![]() Add me to mailing list |

Add me to mailing list | ![]() Change email |

Change email | ![]() |

| ![]() Search

Search

Advertising | All Lists | Archives | Classified Ads | This Day In American History

Leasing News is a web site that posts information, news, and

entertainment for the commercial bank, finance and leasing industry

kitmenkin@leasingnews.org

![]()

Irvine, California Finance/Credit Analyst Manage lease transactions through the entire credit review, documentation and funding process.

|

Wednesday, March 12, 2014

Today's Equipment Leasing Headlines

Clarification:

Renasant Bank Will Consider Third Party Originations

Classified Ads---Credit

Balboa Capital Sues Regents Capital

They Are After Salesmen Who Left

Banks earned record net income in 2013,

thanks to large institutions

Classified Ads---Help Wanted

Marlin Business Services 10K---104 pages

Highlights

Letters---We get eMail

Meet Leasing News Advisor Paul Weiss

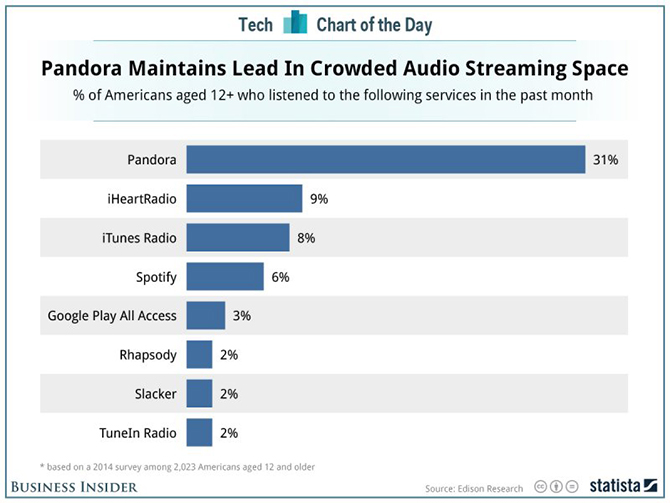

Streaming Audio Belongs to Pandora—Heads Down!

Madison Capital Partners with NextGen GA Fund

to help finance NextGen Installations

Rottweiler/Purebred

Baltimore, Maryland Adopt-a-Dog

Collector/Collections/Consultant/Communications

News Briefs---

More Auto's Are Being Leased

Pizza chain Papa Murphy’s plans $70M IPO

Jos. Bank to be acquired by Men's Wearhouse for $1.8 billion

Toyota Raises Wages for First Time Since ’08 Amid Record Profits

Broker/Funder/Industry Lists |

Features (collection)

Top Ten Stories Chosen by Readers |

Top Stories last six months

www.leasingcomplaints.com (Be Careful of Doing Business)

www.evergreenleasingnews.org

You May have Missed---

SparkPeople--Live Healthier and Longer

Poem

Sports Briefs---

California Nuts Brief---

"Gimme that Wine"

This Day in American History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

######## surrounding the article denotes it is a “press release”

and was not written by Leasing News nor information verified, but from the source noted. When an article is signed by the writer, it is considered a “by line.” It reflects the opinion and research of the writer.

Please send to a colleague and ask them to consider subscribing.

We are free.

[headlines]

--------------------------------------------------------------

Clarification:

Renasant Bank Will Consider Third Party Originations

"Renasant Bank has expanded services to include equipment financing and leasing. The unit will operate in a variety of commercial industries including transportation, medical, manufacturing, construction and machine tools. New business will be generated through direct calling and third party referrals. Renasant’s Equipment Finance and Leasing division operates in Alabama, Tennessee, Mississippi and Georgia and offer a full suite of financing and leasing products.

"BTW, I have been a subscriber to Leasing News for many years. Certainly enjoy the content.”

Patricia T. Reid

Attorney at Law

Senior Vice President

Renasant Bank

2001 Park Place

Suite 525

Birmingham, AL 35203

Phone: 205 327 4304

Cell: 205 542 8406

PReid@renasant.com

Former Marks & Associates Employee to Head

Renasant Bank Equipment Financing Division

http://leasingnews.org/archives/Mar2014/3_10.htm#renasant

| Working Capital Loans $10,000-$250,000 | |

|

|

[headlines]

--------------------------------------------------------------

Classified Ads---Credit

(These ads are “free” to those seeking employment or

looking to improve their position)

Credit, syndication, workout experience |

| Orlando, Florida As a Commercial Credit Analyst/Underwriter, I have evaluated transactions from sole proprietorships to listed companies, across a broad spectrum of industries, embracing a multitude of asset types. Sound understanding of balance sheet, income statement and cash flow dynamics which impact credit decisions. Strong appreciation for credit/asset risk. rpsteiner21@aol.com 407 430-3917 |

Free Posting for those seeking employment in Leasing

http://www.leasingnews.org/Classified/Jwanted/Jwanted-post.htm

All “free” categories “job wanted” ads:

http://www.leasingnews.org/Classified/Jwanted/Jwanted.htm

|

[headlines]

--------------------------------------------------------------

Balboa Capital Sues Regents Capital

They Are After Salesmen Who Left

by Christopher Menkin

Balboa Capital, Irvine, California, in a twist of events, has sued some ex-employees for allegedly taking trade secrets and a customer list from Balboa. Readers might remember that it was Balboa that was sued by Direct Capital, Portsmouth, Maine, and TimePayment, Burlington, Massachusetts over taking customer lists. So the pot is calling the kettle black.

On February 19, 2014, Balboa Capital sued seven former employees and their new employer, Regents Capital, Costa Mesa, California, claiming proprietary information and customer’s lists were “stolen.”

Filed in Orange County, the suit names “REGENTS CAPITAL CORPORATION; DONALD HANSEN; DENNIS ODIORNE; KIR STEN MERZA; CHELSA HAINES; JAVIER ENRIQUEZ; KEVIN KUTTER; TRAVIS POWER; DOES 1 through 25, inclusive.”

As Leasing News reported on February 25, 2014, eight salesmen reportedly left Balboa Capital over changes in the protection of previous customers and vendors. (1) Leasing News then learned the new company was Regents Capital with Don Hansen as president (2). Hansen is a public figure.

Hansen was first elected to the Huntington Beach City Council at the age of 32 in 2004, and was re-elected in 2008. In his final year on the council Don served as Mayor of Surf City, USA. He was also a 19 year veteran of Balboa, knowing the co-founder Patrick Byrne and his escapades. He knew he would be sued when he left, as that is the practice of Patrick Byrne. Readers may remember the story of him going through garbage for files (3) and the practice of Byrne’s old nemesis, Jim Raeder, and the Kinko’s video of the use of a computer to send out emails to all Raeder’s funding sources. (4).

In addition, since the story of Balboa being tagged for stealing secrets (5) and armed with this knowledge, and other stories, it is hard to imagine that Don Hansen and the other sales personnel exited Balboa and downloaded customer lists. They knew the train would be coming down the tracks.

None of the parties are talking to Leasing News, but for sure, it's going to get more intense before it is resolved, and will likely include testimony from ex-employees on the culture at Balboa Capital. Stay tuned!!!

Eighty-nine page complaint for a jury trial: (6)

-

Balboa Capital Top Salesmen Leave to Start Own Company

http://leasingnews.org/archives/Feb2014/2_25.htm#balboa

-

Balboa Capital Salesmen Start Regents Capital

http://leasingnews.org/archives/Feb2014/2_27.htm#balboa

-

Another Equipment Lessor Gets Sued for Stealing Trade Secretshttp://leasingnews.org/archives/May2013/5_28.htm#stealing_secrets

-

Insider says it was an employee at Balboa Capital. Jim Raeder will not reveal name of party or company. He says he received "cash settlement" and believes matter is "resolved." (10/04) A number of readers question how Kinko's turned over a video so quickly, while others believe it is an ex-employee that is the culprit and thus the real reason the name is not being revealed. (10/04) We do not receive any benefit in publicly humiliating the individuals responsible for this misconduct. Our intentions are to hold them responsible and liable for the consequences of their statements, and to recover damages they have caused to our business, says Raeder. (10/04) Survey Results: Let Us Know the Name http://www.leasingnews.org/archives/October%202004/10-01-04.html#survey (9/04) Jim Raeder to reveal culprits’ names. (8/04) Jim Raeder allegedly sees video at Kinko's, sales slip, talks to clerk, knows party's name and company. (8/04) Derogatory and malicious accusations spread around internet and to funders, industry readers, and becomes chain letter. 8/04) New York Times criticizes company for not returning advance rentals. Controversy grows regarding story and commitment fees in general.

-

Balboa Capital Tagged for Stealing Corporate Trade

Secrets of TimePayment Systems

http://www.leasingnews.org/Pages/balboa_stealing.html

-

89 page complaint for jury trial

BalboaCapitalComplaint_3122014.pdf

[headlines]

--------------------------------------------------------------

Banks earned record net income in 2013

thanks to large institutions

By Maria Tor and Zuhaib Gull

Commercial banks and savings banks earned $154.62 billion in 2013, a record high in the 23 years that SNL Financial has tracked bank regulatory data. More than half of the year's profits were earned by the largest 10 banks by assets.

In the fourth quarter, banks earned net income of $40.32 billion in aggregate. Profits were up compared to both the prior quarter and year-ago quarter, when banks made $36.01 billion and $34.68 billion, respectively.

Net income earned by the industry in 2013 was the highest in a single year among all years since 1990. When adjusting for inflation using the core Personal Consumption Expenditures Index, 2006 was the only year more profitable than 2013 among the years SNL Financial analyzed.

Commercial banks and savings banks earned $154.62 billion in 2013, a record high in the 23 years that SNL Financial has tracked bank regulatory data. More than half of the year's profits were earned by the largest 10 banks by assets.

In the fourth quarter, banks earned net income of $40.32 billion in aggregate. Profits were up compared to both the prior quarter and year-ago quarter, when banks made $36.01 billion and $34.68 billion, respectively.

Net income earned by the industry in 2013 was the highest in a single year among all years since 1990. When adjusting for inflation using the core Personal Consumption Expenditures Index, 2006 was the only year more profitable than 2013 among the years SNL Financial analyzed.

While the dollar amount of profits soared in 2013, the industry's net interest margin remained low. The aggregate net interest margin was 3.22% in the fourth quarter, a slight uptick from 3.21% in the third quarter, but down from 3.31% in the year-ago period. Comparatively, the aggregate net interest margin in the early to mid-1990s was above 4% among commercial banks. Savings institutions, which by nature of their charter rely on lower-earning assets, saw their aggregate net interest margin range between 2.27% and 3.07% in the 1990s.

On a median basis, which removes the skewing effect of the largest banks, the net interest margin for all commercial banks, savings banks and savings institutions is the lowest of all of the years tracked by SNL at just 3.60%. In 1992, by comparison, the median was 4.51%.

FDIC Chairman Martin Gruenberg commented on the small increase in the fourth-quarter net interest margin in remarks about the agency's fourth-quarter quarterly banking profile, released Feb. 26.

"The steeper yield curve in 2013 helped net interest margins, as banks generally borrow short and lend for longer terms," he said in a news release. "Margins increased across all size groups in the fourth quarter except for the largest group of banks, where they generally have declined since 2010 due to growth in low-yield reserve balances held at Federal Reserve banks."

On a quarterly basis, net interest income of the banking industry grew to $106.64 billion from $104.54 billion in the prior quarter and $105.86 billion a year prior. Meanwhile, provision expenses were up to $7.01 billion in the fourth quarter from $5.80 billion in the third quarter. Provision expenses in the last quarter of 2012 were $15.15 billion.

[headlines]

--------------------------------------------------------------

Leasing Industry Help Wanted

Irvine, California Finance/Credit Analyst Manage lease transactions through the entire credit review, documentation and funding process.

|

[headlines]

--------------------------------------------------------------

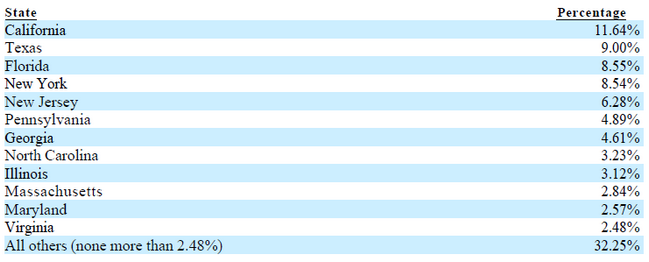

Marlin Business Services 10K---104 pages

Highlights

A browser search for “Marlin Leasing” comes up with “Marlin Finance,” another indication of the move into business loans being promoted by Marlin. February 5, 2014, the company issued a press release on its 4th Quarter and Year-end, 2013. (1) On Valentine’s Day, Marlin announced “Marlin Business Services Corp. Reaches One Millionth Customer Credit Application”

Leasing News has been following the “Evergreen Clause” usage of Marlin for over five years, so here is the news from their March 10, 2014 SEC filing. Renewal income was off, but evidence of “Evergreen Clauses” is still a major profit maker for this company: “Renewal income, net of depreciation, totaled approximately $5.1 million, $6.7 million and $7.5 million for the years ended December 31, 2013, 2012 and 2011, respectively.”

page 51

As noted, the Marlin Business Services Corp. (NASDQ-MRLN) SEC filing is 104 pages long. Here is a selective view with the full filing at the bottom of this article:

“We are a Pennsylvania corporation with our principal executive offices located at 300 Fellowship Road, Mount Laurel, NJ 08054” (Laws in Pennsylvania are more favorable to leasing companies. editor).

---

page 19

“At December 31, 2013, we operated from five leased facilities including our executive office facility, a Philadelphia office facility, the branch offices and the headquarters of MBB. Our Mount Laurel, New Jersey executive offices are housed in a leased facility of approximately 50,000 square feet under a lease that expires in May 2020. We also lease 3,524 square feet of office space in Philadelphia, Pennsylvania, where we perform our lease recording and acceptance functions. Our Philadelphia lease expires in July 2014. In addition, we have a regional office in Johns Creek, Georgia (a suburb of Atlanta). Our Georgia office is 3,085 square feet and the lease expires in June 2019. The headquarters of MBB in Salt Lake City is 5,764 square feet and the lease expires in October 2014. We also lease 300 square feet for a sales office in Sherwood, Oregon. This lease commenced September 2010 and is on a month-to-month basis.

“In February 2013, the Company extended its lease agreement on its executive offices in Mount Laurel, New Jersey. The original expiration date of May 2013 was extended to May 2020…”

---

page 24

“Our average original lease transaction was approximately $13,000 at December 31, 2013, and we typically do not exceed $250,000 for any single lease transaction. This under $250,000 segment of the equipment leasing market is commonly known in the industry as the small-ticket segment. We access our end user customers primarily through origination sources comprised of our existing network of over 11,900 independent commercial equipment dealers, various national account programs and, to a much lesser extent, through direct solicitation of our end user customers and through relationships with select lease brokers… As of December 31, 2013, we serviced approximately 75,000 active equipment leases having a total original equipment cost of $973.5 million for approximately 63,000 small and mid-sized business customers.”

---

page 5

"Of our 285 total employees as of December 31, 2013, we employed 124 sales account executives, each of whom receives a base salary and earns commissions based on his or her lease and loan originations. We also have six employees dedicated to marketing as of December 31, 2013.

“Our direct sales origination channels, which account for approximately 94% of the active lease contracts in our portfolio, involve:

“Independent Equipment Dealer Solicitations…. Our typical independent equipment dealer has less than $10.0 million in annual revenues and fewer than 40 employees.

“Major and National Accounts…. larger independent dealers, distributors and manufacturers…

“End User Customer Solicitations. This channel focuses primarily on soliciting our existing portfolio of approximately 63,000 end user customers for additional equipment leasing or financing opportunities…

“Indirect Channels. Our indirect origination channels account for approximately 6% of the active lease contracts in our portfolio and consist of our relationships with lease brokers and certain equipment dealers who refer end user customer transactions to us for a fee or sell us leases that they originated with end user customers.”

---

page 6

“In May 2000, we established AssuranceOne, our Bermuda-based, wholly-owned captive insurance subsidiary, to enter into a reinsurance contract with the issuer of the master property insurance policy…. During the year ended December 31, 2013, income recognized in connection with our insurance product covering equipment not financed through the Company comprised approximately $0.2 million of our total insurance income of $4.9 million.

“Portfolio Overview

“At December 31, 2013, we had approximately 75,000 active leases in our portfolio, representing aggregate minimum lease payments receivable of $682.1 million. With respect to our portfolio at December 31, 2013:

“the average original lease transaction was approximately $13,000, with an average remaining balance of approximately $9,100;

“the average original lease term was approximately 46 months; our active leases were spread among approximately 63,000 different end user customers, with the largest single end user customer accounting for only 0.10% of the aggregate minimum lease payments receivable;

“over 79.3% of the aggregate minimum lease payments receivable were with end user customers who had been in business for more than five years;

“the portfolio was spread among 12,181 origination sources, with the largest source accounting for only 1.42% of the aggregate minimum lease payments receivable, and our 10 largest origination sources accounting for only 8.9% of the aggregate minimum lease payments receivable…”

---

page 8

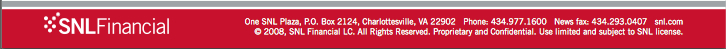

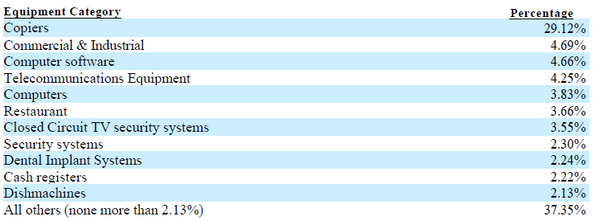

Equipment Leased

States Leased

---page 9

“In 2013, approximately 41% of credit decisions made on new applications have been made using the scorecards.”

--- page 11

How Covenant with Wells Fargo was handled:

“Officer, effective between January 15, 2014 and March 31, 2014, and announced that Mr. Pelose’s duties would be split between Daniel P. Dyer, the Company’s Chief Executive Officer, and Edward R. Dietz, the Company’s Senior Vice President of Administration and General Counsel. Mr. Pelose retired on March 5, 2014. We do not expect the change to have any material adverse effect on our financing arrangement with Wells Fargo Capital Finance, because, as noted above, Mr. Pelose, has been replaced by persons with skills and experience appropriate for performing his former duties. A change in the Chief Executive Officer, Chief Operating Officer or Chief Financial Officer is an event of default under our long-term loan facility with Wells Fargo Capital Finance, unless we hire a replacement with skills and experience appropriate for performing the duties of the applicable positions within 120 days.”

---

page 19

“Salaries and benefits expense. Salaries and benefits expense increased $2.8 million, or 11.2%, to $27.7 million for the year ended December 31, 2013 from $24.9 million for the year ended December 31, 2012. The increase was primarily due to increased headcount and due to the separation agreement related to the departure of Marlin’s Chief Operating Officer. Salaries and benefits expense, as a percentage of average total finance receivables, was 5.12% for the year ended December 31, 2013 compared with 5.74% for the year ended December 31, 2012. Total personnel increased to 285 at December 31, 2013 from 265 at December 31, 2012, primarily due to increased staffing levels in the credit, marketing and collection teams, and increased sales staffing levels, which included 124 sales account executives at December 31, 2013, compared to 114 sales account executives at December 31, 2012."

---

page 42

“Provision for credit losses. The provision for credit losses increased $3.7 million, or 62.7%, to $9.6 million for the year ended December 31, 2013 from $5.9 million for the year ended December 31, 2012, primarily due to the impact of portfolio growth and the ongoing seasoning of the portfolio, as reflected in the mix of origination vintages and the mix of credit profiles.”

---

page 43

“Fee income increased $1.4 million, or 11.7%, to $13.4 million for the year ended December 31, 2013 from $12.0 million for the year ended December 31, 2012. Fee income included approximately $2.7 million of net residual income for the year ended December 31, 2013 and $3.6 million for the year ended December 31, 2012. The decrease in net residual income was primarily due to lower renewal income since fewer leases reached the end of their original contractual terms during 2013, as a result of the lower originations during the 2008 to 2010 timeframe.

“Fee income also included approximately $9.1 million in late fee income for the year ended December 31, 2013, which increased 24.7%, compared to $7.3 million for the year ended December 31, 2012. The increase in late fee income was primarily due to the increase in average total finance receivables.

“Fee income, as a percentage of average total finance receivables, decreased 29 basis points to 2.48% for the year ended December 31, 2013 from 2.77% for the year ended December 31, 2012. Late fees remained the largest component of fee income at 1.68% as a percentage of average total finance receivables for the year ended December 31, 2013, compared to 1.69% for the year ended December 31, 2012. As a percentage of average total finance receivables, net residual income was 0.50% for the year ended December 31, 2013, compared to 0.82% for the year ended December 31, 2012.”

---

page 41

“Residual Performance.

“Our leases offer our end user customers the option to own the equipment at lease expiration. As of December 31, 2013, approximately 68% of our leases were one dollar purchase option leases, 31% were fair market value leases and 1% were fixed purchase option leases, the latter of which typically contain an end-of-term purchase option equal to 10% of the original equipment cost. As of December 31, 2013, there were $28.4 million of residual assets retained on our Consolidated Balance Sheet, of which $22.7 million, or 79.8%, were related to copiers. As of December 31, 2012, there were $29.9 million of residual assets retained on our Consolidated Balance Sheet, of which $23.8 million, or 79.6%, were related to copiers. No other group of equipment represented more than 10% of equipment residuals as of December 31, 2013 and 2012, respectively. Improvements in technology and other market changes, particularly in copiers, could adversely impact our ability to realize the recorded residual values of this equipment.”

---

page 50

“We consider renewal income a component of residual performance. Renewal income, net of depreciation, totaled approximately $5.1 million, $6.7 million and $7.5 million for the years ended December 31, 2013, 2012 and 2011, respectively. The decline in renewal income was primarily due to fewer leases reaching the end of their original contractual terms during 2013, as a result of the lower originations during the 2008 to 2010 timeframe.”

---

page 51

“At December 31, 2013, we have approximately $85.0 million of available borrowing capacity in addition to available cash and cash equivalents of $85.7 million. This amount excludes additional liquidity that may be provided by the issuance of insured deposits through MBB. Our debt to equity ratio was 3.09 to 1 at December 31, 2013 and 2.26 to 1 at December 31, 2012.

Net cash used in investing activities was $104.9 million for the year ended December 31, 2013, compared to net cash used in investing activities of $101.0 million for the year ended December 31, 2012 and $25.3 million for the year ended December 31, 2011. Investing activities primarily relate to leasing activities.”

---

page 52

page 93

-

Marlin Leasing 4th Quarter Drop/Up Year-endhttp://leasingnews.org/archives/Feb2014/2_07.htm#marlin

10-K Marlin Business Services—104 pages

http://www.leasingnews.org/PDF/Marlin_10K_3122014.pdf

|

[headlines]

--------------------------------------------------------------

Letters---We get eMail

Former Marks & Associates Employee to Head

Renasant Bank Equipment Financing Division

http://leasingnews.org/archives/Mar2014/3_10.htm#renasant

“This was a gracious article, a cut above just a cold announcement, and I appreciate it!

“NEWS: Lily Anne Dunn was born to my daughter, Lauren, yesterday! Mom and child are well. As you can imagine, after losing my other daughter...this is a very emotional time!”

Barry S. Marks

Marks & Associates

-----

Leasing Veteran Chuck Thorn Passes Away

http://leasingnews.org/archives/Mar2014/3_05.htm#thorn

“I am sorry to hear of Chuck’s passing. He was blessed in many ways to be able to beat his illness and enjoy his family for many years. He established one of the early, multi-generational, iconic leasing family legacies. I have great memories of his professionalism and wisdom in the crazy niche of garment industry equipment leasing in California.”

Paul J. Menzel, CLP

President, Financial Pacific

-----

Borrower Tags Mortgage Service for Violation

of Soldiers and Sailors Relief Act

http://leasingnews.org/archives/Feb2014/2_20.htm#fees

“Thank you so much for bringing this reprehensible story about the strong arm tactics the mortgage company used on Lt. Brewster to the forefront.

“It is appalling to say the least. The readers of Leasing News know very well that Tom McCurnin is above board and practice the highest of ethical standards. This story sickens me and I can see it really got to his very core. He is so high above the slime ball lawyers who would do such a thing. Thanks again to Tom for spreading this story and thank you Kit for publishing it. Hats off to both of you fine gentlemen”

Rosanne Wilson, CLP, BPB

1st Independent Leasing, Inc

------

“Just read Tom McCurnin’s article in today’s leasing News and wanted to thank him for shedding some light on an absolute travesty. The people that risk their lives to protect us all should considered the best of the best and treated accordingly.”

Rick Wilbur

Managing Partner

CHARTERCAPITAL---

------

“Way beyond perfectly hilarious! ...and...great acting.”

Dave Silverman

“He's got MY vote for president of the year. I always knew bankers had a sense of humor; I just didn't know where they kept it. Glad to see they let it out for once!”

BT

Bob Teichman, CLP

Teichman Financial Training

“funny!”

Steve Fix

John Kenny • Fraud Investigations • Credit Investigations • Asset Searches • Skip-tracing • Third-party Commercial Collections john@jkrmdirect.com | ph 315-866-1167| www.jkrmdirect.com |

(Leasing News provides this ad as a trade for investigations

and background information provided by John Kenny)

[headlines]

--------------------------------------------------------------

Leasing News Advisor

Paul Weiss

![]()

Paul Weiss has been in and around equipment leasing for 27 years.

Among other leasing industry affiliations, Paul co-led the leveraged buyout of ICON Capital in 1996 with Beau Clarke (since deceased) and served as its President and Vice Chairman until he sold his substantial ownership stake in late 2006. ICON was then the largest in its field in syndication volume for lease investment programs to individual investors. He was responsible for the company's lease acquisitions and securities sales and marketing efforts. According to the Monitor, ICON became one of the largest independently owned leasing companies in the United States after it was acquired by Mr. Weiss and his partners in 1996.

In the first year after his non-compete clause ended, he was approached by a former ICON colleague to get back into the leasing business and form Panthera. Paul believed that after the industry pullback in 2008 there has been a lack of real equity in the leasing markets, and that many players had moved to more conservative financing type transactions as a consequence. Still, many sectors still require or desire traditional equipment based equity investors to have true lease and rental alternatives for equipment users. Panthera was therefore formed last year to "bring a substantial pool of capital to U.S. and European equipment leasing, renting and trading market" he is back with "creative problem-solving equity deals." Panthera enjoys substantial private equity backing. Since its formation Panthera has been active in such disparate markets as rail, aircraft rotables, locomotives and industrial equipment, and actively seeks out relationships with manufacturers, lessors and brokers for any equipment transactions where the equipment has a long useful life.

He is also a private investor and an Advisor to or Director of numerous Bay Area emerging growth companies. He is a frequent speaker on business development and entrepreneurship and a frequent judge on startup and emerging growth company financing competitions.

Prior to acquiring ICON in 1996 Mr. Weiss was Executive Vice President and a co-founder of Griffin Equity Partners (1993-1996), Senior Vice President of Gemini Financial Holdings, Inc. (1991-1993) and Vice President of Pegasus Capital Corporation (1988-1991); in each of these capacities he was responsible for large ticket seasoned lease portfolio acquisitions. Mr. Weiss believes he has been involved with more than $4 billion of large ticket leasing acquisitions during his career as a principal. He was named as one of the top 25 most influential in the leasing industry by Leasing News in 2009. Prior to entering the equipment leasing business in 1988, Mr. Weiss was an investment banker and securities analyst.

He is a longtime resident of Marin County, California. Paul can be reached atpaul@pantheraleasing.com.

[headlines]

--------------------------------------------------------------

Streaming Audio Belongs to Pandora—Heads Down!

[headlines]

--------------------------------------------------------------

### Press Release ############################

Madison Capital Partners with NextGen GA Fund

to help finance NextGen Installations

Owings Mills, MD- Madison Capital, a leading provider of equipment and commercial vehicle financing solutions, is pleased to announce their partnership with Nexa Capital and the NextGen GA Fund. The NextGen GA Fund is a public-private partnership formed between the U.S. Congress, the aerospace industry and the private-sector investment community. The Fund will help modernize the general aviation fleet, benefiting tens of thousands of pilots and owners and increasing aircraft value along the way.

Madison Capital will serve as a financing partner with The NextGen GA Fund which will finance NextGen installations, using stipulated equipage families to include WAAS-capable GPS, ADS-B In, ADS-B Out, RNAV/RNP avionics, data communications, SWIM, flat panel displays, antennas, electronic components, instrument panel modifications, installation and certification costs. “Madison Capital is very excited to join with The NextGen GA Fund as a financing partner. The Fund will enable the retrofit of tens of thousands of general aviation aircraft and assist pilots and aircraft owners in overcoming financial challenges to completing these mandated safety-enhancing installations ,” said Allan Levine, President, Madison Capital.

For more information about the NextGen GA Fund, visit www.nexacapital.com or visit booth No. 119 in the exhibit hall during the AEA International Convention & Trade Show, March 12-15, in Nashville, Tenn., at the Gaylord Opryland Convention Center.

About Madison Capital, LLC.

Madison Capital has over 40 years of expertise in commercial equipment financing and leasing and is a direct funding source for most types of business equipment and vehicles. Madison provides its financing services throughout the U.S., Canada, and Puerto Rico. In addition, Madison offers loan portfolio servicing capabilities concentrating on firms looking to outsource their billing and collection functions. For more information, please visit www.madisoncapital.com or call 800-733-5529.

About the NextGen GA Fund

The NextGen GA Fund LLC is managed by the NEXA General Partnership and Management Company. This Fund was formed by NEXA Capital Partners LLC, which provides specialized transaction-focused services including business advisory, capital planning, corporate finance and investment banking for the aerospace sector. With offices in Washington D.C., NEXA also works closely with government and industry organizations that drive regulatory requirements so important for the aerospace and airline sectors. For more information, visit www.nexacapital.com.

#### Press Release #############################

|

[headlines]

--------------------------------------------------------------

Rottweiler/Purebred

Baltimore, Maryland Adopt-a-Dog

Animal ID: 21943285

Taz

Breed: Rottweiler/Purebred

Age: 5 years 2 months 10 days

Sex: Male

Size: Large

Color: Black/Tan

Neutered

Declawed: No

Housetrained: Unknown

Site: Baltimore Humane Society

Location: Kennel

Intake Date: 2/25/2014

Hi there! Taz here! I'm a big cuddle bug! I really enjoy hanging out with people, playing with stuffed animals and squeaky toys. Those are my favorite. I consider myself a fast learner. I already know commands like: Sit, Down, Paw and Army Crawl! Impressive right? I hope to find my forever family soon. Whether it be going on a long hike or being a couch potato, I'm content. Think I'm the guy for you? Come in and meet me!"

Webcam

http://bmorehumane.org/adopt/adopt-dog/

Adult dogs (over the age of 6 months and over 25 lbs.): $100

Baltimore Humane Society

1601 Nicodemus Road

Reisterstown, MD 21136

410-833-8848

shelter@bmorehumane.org

Tuesday - Sunday

12pm - 6pm

Adopt a Pet

http://www.adoptapet.com/

[headlines]

--------------------------------------------------------------

Collector/Collections/Consultant/Communications

Classified ads

| Collector: Atlanta, GA Asset Recovery Specialist. We get your money or we get your > equipment back for you. Physical Asset Recovery Experts! E-mail: mcrouse911@joimail.com |

Collector: Cleveland, OH Huntley Capital & Associates is your solution to late payments, no payments, and asset recovery. Call 216-337-7075. Email: ghpatey@msn.com |

||

| Collections: Dallas, Texas Contingency Fee basis. Receivables Outsourcing. We are a fully bonded nationwide licensed agency. We collect for nationally known banks and leasing companies. 800-886-8088. |

Collector: Los Angeles, CA Expert skiptracers covering Southern California. We locate skips, judgment debtors and collateral. When you can't get the job done in house, give us a call at 1-800-778-0794. E-mail: ceo@interagencyLA.com |

||

| Collector: Louisville, KY We are a full service collection agency with attorney network. 21 years experience. Please call Jon Floyd, VP at 1-800-264-6850 email: jfloyd@collectcsg.com |

Collector: Louisville, KY Euler Hermes/UMA 92 year old Global Receivables Outsourcing. Presence in 143 Countries. Work w/ 4 out of 5 Fortune 500 firms. Contingency Fee Structure. 20% off first time clients.! Andrew.Newton@eulerhermes.com 1-800-237-9386 x 205. |

||

| Collector: Mandeville, MI International commercial collection services all fees are on contingency on line access. E-mail: rmelerine@collect-now.com www.drspay.com www.collect-now.com |

|

||

Collector: Nationwide |

Collector: Saint Louis, MO Complete commercial collection agency. Licensed bonded in all states and will out performed any other agency! Call 1-800-659-7199 ext.315 E-mail: jfloyd@lindquistandtrudeau.com |

||

| Consultant: Nationwide 25 yrs. experience: Creating/Refining Business Plans to raise capital· Credit Underwriting support/policy/procedure development · Operations Support/policy/procedure development. Call: 610-246-2178, McCarthy Financial, LLC, David.mccarthy@mccarthy-financial.com |

Consultant: Burlington, CT We provide our clients with a full range of consulting services such as portfolio conversions, reconciliation, custom programming and leasing operations utilizing InfoLease. Email: info@new-millennium-assoc.com |

||

| Consultant: Europe 15 years doing deals/running own technology leasing company – looking to advise/ lead new entrants to take advantage the European market opportunity. www.clearcape.co.uk or kevin.kennedy@clearcape.co.uk |

Consultant: Henderson, NV Focus on new business development and process efficiencies to create incremental revenue and profitability. Executive level vendor experience, and satisfied outsourcing clients. Incredible track record. E-mail: rbutzek@cox.net |

||

Consultant: Sausalito, CA |

Consultant: North of Detroit, MI |

||

Consultant: Ridgefield CT. |

Email: dan@danscartoons.com Go to http://www.danscartoons.com

|

All "Outsourcing" Classified ads (advertisers are both requested and responsible to keep their free ads up to date:

http://www.leasingnews.org/Classified/Outsourcing/Outsourcing.htm

How to Post a free "Outsourcing" classified ad:

http://www.leasingnews.org/Classified/Outsourcing/Outsourcing-post.htm

|

[headlines]

--------------------------------------------------------------

![]()

News Briefs----

More Auto's Are Being Leased

http://www.autoremarketing.com/financial-services/leasing-tracks-toward-middle

Pizza chain Papa Murphy’s plans $70M IPO

http://seattletimes.com/html/businesstechnology_pizzaipoxml.html

Jos. Bank to be acquired by Men's Wearhouse for $1.8 billion

http://www.baltimoresun.com/business/bs-bz-jos-bank-mens-wearhouse-reach-deal-20140311,0,5718840.story

Toyota Raises Wages for First Time Since ’08 Amid Record Profits

http://www.bloomberg.com/news/2014-03-12/toyota-raises-wages-for-first-time-since-08-amid-record-profits.html

[headlines]

--------------------------------------------------------------

--You May Have Missed It

Live San Francisco Video

http://sanfrancisco.cbslocal.com/live-video/

[headlines]

--------------------------------------------------------------

SparkPeople--Live Healthier and Longer

![]()

Skinny Shamrock Shake

http://recipes.sparkpeople.com/recipe-detail.asp?recipe=2431377

[headlines]

--------------------------------------------------------------

Winter Poem

-- This Is Just to Say

by William Carlos Williams

I have eaten

the plums

that were in

the icebox

and which

you were probably

saving

for breakfast

Forgive me

they were delicious

so sweet

and so cold

[headlines]

--------------------------------------------------------------

Sports Briefs----

Barry Bonds returns to Giants, larger than life no longer

http://www.sfgate.com/giants/article/Barrry-Bonds-returns-to-Giants-larger-than-life-5305117.php

49ers trade for Martin

http://blog.sfgate.com/49ers/2014/03/11/49ers-trade-for-ot-jonathan-martin/

Redskins add more weapons for RG3

http://www.csnwashington.com/football-washington-redskins/talk/redskins-add-more-weapons-rg3?p=ya5nbcs&ocid=yahoo

There's been a trade: 49ers deal for QB Blaine Gabbert

http://blogs.sacbee.com/49ers/archives/2014/03/theres-been-a-trade-49ers-deal-for-qb-blaine-gabbert.html

Donte Whitner leaves 49ers for Browns

http://www.pressdemocrat.com/article/20140311/sports/140319919

|

((Please Click on Bulletin Board to learn more information))

(Leasing News provides this ad “gratis” as a means

to help support the growth of Lease Police)

[headlines]

--------------------------------------------------------------

California Nuts Briefs---

National parks you’ll fall in love with

http://blog.sfgate.com/getlost/2014/03/07/national-parks-youll-fall-in-love-with/#13820103=0&21252101=0

5-alarm fire destroys San Francisco apartment building under construction

http://abclocal.go.com/kgo/story?section=news

/local/san_francisco&id=9462799

[headlines]

--------------------------------------------------------------

![]()

“Gimme that Wine”

http://www.youtube.com/watch?v=EJnQoi8DSE8

The Mr. Miyagi of Wine Sommeliers

http://www.thedailybeast.com/articles/2014/03/08/the-mr-miyagi-of-wine-sommeliers.html

Free Mobile Wine Program

http://leasingnews.org/archives/Feb2010/2_26.htm#mobile

Wine Prices by vintage

http://www.winezap.com

http://www.wine-searcher.com/

US/International Wine Events

http://www.localwineevents.com/

Winery Atlas

http://www.carterhouse.com/atlas/\

Leasing News Wine & Spirits Page

http://two.leasingnews.org/Recommendations/wnensprts.htm

[headlines]

----------------------------------------------------------------

![]()

This Day in History

1609-Quite by accident, Bermuda was colonized. The ship of Admiral Sir George Somers, taking settlers to Virginia, was wrecked on the reefs of Bermuda. The islands had been discovered in the early 1500s, but were uninhabited until 1609.

1613-The first colonial warfare between England and France in America occurred at Mount Desert, ME, where Father Pierre Biard, superior of Saint Sauveur, had established a settlement of French Jesuits. The settlement was attacked by an English expedition under the command of Captain Samuel Argall. His aim was to suppress piracy and defend England’s claim to the country, which was based on explorations made by John and Sebastian Cabot in the 15th and 16th centuries. The seas around

this area were also ripe with fish and European countries would set sail for the area just

for the fishing.

1664 - The Duke of York obtains a grant that gives him authority over all lands between the Connecticut and Delaware Rivers. This land grant includes all Dutch holdings in North America.

1676 - Indians attack Plymouth, Massachusetts.

1773- French-African Jeanne Baptiste Pointe de Sable founded settlement now known as Chicago, Ill.

http://www.choosechicago.com/HISTORY.HTM

http://www.chipublib.org/004chicago/timeline/dusable.html

1831-Clement Studebaker was born in Gettysburg, Pennsylvania. Clement and his brother, Henry Studebaker, founded H. & C. Studebaker, a blacksmith and wagon building business in South Bend, Indiana. The Studebaker brothers made their fortune manufacturing carriages for the Union Army during the Civil War. By the end of the war, the Studebaker Brothers Manufacturing Company had become the world's largest manufacturer of horse-drawn carriages. With the advent of the automobile, Studebaker converted its business to car manufacturing, becoming one of the larger independent automobile manufacturers. Another major war would affect the company's fortune almost a century after its founders had benefited from the demand caused by the Civil War. During World War II, Studebaker manufactured airplane engines, trucks, and weasels (small military vehicles) for the war effort. Like many of the independents, Studebaker fared well during the war by producing affordable family cars. As their advertisement claimed, "Studebaker is building an unlimited quantity of airplane engines, military trucks, and other materiel for national defense... and a limited number of passenger cars, which are the finest Studebaker has ever produced." However, after the war, the Big Three--GM, Ford, and Chrysler--bolstered by their new government-subsidized production facilities, were too much for many of the independents, and Studebaker was no exception. Post-WWII competition drove Studebaker to its limits, and the company was absorbed by the Packard Corporation in 1954.

1877-- David McKendree served as Postmaster General in the cabinet of President Rutherford B. Hayes this day until August 24, 1880. McKendree was a lieutenant colonel in the 43rd regiment of Tennessee and had been wounded and captured at Vicksburg. He also was a U.S. Senator. The appointment was quite controversial at the time.

1884 - The State of Mississippi authorized the first state-supported college for women. It was called the Mississippi Industrial Institute and College.

1896 -- Jesse "Lone Cat" Fuller born, Jonesboro, Georgia. A country blues singer and one-man-band, he wrote the classic "San Francisco Bay Blues," among many other songs, and influenced numerous early-60s white folk-blues artists.

http://www.taco.com/roots/fuller.html

1888-One of the most devastating blizzards to hit the northeastern US began in the early hours of Monday. A snowfall of 40-50 inches, accompanied by gale-force winds, left drifts as high as 30-40 feet. More than 400 persons died in the storm (200 at New York City alone). Some survivors of the storm, known as "The Blizzard Men of 1888”, held annual meetings at New York City as late as 1941 to recount personal recollections of the event.

1901---Andrew Carnegie donates $5.2 million to build 65 branch libraries in New York. Between 1900 and his death in 1919, Carnegie used his vast his riches to establish over 2500 libraries. He believed reading to be very important. In 1775, less than 60% could read, not including slaves who were less literate, and women, reportedly 75% of whom could not read or write. The free education system through reading brought equality and a better quality of life for the entire country.

http://memory.loc.gov/ammem/today/mar12.html

1903 - One of the American League's eight charter franchises, the Baltimore Orioles, moved to New York City and became the New York Highlanders, before taking the "Yankees" as their official name in 1913.

1904-Raphael Hawaweeny was ordained Eastern Orthodox bishop of Brooklyn, NY, at St. Nicholas Church. As a vicar under the Holy Synod of the Church of Russia, Hawaweeny thus became the first Russian Orthodox bishop ordained in America.

1912- Juliet Low founded the Girl Scout of the USA at Savannah, Georgia. As is the tradition, Girl Scout cookies are on sale during this week. At first, the girls weren’t called Girl Scouts at all. They were called Girl Guides until the name was officially changed a short time after the group’s founding.

1917- Earl Heywood, known as "Canada's Number-One Cowboy Singer," was born in London, Ontario. He began his career in 1941 on CFCO in Chatham, Ontario. The following year he moved to CKNX in Wingham, where he remained as a singer and announcer for more than 35 years. Heywood appeared for almost 20 years on the weekly "CKNX Barn Dance" and was host for "Serenade Ranch" from 1946 to 1953. Heywood and his Serenade Ranch Boys recorded 18 songs for RCA Victor, the most popular of which was "Alberta Waltz."

http://www.hillbilly-music.com/artists/artist_details.cfm?artistid=12027

1917-Chess record producer Leonard S. Chess was born in Motol, Poland.

Without the two Chess brothers, most of the blues songs would not have been recorded, or influenced the Rock’n’Roll musicians that followed.

http://www.artistdirect.com/music/artist/bio/0,,414291,00.htm

l?artist=Leonard+Chess

http://www.cnn.com/2000/books/news/09/08/arts.us.bluesintogold.ap/

http://www.saveamericastreasures.org/profiles/chess.htm

1918-Organ player Sir Charles Thompson born Springfield OH

http://search.centerstage.net/music/articles/charlesthompson.html

http://www.home.earthlink.net/~steveja7/SCT.htm

http://www.allaboutjazz.com/reviews/r1200_137.htm

1922- American poet and novelist Jack (Jean-Louis) Kerouac, leader and spokesman for the Beat movement, was born at Lowell, MA. Kerouac is best known for his novel “On the Road”, published in 1957. It celebrates the Beat ideal of nonconformity. Kerouac published “The Dharma Bums” in 1958, followed by “The Subterraneans” the same year, “Doctor Sax” and its sequel “Maggie Cassidy” in 1959; “Lonesome Traveler” in 1960, “Big Sur” in 1962 and “Desolation Angels” in 1965. Kerouac died at St. Petersburg, FL, at age 47, Oct 21, 1969. A previously unpublished part of “On the Road” called “Visions of Cody” was published posthumously in 1972.

http://www.levity.com/corduroy/kerouac.htm

http://www.kirjasto.sci.fi/kerouac.htm

1923- the first movie with sound was shown before the New York Electrical Society in New York City by Dr. Lee De Forest. Called “ The Gavote”, it showed a man and woman dancing to old-time music performed by four musicians playing on wind, percussion and string instruments. An Egyptian dance “trailer” was also shown. No voices were heard, only music. As a pioneer of ‘modern’ radio in the early 1900’s, DeForest called his invention phonofilm. Today it's called soundtrack.

1926-“The Home of the Happy Feet,” Harlem’s famous Savoy Ballroom opens. “Stompin” at the Savoy,” was one of Count Basie’s and Benny Goodman’s hits. The entrance fee was very small and often the crowd was 15% to 25% white. Supposedly the room was very well lit so you could view other dancers and very well-ventilated.

(In the days before air conditioning this was very important.)

http://www.findarticles.com/g1epc/tov/2419101066/p1/article.jhtml

http://www.savoyplaque.org/about_savoy.htm

http://www.savoyballroom.com/

http://www.savoystyle.com/history.html

http://www.savoystyle.com/movies.html

1928-sax player Willie Maiden born Detroit MI

http://www.artistdirect.com/music/artist/bio/0,,462246,00.html?

artist=Willie+Maiden

1928 - The St. Francis Dam 40 miles north of Los Angeles burst and flooded the valley. Over 500 people were drowned.

http://www.usc.edu/isd/archives/la/scandals/st_francis_dam.html

http://seis.natsci.csulb.edu/VIRTUAL_FIELD

/Francesquito_Dam/franmain.htm

1932- Andrew Young, civil rights leader, former mayor of Atlanta, GA, born New Orleans, LA.

http://search.eb.com/blackhistory/micro/650/54.html

1933- Eight days after he was inaugurated, President Franklin Delano Roosevelt gave his first presidential address to the nation, the first of his famous "Fireside Chats". The name was coined by newsman, Robert Trout, who thought the President sounded as if he was sitting in living rooms all over the nation, next to a roaring fire.

Speaking by radio from the White House, he reported rather informally on the economic problems of the nation and on his actions to deal with them. His subject was the reopening of the banks during the following week.

1935 - Pari-mutuel betting came into being as horse race bets were legalized in Nebraska. Today, there are still states where horse racing, betting, or other forms gambling still bother legislatures, despite the fact that other states have been participating in these activities for years.

1935-Pianist Hugh Lawson was born Detroit MI

http://www.52ndstreet.com/reviews/reissues/lawsoncolours.reissues.html

1939 - Artie Shaw and his band recorded "Deep Purple" for the Bluebird label. After the first minute, you can hear Helen Forrest sing the vocal refrain. Larry Clinton had a number one song with a similar arrangement of the same song this same year. In 1963 it was a hit for saxophonist, Nino Tempo and his sister, April Stevens. Hundreds of versions of this song have been recorded.

1940—Singer Al Jarreau born Milwaukee WI

http://www.aljarreau.com/biography.html

1942- Paul Kantner, guitar player with Jefferson Airplane, was born. His biggest hit is the million-selling No. 1 song "You've Got a Friend" in 1971.

1946 - The filming of the controversial “Forever Amber” began in Hollywood, with a record-breaking $3 million budget. The film, based on the steamy best-selling novel by Kathleen Winsor which was banned in Australia, starred Linda Darnell, Cornel Wilde, George Sanders, Richard Haydn, Leo G. Carroll, and Jessica Tandy. The film went way over budget, ultimately costing $6.5 million, or $2.5 million more than “Gone With the Wind” less than a decade earlier. The film's budget skyrocketed partly because Darnell replaced actress Peggy Cummins in the lead role after she was fired, which forced a temporary production shut-down. Despite its stellar cast, superb musical score, expensive costumes, and ambitious plans, the 140-minute epic was a big flop at the box office.

http://www.norcalmovies.com/ForeverAmber/

1946—vocalist Liza Minnelli born in Los Angeles, CA, the daughter of Judy Garland and film director Vincent Minnelli. She made her professional debut at the age of three in a quick role in the film "In the Good Old Summertime," directed by her father and starring her mother. But Liza Minnelli soon dispelled notions that she was coasting on her parents' reputations. When she was 19, she became the youngest performer to win a Tony Award for her role in the Broadway musical "Flora, the Red Menace." Six years later, she was a star of the first magnitude, capturing an Oscar for her singing, dancing, and acting in "Cabaret."

http://www.lizamay.com/

1947 – President Harry S. Truman asks Congress for "anticommunist" aid to Greece and Turkey. The speech is dubbed as the Truman Doctrine and officially ushers in the Cold War era. President Truman declares the U.S. must help "free peoples who are resisting attempted subjugation by armed minorities or by outside pressures." President Truman declares the world "must choose between alternative ways of life." One based on "the will of the majority . . . distinguished by free institutions"; the other on "the will of a minority . . . terror and oppression . . . the suppression of personal freedoms."

http://www.picturehistory.com/find/p/17456/mcms.html

http://www.whitehouse.gov/history/presidents/ht33.html

1948-Singer/composer James Taylor was born Boston, MA. His first professional experience was with a rock band called the Flying Machine. Then came his first solo album for the Beatles' Apple Records. It didn't do very well, but after a switch to Warner Brothers, he hit it big. Taylor's second album, "Sweet Baby James," sold three-million copies. "Fire and Rain" from that LP hit the top of the singles chart in 1970 and helped make James Taylor a household name. He won a Grammy Award in 1978 for his recording of "Handy Man," a slowed-down version of the old Jimmy Jones rock 'n' roll song. Taylor married singer Carly Simon in 1972, but she sued for divorce ten years later.

http://www.james-taylor.com/

1951-WOMACK, BRYANT E. Medal of Honor

Rank and organization: Private First Class, U.S. Army, Medical Company, 14th Infantry Regiment, 25th Infantry Division. Place and date: Near Sokso-ri, Korea, 12 March 1952. Entered service at: Mill Springs, N.C. Birth: Mill Springs, N.C. G.O. No.: 5, 12 January 1953. Citation: Pfc. Womack distinguished himself by conspicuous gallantry above and beyond the call of duty in action against the enemy. Pfc. Womack was the only medical aid man attached to a night combat patrol when sudden contact with a numerically superior enemy produced numerous casualties. Pfc. Womack went immediately to their aid, although this necessitated exposing himself to a devastating hail of enemy fire, during which he was seriously wounded. Refusing medical aid for himself, he continued moving among his comrades to administer aid. While he was aiding 1 man, he was again struck by enemy mortar fire, this time suffering the loss of his right arm. Although he knew the consequences should immediate aid not be administered, he still refused aid and insisted that all efforts be made for the benefit of others that were wounded. Although unable to perform the task himself, he remained on the scene and directed others in first aid techniques. The last man to withdraw, he walked until he collapsed from loss of blood, and died a few minutes later while being carried by his comrades. The extraordinary heroism, outstanding courage, and unswerving devotion to his duties displayed by Pfc. Womack reflect the utmost distinction upon himself and uphold the esteemed traditions of the U.S. Army.

1951—Top Hits

If - Perry Como

My Heart Cries for You - Guy Mitchell

Be My Love - Mario Lanza

There’s Been a Change in Me - Eddy Arnold

1954-A bridge hand in which each player was dealt a perfect hand of 13 cards of the same suit occurred at Cranston, RI. Irene Motta bid seven hearts and won the bid.

1954 -a blizzard raged from eastern Wyoming into the Black Hills of western South Dakota while a severe ice storm was in progress from northeastern Nebraska to central Iowa. The ice storm isolated 153 towns in Iowa. Dust from the Great Plains caused brown snow, while hail and muddy rain fell over parts of Wisconsin and Michigan.

1955 - “Bird Lives”. Jazz alto saxophonist Charlie "Bird" Parker dies in New York City of heart failure. He more-or-less invented the be-bop form of music and just the week before played at the New York City jazz club Birdland, which was named after him. Charlie Parker was 34 years old. Among several streets in New York, written in chalk on the sidewalk, “The Bird Lives." The tradition continues on this day, at least here in Saratoga, California.

http://www.chasinthebird.com

http://www.abraxis.com/cmjazz/Parker.html

http://www.cmgww.com/music/parker/bio.html

http://www.charlieparkerresidence.net/ (national register of historic places)

1955 - One of the great groups of jazz appeared for the first time at Carnegie Hall in New York City. The Dave Brubeck Quartet presented a magnificent concert for jazz fans. Joining with Brubeck, in what would become one of the most popular concert draws on college campuses, were names that would become legends in their own right, including Paul Desmond on alto sax, Joe Morello on drums and Eugene Wright on bass.

http://www.cosmopolis.ch/english/cosmo17/dave_brubeck.htm

1956-Dick Farley of the Syracuse Nationals fouled out on an NBA game against the St. Louis Hawks after playing just five minutes, the fastest disqualification in league history.

1959--- Top Hits

Venus - Frankie Avalon

Charlie Brown - The Coasters

Alvin’s Harmonica - David Seville & The Chipmunks

Don’t Take Your Guns to Town - Johnny Cash

1964 -Malcolm X confirms his resignation from Nation of Islam

http://www.cmgww.com/historic/malcolm/bio.html

1966- Chicago Blackhawks left wing Bobby Hull became the first NHL player to score more than 50 goals in a season when he tallied his 51st goal of the year against the New York Rangers.

1966-In San Francisco, The Alligator Clip, the Charlatans, Sopwith Camel, and Duncan Blue Boy and his Cosmic Yo-Yo, at the Firehouse on Sacramento Street.

1967---Top Hits

Love is Here and Now You’re Gone - The Supremes

Baby I Need Your Lovin’ - Johnny Rivers

Penny Lane - The Beatles

The Fugitive - Merle Haggard

1967 -a tremendous 4 day storm was in progress across California. Winds to 90 mph closed mountain passes, heavy rains flooded the lowlands, and in 60 hours Squaw Valley was buried under 96 inches of snow.

1968 -McCarthy does well in the Democratic primary. Senator Eugene McCarthy (D-Minnesota), an outspoken critic of the Johnson administration's policies in Vietnam, polls 42 percent of the vote in New Hampshire's Democratic presidential primary. President Lyndon B. Johnson got 48 percent. A Harris poll later showed that anti-Johnson, rather than antiwar, sentiment provided the basis for McCarthy's surprisingly strong performance.

McCarthy had been a contender to be President Lyndon B. Johnson's running mate in the 1964 election, but since then he had become increasingly disenchanted with Johnson's policies in Vietnam and the escalation of the war. In 1967, he published The Limits of Power, an assessment of U.S. foreign policy that was very critical of the Johnson administration. McCarthy announced his candidacy for the Democratic presidential nomination in January 1968, saying that he hoped to harness the growing antiwar sentiment in the country, particularly among the young. His showing in the New Hampshire primary astonished most of the political pundits. Johnson, frustrated with his inability to reach a solution in Vietnam and stunned by his narrow victory in New Hampshire, announced on March 31, 1968, that he “would neither seek nor accept the nomination of his party for re-election”. The rest of McCarthy's campaign was almost an anticlimax. Senator Robert Kennedy of New York entered the race and won most of the Democratic primaries until his assassination in June. When the Democratic National Convention opened in Chicago, a conflict immediately erupted over the party's Vietnam platform. While demonstrations against the war took place in the streets outside the convention hall, Vice President Hubert Humphrey won the party nomination. Humphrey was defeated in the general election by Republican Richard Nixon. McCarthy retired from the Senate in 1971, but his surprising showing in the primary was evidence of the strong antiwar sentiment in the country.

1969 - Paul McCartney marries photographer Linda Eastman. Contrary to the popular rumor of the day, she is not related to the Eastmans of Eastman-Kodak fame. Paul's brother, Mike McGear is the best man. None of the other Beatles is in attendance.

1974 - "Wonder Woman" debuted on ABC-TV, although it eventually moved to CBS. It starred Lynda Carter as Wonder Woman, whose real name was Diana Prince. Wonder Girl, Diana's sister, was Donna Troy.

http://timstvshowcase.com/wonderwomanbak.jpg

1975---Top Hits

Have You Never Been Mellow - Olivia Newton-John

Black Water - The Doobie Brothers

My Eyes Adored You - Frankie Valli

Linda on My Mind - Conway Twitty

1983-U2's "War" enters the British LP chart at #1.

1983---Top Hits

Billy Jean - Michael Jackson

Shame on the Moon - Bob Seger & The Silver Bullet Band

Do You Really Want to Hurt Me - Culture Club

The Rose - Conway Twitty

1984-A the World Figure Slaking Championships, Jayne Torvill and Christopher Dean of Great Britain became the first ice dancing team to earn nine perfect marks of 6.0

1985 - Larry Bird of the NBA’s Boston Celtics scored a club-record 60 points in a 126-116 victory over the Atlanta Hawks. Bird broke the record previously held by teammate Kevin McHale, who scored 56 points just nine days earlier.

1985 - Auto dealer Tom Bensen and several investors plunked down about $64 million to buy the New Orleans Saints NFL team. http://www.neworleanssaints.com/stories.php?story_id=8

1986 -- Susan Butcher wins 1,158 mile Iditarod Trail Sled Dog Race.

http://www.achievement.org/autodoc/page/but0pro-1

http://www.barberusa.com/motive/butcher_susan.html

1987 - After breaking all records for advance ticket sales, the British musical “Les Miserables” opened on Broadway.

1987- A&M Records presented Special Olympics International with a check for $5million. It was the first proceeds from sales of "A Very Special Christmas," a collection of yuletide songs by such superstars as Bruce Springsteen, U2, Bon Jovi, and Run-DMC.

1989 - An early season heat wave continued in the southwestern and central U.S. Nineteen cities reported record high temperatures for the date. Wichita Falls TX, which six days earlier reported a record low of 8 above, reported a record high of 95 degrees. Childress TX was the first spot in the country in 1989 to hit the century mark

1990 -unseasonably warm temperatures occurred from the Mississippi Valley to the Atlantic coast. Over 90 high temperature records for this date were broken or tied. Many of the records were topped by 15 degrees or more and some of the records broken had been set 100 years ago or more. The high temperature for the nation was recorded in Baltimore, Maryland where the temperature reached 95 degrees. Washington, DC and Richmond, Virginia both recorded 89 degrees.

1991---Top Hits

Someday - Mariah Carey

One More Try - Timmy -T-

Show Me the Way - Styx

I’d Love You All Over Again - Alan Jackson

1992- Eric Clapton appeared on MTV's "Unplugged." His acoustic performance was released as an album, becoming one of his biggest sellers. It included a remake of his 1970 Top-10 hit "Layla," which almost matched the original in popularity. The format produced many other “relaxed, simple, and intimate” performances and records.

1993 -what was to become the "Great Blizzard of '93" began to develop as a huge mesoscale convective complex formed in the western Gulf of Mexico. As the low pressure area moved eastward and intensified, howling north winds exceeding hurricane force behind the storm were reported by platforms in the Gulf. One platform near 28.5n/ 92.5w recorded sustained winds of 85 mph with gusts to 99 mph. As the low crossed the coast around midnight near Panama City, Florida, the central pressure was already down to 980 millibars (28.94 inches). During the late evening into the early morning hours of the 13th, a vicious squall line swept through Florida and spawned 11 tornadoes resulting in 5 fatalities. Thunderstorm winds gusted to 110 mph at Alligator Point and 109 mph at Dry Tortugas. Extremely high tides occurred along the western Florida coast. A 13 foot storm surge occurred in Taylor county, Florida, resulting in 10 deaths with 57 residences destroyed. Over 500 homes were destroyed with major damage to another 700 structures.

1994 - The Church of England broke with 460 years of male dominance when it ordained its first women priests in Bristol Cathedral.

1996 - Nancy Sinatra gives her famous white go-go boots, the ones that were made for walkin', to the Beverly Hills Hard Rock Cafe.

1996-Directly contradicting an agreement signed with Netscape the previous day, AOL agrees to use and promote Microsoft's Internet Explorer browser exclusively. In exchange, Microsoft agrees to bundle AOL software with its Windows 95 operating system. The abrupt about-face became an important issue in the Department of Justice's 1998 antitrust suit against Microsoft. A senior vice president at AOL testified that his company had initially avoided selecting the Microsoft browser because Microsoft seemed to be in direct competition with AOL.

2001- Richard Hidalgo signs the third-richest contract in Houston Astro history with a four-year, $32 million deal with the club. The outfielder's pact is less than teammate Jeff Bagwell's $85 million (5-years), and Craig Biggio's $33 million (4-years).

2001-In a poll conducted by the Recording Industry Association of America, music fans voted Judy Garland's "Over The Rainbow" as the Song Of The Century. The Rolling Stones' "Satisfaction" came in at #16 and The Beatles' "I Want To Hold Your Hand" was #26.

2003- The second exhibition season bench-clearing brawl this week occurs as a raging Mike Piazza, after being hit by a pitch, charges the mound in pursuit of Guillermo Mota, who makes to the dugout without being caught. The incident may be a follow-up to an incident the previous spring which resulted in a shoving match after a similar event at which the Met All-Star catcher waited for the Dodger reliever, who was coming off the field in the eighth inning and grabbed him by the jersey.

2006 - Phoenix's record run for dry days finally ends at 143 days. The last measured rain fell on October 18, 2005. Not only did the rain break the dry spell, the 1.40 inches that fell was a record amount for the date.

2008 - An all-Beatles-song episode of FOX-TV's “American Idol”, seven years in the making, draws an estimated 31 million viewers.

-------------------------------------------------------------

SuDoku

The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler?

http://leasingnews.org/Soduku/soduko-main.htm

--------------------------------------------------------------

Daily Puzzle

How to play:

http://www.setgame.com/set/puzzle_frame.htm

Refresh for current date:

http://www.setgame.com/set/puzzle_frame.htm

--------------------------------------------------------------

http://www.gasbuddy.com/

http://www.gasbuddy.com/GB_Map_Gas_Prices.aspx

http://www.gasbuddy.com/GB_Mobile_Instructions.aspx

--------------------------------------------------------------

Weather

See USA map, click to specific area, no commercials

--------------------------------------------------------------

Traffic Live---

Real Time Traffic Information

You can save up to 20 different routes and check them out with one click,

or type in a new route to learn the traffic live

--------------------------------