Connect with Leasing News

Connect with Leasing News ![]()

![]()

![]()

![]()

![]() Add me to mailing list |

Add me to mailing list | ![]() |

| ![]() Search |

Search | ![]() Stress Release

Stress Release

Advertising | All Lists | Archives | Classified Ads | This Day In American History

Independent, unbiased and fair news about the Leasing Industry

kitmenkin@leasingnews.org

![]()

Wednesday, June 13, 2012

Today's Equipment Leasing Headlines

Paul Weiss, Back in the Saddle

Re-Joins Leasing News Advisory Board

Classified Ads---Sales Manager

Pawnee Reports on Fire in Colorado

Positron Complaint Investigation

by Christopher Menkin

Commitment Forms

Summer Special---Classified Help Wanted Ads

Leasing Icon Sudhir Amembal Gets Award

--Since 1993, Chairman World Leasing Convention

Letters??---We get eMail

May—The List

Changes as Why Housing Continues Down

by Albert Schuler

Almost $4 Million Plus Tax Evasion

Annual Elder Abuse Awareness Day on June 15

Lab Mix

Downers Grove, Illinois Adopt-a-Dog

Classified ads—Finance/Human Resources

News Briefs---

Firefighters battle huge blazes across US West

Austrailia Aircraft, Container/Transport Equipment Leasing

Bombardier shares rally on massive NetJets order

Global Financial & Remarketing Services New Chicago Office

Balboa Introduces Financing for Cloud Computing Services

Study: Facebook ads are effective

Nasdaq CEO Seeking Amends in Silicon Valley

Broker/Funder/Industry Lists |

Features (collection)

Top Ten Stories Chosen by Readers |

Top Stories last six months

SparkPeople--Live Healthier and Longer

Sports Briefs---

Baseball Poem

California Nuts Brief---

"Gimme that Wine"

This Day in American History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

######## surrounding the article denotes it is a “press release” and was not written by Leasing News nor information verified, but from the source noted. When an article is signed by the writer, it is considered a “by line.” It reflects the opinion and research of the writer. It is considered “bias” as it is the writer’s viewpoint.

Please send Leasing News to a colleague and ask them to subscribe.

We are Free!!! and no registration, just email address.

[headlines]

--------------------------------------------------------------

Paul Weiss, Back in the Saddle

Re-Joins Leasing News Advisory Board

![]()

Paul Weiss has been in and around equipment leasing for 25 years. He was a long time member of the Leasing News Advisory Board, but he resigned when he also resigned as President of ICON Capital and as Vice-Chairman of the Board of Directors, of which Mr. Weiss was a substantial shareholder in its ultimate parent (he sold his shares simultaneously with his resignation). ICON Capital was then the largest in its field in syndication volume for lease investment programs to individual investors. He was responsible for the company's lease acquisitions and securities sales and marketing efforts. Mr. Weiss stayed at ICON as its president until the end of 2006.

In the first year after his non-compete clause ended, he was approached by a former ICON colleague to get back into the leasing business and form Panthera. Paul believed that after the industry pullback in 2008 there has been a lack of real equity in the leasing markets, and that many players had moved to more conservative financing type transactions as a consequence. Still, many sectors still require or desire traditional equipment based equity investors to have true lease and rental alternatives for equipment users. Panthera was therefore formed last year to "bring a substantial pool of capital to U.S. and European equipment leasing, renting and trading market" he is back with "creative problem-solving equity deals." Panthera enjoys substantial private equity backing. Since its formation Panthera has been active in such disparate markets as rail, aircraft rotables, locomotives and industrial equipment, and actively seeks out relationships with manufacturers, lessors and brokers for any equipment transactions where the equipment has a long useful life.

In addition to being a principal at Panthera Leasing, he is the non-executive board chairman of Pacific Rim Partners KK, a consumer products distributor based in Tokyo. He is also a private investor and an Advisor to or Director of numerous Bay Area emerging growth companies. He is a frequent speaker on business development and entrepreneurship and a frequent judge on start up and emerging growth company financing competitions.

Upon designing and completing the acquisition of ICON from its founders in 1996 he (along with Beau Clarke, since deceased) joined that company on a full time basis and was at various times responsible for all of the acquisition of leases and other transactions for the ICON Funds and for marketing and management of ICON's large public investment programs. According to the Monitor, ICON became one of the largest independently owned leasing companies in the United States after it was acquired by Mr. Weiss and his partners in 1996. Prior to that time Mr. Weiss was Executive Vice President and a co-founder of Griffin Equity Partners (1993-1996), Senior Vice President of Gemini Financial Holdings, Inc. (1991-1993) and Vice President of Pegasus Capital Corporation (1988-1991); in each of these capacities he was responsible for large ticket seasoned lease portfolio acquisitions. Mr. Weiss believes he has been involved with more than $4 billion of large ticket leasing acquisitions during his career. He was named as one of the top 25 most influential in the leasing industry by Leasing News in 2009. Prior to entering the equipment leasing business in 1988, Mr. Weiss was an investment banker and securities analyst.

He describes his other interests as including a secret passion for model trains, the pursuit of being minor though perhaps inconsequential philanthropist, and the mentoring of large and small businesses (which on rare instances actually consider his advice). He is a longtime resident of Marin County, California. Paul can be reached at paul@pantheraleasing.com

Leasing News |

|

Chairman, Advisory Board |

|

| Bob Teichman, CLP | Teichman Financial Training, Sausalito, CA. |

Advisory Board |

|

| Steve Crane, CLP | Bank of the West, Walnut Creek, CA |

Endeavor Financial Services, Costa Mesa , CA |

|

| Phil Dushey | Global Financial Services, Manhattan, NY |

| Ken Greene, Esq. | Hamrick & Evans, Universal City, CA |

| Shawn D. Halladay | The Alta Group, Salt Lake City, UT |

| Robert S. Kieve | Empire Broadcasting, San Jose, CA |

| Bruce Kropschot | Kropschot Financial Services, The Villages, FL |

| Bruce Lurie | Douglas-Guardian Services Corporation, Houston, TX |

| Andrew Lea, M.A. | NetSol Technologies, N.A., Alameda, CA |

| Allan Levine | Madison Capital, LLC., Owings Mills, MD |

| Don Myerson | BSB Leasing, Colorado, Hawaii |

| Armon L. Mills, CPA | J.H. Cohn, LLP, San Diego, CA |

| Tom McCurnin | Barton, Klugman & Oetting, Los Angeles, CA |

| Hugh Swandel | The Alta Group, Canada |

| Paul Weiss | Panthera Leasing, San Francisco, CA |

| Rosanne Wilson, CLP | 1st Independent Leasing, Beaverton, OR |

| Ginny Young | former Brava Capital, Orange, CA |

Editor/Publisher |

|

| Christopher Menkin | Saratoga, California |

[headlines]

--------------------------------------------------------------

Classified Ads---Sales Manager

(These ads are “free” to those seeking employment or looking

to improve their position)

| Fort Myers, Florida Very experienced and strong skills with both Captive and Specialty Sales Management. Over 25 years , will relocate and travel---successful and team player. e-mail: tlinspections@gmail.com |

Free Posting for those seeking employment in Leasing:

http://www.leasingnews.org/Classified/Jwanted/Jwanted-post.htm

All “free” categories “job wanted” ads:http://www.leasingnews.org/Classified/Jwanted/Jwanted.htm

|

[headlines]

--------------------------------------------------------------

Pawnee Reports on Fire in Colorado

From Gary Souverein, President & COO, Pawnee Leasing, Fort Collins Colorado:

"We have, as of this morning, a major fire that started burning fifteen miles outside Fort Collins. Many readers may be aware of the many fires out of control in this part of the country. This fire began Saturday morning. While it won't threaten our offices or any of our employees’ homes it has been remarkable to see this disaster develop so close to home. I took one the photos outside our office and the other from my office window this morning which if you look very closely you can see the fire moving down the nearest foothills to the west of Fort Collins.

"It is predicted to be the worst fire in northern Colorado in many, many years. Mother Nature is conspiring against the very brave firefighting personnel as its 10% contained and we are in the middle of a hot, dry, windy week. The fire may last for weeks TV news is telling us.

"While we're open as usual its hard not to be distracted thinking of our community members that are being affected by this disaster and our prayers are with them and the firefighting personnel that they stay out of harm's way. "

Gary DiLillo, President

440.871.0555 or gary@avptc.com |

Send Leasing News to a Colleague. We are free!!!

[headlines]

--------------------------------------------------------------

Positron Complaint Investigation

by Christopher Menkin

There are many “red flags” here, and again stemming from the vendor and perhaps equipment. This may be the beginning to be brought to Leasing News reader’s attention. The equipment may be sold direct or through vendors, but placed often to funders by Positron.

Leasing News has been investigating a complaint against Positron, Westmont, Illinois, a publically held company, considered by many as a leader in nuclear cardiology equipment. Stephen E. Shinkman, President, Kendall Nuclear Medicine, Inc., Miami, Florida, produced a copy of a check for $35,000 and proposed lease from Positron ("or its designee") dated January 17, 2011. (1) There are many copies of emails and correspondence, as well as several "off the record" telephone conversation with Corey N. Conn, Chief Financial Officer.

Several funders have contacted Leasing News but would like to remain “off the record” for the time being.

A recent press release quotes, "Positron Corporation is a leading molecular imaging healthcare company, specializing in the field of nuclear cardiology announces completion of its first strontium validation effort."

There is the last email between the two promising the deposit to be returned on June 1, 2012. Since then, both sides have attorneys handling the matter who do not want any public statements given.

It is known there are regulatory problems, perhaps solved, as well as manufacturing problems with the medicine used in the process.

There is also a SEC complaint filed November 16, 2011 regarding "Oakbrook, Ill. resident Patrick G. Rooney and his company Solaris Management LLC for fraudulently misusing the assets of the Solaris Opportunity Fund LP, to which it was the investment adviser.

According to the SEC’s complaint filed on Nov. 16, 2011 in federal court in Chicago, Rooney and Solaris made a radical change in the fund’s investment strategy, contrary to the fund’s offering documents and marketing materials, by becoming wholly invested in Positron Corp., a financially troubled microcap company. (2)

A June 5, 2012 press release notes the first strontium validation effort. "Jason Kitten, President of MIT, commented on completion of this milestone, 'This is the first strontium-82 validation to be performed outside of the national laboratory arena and sets the stage for private entry into the strontium-82 radioisotope supply chain. The objective of Positron's isotopes mission is to improve the reliability and increase the availability of Sr-82 supply; further advancing cardiac PET. Positron's dedication to cardiac PET will lead the way in liberating the United States dependency on reactor-based isotopes, thereby reducing the need for highly enriched uranium. Sr-82 production, processing, and Rb-82 PET are well-established technologies; the techniques, modalities, and know-how have been available for some time and only now, though Positron's vertically integrated strategy, a full solution is becoming a reality'."

Without further information from both sides, this perhaps is not a "Bulletin Board Complaint," although Stephen E. Shinkman, President, Kendall Nuclear Medicine, Inc., believes it is. Perhaps it is more a financial dilemma, as illustrated by Marketwatch's report on the company's three month statement:

-

A net loss of $2,962,000 for the three months ended March 31, 2012 compared to a net loss of $735,000 for the three months ended March 31, 2011.

-

Revenues for the three months ended March 31, 2012 were $829,000 as compared to $2,871,000 for the three months ended March 31, 2011

-

Systems sold during the three months ended March 31, 2012 were $353,000 while system sales for the same period in 2011 were $2,623,000

-

General and administrative expenses during the three months ended March 31, 2012 were $1,765,000 as compared to $506,000 for the three months ended March 31, 2011.

-

At March 31, 2012, the Company had current assets of $1,863,000 and current liabilities of $5,950,000 compared to December 31, 2011 when the Company had current assets and current liabilities of $1,951,000 and $5,176,000, respectively.

-

Cash and cash equivalents at March 31, 2012 were $3,000 compared to $1,000 at December 31, 2011. Accounts receivable was $695,000 at March 31, 2012 compared to $612,000 at December 31, 2011. Note current liabilities and compare to other numbers.

http://www.marketwatch.com/story/10-q-positron-corp-2012-05-21

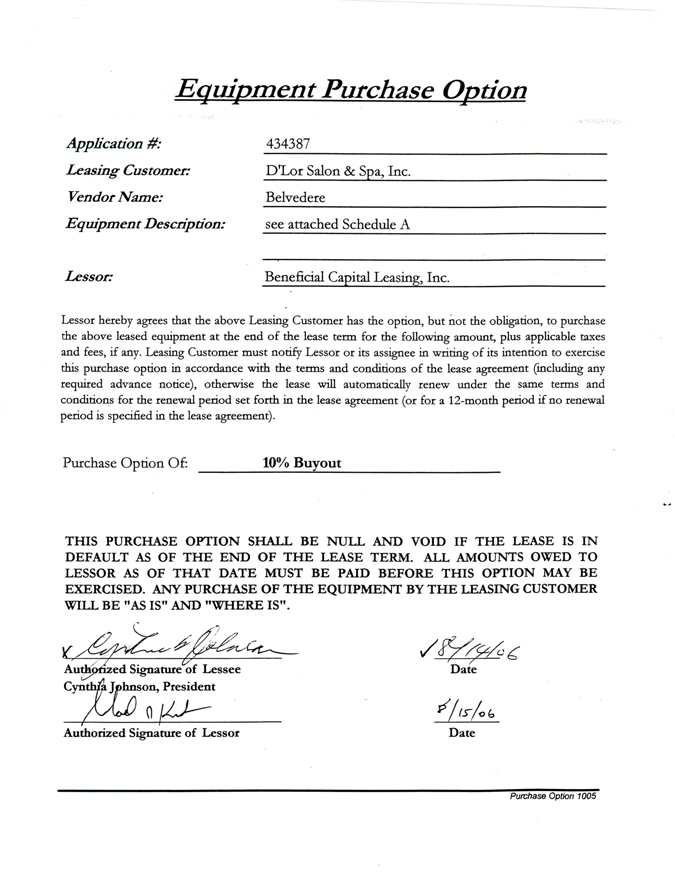

(1) Positron Lease Proposal:

http://www.leasingnews.org/PDF/Positron.pdf

(2) SEC Complaint:

http://www.leasingnews.org/PDF/SECPositronComplaint.pdf

((Please Click on Bulletin Board to learn more information))

(Leasing News provides this ad “gratis” as a means

to help support the growth of Lease Police)

[headlines]

--------------------------------------------------------------

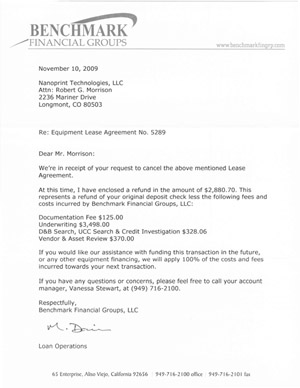

Commitment Forms

The dollar size of the lease proposal often dictates the details and length of the commitment letter.

In small ticket lease, the actual lease payment is often given and calls for the first and last as well as the documentation fee. Often a clause contains a "documentation" fee for $495.00, which is non-refundable if the lease is not approved. The wording is different and seems to be buried and whether written originally by an attorney or taken from the use of another leasing companies form is not known.

According to ex-employees as well as complaints that have appeared in Leasing News, many companies get such proposals signed in advance knowing they will be unable to proceed with the lease due to the nature of the equipment or the proposed lessee telling them of their credit difficulties in the presentation or from running a consumer credit report.

In larger ticket size leases, often a form such as this is used, which specifically charges a fee to process the application:

http://two.leasingnews.org/loose_files/Lease_app_agreement.rtf

Loans or “Working Capital” commitment letters are explicit and require the broker to often be licensed. This form is for use in California:

http://two.leasingnews.org/loose_files/Authorization_to_find_lender.rtf

This form is one of the most widely used in the leasing industry for leases $50,000 and above and covers most of the bases. Note: Last sentences about the signatures makes this more a “proposal,” than commitment. If required, these sentences may be removed.

http://two.leasingnews.org/loose_files/Generic%20commit%20Letter.DOC

It is a good idea to have the form you use reviewed by an attorney with equipment leasing experience. This does not mean your college friend who became a lawyer. You wouldn't take your children to an Endodontist to get braces on their teeth, although the practitioner is a "dentist." The same with going to an attorney. You don't go to a divorce attorney to go over a lease commitment contract.

Some things to consider in your form.

#1: ACH---If you are going to require it or may require it, you should have this spelled out in the agreement. If not in the contract and becomes a requirement of the lease, the proposal is invalid.

#2 Date---It is a good idea to have a time period involved, and perhaps if not approved, from completion of all the documents and/or lease contracts. A prospect can back out after 30 days and bring this up in small claims court, unless spelled out the time begins after all documentation is complete ( attorneys will have different opinions on this and its wording, but the complaint may make it into Leasing News when it takes months before anything happens.)

#3 Personal guarantee--of all officers who own 10% or more of a privately held corporation. (This will protect if the final approval comes in with terms and conditions, but requires other guarantors who are not named on the application or in the proposal.)

This form was developed by Ken Greene now at partner at Hamrick & Evans, LLP, Universal City, California, with offices also in Northern California.

http://www.leasingnews.org/Conscious-Top%20Stories/Greene_Lease_agreement.htm

To Contact Ken Greene:

Kenneth C. Greene, Partner

Hamrick & Evans, LLP

10 Universal City Plaza, Suite 2200

Universal City California 91608

818-763-5292

Fax: 818-763-763-2309

kgreene@hamricklaw.com

The form makes it a contract between both parties, and is not one sided as appeared in this Leasing News Bulletin Board Complaint:

from this Leasing News Bulletin Board Complaint:

http://leasingnews.org/archives/December%202009/12-14-09.htm#benchmark

[headlines]

--------------------------------------------------------------

Leasing News Help Wanted Ad Pricing

25% Off regular rate below plus 30 day run

Help Wanted Web Ad New Programs Classified Ad Section 21 days in a row: Design work is free. Logo is free as well as company description not to exceed the number of lines of the ad. Ads are placed in the "Help Wanted' section by category, alphabetical, with the ad with the most lines first in the group. They appear on the web site and in each news edition at the top in a rotation basis per issue. * Help Wanted” ads appear in each issue on a chronological basis above the top headline as a courtesy. This position is not available as a paid position, but is generally on a rotation basis. At the same time, the ad continues in the classified help wanted section in the news edition and web site, so in effect appears twice. Leasing News reserves the right to refuse advertising, particularly to a company that has appeared in the complaint bulletin board |

[headlines]

--------------------------------------------------------------

Leasing Icon Sudhir Amembal Gets Award

Since 1993, Chairman World Leasing Convention

Sudhir P. Amembal, Chairman, Amembal & Associates, was honored by Euromoney at the 30th Annual World Leasing Convention, recently held in St. Petersburg, Russia, for having served as the Chairman continually for 18 years of the annual international convention with top leasing companies from all over the world.

Noted Leasing Industry Icon, lecturer, author, active in many ventures, including Worldleasingnews.com, he accepted the plaque, stating "the past three plus decades have been an incredible personal journey," noting he has learned as much as he has taught, establishing close relationships with hundreds in varied parts of the world and travelling nine million miles in the process!"

In presenting a plaque to Mr. Amembal, Ms. Natasha Wood from Euromoney, organizers of the Convention, stated that Mr. Amembal was being honored in recognition of his outstanding service to the development, growth and longevity of the Convention, as well as for his stellar service to the global leasing industry.

She also noted his commitment to not for profit work on behalf of animals. Many readers may not be aware he is the founder and president of www.animaladvisory.com.

Mr. Amembal biography:

http://www.amembalandassociates.com/whoweare.html

[headlines]

--------------------------------------------------------------

Letters??---We get eMail

(Mostly in Chronological Order)

Resouce America dumps LEAF?

"RAI dumped LEAF, outsourced most of the corp IT dept. after losing money for years in the CDO biz"

Leasing, LEAF Funds, CDO biz... tough sinking...how can Cohen's bail this out..or not?"

(Name With Held)

(More news on this in Friday's edition)

Bulletin Board Complaint

New Leaf Funding Corporation, Maitland, Florida

http://leasingnews.org/archives/Jun2012/6_06.htm#complaint

"I gleaned this from a Bankrate.com article through Yahoo Finance. This is the same kind of complaint that finds itself to Leasing News more than any other type. The independent leasing broker industry will invite regulation if this practice continues. The integrity of our industry depends on our ability to police ourselves.

“ Your website has shined a light on the underbelly of an otherwise stellar record of industry practices. By doing so, we can continue to insure that our 'fee for service” model delivers real value to small businesses across the U.S. (and Canada) and be fairly compensated for the quality of our work and the risks that we take. "

Paul J. Menzel, CLP

President & CEO

FINANCIAL PACIFIC LEASING, LLC

Consumer complaint No. 5: Advance-fee loans

Last year, 44,020 consumers filed complaints with the Federal Trade Commission regarding advance-fee loans. These loans lure consumers with the promise of a loan or credit card, regardless of an applicant's credit history, and require the payment of a fee in advance. Often, these loans turn out to be too good to be true.

"With advance-fee loans, they take the money and oftentimes, the loan doesn't appear," says David Torok, director of the division of planning and information at the FTC. "Be very, very cautious."

A lender that isn't interested in your credit history but requests personal information, such as a Social Security number or bank account number, is a red flag for an advance-fee loan offer, according to a fact sheet from the FTC.

Other warning signs include fees that are not clearly disclosed and a loan offer made by phone that requires you to pay in advance.

Before applying for a loan, check to see if a lender is registered in your state by contacting your state attorney general's office or your state's department of banking or financial regulation, according to the FTC's website

----

CLP Spotlight

Bob Teichman, CLP

Teichman Financial Training

"Thanks for publishing the CLP profile. Always appreciate the exposure. Good edition today (Teichman profile notwithstanding), especially the column by Bernie B. Also, I enjoyed re-reading Casey at the Bat. Great American classic."

http://leasingnews.org/archives/Jun2012/6_06.htm

--

Bulletin Board Complaint

Liberty Capital, LLC, Aliso Viejo, California

http://leasingnews.org/archives/May2012/5_30.htm#complaint_liberty

“Good call on bringing out the details on that deal with Liberty Capital. It could help others avoid a similar situation. Kudos.”

Jim Yokoyama

---

“These types of complaints are very disturbing. The part that bothers me the most is the comment about getting the customer working capital through a ‘vendor friend’. We see these types of fraud on a somewhat regular basis and it can be extremely damaging to a broker / funder that gets involved and actually funds them. These ‘vendors’ need to be made public so that others can be forewarned. With the help of the funders that do business w/ Liberty Capital, I bet you would be able to determine who this “vendor friend” is. Unfortunately, most funding sources aren’t always on board when trying to determine if they are funding fraudulent transactions as it makes them look bad.”

Ross Stites, CLP

Credit Officer - Culver Capital Group

--

Google Visits De Lage Landen Financial Services

http://leasingnews.org/archives/May2012/5_30.htm#google

“The dog pictures were great and very funny. Thanks for the laugh.”

Pat McCann

Universal Financial Group, Inc.

---

Vendor Vartanian Makes Lease Fleece Plea Agreement

http://leasingnews.org/archives/May2012/5_22.htm#vendor

“Do you know if Jim Raeder's sentencing got moved to another date? You have him listed as being sentenced June 4th.

“McQuitty and Ziya Arik got pushed back is why I'm wondering.”

(Name With Held)

((ORDER TO CONTINUE Sentencing by Judge Cormac J. Carney as to Defendant James Raeder. Sentencing continued to 9/10/2012 11:00 AM before Judge Cormac J. Carney. (mt) (Entered: 05/11/2012))

--

My name is Ed Dietz. I am General Counsel for Marlin Business Services Corp., parent company of Marlin Leasing Corporation and Marlin Business Bank (collectively, "Marlin"). I am writing in reference to your March 9, 2012 post on www.leasingnews.org entitled "Why the Evergreen Clause is important to Marlin Leasing" (http://leasingnews.orearchives/Mar2012/3 09.htm#marlin) and your May 11, 2012 post picked up by Seeking Alpha and appearing on Marlin's Yahoo! Finance page (http://seekingalpha.com/article/580711-marl in-does-not-disclose-possible-loss-of-evergreen payments). There are gross misstatements of fact and untrue implications in the posts. While difficult to decipher exactly what is being communicated in the posts, the implications seem to be that (1) so called "evergreen clauses" are illegal in certain jurisdictions, and (2) Marlin does not send notification letters to end user lessees in such jurisdictions whose leases will enter a renewal period absent proper notice from the end user lessees.

Contract renewal clauses are illegal in exactly zero states. What I think you're trying to communicate is that four states have enacted laws requiring notification in connection with the renewal of commercial leases. Not only does Marlin comply with such statutes, but Marlin also sends notice letters to every single end user lessee (in every state) prior to any lease entering renewal status. Stated differently, Marlin, as part of our standard operating procedure, provides (and has always provided) exactly the type of notice you incorrectly state Marlin does not provide.

Please allow this letter to serve as Marlin's formal demand that you immediately (1) post a correction on www.leasingnews.org stating that Marlin does, in fact, notify lessees in advance of lease expiration (and locate such correction in at least as prominent a position as you gave to the inaccurate information you previously posted), and (2) add Marlin's name to the list on www.leasingnews.org of leasing companies that notify lessees in advance of lease expiration. I expect the correction to appear today.

Please note, if you wish to re-print any of the text from this letter, I authorize you to do so only if you publish it in its entirety.

If you have any questions, I can be reached at 856.505.4458 or edietz@marlincorp.com.

Nothing herein shall impair, or be construed as a waiver of, any legal or equitable rights or remedies available to Marlin.

Sincerely,

Edward R. Dietz, Jr., Esq. General Counsel

---

William G. Sutton, CAE

President & Chief Executive Officer

Equipment Leasing and Financial Association

wsutton@elfaonline.org

cc: kitmenkin@leasingnews.org

“Mr. Sutton:

“Please see the attached letter sent yesterday by Marlin Business Services Corp. to Kit Menkin, proprietor of the website www.leasingnews.org. As the President and CEO of the trade association representing the U.S. equipment finance sector, I want to share the attached with you in order to (1) let you and the ELFA know the type of reckless and inaccurate statements Mr. Menkin posts on his site about an ELFA member and (2) provide you with Marlin's response in order to clear up any misconceptions that Mr. Menkin's erroneous postings may have created.

“If you have any questions or comments, please feel free to contact me. My contact information is listed below.

“Thank you for the great work that you and the ELFA do for our industry.

“Regards,”

Ed

Response from the editor to Mr. Deita, Esq.:

A correction was made at the top of the May 22 Leasing News Edition articles:

http://leasingnews.org/archives/Apr2012/4_04.htm#marlin

Correction: Evergreen Legal in all 50 states

Edward R. Dietz, Vice President and General Counsel, Marlin Business Services Corp., Mount Laurel, New Jersey, requested we inform readers that Evergreen clauses are legal in all 50 states.

In this article, “Marlin Does Not Disclose Possible Loss of Evergreen Payments,” (http://seekingalpha.com/article/580711-marlin-does-not-disclose-possible-loss-of-evergreen-payments) it was stated: "Evergreen clauses are illegal in four states, meaning automatic payments cannot continue, especially prevalent in ACH payments."

Leasing News has placed a comment to correct the story that Evergreen clauses are legal in all 50 states in “Seeking Alpha,” where the article appeared with the sentence, “Evergreen clauses are illegal in four states, meaning automatic payments cannot continue, especially prevalent in ACH payments.”

The shorter story that appeared in Seeking Alpha was edited from the original story which appeared in Leasing News, where it was stated:

"At this time, these states require the lender or lessor to inform the borrower or lessee regarding the termination of the initial lease contract:

"New York

Rhode Island

Texas

Illinois

(In Illinois, Consumer law, but may affect commercial, especially a proprietorship, partnership or personal guarantee)"

Many leasing companies require the lessee in 46 states to notify the lessor 90 days in advance by certified letter regarding the exercise of the residual, and if not, payments will continue for an additional twelve months. In the four states above, the lessor is to notify the lessee in advance.

Leasing News apologizes for any confusion. The Evergreen clause is legal in 50 states.

Original article:

It's Evergreen Again with Marlin's Profits by Christopher Menkin

http://leasingnews.org/archives/May2012/5_07.htm#marlin

-----------

As to responding to the email to Mr. Sutton, Leasing News is not a member of ELFA therefore not under its jurisdiction. Leasing News has written many stories regarding ELFA’s lack of transparency in regards to the issue of lessors notifying in advance the termination of their original lease contract. In fact, ELFA has attended state legislative hearings voicing its opposition to notification by the funder to the lessse, which Leasing News has written about the last few years.

Regarding Mr. Dietz request concerning notification of lessees regarding residuals, please start the dialogue by responding to this complaint posted April 4, 2012:

Marlin Business Services, Mount Laurel, New Jersey

Bulletin Board Complaint

Leasing News has attempted since March 22, 2012 to contact officers at Marlin Leasing, with over six emails to one officer, including four telephone calls, as well as two emails to four officers followed up with two telephone calls. The emails included the complaint as well as the documents, and the telephone calls were follow-up to the emails.

There has been no response.

From:

Ken J. Krebs

Beneficial Capital

(800) 886 - 8944

ken@bencap.com

“I’ve been in this industry for about twenty years and although the past three have been rough, overall it has been a great experience. We have worked closely with so many quality people over the years, many who unfortunately are no longer around...I’m looking for some help, and hoping you may be able and willing. One of our Lessee’s contracts, that had been sold to Marlin, was put into auto renewal because the Lessee neglected (forgot) to exercise their purchase option. The contract was originally structured with two payments in advance as security deposit, followed by 60 monthly payments, and a 10% purchase option. They’ve recently realized they have now made 65 payments (five extra). In an effort to settle, they have offered to pay Marlin an additional $1,500 and to forfeit the return of their security deposit. This is a $25,000 contract with a $2,500 purchase option. The security deposit amount is $1,196.36. So, they are offering $1,500 plus $1,196.36 to settle the $2,500 purchase option. If accepted, this would give Marlin an additional 5 full payments plus $196.36. Marlin has declined the offer and in turn has requested an additional $3,000 payment as well as forfeiture of the security deposit. Can you help with this?"

From:

Patrick and Cynthia Tingling

D'Lor Salon & Spa

Atlanta, Georgia

“This is Patrick & Cynthia Tingling Owners of D’Lor Salon & Spa in Atlanta. We Regret that we have to take this course of action.

We feel that Marlin has received enough funds for the value of the equipment that was leased. We are willing to meet our obligations if they would meet us half way... the experience with marlin have left us a bad taste, hopefully you will be able to make sense to then that sometimes goodwill is far more valuable than driving customers away from the industry.

We must make a decision by tomorrow in order to prevent another monthly deduction from our bank account.

Thanks

Patrick and Cynthia..."

It appears the lease payments are ACH and the lessee was not aware that the original lease was up until they had made five extra payments on a 10% Purchase Option, which they are will to make:

There is no doubt this is not a "true lease" but a "capital lease" or "loan" in many states. This lease has a Pennsylvania choice of law and a Pennsylvania mandatory forum -- even though the lessee is in Georgia, the vendor is in Missouri, and there is absolutely no connection to Pennsylvania.

From:

Michael J. Witt, Esq.

MICHAEL J. WITT LAW OFFICES

4342 Oakwood Lane

West Des Moines, IA 50265

Tel: (515) 657-8706

Mobile: (515) 868-1067

Fax: (515) 223-2352

witt-law@live.com

“In my opinion Marlin stands on shaky grounds here. Most so-called ‘10% purchase option’ transactions in the small-ticket arena are not true leases under UCC 1-302 but are, instead, loans. It is preposterous to say that a loan can have an ‘automatic renewal’ provision. (How would anyone feel if, after paying off their mortgage over 30 years, the bank called and said the mortgage had "automatically renewed" for an additional 12-month period based on an auto-renewal clause hidden in the fine print?!)

“Marlin, we must all admit, was entitled to a particular return at the end of the 5-year term of this lease. However, it is now trying to illegitimately (in this one attorney's opinion) bloat its originally planned-for return by taking advantage of the fact that when this small-business lessee took out this lease in 2006, it did not purchase a un-purchasable 2011 calendar to mark the date it was required to notify Marlin not to renew the lease.

“Few people know that if Marlin did not have an auto-renewal program, it would be losing money (which only begs the question, how much longer do Marlin investors think that this flimsy business model can endure?). If this is not a true crime under our criminal codes, it is a crime against the industry that so many of us try to uphold every day we go to work.”

D’Lor Salon & Spa Lease Contracts:

http://www.leasingnews.org/PDF/DLor_Lease.pdf

---

Correction: Evergreen Legal in all 50 states

http://leasingnews.org/archives/May2012/5_22.htm#correction

From a reader:

“Edward R. Dietz, Vice President and General Counsel, Marlin Business Services Corp., Mount Laurel, New Jersey, requested we inform readers that Evergreen clauses are legal in all 50 states.” Did I not read in Leasing News some time ago that most of the profits from leasing at Marlin Business Services are from evergreen leases? A nice bit of profit and justification for Evergreen Leasing that Mr. Dietz surely wants to protect from the possible taint of illegality. If four states were not allowing such financial chicanery what would that say about those states that did allow it and about those companies who use Evergreen Leases? Someone had to put their finger in the hole of the dike to prevent the cleansing water of ethics from spreading and drowning the practitioners of Evergreen leasing.

“It is comforting to see attention to such details of the law that defends a practice that extracts money from unsuspecting customers and yet provide a clear cut example of how law deviates from the path of ethics. The “letter of the law” view of the legal system provides cover for and allows certain unethical but legal behavior to exist. If one robs a person with a gun they go to prison but if one uses a pen to take money from an uninformed borrower one goes to the bank. Maybe both behaviors should be classified as illegal.”

Jerry Bernardy

---

May 18, 2005 Archive

NAELB Conference

By: Charlie Lester

“I wanted to drop you a quick note and say thank you for your newsletter that you put out on Friday May 18th. Being that it was approximately two years ago (May 10, 2010) that Charlie passed away. It was such a nice surprise to see the article that Charlie had written about the NAELB conference re-published. Charlie had such a passion for the leasing industry and loved working with some many of the people with in the industry. Re-reading the article brought back so many great memories of Charlie as well as made me realize how much I really miss him.

“For someone like me, your newsletters serve as constant reminders that there really are some good people that truly care about our industry still around. Keep up the great work!

“Thank you for all that you do.

“God Bless,”

Kurt Hess

LPI Healthcare Financial Services

----

“Thank you for connecting with me on LinkedIn today. At your convenience, I’d like to speak with you briefly. I have been aware of you and your publication for many years, but have never had the opportunity to interact with you before.

“FalconBridge Capital Markets is a boutique, FINRA and SEC registered investment bank that focuses exclusively on capital raising and merger advisory for financial services and financial technology companies. I always find it useful to trade notes with market participants – invariably these discussions result in common areas of interest, even if not immediately apparent.”

Stephen A. Geis

Managing Director

FalconBridge Capital Markets, LLC

---

“Your Leasing News is far superior, informative, and practical, than any of the other leasing publications.”

Bob Borden

ULS

---

“I have enjoyed reading leasing news over the last four years. I have changed jobs and am not involved in leasing anymore. I don’t have time to read Leasing News on a regular basis but I always know where to find it if something changes.”

Marci Jaman

---

“I enjoyed Leasing News when I worked in Irvine at Balboa Capital, for 4 years as a Sales Manager, especially the archive section! Here is our story. Let’s keep in touch.”

Best Regards,

Rob Selway

First Enterprise Bank

About First Enterprise Bank:

http://www.leasingnews.org/PDF/1stEnterpriseBankForbes.pdf

[headlines]

--------------------------------------------------------------

May—The List

Liberty Capital, Aliso Viejo, CA (05/12) Bulletin Board Complaint

http://leasingnews.org/archives/May2012/5_30.htm#complaint_liberty

Element Financial, Toronto, Canada (05/12) Acquires the vehicle fleet business from Scotiabank for $146.7 million, plus debt, and he receives a report $430 million of lease assets. Goes back to the market for more cash.

Chase Industries Grand Rapids, Michigan (05/12) Founder files BK, says Chase Industries is dissolved.

http://leasingnews.org/archives/May2012/5_14.htm#chase

Newport Financial Partners, Inc., Newport Beach, CA (05/12) Bulletin Board Complaint.

http://leasingnews.org/archives/May2012/5_09.htm#bbc

Marlin Leasing, Mount Laurel, NJ (05/12) Three months again shows Evergreen is their net profit maker.

http://leasingnews.org/archives/May2012/5_07.htm#marlin

LEAF Financial/Commercial, New Jersey (05/12) Resource America/LEAF moving in different directions.

http://leasingnews.org/archives/May2012/5_07.htm#moving

Alphabetical List

http://www.leasingnews.org/list_alpha_new.htm

Chronological List

http://www.leasingnews.org/list_chron_new.htm

[headlines]

--------------------------------------------------------------

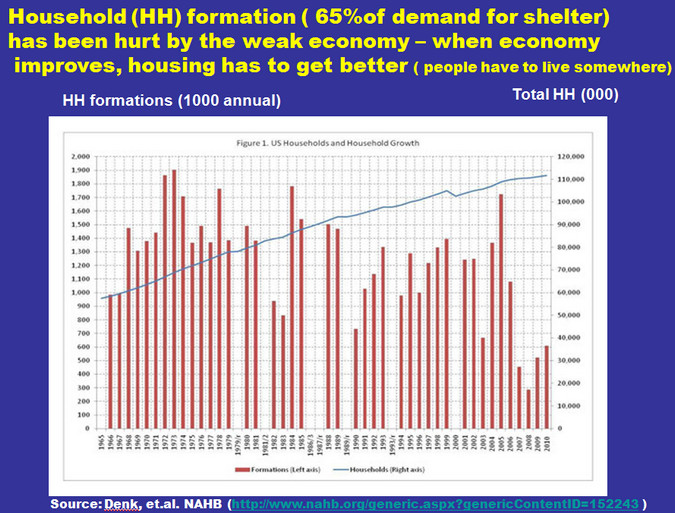

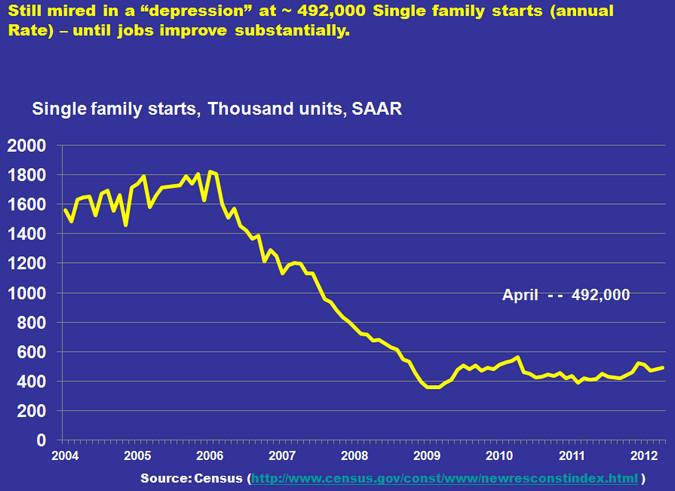

Changes as Why Housing Continues Down

by Albert Schuler

-

Household formations down significantly (Fewer marriages; “Junior moves back home”; etc.)

-

Homeownership down as renting gains favor

-

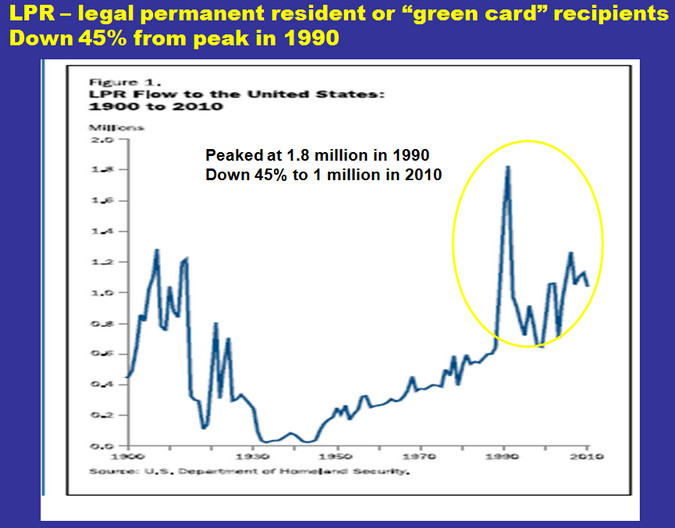

Immigration is off considerably ( this impacts household formations)

Al Schuler, former US Agriculture Timber, Economist, now retired, but continues his newsletter.

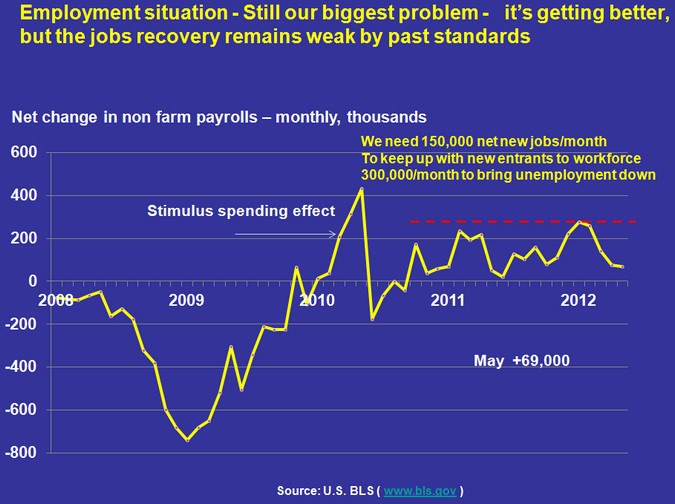

Europe is the biggest immediate headache, and China is showing signs of slowing. The U.S. economy is recovering from a financial/banking recession, and recoveries from such recessions are historically much slower than from a more typical “currency/inflation” recession. The more typical recession is often caused by the Fed raising interest rates to cool an overheated economy – once cooled, the Fed lowers interest rates to get things going again. With banking/financial crises, the damage is deeper and more widespread, and hence, is more difficult (and time consuming) to correct.

ELLEN MICHELE STERN, ATTORNEY Free initial consultation |

[headlines]

--------------------------------------------------------------

### Press Release ############################

Almost $4 Million Plus Tax Evasion

Louis Joseph Vadino, Santa Ana, California appeared before United States Magistrate Judge Robert N. Block. On June 6, 2012, a federal grand jury indicted Vadino, 70, on charges of evasion of payment of federal taxes and making false statements to the Internal Revenue Service.

The indictment alleges that on April 27, 2006, after several years of attempting to audit and assess the tax due and owing for Vadino’s1999 federal tax return, the IRS notified Vadino that his outstanding tax liability for 1999 was $1,251,360. Beginning after this date, the IRS actively attempted to collect Vadino’s outstanding liability (tax, penalties and interest) of approximately $3,919,861.

According to the indictment, between 1998 and 2007, Vadino formed foreign companies in the British Virgin Islands (Ambrite Properties, Euromarket Finance Limited, and Media Partners Investment Limited) and in Panama (S& L Development) to hold title to properties and open foreign bank accounts. The indictment alleges Vadino willfully attempted to evade and defeat the payment of his outstanding taxes due and owing by concealing and attempting to conceal from the IRS the nature and extent of defendant Vadino’s assets and the location thereof, making false statements to agents of the IRS, placing funds and property in the names of nominees, and using offshore accounts to place funds and property beyond the reach of process of the IRS.

Between June 8, 1999, and March 29, 2002, Vadino purchased five residential properties in Lake Forest, California, under Ambrite Properties with over $1.8 million in cash; Vadino, his mother, and his three daughters lived in each of these properties. According to the indictment, after the IRS assessed Vadino’s outstanding tax liability, Vadino transferred four of the properties into his daughter’s name, sold one of the properties and refinanced three other properties, causing approximately $2 million in wire transfers to be made into a Greek bank account in which Vadino was the sole signatory. The indictment also alleges that Vadino caused over $1.6 million in wire transfers from offshore bank accounts to be made for the purchase of real property in Ramona, California, to buy two trucks, to make mortgage payments on the Lake Forest properties, as well as to pay for Vadino’s personal expenses.

Vadino is also charged with making false statements to Special Agents, including that Vadino told agents that he did not own or control real property and had no income to pay his personal expenses and tax liabilities, in April 2006 when the IRS assessed Vadino’s taxes due and owing or at any time since.

Trial is scheduled before United States District Judge Andrew J. Guilford on July 31, 2012.

The criminal investigation of Louis Joseph Vadino was conducted by IRS - Criminal Investigation in Los Angeles in conjunction with the United States Attorney’s Office for the Central District of California.

An indictment contains allegations that a defendant has committed a crime. Every defendant is presumed innocent until proven guilty in court.

United States Attorney’s Office contact:

Brett Sagel, Assistant United States Attorney

(714) 338-3598

#### Press Release #############################

| Mr. Terry Winders available as a consultant regarding assisting attorneys in resolving disputes or explaining procedures or reviewing documents as utilized in the finance and leasing industry. He is the author of several books, including DVD's, as well as weekly columnist to Leasing News. He also performs audits of leasing companies as an expert on documentation, and has acted as an expert witness on leasing for litigation in legal and tax disputes, including before the IRS. He also has taught the senior bank examiners, how to review a bank leasing department, for the Federal Reserve in Washington D.C. and has trained the examiners for the FDIC on how to prepare a lease portfolio for sale. 502.649.0488/Leaseconsulting@msn.com |

(This ad is a “trade” for the writing of this column. Opinions

contained in the column are those of Mr. Terry Winders, CLP)

[headlines]

--------------------------------------------------------------

#### Press Release #############################

Annual Elder Abuse Awareness Day on June 15

SACRAMENTO, CA – The California Department of Corporations encourages Californians to observe the 7th Annual World Elder Abuse Awareness Day (WEAAD) on Friday, June 15, 2012, by participating in events around the state and promoting awareness of elder abuse issues by wearing purple that day.

The department will participate in events and resource fairs the week of June 11, including a panel in support of World Elder Abuse Awareness Month with the Department of Insurance and the US Postal Inspector. This panel will meet on Thursday, June 14, at the Jackie Robinson Community Center in Pasadena. On Friday, June 15, Department staff will be present to advise attendees on senior investment scams and/or share materials at the Alpert Jewish Community Center in Long Beach and the Prince of Peace Lutheran Church in Hemet. Details on these and other upcoming events are available at the Department’s Education and Outreach Events Calendar on the website here: http://www.corp.ca.gov/Consumer/Events.asp.

"As the state’s chief regulator of the investment advisor community, the Department is especially sensitive to the needs and vulnerability of seniors in California,” said Corporations Commissioner Jan Lynn Owen. "We have special materials to address senior investment scams, including our Seniors Against Investment Fraud (SAIF) program which is well-respected and much emulated.”

Seniors Against Investment Fraud (SAIF) alerts and educates Californians over the age of 50 about financial and investment fraud, scams, and unscrupulous sales practices that specifically target seniors. SAIF provides valuable information and resources for seniors to make well-informed financial decisions. SAIF is available in English, Spanish, Chinese and Tagalog and may be ordered in printed books from the Department or downloaded from http://www.corp.ca.gov/Consumer/SAIF/Pubs/Default.asp.

Many communities and organizations throughout California will issue proclamations declaring June 15, 2012 as World Elder Abuse Awareness Day (WEAAD) and host events designed to raise their communities’ awareness of elder abuse. The first Awareness Day in 2006 involved several hundred organizations and governmental bodies at international, national, regional, local, community and neighborhood level, in every continent in the world. The day recognizes the significance of elder abuse as a public health and human rights issue.

To learn more and to download a free copy of the Community Guide World Day Tool Kit, visit the website of the International Network for the Prevention of Elder Abuse (INPEA) www.inpea.net/weaad.html.

### Press Release #############################

Send Leasing News to a colleague.

Ask them to subscribe.

We are Free!!

[headlines]

--------------------------------------------------------------

Lab Mix

Downers Grove, Illinois Adopt-a-Dog

Romona

Description: Lab Mix

Gender: Female

Age: 6 mos. — born late 2011

Size: Medium

Neutered? Yes

House trained? TBD

Location: Temp-care

OK with children? Good

OK with other dogs? Good

OK with cats? Good

Crate trained? Yes

Leash trained? TBD

"I am currently in a foster home while I am waiting to find my forever home. I am such a sweet girl. I am crate trained and working on housebreaking. I am good with kids, cats and other dogs. As a matter of fact, I like other dog so much that I need to live with another dog in my new home. As with any young dog, I would benefit from obedience training. I do have a lot of energy so I need to live in a house with a large fenced in backyard so I can run and play. If you are interested in setting up a time to meet me, click here to download a copy of the dog application.

Adopt a Pet

http://www.wshs-dg.org/wshs/adopt

Dog Adoption Form:

http://www.wshs-dg.org/media/wshs/files/Dog_Application_Form_2012.pdf

Please fax it back to our adoption desk manager at 630-960-9604 or email her at adoptiondesk@wshs-dg.org.

Once she has received it, she will set up a time for you to meet me. You won't be disappointed!"

West Suburban Humane Society

1901 Ogden Avenue

Downers Grove, IL 60515

Telephone: (630) 960-9600

Facsimile: (630) 960-9604

Email: Director@wshs-dg.org

Adopt-a-Pet by Leasing Co. State/City

http://www.leasingnews.org/Conscious-Top%20Stories/Adopt_Pet.htm

Adopt a Pet

http://www.adoptapet.com/

[headlines]

--------------------------------------------------------------

Classified ads— Finance / Human Resources

Leasing Industry Outsourcing

(Providing Services and Products)

Transaction Summary | The Lechner Group Website: www.tlgattorneycpa.com |

Finance: Naperville, IL Your guide to the right questions and answers in finance. Expert in capital raising, GAAP, acquisitions, lease economics. CPA. MBA. E-mail: m.willow@ameritech.net |

||

| Finance: Charlotte, NC 15 Years of Equipment Leasing Experience and Recruiting with Business Aviation niche. Visit us at www.turningpointgrp.com E-mail: info@turningpointgrp.com |

Human Resource Consultant: New York, NY Employee Relations, Recruiting, Benefits, employee customer surveys, plus payroll administration "ON-LINE" services-- AND IN PERSON at your location Please visit:www.adviceonhr.com |

||

| Information System: North Detroit, MI INFOLEASE EXPERT - 18 years experience. Since being downsized in 2002, working as a consultant for several leasing companies. Seeking consulting projects nationwide. email: darwint@prodigy.net |

Finance: New York, NY Finance: New York, NY“Think Outside the Bank”. Barrett Capital is a merchant banking and consulting firm, specializing in asset based financing: equipment, vehicles, receivables and real estate. Email: bkorn@barrettcapital.com Web: www.barrettcapital.com |

All "Outsourcing" Classified ads (advertisers are both requested and responsible to keep their free ads up to date:

http://www.leasingnews.org/Classified/Outsourcing/Outsourcing.htm

How to Post a free "Outsourcing" classified ad:

http://www.leasingnews.org/Classified/Outsourcing/Outsourcing-post.htm

[headlines]

----------------------------------------------------------------

![]()

This Day in History

-------------------------------------------------------------

SuDoku

The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler?

http://leasingnews.org/Soduku/soduko-main.htm

--------------------------------------------------------------

Daily Puzzle

How to play:

http://www.setgame.com/set/puzzle_frame.htm

Refresh for current date:

http://www.setgame.com/set/puzzle_frame.htm

--------------------------------------------------------------

http://www.gasbuddy.com/

http://www.gasbuddy.com/GB_Map_Gas_Prices.aspx

http://www.gasbuddy.com/GB_Mobile_Instructions.aspx

--------------------------------------------------------------

Weather

See USA map, click to specific area, no commercials

--------------------------------------------------------------

Traffic Live---

Real Time Traffic Information

You can save up to 20 different routes and check them out with one click,

or type in a new route to learn the traffic live

--------------------------------