![]() Add me to mailing list |

Add me to mailing list | ![]() Change email |

Change email | ![]() |

| ![]() Search

Search

Advertising | All Lists | Archives | Classified Ads | This Day In American History

Leasing News is a web site that posts information, news, and

entertainment for the commercial bank, finance and leasing industry

kitmenkin@leasingnews.org

![]()

Tuesday, November 12, 2013

![]()

Today's Equipment Leasing Headlines

De Lage Landen/Element Financial Settle Dispute

--Original story by Tom McCurnin, Leasing News Legal Editor

Classified Ads---Collections

Insiders on Why Pelose is Leaving Marlin Leasing

by Christopher Menkin

Commerce National Bank Leasing Now

Argent Bank Leasing

Change in Funder List “A”

Funders Looking for New Broker Business

“Tips on Handling “Bullying” in the Workplace?”

Career Crossroad---By Emily Fitzpatrick/RII

Classified Ads---Help Wanted

NAELB Adds 17 New Members in October

Corey Bell Resigns as President of NAELB

Sutton Receives Two Eagle Scout Awards

Highlights from Marlin Business Service 10-Q 3rd Q

by Christopher Menkin

Marlin Evergreen Clause Still Bringing Net Profit

From Marlin Third Quarter 10-Q:

Companies Who Do Not Notify Leases

End of Contract or Use PPB

Leasing 102 by Mr. Terry Winders, CLP

Executory Contracts

UCC Article 9 survey

by Corporation Service Company

Community banks generate loan growth — barely

By Kevin Dobbs and Marshall Schraibman

Top Stories November 5-November 7

(You May Have Missed One)

Labrador Retriever

Danville, Pennsylvania Adopt-a-Dog

News Briefs---

The Time is Ripe for Innovative Solutions in Equipment Leasing

Leasing vs. buying machinery

Pulaski Financial says it uncovers leasing fraud

$2500 Leasing Market Report

The History of Puritan Leasing; Santa Barbara, California

The Case for Keeping Mobile and Online Banking Separate

High Costs, Consumer Demands Drive Fresh Approaches to Branch Tech

Suit: Bank of America Neglected RI Skyscraper

Broker/Funder/Industry Lists |

Features (collection)

Top Ten Stories Chosen by Readers |

Top Stories last six months

www.leasingcomplaints.com (Be Careful of Doing Business)

www.evergreenleasingnews.org

You May have Missed---

SparkPeople--Live Healthier and Longer

Sports Briefs---

California Nuts Brief---

"Gimme that Wine"

This Day in American History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

######## surrounding the article denotes it is a “press release” and was not written by Leasing News nor information verified, but from the source noted. When an article is signed by the writer, it is considered a “by line.” It reflects the opinion and research of the writer.

| Working Capital Loans $10,000-$250,000 | |

|

|

Please send to a colleague. Spread the news.

Also ask them to join

our mailing list or bookmark our site.

We are free!

De Lage Landen/Element Financial Settle Dispute The matter regarding De Lage Landen Financial Service v. Thomas Thomasian Appeal from: United States District Court for the Eastern District of Pennsylvania and the Montgomery County case have been withdrawn in the local case and in amended complaint now under seal with memorandum of law (1). No doubt this means De Lage Landen (DLL) prevailed, but obviously it includes a non-disclosure agreement as all is sealed since Leasing News published the case. The story centered on De Lage Landen suing Element Financial Corp. for activities of former employee who after accepting employment with competitor and while still employed by DLL, turned over his laptop to the competitor; appearing May 28, 2013 (2). The facts originally came from the original complaint filed, as noted in Tom McCurnin report (3): “Patrick Neary was a former employee, for 20 years, of De Lage Landen, Wayne, Pennsylvania, a wholly owned subsidiary of the Dutch Rabobank Group ( DLL.) One of his salesmen was Thomas Thomasian, who also worked for DLL. Both signed confidentiality agreements. “In 2012, Patrick Neary quit and accepted employment at Co-Active Partners, Horsham, Pennsylvania, (which was acquired by Element Financial, Toronto, Ontario, Canada on November 9th from Marubeni Corporation for $300 million including repayment of debt.). Of course, one of the things they wanted to do was acquire Thomasian. On January 3, 2013, Thomasian met with the senior officers of Element Financial, told them about the confidentiality agreement, and despite that restriction, he was offered a job. Surprisingly, he did not immediately resign, and continued to work at DLL. But while employed, he did the following things: “• Downloading of Contacts. Thomasian took an Element Financial supplied iPhone and transferred all the contacts from his DLL phone to that Element Financial phone. “• Consulting with Element Financial re: Business Strategies. Again, while still employed by DLL, Thomasian answered emails from Patrick Neary about vendor finance and certain strategies which worked for DLL. “• Laptop Turnover. On January 23, while still employed at DLL. Thomasian gave Patrick Neary his DLL laptop and a rotating security code, so Neary could download all the reports he wanted from DLL’s secure site. The information included emails, daily sales dollar numbers, “• Monthly Sales Reports. Thomasian forwarded Patrick Neary the monthly sales reports of Thomasian’s team. “Finally, on February 10, 2013, after receiving his DLL bonus, Thomasian resigned from DLL along with one of his sales team.” (1) Court Filings: (B) Montgomery County Under Seal (2) Another Equipment Lessor Gets Sued for Stealing Trade Secrets (3) De Lage Landen Court Complaint (50 pages): [headlines] Classified Ads---Collections (These ads are “free” to those seeking employment or Free Posting for those seeking employment in Leasing: All “free” categories “job wanted” ads: [headlines] Insiders on Why Pelose is Leaving Marlin Leasing Insiders tell Leasing News that George D. Pelose leaving as Executive Vice President, General Counsel and Secretary of Marlin Business Services was not a decision by CEO Dan Dyer or the board of directors. Leasing News was told by two well-informed sources that Marlin was about to be sold to Mitsubishi Bank, which of course would allow Mr. Pelose to cash out and become a multi-millionaire, but the bank pulled out at the very last moment -- just as a press release was to go out. None of the insiders “off the record” believed the deal fell apart due to Mr. Pelose. Another insider said Dyer’s right hand man was looking for a chance to break free, and when the deal fell apart, he thought it was the best time for him to leave; that it was a sudden decision. Many of those who Leasing News spoke to said they believe he left because he “just had it.” Page 50 of the third quarter SEC filing may further indicate this was a sudden decision: "In connection with his retirement his employment agreement with the Company was amended. Pursuant to the amended employment agreement, the retirement will be treated as a termination 'without cause' or a resignation “for good reason” for purposes of determining the severance benefits payable. The Company anticipates a fourth quarter 2013 after-tax charge of approximately $1.3 million due to the amended employment agreement related to his departure." January, 2007 was the last time Leasing News communicated with George D. Pelose. He basically wrote by email: “As a public company subject to Regulation FD, we have determined that the best course of action is to release material news through the methods set forth in the securities laws, such as the Form 8-K.” This was the time period he was put in charge: "George Pelose, who is also the Company's General Counsel, has been an integral part of the senior management team since joining Marlin in 1999 and has played important roles in many aspects of the Company's business. As Marlin's COO, Mr. Pelose will add the leasing Sales and Credit functions to his existing reporting lines, which include Collections, Customer Service, Asset Management, Insurance and Legal.” 12/21/2006 Marlin Business Service Press Release And in this time period, these key performers either left or were let go: Gary Shivers, former president of Marlin. When Gary R. Shivers "resigned" as president and as director of Marlin Business Service in December, 2006, he really was not "resigning" as it appears George D. Pelose is not "retiring" at age 48. In my opinion, the announcement by Marlin was just too long and didn't mention anything about stock or agreement not to compete, as did Shivers (2) nor did it refer to the Page 50 of the third quarter SEC information. The press release and quotes from Chairman Dyer were classic. (3) Certainly stock played a big issue, as the following past articles: (High pay) (Continued Stock Options) http://www.leasingnews.org/archives/February%202006/02-10-06.htm#marlin http://leasingnews.org/archives/Oct2011/10_19.htm#stock Certainly the company has been profitable and stock doing well, but as reported in many stories, much of the net profit can be attributed to Evergreen clauses, and primarily copiers, as outlined in the many SEC filings and other articles by Leasing News (4) There may be other issues regarding Marlin Bank, but certainly there are indications of a major change that was to about happen, and indication of events: Page 47 of the Marlin SEC third quarter filing notes "$75.0 million, three-year committed loan facility with the Lender Finance division of Wells Fargo Capital Finance. The facility is secured by a lien on MRC’s assets and is supported by guaranties from Marlin Business Services Corp. and Marlin Leasing Corporation...was extended from October 9, 2012 to October 9, 2015.... An event of default, such as non-payment of amounts when due under the loan agreement or a breach of covenants, may accelerate the maturity date of the facility. However, there is no amount outstanding under the facility at September 30, 2013. "On September 24, 2010, the Company’s subsidiary, MLR XIII, closed on a $50.0 million three-year committed loan facility with Key Equipment Finance Inc. The facility was secured by a lien on MLR XIII’s assets. Advances under the facility were made pursuant to a borrowing base formula, and the proceeds were used to fund lease originations. The maturity date of the facility was September 23, 2013. On March 15, 2013, the Company elected to exercise its option to repay the remaining $1.3 million of the facility." "Financial Covenants 10Q Third Quarter SEC Filing (56 pages): [headlines] Commerce National Bank Leasing A -Accepts Broker Business | B -Requires Broker be Licensed Full Funder “A” List: Funders Looking for New Broker Business: Merger of Three Banks [headlines] “Tips on Handling “Bullying” in the Workplace?” Question: How does one handle “bullying” in the workplace? Answer: That’s an appropriate question considering the latest Miami Dolphins (my team) controversy. I think we would all agree that “bullying” or intimidation should not be present in ANY working environment. Maybe these bullies were trained young (family environment or team sports) to use whatever means necessary to get something or accomplish a goal – or maybe an extension of fraternity hazing, often happening when a pack of boys get together (women are guilty of it, too). Toxic/dysfunctional environments include bullying, manipulative politicking, intimidating, throwing things, etc… In general, Executives and Managers set the tone of the environment and the above behaviors should not be tolerated. Policies and procedures need to be in place and presented to new employees during the onboarding process. Often, surprisingly, it turns out the boss is the culprit! In the Miami Dolphins case, the coach said he was not aware. I can’t imagine any boss not knowing what is going on in his office—eventually. Maybe not every minute, but… Executive Management & HR must be aware of the impact that this type of behavior has on any organization. When an organization considers the cost of turnover from employees leaving due to a toxic environment, it should be motivated to stop this behavior and take measures to educate their employees at all levels. It is condoning poor behavior and does not produce an efficient or positive place employees look forward to coming to work. Career Crossroads Previous Columns [headlines] Classified Ads---Help Wanted

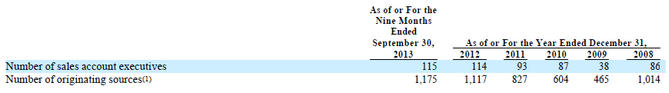

Sales Account Executives

Navitas Lease Corp is an innovator in the Small Ticket Leasing Software Programmer www.pawneeleasing.com [headlines] NAELB Adds 17 New Members In October Business Credit Reports - Gallatin, TN Brings membership up to 558 [headlines] Corey Bell Resigns as President of NAELB Corey Bell, United funding, LLC, Chattanooga, Tennessee, son of well-known broker Bob Bell, CLP, United Funding, resigns as president of the National Association of Equipment Leasing Brokers. In open letter to NAELB members, he basically states: "The most rewarding experience of my 16 year broker career has been serving the NAELB." (1) He is ending his career as a broker, but does not state where he is going, although an insider told Leasing News he is going to work for a "captive lessor;" who also reportedly does not work with brokers. President-elect Joan Modes, BPB, Gem commercial Credit, Inc., Livonia, Michigan will immediately take over as president, severing 1 1/2 years instead of the regular one year. News from NAELB - A Fond Farewell [headlines] Sutton Receives Two Eagle Scout Awards William G. Sutton, CAE, President and CEO of the Equipment Leasing and Finance Association (ELFA), has received the Distinguished Eagle Scout Award from the National Eagle Scout Association and the 2013 Financial Services “Good Scout” Award from the National Capital Area Council of the Boy Scouts of America. “Scouting is one of our treasured national institutions, and the lessons I learned in scouting have helped me throughout my career, both in the Navy defending this great nation and in business working for our country’s future prosperity,” said Sutton, an Eagle Scout. “I am deeply honored to receive both of these awards.” Sutton has held leadership roles in the military, government and association arenas throughout his distinguished career. A former U.S. Navy Rear Admiral with 30 years' military service, he took the helm of ELFA in 2010. Previously, he served as Assistant Secretary of Manufacturing and Services, a unit of the U.S. Department of Commerce's International Trade Administration. He joined the Commerce Department after serving for five years as president of the Air Conditioning and Refrigeration Institute. He holds an M.S. in Naval Architecture and Marine Engineering from the Massachusetts Institute of Technology and a B.S. in Naval Engineering from the United States Naval Academy. The Distinguished Eagle Scout Award was established by the National Eagle Scout Association in 1969 to acknowledge Eagle Scouts who have received national-level recognition within their field and have a strong record of voluntary service to their community. http://www.nesa.org/distinguishedaward.html [headlines] Highlights from Marlin Business Service 10-Q 3rd Quarter “During the three months ended September 30, 2013, we generated 6,223 new leases with a cost of $86.1 million, compared to 6,227 new leases with a cost of $81.6 million generated for the three months ended September 30, 2012. Sales staffing levels increased from 112 sales account executives at September 30, 2012 to 115 sales account executives at September 30, 2013. Approval rates remained stable at 65% for the quarter ended September 30, 2013, compared to 67% for the quarter ended September 30, 2012.” “Salaries and benefits expense. Salaries and benefits expense increased $0.6 million, or 10.0%, to $6.6 million for the three-month period ended September 30, 2013 from $6.0 million for the same period in 2012. The increase was primarily due to increased headcount. Salaries and benefits expense, as an annualized percentage of average total finance receivables, was 4.75% for the three-month period ended September 30, 2013 compared with 5.34% for the same period in 2012. Total personnel increased to 276 at September 30, 2013 from 258 at September 30, 2012, primarily due to increased staffing levels in the credit, marketing and collection teams.” “Provision for credit losses. The provision for credit losses increased $0.9 million, or 64.3%, to $2.3 million for the three months ended September 30, 2013 from $1.4 million for the same period in 2012, primarily due to the impact of portfolio growth, the ongoing seasoning of the portfolio as reflected in the mix of origination vintages and the mix of credit profiles. These factors affect the provision for credit losses because they impact both net charge-offs and the allowance for credit losses. Lease portfolio losses tend to follow patterns based on the mix of origination vintages comprising the portfolio. “The anticipated credit losses from the inception of a particular lease origination vintage to charge-off generally follow a pattern of lower losses for the first few months, followed by increased losses in subsequent months, then lower losses during the later periods of the lease term. Therefore, the seasoning, or mix of origination vintages, of the portfolio affects the timing and amount of anticipated probable and estimable credit losses. Net charge-offs were $2.1 million for the three-month period ended September 30, 2013, compared to $1.0 million for the same period in 2012. The increase in net charge-offs was primarily due to portfolio growth, the ongoing seasoning of the portfolio as reflected in the mix of origination vintages and the mix of credit profiles. Net charge-offs as an annualized percentage of average total finance receivables increased to 1.55% during the three-month period ended September 30, 2013, from 0.89% for the same period in 2012. The allowance for credit losses increased to approximately $7.1 million at September 30, 2013, an increase of $0.6 million from $6.5 million at December 31, 2012.” “Fee income increased $0.8 million to $9.7 million for the nine-month period ended September 30, 2013, compared to $8.9 million for the nine-month period ended September 30, 2012. Fee income included approximately $2.1 million of net residual income for the nine-month period ended September 30, 2013 and $2.7 million for the nine-month period ended September 30, 2012." “Insurance income. Insurance income increased $0.5 million to $3.6 million for the nine-month period ended September 30, 2013 from $3.1 million for the nine-month period ended September 30, 2012, primarily due to higher billings from higher total finance receivables. Other income. Other income increased to $1.2 million for the nine-month period ended September 30, 2013 from $1.1 million for the nine-month period ended September 30, 2012. Other income includes various administrative transaction fees and fees received from lease syndications.” “Provision for credit losses (nine month). The provision for credit losses increased $2.9 million, or 82.9%, to $6.4 million for the nine-month period ended September 30, 2013 from $3.5 million for the same period in 2012, primarily due to the impact of portfolio growth, the ongoing seasoning of the portfolio as reflected in the mix of origination vintages and the mix of credit profiles. These factors affect the provision for credit losses because they impact both net charge-offs and the allowance for credit losses. Lease portfolio losses tend to follow patterns based on the mix of origination vintages comprising the portfolio. The anticipated credit losses from the inception of a particular lease origination vintage to charge-off generally follow a pattern of lower losses for the first few months, followed by increased losses in subsequent months, then lower losses during the later periods of the lease term. Therefore, the seasoning, or mix of origination vintages, of the portfolio affects the timing and amount of anticipated probable and estimable credit losses." $5.1 Million Remaining in Stock Repurchase Plan “Item 2. Unregistered Sales of Equity Securities and Use of Proceeds Information on Stock Repurchases “On November 2, 2007, the Company’s Board of Directors approved a stock repurchase plan. Under this program, the Company is authorized to repurchase up to $15 million in value of its outstanding shares of common stock. This authority may be exercised from time to time and in such amounts as market conditions warrant. Any shares purchased under this plan are returned to the status of authorized but unissued shares of common stock... "In addition to the repurchases described above, pursuant to the 2003 Equity Plan, participants may have shares withheld to cover income taxes. There were 3,447 shares repurchased to cover income tax withholding pursuant to the 2003 Plan during the three-month period ended September 30, 2013, at an average cost of $22.52 per share. At September 30, 2013, the Company had $5.1 million remaining in its stock repurchase plan authorized by the Board of Directors." Full 10Q report: Marlin Press Release:

[headlines] Marlin Evergreen Clause Still Bringing Net Profit “RESIDUAL PERFORMANCE Our leases offer our end user customers the option to own the equipment at lease expiration. As of September 30, 2013, approximately 68% of our leases were one dollar purchase option leases, 31% were fair market value leases and 1% were fixed purchase option leases, the latter of which typically contain an end-of-term purchase option equal to 10% of the original equipment cost. As of September 30, 2013, there were $28.9 million of residual assets retained on our Consolidated Balance Sheet, of which $23.0 million, or 79.6%, were related to copiers. As of December 31, 2012, there were $29.9 million of residual assets retained on our Consolidated Balance Sheet, of which $23.8 million, or 79.6%, were related to copiers. No other group of equipment represented more than 10% of equipment residuals as of September 30, 2013 and December 31, 2012, respectively. Improvements in technology and other market changes, particularly in copiers, could adversely impact our ability to realize the recorded residual values of this equipment. Fee income included approximately $0.7 million and $0.8 million of net residual income for the three-month periods ended September 30, 2013 and September 30, 2012, respectively. "Fee income included approximately $2.1 million and $2.7 million of net residual income for the nine-month periods ended September 30, 2013 and September 30, 2012, respectively. Net residual income includes income from lease renewals and gains and losses on the realization of residual values of leased equipment disposed at the end of term as further described below. “Our leases generally include renewal provisions and many leases continue beyond their initial contractual term. Based on the Company’s experience, the amount of ultimate realization of the residual value tends to relate more to the customer’s election at the end of the lease term to enter into a renewal period, purchase the leased equipment or return the leased equipment than it does to the equipment type. We consider renewal income a component of residual performance. Renewal income net of depreciation totaled approximately $1.2 million and $1.6 million for the three-month periods ended September 30, 2013 and September 30, 2012, respectively. Renewal income net of depreciation totaled approximately $3.9 million and $5.2 million for the nine-month periods ended September 30, 2013 and September 30, 2012, respectively. The decline in residual income was primarily due to fewer leases reaching the end of their original contractual terms, as a result of the lower originations during the 2008 to 2010 timeframe." Marlin Third Quarter 10-Q

Sales Account Executives

Navitas Lease Corp is an innovator in the Small Ticket Leasing [headlines] Companies Who Do Not Notify Leases The inclusion of automatic renewal (or “evergreen”) clauses in true leases has been a fairly common practice from time immemorial. It is included in most company leasing contracts, whether the purchase options are "fair market value, " 10%, or even $1.00 (Yes, companies will continue payments if not notified and there have been several cases where the residuals is $1.00) There is no question that these clauses provide important protections to the lessor to obtain their residual. If the lessee has no intent to renew, the lessor has in interest in knowing it before the end of the term so that he can start planning for remarketing or some other disposition of the equipment, by which to realize the residual. However, the question of whether a lessee should be reminded by the lessor of the notice deadline in plenty of time for the lessee to react is an entirely different question. These states have statutes requiring commercial equipment lessors to provide a written notice – a fair warning – before the notice deadline date arrives: This is an unofficial list: These companies have received complaints or law suits indicating abuse of the notification process: ACC Capital, Midvale, Utah (Click on name to learn more about the company on this list) [headlines] Leasing 102 Executory Contracts (of a law, agreement, etc.) coming into operation at a future date; Bankruptcy is different for true leases (Article 2A) than for leases intended for security (Article 9). When bankruptcy is declared the lease transaction is judged by which Article of law is applicable to the lease. If the lease fails the Article 2A definition of a legal lease then it is judged to be an Article 9 transaction. If it is an Article 9 lease intended as a security and the UCC-1 lien filing has been filed properly then the lessor is in the same position as a lender and must file a claim on the equipment and wait for the first meeting of creditors. Article 9 recognizes the lessee as the owner and the lessor as a lien holder. The trustee may reach a decision to retain the equipment if they think the value is greater than the lessors balance. If the equipment appears to be greater than the lessors balance, the trustee of the bankruptcy court will sell the asset to gain the difference above the lease balance for other creditors. If the lease meets the requirements of Article 2A, the law recognizes the lessor as the owner of the equipment, therefore, the lessor can file an order for relief and request a return of the equipment in sixty days. The lease is called an “Executory Contract;” an unexpired lease. The trustee must reject the lease and return the leased equipment or assume it and also bring the rent current. Under Section 365, the trustee, subject to court’s approval, may assume or reject the lease transaction--- but also has the authority to reduce the rent, if they think it is too high. Most lessors know that the best you can hope for when a lessee declares bankruptcy is to get the equipment back as soon as possible. If the lessee is allowed to continue to use and abuse the equipment, the loss will grow way beyond what it would have been if you could have gained access to the equipment. Therefore, a true lease (legal lease) is much better than a lease intended as a security. You have access to your collateral, often quickly, rather than joining other creditors and waiting for all assets and prior claims to be settled. This usually results in more attorney and court costs. One recommendation I have written about numerous times is the proper description of the equipment. In each bankruptcy hearing I have attended there have been numerous claims on equipment by the other creditors. This is usually brought on by a poor description or an incomplete description. The equipment may have numerous attachments or accessories that came with the equipment but the vendors invoice failed to include them. Consequently, any lessor that uses the vendors invoice to identify the equipment will be in trouble during bankruptcy. A “complete” description is necessary in leasing and probably the number one disregarded rule in leasing. I am still, and will always be a fan of placing stick on labels on all equipment and attachments or accessories. Then upon equipment inspections (good marketing opportunities) the inspector can verify the existence of the equipment and missing parts. Filing liens on time and filing a UCC-1 for public notification on legal leases is one of the most important tasks for a leasing company. Without this you best have a very large lease loss reserve. Mr. Terry Winders, CLP, has been a teacher, consultant, expert witness for the leasing industry for thirty-five years and can be reached at terrywinders11@yahoo.com or 502-649-0448 He invites your questions and queries. Previous #102 Columns: Mr. Winders received his Master of Business Administration and his Bachelor of Science degrees from the College of Notre Dame. 502.649.0448/terrywinders11@yahoo.com (This ad is a “trade” for the writing of this column. Opinions [headlines] UCC Article 9 survey Corporation Service Company (CSC) has launched a survey for those in the finance business to assembly a comprehensive view of UCC Article 9 best practices and insights. Partial survey results will be released at the end of this year, but only survey participants will receive exclusive access to the full results. Please take Survey when you create ten minutes to do so: [headlines] Community banks generate loan growth — barely Median third-quarter loan growth among lenders with less than $10 billion in assets, when compared with the previous quarter, came in at a mere 1.25% nationwide. Compared with a year earlier, median growth just topped 3%, according to an SNL Financial analysis. A SNL Financial Exclusive Report Yadkin Financial Corp. President and CEO Joseph Towell, after reporting a third-quarter profit, struck an optimistic tone on loan growth, telling analysts that "our lending teams are on the offensive, looking for quality deals with creditworthy borrowers." But the Elkin, N.C.-based company's total loan balances — nudged by modest commercial real estate and C&I growth — advanced slightly during the third quarter and are up just 2% on the year. That, Towell said of his $1.8 billion-asset bank, "is right in line with our market expectations for 2013." Such is the definition of optimism on the loan growth front this year. An SNL Financial analysis of regulatory filings found that Yadkin Financial experience is emblematic of what community banks nationally are experiencing. Median third-quarter loan growth among commercial banks with less than $10 billion in assets, when compared with the previous quarter, came in at a mere 1.25% nationwide. Compared with a year earlier, median growth barely topped 3%. Generally tepid demand resulted in anemic growth in every region of the country during the third quarter. When compared with the linked quarter, no region reached the 2% median growth level, according to the SNL analysis. The mid-Atlantic region fared best, at 1.75% growth, while the Southeast produced the weakest result, with 0.66% growth. "Organic growth was OK in that we got some growth," D.A. Davidson & Co. analyst Jeff Rulis told SNL. Rulis said commercial borrowers and consumers continue to be aggressive in paying down debts and, as such, pay-downs and payoffs cut into loan balances and in some cases may mask decent loan growth. He said that, while spotty, some banks are making advancements in C&I, CRE and residential construction. "But it's sort of hot and cold — depending on the company," he said. "And there was nothing to indicate that a wave of demand came in," Rulis said, noting that loan growth of late at certain banks often tends to come via stealing share from competitors. "Demand is still light." From a year earlier, median growth was notable in some regions, but still hovered in single digits. New England produced the strongest median expansion, at 6.23%, while the Southeast again struggled the most, generating median loan growth of just 1.06%, SNL found. By asset size, there was little to differentiate one group from the other. From the second quarter, banks with less than $100 million in assets eked out median loan growth of 1.20%; lenders with $100 million to $1 billion produced 1.21%; and banks with $1 billion to $10 billion produced 1.52% median growth. Chicago-based MB Financial Inc., with just over $9 billion in assets, falls into the latter category. Its third-quarter loans were flat from the previous quarter and, excluding covered loans, were up just 3.6% from a year earlier. MB Financial President and CEO Mitchell Feiger, after reporting a third-quarter profit, told analysts that, with overall demand from prized borrowers modest, competition for good loans is fierce, making it difficult to produce strong growth without compromising on terms. "The Chicago market is hyper-competitive with tremendous pricing pressure and a steady decline in credit structure," Feiger said. His concerns were echoed by bankers and analysts across the country during earnings season. In the face of persistently challenging competition and only modest overall loan demand, many banks are considering mergers and acquisitions as a way to fuel near-term growth and to gain heft to leverage for longer term expansion. MB Financial, for one, in July agreed to acquire Rosemont, Ill-based Taylor Capital Group Inc. Yadkin Financial, meanwhile, is reportedly in talks to merge with Raleigh, N.C.-based VantageSouth Bancshares Inc. Rumors about a possible Yadkin sale have circulated for months. VantageSouth and Yadkin Financial combined would have almost $4 billion in total assets and 80 branches; that would make it the fourth-largest bank in North Carolina. With organic loan growth hard to come by and regulatory expenses weighing heavily on small banks, observers say more lenders are likely to grow frustrated with the current sluggish environment and at least consider sales. Charles Wendel, president of Financial Institutions Consulting Inc., put it this way to SNL in a recent interview: "I don't think there are many community banks that expect loan growth to suddenly take off and profits to surge and life as a standalone bank to become easy. … People are looking at their options." • End of Lease Negotiations & Enforcement The Solution to Your Credit & Accounts Receivable Needs (Leasing News provides this ad as a trade for investigations [headlines] Top Stories November 5-November 7 Here are the top stories opened by readers: (1) Marlin Leasing Reports $4.7 MM 3rd Quarter (Tie) (2) Archives---November 5, 2001 (Tie) (2) USA Equipment Leasing Market Continues to Sizzle (4) NAELB Regional Conference: "Why, Indeed?" (5) New Hires—Promotions (6) Leasing 102 by Mr. Terry Winders, CLP (7) New Hires—Promotions (8) Aggregate Funding Sources (9) Marlin Business Services Corp. Announces (Tie)(10) “More than just a new name!” (Tie)(10) Marlin Leasing Web Site Information (12) "Using My LinkedIn Profile as My Resume"

[headlines] Labrador Retriever Animal ID 21243008 Charlotte Contacts: http://www.petstew.com/22/danville-dogs-for-adoption-in-pa.html Adopt a Pet [headlines]

The Time is Ripe for Innovative Solutions in Equipment Leasing Leasing vs. buying machinery Pulaski Financial says it uncovers leasing fraud $2500 Leasing Market Report The History of Puritan Leasing; Santa Barbara, California The Case for Keeping Mobile and Online Banking Separate High Costs, Consumer Demands Drive Fresh Approaches to Branch Tech Suit: Bank of America Neglected RI Skyscraper Dell officially goes private: Inside the nastiest tech buy out ever SparkPeople--Live Healthier and Longer The Cold and Flu Survival Guide 9 Home Remedies You Should Never Try [headlines] Football Poem Hey nonny no! Men are fools that wish to die! -Anonymous (17th century)- 'Appalled' Dolphins owner to meet with Martin Peyton Manning 'definitely will play' vs. undefeated Chiefs Packers continue to be ravaged by injuries in loss to Eagles Atlanta Won't Help Baseball Team, Now Moving Cobb County Cutler out for Ravens game with high ankle sprain Getting a read 49ers coach Jim Harbaugh [headlines] Local expansions fill long-vacant Disney offices [headlines] http://www.youtube.com/watch?v=EJnQoi8DSE8 Second large harvest drives financing demand Parker's Perfect Napa Dozen Hobbs marvels at Malbec success story Dry Cider, an American Favorite, Rebounds Free Mobile Wine Program Wine Prices by vintage US/International Wine Events Winery Atlas Leasing News Wine & Spirits Page [headlines] This Day in History 1602 - The Vizcaino expedition held Mass on the feast day of San Diego de Alcala. He named the California landing port after the saint. ------------------------------------------------------------- SuDoku The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler? http://leasingnews.org/Soduku/soduko-main.htm -------------------------------------------------------------- Daily Puzzle How to play: Refresh for current date: -------------------------------------------------------------- http://www.gasbuddy.com/ -------------------------------------------------------------- Weather See USA map, click to specific area, no commercials -------------------------------------------------------------- Traffic Live--- Real Time Traffic Information You can save up to 20 different routes and check them out with one click, --------------------------------

[headlines]

--------------------------------------------------------------

Original story by Tom McCurnin, Leasing News Legal Editor

(A) Third Circuit Case sealed

http://www.leasingnews.org/PDF/ThirdCircuitCasesealed_2013.pdf

http://www.leasingnews.org/PDF/MontgomeryCoUnderSeal_2013.pdf

http://leasingnews.org/archives/May2013/5_28.htm#stealing_secrets

http://www.leasingnews.org/PDF/DeLageLandenComplaint_5282013.pdf

--------------------------------------------------------------

Long Grove, Illinois

Financial services professional with a proven track record of positively impacting corporate finances through effective management of cash flow, collections and financial assets. Strategic thinker capable of analyzing financial issues and processes in order to implement changes that improve efficiency and profit margins. Well-versed in all aspects of corporate financial affairs. roborgaard@aol.com | Resume

looking to improve their position)

http://www.leasingnews.org/Classified/Jwanted/Jwanted-post.htm

http://www.leasingnews.org/Classified/Jwanted/Jwanted.htm

--------------------------------------------------------------

by Christopher Menkin

Gary Kester, former VP of credit services.

Mike Bennie, former VP in charge of broker services.

Mark King, former director of credit.

Brian Cornell, former director of sales.

John Forsyth, former jack of all trades.

(Sales, syndications, major accounts, etc.)

Marcel Gilbert, former VP of IT (considered one of the best in the business)

Dominic Janney, former VP in charge of retail sales.

Tom Mancini, former VP in charge of copier sales and residuals.

http://leasingnews.org/archives/Nov2011/11_07.htm#pay

Our secured borrowing arrangement contains numerous covenants, restrictions and default provisions that we must comply with in order to obtain funding through the facility and to avoid an event of default. A change in the Chief Executive Officer, Chief Operating Officer or Chief Financial Officer is an event of default under our long-term loan facility, unless we hire a replacement acceptable to our lenders within 120 days."

http://www.leasingnews.org/PDF/Pelose_email_2013.pdf

http://www.leasingnews.org/archives/December%202006/12-20-06-flash.htm

(b) Bio and Current Stock Informationhttp://leasingnews.org/archives/Nov2013/11_07.htm#pelose

http://www.leasingnews.org/Conscious-Top%20Stories/Marlin_Leasing_2008.htm

http://www.leasingnews.org/PDF/Form10-QMarlinBusiness_2013.pdf

--------------------------------------------------------------

Now Argent Bank Leasing

Change in Funder List “A”

Funders Looking for New Broker Business

(formerly Commercial

National Bank Leasing)

2003

3818 E. Coronado St., Suite 100

Anaheim, CA 92807

Steve Reid, CLP

Steve.Reid@bankwithargent.com

V.P. Equipment Finance

Direct: 714-678-5306

Cell: 714-422-7602

www.bankwithargent.com

NAELB

Average commercial $195K

| C -Sub-Broker Program | D -"Private label Program" | E - Also "in house" salesmen

http://www.leasingnews.org/Funders_Only/Funders.htm

http://www.leasingnews.org/Funders_Only/New_Broker.htm

Umpqua Brings Commerce National, FinPac, Sterling Together

May Become Largest Broker Originated Operation

http://leasingnews.org/archives/Sep2013/9_26.htm#umpqua

--------------------------------------------------------------

Career Crossroad---By Emily Fitzpatrick/RII

Emily Fitzpatrick

Sr. Recruiter

Recruiters International, Inc.

Phone: 954-885-9241

Cell: 954-612-0567

emily@riirecruit.com

Invite me to Connect on LinkedIn

www.linkedin.com/pub/emily-fitzpatrick/4/671/76

Also follow us on Twitter #RIIINFO

http://www.leasingnews.org/Conscious-Top%20Stories/crossroad.html

--------------------------------------------------------------

Jacksonville, FL/Philadelphia, PA

Small Ticket funder with broad funding and

exceptional vendor service

capabilties.

E-mail resume to: garyshivers@navitaslease.com

Industry. We offer solutions to small-to-medium sized businsses looking to acquire and finance equipment.

Fort Collins, Colorado

SQL & .Net programmer for Vision Commerce

Platform, Min. 2yr. exp.,Bachelor’s degree

---or Course Work in related field

Click here for more information

-Est. 1982, specializing in the under $75,000

marketplace to smaller, closely-held businesses--

--------------------------------------------------------------

Anderson Rabinowitz LLC - Irvine, CA

Commercial Finance Solutions, LLC – Boynton Beach, FL

EQX Financial, Inc. - Mooresville, NC

Express Leasing Solutions - Scottsdale, AZ

FC Capital - Atlanta, GA

Florida Financial Solutions - Seminole, FL

Gulf Capital, LLC - Mobile, AL

Oak Capital - Woodland Hills, CA

Power Capital Direct - Miami, FL

Structured Asset Finance - West Des Moines, IA

Venture Financial Group, Inc. - Aliquippa, PA

Mesa Leasing, Inc. - San Diego, CA

North Mill Equipment Finance, LLC - Norwalk, CT

Pinnacle Specialty Capital, LLC - Alpharetta, GA

RapidAdvance, LLC - Bethesda, MD

Stalwart Contract Finance, LLC - Salt Lake City, UT

--------------------------------------------------------------

http://www.leasingnews.org/PDF/Fond_Farewell_2013.pdf

--------------------------------------------------------------

--------------------------------------------------------------

by Christopher Menkin

page 26

--

page 30

--

page 35

--

page 36

--

page 40

--

page 41

--

page 42

--

Page 53

http://www.leasingnews.org/PDF/Form10-QMarlinBusiness_2013.pdf

http://leasingnews.org/archives/Nov2013/11_07.htm#marlin

--------------------------------------------------------------

From Marlin Third Quarter 10-Q:

--

page 44

http://www.leasingnews.org/PDF/Form10-QMarlinBusiness_2013.pdf

Jacksonville, FL/Philadelphia, PA

Small Ticket funder with broad funding and

exceptional vendor service

capabilties.

E-mail resume to: garyshivers@navitaslease.com

Industry. We offer solutions to small-to-medium sized businsses looking to acquire and finance equipment.

--------------------------------------------------------------

End of Contract or Use PPB

New York

Rhode Island

Texas

Illinois

(Consumer, may affect commercial,

especially a proprietorship,

partnership or personal guarantee)

Balboa Capital, Irvine, California

IFC Credit, Morton Grove, Illinois

Jules and Associates, Los Angeles, California

LEAF Financial Group, Philadelphia, Pennsylvania

Marlin Business Leasing, Mount Laurel, New Jersey

Marquette Equipment Finance, Midvale, Utah

Mazuma Capital Corporation, Draper, Utah

Onset Financial, South Jordan, Utah

Pacific Western Equipment Finance, Cottonwood Heights, Utah

Republic Bank, Bountiful, Utah

Tetra Financial Group, Salt Lake City, Utah

--------------------------------------------------------------

by Mr. Terry Winders, CLP

not yet effective: an executory contract.

http://www.leasingnews.org/Conscious-Top%20Stories/Leasing_102/Index.htm

contained in the column are those of Mr. Terry Winders, CLP)

--------------------------------------------------------------

by Corporation Service Company

http://www.surveymonkey.com/s/cscuccsurvey

--------------------------------------------------------------

By Kevin Dobbs and Marshall Schraibman

John Kenny Receivables Management

www.jrkrmdirect.com

• Fraud Investigation

• Credit Investigations

• Asset Searches

• Skip-tracing

• Third-party Commercial Collections

John Kenny

315-866-1167 | John@jkrmdirect.com

and background information provided by John Kenny)

--------------------------------------------------------------

(You May Have Missed One)

http://leasingnews.org/archives/Nov2013/11_07.htm#marlin

Regional Sales Manager for Saddleback Financial

http://leasingnews.org/archives/Nov2013/11_05.htm#archives

ZRG Third Quarter Report

http://leasingnews.org/archives/Nov2013/11_05.htm#usa

by Dwight Galloway, CLP, Senior V.P. Broker Operations

RLC Funding

http://leasingnews.org/archives/Nov2013/11_05.htm#naelb

http://leasingnews.org/archives/Nov2013/11_05.htm#hires

Solicitation of Current Lessees

http://leasingnews.org/archives/Nov2013/11_05.htm#solicitation

http://leasingnews.org/archives/Nov2013/11_07.htm#hires

(On Line: connects lessees, lessors, and vendors)

http://leasingnews.org/archives/Nov2013/11_07.htm#sources

Retirement of George D. Pelose

http://leasingnews.org/archives/Nov2013/11_07.htm#retirement

Hennessey Capital Is Now Hitachi Business Finance

http://leasingnews.org/archives/Nov2013/11_05.htm#hitachi

George Pelose

http://leasingnews.org/archives/Nov2013/11_07.htm#pelose

Career Crossroad---By Emily Fitzpatrick/RII

http://leasingnews.org/archives/Nov2013/11_05.htm#crossroad

--------------------------------------------------------------

Danville, Pennsylvania Adopt-a-Dog

Breed: Retriever, Labrador/Mix

Age 8 years 30 days

Sex Female

Size Large

Color Black/White

Spayed/Neutered

Declawed No

Housetrained: Unknown

Intake Date : 10/12/2013

http://www.petango.com/Adopt/Dog-Retriever-Labrador-21243008

Adopt-a-Pet by Leasing Co. State/City

http://www.leasingnews.org/Conscious-Top%20Stories/Adopt_Pet.htm

http://www.adoptapet.com/

--------------------------------------------------------------

![]()

News Briefs----

http://online.wsj.com/article/PR-CO-20131111-905240.html?dsk=y

http://www.agriculture.com/news/business/leasing-vs-buying-machinery_5-ar35051

http://www.stltoday.com/business/local/pulaski-financial-says-it-uncovers-fraud/article_92da5ac0-d36c-5662-b156-313278916faf.html

http://www.reportsnreports.com/reports/269944-equipment-finance-market-in-us-2012-2016.html

http://www.noozhawk.com/article/david_petry_puritan_leasing

http://www.americanbanker.com//issues/178_217/the-case-for-keeping-mobile-and-online-banking-separate-1063542-1.html

http://www.americanbanker.com//issues/178_217/high-costs-consumer-demands-drive-fresh-approaches-to-branch-tech-1063504-1.html

http://abcnews.go.com/US/wireStory/suit-bank-america-neglected-ri-skyscraper-20852593

[headlines]

--------------------------------------------------------------

--You May Have Missed It

http://www.heraldsun.com.au/technology/dell-officially-goes-private-inside-the-nastiest-tech-buy-out-ever/story-fni0bykh-1226749789143

[headlines]

--------------------------------------------------------------

![]()

--------------------------------------------------------------

Is’t not fine to dance and sing

When the bells of death do ring?

Is’t not fine to swim in wine,

And turn upon the toe

And sing hey nonny no,

When the winds blow and the seas flow?

Hey nonny no!

[headlines]

--------------------------------------------------------------

Sports Briefs----

http://www.miamiherald.com/2013/11/11/3746857/miami-dolphins-owner-stephen-ross.html

http://www.usatoday.com/story/sports/nfl/broncos/2013/11/11/peyton-manning-mri-ankle/3498281/

http://sports.yahoo.com/blogs/nfl-shutdown-corner/packers-continue-ravaged-injuries-loss-eagles-221110161--nfl.html

http://www.ajc.com/news/news/reed-tax-breaks-to-braves-city-was-unwilling-to-do/nbpXF/

http://www.chicagotribune.com/sports/football/bears/chi-chicago-bears-jay-cutler-ankle-sprain-20131111,0,2140473.story

http://www.contracostatimes.com/tim-kawakami/ci_24501356/kawakami-getting-read-49ers-coach-jim-harbaugh

--------------------------------------------------------------

California Nuts Briefs---

http://www.northbaybusinessjournal.com/82835/local-expansions-fill-long-vacant-disney-offices/

--------------------------------------------------------------

![]()

“Gimme that Wine”

http://www.northbaybusinessjournal.com/82706/second-large-harvest-drives-financing-demand/

http://www.wine-searcher.com/m/2013/11/parkers-perfect-napa-dozen

http://www.thedrinksbusiness.com/2013/11/hobbs-marvels-at-malbec-success-story/

http://www.nytimes.com/2013/11/13/dining/reviews/dry-cider-an-american-favorite-

http://leasingnews.org/archives/Feb2010/2_26.htm#mobile

http://www.winezap.com

http://www.wine-searcher.com/

http://www.localwineevents.com/

http://www.carterhouse.com/atlas/\

http://two.leasingnews.org/Recommendations/wnensprts.htm

----------------------------------------------------------------

![]()

1701- The Carolina Assembly passed a Vestry Act making the Church of England the official religion of the Carolina Colony. (Strong opposition by Quakers and other resident Nonconformists forced the colony's proprietors to revoke their legislation two years later.)

1751- Margaret Molly Corbin birthday, revolutionary war hero who was near her husband at a battle when he was killed (women were on the battlefields of the war both as participants and as water, food, and munitions suppliers) and she immediately took over the cannon until she was wounded by enemy fire. Disabled, she lost the use of her left arm, she was granted a soldier's half- pay as a pension, was considered a full member of the military until mustered out in 1783. Margaret Corbin was listed on military rolls until April 1783. In 1926, the Daughters of the American Revolution had her remains moved from an obscure grave and re-interred with other soldiers behind the Old Cadet Chapel at West Point where they also erected a monument to her. Near the place of the battle, in Fort Tryon Park in New York City, a bronze plaque commemorates Margaret Corbin "the first American woman to take a soldier's part in the War for Liberty".

http://www.hhoc.org/hist/

http://www.thejukejoint.com/cabcalloway1.htmlmc_corbin.htm

http://www.distinguishedwomen.com/biographies/corbin.html

1775 -General Washington forbids recruiting officers enlisting blacks who were not “free men.” He later rescinds this as many blacks enlist in the British Army to earn their freedom from slavery.(Washington was from Virginia and was one of the largest land owners and slave owners in the state. As a side note, his best friends included the father of Robert E. Lee, who was to become a Confederate general. Henry Lee was to be the main drafter of the Declaration of Independence as he was very popular, very well respected and educated, but due to a family emergency at his farm, he suggested Thomas Jefferson fill his stead. Coda: In the 1800's, Washington freed many of his slaves, who continued to work the land as “free men” and after his death granted land to those remaining.

http://www.americanrevolution.org/blk.html

1815- birthday of Elizabeth Cady Stanton; American woman suffragist and reformer, Elizabeth Cady Stanton was born at Johnstown, NY. “We hold these truths to be self-evident,” she said at the first Women's Rights Convention, in 1848, “that all men and women are created equal.” For 54 years she was the women's rights movement's principal leader, organizer, theorist, and writer. Preserved the early women's movement her story in the first three volumes of the monumental History of Woman Suffrage (1881-1922) written along with Susan B. Anthony and Joseyln Gage. She died at New York, NY. Oct 26,1902 You can read some of Stanton's works in the WiiN Library:

http://www.womenshistory.about.com/library/bio/blstanton.htm

http://www.nps.gov/wori/ecs.htm

http://www.pbs.org/stantonanthony/.

http://memory.loc.gov/ammem/today/nov12.html

1864- Union General William T. Sherman orders the business district of Atlanta destroyed before he embarks on his famous March to the Sea.When Sherman captured Atlanta in early September 1864, he knew that he could not remain there for long. His tenuous supply line ran from Nashville, Tennessee, through Chattanooga, then one hundred miles through mountainous northern Georgia. The army he had just defeated, the Army of Tennessee, was still in the area and its leader, John Bell Hood, swung around Atlanta to try to damage Sherman's lifeline. Of even greater concern was the Confederate cavalry of General Nathan Bedford Forrest. Forrest was a brilliant commander who could strike quickly against the railroads and river transports on which Sherman relied. During the fall, Sherman conceived of a plan to split his enormous army. He sent part of it, commanded by General George Thomas, back toward Nashville to deal with Hood while he prepared to take the rest of the troops across Georgia. Through October, Sherman built up a massive cache of supplies in Atlanta. He then ordered a systematic destruction of Atlanta to prevent the Confederates from recovering anything once the Yankees had abandoned the city. By one estimate, 37 percent of the city was ruined. This was the same policy Sherman would apply to the rest of Georgia as he marched to Savannah. Before leaving on November 15, Sherman's forces had burned the industrial district of Atlanta and left little but a smoking shell. In retaliation, the Confederates attempt to burn New York City on November 25 th (more on this on November 25 th ) As a side note: Historians believe much of the destruction of Atlanta was also caused by Confederate soldiers leaving no supplies for the invading Union Army, causing fires in residential areas.

1892-William “Pudge” Heffelfinger became the first generally-acknowledged professional football player when he was paid $25 for expenses and a cash bonus of 4500. It was the cash bonus that made him professional. Scoring the winning touchdown for the Allegheny Athletic Association, he helped his team beat the Pittsburgh Athletic Club, 4-0.

1898-Birthday of Flora Belle Ludington, innovative librarian of Mount Holyoke College who advanced the cooperative Inter-library system that allows students and researchers use of the entire library system of the United States.

1906 - The mercury soared to 106 degrees at Craftonville, CA, a November record for the U.S

1911-Trumpet player Buck Clayton birthday

http://www.harlem.org/people/clayton.html

http://www.umkc.edu/lib/spec-col/clayton.htm

http://www.harlem.org/people/clayton.html

http://www.thejukejoint.com/cabcalloway1.html

1915 - Harvard University's Theodore W. Richards became the first American to be awarded the Nobel Prize for chemistry. He was given his award in Stockholm, Sweden.

http://www.nobel.se/chemistry/laureates/1914/richards-bio.html

1920- in the wake of the growing scandal surrounding accusations that members of the Chicago White Sox conspired to fix the 1919 World Series, baseball owners appointed Federal Judge Kenesa Mountain Landis, the game's first commissioner with extremely broad powers. Landis replaced the National Commission, a three man governing board, to a seven-year term from 1921 to 1928. He received a salary of $42,500 a year plus $10,000 for expenses to rule the 16 American and National League baseball clubs. He was re-elected three times and died in office on November 24, 1944.

1925-First Louis Armstrong Hot Five recording, Chicago (Okeh label)

1920- an underwater highway tunnel with twin tubes was started this day to run from New York City to Jersey City under the Hudson River. It was named after its chief engineer, Clifford Milburn Holland. It was opened on

November 12,

1927- by President Calvin Coolidge, who gave the signal form the presidential yacht Mayflower anchored in the Potomac River off Washington, DC. In that first hour, 20,000 people walked through the tunnel from shore to shore. Vehicular traffic was allowed through on November 13, 1927. 1921, the first conference of great powers to be held on American soil and affecting American interests was the Conference on the Limitation of Armaments, which was assembled at Memorial Continental Hall in Washington, DC, from this day to February 6, 1922. Nine nations took part in this conference: The United States, Great Britain, France, Italy, Japan, China, Holland, Belgium, and Portugal. The American delegation was headed by Secretary of State Charles Evans Hughes.

1925- Louis Armstrong Hot Five makes their first recording,

Chicago, ILL Okeh

1929- birthday of Grace Kelly; American award-winning actress (Rear Window, To Catch a Thief) who became Princess Grace of Monaco when she married that country's ruler, Prince Rainier Ill, in 1956. Born at Philadelphia, PA, she died of injuries sustained in an automobile accident, Sept 14, 1982, at Monte Carlo, Monaco. 1936 –San Francisco-Oakland Bay Bridge opens.

http://www.lib.berkeley.edu/Exhibits/Bridge/sfobay.html

http://www.sfmuseum.org/assoc/bridge00.html

1933-First Sunday football game in Philadelphia (previously illegal)

1941-Madame Lillian Evanti, opera singer, founds the National Negro Opera Company.

http://www.aaregistry.com/african_american_history/223/

Americna_Negro_Theatre_formed

1942 - The naval battle of Guadalcanal began between Japanese and American forces during World War II. The battle lasted until November 15. The U.S. scored a major victory, inflicting heavy losses on a Japanese task force and preventing Japanese reinforcements from reaching the island. The early TV series “Victory at War” captures much of the famous battle.

http://www.friesian.com/history/guadal.htm

1945-Singer Neil Young born Toronto, ON, Canada.

1946- drive-in banking service was instituted by the Exchange National Bank of Chicago, IL. Ten tellers' windows protected by heavy bulletproof glass and impregnable corrugated steel were equipped with automatic slide out drawers to enable motorists to transact business without leaving their cars.

1951---Top Hits

Because of You - Tony Bennett

Sin (It's No) - Eddy Howard

And So to Sleep Again - Patti Page

Slow Poke - Pee Wee King

1955 - The worst recorded attendance to a football game occurred in the Washington State vs. San Jose State game at Pullman, Washington. The game was played as scheduled, despite high winds and a temperature of 0 degrees F. The total paid attendance was 1.

1955-Billboard publishes the results of its annual disc jockey poll. The most played R&B single is Johnny Ace's "Pledging My Love," most promising artist is Chuck Berry and the favorite R&B artist is Fats Domino. In the pop category, rock and roll is barely present. Elvis Presley is voted the most promising country & western artist.

1955 -- Sci-Fi author L. Sprague de Camp, one of my favorite authors, is elected royal chronicler of the Hyborian Legion.

1957--A film called Jamboree previews in Hollywood. Among those featured are Jerry Lee Lewis, Fats Domino, Carl Perkins, Frankie Avalon, Slim Whitman and Connie Francis; consider a classic today.

1957-"Jamboree," the first movie starring Jerry Lee Lewis, previews in Hollywood. Among those featured in the flick are Fats Domino (with whom Lewis shares top billing), Carl Perkins, Frankie Avalon, Slim Whitman and Connie Francis.

1959---Top Hits

Mack the Knife - Bobby Darin

Mr. Blue - The Fleetwoods

Don't You Know - Della Reese

Country Girl - Faron Young

1959 - Between Noon on the 11th and Noon on the 12th, a winter storm buried Helena, MT, under 21.5 inches of snow, which surpassed their previous 24 hour record by seven inches.

1964--Shirley Ellis records "The Name Game" as a follow-up to her #8 hit, "The Nitty Gritty". Her latest effort would reach #3.

1966--Donovan's "Mellow Yellow" is released, and begins its climb to #2 in the US. It was long rumored that the song is about smoking dried banana skins, which was believed to be a hallucinogenic drug in the 1960s, but this rumor has since been debunked. The song's title actually refers to the fact that Donovan had suffered from liver disease in early 1966 and had become severely jaundiced. He originally says it refers to his trip in the Greek Isle's and remembers Sapho the poetess and safron in the food making it yellow.

http://en.wikipedia.org/wiki/Mellow_Yellow

1966-Donovan's "Mellow Yellow" is released. He wrote the song as under the influence of "smoking banana skins".

http://www.alohatropicals.com/mb-01.html

1967 - On Broadway, Pearl Bailey took over the lead role in the musical, "Hello Dolly". "Pearlie Mae", as Buck was called, was a hit.

1967 - The Detroit Lions set an NFL record by fumbling the football 11 times and losing it 5 of those times.

1967—Top Hits

To Sir with Love - Lulu

Soul Man - Sam & Dave

It Must Be Him - Vikki Carr

You Mean the World to Me - David Houston

1967--BARNES, JOHN ANDREW III Medal of Honor

Rank and organization: Private First Class, U.S. Army, Company C, 1st Battalion, 503d Infantry 173d Airborne Brigade. Place and date: Dak To, Republic of Vietnam, 12 November 1967. Entered service at: Boston, Mass. Born: 16 April 1945, Boston, Mass. Citation: For conspicuous gallantry and intrepidity in action at the risk of his life above and beyond the call of duty. Pfc. Barnes distinguished himself by exceptional heroism while engaged in combat against hostile forces. Pfc. Barnes was serving as a grenadier when his unit was attacked by a North Vietnamese force, estimated to be a battalion. Upon seeing the crew of a machine gun team killed, Pfc. Barnes, without hesitation, dashed through the bullet swept area, manned the machine gun, and killed 9 enemy soldiers as they assaulted his position. While pausing just long enough to retrieve more ammunition, Pfc. Barnes observed an enemy grenade thrown into the midst of some severely wounded personnel close to his position. Realizing that the grenade could further injure or kill the majority of the wounded personnel, he sacrificed his life by throwing himself directly onto the hand grenade as it exploded. Through his indomitable courage, complete disregard for his own safety, and profound concern for his fellow soldiers, he averted a probable loss of life and injury to the wounded members of his unit. Pfc. Barnes' extraordinary heroism, and intrepidity at the cost of his life, above and beyond the call of duty, are in the highest traditions of military service and reflect great credit upon himself, his unit, and the U.S. Army.

1968-baseball player Sammy Sosa born San Pedro de Marcoris, Dominican Republic.

1968 -- Supreme Court voids Arkansas law banning teaching of evolution in public schools. Alabama continues warning high school students evolution is 'controversial', putting stickers on biology books.

1968 - A severe coastal storm produced high winds and record early snows from Georgia to Maine. Winds reached 90 mph in Massachusetts, and ten inches of snow blanketed interior Maine.

1972- Don Shula of the Miami Dolphins became the first NFL coach to win 100 regular season games in only 10 seasons as the Miami Dolphins defeated the New England Patriots, 52-0.

1974 - A great Alaska storm in the Bering Sea caused the worst coastal flooding of memory at Nome AK with a tide of 13.2 feet. The flooding caused 12 million dollars damage, however no lives are lost.

1975---Top Hits

Island Girl - Elton John

Lyin' Eyes - The Eagles

Who Loves You - Four Seasons

I'm Sorry - John Denver

1979-Jefferson Starship singer Marty Balin's rock opera "Rock Justice" opens a four-day run at San Francisco's Old Waldorf night club. Balin stars in and co-directs the musical, about a rock star who dreams he's on trial for not having a hit record.

1981 - The space shuttle Columbia was launched for the second time; it was the first space vehicle to be used more than once.

1983 - Lionel Richie started the first of four consecutive weeks at #1 on the music charts as "All Night Long (All Night)" became the United States most popular song.

1983---Top Hits

Islands in the Stream - Kenny Rogers & Dolly Parton

All Night Long (All Night) - Lionel Richie

One Thing Leads to Another - The Fixx

Somebody's Gonna Love You - Lee Greenwood

1984-Madonna releases the "Like A Virgin" LP.

1986 - For the first time in the history of the NBA both head coaches were absent from the game when coached K.C. Jones and Don Nelson were too sick to be at the Boston-Milwaukee game. The Boston Celtics had their 44th straight home victory as they defeated the Milwaukee Bucks 124-116.

1986- Red Sox Roger Clemens becomes only the second American League pitcher to unanimously win the Cy Young Award. Denny McLain was the first to accomplish the feat in 1968.

1987 - Heavy snow spread across much of New England. Totals in Massachusetts ranged up to 14 inches in Plymouth County. The seven inch total at the Logan Airport in Boston was their highest of record for so early in the season, and the 9.7 inch total at Providence RI was a record for November. Roads were clogged with traffic and made impassable as snowplow operators were caught unprepared for the early season snowstorm.

1988 - "Rattle and Hum", the album by U2, started a six-week run at the top of the U.S. album charts. Hum along now, as we list the tracks on the "Rattle and Hum": "Helter Skelter", "Van Diemen's Land", "Desire", "Hawkmoon 269", "All Along the Watchtower", "I Still Haven't Found What I'm Looking For", "Freedom for My People", "Silver and Gold", "Pride (In the Name of Love)", "Angel of Harlem", "Love Rescue Me", "When Love Comes to Town", "Heartland", "God Part II", "The Star Spangled Banner", "Bullet the Blue Sky", "All I Want is You".

1989 - Thirty-three cities reported record high temperatures for the date as readings soared into the 70s and 80s from the Southern and Central Plains to the Southern and Middle Atlantic Coast Region. The afternoon high of 80 degrees at Scottsbluff NE was a record for November, and highs of 76 degrees at Rapid City SD and 81 degrees at Chattanooga TN were the warmest of record for so late in the season.

1991—Top Hits

Cream - Prince & The N.P.G.

Can't Stop This Thing We Started - Bryan Adams

Real, Real, Real - Jesus Jones

Someday - Alan Jackson

1995 — -- Miami quarterback Dan Marino passes Fran Tarkenton (47,003 yards) to become the NFL's all-time passing yards leader on a 9-yard toss to Irving Fryar in the Dolphins' 34-17 loss to New England. Marino finishes his career with 61,361 yards passing.

1996-Reverend Jesse Jackson threatened to lead a potentially crippling boycott against Texaco if the oil giant failed to settle a lingering racial- discrimination lawsuit. Six Texaco employees initially filed the $520 million suit in 1994; the ensuing years saw the case mushroom into a complaint backed by some 1,400 workers. Despite growing pressure, Texaco was slow to respond to the case. However, Jackson's involvement, coupled with the revelation of a "secret" audio tape that captured Texaco executives making racial slurs and plotting to derail the lawsuit, helped bring the case to a close. On November 15, Texaco announced what was believed to be a $ 175 million settlement to the case, which included a one-time salary boost for minority employees, as well as the establishment of "diversity training and sensitivity programs".

1998---Top Hits

Doo Wop (That Thing)- Lauryn Hill

Lately- Divine

The First Night- Monica

One Week- Barenaked Ladies

2002- Miguel Tejada, who receives 356 points from the Baseball Writers' Association, including 21 first-place votes of the 28 cast, is selected as the American League's Most Valuable Player. The A's shortstop joins countrymen Sammy Sosa and George Bell as Dominican Republic natives to win the award.

http://www.setgame.com/set/puzzle_frame.htm

http://www.setgame.com/set/puzzle_frame.htm

http://www.gasbuddy.com/GB_Map_Gas_Prices.aspx

http://www.gasbuddy.com/GB_Mobile_Instructions.aspx

or type in a new route to learn the traffic live