![]() Add me to mailing list |

Add me to mailing list | ![]() Change email |

Change email | ![]() |

| ![]() Search

Search

Advertising | All Lists | Archives | Classified Ads | This Day In American History

Leasing News is a web site that posts information, news, and

entertainment for the commercial bank, finance and leasing industry

kitmenkin@leasingnews.org

![]()

Monday, July 21, 2014

Today's Equipment Leasing Headlines

1999—Pictures from the Past

Meet the Northwest Team US Bancorp

Manifest Funding Services

Classified Ads---Credit

H.8 data indicates banks had lending/leasing surge in Q2

SNL Financial Exclusive Report

Bank Failure in Georgia

Not All Banks Doing Well

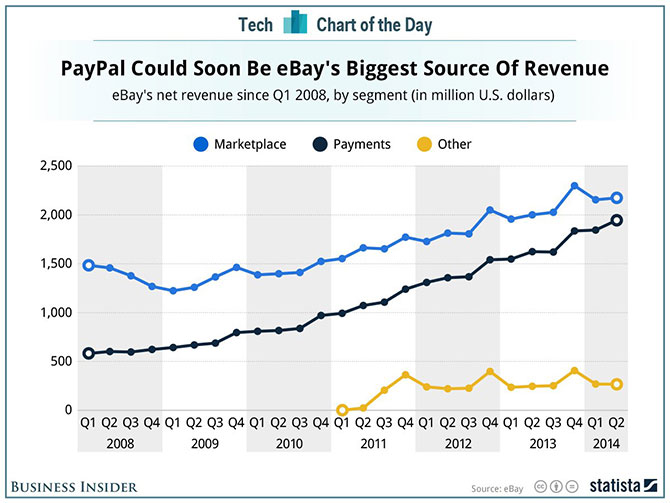

PayPal Could Soon Be eBay’s Biggest Source of Revenue

“References—Who Should I Give?”

Career Crossroad---By Emily Fitzpatrick/RII

Leasing Industry Ads---Help Wanted

Financial and Sales Training

Leasing 102 by Mr. Terry Winders, CLP

Purchase Money Security Interest (PMSI)

Notes on Purchase Money Security Interests

by Tom McCurnin, Leasing News Legal Editor

Secured Lender Loses Security Interest in Two Cranes

Which Are Sold Under its Nose

By Tom McCurnin, Leasing News Legal News Editor

CLP Study Session This Wednesday, Chicago

Top Stories July 15—July 17

(You May Have Missed One)

Black Labrador

Murray, Utah Adopt-a-Dog

Classified ads—Asset Management

News Briefs---

Huntington Bank sees 39 percent increase in auto loans;

commercial loans increase too

In a Subprime Bubble for Used Cars, Borrowers Pay Sky-High Rates

U.S. Bancorp Seeing Stable Credit and Early Signs of Lease, Loan Growth

Export-Import bank renewal debated

General Electric's (GE) CEO Jeff Immelt on Q2 2014 Results

- Earnings Call Transcript

Dell Begins Accepting Bitcoin on Its Website

Northwest Wildfires: More than 940,000 acres burn in Oregon and Washington

James Garner, Witty, Handsome Leading Man, Dies at 86

James Garner's key roles

(My father wrote scripts for many of these series with Garner)

Broker/Funder/Industry Lists | Features (writer's columns)

Top Ten Stories Chosen by Readers | Top Stories last six months

www.leasingcomplaints.com (Be Careful of Doing Business)

www.evergreenleasingnews.org

Leasing News Icon for Android Mobile Device

You May have Missed---

SparkPeople--Live Healthier and Longer

Poem

Sports Briefs---

California Nuts Brief---

"Gimme that Wine"

This Day in American History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

######## surrounding the article denotes it is a “press release”

and was not written by Leasing News nor information verified, but from the source noted. When an article is signed by the writer, it is considered a “by line.” It reflects the opinion and research of the writer.

Please send to a colleague and ask them to subscribe to our news

editor or bookmark us (www.leasingnews.org) as each news edition

appears on our web site.

[headlines]

--------------------------------------------------------------

1999—Pictures from the Past

Regional Sales Manager

Jim Stekl

Account Executive

George Vandel

Broker Sales Representative

Deb Schnaible

TODAY

Jim Stekl

National Business Development Manager

Western Equipment Finance

Sioux Falls, South Dakota

George Vandel

Owner, Capital Partners, LLC

Sioux Falls, South Dakota

Deb Schnaible

National Account Manager

GreatAmerica Financial Services

Marshall, Minnesota

[headlines]

--------------------------------------------------------------

Classified Ads---Credit

(These ads are “free” to those seeking employment or looking

to improve their position)

Credit, syndication, workout experience |

| Orlando, Florida As a Commercial Credit Analyst/Underwriter, I have evaluated transactions from sole proprietorships to listed companies, across a broad spectrum of industries, embracing a multitude of asset types. Sound understanding of balance sheet, income statement and cash flow dynamics which impact credit decisions. Strong appreciation for credit/asset risk. rpsteiner21@aol.com 407 430-3917 |

Free Posting for those seeking employment in Leasing:

http://www.leasingnews.org/Classified/Jwanted/Jwanted-post.htm

All “free” categories “job wanted” ads:

http://www.leasingnews.org/Classified/Jwanted/Jwanted.htm

[headlines]

--------------------------------------------------------------

H.8 data indicates banks had lending/leasing surge in Q2

SNL Financial Exclusive Report

by Divya Lulla

Aggregate loans and leases at commercial banks grew at an annualized 7.7% in the second quarter, higher than the annual growth rates for the years 2009 through 2013 and the annualized 5.5% growth posted in the first quarter, according to the Federal Reserve's July 11 weekly H.8 release.

Average deposits grew slightly less than loans, at an annualized rate of 7.6%, down slightly from the first quarter's 8.3% rate.

Loans and leases held by banks averaged $7.667 trillion in June, up $62.20 billion, or an annualized 9.8%, during June, from $7.605 trillion in May. Average deposits rose $29.40 billion or 3.5% during June to $10.162 trillion, from $10.132 trillion in May.

The Federal Reserve's H.8 report presents estimated aggregate balances of assets and liabilities at commercial banks in the U.S. The Fed estimates the data by benchmarking weekly reports provided by a sample of banks to quarter-end call reports. The Fed calculates the monthly estimates by averaging the weekly estimates for the month. The Fed includes all domestically chartered banks and U.S. branches and agencies of foreign banks in its definition of "commercial banks." The Fed seasonally adjusts all data.

Deposits

Deposits at large commercial banks averaged $5.860 trillion over the month of June, up 0.56%, or $32.90 billion, from $5.827 trillion in May. Small commercial banks grew average deposits to $3.178 trillion, up 0.24%, or $7.60 billion, compared to $3.171 trillion in May.

Loans and leases

Average loans and leases at small, domestically chartered banks grew by 0.73%, or $18.80 billion, to $2.604 trillion in June. Large commercial banks grew average loans by 0.58%, or $24.70 billion, to $4.317 trillion during the month, up from $4.292 trillion in May. A few banks have already reported their second-quarter results, including JPMorgan Chase & Co. The bank did indeed see loan growth, reporting record originations in its business banking segment. CFO Marianne Lake said during the company's July 15 conference call that originations in business banking were up 46% year over year, according to a transcript.

The Federal Reserve defines large commercial banks as the top 25 domestically chartered commercial banks, ranked by domestic assets as of the last call report filing. Small commercial banks comprise all domestically chartered commercial banks not included in the top 25. Commercial banks include the U.S. branches of foreign banks in addition to domestically chartered banks.

Commercial and industrial lending grew by 0.96% during June among U.S. commercial banks. Small banks grew their loans by 0.87%, while their larger peers increased lending at 0.97% during June.

Consumer lending increased 0.55% during the month. Average consumer loans were recorded at $1.170 trillion during June, up from $1.163 trillion in May. Credit cards and other revolving plans increased 0.25% during the month, while other consumer loans rose 0.87%. Consumer lending grew 0.92% for small, domestically chartered banks while their larger counterparts recorded an increase of 0.40% in their consumer lending portfolios.

Real estate loans also recorded an increase of 0.62% during the month. Average real estate loans during June were recorded as $3.594 trillion, up $22.1 billion, from $3.572 trillion during May. Revolving home equity loans declined whereas close-end residential loans and commercial real estate loans rose during the month.

Sandler O'Neill analyst R. Scott Siefers commented in a July 14 research report on the second-quarter H.8 data, terming it as the "best quarterly performance since first quarter 2008." He further added, "While this cycle's lending recovery certainly has not been history's strongest, we remain encouraged that total loan growth continues on a pretty steady acceleration. … In other words, lending momentum seemingly continues to pick up steam as time rolls on."

Unrealized gains and losses

Unrealized gains declined in June, with commercial banks reporting $8.9 billion in gains, down from $10.3 billion in gains reported for May. Unrealized gains at large commercial banks declined 23.20% during the month, with the group posting $9.6 billion in gains, compared to the $12.5 billion reported in May. Small commercial banks recorded gains for the first time in six months and posted $1.1 billion in gains in June as opposed to $300 million in losses in May.

SNL Financial compiled the 15 U.S. commercial banks with the highest change in net unrealized gains or losses in the first quarter. Cincinnati-based Fifth Third Bancorp booked the highest unrealized gains in the quarter with $232.5 million, up $109.7 million from $122.7 million at the end of the fourth quarter of 2013.

Collector, Atlanta, GA Sales, Chicago, Atlanta Work out of main office and satellite. Heavy phone sales calling on both independent dealers and end users (cold/warm calling), marketing, weekly reporting to management. Outside territorial salespeople will also be considered. Contact: Michael Testa 312-881-3133 mtesta@secondcityleasing.com www.secondcityleasing.com |

[headlines]

--------------------------------------------------------------

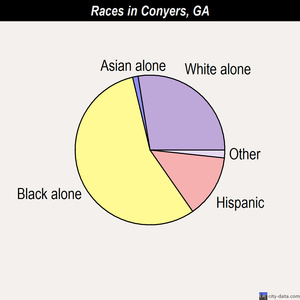

Bank Failure in Georgia

Not All Banks Doing Well

The two offices of Eastside Commercial Bank, Conyers, Georgia, were closed with Community & Southern Bank, Atlanta, Georgia, to assume all of the deposits. Founded in November 1, 2005, as of March 30, 2014, the bank had 17 full time employees at its offices in Conyers and Duluth. Year-end 2007, there were 27 full time employees. Tier 1 risk-based capital ratio: 2.52%

Eastside Commercial Bank is the 13th FDIC-insured institution to fail in the nation this year, and the first in Georgia. The last FDIC-insured institution closed in the state was Sunrise Bank, Valdosta, on May 10, 2013. The state had five bank failures in 2008. It hit 25 in 2009, 21 in 2010, 23 in 2011, and 10 in 2013, making it one of the states with the most bank failures. There were only three in 2013.

Conyers is the only city in Rockdale County, Georgia, 24 miles east of Atlanta. Most recent census, 2009, reported population of 13,941.

Zillow has 1271 homes for sale in Conyers

http://www.zillow.com/conyers-ga/

| Black alone | 8,794 (58.2%) |

| White alone | 3,817 (25.3%) |

| Hispanic | 1,999 (13.2%) |

| 2 or more races | 303 (2.0%) |

| Other race alone | 148 (1.0%) |

| American Indian | 28 (0.2%) |

| Asian alone | 13 (0.09%) |

13 banks located in Conyers

http://www.city-data.com/city/Conyers-Georgia.html

USA Today reports: "The bank with the highest Texas ratio: Eastside Commercial Bank, in Conyers, Ga., clocking in at 1,030.75%. Second-highest: First City Bank of Florida, in Fort Walton Beach, Fla., with a 639.12% Texas ratio.

"Georgia has 40 banks with Texas ratios higher than 100%, the most of any state, and Illinois comes in second, with 24. Texas had only two."

John May was the original President and CEO of Eastside Bank, who told the "rockdalecitizen.com" November 30, 2009. "Our problems are largely a result of the slowdown in the residential construction industry that occurred dating back to 2008," he said. "We identified those problems early and took action and have begun to make progress."

May said that the cease and desist order has had and will continue to have no impact on Eastside Bank's customers.

"We still have full FDIC coverage. Our customers can still take out loans and make deposits," May said.

He said the bank had already stopped making loans two years ago to residential construction companies, which represented just a portion of its customer base.

"We continue to maintain our focus on small- to medium-sized businesses," he said.

May said Eastside Bank will continue to operate under the guidelines of the cease and desist order until the FDIC re-examines the bank at some yet-to-be-determined date.

"It's usually a one- to two-year process, but as long as we're compliant with the agreement, then we're fine," he said.

http://www.rockdalecitizen.com/news/2009/nov/30/eastside-bank-complies-with-fdic-orders/#comments

Charge Offs

(in millions, unless otherwise)

2006 0

2007 0

2008 $2.8 ($2.76 construction/land development, $84,000 commercial/industrial loans)

2009 $2.1 ($2.0 constr./land, $85,000 commercial/industrial, $14,000 individuals loans)

2010 $2.9 ($1.7 constr./land, $827,000 commercial/ind., $409,000 multifamily, $3,000 indiv.)

2011 $2.6 ($1.3 nonfarm/nonres., $746,000 const./land, $387,000 multifamily, $81,000 1-4 family, $53,000 commercial/industrial)

2012 $4.3 ($2.3 nonfarm/nonres.,$1.7 construct./land, $126,000 1-4 family, $114,000 multifamily (-$31,000 commercial/industrial)

2013 $781,000 ($479,000 construct./land, $153,000 nonfarm/nonres., $137,000 multifamily, $23,000, 1-4 family, -$11,000 commercial/industrial)

3/31 $1.5 ($1.2 commercial/industrial, $269,000 nonfarm/nonres., $24,000 construct./land)

Construction and Land, 1-4 family multiple residential, Multiple Family Residential, Non-Farm Non-Residential loans.

(in millions, unless otherwise)

Non-Current Loans

2006 0

2007 0

2008 $10.4

2009 $13.7

2010 $6.1

2011 $12.5

2012 $14.0

2013 $13.8

3/31 $12.4

Profit

2006 $537,000

2007 $1.3

2008 -$2.4

2009 -$1.3

2010 -$4.1

2011 -$5.6

2012 -$4.6

2013 -$600,000

3/31 -$778,000

Net Equity

2006 $12.0

2007 $19.5

2008 $17.2

2009 $18.6

2010 $14.5

2011 $9.2

2012 $4.5

2013 $2.4

3/31 $1.9

As of March 31, 2014, Eastside Commercial Bank had approximately $169.0 million in total assets and $161.6 million in total deposits. In addition to assuming all of the deposits of Eastside Commercial Bank, Community & Southern Bank agreed to purchase approximately $104.7 million of the failed bank's assets. In a separate transaction, the FDIC will enter into an agreement with State Bank and Trust Company, Macon, Georgia, to purchase $42.6 million of Eastside Commercial Bank's loans. The FDIC will retain the remaining assets for later disposition.

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $33.9 million.

http://www.fdic.gov/news/news/press/2014/pr14058.html

List of Bank Failures:

http://www.fdic.gov/bank/individual/failed/banklist.html

Leasing News Bank Beat:

http://www.leasingnews.org/Conscious-Top%20Stories/Bank_Beat.htm

[headlines]

--------------------------------------------------------------

[headlines]

--------------------------------------------------------------

“References—Who Should I Give?”

Career Crossroad---By Emily Fitzpatrick/RII

Question: Can you give me some tips on supplying references?

Answer: Reference checks are often part of a comprehensive employment-screening program, which can also include verification of employment eligibility, e.g. immigration status, credit checks, and background checks. References add to the information that a hiring manager has gathered thus far, e.g. resume on a potential candidate. What the prospective employer finds out from your references should confirm their interest in extending an offer!

The definition of “reference” includes two functions in a job search. According to the Merriam-Webster Dictionary, a reference is “a person to whom inquiries as to character or ability can be made” and is also defined as “a statement of the qualifications of a person seeking employment or appointment, given by someone familiar with the person.

According to the Society for Human-Resource Management (SHRM) survey, 76 percent of organizations conduct reference checks for job candidates. The survey defined “reference background checks” as verification of information provided by a job applicant or communication with people regarding the job applicant.

The first step is identifying who you should consider to be your references.

Selecting Your References

Generally, a potential employer will want at least two of your references to be former employers. The advantage of preparing your references is that you can provide the “best” references, and you can present them in the order you would like to have them contacted. That does not guarantee that the prospective employer will not contact people who aren’t on your reference list.

You will want to select 3-7 individuals to be your “preferred” references. These individuals may be current/former managers or supervisors, co-workers, peers, or team members, current/former customers of the company, vendors or suppliers, and people you have supervised. If you do not have current work experience, it can be members of committees you volunteer with, or pro bono clients. If you have recent educational experience, you can also ask professors, faculty members, and advisors.

Select references that know your work well. You want someone who has seen you in action and can speak to your abilities. It is better to have someone who can speak to your skills and accomplishments than a “big name” on your list of professional references. If someone seems hesitant to serve as your reference, ask someone else.

There are a couple of reasons to consider including “personal” references. These individuals meet the criteria of providing “character” references. A personal reference should know you well, and have known you for at least five years; they can include business acquaintances, coaches, and community leaders.

Start Contacting Your References Early

The best time to start thinking about your references is when you are putting your resume together. You should not wait until you’re called in for interviews to contact people you want to use as references.

It can take some time to track down and reach references, and obtain their contact information. You do not want to try to do that while you are researching and preparing for a job interview. Additionally, having your references ready when requested shows professionalism. If your goal is to get a job, you should be prepared to provide references when asked.

IF employed, be careful of letting too many people know of your new career search (contact us for advice on handling this scenario).

Emily Fitzpatrick

Sr. Recruiter

Recruiters International, Inc.

Phone: 954-885-9241

Cell: 954-612-0567

emily@riirecruit.com

Invite me to Connect on LinkedIn

www.linkedin.com/pub/emily-fitzpatrick/4/671/76

Also follow us on Twitter #RIIINFO

Career Crossroads Previous Columns

http://www.leasingnews.org/Conscious-Top%20Stories/crossroad.html

[headlines]

--------------------------------------------------------------

Leasing Industry Help Wanted

Collector, Atlanta, GA Sales, Chicago, Atlanta Work out of main office and satellite. Heavy phone sales calling on both independent dealers and end users (cold/warm calling), marketing, weekly reporting to management. Outside territorial salespeople will also be considered. Contact: Michael Testa 312-881-3133 mtesta@secondcityleasing.com www.secondcityleasing.com |

Leasing Operations Manager

flexxrl.com |

For information on placing a help wanted ad, please click here:

http://www.leasingnews.org/Classified/Hwanted/Hwanted-post.htm

Please see our Job Wanted section for possible new employees.

[headlines]

--------------------------------------------------------------

Financial and Sales Training

(For our "Lease School/Franchisors" list, please click here)

These individuals act as a consultant in 75% or more of their main business, actually training staff or individuals of a leasing company. These are not schools or franchisors, which can be viewed by clicking here.

| Winders Consulting Co., Inc. | |

| Adrian Miller | Wheeler Business Consulting, LLC |

Several hold classes, and most will travel to their client's premise.

[headlines]

--------------------------------------------------------------

Leasing 102

by Mr. Terry Winders, CLP

Purchase Money Security Interest (PMSI)

We usually file a UCC-1 Financing statement to protect our leased asset. However, a UCC-1 is a requirement of Article 9, which is a legal code for lending, not leasing. Transactions that do not qualify as leases, even though they are on lease documents, will be judged as Article 9 leases intended as a security. This will not always be treated in this manner, as often in a bankruptcy court, the judge will treat the transaction as a lease and allow the lessor to take possession of the personal property, if there is not a blanket lien.

It is hard to establish ownership without a title, so Article 9 has created a system to protect lenders by establishing a procedure where the lender can file a financing statement (UCC-1), and file it in the State where the company has filed its business papers.

Whoever files the first lien has first right to the asset in a default. If the balance is received, then the remaining balance is given to the next lien holder.

There are two kinds of liens. A lien filed on a specific list of asset, or a blanket lien on all the borrowers assets. Most banks prefer to file blanket liens. If a borrower replaces an asset, the blanket lien covers the new purchase.

When the lease transaction is an Article 9 deal, then the lessor needs to file a UCC-1. The problem then is how do you obtain preference over a filed blanket lien? Article 9 provides an additional lien filing, often called a “Purchase Money Security Interest.” If the lender/lessor provides the money for the lessee to obtain the equipment, and files the UCC within 20 days of the lessee taking possession, the lessor then has preferential treatment over the blanket lien holder who files after the specific filing.

To prove when the lessee took possession, you should get a copy of the delivery slip, often called a “Bill of Lading, often signed by

the lessee or its designee when the first piece of the equipment is delivered. A bill of lading is a document issued by a carrier which details a shipment of merchandise and gives title of that shipment. It

is important to verify that the UCC lien was filed within the 20 day limit of delivery. If not, you need to get a subordination agreement from each blanket lien holder that states your lien comes before theirs.

One of the problems of asset protection is the lack of knowledge by the public of the UCC liens. In addition, if a company filed its papers in a faraway State, the public would have a hard time discovering the State in which to search for liens. The search should definitely be made where the company has filed its business papers.

To give notice to the public that the equipment is owned by a lessor and not the company in possession thereof, it is sometimes prudent to attach to the equipment labels or stickers with the lessor’s name and address with a statement that the equipment cannot be removed without their permission.

A filing is good for 60 months which means that if your transaction terminates early or in fewer than 60 months, you have to release the lien. A UCC-3 is utilized to release the lien. I also recommend issuing a "Bill of Sale." Many companies have a fee written into their lease contract to cover the cost of the UCC-3 and creating a "Bill of Sale."

There is the issue of keeping the lien active, if the residual or any other amounts owing, are not completed within the 60 month window

of the filing. Of course, you can always renew the filing without the consent of the lessee or borrower before expiration. In many states, you just check a box to renew it. No need to re-write it. You can even do it online in most states.

Mr. Terry Winders, CLP, has been a teacher, consultant, expert witness for the leasing industry for thirty years and can be reached at terrywinders11@yahoo.com or 502-649-0448.

He invites your questions and queries.

Previous #102 Columns:

http://www.leasingnews.org/Conscious-Top%20Stories/Leasing_102/Index.htm

Mr. Terry Winders available as a consultant regarding assisting attorneys in resolving disputes or explaining procedures or reviewing documents as utilized in the finance and leasing industry. He is the author of several books, including DVD's, as well as weekly columnist to Leasing News. He also performs audits of leasing companies as an expert on documentation, and has acted as an expert witness on leasing for litigation in legal and tax disputes, including before the IRS. He also has taught the senior bank examiners, how to review a bank leasing department, for the Federal Reserve in Washington D.C. and has trained the examiners for the FDIC on how to prepare a lease portfolio for sale. 502.649.0448/terrywinders11@yahoo.com |

(This ad is a “trade” for the writing of this column. Opinions

contained in the column are those of Mr. Terry Winders, CLP)

[headlines]

--------------------------------------------------------------

Notes on Purchase Money Security Interests

by Tom McCurnin, Leasing News Legal Editor

Purchase Money Security Interest (“PMSI”) is an exception to the “first in time is first in line” doctrine under the UCC. A PMSI is automatically perfected without filing for a period of twenty (20) days from possession of the goods.

When that 20 days starts is debatable, but physical control of the goods is the biggest factor. For equipment which was required to be assembled, there are many cases which hold the 20 days does not start until the equipment is assembled and working.

While the creditor has a 20 day reprieve to file its UCC, there is no reason why it should wait. If filed before the debtor received possession, the UCC is still effective.

PMSIs usually start and end with a three-party purchase order, in which the creditor agrees to fund the purchase with the consent of the borrower and vendor, and the equipment is delivered to the borrower, but is titled in the name of the creditor, so the creditor has all the rights in the collateral and the borrower has none. Large acquisitions are structured with either an escrow or a letter of credit, so the vendor is not paid until the goods are actually delivered and in the possession of the borrower.

A PMSI from an equipment dealer will not protect the creditor from losing the security interest to a buyer in the ordinary course of business. Creditors that finance dealerships need to understand that inventory fluctuates and the collateral at the dealership lot today may be gone tomorrow, and the creditor will have lost its security interest. This is why, even with a PMSI, creditors that finance equipment dealers usually employ third parties to do site inspections daily, weekly, or monthly and require the dealership to submit reports of purchases and sales in a similar time frame.

PMSIs in inventory require special attention, especially if there is a senior security interest in the same collateral. The UCC makes an exception to inventory financing, and a junior secured lender can finance inventory for a borrower subject to a senior security interest if the junior creditor sends a notice to the senior secured as to the date of the security interest, inventory description, the name of the debtor, and the name of the secured creditor.

Tom McCurnin is a partner at Barton, Klugman & Oetting

in Los Angeles, California.

Tom McCurnin

Barton, Klugman & Oetting

350 South Grand Ave.

Suite 2200

Los Angeles, CA 90071

Direct Phone: (213) 617-6129

Cell (213) 268-8291

Email: tmccurnin@bkolaw.com

Visit our web site at www.bkolaw.com

|

[headlines]

--------------------------------------------------------------

Secured Lender Loses Security Interest in Two Cranes

Which Are Sold Under its Nose

By Tom McCurnin

Leasing News Legal News Editor

Creditors That Make Purchase Money Security Interests Mistakenly Think That a PMSI Is An Unbeatable Lien. Here, Lender did not file PMSI for One Crane and Lost to Buyer in the Ordinary Course of Business. For Second Crane, Creditor Was Unaware That Borrower Did Not Yet Have Possession of Second Crane When It Made Its Second Advance

Liebherr Crane

Financial Federal Credit, Inc. v. Crane Consultants, LLC 2014 WL 1883811 (W.D.N.Y. 2014

“Vigilantibus et non dormientibus jura subveniunt”—Latin for “the law aids the vigilant and not the indolent”

Today’s case demonstrates what happens when a creditor doesn’t plan ahead and lets events roll by, seemingly oblivious to what is going on around it. In this case, the result was the creditor advanced $1.1 million dollars, ostensibly secured by two cranes, and ended up with nothing.

The facts are super-complicated, so I’ll take some liberties with the facts to simplify things

Financial Federal extended credit to CraneCon, a crane dealer, to enable it to purchase a certain crane (“the Liebherr crane”), in the amount of $660,750 from supplier Crane Rigging. At the same time, as generally part of the same transaction, the Liebherr crane was under contract to sell to Ramar for $775,000. As part of the same general transaction, Ramar agreed to sell to CraneCon another crane, called the “Tadano crane” for $450,000, documented through a promissory note. This two part transaction was memorialized by a purchase order. The record is silent whether the creditor had a copy of the purchase order, but presumably did have one.

Financial Federal loaned CraneCon $400,750 to acquire the Tadano crane as well. Financial Federal did not file a specific lien on the Liebherr crane, but did file one on the Tadano crane. Financial Federal apparently relied on its blanket security interest for the Liebherr crane. Financial Federal did not escrow the monies, use a letter of credit, or retain a floor plan inspector to insure the equipment was received by the borrower before the monies left FinFed.

Part of the deal materialized, and part of the deal, blew up. The first part of the deal went through, and CraneCon acquired the Liebherr Crane and re-sold it to Ramar, which paid the proceeds to CraneCon. So far, so good. But CraneCon defaulted on its purchase of the Tadano crane and the note to Ramar, even though it had the money from the Liebherr crane and had Financial Federal’s advance. Ramar kept the Tadano crane and never parted with possession of it.

When CraneCon defaulted on Financial Federal’s loans/contracts, FinFed sued Ramar claiming a security interest in both cranes, the Liebherr crane and the Tadano crane.

Ramar defended the action and two positions. For the Liebherr crane, Ramar claimed it purchased the crane from CraneCon, a dealer in cranes, and therefore was a buyer in the ordinary course of business. This UCC provision allows ordinary people who buy goods from a dealer, without knowledge of the security interest, to take the equipment free of the senior security interest.

Why Financial Federal, which presumably had a copy of the purchase order, allowed the crane to be shipped out of possession of CraneCon while the loan was outstanding, and without a security interest from Ramar, remains a mystery.

On the Tadano crane, Ramar argued that CraneCon never had possession or delivery of the crane, so any security did not “attach.” Why Financial Federal parted with $400,750 without assuring itself that the crane was in the possession of CraneCon also is a mystery.

The United States District Court for the Western District of New York heard competing summary judgments by Financial Federal and Ramar. The Court ruled against Financial Federal and for Ramar on both counts.

First, with respect to the Liebherr crane, the Court agreed with Ramar that Ramar purchased the crane, from a dealer, and in the ordinary course of CraneCon’s business.

Although FinFed argued that the deal was so squirrely (there was a deferred buy back provision) that it couldn’t have been “in the ordinary course of business,” depositions of the parties seemed to establish that the deal, while a bit complicated, was not out of the ordinary, and was used by CraneCon before.

Neither Ramar’s nor CraneCon’s principal had knowledge of the FinFed blanket lien which would arguably lien the Liebherr crane. Why FinFed did not have CraneCon (or Ramar) pledge a specific security interest in the Liebherr crane, take a security interest by assignment of the purchase order, or otherwise communicate to Ramar remains a mystery. Perhaps it assumed that things would go smoothly and there would be no need for a “Plan B.” So, the Court ruled that Financial Federal lost its security interest to Ramar, as a buyer in the ordinary course of business.

With respect to the Tadano crane, the Court noted that the sale never took place--- and CraneCon never had an interest in the crane.

While Financial Federal argued that CraneCon had rights vis-à-vis the purchase order, that transaction never took place. In order for a security interest to be perfected, the security interest must “attach” under UCC § 9-203. Attachment generally means that the debtor has rights in the collateral, usually by possession. Here, CraneCon neither paid for the Tadano crane, nor received possession of it. All it had, by way of an interest, was an unperformed promissory note. Control is an essential element. So, the Court concluded that Financial Federal never had a security interest, even though it filed a UCC-1, because its debtor never had an interest in the crane.

Financial Federal then argued that the Tadano crane was part of CraneCon’s inventory, thus, its blanket security interest did attach. But the Court noted that the definition of “inventory” seems to require that CraneCon take possession of the crane, a fact which never occurred. So Financial Federal lost its security interest in the second crane, because its borrower never held possession of it.

What are the lessons here for equipment lessors?

• First, these were obviously two purchase money security interests, but the lessor treated them like an inventory line of credit. Perhaps $660,750 was enough to warrant extra scrutiny, but why weren’t the funds escrowed until CraneCon had possession?

• Second, I would hope that before parting with $1.1 million dollars, the lessor had a full set of documents as to what was going to happen to the two cranes. If so, why not enter into a four way agreement, between the Crane Rigging, CraneCo, Ramar and the lessor? This way, Ramar would agree to pay Financial Federal, not CraneCo.

• Third, any time a creditor finances inventory of a dealer, the creditor is at risk for that collateral to a buyer in the ordinary course of business. For that reason, most car floor financings call for daily hands-on monitoring of the vehicles that get purchased and that are in possession of the borrower. The events in this case occurred over almost a year, while the creditor was apparently asleep at the switch. Why the lessor didn’t know the crane was delivered and re-sold out from under its nose remains a mystery to me.

The bottom line to this case is that if the lessor is financing purchase money equipment and inventory to a dealer, extra precaution and safeguards are needed. The law protects the vigilant, not those that sleep on their rights.

Financial Federal Case (12 pages)

http://www.leasingnews.org/PDF/FinancialFederalCase_72014.pdf

Tom McCurnin is a partner at Barton, Klugman & Oetting

in Los Angeles, California.

http://www.leasingnews.org/photos/Tom_sig.jpg

Tom McCurnin

Barton, Klugman & Oetting

350 South Grand Ave.

Suite 2200

Los Angeles, CA 90071

Direct Phone: (213) 617-6129

Cell (213) 268-8291

Email: tmccurnin@bkolaw.com

Visit our web site at www.bkolaw.com

Previous Tom McCurnin Articles:

http://www.leasingnews.org/Conscious-Top%20Stories/leasing_cases.html

|

[headlines]

--------------------------------------------------------------

CLP Study Session This Wednesday, Chicago

The Institute for Leasing Professionals 2 day program is a comprehensive education program designed by equipment leasing and financing professionals. It is a 16-module course that covers the most important subjects in the equipment leasing and financing profession.

Chicago ILP: July 23-24th

Location: ECS Financial Services

CLP Exam: July 25th

Information:

http://www.leasingnews.org/PDF/ChicagoLPCourse_2014.pdf

California ILP: August 8-9th

Location: Banc of California

CLP Exam: August 10th

Information:

http://www.leasingnews.org/PDF/SouthernCaliforniaLPCourse_2014.pdf

Washington ILP: August 12-13th

Location: Financial Pacific Leasing

CLP Exam: August 14th

Information:

http://www.leasingnews.org/PDF/WashingtonLPCourse_2014.pdf

Maryland ILP: October 10-11th

Location: FSG Capital

CLP Exam: October 12th

Information:

http://www.leasingnews.org/PDF/MarylandLPCourse_2014.pdf

For additional Information:

Reid Raykovich, CLP - Executive Director

(206) 535-6281 - direct

reid@clpfoundation.org

Why I Became a CLP

http://www.leasingnews.org/CLP/Index.htm

((Please Click on Bulletin Board to learn more information))

(Leasing News provides this ad “gratis” as a means

to help support the growth of Lease Police)

[headlines]

--------------------------------------------------------------

Top Stories July 15—July 17

(You May Have Missed One)

Here are the top stories opened the most by readers:

(1) Archives--July 15, 2009

Most Influential Women in Leasing

http://leasingnews.org/archives/Jul2014/7_15.htm#archives

(2) Who is Financing the Other Four?

by Christopher Menkin

http://leasingnews.org/archives/Jul2014/7_17.htm#who

(3) New Hires---Promotions in the Leasing Industry

http://leasingnews.org/archives/Jul2014/7_17.htm#hires

(4) Leasing 102 by Mr. Terry Winders, CLP

Lease Pricing

http://leasingnews.org/archives/Jul2014/7_15.htm#lease_pricing

(5) Fed’s Operation Choke Point Goes After Pay Day Lenders and Other “Undesirable Customers”

By Tom McCurnin, Leasing News Legal News Editor

http://leasingnews.org/archives/Jul2014/7_15.htm#fed

(6) Microfinancial Reports $2.5 Million 2nd Quarter Profit

Approves 410 New Dealers and Brokers

http://leasingnews.org/archives/Jul2014/7_17.htm#micro

(7) Business Solar Panel Financing

by Thomas L. Cadle, CLP

http://leasingnews.org/archives/Jul2014/7_17.htm#solar

(8) Archives—July 17, 2000

BULLETIN BOARD

http://leasingnews.org/archives/Jul2014/7_17.htm#archives

(9) Iowa Court Upholds the Use of Dragnet Clause

By Tom McCurnin, Leasing News Legal News Editor

http://leasingnews.org/archives/Jul2014/7_17.htm#iowa

(Tie) (10) Dakota Financial saves $14,400 in document storage costs

after deploying Office 365

http://leasingnews.org/archives/Jul2014/7_15.htm#dakota

(Tie) (10) House Passes Bonus Depreciation Bill

http://www.accountingweb.com/article/house-passes-bonus-depreciation-bill/223603

|

[headlines]

--------------------------------------------------------------

Black Labrador

Murray, Utah Adopt-a-Dog

MAJOR - ID#A078196

I am a neutered male, black and white Labrador Retriever mix. The shelter staff thinks I am about 1 years and 0 months old. I have been at the shelter since Jul 10, 2014.

Shelter Staff made the following comments about this animal:

I CAME TO THE HUMANE SOCIETY OF UTAH FROM ANOTHER SHELTER. FORTUNATELY I HAVE BEEN GIVEN A CHANCE FOR A NEW LIFE!

ALTHOUGH MY HISTORY IS UNKNOWN I HAVE DONE WELL WITH MANY DOGS HERE IN DAWGVILLE.

REGULAR MENTAL STIMULATION (TRAINING) & PHYSICAL EXERCISE WILL KEEP ME HAPPY & HEALTHY.

I WOULD ALSO BENEFIT FROM A SOLID, DAILY ROUTINE & PROPER CRATE TRAINING. THIS WOULD ALSO ENSURE HOUSE MANNERS IN MY NEW HOME.

IF YOU THINK WE'RE A MATCH, PLEASE BRING YOUR CURRENT CANINE COMPANION & ENTIRE FAMILY TO THE HUMANE SOCIETY OF UTAH TO MEET ME TODAY!

DAWGVILLE "THE WAIT IS OVER, ROVER" -

TINY TOWN @THE HUMANE SOCIETY OF UTAH

4242 SOUTH 300 WEST

MURRAY, UTAH 84107

(801) 261-2919

UTAHHUMANE.ORG

.

Adopt a Pet

http://www.adoptapet.com/

[headlines]

--------------------------------------------------------------

Classified ads—Asset Management

Leasing Industry Outsourcing

(Providing Services and Products)

Asset Management: Atlanta, GA |

Asset Management: Boston, MA Nationwide appraisals, remarketing, audits, inspections and more! Over 15-years industry experience and dedicated to deliver personal, prompt, professional services. Call Chris @ 508-785-1277 Email: chris@dovermanagementgroup.com |

Asset Management: Minneapolis, MN |

Asset Management: Monroe, NC Recover a greater return on your investment. We specialize in the woodworking, pallet, sawmill and forestry industries. Carolinamachinerysales.com/ Melinda Meier (704)288-1904 x103 |

| Asset Management: Nationwide BUYER/LENDER BEWARE. Don't sign anything until Collateral Verifications Inc. goes onsite, knocks on the door and gets the facts. http://www.i-collateral.com Email: mark@i-collateral.com |

Nationwide |

| Asset Storage/Re-Marketing: Ohio & surrounding states. Providing no cost warehousing, condition reports, digital photos and remarketing of off-lease forklifts & industrial equipment. NAFTA wide dealer network. Email to GCochran@OhioLift.com |  Asset Management Asset ManagementMelville, New York Auctions, Appraisals, National Repossessions. ALL asset classes. 20+ year team works for you. Spend less, Net More… Fast! Ed Castagna 516-229-1968ecastagna@inplaceauction.com |

| Asset Management: Global Specializing in Semiconductor and Electronic Test Equipment collateral. Lender services include Consignment Sales, Remarketing, Portfolio Purchases, Inspections, De-installation, Repairs and Warehousing. testequipmentconnection.com |

|

| Bulldog Asset Management provides recovery and remarketing services with a difference. Contingent repos, free storage and industry experts to remarket. Email:Jamie@bulldogasset.com www.bulldogasset.com |

Asset Management: Portsmouth, NH |

All "Outsourcing" Classified ads (advertisers are both requested

and responsible to keep their free ads up to date:

http://www.leasingnews.org/Classified/Outsourcing/Outsourcing.htm

How to Post a free "Outsourcing" classified ad:

http://www.leasingnews.org/Classified/Outsourcing/Outsourcing-post.htm

John Kenny • Fraud Investigations • Credit Investigations • Asset Searches • Skip-tracing • Third-party Commercial Collections john@jkrmdirect.com | ph 315-866-1167| www.jkrmdirect.com |

(Leasing News provides this ad as a trade for investigations

and background information provided by John Kenny)

[headlines]

--------------------------------------------------------------

![]()

News Briefs----

Huntington Bank sees 39 percent increase in auto loans; commercial loans increase too

http://www.cleveland.com/business/index.ssf/2014

/07/huntington_bank_sees_39_percen.html

In a Subprime Bubble for Used Cars, Borrowers Pay Sky-High Rates

http://dealbook.nytimes.com/2014/07/19/in-a-subprime-bubble-for-used-cars-unfit-borrowers-pay-sky-high-rates/

U.S. Bancorp Seeing Stable Credit and Early Signs of Lease and Loan Growth

http://seekingalpha.com/article/2320375-u-s-bancorp-seeing-stable-credit-and-early-signs-of-loan-growth

Export-Import bank renewal debated

http://www.greenvilleonline.com/story/money/business/2014/07/18/sc-politicians-debate-merits-renewing-export-import-bank/12872435/

General Electric's (GE) CEO Jeff Immelt on Q2 2014 Results

- Earnings Call Transcript

http://seekingalpha.com/article/2323025-general-electrics-ge-ceo-jeff-immelt-on-q2-2014-results-earnings-call-transcript

Dell Begins Accepting Bitcoin on Its Website

http://blogs.wsj.com/digits/2014/07/18/dell-begins-accepting-bitcoin-on-its-website/?mod=ST1

Northwest Wildfires: More than 940,000 acres burn in Oregon and Washington

http://www.oregonlive.com/pacific-northwest-news/index.ssf/2014/07/northwest_wildfires_more_than.html#incart_m-rpt-1

James Garner, Witty, Handsome Leading Man, Dies at 86

http://www.nytimes.com/2014/07/21/movies/james-garner-actor-dies-at-86.html

James Garner's key roles

(My father wrote scripts for many of these series with Garner)

http://www.latimes.com/entertainment/la-et-james-garner-obit-gallery-20140721-story.html#page=1

Leasing Operations Manager

flexxrl.com |

[headlines]

--------------------------------------------------------------

--You May Have Missed It

Golfer gets luxury car he desired all along for hole-in-one at Granite Bay charity event

http://www.sacbee.com/2014/07/17/6562992/golfer-gets-luxury-car-he-desired.html

[headlines]

--------------------------------------------------------------

SparkPeople--Live Healthier and Longer

![]()

50 Easy Ways to Cut 100 Calories

Lose Weight Without Deprivation

http://www.sparkpeople.com/resource/nutrition_articles.asp?id=1183

[headlines]

--------------------------------------------------------------

Baseball Poem

|

The Batter |

From the book |

|

That Sweet Diamond |

|

by Paul B. Janeczko, Carole Katchen (Illustrator) |

He approaches the plate,

ponderous,

swinging smoothly

in slow motion

knowing his choice is simple:

swing or not.

As he paws

the back line of the batter's box,

matching concentration and stare

with the pitcher,

he knows

indecision

or

hesitation

makes failure likely.

Pitcher rocks.

Batter waits.

Then, in the time it takes

a happy heart to beat,

decides.

[headlines]

--------------------------------------------------------------

Sports Briefs----

British Open 2014: Rory McIlroy Wins Third Major Championship

http://www.nytimes.com/2014/07/21/sports/golf/british-open-2014-rory-mcilroy-wins-third-major-championship.html?emc=edit_na_20140720&nlid=31282772

Cowboys training camp preview: The five biggest concerns as camp begins

http://www.dallasnews.com/sports/dallas-cowboys/headlines/20140719-cowboys-training-camp-preview-the-five-biggest-concerns-as-camp-begins.ece

A position-by-position analysis of the Seahawks

http://seattletimes.com/html/seahawks/

2024114347_seahawks20xml.html?cmpid=2628

Hometown roots run deep for Anquan Boldin, 49ers’ fierce wide receiver

http://www.sacbee.com/2014/07/20/6568271/anquan-boldins-hometown-roots.html

[headlines]

--------------------------------------------------------------

California Nuts Briefs---

Local investment fund accused of defrauding investors out of $700 million

http://www.contracostatimes.com/news/ci_26181046/local-investment-fund-accused-defrauding-investors-out-700

SF Bay Area rents continue their climb

http://www.contracostatimes.com/business/ci_26152150/bay-area-apartment-rents-continue-relentless-rise

Legal battle over Drakes Bay Oyster Co. is not quite over

http://www.sfgate.com/bayarea/article/Legal-battle-over-Drakes-Bay-Oyster-Co-is-not-5631515.php

Bella Italia: A Tribute to Sophia Loren

http://www.sfgate.com/entertainment/slideshow/Bella-Italia-90046.php

[headlines]

--------------------------------------------------------------

![]()

“Gimme that Wine”

http://www.youtube.com/watch?v=EJnQoi8DSE8

How the world’s best wine was ‘kidnapped’ for a $1.3M ransom

http://nypost.com/2014/07/19/how-the-worlds-best-wine-was-kidnapped-for-a-1-3m-ransom/

Launch of First National Online Directory of Canada's Wineries

http://www.marketwired.com/press-release/launch-of-first-national-online-directory-of-canadas-wineries-1930817.htm

Was Parker right about first growth pricing?

http://www.thedrinksbusiness.com/2014/07/was-parker-right-about-first-growth-pricing/

Free Mobile Wine Program

http://leasingnews.org/archives/Feb2010/2_26.htm#mobile

Wine Prices by vintage

http://www.winezap.com

http://www.wine-searcher.com/

US/International Wine Events

http://www.localwineevents.com/

Winery Atlas

http://www.carterhouse.com/atlas/\

Leasing News Wine & Spirits Page

http://two.leasingnews.org/Recommendations/wnensprts.htm

[headlines]

----------------------------------------------------------------

![]()

This Day in History

1667 - The Peace of Breda ended the Second Anglo-Dutch War and ceded Dutch New Amsterdam (Manhattan) to the English. The South American country of Surinam, formerly Dutch Guiana, including the nutmeg island of Run was ceded by England to the Dutch in exchange.

1669 - John Locke's Constitution of English colony Carolina was approved.

1823 - After pirate attack, Lt. David G. Farragut leads landing party to destroy pirate stronghold in Cuba.

1828 - The first strike in which a militia was called out occurred in Paterson, NJ when the Godwin Guards of the national militia were ordered to keep peace during a strike brought about by the changing of the lunch hour from noon to one o’clock. The strikers were defeated, but the noon lunch hour was afterwards restored.

1832 - Henrietta King’s Birthday – Founder of King Ranch in Texas. She inherited a good size ranch in west Texas - 500,000 acres - from her husband and a king-sized debt. By all reason, the ranch should have gone on the auction block, but Henrietta was a stubborn woman. She decided to run it herself, hiring her son-in-law to assist. Together they streamlined the ranch operations. She personally developed the Santa Gertrudis cattle breed that became the mainstay of the Texas cattle business. When she died at age 92 in 1925, she had parlayed that nearly bankrupt ranch into the world-renowned King Ranch of 1,280,000 debt-free acres and an estate in excess of $5 million.

http://www.tsha.utexas.edu/handbook/online/articles/view/KK/fki16.html

http://www.harcourtschool.com/activity/biographies/hking/

http://www.taliesyn.com/hmking/hmking.htm

1846 - Mormons found first “American” settlement in California (San Joaquin Valley) called “New Hope.”

http://www.amazon.com/exec/obidos/ASIN/0934153094/inktomi-bkasin-20/

103-5362656-4423850

http://wwwlibrary.csustan.edu/bsantos/calif.html

1853 - Anna Adams Gordon birthday - U.S. social activist. At 24, she became the live-in private secretary of the Women's Christian Temperance Union (WCTU) organizer and its long-time President, Frances Willard. She became a prominent activist in the WCTU in addition to her duties to Willard and she served as national and world WCTU President after Willard's death. It was under her presidency that the U.S. adopted the 18th Amendment prohibiting the manufacture and sale of liquor, the last major attempt by government to legislate morality and like all others, it failed. Contrary to popular belief, deaths from alcohol abuse recorded by hospitals went down considerably, as did traffic accidents.

http://search.eb.com/women/articles/Gordon_Anna_Adams.html

1856 - Louise Blanchard Bethune birthday - U.S. architect. She was the first female professional architect in the U.S. In 1889, she was elected the first woman member of the American Institute of Architects.

http://www.fredbecker.org/News%20Letter/L%20Bethune.htm http://ah.bfn.org/a/archs/beth/bethberk.html http://www.distinguishedwomen.com/biographies/bethunel.html

1861 - In the first Battle of Bull Run, Union General Irvin McDowell was defeated by Confederate troops led by General Joseph E. Johnston at Manassas, VA. It was the first major engagement of the war. It was during this battle that Confederate General won the nickname “Stonewall” (by the way, the movie “Gods and Generals” is not only boring, but inaccurate.) In the second Battle of Bull Run, August 29-30, 1862, Union General John Pope was badly defeated by General Robert E. Lee. For trivia buffs, CS Col Francis Stebbins Bartow, 8th GA, killed at 1st Bull Run July 21, 1861, was the first Georgian to die in the war.

On July 18, 1861, with Confederate and Union troops gathering nearby, a Union shell dropped through the chimney of the home of Wilmer McLean who had retired to an estate near Manassas Junction, VA. When the smoke had cleared and the first major battle of the war known as 1st Bull Run was over, McLean moved away from the war to a small quiet area of Virginia known as Appomattox Court House. On Sunday, April 9, 1865, the war ended in McLean's parlor with the meeting of Lee and Grant for the signing of the surrender of the Army of Northern Virginia. (lower half of : http://memory.loc.gov/ammem/today/jul21.html)

1865 - The New Orleans Tribune, first daily Black newspaper, is published in English and French. Belgian scientist Jean- Charles Houzeau became managing editor of the New Orleans Tribune that year. Ardently sympathetic to the plight of Louisiana’s black population and reveling in the fact that his dark complexion led many people to assume he was black himself, Houzeau passionately embraced his role as the Tribune’s editor and principal writer. The paper closed on February 28, 1869. Presently, the New Orleans Tribune is a monthly newsmagazine targeted to the upscale African-American community. Founded in 1985 by Dr. Dwight and Beverly McKenna, the Tribune has earned a reputation as a fearless, pioneering advocate for social, economic and political issues often ignored by the mainstream press.

http://www.aaregistry.com/african_american_history/1219/

The_New_Orleans_Tribune_founded

http://www.neworleanstribune.com/

1873 - Jesse James and his gang conducted the first train robbery in America. At Adair, Iowa, James and company took $3,000 from the Rock Island Express.

1877 - After rioting by Baltimore and Ohio Railroad workers and the deaths of nine rail workers at the hands of the Maryland militia, workers in Pittsburgh, Pennsylvania stage a sympathy strike that is met with an assault by the state militia.

1886 - The cardinal's hat was conferred upon Elzear Alexandre Taschereau, 66, Archbishop of Quebec. He was the first Canadian to be made a cardinal in the Catholic Church.

http://www.archiv.umontreal.ca/Galeries/Groupe/TaschereauCardinal.htm

http://www.newadvent.org/cathen/14462b.htm

1896 - National Association of Colored Women founded by Mary

Church Terrell in Washington ,DC

http://memory.loc.gov/ammem/aap/terrell.html

http://www.tnstate.edu/library/digital/terrell.htm

http://www.spartacus.schoolnet.co.uk/USAnacw.htm

http://www.cr.nps.gov/nr/travel/civilrights/dc2.htm

http://gos.sbc.edu/t/terrellmary.html

1898 - Sara Dougherty Carter birthday - U.S. music legend. With her husband A.P., she formed the nucleus of the Carter family singing group that included cousin Maybelle Carter (B. 05-10-1909) and Maybelle's children (including June Carter) as they grew up. The group disbanded in 1943. They were responsible for the popularization of Appalachian and folk music and was the first group to be elected to the Country Music Hall of Fame. Much of today's country music depends on the innovative guitar styling of Maybelle as well as Sara's slide picking.

http://www.artistdirect.com/music/artist/bio/0,,412598,00.htm

l?artist=Sara+Carter

http://www.bartleby.com/65/ca/CarterFam.html

1899 - Birthday of Ernest Hemingway, American short story writer and novelist, born at Oak Park, IL. Among his most famous works are: “The Sun Also Rises” (1926), “A Farewell to Arms” (1929), “For Whom the Bell Tolls” (1940) and “The Old Man and the Sea” (1952). He was awarded the Nobel Prize in 1954 and wrote little thereafter; he shot himself July 2, 1961, at Ketchum, ID, having been seriously ill for some time.

http://memory.loc.gov/ammem/today/jul21.html

1902 – At Buffalo, NY, Willis Carrier invented the first air conditioner…yea, in Buffalo!!

1911 - Birthday of (Herbert) Marshall McLuhan, university professor and author, called "the Canadian sage of the electronic age," at Edmonton, Alberta, Canada. “Understanding Media” and “The Medium is the Massage” (not to be confused with his widely quoted aphorism: "The medium is the message"), among other books, were widely acclaimed for their fresh view of communication. McLuhan is reported to have said: "Most people are alive in an earlier time, but you must be alive in our own time." He died at Toronto, Ontario, Dec 31, 1980.

1918 – U-boat 156 shells Nauset Beach, MA.

1919 - The dirigible “Wingfoot Air Express” crashes into the Illinois Trust and Savings Building in Chicago, Illinois, killing 12 people.

1922 – American singer Kay Starr is born in Dougherty, Okla. She begins her musical career with Joe Venuti's orchestra at age 15. She sings briefly with Glenn Miller, Charlie Barnet and Bob Crosby before launching a solo career in 1945. Her biggest hits are the No. 1 songs "Wheel of Fortune" and "Rock & Roll Waltz."

1925 - Following a sensational 12-day trial, high school biology teacher John T. Scopes was found guilty of teaching evolution in his Dayton, TN classroom and was fined $100. This historic trial was popularized in the movie “Inherit the Wind”, starring Spencer Tracy as Scopes’ attorney and Frederic March as a William Jennings Bryan caricature.

http://www.pbs.org/wgbh/amex/monkeytrial/timeline/index.html

http://www.law.umkc.edu/faculty/projects/ftrials/scopes/evolut.htm

http://www.law.umkc.edu/faculty/projects/ftrials/scopes/menk.htm

http://www.freeessays.cc/db/26/hmd422.shtml

http://xroads.virginia.edu/~UG97/inherit/1925home.html

1929 - Birthday of singer Helen Merrill singer in New York

http://www.museum.media.org/ella/carnegie/artists/merrill.html

1931 - Birthday of tenor sax player Plas Johnson at Donaldsville, LA

http://www.plasjohnson.com/

http://www.spaceagepop.com/johnson.htm

1934 - 113ø F (45ø C), near Gallipolis, Ohio (state record)

1943 - "Stormy Weather" premieres in New York City with Lena Horne, Bill "Bo Jangles" Robinson, Fats Waller, Cab Calloway, the Nicholas Brothers, and Katherine Dunham. A week before the premiere, Horne said of African American actors, "All we ask is that the Negro be portrayed as a normal person. A worker in a union meeting, a voter in the polls...or an elected official. Perhaps I'm being naive. Perhaps these things will never be straightened out on the screen itself, but we will have to wait until... [they're] solved in real life."

http://www.parabrisas.com/m_hornel1.html

http://www.reelclassics.com/Actresses/Horne/horne.htm

http://www.pbs.org/wnet/americanmasters/database/horne_l.html

http://www.amazon.com/exec/obidos/ASIN/B000001HKG/i

nktomi-musicasin-20/

103-5362656-4423850

1944 – In WWII, American troops land on Guam starting the battle. It would end on August 10.

1946 - Top Hits

“The Gypsy” - The Ink Spots

“They Say It’s Wonderful” - Frank Sinatra

“Surrender” - Perry Como

“New Spanish Two Step” - Bob Wills

1949 – NATO Treaty is ratified by the US Senate.

1948 – Birthday of Doonesbury cartoonist Gary Trudeau.

1949 - Birthday of Modern Blues Record owner/producer Dan Jacoubovitch, Roslyn, L.I., N.Y.

http://www.bluespower.com/armod.htm

http://www.bluespower.com/alph.htm

1950 – Medal of Honor----Major General William F. Dean was reported missing in action as his 24th Infantry Division fought its way out of Taejon. During that action, he set the example by single-handedly attacking a T-34 tank with a grenade and directing the fire of others from an exposed position. As his division withdrew, he remained with the rearguard, rounding up stragglers and aiding the wounded. It was learned later that he had been captured about 35 miles south of Taejon on Aug. 25. Since the communists kept his capture a secret, he was presumed dead. In early 1951, President Truman presented the Medal of Honor to his wife in a White House ceremony. He was the only general officer and, at 51, the oldest man to receive the Medal of Honor during the Korean War.

1951 - The National Association for the Advancement of Colored People protested the television version of "Amos 'n' Andy." The NAACP called it "a gross libel on the Negro and distortion of the truth".

1952 - Birthday of Robin Williams, comedian, actor ("Mork and Mindy," “Mrs. Doubtfire”, “Dead Poets Society”, “Good Will Hunting”, “Good Morning, Vietnam”), at Chicago, IL.

1954 - Top Hits

“Little Things Mean a Lot” - Kitty Kallen

“Sh-Boom” - The Crew Cuts

“Goodnight, Sweetheart, Goodnight” - The McGuire Sisters

“Even Tho” - Webb Pierce

1956 - In a 13-6 defeat to the Cubs, Dodger shortstop Pee Wee Reese becomes one of five active players to collect his 2000th hit and Junior Gilliam sets a major league record by handling 12 assists at second base.

1956 - Billboard calls Elvis Presley "the most controversial entertainer since Liberace." The article also notes that Ed Sullivan, who once said Presley would never appear on his show, just signed the singer for three appearances

1957 - When she won the Women's National clay-court singles competition, Althea Gibson became the first black woman to win a major United States tennis title

1958 - On CBS-TV, the last installment of "Arthur Godfrey’s Talent Scouts" aired. Many artists owed their starts to "Talent Scouts," including Tony Bennett, Pat Boone, The McGuire Sisters and a singer named Connie Francis, who not only sang, but played the accordion.

1958 - "Hard Headed Woman" by Elvis Presley was the top tune on the Billboard chart. At the time, the King was in Fort Hood Texas, doing basic training in the US Army.

1959 - NS Savannah, the first nuclear-powered cargo-passenger ship, is launched as a showcase for Dwight D. Eisenhower's "Atoms for Peace" initiative.

1959 - "Pumpsie" Green becomes the first African-American to play for the Boston Red Sox, the last Major League team to integrate. He came in as a pinch runner for Vic Wertz and stayed in as shortstop in a 2-1 loss to the Chicago White Sox.

1961 - Following his success as a songwriter, penning Bobby Vee's "Rubber Ball" and Rick Nelson's "Hello Mary Lou", Gene Pitney makes his first appearance on American Bandstand, singing "Every Breath I Take".

1962 - Top Hits

Roses are Red - Bobby Vinton

The Wah Watusi - The Orlons

Johnny Get Angry - Joanie Sommers

Wolverton Mountain - Claude King

1963 - The usually mild-mannered Dodger manager Walter Alston is thrown out of both games of a doubleheader as the Braves sweep a twin bill for the first and only time in Milwaukee, 7-2 and 13-7. To make matters worse, the Los Angeles skipper has beer thrown in his face by a hometown fan as he leaves the second game.

1967 - The Youngbloods and Wildflower performed at the San Francisco grand opening of the Straight Theatre at Haight and Cole. It was the former Haight Theatre, but was now a hippie-run alternative to the commercially successful Fillmore Auditorium and Avalon Ballroom.

[delete-redundant] 1967 - Grand opening of the Straight Theatre at Haight and Cole in San Francisco. It was the former Haight Theatre, but was now a hippie-run alternative to the commercially successful Fillmore Auditorium and Avalon Ballroom.

1968 - Arnold Palmer became the first golfer to surpass the $1 million mark in career earnings despite losing the PGA championship to Julius Boros by one stroke.

1968 - Brandi Chastain’s birthday. US soccer player born right here in San Jose, California where women take off their shirt all the time when hot…and after striking the winning goal in the 1994 World Cup.

1969 - One day after Neil Armstrong stepped onto the moon, on ABC-TV, Duke Ellington and some of his band performed a 10-minute composition titled, "Moon Maiden." The tune featured piano, drums, bass and vocals.

1970 - No. 1 Billboard Pop Hit: "(They Long to Be) Close to You," Carpenters.

1970 - Top Hits

“Mama Told Me (Not to Come)” - Three Dog Night

“(They Long to Be) Close to You” - Carpenters

“Band of Gold” - Freda Payne

“He Loves Me All the Way” - Tammy Wynette

1971 - Carole King receives a gold album for "Tapestry."

1972 - George Carlin charged with disorderly conduct & profanity after performing his famous "7 Words" routine at Summerfest in Milwaukee.

http://georgecarlin.com/

1972 - Rod Stewart releases "Never a Dull Moment." The album peaks at number two and has two top 40 hits, "You Wear it Well" and a re-make of Jimi Hendrix's "Angel”.

1973 - Jim Croce got his first big hit when "Bad, Bad Leroy Brown" reached #1 on the "Billboard" pop-singles chart. Two months later on September 20, 1973, Croce died in a plane crash.

1975 - No. 1 Billboard Pop Hit: "The Hustle," Van McCoy & the Soul City Symphony.

1975 - Felix Millan of the New York Mets got four singles, but each time he was erased from the base paths as teammate Joe Torre grounded into four double plays. The Mets lost to the Houston Astros, 6-2.

1978 - Top Hits

“Shadow Dancing” - Andy Gibb

“Baker Street” - Gerry Rafferty

“Miss You” - The Rolling Stones

“Only One Love in My Life” - Ronnie Milsap

1979 –National Women’s Hall of Fame: 35th Anniversary. Seneca Falls, NY. Founded to honor American women whose contributions "have been of the greatest value in the development of their country" and located in the community known as the "birthplace of women's rights," where the first Women's Suffrage Movement convention was held in 1848, the Hall of Fame was dedicated with 23 inductees. Earlier National Women's Hall of Fame, honoring "Twenty Outstanding women of the Twentieth Century," was dedicated at New York World's Fair, on May 27, 1965.

1979 - Genesis' first album in over two years, "Duke," goes gold. The LP makes it up to #11 and gives the group their first major hit, "Turn It on Again."

1979 - Robert Palmer's "Bad Case of Loving You" is released

1980 – Birthday of pitcher CC Sabathia, currently with the New York Yankees after stints with the Cleveland Indians and Milwaukee Brewers.

1983 - Diana Ross plays a famous free concert in New York City's Central Park that is unfortunately interrupted by torrential rains. Ignoring the danger, Diana continues singing, urging the crowd to ignore the downpour, saying, "I need a bath, anyway, it's too hot," and "It took me a lifetime to get here... I ain't goin' nowhere." Unfortunately, the show does indeed stop when the rain proves to be too much for the band and the crowd, forcing Diana to reschedule the concert for the next day.

1984 - The first reported killing of a human by a robot occurred at Jackson, MI. A robot turned and caught a 34-year-old worker between it and a safety bar, crushing him. He died of the injuries July 26, 1984. According to the National Institute for Occupational Safety and Health, it was "the first documented case of a robot-related fatality in the US."

1985 - John Henry, the greatest money winner in thoroughbred racing history, was retired after earning $6,597,947. John Henry started 83 races and won 39 times.

1985 - No. 1 Billboard Pop Hit: "Everytime You Go Away," Paul Young.

1986 - Top Hits

“Invisible Touch” - Genesis

“Sledgehammer” - Peter Gabriel

“Nasty” - Janet Jackson

“Until I Met You” - Judy Rodman

1988 - The Red Sox suspend Jim Rice for three days for shoving manager Joe Morgan. The Boston outfielder became upset when the skipper pinch hit for him using the light-hitting shortstop Spike Owen.

1988 - While cool air invaded the central U.S., unseasonably hot weather continued over the western states. The temperature at Spring Valley, NV, soared from a morning low of 35 degrees to an afternoon high of 95 degrees. Fallon, NV, reported an all-time record high of 108 degrees, and Death Valley, CA, reported their sixth straight day of 120 degree heat.

1989 - Weird Al Yankovic's first movie, "UHF" opens.

1996 - Gretzy signs with the Rangers: after playing less than half a season with the St. Louis Blues, the team to which he had been traded from the Los Angeles Kings, center Wayne Gretzky signed a 2-year contract with the New York Rangers estimated to be worth $4 million per year plus incentives. Gretzky earned his money and defied those who thought he was too old and fragile to play regularly any more. He played every one of the Rangers’ games and finished fourth in the league in scoring.

1997 - Executive officer of a man-of-war who was a woman was Lieutenant Commander Claire V. Bloom, of the frigate U.S.S. Constitution, the flagship of the Navy, during the 200th anniversary voyage that began in Marblehead, MA.

2000 - Thanks to Harold Baines' four hits, the Orioles halt its 20-game Canadian losing streak defeating the Blue Jays, 9-5. It is Baltimore's first victory north of the border since June 13, 1998.

2004 - A third piece of concrete, which apparently fell from the park's upper deck, is discovered at Wrigley Field by a club employee. Two other chunks have also fallen recently in different sections in the 90-year-old stadium, prompting Mayor Richard Daley to say he would not hesitate to close sections -- or all -- of the facility to protect fans from potential harm.

2006 - Los Gatos/Saratoga, fourth day of over 100, and they say the weekend will even be hotter. Heat wave hits the entire country.

2011 – NASA’s Space Shuttle Program ends with the landing of Space Shuttle Atlantis.

-------------------------------------------------------------

SuDoku

The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler?

http://leasingnews.org/Soduku/soduko-main.htm

--------------------------------------------------------------

Daily Puzzle

How to play:

http://www.setgame.com/set/puzzle_frame.htm

Refresh for current date:

http://www.setgame.com/set/puzzle_frame.htm

--------------------------------------------------------------

http://www.gasbuddy.com/

http://www.gasbuddy.com/GB_Map_Gas_Prices.aspx

http://www.gasbuddy.com/GB_Mobile_Instructions.aspx

--------------------------------------------------------------

Weather

See USA map, click to specific area, no commercials

--------------------------------------------------------------

Traffic Live---

Real Time Traffic Information

You can save up to 20 different routes and check them out with one click,

or type in a new route to learn the traffic live

--------------------------------