Connect with Leasing News ![]()

![]()

![]()

![]()

![]() Add me to mailing list |

Add me to mailing list | ![]() |

| ![]() Search |

Search | ![]() Stress Release

Stress Release

Advertising | All Lists | Archives | Classified Ads | This Day In American History

Leasing News is a web site that posts information, news, and

entertainment for the commercial bank, finance and leasing industry

kitmenkin@leasingnews.org

![]()

Friday, January 4, 2013

Today's Equipment Leasing Headlines

Archives: January 4, 2001

The List is Up-Dated

Classified Ads---Sales

Leasing Benefits from Business Tax Extenders

by Terry Winders, CLP

(Copy of 2013 Tax Law included)

New Year---New Career?

Career Crossroad---By Emily Fitzpatrick/RII

Classified Ads---Help Wanted

Bob Teichman named CLP Chairman of the Board

California Regulators Going After Debt Collectors

for Perceived Collection Abuses

By Tom McCurnin

Leasing 102 by Mr. Terry Winders, CLP

Typical Certificate of Insurance

Credit card loans at US Commercial Banks Down

Rate Tracker: Mortgage rate champions

By Harish Mali and David Hayes, SNL Financial

Ways to Find Money to Offset Social Security Tax Hike

German Shepherd/Black and Tan Coonhound Mix

Louisville, Kentucky Adopt-a-Dog

Fernando Movie Reviews

News Briefs---

Bank of Ann Arbor acquires locally-based Ervin Leasing

MB Financial Bank, N.A. Acquires Celtic Leasing Corp.

Landstar/OOIDA Settle "Truth in Leasing" Litigation

World's 100 richest gained $241B last year

Swiss Bank Pleads Guilty to Tax Law Violations

----to pay $57.8M in U.S. tax evasion plea

New Partnership Between the NFL & International Franchise Assoc.

Boeing 737 Max Orders Top 1,000 on $6 Billion Lessor Deal

Boeing poised to regain title of world's largest planemaker

Some Pork Got Through Fiscal Cliff Bill

Ag Retailers Watching Farm Bill, water quality and taxes

Chrysler shines, GM, Ford follow in 2012 sales gains

Tory Burch hits jackpot

Broker/Funder/Industry Lists |

Features (collection)

Top Ten Stories Chosen by Readers |

Top Stories last six months

You May have Missed---

SparkPeople--Live Healthier and Longer

Sports Briefs---

Football Poem

California Nuts Brief---

"Gimme that Wine"

This Day in American History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

Leasing News Person of the Year 2012

in Monday’s Edition

######## surrounding the article denotes it is a “press release”

and was not written by Leasing News nor information verified, but from the source noted. When an article is signed by the writer, it is considered a “by line.” It reflects the opinion and research of the writer.

Please send Leasing News to a colleague and ask them to subscribe.

We are free!

[headlines]

--------------------------------------------------------------

Archives: January 4, 2001

The List is Up-Dated

Exclusive Interview: Mark Seif/Preferred Capital

Preferred Capital is for sale, according to their general counsel Mark Seif. Last November, 1999, they did $17 million in capital equipment cost. That was their best month. They had been doing anywhere from $14 to $15 million each month, according to informed sources. Not anymore.

Preferred Capital was very heavy in the mail marketing and telephone solicitation with the "Pre-approved" approach, selling mini-paper to GE/Colonial Pacific, Advanta, Manifest, Commerce Security, among others. With the changes of policy at their funders, placing business started to decline and warehouse lines could not find take-outs, resulting in serious cash flow problems, especially in October and November of last year, it was reported.

"Yes, we have not been sold," Seif said in an exclusive interview. They have had many offers, but the two original principals could not agree on the selling price, and from a high of 270 employees, closed their branches, and are now down to one-quarter their original size with their main facility in Tahoe City, according to Seif.

"We have 42 sales reps now," he says. "The commissions are now based on rewards. We have cut the boats, cars, and all the frills...We are aggressive, but not what we used to be. Right now, we are actively talking to investors, strategic partners."

He blames credit tightening, more competition, more sources for the dramatic change in the small ticket market.

He and Louis Schneider are basically managing the company. David Murray left on November 7, 2000.

"Basically David didn't like laying off his friends, facing the financial difficulties of a downsized company, closing offices, and didn't want to remain in the leasing business anymore," Seif explains. "It wasn't fun... And yes, the small ticket market is no longer what it used to be."

For more about this company, please go our original story:

http://www.leasingnews.org/archives/December/12-20-00.htm

Old Kent Financial Sale

Fifth Third Bank (Cincinnati, Ohio) on announced on Nov. 20th that they were going to acquire Old Kent Financial (Grand Rapids, Michigan) including Old Kent Leasing Services Corp. (Lombard, Illinois). Closing expected in the second quarter, perhaps by April.

The acquisition of Old Kent appears on the Fifth Third stock announcement board (FITB). The purchase amount was $4.9 Billion on 11/20/00 and should be completed in April, 2001 according to the press release.

It will be interesting to see how this acquisition impacts Old Kent Financial Services (which has been small ticket oriented, both direct and indirect) when they become part of Fifth Third whose leasing activities have principally been middle market and large ticket leases to excellent credits. (In 1997 Gateway Leasing to Fifth Third, Bruce Kropschot was involved, and in 1999 they decided to exit the small ticket leasing business by selling Gateway to Sierra Cities.)

Unicapital--No response form Steve Dallas about taking on new business, as suggested would happen this year. The companies dealing with them say, "no change."

"No checks. No docs. No return calls. I did send Steve an e-mail to which he responded about a week ago. He basically lamented the treatment by Lehman and said he was doing all he can. I empathize. It has been a problem for us, though."

Name With held

BSB Leasing is BACK!!!!!

Don Myerson bought back the company and they are back in business at 303-329-09227. Official announcement to be made soon. They are notifying brokers to start sending them business again.

61 Leasing Companies Major Changes

( For specific stories, use search on our site, or go to archives: http://www.leasingnews.org/archives.htm)

Advanta Leasing (9/2000 for sale, former prez now at eOriginals, others let go like Kaye Lee.)

Affinity Leasing, Washington ( 12/2000 to close and concentrate on Financial Pacific biz )

American Business Leasing ( gone )

Balboa Capital ( 9/2000 Founder Pat Byrne "...office available any time he wants to use it" ).

Banc One Leasing ( 12/2000 Lays Off 60, Closes 5 offices )

The Bancorp Group, Inc. (Southfield, MI) (Not accepting news business. The BOD of the parent bank is assessing what to do with the leasing subsidiary.....currently servicing portfolio but not originating. no longer in business )

Bankvest (bankrupt)

Bayview Capital ( 12/2000 announces $17 million loss/later does not issue dividend )

Bombadier ( 12/2000 reported having leasing problems, not confirmed, company strong in other divisions, but appears backing out of leasing division)

BSB Leasing ( 1/2001 Don Myerson bought back the company and they are back in business at 303-329-09227. Official announcement to be made soon. They are notifying brokers to start sending them business again. 12/2000 Don Myerson says to be "re-born"11/2000 closed to accepting new business.)

Charter Financial ( purchased by Wells Fargo 9/5/2000 )

Colonial Pacific (11/98) purchased by GE Capital 5/2000 no more re-brokered applications, except from one or two sources, such as Steve Dunham's Leasing Associates )

Commerce Security ( 9/99 closed to leasing broker program )(11/99 last fundings)

Comstock Leasing ( 3/2000 Unicapital then Linc and discontinued operation this date )

Conseco Finance Vendor Service ( 12/2000 purchased by Wells Fargo Leasing. Copelco ( 4/2000 sold to Citibank/10/2000 stock down rated/10/2000 ceases broker business, many complaints in manner turning off faucet )

Dana ( 7/2000 sold off portfolio, active as captive lessor )

DVI Capital (12/2000 out of broker )

El Camino Leasing, Woodland Hills, California (10/2000 No longer taking broker business 11/2000 struggling to stay in leasing business, according to insider reports )

eLease ( June/July/2000 senior management changes )

Finatra (11/2000 will eliminate its commercial finance operations in order to focus on its two core finance platforms, consumer finance and services and consumer mortgage lending. )

FMA Finance ( 4/2000 reportedly closed to brokers )

Fidelity ( 4/2000 acquired by EAB, a wholly owned subsidiary of ABN AMRO Bank N.V., headquartered in the Netherlands, raising funds )

Finova ( 12/2000out of market place, many problems, raises $250 MM, but not enough ) ( 10/2000 Dow Jones headlines "Finova Stock Falls As Buyout Hopes Wane 10/2000 Dow Jones notes stock falling and problems at Finova 11/2000 Announces they will discontinue business, sell units 11/2000 Suspends Dividend 11/2000 Leucadia National to Invest $350 Million in Finova 11/2000 reports $274 million loss ))

First State Bancorp, Albuquerque, N.M ( 3/2000 sold leasing division-$64 million---)

Franklin Leasing, Des Moines, Iowa--owned by Liberty Bank-- (2/2000)-no longer writing leases ( limited by regulations and leases are for sale ).

Franchise Mortgage Acceptance Corporation (FMAC) 11/1999 purchased by Bay View Commercial Corporation (Bay View Bank) 9/2000 discontinuing all franchise loan and lease production.

Golden Gate Funding ( 2/99 purchased by Westover Financial )

Heller Financials Commercial Services Unit ( 10/99 purchased by CIT )

Imperial Credit Industries (ICII) ( sold portfolio )

Japan Leasing Credit claims ( JLC --6/99 purchased by Orix )

Lease Acceptance Corp---( ceases broker business 7/26/2000 )

Leasing Solutions ( bankrupt )

Liberty Leasing ( closed, California company )

Linc Capital ( out of vendor and broker business, Nasdaq halts stock sales, $13.4 loss last quarter,10/2000 assets for sale )

Lyon Credit Corporation ( 9/99 purchased by Hudson United Bancorp )

Manifest Group--( 9/1/2000 purchased by US Bancorp Leasing and Financial, "...a win for all the parties involved," Brian Bjella. Matsco Financial (12/2000 purchased by Greater Bay Bank )

Merit Leasing ( gone )

Metwest Leasing, Spokane Wa. ( 9/2000 advising brokers that they have run out of funds so they are unable to fund a transaction we have there for funding. 11/2000 Metwest Leasing Spokane, WA. is pulling the plug, confirmed by five sources. )

Metrolease--( 5/2000 reports closing operation, John Blazek at Evergreen Leasing, Hathcock losing assets, will not confirm nor deny; many serious rumors of serious fraud floating around the marketplace, including debt to Textron Financial, reported to file bk.)

NationsCredit, Business Leasing Group (1/29/99 sold to Textron**)

*"The Business Leasing Group of Nations Credit was sold to Textron and we still do broker business," says Jim Merrilees, past UAEL president.

NIA National Leasing ( 3/2000 purchased by Lakeland Bancorp )

New England Capital ( 6/2000 sold to Network Capital Alliance a division of Sovereign Bank. Sovereign did hire two people who will run a sales office in CT, doing basically the same deals with the same people as before. Little will change in that aspect.

Newcourt ( 8/2000 sold off )

Old Kent Financial ,Grand Rapids, Michigan ( 11/2000 Fifth Third Bank, Cincinnati, Ohio announces acquirement, to close second quarter 2001-Gateway Leasing sold to Old Ken in 1997, small ticket leasing specialists )

Onset Capital ( 9/2000 Irwin buys 87% equity )

Orix 11/10 First Six Month Profits up 14% at Orix! ) 10/2000 "long-term Outlook has been revised from Stable to Negative" Credit Allianchat it has changed its name to ORIX Financial Services, 9/2000 Japanese Bank President Commits Suicide (Orix is a 14.7% shareholder in bank having problems ), ( 8/2000 closes small ticket vendor division in Portland, Oregon, "Business as usual (in New Jersey and with brokers)," says Steve Geller 11/8 New President at Orix appointed 11/10 First Six Month Profits up 14% at Orix! No negative reports, company appears to be doing very well. )

Phoenix ( 5/2000 both divisions closed )

Preferred Capital ( 12/2000 On the block. David Murray left 11/7 "didn't like letting his friends go." 01/2000 Mark Seif confirms )

Republic Leasing, South Carolina 9/27/2000 ( "The expected result will be a sale of Republic Leasing"---Dwight Galloway )

Resource Leasing, Herndon, Virginia ( 11/2000 MicroFinancial/Leasecomm acquires major portion of the assets.)

Rockford ( sold to American Express )

Scripp Financial ( 6/29/2000 ( purchased by US Bancorp )

Signature Leasing, Dublin, California ( 11/2000 no longer in small ticket marketplace )

SDI ( 5/2000 closed to broker programs )

SFC Capital ( 9/15/2000 purchased by Trinity Capital )

SierraCities (11/2000 to be acquired by Vertical Net Credit on December 29, now extended to January 16,2000 , Sells Off UK Assets )

T&W, Washington (10/2000 filed Chapter 11. Creditors meeting on 12-4-00 Seattle. Case # 00- 10868 US Bankruptcy Court Western District of Wash. 206-553-7545. Debtor Attorney-Marc Barreca 206-623-7580)

Transamerica ( 11/2000 for sale, but no buyers, so taken off marketplace, no longer for sale )

Unicapital ( 12/2000 files bk ) *** series of company that may be affected, end of report )

United Capital, Austin Texas ( 12/2000 no new deals until after the 1st of year, Steve Dallas says, " We will survive." Varilease ( 11/2000 closed down )

USA Capital Leasing ( gone-bk )

any corrections, additions, comments will be appreciated.

We are presently working on dividing the list into last twelve months and prior. We are close to completion on this project

***Original Purchases by Date by Unicapital

American Capital Resources 2/98

Boulder Capital Group 2/98

Cauff, Lippman Aviation 2/98

Jacom Computer Services 2/98

Matrix Funding 2/98

Merrimac Financial Associates 2/98

Municipal Capital Markets Group 2/98

The NSJ Group 2/98

Portfolio Financial Servicing 2/98 --acquires assets of Unicapital

Vanlease 2/98

The Walden Group 2/98

K.L.C., Inc. dba Keystone Leasing 5/98

Jumbo Jet 7/98

HLC Financial 7/98

Saddleback Financial Corporation 7/98

U.S. Turbine Engine Corp. 7/98

The Myerson Companies dba BSB Leasing 9/98

--- to start again says Don Myerson Please note, we are continuing to fill in the dates, so we can break this list into a "current" and " recent" list. We have also deleted smaller companies and sales of portfolio's as the list was getting too large. Editor had not completed new chronological section.

We give you permission, and in fact, encourage you to pass on information to your colleagues. If you would like to join our leasing news network, we are free, with no advertising or banners, too--- all you need to do is e-mail us. View Us on Line, too: www.leasingnews.org

|

((Please Click on Bulletin Board to learn more information))

(Leasing News provides this ad “gratis” as a means

to help support the growth of Lease Police)

[headlines]

--------------------------------------------------------------

Classified Ads---Sales

(These ads are “free” to those seeking employment or looking

to improve their position)

| Central Valley, California 6 years sales, management, marketing, business development, budget planning, finance. Proven track record challenging and competitive situations. Expert: healthcare, banking, and entrepreneurship. dsp559@outlook.com| Resume |

| Garfield, NJ 15 years experience small to large ticket sales exp. All types of equipment industries. Vendor & direct. Self motivated. Work with leasing company or broker. Tony Lio tonylio@optonline.net |

| Montgomery, AL Individual with 10 years advertising sales exp. & 7 years insurance sales exp. Wants independent contractor situation in Alabama. Work with leasing company or broker. 334-590-5133 E-mail: billmcneal2003@yahoo.com |

Orange County, CA |

San Francisco Bay Area: |

| Texas/Oklahoma 15 year lease vet looking for plact to take business.great references. all major equipment types. open to compensation. please contact if interested. E-mail: bankingdallas@yahoo.com |

http://www.leasingnews.org/Classified/Jwanted/Jwanted-post.htm

All “free” categories “job wanted” ads:

http://www.leasingnews.org/Classified/Jwanted/Jwanted.htm

|

[headlines]

--------------------------------------------------------------

Leasing Benefits from Business Tax Extenders

by Terry Winders, CLP

(Copy of 2013 Tax Law included)

Commercial equipment leasing will remain popular this year because the changes in lease accounting have been pushed back and are not expected to become effective until January 1, 2015. That means operating leases will still allow off balance sheet accounting and the expensing of rent payments as they are paid. If the lessee desires a lease payment that is higher in the beginning and lower in the second half to match maintenance costs or heavy use it remains acceptable. When combined with the section 179 benefits, equipment costs after the $2 million can also increase the tax write-off and provide a strong showing for 2013.

Many companies will see the changes set for 2014 and will be looking to make up for lost time and begin to acquire equipment to improve production or improve performance. Calling on tax and accounting managers should be on the list of markets in 2013 for lessors. Companies that are profitable are going to be looking for methods to reduce taxes and control expenses.

The commercial equipment industry should be looking at 2013 as a year of growth and begin to bang the drums as soon as possible.

Passed in the so called “Fiscal Cliff Bill:”

Section 179 limit enhancements as well as 50% bonus depreciation have been extended for the 2013 tax year within the H.R. 8: American Taxpayer Relief Act of 2012

Section 179 was to be reduced to $139,000 in 2012 and $25,000 in 2013. The new law extends the $500,000 limit through 2013, and pushes the $25,000 cap to 2014. The total capital expenditures allowed for these small companies for 2013 must be under $2 million and $200,000 starting in 2014. This continues to allow true leasing to support firms that exceed the capital expenditure limit and want to retain the benefits of section 179.

Leased equipment that qualifies as a true tax lease is not considered a capital expenditure. Whereas; a lease that does not qualify as a tax lease is considered a conditional sales agreement and does add to the lessee’s capital purchases.

2013 also sees the extension of the bonus depreciation of 50 percent (and sometimes more) of certain kinds of investment in the first year, providing the equipment is new. In some cases, the bonus depreciation is extended through 2014.

There are other benefits for capital leases and

loans as well as employers:

•Fifteen-year depreciation for qualified improvements to leasehold, retail or restaurant property: Under this provision, which expired in 2011, a renter, retailer, or restaurateur can write off improvements in 15 years, rather than over 39 years (which may be longer than the business would even exist). It has been extended through 2013.

•Work opportunity tax credits: These are tax credits for employers who hire military veterans or people belonging to certain disadvantaged groups (for example, people receiving government assistance or living in distressed areas). Tax credits for hiring the disadvantaged expired in 2011 and those for veterans expired at the end of 2012; both have been extended through 2013.

Leasing News will present more of these benefits for the financial and leasing industry in news editions to follow.

Copy of January 31, 2012 bill (154 pages):

http://www.leasingnews.org/PDF/fiscal_cliff_bill.pdf

CCH Tax Briefing (11 pages)

http://www.leasingnews.org/PDF/CCH_Tax_Breifing.pdf

Why Choose Advanced Property Tax Compliance?

|

Dedicated to the leasing industry |

[headlines]

--------------------------------------------------------------

New Year---New Career?

Career Crossroad---By Emily Fitzpatrick/RII

Question: New Year – How should I go about thinking about my career?

Answer: There is a DEFINITE distinction between those who have successful and gratifying careers as opposed to those who never seem to get ahead and “hate” their jobs.

Successful people have the desire to make it … they want to be proficient at their work not ONLY for financial rewards but perhaps more importantly, for the evidence that they are good at what they do.

Those who seem to flounder through their careers see their jobs merely as “work”. They have to do it to survive; they derive little pleasure from doing it well. I assume you share the characteristics of successful people … you care about your career and want it to be more than a job, more than a means of subsistence. Do not minimize this quality, without it; you do have much of a chance to succeed.

Evaluate if your current job is what you had foreseen for yourself. Are you enjoying your work? If not, use your favorite past job as a frame of reference. We tend to gravitate to and be interested in areas that are consistent with our personalities. If this is not in sync, it may be time to re-evaluate your current position / employer.

Take the steps to make sure you will be going in the right direction for your future. Don’t put it off, as this is the start of a new year, and you may find out the start of a new search for a job you look forward to coming to every morning!

Happy New Year - We wish you a Successful & Prosperous 2013!

Emily Fitzpatrick

Sr. Recruiter

Recruiters International, Inc.

Phone: 954-885-9241

Cell: 954-612-0567

emily@riirecruit.com

Invite me to Connect on LinkedIn

www.linkedin.com/pub/emily-fitzpatrick/4/671/76

Also follow us on Twitter #RIIINFO

Career Crossroads Previous Columns

http://www.leasingnews.org/Conscious-Top%20Stories/crossroad.html

[headlines]

--------------------------------------------------------------

Leasing Industry Help Wanted

www.madisoncapital.com |

For information on placing a help wanted ad, please click here:

http://www.leasingnews.org/Classified/Hwanted/Hwanted-post.htm

Please see our Job Wanted section for possible new employees.

[headlines]

--------------------------------------------------------------

Bob Teichman named CLP Chairman of the Board

The Certified Leasing Professional Foundation has added a "chairman of the board" to its 2013 board of directors, naming Robert Teichman, CLP, Teichman Financial Training, who also is long time chairman of the Leasing News Advisory Board.

In this newly enacted position, he will serve as “senior advisor.”

The CLP Foundation is the official governing body for the Certified Lease Professional ("CLP") Program. The CLP designation sets the standard for professionalism in the equipment finance industry.

This designation identifies and recognizes individuals within the equipment finance industry who have demonstrated their competency through continued education, testing and conduct. The letters "CLP" behind their name represent a visible recognition of this professional achievement and status.

Serving her second year term as president is Rosanne Wilson, CLP, Independent Leasing, Beaverton, Oregon, who will conduct meetings and continue in her role as “chief executive officer” of the foundation.

http://leasingnews.org/archives/Mar2012/3_07.htm#clp

Named vice-president was David Normandin, CLP, Senior Vice-President, PacTrust Bank, Irvine, California

http://leasingnews.org/archives/Aug2012/8_30.htm#clp

D. Paul Nibarger, CLP, Nibarger Associates, Rancho Palos Verde, California was named Secretary.

http://www.leasingnews.org/CLP/Paul_Nibarger.htm

Jeffery Elliott, CLP, Huntington Equipment Finance, Columbus, Ohio was named Treasurer.

The remainder of the CLP Foundation Board of Directors were elected by their CLP peers in Good Standing or appointed by our supporting associations, the National Equipment Finance Association (NEFA) and the National Association of Equipment Leasing Brokers (NAELB):

Mary Armstrong, CLP, Broker Relations Manager, Financial Pacific Leasing, Federal Way, Washington

http://leasingnews.org/archives/Feb2012/2_10.htm#clp

Lori Dean, CLP , Operations Manager, Vice-President, Arvest Equipment Finance, Fort Smith, Arkansas

http://leasingnews.org/archives/Nov2012/11_07.htm#clp

Nancy Geary, CLP, CPA, ECS Financial Services, Northbrook, Illinois

Kyle Gilliam, CLP, President, Arvest Equipment Finance, Fort Smith, Arkansas

http://leasingnews.org/archives/Jul2012/7_02.htm#clp

Pete Sawyer, CLP, President, Sun South Equipment Leasing, Lakeland, Florida

Brian Schonfeld, CLP, Project & Information Manager, Pawnee Leasing, Fort Collins, Colorado

http://leasingnews.org/archives/Jul2012/7_11.htm#clp

Amy Spragg, CLP, Managing Director, Pacifica Capital, Encinitas, California

Carl Villella, CLP, Acceptance Leasing and Finance Service, Inc., Acceptance Leasing and Financing Service, Inc., Moon Township, Pennsylvania

http://www.leasingnews.org/CLP/Carl_Villella.htm

Scott Wheeler, CLP, Wheeler Business Consulting, Baltimore, Maryland

Reached close to press time, Bob Teichman, CLP, wrote:

“The CLP Foundation has done me the honor of electing me as Chairman for 2013 and I will do my very best to be worthy of their trust and confidence.

“My role will be that of a Senior Advisor, occupied, among other things, with advance planning, strategies, international outreach and program development.

“Rosanne Wilson, CLP, will continue to do her usual superb job as President working on day-to-day activities with Executive Director, Reid Raykovich, CLP and with the Board and its Committees. I am excited to be able to work with the 2013 Board, which is made up of exceptional individuals, all dedicated to the continued success of the Certified Lease Professional program, the only leasing certification program recognized world-wide.”

Rosanne Wilson reached afterwards, added:

“Happy New Year from the CLP Foundation. It is with great excitement that I welcome Bob Teichman as the 2013 Chairman of the Board of the CLP Foundation. Most people in the equipment finance business know of the legendary Bob Teichman. He was the 2008 Leasing Person of the Year and has given over 50 years of service to the leasing industry.

“Bob Teichman is one of the original founders of the CLP Program and one of our greatest teachers and mentors. He helped author the CLP Handbook. I will remain on as this year's President of the CLP Foundation, and I look forward to working with Bob to advance the CLP program as the most coveted certification in our industry. I know I speak for the entire Board of Directors in announcing how thrilled we are to have Bob Teichman on the 2013 Board.”

Why I Became a CLP series:

http://www.leasingnews.org/CLP/Index.htm

[headlines]

--------------------------------------------------------------

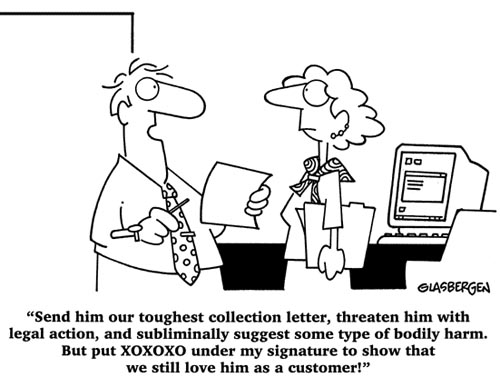

California Regulators Going After Debt Collectors

for Perceived Collection Abuses

By Tom McCurnin

Barton, Klugman & Oetting

Debt Collection Agency Mistakenly Attempts Garnishment of

Wages of State Senator. New Call on State and Federal Level for

Tougher Debt Collection Laws

In golf glossary, it’s called a “duff” or a “sprachle”, a horrible shot, and one collector shanked one last year, resulting in proposed legislation which may affect not only his company, but the whole of the collection industry in California, if not the whole Nation.

This shank was the attempted garnishment of the wages of one Lou Correa for a Sears credit card. While that is no big deal, they garnished the wrong man’s wages for a debt which wasn’t his. That’s not unheard of either. Except the wrong man whose wages were attempted to be garnished was California State Senator Lou Correa (D. Santa Ana). The Brachfeld Law Group of El Segundo, California tried to garnish Senator Correa’s wages over a Sears credit card which belonged to another individual, Louis Correa.

Correa’s problems began when he received a call from a collector about an overdue Sears charge card. He told the collector that he had the wrong man, and provided the collector with his personal information. However, the collection agency nevertheless obtained a garnishment order and served it on the California Senate to garnish the Senator’s wages. Someone at the Senate tipped Correa off and some phone calls resulted in the collector finally figuring out that they did indeed have the wrong man. Although none of the Senator’s wages were taken, the stupidity of collection agencies and lack of control are now in the center of State and National news.

Senator Correa is now a co-sponsor, with California State Senator Mark Leno (D. San Francisco), to require collectors to document that the person they are pursuing is in fact the actual judgment debtor. The Bill is SB 890 and has passed the Senate and should breeze through the California Assembly this year.

The problem of over-aggressive collectors has reached National proportions as well. According the LA Times (August 20, 2012), in 2010, the Federal Trade Commission, which enforces the Fair Debt Collection Practices Act, received over 180,000 complaints, which is up 73%. Of those complaints, 30,000 of them concerned either that debt collectors were trying to collect a debt which the consumer did not owe, or were trying to collect more than what was actually owed.

Some of the scofflaws include International Asset Group of Amherst, NY (which per the BBB was fined $175,000 for caller ID spoofing; Brachfeld Law Group (which started garnishment proceedings against Sen. Correa); Asset Acceptance (which signed a $2.5 million dollar consent decree requiring it to validate the amount and identity of debtors); and Encore Capital (which has been sued by the State of Minnesota for robo-signed and other false affidavits).

Almost without exception the principal violators of the FDCPA are debt buying companies. This industry was formed about 20 years ago, in the wake of the savings and loan scandal. Indeed, the Resolution Trust Corporation was formed specifically to sell bad debt on the open market. It sold over $450 billion in debt according to the Wall Street Journal (Boom in Debt Buying Fuels Another Boom 11-28-10).

Seeing a new market niche, debt buyers thereafter began to purchase other kinds of debt. In 1993 debt buyers purchased an estimated $6 billion in old debt, but by 2005 that figure spiked to over $100 billion, according to the National Consumer Law Center. The Federal Trade Commission has estimated that the country’s nine largest debt buyers have acquired 75 percent of all purchased debt. The four largest publicly-traded debt buyers (including Encore) reportedly purchased almost $20 billion in receivables in 2009, according to published reports.

The problem with this industry is that they rarely play with their own chips. They purchase the debt for near nothing, so there is really nothing to lose by being aggressive in collection phone calls and strategies. They typically recover three times what they spend buying debt, according to the Association of Credit and Collection Professionals, a collection trade group.

Many or their collection lawyers are low end, knuckle dragging Neanderthals whose only tool is a sledge hammer. Don’t even think about trying to speak with one of their lawyers on the phone, as the caller will only get a commissioned collector who has no motivation to solve problems, only separate the debtor from his or her money.

One reported abuse involved Montana resident, Timothy McCollough, who was sued for $9,000 on a credit card from Chase, but the account was over 8 years old, well beyond the statute of limitations. McCollough counter-sued and recovered over $350,000.

It’s these type of abuses that the California’s SB 890 seeks to remedy. Some of the more salient features of the Bill include:

• Defines a debt buying company.

• Prohibits a debt buying company from filing suit unless it is the sole owner of the debt and the debtor is proper individual

• Makes illegal the practice to sue on debts for which the statute of limitations has expired. Up to now, this is an affirmative defense to be raised by the debtor.

• Requires proof of the debt to be by signed affidavit by a person with personal knowledge of the debt.

• Statutory violations are capped at $1,000 per violation.

• Incorporates the bona fide error exception whereby honest mistakes, as opposed to a firm practice, are not actionable.

What does this Bill and the contemplated FTC crackdown on debt buyers mean for the leasing industry? Since the FDCPA and SB 890 both apply to consumer debt collection, the Bill arguably is not applicable to our industry. However, several consumer rights lawyers, notably Aidan Butler and others, often opine that it is not what is in the agreement which governs applicability of the FDCPA, but how the funds are spent. Notwithstanding those opinions, my view of the law is that it is agreement, at the time it is made, governs whether the transaction is a consumer loan, not when the collection is made. See Martin v Wells Fargo Bank, 91 Cal.App.4th 489, 499 (2001).

However, it is better to be safe than sorry, therefore under the cover of “best practices” it is wise to be aware of the various edicts of the FDCPA and SB 890, and to adjust collection procedures accordingly. While it may not be applicable, certainly some of the Act’s more common sense provisions such as not calling the debtor at his/her employment, or placing calls at odd times, or spoofing the debtor would be wise procedures to have in placed at any collection shop, whether consumer or commercial.

One of the most important procedures to have in place is a book of procedures. The FDCPA has a bona fide mistake rule, which can often exculpate the collector if the collector made a genuine mistake and the institution has a set of policies and procedures for the collectors. In golfing terms, it’s a “mulligan.”

Tom McCurnin

Barton, Klugman & Oetting

350 South Grand Ave.

Suite 2200

Los Angeles, CA 90071

Direct Phone: (213) 617-6129

Cell (213) 268-8291

Email: tmccurnin@bkolaw.com

Visit our web site at www.bkolaw.com

Previous Tom McCurnin Articles:

http://www.leasingnews.org/Conscious-Top%20Stories/leasing_cases.html

Don't forget to bookmark us! (CTRL-D)

[headlines]

--------------------------------------------------------------

Leasing 102

by Mr. Terry Winders, CLP

Typical Certificate of Insurance

A properly executed insurance certificate carries the names and addresses of both the agency coordinating the insurance coverage’s and the insurance companies issuing them. The certificate must also clearly state the name(s) of the primary insured party (the Lessee), with the Lessor identified as loss payee (for property coverage) and additional insured (for liability). In addition, the insurance coverage amounts, policy numbers, a complete description of the asset(s) covered, cancellation notification stipulation, and the date of insurance issuance should all be clearly stated on the certificate.

It is important that the Lessor, as asset owner, require at least 30 days’ notice from the insurance company of any pending insurance policy cancellation. This allows enough time to prevent any lapse in coverage should the issuing company decide to cancel the policy. The usual reason for cancellation is nonpayment of premium. Notification of impending cancellation could signify deterioration of the Lessee’s financial condition; a situation of utmost importance to any Lessor. A wise Lessor must be as concerned about the credit ratings and paying habits of his customers as he is about insuring the assets under lease.

For the same reasons, the Lessor should also require notification of non-renewal of the policy as well as cancellation. If the Lessor received notification of non-renewal, immediately contact the lessee to make certain new coverage is provided.

Pre-Commencement and Termination

The lease agreement should require the Lessee to place insurance coverage on the asset upon possession and not upon acceptance. The period of time the Lessee takes to uncrate, assemble, and test the asset prior to acceptance could run into weeks or a few months. A proper insurance requirement states that insurance is due upon taking possession and rent is due upon acceptance. This will protect the Lessor during the acceptance phase of the agreement.

The requirement for insurance should also require the insurance be in force until the asset is returned or purchased at Termination. This includes any additional time after the lease terminates and rent is not due but the asset is being transported to the location stated by the Lessor.

If the Lessor decides to recover the asset at termination or due to early termination, or repossession in a default, then it is the Lessors responsibility to provide his own insurance coverage. Also the method of transport and by who will impact the amount of the premium required by the insurer. Occasionally a Lessor believes the return of the asset if handled by Lessor employees will to be covered by the current umbrella liability coverage and this is usually not the case. The insurer for the Lessor should be contacted to discuss all issues about insurance on off lease assets.

Additional Language

In the insurance paragraph the lessee must allow the lessor to purchase insurance and bill the lessee for the cost, if the insurance binder is not in place at the time of equipment delivery or the insurance lapses during the lease term. The paragraph must require lessor notification if the lessee changes insurance carriers to prevent the lessors purchasing replacement insurance. Usually if the insurance is canceled it is cheaper to pay the premium than it is to purchase new insurance called forced place insurance. Insurance protects the lessor as much as it protects the lessee and is an important part of the lease process.

Mr. Terry Winders, CLP, has been a teacher, consultant, expert witness for the leasing industry for thirty years and can be reached at leaseconsulting@msn.com or 502-649-0448.

He invites your questions and queries.

Previous #102 Columns:

http://www.leasingnews.org/Conscious-Top%20Stories/Leasing_102/Index.htm

Mr. Terry Winders available as Expert Witness. 35 years as a professional instructor to the top equipment leasing and finance companies in the United States, author of several books, including DVD's, as well as weekly columnist to Leasing News. He also performs audits of leasing companies as an expert on documentation, and has acted as an expert witness on leasing for litigation in legal and tax disputes, including before the IRS. He also has taught the senior bank examiners, how to review a bank leasing department, for the Federal Reserve in Washington D.C. and has trained the examiners for the FDIC on how to prepare a lease portfolio for sale.

Mr. Winders received his Master of Business Administration and his Bachelor of Science degrees from the College of Notre Dame. 502.649.0488/Leaseconsulting@msn.com |

(This ad is a “trade” for the writing of this column. Opinions

contained in the column are those of Mr. Terry Winders, CLP)

[headlines]

--------------------------------------------------------------

Credit card loans at US Commercial Banks Down

Credit card and other revolving loans by U.S. Commercial Banks stood at 10.78% by year-end 2010, according to SNL Financial. By the end of the third quarter of 2012, total credit card and other revolving loans had fallen to $668.97 billion, or 9.70% of the industry's total loan portfolio.

Across the country, the average rate for a "platinum" credit card was 9.90% at the end of 2012, but numerous institutions offered rates well below that level. Memphis, Tenn.-based First Tennessee Bank NA topped the charts for commercial banks with its 5.15% average rate. Hills, Iowa-based Hills Bank & Trust Co. tied with Denver-based Vectra Bank Colorado NA for second place with a 5.25% average platinum card rate.

According to SNL Financial, at the end of 2010, aggregate credit card loans and other revolving credit plans stood at $36.37 billion at U.S. credit unions, accounting for 6.35% of their total loans. By Sept. 30, 2012, that number had grown to $38.25 billion, or 6.39% of the total loan portfolio.

[headlines]

--------------------------------------------------------------

Rate Tracker: Mortgage rate champions

By Harish Mali and David Hayes, SNL Financial

(Bank Rate wrote “Mortgage rates barely changed this week, despite a rally in the stock market after Congress finally reached an agreement and passed legislation to avoid going over the ‘fiscal cliff.’

(“The benchmark 30-year fixed-rate mortgage fell to 3.58 percent from 3.59 percent, according to the Bankrate.com national survey of large lenders. The mortgages in this week's survey had an average total of 0.35 discount and origination points. One year ago, the mortgage index stood at 4.18 percent; four weeks ago, it was 3.5 percent.

(“The benchmark 15-year fixed-rate mortgage rose to 2.88 percent from 2.87 percent. The benchmark 5/1 adjustable-rate mortgage fell to 2.76 percent from 2.77 percent.)

The nation's mortgage rates have dropped even further since SNL's last analysis, helped by an accommodating Federal Reserve eager to fan the embers of a reluctant recovery. The average nationwide rate for a 30-year fixed mortgage was 3.51% on Dec. 19, with the average 15-year rate coming in at 2.93%. Both averages are significantly below the 3.85% 30-year rate and the 3.20% 15-year rate posted in the previous, late-June analysis.

The Federal Open Market Committee recently announced that it would begin purchasing $45 billion in longer-term Treasury’s every month until the national unemployment rate declines to 6.5%. This is in addition to the $40 billion the committee is already spending buying mortgage-backed securities every month.

Would-be homebuyers in Alaska will be happy to know that their state boasts the nation's lowest average rates on both 15- and 30-year mortgages. Alaska's average 15-year mortgage rate was 2.63% and its average 30-year rate was 3.29%. Montana came in second place for both products, offering an average of 2.68% on a 15-year mortgage and 3.33% on a 30-year mortgage.

On the other end of the spectrum, Maine's 3.16% average rate for a 15-year mortgage was the highest of all 50 states followed by Delaware at 3.12%. The two states also posted the two highest average rates for 30-year mortgages with Delaware averaging 3.78% and Maine 3.73%

Spartanburg Regional Federal Credit Union led the nation with an average rate of 2.50% on a 30-year mortgage, beating out second place San Juan, Puerto Rico-based Scotiabank de Puerto Rico's 2.63%. Spartanburg's two branches are in northwestern South Carolina in Spartanburg and Duncan.

Scotiabank de Puerto Rico's 40-plus branches are all in Puerto Rico. The bank has grown significantly in the last few years from $1.53 billion at the end of 2008 to $6.30 billion at Sept. 30, 2012. This growth was primarily due to the bank's purchase of R-G Premier Bank of Puerto Rico after it failed in April 2010. The acquisition of R-G Premier significantly altered Scotiabank de Puerto Rico's loan books as well, as one- to four-family residential loans went from 21.58% of the company's total loans at March 31, 2010, to 56.35% at June 30, 2010. That concentration in one- to four-family mortgages has remained approximately the same ever since accounting for 50.39% of the company's total loans in the most recent quarter.

Scotiabank de Puerto Rico also tied for first with Canton, Ga.-based Cherokee Bank NA, with both offering an average rate of 2.00% on a 15-year fixed mortgage, the lowest rate in the country. Cherokee's three branches are all located just north of Atlanta alongside Interstate 575. Like Scotiabank, Cherokee's real estate lending has shifted over the years as well. Construction and land development loans accounted for 29.72% of the company's loan book at the end of 2008, but that number has since fallen to 10.60% as of Sept. 30, 2012. In contrast, Cherokee's one- to four-family residential loans rose from 17.72% to 27.28% over the same time frame.

Only six credit unions, including Spartanburg Regional FCU, made it on SNL's lists of banking institutions with the lowest mortgage rates. A separate SNL analysis recently revealed that, when compared to commercial banks and savings banks, credit unions, on average, offered the best rates in all product categories, except for mortgages.

[headlines]

--------------------------------------------------------------

#### Press Release #############################

Ways to Find Money to Offset Social Security Tax Hike

Washington, DC – Paychecks are getting smaller. While many Americans are breathing a sigh of relief that their income tax did not increase, there is nonetheless a tax increase that will impact all paychecks.

The Social Security payroll tax rate was reduced for 2011 and 2012, with the employee contribution cut from 6.2 percent to 4.2 percent. The intent was to put more money in people’s pockets, thus stimulate spending. The rate will now increase to the former level, resulting in smaller paychecks for American workers.

“If a person was fortunate enough to have received a pay raise, it’s likely that this Social Security tax increase will wipe out most of it,” said Gail Cunningham, spokesperson for the National Foundation for Credit Counseling (NFCC). “Americans, particularly those already living on the financial edge, need to act fast to adjust their budgets accordingly.”

To help consumers find extra money to offset the tax hike, the NFCC suggests exploring the following areas:

• Adjust withholding – Millions of Americans receive large income tax refunds each year when they could have extra money each month. Calculate the proper number of withholding allowances by utilizing the worksheet at www.IRS.gov.

• Pay with cash – People who pay for purchases with cash typically save 20 percent compared to previous credit spending, and never feel deprived.

• Refinance the mortgage – Take advantage of historically low rates to reap a lower monthly mortgage payment.

• Ten dollars from 10 categories – Carving $10 off of 10 spending categories is a painless way to find extra money.

• Do it yourself – Small savings add up. Stop paying for things you can do yourself such as washing the car, cleaning the house, or mowing the lawn.

• Stop bad habits – Make good on those New Year’s Resolutions to stop smoking, drinking, and playing the lottery.

• Clean out the storeroom – It’s a double-play to sell the contents of the storeroom, thus eliminating the need for extra storage. Money in the pocket from the sale, and no more rent payments.

• Save on insurance premiums – Examine all policies and compare rates. Inquire about ways to lower premiums, and ask about any discounts for loyalty, good driving and the bundling of multiple polices.

• Examine bank statements – Don’t continue to pay for things no longer needed just because they’re set up as auto-pay. Avoid unnecessary charges by not using out-of-network ATMs. Negotiate with the financial institution for lower fees or change banks.

• Earn extra income – Getting paid to do something fun won’t feel like work, and honing a skill can pay dividends beyond financial.

For help finding hidden money in your budget, reach out to a trained and certified counselor. To find the NFCC Member Agency closest to you, dial toll-free to (800) 388-2227, or go online to www.DebtAdvice.org. For assistance in Spanish, call (800) 682-9832.

The National Foundation for Credit Counseling (NFCC), founded in 1951, is the nation’s largest and longest serving national nonprofit credit counseling organization. The NFCC’s mission is to promote the national agenda for financially responsible behavior, and build capacity for its members to deliver the highest-quality financial education and counseling services. NFCC Members annually help more than three million consumers through close to 750 community-based offices nationwide. For free and affordable confidential advice through a reputable NFCC Member, call (800) 388-2227, (en Español (800) 682-9832) or visit www.nfcc.org. Visit us on Facebook: www.facebook.com/NFCCDebtAdvice, on Twitter: twitter.com/NFCCDebtAdvice, on YouTube: www.YouTube.com/NFCC09 and our blog: http://financialeducation.nfcc.org/.

##### Press Release ############################

Send Leasing News to a Colleague. We are free!!!

[headlines]

--------------------------------------------------------------

German Shepherd/Black and Tan Coonhound Mix

Louisville, Kentucky Adopt-a-Dog

Dodger

A480811

German Shepherd/Plott Hound mix

6 yrs.

Male

Dodger is a 6-year-old German Shepherd/Plott Hound mix. He's a happy boy, very friendly with new people and with unfamiliar dogs. He has a lot of energy and is ready to stay on the move. He can pull pretty hard on the leash in his eagerness to meet new people across the play yard. Dodger is an affable, outgoing guy!

While Metro cannot guarantee an animal is housebroken, Dodger waited until he was outside to completely relieve himself, which is a good sign.

DODGER'S CONTACT INFO

Metro Animal Services, Louisville, KY

502-473-PETS (7387)

animals@louisvilleky.gov

http://www.petfinder.com/shelters/KY102.html

Adopt-a-Pet by Leasing Co. State/City

http://www.leasingnews.org/Conscious-Top%20Stories/Adopt_Pet.htm

Adopt a Pet

http://www.adoptapet

[headlines]

--------------------------------------------------------------

[headlines]

--------------------------------------------------------------

| John Kenny Receivables Management www.jrkrmdirect.com • End of Lease Negotiations & Enforcement The Solution to Your Credit & Accounts Receivable Needs |

(Leasing News provides this ad as a trade for investigations

and background information provided by John Kenny)

![]()

News Briefs----

Bank of Ann Arbor acquires locally-based Ervin Leasing

http://www.bankofannarbor.com/news/post/Bank-of-Ann-Arbor-Acquires-locally-based-Ervin-Leasing.aspx

MB Financial Bank, N.A. Acquires Celtic Leasing Corp.

http://www.celticfinance.com/announcements/press-release

Landstar/OOIDA Settle "Truth in Leasing" Litigation

http://www.truckinginfo.com/news/news-detail.asp?news_id=78926&news_category_id=6

World's 100 richest gained $241B last year

http://www.usatoday.com/story/money/2013/01/02/worlds-100-richest-added-241-billion-in-2012/1805021/

Swiss Bank Pleads Guilty to Tax Law Violations

----to pay $57.8M in U.S. tax evasion plea

http://dealbook.nytimes.com/2013/01/03/swiss-bank-pleads-guilty-to-tax-law-violations/

New Partnership Between the NFL & International Franchise Assoc.

http://www.qsrmagazine.com/exclusives/national-franchising-league?utm_campaign=20130103&utm_source=jolt&utm_medium=email

Boeing 737 Max Orders Top 1,000 on $6 Billion Lessor Deal

http://www.businessweek.com/news/2013-01-02/boeing-s-737-max-orders-top-1-000-with-6-billion-deal

Boeing poised to regain title of world's largest planemaker

http://www.chicagotribune.com/business/breaking/chi-boeing-poised-to-regain-title-of-worlds-largest-planemaker-20130103,0,3281210.story

Some Pork Got Through Fiscal Cliff Bill

http://www.huffingtonpost.com/matt-stoller/eight-corporate-subsidies_b_2396559.html

Ag Retailers Watching Farm Bill, water quality and taxes

http://www.croplife.com/article/32248/agricultural-retailers-association-environmental-policy-taxation-top-issues-to-watch

Chrysler shines, GM, Ford follow in 2012 sales gains

http://www.usatoday.com/story/money/cars/2013/01/03/gm-sales-december/1805321/

Tory Burch hits jackpot

http://www.nypost.com/p/pagesix/tory_hits_jackpot

[headlines]

--------------------------------------------------------------

---You May Have Missed

Why Not Drop Health Insurance and Pay the Penalty?

http://www3.cfo.com/article/2013/1/regulation_pay-or-play-healthcare-risk-lupin-insurance

[headlines]

--------------------------------------------------------------

SparkPeople--Live Healthier and Longer

![]()

SparkPeople--Live Healthier and Longer

9 Noteworthy Nutrition Goals for the New Year

http://www.sparkpeople.com/resource/nutrition_articles.asp?id=1432

[headlines]

--------------------------------------------------------------

Sports Briefs----

Chipper Jones blasts Gators after ugly Sugar Bowl loss

http://www.usatoday.com/story/gameon/2013/01/03/chipper-jones-blasts-florida-gators-after-sugar-bowl-loss-louisville/1807471/?morestories=obinsite

One-point safety adds spice to dull Fiesta Bowl

http://www.usatoday.com/story/gameon/2013/01/03/fiesta-bowl-kansas-state-oregon-one-point-safety/1808299/

Randy Moss, LaMichael James might be The Difference for the San Francisco 49ers

http://www.mercurynews.com/monte-poole/ci_22308503/poole

Chargers lose Rich Bisaccia to Auburn

http://www.utsandiego.com/news/2013/jan/03/chargers-lose-rich-bisaccia-auburn/

[headlines]

--------------------------------------------------------------

American Football Poem

“Every Good Boy Does Fine”

I practiced my cornet in a cold garage

Where I could blast it till the oil in drums

Boomed back; tossed free throws till I couldn't move my thumbs;

Sprinted through tires, tackling a headless dummy.

In my first contest, playing a wobbly solo,

I blew up in the coda, alone on stage,

And twisting like my hand-tied necktie, saw the judge

Letting my silence dwindle down his scale.

At my first basketball game, gangling away from home

A hundred miles by bus to a dressing room,

Under the showering voice of the coach, I stood in a towel,

Having forgotten shoes, socks, uniform.

In my first football game, the first play under the lights

I intercepted a pass. For seventy yards, I ran

Through music and squeals, surging, lifting my cleats,

Only to be brought down by the safety man.

I took my second chances with less care, but in dreams

I saw the bald judge slumped in the front row,

The coach and team at the doorway, the safety man

Galloping loud at my heels. They watch me now.

You who have always homed your way through passages,

Sat safe on the bench while some came naked to court,

Slipped out of arms to win in the long run,

Consider this poem a failure, sprawling flat on a page

David Wagoner's “Traveling Light :From Collected Poems, 1956-1976

When my kids were growing up, I only had a few rules about participating in different activities: if you started something you had to finish it; if you played you had to do your best; and, you could always quit at the end of the season if you wanted to, it was your choice, not mine. As a result, they both seem to have grown up more confident than I ever was and are both willing to risk many things I never would.

All of us are probably haunted by our failures, but the real failures are those who are afraid to take the chances to do what they really want to do. There's no reason to play football, or participate in one particular activity, but it's a mistake not to play football or participate in a play simply because you're afraid you will fail. Failure is less destructive than not giving life a chance.

Needless to say, I don't consider this poem a failure.

loren

[headlines]

--------------------------------------------------------------

![]()

California Nuts Briefs---

S.F. Bay Area rents, home prices up sharply

http://www.sfgate.com/realestate/article/Bay-Area-rents-home-prices-up-sharply-4163037.php

Rains' promise seen in deep Sierra snow pack

http://www.mercurynews.com/science/ci_22300614/rains-promise-seen-deep-sierra-snow-pack

[headlines]

--------------------------------------------------------------

![]()

“Gimme that Wine”

http://www.youtube.com/watch?v=EJnQoi8DSE8

Top Wine Videos of 2012

http://www.winespectator.com/webfeature/show/id/47830

The weird and wacky year in wine and spirits

http://mainlinemedianews.com/articles/2013/01/02/

The German Roots of California Wine

http://www.dw.de/the-german-roots-of-california-wine/a-16491114

The biggest wine stories in 2012

http://napavalleyregister.com/lifestyles/food-and-cooking/wine/columnists/paul-franson/the-biggest-wine-stories-in/article_aa50769e-508e-11e2-b1f5-0019bb2963f4.html

Top stories of 2012: Happier times for wine

http://www.northbaybusinessjournal.com/66572/top-stories-of-2012/

Free Mobile Wine Program

http://leasingnews.org/archives/Feb2010/2_26.htm#mobile

Wine Prices by vintage

http://www.winezap.com

http://www.wine-searcher.com/

US/International Wine Events

http://www.localwineevents.com/

Winery Atlas

http://www.carterhouse.com/atlas/\

Leasing News Wine & Spirits Page

http://two.leasingnews.org/Recommendations/wnensprts.htm

[headlines]

----------------------------------------------------------------

![]()

This Day in History

1838- Charles Sherwood Stratton, known as “ Tom Thumb, “ perhaps the most famous midget in history, was born at Bridgeport, CT. He eventually reached a height of three feet, four inches and a weight of 70 pounds. Discovered by P.T. Barnum in 1842, Stratton, as “General Tom Thumb,” became an internationally known entertainer and performed before Queen Victoria and other heads of state. On Feb 10, 1863, he married another midget, Lavinia Warren. Stratton died at Middleborough, MA, July 15, 1883.

1847 - Samuel Colt rescues the future of his faltering gun company by winning a contract to provide the U.S. government with 1,000 of his .44 caliber revolvers. Before Colt began mass-producing his popular revolvers in 1847, handguns had not played a significant role in the history of either the American West or the nation as a whole. With the help of Eli Whitney and other inventors, Colt developed a system of mass production and interchangeable parts for his pistols that greatly lowered their cost. Though never cheap, by the early 1850s, Colt revolvers were inexpensive enough to be a favorite with Americans headed westward during the California Gold Rush. Between 1850 and 1860, Colt sold 170,000 of his "pocket" revolvers and 98,000 "belt" revolvers, mostly to civilians looking for a powerful and effective means of self-defense in the Wild West.

1856--New post office law made required that all letters shall bear postage stamps.

1863 - Union General Henry Halleck, by direction of President Abraham Lincoln, orders General Ulysses Grant to revoke his infamous General Order No. 11 that expelled Jews from his operational area.

1869- the fist School for blind African-American students was the state School for the Blind and the Deaf, opened in Raleigh, NC, with 26 pupils.

1893- President Benjamin Harrison issued a proclamation granting full amnesty and pardon to all persons who had since November 1, 1890, abstained from unlawful cohabitation of a polygamous marriage. This was intended in the main for a specific group of elderly Mormons who had continued in the practice of contracting serial marriages. Amnesty was based on the condition that those pardoned must obey the law in the future or be " vigorously prosecuted." The practice of polygamy as a factor interfering with attainment of statehood for Utah.

1888 - Sacramento, CA, received 3.5 inches of snow, an all-time record for that location. The heaviest snow in recent history was two inches on February 5th in 1976.

1896 - Six years after Wilford Woodruff, president of the Mormon church, issued his Manifesto reforming political, religious, and economic life in Utah, the territory is admitted into the Union as the 45th state. In 1823, Vermont-born Joseph Smith claimed that an angel named Moroni visited him and told him about an ancient Hebrew text that had lost been lost for 1,500 years. The holy text, supposedly engraved on gold plates by a Native-American historian in the fourth century, related the story of Jewish peoples who had lived in America in ancient times. Over the next six years, Smith dictated an English translation of this text to his wife and other scribes, and in 1830, The Book of Mormon was published. In the same year, Smith founded the Church of Christ, later known as the Church of Jesus Christ of Latter-day Saints, in Fayette, New York. The religion rapidly gained converts and Smith set up Mormon communities in Ohio, Missouri, and Illinois. However, the Christian sect was also heavily criticized for its unorthodox practices and on June 27, 1844, Smith and his brother were murdered in a jail cell by an anti-Mormon mob in Carthage, Illinois. Two years later, Smith's successor, Brigham Young, led an exodus of persecuted Mormons from Nauvoo, Illinois, along the western wagon trails in search of religious and political freedom. In July 1847, the 148 initial Mormon pioneers reached Utah's Valley of the Great Salt Lake. Upon viewing the valley, Young declared: "This is the place," and the pioneers began preparations for the tens of thousands of Mormon migrants who would follow. In 1850, President Millard Fillmore named Young the first governor of the territory of Utah, and the territory enjoyed relative autonomy for several years. Relations became strained, however, when reports reached Washington that Mormon leaders were disregarding federal law and had publicly sanctioned the practice of polygamy. In 1857, President James Buchanan removed Young, a polygamist with over 20 wives, from his position as governor, and sent U.S. army troops to Utah to establish federal authority. Tensions between the territory of Utah and the federal government continued until Wilford Woodruff, the president of the Mormon church, issued his Manifesto in 1890, renouncing the traditional practice of polygamy, and reducing the domination of the church over Utah communities. Six years later, the territory of Utah was granted statehood.

1914- Jane Wyman, American actor won the Academy Award for her work in Johnny Belinda (1948) and was nominated three other times. Ronald Reagan, her divorced second husband, the father of her only daughter Maureen went on to become president of the United States. With a reputation as a goody-goody in films, Wyman shocked everyone in the 1940 film “You're in the Army Now!” with a kiss that lasted 185 seconds, the longest kiss ever filmed.

1915- Moses Alexander of Idaho, a Democrat, became the first governor in the United States who was Jewish. he served from January 4, 1915 to January 6, 1919.

1916- guitarist Sam Gaillard, Detroit, MI.

1922 –Jazz tenor and flute player Frank Wess birthdayhttp://www.npr.org/programs/btaylor/pastprograms/fwess.html

1926- "Billboard" Magazine published the first list of best-selling pop records, covering the week that ending 1935. On the list were recordings by the orchestras of Tommy Dorsey and Ozzie Nelson.

1930- Don Shula pro football Hall of Fame couch and former player born Painesville, Ohio,

1935- heavyweight champion Floyd Patterson born Lincointon, GA.

1936- Billboard magazine published the first list of best-selling pop records, covering the week that ended December 30, 1935. On the list were recordings by the Tommy Dorsey and the Ozzie Nelson Orchestras.

1942- British jazz-rock guitarist John McLaughlin was born. He first gained recognition for his work on Miles Davis's "Bitches' Brew" album, and later formed the Mahavishnu Orchestra. This group did much in the 1970's to promote the idea of fusing jazz and rock music.

1944- San Francisco Giants' Tito Fuentes born Havana, Cuba.

1945--JACHMAN, ISADORE S. Medal of Honor

Rank and organization: Staff Sergeant, U.S. Army, Company B, 513th Parachute Infantry Regiment. Place and date: Flamierge, Belgium, 4 January 1945. Entered service at: Baltimore, Md. Birth: Berlin, Germany. G.O. No.: 25, 9 June 1950. Citation: For conspicuous gallantry and intrepidity above and beyond the call of duty at Flamierge, Belgium, on 4 January 1945, when his company was pinned down by enemy artillery, mortar, and small arms fire, 2 hostile tanks attacked the unit, inflicting heavy. casualties. S/Sgt. Jachman, seeing the desperate plight of his comrades, left his place of cover and with total disregard for his own safety dashed across open ground through a hail of fire and seizing a bazooka from a fallen comrade advanced on the tanks, which concentrated their fire on him. Firing the weapon alone, he damaged one and forced both to retire. S/Sgt. Jachman's heroic action, in which he suffered fatal wounds, disrupted the entire enemy attack, reflecting the highest credit upon himself and the parachute infantry.

1948---Top Hits

Ballerina - Vaughn Monroe

How Soon - Jack Owens

Serenade of the Bells - The Sammy Kaye Orchestra (vocal: Don Cornell)

I’ll Hold You in My Heart (Till I Can Hold You in My Arms - Eddy Arnold

1954-- A young truck driver named Elvis Presley enters the Memphis Recording Service in Memphis, TN, ostensibly to record a song for his mother's birthday (which was, in reality, many months away). He records "Casual Love Affair" and "I’ll Never Stand in Your Way." It was this recording that would lead MRS head Sam Phillips to call Presley back to record for his Sun Records label.

1957-- On NBC's The Steve Allen Show, former heavyweight boxing champ Joe Louis introduces the world to singer Solomon Burke, who performs Louis' song "You Can Run, But You Can't Hide."

1956---Top Hits

Memories are Made of This - Dean Martin

The Great Pretender - The Platters

Band of Gold - Don Cherry

Sixteen Tons - Tennessee Ernie Ford

1957-- Elvis Presley reports for his pre-induction Army physical in Memphis

1959- “ College Bowl” premiered on TV. Originally, a quiz show on CBS. Two colleges sent a team of their best and brightest to the academic competition. “College Bowl” was sponsored by General Electric and hosted by Allen Ludden (1959—62) and Robert Earle (1962—70). More recent incarnations of ”College Bowl” have appeared on NBC and Disney with Pat Sajak and Dick Cavett as hosts.

1960-- Marty Robbins' "El Paso" hits #1

1961--After leaping from #100 to #50 last week, Mark Dinning's "Teen Angel" enters the Top 40 of the Billboard Pop chart. The teenage tragedy song will reach the top less than five weeks later.

1964---Top Hits

There! I’ve Said It Again - Bobby Vinton

Louie Louie - The Kingsmen

Forget Him - Bobby Rydell

Love’s Gonna Live Here - Buck Owen

1964--Bobby Vinton's "There! I've Said It Again" becomes the last US number one record before the so called British Invasion. Between Bill Haley's "Rock Around The Clock" in July, 1955 and Vinton's hit, only five non-American artists could manage a US chart topper. All that was about to change

1965- Leo Fender sells Fender Guitars to CBS for $13 million.

1970- the Minnesota Vikings became the first expansion team to win the NFL title when they defeated the Cleveland Browns 27-7 in Minneapolis. The Vikings went on to lose Super Bowl IV to the Kansas City Chiefs.

1970- the Kansas City Chiefs, aided by four interceptions, defeated the Oakland Raiders 17-7, in the last American Football League Championship game. The Chiefs went on to defeat the Minnesota Vikings in Superbowl IV.

1971- Gerald Garrison Hearst, great 49er, number 20, born Lincolnton, Ga.

1971 - A blizzard raged from Kansas to Wisconsin, claiming 27 lives in Iowa. Winds reached 50 mph, and the storm produced up to 20 inches of snow.

1972---Top Hits

Brand New Key - Melanie

American Pie - Don McLean

An Old Fashioned Love Song - Three Dog Night

Kiss an Angel Good Mornin’ - Charley Pride

1974- in a NHL game between the Boston Bruins and the Minnesota North Stars, Burins winger Dave Forbes punched Henry Boucha, fracturing his cheekbone and opening a cut that required 30 stitches to close Forbes was later indicted for using “ excessive force,” becoming the first professional athlete to be prosecuted for actions taken during a game. his trial that summer ended in a hung jury after which all charges were dropped.

1974 - President Richard Nixon refuses to hand over tape recordings and documents that had been subpoenaed by the Senate Watergate Committee. Marking the beginning of the end of his Presidency, Nixon would resign from office in disgrace eight months later.

1975-- Phoebe Snow's "Poetry Man" enters the pop charts

1975-- Elton John's "Lucy in the Sky with Diamonds" hits #1

1980---Top Hits

Escape (The Pina Colada Song) - Rupert Holmes

Please Don’t Go - K.C. & The Sunshine Band

Send One Your Love - Stevie Wonder

Happy Birthday Darlin’ - Conway Twitty

1982 - Milwaukee, WI, was shut down completely as a storm buried the city under 16 inches of snow in 24 hours. It was the worst storm in thirty-five years.

1984, " Night Court" premiered on television. The original cast included Harry Anderson as Judge Harry T. Stone, John Larroquette as prosecutor Dan Fielding, Richard M0II as court officer Bull Shannon and Selma Diamond as court officer Selma Hacker. Karen Austin as clerk Lana Wagner and Paula Kelly as public defender Liz Williams were gone after one season, Ellen Foley then became PD Billie Young but was replaced by Markie Post in 1985 as PD Christine Sullivan. Charles Robinson joined the cast as clerk Mac Robinson in 1985. Diamond died in 1985 and Florence Halop, who then appeared as court officer Florence Kleiner, died in 1986. Marsha Warfield was then brought aboard as Court Officer Roz Russell. Mel Tormé made a few appearances as himself, Harry’s idol. The last telecast was July 1, 1992.

1974- President Richard Nixon rejected the Senate Watergate Committee’s subpoenas seeking White House tapes and documents.

1984-- the last Van Halen album with David Lee Roth as lead singer, "1984," was released. Sammy Hagar was Roth's replacement.

1985- to honor team president and former coach Arnold “ Red” Auerbach, the Boston Celtics retired uniform number 2 in a ceremony prior to a game against the New York Knicks. Auerbach begin coaching the Celtics in 1950-51 and led them to `6 NBA championships as coach, general manager and president.

1985 — The Cowboys play their record 36th postseason game, but Eric Dickerson steals the show, rushing for a playoff-record 248 yards and two touchdowns to lead the Los Angeles Rams to a 20-0 victory over Dallas.

1987 - A storm moving off the Pacific Ocean spread wintery weather across the southwestern U.S., with heavy snow extending from southern California to western Wyoming. Up to 15 inches of snow blanketed the mountains of southern California, and rainfall totals in California ranged up to 2.20 inches in the Chino area.

1988 - Frigid arctic air invading the central and eastern U.S. left Florida about the only safe refuge from the cold and snow. A storm in the western U.S. soaked Bodega Bay in central California with 3.12 inches of rain.

1988---Top Hits

Faith - George Michael

So Emotional - Whitney Houston

Got My Mind Set on You - George Harrison

Somewhere Tonight - Highway 101

1989 - Up to a foot of snow blanketed the mountains of West Virginia, and strong winds in the northeastern U.S. produced wind chill readings as cold as 60 degrees below zero in Maine. Mount Washington NH reported wind gusts to 136 mph along with a temperature of 30 below zero!

1990 - A winter storm moving out of the southwestern U.S. spread heavy snow across Nebraska and Iowa into Wisconsin. Snowfall totals in Nebraska ranged up to 7 inches at Auburn and Tecumseh. Totals in Iowa ranged up to 11 inches at Carlisle. In Iowa, most of the snow fell between midnight and 4 AM.

1990-- Feminists' long-sought for family leave program became a reality in New Jersey when Governor Jim Florio signed a bill that requires employers to give their employees up to 12 weeks off to care for a newborn or adopted child, or for an ill or injured immediate family member. The leave is unpaid, but health insurance and other benefits stay in effect and the furloughed workers would be guaranteed their old job or its equivalent. President Bill Clinton would get the same basic bill passed by the U.S. Congress three years later. Women who usually act as the family caretakers in time of sickness are the workers with the most need for these laws.

1994 - A major winter storm blanketed much of the northeastern U.S. with heavy snow. More than two feet was reported in northwestern Pennsylvania, with 33 inches at Waynesburg. There were ten heart attacks, and 185 injuries, related to the heavy snow in northwest Pennsylvania. Whiteout conditions were reported in Vermont and northeastern New York State. A wind gusts to 75 mph was clocked at Shaftsbury VT. In the Adirondacks of eastern New York State, the town of Tupper reported five inches of snow between 1 PM and 2 PM

1995 - Rep. Newt Gingrich (R-GA) was formally elected Speaker of the U.S. House of Representatives. He was the first Republican to hold the post in 40 years and the first Georgia Speaker in over 100 years.

1999 - Minnesota inaugurated pro wrestler Jesse Ventura as its 38th governor. The only Reform Party candidate to ever win statewide office, Ventura had shocked the political establishment by defeating Attorney General Hubert H. (Skip) Humphrey III and St. Paul Mayor Norm Coleman in an upset victory.

2000 - The Nasdaq composite index was hit for its worst point loss, falling more than 229 points (5.6 percent) to 3,901. The market appeared to be concerned about future Fed rate hikes. The Dow Jones Industrial Average plunged 359 points (3.2 percent) to 10,997.

-------------------------------------------------------------

SuDoku

The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler?

http://leasingnews.org/Soduku/soduko-main.htm

--------------------------------------------------------------

Daily Puzzle

How to play:

http://www.setgame.com/set/puzzle_frame.htm

Refresh for current date:

http://www.setgame.com/set/puzzle_frame.htm

--------------------------------------------------------------

http://www.gasbuddy.com/

http://www.gasbuddy.com/GB_Map_Gas_Prices.aspx

http://www.gasbuddy.com/GB_Mobile_Instructions.aspx

--------------------------------------------------------------

Weather

See USA map, click to specific area, no commercials

--------------------------------------------------------------

Traffic Live---

Real Time Traffic Information

You can save up to 20 different routes and check them out with one click,

or type in a new route to learn the traffic live

--------------------------------