Connect with Leasing News ![]()

![]()

![]()

![]() Add me to mailing list |

Add me to mailing list | ![]() |

| ![]() Search |

Search | ![]() Stress Release

Stress Release

Advertising | All Lists | Archives | Classified Ads | This Day In American History

Leasing News is a web site that posts information, news, and

entertainment for the commercial bank, finance and leasing industry

kitmenkin@leasingnews.org

![]()

Thursday, May 30, 2013

![]()

Today's Equipment Leasing Headlines

Archives---May 30, 2000

-- Rick Wilbur shares a recent experience --

Classified Ads---Controller

New Hires---Promotions

Balboa Capital Continues Accelerated Growth,

Adds 70 Employees and Additional Office Location

Letters?---We get eMail!

(Mostly chronological)

Classified Ads---Help Wanted

Financial and Sales Training

Low Default Rate, Growing Risk Receptivity

Fitch Credit Desk April, 2013 Report

FDIC-Insured Institutions Earned $40.3 Billion

in The First Quarter of 2013

Banks Net Interest Margin Pain Deepens

By Kevin Dobbs and Marshall Schraibman

Star Trek into Darkness/Stories We Tell

The Last Stand/Life Is Sweet/The File on Thelma Jordon

Film/DVD Reviews by Fernando Croce

Classified ads—

Collector/Collections/Consultant/Communications

Chinese Shar-Pei/German Shepherd Dog/Mixed (medium coat)

San Francisco, California Adopt-a-Dog

News Briefs---

IASB and FASB Publish New Dual Approach to Lease Accounting

4 Myths About Leasing A New Car

Why Small Businesses Have Trouble Getting Credit

Risk of Bank Failures Is Rising in Europe, E.C.B. Warns

Bank of Montreal misses estimates, charges squeeze profit

Family Breadwinner Is More Often a Woman

Switzerland to Allow Its Banks to Disclose Hidden Accounts

No dodging mess: Guggenheim may lose $1B in cable deal re-do

Nasdaq Is Fined $10 Million Over Facebook I.P.O.

Amelia Earhart's plane found?

Adam Levine Clarifies ‘I Hate This Country’ Remark

Broker/Funder/Industry Lists |

Features (collection)

Top Ten Stories Chosen by Readers |

Top Stories last six months

www.leasingcomplaints.com (Be Careful of Doing Business)

You May have Missed---

SparkPeople--Live Healthier and Longer

Sports Briefs---

California Nuts Brief---

"Gimme that Wine"

This Day in American History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

######## surrounding the article denotes it is a “press release” and was not written by Leasing News nor information verified, but from the source noted. When an article is signed by the writer, it is considered a “by line.” It reflects the opinion and research of the writer.

Please send Leasing News to a colleague and ask them to subscribe

Real news on banking, financing, leasing.

Contact: kitmenkin@leasingnews.org

[headlines]

--------------------------------------------------------------

Archives---May 30, 2000

-- Rick Wilbur shares a recent experience --

“Kit: Given the prevailing funding environment I thought it appropriate and timely to share a recent experience with you. Please feel free to pass this along.

“I recently had a conversation with the credit manager of a 'funding source', a gentleman that I've known and respected for many many years. During the course of the conversation I asked him how their operation was doing since the last transaction we did with them was an absolute nightmare to complete (documentation and funding). He told me things were much better and encouraged me to try them again. Due, at least in part, to my long standing relationship with him I responded by previewing a transaction I had on my desk for a Lessee that we had done 12 Corp Only leases for during the past eighteen months. A very good customer. After providing transaction details he thought the deal would be approved and invited it in. I agreed to submit it despite this funding sources high rate. In my opinion I was offering them 'a cherry'.

“Early the next day we received a faxed approval for a $50,000 Corp Only with a limitation on points. I asked if we exceeded the allowed limitation on points could we split the difference with the funding source. My old friend didn't know but would check. Approximately five hours later we received another fax from 'the Broker Manager'. Paraphrased the fax said:(1) the deal didn't fit their normal corp only requirements and essentially they made several exceptions for us (this was news to me because I didn't know what their normal corp only requirements were and didn't ask for any exception to be made), (2)the paydex was too low to do a Corp Only (our D&B reported a Paydex of 79), (3) the company had too few employees (D&B reported 40 and a recent article that we provided reported not only had the company just raised an additional $6.4 million but also stated the company expected to increase from 70 employees to 100 by the end of July).

“The guy wasn't impressed and bottom line they now wanted a comparable corp only reference that dated back at least a year and a written explanation of numerous inquiries on the principals TRW despite the fact that there was no personal guaranty (this started to feel a lot like homework). When I told him that it was a bit late in the process to add conditions to their approval he pretty much told me ....'too %#@^ing bad'. I told him that I'd try to get the information but in light of the fact that we had not needed that information for any of the 12 other transactions we completed and that we had already conveyed their approval, I wasn't sure I could get the information. I asked him if he would honor his approval if I couldn't get what he wanted and the guy absolutely refused to answer my question. He told me point blank that he wasn't going to tell me. Almost thirty-five years in this business and I thought I'd heard it all.

“I believe the relationships that we enjoy with most of our funding sources are based on mutual respect, mutual trust and a sincere concern and appreciation for the other. Fortunately, the situation I described in this e-mail is an aberration but I believe it may be an indication of the current mentality of some in the community. If the funders can't trust and respect the originators and the originators can't trust and respect the funders we're all in for a very rough ride.”

Rick Wilbur

Managing Partner

Media Capital Associates, LLC

Today

rwilbur@charterAZ.com

Managing Partner

Charter Capital

Member of OneWorld Business Finance

(Still going strong at www.charterAZ.com)

Bookmark us

[headlines]

--------------------------------------------------------------

Classified Ads---Controller

(These ads are “free” to those seeking employment

or looking to improve their position)

| Chicago, IL experienced in lease accounting, operations, management, and Sarbanes-Oxley. Seeking position with equipment lessor. Would consider contract assignments or relocating. Email: leasecontroller@comcast.net |

| Southeastern, MI Controller & Management experience w/ equip lessors &broker. MBA, CPA w/ extensive accounting, management, securitization experience with public and private companies. Willing to relocate. Email: Leasebusiness@aol.com |

Free Posting for those seeking employment in Leasing:

http://www.leasingnews.org/Classified/Jwanted/Jwanted-post.htm

All “free” categories “job wanted” ads:

http://www.leasingnews.org/Classified/Jwanted/Jwanted.htm

[headlines]

--------------------------------------------------------------

New Hires---Promotions

Corinne Mulqueen Seton joined NXT Capital Equipment Finance, Chicago, Illinois, as Managing Director of Capital Markets in February, 2013. Her "...responsibilities include managing NXT’s third party indirect origination and syndication activities. She is located in San Francisco, California. Previously she was lease originations & acquisitions, Cypress Financial Corporation (April, 2010-December, 2012), senior vice president, GE Capital (2005-2010), managing director, GATX Corporation (1990-2005), vice-president, Security Pacific Bank (1987-1990). Yale University, Bachelor of Arts, English Literature .Organizations: San Francisco Yacht Club, Tiburon Peninsula Club Dollar Point Homeowners Association, Equipment Leasing & Finance Association.

www.linkedin.com/pub/corinne-mulqueen-seton/2/687/49b

[headlines]

--------------------------------------------------------------

#### Press Release ##############################

Balboa Capital Continues Accelerated Growth

Adds 70 New Employees and Additional Office Location

(This company has Bulletin Board Complaints plus “Tagged for Stealing Corporate Secrets” www.leasingcomplaints.com)

Company responds to strong demand for fast, dependable financing solutions by expanding staff in all departments.

Balboa Capital opened an additional office location in Irvine, California

There is a strong demand for our diverse portfolio of financing products, and we are expanding our staff to meet the needs of our valued customers and vendor partners.

Balboa Capital, a leading provider of small business loans and equipment leasing in the United States, hired 70 new employees to accommodate the company’s rapid increase in new business and acquisition of several new strategic partners. To accommodate its growth, Balboa Capital added a new office location in a building adjacent to its corporate headquarters in Irvine, California.

Phil Silva

President

Balboa Capital

“This is a great time for Balboa Capital,” said Phil Silva, President of Balboa Capital. “There is a strong demand for our diverse portfolio of financing products, and we are expanding our staff to meet the needs of our valued customers and vendor partners, and provide them with the exemplary level of customer service we are known for.” Balboa Capital’s 70 new staff members work in a variety of departments throughout the company, including sales, business development, accounting, customer service, marketing and information technology (IT).

Balboa Capital recently conducted a survey of over 500 of its customers nationwide, and 98% of them gave the company the highest satisfaction marks possible. “The results of this survey validate our mission, which is to provide our customers with the best financing experience possible,” said Mr. Silva. Balboa Capital knows that many business owners seek out unbiased opinions from their peers – or look for customer testimonials – when it comes time to select a financing company. So, the company has a YouTube Channel and dedicated website page with equipment leasing video testimonials from its actual customers.

About Balboa Capital

Balboa Capital is one of the largest privately-held independent finance companies in the United States delivering access to capital, speed of processing, dependable funding, industry-leading technology and innovative marketing tools that small and medium-sized customers require to fuel their growth and success. Celebrating 25 years in business in 2013, Balboa Capital markets its products through their small ticket, middle market and vendor sales channels. The company’s comprehensive capabilities include equipment leasing, commercial financing, small business loans, equipment vendor financing and franchise financing. You can learn more by visiting http://www.balboacapital.com.

#### Press Release #############################

[headlines]

--------------------------------------------------------------

Letters?

---We get Email!

(Mostly chronological)

Another Equipment Lessor Gets Sued

for Stealing Trade Secrets

By Tom McCurnin

http://leasingnews.org/archives/May2013/5_28.htm#stealing_secrets

"I read Tom McCurnin’s article today in The Leasing News. As a person who was very close to the situation involving Balboa and Truxton I was immediately whisked back to that night and have had this stupid smile on my face all morning. I’m still smiling. I believe a Balboa salesman and the police were also involved and there may have been a picture or two. We all do stupid things as young men but some of us have a penchant for over the top. One of the funniest moments in my very long leasing life.

"Thanks for the reminder."

Rick Wilbur

Managing Partner

CHARTERCAPITAL

---------------------------------

Equipment Rental and Leasing in Canada Report

http://leasingnews.org/archives/May2013/5_28.htm#canada

"Thanks for the linking to the IBISWord report entitled Industrial Equipment Rental & Leasing. I purchased the report expecting to read insights into both equipment Rental and Leasing in Canada. Sadly the report is really about the short term rental business and there is very little content covering the equipment leasing industry in Canada.

"The report is good but it is does not provide insight into industrial equipment leasing activity of traditional market participants (Wells, Element, CIT, etc.). I actually requested a refund from IBISWorld after reviewing the content of the report. The report discusses the market leadership of Hertz and United Rentals. Neither firm is a member of the Canadian Finance and Leasing Association and most of the additional discussion relates to the economic drivers of equipment rental activity.

"Readers of the description of the report may get the wrong impression of the size of the Canadian Commercial Equipment Finance market."

Regards

Hugh Swandel

Senior Managing Director, Canada

The Alta Group

(I have been trying to put in more "Canadian" lease/finance stories in Leasing News. IBIS/World is an Australian research company formed in 1971. The description of the report came from their web site. There are a number of banks and funders who lease to the rental industry, and want to do more, such as Paul Weiss at Panthera, and perhaps the Canadian marketplace echoes the U.S. I do hope you get your money back since you were dissatisfied. Editor)

---------------------------------

Balboa Capital Tagged for Stealing Corporate Trade

Secrets of TimePayment Systems

By Tom McCurnin, Leasing News Legal Editor

leasingnews.org/archives/May2013/5_20.htm#balboa_stealing_secrets

Lessons/Law of Trade Secrets/If a salesperson!

What Lessor Can Do to Stop Trade Secret Theft

By Tom McCurnin

http://leasingnews.org/archives/May2013/5_22.htm#lessons

"Tom McCurnin has done outstanding work for Leasing News. The insights from your experiences are valuable to the readers. I was especially pleased to read your detailed explanation of the Balboa-MicroFinancial case.

"His efforts will undoubtedly be helpful in cleaning up some of the shady practices in the leasing industry."

Bruce Kropschot, Senior Managing Director and

Merger & Acquisition Advisory Practice Leader

The Alta Group

--

"I have emailed Tom in the past to tell him how much I enjoy his writings in Leasing News. He has a real gift. I let him know how much I love reading his articles. I sure hope others email him with compliments because he puts a lot of his own time into educating the readers."

Rosanne Wilson, CLP, BPB

1st Independent Leasing, Inc.

---------------------------------

Four New CLP's from First American Equipment Finance

http://leasingnews.org/archives/May2013/5_22.htm#clp

"Thank you or the nice article about CLP’s in Leasing News. As a board member of the Certified Leasing Professional Foundation it is my hope to give back to the industry that has supported me for the past 20 years. I believe promoting education of our craft is a way to do that. Support from the community such as your article makes our job a little easier.

Carl Villella, CLP

President

Acceptance Leasing & Financing Service, Inc.---

---

"I just wanted to drop you a thank you note for the awesome article on the new CLP’s. That will surely create some buzz on the foundations behalf!"

Blessings, Kyle

Kyle W. Gilliam, CLP

President

Arvest Equipment Finance

---------------------------------

![]()

"I am interested in receiving updated cases on leasing issues. Can you guide me on how to receive this information from leasing news website?"

Sherry Lowe Johnson

Dilworth Paxson LLP

Philadelphia, PA

(Thank you, I bet many readers would be interested in my response...

Updates will be in top stories, although we are behind in posting and will have more updates posted hopefully by the end of this week.

(Also features are updated, such as bank beat, career crossroads, leasing 102, Tom McCurnin and others. Both are available by clicking on "Top Stories" in the top right hand section of both the news edition and the web site. Search is in the top tool bar with the magnifying glass icon.

(Also in the middle of the masthead, between the headlinesand news briefs the specific sites are noted:

((Broker/Funder/Industry Lists | Features (collection)

Top Ten Stories Chosen by Readers | Top Stories last six months

www.leasingcomplaints.com (Be Careful of Doing Business)

(In addition, don't hesitate to send me an email if you are looking for something specific, and can't find it. kitmenkin@leasingnews.org)

---------------------------------

Balboa Capital, Newport Beach, California

Bulletin Board Complaint #12--Decisive

By Christopher "Kit" Menkin, Publisher

leasingnews.org/archives/May2013/5_13.htm#balboa_capital_complaint

"What amazes me is the banks & funding sources that still do business with BC. BC has no boundaries. They are unscrupulous and continue to give our industry a bad name. Why don’ you write an article about that?"

Regards,

Craig Rose

Magellan Financial, Inc.

(The Company did make the Leasing News Hall of Fame: Bad Boys

http://www.leasingnews.org/Conscious-Top%20Stories/bad_boys.htm )

---

"Just a note to say how much I appreciate the good work you are doing to expose 'frauds' and 'scammers' and those who misrepresent their business."

Craig Callaway, President

Callaway Financial Solutions

---------------------------------

Labrador Hound Mix

Sudbury, Massachusetts Adopt-a-Dog

http://leasingnews.org/archives/May2013/5_20.htm#adopt

"Lived in Sudbury for almost 30 years and have many friends who have adopted animals from Buddy Dog. It is a wonderful place !!"

Tom Reihle

2001 Financial Corporation

Financing for Business and Professionals

---------------------------------

NAELB Welcomes New Board of Directors

http://leasingnews.org/archives/May2013/5_15.htm#naelb

"Not all brokers are singing the blues...2013 has the makings of another amazing year for my business. Here are some early highlights:

1) Avg. points per deal up +1.5 points vs. 2012

2) 50% of 2012 fee income already booked (100K+)

3) New Business 25% of 2013 Volume

4) Funded deals with 20 different banks in 2013

"I do not have a website, have never paid for a lead and refuse to sell working "capital" in its current form. Rarely do my customers go elsewhere after we fund our first transaction. In last five years, I have funded over 100 customers netting $675K in fee and can count on one hand the number of deals lost to the competition in 2013."

(Name Withheld at reader's request)

---------------------------------

Sales Makes it Happen by Steve Chriest

“Rethinking Customer Loyalty”

"As a thought provoking reaction to Steve Chriest’s article on Rethinking Customer Loyalty.

"Loyalty is Convenience. It is difficult to change suppliers. New contracts, rewrite of procedures, red tape, exit fees. The barrier to exit is a driver to loyalty.

"I think Steve is right. Also in his statement that loyalty is dependent on the rewards. Unfortunately, there is a lack of knowledge and sometimes just quantifiable data to make the assessment of what loyalty is worth. But how will you find out?

"The improvements made in search engines, the functionality of rating and comparison web sites and the ever increasing focus on cost (we want cheap - cheaper - free) are actively undermining any customer loyalty program.

If there are 30 ways to measure your customer relationship, you can be sure to find maybe just 2 relevant ones that people will compare. But they may not be descriptive of your service. Especially websites where you may sort suppliers on price, available stock, location, customer review scores, etc.

In modern days, the choice for a product or service is more and more decided on references. It may well pay off to create incentives and ways for customers to recommend their experience with your company to their network. On Amazon and EBay, when I buy something a second time, I mention I am a return customer. Still, even such feedback sure doesn't show in a statistic that can be sorted!

"I think that while the web is more and more the place to store and find information on products and services, the content and search options are fundamentally flawed to assist companies in making clear their true added value on all aspects of their service offering.

"Perhaps in modern days we need to rethink loyalty to the level of letting it go. A stable flow of new customers may be just as valuable as a constant number of loyal customers. I realize though this comes at a price. Systems and controls must be set-up to add and qualify new customers at an increasing rate. And also the checks to deactivate unprofitable relationships may need a review (like hire-and-fire).

"One way to destroy loyalty is to offer entry bonuses to new customers that are not available to existing ones. This way of rewarding promotes frequent change of supplier and builds in disloyalty. Should not complain if you work that way and perhaps the offerings in the telecom and energy sector (at least in the Netherlands) indicates that this mindshift has already taken place in some industries. Long term customers are losers who pay too much for the same offering....

"Did we lose something on the internet highway??

Kind regards,

Sicco Jan Bier

Weesp, Netherlands

[headlines]

--------------------------------------------------------------

Financial and Sales Training

(For our "Lease School/Franchisors" list, please click here)

These individuals act as a consultant in 75% or more of their main business, actually training staff or individuals of a leasing company. These are not schools or franchisors, which can be viewed

by clicking here.

| Winders Consulting Co., Inc. | |

| Adrian Miller | Wheeler Business Consulting, LLC |

Several hold classes, and most will travel to their client's premise.

To qualify for this page, they must be an active member in an equipment leasing association.

| Working Capital Loans for Small Businesses | |

Channel Partners is now offering a new Easy Rewards program that allows you to earn rewards on EVERY deal over $15,000 in EVERY state! |

|

[headlines]

--------------------------------------------------------------

Leasing Industry Help Wanted

Please see our Job Wanted section for possible new employees

[headlines]

--------------------------------------------------------------

Low Default Rate, Growing Risk Receptivity

Fitch Credit Desk April, 2013 Report

"Banks Loosen Up: The persistently low interest rate environment is having a more pronounced impact on risk receptivity: 66% of ‘CCC’ or lower rated volume was recently trading above par, and the equity value of a group of 172 ‘B’ rated companies had expanded 22% since the beginning of the year...

"...the second-quarter edition of the Federal Reserve’s 'Senior Loan Officer Survey' revealed the most accommodating conditions for borrowers in two years. The surge in asset values provides a strong support for the low default rate environment. However, the same easy money conditions that have been an aid in the recovery can also begin to contribute more significantly to risk buildup. While debate rages on regarding the timing of the Fed’s exit strategy, history cautions that the impact of easy money policy can linger and the default rate can remain deceptively low even as credit quality deteriorates. The last episode of Fed loosening and tightening offers insight into this dynamic...

"This year's surge in asset values provides a strong support for the low default rate environment - recently 66% of ‘CCC’ or lower rated volume was trading above par, and the equity value of a group of 172 ‘B’ rated companies had expanded 22% since the beginning of the year. However, the same easy money conditions that have been an aid in the recovery can also begin to contribute more significantly to risk buildup. While not in the league of 2005 - 2007 trends, the growing volume of covenant-lite loans illustrates that post credit crisis conservatism is waning. In addition, corporate profit growth is decelerating while debt is rising.

"From Stemming Crisis to Checking Excess: The Fed’s last tightening campaign began in June 2004 and continued for two years until the summer of 2006:

"Despite the Fed’s best efforts to tame speculative behavior, the accumulated impact of loose monetary policy in the aftermath of the 2001–2002 downturn persisted, and transactions continued to come to market with aggressive terms and leverage levels. This occurred even as credit quality was deteriorating. In 2007 especially, corporate profit growth was under significant strain but that year, ‘CCC’ rated issuance soared to, at the time, a record high. Given the heated funding environment, the default rate remained below 1% in 2006 and 2007.

"The low default rate perpetuated the cycle of aggressive transactions and was in the end a red flag of systemic risk rising rather than shrinking.

Context Is Key: While not in the league of 2005–2007 trends, the growing volume of covenant-lite loans (year over year, up seven-fold to $93 billion, according to Thomson Reuters LPC) illustrates that postcredit crisis conservatism is beginning to evaporate. Debt is also rising as corporate profitability slows and investment remains sluggish.

Full 28 page report with charts:

http://www.leasingnews.org/PDF/CreditDeskReport_5302013.pdf

[headlines]

--------------------------------------------------------------

FDIC-Insured Institutions Earned $40.3 Billion

in The First Quarter of 2013

Commercial banks and savings institutions insured by the Federal Deposit Insurance Corporation (FDIC) reported aggregate net income of $40.3 billion in the first quarter of 2013, a $5.5 billion (15.8 percent) increase from the $34.8 billion in profits that the industry reported in the first quarter of 2012. This is the 15th consecutive quarter that earnings have registered a year-over-year increase.

Half of the 7,019 insured institutions reporting financial results had year-over-year increases in their earnings. The proportion of banks that were unprofitable fell to 8.4 percent, from 10.6 percent a year earlier.

"...tighter net interest margins and slow loan growth create an incentive for institutions to reach for yield, which is a matter of ongoing supervisory attention, FDIC Chairman Martin J. Gruenberg said (note the story that follows on "Net Interest Margins."

First quarter net operating revenue (net interest income plus total noninterest income) totaled $170.6 billion, an increase of $2.7 billion (1.6 percent) from a year earlier, as noninterest income increased by $5.1 billion (8.3 percent) and net interest income declined by $2.4 billion (2.2 percent). The average net interest margin fell to its lowest level since 2006. Total noninterest expenses were $5.3 billion (3.9 percent) below the level of the first quarter of 2012. Banks set aside $11 billion in provisions for loan losses, a reduction of $3.3 billion (23.2 percent) compared to a year earlier.

Asset quality indicators continued to improve as insured banks and thrifts charged off $16.0 billion in uncollectible loans during the quarter, down $5.8 billion (26.7 percent) from a year earlier. The amount of noncurrent loans and leases (those 90 days or more past due or in nonaccrual status) fell by $15.7 billion (5.7 percent) during the quarter, and the percentage of loans and leases that were noncurrent declined to the lowest level since 2008.

The number of problem banks continued to decline.

The number of banks on the FDIC's "Problem List" declined from 651 to 612 during the quarter. The number of "problem" banks reached a recent high of 888 institutions at the end of the first quarter of 2011. Four FDIC-insured institutions failed in the first quarter, the smallest number since the second quarter of 2008 when two institutions were closed. Thus far in 2013, there have been 13 failures, compared to 24 during the same period in 2012.

The Deposit Insurance Fund (DIF) balance continued to increase.

The DIF balance — the net worth of the fund — rose to $35.7 billion as of March 31 from $33.0 billion at the end of 2012. Assessment income was the primary contributor to growth in the fund balance. While the end of unlimited coverage for noninterest-bearing transaction accounts resulted in an 18.7 percent decline in estimated insured deposits in the first quarter, the estimated balances covered by the $250,000 insurance limit rose 2.6 percent during the quarter.

The complete Quarterly Banking Profile is available at:

http://www2.fdic.gov/qbp/index.asp?source=govdelivery

[headlines]

--------------------------------------------------------------

Banks Net Interest Margin Pain Deepens

By Kevin Dobbs and Marshall Schraibman

SNL Financial

(This follows the story above and observation by

FDIC Chairman Martin J. Gruenberg)

Net interest margins (NIM) contracted during the first quarter of this year at a majority of major banking companies, an SNL Financial analysis found, the result of Federal Reserve policies aimed at keeping rates low.

With the Fed maintaining its stance, bankers and analysts anticipate continued margin pressure throughout this year, a development that could squeeze bottom lines as the strong loan growth necessary for many to offset NIM headwinds is difficult to come by amid an uneven economic recovery, modest loan demand and fierce competition.

"It's going to be more and more difficult to offset pressure," analyst Brad Milsaps of Sandler O'Neill & Partners LP told SNL, because most banks have used up much of the wiggle room they have on the funding side and competition is not expected to ease, meaning pricing pressure on loans. "So it will be an even bigger challenge" in coming quarters "as banks will have to grow loans at a greater clip than they have in recent quarters to manage their "Net Interest Margins," and significant loan growth could prove difficult in a still bumpy economy."

Banks can of course offset NIM pressure via strong loan growth. And cometition is intensifying as major banks pursue this route.

Fifth Third Bancorp, for one, is banking on it, as it tries to build up certain business lines.

"The bottom line is that generating earning asset growth is the most effective way and the right way now to stabilize and grow net interest income by offsetting the impact of lower margins," Fifth Third CFO Daniel Poston said while speaking at a conference this month.

Fifth Third reported average sequential loan growth of 2% in the first quarter, with particular strength in commercial-and-industrial loans.

"From a balance sheet perspective, we continue to see good growth; commercial and consumer loan growth remains solid, particularly in C&I and in residential mortgages, which were up 16% and 12%, respectively, over the last year," Poston said.

"The rate environment and economic expectations are impacting competition for better credit deals, particularly in C&I and the auto lending space," he added. "But market disruptions across our footprint have allowed us to attract talent. Talented bankers are now contributing to our growth. We continue to invest in our national lending businesses, particularly in promising industry segments such as health care, and more recently, in the energy sector, which have allowed us to maintain and accelerate our momentum."

But even for the optimistic, NIM pain is a harsh reality. Fifth Third's margin contracted in the first quarter and Poston conceded pressure is bound to persist.

The "low interest rate environment is a difficult one for us and for other banks," Poston said, calling NIM compression "somewhat inevitable."

It is a common concession, analysts say.

Many banks' net interest margins "will continue to bleed throughout the year," Milsaps said. To be sure, he added, "I don't see anybody having a lot of margin expansion by any stretch."

Lower yields on securities, too, are crimping many banks. U.S. Bancorp, whose NIM declined during the first quarter, counts itself as a case in point on this front. "The principal headwind that we have today in the margin is the securities portfolio," U.S. Bancorp CFO Andrew Cecere said while speaking at a conference this month.

"Every month, I have about $2 billion that pays down or runs off in the securities portfolio," he explained. "We have about a $75 billion securities portfolio. That security that I'm putting on to replace that is coming on at 60 to 70 basis points lower than that which is rolling off. I'm trying to stay short. I'm staying asset-sensitive; I'm not taking extensive duration risk. So that continues to be a principal headwind."

As SNL reported, testimony before Congress from Fed Chairman Ben Bernanke this month and the latest FOMC minutes suggest that the central bank will continue its latest quantitative easing program, widely known as QE3, in the near term, keeping downward pressure on rates. Bernanke declined to signal when the Fed could commence monetary tightening, saying only that it would make adjustments based on incoming labor and economic data. The FOMC minutes, meanwhile, showed that most committee members want to see "continued progress, more confidence in the outlook or diminished downside risks" before beginning to unwind QE3.

U.S. commercial banks reported an aggregate NIM of just under 3.30% in the first quarter — down from the previous quarter and continuing a long-running and rarely interrupted trend that dates to the fourth quarter of 2009, when the aggregate NIM reached 3.71%. (SNL based its analysis on bank regulatory data, which can have different reporting standards than GAAP.)

As Brett Rabatin, an analyst at Sterne Agee & Leach Inc., put it to SNL in the wake of first-quarter earnings results: "There has been talk at times of rates moving up, but so far they haven't really, and so the margins remain vulnerable. It's a reality for the banks."

In addition to QE3, previous Fed programs, including its so-called Operation Twist in 2011, have been aimed at flattening the yield curve. The Fed has bought long-term Treasuries and sold shorter-term ones, resulting in tighter spreads between two- and 10-year Treasuries as well as between two- and 30-year Treasuries. This has pressured NIMs.

"I don't see short rates going up much any time soon," Milsaps said. "I see those rates pretty much anchored. And no bank I follow is assuming higher rates this year or even next."

((Please click on ad to learn more))

(Leasing News provides this ad “gratis” as a means

to help support the growth of Lease Police)

[headlines]

--------------------------------------------------------------

Fernando's View

By Fernando F. Croce

A sci-fi blockbuster (“Star Trek into Darkness”) and an intimate documentary (“Stories We Tell”) contrast at the box-office, while new DVD releases offer action (“The Last Stand”), bittersweet humor (“Life Is Sweet”) and classic suspense (“The File on Thelma Jordon”).

In Theaters:

Star Trek into Darkness (Paramount Pictures): Following its successful 2009 reboot, the Star Trek franchise continues with this action-packed new installment, directed by J.J. Abrams ("Super 8"). Captain Kirk (Chris Pine) is back in the Enterprise spaceship, this time facing new forms of danger as a cold-blooded intergalactic terrorist (played by Benedict Cumberbatch) sets his nefarious plan in motion. Making it his personal mission to track down the villain, Kirk blasts off into a dangerous space war-zone despite the warnings of his colleague and friend Spock (Zachary Quinto). Will this journey take him to victory, or to his own personal darkness? Featuring such series favorites as Uhura (Zoe Saldana), Scotty (Simon Pegg) and Sulu (John Cho), this polished sci-fi blockbuster promises surprise and excitement to fans and non-fans of the series alike.

Stories We Tell (Roadside Attractions): For her third movie as a director, Sarah Polley ("Away We Go") turns to the documentary genre to craft a moving letter to her loved ones. Using her camera as a detective's magnifying glass, she conducts a string of interviews with family members and friends, often getting complicated and humorously contradictory responses. Kicking off with questions about the marriage of her parents, Polley gradually enlarges the scope of the film, setting off a ripple effect of emotions. With each person telling his or her own version of facts, the concept of "truth" becomes more and more slippery. Unfurling as something both profoundly personal and universally accessible, Polley's inspired movie is a poignant, funny and inventive look at the crossroads of memory and storytelling.

Netflix Tip: Though never as famous as fellow actress-singer Judy Garland, Deanna Durbin (1921-2013) left behind a series of fresh, enjoyable musicals from her heyday in the 1940s. So remember this charming talent with movies like “The Amazing Mrs. Holliday,” “His Butler’s Sister” and “Christmas Holiday.” |

On DVD:

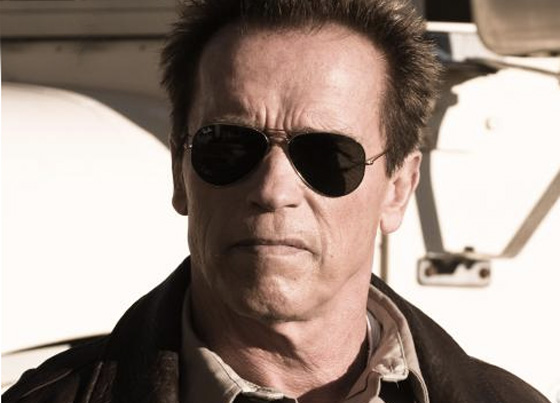

The Last Stand (Lionsgate): With the action-movie genre feeling oddly weary these days, it’s a good thing to have seasoned action pros like Arnold Schwarzenegger to keep things juicy at the box-office. Schwarzenegger stars as Sheriff Owens, a veteran police officer who, following troubled times with the LAPD, decides to settle down in an uneventful town near the Mexican border. However, his peaceful period is about to come to an end when a notorious drug kingpin (Peter Stormare) escapes from the FBI and heads over Owens' direction with an armored vehicle full of thugs and hostages. With only a ragtag of local eccentrics by his side, can he stand his ground once more? The Western-style plot may be predictable, but Korean director Kim Jee-woon brings genuine cinematic gusto to the film's many set pieces, and Schwarzenegger radiates brawn, humor and surprising gravitas. The result is a most enjoyable thriller.

Life Is Sweet (Criterion): More like "Life Is Bittersweet," in this 1990 gem from the great British filmmaker Mike Leigh. Taking place in a struggling middle-class neighborhood near London, the film chronicles the domestic agonies and occasional joys of an unforgettable family. Andy (Jim Broadbent) is a cook trying his best to dodge chores at home with his dilapidated lunch wagon, while his wife Wendy (Alison Steadman) teaches aerobic classes when not laughing drolly at the world around her. Meanwhile, their twin kids Natalie (Claire Skinner) and Nicola (Jane Horrocks) go through their own teenage troubles. Serving up his trademark combination of despair and humor, Leigh paints a superb comedy-drama filled with moments of piercing truth and unpretentious human warmth. The top-notch cast also includes Stephen Rea, Timothy Spall and David Thewlis.

The File on Thelma Jordon (Olive Films): Though not as well remembered today as Germanic masters like Fritz Lang or Billy Wilder, Robert Siodmak directed a series of engrossing noir dramas during the 1940s and 1950s. This sleeper is a terrific reminder of his gift for tension and irony, and a classic just waiting to be discovered by movie buffs. Barbara Stanwyck stars as Thelma Jordon, a mysterious, wily woman who becomes involved with a lovestruck assistant district attorney (Wendell Corey). What he doesn't suspect, however, is that romancing Thelma will lead him down a twisty rabbit hole full of unsavory jewel thieves and wealthy relatives. Involving, well-acted and visually atmospheric, the movie is a prime example of Olive Films' willingness to release lesser-known sleepers for eager cinephiles.

[headlines]

--------------------------------------------------------------

Classified ads—

Collector/Collections/Consultant/Communications

Leasing Industry Outsourcing

(Providing Services and Products)

| Collector: Atlanta, GA Asset Recovery Specialist. We get your money or we get your > equipment back for you. Physical Asset Recovery Experts! E-mail: mcrouse911@joimail.com |

Collector: Cleveland, OH Huntley Capital & Associates is your solution to late payments, no payments, and asset recovery. Call 216-337-7075. Email: ghpatey@msn.com |

||

| Collections: Dallas, Texas Contingency Fee basis. Receivables Outsourcing. We are a fully bonded nationwide licensed agency. We collect for nationally known banks and leasing companies. 800-886-8088. |

Collector: Los Angeles, CA Expert skiptracers covering Southern California. We locate skips, judgment debtors and collateral. When you can't get the job done in house, give us a call at 1-800-778-0794. E-mail: ceo@interagencyLA.com |

||

| Collector: Louisville, KY We are a full service collection agency with attorney network. 21 years experience. Please call Jon Floyd, VP at 1-800-264-6850 email: jfloyd@collectcsg.com |

Collector: Louisville, KY Euler Hermes/UMA 92 year old Global Receivables Outsourcing. Presence in 143 Countries. Work w/ 4 out of 5 Fortune 500 firms. Contingency Fee Structure. 20% off first time clients.! Andrew.Newton@eulerhermes.com 1-800-237-9386 x 205. |

||

| Collector: Mandeville, MI International commercial collection services all fees are on contingency on line access. E-mail: rmelerine@collect-now.com www.drspay.com www.collect-now.com |

|

||

Collector: Nationwide |

Collector: Saint Louis, MO Complete commercial collection agency. Licensed bonded in all states and will out performed any other agency! Call 1-800-659-7199 ext.315 E-mail: jfloyd@lindquistandtrudeau.com |

||

| Consultant: Nationwide 25 yrs. experience: Creating/Refining Business Plans to raise capital· Credit Underwriting support/policy/procedure development · Operations Support/policy/procedure development. Call: 610-246-2178, McCarthy Financial, LLC,David.mccarthy@mccarthy-financial.com |

Consultant: Burlington, CT We provide our clients with a full range of consulting services such as portfolio conversions, reconciliation, custom programming and leasing operations utilizing InfoLease. Email: info@new-millennium-assoc.com |

||

| Consultant: Europe 15 years doing deals/running own technology leasing company – looking to advise/ lead new entrants to take advantage the European market opportunity. www.clearcape.co.uk kevin.kennedy@clearcape.co.uk |

Consultant: Henderson, NV Focus on new business development and process efficiencies to create incremental revenue and profitability. Executive level vendor experience, and satisfied outsourcing clients. Incredible track record. E-mail: rbutzek@cox.net |

||

Consultant: Sausalito, CA |

Consultant: North of Detroit, MI |

||

Consultant: Ridgefield CT. |

Email: dan@danscartoons.com Go to http://www.danscartoons.com

|

All "Outsourcing" Classified ads (advertisers are both requested

and responsible to keep their free ads up to date:

http://www.leasingnews.org/Classified/Outsourcing/Outsourcing.htm

How to Post a free "Outsourcing" classified ad:

http://www.leasingnews.org/Classified/Outsourcing/Outsourcing-post.htm

• Contract Negotiations • Fraud Investigations john@jkrmdirect.com | ph 315-866-1167| www.jkrmdirect.com |

(Leasing News provides this ad as a trade for investigations

and background information provided by John Kenny)

[headlines]

--------------------------------------------------------------

Chinese Shar-Pei/German Shepherd Dog/Mixed (medium coat)

San Francisco, California Adopt-a-Dog

Rescue ID: 12-0257

Eye Color: Brown

Current Size: 40 Pounds

Current Age: 7 Years 6 Months (best estimate)

Housetrained: Yes

Obedience Training Needed: Has Basic Training

Exercise Needs: Moderate

Shedding Amount: Moderate

Reaction to New People: Cautious

“Good with Dogs, Good with Kids, Good with Adults, Quiet, Does Good in the Car, Leash trained, Obedient, Timid, Affectionate, Intelligent, Even-tempered, Gentle---

“Coco needs a caretaker or foster! Won't you consider helping her get a new start?

“Coco comes to us from Castaic. The shelter staff and volunteers had fallen for her soulful eyes and gentle demeanor and wanted her rescued. Having been surrendered not once but twice (her family felt guilty after the first surrender and took her back only to leave her again) has done a number on her ability to trust, but we are making strides every day. She is already rolling over for belly rubs! She is extremely respectful of her place in the house by not jumping on furniture or beds, preferring her own dog bed on the floor. She places her paw into yours when she asks for affection and considers walks to be the best treat ever. Mostly, she is just contented to be with her human. We are looking for a wonderful home for this sweet, calm and intelligent girl whose teeth - by the way - do not look like those of a seven year olds.”

Adoption Form:

http://www.nocalfamilydogrescue.org/forms/form_humanverify?formid=1785

Email Us: adopt@norcalfamilydogrescue.org

Website: http://www.norcalfamilydogrescue.org/

Write Us: Northern California Family Dog Rescue

PO Box 40177

San Francisco, CA 94104-0177

Adopt-a-Pet by Leasing Co. State/City

http://www.leasingnews.org/Conscious-Top%20Stories/Adopt_Pet.htm

Adopt a Pet

http://www.adoptapet.com/

[headlines]

--------------------------------------------------------------

|

![]()

News Briefs----

IASB and FASB Publish New Dual Approach to Lease Accounting

http://www.cfo-insight.com/reporting-forecasting/accounting/iasb-and-fasb-publish-new-dual-approach-to-lease-accounting/

4 Myths About Leasing A New Car

http://www.candofinance.com/loans/myths-about-leasing-a-new-car/

Why Small Businesses Have Trouble Getting Credit

http://smallbiztrends.com/2013/05/why-small-businesses-have-trouble-getting-credit.html?goback=%2Egde_2885246_member_245062019

Risk of Bank Failures Is Rising in Europe, E.C.B. Warns

http://www.nytimes.com/2013/05/30/business/global/risk-of-bank-failures-rising-in-europe-ecb-warns.html

Bank of Montreal misses estimates, charges squeeze profit

http://www.reuters.com/article/2013/05/29/us-bankofmontreal-results-idUSBRE94S0IO20130529

Family Breadwinner Is More Often a Woman

http://www.nytimes.com/2013/05/30/business/economy/women-as-family-breadwinner-on-the-rise-study-says.html?ref=business

Switzerland to Allow Its Banks to Disclose Hidden Client Accounts

http://dealbook.nytimes.com/2013/05/29/swiss-officials-to-allow-banks-to-sidestep-secrecy-laws/?ref=business

No dodging mess: Guggenheim may lose $1B in cable deal re-do

nypost.com/p/news/business/no_dodging_mess_cJ2zjtJSgMYSvwam

Nasdaq Is Fined $10 Million Over Facebook I.P.O.

http://dealbook.nytimes.com/2013/05/29/nasdaq-to-pay-10-million-fine-over-facebook-i-p-o/?ref=business

Amelia Earhart's plane found?

http://www.foxnews.com/science/2013/05/29/amelia-earhart-plane-found-sonar-images-may-have-pinpointed-wreck/

Adam Levine Clarifies ‘I Hate This Country’ Remark

http://tv.yahoo.com/news/adam-levine-clarifies-hate-country-remark-202612362.html

[headlines]

--------------------------------------------------------------

---You May Have Missed

ASCM American Fitness Reports--full and by city

http://www.americanfitnessindex.org/report.htm

[headlines]

--------------------------------------------------------------

SparkPeople--Live Healthier and Longer

![]()

SparkPeople--Live Healthier and Longer

7 Comfort Foods that are Good for You

http://www.sparkpeople.com/resource/nutrition_articles.asp?id=198

[headlines]

--------------------------------------------------------------

Baseball Poem

Alone At The Plate

( Inside the front cover of the book “You Can Teach Hitting,”

by Dusty Baker, there appears this poem about a Little Leaguer...)

He pulls on a helmet, picks up the bat,

and walks to the plate, "gotta hit and that's that."

The crowd starts to yell, the game's on the line,

last inning, two outs, the score's nine to nine.

Dad yells, "Go get it," Mom wrings her hands,

coach hollers, "hit it," but alone there he stands.

Heros are made in seconds such as this,

but he's just a little boy, what if he should miss?

Years after this game's ended and he's little no more,

will he remember the outcome or even the score?

No he'll have forgotten if he was out, hit, or a run,

he'll only look back on his friends and the fun.

So cheer this boy on, alone with his fate;

help him remember with fondness this stand at the plate.

Spend your time wisely and help in his quest

to be a hitter with confidence and always his best.

And when the game's over, this boy can stand tall,

for you've helped him prepare to give it his all!

[headlines]

--------------------------------------------------------------

Sports Briefs----

Blackhawks win Game 7 send Red Wings home

http://www.chicagotribune.com/sports/hockey/blackhawks/ct-spt-0530-blackhawks-red-wings-chicago-20130530,0,2455369.story

Report: QB Manning shoots 77 at Augusta National

http://www.golfchannel.com/news/golftalkcentral/qb-manning-shows-skills-on-the-course-too/

Game 7 silences Sharks

http://www.mercurynews.com/mark-purdy/ci_23342079/purdy

Anquan Boldin impresses early on for 49ers

http://sports.yahoo.com/news/anquan-boldin-impresses-early-49ers-145121934--nfl.html

New York Jets' Marty Mornhinweg on Mark Sanchez: Accuracy Sky High

http://sports.yahoo.com/news/york-jets-marty-mornhinweg-mark-sanchez-accuracy-sky-144400718.html

Lions: Lewis competes for No. 3 QB

http://sports.yahoo.com/news/lewis-mix-no-3-detroit-221116396--nfl.html

Broncos sign Quentin Jammer

http://www.utsandiego.com/news/2013/may/29/quentin-jammer-broncos-chargers/

[headlines]

--------------------------------------------------------------

![]()

California Nuts Briefs---

State orders department-wide review of Caltrans

http://blogs.sacbee.com/capitolalertlatest/2013/05/state-orders-department-wide-review-of-caltrans.html

Oakland bank manager charged in thefts

http://www.sfgate.com/crime/article/Oakland-bank-manager-charged-in-thefts-4555056.php

[headlines]

--------------------------------------------------------------

![]()

“Gimme that Wine”

http://www.youtube.com/watch?v=EJnQoi8DSE8

Sonoma Wine Picks

www.pressdemocrat.com/article/20130527/LIFESTYLE/130529825

TTB Issues Guidelines for Voluntary Serving Facts Statements

http://www.ttb.gov/rulings/2013-2.pdf

New beginnings for Barrel Blasting

http://napavalleyregister.com/business/new-beginnings-for-barrel-blasting/article_41fd7906-c281-11e2-9cd2-001a4bcf887a.html

Cabrillo College Revives Wine Program

www.winesandvines.com/template.cfm?section=news&content=11708

Dunne on Wine: By way of New Zealand

http://www.sacbee.com/2013/05/29/5453435/by-way-of-new-zealandchasing-venus.html

Free Mobile Wine Program

http://leasingnews.org/archives/Feb2010/2_26.htm#mobile

Wine Prices by vintage

http://www.winezap.com

http://www.wine-searcher.com/

US/International Wine Events

http://www.localwineevents.com/

Winery Atlas

http://www.carterhouse.com/atlas/\

Leasing News Wine & Spirits Page

http://two.leasingnews.org/Recommendations/wnensprts.htm

[headlines]

----------------------------------------------------------------

![]()

This Day in History

1498 - Christopher Columbus set sail with six ships from Sanlucar in Spain on his third voyage of exploration to the Americas. In reality, he never discovered the main land, only a group of islands in the Bahama's that he thought were islands off of India, thus he named the natives he found on these islands: Indians. And why we call the native American Indians this name. The scuttlebutt of the time was that these natives were the lost tribe of the Hebrews (I am not making this up. Read your history.) Historians have also proven that Cristo Colombo was Jewish, as was his navigator who actually is the one who sited the land. As well as Queen Isabella never financed the journal (this was made up by children's story tellers). He actually was financed by two Jewish merchants.

1539 - Spanish explorer Hernando de Soto landed at Tampa Bay, Florida, with 600 soldiers in search of gold. Hernando de Soto returned to the New World at the head of a 1,000-man expedition into North America. He landed near present-day Tampa Bay and proceeded through what is now Alabama and Tennessee, making treaties with some Indian, viciously fighting with others.

http://www.floridahistory.com/inset11.html

http://www.floridahistory.com/inset44.html

1734- Benjamin Franklin published the first American Masonic Book. The Masons were a strong movement for several centuries in America.

http://members.aol.com/jobiefamly/benfrank.htm

http://www.npg.si.edu/exh/franklin/chamber.htm

1783- the Pennsylvania Evening Post became the first daily newspaper published in the US. The paper was published at Philadelphia, PA, by Benjamin Towne.

http://www.historycooperative.org/journals/ht/35.1/br_4.html

1806- Dueling was common in early America. Future president Andrew Jackson shot and killed Charles Dickson this day at Harrison's Mills on the Red River, Logan County, KY. The combatants stood 24 feet apart. Dickinson fired first. The shot broke a couple of Jackson's ribs and grazed his breastbone. Despite the injury, Jackson fired and killed Dickinson. It was one of a hundred duels and brawls in which Jackson is said to have participated. Jackson served as president of the United States from March 4, 1829, to March 3, 1837.

1818-May 30 Douglas and Lincoln not allowed to speak at funeral

http://www.geocities.com/logicalthinker_2000/Freddouglass.html

1848- William G. Young of Baltimore, MD patented the “ice cream freezer.” A record of a purchase for a “cream machine for ice” is contained in George Washington's expense ledger under date of May 17,1784, and there were such machines dated earlier, but this is the first patent and production manufacturing of it followed for two centuries.

http://www.napalinks.com/website/002/page-03.htm

1854 - The territories of Nebraska and Kansas were established. The governor of the Kansas Territory was James William Denver. Pres. Pierce kept appointing proslavery governors. The Kansas-Nebraska Act repealed the Missouri Compromise and opened the north to slavery. This period of Kansas history was incorporated into the 1998 novel “The All-True Travels and Adventures of Lidie Newton,” by Jane Smiley.

1868 - Memorial Day was observed for the first time in the United States -- at the request of General John A. Logan, the national commander of the Grand Army of the Republic. It was first called Decoration Day because the General had seen women decorating graves of Civil War heroes.

http://www.historychannel.com/cgi-bin/frameit.cgi?p=http%3A//www.historychannel.com/

exhibits/memorial/memorial.html

http://memory.loc.gov/ammem/today/may30.html

1879 - A major outbreak of severe weather occurred in Kansas and Western Missouri. Tornadoes in Kansas killed 18 persons at Delphos and claimed 30 lives at Irving where two twisters struck within minutes of one another, reducing the small community to rubble. The second tornado was perhaps two miles wide and exhibited multiple vortices.

1886-Seeing eye dog creator Dorothy Wood Eustis born in Philadelphia, Pennsylvania. As a widow she moved from the U.S. to Switzerland where she continued her experiments in breeding German Shepherd dogs of great intelligence and easy dispositions. Her dogs were soon in great demand all over Europe for police work. A school was developed in Europe to train the intelligent dogs for what we know today as the seeing eye dogs for the blind. She returned to the U.S. to establish the seeing eye movement, setting up a training school for dogs and owners. At her death her school had trained more than 1300 guide dogs for the blind - all based on her breeding acumen.

http://search.eb.com/women/articles/Eustis_Dorothy_Leib_Harrison_Wood.html

1902-birthday of actor/comedian Stepin Fetchit, Key West, FL Died, Woodland Hills, CA. 1985

http://us.imdb.com/Name?Fetchit,+Stepin

1903-birthday of African-American poet Countee Cullen, Baltimore, MD

http://members.aol.com/hynews/cullen.htm

http://www.nku.edu/~diesmanj/cullen.html

1905-birthday of trumpet player Sidney DeParis, Crawfordsville, IN

http://www.centrohd.com/biogra/d2/sidney_deparis_b.htm

http://www.centrohd.com/biogra/d2/sidney_deparis_b.htm

1909-Benny Goodman' birthday

http://www.duke.edu/~eca/

http://www.mala.bc.ca/~mcneil/cit/citlcgoodmanb.htm

1909 - A very narrow but intense tornado, rated f4 on the Fujita Scale, cut across the sleeping town of Zephyr, Texas shortly after midnight. 34 people were killed and 70 were injured. Many homes were literally swept away with nothing left on the sites, just vacant lot after vacant lot.

1910-birthday of African-American Ralph Metcalfe, Olympic gold medal sprinter born at Atlanta, GA. Metcalfe set world records in the 100 years, 100 meters and 200 meters between 1932 and 1936. At the 1936 Berlin Olympics he finished second to Jesse Owens in the 100 meters and won a gold medal as a member of the 400-meter relay team. After World War II, Metcalfe was very active in Democratic politics, serving as a convention delegate, first Illinois Athletic commissioner, elected four times to the US House of Representatives. He founded the Ralph H. Metcalfe Youth Foundation which provided athletic and educational programs for youth. He was named a member of the President's Commission on Olympic Sports in 1975. The federal building at 77 W. Jackson in Chicago was named for him when it was dedicated in 1991. Died at Chicago, IL, October 10,1978

http://bioguide.congress.gov/scripts/biodisplay.pl?index=M000675

1911-The first Indianapolis 500. The race was created by Carl Fisher, who in 1909 replaced the stone surface of his 2.5-mile racetrack with a brick one—hence the nickname “The Brickyard.” The first long-distance race was won by Ray Harroun, 29 years old, who drove a 16-cyclinder Marmon Wasp over the 2.5 mile oval course for a distance of 500 miles in 6 hours, 41 minutes, 8 seconds, an average of 74.7 miles per hour. Only 38 of the 44 cars entered completed the race. One contestant was killed in an accident. The race was witnessed by 85,000 spectators.

http://www.diecast.org/diecast98/html/asp/list_reviews/xq/ASP/id.CA431/qx/reviewpix.htm

1912-During the second running of the Indianapolis 500, driver Ralph Mulford was told he would have to finish the race to collect 10 th -place money. Mulford did so, but it took him eight hours, 53 minutes, more than 2 ½ hours longer than the winner. He stopped for fried chicken several times along the way, and the rule was changed the following year.

http://www.bridgestone-usa.com/indexfr.htm

1922- Lincoln Memorial Dedication. If you haven't seen it in person, it is well worth the trip. The memorial is made of marble from Colorado and Tennessee and limestone from Indiana. It stands in West Potomac Park at Washington, DC. The outside columns are Doric, the inside, Ionic. The Memorial was designed by architect Henry Bacon and its cornerstone was laid in 1915. A skylight lets light into the interiors where the compelling statue “Seated Lincoln,” by sculptor Daniel Chester French, is situated

http://www.nps.gov/linc/

1923 - Howard Hanson's 1st Symphony "Nordic," premiered.

1927-- birthday of actor Clint Walker , Hartford,IL ( My father Lawrence Menkin wrote many of the TV show Cheyenne series that Clint Walker starred in, that's the main reason he makes this list.

http://classicimages.com/1999/april99/walker.html

1935-Tommy Dorsey splits from Jimmy after disagreement on tempo on “I'LL Never Say Never Again Again” at the Glen Island Casino, New Rochelle, NY. They would not talk to each other until the 1950's, playing only one more time together on a television special.

1943-Battle of the Aleutian Island. The islands of Kiska and Attu in the Aleutian Islands off the coast of Alaska were retaken by the US 7 th Infantry Division. The battle (Operation Land grab)began when an American force of 11,000 landed on Attu May 12. In three weeks of fighting US casualties numbered 552 killed and 1,140 wounded. Only 28 wounded Japanese were taken prisoner. Their dead amounted to 2,352 of whom 500 committed suicide.

1943-birthday of Gale Eugene Sayers, pro Football Hall of Fame running back, born Wichita, KS.

http://communities.msn.com/Blackside/tributetoblackathletes.msnw?action=

ShowPhoto&PhotoID=56

http://search.biography.com/print_record.pl?id=19207

1950-Top Hits

My Foolish Heart - The Gordon Jenkins Orchestra (vocal: Eileen Wilson)

Bewitched - The Bill Snyder Orchestra

It Isn't Fair - The Sammy Kaye Orchestra (vocal: Don Cornell)

Birmingham Bounce - Red Foley

1956-African-Americans in Tallahassee began a bus boycott in that city. They were protesting the system of segregation that required non-whites to ride in the back of busses.

1958-Top Hits

All I Have to Do is Dream - The Everly Brothers

Return to Me - Dean Martin

Do You Want to Dance - Bobby Freeman

Just Married - Marty Robbins

1963 - No. 1 Billboard Pop Hit: "It's My Party," Lesley Gore.

1964- Wynonna Judd birthday, U.S. country western singer who won the Grammy 1985, 86, 87, 89 She was voted top female country artist award in 1994.

http://www.wynonna.com/

1964-- The Beatles' "Love Me Do" hits #1

1966-Top Hits

When a Man Loves a Woman - Percy Sledge

A Groovy Kind of Love - The Mindbenders

Paint It, Black - The Rolling Stones

Distant Drums - Jim Reeves

1967 - Daredevil Evel Knievel jumped 16 automobiles in a row in a motorcycle stunt at Ascot Speedway in Gardena, Georgia.

1970-- Ray Stevens' "Everything Is Beautiful" hits #1

1971 - The spacecraft Mariner 9 was launched in the direction of Mars. It became the first craft to orbit another planet, returning many images of Mars. The images revealed what appear to be riverbeds on the surface, suggesting the presence of water on Mars at some point in the past. Mariner 9 photographed the entire surface of Mars.

1971-36 Grateful Dead fans treated for hallucinations caused by LSD they unwittingly ingested from a spiked apple drink served at San Francisco's Winterland. Although group members are suspected of supplying the drug, they are not accused.

1973 - No. 1 Billboard Pop Hit: "My Love," Paul McCartney & Wings. The song is McCartney's first No. 1 song with Wings, a group he formed after the breakup of the Beatles.

1974-Top Hits

The Streak - Ray Stevens

Dancing Machine - The Jackson 5

The Show Must Go On - Three Dog Night

No Charge - Melba Montgomery

1975 - Alice Cooper received a gold record for the romantic album, "Welcome to My Nightmare". Alice's real name was Vincent Furnier. He changed his name to Alice Cooper in 1966 and was known primarily for his bizarre stage antics. He appeared in the film "Prince of Darkness" in 1987 and had 11 hits on the pop/rock charts in the '70s and '80s, including a pair of million-selling singles: "I Never Cry" and "Poison

1982-Top Hits

Ebony and Ivory - Paul McCartney with Stevie Wonder

Don't Talk to Strangers - Rick Springfield

I've Never Been to Me - Charlene

Just to Satisfy You - Waylon & Willie

1977-- "In company with the first lady ever to qualify at Indianapolis -- Gentlemen, start your engines." So began the 1977 Indianapolis 500, and the lady in question was the American race car driver Janet Guthrie.

http://www.janetguthrie.com/

http://www.amazon.com/exec/obidos/ASIN/0817858822/avsearch-bkasin-20/

002-0667839-4443242

1985 - ABC-TV announced that every game of the baseball World Series would be played under the lights for the biggest baseball audience possible.

1985 -The temperature in Oklahoma City reached a sizzling 104 degrees, making it the highest ever for so early in the season. Also, this marked the very first time the temperature had reached the 100 degree plateau in the month of May at Oklahoma City.

1986 - Hanford, Washington hit a scorching 104 degrees, breaking the all-time record high temperature for May for Eastern Washington. Yakima, Washington hit 102 degrees, a record high for the month of May for Yakima. Records also fell at Boise and Reno.

1988 - No. 1 Billboard Pop Hit: "One More Try," George Michael.

1990-Top Hits

Vogue - Madonna

All I Wanna Do is Make Love to You - Heart

Hold On - Wilson Phillips

Walkin' Away - Clint Black

2001-- Barry Bonds hits career homer No. 522 passing Willie McCovey and Ted Williams to move up to #11 on the all time list, and making him the number one lefty home run hitter in National League history. The round tripper is the 17th hit by the Giant outfielder in May breaking the record set by Mickey Mantle (1956) and Mark McGwire (1998).

2002-World Trade Center Recovery and Cleanup Ends. A solemn and mostly silent ceremony marked the symbolic end of recovery operations t Ground Zero, the former site of the World Trade Center, after the September 11,2002, terrorists attacks. The last standing steel girder was cut down on May 28. An honor guard carried an empty stretcher draped with an American flag to represent those victims who were not recovered from the ruins. Members of the NYPD, NYPD and city, state and federal workers, as well as family members and Ground Zero recovery teams, participated in the ceremony.

2009-- Little Richard, Chuck Berry, and B.B. King gather for a benefit concert to raise money for New Orleans public schools struggling to rebuild after Hurricane Katrina. Though too ill to perform, Katrina survivor Fats Domino attends as a special guest.

Stanley Cup Champions This Date

• Edmonton Oilers

-------------------------------------------------------------

SuDoku

The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler?

http://leasingnews.org/Soduku/soduko-main.htm

--------------------------------------------------------------

Daily Puzzle

How to play:

http://www.setgame.com/set/puzzle_frame.htm

Refresh for current date:

http://www.setgame.com/set/puzzle_frame.htm

--------------------------------------------------------------

http://www.gasbuddy.com/

http://www.gasbuddy.com/GB_Map_Gas_Prices.aspx

http://www.gasbuddy.com/GB_Mobile_Instructions.aspx

--------------------------------------------------------------

Weather

See USA map, click to specific area, no commercials

--------------------------------------------------------------

Traffic Live---

Real Time Traffic Information

You can save up to 20 different routes and check them out with one click,

or type in a new route to learn the traffic live

--------------------------------