![]() Add me to mailing list |

Add me to mailing list | ![]() Change email |

Change email | ![]() |

| ![]() Search

Search

Advertising | All Lists | Archives | Classified Ads | This Day In American History

Leasing News is a web site that posts information, news, and

entertainment for the commercial alternate financing,

bank, finance and leasing industry

kitmenkin@leasingnews.org

![]()

Monday, January 19, 2016

Today's Equipment Leasing Headlines

Position Wanted –Credit

Work Remotely or Relocate for Right Opportunity

Top Stories January 8 – January 15th

(Opened Most by Readers)

ACC Capital's Residual Claim in Alabama Thrown

Out of Court for Bait and Switch

by Tom McCurnin, Leasing News Legal Editor

Leasing Industry Ads---Help Wanted

Plus Help Wanted Ad Policy

“How Do I Handle an Applicant Tracking System?”

Career Crossroad---By Emily Fitzpatrick/RII

Approaching Funding Sources

Leasing 102 by Mr. Terry Winders, CLFP

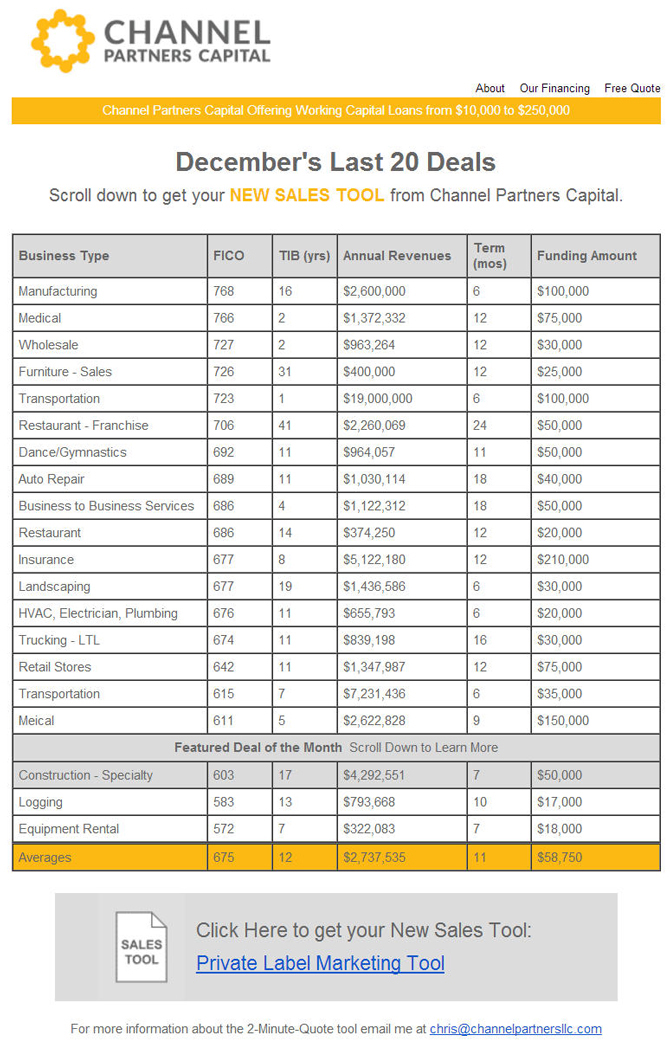

Channel Partners--December's Last 20 Deals

FICO/TIB/Annual Revenues/Term/Funding Amount

Saluting Leasing News Advisor

Ben Carlile

2017 Ford Torino GT

Muscle Car to be Back on the Road

Bankruptcies Sink to Lowest Point Since 2006

But Commercial Chapter 11 Fillings Increased 2%

United States Loan/Lease Regulations

Updated

Labrador Retriever Mix

Birmingham, Alabama Adopt-a-Dog

Leasing News Display Advertising

Rates and Terms

News Briefs---

Tiny bank, huge ROE: WebBank’s Fintech hidden recipe

FDIC Insured - 59% ROE and a very low risk classification

E-Smart Owes $21 Million for Defrauding Investors

Identify-Verification was "pie in the sky"

It's official! Wells Fargo passes Citi

as 3rd largest bank

IASB to Bring All Leases onto Corporate Balance Sheets

IFRS 16 will be effective from January 1, 2019

Broker/Funder/Industry Lists | Features (writer's columns)

Top Ten Stories Chosen by Readers | Top Stories last six months

www.leasingcomplaints.com (Be Careful of Doing Business)

www.evergreenleasingnews.org

Leasing News Icon for Android Mobile Device

You May have Missed---

SparkPeople--Live Healthier and Longer

Poem

Sports Briefs---

California Nuts Brief---

"Gimme that Wine"

This Day in American History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

######## surrounding the article denotes it is a “press release” and was not written by Leasing News nor information verified, but from the source noted. When an article is signed by the writer, it is considered a “by line.” It reflects the opinion and research of the writer.

Leasing News was designed for mobile devices to be read in

Portrait Style, with the ability to expand to create a larger font.

[headlines]

--------------------------------------------------------------

Position Wanted –Credit

Work Remotely or Relocate for Right Opportunity

Each Week Leasing News is pleased, as a service to its readership, to offer completely free ads placed by candidates for jobs in the industry. These ads also can be accessed directly on the website at:

http://www.leasingnews.org/Classified/Jwanted/Jwanted.htm

Each ad is limited to (100) words and ads repeat for up to 6 months unless the candidate tells us to stop. Your submissions should be received here by the end of each week.

Please encourage friends and colleagues to take advantage of this service, including recent graduates and others interested in leasing and related careers.

Will relocate for the right opportunity and can work remotely. I have (25+) years in making credit decisions, as well as helping sales team and third party originators close more transactions via understanding their applicant's financial abilities. I can create alternative or additional opportunities (and income) by knowing which type of loan is best for the borrower |

Chicago, Illinois |

| Orlando, Florida As a Commercial Credit Analyst/Underwriter, I have evaluated transactions from sole proprietorships to listed companies, across a broad spectrum of industries, embracing a multitude of asset types. Sound understanding of balance sheet, income statement and cash flow dynamics which impact credit decisions. Strong appreciation for credit/asset risk. rpsteiner21@aol.com 407 430-3917 |

|

[headlines]

--------------------------------------------------------------

Top Stories January 8 – January 15th

(Opened Most by Readers)

(1) Correction:

Curt Ritter No Longer at CIT Group

http://leasingnews.org/archives/Jan2016/01_13.htm#correction

(2)IKEA Job Interview

Cartoon

http://leasingnews.org/archives/Jan2016/01_13.htm#cartoon

(3) Dash Menkin, Riverine Duty

Same Duties as Crew who Stumbled into Iran Waters

http://leasingnews.org/archives/Jan2016/01_15.htm#dash

(4) New Hires---Promotions in the Leasing Business

and Related Industries

http://leasingnews.org/archives/Jan2016/01_15.htm#hires

(5) Ascentium Capital Achieves 56% Increase Funded Volume

CEO Names Technology Infrastructure Breakthrough & Personnel

http://leasingnews.org/archives/Jan2016/01_13.htm#achieves

(6) Another Credit Card Processing Lessor Loses Cases

in Forum Selection Clause Battle

By Tom McCurnin, Leasing News Legal Editor

http://leasingnews.org/archives/Jan2016/01_15.htm#another

(Tie)(7) 5 Reasons New Lenders Are Ignoring FICO Credit Scores

http://www.forbes.com/sites/nickclements/2015/04/21/5-reasons-new-lenders-are-ignoring-fico-credit-scores/

(Tie) (7) Banks/Funders Pony Up Another $2.5 Million Plus

in Sheldon Player’ EAR Settlements

by Tom McCurnin, Leasing News Legal Editor

http://leasingnews.org/archives/Jan2016/01_13.htm#pony

(9) New FinTech Lenders Ignore Consumer Credit Ratings

"We Don't Trust FICO Scores"

http://www.wsj.com/articles/silicon-valley-gives-fico-low-score-1452556468

(10) Car dealer moves too fast, must remove 600 vehicles;

Off Lease Only

http://www.sun-sentinel.com/local/broward/fl-north-lauderdale-car-lease-20160107-story.html

(11) Growth of Financial Technology Hitting Leasing

U.S. Financial Hiring Down in Fourth Quarter

http://leasingnews.org/archives/Jan2016/01_11.htm#growth

|

(Leasing News provides this ad as a trade for investigative

reporting provided by John Kenny)

[headlines]

--------------------------------------------------------------

ACC Capital's Residual Claim in Alabama Thrown

Out of Court for Bait and Switch

by Tom McCurnin

Leasing News Legal Editor

Lessee Signs Proposal for $1 Out Lease, But Lease Came Back as

True Lease, Court Determines Restaurant Equipment Has No Value, and Throws Out Lessor’s Complaint For Damages. And the Lessee wins!!!

ACC Capital v Weston Ale House Alabama Case No. 63-CV-2011-900785 (2015) Lessor’s counsel was Justin Little Reynolds, Reynolds & Little of Tuscaloosa, AL. Lessee’s counsel was Jonathan Waller of Birmingham, AL.

I’m a big city litigation lawyer, and sometimes find myself litigating in small towns. In today’s case, a sophisticated equipment lessor might have been too smart for its own good, doing a bait and switch, then litigating the issue in a small town in Alabama, instead of its home state of Utah. This did not end well for the lessor. The facts follow.

Weston Ale House desired to acquire some restaurant equipment and fixtures for a start-up restaurant. Yikes! That fact alone would make me want to run away from this deal. In any event, Weston contracted with a lease broker who negotiated a pretty good deal for the equipment, with a dollar out lease. ACC Capital submitted a written proposal with a dollar out and the lessee signed it, albeit with some minor modifications. ACC Capital’s salesperson, a Chad Reese, received the signed proposal and verbally indicated its acceptance by ACC. So far, so good.

But when ACC Capital sent out the lease in October, 2004 it was not a dollar out deal, but instead was a FMV lease. Oddly enough, the pricing for the $1 out deal and the FMV deal were the same, which to me, evidenced a bait and switch. More on this later. Notwithstanding the fact that the lessor was located in Utah, the lease curiously had a consent to jurisdiction clause for Alabama. None of the parties had any connection to Alabama.

Weston Ale House and the guarantors didn’t bother to read the lease, but signed it, assuming it was a dollar out deal. ACC held onto the lease for a few months, and assigned it to Regions Bank in 2005. Apparently, the lease ran its full term, and the residual, if any was returned to ACC in 2011. Both Regions Bank and ACC internally booked the lease as a dollar out.

ACC sued Weston for a determination of the FMV amount and about $300,000 of interim rent following termination. Yikes again! That is a lot of money on a residual which is essentially frosting on the cake when it was proposed as a dollar out.

ACC contended the lease was an FMV lease and sued for damages, $300,000 in post maturity interim rent. The lessee denied the charges and counter-claimed for fraud, claiming a bait and switch.

The case went to trial.

Shockingly, the trial court entertained evidence as to the fair market value of restaurant fixtures to establish that notwithstanding the FMV status, the lease was really a conditional sale. Surprisingly, the lessor did not put on any evidence of the equipment value, and instead called a legal expert to tell the judge the law, which is usually not a good move. The lessee’s expert testified that the equipment had no meaningful value at the end of the lease term.

The court concluded that under UCC § 1-203, if the value of the residual was “nominal” then the lease was a conditional sale, and not a true lease. The court then concluded that the equipment had no value, and was therefore a conditional sale. The court had little options here, since the lessor put no evidence on as to the value of the equipment.

The lessor also missed a good opportunity relative to proving FMV. I’ve been in these situations and argued successfully that the FMV is not the value of the stuff ripped out sitting on a pallet on the sidewalk, but instead is the replacement value of the stuff, discounted to present value. Those arguments were oddly not made by the lessor.

Consequently, the court ruled that the lease was not a true lease, but a conditional sale, because there was no residual value. Because the lease was a conditional sale, the equipment was owned by the lessee at the end of the lease, there was no post maturity rent due, and the lessee owned the equipment. In essence, although styled as a true lease, the court’s determination of value (without the lessor’s valuation evidence) turned an FMV lease into a conditional sale.

So the lessee won and the lessor lost. Doesn’t happen that often, but a win

for the lessee’s attorney, Jonathan Waller.

Insofar as the lessee’s counter-claim for fraud, the court quickly dismissed that claim because the lessee admitted he never read the lease. Well, it’s hard to rely upon a false representation if you don’t know it exists. Anyway, the parties to a contract are under a legal duty to read the terms and cannot later be heard to say that they didn’t understand the contract, if they’ve not read it. Lessor won, lessee lost on this issue.

The final result was the whole case being thrown out, the lessor’s claims and the lessee’s claims. Apparently, the lease had an attorney fee provision, but a one-way term, granting the right to attorney fees only to the lessor.

Apparently that type of clause is both common and enforceable in Alabama, so although the lessee won, it could not recover its attorney fees.

What are the takeaways here?

• First, the bait and switch lease contract has been all too common of a business practice by some leasing companies. Here with the lessor’s own salesman apparently stating that the terms were acceptable, the lessee had no trouble proving the bait and switch. What was damning was that the $1 out lease term and the FMV lease were identical in terms of payment terms and the lease was booked internally as a buck out, which to me was clear evidence of a bait and switch.

• Second, for equipment lessors. I certainly understand relying on documents, but bad facts make bad law, and finding yourself litigating, what I considered to be a sharp business practice, in Tuscaloosa, Alabama may not be the smartest move, especially when you’re demanding $300,000. I was shocked this went to trial and that the lawyers went all over the country taking depositions and hiring experts. If the lessor is faced with this issue, it might be a smart move to threaten something like this, but quickly settle, unless you have more money than brains.

• Third, the lease had a consent to jurisdiction clause for Alabama, not a mandatory forum selection clause. For lessors, it is usually a smart move to sue in your own state. I was puzzled why the suit was not filed in Utah.

• Fourth, for lessors, when faced with an FMV lease, the lessor should be prepared to put up valuation evidence of both the value removed and the replacement value. Neither type of evidence was proffered to the trial judge, so he only had one choice in assessing the value.

The bottom line to this case is that the Court was obviously fairly angered by the actions of ACC Capital Corporation and took it upon himself to make things right. This case should not have been filed, or having been filed, should have settled.

This is what happens when you do a bait and switch and try to run this past a small town Alabama judge.

Tom McCurnin is a partner at Barton, Klugman & Oetting

in Los Angeles, California.

Tom McCurnin

Barton, Klugman & Oetting

350 South Grand Ave.

Suite 2200

Los Angeles, CA 90071

Direct Phone: (213) 617-6129

Cell (213) 268-8291

Email: tmccurnin@bkolaw.com

Visit our web site at www.bkolaw.com

Previous Tom McCurnin Articles:

http://www.leasingnews.org

Previous Tom McCurnin Articles:

http://www.leasingnews.org/Conscious-Top%20Stories/leasing_cases.html

[headlines]

--------------------------------------------------------------

Leasing Industry Ads---Help Wanted

This Way Up/Credit Analyst

Credit Analyst www.finpac.com |

Help Wanted Ad Policy

Leasing News puts a "help wanted" on top of the "masthead" so it is the first thing that a reader sees when they open the news edition or go to the website. The ad is changed in each news edition. It is designed to be a "display ad," not a "classified ad." In addition to the masthead position, the "help wanted" ad also appears in the "news briefs" section, the second most-read section, and it is rotated in each news edition. It is not hidden. It is clearly visible. The full section of "help wanted ads” also appears in each news edition, in each edition, as well as appears on the web site. It also is not “hidden.” The idea of the ad is to draw attention, and have the reader interested in what the company offers from the advertisement rather than a "job description." Most ads then direct the reader to their website for a full job description, if interested, or to a separate flyer. The main idea is to get the reader to make an inquiry. Cost Logo on top is free, as well as the web address and information about the address at the bottom. Lines are $595 for the first four and $40 for each additional line or space. The ad will appear for 21 days. For returning advertisers during the year, Leasing News offers 30 days and a reduced rate. Note: most ads point to a full job description as well as click to an email address. Leasing News reserves the right to refuse advertising, |

[headlines]

--------------------------------------------------------------

“How Do I Handle an Applicant Tracking System?”

Career Crossroad---By Emily Fitzpatrick/RII

Q: I have heard of “Applicant Tracking Systems.” Is it becoming more common? What should I know?

A: Typically reserved for larger organizations, Applicant Tracking Systems (ATS) are being utilized more and more by all types of organizations as technology gets better and better. An ATS is an easier way for an employer/HR Department to keep track of potential Candidates and allows information to be accessible throughout the organization.

You will encounter these systems (typically) when you upload your resume to a website or job board. As such, it is imperative that your resume is in a format that will be “recognized” by any/all ATS systems OR be prepared to have it discarded and never seen by decision makers.

Advise for the Candidate Working with Applicant Tracking Systems

- When applying for a specific position, include that job title on the resume

- Use the descriptors “phone:” and “email:” in front of the phone number and email address so the ATS can identify this information

- When listing dates for employment or education, put the dates to the right of the information or on a separate line

- Include section headers to make it easy for the applicant tracking system to categorize the information

- Be mindful of special characters and accents you use on your resume

- Do not list your credentials (MBA, CPA, etc.) next to your name; include that information on a separate line

Checklist for your Resume …

- … is saved in an approved format - DOC, DOCX, or TXT (PDF, RTF, and JPG formats are not ATS-friendly)

- … does not use templates, borders, or shading

- … is in a single column format (no tables, multiple columns, or text boxes)

- … uses simply formatted text of a reasonable size (10 point size or above)

- … includes standard fonts (Arial, Georgia, Tahoma, and Verdana are all “safe” choices)

More than one-fourth of all companies use some kind of an applicant tracking system to manage applications and candidates, and this number continues to grow. When in doubt, submit an ATS-friendly resume AND you can email a formatted (non-ATS-friendly) resume or bring the formatted version with you to the interview.

For more Free Tips, contact us

Emily Fitzpatrick

Sr. Recruiter

Recruiters International, Inc.

Phone: 954-885-9241

Cell: 954-612-0567

emily@riirecruit.com

Invite me to Connect on LinkedIn

www.linkedin.com/pub/emily-fitzpatrick/4/671/76

Also follow us on Twitter #RIIINFO

Career Crossroads Previous Columns

http://www.leasingnews.org/Conscious-Top%20Stories/crossroad.html

[headlines]

--------------------------------------------------------------

Approaching Funding Sources

Leasing 102 by Mr. Terry Winders, CLFP

There is a growing demand for Alternate Financing. Most of the transactions have been turned down by banks or can't go to banks, therefore are subject to higher interest rates. The crowdfunding financing is becoming more popular, but eventually their borrowers begin to not be happy about the higher interest rates or find themselves unhappy with collectors, winding up like mortgage deals, their loan being sold and re-sold to others who collect the payments.

Don’t be fooled by “internet claims,” sales work best as a “relationship business,” especially if you want repeat business or to hang on to your vendor.

I recommend developing your own by contacting a local community bank in the neighborhood of the lessee and teaching them how you can be a marketing force for them and then sell them the payment stream. However there is a correct procedure to prepare you prior to contacting an established funding source. If you have the information they want it will speed up the process and make you look professional.

Regardless of the type of funding source, they will want to know a lot about you. I suggest you prepare a resume on yourself to present to them containing your years in business, employment history, knowledge of leasing and discounting, (a CLFP helps nicely here), your average size deal and the different industries you are working in. They may request your financial statement and want to review your credit prior to engaging in any transactions with you. Have all this done so you can send it to them with no delay. In fact, you should contact different funding sources in advance of sending them business because their individual likes and dislikes will help guide you to the best source when you have a transaction to fund.

Regardless of the type of funding source, many have been burnt on one transaction or another and management will delay or reject anything that reminds them of that type of business. Also, you need to request a series of answers to questions about their operation to determine what they are looking to accept. Make out a list of questions and then tell the funding source the answers will help you to direct the correct type and style of business to them. On occasion, some funding groups are looking to a consistent flow of business so be sure to ask if they would take only an occasional deal.

It is best to have several, but not many, as you not only get to know the funding source better, they also get to know you and trust your submissions more over time.

Questions to ask beyond the most common are:

1) Average size deal. If your deal is too small or too large, do not expect a quick turnaround?

2) Equipment they will not fund. Most funders hate certain types of deals.

3) Credit requirements... Do they need financials, tax returns, personal guarantees, or company histories? Sometimes the rate of the funding is tied to the quality of the package you present so always "over" provide this type of information.

4) Territorial restrictions? What states will they buy deals in because many institutions are only licensed in a few States.

5) Do you accept our documentation? Some prefer to use only their own documents but may accept yours if you send them a copy for legal review.

6) Do they need collection support? If you help in troubled deals they are more apt to do business with you.

7) Will they take security deposits, advanced rent, or personal guarantees to shore up the lack of a down payment? Are they collateral lenders or balance sheet lenders?

8) Average turnaround time... Do not be persistent but knowing how long they review a deal will help you decide what to tell your lessee. Remember the time it takes is in direct contrast to the amount of "complete" information you provide.

9) Participation in "end of the lease" options... if you handle the termination can you participate in the additional income?

10) Most important, even if you don’t get a relationship right away, refer client to the bank. You will be doing your client and the bank a favor with the referral. As I wrote, sales should be a “relationship business,” especially to obtain repeat business.

Establishing a good funding source today is perhaps as important as finding good lessees but it is a necessary first step in providing for your future.

Remember to take good care of your sources because they are the lifeblood of a good leasing company.

Also my last tip for this column, you become known for what you attract for customers. Work on better credits, not just “quick, easy subprime deals.”

Previous #102 Columns:

http://www.leasingnews.org/Conscious-Top%20Stories/Leasing_102/Index.htm

|

[headlines]

--------------------------------------------------------------

[headlines]

--------------------------------------------------------------

Leasing News Advisor

Ben Carlile

Ben Carlile

Marin County, California

bencarlile9@gmail.com

Ben is a commercial lending consultant providing expertise in creating operational effectiveness in portfolio management, employee development and credit underwriting.

Ben joined the Leasing News Advisory Board in 2014, bringing his 26 years of management and lease operation experience as well as his desire to provide his insight and expertise toward a good cause. He is a strong ethical leader with an enduring commitment to the success of our industry.

Previously, Ben was Managing Director and President of Allegiant Partners Inc., an independent equipment finance company in San Rafael, CA. He was Chief Credit Officer, Board of Directors member, and shareholder since 2000, involved in strategic planning and pricing, developing access to capital and bank relationships, hiring, training and managing personnel, implementing processes and growing revenues. His skills in underwriting and portfolio management drove the performance of Allegiant’s non-prime and near-prime small business leases and loans to a level comparable to the “A-Grade” portfolios of the best-managed banks.

Prior to Allegiant, Ben spent 11 years as Vice President of Credit Administration for Trinity Capital Corporation, San Francisco, California. At Trinity, he managed strong portfolio growth and performance that led to excellent bank relationships, low cost credit facilities, a lucrative servicing business and a profuse interest in optimizing Trinity’s valuation, which ultimately led to Trinity’s successful acquisition by Bank of the West in 2002.

His earlier experience includes management positions at Bank of America, and CIT. He also served on the Novato Charter School Board (2008-2011), including a term as President. He is a Rosarian and shares an interest in financial innovation and data intensive technologies.

Ben is currently serving his third year as a member of the Equipment Leasing and Finance Association (ELFA) Credit and Collections Committee. He and his wife and sons live in Marin County, CA.

[headlines]

--------------------------------------------------------------

2017 Ford Torino GT

Muscle Car to be Back on the Road

2015 Ford Torino *

Ford production of model called Torino began in 1968. The 1968 Torino had a regular six-cylinder engine of 3.3 liters, the V8 on the other hand was offered in 4.8 and 4.9.

The 2017 Ford Torino GT is anticipated to be released during the late months of 2016 and its price is expected to be about $40,000. Maybe

the model is based on the NASCAR entry.

Get on the list now as this will be among the most demanded muscle cars once it is released to the market.

*2015: Powered by a 5.0 liter V8 Ti-VCT engine from Ford Mustang GT. This engine will be able to produce 435 horsepower, using 93-octane fuel and a torque of 400 lb.-ft.

Inside this Ford’s 2015 muscle car there is be an eight inch LCD screen on the dashboard which will be used to control various functions of the car. The steering wheel has been lowered a bit to enable better handling. The seats of this car are covered with leather and there is ample leg space for the passengers and the driver.

For connectivity purposes this car has a standard USB port on the dashboard and optional GPS and Bluetooth. The Torino GT 2015 is also endowed with various entertainment functions such as powerful speakers. It also has airbags for everyone including a leg airbag for the driver to enhance safety.

1968 Ford Torino GT

[headlines]

--------------------------------------------------------------

Bankruptcies Sink to Lowest Point Since 2006

But Commercial Chapter 11 Fillings Increased 2%

ALEXANDRIA, Va. - It’s been nearly a decade since the industry witnessed this small an amount of bankruptcy filings. But observers noticed economic conditions and other factors that could reverse the trend.

The American Bankruptcy Institute highlighted that bankruptcy filings totaled 819,240 nationwide for the year, representing a 10-percent decrease from the 910,397 total filings during the same period a year ago.

According to data provided by Epiq Systems, the 789,222 total noncommercial filings during 2015 also marked a 10-percent drop from the noncommercial filing total of 875,648 during 2014.

Total commercial filings during 2015 came in at 30,018, a 14 percent drop from the 34,749 filings during the same period a year earlier. Conversely, commercial Chapter 11 filings registered their first year-over-year percentage increase since 2009 as the 5,309 filings during 2015 represented a 2-percent increase over the 5,188 commercial Chapter 11 cases filed the previous year.

“While commercial chapter 11 filings increased slightly last year, total filings fell for the sixth consecutive year and bankruptcies decreased to their lowest number recorded since 2006,” ABI executive director Samuel Gerdano said.

“However, as interest rates increase the cost of borrowing, more debt-burdened consumers and businesses may turn to the financial fresh start of the bankruptcy code in 2016,” Gerdano continued.

ABI mentioned the 53,806 total bankruptcy filings for the month of December represented a 15-percent decrease compared to the 63,202 filings in December of the previous year.

The 51,171 total noncommercial filings for December represented a 16 percent drop from the December 2014 noncommercial filing total of 60,700.

Conversely, total commercial filings for December totaled 2,635, representing a 5 percent increase from the 2,502 filings during the same period in 2014.

The 396 commercial Chapter 11 filings in December registered an 11-percent increase over the 357 filings in December of the previous year.

Average total filings per day in December were 1,736, a 15-percent decrease from the 2,039 total daily filings in the same month of 2014.

The average nationwide per capita bankruptcy filing rate for 2015 decreased to 2.63 (total filings per 1,000 per population) from the 2.93 rate during 2014. States with the highest per capita filing rate (total filings per 1,000 population) through 2015 were:

1. Tennessee (5.73)

2. Alabama (5.36)

3. Georgia (5.02)

4. Illinois (4.34)

5. Utah (4.28)

By SubPrime Auto Finance News Staff

(Leasing News provides this ad as a trade for appraisals and equipment valuations provided by Ed Castagna)

[headlines]

--------------------------------------------------------------

Loan/Lease Regulations --- Update

While there is a conception that equipment leasing is not licensed, it is not quite true. Most states have license requirements, and all have issues on usury, requiring a sales/use tax permit, corporation filing to do business in a state, as well as many states have personal property license requirements from the owner of the equipment.

It is true that there are no state or national associations that regulate the industry as banks and other financial institutions or accountants, attorneys, realtors, to name a few. The closest may be the Certified Leasing Professional Foundation where they are 200 individuals that have passed a test, an annual test, and abide by a set of rules and regulations.

In most states, banks are not required to have a leasing license as well as manufacturers. Banks are generally exempt because they are regulated by the FDIC.

The common thread among licensing statutes is that if the entity which should otherwise have a license, is licensed by another government agency (real estate brokers is one example), then no license is required.

An expert on this who has won cases against company’s not licensed in California, notably CMC Commercial Credit, Tom McCurnin, Barton, Klugman & Oetting, Los Angeles, California told Leasing News: “A property owner can sell his property on credit without a license or without usury issues. Its called the Time Price Doctrine or Time Price Differential.

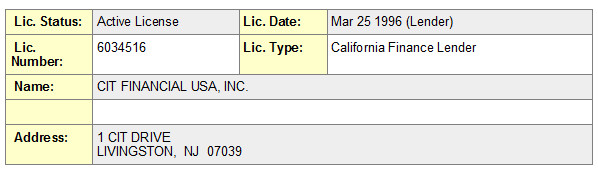

“CIT on the other hand doesn't own the stuff and is therefore making a loan and is required to have a license.

“A gray area might be for the leasing company to buy the stuff and have it shipped to them, and they, in turn re-ships to the customer. May not be required to have a license. Simple invoices and drop shipping probably would not pass muster.”

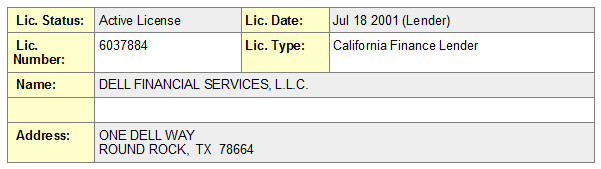

Captive Lessors are required to have a license, and all those that I checked do, such as Dell, who also sells other products than the ones they manufacture.

And while there are financial institutions that also have a bank, such as CIT, they hold a license.

In California, those engaged in true leases, such as Mar Vista, address, do not need to be licensed, but everyone who is involved in “capital leases” with a bargain purchase option, particularly a dollar, are required to be licensed. Without it, they may not accept a commission, engage with a licensed financial institution, and may find their leases in court dismissed for lack of a license. While the fines are not very much, the clout comes in immediate suspension from doing business in California, and while a hearing may be required or filed by an attorney, they may not engage in business during this time.

“NO BROKERAGE COMMISSIONS TO UNLICENSED BROKERS. California Administrative Code Title 10 §1451.”

Commissions may not be paid to unlicensed brokers. There are companies who use other companies’ documents and therefore believe they do not need to be licensed. This may be accurate in dealing with a bank, but not with another licensed financial institution or financial institution out of state that is not licensed in California.

If you are registered by license as a broker, lender, lessor in states that require it, you do not need a city business license (in most states). Cities that require a business license, also require a business license if you work out of your residence. Many cities now are using Schedule C from tax returns, such as in San Jose, California, to catch those without a city license, and they will go back several years as well as a fine, so best to get a license now in case they check your city.

While not all states require a lender's license, many require a license to accept a deposit or advance rental. And remember, a capital lease may be considered a loan as it is with the IRS in many states. If the state requires a license, and your company is not licensed, the transaction may be subject to usury laws.

46 states do not require the lessor to notify the lessee regarding the end of the original term of the lease and can invoke an Evergreen clause, except in these states that do require notification and if not, can void the residual as well as bring on a fine or worse, depending on the number of such transactions and complaints received.

States who require notification:

New York

Rhode Island

Texas

Wisconsin

Illinois

(In Illinois, Consumer law, but may affect commercial, especially a proprietorship, partnership or personal guarantee)

--Christopher Menkin

---Current Regulations

(Any up-dates or additions, please send

to kitmenkin@leasingnews.org)

Arizona: All "advance fee loan brokers" must register annually with the state. Includes "commitment fees." Stiff penalty and on line form for a complaint for the state to investigate. Arizona Revised Statutes, sec. 06-1303-1310 (1996)

Registration process: http://www.azdfi.gov/Licensing/Licensing-FinServ/ALB/ALB.html

Arkansas: All brokers of "a loan of money, a credit card or a line of credit" may not assess or collect an advance fee. In addition, all brokers must register with the Securities Commissioner, post a surety bond of $25.000 and have a net worth of $25,000.

Arkansas Code Annotate sec. 23-39-401 (1995)

California: New Law into effect requires all those doing commercial loans

and capital leases to obtain a California Lender's License (Banks

may be an exception).

http://www.leasingnews.org/Conscious-Top%20Stories/sb197.htm

Florida: Brokers of a "loan of money, a credit card, line of credit or related guarantee, enhancement or collateral of any nature" may not assess or collect an advance fee.

Florida Statues, Chapter 687.14 (1992)

Georgia: A broker of "loans of money, a credit card, a line of credit or related guarantee, enhancement or collateral of any kind or nature" may not assess or collect an advance fee unless such fee is for "actual services necessary to apply for the loan." Official Code of Georgia Annotated, sec. 7- 7-1 (1992)

Idaho: No fee may be collected unless a loan is actually made.

Idaho Code, sec. 26-2501 (1992) Illinois: Code, 815 ILCS 175/15-5.03 Under the Act, a" loan broker" means any person who, in return for a fee from any person, promises to procure a loan for any person or assist any person in procuring a loan from any third party, or who promises to consider whether or not to make a loan to any person. 815ILCS 175/15-5- 15(a)

Specifically excluded from the application of the Act, however, are (1) any bank …regulated by any service loans for the Federal National Mortgage Association… (3) any insurance producer or company authorized to do business in [Illinois], (4) any person arranging financing for the sale of the person's product, (note that this exception does not apply to any person selling someone else's product and only applies to "the" person's product, implying the exception is for the owner of the product arranging for financing), (5) any person authorized to conduct business under the Residential Mortgage License Act of 1987 and (6) any person authorized to do business in [Illinois] and regulated by the Department of Financial Institutions or the Office of Banks and Real Estate. "In the event that the Act is violated by the broker, the Secretary of State is empowered by the statute to make investigations and examinations, suspend or evoke the broker's approval, subpoena witnesses, compel the production of books and records, order depositions and obtain temporary restraining orders and injunctions against the broker. In the vent that a violate is found, the Secretary of State may impose a fine in the amount of $10,000 for each violation and the broker shall be liable to any person damaged in the amount of tactual damages plus attorney’s fees." This appears as standard language on most states.

Idaho: No fee may be collected unless a loan is actually made.

Idaho Code, sec. 26-2501 (1992)

Illinois: Code, 815 ILCS 175/15-5.03 Under the Act, a" loan broker" means any person who, in return for a fee from any person, promises to procure a loan for any person or assist any person in procuring a loan from any third party, or who promises to consider whether or not to make a loan to any person. 815ILCS 175/15-5- 15(a) specifically excluded from the application of the Act, however, are (1) any bank …regulated by any service loans for the Federal National Mortgage Association… (3) any insurance producer or company authorized to do business in [Illinois], (4) any person arranging financing for the sale of the person's product, (note that this exception does not apply to any person selling someone else's product and only applies to "the" person's product, implying the exception is for the owner of the product arranging for financing), (5) any person authorized to conduct business under the Residential Mortgage License Act of 1987 and (6) any person authorized to do business in [Illinois] and regulated by the Department of Financial Institutions or the Office of Banks and Real Estate. "In the event that the Act is violated by the broker, the Secretary of State is empowered by the statute to make investigations and examinations, suspend or revoke the broker's approval, subpoena witnesses, compel the production of books and records, order depositions and obtain temporary restraining orders and injunctions against the broker. In the vent that a violate is found, the Secretary of State may impose a fine in the amount of $10,000 for each violation and the broker shall be liable to any person damaged in the amount of tactual damages plus attorneys’ fees." This appears as standard language on most states.

Iowa: A broker of loans of "money or property" may not assess or collect an advance fee except for a "bona fide third-party fee" and a broker must obtain a bond or establish a trust account and file required documents with the Commissioner or Insurance.

Iowa Code, sec. 535C (19920)

Kansas : Broker is not exempt. Discounter or Lessor is exempt: " 'Creditor' means any person to whom a loan is initially payable on the face of the note or contract evidencing the loan" is exempt. Anyone who earns a fee or accept a deposit, except a bank, financial institution, discounter or lessor, must be registered.

http://www.securities.state.ks.us/rules/loan.rtf

Kentucky: Brokers of "a loan of money, a credit card, a line of credit or related guarantee, enhancement or collateral of any kind or nature" may not assess or collect an advance fee.

Kentucky Revised Statutes Annotated, sec. 367.380 (1992)

Louisiana: A broker of loans of "money or property…whether such agreement is styled as a loan, a lease or otherwise" must obtain a surety bond or establish a trust account in the amount of $25,000. A broker may not collect an advance fee but may collect an "advance expense deposit for commercial loans" only for actual expenses incurred in obtaining the loan. Louisiana Revised Statutes Annotated, sec. 9:3574 (1993); Louisiana Revised Statutes Annotated, Sec. 51:1910 (1992)

Maine: No license required: "the regulation of commercial loan brokers does not fall under the jurisdiction of the Maine Bureau of Consumer Credit Protection. Transactions involving two businesses are legal/contractual in nature. Therefore, disputes involving a commercial loan between a business and commercial loan provider or broker must be settled in the court system."

http://www.maine.gov/pfr/consumercredit/faqs/loan_broker_faq.htm#j

Mississippi: A broker or loans of money may not assess or collect an advance fee and can be fined up to $5,000 for each violation. Mississippi Code Annotated, sec. 81-19-17 (1997)

Missouri: A broker of loans of "money or property" may not assess or collect an advance fee. Missouri Revised Statues, sec. 367 300 (19920

Nebraska: A broker of loans of money may not assess or collect an advance fee. Nebraska Revised Statutes, sec. 45-189 (1993)

New Jersey: Brokers of "loans of money" may not assess or collect an advance fee.

New Jersey Rev. Statutes, sec. 17:10B (1992)

New Mexico: New Mexico currently requires Brokers/Lessors to register for Licensing under the NM Mortgage loan Company or Loan Broker Act with the Financial Institutions Division of the State of New Mexico. Banks with Brick and Mortar within the State of New Mexico are exempt. Prior to licensing applicants must submit the Following:

Articles of Incorporation

Listing of all principals (including management)

A full financial Package (to meet their minimum requirements of liquidity)

Personal financial statements on all principals

Disclosure of all current or past suits (civil or criminal)

Attach a corporate surety bond

Include a $400.00 registration fee renewable yearly

North Carolina: A broker of "loans of money or property…whether such agreement is styled as a loan, a lease or otherwise" must obtain a surety bond or establish a trust account in the amount of $25,000 and obtain a license. North Carolina General Statutes, sec. 66-106 (1992)

North Dakota: Brokers may not accept an advance fee unless the broker is licensed. North Dakota Century Code, 13-04. 1-09.1 (1993) Ohio: Department of Commerce, Division of Financial Institutions

(Certificate to engage in the business of a credit services organization in accordance with the provisions of Sections 4712.01 to 4712.14 of the revised code of Ohio, subject to all the provisions thereof and to the regulations of the division.) Ohio Department of Taxation requires a "Vendor's License" under provision 5739.17 of the Revised Code (...is hereby authorized to sell tangible personal property and selected services at the retail location specified below.) This also makes the lessor responsible for all taxes with penalties for not doing so.

South Carolina: A broker of "a loan of money, a credit card, a line of credit or related guarantee, enhancement or collateral of any kind or nature" may not assess or collect an advance fee. South Carolina Code Annotated, sec. 34-36-10 91992)

South Dakota: Money Lending License

Required for individuals or corporations to engage in the business of lending money, including creating and holding or purchasing and acquiring any installment loan ("Capital Lease" or EFA), single pay loan, or open-end loan which may be unsecured or secured by personal property. Requires filing a surety bond application. State and national banks, bank holding companies, other federally insured financial institutions, and the subsidiaries of those institutions are exempt from licensure. In addition, SD chartered trust companies are exempt from licensure. Any individual or corporation holding this license is required to pay the bank franchise tax.

Duration: 1 year

Cost: Application $600

Vermont: Commercial Loans

Commercial loan license would apply to EFA and "Capital Leases." Exemptions include transactions over $1 million, and brokers who do not engage in transactions more than $50,000 in one year at rates not exceeding 12 percent per annum.

[headlines]

--------------------------------------------------------------

Labrador Retriever Mix

Birmingham, Alabama Adopt-a-Dog

Bells

Pet ID: 161208

Female

Age: 2 Years, 1 month

Weight: 42 lbs.

Spayed

Current on Vaccinations

Greater Birmingham Humane Society

300 Snow Drive

Birmingham, AL 35209

205-942-1211

Contract Form:

https://www.petfinder.com/petdetail/34086910#

ADOPTION CENTER HOURS:

Monday: Closed

Tuesday-Friday: 11 a.m. – 6 p.m.

Saturday: 10 a.m. – 4:30 p.m.

Sunday: Noon to 4:30 p.m.

All adoption applications must be submitted 30 minutes before closing to be considered for adoption the same day.

Adopt a Pet

http://www.adoptapet.com/

[headlines]

--------------------------------------------------------------

Display Advertising

![]()

The editor tries to place banner ads where they will be read by those the advertisers want to reach, rather than placed at random. News stories that will have an “ill” effect are avoided as best as possible. Often it is the position of the banner ad that attracts more response. This is at the sole discretion of the editor.

Samples of ads follow as well as the Rate Card:

|

$695.00

6.5W X 2.5 H - 468W X 180H

21 days

$895.00

6.5W X 4" H - 468W X 288H

21 days

$995.00

6.5W X 5" H - 468W X 360H

21 days

Rate Card

Display Ad

Web Display Advertising |

|||

Price |

Ad Size |

Pixels Size |

Term |

| $695.00 | 6.5" W X 2.5" H |

468W X 180H |

21 days |

| $895.00 | 6.5" W X 4" H |

468W X 288H |

21 days |

| $995.00 | 6.5" W x 5"H |

468W X 360H |

21 days |

These display ads appear below the headline section and Constant Contact News Edition in a chronological order at the discretion of the editor or are placed by the editor in appropriate articles to gain the maximum attention.

- All design work is free.

- Clicking to a web site or another page is free.

- If design work sent, please send jpeg or gif and with right click of mouse, please check pixel size of ad.

Leasing News reserves the right to refuse advertising, particularly to a company that has appeared in the complaint bulletin board.

Email: Kitmenkin@leasingnews.org

[headlines]

--------------------------------------------------------------

![]()

News Briefs---

Tiny bank, huge ROE: WebBank’s Fintech hidden recipe

FDIC Insured - 59% ROE and a very low risk classification

http://bankinnovation.net/2016/01/tiny-bank-huge-roe-webbanks-fintech-hidden-recipe/

E-Smart Owes $21 Million for Defrauding Investors

Identify-Verification was "pie in the sky"

http://www.courthousenews.com/2016/01/15/e-smart-owes-21m-for-defrauding-investors.htm

It's official! Wells Fargo passes Citi as 3rd largest bank

http://www.usatoday.com/story/money/2016/01/15/wells-fargo-passes-citi-3rd-largest-us-bank/78840726/

IASB to Bring All Leases onto Corporate Balance Sheets

IFRS 16 will be effective from January 1, 2019

http://www.tax-news.com/news/IASB_To_Bring_All_Leases_Onto_Corporate

_Balance_Sheets____70183.html

Credit Analyst www.finpac.com |

[headlines]

--------------------------------------------------------------

--You May Have Missed It

Tough Times Continue for Coal Industry

http://www.courthousenews.com/2016/01/15/tough-times-continue-for-coal-industry.htm

[headlines]

--------------------------------------------------------------

SparkPeople--Live Healthier and Longer

![]()

The Case for Cold Brew Coffee

Can You Stomach It?

http://www.sparkpeople.com/resource/nutrition_articles.asp?id=2065

[headlines]

--------------------------------------------------------------

Football Poem

Born To Win

by R.G. Graham

When you were in your crib tiny and small,

And everyone was looking at you one and all,

They smiled with pride and said again and again,

This child is special and was born to win!

Grandma and grandpa and mom and dad too,

Brother and sister were all looking at you,

They just couldn’t help getting a grin,

And saying this child is special and was born to win!

And now you’re getting older probably past two,

And they keep saying there’s nothing you can’t do

Because you’re kind to all and obey your mom and dad,

You pick up your toys and go early to bed.

You’re kind to your neighbors and all your friends too,

You share with them things that are special to you,

And children are so happy that you are their friend,

They know in their heart you were born to win.

So when you go to school and see children that are sad.

Pat them on the back and say it’s not so bad.

Because I like you, would you please be my friend,

Because you and I are special, we were born to win!

[headlines]

--------------------------------------------------------------

Sports Briefs----

Chip Kelly’s 49ers coaching staff starting to fall into place

http://www.mercurynews.com/49ers/ci_29397691/49ers-staff-starts-take-shape

Chiefs head into offseason with cornerstones in question

https://www.washingtonpost.com/sports/redskins/chiefs-head-into-offseason-with-cornerstones-in-question/2016/01/18/48838d4c-be3c-11e5-98c8-7fab78677d51_story.html

Mike McCarthy tells Eddie Lacy to shape up or ship out

http://profootballtalk.nbcsports.com/2016/01/18/mike-mccarthy-tells-eddie-lacy-to-shape-up-or-ship-out/?ocid=Yahoo&partner=ya5nbcs

|

((Please Click on Bulletin Board to learn more information))

(Leasing News provides this ad “gratis” as a means

to help support the growth of Lease Police)

[headlines]

--------------------------------------------------------------

California Nuts Briefs---

Napa Valley hotel spending jumps 15% in 2015

http://www.northbaybusinessjournal.com/northbay/napacounty/5091779-181/napa-valley-hotel-spending

Netflix: The most feared force in Hollywood?

http://www.mercurynews.com/business/ci_29400948/netflix-most-feared-force-hollywood

Santa Cruz County's famed apple industry at a crossroads

http://www.mercurynews.com/science/ci_29394849/watsonvilles-famed-apple-industry-at-crossroads

[headlines]

--------------------------------------------------------------

![]()

“Gimme that Wine”

http://www.youtube.com/watch?v=EJnQoi8DSE8

U.S. Wine Sales Total $38 billion Key industry metrics

stay positive through the end of 2015

http://www.winesandvines.com/template.cfm?

section=news&content=163380

Kendall-Jackson Wine Maker Buys Former

Evergreen International Headquarters

http://blogs.wsj.com/bankruptcy/2016/01/14/kendall-jackson-wine-maker-buys-former-evergreen-international-headquarters/

Santa Cruz Cabernet: Wines You Never Knew

http://www.nytimes.com/2016/01/20/dining/cabernet-sauvignon-santa-cruz-mountains.html?_r=1

Free Mobile Wine Program

http://leasingnews.org/archives/Feb2010/2_26.htm#mobile

Wine Prices by vintage

http://www.winezap.com

http://www.wine-searcher.com/

US/International Wine Events

http://www.localwineevents.com/

Leasing News Wine & Spirits Page

http://two.leasingnews.org/Recommendations/wnensprts.htm

[headlines]

----------------------------------------------------------------

![]()

This Day in American History

1770 - Battle of Golden Hill in Lower Manhattan. Although no one was killed, the Battle of Golden Hill was the first significant clash between citizens and British troops as the colonies moved toward revolution. Several New Yorkers had been wounded in a similar confrontation three years earlier, but Golden Hill was a more direct challenge to the British and the wounds suffered by the patriots were more severe.

http://www.u-s-history.com/pages/h1265.html

http://www.nyfreedom.com/Goldenhill.htm

1807 - Confederate General Robert E. Lee's (d. 1870) birthday, Stratford Hall, VA. He was considered the greatest military leader of the Confederacy, son of Revolutionary War General Henry “Light Horse Harry” Lee, George Washington’s best friend. His most daring plan was to turn the war by directly attacking Washington, DC, although his troops were discovered quite by accident in Gettysburg, Pa, resulting in one of the bloodiest battles of the Civil War. His surrender April 9, 1865, to Union General Ulysses S. Grant, brought an end to the Civil War. His birthday is an official state holiday for the State of Texas. His birthday is also observed in Florida, Kentucky, Louisiana, and Tennessee. It is also observed the third Monday in January in Alabama, Arkansas and Mississippi.

1809 - American poet and story writer Edgar Allan Poe (d. 1849) was born at Boston, MA. He was orphaned in dire poverty in 1811 and was raised by Virginia merchant John Allen. In 1846, he married his 13-year old cousin, Virginia Clemm. A magazine editor of note, he is best remembered for his poetry, especially “The Raven.” and for his tales of suspense. The NFL Baltimore Ravens are named in honor of the poem.

1810 - The famous "cold day" in New England. Gale force winds wrecked homes, and accompanied a sudden overnight drop in temperature of 50 degrees. Tragedy struck Sanbornton, NH where three children froze to death.

1825 - Ezra Daggett and Thomas Kensett obtained a patent for a process for storing food in a can.

1846 - The first military prison on an island was Fort Jefferson, Monroe County, FL. Construction began in 1846 on an island in the Gulf of Mexico, 60 miles from Key West. It was garrisoned by Brevet Major Lewis Golding Arnold, 2nd U.S. Artillery, with four officers and 62 men. The fort had not been completed and was barely defensible. A prison for the confinement of U.S. Military prisoners was established in 1863. The prison was often called Dry Tortugas. During the Civil War, the fort was a military prison for captured deserters. It also held the 4 men convicted of complicity in President Abraham Lincoln’s assassination in 1865, the most famous being Dr. Samuel Mudd. The Fort was plagued with construction problems and Yellow Fever epidemics. The invention of the rifled cannon made the Fort obsolete, as its thick walls could now be penetrated. The Army finally abandoned Fort Jefferson in 1874. Today it is a national park.

http://www.smithsonianmag.si.edu/smithsonian/issues99/

nov99/tortugas.html

http://www.nps.gov/drto/

http://www.fortjefferson.com/home.htm

1847 - After killing the sheriff and a prefect, Native American Indians force their way into the house of New Mexico's first American Territorial Governor, Charles Bent, and scalped him and three others in Taos.

1857 - A great cold storm swept across the Atlantic Seaboard. Snowfall totals of 12 inches were common, whole gales caused shipwrecks and damage property on islands, and temperatures near zero prevailed from Virginia northward. Great drifts of snow blocked transportation. Richmond, VA was cut off from Washington, DC for a week.

1861 - Georgia becomes 5th state to secede.

1862 - Laws were passed in the State of New York granting equal guardianship of children to mothers. Up to that point, fathers had EXCLUSIVE rights to the children as they did in England and could will the children to anyone they wanted at their deaths or could give them away during their lifetime.

1863 - The founder of the Goodwill Industries, Edgar J. Helms (d. 1942), was born near Malone, NY. Reverend Dr. Helms became a minister to a parish of poor immigrants in Boston’s South End. In that capacity, he developed the philosophy and organization that eventually became Goodwill Industries.

1865 - Union occupies Fort Anderson NC

1871 - First Negro lodge of US Masons approved, New Jersey.

1881 - Western Union buys rival telegraph company, in vain. Jay Gould, the ravenous financier and archetypal robber baron, used his wiles and ways to seize control of Western Union, William Vanderbilt's mighty telegraph company. Gould mounted an elaborate campaign to drive down the company's stock, using his newspaper, as well as his influence on Wall Street, to raise doubts about Western Union's leadership and hefty stock price. He also started a rival telegraph concern, the Atlantic and Pacific Company, in hopes of raising doubts about Western Union’s dominance over the industry. The gambits worked and Western Union's stock swooned. In a desperate attempt to staunch the bleeding, Western Union snapped up the Atlantic and Pacific Company on this day in 1881. Far from staving off the competition, the deal further fattened Gould's pocketbook and, more importantly, primed him for the final phase of his takeover scheme. Gould convinced his Wall Street associates to start another raid on Western Union. However, as the traders were busy driving down Western Union’s asking price, Gould, in the guise of an "anonymous" investor, started gobbling up the company’s suddenly cheap stock. When the dust settled, Gould’s cronies were left counting their losses; meanwhile, the devious financier had successfully wrested control of Western Union.

1887 - Birthday of Alexander Woolcott (d. 1943), in Phalanx, (now Colts Neck) New Jersey. The model for the egotistical Sheridan Whiteside in Kaufman & Hart's “The Man Who Came to Dinner” will be "the smartest of Alecs" to Heywood Broun and "Old Vitriol & Violets" to James Thurber.

1898 - The first college ice hockey game ever played saw Brown University defeat Harvard University 6-0. Fifty years later, the NCAA staged its first college hockey championships.

1905 - Birthday of Oveta Culp Hobby (d. 1995), Killeen, TX. U.S. newspaper executive and the first U.S. Secretary of Health, Education, and Welfare, director of the Woman's Army Corps (1942-1945). She was noted for her organizational abilities before marrying into the family which owned the Houston Post newspaper. She ran it as executive vice president and later chaired the board for 19 years.

1915 - World famous labor organizer and songster Joe Hill is arrested in Salt Lake City, Utah. He is convicted on trumped-up murder charges and was executed 21 months later despite worldwide protests and two attempts to intervene by Beloved & Respected Comrade Liberal, President Woodrow Wilson. In a letter to Bill Haywood shortly before his death, he penned the famous words, "Don't mourn - organize

I dreamed I saw Joe Hill last night,

Alive as you and me.

Says I "But Joe, you're ten years dead"

"I never died" said he,

"I never died" said he.”

Also, 20 rioting strikers are shot by factory guards at Roosevelt, New Jersey.

http://en.wikipedia.org/wiki/Joe_Hill

http://www.kued.org/joehill/

1915 - Isadora Duncan dance "Dionysion" premiers at the NY Met.

1920 – US voted against joining the League of Nations.

1925 – Maine state record low temperature, -48ºF (-44ºC), Van Buren, ME.

1933 - Giant Forest, CA received 60 inches of snow in just 24 hours, a state record, and the second highest 24 hour total of record for the U.S.

1934 – The appeal for reinstatement by Shoeless Joe Jackson was rejected by Commissioner Landis. Jackson was one of eight Chicago White Sox players banned for their part in throwing the 1919 World Series.

1937 – Howard Hughes set a transcontinental air record, when he flew from Los Angeles, California to New York City in 7 hours, 28 minutes and 25 seconds.

1937 - The second annual Baseball Hall of Fame election saw second baseman Nap Lajoie, center fielder Tris Speaker, and pitcher Cy Young elected to the shrine. The trio was honored at the Hall's first induction ceremony in 1939.

1943 – Birthday of singer Janis Joplin (d. 1970), Port Arthur, Texas. Possibly the most highly regarded white female blues singers of our time, Joplin’s appearance with Big Brother and the Holding Company at the Monterey International Pop Festival in August, 1967, launched her superstar status.

I was there and she was quite loaded, but then again, most of the audience was either drunk or high and the music very loud and emotion high. Among her recordings hits were “Get it While You Can,” “Piece of My Heart,” “Ball and Chain” and “The Windshield Song.” She died of a heroin overdose October 4, 1970 at Hollywood, CA, age 27.

1944 – Pop singer and actress Shelley Fabares was born in Santa Monica, California. On her 18th birthday, in 1962, Fabares’ recording of “Johnny Angel” hit number one on the Billboard chart. A year later, she retired when she married record producer Lou Adler.

1946 – Country star Dolly Parton was born in Sevierville, Tennessee. She gained wide exposure as part of Porter Wagoner’s TV and road show from 1967 to 1974. And Parton did even better on her own. Hits such as “Nine to Five,” from the movie in which she starred, and “Heartbreak Express” brought her a wider audience than most country artists enjoy.

1947 – Top Hits

“For Sentimental Reasons” – Nat King Cole

“Ole Buttermilk Sky” – The Kay Kyser Orchestra (vocal: Mike Douglas & The Campus Kids)

“A Gal in Calico” – Johnny Mercer

“Rainbow at Midnight” – Ernest Tubb

1949 – Birthday of rock singer Robert Palmer, West Yorkshire, England. Best known for his song, “Addicted to Love”.

http://www.robertpalmer.org/

1949 - The salary of the President of the United States was increased from $75,000 to $100,000, with an extra $50,000 expense allowance for each year in office. As of 2001, the President makes $1,000,000 a year.

1952 - PGA Admits Blacks: The Professional Golfers Association of America amended its rules to allow black golfers to participate in tournaments.

1953 - Sixty-eight percent of televisions in the United States tuned to CBS-TV, to see Lucy Ricardo, of "I Love Lucy", give birth to a baby boy, as she actually did in real life. The program's audience was larger than that watching the inauguration of President Dwight D. Eisenhower next day. In fact, in many papers, the Lucille Ball baby story kicked the inauguration off the front page.

1953 - Marty Robbins made his debut on the Grand Ole Opry. His first big hit, "Singin' the Blues," was at the top of the country charts at the time.

1954 – Former NFL QB Steven L. “Steve” DeBerg, born Oakland, Ca. Although he is remembered as a journeyman QB, DeBerg passed for over 34,000 career yards, and ranks in the top 20 all-time for attempts, completions, and yards passing. He is also credited with mentoring, as a teammate or backup, some of the game’s greatest QBs, including Joe Montana, John Elway, and Steve Young, all Hall of Famers.

1955 - Top Hits

“Mr. Sandman” - The Chordettes

“Hearts of Stone” - The Fontane Sisters

“Make Yourself Comfortable” - Sarah Vaughan

“Loose Talk” - Carl Smith

1955 - "The Millionaire" premiered on television. The CBS drama that had all of America hoping to find Michael Anthony on their doorstep. Mr. John Beresford Tipton was a millionaire who made a hobby of giving away million dollar checks anonymously to unknown people to see how they handled the sudden wealth. Michael Anthony, played by Marvin Miller, was Mr. Tipton's personal secretary and the star of "The Millionaire.” No one ever saw Mr. Tipton but his voice would greet Anthony at the opening of each show and issue instructions for delivery of the next check. Anthony would then find the recipient and give him or her the check, explaining that the recipient had to agree never to divulge the amount or how it was acquired.

1955 - The first Presidential news conference filmed for television and newsreels was held in the treaty room of the State Department building, Washington, DC, where President Dwight David Eisenhower held a 33-minute conference. The film was cut to 28 minutes, 25 seconds, plus introduction and closing remarks, to fit television time formats.

1957 – Hoboken, NJ dedicated a plaque honoring the achievements of Alexander Cartwright in organizing early baseball at Elysian Fields in Jersey City. Why Jersey City did not recognize this is unknown.

1957 - Philadelphia comedian, Ernie Kovacs, became a star, when he successfully completed a challenge to do a half-hour television show without saying a single word of dialogue.

1957 - Elvis Presley records: "It Is No Secret,” "Blueberry Hill,” "Have I Told You Lately That I Love You,” "Is It So Strange."

1957 - Pat Boone performs at the inaugural ball for President Dwight D. Eisenhower.

1957 - Johnny Cash makes his first national television appearance on CBS' “Jackie Gleason Show.”

1959 - Dick Clark's "American Bandstand" was rated the number-one daytime television program.

1959 - The Platters' "Smoke Gets in Your Eyes" hits #1.

1963 - Top Hits

“Go Away Little Girl” - Steve Lawrence

“Hotel Happiness” - Brook Benton

“Tell Him” - The Exciters

“The Ballad of Jed Clampett” - Flatt & Scruggs

1966 - Robert Montgomery, actor-producer and White House advisor on Presidential telecasts, testified on this date to the FCC that the reports of quiz-show fixing and payola were widespread within the broadcasting industry long before the charges were made public.

1966 - Ken Kesey is arrested in San Francisco a second time for the possession of marijuana. He subsequently jumps bail and flees to Mexico, trying to mislead law enforcement authorities with a faked suicide note.

1968 - YNTEMA, GORDON DOUGLAS, Medal of Honor

Rank and organization: Sergeant, U.S. Army, Company D, 5th Special Forces Group (Airborne). Place and date: Near Thong Binh, Republic of Vietnam, 16-18 January 1968. Entered service at: Detroit, Mich. Born: 26 June 1945, Bethesda, Md. Citation: For conspicuous gallantry and intrepidity in action at the risk of his life and above and beyond the call of duty. Sgt. Yntema, U.S. Army, distinguished himself while assigned to Detachment A-431, Company D. As part of a larger force of civilian irregulars from Camp Cai Cai, he accompanied 2 platoons to a blocking position east of the village of Thong Binh, where they became heavily engaged in a small-arms fire fight with the Viet Cong. Assuming control of the force when the Vietnamese commander was seriously wounded, he advanced his troops to within 50 meters of the enemy bunkers. After a fierce 30 minute fire fight, the enemy forced Sgt. Yntema to withdraw his men to a trench in order to afford them protection and still perform their assigned blocking mission. Under cover of machinegun fire, approximately 1 company of Viet Cong maneuvered into a position which pinned down the friendly platoons from 3 sides. A dwindling ammunition supply, coupled with a Viet Cong mortar barrage which inflicted heavy losses on the exposed friendly troops, caused many of the irregulars to withdraw. Seriously wounded and ordered to withdraw himself, Sgt. Yntema refused to leave his fallen comrades. Under withering small arms and machinegun fire, he carried the wounded Vietnamese commander and a mortally wounded American Special Forces advisor to a small gully 50 meters away in order to shield them from the enemy fire. Sgt. Yntema then continued to repulse the attacking Viet Cong attempting to overrun his position until, out of ammunition and surrounded, he was offered the opportunity to surrender. Refusing, Sgt. Yntema stood his ground, using his rifle as a club to fight the approximately 15 Viet Cong attempting his capture. His resistance was so fierce that the Viet Cong were forced to shoot in order to overcome him. Sgt. Yntema's personal bravery in the face of insurmountable odds and supreme self-sacrifice were in keeping with the highest traditions of the military service and reflect the utmost credit upon himself, the 1st Special Forces, and the U.S. Army.

1969 - The West is best, topping the East 38-25 in the AFL Pro Bowl and 10-7 in the NFL Pro Bowl.

1969 - Football player Tiaina “Junior” Seau, Jr. birthday, born San Diego, CA. A 12-time Pro Bowler and 10-time All-Pro, Seau was inducted into the Pro Football Hall of Fame in 2015, three years after his suicide. Later studies by the National Institutes of health concluded that Seau suffered from chronic traumatic encephalopathy (CTE), a type of chronic brain damage that has also been found in other deceased former NFL players.

1970 - The soundtrack to the film, "Easy Rider" earned a gold record, making it the first pop-culture, film soundtrack to earn the award.

1971 - Top Hits

“My Sweet Lord/Isn’t It a Pity” - George Harrison

“Knock Three Times” - Dawn

“Lonely Days” - Bee Gees

“Rose Garden” - Lynn Anderson.

1971 - Houston safety Ken Houston returns two interceptions for touchdowns in the Oilers' 49-33 victory over San Diego to set the NFL career record with nine touchdowns on interception returns. He also sets the single-season record with four interception return touchdowns.

1971 - Ruby Keeler had her comeback in the play, "No, No Nanette", opening at the 46th Street Theatre in New York City. Keeler played Sue Smith in the revival of the 1925 musical. The show played for 861 performances.

1972 – The Baseball hall of Fame elected Sandy Koufax, Yogi Berra, and Early Wynn. Koufax made it in his first try and, at 36 years of age, is the youngest honoree in history.

1973 - Yuba City, California labor contractor Juan V. Corona found guilty of murdering 25 itinerant farm workers he employed South Bend, Indiana, Notre Dame ended UCLA’s 88-game winning streak. The Fighting Irish enjoyed a 71-70 basketball win over the Bruins of the University of California at Los Angeles. 1974 - Al Wilson's "Show and Tell" hits #1.

1975 - Minnie Ripperton "Lovin' You" released.

1977 – Ernie Banks was elected to the Baseball Hall of Fame in his first year of eligibility. In a 19-season career, Banks hit 512 HRs, had 11 All-Star selections, and won back-to-back NL MVP Awards.

1977 – President Gerald Ford pardoned Iva Ikuko Toguri D'Aquino…Tokyo Rose. She was born in Los Angeles. She participated in English-language propaganda broadcasts transmitted by Radio Tokyo to Allied soldiers in the South Pacific during World War II. After the Japanese defeat, Toguri was detained for a year by the US military before being released for lack of evidence. Department of Justice officials agreed that her broadcasts were "innocuous". But when Toguri tried to return to the US, a popular uproar ensued, prompting the FBI to renew its investigation of Toguri's wartime activities. She was subsequently charged with eight counts of treason. Her 1949 trial resulted in a conviction on one count, making her the seventh American to be convicted on that charge, for which she spent more than six years out of a ten-year sentence in prison. Journalistic and governmental investigators years later pieced together the history of irregularities with the indictment, trial, and conviction, including the allegation that key witnesses had perjured themselves at the various stages of their testimonies.

1977 – Snow fell in Miami for the only time in the city’s history.

1978 - Johnny Paycheck's cover of David Allan Coe's ode to workplace frustrations, "Take This Job and Shove It", reached during 1970 - 1971.

1974 - At the top spot on the Billboard Country chart. Although the song failed to crack the Pop chart Top 40, it still seems to be one that we all know and can relate to.

1978 – Eddie Mathews was elected the Baseball Hall of Fame. A six-time All-Star, he hit 512 HRs in his career, leading the NL twice in HRs. He hit over 30 HRs ten times and over 40 twice.

1979 - Top Hits

“Too Much Heaven” - Bee Gees

“Le Freak” - Chic

“My Life” - Billy Joel

“Lady Lay Down” - John Conlee

1983 - Apple Chairman Steve Jobs and President John Sculley announced the Apple Lisa, slated for release in the spring of 1983. The Apple Lisa was a major milestone in user-friendly computing. Unfortunately, Lisa's $12,000 price tag placed it out of the consumer market. Lisa's most successful graphical features were handed down to a new Apple computer in 1984, nicknamed "Lisa's Little Brother" — the Macintosh. The Mac, though not immediately successful, eventually changed user expectations about computing, prompting Microsoft to develop its own graphic user interface, Windows.

1985 - Lenny Wilkens became the first person in NBA history to play and coach in 1,000 games as his Seattle SuperSonics defeated the Cleveland Cavaliers, 106-105. Wilkens had played in 1,077 games in a career that ended in 1975.

1987 - A storm tracking toward the northeastern U.S. produced up to 14 inches of snow in northern Indiana. Peru, IN reported a foot of snow. Six cities in Florida reported new record high temperatures for the date. The afternoon high of 88 degrees at Miami equaled their record for the month of January.

1987 - Top Hits

“Shake You Down” - Gregory Abbott

“C’est La Vie” - Robbie Nevil

“Open Your Heart” - Madonna

“What Am I Gonna Do About You” - Reba McEntire

1988 - A powerful storm hit the central U.S. producing blizzard conditions in the Central High Plains, and severe thunderstorms in the Lower Mississippi Valley. Snowfall totals ranged up to 36 inches at Wolf Creek Pass, CO, with 31 inches at Elsmere, NE. Tornadoes claimed five lives in Tennessee, and a tornado at Cullman, AL injured 35 persons.

1989 - The high temperature for the day at Fairbanks, AK, was a frigid 41 degrees below zero, and the morning low of 24 degrees below zero at Anchorage AK was their coldest reading in fourteen years.

1990 - Elizabeth M. Watson, became the first woman to head the police force of a major American city. Houston Mayor Kathryn Whitmire named Watson, who wore maternity "uniforms" and also became the first police chief to birth a baby while on active duty.

1993 - Robert M Gates, ends term as 15th director of CIA.

1993 - A pre-inaugural gala in Landover, Md., toasting incoming president Bill Clinton features a reunion of Fleetwood Mac performing “Don't Stop (Thinking About Tomorrow),” the unofficial campaign song for Clinton and his running mate, Al Gore. Other performers included Aretha Franklin, Barbra Streisand, Michael Jackson, Little Richard and Chuck Berry.

1994 - The Ninth Annual Rock and Roll Hall of Fame induction ceremonies are held in New York City. Inductees include The Animals, The Band, Duane Eddy, The Grateful Dead, Elton John, John Lennon, Bob Marley, and Rod Stewart.

1994 - Coldest day ever recorded in Cleveland, OH: -20ºF (-29ºC) at 5:32 AM.

1994 – Indiana state record low temperature, -36ºF (-38ºC) in New Whiteland.

1996 - Top Hits

“On Bended Knee” - Boyz II Men

“Another Night” - Real McCoy

“Always” - Bon Jovi

“Take a Bow” - Madonna

1996 – The NHL approved the move of the Winnipeg Jets to that world hockey hotbed, Phoenix.

1998 - Hearn Broadcasts 3,000th Straight Game: Francis Dayle “Chick” Hearn, the only play-by-play announcer the Los Angeles Lakers have ever had, broadcast his 3,000th consecutive game when the Lakers hosted the Orlando Magic. Hearn’s streak began after he missed a game on November 20, 1965, because bad weather kept him from making an airplane flight.

1999 - In methodical, sometimes blunt fashion, White House Counsel Charles Ruff opens the defense case in President Bill Clinton's impeachment trial, saying there is no factual or constitutional basis to remove Clinton from office for his alleged misdeeds in the Monica Lewinsky affair.

2000 - Top Hits

“What A Girl Wants” - Christina Aguilera

“I Knew I Loved You” - Savage Garden

“Smooth” - Santana Featuring Rob Thomas

“Back At One” - Brian McKnight

2001 - President Clinton admits wrongdoing, will not be indicted. The Whitewater special prosecutor closes down his investigations in a deal in which Clinton admitted make false testimony under oath about Monica Lewinsky, is barred from law practice for 5 years, and pays a $25,000 fine in return for being freed from the threat of being indicted.

2006 - Major League Baseball owners unanimously approve the November transaction in which Bob Castellini and two other Cincinnati businessmen bought control of the Reds from previous owner Carl Lindner. It is reported the trio, which includes investors Thomas Williams and William Williams Jr., acquired approximately 70 percent ownership of the oldest franchise in baseball history, believed to be valued at an estimated $270 million.

2010 - United States Navy troops landed near the Haitian presidential palace, bringing food, water, and equipment to aid victims of the earthquake.

2012 – Kodak filed for bankruptcy protection.