Connect with Leasing News ![]()

![]()

![]()

![]() Add me to mailing list |

Add me to mailing list | ![]() |

| ![]() Search |

Search | ![]() Stress Release

Stress Release

Advertising | All Lists | Archives | Classified Ads | This Day In American History

Leasing News is a web site that posts information, news, and

entertainment for the commercial bank, finance and leasing industry

kitmenkin@leasingnews.org

![]()

Monday, June 3, 2013

![]()

Today's Equipment Leasing Headlines

Popular Bank to Remain in Commercial US Mainland Market

---But Confirms No Longer in Equipment Leasing

Classified Ads---Collection

June Update --Leasing Schemes’ Court Cases

by Christopher Menkin

HL Leasing, Fresno, Palm Desert, California

IFC Credit--Rudy Trebels

NorVergence

Operation Lease Fleece--Sentencing

Sheldon Player—Equipment Acquisition Resources

“Creating a LinkedIn and Facebook page?”

Career Crossroad---By Emily Fitzpatrick/RII

Classified Ads

Cobra Capital Joins Funder, Story Credit,

Funder Looking for New Broker business Lists

Leasing 102 by Mr. Terry Winders, CLP

Vendor Support Agreements

Regional Banks Step in to Lend as Larger Banks Slide

By Robb Soukup and Robert Clark

Wisconsin Banks Raise Capital, but one not enough

---Bank of Kenosha Fails

Letter of Credit’s Interpretation Limited to

Face of the Letter of Credit

By Tom McCurnin

Channel Partners Construction Deals Last 30 Days

Top Stories May 28-May 30

(You May Have Missed)

Two Promoters of Tax Fraud Scheme Who Sought Millions

in Fraudulent Tax Refunds Sentenced 96 & 87 Months

Rottweiler Puppy

Denver, Colorado Adopt a Dog

Open Positions at Leasing Funders/Various Locations

News Briefs---

Cheap leases offered to spur electric-car sales

Why It's Riskier to Lend to East Coast Small Businesses

Mortgage rates soar; has refi window shut?

PacWest Completes Acquisition First California Financial Group

GE Capital/Element Financial Establish Border Fleet Services Alliance

SQN Capital Management, LLC Announces SQN AIF IV, L.P.

Japan Output Gains as Tokyo Prices End Four-Year Slide

Huge tax-reform proposal/eats Wall Street hedging operations

Dell board goes with Michael Dell's $24.4 billion deal

Japan’s wheat-import suspension worries state growers

Seven & I Sees More Than Doubling North America Stores

Broker/Funder/Industry Lists |

Features (collection)

Top Ten Stories Chosen by Readers |

Top Stories last six months

www.leasingcomplaints.com (Be Careful of Doing Business)

You May have Missed---

SparkPeople--Live Healthier and Longer

Sports Briefs---

California Nuts Brief---

"Gimme that Wine"

This Day in American History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

######## surrounding the article denotes it is a “press release” and was not written by Leasing News nor information verified, but from the source noted. When an article is signed by the writer, it is considered a “by line.” It reflects the opinion and research of the writer.

Please send Leasing News to a colleague

and ask them to subscribe

Contact: kitmenkin@leasingnews.org

[headlines]

--------------------------------------------------------------

Popular Bank to Remain in Commercial US Mainland Market

But Confirms No Longer in Equipment Leasing

![]()

"Popular Community Bank (PCB), remains committed to enabling commercial lending and has materially further enhanced its capabilities through the addition of several new highly experienced commercial banker," a spokesperson for the bank told Leasing News.

"While PCB continuously evaluates its diverse lines of business and product offerings, it was ultimately determined that reengagement in the equipment leasing business was not in line with the bank’s immediate strategic objectives. This could change in the future."

"PCB’s commitment to its customers and communities that we serve has never been stronger, as we continue to provide a broad array of loans and banking services throughout our geographic footprint - 93 branches in five states (CA, NY, NJ, IL and FL).

"Mr. Richard Carrión will continue to serve as the President, Chief Executive Officer and Chairman of the Board of Directors of Popular, Inc. In the event that Mr. Carrión is elected IOC President, he will remain with the Company as Board Chairman and the Board of Directors will appoint a new President and Chief Executive Officer.

“Popular, Inc.’s Board fully supports his endeavor. Mr. Carrión has led the growth and development of Popular, Inc. for more than 30 years. At the same time, he has been a member of the IOC since 1990 and has played key roles at the organization during his time there.

"Furthermore, PCB has been in the U.S. mainland for over 50 years. There has been no announcement made that discusses an exit. PCB continues to invest in its communities, renovating branches, hiring, introducing new services - including mobile banking for businesses and consumers. The bank also invested in a rebranding initiative to continue to attract clients."

"For more facts on Popular’s corporate strategy, (information presented on Investor Day from Q1 2013) it can be found here: https://www.popularcommunitybank.com/us/presentations-webcasts

Bookmark us

[headlines]

--------------------------------------------------------------

Classified Ads---Collections

(These ads are “free” to those seeking employment

or looking to improve their position)

Long Grove, Illinois

Financial services professional with a proven track record of positively impacting corporate finances through effective management of cash flow, collections and financial assets. Strategic thinker capable of analyzing financial issues and processes in order to implement changes that improve efficiency and profit margins. Well-versed in all aspects of corporate financial affairs. roborgaard@aol.com | Resume

Free Posting for those seeking employment in Leasing:

http://www.leasingnews.org/Classified/Jwanted/Jwanted-post.htm

All “free” categories “job wanted” ads:

http://www.leasingnews.org/Classified/Jwanted/Jwanted.htm

[headlines]

--------------------------------------------------------------

June Update --Leasing Schemes’ Court Cases

by Christopher Menkin

- HL Leasing

- IFC Credit--Rudy Trebels

- NorVergence

- Operation Lease Fleece

- Sheldon Player—Equipment Acquisition Resources

• Contract Negotiations • Fraud Investigations john@jkrmdirect.com | ph 315-866-1167| www.jkrmdirect.com |

(Leasing News provides this ad as a trade for investigations

and background information provided by John Kenny)

HL Leasing, Fresno, Palm Desert, California

John Otto, the alleged perpetrator of the Ponzi scheme, where money was lent by investors for a rate of return for leases that did not exist, committed suicide. Corporate officers were taken to a class action suit in Fresno where a jury ruled for a judgment against Heritage Leasing, MAC dba Heritage Leasing, Kathleen Otto (wife of John where bookkeeping was maintained at their house in Palm Desert (and Air Fred (small airline where they leased planes) for $114.5 million, plus $46.5 million against both Dan Ramirez and Andy Fernandez; $720,000 on top of that against Dan Ramirez.

Ara Jabagchourian and Aron K. Liang of Cotchett, Pitre & McCarthy, LLP and Donald Fischbach of Dowling, Aaron & Keeler, Inc. began search for the assets. At this time Appellate briefs have been filed for Kathleen Otto's case. Ramirez has not his brief yet. He has "sold" his home to his wife even though Cotchett, Pitre & McCarthy had a lien on it. Kathleen Otto has sold her vehicles and transferred real estate before she filed personal bankruptcy.

Leasing News continues to receive emails from victims who lost retirement, savings for college for their kids, their life savings, as well as were forced to seriously downsize their lifestyle.

Previous Stories:

http://www.leasingnews.org/Conscious-Top%20Stories/heritage_leasing.htm

IFC Credit--Rudy Trebels

There are six court cases open regarding Rudy Trebels and IFC Credit Corporation. Readers tell me he is still playing golf in Florida, as well as vendors and lessees email Leasing News asking about doing business with him, finding stories written about him in the internet.

An Omnibus Claims Objection Procedure was made on May 23, 2013 for the Chapter 7 Bankruptcy of IFC Credit Corporation field on July 27, 2009, seeking all claims:

"Upon the Motion ('Motion') of David P. Leibowitz ('Trustee'), chapter 7 trustee for the estate of IFC Credit Corporation ('Debtor') and the following substantively consolidated entities: (a) Augusta Mill Acquisition LLC; (b) Augusta Real Estate Owner, LLC; (c) First Portland Corporation; (d) FP Holdings, Inc.; (e) FPC Leasing, LLC; (f) IFC Capital Funding III, LLC; (g) IFC Capital Funding VII, LLC; and (h) Pioneer Capital Corporation of Texas (collectively, the "SubCon Entities"), for an order establishing omnibus claims procedures, after due and proper notice, for cause shown, and statements made on the record, the Court being advised in the premises of the Motion..."

Omnibus Claims Objection Procedure PDF

In the only civil case, brought by CoActiv Capital Partners on September 30, 2009, suit is for over $2 million against IFC Credit Corporation, Morton Grove, Illinois, one of their funding groups, and the two main principals, claiming the officers committed fraud as individuals, specifically not paying off leases when the lessee terminated early, and knowing that the company was "essential insolvent" for almost a year. Since Element Financial has purchased CoActive Capital Partners where this will remain in the bankruptcy court is not known.

Omnibus Claims Objection Procedure:

.leasingnews.org/PDF/OmnibusClaimsObectionProcedure_632013.pdf

Rudy Trebels Saga

http://www.leasingnews.org/Conscious-Top%20Stories/trebels.html

Previous stories:

http://www.leasingnews.org/Conscious-Top%20Stories/IFC_stories.htm

NorVergence

The Aberdeen Kid Yahoo blog has diminished.

No change since filing of bankruptcy and no information on case in Lake Charles, Louisiana regarding Thomas N. Salzano, the mastermind behind the 10,629 leases with over 50 bank and leasing companies. It keeps being postponed.

Previous Stories:

http://www.leasingnews.org/Conscious-Top%20Stories/Novergence_main.htm

Operation Lease Fleece--Sentencing

Mark McQuitty of CapitalWerks was sentenced for 24 months starting 12 noon, March 21, 2013, plus three years’ probation and other stipulations (1). He was given a Greyhound bus ticket and took a ride with other "low risk" prisoners to Reeves II Federal Penitentiary, Pecos, Texas.

Reeves I,II,III ---population 4,400

Prison records show McQuitty as inmate 45507-112 51-White-M to get out 12-15-2014 (Could not find a “mugshot.”) Reportedly 47.2% is drug relational, and they have an excellent 18month alcohol and drug rehabilitation program.

http://www.bop.gov/about/facts.jsp#15

McQuitty blamed his problems on alcohol, he had four DUI's, and reportedly was anxious to get on first both with the sentencing after pleading and then anxious to start serving his time so he could get out.

ISystems President Chant Vartanian signed a plea agreement with the United States Attorney's Office for the Central District of California, represented by Jennifer L. Waier, Assistant Attorney General, who has been the lead on all the "Fleece" cases. He was sentenced to one day and served his time, now out of jail:

"JUDGMENT AND COMMITMENT by Judge Cormac J. Carney as to Defendant Chant Vartanian (1), Count(s) 1, Committed on Count 1 of the 3-Count Indictment to the custody of the Bureau of Prisons to be imprisoned for a term of 1 day, which the Court deems has been served in full. Pay $100 special assessment. Pay total fine of $6,000. 3 years supervised release under terms and conditions of US Probation Office and General Orders 05-02 and 01-05. Count(s) 2, 3, Government's motion, all remaining counts ordered dismissed. (mt) (Entered: 10/17/2012)" (2)

Sarkus Vartanian, vice-president of ISystems Technology and Solutions, brother of Chant indictment was dismissed without prejudice. Reportedly he told assistant US Deputy Attorney Jennifer L. Waier he had cancer (it was never verified, according to court records and attorneys involved).

It seems after the original plea agreements, the next series fought a plea agreement, several wanting jury trials, as does the one waiting now:

Ziya Arik, CapitalWerks/Preferred Lease, sentencing before Judge Cormac J. Carney was continued again to October 1, 2013 for a trial. Reportedly one of the toughest salesmen who was rough on customers, competing with Brian Acosta, CLP, for accounts. There were many complaints about his “performance.”

It appears the “Orange County Weekly” blames U.S. District court Judge Cormac J. Carney “light sentencings.” (3)

In Operation Fleece the sentencing has been light, even for the two with the longest terms, Adam Zuckerman 37 months Jim Raeder 12 months half-way house, one day jail (equals time served). Michael Scott Grayson got one day of probation although stole $1 million, according to the Orange County Weekly.[**Note: Carney officially sentenced Grayson to one day in prison, and then immediately considered it served.] (3)

"Even Assistant United States Attorney Jennifer L. Waier--the prosecutor on Grayson's case and a person not known for advocating tough punishments if she can reach a quick plea bargain that saves her from trial work--argued in her sentencing brief that the interests of justice required that the businessman's huge theft demanded at least a "low end" guideline punishment of 30 months in a federal prison." (3)

In my experience, the judge usually goes with the recommendation of the prosecuting attorney, who in these cases seem to give up against those fighting the charge. According to various attorneys over the course of events, it is the dollar figure that also factors into the sentencing, and most important, the creditors, lessors, banks, financing companies never showed up in the sentencing. They did in the Zuckerman case as well as Raeder, who is still not popular in Colorado where he was living (many telephone calls to Leasing News from his "fans.")

The long waiting, evidently at the direction of Assistant United States Attorney Jennifer L. Waier may be considered a punishment, as they could not work in their profession (nor can they after being sentenced ever get involved in leasing, financing, or the like occupation) as well as those sentenced are all now felons---- and all on probation, most for three years.

In addition, in the “Operation Lease Fleece,” they did not have “victims,” but business owners who participated in the deception of “sales/leasebacks” and/or equipment that did not exist. In reality, they were part of the scam. Not complaining they were not named, due to all the work that would be involved, but the point is the victims were the funders stupid enough to deal with Mark McQuitty and Jim Raeder. But then, there are many like them that funders know about today that they still do business with…

Moreover, if the funders really were concerned, they would have gotten more involved in the cases, including sentencing, instead of just writing it off and going back to business (that’s my opinion.) It seems the almighty buck overrules doing business with people you should not be doing business with.

Leasing News will do a full wrap-up after the case is finalized, although the various sentences are in the collection.

Following the various “Operation Lease Fleece” cases since the beginning, more than any other news media, I give Judge Carney high marks for his patience, ethics, and skill in the entire proceedings.

Kit Menkin, editor/publisher

(1) McQuitty Other Stipulations:

http://www.leasingnews.org/PDF/mcquity_other_stipulations.pdf

(2) Vartanian Sentence

http://www.leasingnews.org/PDF/VartanianSentence_632013.pdf

(3) OC Weekly Criticizes Judge Carney ocweekly.com/navelgazing/2013/04/michael_scott_grayson_verizon.php

Operation Lease Fleece Stories

http://www.leasingnews.org/Conscious-Top%20Stories/Lease_Fleece.htm

Sheldon Player—Equipment Acquisition Resources

The Trustee continues to settle claims with the latest May 15, 2013 settlement for Nowlin Excavation to pay $4,000. The bankruptcy was filed 10/23/2009. Sheldon Player has not been arrested for fraud or any other charges. He reportedly has a lot of cash and continues gambling through beautiful escorts he takes to mostly riverboat gambling casinos.

Why he is not in jail, you got me

Previous Stories:

http://www.leasingnews.org/Conscious-Top%20Stories/Sheldon_Player.htm

[headlines]

--------------------------------------------------------------

Creating a LinkedIn and Facebook page

Career Crossroad---By Emily Fitzpatrick/RII

Question: I am creating a LinkedIn Page and Facebook Page and I do not want to insinuate that I am looking for a new career opportunity. Do you have any suggestions?

Answer: There are “good,” “bad,” and “look out for” on social media sites.

These opinions vary, and it also depends on your purpose. Often these social media sites only allow one name, meaning is your intent personal or business? If your goal is to create a professional presence, be careful about what you share and post. If anyone has an existing pages scrub your page and get rid of any questionable posts or pictures. Be forewarned the first thing employers, or potential employers DO look at: your Facebook page, second other professional social media pages, first perhaps being LinkedIn. You can make you Facebook private to family and friends, and I suggest that, as well as test it from time to time by having the password not saved and logging in to Facebook under another email name. If you are using Facebook for “business,” good for you!

Employers and potential employers are aware that LinkedIn is utilized to generate sales leads, network with other like-minded professionals and keep abreast of industry trends. It is an excellent source to network. Many companies use also to contact those in the industry and try to lure them to work for them.

In developing your page, include the following:

-

An abbreviated version of your resume highlighting your accomplishments / achievements

-

Your education & certification

-

Any associations (professional) that you are affiliated with

-

References or Letters of Reference from previous employers or clients

-

Use a professional photo (I can’t tell you how many photo’s turn professionals off, especially real “cute” ons.

I recommend:

-

Being an OPEN Networker - this allows you to accept messages (known as “InMails”) from anyone, this way others can reach you easily & you have the option to respond or not

-

Very Important: Including your contact information: Under the section of how to contact (InMail) include your email and phone number – without this many users of the FREE Version cannot connect with you (over 90% are FREE users)

Remember you are creating a social presence - one that, virtually, can be viewed globally!

Take the take to develop your page in the most professional manner possible.

The following information is from LinkedIn:

76.9% of the LinkedIn users said the professional network helped them research people and companies

68.6% says LinkedIn helped them reconnect with past business and associates

49.7% Build new networking relationships with individuals who may influence potential customers

44.5% Increase face-to-face networking effectiveness

Emily Fitzpatrick

Sr. Recruiter

Recruiters International, Inc.

Phone: 954-885-9241

Cell: 954-612-0567

emily@riirecruit.com

Invite me to Connect on LinkedIn

www.linkedin.com/pub/emily-fitzpatrick/4/671/76

Also follow us on Twitter #RIIINFO

Career Crossroads Previous Columns

http://www.leasingnews.org/Conscious-Top%20Stories/crossroad.html

| Working Capital Loans for Small Businesses | |

Channel Partners is now offering a new Easy Rewards program that allows you to earn rewards on EVERY deal over $15,000 in EVERY state! |

|

[headlines]

--------------------------------------------------------------

Leasing Industry Help Wanted

Help Wanted Classified Ads Cost The classified ad will appear for 21 days. The idea is to attract an applicant to learn more, either to click to a full description on your web site or to a full job description attachment (free, no charge). All "Help Wanted" ads go into the "Help Wanted" classified ad section, which appears in each news edition, and is well read. The ad will also appear on the web site for those who go directly to the web site section. A "Help Wanted" ad appears at the top of the headlines in each edition in a chronological basis with other help wanted ads. The position cannot be purchased. The ad also continues to appear in the classified ad section in the news edition as well as the web site in addition to appearing above the headlines. If there is only one help wanted ad, a display ad may be utilized in the rotation basis as this position, meaning the one help wanted ad is not going to be on top in every edition. Contact kitmenkin@leasingnews.org for more Leasing News reserves the right to refuse advertising, particularly to a company that has appeared in the complaint bulletin board |

[headlines]

--------------------------------------------------------------

Cobra Capital Joins Funder, Story Credit,

Funder Looking for New Broker business Lists

Cobra Capital LLC Darien, Illinois Dale R. Kluga, President dale@cobrallc.com Office:630-985-3500 Fax: 630-985-3567 www.cobrallc.com ELFA (Footnote) |

6 |

Nationwide |

$50,000 - $1MM $250,000 average transaction. |

Y |

N |

Y |

N |

N |

A -Accepts Broker Business | B -Requires Broker be Licensed | C -Sub-Broker Program | D -"Private label Program" | E - Also "in house" salesmen

Footnote:

*Sub-Broker Program - yes, but only with full disclosure of all broker names

Minimum Lease Size: $50,000

Lease Size Range: $50,000 to $500,000

Credit Profile: A Quality, B Quality, Start-ups

Term: 1 to 5 Years

Geography: Nationwide

Lease Types: Operating Lease, Direct/Finance Lease, Single Investor Lease

Prohibitions: No trains, planes, boats or restaurants

Funder List "A"

http://www.leasingnews.org/Funders_Only/Funders.htm

Funders Looking for New Broker Business

http://www.leasingnews.org/Funders_Only/New_Broker.htm

Story Credit Lessors

http://www.leasingnews.org/Story_Credit/Story_Credit.htm

|

[headlines]

--------------------------------------------------------------

Leasing 102

by Mr. Terry Winders, CLP

Vendor Support Agreements

Usually when a vendor has a high margin and fells strongly about a poor credit risk they will offer recourse to encourage the lessor to fund the transaction. Recourse is a very complex issue and therefore requires proper documentation. There are many types of recourse such as; full recourse, limited recourse, dealer participating non-recourse, and rent to lease/own programs, and remarketing agreements.

Full recourse is a term that means the seller of the equipment guarantees the performance of the lessee, and if the lessee defaults, is prepared to cover the loss of the funding source. Full recourse allows some transactions that would normally be turned down to be acceptable, but the recourse document needs to be carefully drafted. The agreement must cover many points to establish where, and when, the responsibilities of both parties are effective. For instance, when does the vendor cover the loss, and most important how much? Is the recourse to cover all recovery costs or just the net present value of the unpaid lease payments? If late charges are unpaid are they included in the payoff? Who pays for the recovery costs and if a replevin action is necessary who pays the attorney and court costs. Plus who makes the decision on when to pull the plug? In addition, once the equipment is in the possession of the vendor, and it takes some time to remarket, is the balance paid to the lessor upon re-possession or after it is remarketed. If after remarketing, how long is the remarketing going to take and should a time frame be attached?

Good communication about the scope of the recourse is necessary to make sure both parties to the agreement are fully aware of what part each plays, and who has the power to make decisions.

The days of self-help repossession are long gone and it takes a replevin action to get the legal right to go after the equipment. Some States still allow self-help repossession but the risk it represents, if not done correctly, make it a very poor approach. If a Lessee voluntarily surrenders the equipment even then a legal statement, defining the lessee's request you take the equipment with acceptance of continuing responsibilities, needs to be signed to have the right to obtain recover a loss.

Collection costs have raised the bar on the value of recourse today, because if the lessee defaults, the expense of repossession and remarketing add so much to the balance that if it is done correctly, and explained completely, most vendors shy away from it. The equipment must carry a high resale value to make recourse work and a tight reign on delinquency is necessary to avoid letting time slip away. Done with poor documentation a disagreement will always arise with the vendor and it will destroy a good vendor relationship.

Recourse can work if the transaction is a direct finance lease for the lessor so the only consideration is the unpaid balance and the recover costs. If the transaction is a true lease with tax lease considerations then the payoff is larger and makes it almost impossible to come out clean if a default occurs. The best way to reduce the risk is with a security deposit or increased payments in the early years to reduce the balance as soon as possible.

Once in a while the vendor will offer “Limited Recourse” to cover the first two years, or one third of the lease term, to help the lessee prove his ability to pay the lease payments. This is a lessor decision but it still required that you properly document the agreement so if a default occurs, both parties understand their responsibility.

A popular recourse arrangement is one were the vendor receives a commission on each transaction but it is held in reserve against any losses. It is called a dealer participating non- recourse arrangement. A dollar amount, or a percentage of the outstanding portfolio, is assigned so that at the end of each year any funds in the account over the selected amount can be paid out to the vendor. The incentive to the vendor is that with few or no losses he gets the full commission. This puts the vendor in the decision tract on what limited credits are acceptable. If the losses are small then the reserve handles the loss and both the lessor and the vendor are covered. However, a proper document is required just like a full recourse agreement to establish timing and cost allocations.

Rent to lease/own programs place the vendors recourse on a short time frame and the lessee's payment on an elevated payment schedule to cover the risk. These are not done for poor credits but for startups and lessees with short histories. An example is to subtract the wholesale value of the equipment after six months of use from the selling cost. Then create a rent period for six months at a lease payment that will reduce the balance to the wholesale value. The vendor is on full recourse for the six months and then a non-recourse finance or lease program for a longer period of time is offered at a much lower payment amount. The theory is that if the lessee could make the higher payments for six months then the lower payments should be OK and by that time a good equity has been placed into the equipment lowering the risk to the lessor.

The last effort for support is to ask the vendor for remarketing. If they agree an agreement should be drafted to spell out all of the issues such as: commissions paid for the remarketing effort, time in inventory, get ready charges, insurance, advertising costs, and storage. If the commission is not at an equal par with those paid for normal inventory you can expect your equipment to be stored and probably take a very long term to sell.

Conclusion:

Vendor support is a good program under the correct set of circumstances but should not be thought of as a way of shifting the burden of risk. Lessors are better equipped to make credit and equipment judgments and sometimes good intentions can lead to loss business because usually bad credits will mean a high degree of loss for someone--- and as my mentor in the business said: “Life is too short to do business with companies of low character.”

Mr. Terry Winders, CLP, has been a teacher, consultant, expert witness for the leasing industry for thirty-five years and can be reached at WindersConsulting@yahoo.com or 502-649-0448

He invites your questions and queries.

Previous #102 Columns:

www.leasingnews.org/Conscious-Top%20Stories/Leasing_102/Index.htm

Mr. Terry Winders available as Expert Witness. 35 years as a professional instructor to the top equipment leasing and finance companies in the United States, author of several books, including DVD's, as well as weekly columnist to Leasing News. He also performs audits of leasing companies as an expert on documentation, and has acted as an expert witness on leasing for litigation in legal and tax disputes, including before the IRS. He also has taught the senior bank examiners, how to review a bank leasing department, for the Federal Reserve in Washington D.C. and has trained the examiners for the FDIC on how to prepare a lease portfolio for sale.

Mr. Winders received his Master of Business Administration and his Bachelor of Science degrees from the College of Notre Dame. 502.649.0448/WindersConsulting@yahoo.com |

(This ad is a “trade” for the writing of this column. Opinions

contained in the column are those of Mr. Terry Winders, CLP)

[headlines]

--------------------------------------------------------------

Regional Banks Step in to Lend as Larger Banks Slide

By Robb Soukup and Robert Clark

SNL Financial

(Edited for length)

Lending slid at most of the nation's largest banks, despite many of those institutions having room to grow loans and claims from smaller competitors that the mega-banks are driving pricing wars in bids to win new credits. Bank of America Corp., for example, saw annualized linked-quarter loan growth decline 3.75%, and Citigroup Inc. reported a 4.75% slide for the same period. Capital One Financial Corp. reported a more substantial slump of 15.72% in loan growth. Capital One CFO Gary Perlin attributed the quarterly decrease to seasonal factors during a May 22 investor presentation.

The greatest declines in the industry, though, occurred at some smaller institutions. Guaranty Financial MHC reported that loan growth fell 83.23% during the quarter. Flagstar Bancorp Inc. saw annualized linked-quarter loan decline of 79.09%. The company, which has struggled with capital and regulatory issues, recently installed a new CEO.

Some of the banks and thrifts with the highest capacity to lend grew loans aggressively during the first quarter.

Miami Lakes, Fla.-based BankUnited Inc. was the largest of institutions with the highest lending capacity, measured by loans as a percentage of assets, according to SNL data, although that may change quickly. The company, whose reported loans were 45.87% of its total assets, grew loans 19.55% during the quarter, compared to the fourth quarter of 2012. BankUnited Chairman, President and CEO John Kanas touted the success of the company's organic growth efforts during a Bloomberg TV interview and also said the company is poised to accelerate that growth now that it has entered the New York market. Kanas estimated that the company already had $200 million in its N.Y.-based loan pipeline after just six weeks of operation.

Kanas had previously said during the company's first-quarter earnings call that the company expects its four locations in New York to match the loan growth of its Florida branch network. "We will start to see tangible evidence of the growth of this franchise in New York by the end of this quarter, without fail," Kanas said during the call, adding "the prospects for growth of loan assets in Florida and New York are stronger than ever."

Another Fla.-based franchise, Bond Street Holdings Inc., was also able to make considerable use of its lending capacity, notching annualized quarter-over-quarter loan growth of 35.31%. The company, whose loans totaled 44.12% of its assets, has plenty of powder left to deploy. At the end of the quarter, the company reported that tangible common equity was 20.96% of tangible assets.

Atlanta-based CertusHoldings Inc.'s 59.32% loan growth was the highest among companies with the most capacity to lend. At the other end of the spectrum, Omaha, Neb.-based Lauritzen Corp. saw loans fall 20.25%, and Greenwood Village, Colo.-based National Bank Holdings Corp. reported a 16.09% drop in loan growth from the preceding quarter.

[headlines]

--------------------------------------------------------------

Wisconsin Banks Raise Capital, but one not enough

---Bank of Kenosha Fails

The two branches of Banks of Wisconsin, which did business as Bank of Kenosha, Kenosha, Wisconsin, were closed with North Shore Bank, FSB, Brookfield, Wisconsin, to assume all of the deposits. The acquisition of Banks of Wisconsin is their second purchase. September 17, 2010, they acquired Maritime Savings Bank, West Allis, Wisconsin, acquiring $177.6 million in assets and $350.5 million in deposits.

The Bank of Kenosha was established June 26, 2000 and had two offices in Kenosha with 41 full time employees as of March 31, 2013. Year-end 2007, the bank had 71 full time employees.

"With a population of 99,738 as of November 2011, Kenosha is the fourth-largest city in Wisconsin. Kenosha is also the fourth-largest city on the western shore of Lake Michigan, preceded by Chicago, Milwaukee, and Green Bay. Kenosha lies on the southwestern shore of Lake Michigan, 35 miles (56 km) south of Milwaukee and 50 miles north of Chicago.

"The 1902 Rambler was also the first automobile to incorporate a steering wheel, rather than use the then-common tiller-controlled steering. In 1916 Jeffery was purchased by auto executive Charles W. Nash and became Nash Motors. In May 1954, Nash acquired Detroit-based Hudson and the new firm was named American Motors Corporation...Snap-on Tools world headquarters are located in Kenosha.

http://en.wikipedia.org/wiki/Kenosha,_Wisconsin

There are several banks in the Kenosha area were "saved" with the injection of capital as the real estate bubble hit all community banks here. Biztimes.com reports:

"In 2010, a group of existing Southport (bank in Kenosha) shareholders injected $4 million of equity into the bank. Angel investor Guy Cecchini, the uncle of founding shareholder Jim Cicchini, chipped in $10 million...The Johnson family invested $235 million of private funds into Johnson Bank (Racine) in February, while the Lubar family announced plans to invest $20 million in ISB parent Ixonia Bancshares in April..."

http://www.biztimes.com/article/20120611/MAGAZINE03/120609801/

June 21,2012 ISB Community Bank, Ixonia, received $12 million: "Members of the Lubar family added $16.5 million in badly needed capital to the bank, and the remaining $4.5 million came from existing shareholders, employees, and some new investors."

http://www.wdtimes.com/news/article_17dab8f2-bbb9-11e1-af4a-0019bb2963f4.html

Following a FDIC consent order for Bank of Kenosha to increase its financial strength, Gary R Hutchins, President & Chief Executive Officer, in 2010 hit the bricks and was raised more than $4 million in new capital.

"Hutchins noted that Kenosha County has been one of the fastest-growing areas in the state, and Banks of Wisconsin, as a local bank, made construction and real estate loans to help fuel the growth.

" 'Some of our customers have been affected by the downturn in the economy and we have been working with them to help get them through these tough times," Hutchins said. "We remain confident that our local economy will recover from this downturn just like it has from other difficult times in the past.'

"In an interview Friday, Hutchins said his bank also was hit by troubled loan 'participations,' in which the bank joined with other banks to finance construction projects, including a condominium development in Florida."

http://www.jsonline.com/business/83088157.html

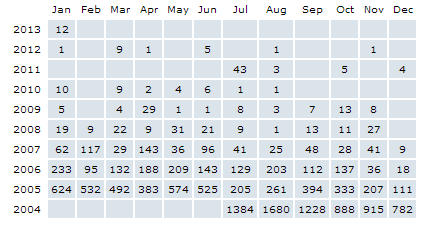

Real Estate was the number one problem with non-current loans and defaults. Unfortunately non-current loans hit $23.1 million year-end 2010 and charge offs grew from $4 million in 2009, to $4.8 million in 2010, to $5.5 million in 2011, resulting in lower non-current loans by the dollars charged off, but also reducing profit and equity.

(in millions, unless otherwise)

Non-Current Loans

2006 $730,000

2007 $3.2

2008 $3.7

2009 $13.7

2010 $23.1

2011 $19.3

2012 $12.6

3/31 $12.5

Charge Offs

2006 $12,000 ($6,000 commercial/indusrial,$3,000 1-4 family, $3,000 individual.)

2007 $365,000 ($322,000 commercial/indust., $30,000 indiv.,-$1,000 1-4 fam.)

2008 $993,000 ($964,000 nonfarm/nonres.,$27,000 commercial, $3,000 individual.-$1,000 1-4 family)

2009 $4.0 ($2.1 construction/land, $970,000 commercial, $506,000 multi-family,$385,000 1-4 family, $27,000 individual.

2010 $4.8 ($1.6 construction/land, $1.6 commercial/ind., $588,000 1-4 family, $530,000 nonfarm-nonres, $451,000 multi-family, $18,000 indiv.)

2011 $5.5 ($1.4 1-4 family, $1.2 multi-family, $951,000 commercial/ind.,$769,00 nonfarm/nonres.,$20,000 individ.)

2012 $2.3 ($1.1 multifamly,$587,000 1-4 family, $17,000 indivd., $6,000 commercial, -$14,000 nonfarm/nonres.)

3/31 $10,000 ($16,000 commercial-industrial, -$5,000 nonfarm/nonres.,-$1,000 1-4 family.)

Construction and Land, 1-4 family multiple residential, Multiple Family Residential, Non-Farm Non-Residential loans.

As noted, non-current and charges offs reduced profit and equity:

(in millions, unless otherwise)

Profit

2006 $1.4

2007 $1.2

2008 -$355,000

2009 -$5.8

2010 -$3.6

2011 -$8.1

2012 -$2.2

3/31 -$588,000

Net Equity

2006 $16.3

2007 $18.1

2008 $18.4

2009 $13.2

2010 $14.1

2011 $7.0

2012 $3.4

3/31 $2.9

A strong indication of the real estate market is evident in the following---

Single-family new house construction building permits:

1997: 136 buildings, average cost: $104,500

1998: 175 buildings, average cost: $113,700

1999: 237 buildings, average cost: $115,700

2000: 233 buildings, average cost: $105,400

2001: 209 buildings, average cost: $119,700

2002: 227 buildings, average cost: $120,200

2004: 326 buildings, average cost: $165,400

2005: 375 buildings, average cost: $163,600

2006: 358 buildings, average cost: $175,500

2007: 295 buildings, average cost: $186,100

2008: 144 buildings, average cost: $190,300

2009: 98 buildings, average cost: $162,900

2010: 65 buildings, average cost: $157,700

2011: 36 buildings, average cost: $184,100

http://www.city-data.com/city/Kenosha-Wisconsin.html

March 31, 2013: Tier 1 risk-based capital ratio 2.67%

As of March 31, 2012, Banks of Wisconsin had approximately $134.0 million in total assets and $127.6 million in total deposits. In addition to assuming all of the deposits of the failed bank, North Shore Bank, FSB agreed to purchase approximately $97.4 million of the failed bank's assets. The FDIC will retain the remaining assets for later disposition.

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $26.3 million.

Bank of Kenosha was the 14th FDIC-insured institution to fail in the nation this year, and the first in Wisconsin. The last FDIC-insured institution closed in the state was Legacy Bank, Milwaukee, on March 11, 2011.

http://www.fdic.gov/news/news/press/2013/pr13046.html

List of Bank Failures:

http://www.fdic.gov/bank/individual/failed/banklist.html

Bank Beat:

http://www.leasingnews.org/Conscious-Top%20Stories/Bank_Beat.htm

[headlines]

--------------------------------------------------------------

Letter of Credit’s Interpretation Limited to

Face of the Letter of Credit

By Tom McCurnin

Leasing News Legal News Editor

Court of Appeals Correctly Follows Law to Only Look at the

Four Corners of the Letter of Credit

There’s an American idiom, which loosely paraphrased says “not to lock the barn door after the cattle are gone.” Applied to documenting deals, it’s pretty ineffective to complain about the language in a deal 4 years after it’s been inked. A Kentucky Bank and a shopping center owner should have probably looked that idiom up before doing this deal involving a Letter of Credit.

I use Letters of Credit on dicey deals all the time. Many lessees simply don’t have the credit to support the lease of a large capital item, and in some instances the capital item may not have the resale value after protracted litigation, foreclosure and resale. It is for this reason that many lessors use Letters of Credit (“L/C”) to as credit enhancements for shaky deals, residuals, or buyouts.

Today’s case is Louisville Mall Associates, LP v. Wood Center Properties, LLC, 361 S.W.3d 323 (Ky. Ct. App. 2012). Banks rarely issue L/Cs for more than a year, but credit deals are generally more than a year. So, as a compromise, the Bank is required to send a notification that it won’t renew the L/C. The failure to the renew the L/C is generally a condition of default. The notification is generally sent about 60 days before expiration, so the Bank pretty much knows that they have 60 days of exposure and the creditor will probably draw against the L/C—that is of course, if the Bank actually sends out the notification.

The Bank failed to send out the notification, and the L/C allegedly expired, and soon after the expiration, the borrower defaulted and presumably thought it could safely do so, because the L/C was presumably gone. Alas, no one knew that the Bank failed to send out the proper notice. The Creditor drew against the L/C, the Bank realized its error, but the fact was that without the notification, the L/C was still in play.

The other issue was the magic language required to be placed on the L/C. Most L/Cs have specific language which simply states “if you give Bank the following pieces of paper that say the following things then the Bank will pay the creditor the stated amount on the L/C without regard to the terms of the underlying agreement with the borrower.” Thus, the Bank is not expected, nor entitled, to look beyond the L/C and the attached pieces of paper to determine whether the statements they contain are true. Typically, the L/C requires the creditor drawing on the L/C to submit a draft, an invoice, and a certification that the amount is owing. Here, the Debtor argued that the Court should look to documents outside the four corners of the L/C to determine if the magic language was sufficient.

Here, the Creditor supplied the necessary magic language on the draft, and the lower court held that (1) The L/C had not expired because there was no notice of expiration, so it was automatically renewed; and (2) the Creditor supplied the magic language required on the draft.

On appeal, the Court of Appeal affirmed holding that only the language in the four corners of the L/C mattered.

The lessons for the equipment lessor here are to consider using Letters of Credit as credit enhancements for bad deals. In the world of leasing they can collateralize a balloon payment or a residual. But if the lessor decides to use a Letter of Credit, the terms of the Letter of Credit must be complete in and of themselves, and a Court will not be able to look at other documents outside the Letter of Credit to decide whether or not to enjoin the payment of the Letter of Credit.

This way, the Creditor will know exactly what it is agreeing to and what has to be on the Draft.

Tom McCurnin is a partner at Barton, Klugman & Oetting in Los Angeles, California.

Tom McCurnin

Barton, Klugman & Oetting

350 South Grand Ave.

Suite 2200

Los Angeles, CA 90071

Direct Phone: (213) 617-6129

Cell (213) 268-8291

Email: tmccurnin@bkolaw.com

Visit our web site at www.bkolaw.com

Previous Tom McCurnin Articles:

http://www.leasingnews.org/Conscious-Top%20Stories/leasing_cases.html

[headlines]

--------------------------------------------------------------

Channel Partners Construction Deals Last 30 Days

[headlines]

--------------------------------------------------------------

Top Stories May 28-May 30

(You May Have Missed)

Here are the top stories opened by readers:

(1) Another Equipment Lessor Gets Sued

for Stealing Trade Secrets By Tom McCurnin

http://leasingnews.org/archives/May2013/5_28.htm#stealing_secrets

(2) Balboa Capital Continues Accelerated Growth,

Adds 70 Employees and Additional Office Location

http://leasingnews.org/archives/May2013/5_30.htm#balboa_growth

(3) Archives---May 30, 2000

-- Rick Wilbur shares a recent experience --

http://leasingnews.org/archives/May2013/5_30.htm#archive

(4) "The List" April, 2013

--- Mergers, Acquisitions & Changes

"The Good, the Bad and the Ugly"—

http://leasingnews.org/archives/May2013/5_28.htm#list_april

(5) Leasing 102 by Mr. Terry Winders, CLP

Leasing Term Confusion

http://leasingnews.org/archives/May2013/5_28.htm#confusion

(7) Sears-Roebuck Joins "Why Not Lease It?"

by Kit Menkin

http://leasingnews.org/archives/May2013/5_28.htm#sears

(8) New Hires---Promotions

http://leasingnews.org/archives/May2013/5_30.htm#hires

(9) Amelia Earhart's plane found?

http://www.foxnews.com/science/2013/05/29/amelia-earhart-plane-found-sonar-images-may-have-pinpointed-wreck/

(10) How to Text from Your Computer/Tablet

http://leasingnews.org/archives/May2013/5_28.htm#text

|

[headlines]

--------------------------------------------------------------

### Press Release ############################

Two Promoters of Tax Fraud Scheme Who Sought Millions

in Fraudulent Tax Refunds Sentenced 96 & 87 Months

SANTA ANA– Arturo Villarreal-Alba, of Whittier, was sentenced to 96 months imprisonment and three years of supervised release following imprisonment for conspiracy to defraud the U.S. and mail fraud. Restitution will be determined at a hearing on August 30, 2013 before U.S. District Judge Josephine Staton Tucker.

On October 2, 2012, Arturo Villarreal-Alba, 44, pleaded guilty to conspiracy to defraud the U.S. in a fraudulent federal income tax return filing scheme which claimed false federal income tax refunds and pleaded guilty to mail fraud in a vehicle registration “title washing” scheme.

The investigation led to 55 people being indicted by a federal grand jury in the fall of 2011.

To date, the Operation Stolen Treasures investigation has resulted in 26 defendants pleading guilty to charges filed against them (seven defendants have been sentenced and the remaining 19 defendants are awaiting sentencing); 25 defendants are currently scheduled for trial beginning in June; and three defendants have been convicted at trial.

According to court documents, beginning around March 2009, Arturo Villarreal-Alba, an undocumented alien, began to participate, acting as a promoter, with others in a fraudulent OID (Original Issue Discount) scheme that filed false federal income tax returns with the IRS claiming hundreds of thousands, sometimes millions, in false tax refunds.

The OID schemes conducted by Villarreal-Alba were conducted through two companies “Old Quest Foundation, Inc.” in Fontana and “De La Fuente Ramirez and Associates” (DLFRA) in Rancho Cucamonga, both of which became a subject of investigation conducted by Special Agents with IRS Criminal Investigation known as “Operation Stolen Treasures.”

Villarreal-Alba admitted that between 2009 and 2011, he participated in a vehicle “title-washing” scheme in which he falsely told victims that there was a “special program” wherein vehicles could be paid off and victims would end up owning one or more of the vehicles free and clear. Many victims purchased several vehicles by using their good credit to obtain loans from the car dealers. Rather than having the car loans paid, the victim’s signatures on DMV documents were forged to obtain clear title from the DMV, and then he and his co-schemers would either re-sell the vehicles to unsuspecting victims or obtain title liens on the vehicles from vehicle title loan companies.

According to his plea agreement, Villarreal-Alba admitted that he referred various customers to the OID scheme. Villarreal-Alba also admitted he caused at least two false 2009 OID-based federal income tax returns to be prepared and filed. On March 17, 2010, he caused the filing of a fraudulent tax return using fictitious federal income tax withholding in the amount of $668,000, which claimed a false tax refund of $452,572. He also caused a 2009 OID-based tax return claiming a $535,898 refund in 2010.

Villarreal-Alba used the U.S. mail system in the scheme by fraudulently receiving the “cleaned” pink slips from the DMV by mail. He admitted that he failed to file tax returns and report to the IRS between thousands of dollars in income he made 2009 and 2010 from the tax and vehicle title washing scheme.

Earlier, on May 17, 2013, Osman Norales, 35, of Rancho Cucamonga, the owner and founder of DLFRA, was sentenced by U.S. District Judge Josephine Staton Tucker to 87 months imprisonment, three years of supervised release following imprisonment and ordered to pay restitution to the IRS in the amount of $512,471.

On February 22, 2013, after a two-week jury trial, Osman Norales and his fellow defendant, Genaro De La Fuente of De La Fuente and Associates (DLFRA), were convicted of orchestrating a tax fraud scheme that illegally sought millions of dollars in fraudulent tax refunds. The case against Osman Norales and Genaro De La Fuente also stem from the Operation Stolen Treasures investigation.

The evidence at trial further showed that Norales fraudulently told clients they each could receive tax refunds of hundreds of thousands of dollars by accessing “secret government accounts” through a process that included the filing of IRS Forms 1099 OID. In exchange for the payments, he prepared and filed false income tax returns, which routinely sought hundreds of thousands of dollars – and sometimes millions of dollars – in income tax refunds.

The evidence presented during trial established that Osman Norales was involved with every facet of the fraudulent scheme, including recruiting customers and transmitting millions of dollars by filing false Forms 1099 OID to the IRS, including one tax refund in the amount of $815,000 and one in the amount of $760,000. Norales also charged clients up-front fees of approximately $2,500 and a portion of the false refund received by the client.

In addition to preparing and filing false tax returns for customers, Norales filed two false OID-based income tax returns for himself and his wife. On March 11, 2009, he filed a false 2008 OID-based income tax return for himself, which falsely reported $597,631 in federal income tax withheld and fraudulently claimed a $403,648 refund. Norales was notified by the IRS in a letter dated May 8, 2009 that his OID based tax return was frivolous.

In May 2009, Norales filed a false 2007 OID-based income tax return for himself, which falsely reported $109,984 in federal income tax withheld, fraudulently claiming a $100,916 refund. The evidence at trial showed that Norales mailed the 2007 OID based income tax return after he received the IRS notification.

On September 30, 2009, IRS special agents executed a search warrant at his business at which time Norales was interviewed by IRS special agents. While being interviewed, Norales lied when he told the agents that customers do not pay for his services and that he never gave or attended seminars. Evidence at trial established that Norales and other members of the conspiracy made presentations across the Southland and promoted the secret account theory and other frivolous arguments. Norales also attempted to thwart the investigation by responding to the IRS for customers with arguments that had no basis in the law. Norales also sent three threatening letters to the investigating special agents demanding payment of $20,000,000, then $25,000,000 and $35,000,000 to him in attempts to intimidate them. To thwart the investigation, he also instructed witnesses to lie to the grand jury during the grand jury investigation.

Norales further obstructed justice by fleeing to Texas after indictment and attempted to mislead the U.S. Magistrate Court during a detention hearing in May 2012 by providing materially false information during testimony.

The investigation of Arturo Villarreal-Alba, Osman Norales and other defendants in Operation Stolen Treasures are being conducted by IRS Criminal Investigation in conjunction with the U.S. Attorney’s Office for the Central District of California. The California Highway Patrol-Task Force for Regional Auto Theft Prevention (CHP-TRAP) jointly investigated the vehicle title-washing scheme of Arturo Alba-Villarreal.

#### Press Release #############################

Bookmark us

[headlines]

--------------------------------------------------------------

Rottweiler Puppy

Denver, Colorado Adopt a Dog

THIS PUPPY WILL BE AVAILABLE AT OUR NEXT ADOPTION EVENT: Saturday, June 8th from 11:00 am - 2:00 pm (Or until all of our pups have found homes.) Held at the Petco at Colorado Blvd and I-25. Click for a MAP Do not call Petco. They do not have information on our puppies. Click to visit our website and view our adoption policies, procedures and tips. (Adopt by Owner Dogs will not be at our adoption event.)

AGE: 8 weeks

Good with Dogs

Good with Kids

Up-to-date with Vaccines

More About 411

Not Housetrained

Location: 80222

THIS PUPPY WILL BE AVAILABLE AT OUR NEXT ADOPTION EVENT: Saturday, June 8th from 11:00 am - 2:00 pm (Or until all of our pups have found homes.) Held at the Petco at Colorado Blvd and I-25. 4100 East Mexico Avenue: 9am - 9pm.

http://www.petco.com/content/locator/Details.aspx?storeId=1497&Nav=2

Petco does not have information on our puppies. Click to visit our website and view our adoption policies, procedures and tips. (Adopt by Owner Dogs will not be at our adoption event.)

ADOPTION FEE: This puppy is available for a $150 adoption fee and a $50 spay and neuter deposit. Cash, Visa and MasterCard accepted. We do not accept checks.

BREED CHARACTERISTICS: (Breeds are our best guess)

The Rottweiler dog breed is an intelligent one that thrives with attention from its owners. Rottweilers are quick learners and are eager to please. They will get creative to get any attention. This being said, they must be trained early on with socialization an important aspect.

Two traits define the German shepherd- high intelligence and high energy. This dog was bred to work, so it won't tolerate lazing on the couch all evening. The shepherd requires interesting activities, careful training, and, most importantly a strong hand. Shepherds shed like crazy but are a friend of children and a fearless, disciplined guardian, and a devoted companion.

ABOUT ADOPTING FROM CPR: Our puppies are only available at our adoption events. CPR does not reserve or take requests. Due to our limited foster homes, we cannot hold puppies for anyone nor can we board puppies after being adopted. Because of the overwhelming demands on our foster homes, all adoptions must be done on a first-come, first-served basis. Arrive early. Many people arrive as early as 9am when Petco opens to sign up on the list. The first good, properly qualified prospective home will be able to adopt the puppy. A personal visit to our adoption event is required. We do not ship out of state.

http://www.coloradopuppy.org/availablepups.html

Adopt-a-Pet by Leasing Co. State/City

http://www.leasingnews.org/Conscious-Top%20Stories/Adopt_Pet.htm

Adopt a Pet

http://www.adoptapet.com/

[headlines]

--------------------------------------------------------------

Open Positions at Leasing Funders/Various Locations

You will find many jobs open in various leasing companies. Most are at the main office or a branch. The larger companies change listings and readers should click to them, as they change weekly, if not daily.

Leasing News invites other employers to list their "open positions."

The listing is free.

Advantage Funding

http://www.advantagefund.com/employment.htm

AIG

http://www.aigcorporate.com/addresources/globalcareers.html

Altec

https://careers.altec.com/psc/P90HALT_APP/APPLICANT

/HRMS/c/HRS_HRAM.HRS_CE.GBL?nocrumbs=yes&

Alter Moneta

http://www.altermoneta.com/careers/opportunities.html

Atlas Copco

http://www.atlascopco.com/us/careers/openjobs/

Ascentium Capital

http://ascentiumcapital.atsondemand.com/

Balboa Capital

http://www.balboacapital.com/about_us/careers.aspx

Bank of America

http://careers.bankofamerica.com/overview/overview.asp

Bank of Ozarks

https://bankozarks.applicantharbor.com/jobmainlist.php?a=m

Bank of the West

https://www.bankofthewest.com/about-us/careers/job-search.html

(type in state, and keyword leasing or category)

Channel Partners

http://www.channelpartners.com/careersearch.html

CIT Job Openings

http://sj.tbe.taleo.net/SJ1/ats/careers/

CSI Leasing

http://www.csileasing.com/ViewJobPostings.aspx

Data Sales

http://www.datasales.com/open_jobs.html

De Lage Landen Financial

https://tbe.taleo.net/NA4/ats/careers/jobSearch.jsp

Direct Capital

http://tbe.taleo.net/NA2/ats/careers/jobSearch.jsp

Farm Credit

http://www.farmcreditnetwork.com/careers/opportunities

Financial Pacific

http://www.finpac.com/careers.aspx

Fifth-Third Bank

https://cvg53.cvgs.net/Main/careerportal/JobAgent.cfm

GE Capital

www.ge.com/careers

GreatAmerica Leasing

http://jobs.greatamerica.com/

Home Savings Bank

http://www.home-savings-bank.com/careers.php

Huntington Bank

https://www.huntington.com/us/HNB3400.htm

Key Bank

Click here

Macrolease

http://leasingnews.org/hwanted_macrolease3.html

Marlin Business Services

https://www.marlinfinance.com/career-postings.asp

Madi$on Capital

http://www.madisoncapital.com/employment.

Meridian Bank

https://www.meridianbank.com/careers.html

Microfinancial/Timepayment

http://www.hirebridge.com/jobseeker2/Searchjobresults.asp?cid=5224

Northern California Farm Credit (office listings)

http://www.norcalfc.com/locations.html

Pacific Capital Companies

http://leasingnews.org//hwanted_pacificcap2.html

People's United Bank

https://www3.ultirecruit.com/PEO1003/JobBoard/ListJobs.aspx

PL Capital

http://www.plcapital.com/careers.asp

Prime Alliance Bank

http://www.primealliancebank.com/home/careers

Regions Bank

https://regions.taleo.net/careersection/2/jobsearch.ftl

Republic Financial

http://tbe.taleo.net/NA8/ats/careers/jobSearch.jsp

Sterling Bank

https://www.synovus.apply2jobs.com/ProfExt/index.cfm?fuseaction=m

External.showSearchInterface

Taycor Financial

http://www.taycor.com/about-taycor-financial/careers/

TCF Bank

https://tcfbank.taleo.net/careersection/corporate/jobsearch.ftl?lang=en

TD Bank

https://tderec.ijob.com/recruit/servlet/com.lawson.ijob.util.Login

US Bank

(type position in blank space and/or state)

http://www.usbank.com/cgi_w/cfm/careers/careers.cfm

Wells Fargo

https://employment.wellsfargo.com/psp/PSEA/APPLICANT

Zions Bank

https://zionsbancorp.taleo.net/careersection/

[headlines]

--------------------------------------------------------------

![]()

News Briefs----

Cheap leases offered to spur electric-car sales

http://durangoherald.com/article/20130602/NEWS04/130609996/-1/s

Why It's Riskier to Lend to East Coast Small Businesses

http://www.businessweek.com/articles/2013-05-21/why-its-riskier-to-lend-to-east-coast-small-businesses

Mortgage rates soar; has refi window shut?

http://www.bankrate.com/finance/mortgages/mortgage-analysis.aspx?ic_id=Top_Financial%20News%20Center_link_1

PacWest Completes Acquisition First California Financial Group

http://www.4-traders.com/news/PacWest-Bancorp-Announces-the-Completion-of-Its-Acquisition-of-First-California-Financial-Group--16920842/

GE Capital/Element Financial Establish Border Fleet Services Alliance

http://www.heraldonline.com/2013/05/31/4906823/ge-capital-and-element-financial.html

SQN Capital Management, LLC Announces SQN AIF IV, L.P.

http://www.prnewswire.com/news-releases/sqn-capital-management-llc-announces-sqn-aif-iv-lp-breaks-escrow-209645591.html

Japan Output Gains as Tokyo Prices End Four-Year Slide

http://www.bloomberg.com/news/2013-05-31/japan-output-exceeds-estimates-in-boost-for-abe-revival-campaign.html

Huge tax-reform proposal/eats Wall Street hedging operations

www.nypost.com/p/news/business/the_most_feared_man_on_wall_st

Dell board goes with Michael Dell's $24.4 billion deal

http://www.upi.com/Business_News/2013/05/31/Dell-board-goes-with-Michael-Dells-244-billion-deal/UPI-27041370042475/

Japan’s wheat-import suspension worries state growers

http://seattletimes.com/html/businesstechnology/

Seven & I Sees More Than Doubling North America Stores

http://www.bloomberg.com/news/2013-06-02/seven-i-sees-more-than-doubling-north-america-stores.html

[headlines]

--------------------------------------------------------------

---You May Have Missed

The 12 Worst Supermarkets in America

http://www.thefiscaltimes.com/Media/Slideshow/2012/04/13/12-Worst-Supermarkets-in-America.aspx?index=1

[headlines]

--------------------------------------------------------------

SparkPeople--Live Healthier and Longer

![]()

SparkPeople--Live Healthier and Longer

Secret Weapon Ingredients-Healthy Foods That Go With Almost Anything

http://www.sparkpeople.com/resource/nutrition_articles.asp?id=221

[headlines]

--------------------------------------------------------------

Baseball Poem

Three Run Homers, or, Rupert Brooke Celebrates Baseball

I think that I shall never see

A poem lovely as a three

Run homer when the team is pressed

Against the wall and quite distressed,

A homer that may at evening scare

A nighthawk circling in the air,

Or, 'neath the arc lights blazing bright,

Restore the score and set things right,

Rescue the pitcher and save the game,

And set the home team crowd aflame:

Poems are made by fools like me,

But only heroes knock in three.

-annoymous-

[headlines]

--------------------------------------------------------------

Sports Briefs----

McNabb: RGIII has too much going on

http://www.washingtonpost.com/sports/redskins/donovan-mcnabb-has-some-advice-for-robert-griffin-iii-whos-doing-too-much/2013/05/31/1dd7ec4c-ca37-11e2-9245-773c0123c027_story.html

Kuchar wins Memorial; Woods finishes with largest deficit since 1996

http://www.nypost.com/p/sports/golf/kuchar_wins_memorial

Ohio State prez apologizes for comments

http://espn.go.com/college-sports/story/_/id/9335760/ohio-st-president-gordon-gee-apologizes-big-ten-comments-notre-dame-sec

[headlines]

--------------------------------------------------------------

![]()

California Nuts Briefs---

Inside San Jose's largest homeless encampment, the Jungle

http://www.contracostatimes.com/bay-area-news/ci_23366229/inside-san-joses-largest-homeless-encampment-jungle

Albany city manager will step down

http://www.contracostatimes.com/west-county-times/ci_23353558/albany-city-manager-will-step-down

Vineman Triathlon bearing plenty of fruit

http://www.pressdemocrat.com/article/20130601/SPORTS/130

Teen swept over Yosemite falls

http://www.sfgate.com/bayarea/article/Search-continues-for-Yosemite-visitor-19-4570053.php

[headlines]

--------------------------------------------------------------

![]()

“Gimme that Wine”

http://www.youtube.com/watch?v=EJnQoi8DSE8

If Only the Grapes Were the Whole Story---Eric Asimov

http://www.nytimes.com/2013/06/05/dining/the-big-question-whats-in-wine.html?ref=dining&_r=0

Wineries Banking on Busier Tourist Season

http://www.winesandvines.com/template.cfm=news&content=117020

Costco Reports 8% Rise In Beverage Alcohol For First Three Quarters As Spirits Sales Lead Growth

http://www.shankennewsdaily.com/index.php/2013/05/31/5969/costco-reports-8-rise-in-beverage-alcohol-for-first-three-quarters-as-spirits-sales-lead-growth/

Sonoma County sees surge in new vineyard projects

http://www.pressdemocrat.com/article350?Title=A-vineyard-renaissance

AUCTION NAPA VALLEY 2013

http://707.pressdemocrat.com/wineries

The Best Place in Canada for Wine Tourism

http://www.huffingtonpost.ca/vacayca/okanagan

Free Mobile Wine Program

http://leasingnews.org/archives/Feb2010/2_26.htm#mobile

Wine Prices by vintage

http://www.winezap.com

http://www.wine-searcher.com/

US/International Wine Events

http://www.localwineevents.com/

Winery Atlas

http://www.carterhouse.com/atlas/\

Leasing News Wine & Spirits Page

http://two.leasingnews.org/Recommendations/wnensprts.htm

[headlines]

----------------------------------------------------------------

![]()

This Day in History

1539 - Hernando De Soto claimed Florida for Spain.

1621 - The Dutch West India Company received a charter for New Netherlands, now known as New York.

1770-Mission San Carlos Borromeo de Carmelo: the second California mission to the Indians.

http://www.californiamissions.com/cahistory/sancarlos.html

http://missions.bgmm.com/index.htm

1781-Jack Jouett made a heroic 45-mile ride on horseback during the night of June 3-4, to warn Virginia Governor Thomas Jefferson and the legislature that the British were coming. Jouett rode from a tavern in Louisa County to Charlottesville, VA, in about 6 ½ hours, arriving at Jefferson's home at dawn on June 4. Lieutenant Colonel Tarleton's British forces raided Charlottesville, but Jouett's warning gave the Americans time to escape. Jouett was born at Albermarle County, VA, December 7, 1754 and died at Bay, JY, in 1822 ( exact date not known ).

http://www.ushistory.com/jouett.htm

1800 - John Adams, the second president of the United States, becomes the first president to reside in Washington, D.C., when he takes up residence at Union Tavern in Georgetown. The city of Washington was created to replace Philadelphia as the nation's capital because of its geographical position in the center of the existing new republic. The states of Maryland and Virginia ceded land around the Potomac River to form the District of Columbia, and work began on Washington in 1791. French architect Charles L'Enfant designed the city's radical layout, full of dozens of circles, crisscross avenues, and plentiful parks.

1808-birthday of Jefferson Davis, American statesman, US Senator, only president of the Confederate States of America. Imprisoned May 10, 1865-May 13, 1867, but never brought to trial, deprived of rights of citizenship after the Civil War. Davis was born at Todd County, KY, and died at New Orleans, LA, Dec. 6,1889. His citizenship was restored, posthumously, October 17,1978, when President Carter signed an Amnesty Bill. This bill, he said, “ officially completes the long process of reconciliation that has reunited our people following the tragic conflict between the states. “ Davis's birthday anniversary is observed in Florida, Kentucky, and South Carolina on this day, in Alabama on the first Monday in June and in Mississippi on the last Monday in May. Davis's birth anniversary is observed as Confederate Memorial Day in Tennessee.

http://www.beauvoir.org/

1851-First Baseball Uniforms: The Knickerbocker Base Ball Club of New York City donned the sport's first uniforms: straw hats, blue full-length trousers and white shirts.

1856-Cullen Whipple of Providence, RI obtained a patent for a screw machine to make pointed screws. Prior to this invention, screws were blunt on their threaded ends, and it was necessary to bore a hole in order to insert them.

1856-Gov. Johnson proclaimed San Francisco in a state of insurrection because of Committee of Vigilance activities, and ordered all persons subject to military duty to report to Maj.-Gen. William T. Sherman to quell the insurrection.

1860 -The Great Camanche Tornado began its deadly trek near Cedar Rapids, Iowa, and ended its journey over Lake Michigan. 175 people lost their lives and 329 were injured. The town of Camanche, Iowa, on the Mississippi River, was destroyed. Total damage was 945,000 dollars (note - 1860 dollars).

1862-Haiti recognized as a nation by the United States.

1862-Liberia recognized as a nation by the United States

1863 - Gen. Lee, with 75,000 Confederates, launched a second invasion of the North. Lee led his troops into Maryland and then Pennsylvania, to meet the Army of the Potomac again, this time around a small town called Gettysburg.

1864-Battle of Cold Harbor. Although Confederate General Robert E. Lee had placed his troops behind considerable breastworks, Union General Ulysses S. Grant launched an all-out attack on the Southern army. More than 7,000 Federal troops were killed within on-half hour of the battle on the first attack. General Lee won his last victory over Union forces, numbering 108,000 against this 59,000. 1500 Confederate troops were also killed. In an eight –minute period more men fell in an assault on entrenched Confederate troops than in any other like period of time. After a second unsuccessful attack, Grant's orders for a third assault were all but ignored. Grant had new and ill trained troops, and his battle plan was not carried out by his officers. Compounding this was the battlefield tradition held that the first commander who sought a truce in order to tend to the wounded was the loser. Grant refused to admit defeat by seeking such a truce and the wounded were left on the ground for three days following the battle. General Lee also refused to be the first to go after his wounded, and therefore thousands of wounded men from both sides died either from their wounds, hunger, thirst or exposure. Between May 7 and June 3, federal losses were 50,000 men, Confederate 32,000. The North could replace its losses fully, especially paying for troops, many of them immigrants from Europe, but the South could not.

(bottom half of http://memory.loc.gov/ammem/today/jun03.html )

http://saints.css.edu/mkelsey/cold.html

http://civilwar.bluegrass.net/battles-campaigns/1864/640601-03b.html

1877- Elizabeth Fires Lummis Ellet birthday; U.S. author and historian who used primary and direct research for her monumental three-volume Women of the American Revolution (1848), and the Pioneers of the American West (1852) as well as other books about women.

http://chnm.gmu.edu/dimenovels/authors/fleming.html

1884-the first national political convention of a major party president over by an African-American met in the Exposition Building, Chicago, IL. John Roy Lynch, an African-American politician who has served three terms as a congressman from Mississippi, was nominated for temporary chairman of the Republican Party by Henry Cabot Lodge. The nomination was supported by Theodore Roosevelt and George William Curtis, and was carried by a vote of 424 for Lynch a to 384 for Powell Clayton. The convention nominated James Gillespie Blaine for president and General John Alexander Logan for vice president. November 4 th Grover Cleveland was elected president of the United Sates and Thomas A. Hendricks was elected vice-president. The electoral vote was Cleveland, 219, James G. Blaine, Republican of Maine, 182. The popular vote was Cleveland, 4,911,017 and Blaine 4,848,224. A very interesting presidential election as it was fought mainly with attacks on the reputation of the rival candidates. The Republican candidate, James G. Blaine, on his basis of letters he had written, was accused of having profited from the Credit Moblier scandal involving the building of the Union Pacific Railroad. His opponents sang: “Blaine, Blaine, James G. Blaine, the continual liar from the state of Maine.” The Democratic candidate Grover Cleveland, was accused of having fathered an illegitimate child, which in his forthright manner, he admitted. The turning point of the election was a remark made on October 9 by the Rev.. Samuel D. Burchard in New York, in the presence of Blaine, that the Democrats were the party of “Rum, Romanism and Rebellion.” Blaine did not disavow the remark, and the Irish-American Roman Catholics of New York were outraged. Cleveland carried the state by 1149 votes and thereby won the election. In 1888, President Grover Cleveland did not campaigning, saying it was beneath the dignity of the office of the president. Benjamin Harrison, the Republican candidate, brought the front porch campaign to its peak, and won. In 1892, Grover Cleveland campaigned and won the election as president along with Adlai E. Stevenson as vice-president. The electoral vote was 277 to Harrison's 145, and popular vote 5,554,414 to President Harrison's 5,190,802. The Populist Party won Electoral College votes, carrying Kansas, Colorado, Idaho and Nevada, 22 electoral votes and $1,027,329 for candidate James B. Weaver, perhaps the Ross Perot of his day.

http://www.arlingtoncemetery.com/jrlynch.htm

http://www.amazon.com/exec/obidos/ASIN/0226498182/

inktomi-df1-2-20/104-3603723-3237564

1880- Alexander Graham Bell transmitted the first wireless telephone message on his newly-invented "photophone.” The photophone functioned similarly to the telephone, except the photophone used light as a means of projecting the information, while the telephone relied on electricity. http://memory.loc.gov/ammem/today/jun03.html

1888 -- "Casey at the Bat" first appears in print, in the San Francisco Examiner.

1886 - Grover Cleveland became the first U.S. President to get married in the White House. He exchanged vows with his bride, Florence Folsom. His bride was 27 years younger than he. While he ran for a second term, he did not campaign, but stayed in the White House with his young bride. He lost. But he ran again in 1892, this time, he campaigned, and he won. The only president to lose his office and then win it back again.

1904-birthday of Charles Drew-African American physician who discovered how to store blood plasma and who organized the blood bank system in the US and UK during WWII. Born at Washington, DC, he was killed in an automobile accident near Burlington, NC, April 1, 1950.

http://dearborn.boston.k12.ma.us/gr7c.htm

http://www.galegroup.com/free_resources/bhm/bio/drew_c.htm

1906-birthday of African-American Josephine Baker, the very popular Parisian chanteuse known as "Le Jazz Hot," was a heroine of French resistance in WWII. She was born in St. Louis, Missouri, but moved to France because she was a black Lesbian and received better acceptance in Europe. She received Legion d'Honneur and the rarer Medaille de la Resistance from French President Charles de Gaulle for her work during World War II on behalf of France. She acted as a courier when she toured North Africa and other places as she sang and performed for Allied troops. She adopted 19 children, all from different nationalities. In later life when her money ran out and she was evicted from her home in France, Princess Grace of Monaco (formerly Grace Kelly of Philadelphia and Hollywood) gave her a villa in Monaco and financed her new act Josephine '75 to celebrate her 50 years in Paris. She died in her sleep after 14 performances. After WWII she had returned to the U.S. to try again but faced such racial discrimination for her act at the Stork Club that she returned to France where she was an honored entertainer and admired hero.

http://www.cmgww.com/stars/baker/

http://www.jerryjazzmusician.com/mainHTML.cfm?page=eanwood.html

1911-Birthday of Jean Harlow - the original blond sex-queen of Hollywood who was haunted by a chaotic private life. She died when when her mother, as an abiding by Christian Scientist, refused to send her to a hospital for kidney failure. Her kidneys had been injured by a former husband who then shot himself. Her persona in the movies was a wise- cracking blond bombshell with a heart of gold.

http://www.jeanharlow.com/