Connect with Leasing News ![]()

![]()

![]()

![]()

![]() Add me to mailing list |

Add me to mailing list | ![]() |

| ![]() Search |

Search | ![]() Stress Release

Stress Release

Advertising | All Lists | Archives | Classified Ads | This Day In American History

Leasing News is a web site that posts information, news, and entertainment for the commercial leasing and finance industry. The News Edition is updated Monday, Wednesday and Friday.

![]()

|

Equipment Leasing Opportunities throughout the U.S. |

Friday, July 22, 2011

Today's Equipment Leasing Headlines

M&T Bank and IFC Credit Evergreen $1.00 Lease

Classified Ads---Asset Management/Operations

Growth in Deposits, New Lending, Revenue Buoys U.S. Bancorp

Net Revenue: $4.7 Billion; Earns Over $1.2 Billion in Net Income

Classified Ads---Help Wanted

NorVergence’s Tom Salzano on Trial in Louisiana

by Christopher Menkin

A Case Against HL Leasing, Another Against Leasing Companies

Felony Charges Dropped on Brendan Messenheimer

Former NASA Special Agent Pleads Guilty Tax Return

Hermosa Beach Man Fails to Report $1 Million in Income

Longest Living Cities

Winnie the Pooh/ Tabloid

Fernando F. Croce Movie/DVD Reviews

Limitless/Potiche/Uncle Boonme Who Can Remember

Buffalo, New York-- Adopt-a-Dog

News Briefs----

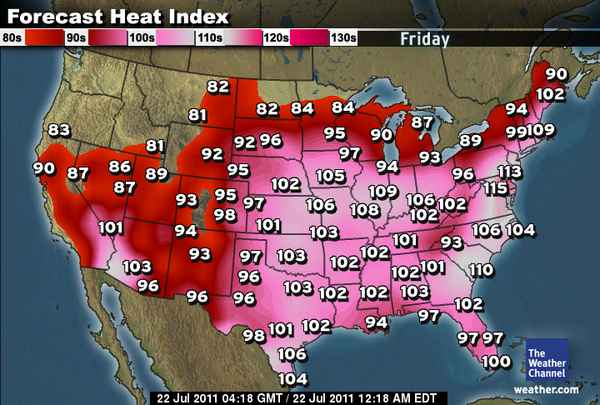

U.S. Forecast Heat Index

GE expected to report 13 percent rise in profit

Wells Fargo paying record fine of $85 million

Optimistic outlook for European vehicle leasing industry

Microsoft's results beat expectations, Windows Down

Canada jobless claims down for 8th month

Massachusetts unemployment rate unchanged at 7.6%

Trustee in Madoff case drops claim involving Mets ownership

Broker/Funder/Industry Lists |

Features (collection)

Top Ten Stories Chosen by Readers |

Top Stories last six months

Portland most affordable place to retire

You May have Missed---

Sports Briefs

California Nuts Brief---

"Gimme that Wine"

This Day in American History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

######## surrounding the article denotes it is a “press release”

and was not written by Leasing News nor information verified, but from the source noted. When an article is signed by the writer, it is considered a “by line.” It reflects the opinion and research of the writer. It is considered “bias” as it is the writer’s viewpoint.

[headlines]

--------------------------------------------------------------

M&T Bank and IFC Credit Evergreen $1.00 Lease

First, M&T Bank, Buffalo, New York appears they have been holding leases that were being serviced or sold to IFC Credit, now in bankruptcy. Leasing News has been experienced complaints from several of the lessees with various banks, primarily regarding the residual on documents being $1.00 but the banks claiming 10 percent and Fair Market Value on IFC Credit documents. To date, most of the claims that have come to our attention have been settled as the original documents prevail. Whether that is the fault of the documentation or not or how many have not come to our attention is not known.

Readers may not be aware of this but Leasing News receives about five complaints from lessees a week, most of them settled, many of them now automatic Evergreen payments. This is no exception.

Leasing News has been attempting to contact the party to discuss this with, and has made telephone and email attempts. Simply put here is one where IFC Credit Corporation dba FIRSTCORP has on the face of the lease contract Purchase Option: $1.00.

This was sent to the lessee from M&T Bank: “Just a reminder that written notice of termination was to have been sent to IFC not more than 120 days and not less than 90 days prior to the scheduled termination of the lease. If notice was not given, the lease automatically renews on a month-to-month basis until terminated by written notice. IFC will be collecting any additional rentals from renewal as M&T only purchased the normal rental stream."

Evergreen clauses are illegal in New York, and they are illegal if a “consumer” is involved in Illinois, meaning a personal guarantee or proprietorship.

In October, 2008 announced M&T Bank announced they"...will no longer offer equipment lease and finance services for business and professional banking customers. M&T will honor approved applications up to 90 days after the approval date, and existing contracts will continue to be serviced through their expiration.”

Hopefully this incident will not make the Leasing News Complaint Bulletin board and someone at M&T Bank will return emails or telephone calls.

Otherwise the bank is doing well, as they reported their second quarter with financial highlights show net operating income of $289,497,000 with a net income after taxes of $322,358,000 for the second quarter, compared to $206,273,000 the first quarter, or perhaps as important a great growth since the $188,749,000 for the second quarter of 2010. Another event: The press release stated, "Most significantly, M&T completed its acquisition of Wilmington Trust Corporation (“Wilmington Trust”), effective May 16, 2011, including the issuance of 4.7 million common shares."

In addition, "Other actions initiated by M&T during the recent quarter included the purchase from the U.S. Department of the Treasury (“Treasury Department”) and subsequent retirement of $330 million of preferred stock that Wilmington Trust issued pursuant to the Troubled Asset Relief Program (“TARP”), the redemption of $370 million of M&T Series A Preferred Stock issued to the Treasury Department by M&T pursuant to the TARP, and the issuance by M&T of $500 million of fixed rate, perpetual non-cumulative preferred stock to supplement its Tier 1 capital."

You would think they have enough money to provide better customer service as evidenced in the Evergreen Clause

M&T Second Quarter 8-K:

http://www.leasingnews.org/PDF/MTB8-KJuly%2020.pdf

[headlines]

--------------------------------------------------------------

Classified Ads---Asset Management/Operations

(These ads are “free” to those seeking employment or looking

to improve their position)

Experienced Asset Manager of various portfolio's for a bank, broker and leasing company. Utilized specialized remarketing companies to maximize collateral values. Worked remote two years. geoff.taylor@verizon.net | Resume | Reference 1 | Reference 2 |

30 years equipment leasing, credit, collections experience. I want to work for a funding source with the broker/lessor community. Email - Resume |

Seasoned Ops, Broker Development, Credit, Legal, Strategy, P & L Management detail oriented team player seeks position with Small ticket direct lender. Wgriffith61@yahoo.com | Resume |

Free Posting for those seeking employment in Leasing:

http://www.leasingnews.org/Classified/Jwanted/Jwanted-post.htm

All “free” categories “job wanted” ads:

http://www.leasingnews.org/Classified/Jwanted/Jwanted.htm

[headlines]

--------------------------------------------------------------

Growth in Deposits, New Lending, Revenue Buoys U.S. Bancorp

Net Revenue: $4.7 Billion; Earns Over $1.2 Billion in Net Income

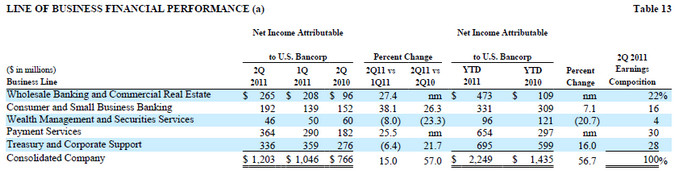

US Bancorp, Minneapolis, Minnesota reported net income of $1,203 million for the second quarter of 2011, as well as showing new lending activity of $52.7 billion and a list of very positive numbers.

U.S. Bancorp Chairman, President and Chief Executive Officer Richard K. Davis said, "Our second quarter results clearly illustrate our Company's continuing ability to produce solid, repeatable, and high quality earnings in a challenging environment..."

Richard K. Davis

"As expected, credit quality continued to improve during the second quarter, as evidenced by favorable trends in net charge-offs, nonperforming assets, delinquencies and criticized assets."

“I am especially proud of our Company's performance and, importantly, the many dedicated employees that have faced the challenges presented, navigated the hurdles and continued to produce these exceptional results. I am confident that our strong business model, our adherence to prudent risk policies and our outstanding employee leaders will allow us to continue to invest, innovate, adapt and perform for the benefit of our customers, communities and shareholders."

Leasing News readers ask me if US Bank Manifest will ever return to its "hey day." While not privy to management decisions, there have been many cuts and shifts, including more diversification in employees not working out of Marshal, Minnesota. My guess is it will not go back to the "old days," nor will the small ticket marketplace return to the frenzy of booking leases with no time for serious regard. With the changing economy, internet and wireless communication, all financial industries are changing with more first level decentralization; banking particularly.

Back to answering the question, let's look at the numbers and see what they tell us:

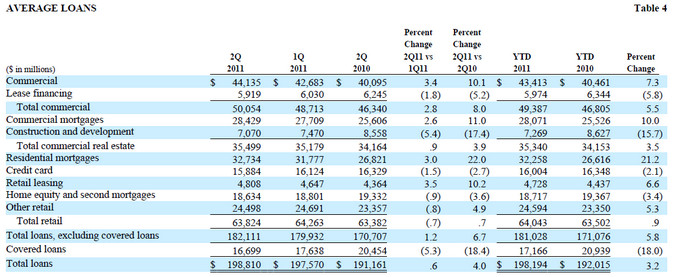

Lease financing continues a downward trend, although only a 1.8% changes from the first quarter, $6,030to $5,919 (billions). Commercial transactions are up overall. Construction and development is down, a category that has had many losses in the past to almost all banks; however, commercial real is up. The drop in credit card business brought retail down below the first quarter, but overall loans were up enough to bypass the drop in covered loans to raise total loans to $198,810.

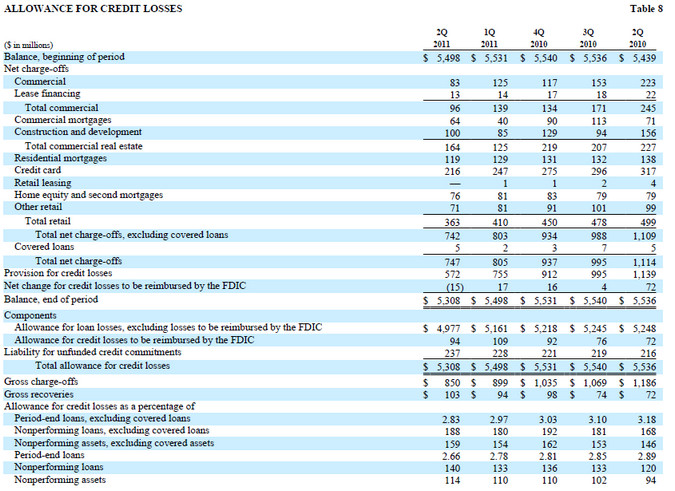

The difference between the second quarter, 2010 of $22 million in lease financing charge offs to $13 million second quarter of 2011 is quite good, as is the trend since the second quarter of 2010.

All the loss numbers are good, except for an increase, although minor, in nonperforming loans and nonperforming assets, according to the allowance. According to the income side construction and development is down, the major category of banks who have recently failed, but the allowance for the second quarter here is up to $100 million from the previous quarter of $85 million, but better than the 4th quarter of 2010 at $129 million. Overall there has been good improvement, and while some of the categories can be picked over, they should not be as most of this is very positive news.

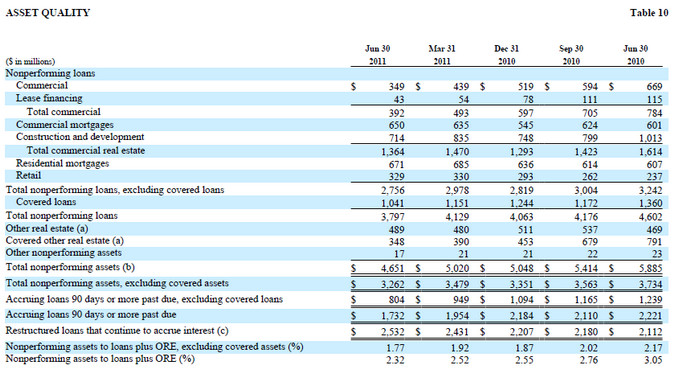

Here is where the key to the performance improvement in the bank stands out with commercial loans down from second quarter of 2010 of $784 to the second quarter of 2011 of $349. Leasing numbers are also very encouraging down from the previous period of $115 to $43. Overall all the nonperforming loans are down!!!

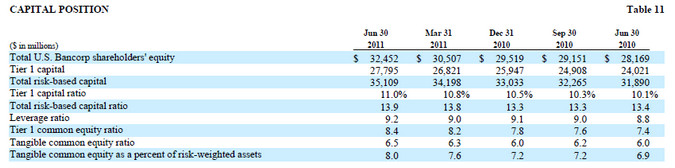

And solid here, too, showing equity going up from $30,507 to $32,452 and Tier 1 capital 11% with a risk-based capital ratio of 13.9

The 8K Statement notes to the charge noted Wholesale Bank and Commercial up, lower provision for credit losses due to performance, and a guideline that shows positive, even though you might think it does not, "Total noninterest expense increased $24 million (7.9%) over a year ago, primarily due to higher compensation and employee benefits expenses. In rough times, these are cut. In good times, it goes up as an indication of growth and reward for performance.

US Bancorp 8-K:

http://www.leasingnews.org/PDF/USBankcorp7202011.pdf

Comprehensive personal property tax outsourcing services |

------------------------------------------

Leasing Industry Help Wanted

EQUIPMENT LEASING SALES

Nationwide- Grand Island, Nebraska AXIS Capital, Inc. has immediate opportunities in Texas (Houston or Dallas based) for experienced customer direct leasing sales executives with established current end user relationships preferred. AXIS Capital Inc. is a National Independent Leasing company. Our ideal candidate will have the opportunity to utilize their industry expertise with the opportunity to grow their existing equipment lessee customer base. |

Equipment Leasing Opportunities throughout the U.S. |

For information on placing a help wanted ad, please click here:

http://www.leasingnews.org/Classified/Hwanted/Hwanted-post.htm

Please see our Job Wanted section for possible new employees.

[headlines]

--------------------------------------------------------------

NorVergence’s Tom Salzano on Trial in Louisiana

by Christopher Menkin

The Louisiana Attorney General and Lake Charles District Attorney appear to be the only ones active in tying up the loose ends of the NorVergence scandal.

Before getting into the Lake Charles, Louisiana case and what is going on today, for new readers, you may not be as familiar with who are the Salzano’s and how NorVergence gave the leasing industry a beating that we still feel the effects today. In addition to the loss of money to the all the creditors, lessees, banks and leasing companies, the bankruptcy of this company perhaps almost single handedly changed "hell and high water" contracts in he United States making vendors and lessors responsible for lack of due diligence, for having the responsibility with the vendor and of the choice of equipment, or in this instance, having knowledge that in this case the service was the dollar amount in the lease not the $500 device for $20,000 to $50,000 telephone lease transactions. When the service ended, the lessees refused to make payments for something not working, and over 10,000 accepted Attorney General settlements ranging from 85% to 95% of what was owed, plus return of insurance, if applicable, and personal property tax. Over $300 million was lost to creditors.

NorVergence was forced into Chapter 11 on June 30, 2004, but was soon converted into a Chapter 7 on July 14, 2004 and assigned to Judge Rosemary Gambardella, U.S. Bankruptcy Court, District of New Jersey. There are over 1100 queries, plus, as other reports are included in various queries.

The last recorded is the dismissal of a claim between Charles M. Forman Trustee of the Estate of NorVergence and defendant Terry Skemmer dated January 31,2011 by the Special Litigation Counsel to the Trustee. What follows are a list of 15 Adversary Case that are closed, with the latest dated July 18, 2011.

4/29/2010 there is quite a list. To sum it up, the Bankruptcy has not been dismissed, and perhaps at that point the financial conclusion will be also final.

The Federal Trade Commission with Senior Attorney Randall H. Brook filed against Thomas N. Salzano and Peter J. Salzano on September 11, 2006 and won a stipulation judgment on October 17, 2007. The FTC won $181.7 million default judgment against NorVergence and the stipulated judgment kept Salzano out of related businesses, following other compliances, and any money up to $50 million was owed to NorVergence lessees. The problem is Salzano didn't own much of anything. The NorVergence BK judge also was seeking money for his wife and son for money allegedly taken from NorVergence to pay personal bills, purchase a house, and a list of other such personal expenditures.

In Louisiana, they didn't sit still. Thomas J. Salzano, the man who pulled the strings at NorVergence a company that allegedly defrauded 11,000 users and $300 million via private label leasing contracts, was indicted in January, 2008 for $100,000 from five Louisiana NorVergence telephone users on multiple counts of money laundering, conspiracy and theft. He spent the night in jail, pled not guilty not guilty in the morning, voluntarily surrendered his passport, plus posted a $75,000 bond and been released from jail.

Calcasieu County District Attorney John DeRosier told KPLC News, "The 11,000 plus victims around the country and the total amount of money that they have lost through this scheme is in excess of $300 million and nobody was doing anything about it. Now, they come to Calcasieu Parish and that's where we draw the line. We're not afraid to go after a complicated case. I think that it is a legitimate case of fraud."

Assistant Attorney General David Caldwell told KPCL other states and the Federal Trade Commission has taken civil action against Salzano but Louisiana is the first to pursue a criminal case."

While the court records of the Louisiana State Attorney General and Lake Charles District Attorney are sealed, Leasing News has learned, "Thomas Salzano has been indicted for felony theft in Lake Charles Louisiana by the Attorney General's Office in conjunction with the local DA. We have been fighting that case in criminal court for over two years. It is currently on remand from the third circuit court of appeals for August 10 of this year. We would be anticipate a trial date by the first of next year.

“We are the ONLY state or federal agency to have followed this through. We had a total of five victims in Louisiana out of 13,000. For the only individual business owner in our state we obtained FULL restitution from LIBERTY bank in an amount over 160k, and in order to do that we filed criminal charges for filing false public records in Shreveport Louisiana. We were the only agency to have obtained those results on behalf of its citizens. We've been busting our butts on this case, have run up against everything you can think of that would delay getting this case done, and we're still fighting. The wheels of justice turn slow, but that's not our fault. I can't make other states or federal agencies fall in line."

It seems most of the other state attorney general were satisfied with the resolution of the lease contracts (for those who took the arrangement), but in Louisiana, they do things differently!

NorVergence Creditors Group:

http://www.leasingnews.org/PDF/NorVergenceCreditorGroup.pdf

NorVergence Dismissal of Claims

http://www.leasingnews.org/PDF/NorVergenceDismisal.pdf

NorVergence Collection of Articles since 2004:

http://www.leasingnews.org/Conscious-Top%20Stories/Novergence_main.htm

|

((Please Click on Bulletin Board to learn more information))

(Leasing News provides this ad “gratis” as a means

to help support the growth of Lease Police)

[headlines]

--------------------------------------------------------------

A Case Against HL Leasing, Another Against Leasing Companies

In the alleged Ponzi scheme of HL Leasing, Fresno, California, where John Otto committed suicide rather than face leases sold to investors that were supposedly American Express leases, there is one class action suits against HL Leasing and crew and one in New York against leasing companies who funded leases for John Otto’s company Heritage Leasing.

The first Cotchett, Pitre & McCarthy, Burlingame, California, filed on May 26, 2009 on behalf of two clients Vicken Massoyan and Maggie Anaramian of Fresno, as well as on the behalf of others. The non-jury trial started on July 26, 2011 in Judge Donald S. Black Fresno County Superior Court room where 148 people are on the witness list.

Ara Jabagchourian, principal

Cotchett, Pitre & McCarthy, LLP

California State University, Fresno

J.D., University of California Hastings College of Law

The American Trial Lawyers Association has selected Jabagchourian as one of the "Top 100 Trial Lawyers" in California for years.

Cotchett, Pitre & McCarthy Attorney Ara Jabagchourian pointed out the scheme started over 20 years ago with longtime investors vouching for the company's success to prospective clients. Dan Ramirez who became president in 1993 said in deposition he was basically a salesman, and in fact, lost hundreds of thousands of dollars in the scheme himself. John Otto's wife Kathy Otto is to testify that while the bookkeeping was down out of the house she shared with Otto, she knew nothing about her husband's business.

There are two main blogs created primarily for investors with http://johnottohlleasing.blogspot.com/ having 32 members (many more followers) and 1043 comments. Many of them lost their life savings, their homes, and life has changed dramatically for them with many of them living the life of poverty, as they had everything invested in HL Leasing.

I was asked by a CPA for an opinion on the class action suits almost two years ago, and unfortunately it basically remains true today: " If the president (Dan Ramirez) can prove he put several hundred thousand dollars into the HL Leasing scam and lost it, it will be pretty hard to prove he had knowledge of what was going on.

"He also has the defense all the bookkeeping was done out of Southern California, checks, etc., and from what he knew, he also believed John Otto, or otherwise would have not invested himself personally.

"When all is said and done, if they hire an attorney or get involved in a class action suit, they will be lose whatever pennies are left. The problem is the victims continue to be victims and nothing is being done as the state and federal agencies are overloaded with cases and the greasy wheel gets the oil. There is not collateral, therefore no assets, and the Otto's have their personal belongings in a trust. It is also the point the wife can file BK and not affect her assets, unless the FBI can prove she was involved in "fraud." More than likely, she will make a deal to turn evidence to the officers who were directly involved.

"So then who is guilty, but more importantly, what money do you win? The house is in a trust. Otto killed himself because all the cash was gone, and he could not keep up the payments. His wife may have had life insurance, but I don't know if it covers suicide. So at worst, she files BK, lives off social security and the house, in trust, as probably other assets are in trust.

"And if she loses, what can she trade for time off---the house is in trust, and in this marketplace, what money is there. The airplane?

Probably money owed on it, too. And who pays the court case and attorney fees, as they come from the class action suit.

“No, I think they only thing going is "revenge" on those who knew and participated, and that is a criminal action---not civil.”

Today I can only guess the evidence presented in the Fresno class action case may help the FBI in their investigation.”

The second class action cased filed in New York by Howard, Lowell, and Wexler in New York City filed on March 25, 2011, a $700,000 claim on behalf of their three clients, Cobalt Investments, LLC, Dragga, LLC, and Real Estate Network, Inc. Profit Sharing Plan, alleging these leasing companies Commercial Equipment Lease Corp., Financial Pacific Leasing, First Sierra Financial, HL Leasing, Heritage Pacific Leasing, Manufactures Acceptance, New Era Funding, Palm Springs Savings Bank, Pentech Financial statement as well as Andy Fernandez, president of HL Leasing, Kathleen J. Otto, wife of John Otto, and the Estate of John W. Otto "had actual knowledge of the fraudulent scheme. One or more of the foregoing defendants, including Centerpoint, had such knowledge by virtue of the fact that they were owned or controlled by Otto. The remaining entities necessarily gained such knowledge in the same manner as Regency Bank and Palm Springs Savings Bank, as described above.

Centerpoint may or may not still be in business, although unlinked, as once owned by John Otto, and First Sierra Financial was sold a long time ago to American Express, who was sold to Key Corp, and New Era Funding has been long gone. Heritage Pacific Leasing ceased to be active upon John Otto’s death, and Pentech Financial has been in a wind down situation for several years.

“92. Upon information and belief, defendants New Era Funding Corp., Commercial Equipment Lease Corp., Centerpoint Financial Services, Financial Pacific Leasing, LLC, First Sierra Financial, Inc. and Belvedere Equipment Finance Corp., provided substantial assistance to the MAC defendants in carrying out their fraudulent scheme, in the same manner set forth in paragraph 90 above.

“93. In addition, upon information and belief, Centerpoint, Pentech, and such other defendants as were owned or controlled by Otto, and thus had knowledge of the fraud, provided substantial assistance in carrying out the fraud through their receipt of funds loaned by the defrauded investors."

Commercial Equipment Leasing Company was terminated from the case on June 16, 2011 and Belvedere Equipment Finance was terminated from the case on July 6, 2011.

Parties are being served with dismissal notice, such as Financial Pacific Leasing and service, while others have been served, awaiting an answer. Who then will be left may be the main characters in the Cotchett, Pitre & McCarthy case going on in Fresno, California.

Previous HL Leasing Stories:

http://www.leasingnews.org/Conscious-Top%20Stories/heritage_leasing.htm

| John Kenny Receivables Management www.jrkrmdirect.com • End of Lease Negotiations & Enforcement The Solution to Your Credit & Accounts Receivable Needs |

(Leasing News provides this ad as a trade for investigations

and background information provided by John Kenny)

[headlines]

--------------------------------------------------------------

Felony Charges Dropped on Brendan Messenheimer

Brendan Messenheimer of AMC Funding, Charlotte, North Carolina, with four Leasing News Alerts about not paying broker commission or bounced checks with vendors, was charged with writing a check for $10,587.88 with insufficient funds.

The felony charges were dropped after he returned all the money, as the district attorney considered this a first time offence. The victim told Leasing News, “I received an overnight check this morning bringing my 9 month nightmare to a conclusion. All I can hope is that he learned a lesson and that this will never happen again."

(Reportedly Messenheimer is back in the leasing business. It is the funders who are keeping these people in business. It is the funders who are still saying non-notification to lessees about the end of leasing contracts is still okay and continue to do business with these discounters.)

Christopher Menkin, editor

Fourth Alert (includes first three alerts)

http://leasingnews.org/archives/Feb2011/2_22.htm#fourth_amc

|

[headlines]

--------------------------------------------------------------

##### Press Release ############################

Former NASA Special Agent Pleads Guilty Tax Return

Los Angeles – A former special agent with the National Aeronautics and Space Administration, Office of Inspector General pleaded guilty Thursday afternoon to charges that he failed to report almost $300,000 on his federal income tax returns from cash tithes he stole from his church.

Alvin Danielle Allen, 42, a resident of Lancaster, pleaded guilty to one count of subscribing to a false tax return.

Appearing before United States District Judge George H. King, Allen pleaded guilty to a count involving his fraudulent 2004 tax return, but also admitted filing fraudulent tax returns for the tax years 2005 through 2008.

Allen, who was arraigned in federal court earlier this month, will remain in jail until his sentencing before Judge King on November 7, 2011.

According to the plea agreement, since approximately 1998, Allen was a deacon at his church, Lancaster Baptist Church, where he was also an officer of the church board. From 2004 through 2009, Allen served on a church committee that counted the tithes after the church services. While serving on the church committee, Allen stole from the church goers’ cash contributions. The amount of money Allen stole varied over the years until approximately October 2009 when Allen was caught on a hidden surveillance camera installed at the church, stealing the church tithing’s and putting the cash into his clothes. Allen stole a total of approximately $299,975 from the church during the period 2004 through 2008.

Allen was previously convicted in state court of grand theft by embezzlement and commercial burglary for stealing the church tithings.

“Alvin Allen’s actions were detestable. Allen violated the trust placed in him by NASA as well as his church community, for his own personal financial gain,” said Special Agent in Charge Leslie P. DeMarco of the IRS-Criminal Investigation Los Angeles Field Office. “Crimes committed by civil servants, whether as part of their official duties or private lives, violate public trust. IRS-CI helps ensure that everyone pays their fair share.”

In relation to his 2004 tax return, Allen did not report the cash tithing’s he stole from the church, approximately $42,436, as his income on the tax return. Allen also falsely reported that he sold his rental property for a loss of $17,940, when in fact he had sold his rental property for a profit of approximately $60,000.

Concerning tax years 2005, 2006, 2007 and 2008, Allen failed to report cash tithing’s stolen from the church of approximately $75,096, $61,903, $33,123, and $87,417, respectively. The tax loss to the IRS based on Allen’s failure to report his true income during this time period totals approximately $88,882.

As a result of today’s guilty plea, Allen faces a statutory maximum sentence of three years in federal prison. In addition to the possible prison term, Allen has agreed to pay on or before sentencing all additional taxes, penalties and interest assessed by the IRS on the basis of the returns.

The investigation and prosecution of Allen was conducted by IRS - Criminal Investigation and NASA Office of Inspector General - Office of Investigations, in conjunction with the United States Attorney’s Office for the Central District of California.

##### Press Release ############################

##### Press Release ############################

Hermosa Beach Man Fails to Report $1 Million in Income

Los Angeles – Joseph Ford Proctor, 66, formerly of Hermosa Beach, raised funds from investors for various companies and was convicted of subscribing to two false income tax returns. The jury deliberated for less than an hour before returning their verdict.

The evidence presented during a three day trial in United States District Court showed that in 2002 and 2003, Proctor raised funds from investors for Powerhouse Studios, Inc. and Powerhouse Technologies Group, Inc. Investors in Powerhouse were directed to send their investment funds to a bank account held in the name of Brickhouse Venture Capital Limited. Although Brickhouse was a company opened in the name of the defendant’s brother, Proctor directed how the investor funds would be spent.

In 2002, Proctor caused $240,500 to be wire transferred in the name of his wife from the Brickhouse bank account to a joint bank account that he held with his wife. In that same year, Proctor caused an additional $100,000 to be wire transferred in the name of his wife to a bank account held in her name. In 2003, Proctor caused $610,000 to be wire transferred in the name of his wife from the Brickhouse bank account to the same account held in his wife’s name. The funds were spent to fund the lifestyles of the defendant, his wife and their daughter. According to documents filed with the court, Proctor referred to his wife, a citizen of Thailand at the time, as his walking tax shelter.

Proctor failed to report this $950,500 in income on his federal income tax returns. In 2002, Proctor reported having only $5,500 in income and paid no income tax. In 2003, Proctor reported having only $7,450 in income and paid no income tax.

Proctor is scheduled to be sentenced by United States District Court Judge King on January 23, 2012. At sentencing, Proctor faces a statutory maximum penalty of six years in federal prison, and fines totaling $500,000.

The investigation of Proctor was conducted by IRS – Criminal Investigation in Los Angeles.

### Press Release ###############################

|

[headlines]

--------------------------------------------------------------

Longest Living Cities

(It appears on the average, the women outlive

the men by four years in almost all the cities, some longer.)

1.

San Jose, California

Average male life expectancy in the last decade: 79.2

A

verage female life expectancy in the last decade: 82.9

2.

Honolulu, Hawaii

Average male life expectancy in the last decade: 77.7

Average female life expectancy in the last decade: 83.2

3.

Anaheim, California

Average male life expectancy in the last decade: 78.1

Average female life expectancy in the last decade: 82.3

4.

Bridgeport, Connecticut

Average male life expectancy in the last decade: 77.4

Average female life expectancy in the last decade: 82.1

5.

Seattle, Washington

Average male life expectancy in the last decade: 77.5

Average female life expectancy in the last decade: 81.9

6.

Madison, Wisconsin

Average male life expectancy in the last decade: 77.4

Average female life expectancy in the last decade: 81.9

7.

Aurora, Colorado

Average male life expectancy in the last decade: 77.67

A

verage female life expectancy in the last decade: 81.44

8.

San Francisco, California

Average male life expectancy in the last decade: 75.9

A

verage female life expectancy in the last decade: 82.52

9.

Minneapolis, Minnesota

Average male life expectancy in the last decade: 77.0

Average female life expectancy in the last decade: 81.7

10.

Boise, Idaho

Average male life expectancy in the last decade: 76.93

Average female life expectancy in the last decade: 81.65

11.

Lincoln, Nebraska

Average male life expectancy in the last decade: 76.9

Average female life expectancy in the last decade: 81.6

12.

Plano, Texas

Average male life expectancy in the last decade: 77.4

Average female life expectancy in the last decade: 81.0

13.

San Diego, California

Average male life expectancy in the last decade: 76.85

Average female life expectancy in the last decade: 81.37

14.

Los Angeles, California

Average male life expectancy in the last decade: 76.2

Average female life expectancy in the last decade: 81.4

15.

Oakland, California

Average male life expectancy in the last decade: 76.4

Average female life expectancy in the last decade: 81.2

16.

Austin, Texas

Average male life expectancy in the last decade: 76.6

Average female life expectancy in the last decade: 80.9

17.

Raleigh, North Carolina

Average male life expectancy in the last decade: 76.2

Average female life expectancy in the last decade: 81.0

18.

Miami, Florida

Average male life expectancy in the last decade: 75.4

Average female life expectancy in the last decade: 81.3

19.

Salt Lake City, Utah

Average male life expectancy in the last decade: 76.3

Average female life expectancy in the last decade: 80.7

20.

Rochester, New York

Average male life expectancy in the last decade: 76.1

Average female life expectancy in the last decade: 80.7

Longest Living Cities

http://www.thedailybeast.com/galleries/2011/07/18/longest-living-cities.html

|

[headlines]

--------------------------------------------------------------

Fernando's View

By Fernando F. Croce

First-rate releases for families (“Winnie the Pooh”) and art-house aficionados (“Tabloid”) grace theaters this week, while DVD releases encompass intriguing thrillers (“Limitless”), frothy star tributes (“Potiche”), and one of the year’s best (and most indescribable) films (“Uncle Boonmee Who Can Recall His Past Lives”).

In theaters:

Winnie the Pooh (Walt Disney Pictures): Every child’s favorite honey-crazy bear, Winnie the Pooh returns to the big screen in this tender and lovingly crafted family movie. The plot finds the gang at Hundred Acre Wood looking for Eeyore’s missing tail, while hunting down a fearsome creature that’s supposedly kidnapped Christopher Robin. As with the best of Pooh’s adventures, however, the movie is less about rushing through a story than about interacting with the beloved characters, which include the ever ebullient Tigger and anxious Piglet, along with Owl, Rabbit, and Kanga and Roo. While many animated features nowadays are filled with nonstop noise and visual bravura, the film, directed by Stephen J. Anderson and Don hall, understands how to score points with subtle visual wit and wry emotional generosity. The result is a total charmer.

Tabloid (Sundance Selects): Though he's an Oscar-winning documentarian, there's very little that's predictable or stuffy about Errol Morris' subjects or his handling of them. Case in point: Joyce McKinney, the one-of-a-kind human whirlwind at the center of his immensely entertaining new film. A former beauty queen from Wyoming who in the late 1970s became a media sensation due to her participation in a bizarre scandal involving fake identities, Mormon kidnapping and cloned puppies, the older but still indomitably vivacious McKinney she faces Morris' camera and tells her story in a myriad of cheerfully strange ways. Was she a woman driven by passion? A virtuoso storyteller weaving her own madcap adventure? A creation of a scandal-hungry culture? Without providing easy answers or mocking his subject, Morris brings us closer to her obsessions.

Netflix Tip: A chronicler of unique, sometimes controversial but always endlessly fascinating figures, “Tabloid” director Errol Morris has over the years amassed a striking gallery of real-life characters in his documentaries. Check out Netflix and get acquainted with the pet cemeteries of “Gates of Heaven” (1978), the justice procedurals of “The Thin Blue Line” (1988), the metaphysical puzzles of “Fast, Cheap & Out of Control” (1997) and the Oscar-winning historical analysis “The Fog of War” (2003). |

On DVD:

Limitless (Fox): After dealing with 19th-century magicians in “The Illusionist” and Iraq War vets in “The Lucky Ones,” offbeat director Neil Burger tries his hand at brainy action with this intriguing, fast-paced thriller. “The Hangover’s” Bradley Cooper stars as Eddie Morra, an aspiring writer who, after having his novel rejected and being dumped by his girlfriend Lindy (Abbie Cornish), takes drastic measures to change his life. That’s when he experiments with a new form of medicinal drug, and is suddenly rocketed to the top of the business world. It’s not long, however, before his newfound powers attract mysterious, ominous forces led by a financial mogul (Robert De Niro), who’s got plans of his own. Well-acted and exciting, this is the rare action movie that dishes out thrills without sacrificing intelligence.

Potiche (Music Box Films): Fans of Catherine Deneuve will be delighted by Francois Ozon’s light and colorful comedy, which gives the grand dame of French cinema her most elegantly funny role in years. Deneuve stars as Suzanne, the trophy-wife of Robert (Fabrice Luchini), an industrialist who in the 1970s rules over his employees with an iron fist while openly cheating on Suzanne. After Robert is taken hostage during a strike, however, she must take control of the factory and, to everybody’s surprise, finds a new vocation in dealing with business affairs. Shot in a candy-colored style and featuring a poignant appearance by Gerard Depardieu as the heroine’s former lover and political rival, the film offers infectious fun for fans of Ozon’s earlier and equally frothy “8 Women”. With subtitles.

Uncle Boonmee Who Can Recall His Past Lives (Strand Releasing): The title is just the first unique thing about this marvelous Thai fantasy, the surprise winner of last year’s coveted Palme d’Or at the Cannes Film Festival. The uncle of the title (played by Thanapat Saisaymar) is an aging farmer who, while on his deathbed, receives a visit from his ghostly wife and son, who have come to prepare him for the next world. The plot suggests a horror movie, but director Apichatpong Weerasethakul instead offers a warm and funny look at the fluidity of spirituality and fate. Without compromising his singular cinematic style, Weerasethakul weaves a beguiling mosaic of reincarnation and ghosts that’s at the same time remarkably sophisticated and light as air, challenging and immediately accessible. With subtitles.

[headlines]

--------------------------------------------------------------

Buffalo, New York-- Adopt-a-Dog

Zoey

Female

Rescue ID: D110053

General Color: White

C

urrent Size: 90 Pounds

Current Age: 4 Years (best estimate)

Housetrained: Yes

“Are you looking to give this special girl a home, time, and love she wants? Zoey is a beautiful 4 year old pure Akita female. She knows basic obedience such as sit, paw and can play fetch. She would love a house that is fairly calm. She is good with kids and ok with larger dogs. She is a little shy with strangers, but warms right up after a few minutes. Being an akita she rarely barks. She also loves being outside playing with her best friend a female chocolate lab. Zoey’s current owner loves her, however, they work too many long days and as a single mother of a 3 month old simply does not have the time to give Zoey the attention she needs.”

Adoption Procedure:

http://buffalohumane.rescuegroups.org/user/

login?refererPageID=72&keyID=483&referer=/forms/form_edit.phpQu8FormID=483

Write Us:

Buffalo Humane

3380 Sheridan Dr #276

Buffalo, NY 14226

Call Us:

(716) 862-9183

Email Us:

adopt@buffalohumane.org

Additional Contact Info:

We want to hear from you. Please contact us with any concerns or problems at info@buffalohumane.org or (716) 862-9183. Our fax number is (480) 287-8272.

http://buffalohumane.rescuegroups.org/index.php

Adopt-a-Pet by Leasing Co. State/City

http://www.leasingnews.org/Conscious-Top%20Stories/Adopt_Pet.htm

Adopt a Pet

http://www.adoptapet.com/

|

![]()

News Briefs----

U.S. Forecast Heat Index

GE expected to report 13 percent rise in profit

http://www.reuters.com/article/2011/07/21/us-ge-idUSTRE76K7FO20110721

Wells Fargo paying record fine of $85 million over alleged loan practices

http://www.mercurynews.com/business/ci_18519653?source=most_viewed

Optimistic outlook for European vehicle leasing industry

http://www.fleetnews.co.uk/news/2011/7/15/optimistic-outlook-for-european-leasing-industry/40123/

Microsoft's results beat expectations, but Windows sales slip

http://seattletimes.nwsource.com/html/businesstechnology/2015688252_microsoftearnings22.html

Canada jobless claims down for 8th month

http://www.upi.com/Business_News/2011/07/21/Canada-jobless-claims-down-for-8th-month/UPI-44481311255444/

Massachusetts unemployment rate is unchanged at 7.6 percent

http://www.boston.com/Boston/businessupdates/2011/07/state-unemployment-rate-unchanged/QB7dgYaZkYxNfRF5hMfd6O/index.html

Trustee in Madoff case drops damages claim involving Mets ownership

http://www.nypost.com/p/news/business/ponzi_pullback_9lSRIzelwH6T1kpDteEnEM

You May Have Missed---

Portland most affordable place to retire

http://www.usatoday.com/money/perfi/retirement/2011-07-21-most-affordable-places-to-retire_n.htm

|

Sports Briefs----

San Francisco 49ers and Oakland Raiders could share a stadium, but where?

http://www.mercurynews.com/southbayfootball/ci_18516390?source=most_viewed

![]()

California Nuts Briefs---

Stanford emerging as hub for fast-growing investment trend

http://www.mercurynews.com/business/ci_18523879

Schwarzenegger doesn't want to pay Shriver support

http://news.yahoo.com/schwarzenegger-doesnt-want-pay-shriver-support-191524367.html

Nine of 10 June sales were distressed properties in Lake County

http://realestate.blogs.pressdemocrat.com/11998/nine-of-10-june-sales-were-distressed-properties-in-lake-county/

Rancho Cordova woman arrested following death of dog found in hot car

http://blogs.sacbee.com/crime/archives/2011/07/rancho-cordova-25.html

![]()

“Gimme that Wine”

Go Vines Launches

http://napavalleyregister.com/business/govine-launches/article_cd026cb4-b1cb-11e0-b3db-001cc4c03286.html

Free Mobile Wine Program

http://leasingnews.org/archives/Feb2010/2_26.htm#mobile

Wine Prices by vintage

http://www.winezap.com

http://www.wine-searcher.com/

US/International Wine Events

http://www.localwineevents.com/

Winery Atlas

http://www.carterhouse.com/atlas/\

Leasing News Wine & Spirits Page

http://two.leasingnews.org/Recommendations/wnensprts.htm

[headlines]

----------------------------------------------------------------

Please send to a colleague---Leasing News is Free

![]()

This Day in American History

1587-The second English colony established on Roanoke Island off North Carolina . The Roanoke Island Colony, sponsored by sir Walter Raleigh, was established on Roanoke Island, off the northeast coast of what is now North Carolina , under the leadership of Sir Richard Grenville and Sir Ralph Lane . the settlers fared badly and returned to England in June of 1586. In 1587, Raleigh sent out another group under John White, consisting of 117 men, women and children, who landed this day. White returned to England for supplies, but was unable to get back to Roanoke until August 17, 1590, three years later. He found all the colonists gone; the only clue to their fate was the word Croton carved on a tree. The meaning of this remains unexplained and no trace was ever found of the settlers. Whether they met their fate by Indians, a cold Winter, lack of food, or disease is not known.http://personal.pitnet.net/primarysources/ronoake.html

1620- A small congregation of English Separatists, led by John Robinson, began their emigration to the New World . Today, this historic group of religious refugees has come to be known as the 'Pilgrims.' Pastor John Robinson was the last face the Pilgrims saw as their ship left for the New World . He never made it to America , but this one man is credited with planting a single word — independencehttp://www.ohioroundtable.org/cfdocs/shows.cfm?

showcode=968&fromhome=YES

http://www.revjohnrobinson.com/art.htm

http://www.mlp.org/sermon.html

http://members.aol.com/calebj/robinson_letter.html

http://www.newnorth.net/~johhnson/~jrobinson.html

1667- New Netherland was ceded to England by the Dutch by the Peace of Breda, which ended the second Anglo-Dutch War (1665-1667). The British had captured Fort Amsterdam and divided the territory into New Jersey and New York . Colonization was slow and the territory was re-organized in 1674.

http://www.infoplease.com/ce6/history/A0816459.html

http://www.infoplease.com/ce6/history/A0857845.html

1724 The Alamo , to become famous as the site of a great battle of the war for Texan independence in 1836, was constructed at about this time as a Franciscan mission.

http://www.thealamo.org/faqs.html#one

http://www.americanwest.com/pages/alamo.htm

1796-Surveyors commissioned by General Moses Cleaveland (sic.) completed the plan for the town of Cleaveland (sic.), Ohio . ( lower half of:

http://memory.loc.gov/ammem/today/jul22.html )

http://www.travelcleveland.com/About_Cleveland/cleveland_history.asp

1860-Birthday of Mother Marie Joseph Butler - Irish-born Roman Catholic American nun. As the Mother General of the Congregation of the Sacred Heat of Mary, she began the Marymount school system. She opened 14 schools in the United States , three of which became colleges.

1861-An intention to issue an Emancipation Proclamation was announced by President Lincoln to his Cabinet. He read the entire proclamation. He wanted to issued it the same day as strictly military effort to cripple Confederate manpower. His Cabinet persuaded him to wait as it was not good political timing, both because the Union was not doing well in the war, and many politicians were questioning the cause. Lincoln argued it needed to be done soon, but was persuaded to wait for a more favorable military situation to avoid the appearance of “desperation.”

1864- The Battle of Atlanta , GA. Young General John Bell Hood attacks General William Tecumseh Sherman, resulting in terrible loses for the Confederate Army; Estimated casualties: 12,140 (3,641 Union , 8,499 Confederate)

http://ngeorgia.com/history/battleofatlanta.html

http://www2.cr.nps.gov/abpp/battles/ga017.htm

http://www.civilwarhome.com/hoodbio.htm

http://ngeorgia.com/people/hood.html

http://home.sprynet.com/~randyyoung/ransom.htm

1886-In San Francisco a brewery workers union formed last month among mostly socialist German workers, to resist the prevailing 16-18 hour workday. Today breweries admitted defeat & gave in to union demands for FREE BEER, the closed shop, freedom to live anywhere for brewery workers (who had, until now, typically lived in the brewery itself), a 10-hour day, six-day week, & a board of arbitration.

1872-birthday of Tom “Boss” Pendergast, St. Joseph , MO

http://www.allaboutjazz.com/jazznew.htm

http://www.energy2001.ee.doe.gov/GoinToKC.htm

http://www.experiencekc.com/truman.html\

http://organizedcrime.about.com/library/weekly/aa102500a.htm

1882-birthday of painter Edward Hopper, Nyack , NY .

http://www.artchive.com/artchive/H/hopper.html

http://sunsite.dk/cgfa/hopper/

http://artcyclopedia.com/artists/hopper_edward.html

http://sheldon.unl.edu/HTML/ARTIST/Hopper_E/AS.html

http://art-posters-art-prints.com/edward-hopper.html

http://www.mcs.csuhayward.edu/~malek/Hopper.htm

1888-brithday detective novelist Raymond Chandler

http://www.america.net/~davdmock/chandler.htm

http://www.hifibliss.com/peter/chandler.htm

http://www.kirjasto.sci.fi/rchandle.htm

http://hometown.aol.com/chandlerla/

http://www.angelfire.com/sd/kreelah/chandler.html

http://www.amazon.com/exec/obidos/search-handle-form/

102-8899986-2380120

1890- Rose Kennedy Birthday. If you travel to Boston , be sure to see the

Italian section and where she grew up. Rose Kennedy became the epitome of a stalwart woman who maintained her dignity while her wealthy husband openly flaunted his many adulteries and somehow maintained her composure when three of her four sons were killed, her other son caused the death of a young woman, and a daughter proved to be mentally limited.

http://www.wic.org/bio/rkennedy.htm

http://www.geocities.com/CapitolHill/Senate/1968/rose.htm

http://www.amazon.com/exec/obidos/ASIN/0791016226/

avsearch-bkasin-20/103-5362656-4423850

1890- the observation “Everybody talks about the weather, but nobody does anything about it” was written by editor Charles Dudley Warner in the Hartford Courant., The remark has wrongly attributed to his Hartford friend Mark Twain.

1893-birthday of Karl Menniger, American psychiatrist, born at Topeka , KS . Along with his father and brother, he founded the Menniger Clinic and Foundation at Topeka in the 1920s. He died July 18, 19990, at Topeka .

1899-birthday of sculptor Alexander Calder.http://memory.loc.gov/ammem/today/jul22.html

1906-Birthday of Writer and pilot Anne Morrow Lindbergh, Englewood , New Jersey . Lindbergh attended Smith College , where her writing won several coveted literary awards. At age 23, she married celebrated aviator Charles Lindbergh, who had made the first transatlantic solo flight in 1927. The couple flew frequently, and she became the first woman to receive a glider pilot's license. She got her airplane pilot's license in 1931 and published several books about her experiences, including North to the Orient (1935), about the couple's flight over Canada and Alaska to Asia. The couple's infant son was kidnapped for ransom in 1932, which led to his death. The tragedy affected the entire nation. In 1934, she became the first woman to win the National Geographic Society Hubbard Gold Medal. Her 1944 book, “Gift from the Sea” became a bestseller and was reissued in a special anniversary edition 25 years after its publication.

1908- Amy Vanderbilt birthday- U.S. author. AV wrote Vanderbilt's Complete Book of Etiquette that took a more modern approach to manners and etiquette than did Emily Post.

http://www.allperson.com/allperson/legend/0000000893.asp

http://www.quotationspage.com/quotes.php3?author=Amy+Vanderbilt

1915-birthday of trumpet player/singer Taps Miller, Indianapolis , IN

http://seattletimes.nwsource.com/html/artsentertainment/

134463975_lawrence17.html

1916-A bombing in San Francisco during a Preparedness Day parade killed 10 persons and wounded 40. In 1917 labor leader Tom Mooney was sentenced to hang and Warren K. Billings was sentenced to life imprisonment for the dead. President Wilson commuted Mooney's sentence to life imprisonment in 118, but because of confessions of perjured testimony at the trial, the case was an international cause celebre for many years. On January 8, 1939, Governor Culbert L. Olson of California pardoned Mooney. Billings was released a later in the year.

1917-July 22, Lou McGarity Birthday http://shopping.yahoo.com/shop?d=product&id=1927006

998&clink=dmmu.artist&a=b

Feast day of Mary Magdalene, who, according to Biblical texts, witnessed both the crucifixion and the resurrection of Jesus. According to Biblical texts, she was the only one of Jesus' followers to do that - and the only one to whom Jesus spoke at the tomb - avoiding Peter and asking her to explain to everyone that he was ascending to heaven. Many feminist religious scholars cite Jesus' orders to Mary Magdalene, asking her to spread the word as surpassing the Pauline (Paul) later philosophy that women were not to speak in church or teach men.

http://elvis.rowan.edu/~kilroy/JEK/07/22.html

http://www.pbs.org/wgbh/pages/frontline/shows/religion/

maps/primary/mary.html

http://www.st-mary-magdalene.org/newpage4.htm

http://www.magdalene.org/biblical.htm

1918 - A single bolt of lightning struck 504 sheep dead in their tracks at the Wasatch National Forest in Utah. Sheep often herd together in storms, and as a result the shock from the lightning bolt was passed from one animal to another.

1924- singer Margaret Whiting was born in Detroit . Her father was the famous songwriter Richard Whiting. She began her career in the early 1940's singing with the bands of Freddie Slack and Billy Butterfield. With trumpeter Butterfield, Whiting recorded the 1944 million-seller "Moonlight in Vermont ." Her 1948 recording of "A Tree in the Meadow" also sold a million, as did her 1949 duet with Jimmy Wakely, "Slippin' Around."

http://www.northwood.edu/dw/1994/whiting.html

1924-birthday of pianist Al Haig, Newark , NJ

http://music.barnesandnoble.com/search/artistbio.asp?

userid=0HNQVIRQ19&ctr=70344

http://www.bobjanuary.com/alhaig.htm

http://jazzinstituteofchicago.org/index.asp?target=/

jazzgram/people/alhaig.asp

http://www.amazon.com/exec/obidos/external-search/102-8899986-2380120?tag=drjohnholleman&keyword=al+haig&mode=music

http://music.zodchiy.com/A/Al_Haig.html

1924-birthday of Tensor tax Bill Perkins.http://music.barnesandnoble.com/search/artistbio.asp?

userid=0HNQVIRQ19&ctr=70886

1930-The Philadelphia Athletics executed a triple steal in the first inning of a game against the Cleveland Indians and another one in the fourth inning. This is the only game in which two triple steals have occurred.

1933-the first Opera prima donna who was African American was Caterina Jarboro (born Katherine Yarborough in Wilmington, North Carolina,) who appeared as Aida, the Ethiopian slave, in Giuseppe Verdi's opera Aida, presented by Alfredo Salmaggi's Chicago Opera Company at the New York Hippodrome, Sixth Avenue and 43 rd Street, New York City. Caterina attended school in Wilmington (where she is noted in their “Walk of Fame” until, at age 13, she journeyed to New York to study music. During her illustrious career, she achieved international fame as a soprano and paved the way for other talented African-Americans in American opera. Caterina performed in many of the world's great opera houses, including Paris , Vienna , Warsaw , Madrid , Moscow and the United States . She also thrilled Wilmington audiences on two occasions by performing at the Academy of Music (Thalian Hall) and the Williston High School auditorium . Died August 23,1986 at the age of 88. Manhattan , NY

http://www.spinnc.org/spinsites/arts/wof_jarboro.htm

1934-birthday of tenor sax player Herman “Junior” Cook, Pensacola , FL

Died February 4,1992. http://members.tripod.com/~hardbop/jrcook.html

http://www.fantasyjazz.com/catalog/cook_j_cat.html

1936-birthday of Don Patterson, organ, Columbus , OH

http://www.amazon.com/exec/obidos/tg/stores/artist/glance/-/49897/ref=m_art_dp/102-8899986-2380120

1937 - Hal Kemp and his orchestra recorded the now-standard, "Got a Date with an Angel", for Victor Records in Hollywood , California . The distinctive vocal on the tune is provided by Skinnay Ennis

1939- the first judge who was an African-American woman was Jane Matilda Bolin, who on this day was appointed judge of the Court of Domestic Relations by Mayor Fiorello La Guardia of New York City . She was also the first African-American woman to graduate from Yale Law School and the first to be admitted to the New York City Bar.http://www.blackseek.com/bh/2001/172_JBolin.htm

1941-Robert “Lefty” Grove of the Boston Red Sox won the 300 th and last game of his major league career, defeating the Cleveland Indians, 10-6.

1942-Harry James with Helen Forrest record “ I Had the Craziest Dream.”

1943-Two weeks after the July 10 Allied invasion of Sicily , the principal northern town of Palermo was captured. Americans had cut off 50,000 Italian troops in the west, but Germans were escaping to the northeastern corner of the island After 39 days, on August 17, 1943, the entire island of Sicily was under the control of Allied forces. The official total of Germans and Italians captured was put at 130,000. The Germans, however, managed to transfer 50,000 of their 90,000 men back to the Italian mainland.

1944 - The Bretton Woods ( New Hampshire ) Conference created the International Monetary Fund on this day. The IMF is “...a cooperative institution that [many] countries have voluntarily joined because they see the advantage of consulting with one another in this forum to maintain a stable system of buying and selling their currencies so that payments in foreign money can take place between countries smoothly and without delay.” The IMF was based on the ideas of the U.S. Treasury Department's Director of Monetary Research, Harry Dexter White, John Maynard Keynes of England and the IBRD (International Bank for Reconstruction & Development). The IMF began operations in Washington , D.C. in May 1946 with 39 member countries.

1944--SKAGGS, LUTHER, JR. Medal of Honor Rank and organization: Private First Class, U.S. Marine Corps Reserve, 3d Battalion, 3d Marines, 3d Marine Division. Place and date: Asan-Adelup beachhead, Guam, Marianas Islands, 21 -22 July 1944. Entered service at: Kentucky. Born: 3 March 1923, Henderson, Ky. Citation: For conspicuous gallantry and intrepidity at the risk of his life above and beyond the call of duty while serving as squad leader with a mortar section of a rifle company in the 3d Battalion, 3d Marines, 3d Marine Division, during action against enemy Japanese forces on the Asan-Adelup beachhead, Guam, Marianas Islands, 21 -22 July 1944. When the section leader became a casualty under a heavy mortar barrage shortly after landing, Pfc. Skaggs promptly assumed command and led the section through intense fire for a distance of 200 yards to a position from which to deliver effective coverage of the assault on a strategic cliff. Valiantly defending this vital position against strong enemy counterattacks during the night, Pfc. Skaggs was critically wounded when a Japanese grenade lodged in his foxhole and exploded, shattering the lower part of one leg. Quick to act, he applied an improvised tourniquet and, while propped up in his foxhole, gallantly returned the enemy's fire with his rifle and hand grenades for a period of 8 hours, later crawling unassisted to the rear to continue the fight until the Japanese had been annihilated. Uncomplaining and calm throughout this critical period, Pfc. Skaggs served as a heroic example of courage and fortitude to other wounded men and, by his courageous leadership and inspiring devotion to duty, upheld the high traditions of the U.S. Naval Service.

1945-birthday of guitarist Al DiMeola, Jersey City , NJ

http://www.aldimeola.com/

http://www.pixelplanet.com/Music/EG.htm

http://www.daddario.com/DADDARIO_ENDORSEES/ALDIMEOL.HTM

http://www.dwponline.com/rock/dimeola.htm

1947---Top Hits

Peg o' My Heart - The Harmonicats

I Wonder, I Wonder, I Wonder - Eddy Howard

Chi-Baba, Chi-Baba - Perry Como

Smoke! Smoke! Smoke! (That Cigarette) - Tex Williams

1948- Peggy Fleming birthday - U.S. figure skater, winner of 1968 Olympic singles gold medal. She became an outstanding business woman who revamped the ailing Ice Capades show into a profitable business. She lives right here in Los Gatos , California , where she is active in the Silicon Valley Community

1949-birthday of film score composer Alan Menken, New Rochelle , NY .

http://disney.go.com/DisneyRecords/Biographies/Menken_Bio.html

http://menken.dyns.net/

1954- In an attempt to put more pop in the lineup, Casey Stengel inserts Mickey Mantle in the infield as the shortstop. The experiment works as the 'Commerce Comet' homers in the tenth inning giving the Yankees a 3-2 victory over the White Sox.

1955---Top Hits

Rock Around the Clock - Bill Haley & His Comets

Honey-Babe - Art Mooney

The House of Blue Lights - Chuck Miller

I Don't Care - Webb Pierce

1962-Gary Player of South Africa became the first nonresident of the US to win the PGA championship. He defeated Bob Goalby by one stroke at Aronimink Golf Club in Newtown Square, PA.

1963---Top Hits

Surf City - Jan & Dean

So Much in Love - The Tymes

Memphis - Lonnie Mack

Act Naturally - Buck Owens

1963- history records the first bank to lease personal property was the Bank of America , San Francisco , CA , which instituted the service this day, under the direction of Robert D'Oyly Syer. James Joseph Saxon comptroller of the currency, advised national banks on March 18, 1963, that they were permitted to lease personal property, buying equipment and leasing it directly to customers.

1963-The Beatles' first US album, "Introducing The Beatles" was pressed by Vee-Jay Records, who thought they had obtained the legal rights from EMI affiliate, Trans-Global Records. When it was finally released in January, 1964, Capitol Records would hit Vee Jay with an injunction against manufacturing, distributing, advertising, or otherwise disposing of records by the Beatles. After a trial, Vee-Jay was allowed to release any Beatles records that they had masters of in any form until October 15th, 1964. After that time, they no longer had the right to issue any Beatles product.

1963 - World Heavyweight Champion Sonny Liston hung on to his boxing title by knocking out challenger Floyd Patterson in the first round of a bout in Las Vegas , NV .

1965 - "Till Death Us Do Part" debuted on England 's BBC-TV. The show was so popular that it became a TV series in Great Britain and was the forerunner of the 1971-92 CBS-TV hit, "All In The Family", starring Carroll O'Connor and Jean Stapleton.

1967- Using five pitchers in same inning, the Braves establish a major league mark for the number hurlers called upon in one inning. Ken Johnson, Ramon Hernandez, Claude Raymond, Dick Kelley and Cecil Upshaw all face the Cardinals in the ninth inning.

1967 - The "Billboard" singles chart showed that "Windy", by The Association, was the most popular record in the U.S. for the fourth straight week. The Los Angeles-based sextet would make way for Jim Morrison and The Doors a week later when "Light My Fire" became the hottest record of the mid-summer.

1968-- Elvis Presley begins filming his twenty-ninth movie, Charro!, on location in Arizona. It is the only Elvis movie where he sports a beard, and the only one in which he does not sing on-camera -- only two songs are recorded for the film, and only the title track, another Mac Davis composition, is used... over the credits only. A "serious" Western, it is nonetheless a critical and commercial failure.

1969- The All-star game is postponed by rain for the first time in major league history.

1971---Top Hits

It's Too Late/I Feel the Earth Move - Carole King

You've Got a Friend - James Taylor

Don't Pull Your Love - Hamilton, Joe Frank & Reynolds

When You're Hot, You're Hot - Jerry Reed

1971- The Doors' "L.A. Woman" is certified gold

1973 -The Reds All-Star shortstop Dave Concepcion will miss the rest of the season due to a broken ankle.

1975 - Confederate General Robert E. Lee had his U.S. citizenship restored by the U.S. Congress.

1977 - Tony Orlando announced his retirement from show business. Orlando was performing in Cohasset , MA when he said that he had finally decided to call it quits. Orlando had two solo hits in 1961 ("Halfway to Paradise " and "Bless You") and 14 hits with his backup singers (known as Dawn) through the mid-1970s. He also hosted a weekly TV variety show with Dawn (Telma Hopkins and Joyce Vincent) from 1974-1976.

http://www.tonyorlandoonline.com/

http://www.friends-of-toad.com/

1979---Top Hits

Bad Girls - Donna Summer

Good Times - Chic

Makin' It - David Naughton

Shadows in the Moonlight - Anne Murray

1979- golfer Sam Snead, age 67, became the first to shoot below his age on a Professional Tour, on the fourth day of the Quad Cities Open Tournament at Coal City, IL. His score was 277 ( 70,67,74, 66 ).

1983 -128ø F (-89ø C) recorded, Vostok, Antarctica (world record

1984- Kathy Whitworth won the Rochester Open to become the all-time winningest professional golfer. Her 85 th victory surpassed the 84 tournament wins of Sam Snead. Her picture made the Wheaties “Breakfast of Champions” box.http://www.golfweb.com/u/ce/feature/pgatour/0,1977,839844,00.html

http://www.golfeurope.com/almanac/players/whitworth.htm

1984- TV Host George Alexander "Alex" Trebek born July 22, 1940 Sudbury, Ontario, Canada, began hosting Jeopardy in 1984.

http://www.imdb.com/name/nm0871618/

1985- Bruce Springsteen's fans disabled the phone system in Washington , D-C by overloading the circuits with requests for tickets to the Boss's show at Robert F. Kennedy Stadium. The concert was sold out within an hour-and-a-half.

1986 - Hurricane Estelle passed 120 miles south of the Hawaiian Islands creating a ten to twenty foot surf. The large swells resulted from a combination of high tides, a full moon, and 50 mph winds. The hurricane also deluged Oahu Island with as much as 6.86 inches of rain on the 24th and 25th of the month.

1987---Top Hits

Alone - Heart

Shakedown - Bob Seger

Don't Disturb This Groove - The System

I Know Where I'm Going - The Judds

1988-The Atlanta Hawks began a 13-day trip through the Soviet Union by beating a Soviet team, 85-84. The Hawks won the second game but then lost the third to conclude the first such tour by an NBA team.

1990 - Greg LeMond won his third Tour de France. He outdistanced all other cyclists by finishing in 90 hours, 43 minutes and 20 seconds. His time was slower than his past wins. LeMond won in 1986 and again in 1989 with his best time of 87 hours, 38 minutes and 35 seconds. It seems like you have to be French to win

1994- more than 54-thousand fans jammed Giants Stadium in East Rutherford, New Jersey, as Billy Joel and Elton John performed the first of five concerts together. They duetted on "Your Song," "Honesty” and "I Guess That's Why They Call It the Blues."

2002- Over 20,000 fans gather at Fenway for a two-hour tribute entitled, "Ted Williams: A Celebration of an American Hero," The two hour salute of the man many consider to be the greatest hitter in baseball history, a vet of the World War II and the Korean War and a generous supporter of the Jimmy Fund, in addition to moving music and video, includes comments from present and former Red Sox players and broadcasters, historian Ken Burns, and former U.S. Senator John Glenn, who was Ted's wing man during the Korean War.

2006-The fourth day over 100 in Los Gatos/Saratoga. Today it reached 107, and we didn't go into the swimming pool until after 6pm when there was more shade in the backyard, as the sun was much too hot, even to go into the water.

-------------------------------------------------------------

SuDoku

The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler?

http://leasingnews.org/Soduku/soduko-main.htm

--------------------------------------------------------------

Daily Puzzle

How to play:

http://www.setgame.com/set/puzzle_frame.htm

Refresh for current date:

http://www.setgame.com/set/puzzle_frame.htm

--------------------------------------------------------------

http://www.gasbuddy.com/

http://www.gasbuddy.com/GB_Map_Gas_Prices.aspx

http://www.gasbuddy.com/GB_Mobile_Instructions.aspx

--------------------------------------------------------------

Weather

See USA map, click to specific area, no commercials

--------------------------------------------------------------

Traffic Live---

Real Time Traffic Information

You can save up to 20 different routes and check them out with one click,

or type in a new route to learn the traffic live

--------------------------------