign corporation can also choose to incorporate a subsidiary, either federally or provincially. If a subsidiary is incorporated provincially in Ontario, it may have to obtain an extra-provincial license to carry on business in other provinces. An Ontario-incorporated company does not have to obtain a license to carry on business in Quebec but does have to make annual information filings. 3. Bank Act If the financing company is a bank and intends to carry on business in Canada, it must obtain appropriate approval under the Bank Act 1991 c. 46. Whether an entity will be considered a bank under the Bank Act needs to be reviewed on a case-by-case basis, as there are a number of relevant factors.

[headlines]

--------------------------------------------------------------

Leasing News Advisor

Shawn Halladay

Shawn Halladay has been a frequent contributor of articles, particularly regarding accounting, changes to FASB rules, tax rulings, as well as covering several of the Equipment Leasing and Finance Association events and conferences. He joined the Leasing News Advisory Board on April 17, 2006.

Shawn Halladay

352 Denver Street, Suite 224

Salt Lake City, UT 84111

801/322-4499

shawn@amembalandhalladay.com

www.amembalandhalladay.com

Shawn is Managing Director of Amembal & Halladay, the premier training and consulting firm serving the global equipment leasing industry. He has authored or co-authored eight books on equipment leasing, including "A Guide to Equipment Leasing,", "A Guide to Accounting for Leases" and "The Handbook of Equipment Leasing."

His professional expertise stretches across all leasing sectors and around the globe. Based in Salt Lake City, Utah, he has served lessors throughout North and South America, Africa, Asia, and Europe, providing training in all aspects of equipment leasing. His consulting services include implementing best practices, benchmarking studies, strategic planning, leasing system selection and implementation, litigation support, accounting, and quantitative analyses.

He likes to travel as an excuse to attend soccer games, one of his passions.

[headlines]

--------------------------------------------------------------

Leasing Industry Help Wanted

For information on placing a help wanted ad, please click here:

http://www.leasingnews.org/Classified/Hwanted/Hwanted-post.htm

Please see our Job Wanted section for possible new employees.

[headlines]

--------------------------------------------------------------

Sales Make It Happen – By Steve Chriest

Hidden Issues

You've just delivered a killer proposal to a prospective vendor you desperately want to count as a new customer for you and your company. Your company has offered the vendor special pricing and relaxed credit parameters designed to increase the percentage of his customers who qualify for financing. Your proposal, as far as you know, addresses all of the vendor's needs, and it makes perfect sense.

After you present your proposal, the vendor thanks you for your time and the work you did to develop your proposal and deliver an excellent presentation. He then tells you that his company has decided to remain a customer of their present financing source. Shocked, you thank the vendor for his time, and you make your exit, asking yourself what happened?

First, you should probably revisit your proposal and assure yourself that the deal you offered was indeed as good as you thought. If you are then still convinced that a prudent man in the same situation as the vendor wouldn't think twice about accepting your proposal, you may be the victim of a "Hidden Issue."

Hidden Issues are negative feelings or perceptions about you, your company, your industry, and maybe salespeople in general. It also could be something wholly unrelated to business. The buyer may carry some resentment toward your company for the way he was treated in the past by a former salesperson. Perhaps, during a previous time of need, your company refused to consider the type of deal you are now proposing, and the vendor is in no mood to forget the past.

A buyer who harbors resentment toward you or your company for past missteps can be tough to deal with. Worse is the buyer whose dislike of you or your company is irrational. During your presentation, for example, you may have reminded the buyer of the uncle that used to embarrass him when he was a child. As the buyer watched you present, and listened to you speak, his identification of you with his uncle made it emotionally impossible for him to want to associate with you! Irrational? Yes. And it happens to salespeople more often than you might guess.

Next week we'll discuss what you might do if you think you are or have been the victim of a Hidden Issue.

Steve Chriest is the CEO of Open Advance and author of Selling to the E-Suite, The Proven System for Reaching and Selling Senior Executives and Business Acumen 101. He recently re-named his

company from Selling-Up. He produces video and radio blogs, as well as continues as a columnist for Leasing News.

www.openadvance.com/contact/

925-263-2702

www.openadvance.com/

Sales Makes It Happen Articles:

http://www.leasingnews.org/Legacy/index.html

[headlines]

--------------------------------------------------------------

Longest Active Certified Leasing Professional

Since 1985 W. Russell (Russ) Runnalls

The Certified Leasing and Finance Professional Foundation is celebrating their 30th anniversary of the designation and 15th for the formation of the Foundation. Originally started by the Western Association of Equipment Lessors (WAEL) in 1985, later joining support from the Eastern Association of Equipment Lessors and National Association of Equipment Leasing Brokers, this series salutes those who remain active.

John Torbenson, then Heritage Leasing, Bellevue, WA, still active in leasing at Odyssey Equipment Financing, Scottsdale, Arizona, was president of WAEL in 1985, who set up a committee under Executive Director Randy Bauler, composed of:

Chairman Ray Carob, BEHR Leasing, Los Angeles, CA.

Leon Frick Washington Leasing Corp., Seattle, WA.

Bill Stokcard, Financial Conveyance, Salt Lake City, Utah

Jim Swander, RS Leasing, Santa Clara, CA.

Bob Jacobson, TriContinental Leasing, Sunnyvale, CA.

(WAEL Newsline, February, 1985)

Two Exam dates were set up, one for August 12 in San Francisco, and

the Other for September 10 in Seattle. "Ten candidates have qualified to take the comprehensive test, covering most aspects of equipment leasing, including history of equipment leasing, , terminology, marketing, leasing law and documentations, rates and yields and several over category. The exams will be scored and results announced this fall...the first Certified Lease Professional (CLP) designations are scheduled for WAEL's 1986 Spring Conference in Las Vegas"

(WAEL: Newsline, August 1985)

Eight Pass the Exam

Raymond Carob

BEHR Leasing and Financial Corp

Los Angeles, CA

Peter Davis

Lease Management Services, Inc.

Menlo Park

Leon Frick

Trinity Financial Corp.

Lynnwood, WA

Hal Horowitz

BEHR Leasing and Financial Corp

Los Angeles, CA

Robert Jacobson III

Tri Continental Leasing Corp.

Sunnyvale, CA

Patrick O'Rourke

Commercial Finance Association

Capitola, CA

Russ Runnalls

Markey Lending Corp.

Thousand Oaks, CA

James Swander

RSN Equipment Leasing

Santa Clara, CA.

(WAEL Newsline, October, 1985)

1991

Receiving his Certified Leasing Professional Plaque from Certification Committee Chairman Russ Runnalls, CLP, Charter Equipment Leasing (left) is Charles Meaker, CLP, President, Lease Financing, Inc., Tucson, Arizona.

(WAEL Newsline, 1991)

TODAY

W. Russell (Russ) Runnalls, CLFP

Vice President Middle Market Financing

TEQlease Capital

www.linkedin.com/pub/w-russell-runnalls-clp/0/947/b48

Charlie Meaker

Independent Real Estate Professional

Tucson, AZ

www.linkedin.com/pub/charlie-meaker/2a/349/7a3

WHY I BECAME A CLP

Russ Runnalls

"In April 1978, I closed an engineering company that I owned with two other partners. My intention was to get my real estate broker’s license and open up a brokerage business. My good friend Bill Watkins questioned the wisdom of that decision and suggested that I go to work for him in the leasing business. So, with absolutely no idea what a lease was, in June of 1978 I went to work for Bill Watkins and Don Froomer in sales at Enterprise Leasing Corporation in Sherman Oaks, California.

"Leasing was not a concept that came quickly to me. However, with the patience I received from Bill, and the intense and lengthy tutoring that I got from Don, one day, about six month later, all the lights came on, I got it, and the career path for the rest of my life had been set. I stayed at Enterprise until 1982. During that time at Enterprise, I took over the sales department, eventually became EVP, met Tamara Quinn who eventually became my wife, and got quite involved in the Western Association of Equipment Lessors (WAEL).

"In January 1982, I left Enterprise and became a 40% partner in Markay Equipment Leasing, Inc. (later changed to Markay Financial Corporation when I owned 100%). My involvement in WAEL continued and intensified due to the desire of the association to establish a method of increasing and recognizing professionalism within the industry through training and testing. This was something I was very interested in and very much in favor. The Certified Lease Professional (CLP) program and designation was established in 1985. It was determined that the first testing for the first group of CLP’s would be late 1985. At that time, the only material available for preparing for the exam was experience and a leasing manual produced by Ted Parker. I had a copy and studied for the exam.

"Since that time, I still own Markay (run by my wife), and I have worked for or consulted for Charter Leasing, Capital Network and joined TEQlease Capital in 2008. I was a contributor to the original Certified Lease Professionals’ Handbook, and in 1991 I served as the Certification Committee Chairman. I am proud to have been involved in and part of the beginning of the CLP program. It has developed over the years into the great and valuable program that it is today. Its training programs have raised the sophistication and knowledge of all the players in our industry, and it has elevated the legitimacy of, and respect for our industry. I believe the CLP designation gave me a beneficial and invaluable recognition with my peers in the leasing industry, as I do now with other CLFP's."

[headlines]

--------------------------------------------------------------

Letters?---We get eMail!

(News and Reactions to News)

ELFA President and CEO William G. Sutton, CAE,

to Retire at End of 2015

Chief Operating Officer Ralph Petta to Succeed Sutton in 2016

http://www.leasingnews.org/Pages/sutton_retires2015.html

"Woody Sutton has done a fantastic job navigating the association through rough seas and Ralph Petta is the perfect choice to lead the ELFA into the future. Congratulations Ralph your new position has been well earned. I'm very happy for you! "

Edward Castagna

InPlace Auction

--

Former Marlin EVP & COO is Available

George D. Pelose

http://leasingnews.org/archives/Dec2014/12_31.htm#pelose

"I usually like the articles you post but was the one on George Pelose necessary? I realize that the information is public but I don't think you should have put it out front. Yes, he made a lot of money but he may not be looking for a lot now, yet that article will probably scare away potential employers.

"A little more finesse on your part in the future may help."

Chet het

(The story followed up on our policy of profit from Evergreen clauses.

http://leasingnews.org/archives/Jul2012/7_13.htm#response

http://www.leasingnews.org/archives/April%202007/04-27-07.htm#marlin

(There also is the issue of the officers receiving much more than the company made in profits, which could be seen by seeing what the other officers received, and has been written since 2006, all the net profit is from Evergreen Clauses, mostly copiers...

(I did take your letter to heart, and followed up with this one. Editor:)

What it May Take to Hire George D. Pelose

Former Marlin Business Services EVP & COO

http://leasingnews.org/archives/Jan2015/1_05.htm#peolose

----

"I’ve had a number of my Utah based banks that are funding lease transactions sign up for your newsletter, and they frequently comment on articles they’ve read. It is a great source to keep in the know. Thanks for your efforts, I know that takes a lot of your time.

"Again, thanks for your efforts to bring folks who reflect negatively on our industry out in the open."

Mark C. Loosli – ASA

President

Loosli Management, Inc.

Washington, Utah

"Anyway the new company I am working for is questioning when “Audit Phone Calls” should be done and what the actual benefit of doing them is. I tried to dig through your old articles and really could not find anything that addressed the issue."

Bruce L Braviroff

DANJON CAPITAL, Inc.

(Tom McCurnin has touched on this subject in recording the acceptance of equipment, but would be a good topic for Leasing 102, and looking for someone to take over this column on a more regular basis as Terry Winders, CLFP, did for many years. editor)

"Great Job, Kit !! Thanks for all you do for us."

Bob Migliori

Boca Leasing Center

Boca Raton, Florida

------------

"Please add me to your e-mail list for the Leasing News. I always read via LinkedIn but I tend to miss a few days here and there. I don’t know why I waited so long to get on the list. Thanks for your help and continue the good work! It’s a pleasure reading your material."

Thank You,

Christian Campbell

Priority Capital

Melrose, Massachusetts

|

[headlines]

--------------------------------------------------------------

Ninth Circuit Allows Bank to Freeze Chapter 7 Account

---But New York Court Sanctions Bank for Same Conduct

By Tom McCurnin

Leasing News Legal Editor

What Do Banks Do When Their Customer Files a Chapter 7 Bankruptcy Petition? Some Banks Freeze the Accounts. Ninth Circuit Holds That This Administrative Freeze Does Not Violate the Automatic Stay. But New York

Bankruptcy Court Holds That Bank May Not Freeze Account,

Even for a Day. What Should a Bank Do?

In re Mwangi, 2014 WL 4194057 (9th Cir. 2014).

In re Weidenbenner 2014 WL 7139994 (Bankr. S.D. NY 2014).

Today’s cases concern the right of a depository bank to freeze accounts of its customer, upon the filing of a Chapter 7 bankruptcy by the bank’s customer.

Today I offer two cases with similar facts in which the bankruptcy court issued two different opinions—in one instance, approving of the freeze, and in the other case, actually sanctioning the bank. It’s hard to reconcile these cases, but I’ll try at the end of this article to offer some common sense advice for bankers. The facts and holdings of the two cases follow.

In the Mwangi case, a bank held deposit accounts for its customer, Eric Mwangi. Mwangi filed a Chapter 7 Bankruptcy. The bank ran a daily computer run of its customers as against the previous day’s bankruptcy filings and discovered the bankruptcy of Mwangi. The bank placed “an administrative pledge” on the account, effectively freezing the account until instructions were received from the Chapter 7 Trustee. The Trustee apparently never took a position, so the funds remained frozen.

Mwangi objected, claiming that the proceeds of the account were wages and therefore were exempt. The Trustee again did not take a position. The bank continued to hold the customer’s funds.

Mwangi filed a motion for an order granting his exemption. The bank continued to hold Mwangi’s funds. The Bankruptcy Court granted the motion, but the bank continued to hold the Mwangi’s funds.

Mwangi filed a motion for sanctions. The Bankruptcy Court ruled that although the bank may have held onto the funds longer than it was entitled to, the debtor suffered no damages. Undeterred, Mwangi filed an adversary complaint for damages, and the Bankruptcy Court ruled that he had no right to possession of the funds, since it was property of the estate, and the right to the funds vested with the Trustee, not Mwangi. Mwangi appealed to the District Court.

On appeal, the District Court had a two-pronged argument which doomed the customer’s position. First, the District Court held that since prior to a hearing on the customer’s possible exemption to funds, the funds belonged to the Trustee, the bank could not violate the automatic stay, because the money belong to the Trustee. After the exemption, the monies were not part of the estate, and therefore, there was no remedy for violating the automatic stay.

On appeal to the Ninth Circuit, the Ninth Circuit affirmed for the identical reasons.

In the Weidenbenner case, the bank customer also filed a Chapter 7 bankruptcy and also claimed an exemption to the funds, and the bank also froze the account. The bank’s customer, objected and like Mwangi, claimed the funds were exempt. The bank contacted the trustee, he declined to assert and interest in the funds, and the bank released the freeze the next day.

The Bankruptcy Court held that the bank’s administrative freeze violated the automatic stay, and the bank’s claim that it was routine, was not borne out by the facts, since apparently the bank only freezes accounts subject to a bankruptcy if the amount in the account exceeds $5,000. The bank was sanctioned $25 plus attorney fees and costs.

How does one reconcile these two cases with almost identical facts and different holdings? The short answer is that one cannot reconcile the two decisions.

What should be the advice of financial institution lawyers to depository institutions when faced with a Chapter 7 bankruptcy? The answer here is probably take the road of least risk, which would not involve freezing the customer’s accounts. There is certainly no statute which requires a depository bank to freeze the account, in absence of a direction by a Chapter 7 trustee. If there is no requirement to freeze account, why do it?

So what are the lessons here?

First, the issue of whether or not a depository institution should freeze depository accounts subject to a Chapter 7 bankruptcy is a high level policy decision which needs to be made by the bank’s legal department at the highest level. While it is possible that trustee’s might assert claims to the proceeds of the account, without empirical data and case law, that fear may, or may not, be well-founded. I don’t have the data to make recommendations to banks on this issue in general.

Second, assuming the bank wants an opinion in a vacuum, I think my thought is that a financial institution should not automatically freeze bank accounts unless the circumstances warrant that extreme action. While a $25 sanction is certainly not much of deterrent in this case, the financial institution may be responsible for the customer’s attorney fees and damages, which could be more, if the facts were different. If the amount in the deposit account is significant, and there are multiple parties demanding the money (judgment creditor, trustee, or customer), then depositing the money with the court might be a viable option, but only in extreme circumstances.

The bottom line is that administrative freezes of bank accounts subject to a bankruptcy should be carefully considered in light of these two conflicting decisions.

Mwangi Case

http://www.leasingnews.org/PDF/MwangiCase2015.pdf

MwangWeidenbenner Case

http://www.leasingnews.org/PDF/MwangiWeidenbennerCase2015.pdf

Tom McCurnin is a partner at Barton, Klugman & Oetting

in Los Angeles, California.

Tom McCurnin

Barton, Klugman & Oetting

350 South Grand Ave.

Suite 2200

Los Angeles, CA 90071

Direct Phone: (213) 617-6129

Cell (213) 268-8291

Email: tmccurnin@bkolaw.com

Visit our web site at www.bkolaw.com

Previous Tom McCurnin Articles:

http://www.leasingnews.org/Conscious-Top%20Stories/leasing_cases.html

|

[headlines]

--------------------------------------------------------------

Tick of the Clock Grows Louder for

Small Business Lending Fund Repayments

Approximately 3.5 years since the Treasury's Small Business Lending Fund issued its first loans to banks and community development loan funds, growth in small-business lending at participating institutions has remained strong. But just one more year remains until many of the participating banks must either repay the loans or face higher dividends.

SBLF was enacted as part of the Small Business Jobs Act of 2010, which defined small-business loans as loans of up to $10 million to businesses with less than $50 million in annual revenue. The loans include commercial and industrial loans; loans secured by owner-occupied nonfarm, nonresidential real estate; agricultural production loans; and loans secured by farmland. Banks and thrifts with less than $10 billion in assets could receive investments from the Treasury in the form of preferred stock, debt or equity equivalents. Banks that received the funding then had to grow their small-business loan portfolios at a certain rate above a baseline number, or face higher dividend payments on the Treasury's investment. SBLF participants filed a supplemental report to the quarterly call report identifying the loans that qualify as small-business lending under the rules of the program.

The most recent Treasury report from Jan. 7, which contains loan growth data through Sept. 30, 2014, shows that the 229 banks remaining in the program as of Dec. 31, 2014, have grown small-business lending by $13.80 billion over the baseline. This is up from $13.19 billion as of June 30, 2014, for the 234 banks remaining as of Sept. 30, 2014. Total small-business lending at the 229 banks remaining in the program reached $44.54 billion at Sept. 30, 2014.

Median loan growth at remaining banks was 49.96% as of Sept. 30, up from 46.33% the period prior for the banks in the program at the time.

Full Report:

https://www.snl.com/InteractiveX/Article.aspx?cdid=A-30905874-10036

[Note: The 2015-16 budget submitted by President Obama calls for a significant reduction in SBA funding, on the order of 25%. As this segment is a sweet spot for EFL, and although the SBA loan amounts tend toward 7 and 8 figures, if this budget proposal passes, there could be opportunity for the EFL industry to pick up the slack. A UCC search filtering the SBA may be a good place to start. Assoc. Editor Ralph Mango]

[headlines]

--------------------------------------------------------------

Niche PR Firm Launches New Marketing Campaign Platform

Susan Carol Associations

Fredericksburg, VA. -- Susan Carol Associates Public Relations announced this week that it has unveiled a new online marketing platform that integrates all facets of communication—from publicity and digital marketing to social media—to increase the effectiveness of marketing campaigns in generating specific business leads for clients.

Susan Carol, APR, the agency’s owner and CEO, explained, “We want to help our clients develop and nurture business leads based on multifaceted campaigns and provide them with robust reporting.”

“Our streamlined process delivers reports and analytics that business and healthcare executives will love. It goes beyond measuring clicks and impressions to generate actionable sales data through the use of compelling content, campaign Web landing pages and an integrated process.”

With a myriad of new media channels and the changing landscape of media and marketing providers to consider, many clients are overwhelmed with choices and are unsure what strategies work best for them, Carol noted. Her agency’s blog, PR Buzz, covers this subject and as well as journalist interviews, editorial advice and social media tips.

The agency is offering complimentary consultations during February to introduce its expanded capabilities. Susan Carol Associates, composed of a variety of writers, media specialists, web developers, designers and marketing professionals, has more than 25 years of experience serving local and national clients.

Their clients have included equipment leasing and finance companies, consultancies, information technology providers, trade groups and healthcare providers. The firm also has worked with multinational companies and has deep experience in healthcare, technology and commercial finance. The agency also has a website, Healthindustrywriters.com, to introduce its healthcare team and the team’s portfolio of work.

Susan Carol, APR, is an accredited member of the Public Relations Society of America and the agency is a long-standing member of the Equipment Leasing and Finance Association, and recent past board director. Her firm is active in the Fredericksburg Regional Chamber of Commerce and Carol is also on the board of the Women and Girls Fund of the Community Foundation based in Fredericksburg, Va.

Susan Carol can be reached via sca@scapr.com

or @scapr on Twitter.

[headlines]

--------------------------------------------------------------

St. Bernard (Mix)

Columbus, Ohio Adopt-a-Dog

Thor

Kennel: A20

ID: 72466

Location: WARD A (ADOPTION)

Age: 1.1 Year

Breed: Saint Bernard (Mix)

Adult Size: Extra Large

Weight: 101 lbs.

Sex: Male (Neutered)

Cost: $123

"Thor is a very outgoing boy! He loves attention from people and his tail is always wagging. Thor has a goofy personality and could benefit from basic obedience training. We recommend him for an owner with large dog experience. Thor is looking for a home where he would be the only dog.

"Busy Bee

I'm a naturally playful, curious, and trusting canine. Take me for a big walk every day; give me something to do. After my job's done, I'll curl up in front of the fire with you in the evenings. I'm a dog on a mission to please you and myself.

“ - Thor is a very outgoing boy! He loves attention from people and his tail is always wagging. Thor has a goofy personality and could benefit from basic obedience training. We recommend him for an owner with large dog experience. Thor is looking for a home where he would be the only dog.”

Franklin County Dog Shelter & Adoption Center

4340 Tamarack Blvd

Columbus, OH 43229

(614) 525-DOGS (3647)

Email: adoptions@FranklinCountyOhio.gov

Mon-Fri 11 a.m. - 7 p.m.

Sat & Sun 9 a.m. - 5 p.m.

Adopt a Pet

http://www.adoptapet.com/

[headlines]

--------------------------------------------------------------

Attorneys Who Specialize in

Banking, Finance, and Leasing

| Birmingham, Alabama The lawyers of Marks & Associates, P.C. have over 30 years experience in dealing with virtually every type of equipment financing and are recognized throughout the industry for prompt, practical solutions and exemplary service. They offer cost-conscious, effective lease enforcement and good counsel. Email: Barry@leaselawyer.com Website: www.leaselawyers.com |

California, National: city: Riverside Ellen Stern - get results, reasonable pricing; numerous industry contacts, nearly 30 yrs exp.in SoCal, 20 yrs equip.: CFL license specialist, documentation, work-outs, litigated collections, recoveries; deal-maker. Email: leaselaw@msn.com |

||

|

Connecticut, Southern New England: EVANS, FELDMAN & BOYER, LLC Collections, litigation, documentation, portfolio sales and financing, bankruptcy. We represent many of the national and local leasing companies doing business in this state. Past chairman EAEL legal committee. Competitive rates. email: rcfeldman@snet.net |

||

| Los Angeles/Santa Monica Hemar & Associates, Attorneys at Law Specialists in legal assistance, including debt collection, equipment recovery, litigation for 35 years. Fluent in Spanish. Tel: 310-829-1948 email: phemar@hemar.com |

|||

| Los Angeles, Southern CA Seasoned attorney representing secured creditors in auto finance and truck/equipment lease industry. Bankruptcy and State Court litigation. Vincent V. Frounjian (818) 990-0605or email: vvf@pacbell.net. |

Encino, California: Statewide “ELFA” |

||

Los Angeles, Statewide: CA. "ELFA" Aggressive creditors rights law firm specializing in equipment leasing handling collection matters on a contingency, fixed fee or hourly cbasis. email:RGarwacki@prodigy.net |

Los Angeles, Statewide: CA "ELFA" |

||

Los Angeles- Statewide, CA Lawyer specializing in banking and leasing issues statewide. Documents and litigation. Tom McCurnin, Barton, Klugman & Oetting. Voice: (213) 617-6129 Cell:(213) 268-8291 Email: tmccurnin@bkolaw.com |

California & National Paul Bent – More than 35 years experience in all forms of equipment leasing, secured lending, and asset based transactions. Financial analysis, deal structuring, contract negotiations, documentation, private dispute resolution, expert witness services. (562) 426-1000 www.paulbentlaw.com pbent@paulbentlaw.com |

||

Illinois |

Law Firm - Service, Dallas, TX. "ELFA" Mayer regularly practices in leasing, secured financing, project development and finance and corporate finance. email: dmayer@pattonboggs.com Website: www.pattonboggs.com |

||

| Massachusetts (collection/litigation coast to coast) Modern Law Group focuses its practice on collections, lease enforcement and asset recovery. For the past five years, our attorneys have helped clients recover millions of dollars. We are able to cover your needs coast to coast. Email phone 617-855-9085www.modernlawgroup.com |

Michael J. Witt, experienced bank, finance, and leasing attorney, also conducts Portfolio Audits. Previously he was Managing Counsel, Wells Fargo & Co. (May, 2003 – September, 2008); Senior Vice President & General Counsel, Advanta Business Services (May, 1988 – June, 1997) Tel: (515) 223-2352 Cell: (515) 868-1067 |

||

| National: The OMEGA Network Group-nationwide legal representation of small and mid ticket equipment lessors-flat fee bankruptcy & replevin, contingent collection, billable litigation (704-969-3280) tong_92@yahoo.com |

National: Coston & Rademacher: Business attorneys serving the lease-finance industry since 1980. Transactional, documentation, corporate/finance, workouts, litigation, bankruptcy, portfolio management. Chicago-based national practice. Jim Coston, CLP (Members: ELFA, NEFA). |

||

| St. Louis County , MO. - statewide: Schultz & Associates LLP., collections, negotiation, and litigation. Also register and pursue recovery on foreign judgments. Contingency and reasonable hourly rates. Ronald J. Eisenberg, Esq. (636) 537-4645 x108 reisenberg@sl-lawyers.com www.sl-lawyers.com |

NJ,De,Pa: Specializing in leased equipment/secured transactions. Collections, replevins/workouts reasonable rates. Sergio Scuteri/Capehart & Scratchard, PAsscuteri@capehart.com / www.capehart.com | ||

| New York and New Jersey Peretore & Peretore, P.C. documentation, portfolio purchase & sale, replevin, workouts, litigation, collection, bankruptcy. Aggressive. Over 25 years experience.www.peretore.com |

Thousand Oaks, California: |

|

[headlines]

--------------------------------------------------------------

![]()

News Briefs----

$1.4 Billion Recovered as Result of Sigtarp Investigations

http://www.sigtarp.gov/Press%20Releases/

SIGTARP_Recoveries_Press_Release.pdf

Central Banks in India and Australia Take Steps to Lift Growth

http://www.nytimes.com/2015/02/04/business/international/india-central-bank-stimulates-lending.html?_r=0

King of ‘Hamptons Versailles’ in court over $250M palace

http://nypost.com/2015/02/02/billionaire-rennert-bilked-firm-to-build-250m-mansion-trustee/

10 years later, Amazon celebrates Prime’s growth

http://seattletimes.com/html/businesstechnology/2025608095_amazonprimexml.html

(Leasing News provides this ad “gratis” as a means

to help support the growth of Lease Police)

[headlines]

--------------------------------------------------------------

--You May Have Missed It

More than 50,000 undocumented California immigrants get driver’s licenses

http://www.sacbee.com/news/politics-government/capitol-alert/article9137156.html

[headlines]

--------------------------------------------------------------

SparkPeople--Live Healthier and Longer

![]()

When to Call a Doctor for the Flu

How the Flu Can be Downright Dangerous

http://www.sparkpeople.com/resource/wellness_articles.asp?id=1931

[headlines]

--------------------------------------------------------------

Winter’s Embrace

By Joanna Fuchs

When winter blows its cold breath everywhere,

And throws a chill white blanket on the ground,

The sun makes sparkling diamonds on the snow,

And trees with icy diadems are crowned.

It’s time to snuggle in for winter fun

In cozy places, maybe by a fire.

A good book and some cocoa feel just right

In flannels, sweaters, winter’s warm attire.

Winter’s gloom is comforting somehow,

As life retreats from its rushed and frantic pace.

We’re ready now to stay indoors awhile,

As we settle into winter’s calm embrace.

[headlines]

--------------------------------------------------------------

Sports Briefs----

Days later, fans struggle with Seahawks' Super Bowl loss

http://sports.yahoo.com/news/days-later-fans-struggle-seahawks-super-bowl-loss-232039416--nfl.html

NFL suspends Browns WR Josh Gordon for year

http://sports.yahoo.com/news/nfl-suspends-browns-wr-josh-gordon-233831539--nfl.html

New Falcons coach Dan Quinn: I’m so fired up to be here

http://profootballtalk.nbcsports.com/2015/02/03/new-falcons-coach-dan-quinn-im-so-fired-up-to-be-here/

[headlines]

--------------------------------------------------------------

California Nuts Briefs---

California met 20% water conservation goal in December

http://www.sacbee.com/news/local/environment/article9118931.html

Silicon Valley powers to record job boom, but surge produces income gap

http://www.mercurynews.com/business/ci_27449198/report-record-job-boom-silicon-valley-but-surge

Costs in once ‘affordable’ neighborhoods show marked shift in city’s rental market

http://blog.sfgate.com/ontheblock/2015/02/03/costs-in-once-affordable-neighborhoods-show-marked-shift-in-citys-rental-market/

Marin Civic Center nominated as World Heritage site

http://www.marinij.com/marinnews/ci_27428589/marin-civic-center-nominated-world-heritage-site

Bay Area traffic woes may be gruesome, but they're the most predictable in the country

http://www.mercurynews.com/bay-area-news/ci_27446009/bay-area-traffic-woes-may-be-gruesome-but

[headlines]

--------------------------------------------------------------

![]()

“Gimme that Wine”

http://www.youtube.com/watch?v=EJnQoi8DSE8

California Vineyards Report Early Bud Break

Strange winter brings 'premature' bud break in late January

http://www.winesandvines.com/template.cfm?section=news

&content=145614

Vintner unveils plan for large winery outside Santa Rosa

http://www.pressdemocrat.com/news/3472664-181/vintner-unveils-plan-for-large

Oregon Wines, Part 2: Strong Growth Lures New Investment

From U.S. And Global Players

http://www.shankennewsdaily.com/index.php/2015/02/03/11656/oregon-wines-part-2-strong-growth-lures-new-investment-from-u-s-and-global-players/

Chinese now own 100 Bordeaux chateaux, as wine mania grows

http://www.telegraph.co.uk/news/worldnews/europe/france/11380807/

Chinese-now-own-100-Bordeaux-chateaux-as-wine-mania-grows.html

Washington Merlot a love affair

http://www.greatnorthwestwine.com/2015/02/01/washington-merlot-love-affair/

Auction Napa Valley 2015 Tickets Now On Sale

http://napavintners.com/press/press_release_detail.asp?ID_News=800049

Basketball's Tim Duncan Suing Terroir Founder Charles Banks

http://www.winespectator.com/webfeature/show/id/51179Free Mobile Wine Program

http://leasingnews.org/archives/Feb2010/2_26.htm#mobile

Wine Prices by vintage

http://www.winezap.com

http://www.wine-searcher.com/

US/International Wine Events

http://www.localwineevents.com/

Leasing News Wine & Spirits Page

http://two.leasingnews.org/Recommendations/wnensprts.htm

[headlines]

----------------------------------------------------------------

![]()

This Day in American History

1746 - Birthday of Thaddeus Kosciusko in the Polish–Lithuanian Commonwealth, in a village that is now in Belarus. In 1776, Kościuszko moved to North America, where he became a colonel in the Continental Army. An accomplished military architect, he designed and oversaw the construction of state-of-the-art fortifications, including those at West Point. In 1783, in recognition of his services, the Continental Congress promoted him to brigadier general. He died at Solothurn, Switzerland on Oct 15, 1817.

http://www.polskiinternet.com/english/info/thadeuskosciuszko.html

1779 - John Paul Jones takes command of Bonhomme Richard.

1783 - Britain declared a formal cessation of hostilities with its former colonies, the United States of America.

1787 - In an attack on Shays’ insurgents at Petersham, Massachusetts, General Benjamin Lincoln captures 150 rebels and forces Shays to flee for Vermont. By the end of the month, the uprising has been completely suppressed. In March, the Massachusetts legislature offers a pardon to all except Shays, Luke Day and two other leaders. Shays will be pardoned on 13 June, 1788. This rebellion has the effect of causing the state legislature to avoid direct taxation, to lower court costs, and to exempt household necessities and workmen’s tools from the debt process. Shays’ Rebellion is also an important factor in influencing the creation of a new federal constitution, since the states have seen how essentially powerless they are to prevent such incidents of violence.

1787 - The first Anglican bishops of New York and Pennsylvania were consecrated in London.

1789 - The only president to receive the unanimous vote of the presidential electors was George Washington who received all of the 69 votes cast by the election from the 10 states that voted this day. This was the first meeting of the Electoral College. Presidential electors met and chose George Washington as America’s first President. The Federalist Party was formed by those who had supported ratification of the Constitution. Its first candidate was Washington. As President, Washington guided the new government as it moved from the concepts expressed in the Constitution into a functioning federal republic, and he firmly established many traditions and precedents which still guide how we as a nation view the presidency. After serving two terms in office, he refused to seek a third one, believing that two terms were the most that any President should serve. The Federalist, considered pro-English, enjoyed considerable success until 1800, when Thomas Jefferson, a Democratic-Republican, defeated John Adams for the presidency. Eventually the party lost its supporters and ceased to exist about 1820. Alexander Hamilton was one of the party's founders and foremost leaders. As a point of history, by April 6, the first Congress was formally organized. By its end in 1791 the first Congress consisted of 26 senators of whom 17 supported the Washington administration and 9 were generally in opposition. In the House, the division was 38 and 26. Senators were chosen by each of the state's legislators until the 20th century when the 17th amendment called for the direct election of Senators. A nearly unanimous vote took place in November, 1816, when James Monroe of Virginia received 231 of the 232 votes casts by the electors from 24 states. The dissenting vote was cast by William Plumer of New Hampshire.

http://www.senate.gov/artandhistory/history/common/briefing/

Direct_Election_Senators.htm

1801 - John Marshall was sworn in as the fourth Chief Justice of the Supreme Court. He is the longest-serving Chief Justice in US history.

1810 - The Cumberland Presbyterian Church was organized in Tennessee as an outgrowth of the Great Revival of 1800. Standing between Calvinism and Arminianism, the denomination holds a "medium theology" which affirms unlimited atonement, universal grace, conditional election, eternal security of the believer and salvation of all children dying in infancy.

1822 - Free American Blacks settled Liberia, West Africa. The first group of colonists landed in Liberia and founded Monrovia, the colony's capital city, named in honor of President James Monroe.

1824 – J.W. Goodrich introduced rubber galoshes to public.

1825 – Ohio legislature authorized the construction of the Ohio and Erie Canal and the Miami and Erie Canal.

1826 - “The Last of the Mohicans” by James Fennimore Cooper is published. One of the earliest distinctive American novels, the book is the second of the five-novel series called the “Leather-stocking Tales.” He continued to write about the American frontier in his third book, The Pioneer, which featured backcountry scout Natty Bumppo, known in this book as “Leather-stocking.” The character, representing goodness, purity, and simplicity, became tremendously popular, and reappeared, by popular demand, in five more novels, known collectively as the “Leather-stocking Tales.” The second book in the series, “The Last of the Mohicans”, is still widely read today. The five books span Bumppo’s life, from coming of age through approaching death.

1841 - Plagued by poor investment decisions and an uncertain economic climate, the Bank of the United States was forced to call it quits on February 4, 1841. It was a painful end for an institution that had suffered through one of the more contentious episodes in the nation’s early financial history. Indeed, the Bank was the direct product of President Alexander Hamilton’s controversial push for a national banking system. Despite the staunch objections of Thomas Jefferson, the federal government chartered the first Bank of the United States in 1791. However, Jefferson kept up his attack, and in 1811, led his supporters in Congress in a successful attempt to block the renewal of the bank’s charter. Buoyed by a confluence of conditions, including state banks’ recent run of woes and political shifts in the House, pro-bank forces forged a new charter in 1816. Under the charge of Nicholas Biddle, the revived Bank of the U.S. enjoyed some healthy years. However, before long, the Bank faced another round of opposition, this time led by President Andrew Jackson, who fiercely opposed the notion of a central bank system. A nasty and protracted political battle ensued, as the President attempted to use his executive power to do away with the bank. Jackson eventually won out, and when the bank’s charter expired in 1836, Biddle shifted course and reestablished the Bank of the United States as a state institution based in Pennsylvania. Biddle’s bank limped on for a few more years before being finally shut down on February 4, 1841.

1846 - The ship “Brooklyn” left New York bound for San Francisco with members of the Church of Latter-Day Saints aboard. They had been instructed to “flee Babylon.” They departed for California the same day other Saints left Nauvoo, Illinois, following clashes with settlers over polygamy. The party from Nauvoo was to meet Brannan’s group at Yerba Buena.

1847 - Magnetic Telegraph of Maryland opened four offices in New York City for $250 a year, Philadelphia for $150, in Baltimore for $150, and Washington, DC for $50 a year to become the first Telegraph Company. At first, messages were sent by pigeons across the Hudson River from Jersey City, NJ to New York City. Later, a lead pipe enclosing a covered wire saturated with pitch was laid under the river. The rates from Baltimore to Washington were 10?? cents for the first 10 words and 1 cent for each additional minute. The rates from New York to Washington were 50 cents for the first 10 words and 5 cents for each additional word.

1849 - The University of Wisconsin began in one room with 20 students.

1854 - Alvin Bovay proposed the name “Republican Party,” in Ripon, WI.

1861 - The Apache Wars began at Apache Pass, AZ when Army Lieutenant George Bascom arrested Apache Chief Cochise for raiding a ranch. Cochise escaped and declared war. The wars lasted 25 years under the leadership of Cochise and, later, Geronimo.

1861 - The first Confederate congressional session took place, lasting until March 16. Its official title was Congress of the Confederate States. The president of the Senate was Alexander Hamilton Stephens of Georgia, the president pro tempore was Robert Mercer Taliaferro Hunter of Virginia, and the secretary of the Senate was James H. Nash of South Carolina. The House of Representatives under the permanent constitution met in Richmond, VA, on February 18, 1861. Emmet Dixon of Georgia was elected clerk and Thomas Salem Bocock of Virginia was elected speaker. The session adjourned on April 21, 1862. The first order of business was drafting a constitution. They used the U.S. Constitution as a model, and most of it was taken verbatim. It took just four days to hammer out a tentative document to govern the new nation. The president was limited to one six-year term. Unlike the U.S. Constitution, the word “slave” was used and the institution protected in all states and any territories to be added later. Importation of slaves was prohibited, as this would alienate European nations and would detract from the profitable “internal slave trade" in the South. Other components of the constitution were designed to enhance the power of the states: governmental money for internal improvements was banned and the president was given a line-item veto on appropriations bills. The Congress then turned its attention to selecting a president. The delegates settled on Jefferson Davis, a West Point graduate who was the U.S. Secretary of War in the 1850s and a senator from Mississippi. It was emphatic that the purpose of the confederacy was to preserve slavery. There were many rich slave owners in the south and the loss of their property would mean not only substantial loss of their assets, but future income as they would have to pay for work on their farms and other businesses. (an irony of the times, there were Negroes who were also “slave owners”. At the turn of the century, there were slaves also owned in the North.)

Here is one county, Lowndes District in the County of Lowndes, State of Alabama, that illustrates an idea of the division of “property.”

http://www.ccharity.com/census/1850lowndes.htm

This will substantiate that there were “free Blacks” who also owned “Black slaves.”

http://americancivilwar.com/authors/black_slaveowners.htm

Slave Census of Connecticut and Washington, 1790. It is also correct many of the Northern states began to outlaw slavery in their state after the ratification of the Constitution.

http://www.ctnow.com/extras/html/slaveowners.htm

But make it clear, the purpose of the Confederate States of America was to preserve slavery and was so stated in their constitution.

1865 - Hawaii Territory established its first Board of Education.

1865 - Robert E. Lee was named general-in-chief of Confederate forces

1873 - Birth of George Bennard in Youngstown, OH. A Methodist evangelist, he penned over 300 Gospel songs during his lifetime, but is primarily remembered today for one: "The Old Rugged Cross."

1887 - Interstate Commerce Act authorized federal regulation of railroads and created the Interstate Commerce Commission.

1895 - In Chicago, Illinois, the Van Buren Street Bridge opened. It was the first rolling lift bridge. It consisted of two arms meeting at the center of the river. The bridge was operated by two 50 horsepower electric motors on each side of the bridge.

http://www.chicagohs.org/fire/ruin/pic0093.html

http://www.deldot.net/static/projects/archaeology/

historic_pres/delaware_bridge_book/PAGE_162.PDF

http://tigger.cc.uic.edu/depts/ahaa/imagebase/

intranet/chiviews/page177.html

1899 - The Philippine-American War began with fighting between American and Philippine revolutionary forces

1902 - Birthday of Charles Augustus Lindbergh in Detroit. American aviator, nicknamed “Lucky Lindy,” and “The Lone Eagle”, he was the first to fly solo and nonstop over the Atlantic Ocean, New York to Paris, May 20-21, 1927. In a decade that gave us the invention of television, talking pictures, and Babe Ruth, there was no one more admired, feted, fawned over than Lindbergh. Later, in 1932, his son was kidnapped and later found murdered in a saga that captured America. The trial of Bruno Richard Hauptman, the alleged murderer, was called the ‘Trial of the Century.’ As the 1930s came closer to war, he became a Nazi sympathizer, accepting awards from Adolph Hitler and after the war, efforts were made to downplay his lobbying for the Nazi regime. He became a recluse and moved to Hawaii where died at Kipahulu, Maui on Aug 27, 1974.

1904 – Birthday of writer MacKinlay Kantor in Webster City, Iowa. His best seller, “Andersonville” was a story about the infamous Andersonville prison of the Civil War, into which tens of thousands of Northerners were inhumanely confined under obscene conditions. Died on October 11, 1977.

http://www.lib.uiowa.edu/spec-coll/MSC/IaAuthor/Kantor/kantor.html

http://www.amazon.com/exec/obidos/ASIN/0452269563/inktomi-bkasin-20/

002-1958450-0644835/

1906 – Clyde Tombaugh, American astronomer, discovered the former planet Pluto, was born in Streator, IL. He died in 1997.

1908 - Birthday of trumpet player Mannie Klein, New York City

http://www.trumpetjazz.com/artists.cgi?name=Manny+Klein&x=5&y=9

http://www.jazzoracle.com/reviews/

http://ms.cc.sunysb.edu/~alhaim/recordingsanalysis.htm

http://user.tninet.se/~npt755v/bosw2.htm