Monday, June 7, 2010

Drummer Bill Kreutzmann born May 7, 1946 in Palo Alto, California; best known as one of the co-founders of the Grateful Dead, drummer from 1965 to 1995, making him one of four members to play at every one of the band's 2,300 shows, along with Garcia, Weir and Lesh.

http://billkreutzmann.com/performances.html |

Headlines---

Classified Ads---Syndicator

What will happen to Puget Sound Leasing---

Same as NetBank Business Finance?

Same Day Funding with American Lease Insurance

Bank Beat---Three reasons for three bank failures

Leasing 102 by Mr. Terry Winders, CLP

Limited Use Property

Classified Ads---Help Wanted

Top Stories --- June 1-4

Book Review: "Cole Calling" by Mike Berke

Google Share of Searches at 71% for April 2010

Kent, Washington----Adopt-a-Dog

Classified ads—Job Search

You May have Missed---

Sports Briefs---

"Gimme that Wine"

Today's Top Event in History

This Day in American History

Baseball Poem

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

######## surrounding the article denotes it is a “press release”

and was not written by Leasing News nor information verified, but from the source noted. When an article is signed by the writer, it is considered a “by line.” It reflects the opinion and research of the writer. It is considered “bias” as it is the writer’s viewpoint.

[headlines]

--------------------------------------------------------------

[headlines]

--------------------------------------------------------------

What will happen to Puget Sound Leasing---

Same as NetBank Business Finance?

by Christopher Menkin

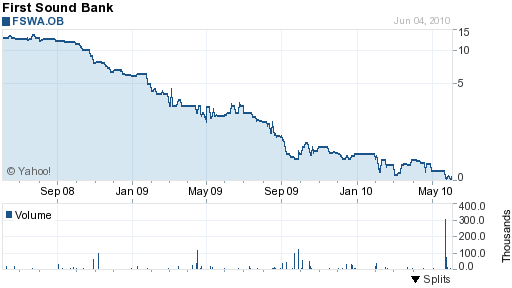

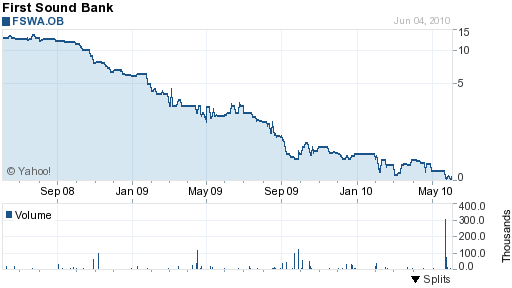

Last Trade: 0.04

Trade Time: Jun 4

Change: 0.04 (50.00%)

Prev Close: 0.08

Open: 0.05

Day's Range: 0.04 - 0.05

52wk Range: 0.03 - 3.25

Volume: 11,000

Avg Vol (3m): 7,525

Reportedly no investors or buyers for First Sound Bank; not even one bid, a highly reliable source told Leasing News. The Washington Department of Financial Institutions reportedly has been talking to the Federal Deposit Insurance Corporation as receiver. It may come to the point of just closing the bank operation down.

Chairman, CEO Don L. Hirtzel, President, COO Steven M. Shaughnessy as well as the board of directors had their chance and blew it. It's not just my opinion, the investors voted by selling their shares down to four cents last Friday, basically worthless.

It is not just handling the Pugent Sound Leasing matter improperly, but bad real estate and other commercial loans, as well as expanding at the wrong time. It’s just plain bad bank management. The numbers speak louder as reported to the FDIC as part of their agreement for insurance for depositors:

March 1, 2008 First Sound Bank (an anachronism) purchased Larasco dba Pugent Sound Leasing. The lawsuit against the Larasco and the Secords saw the equity had dropped from $30.6 million to $24.7 million the end of year 2008. Profit had gone from $1.73 million 2007 year-end to a $20 million loss. Non-current loans and leases from $550,000 to $9.2 million. The loss comes from a pre-tax net operating income of $13.8 million and a net gain loss of $6.2 million. The actual charge offs were $1.73 million ($1.16 lease receivables, $300,000 commercial and industrial loans, $247,000 construction and land development. During the same period the bank increased employees from 34 to 83 full time employees.

Year-end 2009 found 61 full time employees with bank equity dropping to $5.8 million after posting an $18.9 million loss. Non-current loans and leases were $44.5 million, a major jump from the prior year of $9.2 million. Pre-tax net operating income was a negative $18.9 million. Net charge offs were $10.19 million ($5.3 million in lease receivables, $4.3 million in commercial and industrial loans, $504,000 in construction and land development). Tier 1 risk-based capital ratio: 3.02%

The FDIC was writing "cease and desist orders."

March 31, 2009 the bank is down to 50 full time employees. Equity is $5.1 million with a $1.1 million loss for the first quarter of the year. Non-current loans are $30.78 million with net charge offs $3.79 million (commercial and industrial loans $3 million, lease finance receivables $632,000). Tier 1 risk-based capital ratio 2.96% FDIC files tells bank to sell or raise capital by May 28, 2010.

First Sound Bank issues press release:

"First Sound Bank has informed the FDIC of its pending lawsuit with LARASCO, Inc., which is scheduled for trial commencing June 1, 2010, and believes they will not take any further enforcement action until the lawsuit has been resolved — provided the bank maintains a Tier 1 Capital Ratio of not less than 2.5 percent."

(It should be noted that perhaps that was a “verbal guideline” as this does not appear in the 28th of April, 2010 directive signed by J. George Doerr, Deputy Regional Director, Division of Supervision and Consumer Protection.)

"Chairman and CEO Don Hirtzel noted, ‘First Sound Bank faces a unique problem stemming from the acquisition of LARASCO, Inc., a leasing company formerly known as Puget Sound Leasing. We hope to resolve this dispute shortly and then intend to recapitalize the bank through additional support from our shareholders."

Perhaps over a million dollars in attorney fees, not counting time away from bank matters, or reputation with other bankers, and the board is still stuck in a mode that got them into trouble in the first place May 27 Larasco files bankruptcy. May 28 both Secords file bankruptcy, June 1, court "stays" trial pending bankruptcy proceedings.

In a similar situation involving NetBank which also assumed CMC debt, allegedly secured by insurance, the bank was closed by the FDIC with EverBank (EverBank May 21, 2007 acquired approximately $700 million of NetBank mortgage assets but in September terminated its agreement to acquire NetBank's consumer deposit accounts, business finance division and other assets under the transaction announced on May 21, 2007. "This decision comes after it became clear that NetBank would not be able to complete certain conditions required to close and receive regulatory approval,' they reported. February 9, 2010 EverBank completed its acquisition of Tygris Commercial Finance.) During this initial time, NetBank Business Finance, operated by Dwight Galloway in Columbus, South Carolina was placed under FDIC control and became the first leasing company in history to be "operated and controlled" by the FDIC. Dwight Galloway explains that the company operated as if its parent were still in control, but it was the FDIC who was on the premise everyday and he reported to them as he did his parent in the continued operation of the company.

NetBank Business Finance was eventually set out to bid by the FDIC and Resource America subsidiary LEAF Financial was awarded the best bid (a federal government insider told Leasing News there were three bids). In January, Dwight Galloway's operation now called LEAF-Specialty was told to find a buyer or close down within three months. a well informed source told Leasing News. Finding no buyer, the company stopped funding new leases and has been servicing the existing portfolio, looking for a buyer of the portfolio or the operation, Ironically, a real estate agent called Leasing News as they had a major tenant for part of the 21,000 square feet lease (originally this was to be an expansion into the brokerage marketplace instead of the former operation on the West Coast run then by Paul Menzel, CLP.) He called to find out how true it was about LEAF Financial condition as they said they could not contribute anything to a sub-lease situation, as the real estate brokers relied that they did not have the cash, and he wanted to know if LEAF Financial was close to bankruptcy, as that was the impression he received after reading the articles in Leasing News and what he was being told about what was available to help make the sub-lease happen.

While this appears to be a transgression from the original article, it is not, as there are definite similarities between the situations with First Sound Bank and Pugent Sound Leasing.

Going back to the beginning of the purchase, Chairman/CEO Don Hirtzel stated in the press release announcement of the leasing company: "Subject to the terms of the asset purchase agreement, Messrs. Secord, who are the principal owners of Puget Sound Leasing Company, Inc. and currently own four percent of First Sound Bank stock, will receive a combination of First Sound Bank stock and cash at closing. Upon closing, Messrs Secord and their related interests will collectively own 16 percent of First Sound Bank stock and also will receive a fixed percentage of future profits of the Puget Sound Leasing Division for a period of six years. The transaction will dilute current First Sound Bank shares by approximately 13 percent, which is expected to be offset by EPS accretion post closing."

What then happened, according to all the depositions and testimony to date was a clash of a well-regulated bank with an unregulated leasing company where agreements made to non-recourse funding sources of portfolio's would make a "zero loss factor." The Puget Sound Leasing portfolio’s were highly in demand by other leasing companies and banks, according to the declaration of Rob Yohe (1), well received by all the banks involved, who looked forward to purchasing additional portfolio's due to the performance of the leases. At the same time, the standard of security deposits, evergreen and winter green lease clauses, in a unregulated industry helped to create the low loss factor, as well as the relationship with those in the leasing industry of what was common to them but uncommon to Don Hirtzel and his followers. Ironically, the man who was the banks largest stockholder, and a founding director who raised capital through his friends for the bank, who had a definite interest in keeping the bank stock high, and understood the operation of the leasing company, what happens?

He is unceremoniously kicked off the board of directors (reportedly physically escorted out of the building from the board meeting and told the board is going to “get him.” CEO Hirtzel’s first mistake: making it personal, instead of business. He second: the Secords are “street fighters.” The third: not understanding the leasing business.

The Secords certainly had two years to move assets around legally, and more importantly, who was in a better situation to settle the entire matter. Certainly has not been the First Sound Bank Board of Directors.

(1) Rob Yohe Declaration:

http://leasingnews.org/PDF/RobYoheDeclaration.pdf

Previous Leasing News articles:

http://leasingnews.org/archives/Jun2010/6_01.htm#first_sound

http://www.leasingnews.org/Conscious-Top%20Stories/pugent.htm

FDIC First Sound Bank Directive:

http://leasingnews.org/PDF/First_Sound_Bank.pdf

LARSASCO BK Filing:

http://leasingnews.org/PDF/Larsaco%20Response.pdf

Louis A. Secord BK:

Chapter 11 Voluntary Petition. Schedule A due 06/14/2010. Schedule B due 06/14/2010. Schedule C due 06/14/2010. Schedule D due 06/14/2010. Schedule E due 06/14/2010. Schedule F due 06/14/2010. Schedule G due 06/14/2010. Schedule H due 06/14/2010. Statement of Financial Affairs due 06/14/2010. Chapter 11 Current Monthly Income Form 22B Due 06/14/2010. Summary of schedules due 06/14/2010.Incomplete Filings due by 06/14/2010, Filed by Gayle E. Bush on behalf of Louis A. Secord (Bush, Gayle) (Entered: 05/29/2010 at 11:20:05)\

http://leasingnews.org/PDF/LSecordBK.pdf

Application to Extend Time for Credit Counseling (BK Requirement)

http://leasingnews.org/PDF/LSecordCredit.pdf

Richard A. Secord BK:

Chapter 11 Voluntary Petition. Schedule A due 06/14/2010. Schedule B due 06/14/2010. Schedule C due 06/14/2010. Schedule D due 06/14/2010. Schedule E due 06/14/2010. Schedule F due 06/14/2010. Schedule G due 06/14/2010. Schedule H due 06/14/2010. Statement of Financial Affairs due 06/14/2010. Chapter 11 Current Monthly Income Form 22B Due 06/14/2010. Summary of schedules due 06/14/2010.Incomplete Filings due by 06/14/2010, Filed by Gayle E. Bush on behalf of Richard A. Secord (Bush, Gayle) (Entered: 05/29/2010 at 11:08:34)

http://leasingnews.org/PDF/RSecordBKfiling.pdf

Certificate of Credit Counseling for Debtor (BK requirement):

http://leasingnews.org/PDF/RichardSecordapp.pdf

[headlines]

--------------------------------------------------------------

### Press Release ############################

Same Day Funding with American Lease Insurance

(one day service, in by 10 am, out by 4 pm)

DEVILS LAKE, ND – Western Finance & Lease (Western) has realized a significant marketing benefit with the American Lease Insurance (ALI) Program.

Western Finance & Lease President Laurie Bakke

((voted by Leasing News as one of 25 most influential

women in leasing (1))

“We already had an efficient funding process, so we were always ‘quick,’ states Western Finance & Lease President Laurie Bakke, “but now with one less step we almost always deliver same-day funding.” The ALI Program eliminates the need to obtain insurance verification as it provides complete portfolio coverage on all eligible assets automatically from contract signing to final payoff or termination. “Most importantly, we know that our portfolio is protected,” adds Bakke.

Steve Dinkelaker, ALI president

Steve Dinkelaker, ALI president, remarks, “We are very pleased to be able to provide a program that delivers security to Western at an attractive ‘group’ cost to their customers. Enabling Western to fund faster is an additional benefit they realize through working with us.”

According to Bakke, it’s a first-rate match. “ALI is an excellent insurance partner, well-respected for good reason. I rely on Steve as an expert in insurance, and his entire group is knowledgeable, dependable and extremely responsive. They trained our staff, and ensured seamless implementation.” Prior to introducing ALI to Western, Bakke had worked with ALI for ten years, and had been impressed with ALI’s attention to customer needs, including immediate response to losses resulting in timely processing of claims.

Underwritten by an insurer rated “A+” by A.M. Best and Company, the ALI Program provides full replacement cost coverage with no deductible, more comprehensive coverage than offered by typical commercial equipment policies. It also tracks alternate coverage arranged by customers, allowing them to use ALI Program coverage at expiration or cancellation of other coverage, rather than renewing or reinstating it. Customers who use ALI Program coverage benefit from the competitive “group” cost and convenience of monthly insurance charges that are fixed for the entire contract term. The ALI Program is completely automated and offers financing and leasing companies 24/7 access to insurance information.

-

25 Most Influence Women in Leasing:

Laurie Bakke--athlete, sailor, Athletic Hall of Fame - 2000. After learning the finance and leasing business at ITT Commercial Finance, including Manager, Quality Control and Credit Manager, she joined NordFinance, Inc., a subsidiary of Nordbanken, AB, Sweden's largest financial institution, credit manager, vice-president Vendor program, finally named President. She then joined Irwin Commercial Finance as Executive Vice President and General Manager. She brought her vendor and operation skills to Huntington National Bank as Vice President, Vendor Finance. She has served on the board of directors of the Equipment Leasing and Finance Association and on the board of trustees for the Leukemia & Lymphoma Society.

http://www.linkedin.com/in/bakke2009

American Lease Insurance Agency Corporation provides comprehensive insurance programs to more than 25 equipment finance and leasing companies. Founded in 2000 by licensed insurance producer Steve Dinkelaker, ALI is headquartered in Sunderland, Massachusetts, and is an active member of all major equipment financing and leasing associations. For more information, go to www.aliac.net.

Western Finance & Lease is a national commercial equipment finance company that provides both lease and conventional finance options for new and used equipment. Established in 1990 in Devils Lake, North Dakota, Western Finance & Lease is a subsidiary of Western State Bank, established in 1901. Western State Agency, the employee-owned parent company of Western Finance & Lease and Western State Bank, is one of North Dakota’s largest community financial institutions with $405 million in total assets.

#### Press Release #############################

[headlines]

--------------------------------------------------------------

Bank Beat---Three reasons for three bank failures

The sole branch of First National Bank, Rosedale, Mississippi, was closed with The Jefferson Bank, Fayette, Mississippi, to assume all of the deposits.

The bank had a charge off March 31, 2010 of $10.57 million, primarily in the category of "other loans:" $10.56 million. The Bolivar Commercial newspaper noted a rumor concerning" longtime bank president Henry McCaslin misappropriating funds." This was not explained in the FDIC filing, nor was much information available from local newspapers. Tier 1 risk-based capital ratio -7.14%

This was a very small bank formed March 13, 1907 and had ten full time employees, evidently still part of the “ole South.” As of March 31, 2010, First National Bank had approximately $60.4 million in total assets and $63.5 million in total deposits. The FDIC and The Jefferson Bank entered into a loss-share transaction on $43.5 million of First National Bank's assets.

From March 31, 2009 to March 31, 2010 bank equity had dropped from $9.7 million to a minus $3.17 million with non-current loans jumping from $57,000 to $15.6 million, profit from $562,000 to a negative loss of $13.5 million.

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $12.6 million.

http://www.fdic.gov/news/news/press/2010/pr10130.html

TierOne Bank, Lincoln, Nebraska, was closed with Great Western Bank, Sioux Falls, South Dakota, to assume all of the deposits of TierOne Bank. 81st FDIC-insured institution to fail in the nation this year, and the first in Nebraska.

The bank had been trying to recapitalize and the proposed sale of 32 branches to Great Western Bank of Sioux Falls, South Dakota was turned down by the Office of Thrift Supervisors as the opinion was it would have left TierOne in worse financial position.

69 branches in March 31, 2009 had 842 full time employees and by March 31, 2010 it was down to 764 full time employees. In the same time period, equity had fallen from $289.3 million to $79.6 million, non-current loans from $159.8 million to $444.1 million, following two years of losses in this period: $9.3 million 2009 and $19.6 million 2010 with $15 million in charge offs ($9.6 million in construction and land development, $2.67 million secured by 1-4 multi-family residential property, $1.1 million secured by non-farm non-residential property, and $1 million in commercial and industrial loans). Tier 1 risk-based capital ratio 3.58% .

As of March 31, 2010, TierOne Bank had approximately $2.8 billion in total assets and $2.2 billion in total deposits.

Great Western Bank will pay the FDIC a premium of 1.5 percent to assume all of the deposits of TierOne Bank. In addition to assuming all of the deposits of the failed bank, Great Western Bank agreed to purchase essentially all of the assets.

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $297.8 million.

http://www.fdic.gov/news/news/press/2010/pr10132.html

The Federal Deposit Insurance Corporation (FDIC) approved the payout of the insured deposits of Arcola Homestead Savings Bank, Arcola, Illinois. The bank was closed Friday by the Illinois Department of Financial Professional Regulation – Division of Banking, which appointed the FDIC as receiver. There were six full time employees for this bank founded January 1, 1883 in Douglas County. 2000 population was close to 20,000, located in the center of Illinois, the county named in honor of Stephen A. Douglas, who was elected to the United States Senate in 1858, following the Lincoln-Douglas Debates.

Arcola Homestead Savings Bank, established in 1883, is the smallest of three banks with offices in Arcola.

The FDIC was unable to find another financial institution to take over the banking operations of Arcola Homestead Savings Bank.

As of March 31, 2010, Arcola Homestead Savings Bank had approximately $17.0 million in total assets and $18.1 million in total deposits. At the time of closing, there did not appear to be any uninsured funds. Equity of the Bank had dropped from $2.2 million March 31, 2009 to minus $1.1 million March 31, 2010. Non-current loans $572,000 with a loss of $619,000 March 31, 2010 with Tier 1 risk-based capital ratio -11.51%.

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $3.2 million.

http://www.fdic.gov/news/news/press/2010/pr10131.html

List of Bank Failures

http://www.fdic.gov/bank/individual/failed/banklist.html

Bank Beat:

http://www.leasingnews.org/Conscious-Top%20Stories/Bank_Beat.htm

[headlines]

--------------------------------------------------------------

Leasing Industry Help Wanted

Sales

We are looking for experienced business development

professionals with established vendor / client

contacts in general manufacturing equipment,

road maintenance, material handling , radio/TV broadcasting

and other hard collateral.

We have openings for in-house business development positions

and Independent Sales Associates.

Contact or send resumes to: John Martella SVP

800 800 8098 ext 5209 or direct: 248 743 5209

jmartella@leasecorp.com

|

Please see our Job Wanted section for possible new employees.

[headlines]

--------------------------------------------------------------

Leasing 102

by Mr. Terry Winders, CLP

Limited Use Property

The most desirable equipment to lease is something that has a long useful life and maintains its value because it has a wide market. The least desirable is equipment with a short life and a questionable value because of a narrow market. I state this because it seems that it should be common knowledge or at least logical. However as I review lease portfolios to review their quality and performance I constantly find equipment very poorly described and no review what so ever. Just because equipment is large, expense and good looking does not make it good to lease.

If the credit is great we tend not to do our job correctly and review the equipment. This could be a problem if we are about to lease limited use property. The IRS will reject capital recover benefits if it is found the equipment has limited use or could only be used by the lessee. If the equipment is special order or made to compliment or become an attachment on another piece of equipment without being of value otherwise then they will only award capital recovery benefits to the lessee. Remember the IRS guidelines are based on “use”, not ownership. So if no one else could make use of the equipment then the only one allowed to take depreciation is the lessee. You also break the 80% use rule for legal and the 75% use rule for GAAP.

Residual value is only capable when the ability to remarket off lease equipment is greater than the cost to sell it. A guide book may define the estimated future value of equipment but it rarely defines how hard it is to sell or where to sell it. One of the things you should know before leasing equipment is where can I dump this thing if everything goes wrong? Try and keep records of every secondary market seller you contact so as time goes by you will build up a list of people that will supply you with information on what the risks are in out of the way markets. You must also consider storage, insurance, advertising, commissions and the time value of the money you have invested in the equipment until it is sold.

It is hard to know what industries will be up and which will be down when your lease terminates but the biggest risk today is how quickly the equipment becomes outdated. This all sounds like a reason not to take residuals but that is not true. It is a warning on the troubles you can get in for not investigating the equipment you want to lease with the same interest you investigates credit. Remember our industry starts with the word “equipment”.

Some questions to ask the vendor to ease your mind are: How many have you sold this year? Are spare parts readily available? Is it current technology, or new technology? (which means is it new to the marketplace or has it been around awhile), How much instillation is there? and do you remarket the off lease or used equipment?

If a vendor does not remarket there equipment in a used condition then ask who does and contact them about the ease of remarketing the equipment. If there is not a market for the used equipment or a very limited one then you may have limited use equipment on your hands which requires a non-tax leased and non-legal lease plus better than average credit!

Mr. Terry Winders, CLP, has been a teacher, consultant, expert witness for the leasing industry for thirty years and can be reached at leaseconsulting@msn.com or 502-327-8666.

He invites your questions and queries.

Previous #102 Columns:

http://www.leasingnews.org/Conscious-Top%20Stories/Leasing_102/Index.htm

$200 for two and 1/2 day seminar

Little Rock, Ark.

Meet and learn from Mr. Terry Winders, CLP

Leasing #102 columnist for Leasing News,

long time educator and trainer

Sales and Operations

click here for course information and to register

June 9, 10, until Noon on the 11th

Little Rock, Arkansas

Hosted by Arvest Equipment Finance

$200 for two and 1/2 day seminar

"Certified Leasing Professionals attending this seminar will earn CPEs (Continuing Professional Education)

Credits toward their recertification" |

(This ad is a “trade” for the writing of this column. Opinions

contained in the column are those of Mr. Terry Winders, CLP)

[headlines]

--------------------------------------------------------------

[headlines]

--------------------------------------------------------------

Book Review: "Cole Calling" by Mike Berke

This is Mike Berke's second book, following "Hot Cole."

Spending most of his career in equipment leasing sales, Mike Berke’s employers included Leasco Capital Corporation (now Reliance Group, Inc.), Sussex Leasing Corp., Eaton Financial Corporation and AT&T Capital Corporation.

During that time he also trained hundreds of personnel from manuals, instructional guidelines and how-to’s he wrote, additionally authoring numerous articles for industry association publications, magazines, periodicals and newsletters. He frequently performed as speaker, moderator, panelist and participant at national, regional, and local industry association conferences arranged by groups including the Equipment Leasing Association (ELA), Eastern Association of Equipment Lessors (EAEL) and National Association of Equipment Leasing Brokers (NAELB).

In 1994 he authored the 250-page text Selling Equipment Leasing, published by the AMACOM division of The American Management Association. Currently out of print, the book is still available through resale.

About Bobby Cole:

Bobby Cole, former bartender in Manhattan, is now a professional bodyguard. His occupation takes him into some serious situations, in this book involving a gambling casino in Atlantic City, NJ and a major league baseball pitcher whose life has been threatened by irate fans. Threading through the story, a relationship begins to blossom with a New York City Police Department SWAT team commander whom Bobby met while handling a body guarding assignment. The commander has begun to employ Bobby’s services on an as needed basis for witness protection, leading to his involvement in all sorts of situations now and in the future.

email:mb@bobbycolebooks.com

Both books are available here:

www.bobbycolebooks.com

[headlines]

--------------------------------------------------------------

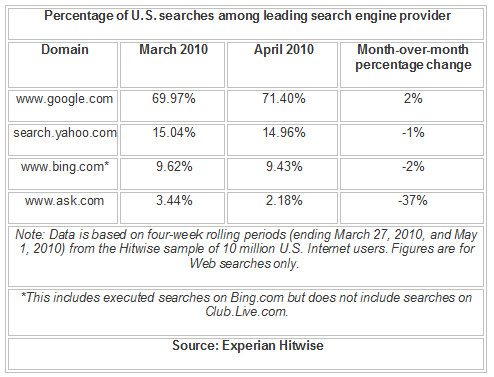

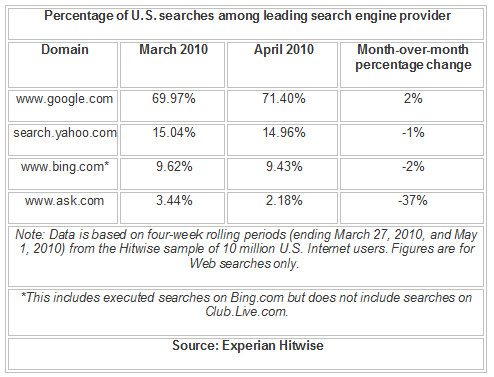

Google Share of Searches at 71% for April 2010

Experian Hitwise announced that Google accounted for 71.40 percent of all U.S. searches conducted in the four weeks ending May 1, 2010. Yahoo! Search, Bing and Ask received 14.96 percent, 9.43 percent and 2.18 percent, respectively. The remaining 78 search engines in the Hitwise Search Engine Analysis Tool accounted for 2.03 percent of U.S. searches.

[headlines]

--------------------------------------------------------------

Kent, Washington---Adopt-a-Dog

|

Rescue Group: |

Homeward Bound Pet Rescue

(206) 272-0582 |

|

Charlie's info...

Breed: Boxer |

Size: Large 61-100 lbs (28-45 kg) |

Color: Unknown |

|

|

|

|

|

Charlie is: |

|

already neutered |

|

housetrained |

|

purebred |

|

good with kids |

|

|

good with dogs |

|

good with cats |

|

|

Charlie's story... Please contact Angela (angelahoschek@msn.com) for more information about this pet.

Name: Charlie Tuxedo

Birthdate/Approx Age: April 2004/5yrs.

Breed: Purebred Boxer

Color: Brindle

M or F: Male

Spayed/Neutered? Yes

Any shots? Rabies in January 2010, will receive Distemper booster prior to adoption.

Microchipped? Adopter will be required to chip within one month of adoption.

Get along with cats? Unknown, I believe we were told he chases them.

Get along with other dogs? Yes, but just now is trying to establish being alpha with our 3 dogs

Get along with kids? Yes, very much

Has this dog been around children under age 3? Not to my knowledge

Get along with all people? Yes, what we have observed so far

Weight now? 61 or so lbs.

Weight full grown? Unknown, had lost wt. and is now slowly regaining

Walks on Leash? Yes

Housebroken? Yes, however, needs work because he has tried to mark in the house and had accidents.

Personality? Very loving, pretty mild activity level for a boxer, has separation anxiety but does well if with a person or another dog.

List good traits: Beautiful dog, listens well (needs some refreshing on commands) and loves, loves people and being in a family.

Any Health Issues? None, vet gave a good health report in Jan. 2010

Any bad habits? At this time, he is marking in the house, has accidents, breaks out of his kennel, and does not bark to let you know he needs to go outside.

Trained to what commands? Come (not consistent), sit, down, back.

Like Doggy Parks? Never been.

Was this dog abused and how? I have conflicting reports from 2 previous owners who claim the other did abuse the dog by keeping him kenneled in a small area, etc. There was evidence of wt. loss from one owner to the other before we got him. He does occasionally flinch when petted.

Has this dog ever bitten anyone? Not to my knowledge, told no.

Any dog aggression problems? Is now starting to become the dominant male with our 3 dogs and has attacked our male and seems to stalk him. These behaviors are not carried over to people.

Any anxiety separation problems? Yes, I was told (too late) that he has had this since he was 1 ½ yrs. The second owner reported she had no trouble with leaving him in the house with another dog. However, the first owner claims that he could bust out of a large paneled kennel. He has gotten out of our small kennel/crate and hurt himself in the process. He has also gotten out of our large 12x12 kennel and even gotten out of our 6 ft. fenced yard. When he is placed in our yard with another dog, he remains in the yard. He just can’t cope with being alone. He has done extensive damage to doors, door casing, carpets, and curtains when left alone in the house. He will need an owner who can take him with to work or is home most of the time. Would probably do well with a female canine companion as well.

Does this dog need a fenced in yard? Yes, a very secure yard.

Who would be the best kind of owner for this particular dog? Someone who can be the alpha and have a firm consistent behavioral approach, a family with another dog and needs a lot of attention to develop security in the family.

Is this dog crate trained? Yes, however, if crated will cause injury to himself to get out.

Where does he/she stay when left home alone? Outside with another dog at this point.

Where does he/she sleep? He sleeps on the floor in our room with us and all dogs.

Application and home visit required. Adoption fee is $250.

|

Address: |

(206) 272-0582

Kent , WA

98031 |

|

About Our Rescue Group... |

Homeward Bound Pet Rescue is dedicated to the rescue and rehabilitation of homeless and neglected pets and placing them in loving, permanent homes. All pets that come to us are spayed/neutered, vaccinated, wormed, treated for fleas (if needed) and microchipped prior to adoption unless otherwise noted. We take great care in placing our pets in loving homes by requiring an application, reference check, and home visit. Adoption fees range from $100-$350 based on breed and age. Although we currently have limited foster homes available, we may be able to help you place your pet. Please email us for more details. |

http://www.adoptapet.com/shelter73364-pets.html

Adopt-a-Pet by Leasing Co. State/City

http://www.leasingnews.org/Conscious-Top%20Stories/Adopt_Pet.htm

Adopt a Pet

http://www.adoptapet.com/

[headlines]

---------------------------------------------------------------

[headlines]

----------------------------------------------------------------

Today in History

1975-the Sony Corporation released its videocassette recorder, the Betamax, which sold for $995. RCA and other introduced the VHS format, selling originally for $1,295. The Betamax was cheaper and supposedly a better system, but Sony would not release the patent and more manufacturers produced VHS, making it cheaper and cheaper, and perhaps what happened to Apple not releasing its software to programmers and Microsoft giving it to software developers for free, happened as Sony stopped making Betamax. If your remember, people were saying the video tape would put the movie industry out of business---just as they are saying today the internet will put the retailers out of business. In reality, both were enhanced and the consumers became the winners. Today VHS has been replaced by the DVD.

[headlines]

----------------------------------------------------------------

This Day in American History

1498 - Christopher Columbus left on his third voyage of exploration.

1712 - The Pennsylvania Assembly banned the importation of slaves.

1769-Daniel Boone arrives in Kentucky, celebrated today as “Boone Day.”

http://memory.loc.gov/ammem/today/jun07.html

( as stated by a relative here, many of the stories about Daniel Boone were invented and are not true; however, he was an American pioneer, nevertheless).

1776 - Richard Henry Lee of Virginia proposed to the Continental Congress the resolution calling for a Declaration of Independence: that "these United Colonies are, and of right ought to be, free and independent States..." Congress delayed the vote on the resolution until July 1.

1777-The Second Continental Congress voted to replace the phrase “United Colonies” in all legislation with the phrase “ United States of America.” The Congress represented only twelve colonies at this date, Georgia not having sent delegates yet.

1816 -At Danville, Vermont, snow and sleet drifted to a depth of 20 inches. The higher elevations remained white the entire day. snow flurries were reported as far south as Boston, Massachusetts. Waltham, Massachusetts reported a low temperature of 33 degrees and New Haven, Connecticut had a low of 35 degrees.

1828 - A party led by Jebediah Smith completed a journey down the Klamath River and were on the verge of starvation when they were visited by Indians who brought food. Smith's party proceeded north to Oregon and most of the party was killed by Umpqua Indians. Smith was killed in 1831 by Comanches on the Cimarron River. Smith’s party was the 1st white people to see Lake Earl, the biggest lagoon on the West Coast.

1879-San Francisco Free Public Library opens on Bush St., with 5,656 books.

1862- the first citizen of the United States to be hung for treason was Williams Bruce Mumford, a retired gambler. During the Civil War, Captain Theodorus Bailey was sent by Admiral David Glasgow Farragut to New Orleans, LA, where he hoisted the American flag over the min on April 28, 1862. After the troops left, Mumford tore down the flag. On May 1, General Benjamin Franklin Butler arrived in New Orleans with 2,000 troops and took possession of the St. Charles Hotel. A crowd gathered in front of it, among them Mumford, who boasted of his exploits in humbling the “old rag of the United States.” Mumford was arrested, tried under the direction of the provost marshal of the district of New Orleans, convicted, and hanged on June 7, 1862. We were serious about people who burned the American Flag in those days.

1860-As more Americans could read, the first mass-market paperback book was a fiction entitled: Malaeska: Indian Wife of the White Hunter, by Mrs. Ann S. Stephens. It was the trend then to hire writers, such as done for the Nancy Drew series, give them an outline and flat fee, no royalties. Mrs. Stephens had never left New York City, had never met an Indians. It was published by Irwin P. Beadle and Company, New York, and first advertised this day in the New York Tribune as “Beadle's Dime Novels No. 1.”

1862-Union General Benjamin Franklin Butler was hated in New Orleans and it perhaps started with this incident, which saw the first person hanged for treason, William Bruce Mumford, a retired gamble. During the Civil War, Captain Theodurs Bailey was sent by admiral David Glasgow Farrague to New Orleans, LA, where he hoisted the American flag over the mint on April 28, 1862. After the troops left, Mumford tore down the flag. On May 1, General Butler arrived in New Orleans with 2,000 troops and took possession of the St. Charles Hotel. A Crowd gather in front of it, among them Mumford, who boasted of his exploit in humbling the “old rag of the United States.” Mumford was arrested, tried under the direction of the provost marshal of the district of New Orleans, convicted, and hanged on June 7, 1862.

1864-BURGLAR ARRESTED written by Mark Twain for The San Francisco Daily Morning Call :John Richardson, whose taste for a cigar must be inordinate, gratified it on Saturday night last by forcing his way into a tobacconist's on Broadway, near Kearny street, and helping himself to fourteen hundred "smokes." In his hurry, however, he did not select the best, as the stolen tobacco was only valued at fifty dollars. He was congratulating himself last evening in a saloon on Dupont street, in having secured weeds for himself and all his friends, when lo! a Rose bloomed before his eyes, and he wilted. The scent of that flower of detectives was too strong even for the aroma of the stolen cigars. Richardson was conveyed to the station-house, where a kit of neat burglar's tools was found on his person. He is now reposing his limbs on an asphaltum floor - a bed hard as the ways of unrighteousness..

1887-revolutionizing printed, Tolbert Lanston of Washington, DC, received five patents for a monotype machine. The machine cast new type, letter by letter, from matrices that were used over and over again.

http://www.agfamonotype.co.uk/DynamicPage/View.cfm?PageName=tl_1844_94

1892-African-American GJ Sampson received patent for clothes dryer.

http://inventors.about.com/library/inventors/blwashingmachines.htm

1892—Wyoming, who recognized women's rights early ( perhaps to attract more women to the state), also became the first women to a national political convention. Therese A. Jenkins of Cheyenne, WY, and Cora G. Carleton of Hilliard, WY, were sent as alternate delegates to the 10 th Republican Party convention at Minneapolis, MN, on June 7-10, 1892.

1892-Homer A. Plessy refuses to move to segregated railroad coach in New Orleans, initiating Plessy v Ferguson.

http://www.watson.org/~lisa/blackhistory/post-civilwar/plessy.html

1897-Birthday of George Szell, Hungarian-born American conductor.

1902--birthday of trombonist Ed cuffee, Norfold, VA.

1906-birthday of bandleader Glen Gray, Roanoke,IL

http://www.lib.neu.edu/archives/collect/findaids/m31find.htm

1909-birthday of Virginia Apgar. Dr. Apgar developed the simple assessment method that permits doctors and nurses to evaluate newborns while they are still in the delivery room to identify those in need of immediate medical care. The Apgar score was first published in 1953 and the Prenatal Section of the American Academy of Pediatrics is named for Dr. Apgar. born at Westfield, NJ. Apgar died Aug. 7, at New York, NY.

1909 - Birthday of Jessica Tandy, British-born U.S. actor. She won the Kennedy Center Honors Award in 1986; won an Academy Award for the lead in Driving Miss Daisy (1989). She won her second Tony award for the Gin Game (1978). Most remember her in her old age and are amazed that her first Tony award was for her creation of Blanche DuBois in Tennessee Williams' A Streetcar Named Desire (1947) - opposite Marlon Brando, Kim Hunter, and Karl Malden.

1915-William Jennings Bryan resigned as secretary of state in a disagreement with President Woodrow Wilson over the wording of a second note to Germany. Robert Lansing was named acting scretary of state.

1917-birthday of Gwendolyn Brooks, poet and first African-American awarded a Pulitzer prize

http://www.math.buffalo.edu/~sww/brooks/brooks.html

1917- Birthday of singer/straight man and movie/tv star Dean Martin (Dino Crocetti), perhaps made more famous with Jerry Lewis and then part of the Frank Sinatra “Rat Pack.”.

1921-Guitarist Tal Farlow birthday

http://www.jazzguitar.com/features/talbook.html nStreet/5563/

http://www.myjazzhome.com/tal_2.htm

http://elvispelvis.com/talfarlow.htm

1930—The New York Times agreed to capitalize the word from n- to Negro.

1930-Gallant Fox, with jockey Earle Sande, became the second horse to win the Triple Crown. Trained by Sunny Jim Fitzsimmons, Gallant Fox won the Belmont Stakes by three lengths over Wichone in 2:31.3

1932 - Over 7,000 war veterans march on Washington, D.C. demanding their bonuses for service in WW I.

1934-- country honky-tonk and ballad singer Wynn Stewart was born in Morrisville, Missouri. He is best known for his 1967 country chart-topper, "It's Such a Pretty World Today."

1940- singer Tom Jones was born in Pontypridd, Wales.

After building a reputation in London clubs, Jones was offered a recording contract in 1964. His first records weren't successful, but in 1965 he achieved international success with "It's Not Unusual," a song written by his manager, Gordon Mills. Jones next reached the top of the charts with the title song from the Peter O'Toole movie "What's New Pussycat?" He followed this with a series of country-flavored pop hits, among them "Green, Green Grass of Home," "Delilah" and "Love Me Tonight." Tom Jones became one of the biggest selling acts in Las Vegas, and had his own US network TV show for a few seasons.

He returned with much gusto in 1994 with a new image, a new label and a new record. Titled 'The Lead and How to Swing It', the ZTT (Trevor Horn's label) released disc featured the hit single 'If I Only Knew' and a duet with Tori Amos called 'I want you back'. Tom also covered the early 80s Yaz tune 'Situation'.

1941-Whirlaway won the Belmont Stakes by 2 ½ lengths over Robert Morris to become the fifth horse to win the Triple Crown. Trained by Ben Jones for Calumet Farms and ridden by Eddie Arcaro, Whirlaway finished the Belmont in 2:31.

1942- It is not very well remembered today, but was very important to the building fear of the times when this day in 1942 the Japanese occupied the undefended island of Attu and the island of Kiska in the Western Aleutian, which was American territory. The capture was announced by the Navy on June 13. The islands were retaken by American Forces in May, 1943 is the only battle fought on U.S. soil during World War II.

1942 - The Battle of Midway--one of the most decisive U.S. victories in its war against Japan--comes to an end. In the four-day sea and air battle, the outnumbered U.S. Pacific Fleet succeeded in destroying four Japanese aircraft carriers with the loss of only one of its own, the Yorktown, thus reversing the tide against the previously invincible Japanese navy. In six months of offensives, the Japanese had triumphed in lands throughout the Pacific, including Malaysia, Singapore, the Dutch East Indies, the Philippines, and numerous island groups. The United States, however, was a growing threat, and Japanese Admiral Isoruku Yamamoto sought to destroy the U.S. Pacific Fleet before it was large enough to outmatch his own. A thousand miles northwest of Honolulu, the strategic island of Midway became the focus of his scheme to smash U.S. resistance to Japan's imperial designs. Yamamoto's plan consisted of a feint toward Alaska followed by an invasion of Midway by a Japanese strike force. When the U.S. Pacific Fleet arrived at Midway to respond to the invasion, it would be destroyed by the superior Japanese fleet waiting unseen to the west. If successful, the plan would eliminate the U.S. Pacific Fleet and provide a forward outpost from which the Japanese could eliminate any future American threat in the Central Pacific. Unfortunately for the Japanese, U.S. intelligence broke the Japanese naval code, and the Americans anticipated the surprise attack. Three heavy aircraft carriers of the U.S. Pacific Fleet were mustered to challenge the four heavy Japanese carriers steaming toward Midway. At the Battle of Midway, Japan lost four carriers, a cruiser, and 292 aircraft, and suffered 2,500 casualties. The U.S. lost the Yorktown, the destroyer USS Hammann, 145 aircraft, and suffered 307 casualties. Japan's losses in the hobbled its naval might--bringing Japanese and American sea power to approximate parity--and marked the turning point in the Pacific theater of World War II. In August 1942, the great U.S. counteroffensive began at Guadalcanal and did not cease until Japan's surrender three years later.

1943 - The worst of the L.A. Zoot Suit Riot violence occurs as soldiers, sailors, and marines from as far away as San Diego travel to Los Angeles to join in the fighting. Taxi drivers offer free rides to servicemen and civilians to the riot areas. Approximately 5,000 civilians and military men gather downtown. The riot spreads into the predominantly African American section of Watts.

1944-Birthday of 1944 guitarist Clarence White of the Byrds was born in Lewiston, Maine. After appearing as a session musician on recordings by such artists as Rick Nelson, the Everly Brothers and the Byrds, he became a permanent member of the Byrds in 1968. White remained with them until the group broke up in 1973. In July of that year, White was killed by a drunken driver in Lancaster, California, while he was loading equipment on to a van following a concert.

1950---Top Hits

My Foolish Heart - The Gordon Jenkins Orchestra (vocal: Eileen Wilson)

Bewitched - The Bill Snyder Orchestra

The Third Man Theme - The Guy Lombardo Orchestra

Birmingham Bounce - Red Foley

1951--HANSON, JACK G. Medal of Honor

Rank and organization: Private First Class, U.S. Army, Company F, 31st Infantry Regiment. Place and date: Near Pachi-dong, Korea, 7 June 1951. Entered service at: Galveston, Tex. Born: 18 September 1930, Escaptawpa, Miss. G.O. No.: 15, 1 February 1952. Citation: Pfc. Hanson, a machine gunner with the 1st Platoon, Company F, distinguished himself by conspicuous gallantry and intrepidity at the risk of his life above and beyond the call of duty in action against an armed enemy of the United Nations. The company, in defensive positions on two strategic hills separated by a wide saddle, was ruthlessly attacked at approximately 0300 hours, the brunt of which centered on the approach to the divide within range of Pfc. Hanson's machine gun. In the initial phase of the action, 4 riflemen were wounded and evacuated and the numerically superior enemy, advancing under cover of darkness, infiltrated and posed an imminent threat to the security of the command post and weapons platoon. Upon orders to move to key terrain above and to the right of Pfc. Hanson's position, he voluntarily remained to provide protective fire for the withdrawal. Subsequent to the retiring elements fighting a rearguard action to the new location, it was learned that Pfc. Hanson's assistant gunner and 3 riflemen had been wounded and had crawled to safety, and that he was maintaining a lone-man defense. After the 1st Platoon reorganized, counterattacked, and re-secured its original positions at approximately 0530 hours, Pfc. Hanson's body was found lying in front of his emplacement, his machine gun ammunition expended, his empty pistol in his right hand, and a machete with blood on the blade in his left hand, and approximately 22 enemy dead lay in the wake of his action. Pfc. Hanson's consummate valor, inspirational conduct, and willing self-sacrifice enabled the company to contain the enemy and regain the commanding ground, and reflect lasting glory on himself and the noble traditions of the military service.

1953-Mary Church Terrell, political activist, wins struggle to end segregation in Washington, DC, restaurants.

http://www.npg.si.edu/exh/harmon/terrharm.htm

http://www.africana.com/Utilities/Content.html?&../cgi-bin/banner.pl?banner=

Education&../Articles/tt_1054.htm

http://www.americaslibrary.gov/pages/jb_0923_terrell_1.html

1953- Kukla, Fran (Allison) and Ollie, along with the Boston Pops Orchestra under the direction of Arthur Fiedler, were featured on the first network telecast in ‘compatible color'. The program was broadcast from Boston, MA.

1953--At age 90, Mary Church Terrell lead the struggle to end segregation in Washington DC restaurants, culminating at the Supreme Court. On June 8, 1953, the court ruled that segregated eating places in Washington, D.C., were unconstitutional.

http://www.cr.nps.gov/nr/travel/civilrights/dc2.htm

http://memory.loc.gov/ammem/aap/terrell.html

http://www.tnstate.edu/library/digital/terrell.htm

1954- Dodger catcher Roy Campanella steals home in the 12th in a 7-5 victory over the Cardinals.

1954-With Big Joe Turner's "Shake, Rattle and Roll" riding high on the Billboard R&B chart, Bill Haley and His Comets enter Decca Records' New York studio to record the same number. Haley's version will enter the Pop chart next August for a an amazing 27 week run and rise to #7, becoming the first Rock and Roll tune to sell a million copies.

1955--First President to appear on color TV (Dwight Eisenhower)

1958-Prince (Prince Roger Nelson) is born in Minneapolis. His biggest hit is "When Doves Cry," which tops Billboard's Hot 100 for five weeks and sells more than 2 million copies. On his 35th birthday in 1993 he changed his name to a symbol.

1958---Top Hits

The Purple People Eater - Sheb Wooley

Secretly - Jimmie Rodgers

Do You Want to Dance - Bobby Freeman

All I Have to Do is Dream - The Everly Brothers

1963- The Rolling Stones' first record, “Come On”, was released

http://personal.redestb.es/jmunoz/stones/comeon.html

1965-The executive committee of the American Football League met in New Jersey and voted to expand the league from eight teams to nine. Tow months later, the league awarded the expansion franchise to Miami for $7.5 million. The ownership group headed by Joe Robbie and entertainer Danny Thomas named its team the Dolphins.

1966---Top Hits

When a Man Loves a Woman - Percy Sledge

A Groovy Kind of Love - The Mindbenders

Paint It, Black - The Rolling Stones

Distant Drums - Jim Reeves

1967-Dr. David E Smith opened the Haight Ashbury Free Clinic, the first free clinic in the U.S. without a religious affiliation. His goal was to provide free medical care for everyone under the motto "Health care is a right, not a privilege." The clinic operated in the Haight-Ashbury District through 2007, then moved most of its operations to the Mission District of San Francisco and continues to provide medical care to those who would otherwise lack access to it. Forty years later, his book: http://www.sfgate.com/cgi-bin/article.cgi?f=/c/a/2007/05/20/MNSOLSMITH20.DTL

1968-The Grateful Dead and The Airplane at the Carousel Ballroom in San Francisco.

1969 - The rock group Blind Faith made its British debut at a free concert at London's Hyde Park. Over 100,000 fans attended what was called “the most remarkable gathering of young people ever seen in England.” The group was composed of Eric Clapton, Ginger Baker, Stevie Winwood and Rick Grech.

1969—The Johnny Cash Show premiered on television, CBS.

http://www.johnnycash.com/

1974---Top Hits

The Streak - Ray Stevens

Band on the Run - Paul McCartney & Wings

You Make Me Feel Brand New - The Stylistics

Pure Love - Ronnie Milsap

1975 --~ Thank God I'm a Country Boy, by John Denver hits #1.

1971-Carole King's album "Tapestry" goes gold. The album retains on the charts for three years and produces her biggest single, "It's Too Late".

1971-Elton John's album, "Captain Fantastic and the Brown Dirt Cowboy" enters the U.S. chart at #1 where it stayed there for seven weeks.

1972- The musical Grease opened on Broadway. It had been playing off-Broadway for about 4 months

http://www.geocities.com/TelevisionCity/Studio/8849/Moviemusicals/

Rydell/Grease.htm#stag

1974 - "The Entertainer", the original music from the motion picture "The Sting", earned a gold record for pianist and conductor, Marvin Hamlisch

1975-the Sony Corporation released its videocassette recorder, the Betamax, which sold for $995. RCA and other introduced the VHS format, selling originally for $1,295. The Betamax was cheaper and supposedly a better system, but Sony would not release the patent and more manufacturers produced VHS, making it cheaper and cheaper, and perhaps what happened to Apple not releasing its software to programmers and Microsoft giving it to software developers for free, happened as Sony stopped making Betamax. If your remember, people were saying the video tape would put the movie industry out of business---just as they are saying today the internet will put the retailers out of business. In reality, both were enhanced and the consumers became the winners. Today VHS is being replaced by DVD.

1976 - "The NBC Nightly News", with John Chancellor and David Brinkley, aired for the first time. The partnership lasted until Brinkley moved to ABC News. Chancellor then held the lone, anchor spot until retiring.

1980-Rocky Burnette's "Tired of Toeing the Line" peaks at number 8 on the Billboard Hot 100. Rocky bills himself as The Son of Rock and Roll as his father, Johnny Burnette had scored a 1960 number one hit with "You're Sixteen". The feat of father and child both scoring a Top Ten hit has also been accomplished by Ozzie and Rick Nelson, Frank and Nancy Sinatra, Nat and Natalie Cole as well as Pat and Debbie Boone.

1982---Top Hits

Ebony and Ivory - Paul McCartney with Stevie Wonder

Don't Talk to Strangers - Rick Springfield

I've Never Been to Me - Charlene

Finally - T.G. Sheppard

1982-- Dodger first baseman Steve Garvey becomes only the fifth player in major league history to play in 1,000 consecutive games.

1984 -42 tornadoes touched down in the upper Midwest with 21 of them occurring in Iowa. An F4 tornado tracked 30 miles through Mahaska and Keokuk counties in Iowa, killing 2 people and injuring 51. The small town of Wright was practically wiped out. Barneveld, Wisconsin was devastated shortly before midnight as a F5 tornado chewed up the town. 90 percent of the town was damaged or destroyed, 9 people were killed, and 197 were injured.

1990---Top Hits

Vogue - Madonna

All I Wanna Do is Make Love to You - Heart

Hold On - Wilson Phillips

I've Cried My Last Tear for You - Ricky Van Shelton

1993-The Who's Pete Townshend and Chuck Berry are among those present for the ground breaking ceremony for the Rock and Roll Hall of Fame in Cleveland, seven years after the city won the right to host the building. Guests stood on a guitar shaped stage at the construction site on the shore of Lake Erie.

NBA Finals Champions This Date

1978 Washington Bullets

Stanley Cup Champions This Date

Detroit Red Wings

[headlines]

--------------------------------------------------------------

Baseball Poem

WHY BASEBALL WALTZES WITH LETTERS

by Tim Peeler

A Faulkner sentence is an extra inning game, Simply and finally playing through its Will and exhaustion.

Third Base Coach signals are ee cummings poems-

Gimmicky, sure, but meaningful in their color

When you break the code.

The prisons play contests of Bukowski prose,

Where a stolen base may be a literal image

And everybody gambles nothing.

Weird killers load the bases at a

Stephen King Little League field, the sequel,

A grand slam promise at the bank.

Although Poe would never sit through nine,

His words are a dark season in the cellar,

A team leaving town and the death of a Beautiful groupie.

Finally, Wolfe who wrote slugfest

Double-headers played to million-footed

Throngs, then flickered like so many other

Stars never meant for extra innings.

-------------------

--- with the permission of the author, from his book of baseball poetry:

“Waiting for Godot's First Pitch”

More Poems from Baseball

available from Amazon or direct from the publisher at: www.mcfarlandpub.com

[headlines]

--------------------------------------------------------------

SuDoku

The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler?

http://leasingnews.org/Soduku/soduko-main.htm

[headlines]

--------------------------------------------------------------

Daily Puzzle

How to play:

http://www.setgame.com/set/puzzle_frame.htm

Refresh for current date:

http://www.setgame.com/set/puzzle_frame.htm

[headlines]

--------------------------------------------------------------

http://www.gasbuddy.com/

http://www.gasbuddy.com/GB_Map_Gas_Prices.aspx

http://www.gasbuddy.com/GB_Mobile_Instructions.aspx

[headlines]

--------------------------------------------------------------

Weather

See USA map, click to specific area, no commercials

http://www.weather.gov/

[headlines]

--------------------------------------------------------------

Traffic Live---

Real Time Traffic Information

You can save up to 20 different routes and check them out with one click,

or type in a new route to learn the traffic live

--------------------------------

[headlines] |

![]()

![]()

![]()