![]() Add me to mailing list |

Add me to mailing list | ![]() Change email |

Change email | ![]() |

| ![]() Search

Search

Advertising | All Lists | Archives | Classified Ads | This Day In American History

Leasing News is a web site that posts information, news, and

entertainment for the commercial bank, finance and leasing industry

kitmenkin@leasingnews.org

![]()

Tuesday, March 18, 2014

Today's Equipment Leasing Headlines

Archives--- March 18, 200

Paul A. Larkins resigns from Key National Finance

Classified Ads---Sales

Balboa Capital Loses Decisively

to Put Regents Capital Out of Business Right Now!

“How to Career Search before an Interview”

Career Crossroad---By Emily Fitzpatrick/RII

Classified Ads---Help Wanted

Meet Leasing News Advisor Ginny Young

Leasing 102 by Mr. Terry Winders, CLP

Stipulated Loss Values

Tax Indemnification Agreement (TIA)

New York Court Holds SLV Damage Provisions

in Lease to be Unconscionable

By Tom McCurnin, Leasing News Legal Editor

Sick Banks No Longer an Epidemic

by Nathan Stovall and Robert Clark

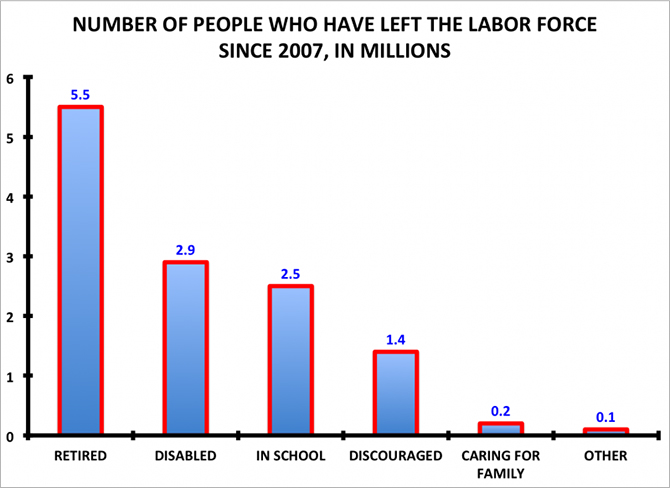

Impact of Retiring Baby Boomers on the Labor Force

Top Stories March 10---March 14

(You May Have Missed One)

Labrador Retriever Puppy

Denver, Colorado Adopt-a-Dog

Classified---Leasing Attorneys

News Briefs---

Tesla fights for a place to park

Mortgage servicer to pay millions to Californians

Caterpillar appeals contract loss for Illinois high-speed train

Silicon Valley billionaire sets record with $201 million

life insurance policy -- but who is it?

Broker/Funder/Industry Lists |

Features (collection)

Top Ten Stories Chosen by Readers |

Top Stories last six months

www.leasingcomplaints.com (Be Careful of Doing Business)

www.evergreenleasingnews.org

You May have Missed---

SparkPeople--Live Healthier and Longer

Poem

Sports Briefs---

California Nuts Brief---

"Gimme that Wine"

This Day in American History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

######## surrounding the article denotes it is a “press release”

and was not written by Leasing News nor information verified, but from the source noted. When an article is signed by the writer, it is considered a “by line.” It reflects the opinion and research of the writer.

Please send to a colleague and ask them to consider subscribing.

We are free.

[headlines]

--------------------------------------------------------------

Archives--- March 18, 2009

Paul A. Larkins resigns from Key National Finance

Confirmed: Paul A. Larkins, CEO of Key National Finance and Key Equipment Finance, Superior, Colorado, and Leasing News Person of the Year for 2006, has resigned.

A call to his office this morning to get confirmation or denial was directed to Key Public Relations Officer Tricia Akins, who did not return the telephone call. The reaction by Mr. Larkins’ secretary, known to Leasing News, the fact that he was not available, email returned, and comments were referred to public relations indicates the group was not prepared.

Late afternoon email from Tricia Atkins:

“Peter Hancock, Vice Chairman of Key’s National Banking organization, announced today that Paul Larkins, President and CEO of Key National Finance, will be resigning at the end of the month to take a position at an asset management firm specializing in distressed debt. Key remains committed to the leasing business, known as Key Equipment Finance (KEF). Business groups that previously reported to Larkins, including KEF, will now report to Hancock. We are grateful to Paul for his leadership, and wish him the best in his new endeavors.”

Larkins had just won an award for his education program, plus was recently named top business newsmakers in Colorado for the third consecutive year by the Denver Business Journal.

November 11, 2008 he announced 180 positions were let go from the estimated 1,100 employees, including 30 positions of the company's 352 person Boulder, Colorado headquarters being let go or not replaced via attrition.

Previous quarterly reports from Key Bank SEC filings showed the leasing division was doing relatively well.

TODAY

President and CEO

SquareTwo Financial

"Since 1994, SquareTwo Financial has worked with more than two million individuals and small businesses in North America. We provide practical solutions to our Customers’ outstanding financial obligations so they can improve their financial position and become active participants in our economy. Each quarter, we give hundreds of thousands of Customers the chance to regain financial stability, secure a new job, or even take steps towards owning their first home. We do this by removing the burden of debt."

http://www.squaretwofinancial.com/

[headlines]

--------------------------------------------------------------

Classified Ads---Sales

(These ads are “free” to those seeking employment or

looking to improve their position)

| Boston, Mass. Accomplished Sales & Relationship Management Professional with business development experience in the financial services industry. Recognized by market leaders as industry expert in Professional Practice financing, as well as Residential Mortgage Lending. Keen insight and understanding of transaction process and financial requirements of customer. Proven record of exceeding sales goals. deb.harold@hotmail.com |

| Work Remotely Business Development - Are you looking to enter/increase your Healthcare lending? Let me identify and qualify healthcare (all verticals) vendors, distributors, and end users who utilize leasing/financing as a tool to sell equipment for you. Many years experience - contact Mitchell Utz at mitutz@msn.com or (215) 460-4483. |

Free Posting for those seeking employment in Leasing

http://www.leasingnews.org/Classified/Jwanted/Jwanted-post.htm

All “free” categories “job wanted” ads:

http://www.leasingnews.org/Classified/Jwanted/Jwanted.htm

[headlines]

--------------------------------------------------------------

Balboa Capital Loses Decisively

to Put Regents Capital Out of Business Right Now!

by Christopher Menkin

Balboa Loses TRO Because It Had No Facts to Support Allegations of Theft of Customer List. Papers Contain Revelation That Balboa Paid a 1% Bounty If Its Salesmen Stole Competitors Customer List.

Pat Byrne’s Balboa Capital, Irvine, California, is back in the news, trying to shut down Regents Capital with a restraining order. The actual lawsuit calls for a jury trial, which could easily be two years down the road. The attempt then is to close Regents Capital before it can get established. The lesson is obvious to not only punish those who left, but who might leave, or want to disclose inside information on the culture of Balboa Capital. The ex parte Temporary Restraining Order was denied, but a hearing for Preliminary Injunction is scheduled for April 24, 2014 at 2:00pm is scheduled before Judicial Officer Kirk Nakamura.

Balboa Capital on March 11 introduced 249 pages for an ex parte TRO. The pages basically state Regents Capital contacted a few customers. (1)

The Application for ex parte TRO and Preliminary Injunction contains no factual support for the conclusion regarding the assertion that Regents Capital took customer lists. One would think that if Balboa Capital’s CEO Patrick Byrne had actual proof, as opposed to conjecture, you could assume that there are no facts, and it didn’t happen.

That the Judicial Officer denied the motion, leads me to three conclusions: First, there is no factual basis for this suit and it simply filed out of spite. Second, the idea that a salesperson could download or physically take customer lists from 1998 is just silly. It would take a moving van and presumably Chief Operating Officer Robert Rasmussen and President Phil Silva would have been watching this all happen. Third, this is just a vendetta.

Knowing that he certainly would be sued by Byrne and company, as that is the practice of this company since inception, Don Hansen, president of Regents Capital appears to have taken serious steps to make sure he was taking no files or customer documentation, and obviously was following an attorney’s advice in the careful manner he resigned and left employment. As to contacting a few Balboa Capital customers, Hansen explains it well enough to get the TRO denied.

It’s no secret to Leasing News readers that Balboa Capital has a practice of obtaining information and customer lists from companies where the new hires come from; as noted in previous Leasing News articles regarding Direct Capital and TimePayment (2a).

In a rebuttal against a preliminary injunction, Hansen gives further insider testimony to Balboa Capital practices of obtaining customers lists from competitors:

“(10) During my employment and pursuant to my compensation agreement, if I brought in new employees who brought with them their "books of business", also known as their customer list from their prior employer, I would receive additional compensation in the form of 1% of gross margin generated by "Books of Business" salespeople for any such salespeople that I brought in. Thus, Balboa incentivized employees to get individuals to join Balboa and take their prior employer's customer list with them. This is one way the company has grown.”

(3a, Page 4)

There is no doubt that since this was the practice of obtaining customer lists and other information from a competitor, Balboa Capital suspected Hansen would be doing the same with his new company.

Here is an excerpt of Hansen’s ten page response, where he addresses contacting a few Balboa Capital customers:

“(2) I began working at Balboa Capital Corporation ("Balboa") in August 1994 as an Account Executive. In 1997, I took the position of Vice President of the Commercial Finance Division. I was in this position when I resigned.

“(3) Balboa is a lending company that specializes in equipment leasing, working capital loans and franchise financing. Balboa was created when Patrick Byrne and his co-worker Shawn Giffin together left one equipment financing corporation to start their own competing company. Balboa has grown to have over 150 employees.

“(4) As the Vice President of the Commercial Finance Division, I was responsible for management and oversight of the Commercial Finance Division. At the time of my resignation in December 2013, there were approximately 20 employees in the Commercial Finance Division including Dennis Odiorne, Kirsten Merza, Chelsea Haines, Javier Enriquez, Kevin Kutter and Travis Power. I worked closely with each of these individuals. Our division focused on middle market customers — namely, companies with annual revenues from $10 million to $250 million. In my experience, personal relationships are very important in this industry. During the last few years of my employment, the number of middle market transactions constituted approximately 20% of Balboa's deals while the remaining 80% were small ticket transactions (loans of $150,000 or less).

“(7) During my almost twenty years of employment with Balboa, I have reviewed thousands of applications from thousands of different companies for thousands of different equipment leasing loans and working capital loans. Some of these applications were converted to transactions and many others were not. I would not be able to remember the name of every company who submitted an application that I reviewed while working at Balboa.

“(8) At no time during my employment at Balboa did I have any formal written customer list or excel spreadsheet with information regarding all of the customers I worked with. There was a database on which information relating to leads/prospective customers and actual customers was kept but I was unable to run a list from that database due to Balboa's security measures.

“(9) During my time at Balboa, the company has publicly announced customer information in places such as video testimonials that are posted on Balboa's website, YouTube, Twitter, LinkedIn, and Facebook. These can be found at http://www.balboacapital.com/testimonials/. The company "likes" its customers on Facebook, therefore a list of all customers Balboa "likes" is shown to anyone who visits Balboa's Facebook page. Similar to Balboa's "likes" on Facebook, it also frequently tweets on Twitter different companies to connect with and to follow on follow Friday ("#FF"). Many of these companies Balboa publicly asks people to follow on its Twitter page are customers of Balboa. Similarly, on Balboa's LinkedIn page, it has 1,541 followers as of March 11, 2014, many of whom have been Balboa customers. Balboa also has a Google+ page on which it is connected to 1,707 people/companies in its circle as of March 11, 2014, many of whom have been Balboa customers. In addition, Balboa frequently releases press releases when it reaches financing deals with customers. Through all of these means, Balboa publicly advertises the identities of many of its customers.

“(11) I am not aware of Balboa using any specialized marketing techniques or strategies to target potential customers that are markedly different from those techniques and strategies used by other companies in the industry. Balboa is a member of the same trade groups and receives industry magazines, like many other companies in the equipment financing business. Through these groups and publications, we share ideas.” (3a)

Hansen’s ten page statement is below along with the statement of Tiffany Brosan as noted below (3a, 3b). There was no “hard facts” in the complaint for a Temporary Restraining Order by Balboa Capital. Certainly there is more to follow as both sides reveal what really goes on, including perhaps previous officers and employees. The statements from Balboa Capital are in footnote (1) as well as the original complaint (2, b).

Leasing News has sought a statement from both main parties but has not received one. All these records are from the Orange County Court Reports, Case Id: 30-2014-00705733-CU-BT-CJC

Case Title: BALBOA CAPITAL CORPORATION VS. REGENTS CAPITAL CORPORATION

(1) ex parte TRO

(a) EX PARTE APPLICATION - OTHER FILED BY BALBOA CAPITAL CORPORATION ON 03/11/2014

http://www.leasingnews.org/PDF/EXPARTEAPPOTHERFILEDBALBOA.pdf

(b) DECLARATION IN SUPPORT (OF EX PARTE) FILED BY BALBOA CAPITAL CORPORATION ON 03/11/2014

http://www.leasingnews.org/PDF/DECLARATIONREEX-PARTEFILEDBALBOA.pdf

(c) PROPOSED ORDER (TRO) RECEIVED ON 03/11/2014.

(d) PROPOSED ORDER (OSC RE PRELIMINARY INJUNCTION) RECEIVED ON 03/11/2014.

http://www.leasingnews.org/PDF/PROPOSEDORDER(TRO)RECEIVED.pdf

(e) MOTION FOR PRELIMINARY INJUNCTION RECEIVED ON 03/11/2014.

http://www.leasingnews.org/PDF/MOTIONFOR

PRELIMINARYINJUNCTIONRECEIVEDON.pdf

(f) DECLARATION IN SUPPORT (OF MOTION) RECEIVED ON 03/11/2014.

http://www.leasingnews.org/PDF/DECLARATIONINSUPPORTOFMOTION.pdf

(g) PROPOSED ORDER (ON MOTION) RECEIVED ON 03/11/2014.

http://www.leasingnews.org/PDF/PROPOSEDORDERMOTION.pdf

(h) DECLARATION RE: EX-PARTE NOTICE FILED BY BALBOA CAPITAL CORPORATION ON 03/11/2014

http://www.leasingnews.org/PDF/DECLARATIONREEX-PARTEFILEDBALBOA.pdf

(2) Balboa Capital Sues Regents Capital

They Are After Salesmen Who Left

http://leasingnews.org/archives/Mar2014/3_12.htm#balboa

(b) Balboa Complaint

http://leasingnews.org/PDF/BalboaCapitalComplaint_3122014.pdf

-

(a)Declaration of Don Hansen

(b) Declaration of Tiffany Brosan

http://www.leasingnews.org/PDF/DeclarationofDonHansen.pdf

http://www.leasingnews.org/PDF/DeclarationofTiffanyBrosan.pdf

-

(a) Opposition to Restraining Order

(b) Declaration of Don Hansen and Dennis Odiorne

http://www.leasingnews.org/PDF/OppositiontoTRO.pdf

http://www.leasingnews.org/PDF/DeclarationDonHansen

andDennisOdiorne.pdf

[headlines]

--------------------------------------------------------------

“How to Career Search before an Interview”

Career Crossroad---By Emily Fitzpatrick/RII

Question: What questions should I be asking myself before a career search and/or interview?

Answer: There are a lot of questions to ask yourself while contemplating a career move. Answering these questions should enable you to define both short and long-term goals. Additionally, they will help you better assess the fit between you and the company’s culture, position, etc… they will help you evaluate future job offers and potential employers.

The following will help you asses who you are and what is important to you:

Sample aspects to be considered

-

What are your key values you will bring up?

-

Are you a risk-taker?

-

Do you rise to a challenge or back away?

-

Are you overly competitive?

-

What in your personal life causes you the most stress?

-

If you were to ask acquaintances to describe you, what adjectives would they use?

-

What kinds of people do you like working with?

-

What are your goals and aspirations?

Sample practical aspects to consider

-

Geographically, where do you want to work?

-

What kinds of products / services would you prefer to work with?

-

Do I mind traveling frequently – what percentage is reasonable?

-

Do you prefer a large or smaller type company?

-

Is it important to me that the company have an employee-training program?

For more samples, feel free to contact us.

Emily Fitzpatrick

Sr. Recruiter

Recruiters International, Inc.

Phone: 954-885-9241

Cell: 954-612-0567

emily@riirecruit.com

Invite me to Connect on LinkedIn

www.linkedin.com/pub/emily-fitzpatrick/4/671/76

Also follow us on Twitter #RIIINFO

Career Crossroads Previous Columns

http://www.leasingnews.org/Conscious-Top%20Stories/crossroad.html

[headlines]

--------------------------------------------------------------

Leasing Industry Help Wanted

[headlines]

--------------------------------------------------------------

Meet

Leasing News Advisor

Ginny Young

![]()

Ginny is one of the original founders of the Leasing News Advisory Board. She had been in the finance industry for 35 years, including being very active for over 20 years in equipment leasing. She retired from the commercial finance industry in 2005.

Since closing Brava Capital, Ginny has become CFO of the family’s construction business which specializes in playground and other site amenity construction for municipalities such as cities, counties, school districts, and HUD. She still keeps in touch with her friends in the leasing business and participates in Leasing News Advisory Board discussions and meetings.

Ginny Young

Ortco, Inc.

2163 N. Glassell Street

Orange, CA 92865-3307

714-998-3998

ginny@ortcoplays.com

Her prior company Brava Capital specialized in franchise financing. She was a very active member of the United Association of Equipment Leasing having chaired several committees, worked on regional committees and was a speaker/panelist at annual conferences. She wrote articles for "Newsline." She chaired the very successful 1999 Annual Conference and Exhibition and served on the Board of Directors for four years.

Ginny enjoys spending time in her mountain home in Lake Arrowhead, CA, which is only a little over an hour away. The weather is usually 10-15 degrees cooler in the summer than her home in Orange County.

[headlines]

--------------------------------------------------------------

Leasing 102

by Mr. Terry Winders, CLP

Stipulated Loss Values

Tax Indemnification Agreement (TIA)

A true lease is a non-cancelable transaction so the lessee has no right to terminate the lease early. However, if the equipment is destroyed or made inoperable, the lease language contains a provision that such events constitute defaults. Because of the non-cancelable clause, the loss must be stipulated as a loss and that is why it is a default. In the default language, the lessee should be required to pay the balance of the rent plus the purchase option, and if an operating lease, the stipulated loss value (SLV), or the current street value whichever is greater.

In a true lease, the lessor is considered the tax owner of the equipment and is using MACRS depreciation to reduce the lessor’s income tax. The amount to clear both the book balance and remove the asset from the tax books requires a complex calculation. The tax impact develops because book depreciation is straight line and MACRS depreciation for income tax is accelerated. Therefore, the balance for book is usually higher that the undepreciated balance for income tax.

The amount charged to the lessee to terminate the lease is considered a sale of a capital asset. If the book balance is higher than the undepreciated tax value a profit is created and a recovery tax is necessary. This additional tax will raise the amount required from the lessee to clear both book and tax.

In the thought process of the IRS, we have over depreciated the asset beyond its true value and need to recapture the tax savings. This tax must come from someone, so the lessor passes this on to the lessee by raising the payoff. The lessor must increase the early termination value (SLV) with the increased tax. The problem is that if you increase the SLV with the tax, you are increasing the difference that increases the tax. So there is a tax on a tax on a tax. The procedure to determine the correct SLV usually requires a computer-based pricing program that can do the calculations properly.

You must remember in an operating lease, the equipment is owned by the lessor, so if the loss comes near the end of the lease, the SLV may be too low. The current value of the asset may be higher. Outside appraisers may be necessary to determine the real value for loss consideration.

Most lessors compute the SLV at the time the transaction is booked and place the schedule in the folder. Some lessors provide this to the lessee, but it is not wise to do this because if the actual street value is the greatest value, do you want to sell “your asset” for less than its worth?

The major penalty from the tax effect comes in the first few years when the difference between the book value and the undepreciated tax value is the greatest. Knowing the SLV in advance helps with early termination values if the lessee needs some outs in case of changes in equipment needs.

To compensate the lessor for a tax differential, it is not uncommon to include a Tax Indemnification Agreement (TIA), which requires the lessee to pay the tax consequences for destruction of the equipment and a corresponding shortfall by the lessor.

Mr. Terry Winders, CLP, has been a teacher, consultant, expert witness for the leasing industry for thirty-five years and can be reached at terrywinders11@yahoo.com or 502-649-0448

He invites your questions and queries.

Previous #102 Columns:

http://www.leasingnews.org/Conscious-Top%20Stories/Leasing_102/Index.htm

Mr. Terry Winders available as Expert Witness. 35 years as a professional instructor to the top equipment leasing and finance companies in the United States, author of several books, including DVD's, as well as weekly columnist to Leasing News. He also performs audits of leasing companies as an expert on documentation, and has acted as an expert witness on leasing for litigation in legal and tax disputes, including before the IRS. He also has taught the senior bank examiners, how to review a bank leasing department, for the Federal Reserve in Washington D.C. and has trained the examiners for the FDIC on how to prepare a lease portfolio for sale.

Mr. Winders received his Master of Business Administration and his Bachelor of Science degrees from the College of Notre Dame. 502.649.0448/terrywinders11@yahoo.com |

(This ad is a “trade” for the writing of this column. Opinions

contained in the column are those of Mr. Terry Winders, CLP)

[headlines]

--------------------------------------------------------------

New York Court Holds SLV Damage Provisions

in Lease to be Unconscionable

By Tom McCurnin

Leasing News Legal News Editor

Lessor’s Lease Which Contained Both a Stipulated Loss Value and Acceleration Clause Was Unconscionable. Lessor Could Have Stipulated Loss Value or Expectancy Damages, But Not Both.

Lessee Failed to Make Critical Suretyship Argument,

Which Might Have Won the Day.

CIT Group/Equipment Financing, Inc. v. Shapiro 2013 WL 1285269 (S.D.N.Y. 2013)

Today’s case is a double edged sword, dealing with both an assignment of the lease by the lessee and a Stipulated Loss Value. The lessor made two minor errors in failing to document a transfer and assumption of the lease, and having both a stipulated loss value and contract damages in one clause. Sound a bit greedy? A New York Court agreed and cut the lessor’s damages in half. The facts follow.

The CIT Group leased a scanner to Shapiro and after two years, the Lessee transferred the equipment and assigned the lease to Capitol. It does not appear that The CIT Group was part of this assignment or consented to the terms. However, Shapiro remained liable on the lease. When Capitol breached the lease and filed bankruptcy, the Lessor merely sued Shapiro. The Lessor sought both the Stipulated Loss Value and contract damages. The Lessor sought $1,225,580.61 for unpaid rent and taxes, and $606,063.84, for the stipulated loss value schedule less the proceeds of a sale of the equipment.

Shapiro made two arguments, one dealing with the assignment and his lack of notice, and a second argument concerning the SLV.

First, Shapiro claimed that it was not notified of the breach by Capitol nor was it given an adequate opportunity to cure the lease before the repossession of the equipment. However, the court held that the Lessee could easily have contracted with Capitol, or developed some other informal arrangement, to monitor their obligations under the Assignment, rather than the file and forget assignment that was negotiated.

Second, Shapiro claimed the lessor’s proposed recovery of both the SLV and the contract expectancy damages was double-dipping and unconscionable. The Lessor argued that it was not and urged the court to give it both past due and future rent as well as the SLV.

A New York Federal Court shared Shapiro’s concern, and had a problem with the two types of remedies, especially when they were combined. CIT’s lease stated

15(e). Upon the occurrence of an Event of Default, Lessor may, at its option, do one or more of the following...declare immediately due and payable (i) all Rent Payments due under the Lease; (ii) as liquidated damages for loss of the bargain and not as a penalty, an amount (“Liquidated Damages Amount”) equal to the Stipulated Loss Value for the Equipment as of the Rent Payment Date immediately preceding the date Lessor declares or Lessee knows of an Event of Lessee…”

As can be seen by the above clause, in the event of default, CIT would recover both the Stipulated Loss Value and contract damages. The Lessor sought $1,225,580.61 for unpaid rent and taxes, and $606,063.84, for the stipulated loss value schedule less the proceeds of a sale of the equipment.

The court found this to be unfair, and held that in the ordinary course, the Lessor would only be entitled only to expected damages—the default remedy in contract law—the sum of the future lease payments and the residual, if any. Therefore, the court called the Stipulated Loss Value “troubling” and stated the Lessor unfairly sought to profit by selling the leased equipment and the proposed future rent payments on a machine that—by virtue of the contractually mandated sale—the Lessor no longer owned.

Therefore, the court struck down the SLV provision as unconscionable.

What are the lessons here?

First, SLV provisions are handy when the lease equipment is destroyed or there is a contractual breach. But a lessor may not have its cake and eat it too. Pick a specific remedy upon destruction or default and put that single remedy in the lease. Putting two combined remedies puts the court in a position of choosing the more reasonable remedy. The lessor wants to be the person making that choice, not the court.

Second, SLVs are generally drafted at the inception of the deal, and as Mr. Winders stated, there may be negative tax ramifications for the lessor. The common precaution is a Tax Indemnity Agreement (“TIA”) appended to the lease. In any event, the lessor is probably locked into the SLA numbers, so accuracy is important

Third, the Lessor clearly knew the lease had been assigned, but didn’t document it. The Lessor should have declared a default then and there, unless the parties signed a “Transfer and Assumption Agreement.” That type of agreement allows the assignment to go forward, but clearly keeps the original lessee and guarantor on the hook, and provides that it is up the original lessee to monitor the status of the account. The Lessor could have avoided the Lessee’s arguments with a T&A.

Fourth, the existence of the assignment with recourse probably creates a suretyship contract, e.g., a guaranty, and such guaranties provide defenses to the original obligor to force the creditor to pursue the new principal (the assignee) first, unless of course, that right is waived. The Lessor dodged a bullet here, but in any event, this would be covered by any good Transfer and Assumption Agreement.

The bottom line to the CIT decision is that lessors cannot have it both ways. The lessor may not use a SLV and recover contract damages. Pick one. In addition, when leased equipment is sold and the lease assigned to a new lessee, have all parties sign a Transfer and Assumption Agreement. The Lessor dodged a bullet on the suretyship issue.

CIT Group Case

http://www.leasingnews.org/PDF/CITGroupCase_32014.pdf

Tom McCurnin is a partner at Barton, Klugman & Oetting in Los Angeles, California.

Tom McCurnin

Barton, Klugman & Oetting

350 South Grand Ave.

Suite 2200

Los Angeles, CA 90071

Direct Phone: (213) 617-6129

Cell (213) 268-8291

Email: tmccurnin@bkolaw.com

Visit our web site at www.bkolaw.com

Previous Tom McCurnin Articles:

http://www.leasingnews.org/Conscious-Top%20Stories/leasing_cases.html

[headlines]

--------------------------------------------------------------

Sick Banks No Longer an Epidemic

by Nathan Stovall and Robert Clark

A SNL Financial Exclusive

As market conditions continued to improve in 2013, undercapitalized banks fell to pre-crisis levels and the number of problem banks experienced a dramatic decline.

The number of undercapitalized banks dwindled throughout 2013 and not necessarily through failures, which was the case during 2011 and 2012. More banks found their ways out of trouble through positive means in 2013 even if true success stories are still not commonplace for most troubled banks. Raising capital today is still difficult for a weaker institution, but with the economy improving, banks looking to raise funds, particularly institutions with some scale, can often find an audience with investors.

As one investment banker recently said to SNL, "There's more opportunity today than there was last year and there was more opportunity last year than there was the year before."

The number of undercapitalized institutions looking to raise funds now is much smaller than it was in years past. The FDIC defines undercapitalized banks as those with a total risk-based capital ratio below 8.0%, a Tier 1 risk-based capital ratio below 4.0% or a Tier 1 leverage capital ratio below 4.0%, unless the bank is a CAMELS one-rated institution. In that case, a bank would be undercapitalized if its leverage ratio was less than 3.0%.

Twenty-four banks and thrifts were undercapitalized, based on the criteria of having Tier 1 ratios below 4%, at Dec. 31, compared to 23 institutions at the end of the third quarter and 44 institutions a year ago, according to SNL data. After witnessing several quarters of sizable declines in the number of undercapitalized institutions, the decreases have moderated as the sheer number of banks still reporting low capital ratios has fallen to pre-crisis levels.

The current number of undercapitalized institutions stands in stark contrast to the levels seen three years ago, when 93 banks were considered undercapitalized. Failures were the main contributor to the decrease in undercapitalized institutions in 2011 and 2012. The trend was consistent through those two years, when the number of undercapitalized banks decreased by 49 to 44 institutions. During that period, a number of banks joined the ranks of the undercapitalized and 143 banks failed, while 36 banks found their way out of trouble through recapitalizations, mergers or balance sheet shrinkage and de-risking, coupled with modest earnings in some cases.

The trend was more positive in 2013, when 16 banks, including five in the fourth quarter, found their way out of undercapitalized territory without failing or closing their doors. Just 24 banks failed in 2013 — only two banks failed in the fourth quarter.

In total, four banks previously deemed undercapitalized have failed since SNL last published the list of undercapitalized banks in the industry. When excluding banks that have failed or merged since the end of the fourth quarter, SNL data shows that, as of March 3, 17 banks were undercapitalized based on Dec. 31, 2013, data, compared to 20 banks at the last publication of the list of undercapitalized banks. The 17 undercapitalized banks reported a median Tier 1 ratio of 3.13% at the end of the fourth quarter and the group reported median linked-quarter declines in their capital ratio of 26 basis points.

As one investment banker recently said to SNL, "There's more opportunity today than there was last year and there was more opportunity last year than there was the year before."

The number of undercapitalized institutions looking to raise funds now is much smaller than it was in years past. The FDIC defines undercapitalized banks as those with a total risk-based capital ratio below 8.0%, a Tier 1 risk-based capital ratio below 4.0% or a Tier 1 leverage capital ratio below 4.0%, unless the bank is a CAMELS one-rated institution. In that case, a bank would be undercapitalized if its leverage ratio was less than 3.0%.

Twenty-four banks and thrifts were undercapitalized, based on the criteria of having Tier 1 ratios below 4%, at Dec. 31, compared to 23 institutions at the end of the third quarter and 44 institutions a year ago, according to SNL data. After witnessing several quarters of sizable declines in the number of undercapitalized institutions, the decreases have moderated as the sheer number of banks still reporting low capital ratios has fallen to pre-crisis levels.

The current number of undercapitalized institutions stands in stark contrast to the levels seen three years ago, when 93 banks were considered undercapitalized. Failures were the main contributor to the decrease in undercapitalized institutions in 2011 and 2012. The trend was consistent through those two years, when the number of undercapitalized banks decreased by 49 to 44 institutions. During that period, a number of banks joined the ranks of the undercapitalized and 143 banks failed, while 36 banks found their way out of trouble through recapitalizations, mergers or balance sheet shrinkage and de-risking, coupled with modest earnings in some cases.

The trend was more positive in 2013, when 16 banks, including five in the fourth quarter, found their way out of undercapitalized territory without failing or closing their doors. Just 24 banks failed in 2013 — only two banks failed in the fourth quarter.

In total, four banks previously deemed undercapitalized have failed since SNL last published the list of undercapitalized banks in the industry. When excluding banks that have failed or merged since the end of the fourth quarter, SNL data shows that, as of March 3, 17 banks were undercapitalized based on Dec. 31, 2013, data, compared to 20 banks at the last publication of the list of undercapitalized banks. The 17 undercapitalized banks reported a median Tier 1 ratio of 3.13% at the end of the fourth quarter and the group reported median linked-quarter declines in their capital ratio of 26 basis points.

A total of six banks escaped undercapitalized territory during the fourth quarter, in line with the number of institutions that escaped those ranks in the third quarter.

One of the institutions escaping undercapitalized territory in the fourth quarter, Hunt Valley, Md.-based Community First Bank, actually ceased its operations. The FDIC filed a termination of deposit insurance proceeding against Community First Bank dated Sept. 30, ordering that its status as an insured federal savings bank would be terminated Dec. 31. A FDIC spokesman told SNL that Community First Bank was not a traditional commercial bank and did not take in deposits and was in the trust business.

Three other banks previously deemed undercapitalized were involved in mergers, but two of those institutions entered into transactions that amounted to last-minute lifelines. In fact, former Capital Bancorp units Bank of Las Vegas and Sunrise Bank of Albuquerque, which were previously deemed undercapitalized, agreed to sell to Talmer Bancorp Inc. in a transaction conducted under Section 363 of the U.S. Bankruptcy Code.

While some banks found their way out of undercapitalized territory, others joined those ranks in the fourth quarter. Seven banks, all of which had less than $350 million in assets, gained undercapitalized status during the fourth quarter. The banking industry as a whole, though, finds itself on the mend, with credit quality having improved considerably from the depths of the crisis. Commercial banks' adjusted nonaccrual loans fell to 1.24% of total loans in the fourth quarter, from 1.38% in the prior quarter and 1.71% a year earlier, while net charge-offs declined to just 0.60% of average loans, from 0.61% in the linked quarter and 0.99% one year ago, according to SNL data.

With the improvements, the number of banks on the FDIC's "problem list" continues to decline and even dropped at a faster rate than the decrease in undercapitalized institutions during 2013. The number of institutions on the problem list fell to 467 at the end of the fourth quarter, compared to 515 institutions in the third quarter and 651 a year ago, a 9.3% drop from the linked quarter and down 28.3% from the year prior. The number of problem institutions stood at 813 two years ago.

Banks that continue to grapple with issues and remain on the problem bank list and in undercapitalized territory are largely in areas that suffered from stress during the cycle. The Southeast remains home to more undercapitalized banks than any other region.

Florida, where 70 banks have failed this cycle, had three operating banks falling below the 4% Tier 1 risk-based capital threshold at Dec. 31. Georgia also had three operating, undercapitalized institutions as of March 3, using Dec. 31 data. Eighty-eight banks have failed in Georgia this cycle.

Illinois, the state with the third most bank failures this credit cycle, also had three operating, undercapitalized institutions as of March 3, using Dec. 31 data.

|

[headlines]

--------------------------------------------------------------

Impact of Retiring Baby Boomers on the Labor Force

Businessinsider.com

John Kenny • Fraud Investigations • Credit Investigations • Asset Searches • Skip-tracing • Third-party Commercial Collections john@jkrmdirect.com | ph 315-866-1167| www.jkrmdirect.com |

[headlines]

--------------------------------------------------------------

Top Stories March 10---March 14

(You May Have Missed One)

Here are the top stories opened by readers:

(1) Balboa Capital Sues Regents Capital

They Are After Salesmen Who Left

by Christopher Menkin

http://leasingnews.org/archives/Mar2014/3_12.htm#balboa

(2) Inside Balboa’s Patrick “Evergreen” Byrne’s Head

http://leasingnews.org/archives/Mar2014/3_14.htm#inside

(3) Jim McGrane Passes Away

http://leasingnews.org/archives/Mar2014/3_14.htm#mcgrane

(4) Clarification:

Renasant Bank Will Consider Third Party Originations

http://leasingnews.org/archives/Mar2014/3_12.htm#clarification

(5) Leasing 102 by Mr. Terry Winders, CLP

Internal Revenue Service vs. the Uniform Commercial Code

http://leasingnews.org/archives/Mar2014/3_10.htm#irs

(6) Former Marks & Associates Employee to Head

Renasant Bank Equipment Financing Division

http://leasingnews.org/archives/Mar2014/3_10.htm#renasant

(7) Archives---March 10, 2006

Summit National Chapter 11 BK Up-date

http://leasingnews.org/archives/Mar2014/3_10.htm#archives

(8) Archives---March 14, 2006

Marlborough names LaChance “Business Person of the Year”

http://leasingnews.org/archives/Mar2014/3_14.htm#archives

(9) New Hires---Promotions

http://leasingnews.org/archives/Mar2014/3_14.htm#hires

(Tie) (10) JPMorgan whistleblower gets $63.9 million in mortgage fraud deal

http://www.chicagotribune.com/business/sns-rt-us-jpmor

(Tie) (10) Lease Servicing Pitfalls

By Tom McCurnin, Leasing News Legal News Editor

http://leasingnews.org/archives/Mar2014/3_10.htm#servicing

Not Counted for Technical Reasons

More on the Passing of Jim McGrane from ELFA

(Leasing News provides this ad “gratis” as a means

to help support the growth of Lease Police)

[headlines]

--------------------------------------------------------------

Labrador Retriever Puppy

Denver, Colorado Adopt-a-Dog

Maria

Animal ID: 22222359

Breed: Retriever, Labrador/Mix

Age: 2 months 5 days

Sex: Female

Size: Small

Color: Brindle/Black

Spayed/Neutered

Declawed: No

Housetrained: Unknown

Site: MaxFund Dog Shelter

Location: Small Dog Room

Intake Date: 2/21/2014

"My name is Maria, and I am the sweetest and most adorable Lab mix baby! I think you need to meet me and take me home, OK?

"Because I am still a puppy, you'll need to be prepared for the things that come with puppyhood. Whether a puppy will grow up to be a first-rate canine citizen is directly dependent on the effort that the family puts in. It's my ambition to be the best canine citizen ever, so I'd like a family whose ambitions match mine!

"Do you have the time and patience to teach me the things I need to know? Will you be around most of the time, so I don't get lonely or bored? Will you watch me carefully, so I don't chew up your shoes, electrical cords, or furniture? Will you make sure that I'm never in a yard unattended? Will you forgive my occasional "accidents”? Will you take me through Puppy Kindergarten? Will you give me the best in nutritious foods, so that I'll grow up healthy and strong? Will you give me lots of walks and supervised play and exercise?

"Most importantly, will you love me, forever and ever and ever? I know this sounds like a tall order, but believe me, I will make it worth your while!

Application: http://www.maxfund.org/pdfs/MaxFundApplication.pdf

*Puppies under 6mos. : $200.00

MaxFund Animal Adoption Center

1025 Galapago Street

Denver, Colorado 80204-3942

Phone: 303-595-4917

Fax: 303-595-0192

email: catsanddogs@maxfund.org

Adopt a Pet

http://www.adoptapet.com/

[headlines]

--------------------------------------------------------------

Leasing Attorneys

| Birmingham, Alabama The lawyers of Marks & Associates, P.C. have over 30 years experience in dealing with virtually every type of equipment financing and are recognized throughout the industry for prompt, practical solutions and exemplary service. They offer cost-conscious, effective lease enforcement and good counsel. Email: Barry@leaselawyer.com Website: www.leaselawyers.com |

California, National: city: Riverside Ellen Stern - get results, reasonable pricing; numerous industry contacts, nearly 30 yrs exp.in SoCal, 20 yrs equip.: CFL license specialist, documentation, work-outs, litigated collections, recoveries; deal-maker. Email: leaselaw@msn.com |

||

|

Connecticut, Southern New England: EVANS, FELDMAN & BOYER, LLC Collections, litigation, documentation, portfolio sales and financing, bankruptcy. We represent many of the national and local leasing companies doing business in this state. Past chairman EAEL legal committee. Competitive rates. email: rcfeldman@snet.net |

||

| Los Angeles, Southern CA Seasoned attorney representing secured creditors in auto finance and truck/equipment lease industry. Bankruptcy and State Court litigation. Vincent V. Frounjian (818) 990-0605or email: vvf@pacbell.net. |

Encino, California: Statewide “ELFA” |

||

Los Angeles, Statewide: CA. "ELFA" Aggressive creditors rights law firm specializing in equipment leasing handling collection matters on a contingency, fixed fee or hourly cbasis. email:RGarwacki@prodigy.net |

Los Angeles -statewide: CA "ELFA" |

||

Los Angeles- Statewide, CA Lawyer specializing in banking and leasing issues statewide. Documents and litigation. Tom McCurnin, Barton, Klugman & Oetting. Voice: (213) 617-6129 Cell:(213) 268-8291 Email: tmccurnin@bkolaw.com |

|||

Long Beach, CA |

California & National |

||

Illinois |

Law Firm - Service, Dallas, TX. "ELFA" Mayer regularly practices in leasing, secured financing, project development and finance and corporate finance. email: dmayer@pattonboggs.com Website: www.pattonboggs.com |

||

| National: The OMEGA Network Group-nationwide legal representation of small and mid ticket equipment lessors-flat fee bankruptcy & replevin, contingent collection, billable litigation (704-969-3280) tong_92@yahoo.com |

National: Coston & Rademacher: Business attorneys serving the lease-finance industry since 1980. Transactional, documentation, corporate/finance, workouts, litigation, bankruptcy, portfolio management. Chicago-based national practice. Jim Coston, CLP (Members: ELFA, NEFA). |

||

| St. Louis County , MO. - statewide: Schultz & Associates LLP., collections, negotiation, and litigation. Also register and pursue recovery on foreign judgments. Contingency and reasonable hourly rates. Ronald J. Eisenberg, Esq. (636) 537-4645 x108 reisenberg@sl-lawyers.com www.sl-lawyers.com |

NJ,De,Pa: Specializing in leased equipment/secured transactions. Collections, replevins/workouts reasonable rates. Sergio Scuteri/Capehart & Scratchard, PAsscuteri@capehart.com / www.capehart.com | ||

| New York and New Jersey Peretore & Peretore, P.C. documentation, portfolio purchase & sale, replevin, workouts, litigation, collection, bankruptcy. Aggressive. Over 25 years experience.www.peretore.com |

Thousand Oaks, California: |

[headlines]

--------------------------------------------------------------

![]()

News Briefs----

Tesla fights for a place to park

http://www.nytimes.com/2014/03/18/business/tesla-fights-for-a-place-to-park.html

Mortgage servicer to pay millions to Californians

http://www.latimes.com/business/la-fi-ocwen-foreclosures-20140318,0,1317760.story#axzz2wFWTYnCC

Caterpillar appeals contract loss for Illinois high-speed train

http://www.chicagotribune.com/business/breaking/chi-caterpillar-appeals-contract-loss-for-illinois-highspeed-train-20140317,0,5956452.story

Silicon Valley billionaire sets record with $201 million life insurance policy -- but who is it?

http://www.mercurynews.com/business/ci_25347898/silicon-valley-billionaire-sets-record-201-million-life

| Working Capital Loans $10,000-$250,000 | |

|

|

[headlines]

--------------------------------------------------------------

--You May Have Missed It

How a Presidential phone call gets made

http://news.yahoo.com/how-the-president-makes-a-phone-call-212133128.html

[headlines]

--------------------------------------------------------------

SparkPeople--Live Healthier and Longer

![]()

7 Fun Ways to Burn BIG Calories this Spring

http://www.sparkpeople.com/resource/slideshow.asp?show=26

[headlines]

--------------------------------------------------------------

Winter Poem

Mending Wall

by Robert Frost

| SOMETHING there is that doesn’t love a wall, That sends the frozen-ground-swell under it, And spills the upper boulders in the sun; And makes gaps even two can pass abreast. The work of hunters is another thing: I have come after them and made repair Where they have left not one stone on a stone, But they would have the rabbit out of hiding, To please the yelping dogs. The gaps I mean, No one has seen them made or heard them made, But at spring mending-time we find them there. I let my neighbour know beyond the hill; And on a day we meet to walk the line And set the wall between us once again. We keep the wall between us as we go. To each the boulders that have fallen to each. And some are loaves and some so nearly balls We have to use a spell to make them balance: “Stay where you are until our backs are turned!” We wear our fingers rough with handling them. Oh, just another kind of out-door game, One on a side. It comes to little more: There where it is we do not need the wall: He is all pine and I am apple orchard. My apple trees will never get across And eat the cones under his pines, I tell him. He only says, “Good fences make good neighbors.” Spring is the mischief in me, and I wonder If I could put a notion in his head: “Why do they make good neighbors? Isn’t it Where there are cows? But here there are no cows. Before I built a wall I’d ask to know What I was walling in or walling out, And to whom I was like to give offence. Something there is that doesn’t love a wall, That wants it down.” I could say “Elves” to him, But it’s not elves exactly, and I’d rather He said it for himself. I see him there Bringing a stone grasped firmly by the top In each hand, like an old-stone savage armed. He moves in darkness as it seems to me, Not of woods only and the shade of trees. He will not go behind his father’s saying, And he likes having thought of it so well He says again, “Good fences make good neighbors.” |

[headlines]

--------------------------------------------------------------

Sports Briefs----

Barry Bonds returns to Giants, larger than life no longer

http://www.sfgate.com/giants/article/Barrry-Bonds-returns-to-Giants-larger-than-life-5305117.php

Barry Bonds on his week with the San Francisco Giants and a quick batting cage session

http://www.contracostatimes.com/giants/ci_25355921/barry-bonds-his-week-giants-and-quick-batting?source=most_viewed

49ers Coach Jim Harbaugh Had A Pushup Contest With A Walrus

http://www.huffingtonpost.com/2014/03/17/jim-harbaugh-walrus-push-up-video-49ers_n_4980182.html?ncid=txtlnkusaolp00000592

Video version:

http://blog.sfgate.com/49ers/2014/03/17/watch-jim-harbaugh-do-push-ups-with-a-giant-walrus/

How Dixon's loss impacts 49ers

http://www.csnbayarea.com/49ers/how-dixons-loss-impacts-49ers?p=ya5nbcs&ocid=yahoo

Redskins add more weapons for RG3

http://www.csnwashington.com/football-washington-redskins/talk/redskins-add-more-weapons-rg3?p=ya5nbcs&ocid=yahoo

There's been a trade: 49ers deal for QB Blaine Gabbert

http://blogs.sacbee.com/49ers/archives/2014/03/theres-been-a-trade-49ers-deal-for-qb-blaine-gabbert.html

Donte Whitner leaves 49ers for Browns

http://www.pressdemocrat.com/article/20140311/sports/140319919

[headlines]

--------------------------------------------------------------

California Nuts Briefs---

More than $400 million Asian-focused retail in pipeline in South and East Bay SF

http://www.contracostatimes.com/business/ci_25347405/san-jose-and-fremont-more-than-400-million

Yosemite: Rim Fire zone leaves lasting impression (5-pic gallery)

http://blog.sfgate.com/stienstra/2014/03/17/rim-fire-zone-leaves-lasting-impression-5-pic-gallery/#21609101=0

It's official: Toni Atkins elected speaker of California Assembly

http://blogs.sacbee.com/capitolalertlatest/2014/03/its-official-toni-atkins-elected-speaker.html

Affordable housing in S.F.? Depends on whom you ask

http://www.sfgate.com/bayarea/article/Affordable-housing-in-S-F-Depends-on-whom-you-5321064.php

Are schools ready for the new online Common Core tests?

http://edsource.org/2014/are-schools-ready-for-the-new-online-common-core-tests/58849#.UyeHeKhdUuc

[headlines]

--------------------------------------------------------------

![]()

“Gimme that Wine”

http://www.youtube.com/watch?v=EJnQoi8DSE8

The Mr. Miyagi of Wine Sommeliers

http://www.thedailybeast.com/articles/2014/03/08/the-mr-miyagi-of-wine-sommeliers.html

Sonoma Valley vintners show off wines from the barrel

http://pressdemocrat.com/article/20140315/articles/140319662

Taking a page from California's wine history

http://www.sfgate.com/wine/thirst/article/Taking-a-page-from-California-s-wine-history-5318779.php

Top 10 Wines in the US Press

http://www.thedrinksbusiness.com/2014/03/top-10-wines-in-the-us-press-63/

Will NY Times Readers Join Asimov's Virtual Wine School?

http://www.wine-searcher.com/m/2014/03/will-ny-times-readers-join-asimov-s-virtual-wine-school

Free Mobile Wine Program

http://leasingnews.org/archives/Feb2010/2_26.htm#mobile

Wine Prices by vintage

http://www.winezap.com

http://www.wine-searcher.com/

US/International Wine Events

http://www.localwineevents.com/

Winery Atlas

http://www.carterhouse.com/atlas/\

Leasing News Wine & Spirits Page

http://two.leasingnews.org/Recommendations/wnensprts.htm

[headlines]

----------------------------------------------------------------

![]()

This Day in History

1543- The first record of a flood in the United Sates observed by the Spanish explorer Hernando De Soto. He noted the Mississippi River began overflowing its banks and continued until it crested on April 20. By the end of May, the flood had receded. De Soto introduced wild pigs into the wilderness that environmentalists state changed the animal population considerably, including introducing smallpox that killed millions of Indians. When expeditions returned a hundred years later, they questioned De Soto's reports because of the major changes to the landscape.

http://www.theatlantic.com/issues/2002/03/

1644 - In Virginia, the Opechancanough Indians rise up against the settlers but after two years they will be defeated decisively. They will be forced to give up all the land between the James and York Rivers. The resulting peace will last until 1675.

1692 - Following the accession of William III to the English throne, Pennsylvania is declared a royal colony and New York governor Benjamin Fletcher is declared governor of Pennsylvania, depriving William Penn of his proprietary powers. The Crown takes over Pennsylvania because the pacifist Quakers refused to involve themselves in the war against France and because William Penn had maintained friendly relations with the former English monarch, James II

1748- George Washington visited the public spa at a mineral spring opened to the public. It was deeded to the colony of Virginia in 1756 by Thomas Fairfax, sixth Baron Fairfax “to be forever free to the publick for the welfare of suffering humanities.” The spa was located in Bath, Berkeley County, VA in what is now Berkeley Springs, Morgan County, WV.

1782- Birthday of John Calhoun, American statesman and first vice president of the US to resign that office (Dec 28, 1832). Born at Abbeville District, SC, died at Washington, DC, Mar 31, 1850. Calhoun was considered the South's strongest advocate for slavery. The vice-presidents ran as separate offices in his day and he served under John Quincy Adams from March 4, 1825 to March 4, 1829 and under President Andrew Jackson from March 4, 1829 to December 28, 1832. He resigned to fill the vacancy in the Senate caused by the resignation of Robert Young Hayne, senator form South Carolina. Calhoun was elected to fill the vacancy on December 12, 1832. He had been secretary of war and secretary of state. He was too weak and ill to read his speech or oppose Daniel Webster's brilliant oratory that brought about the “Missouri Compromise” that limited slavery in the Western territory. Senator Daniel Webster argued in favor of the compromise. He both cautioned Southerners that disunion would lead to war and advised Northerners to forgo anti-slavery measures. The Compromise of 1850 was passed and Calhoun died soon after on March 31, 1850.

http://memory.loc.gov/ammem/today/mar18.html

1806-Birthday of African-American Norbert Rillieux, inventor of sugar refining.

http://inventors.about.com/library/inventors/blrillieux.htm

http://gibbsmagazine.com/Rillieux.htm

1813 - David Melville of Newport, Rhode Island patented the gas streetlight. He first installed these lights in front of his own house on Pelham Street. Soon everyone in the neighborhood wanted one.

1837 - the 22nd and 24th president of the US was born. Stephen Grover Cleveland at Caldwell, NJ. Terms of office as president: March 4, 1885—March 3, 1889, and March 4, 1893—March 3, 1897. He ran for president for the intervening term and received a plurality of votes cast but failed to win Electoral College victory for that term. Only president to serve two nonconsecutive terms. Also, the only president to be married in the White House. He married 21-year-old Frances Polsom, his ward. Their daughter, Esther, was the first child of a president to be born in the White House.

1848--"California Star" reported that non-Native population of San Francisco was 575 males, 177 females and 60 children

1856-birthday of African-American Dr. Daniel H. William, who performed first successful open heart operation.

1886 - Edward Everett Horton birthday Narrator: “Fractured Fairy Tales” on “The Rocky and Bullwinkle Show”; actor: “It's a Mad, Mad, Mad, Mad World”, “Lost Horizon”, “Sex and the Single Girl”, “Arsenic and Old Lace”. Died Sep 29, 1970.

1901-- William H. Johnson was born in Florence , South Carolina. A famous African American artist, Johnson spent many years in Europe painting expressionist works. He was strongly influenced by the vivid styles and brushstrokes of Henry 0. Tanner, Vincent van Gogh, Paul Gauguin, Edward Munch and Otto Dix. He left Europe when Hitler began destroying art that had primitivist or African themes. Back in the US, Johnson developed a new, flatter style and delved into subjects of his own experience as well as historical African-American figures and events. “Going to Church” (1940—41) and “Mom and Dad” (1944) are examples of his later work.

1902--29-year-old Italian opera singer Enrico Caruso was paid $50 each to record 10 songs on wax for the Gramophone and Typewriter Company in Italy. He would go on to become the world's first recording star. Two years later, he began recording in America for the Victor Talking Machine Company (later RCA Victor). Over a 16-year span, he would earn millions of dollars in royalties from the retail sales of his 260 recordings.

1907 - The lawyers prosecuting alleged grafters score point after point in the proceedings before the grand jury and announce that they have sufficient evidence to prove that the United Railroads, the Pacific States Telephone Co., Home Telephone Co., the Prize-Fight Trust, and the Gas Co., have bribed San Francisco supervisors and other city officials.

1911- Dean Kinkaide Birthday. Noted big band arranger of Dorsey's “Boogie Woogie,” Goodman's “Bugle Call Rag”. Had many of his arrangements in my high school/college 21 piece band.

1925 - The 'Great Tri-state Tornado' tore a 219 mile path through Missouri, Illinois, and Indiana, resulting in the greatest US tornado disaster ever. 695 people were killed, the largest death toll from a single tornado in US history. 234 deaths occurred at Murphysboro, Illinois, the biggest death toll within a single city from a tornado on record. At one point, the tornado was moving at a record 73 mph. This tornado was easily an F5 on the Fujita scale with winds exceeding 260 mph. Instead of occurring along a cold front or in a squall line, the tornado was closely associated with a surface low pressure area. In all respects, it was a remarkable tornado and stands alone in its own class of tornadic events

1926 - Peter Graves (Arness) born Minneapolis, MN. Actor: “Mission Impossible”, “The Winds of War”, “Airplane”, “Airplane 2”, “Stalag 17”, “The President's Plane is Missing”, “The Night of the Hunter”. Also starred in the television series, “My Friend Flicka”. Brother of actor James Arness, who lived near us and took my brother and I to University High School often. Our next door neighbor, James Whitmore turned down the “Gunsmoke” role and recommended Arness instead.

1931- The first electric razor was manufactured by Schick Company of Stamford, CT, and was delivered today. Remington introduced the dual-headed electric shaver in 1940. The electric shaver was invented by Colonel Jacob Schick, who recognized that soldiers in the field needed a razor that did not require soap or hot water. He patented a tiny electric motor in 1923, and received patents on his “shaving implement” on November 6, 1928. He could not convince anyone to manufacture his invention, so he raised money himself to start his own company.

1932- Author John Updike born, Shillington, PA

http://www.hycyber.com/HF/updike_john.html

1932- Casa Loma Band cuts “Smoke Rings.”

1938- Singer, former minor league baseball player, Charley Pride, born Sledge, MS. He is considered to be the most successful black entertainer in country music. By the early 1970's, Pride had become RCA Victor's biggest-selling artist since Elvis Presley, with hits such as "Is Anybody Going to San Antone?" "Kiss and Angel Good Morning" and "Wonder Could I Live There Anymore." When his first record, "Snakes Crawl at Night," was released in 1965, there was almost no publicity and few people realized that Pride was black. But by the following year, Pride had gained a huge hit and a Grammy Award nomination for "Just Between You and Me." In 1967 he was introduced on the Grand Ole Opry by Ernest Tubb.

1939- Frank Sinatra makes his very first recording, a demo called "Our Love," recorded with the Frank Mane band.

1940- Casa Loma Band cuts “No Name Jive”, (Decca)

1941- Wilson Pickett, one of the great soul singers of the 1960's, was born in Prattville, Alabama. Pickett joined a Detroit group called the Falcons in 1962, and sang lead on their hit, "I Found a Love." But Pickett, on the suggestion of the Falcons' producer, soon began a solo career. He signed with Atlantic in 1964, and had the first of his many hits with "In the Midnight Hour." His backing group on this record was Booker T. and the MG's. Pickett's other successes included "Land of 1,000 Dances," "Funky Broadway" and "I'm a Midnight Mover."

1943--MATHIS, JACK W. (Air Mission) Medal of Honor

Rank and organization: First Lieutenant, U.S. Army Air Corps, 359th Bomber Squadron, 303d Bomber Group. Place and date: Over Vegesack, Germany, 18 March 1943. Entered service at: San Angelo, Tex. Born: 25 September 1921, San Angelo, Tex. G.O. No.: 38, 12 July 1943. Citation: For conspicuous gallantry and intrepidity above and beyond the call of duty in action with the enemy over Vegesack, Germany, on 18 March 1943. 1st Lt. Mathis, as leading bombardier of his squadron, flying through intense and accurate antiaircraft fire, was just starting his bomb run, upon which the entire squadron depended for accurate bombing, when he was hit by the enemy antiaircraft fire. His right arm was shattered above the elbow, a large wound was torn in his side and abdomen, and he was knocked from his bomb sight to the rear of the bombardier’s compartment. Realizing that the success of the mission depended upon him, 1st Lt. Mathis, by sheer determination and willpower, though mortally wounded, dragged himself back to his sights, released his bombs, and then died at his post of duty. As the result of this action the airplanes of his bombardment squadron placed their bombs directly upon the assigned target for a perfect attack against the enemy. 1st Lt. Mathis’ undaunted bravery has been a great inspiration to the officers and men of his unit.

1945---MURPHY, FREDERICK C. Medal of Honor

Rank and organization: Private First Class, U.S. Army, Medical Detachment, 259th Infantry, 65th Infantry Division. Place and date: Siegfried Line at Saarlautern, Germany, 18 March 1945. Entered service at: Weymouth, Mass. Birth: Boston, Mass. G.O. No.: 21, 26 February 1946. Citation: An aid man, he was wounded in the right shoulder soon after his comrades had jumped off in a dawn attack 18 March 1945, against the Siegfried Line at Saarlautern, Germany. He refused to withdraw for treatment and continued forward, administering first aid under heavy machinegun, mortar, and artillery fire. When the company ran into a thickly sown antipersonnel minefield and began to suffer more and more casualties, he continued to disregard his own wound and unhesitatingly braved the danger of exploding mines, moving about through heavy fire and helping the injured until he stepped on a mine which severed one of his feet. In spite of his grievous wounds, he struggled on with his work, refusing to be evacuated and crawling from man to man administering to them while in great pain and bleeding profusely. He was killed by the blast of another mine which he had dragged himself across in an effort to reach still another casualty. With indomitable courage, and unquenchable spirit of self-sacrifice and supreme devotion to duty which made it possible for him to continue performing his tasks while barely able to move, Pfc. Murphy saved many of his fellow soldiers at the cost of his own life.

1945---TREADWELL, JACK L. Medal of Honor Rank and organization: Captain, U.S. Army, Company F, 180th Infantry, 45th Infantry Division. Place and date: Near Nieder-Wurzbach, Germany, 18 March 1945. Entered service at: Snyder. Okla. Birth: Ashland, Ala. G.O. No.: 79, 14 September 1945. Citation: Capt. Treadwell (then 1st Lt.), commanding officer of Company F, near Nieder-Wurzbach, Germany, in the Siegfried line, single-handedly captured 6 pillboxes and 18 prisoners. Murderous enemy automatic and rifle fire with intermittent artillery bombardments had pinned down his company for hours at the base of a hill defended by concrete fortifications and interlocking trenches. Eight men sent to attack a single point had all become casualties on the hare slope when Capt. Treadwell, armed with a submachine gun and hand grenades, went forward alone to clear the way for his stalled company. Over the terrain devoid of cover and swept by bullets, he fearlessly advanced, firing at the aperture of the nearest pillbox and, when within range, hurling grenades at it. He reached the pillbox, thrust the muzzle of his gun through the port, and drove 4 Germans out with their hands in the air. A fifth was found dead inside. Waving these prisoners back to the American line, he continued under terrible, concentrated fire to the next pillbox and took it in the same manner. In this fort he captured the commander of the hill defenses, whom he sent to the rear with the other prisoners. Never slackening his attack, he then ran across the crest of the hill to a third pillbox, traversing this distance in full view of hostile machine gunners and snipers. He was again successful in taking the enemy position. The Germans quickly fell prey to his further rushes on 3 more pillboxes in the confusion and havoc caused by his whirlwind assaults and capture of their commander. Inspired by the electrifying performance of their leader, the men of Company F stormed after him and overwhelmed resistance on the entire hill, driving a wedge into the Siegfried line and making it possible for their battalion to take its objective. By his courageous willingness to face nearly impossible odds and by his overwhelming one-man offensive, Capt. Treadwell reduced a heavily fortified, seemingly impregnable enemy sector.

1945-the first professional hockey player to score 50 goals in one season was Joseph Henri Maurice “Rocket” Richard of the National Hockey League's Montreal Canadiens, who scored his 50th goal in the 17th minute 45th second of the third and last period against the Boston Bruins at the Boston Garden , Boston , MA . He retired in 1960 with 544 goals in 16 regular seasons.

1945- The Japanese released mechanized flying bombs piloted by young Japanese men. These suicide bombs, directed against the US aircraft carrier fleet attacking the Japanese fleet in the Kure-Kobe area, inflicted serious damage on the Enterprise , Intrepid and Wasp.

1945 - About 1300 American bombers, with some 700 escorting fighters, drop 3000 tons of bombs on Berlin, despite heavy anti-aircraft defenses, including numerous jet fighters. The US fleet loses 25 bombers and 5 fighters.

1945--*WILKIN, EDWARD G. Medal of Honor

Rank and organization: Corporal, U.S. Army, Company C, 157th Infantry, 45th Infantry Division. Place and date: Siegfried Line in Germany, 18 March 1945. Entered service at: Longmeadow, Mass. Birth: Burlington, Vt. G.O. No.: 119, 17 December 1945. Citation: He spearheaded his unit's assault of the Siegfried Line in Germany. Heavy fire from enemy riflemen and camouflaged pillboxes had pinned down his comrades when he moved forward on his own initiative to reconnoiter a route of advance. He cleared the way into an area studded with pillboxes, where he repeatedly stood up and walked into vicious enemy fire, storming 1 fortification after another with automatic rifle fire and grenades, killing enemy troops, taking prisoners as the enemy defense became confused, and encouraging his comrades by his heroic example. When halted by heavy barbed wire entanglements, he secured bangalore torpedoes and blasted a path toward still more pillboxes, all the time braving bursting grenades and mortar shells and direct rifle and automatic-weapons fire. He engaged in fierce fire fights, standing in the open while his adversaries fought from the protection of concrete emplacements, and on 1 occasion pursued enemy soldiers across an open field and through interlocking trenches, disregarding the crossfire from 2 pillboxes until he had penetrated the formidable line 200 yards in advance of any American element. That night, although terribly fatigued, he refused to rest and insisted on distributing rations and supplies to his comrades. Hearing that a nearby company was suffering heavy casualties, he secured permission to guide litter bearers and assist them in evacuating the wounded. All that night he remained in the battle area on his mercy missions, and for the following 2 days he continued to remove casualties, venturing into enemy-held territory, scorning cover and braving devastating mortar and artillery bombardments. In 3 days he neutralized and captured 6 pillboxes single-handedly, killed at least 9 Germans, wounded 13, took 13 prisoners, aided in the capture of 14 others, and saved many American lives by his fearless performance as a litter bearer. Through his superb fighting skill, dauntless courage, and gallant, inspiring actions, Cpl. Wilkin contributed in large measure to his company's success in cracking the Siegfried Line. One month later he was killed in action while fighting deep in Germany

1949---Top Hits

Far Away Places - Margaret Whiting

Powder Your Face with Sunshine - Evelyn Knight

Cruising Down the River - The Russ Morgan Orchestra (vocal: The Skyliners)

Don't Rob Another Man's Castle - Eddy Arnold

1950 - Teresa Brewer's "Music! Music! Music!" hits #1

1953- In baseball's first franchise shift in half a century, the Boston Braves announced that they would become the Milwaukee Braves. The team remained in Milwaukee through the 1965 season after which it moved to Atlanta.

1957---Top Hits

Young Love - Tab Hunter

Round and Round - Perry Como

Little Darlin' - The Diamonds

There You Go - Johnny Cash

1957- “Tales of Wells Fargo” premiered on TV. This half-hour western starred Dale Robertson as Jim Hardie, agent for Wells Fargo Transport Company. In the fall of 1961, the show expanded to an hour. Hardie bought a ranch, and new cast members were added, including Jack Ging as Beau McCloud, another agent; Virginia Christine as Ovie, a widow owning a nearby ranch; Lory Patrick and Mary Jane Saunders as Ovie's daughters, and William Demarest as Jeb, Hardie's ranch foreman. Jack Nicholson appeared in one of his first major TV roles in the episode "The Washburn Girl." My father Lawrence Menkin wrote many of the episodes.

1958 - Jerry Lee Lewis becomes the first musician to appear on American Bandstand actually singing and not lip-synching his performance. Singing "Great Balls Of Fire," "Whole Lotta Shakin' Goin' On," and "Breathless" live, he also becomes the first guest to perform three songs on the program.

1959 - Bill Sharman of the Boston Celtics began what was to be the longest string of successful consecutive free throws (56 in a row) to set a new National Basketball Association record.

1959 - President Eisenhower signed the Hawaii statehood bill

1959 - EMI announces its intention to halt production of 78 rpm records.

1960 – “Rio Bravo”, the classic Howard Hawks/John Wayne Western that also stars Dean Martin and Ricky Nelson, opens in US theaters.

1962-Gary "U.S." Bonds appears on The Ed Sullivan Show performing his latest hit, "Twist, Twist, Senora", which will reach #9 in April.

1963 ---The first domed sports stadium that was fully enclosed started to be built this day. It was the Astrodome, Houston, TX, formally known as the Harris County Domed Stadium. The overall cost was $35.5 million. The arena could accommodate 66,000 people. The first baseball game under the dome was played on April 9, 1965 between the Houston Astros and the New York Yankees, who lost 2-1. In the game, Mickey Mantle hit the first home run at the Houston Astrodome. It was off of pitcher Turk Farrell. The first football game was played on September 11, 1965, when the University of Tulsa defeated the University of Houston 14-0.

1964--Birthday of Bonnie Blair, speed skater. Born on March 18, 1964, in Cornwall, N.Y. She moved with her parents to Champaign, Ill., when she was 2 and began skating at that time. In 1988, Blair won the gold medal in the 500 meters at the Winter Olympics in Calgary, and a bronze in the 1,000 meters. In the 1992 games in Albertville, France, she won two gold medals at the same distances, becoming the first American Woman to win three gold medals in the Winter Olympics and in 1994 she added more.

1965---Top Hits

Eight Days a Week - The Beatles

Stop! In the Name of Love - The Supremes

The Birds and the Bees - Jewel Akens

I've Got a Tiger by the Tail - Buck Owens

1966- Robert C. Weaver became first Black presidential cabinet member when sworn in as Secretary of Housing and Urban Affairs, (Johnson Administration)

1967—Wide receiver Andre Previn Rison born Flint , MI.

http://www.andrerison.com/Andre-Rison-News.php

http://www.pro-football-reference.com/players/R/RisoAn00.htm

1967 - The Beatles went gold for the single, “Penny Lane ". The ‘B' side of hit record was the also-popular "Strawberry Fields Forever".

1967-After three minor chart makers, an Oklahoma group called Five Americans release their biggest hit, "Western Union", which would rise to #5 on The Hot 100.

1970-Country Joe McDonald is convicted for obscenity and fined $500 for leading a crowd in his infamous Fish Cheer ("Gimmie an F..!") at a concert in Massachusetts.

http://www.countryjoe.com/

1970 - Brook Benton received a gold record for the hit single, "Rainy Night in Georgia ". It was Benton’s first hit since 1963's "Hotel Happiness".

1970- A wild-cat strike of postal employee’s locals of the National Association of Letter Carriers that began in New York City this day spread to parts of New York, New Jersey, and Connecticut. On March 23, President Richard Nixon declared a state of national emergency and called out 30,000 troops to move the mail. The strike ended on March 24.

1971- high winds accompanied a powerful low pressure system tracking from the Rocky Mountains to the Great Lakes. Winds gusted to 100 mph at Hastings, Nebraska and to 115 mph at Hays, Kansas. High winds caused 2 million dollars in property damage in Kansas.

1972-The Knox-class ocean destroyer escort, the Jesse L. Brown, was named at the Avondale Shipyards, Westwego, LA, becoming the first naval ship to be named for an African-American naval officer. Jesse Leroy Brown of Hattiesburg, MI, was commissioned an ensign on April 15, 1949. He died near the Changjin Reservoir in Korea, becoming the first African-American flier in the Naval Reserve to be killed in combat.

1972-The Chicago vocal group, The Chi-Lites, make their second appearance on TV's Soul Train, where they perform their newest release, "Oh Girl". The tune will go on to top the Billboard Pop and R&B charts and reach #14 in the UK. Not bad for a song that writer Eugene Record would later say he was surprised that the record company even wanted to issue as a single.

1972-Neil Young enjoyed his only solo, US number one hit with "Heart of Gold". Backing vocals were provided by James Taylor and Linda Ronstadt.

1972--Paul Simon's self-titled debut album topped the chart on the strength of the singles "Mother and Child Reunion" and "Me And Julio Down By The School Yard".

1973---Top Hits