Connect with Leasing News ![]()

![]()

![]()

![]() Add me to mailing list |

Add me to mailing list | ![]() |

| ![]() Search |

Search | ![]() Stress Release

Stress Release

Advertising | All Lists | Archives | Classified Ads | This Day In American History

Leasing News is a web site that posts information, news, and

entertainment for the commercial bank, finance and leasing industry

kitmenkin@leasingnews.org

![]()

Thursday, June 6, 2013

![]()

Today's Equipment Leasing Headlines

Flexpoint Announces the Sale of Financial Pacific Leasing

to Umpqua Holdings Corporation

By Christopher “Kit” Menkin

Placard---Compliments of Paul Menzel, CLP

Umpqua and Harris $30 Million Funding for Allegiant

Classified Ads---Controller

Dallin Hawkins, Integrity Finance Groups, Arrested

Lesson Not Learned in 49 States

by Bernie Boettigheimer, CLP, President, Lease Police

CapitalSource Healthcare Finance, Chevy Chase, Maryland

Looking for Information

New Hires---Promotions

Classified Ads—Help Wanted

Top 50 US banks and thrifts by assets

By Aarti Kanjani, SNL Financial

Undercapitalized banks fall to lowest level in 17 quarters

By Nathan Stovall and Robert Clark, SNL Financial

Update IFC Credit--Rudy Trebels

Fall Leasing Conference Update

Beige Book---Modest Recovery, Except for Dallas

Balboa Capital Expands Point-of-Use Water

Equipment Vendor Financing Division

Before Midnight/Hannah Arendt

Oz the Great and Powerful/House of Cards/Jubal

Film/DVD Reviews for Leasing News by Fernando Croce

Classified ads—Finance / Human Resources

Labrador Retriever/Mix

Roseburg, Oregon Adopt-a-Dog

News Briefs---

Hedge-Fund Manager: Small Banks Are the Real Problem

Bank CEO pay up 22 pct; Dimon still amid best paid

Cadillac: An American Luxemobile Comes Roaring Back

Casino equipment maker SHFL reports record revenue

Treasury Department to sell 30 million shares of GM stock

Report: Restaurant sales continue to rise in May

Mastros are free to go, French court rules

NY AG Sues HSBC re: Homeowners Trapped in Foreclosure

Chicago Sun-Times Lays Off Entire Photo Staff,

---Will Give Reporters iPhoneography Training

9 myths on how to build better credit

Broker/Funder/Industry Lists |

Features (collection)

Top Ten Stories Chosen by Readers |

Top Stories last six months

www.leasingcomplaints.com (Be Careful of Doing Business)

You May have Missed---

SparkPeople--Live Healthier and Longer

Sports Briefs---

California Nuts Brief---

"Gimme that Wine"

This Day in American History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

######## surrounding the article denotes it is a “press release” and was not written by Leasing News nor information verified, but from the source noted. When an article is signed by the writer, it is considered a “by line.” It reflects the opinion and research of the writer.

Please send Leasing News to a colleague

and ask them to subscribe

Contact: kitmenkin@leasingnews.org

[headlines]

--------------------------------------------------------------

Flexpoint Announces the Sale of Financial Pacific Leasing

to Umpqua Holdings Corporation

By Christopher “Kit” Menkin

"Financial Pacific Leasing nationally recognized leader in equipment leasing industry Accretive acquisition to diversify and grow Umpqua Bank’s lending platform."

Umpqua Press Release introduction

Flexpoint Ford, LLC , Chicago, a private equity firm focused on the financial services and healthcare sectors, announced a definitive agreement to sell Financial Pacific Holding Corp.(FinPac), Federal Way, Washington to Umpqua Holdings Corporation, Roseburg, Oregon. Financial Pacific has been majority owned by Flexpoint since October 2010.

The transaction is expected to close within the next 30 days, subject to customary regulatory approvals. Following the transaction, Financial Pacific will operate as a subsidiary of Umpqua. The Alta Group provided specialized due diligence and related corporate advisory services to Umpqua Bank.

Paul Menzel, CLP

President & CEO

Financial Pacific Leasing

(2005 Leasing News Person of the Year)

“I have been through a number of mergers and acquisitions within the leasing industry as an independent and bank affiliate over the last 35 years,” Paul Menzel, President & CEO, Financial Pacific Leasing told Leasing News . “This business combination is good for every stakeholder, the sellers, buyers, employees, management, and most importantly our TPOs and their customers. It doesn’t always work that way. We feel very fortunate to be part of Umpqua.”

This is certainly an excellent investment for Umpqua, a successful growing bank, even with its own mobile app for iPhone & Android ---but how it fits in with servicing the 199 branch offices is not very clear at all---unless there are changes to be made. It is my experience in such acquisitions that management will make “adjustments,” particularly with all the opportunity now available for all entities involved. My guess it is more responsibility and more growth, which is very good news, as if, of course, both a lot of capital available and at a lower cost of funds for FinPac. I am not alone in this opinion. Stock Analysts were also as positive. (1)

Here is my view:

FinPac is dedicated to indirect business from a network of 450 active third party originators. A "VendorFlex" plan is available, but for it is for indirect providers of business, http://www.finpac.com/docs/VendorFlex.pdf , as well as a direct vendor plan http://www.finpac.com/equipment_vendors.aspx. In addition, the sweet spot are small ticket leases, under $50,000, particularly under $25,000. Look for this to change.

Terey Jennings, CLP

Senior Vice President

There are 18 Certified Lease Professionals, more than any other leasing or finance company, as well as an excellent third party originator loyal group led by senior vice president Terey Jennings, CLP, for the last 27 years. At one time, there was a small direct sales force, but it did not work out with the independent program. FinPac’s success comes from its service to third party originators.

In addition to perhaps a larger minimum dollar amount, FinPac well be taking on new responsibilities for Umpqua bank customers only. Certainly Menzel is very up-beat, as well as very experienced with his banking background in this field.

Gavin Shea SVP

Equipment Lease & Finance Manager

Umpqua Bank

Current SVP, Equipment Lease & Finance Manager at Umpqua Bank is Gavin Shea, working out of Pleasanton, California, according to his LinkedIn listing. There is a Umpqua Bank in Walnut Creek, about 22 miles away. He was not available for a comment. Shea previously was director of sales Wells Fargo Practice Finance (October, 2008-November, 2011) and regional production manager, Matsco (June, 2004-September, 2007) www.linkedin.com/pub/gavin-shea/51/38a/108/

According to Umpqua press release, the person the officers of FinPac will be reporting to also sees positive changes:

Cort O'Haver

Executive vice President

Umpqua Bank

“Combining FinPac’s talented staff and national reach with Umpqua Bank’s funding will provide valuable diversification and enhance Umpqua’s profitability,” said Cort O’Haver, EVP Commercial Banking of Umpqua Bank. “The platform is scalable, and is consistent with other key expansion initiatives we’ve completed over the last three years, including our business banking, agriculture lending and home builder lending groups.”

-

Umpqua Company Press Release

At this point it certainly appears FinPac is being viewed as an excellent investment, especially considering the remarks by Ray Davis, President/CEO of Umpqua Bank in the company press release.

Ray Davis

President/CEO

Umpqua Bank

“This transaction, along with the dividend increase we announced last month, represents another effective use of our capital,” said Ray Davis, president and CEO of Umpqua Bank. “At eight times 2012 earnings, this represents a disciplined acquisition which leverages excess capital, deploys excess liquidity into significantly higher yielding assets, provides growth and further diversification, and increases profitability. Further, this transaction does not rule out the possibility of additional strategic acquisitions in the future, as we continue to deploy remaining excess capital for the benefit of our shareholders.”

-

Umpqua Company Press Release

(Davis is the author of "Leading for Growth: How Umpqua Bank Got Cool and Created a Culture of Greatness." Available at Amazon:)

http://www.amazon.com/Leading-Growth-Created-Culture-Greatness/dp/0787986070

Umpqua Holdings has two principal operating subsidiaries, Umpqua Bank (the Bank), and Umpqua Investments. Umpqua Bank, Roseburg, is the largest Oregon-based bank with 2,331 full time employees at 199 offices: 80 offices in California, five in Nevada, 80 in Oregon, plus 33 in Washington. March 31, 2013 profit was $25 million with bank equity $1.8 billion. Tier 1 risk-based capital ratio: 14.25 (FDIC March 31,2013 filing, as well as FDIC identifies the bank headquarters location as Roseburg, Oregon, where it was originally founded.)

The transaction is valued at 2.8 tangible book, and UMPQ management reportedly expects 14% earnings accretion in the first year. UMPQ will pay $158 million in cash for FinPac, which had assets of $279 million at 4/30/13; tangible equity of $57 million is expected by the company at deal close, which management expects to occur within 30 days. We preliminarily calculate tangible book dilution of approximately 9.6% (to $8.48 pro forma from $9.38 at 3/31/13) and an earn-back period of approximately seven years based on company guidance for 14% accretion in the first full year.

The Umpqua company press release (2) provides several caveats, including a four year earn-back, as it is expected the business provided by FinPac will add to their holding company as well as benefit net interest margins (Bank analysts report the deal is expected to provided 35 basis points to Net Interest Margins.)

Christ Ackerman, Principal

Flexpoint

"Financial Pacific's unparalleled expertise serving its market niche has allowed the company to achieve tremendous success over the past three years," Chris Ackerman, Principal of Flexpoint, said. "The management team and company have exceeded our high expectations, and have delivered an excellent return for our investors. We are confident that Financial Pacific is well positioned for the future and with Umpqua's support will continue to strengthen its market position." Flexpoint Company press release (3)

Paul Menzel, CLP, CEO

Financial Pacific

(2005 Leasing News Person of the Year)

"We believe this transaction speaks to the strength of the platform we've built in the small-ticket leasing market," Paul Menzel, CLP, Chief Executive Officer of Financial Pacific said. "Flexpoint has been a great partner for Financial Pacific and their insights and advice have been instrumental in building the business to what it is today. We are excited to become a part of Umpqua and we look forward to leveraging our combined strengths for continued growth in the future."

Flexpoint Company Press Release (3)

Interview with Davis:

http://www.youtube.com/watch?v=yKx_WyhP2lk

-

Stock Analysts:

Raymond James

D.A. Davidson & Co.

http://www.leasingnews.org/PDF/DADCOfinpacnote_62013.pdf

http://www.leasingnews.org/PDF/RaymondJamesfinpac_62013.pdf

-

Umpqua Bank Announces Acquisition PFG

http://www.leasingnews.org/PDF/UmpquaAcquisition_62013.pdf

-

Flexpoint Press Release

http://www.leasingnews.org/PDF/FlexpointSale_62013.pdf

[headlines]

--------------------------------------------------------------

--Compliments of Paul Menzel, CLP--

[headlines]

--------------------------------------------------------------

Umpqua and Harris $30 Million Funding for Allegiant

Umpqua Bank participates in an increased $30 million funding facility with Harris N.A. a part of BMO Financial Group for Allegiant Partners, San Rafael, California. Reportedly the facility can be expanded to up to $35 million.

Chris Enbom, CEO

Allegiant Partners

"BMO Harris has once again done an outstanding job in helping Allegiant continue its strong growth," Chris Enbom, CEO of Allegiant Partners said. "We began with a $13 million line during the recession and BMO Harris continues to understand the financing needs of a commercial finance company like Allegiant. Umpqua came into the relationship about one year ago and has also been a great partner."

[headlines]

--------------------------------------------------------------

| Please send Leasing News to a colleague and ask them to subscribe. We are Free! Contact: kitmenkin@leasingnews.org |

Classified Ads---Controller

(These ads are “free” to those seeking employment

or looking to improve their position)

| Chicago, IL experienced in lease accounting, operations, management, and Sarbanes-Oxley. Seeking position with equipment lessor. Would consider contract assignments or relocating. Email: leasecontroller@comcast.net |

| Southeastern, MI Controller & Management experience w/ equip lessors &broker. MBA, CPA w/ extensive accounting, management, securitization experience with public and private companies. Willing to relocate. Email: Leasebusiness@aol.com |

Free Posting for those seeking employment in Leasing:

http://www.leasingnews.org/Classified/Jwanted/Jwanted-post.htm

All “free” categories “job wanted” ads:

http://www.leasingnews.org/Classified/Jwanted/Jwanted.htm

[headlines]

--------------------------------------------------------------

Dallin Hawkins, Integrity Finance Groups, Arrested

Dallin Hawkins, Mug shot

There are three Leasing News bulletin Board complaints (1) against Dallin Hawkins, Integrity Financial Groups, Murray, Utah, as well as new ones under the process, plus one regarding a web site that is also being advertised in Google (2):

| Google Ad “Leasing News - Kit Menkin www.leasingnews.info/ one-sided, biased and un-fair news Kit Menkin posts FALSE information” |

Hawkins was arrested June 3, 2013

“Individuals are innocent until proven guilty in a court of law:"

Charges:

- Prescription utter forge or alter

- Drug paraphernalia MIS B personal use

- DUI-Ignition interlock device violation

- Reckless endangerment

- Expired Registration

- Driving on Suspended Driver’s License

- Bribery or offering a bribe

- Alcohol restricted driver

- Driving on Denied License

- Failure to Signal Lane Change / Improper Lane Travel

- Failure to Signal/Turns/Stop/Lane Change

- Failure to stop at command of a police officer

- Traffic Control Signal-At Intersections-Color of Light Sign

- DUI Driving under the Influence of Alcohol/Drugs

- Failure to Appear

(3)

He has a prior record in Utah (4)

He has over a dozen criminal-traffic complaints in California (5)

(1) Integrity Financial Groups, Murray, Utah

Bulletin Board Complaint

http://leasingnews.org/archives/Aug2012/8_16.htm#bbc

Integrity Financial Groups, Murray, Utah

Bulletin Board Complaint

http://leasingnews.org/archives/Aug2012/8_16.htm#bbc

Integrity Financial Groups, Murray, Utah

Bulletin Board Complaint

http://leasingnews.org/archives/Jul2012/7_09.htm#bbc

(2) Integrity Financial Groups, Murray, Utah

Bulletin Board Complaint

http://leasingnews.org/archives/Jan2013/1_28.htm#bbc

(3) Arrested June 3, 2013

leasingnews.org/PDF/DALLINHAWKINSArrestedJune032013.pdf

(4) Previous Utah Arrest

http://mugshots.com/US-Counties/Utah/Salt-Lake-County-UT/Dallin-Brad-Hawkins.6998553.html

(5) California Criminal Traffic Record: leasingnews.org/PDF/HawkinsCaliforniaarrestrecord_62013.pdf

• Contract Negotiations • Fraud Investigations john@jkrmdirect.com | ph 315-866-1167| www.jkrmdirect.com |

(Leasing News provides this ad as a trade for investigations

and background information provided by John Kenny)

[headlines]

--------------------------------------------------------------

Lesson Not Learned in 49 States

by Bernie Boettigheimer, CLP

President, Lease Police

The story on Monday (1) about two indicted in Colorado for acting as a vendor and a lessee using several company names, acquiring other company names, credit, and identities, for sale/leaseback and "no equipment" was well read, I was told. There was only one Lease Police customer who was stung, but I hesitate to give their name as they never put them into the system or evidently ignored warnings of companies that were sent out by Lease Police.

We are talking about millions of dollars written off. I guess $25,000 here and $50,000 there is considered "small potatoes" and not worthy of any time. It appears “chump change” to many large corporations and institutions---It is just easier to sweep it “under the carpet” and go forward.

Human nature seems to work this way as no one likes to take the blame. No one wants to acknowledge we could have done better. It seems too many prefer to not know or linger on our shortcomings.

I suppose if these problems continue and become bigger they will be solved at that point but isn’t that just “kicking the can down the street”? I am reminded that Ralph Gagliardi (the Colorado Investigator) told me that his research showed Database Developers, Inc. did over $3,000,000 in similar type of transactions and when he called the funding companies involved he was offered little or no acknowledgement and assistance.

What about all the other so called vendors (I can assure you that there are at least 25 similar ones that we are tracking on LeasePolice.com)?

While the investigation started 18 months ago, it picked up speed 8 months ago when an inside tip pointed out an irregularity on a Corporate Reinstatement of one firm. A quick check of the credit card used to pay the delinquent franchise taxes found that it had been used on 34 recent such reinstatements. From there everything sped up and ultimately led to the money trail.

Along the way these suspects had enablers and unsuspecting enablers. However, this resourceful group of investigators went about accumulating an enormous amount of detailed information of names and transactions in every state but unfortunately only a small portion was able to be used under Colorado jurisdiction. John Parks, one of the accused parties, according to the Indictments, used D&B to enhance the credit standing of one of his Reinstated firms and then brought in Daryl Honowitz of Database Developers, Inc., who did a loan/lease with Marlin. The money trail was followed to John Parks who ultimately defaulted on the loan/lease.

Some of this requires legislation and the only active lease/finance association in this field today is the Equipment Leasing and Finance Association:

All state laws should be reviewed in the light of hidden sale lease/back schemes. I wouldn’t be surprised that there are few laws presently on the books.

From my experience at Lease Police, I don't believe:

-

Many Credit Departments review corporate filing history on all new vendors and lessees.

-

Many leasing companies do not make site inspections on all vendors in virtual offices and assuredly after $100,000 in fundings.

-

Many credit departments don't spend the time to perform a credit autopsy on all unsatisfactory terminations.

-

Too much time is spent on being the fastest in making a credit approval, rather than convey to their credit people the fact that all credit losses are bottom-line losses and don’t make up for a higher volume of approvals.

One of the main problems is the small leases of $25,000 here and $50,000 there is not enough money to move to the next level, and this also includes local district attorneys, US attorney general offices, and even the FBI I am told won't open up an investigation unless it is over $1 million in theft or scam in a business matter (consumer, yes; business, it's a civil matter to them, I am told).

But here we have a group and only the Colorado Attorney General has gotten involved, not the other 49 states. My hat is off to Ralph A. Gargliardi, CFE, Colorado Bureau of Investigations.

I wish more of my colleagues would take these small dollar “charge offs’ more seriously as they really add up across the United States and affect many banks and funders as well as those involved in these transactions that are crime.

Bernie Boettigheimer, CLP

President

Lease Police, Inc.

1400 Preston Rd.

Suite 400A

Plano, TX. 75093

www.leasepolice.com

(214) 549-3426

(972) 665-9915

(1) Lease Police Alerts---Two Indicted in Colorado

http://leasingnews.org/archives/Jun2013/6_03.htm#alerts

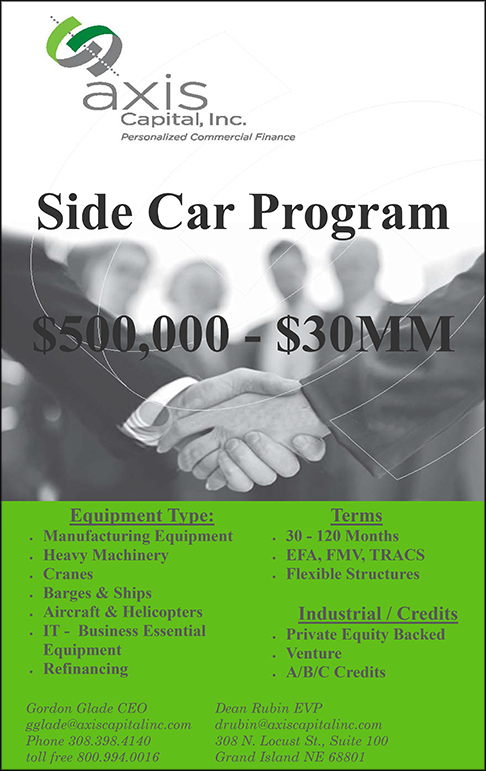

((Please click on ad to learn more))

(Leasing News provides this ad “gratis” as a means

to help support the growth of Lease Police)

[headlines]

--------------------------------------------------------------

CapitalSource Healthcare Finance, Chevy Chase, Maryland

Looking for Information

Looking for information regarding the above, as they don’t return telephone calls, as well it is noted several employees are no longer employed there as they are appearing in the last few “New Hires” since April, 2013.

Reports I have say the company closed this division, or maybe others, but no response from calls started to several, including emails, of last week and this week.

Any information will be held “off the record,” but looking for verification about the status of the company.

kitmenkin@leasingnews.org

| Working Capital Loans for Small Businesses | |

Channel Partners is now offering a new Easy Rewards program that allows you to earn rewards on EVERY deal over $15,000 in EVERY state! |

|

[headlines]

--------------------------------------------------------------

New Hires---Promotions

Martin Golden, 52, was named new director of the U.S. Small Business Administration's Columbus District office, Ohio, which is located in the Arena District. "Golden, who will lead 16 employees across offices in Columbus, Dayton and Cincinnati, said he looks forward to working with the small-business community in furthering the SBA’s mission of helping build strong businesses through training, advocacy and access to capital... He most recently served as senior director with CapitalSource Bank in Portland, Oregon

http://www.bizjournals.com/columbus/news/2013/06/04/health-care-financing-veteran-martin.html?page=all

Previously he was executive vice president, managing director, Marquette Healthcare Finance (2007-2009), managing director, Wells Fargo capital Finance (2005-2006), senior vice president, GE Healthcare Financial services (1999-2005), vice president, Credit Lyonnais (2006-1999), manager, TD (1992-1996). University of California, Berkeley - Walter A. Haas School of Business MBA, Business, University of California, Santa Barbara, BA, Economics

www.linkedin.com/in/martingolden

Ian Grace named business development manager at Mastria Auto Group, Raynham, Massachusetts. Previously he was automotive BDC manager, quirk Chrysler Jeep (July, 2012-May, 2013), litigation coordinator, TimePayment Corp. (March, 2009-November,2012), technical trainer, The First Marblehead Corporation (April, 2006-May, 2008), business consultant/business systems analyst. The First Marblehead Corporation (May, 2004-April, 2006), manager, The First Marblehead Corporation (January, 2004-May, 2004), credit analyst, The First Marblehead Corporation (July, 2002-January, 2004). Boston University Associate Degree, Business Administration, McIntosh College, Criminal Justice, Boston University, Northeastern University College of Professional Studies.

www.linkedin.com/pub/ian-grace/0/591/898/

Joseph (Joe) Louis has been hired to oversee the new San Francisco office for Cole Taylor Equipment Finance. Previously he was owner of MV Capital, (August, 2008-May, 2013), vice president and western regional manager wholesale, Bank of America (1989-1999)."He has also been in business development positions with BTM Capital and Maryland National Leasing Corporation, and he has served in various financial management capacities with firms such as Galoob Toys and Synapse Software Corporation."

http://www.linkedin.com/profile/view?tyah2

Steve Thompson joined Cole Taylor Equipment Finance as vice president, with responsibility for the origination of new equipment loans and leases in Texas, Arkansas, and Louisiana; opening an office in Austin. "Mr. Thompson brings more than 25 years of industry knowledge and direct equipment leasing and finance experience to Cole Taylor. He is especially well versed in the transportation, construction, energy, manufacturing, and marine sectors. Prior to joining Cole Taylor Equipment Finance, Mr. Thompson was a vice president in direct sales with Fifth Third Leasing Company and was with GE Capital prior to that."

[headlines]

--------------------------------------------------------------

Leasing Industry Help Wanted

|

Leasing Operations Coordinator Well-established asset-based direct funding source

for transactions $10,000 up to $250,000. |

For information on placing a help wanted ad, please click here:

http://www.leasingnews.org/Classified/Hwanted/Hwanted-post.htm

Please see our Job Wanted section for possible new employees.

[headlines]

--------------------------------------------------------------

Top 50 US banks and thrifts by assets

By Aarti Kanjani, SNL Financial

SNL Financial's most recent ranking of the largest 50 banks and thrifts in the U.S. reveals some minor movements. The top seven held firm to the same spots in the first quarter as in the fourth quarter of 2012, with JPMorgan Chase & Co. clinging to the No. 1 position.

Again, JPMorgan and Bank of America Corp. remained the only companies with more than $2 trillion in assets, and — along with No. 4 Wells Fargo & Co. — the only companies with more than $1 trillion in deposits.

The largest jumps in the top 50 included Chicago-based BMO Financial Corp., moving up to No. 19 from No. 21, and Pasadena, Calif.-based East West Bancorp Inc., jumping to No. 48 from No. 50. BMO Financial's assets rose to $122.36 billion from $116.11 billion, while East West Bancorp's assets jumped to $23.10 billion from $22.54 billion.

The biggest downward movement was by Birmingham, Ala.-based Regions Financial Corp., dropping to No. 22 from No. 20, as its assets fell to $118.72 billion from 121.35 billion.

SNL's ranking by assets is pro forma for pending M&A deals and transactions that have closed since March 31.

Akron, Ohio-based FirstMerit Corp. — which had entered the rankings at No. 46 in the third quarter of 2012 due to its announced acquisition of Flint, Mich.-based Citizens Republic Bancorp Inc. — remained at the same position in the fourth quarter of 2012 and jumped one position to No. 45 in the first quarter. The ranking is based on Citizens Republic's $9.59 billion in assets as of Dec. 31, 2012, and FirstMerit's $15.27 billion in assets as of March 31. The deal was completed April 12.

Buffalo, N.Y.-based M&T Bank Corp., which rose to the 17th spot in the second quarter of 2012 with its announced $3.81 billion acquisition of Hudson City Bancorp Inc. on Aug. 27 of that year, fell to No. 18 in the fourth quarter of 2012 and remained at the same position in the first quarter. M&T's new ranking is based on a combination of its $82.81 billion in assets and Hudson City's $40.29 billion in assets as of March 31. The asset size has not been adjusted to reflect M&T's intent to pay down approximately $12 billion of Hudson City's long-term borrowings by liquidating its comparably sized investment portfolio. It is the third-largest merger by deal value since 2010, and the companies have delayed the closing date due to regulatory concerns.

St. Petersburg, Fla.-based Raymond James Financial Inc. just cracked the rankings at No. 50 and became the sole newcomer to the list, after dropping off the list in the second quarter of 2012. Its assets increased to $22.74 billion from $22.28 billion in the previous quarter. San Antonio-based Cullen/Frost Bankers Inc., which joined the list in the third quarter of 2012, fell short and dropped from the top 50 in the first quarter, as its assets fell to $22.50 billion from $23.12 billion.

SNL excludes holding companies with deposits totaling less than 25% of assets from the ranking, which means that some large firms regulated as bank holding companies, such as Goldman Sachs Group Inc., General Electric Capital Corp. and Morgan Stanley, are not ranked.

A number of ranked companies recently announced noteworthy specialty finance asset deals. Although these deals met SNL's threshold for calculating a pro forma ranking, there was not enough disclosure to make adjustments. Those deals are: Bank of America's Jan. 6 announcement to sell a residential mortgage servicing rights portfolio, with $215.0 billion in receivables; Citigroup Inc.'s Feb. 19 announcement regarding the acquisition of credit card receivables from Capital One Financial Corp., with $7.0 billion in receivables; Popular Inc.'s May 6 announced sale of nonperforming residential mortgage loans, with $595.0 million in receivables; and HSBC Holdings Plc's sale of a portfolio of consumer loans completed April 1.

![]()

[headlines]

--------------------------------------------------------------

Undercapitalized banks fall to lowest level in 17 quarters

By Nathan Stovall and Robert Clark

SNL Financial

The number of undercapitalized banks fell to the lowest level in 17 quarters at the end of the first quarter, with more banks escaping undercapitalized territory through positive means.

The FDIC defines undercapitalized banks as those with a total risk-based capital ratio below 8.0%, a Tier 1 risk-based capital ratio below 4.0% or a Tier 1 leverage capital ratio below 4.0%, unless the bank is a CAMELS one-rated institution. In that case, a bank would be undercapitalized if its leverage ratio is less than 3.0%.

Thirty-eight banks and thrifts were undercapitalized, based on the criteria of having Tier 1 ratios below 4%, at March 31, compared to 42 institutions at the end of the fourth quarter and 61 institutions a year ago, according to SNL data, representing linked-quarter and year-over-year decreases of 9.5% and 37.7%, respectively. The number of undercapitalized institutions has fallen to the lowest level since the fourth quarter of 2008, when 30 banks were considered undercapitalized.

The number of undercapitalized banks in the industry has steadily declined for the last 10 quarters, with failures — rather than banks finding their way out of trouble through other means — accounting for the bulk of the decline. The trend was consistent through 2012, when the number of undercapitalized banks decreased by 26 to 44 institutions. During that period, a number of banks joined the ranks of the undercapitalized and 51 banks failed, while just 15 banks found their way out of trouble through recapitalizations, mergers or balance sheet shrinkage and de-risking, coupled with modest earnings in some cases.

The trend was more positive in the first quarter of 2013, though, when eight banks found their way out of undercapitalized territory without failing.

The number of undercapitalized institutions has declined at a faster rate than the decrease seen in the number of banks on the FDIC's "problem list" over the past few years. However, the number of institutions on the problem bank list has declined more quickly in the last two quarters.

The number of institutions on the problem list fell to 612 at the end of the first quarter, compared to 651 institutions in the fourth quarter and 772 a year ago, a 6.0% drop from the linked quarter and down 20.7% from a year ago. The number of problem institutions stood at 888 two years ago but totaled 702 at the end of 2009 and just 252 at end of 2008.

Most problem and undercapitalized institutions continue to be in areas that suffered from stress during the cycle. Florida, where 68 banks have failed this cycle, had five operating banks falling below the 4% Tier 1 risk-based capital threshold at March 31. Tennessee also had five operating, undercapitalized institutions as of March 31. Tennessee has not seen nearly as many bank failures as Florida, with just three banks failing in Tennessee this credit cycle.

Nevada and Georgia, which together have produced 99 bank failures this cycle, each had three operating undercapitalized institutions at the end of the first quarter.

The overall pace of resolutions has slowed dramatically in the last two years. Ninety-two banks failed in 2011 after 157 saw their doors closed in 2010. The pace of failures slowed considerably in 2012, with 51 banks failing last year.

One institution that has remained on the verge of failing has distorted the amount of undercapitalized institutions in the banking industry for some time. Capitol Bancorp Ltd. has struggled for a while and had eight of its banking subsidiaries among the list of undercapitalized banks for more than two years. In the first quarter though, five Capitol Bancorp subsidiaries previously deemed undercapitalized found their way out of those ranks, but three of those institutions failed.

In total, 10 banks previously deemed undercapitalized have failed since SNL last published the list of undercapitalized banks in the industry. When excluding the banks that have failed or sold since the end of the first quarter, SNL data shows that 27 banks were undercapitalized based on March 31 data, compared to 38 banks at the last publication of the list of undercapitalized banks.

Three Capitol Bancorp subsidiaries remain in undercapitalized territory. Capitol Bancorp said in a Chapter 11 liquidation plan proposed May 16 that it would seek to sell its interests in some or all of its remaining subsidiary banks. Excluding the Capitol subsidiary banks deemed undercapitalized, the number of operating undercapitalized institutions stood at 24 at May 30.

Seven banks, including two banks with more than $1 billion in assets, joined the ranks of the undercapitalized during the first quarter. Some of these banks had Tier 1 ratios below 4% at the end of the fourth quarter, but their financials were not current at the time of the SNL's last publication of undercapitalized banks. Edinburg, Texas-based First National Bank is among those joining the ranks and is the largest with $3.19 billion in assets. First Security Group Inc. unit FSGBank NA, which has $1.04 billion in assets, was also deemed undercapitalized at the end of the first quarter. However, First Security recently recapitalized and down streamed $65 million in capital to FSBBank, boosting the capital ratios of the bank significantly.

Eighteen banks in all escaped undercapitalized territory during the first quarter, which represents a far greater number than in past periods, but again failures were responsible for the bulk of the decline. Raising much-needed capital has proved very difficult for struggling institutions seeking new funds for defensive purposes, but a handful of banks have enjoyed greater success raising funds this year.

For instance, a few banks previously deemed undercapitalized escaped that territory by raising capital. New Dominion Bank raised in excess of $10 million after spending close to a year on the transaction. And Patterson Bankshares Inc.'s Patterson Bank recapitalized through an unorthodox capital raise where investors injected capital directly into the bank subsidiary.

A few other banks managed to build their capital levels modestly while delivering their balance sheets. And one bank, First National Bank of Baldwin County, found a lifeline selling to First Bancshares Inc. through Section 363 of the U.S. Bankruptcy Code. Under the structure of 363 sales, a bank holding company files for Chapter 11 bankruptcy protection while another entity recapitalizes and purchases the bank subsidiary. The buyer in turn avoids acquiring liability and adverse claims associated with the holding company.

Those transactions have increased in the last year but still are not commonplace. Failures, meanwhile, have slowed considerably and troubled banks seem to have more time to work through issues before facing a closure by their regulators. Just 14 banks have failed this year, and only 41 banks have closed in the last 12 months.

[headlines]

--------------------------------------------------------------

Update IFC Credit--Rudy Trebels

1:09-cv-06116, Rudy Trebles’ counsel has withdrawn and the parties are discussing settlement.

In the Coactive capital Partners, Inc. v. IFC Capital Funding I, LLC and Rudolph Trebels, as an individual, a docket entry was made at the request of counsel to reset for 7/22/2013 as attorneys have withdrawn as it appears a settlement is being made. Attorneys Kristopher J. Stark; Patrick F. Ross and John T. Ruskusky for Trebels have withdrawn with the original hearing for June 11, but that was extended on June 4th.

Changes in this evidently stem from Element Financial, Toronto, Canada acquiring Co-Active Partners, looking to clean up accounts as well as any negative publicity.

Today Trebels

In July,2009, Trebels opened up with Equipment Leasing Group of America, LLC, in Northfield, Illinois, back in business; in August, 2009 Trebels added Wedgewood Investment Group, LLC.

http://www.linkedin.com/profile/view?id=2444321

The Co-Active Capital Partners, Horsham, Pennsylvania filed their suit on July 9, 2009 against IFC Credit and also naming Rudolph D. Trebels, CLP, CEO of the company, and Marc Langs, CFO of the company. They are named as officers of IFC Credit Corporation as well as managers IFC Capital Funding I, LLC. The complaint filed is over 180 pages with five complete exhibits

This was the first public document to declare Trebles and Langs knew IFC Credit was "insolvent" reportedly for over a year. Certainly payments to vendors and brokers that made the Leasing News Bulletin Board can testify to that.

Here is a short synopsis from the 188 page public document:

"9. In December 2007, IFC, IFCI, and CoActiv were parties to a loan transaction wherein CoActiv provided funding to IFCI by means of a $25,000,000.00 credit facility for IFCI to purchase certain leases from IFC. As part of that transaction, IFC and IFCI entered into an Assignment of Servicing Agreement (the "IFCI Servicing Agreement") wherein IFC assumed IFCI's servicing requirements and agreed to service and administer the leases for the benefit of CoActiv. See Loan Agreement and IFCI Servicing Agreement attached hereto as Exhibits "D" and "E", respectively.

"22. Beginning in approximately mid-2008, the Servicing Reports ceased to show that any leases were being terminated by lessors and failed to show that IFC was receiving and depositing into other accounts the monies related to the early termination of the leases owned by CoActiv

"28. As of April 10, 2009, IFC has acknowledged that it wrongly withheld and retained over $1.6 million dollars in termination payments due to CoActiv.

29. Further, CoActiv has determined that IFC has failed to make almost $400,000 in other payments due and owing to CoActiv under the terms of the Servicing Agreements.

"30. Upon a review of IFC's financial situation, CoActiv believes, and therefore avers that IFC has been essentially insolvent over the past year and has been utilizing funds belonging to CoActiv to satisfy cash flow requirements.

"32. Mr. Trebels and Mr. Langs, as officers of IFC, were at all times aware of the funds received by IFC for termination of the leases as well as what information as contained on the Servicing Reports being provided to CoActiv.

"33. Mr. Trebels and Mr. Langs, as officers of IFC, were at all times aware that funds belonging to CoActiv were being dissipated and utilized by IFC without the knowledge of or permission of CoActiv.

34. Mr. Trebels and Mr. Langs knew at all times that the information being provided to CoActiv was false and misleading.

35. Section 13.1 of the Omnibus Agreement provides that Defendants shall pay all attorney’s fees, costs, and expenses incurred by CoActiv arising from the enforcement of CoActiv's rights under the Omnibus Agreement.

41. CoActiv has been damaged as a result of Defendants IFC's and IFCI's conversion in an amount exceeding $2,000,000.00 plus interests, fees, and costs.

51. IFC and IFCI failed to properly distribute nearly $400,000 in payments collected and reported on leases owned by CoActiv for which IFC and IFCI were collecting under the terms of the Servicing Agreement, as well as over $1.6 million in payments collected on leases owned by CoActiv for which IFC and IFCI were servicing under the terms of the Servicing Agreement.

62 Defendants Trebels and Langs knew the Servicing Reports were materially false and inaccurate, yet Defendant Langs, under Defendant Trebels' direct control and supervision, and upon information and belief with his express approval, signed the Servicing Reports on behalf of Defendants IFC and IFCI and actively participated in the fraud.

63. Defendants acted fraudulently towards CoActiv in order to falsely inflate the condition of Defendants IFC's and IFCI's financial operations.

64. Defendants' Trebels and Lang benefited from the fraud since it allowed them to maintain their positions at IFC and IFCI, as well as receiving financial and other benefits related to their positions."

CoActiv Complaint:

http://leasingnews.org/PDF/CoActive%20Complaint.pdf

Exhibit A:

http://leasingnews.org/PDF/Exhibit%20A.pdf

Exhibit B:

http://leasingnews.org/PDF/Exhibit%20B.pdf

Exhibit C:

http://leasingnews.org/PDF/Exhibit%20C.pdf

Exhibit D:

http://leasingnews.org/PDF/Exhibit%20D.pdf

Exhibit E:

http://leasingnews.org/PDF/Exhibit%20E.pdf

Exhibit F:

http://leasingnews.org/PDF/Exhibit%20F.pdf

Leasing News Bulletin Board Complaints:

http://leasingnews.org/archives/Nov2012/11_07.htm#bbc

http://leasingnews.org/archives/Sep2012/9_14.htm#bbc

http://www.leasingnews.org/archives/May%202009/05-08-09.htm#bbc

http://www.leasingnews.org/archives/May%202009/05-01-09.htm#bbc

http://www.leasingnews.org/archives/April%202009/04-29-09.htm#bbc

http://www.leasingnews.org/archives/April%202009/04-08-09.htm#bbc

http://www.leasingnews.org/archives/January%202009/01-28-09.htm#bbc

http://www.leasingnews.org/archives/January%202009/01-14-09.htm#bbc

Rudy Trebels Saga

http://www.leasingnews.org/Conscious-Top%20Stories/trebels.html

Previous stories:

http://www.leasingnews.org/Conscious-Top%20Stories/IFC_stories.htm

[headlines]

--------------------------------------------------------------

Beige Book---Modest Recovery, Except for Dallas

"Overall economic activity increased at a modest to moderate pace since the previous report, except the Dallas District, which reported strong economic growth."

"Overall bank lending increased modestly since the previous report. The Cleveland District noted that consumer demand for auto loans increased and that demand for residential loans shifted from refinancing to new purchases. The Chicago District indicated modest growth in business loan demand. The Dallas District reported robust growth in residential mortgages and auto lending with continued weakness in corporate transactions. The New York District saw an increase in demand for all types of loans except commercial and industrial loans, where demand was unchanged. San Francisco District banking contacts reported ample liquidity and competition among lenders for well-qualified business borrowers but limited credit availability for small businesses. The Philadelphia District noted slow loan growth, and the Atlanta District reported weak loan activity.

"Credit quality improved, on balance. The New York and Cleveland Districts reported widespread decreases in delinquency rates for business and consumer loans. Several Districts reported that credit standards have not changed much since the previous report."

Summary:

beigebook/beigebook201306.htm?summary

By District:

Boston

beigebook/beigebook201306.htm?boston

New York

beigebook/beigebook201306.htm?new_york

Philadelphia

beigebook/beigebook201306.htm?philadelphia

Cleveland

beigebook/beigebook201306.htm?cleveland

Richmond

beigebook/beigebook201306.htm?richmond

Atlanta

/beigebook/beigebook201306.htm?atlanta

Chicago

beigebook/beigebook201306.htm?chicago

St. Louis

beigebook/beigebook201306.htm?st_louis

Minneapolis

beigebook/beigebook201306.htm?minneapolis

Kansas City

beigebook/beigebook201306.htm?kansas_city

Dallas

beigebook/beigebook201306.htm?Dallas

San Francisco

beigebook/beigebook201306.htm?san_francisco

Full Report

beigebook/beigebook201306.htm

[headlines]

--------------------------------------------------------------

##### Press Release ############################

Balboa Capital Expands Point-of-Use Water

Equipment Vendor Financing Division

(This company has Bulletin Board Complaints plus “Tagged for Stealing Corporate Secrets” www.leasingcomplaints.com, which deals with this type of equipment, as well as “fair market value” leases that were supposed to be a dollar at the end.)

Company Adds Staff Members and Enhances Financing Program to Meet the Needs of Point-of-Use Water Equipment Vendors Nationwide

Balboa Capital, a leading independent financing company in the United States since 1988, today announced the expansion of its point-of-use water (POUW) equipment vendor financing team. The company added new finance managers, credit specialists and customer service representatives, plus made several key enhancements to its POUW equipment vendor financing program.

Carla Freberg

Vendor Services Manager

“These efforts address the increased demand from POUW equipment dealers and demonstrate our ongoing commitment to this highly specialized industry,” said Carla Freberg, Vendor Services Manager at Balboa Capital. “The addition of new and talented financing professionals to our team will increase our competitive advantage in POUW equipment vendor financing and allow us to better serve our growing base of POUW equipment dealers throughout the country.” Ms. Freberg also discussed Balboa Capital’s newly enhanced vendor financing program. “We secured a revolving credit facility from Wells Fargo Capital Financing, which greatly increases our lending power, and we streamlined our online financing tools so our POUW vendor partners can manage every aspect of their customers’ accounts from a computer, tablet or mobile device.”

For more information about Balboa Capital’s POUW equipment vendor financing program, please contact Carla Freberg at (949) 553-3448 or via email at carlamf(at)balboacapital(dot)com. You can learn more about Balboa Capital’s capabilities by viewing this water equipment vendor financing video. The company also developed an informative water industry infographic that you can download for free.

About Balboa Capital

Celebrating its 25th year in business in 2013, Balboa Capital has provided financing to thousands of small and medium-sized businesses throughout the United States. Balboa Capital is one of the largest independent finance companies in the nation delivering access to capital, speed of processing, leading-edge technology and state-of-the-art marketing tools that help fuel the growth and success of today’s businesses and equipment vendors. In addition to equipment vendor financing, the company’s portfolio of financing options includes equipment leasing, commercial financing, franchise financing and small business loan options. For more information, visit Balboa Capital's corporate website at http://www.balboacapital.com/

###### Press Release ##########################

[headlines]

--------------------------------------------------------------

Leasing Association 2013 Conferences

World Leasing Convention

June 13-14

Maritime Hotel

Berlin, Germany

http://events.hellotrade.com/conferences/world-leasing-convention/

Canadian Finance &

Leasing Association

September 18-20

Marriott Halifax

Harbourfront, Halifax

September 27-28, 2013

2013 NAELB Western Regional

Irvine, California

2013 Funding Symposium

October 10-13

Nashville Marriott

at Vanderbilt University

Nashville, Tennessee

October 10-11

2013 Annual Convention

Rome, Italy.

http://www.annual-convention.eu/

October 20-22

ELFA 52nd Annual Convention

JW Marriott Grande Lakes-Orlando, Florida

November 1-2, 2013

2013 Eastern Regional

Nashville, Tennessee

November 6-8, 2013

Boca Raton Resort Club, Boca Raton, FL

Commercial Finance Association

69th Annual Convention

November 13 - 15

JW Marriott Los Angeles at L.A. LIVE

Los Angeles, CA

Schedule of Activities

Link

Early Registration Fees

(Until Friday, August 30, 2013)

Member: $1,195

Non-member: $1,795

Standard Registration Fees

(Saturday, August 31, 2013 – Friday, November 8, 2013)

Member: $1,295

Non-member: $1,895

On-site Registration Fees

(After Friday, November 8, 2013)

Member: $1,395

Non-member: $1,995

Registration

Link

Bookmark us

[headlines]

--------------------------------------------------------------

[headlines]

--------------------------------------------------------------

Labrador Retriever/Mix

Roseburg, Oregon Adopt-a-Dog

Miss Chevious

Animal ID: 19924619

Breed Retriever, Labrador/Mix

Age: 1 year 17 days

Sex: Female

Size: Large

Color: Black/White

Spayed

Declawed: No

Housetrained: Unknown

Intake Date: 5/19/2013

Adoption Price: $111.00

I am a 1yr old Labrador Retriever mix. I have a tone of personality and energy. I would make a great hiking, fishing or camping buddy. I love to spend time with my humans and know I could be a great family dog if someone would give me a chance! I would do best with an active household. I would also do best with kids 7 and up as I am young and high energy. If you have any questions about me please ask an adoption host for help.

Saving Grace Pet Adoption Center

450 Old Del Rio Road

Roseburg, OR 97471

Adoption Center - 541.672.3907

Administration Office - 541.672.3853

Donations - 541.672.3853

We are open to the public for animal information, admissions, redemptions and adoptions Noon to 5 pm Tuesday through Sunday and Mondays by appointment.

http://www.savinggrace.info

Adopt-a-Pet by Leasing Co. State/City

http://www.leasingnews.org/Conscious-Top%20Stories/Adopt_Pet.htm

Adopt a Pet

http://www.adoptapet.com/

[headlines]

--------------------------------------------------------------

![]()

News Briefs----

Hedge-Fund Manager: Small Banks Are the Real Problem

http://www.moneynews.com/StreetTalk/Hedge-Fund-Manager-Small-Banks/2013/06/02/id/507531?goback=%2Egde_3853492_member

Bank CEO pay up 22 pct; Dimon still amid best paid

http://www.businessweek.com/ap/2013-06-05/bank-ceo-pay-up-22-pct-dimon-still-amid-best-paid

Cadillac: An American Luxemobile Comes Roaring Back

http://finance.yahoo.com/blogs/the-exchange/cadillac-american-luxemobile-comes-roaring-back-213405454.html

Casino equipment maker SHFL reports record revenue

http://www.vegasinc.com/news/2013/jun/04/casino-equipment-maker-shfl-reports-record-revenue/

Treasury Department to sell 30 million shares of GM stock

http://www.nypost.com/p/news/business/treasury_deparment

Report: Restaurant sales continue to rise in May

http://nrn.com/black-box/report-restaurant-sales-continue-rise-may

Mastros are free to go, French court rules

http://seattletimes.com/html/businesstechnology/2021123625

NY AG Sues HSBC re: Homeowners Trapped in Foreclosure

http://www.leasingnews.org/PDF/NYAGSuesHSBC_62013.pdf

Chicago Sun-Times Lays Off Entire Photo Staff,

---Will Give Reporters iPhoneography Training

http://www.cultofmac.com/229512/chicago-sun-times-lays-off-entire-photo-staff-will-give-reporters-iphoneography-training/

9 myths on how to build better credit

http://www.bankrate.com/finance/debt/9-myths-build-better-credit-1.aspx?ic_id=Top_Stories_link_1

[headlines]

--------------------------------------------------------------

---You May Have Missed

20 Dog Breeds that Have Fallen in Popularity Over the Past Decade

http://shine.yahoo.com/pets/20-dog-breeds-fallen-popularity-over-past-decade-122000047.html

[headlines]

--------------------------------------------------------------

SparkPeople--Live Healthier and Longer

![]()

SparkPeople--Live Healthier and Longer

Water is a Secret Ingredient

Water: The Wild Card of Weight Loss

http://www.sparkpeople.com/resource/nutrition_articles.asp?id=54

[headlines]

--------------------------------------------------------------

Baseball Poem

End of Millennium World Series 2000 by Mark H. Young © |

Published: Baseball Almanac (11-15-2000) |

Yankee tradition, can they be beat? The Yankees did win, as they should Mayor Giuliani had school kids play hooky Fourteen consecutive games in a row The number 4 and 7 trains As the 'Ol Perfessor Casey, would say in Stengeleeze, |

[headlines]

--------------------------------------------------------------

Sports Briefs----

Blackhawks' Keith suspended for Game 4 for high stick

http://www.chicagotribune.com/sports/hockey/blackhawks/chi-duncan-keith-blackhawks-20130605,0,7097439.story

Kings in talks with Larry Bird to run basketball operations

http://blogs.sacbee.com/sports/kings/archives/2013/06/kings-in-talks-with-larry-bird-to-run-basketball-operations.html

Jim Harbaugh Visits Judge Judy

http://www.49ers.com/news/article-2/Harbaugh-Attends-Judge-Judy-Filming/dd4fad2a-ea13-4c18-944b-db9eaa028c11

[headlines]

--------------------------------------------------------------

![]()

California Nuts Briefs---

Bill Cosby Likes Los Gatos Coffee Roasting Company's

Triple Short Caffè Latte!

SF Bay Area economy expected to remain robust, despite sluggish national recovery

http://www.mercurynews.com/business/ci_23390404/bay-area-economy-expected-remain-robust-despite-sluggish

Apple's new campus would add 7,400 jobs, stimulate economy http://www.mercurynews.com/business/ci_23386132/apples-campus-2-would-add-7-400-new

Huffman won't back Sonoma's call to investigate oyster farm closure

http://www.pressdemocrat.com/article/20130605/ARTICLES/call

Big mako shark caught off Calif. could be record

http://www.sfgate.com/news/texas/article/Big-mako-shark-caught-off-Calif-could-be-record-4579590.php

[headlines]

--------------------------------------------------------------

![]()

“Gimme that Wine”

http://www.youtube.com/watch?v=EJnQoi8DSE8

Barefoot Steps Further Ahead in Sales

http://www.winesandvines.com/template.cfm117501

The Press Democrat North Coast Wine Challenge’s “Naked” Wine

http://tastingroom.blogs.pressdemocrat.com/2013/06/05/the-press-democrat-north-coast-wine-competition%E2%80%99s-%E2%80%9Cnaked%E2%80%9D-wine/

Evidence of earliest-ever French winemaking found

http://www.decanter.com/news/wine-news/583965/evidence-of-earliest-ever-french-winemaking-found

Central Coast vineyards growing well

http://westernfarmpress.com/grapes/central-coast-vineyards-growing-well

Trefethan Family Vineyards ‘look fantastic’

http://westernfarmpress.com/grapes/trefethan-family-vineyards-look-fantastic

Free Mobile Wine Program

http://leasingnews.org/archives/Feb2010/2_26.htm#mobile

Wine Prices by vintage

http://www.winezap.com

http://www.wine-searcher.com/

US/International Wine Events

http://www.localwineevents.com/

Winery Atlas

http://www.carterhouse.com/atlas/\

Leasing News Wine & Spirits Page

http://two.leasingnews.org/Recommendations/wnensprts.htm

[headlines]

----------------------------------------------------------------

![]()

This Day in History

1498 - Christopher Columbus left on his third voyage of exploration.

1712 - The Pennsylvania Assembly banned the importation of slaves.

1755- Birthday of Nathan Hale. The American Patriot was caught behind lines gathering troop movements by General William Howe, who ordered him to be hung in the morning, as he was a spy. His alleged last words have become a symbol of American Patriotism: “I only regret that I have but one life to lose for my country." They were attributed to a news story printed in the 19 th century, and were not heard by contemporaries of his time, nor commented upon. A 1777 newspaper article reported Hale as saying that ``if he had ten thousand lives, he would lay them all down, if called to it, in defense of his injured, bleeding country.'' Four years later another newspaper story quoted Hale's last words as: ``. . . my only regret is, that I have not more lives than one to offer in its service.'' Hull's 1848 memoirs give us the pithier version we know today: ``I only regret that I have but one life to lose for my country.'' According to Captain Frederick Mackenzie, a British officer who witnessed Hale's death, he may have been young and courageous, but he never said these words. According to Mackenzie's diary, he wrote that Hale's last words were: “ It is the duty of every good officer to obey any orders given him by his commander-in-chief” James A. Barnes,” Myths of the Bryan Campaign,” Mississippi Valley Historical Review (1947). Also see:

http://www.lihistory.com/4/hs413a.htm

1756-birthday of American painter John Turnbull, Lebanon, Conn. lower half of:

http://memory.loc.gov/ammem/today/jun06.html

1769 - Daniel Boone first began to explore the present-day Kentucky.

1775 - The United Colonies changed their name to United States.

1776 - Richard Henry Lee of Virginia proposed to the Continental Congress the resolution calling for a Declaration of Independence: that "these United Colonies are, and of right ought to be, free and independent States..." Congress delayed the vote on the resolution until July 1

1816 - The temperature reached 92 degrees at Salem MA during an early heat wave, but then plunged 49 degrees in 24 hours to commence the famous "year without a summer".

1828 - A party led by Jebediah Smith completed a journey down the Klamath River and were on the verge of starvation when they were visited by Indians who brought food. Smith's party proceeded north to Oregon and most of the party was killed by Umpqua Indians. Smith was killed in 1831 by Comanches on the Cimarron River. Smith’s party was the 1st white people to see Lake Earl, the biggest lagoon on the West Coast.

1831- “People of Color” Convention held for the first time.

1862-Confederate gunboats engaged a Union flotilla near Memphis, TN. As crowds of spectators watched from the riverbanks, the outgunned Confederates were defeated. The city of Memphis surrendered shortly before noon of that day, effectively opening up the Mississippi region. . The war would rage on as the Union Army through shear source of "numbers of soldiers" would prevail.

http://www.cr.nps.gov/hps/abpp/battles/tn004.htm

http://www.americancivilwar.com/statepic/tn/tn004.html

1872- Susan B. Anthony tests the rights of women and black males to vote under the 14th and 15th amendment, registering and voting in Rochester, New York. She would be arrested, tired, and sentenced to pay a fine. She refused. The judge backed down, fearing she would take this to the Supreme Court for appeal, but nevertheless, the votes were all disqualified and both women and blacks would not be allowed to vote in this century.

1877--Meta Vaux Warrick Fuller - Afro- American sculptor. After success in Paris, she faced race and sex prejudice on her return to the U.S. In 1913 she began using Afro-Americans as models and for the next 50 years she produced major pieces that are part of the permanent collections at a number of museums and universities. Died March 18, 1968.

http://dsc.gc.cuny.edu/part/part6/articles/swilli.html

http://www.indiana.edu/~jah/teaching/2003_03/article.shtml

http://www.askart.com/artist/F/meta_vaux_warrick_fuller.asp?ID=80614

1889 -- Great Fire in Seattle, Washington destroys 25 downtown blocks.

1892-birthday of bandleader Ted Lewis, Circleville,OH

http://www.redhotjazz.com/tedlewis.html

1894 - One of the greatest floods in U.S. history occurred as the Williamette River overflowed to inundate half of the business district of Portland OR.

1899-birthday of pianist William “Fats” Jefferson, Waco, TX

1889-- Bryn Mawr College awarded the first graduate fellowship to a woman in the history of the United States. It went to Emily Greene Balch (B. 01-08- 1867) for "prosecuting sociological studies." Balch went on to win the Nobel Peace Prize in 1946.

1889--- Bryn Mawr College awarded the first graduate fellowship to a woman in the history of the United States. It went to Emily Greene Balch (B. 01-08- 1867) for "prosecuting sociological studies." Balch went on to win the Nobel Peace Prize in 1946. Half the human race is a terrible thing to waste... Bryn Mawr was under the direction of M. Carey Thomas who developed the college to an academic par with Harvard University.

1902—Birthday of band leader Jimmy Lunceford

http://www.pbs.org/jazz/biography/artist_id_lunceford_jimmie.htm

http://www.amazon.com/exec/obidos/search-handle-form/104-3603723-3237564

1904 -- Helen McCloy (1904-1993) American mystery writer, first woman to serve as president of Mystery Writers of America. In 1953 she received Edgar for her criticism.

http://www.kirjasto.sci.fi/hmccloy.htm

1918-Casey Stengel returned to Ebbets Field for the first time since being traded from the Brooklyn Dodgers to the Pittsburgh Pirates over the winter. Stengel celebrated the occasion by striding to the plate for his first at-bat, calling time, doffing his cap and letting a live bird fly out. Fans broke into laughter. He was giving them the bird.

1925-birthday of trombonist Al Grey, Aldie, VA, died March 24,2000

http://www.jazzcanadiana.on.ca/_GREY.htm

http://www.trombone.org/articles/library/algrey-tribute.asp

1930-Dillard University charged in New Orleans, LA

http://www.dillard.edu/

1931-birthday of guitarist Grant Green, St. Louis, Mo.

http://website.lineone.net/~johnharris/grant_green.htm

http://members.tripod.com/vermontreview/CD%20Reviews/gamut.htm

1933-Richard M. Hollingshead, Jr. opened America's first drive-in movie theater in Camden, NJ. At the height of their popularity in 1958, there were more than 4,000 drive-ins across America. In the 1990s, fewer than 600 remained opened.

1934- President Franklin D. Roosevelt signed the Securities Exchange Act that established the SEC. Wall Street had operated almost unfettered since the end of the eighteenth century. However, the stock market crash of 1929 necessitated regulation of the exchanges. The Securities and Exchange Commission is composed of five members appointed by the president of the US.

1939-- Singer Gary (US) Bonds, whose real name is Gary Anderson, was born in Jacksonville, Florida. Bonds had a string of energetic dance records in the early 1960's, the biggest of which was "Quarter to Three," which reached number one in 1961. Bonds' career was revived in 1981 by Bruce Springsteen. "The Boss" wrote "This Little Girl of Mine," which became Gary (US) Bonds' first hit in nearly 20 years. Bonds' comeback album, "Dedication," also made the charts.

1942-Congress on Racial Equality founded.

http://www.core-online.org/

1942-birthday of Marian Wright Edelman, activist and found of the Children's Defense Fund.

http://cdfweb.vwh.net/mwe.html

http://bss.sfsu.edu/edelman/aboutmwe.htm

1942 - The Battle of Midway--one of the most decisive U.S. victories in its war against Japan--comes to an end. In the four-day sea and air battle, the outnumbered U.S. Pacific Fleet succeeded in destroying four Japanese aircraft carriers with the loss of only one of its own, the Yorktown, thus reversing the tide against the previously invincible Japanese navy.

1943 - The worst of the L.A. Zoot Suit Riot violence occurs as soldiers, sailors, and marines from as far away as San Diego travel to Los Angeles to join in the fighting. Taxi drivers offer free rides to servicemen and civilians to the riot areas. Approximately 5,000 civilians and military men gather downtown. The riot spreads into the predominantly African American section of Watts.

1944- In the early-morning hours Allied forces landed in Normandy on the north coast of France. In an operation that took months of planning, a fleet of 2,727 ships of every description converged from British ports from Wales to the North Sea. Operation Overlord involved 2,000,000 tons of war materials, including more than 50,000 tanks, armored cars, jeeps, trucks and half-tracks. The US alone sent 1,700,000 fighting men. The Germans believed the invasion would not take place under the adverse weather conditions of this early June day, especially with their number one General George S. Patton employed elsewhere. But as the sun came up the village of Saint Mèere Eglise was liberated by American parachutists, and by nightfall the landing of 155,000 Allies attested to the success of D-Day. The long-awaited second front had at last materialized.

General Patton joined the war with his tank brigade, pushing toward the Rhine River before the other generals told him he couldn't do that.

http://memory.loc.gov/ammem/today/jun06.html

1944-birthday of pianist Monty Alexander, Kingston, Jamaica

http://www.montyalexander.com

1945--McTUREOUS, ROBERT MILLER, JR. Medal of Honor

Rank and organization: Private, U.S. Marine Corps. Born: 26 March 1924, Altoona, Fla. Accredited to: Florida. Citation: For conspicuous gallantry and intrepidity at the risk of his life above and beyond the call of duty, while serving with the 3d Battalion, 29th Marines, 6th Marine Division, during action against enemy Japanese forces on Okinawa in the Ryukyu Chain, 7 June 1945. Alert and ready for any hostile counteraction following his company's seizure of an important hill objective, Pvt. McTureous was quick to observe the plight of company stretcher bearers who were suddenly assailed by slashing machinegun fire as they attempted to evacuate wounded at the rear of the newly won position. Determined to prevent further casualties, he quickly filled his jacket with hand grenades and charged the enemy-occupied caves from which the concentrated barrage was emanating. Coolly disregarding all personal danger as he waged his furious 1-man assault, he smashed grenades into the cave entrances, thereby diverting the heaviest fire from the stretcher bearers to his own person and, resolutely returning to his own lines under a blanketing hail of rifle and machinegun fire to replenish his supply of grenades, dauntlessly continued his systematic reduction of Japanese strength until he himself sustained serious wounds after silencing a large number of the hostile guns. Aware of his own critical condition and unwilling to further endanger the lives of his comrades, he stoically crawled a distance of 200 yards to a sheltered position within friendly lines before calling for aid. By his fearless initiative and bold tactics, Pvt. McTureous had succeeded in neutralizing the enemy fire, killing 6 Japanese troops and effectively disorganizing the remainder of the savagely defending garrison. His outstanding valor and heroic spirit of self-sacrifice during a critical stage of operations reflect the highest credit upon himself and the U.S. Naval Service.

1946 –Birthday of Janet Lennon Culver City CA, singer (Lennon Sisters)

http://www.singers.com/jazz/vintage/lennonsisters.html

http://www.dead-or-alive.org/dead.nsf/lnames-nf/Lennon+Janet

1946-The Basketball Association of America was founded at a New York meeting of hockey team owners and arena managers interested in having their buildings used on open dates. The BAA played three seasons (1946-47, 1947-48, 1948-49), after which it merged with the National Basketball League, founded in 1937, to form the National Basketball Association. Three original BAA teams remain: The Boston Celtics, The Golden State Warriors (originally the Philadelphia Warriors) and the New York Knicks.

1949---Top Hits

Riders in the Sky - Vaughn Monroe

Again - Doris Day

Some Enchanted Evening - Perry Como

Lovesick Blues - Hank Williams

1951-HANSON, JACK G. Medal of Honor

Rank and organization: Private First Class, U.S. Army, Company F, 31st Infantry Regiment. Place and date: Near Pachi-dong, Korea, 7 June 1951. Entered service at: Galveston, Tex. Born: 18 September 1930, Escaptawpa, Miss. G.O. No.: 15, 1 February 1952. Citation: Pfc. Hanson, a machine gunner with the 1st Platoon, Company F, distinguished himself by conspicuous gallantry and intrepidity at the risk of his life above and beyond the call of duty in action against an armed enemy of the United Nations. The company, in defensive positions on two strategic hills separated by a wide saddle, was ruthlessly attacked at approximately 0300 hours, the brunt of which centered on the approach to the divide within range of Pfc. Hanson's machine gun. In the initial phase of the action, 4 riflemen were wounded and evacuated and the numerically superior enemy, advancing under cover of darkness, infiltrated and posed an imminent threat to the security of the command post and weapons platoon. Upon orders to move to key terrain above and to the right of Pfc. Hanson's position, he voluntarily remained to provide protective fire for the withdrawal. Subsequent to the retiring elements fighting a rearguard action to the new location, it was learned that Pfc. Hanson's assistant gunner and 3 riflemen had been wounded and had crawled to safety, and that he was maintaining a lone-man defense. After the 1st Platoon reorganized, counterattacked, and rescued its original positions at approximately 0530 hours, Pfc. Hanson's body was found lying in front of his emplacement, his machine gun ammunition expended, his empty pistol in his right hand, and a machete with blood on the blade in his left hand, and approximately 22 enemy dead lay in the wake of his action. Pfc. Hanson's consummate valor, inspirational conduct, and willing self-sacrifice enabled the company to contain the enemy and regain the commanding ground, and reflect lasting glory on himself and the noble traditions of the military service.

1955--- Bill Haley & Comets, "Rock Around the Clock" hits #1

1956 - Gogi Grant (born Audrey Brown) reached the top spot on the "Billboard" singles chart for the first and only time in her career. Her hit, "The Wayward Wind", stayed at the top of the top-tune tabulation for eight weeks and on the music charts for 22 weeks. It was her second record release. The first, in October, 1955, was "Suddenly There's a Valley" which climbed to number nine.

http://www.gpproductions.com/acts/grant.html

http://art.staviator.com/G/Gogi_Grant.html

1956--Gene Vincent's recording of "Be Bop A Lula" was released. The song was co-written by Vincent and (Sheriff) Tex Davis, a deejay at a Norfolk, Virginia radio station. "Be Bop a Lula" was a hit on both sides of the Atlantic, selling a million copies. Vincent never was able to match the success of his initial hit. He died in 1971 of a seizure brought on by a bleeding ulcer.

1957---Top Hits

Love Letters in the Sand - Pat Boone

A Teenager's Romance/I'm Walkin' - Ricky Nelson

A White Sport Coat (And a Pink Carnation) - Marty Robbins

Four Walls - Jim Reeves

1960-- Tony Williams of the Platters left the group for a solo career. Williams was the lead singer on the Platters' big hits in the '50s - "Only You," "The Great Pretender" and "Smoke Gets in Your Eyes," among others. In the 1970's, Williams and Buck Ram, manager of the Platters, battled in court over who had the right to use the group's name. Ram won the case, but both later toured with groups billed as the Platters.

1960-- Roy Orbison's "Only the Lonely" was released. It would reach number two on the Billboard Hot 100 and inspire Bruce Springsteen to write "Born to Run."

1960-- The RIAA presents Bing Crosby with a special platinum record honoring the sale of his 200 millionth record, a total which includes not only 125 albums but 2,600 singles!

1962--- The Beatles audition for EMI, recording four demos, the first material the band ever recorded at Abbey Road: three original compositions called "Love Me Do," "Ask Me Why," and "P.S. I Love You," and a cover of the standard "Besame Mucho." Producer George Martin is not at the session, but is called in by engineer Norman "Hurricane" Smith when he hears something he likes in "Love Me Do." Martin is not impressed with the group's songwriting, scruffy outfits, and even scruffier equipment (one of the band's amps blows during the audition), and he tells them so, finishing, "Look, I've laid into you for quite a time, you haven't responded. Is there anything you don't like?" To which George quips, "I don't like your tie!" The tension is broken, and Martin, charmed by the group's personality, agrees to work with them. (Though he later says, "They were pretty awful. I understand why other record companies turned them down.") The band members are paid US $12 each for the session; drummer Pete Best, whose skills Martin remains unimpressed with, would soon be sacked from the group.

1964-- The Dixie Cups' "Chapel of Love" hits #1

1965 - General Westmoreland requests a total of 35 battalions of combat troops, with another nine in reserve. This gave rise to the "44 battalion" debate within the Johnson administration, a discussion of how many U.S. combat troops to commit to the war. Westmoreland felt that the South Vietnamese could not defeat the communists alone and he wanted U.S. combat troops to go on the offensive against the enemy. His plan was to secure the coastlines, block infiltration of North Vietnamese troops into the south, and then wage a war of attrition with "search and destroy" missions into the countryside, using helicopters for rapid deployment and evacuation. Westmoreland had some supporters in the Johnson administration, but others of the president's advisers did not support Westmoreland's request for more troops, because they disagreed with what would be a fundamental change in the U.S. role in Vietnam. In the end, Johnson acquiesced to Westmoreland's request; eventually there would be over 500,000 U.S. troops in South Vietnam.

1965---Top Hits

Help Me, Rhonda - The Beach Boys

Wooly Bully - Sam The Sham and The Pharoahs

Crying in the Chapel - Elvis Presley

What's He Doing in My World - Eddy Arnold

1966-civil rights activist Stokely Carmichael launches “Black Power” Movement. Died Nov 15,1998.

http://www.blackhistory.eb.com/micro/727/78.html

1966 -- Author Truman Capote holds famous "Black & White Ball" — widely regarded as most glittering bas of the decade.

1966 - No. 1 Billboard Pop Hit: "Paint It Black," The Rolling Stones.

1966- The Turtles and Oxford Circle at the Fillmore Auditorium in San Francisco.

1966--- The Beatles record "Eleanor Rigby"

1968-McDONALD, PHILL G. Medal of Honor

Rank and organization: Private First Class, U.S. Army, Company A, 1st Battalion, 14th Infantry, 4th Infantry Division. place and date: Near Kontum City, Republic of Vietnam, 7 June 1968. Entered service at: Beckley, W. Va. Born: 13 September 1941. Avondale, W. Va. Citation: For conspicuous gallantry and intrepidity in action at the risk of his life above and beyond the call of duty. Pfc. McDonald distinguished himself while serving as a team leader with the 1st platoon of Company A. While on a combat mission his platoon came under heavy barrage of automatic weapons fire from a well concealed company-size enemy force. Volunteering to escort 2 wounded comrades to an evacuation point, Pfc. McDonald crawled through intense fire to destroy with a grenade an enemy automatic weapon threatening the safety of the evacuation. Returning to his platoon, he again volunteered to provide covering fire for the maneuver of the platoon from its exposed position. Realizing the threat he posed, enemy gunners concentrated their fire on Pfc. McDonald's position, seriously wounding him. Despite his painful wounds, Pfc. McDonald recovered the weapon of a wounded machine gunner to provide accurate covering fire for the gunner's evacuation. When other soldiers were pinned down by a heavy volume of fire from a hostile machine gun to his front, Pfc. McDonald crawled toward the enemy position to destroy it with grenades. He was mortally wounded in this intrepid action. Pfc. McDonald's gallantry at the risk of his life which resulted in the saving of the lives of his comrades is in keeping with the highest traditions of the military service and reflects great credit upon himself, his unit, and the U.S. Army.

1970---MURRAY, ROBERT C. Medal of Honor