![]() Add me to mailing list |

Add me to mailing list | ![]() Change email |

Change email | ![]() |

| ![]() Search

Search

Advertising | All Lists | Archives | Classified Ads | This Day In American History

Leasing News is a web site that posts information, news, and

entertainment for the commercial bank, finance and leasing industry

kitmenkin@leasingnews.org

![]()

Monday, September 22, 2014

Today's Equipment Leasing Headlines

Pictures from the Past---Year: 2000

Collier, Greene, the Williams

Classified Ads---Sales

Top Stories: September 15--September 19

Opened Most by Readers of Leasing News

Leasing 102 by Mr. Terry Winders, CLP

Decision on Leasing Programs to Promote

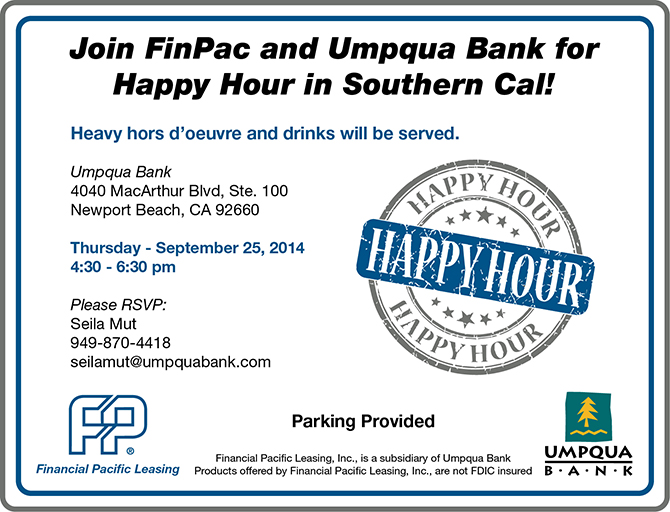

Join FinPac and Umpqua Bank for Happy Hour

Thursday, September 25, Newport Beach, CA

30 companies missed August TARP dividend payment

SNL Financial Exclusive Report

Leasing Industry Ads---Help Wanted

“An Executive Briefing”

Career Crossroad---By Emily Fitzpatrick/RII

October 10-11th, Next CLP Exam

Laurel, Maryland

New York Business Man $146 Million Bank Fraud Scheme

Alleged part of “an Albanian Crew”

$2 Trillion in Idle Savings Accounts

by Dan Geller, MoneyAnxiety.com

Miniature Poodle

Brentwood, L.A., California Adopt-a-Dog

Classified ads—Marketing

Loan/Lease Regulations

--- Update 09/20/14

Sample of Usury Laws in United States

News Briefs---

Thousands of firefighters battle fatigue to keep King fire at bay

King fire’s smoke causes Lake Tahoe Ironman triathlon to be canceled

Exchange Bank's upgraded Windsor branch: The future of banking?

At Climate March in New York, a Clarion Call for Action

Tony Bennett's Jazz Art

Broker/Funder/Industry Lists | Features (writer's columns)

Top Ten Stories Chosen by Readers | Top Stories last six months

www.leasingcomplaints.com (Be Careful of Doing Business)

www.evergreenleasingnews.org

Leasing News Icon for Android Mobile Device

You May have Missed---

SparkPeople--Live Healthier and Longer

Poem

Sports Briefs---

California Nuts Brief---

"Gimme that Wine"

This Day in American History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

######## surrounding the article denotes it is a “press release”

and was not written by Leasing News nor information verified, but from the source noted. When an article is signed by the writer, it is considered a “by line.” It reflects the opinion and research of the writer.

Please send to a colleague and ask them to subscribe to our news

editor or bookmark us (www.leasingnews.org) as each news edition

appears on our web site.

[headlines]

--------------------------------------------------------------

Pictures from the Past---Year: 2000

Collier, Greene, the Williams

2000

Tallest person, Ken Greene, Esq., Ken Green and Associations, 2000 United Association of Equipment Leasing (UAEL) Spring Conference Chairman---In front of him, left to right: Alan Collier, TotalFunding.com, Trish Williams and UAEL Executive Vice-President Dr. Ray Williams.

TODAY

Alan Collier

CEO, Endonovo Therapeutics, Inc.

IP Resources International, Inc.

Managing Member, C2Capital

Woodland Hills, California

Ken Greene

Law Offices of Kenneth Charles Greene

Westlake Village, California

The Williams

(Could not locate)

[headlines]

--------------------------------------------------------------

Classified Ads---Sales

(These ads are “free” to those seeking employment

or looking to improve their position)

| Boston, Mass. Accomplished Sales & Relationship Management Professional with business development experience in the financial services industry. Recognized by market leaders as industry expert in Professional Practice financing, as well as Residential Mortgage Lending. Keen insight and understanding of transaction process and financial requirements of customer. Proven record of exceeding sales goals. deb.harold@hotmail.com |

| Work Remotely Business Development - Are you looking to enter/increase your Healthcare lending? Let me identify and qualify healthcare (all verticals) vendors, distributors, and end users who utilize leasing/financing as a tool to sell equipment for you. Many years experience - contact Mitchell Utz at mitutz@msn.com or (215) 460-4483. |

Free Posting for those seeking employment in Leasing:

http://www.leasingnews.org/Classified/Jwanted/Jwanted-post.htm

All “free” categories “job wanted” ads:

http://www.leasingnews.org/Classified/Jwanted/Jwanted.htm

|

[headlines]

--------------------------------------------------------------

Top Stories: September 15--September 19

Opened Most by Readers of Leasing News

(1) Steve Crane, CLP, Joins BSB Leasing

as Commercial Division Manager

http://leasingnews.org/archives/Sep2014/9_19.htm#crane

(2) Archives---September 15, 2010

Schwartz to Get Out of Jail: $2 Million Bail

http://leasingnews.org/archives/Sep2014/9_15.htm#archives

(3) Illinois Voids Loan Because Lender Was Unlicensed

By Tom McCurnin, Leasing News Legal Editor

http://leasingnews.org/archives/Sep2014/9_19.htm#illinois

(4) Leasing 102 by Mr. Terry Winders, CLP

"Community Banks"

http://leasingnews.org/archives/Sep2014/9_15.htm#community

(5) Sales Makes it Happen by Mr. Terry Winders, CLP

“What Successful Sales Managers Do”

http://leasingnews.org/archives/Sep2014/9_17.htm#what

(6) San Francisco Bay Area Man Convicted in Multimillion Dollar

Mortgage Fraud Scheme

http://leasingnews.org/archives/Sep2014/9_17.htm#fraud

(7) Equipment Finance Programs for Community Banks

September 25th Telephone Seminar

http://leasingnews.org/archives/Sep2014/9_17.htm#equipment

(8) Court Gives First Data Merchant Services a Pass

in Class Action Suit,

By Tom McCurnin, Leasing News Legal Editor

http://leasingnews.org/archives/Sep2014/9_15.htm#court

(9) King Commercial Now Commercial Industrial Finance

http://leasingnews.org/archives/Sep2014/9_15.htm#king

(10) Success Leasing Salesman Sentenced for $945,200 Fraud

http://leasingnews.org/archives/Sep2014/9_19.htm#success

[headlines]

--------------------------------------------------------------

Leasing 102

by Mr. Terry Winders, CLP

Decision on Leasing Programs to Promote

Choosing a type of commercial equipment lease to sell is a function of your capital base and how you expect to develop your leasing company.

By far the most profitable lease type is a “true” lease because of the tax advantages and the opportunity to make additional income from the residuals. However, the way income is determined and how you handle the difference between tax income and book income require an excellent understanding of those differences and the impact it has on capital requirements.

I often see new lessors that arrange a true lease and sell off the payment stream to a funding source and retain ownership for collecting the residuals. They think their income is the difference between the equipment cost and the funding amount, but this is very wrong. If you sold off the payment stream on a non-recourse basis, your taxable income is the “total funded amount” because you have just received all your rent in advance with none of it at risk. Uncle Sam wants an income tax on the whole amount “or” you need to find some way to be at risk for the rent like being at recourse during the term. Not a good idea.

Federal income tax requirements allow you to depreciate the first year’s MACRS allowance, but it is small compared to the total rent stream resulting in a large tax bill.

Non-tax transactions can be sold without any tax problems because even though it is on a lease agreement, it does not qualify the lessor as the equipment owner. Therefore, a new leasing operation needs to offer non-tax leases primarily and completely sell off true leases and try to retain a remarketing agreement to participate in residual or renewal income.

Municipal leases and TRAC leases are also very difficult to retain, but leases to non-profits are acceptable because if the use of the equipment is for a non-profit entity, there is no depreciation allowed and there are no tax issues.

Mr. Terry Winders, CLP, has been a teacher, consultant, expert witness for the leasing industry for thirty-five years and can be reached at terrywinders11@yahoo.com or 502-649-0448

He invites your questions and queries.

Previous #102 Columns:

http://www.leasingnews.org/Conscious-Top%20Stories/Leasing_102/Index.htm

Mr. Terry Winders available as Expert Witness. 35 years as a professional instructor to the top equipment leasing and finance companies in the United States, author of several books, including DVD's, as well as weekly columnist to Leasing News. He also performs audits of leasing companies as an expert on documentation, and has acted as an expert witness on leasing for litigation in legal and tax disputes, including before the IRS. He also has taught the senior bank examiners, how to review a bank leasing department, for the Federal Reserve in Washington D.C. and has trained the examiners for the FDIC on how to prepare a lease portfolio for sale.

Mr. Winders received his Master of Business Administration and his Bachelor of Science degrees from the College of Notre Dame. 502.649.0448/terrywinders11@yahoo.com |

(This ad is a “trade” for the writing of this column. Opinions

contained in the column are those of Mr. Terry Winders, CLP)

[headlines]

--------------------------------------------------------------

[headlines]

--------------------------------------------------------------

Thirty companies missed August TARP dividend payment

SNL Financial Exclusive Report

By Tahir Ali and Zuhaib Gull

(Note: While $425 billion has been disbursed under TARP, according to a fact sheet released by the National Economic Council, at the date of this SNL article, $440 billion has been repaid to the Treasury, including some non-TARP funds paid by bailed-out insurance company AIG. The Treasury so far has received $29.5 billion more from banks than the $245.1 billion it paid out during the crisis. Editor)

Thirty banking institutions missed the August quarterly TARP dividend payment as required by the Capital Purchase Program, according to a Sept. 10 report from the Treasury. This was an improvement over the 40 deferrals seen in May, 48 in February and 56 in November. Missed payments fell in the latest quarter largely due to a mix of mergers, redemptions and Treasury auctions.

As of Aug. 31, the Treasury has received $12.12 billion in dividend and interest payments on securities issued under the CPP, $6.27 million of which came in August.

The Treasury sold preferred shares of six companies with outstanding dividends in its 26th round of multibank TARP auctions. Narberth, Pa.-based Royal Bancshares of Pennsylvania Inc. had accumulated $7.6 million of missed payments as of May 31. The bank's preferred stock sold at a 21% premium in the auction. The other five institutions in the auction were Vero Beach, Fla.-based Marine Bank & Trust Co., Elko New Market, Minn.-based Market Bancorp. Inc., Towson, Md.-based Maryland Financial Bank, San Mateo, Calif.-based United American Bank and Fayetteville, Ark.-based White River Bancshares Co.

Another bank, Mocksville, N.C.-based Bank of the Carolinas Corp., repurchased its TARP preferred stock for $3.3 million in July — $9.9 million less than the Treasury's initial investment in the company. The Treasury also agreed to waive any unpaid dividends on the series A preferred stock, and to cancel the warrant to purchase 475,204 shares of the company's common stock. Prior to its exit from TARP, the bank had missed 14 dividend payments, according to May's dividends and interest report.

As part of its acquisition of Mobile, Ala.-based BCB Holding Co. Inc., Hattiesburg, Miss.-based First Bancshares Inc. redeemed the preferred stock that BCB Holding issued to the Treasury under TARP for approximately $2.1 million. Prior to the redemption, BCB Holding had 13 payments outstanding.

In connection to the acquisition of Garland, Texas-based Central Bancorp Inc., Los Angeles-based Hanmi Financial Corp. agreed to buy all of Central Bancorp's TARP preferred stock from the Treasury for $23.6 million and settle all dues from deferred dividends on Aug. 29. Before the agreement, Central Bancorp Inc. had noncurrent dividends of $4 million and had missed dividend payments on 13 occasions.

The TARP preferred stock of Minneapolis-based Private Bancorp. Inc. was retired after Grand Forks, N.D.-based Alerus Financial Corp. acquired the company in June. All of the company's 15 missed payments, in addition to the initial TARP investment, were paid off in full, according to the Treasury's Sept. 5 transactions' report. Houston-based Farmers & Merchants Bancshares Inc. paid off two of its seven missed payments, according to the Treasury's August dividends and interest report. Noncurrent cumulative dividends at the bank now stand at $709,500.

Kingman, Ariz.-based Community Bancshares Inc. was new to the missed payment list. The bank paid only half of its $102,020 dividend due in August, based on the Treasury's dividends and interest report. Community Bancshares has paid a total of $981,159 in dividends since it started participating in the Capital Purchase Program.

Twenty-nine of the 30 companies that missed the August dividend payments have also missed at least five others in the past. Ten of these institutions have agreed to have a Treasury observer assigned and attend board meetings, while two have denied that request. Under the terms of the CPP, the Treasury has the right to elect up to two directors to the board of any institution that misses six dividend payments.

In addition, there were three companies that missed six or more TARP interest payments as of Aug. 31. Collectively, the 32 companies that missed six TARP dividend or interest payments have amassed more than $72 million in noncurrent payments. Of this amount, $41.8 million is cumulative dividends, $19.2 million is noncumulative dividends and $11.4 million is accrued interest.

Westminster, Calif.-based Saigon National Bank leads all other CPP participants with 23 missed payments to the Treasury. The company has refused to have a Treasury observer attend its board meetings and has noncurrent dividends worth $507,258, according to the Treasury's August dividends and interest report. There are two banks that have missed payments 22 times, while one other has deferred 21 payments as of August.

Doral, Fla.-based U.S. Century Bank has the highest amount of noncurrent dividends to the Treasury among all CPP participants, at $13 million. However, the bank's dividends are noncumulative. The company has missed payments to the Treasury 19 times as of the end of August.

Louisville, Ky.-based Porter Bancorp Inc. owes the Treasury the most in cumulative noncurrent TARP dividends among all other banks under the CPP. The bank's dues total nearly $6 million with 12 missed payments, based on the August dividends and interest report.

![]()

|

[headlines]

--------------------------------------------------------------

Leasing Industry Help Wanted

Collector, Atlanta, GA Sales, Chicago, Atlanta Work out of main office and satellite. Heavy phone sales calling on both independent dealers and end users (cold/warm calling), marketing, weekly reporting to management. Outside territorial salespeople will also be considered. Contact: Michael Testa 312-881-3133 mtesta@secondcityleasing.com www.secondcityleasing.com |

|

For information on placing a help wanted ad, please click here

Please see our Job Wanted section for possible new employment

[headlines]

--------------------------------------------------------------

“An Executive Briefing”

Career Crossroad---By Emily Fitzpatrick/RII

Question: I want to apply to a specific position. Do you have any advice on how my paperwork (resume) can stand out from other applicants?

Answer: A general resume can have its drawbacks. It may be too general to relate your qualifications to a particular position. If you know the specific requirements of a position, adding an Executive Briefing/Executive Summary to your resume can quickly and impressively line the requirements up with your qualifications and skills in a tangible form.

A briefing/summary, which is one form of a cover letter, will enable you to customize your resume quickly to the specific job and will act as a focusing device for the interviewer(s). It should be a simple one-page overview, which includes the job opening requirements and a list of your skills/experience (match point-by-point).

SAMPLE Excerpt

“While my attached resume will provide you with a general outline of my career, my sales abilities, and sample achievements, I have listed your specific requirements and my applicable skills in those areas…” List skills relating to the company’s requirements:

(Example) Requirements

- CLP Certified

- 5+ years leasing sales

(Example) Skills

- CLP (2011)

- 10 years of equipment finance/leasing sales experience

This summary will ensure that each resume you send addresses the job’s specific needs and will increase your chances of obtaining an interview with the company. Sent with a resume it provides a comprehensive picture of a thorough professional, plus a personalized, fast and easy-to read synopsis that details exactly how you will succeed.

The use of these summaries is naturally restricted to jobs that you have discovered through a recruiter, or you have seen advertised. It is obviously not appropriate for sending when the requirements of a specific job are not known.

Emily Fitzpatrick

Sr. Recruiter

Recruiters International, Inc.

Phone: 954-885-9241

Cell: 954-612-0567

emily@riirecruit.com

Invite me to Connect on LinkedIn

www.linkedin.com/pub/emily-fitzpatrick/4/671/76

Also follow us on Twitter #RIIINFO

Career Crossroads Previous Columns

http://www.leasingnews.org/Conscious-Top%20Stories/crossroad.html

[headlines]

--------------------------------------------------------------

October 10-11th, Next CLP Exam

Laurel, Maryland

As noted in Emily Fitzgerald’s column above, it makes a difference

to have CLP after your name.

The Institute for Leasing Professionals 2 day program is a comprehensive education program designed by equipment leasing and financing professionals. It is a 16-module course that covers the most important subjects in the equipment leasing and financing profession.

Maryland ILP: October 10-11th

Location: FSG Capital

CLP Exam: October 12th

Information:

http://www.leasingnews.org/PDF/MarylandLPCourse_2014.pdf

For additional Information:

Reid Raykovich, CLP - Executive Director

(206) 535-6281 - direct

reid@clpfoundation.org

Why I Became a CLP

Kevin F. Clune, CLP

Clune & Company, LC

http://leasingnews.org/archives/Sep2014/9_10.htm#clp

|

[headlines]

--------------------------------------------------------------

New York Business Man $146 Million Bank Fraud Scheme

Alleged part of “an Albanian Crew”

Selim “Sam” Zherka, 46, of Somers, New York, was indicted by a federal grand jury in White Plains, Westchester County, New York, for submitting multiple false loan applications to banks, tax fraud, wire fraud, and witness tampering. He is the owner of two strip clubs in Manhattan, a “modest real estate empire,” and the publisher of “The Westchester Guardian,” a free weekly newspaper.

The brief filed by the prosecutors contended that the former owner of Cheetah’s Gentleman’s Club in Manhattan had accused Mr. Zherka of “shaking him down” and of trying to take over the club by brute force. (Mr. Zherka now owns the club, which is on West 43rd Street.) It also said a prisoner at Sing Sing Prison had told the authorities that Mr. Zherka was part of “an Albanian crew” that distributed narcotics in Queens.

“Zherka is charged with falsifying information on commercial loan applications submitted to North Fork Bank - later purchased by TARP recipient Capital One - to fraudulently obtain more than $36.5 million in loans from the bank,” said Christy Romero, Special Inspector General for the Troubled Asset Relief Program (SIGTARP).

The brief also said “The Westchester Guardian” published a banner-headlined story in March calling a group of federal prosecutors “unethical and corrupt hypocrites” and identifying the towns in which they lived and their birthdays — which the brief said constituted “not-so-veiled threats.”

According to the Indictment, from November 2005 through 2008, Mr. Zherka obtained loans totaling more than $146 million in loans from three banks – North Fork Bank (now Capital One), Sovereign Bank (now Santander), and Signature Bank – for the purchase and/or refinancing of apartment house complexes in New England, Tennessee, New Jersey, and New York by lying about the purchase prices of the real estate he was acquiring, the amount of the down payments he was making toward the purchases in question, his assets, his income, his tax returns, and the nature and circumstances of a 2000 court judgment against him for assault and breach of contract (which, to date, he has not paid).

Additionally, the Indictment charges Mr. Zherka with engaging in a decade-long tax fraud scheme. The Indictment alleges that Mr. Zherka repeatedly submitted fraudulent tax returns to the IRS that overstated depreciation expenses and understated his capital gains on tax returns for the real estate holding companies in which he was a partner and which, in turn, owned the above apartment house complexes, thereby reducing their tax liabilities. The Indictment also charges that Mr. Zherka obstructed the IRS by, among other means, failing to file personal tax returns for over a decade.

U.S. Attorney Pheet Bharara stated: “Selim Zherka, while running his various businesses, allegedly engaged in a string of crimes. Zherka, the owner of commercial real estate and other businesses, stands accused of filing multiple false bank loan applications, engaging in tax fraud, and witness tampering. He is also charged with defrauding a businessman of his right to collect a court judgment against Zherka for assault and breach of contract.”

This case is being prosecuted by the U.S. Attorney’s Office for the Southern District of New York, White Plains Division. Assistant United States Attorneys Elliott B. Jacobson and Perry A. Carbone are in charge of the prosecution. The case is being investigated by SIGTARP, the FBI, and the IRS.

If convicted on the charges in the Indictment, Mr. Zherka faces the following maximum penalties: for each of the 11 counts of submitting a false loan application with which he is charged, 30 years in prison and a $1 million fine or twice the gross gain or loss resulting from the crime; for the count of wire fraud and the count of witness tampering, 20 years in prison and a $250,000 fine or twice the gross gain or loss resulting from the crime on each count; for the count of conspiracy to obstruct the IRS and violate tax laws, five years in prison and a $250,000 fine or twice the gain or loss resulting from the crime; and for each of the 10 counts of making/subscribing to false returns, the 10 counts of aiding/assisting in the preparation of false tax returns, and the count of attempting to interfere with the administration Internal Revenue laws, three years in prison and a $250,000 fine or twice the gross gain or loss resulting from the crime. Additionally, he faces potential criminal forfeitures totaling $146 million, restitution, and the costs of prosecution. The statutory maximum sentences are prescribed by Congress and are provided here for informational purposes only, as any sentencing of the defendant and any forfeiture would be determined by the Court.

[headlines]

--------------------------------------------------------------

##### Press Release ############################

$2 Trillion in Idle Savings Accounts

by Dan Geller, MoneyAnxiety.com

The Federal Open Market Committee stated that the economy is growing only moderately, but it did not say that nearly $2 trillion that normally be used to stimulate the economy is sitting idle in bank accounts.

SAN RAFAEL, Calif. -The U.S. economy is "short" $2 trillion. This money is sitting idle in bank accounts instead of stimulating the economy with consumer spending and investments. In the five years since the end of the Great Recession, consumers incrementally increased bank savings by about $2 trillion relative to GDP compared to the five years prior to the Great Recession. As a result, bank savings, as percentage of GDP, grew from 45.5 percent prior to the recession to 54.7 percent after the recession - an incremental increase of nearly $2 trillion.

When the amount of bank savings, as percentage of GDP, is growing, it means that less money is available for spending and investment. Since nearly 80 percent of the economy, or GDP, is made up of consumer spending and investments, the economy stagnates when consumers divert more of their disposable income to bank savings. Had consumers kept their bank savings at the same pace as they did prior to the Great Recession, the U.S. economy, or GDP, should have been nearly $2 trillion bigger today - $19 trillion as oppose to about $17 trillion currently.

In order for the economy to pick up steam, the $2 trillion in excess savings needs to be diverted back to spending and investment, which will bring the amount of bank savings to its pre-recession level of about 45 percent of GDP. However, for this to happened, consumers need to have a lower level of money anxiety. Prior to the Great Recession, the five-year average for the Money Anxiety Index stood at 58.6 - 13 points lower than its current level of 71.6.

### Press Release ############################

John Kenny • Fraud Investigations • Credit Investigations • Asset Searches • Skip-tracing • Third-party Commercial Collections john@jkrmdirect.com | ph 315-866-1167| www.jkrmdirect.com |

(Leasing News provides this ad as a trade for investigations

and background information provided by John Kenny)

[headlines]

--------------------------------------------------------------

Miniature Poodle

Brentwood, L.A., California Adopt-a-Dog

"Grover is a smiley faced, snuggly 3 year old male apricot mini Poodle. His beautiful fur is non shedding and he loves everyone he meets. Weighing 10 pounds he gets along with everyone and everything. He walks wonderfully on a leash and will make such a great best friend. Grover is up to date on vaccinations, neutered, healthy and microchipped."

Adoption Questions:

Please fill out an application here and a Wags and Walks volunteer will get back you as soon as possible!

Application:

http://www.wagsandwalks.org/adoption-application

Wags and Walks holds adoption events every other Sunday at Brentwood Country Mart and occasionally at Unleashed by PetCo in West Hollywood.

Adopt a Pet

http://www.adoptapet.com/

[headlines]

--------------------------------------------------------------

Classified ads—Marketing

Leasing Industry Outsourcing

(Providing Services and Products)

| Marketing services creative boutique: ads, flyers, premiums, trade show support and much more. Over 15 years experience working with CIT and ORIX. Currently seeking new relationships: www.tollinadvertising.com/ |

SAWBUX: a different kind of marketing firm. Built by deal guys for deal guys, we drive sales and create winning brands. Contact: |

| Marketing: Generate Leads, Build Authority and Showcase your expertise with your own lease blog. Don't have the time? We do it for you. Complete turnkey blog setup and/or content only provided by leasing expert for leasing companies. Email for free evaluation stu@p2plendingexpert.com |

All "Outsourcing" Classified ads (advertisers are both requested

and responsible to keep their free ads up to date:

http://www.leasingnews.org/Classified/Outsourcing/Outsourcing.htm

How to Post a free "Outsourcing" classified ad:

http://www.leasingnews.org/Classified/Outsourcing/Outsourcing-post.htm

[headlines]

--------------------------------------------------------------

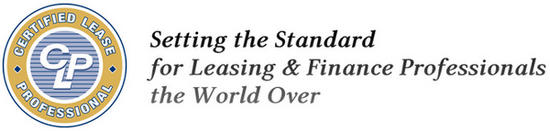

Loan/Lease Regulations --- Update

“Don’t Have a License? Not Caught, You’re Lucky, so Far”

While there is a conception that equipment leasing is not licensed, it is not quite true. Most states have license requirements, and all have issues on usury, requiring a sales/use tax permit, corporation filing to do business in a state, as well as many states have personal property license requirements from the owner of the equipment.

It is true that there are no state or national associations that regulate the industry as banks and other financial institutions or accountants, attorneys, realtors, to name a few. The closest may be the Certified Leasing Professional Foundation where they are 215 individuals that have passed a test, an annual test, and abide by a set of rules and regulations.

In most states, banks are not required to have a leasing license as well as manufacturers. Banks are generally exempt because they are regulated by the FDIC.

The common thread among licensing statutes is that if the entity which should otherwise have a license, is licensed by another government agency (real estate brokers is one example), then no license is required.

An expert on this who has won cases against company’s not licensed in California, notably CMC Commercial Credit, Tom McCurnin, Barton, Klugman & Oetting, Los Angeles, California told Leasing News: “A property owner can sell his property on credit without a license or without usury issues. Its called the Time Price Doctrine or Time Price Differential.

“CIT on the other hand doesn't own the stuff and is therefore making a loan and is required to have a license.

“A gray area might be for the leasing company to buy the stuff and have it shipped to them, and they, in turn re-ships to the customer. May not be required to have a license. Simple invoices and drop shipping probably would not pass muster.”

Captive Lessors are required to have a license, and all those that I checked do, such as Dell, who also sells other products than the ones they manufacture.

And while there are financial institutions that also have a bank, such as CIT, they hold a license.

In California, those engaged in true leases, such as Mar Vista, address, do not need to be licensed, but everyone who is involved in “capital leases” with a bargain purchase option, particularly a dollar, are required to be licensed. Without it, they may not accept a commission, engage with a licensed financial institution, and may find their leases in court dismissed for lack of a license. While the fines are not very much, the clout comes in immediate suspension from doing business in California, and while a hearing may be required or filed by an attorney, they may not engage in business during this time.

“NO BROKERAGE COMMISSIONS TO UNLICENSED BROKERS. California Administrative Code Title 10 §1451.”

Commissions may not be paid to unlicensed brokers. There are companies who use other companies’ documents and therefore believe they do not need to be licensed. This may be accurate in dealing with a bank, but not with another licensed financial institution or financial institution out of state that is not licensed in California.

If you are registered by license as a broker, lender, lessor in states that require it, you do not need a city business license (in most states). Cities that require a business license, also require a business license if you work out of your residence. Many cities now are using Schedule C from tax returns, such as in San Jose, California, to catch those without a city license, and they will go back several years as well as a fine, so best to get a license now in case they check your city.

While not all states require a lender's license, many require a license to accept a deposit or advance rental. And remember, a capital lease may be considered a loan as it is with the IRS in many states. If the state requires a license, and your company is not licensed, the transaction may be subject to usury laws.

46 states do not require the lessor to notify the lessee regarding the end of the original term of the lease and can invoke an Evergreen clause, except in these states that do require notification and if not, can void the residual as well as bring on a fine or worse, depending on the number of such transactions and complaints received.

States who require notification:

New York

Rhode Island

Texas

Wisconsin

Illinois

(In Illinois, Consumer law, but may affect commercial, especially a proprietorship, partnership or personal guarantee)

--Christopher Menkin

---Current Regulations

(Any up-dates or additions, please send

to kitmenkin@leasingnews.org)

Alaska: Money Service License

http://commerce.state.ak.us/dnn/Portals/3/pub/MoneyservicesStatutes.pdf

Arizona: All "advance fee loan brokers" must register annually with the state. Includes "commitment fees." Stiff penalty and on line form for a complaint for the state to investigate. Arizona Revised Statutes, sec. 06-1303-1310 (1996)

Registration process: http://www.azdfi.gov/Licensing/Licensing-FinServ/ALB/ALB.html

Arkansas: All brokers of "a loan of money, a credit card or a line of credit" may not assess or collect an advance fee. In addition, all brokers must register with the Securities Commissioner, post a surety bond of $25.000 and have a net worth of $25,000.

Arkansas Code Annotate sec. 23-39-401 (1995)

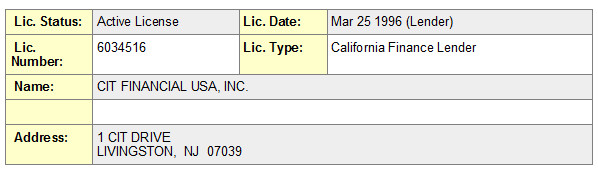

California: "In addition to the lending authority provided by the law, the California Finance Lenders Law provides limited brokering authority. A "broker" is defined in the law as "any person engaged in the business of negotiating or performing any act as broker in connection with loans*made by a finance lender." Brokers licensed under this law may only broker loans to lenders that hold a California Finance Lenders license."

http://www.corp.ca.gov/Laws/Finance_Lenders/Default.asp

(*any transaction that is not a true rent or meets the accounting and tax rules or is re-sold as a loan or discount or has a nominal purchase option is considered under this nomenclature. ) (2)

Delaware : http://banking.delaware.gov/services/applicense/llintro.shtml

Florida: Brokers of a "loan of money, a credit card, line of credit or related guarantee, enhancement or collateral of any nature" may not assess or collect an advance fee.

Florida Statues, Chapter 687.14 (1992)

Georgia: A broker of "loans of money, a credit card, a line of credit or related guarantee, enhancement or collateral of any kind or nature" may not assess or collect an advance fee unless such fee is for "actual services necessary to apply for the loan." Official Code of Georgia Annotated, sec. 7- 7-1 (1992)

Idaho: No fee may be collected unless a loan is actually made.

Idaho Code, sec. 26-2501 (1992)

Illinois: Code, 815 ILCS 175/15-5.03 Under the Act, a" loan broker" means any person who, in return for a fee from any person, promises to procure a loan for any person or assist any person in procuring a loan from any third party, or who promises to consider whether or not to make a loan to any person. 815ILCS 175/15-5- 15(a) specifically excluded from the application of the Act, however, are (1) any bank …regulated by any service loans for the Federal National Mortgage Association… (3) any insurance producer or company authorized to do business in [Illinois], (4) any person arranging financing for the sale of the person's product, (note that this exception does not apply to any person selling someone else's product and only applies to "the" person's product, implying the exception is for the owner of the product arranging for financing), (5) any person authorized to conduct business under the Residential Mortgage License Act of 1987 and (6) any person authorized to do business in [Illinois] and regulated by the Department of Financial Institutions or the Office of Banks and Real Estate. "In the event that the Act is violated by the broker, the Secretary of State is empowered by the statute to make investigations and examinations, suspend or revoke the broker's approval, subpoena witnesses, compel the production of books and records, order depositions and obtain temporary restraining orders and injunctions against the broker. In the vent that a violate is found, the Secretary of State may impose a fine in the amount of $10,000 for each violation and the broker shall be liable to any person damaged in the amount of tactual damages plus attorneys’ fees." This appears as standard language on most states.

Iowa: A broker of loans of "money or property" may not assess or collect an advance fee except for a "bona fide third-party fee" and a broker must obtain a bond or establish a trust account and file required documents with the Commissioner or Insurance.

Iowa Code, sec. 535C (19920)

Kansas : Broker is not exempt. Discounter or Lessor is exempt: " 'Creditor' means any person to whom a loan is initially payable on the face of the note or contract evidencing the loan" is exempt. Anyone who earns a fee or accept a deposit, except a bank, financial institution, discounter or lessor, must be registered.

http://www.securities.state.ks.us/rules/loan.rtf

Kentucky: Brokers of "a loan of money, a credit card, a line of credit or related guarantee, enhancement or collateral of any kind or nature" may not assess or collect an advance fee.

Kentucky Revised Statutes Annotated, sec. 367.380 (1992)

Louisiana: A broker of loans of "money or property…whether such agreement is styled as a loan, a lease or otherwise" must obtain a surety bond or establish a trust account in the amount of $25,000. A broker may not collect an advance fee but may collect an "advance expense deposit for commercial loans" only for actual expenses incurred in obtaining the loan. Louisiana Revised Statutes Annotated, sec. 9:3574 (1993); Louisiana Revised Statutes Annotated, Sec. 51:1910 (1992)

Non-Louisiana leasing companies, with or without offices in the state, must qualify to do business in Louisiana, and are subject to payment of state and local occupational license fees. See: Collector of Revenues v Wells Fargo Leasing Corp., 393 So.2d 1255 (La. App. 1981). Common misunderstanding of Louisiana law. Motor vehicle lessors, with or without offices in Louisiana, additionally are required to be licensed by the Louisiana Motor Vehicle Commission in order to lease a motor vehicle in the state. (La. R.S. 32:1254(N)) Common misunderstanding of Louisiana law.

Maine: No license required: "the regulation of commercial loan brokers does not fall under the jurisdiction of the Maine Bureau of Consumer Credit Protection. Transactions involving two businesses are legal/contractual in nature. Therefore, disputes involving a commercial loan between a business and commercial loan provider or broker must be settled in the court system."

http://www.maine.gov/pfr/consumercredit/faqs/loan_broker_faq.htm#j

Maryland: Lending threshold is $6,000 or less, so now need for license if over

this dollar amount

Massachusetts: Lending threshold is $6,000 or less, so now need for license if over this dollar amount.

Minnesota: Money Transfer License

http://mortgage.nationwidelicensingsystem.org/slr/PublishedState

Documents/MN-Money-Transmitter-Company-Description.pdf

Mississippi: A broker or loans of money may not assess or collect an advance fee and can be fined up to $5,000 for each violation. Mississippi Code Annotated, sec. 81-19-17 (1997)

Missouri: A broker of loans of "money or property" may not assess or collect an advance fee. Missouri Revised Statues, sec. 367 300 (19920

Nebraska: A broker of loans of money may not assess or collect an advance fee. Nebraska Revised Statutes, sec. 45-189 (1993)

Nevada: Foreign Corporations Foreign corporations engaged in activities in Nevada are subject to the provisions of Chapter 80 of the Nevada Revised Statutes. Specifically, NRS 80.010 through 80.055 set forth the requirements for a foreign corporation to qualify to do business in Nevada. Of primary importance are the statutes that establish (a) the filing requirements to qualify to do business (NRS 80.010); (b) the activities in which a foreign corporation may engage that do not constitute “doing business” so as to require qualification (NRS 80.015); and (c) the penalties to which a foreign corporation will be subject for failing to comply with the qualification provisions (NRS 80.055). The penalties for failure to comply with the qualification statutes include a fine (capped at $10,000) and/or denial of the right to maintain a court action. However, failure to comply will not impair the validity of contracts entered into by a foreign corporation nor prevent such corporation from defending itself in court. Foreign LLCs Foreign LLCs engaged in activities in Nevada are subject to the provisions of Chapter 86 of the Nevada Revised Statutes, specifically NRS 86.543 through 86.549. Foreign LLCs seeking to operate in Nevada must comply with the initial filing and registration requirements in NRS 86.544, and annual filing requirements of NRS 86.5461. The LLC must also maintain certain records, such as a list of current members and managers, in accordance with NRS 86.54615. Additionally, NRS 86.5483 lists the activities which do not constitute “doing business” in Nevada for purposes of the Chapter. Foreign LLCs that fail to comply with the Chapter risk penalties similar to those facing a non-compliant foreign corporation. Those penalties are outlined in NRS 86.548.

Nevada has no usury statue.

New Hampshire

Any person making small loans, title loans, or payday loans in New Hampshire must obtain a license from the bank commissioner. N.H. Rev. State. Ann. § 399-A:2. This law does not apply to banks, trust companies, insurance companies, savings or building and loan associations, or credit unions. Id. Any person who violates any provision of this chapter shall be guilty of a misdemeanor if a natural person, or a felony if any other person. N.H. Rev. Stat. Ann § 399-A:18.

New Jersey: Brokers of "loans of money" may not assess or collect an advance fee.

New Jersey Rev. Statutes, sec. 17:10B (1992)

Although New Jersey does not require a lessor to obtain a license to conduct a leasing business in the state, the New Jersey Corporation Business Activities Report Act requires foreign corporations to register with the state. See N.J. STAT. ANN. 14A:13-14. In particular, foreign corporations must file a Notice of Business Activities Report with New Jersey's Department of Taxation. Activities that trigger the requirement of a report include: (a) maintaining an office or other place of business in New Jersey; (b) maintaining personnel in New Jersey, even if the personnel is not regularly stationed in the state; (c) owing or maintaining real or tangible personal property directly used by the corporation in New Jersey; (d) owning or maintaining tangible and/or property in New Jersey used by others; (e) receiving payments from residents in New Jersey, or businesses located in New Jersey, that are greater than $25,000.00; (f) deriving any income from any source or sources within New Jersey; or (g) conducting or engaging in any other activity, property or interrelationships with New Jersey as may be designated by the Director of the Division of Taxation. See N.J.S.A. 14A:13-15. Corporations not required to file a report are those which either received a certificate of authority to do business, or filed a timely tax return under the Corporation Business Tax Act, or Corporation Income Tax Act. See N.J. STAT. ANN. 14A:13-16. Reports must be filed annually by April 15th.

New Mexico: New Mexico currently requires Brokers/Lessors to register for Licensing under the NM Mortgage loan Company or Loan Broker Act with the Financial Institutions Division of the State of New Mexico. Banks with Brick and Mortar within the State of New Mexico are exempt. Prior to licensing applicants must submit the Following:

Articles of Incorporation

Listing of all principals (including management)

A full financial Package (to meet their minimum requirements of liquidity)

Personal financial statements on all principals

Disclosure of all current or past suits (civil or criminal)

Attach a corporate surety bond

Include a $400.00 registration fee renewable yearly

North Carolina: A broker of "loans of money or property…whether such agreement is styled as a loan, a lease or otherwise" must obtain a surety bond or establish a trust account in the amount of $25,000 and obtain a license. North Carolina General Statutes, sec. 66-106 (1992)

North Dakota: Brokers may not accept an advance fee unless the broker is licensed. North Dakota Century Code, 13-04. 1-09.1 (1993) Ohio: Department of Commerce, Division of Financial Institutions

(Certificate to engage in the business of a credit services organization in accordance with the provisions of Sections 4712.01 to 4712.14 of the revised code of Ohio, subject to all the provisions thereof and to the regulations of the division.) Ohio Department of Taxation requires a "Vendor's License" under provision 5739.17 of the Revised Code (...is hereby authorized to sell tangible personal property and selected services at the retail location specified below.) This also makes the lessor responsible for all taxes with penalties for not doing so.

Ohio: Ohio law provides that no person may engage in the business of lending money, credit, or choses in action in amounts of $5,000 or less, or exact, contract for, or receive, directly or indirectly, on or in connection with any such loan, any interest and charges that in the aggregate are greater than the interest and charges that the lender would be permitted to charge for a loan of money if the lender were not a licensee, without first having obtained a license from the Division of Financial Institutions. O.R.C. 1321.02. This rule is applied to any person, who by any device, subterfuge, or pretense, charges, contracts for, or receives greater interest, consideration, or charges than that authorized by such provision for any such loan or use of money or for any such loan, use, or sale of credit, or who for a fee or any manner of compensation arranges or offers to find or arrange for another person to make any such loan, use, or sale of credit. O.R.C. 1321.02.

Rhode Island: Any person who acts as a lender, loan broker, mortgage loan originator, or provides debt-management services must be licensed. R.I. Gen Laws § 19-14-2(a). The licensing requirement applies to each employee of a lender or loan broker. R.I. Gen Laws § 19-14-2(b). No lender or loan broker may permit an employee to act as a mortgage loan originator if that employee is not licensed. R.I. Gen Laws § 19-14-2(b) R.I. Gen. Laws § 19-14-2 (2012) No person engaged in the business of making or brokering loans shall accept applications from any lender, loan broker, or mortgage loan originator who is required to be licensed but is not licensed. R.I. Gen Laws § 19-14-2(d). There is an exemption from the licensing requirement for a person who makes not more than 6 loans in the state within a 12-month period. R.I. Gen Laws § 19-14.1-10. Persons lending money without a license are guilty of a misdemeanor and can be fined not more than $1,000, or imprisoned for not more than 1 year, or both; each violation constitutes a separate offense. R.I. Gen Laws § 19-14-26.

South Carolina: A broker of "a loan of money, a credit card, a line of credit or related guarantee, enhancement or collateral of any kind or nature" may not assess or collect an advance fee. South Carolina Code Annotated, sec. 34-36-10 91992)

South Dakota: Money Lending License

Required for individuals or corporations to engage in the business of lending money, including creating and holding or purchasing and acquiring any installment loan ("Capital Lease" or EFA), single pay loan, or open-end loan which may be unsecured or secured by personal property. Requires filing a surety bond application. State and national banks, bank holding companies, other federally insured financial institutions, and the subsidiaries of those institutions are exempt from licensure. In addition, SD chartered trust companies are exempt from licensure. Any individual or corporation holding this license is required to pay the bank franchise tax.

Duration: 1 year

Cost: Application: $600

South Dakota has no usury status

Vermont: Commercial Loans

Commercial loan license would apply to EFA and "Capital Leases." Exemptions include transactions over $1 million, and brokers who do not engage in transactions more than $50,000 in one year at rates not exceeding 12 percent per annum.

Ontario, Canada: General Requirements: 1. Branch Operation If a foreign corporation wants to carry on business via a branch operation, without a Canadian corporate entity, it may have to obtain a provincial license in each province in which it intends to carry on business. Pursuant to the Ontario Extra-Provincial Corporations Act R.S.O. 1990 c. E.27 ("EPCA"), a class 3 extra-provincial corporation (a corporation that has been incorporated or continued under the laws of a jurisdiction outside Canada) is prohibited from carrying on business in Ontario without a license under the Act [s. 4(2)]. Failure to comply with this licensing requirement can lead to a maximum fine of $2,000 for a person and $25,000 for a corporation [s. 20(1)]. Directors, officers and any person acting as a representative of the corporation can be fined up to $2,000 for authorizing, permitting or acquiescing to an offence by the corporation [s. 20(2)]. For the purposes of the EPCA, an extra-provincial business is considered to be "carrying on business in Ontario" if: a. It has a resident agent, representative, warehouse, office or place where it carries on its business in Ontario; b. It holds an interest, otherwise than by way of security in real property situate in Ontario; or c. It otherwise carries on business in Ontario [s. 1(2)]. This last category is a catchall. Recent case law in the area stresses that it is very much a fact-specific analysis hinging on the extent to which business is actually conducted in Ontario. 2. Incorporation: a foreign corporation can also choose to incorporate a subsidiary, either federally or provincially. If a subsidiary is incorporated provincially in Ontario, it may have to obtain an extra-provincial license to carry on business in other provinces. An Ontario-incorporated company does not have to obtain a license to carry on business in Quebec but does have to make annual information filings. 3. Bank Act If the financing company is a bank and intends to carry on business in Canada, it must obtain appropriate approval under the Bank Act 1991 c. 46. Whether an entity will be considered a bank under the Bank Act needs to be reviewed on a case-by-case basis, as there are a number of relevant factors.

((Please click on ad to learn more))

(Leasing News provides this ad “gratis” as a means

to help support the growth of Lease Police)

[headlines]

--------------------------------------------------------------

Sample of Usury Laws in United States

by Bill Phillips, Esq.

Marks & Associates

These states are particularly troublesome where usury

and licensing are concerned:

California: Willful violation of the finance lender licensing laws is punishable by a fine of up to $10,000 and imprisonment for up to one year. Violators can be subject to a civil penalty of $2,500 per violation.

Colorado: Charging over 45% interest is a felony and carries a minimum one year prison sentence and a fine of $1,000.00.

Florida: Charging an interest rate exceeding 25% is a second degree misdemeanor and charging an interest rate exceeding 45% is a third degree felony.

Kentucky: Failure to obtain the loan license when necessary is a misdemeanor. The statute also provides that any loan contract made in violation of this statute shall be void and the lender shall have no right to collect any principal, charges or recompense whatsoever.”

Maryland: Failure to obtain a required lending license is a misdemeanor subject to fines and/or imprisonment not exceeding 3 years.

Massachusetts: The criminal usury rate is 20%. Violation of the criminal usury statute is punished by imprisonment in the state prison for not more than ten years or by a fine of not more than ten thousand dollars, or by both such fine and imprisonment.

Michigan: Any person guilty of criminal usury may be imprisoned for up to 5 years and/or fined up to $10,000.00. Possession of usurious loan records may also result in imprisonment and a fine. If the borrower is a “business entity” but the lender is not a bank, credit union or similar institution, the maximum interest rate is 25% and that rate is subject to criminal penalties.

Minnesota: Any person who violates the loan licensing statute is guilty of a “gross misdemeanor” and loans made without a license are void. The borrower is not liable to pay any amount under the loan and can obtain a refund of any money paid on the loan.

Montana: Persons who fail to obtain a necessary license for the purchase of installment sale contracts are guilty of a misdemeanor and punishable by a fine and/or imprisonment.

New Jersey: In addition to its civil usury rates New Jersey’s criminal usury rates are: (a) 50% for to loans to corporations, limited liability companies and limited liability partnerships; and (b) 30% to other borrowers Violation of criminal usury laws subjects the lending party to criminal usury liability and a fine up to $250,000.

Rhode Island: The maximum interest rate any entity may charge may not exceed the greater of 21% per annum or 9% above a published index. Violation of the usury statute can result in forfeiture of the entire principal and interest and imprisonment for not more than five years.

Tennessee: Tennessee’s usury rate is a variable published “formula rate”. The willful collection of usury is a misdemeanor punishable by up to eleven (11) months, twenty-nine (29) days in jail or a fine not to exceed two thousand five hundred dollars ($2,500), or both.

State usury and licensing laws differ significantly from state to state. These are just a few examples. Your transactions may not be impacted by the laws referenced above even if you have customers in these states. Factors include your type of financing product, interest rate, type of customers, size of transactions, collateral and whether you are a bank, credit union, unaffiliated financing company or broker.

It is important to understand the risks as well as the rewards of entering into a transaction in a new state.

[headlines]

--------------------------------------------------------------

![]()

News Briefs----

Thousands of firefighters battle fatigue to keep King fire at bay

bee.com/2014/09/20/6723424/thousands-of-firefighters-battle.html

King fire’s smoke causes Lake Tahoe Ironman triathlon to be canceled

http://www.sacbee.com/2014/09/21/6724421/king-fires-smoke-causes-ironman.html

Exchange Bank's upgraded Windsor branch: The future of banking?

http://www.pressdemocrat.com/home/2853974-181/exchange-banks-upgraded-windsor-branch

At Climate March in New York, a Clarion Call for Action

http://www.nytimes.com/2014/09/22/nyregion/new-york-city-climate-change-march.html

Tony Bennett's Jazz Art

http://www.cbsnews.com/pictures/tony-bennetts-jazz-art/

Collector, Atlanta, GA Sales, Chicago, Atlanta Work out of main office and satellite. Heavy phone sales calling on both independent dealers and end users (cold/warm calling), marketing, weekly reporting to management. Outside territorial salespeople will also be considered. Contact: Michael Testa 312-881-3133 mtesta@secondcityleasing.com www.secondcityleasing.com |

[headlines]

--------------------------------------------------------------

--You May Have Missed It

Tim Cook Visits Palo Alto Apple Store

http://www.pcworld.com/article/2686572/tim-cook-launches-iphone-6-sales-in-palo-alto.html

[headlines]

--------------------------------------------------------------

SparkPeople--Live Healthier and Longer

![]()

12 Foods to Eat for a Healthier Ticker

http://www.sparkpeople.com/resource/slideshow.asp?show=51

[headlines]

--------------------------------------------------------------

Baseball Poem

Baseball Poem

WHY BASEBALL WALTZES WITH LETTERS

by Tim Peeler

A Faulkner sentence is an extra inning game,

Simply and finally playing through its Will and exhaustion.

Third Base Coach signals are ee cummings poems-

Gimmicky, sure, but meaningful in their color

When you break the code.

The prisons play contests of Bukowski prose,

Where a stolen base may be a literal image

And everybody gambles nothing.

Weird killers load the bases at a

Stephen King Little League field, the sequel,

A grand slam promise at the bank.

Although Poe would never sit through nine,

His words are a dark season in the cellar,

A team leaving town and the death of a Beautiful groupie.

Finally, Wolfe who wrote slugfest

Double-headers played to million-footed

Throngs, then flickered like so many other

Stars never meant for extra innings.

--- with the permission of the author, from his

book of baseball poetry:

"Waiting for Godot's First Pitch"

More Poems from Baseball

available from Amazon

or direct

from the publisher at: www.mcfarlandpub.com

[headlines]

--------------------------------------------------------------

Sports Briefs----

Report: Minnesota Vikings do not foresee Adrian Peterson in their future

http://sports.yahoo.com/blogs/nfl-shutdown-corner/report--minnesota-vikings-do-not-foresee-adrian-peterson-in-their-future-171004008.html

Brawl erupts in Eagles-Redskins game after cheap shot on Nick Foles

http://ftw.usatoday.com/2014/09/eagles-redskins-brawl

Hawks beat Broncos 26-20 in OT

http://seattletimes.com/html/sports/?from=stnv1

Another week, another second-half no-show: 49ers fall, 23-14, to Cardinals

http://blog.sfgate.com/49ers/2014/09/21/another-week-another-second-half-no-show-49ers-fall-23-14-to-cardinals/

Tony Romo has best game since back surgery; defense makes plays when needed

http://cowboysblog.dallasnews.com/2014/09/5-thoughts-tony-romo-has-best-game-since-back-surgery-defense-makes-plays-when-needed.html/

Oakland Raiders lose 16-9 to New England Patriots

http://www.contracostatimes.com/raiders/ci_26578279/oakland-raiders-lose-16-9-new-england-patriots

Giants Stabilize Season, Cruising Past Texans

http://www.nytimes.com/2014/09/22/sports/new-york-giants-stabilize-season-cruising-past-houston-texans.html?ref=sports

Florida State's win saves the Playoff Committee major headache

http://www.usatoday.com/story/sports/ncaaf/2014/09/21/florida-state-clemson-playoff-committee-jameis-winston/16014737/

The Baltimore Ravens May Become the NFL's Los Angeles Clippers

http://www.forbes.com/sites/mikeozanian/2014/09/20/the-baltimore-ravens-may-become-the-nfls-los-angeles-clippers/

A league deflated: How recent controversies and PR mishaps have altered NFL's image

http://www.crainscleveland.com/article/20140921/SUB1/309219984

[headlines]

--------------------------------------------------------------

California Nuts Briefs---

Feds give green light to California immigrant licenses

http://www.sacbee.com/2014/09/19/6721541/feds-give-green-light-to-california.html

Major League Soccer official declares Sacramento's effort to land team 'tremendous'

http://www.sacbee.com/2014/09/19/6721612/major-league-soccer-official-declares.html

Meet the PayPal Mafia, The Richest Group of Men in Silicon Valley

http://www.businessinsider.com/meet-the-paypal-mafia-the-richest-group-of-men-in-silicon-valley-2014-9

[headlines]

--------------------------------------------------------------

![]()

“Gimme that Wine”

http://www.youtube.com/watch?v=EJnQoi8DSE8

Château de Pommard Sold to U.S. Entrepreneur

http://www.wine-searcher.com/m/2014/09/ch%E2teau-de-pommard-sold-to-u-s-entrepreneur

Ex-Quarterback Drew Bledsoe Wine Vineyard in Walla Walla, Washington

http://www.winespectator.com/blogs/show/id/50565

Free Mobile Wine Program

http://leasingnews.org/archives/Feb2010/2_26.htm#mobile

Wine Prices by vintage

http://www.winezap.com

http://www.wine-searcher.com/

US/International Wine Events

http://www.localwineevents.com/

Winery Atlas

http://www.carterhouse.com/atlas/\

Leasing News Wine & Spirits Page

http://two.leasingnews.org/Recommendations/wnensprts.htm

[headlines]

----------------------------------------------------------------

![]()

This Day in History

1554 - Spanish explorer Francisco Vásquez, his health badly deteriorated from injuries and the toll of his strenuous travels, dies. He never found the fabled cities of gold that he had sought for decades. A quarter-century earlier, Coronado had explored much of the southwestern United States, leading his force of 300 Spaniards and 800 Indians northward from Mexico in search of the Seven Cities of Cíbola that were rumored to have walls made of gold and treasure houses filled with priceless gems. Arriving in the region that today straddles the border between New Mexico and Arizona, Coronado did actually find Cíbola. But after winning a brief battle against the native defenders, Coronado discovered he had conquered only a modest Zuni village built with walls of adobe mud, not gold. While he never found the golden cities he sought, Coronado did succeed in giving the Spanish and the rest of the world their first fairly accurate understanding of the inhabitants and geography of the southern half of the present United States.

1656 – The General Provincial Court at Patuxent, MD, empaneled the first all-woman jury in the colonies to hear the case of Judith Catchpole, accused of murdering her child. The defendant claimed she had never even been pregnant, and after all the evidence was heard, the jury acquitted her.

1692 – The last person hanged for witchcraft in U.S. was executed in Salem, MA.

1711 - The Tuscarora Indian War began with a massacre of settlers in North Carolina, following white encroachment that included the enslaving of Indian children.

1734 - The Moravian settlement in America began with the arrival of George Boehnischt in Pennsylvania. The following year, a group of Moravians led by Augustus Gottlieb Spangenberg came to Georgia for the purpose of converting Native Americans. Their first church was built in 1735 in Savannah, GA, where General James Edward Oglethorpe had given 600 acres of land for a colony. Bishop David Nitschmann arrived from Germany in 1736 and ordained Anton Sieffert as pastor, the first ordination by a Protestant bishop in America. The group soon relocated to Pennsylvania and built a settlement in Bethlehem in 1741. Spangenberg became the Moravians' first American bishop in 1744. Moravians are followers of Jan Hus, the 15th century Bohemian religious reformer, and call themselves, the Church of the Bretheren, or Unitas Fratrum.

http://www.moravianjamaica.org/about_us.htm

http://www.everydaycounselor.com/archives/sh/shistory.htm

http://www.redeemermoravian.org/vision.htm

1776 – Captain Nathan Hale of Connecticut was executed by the British in New York City for spying. Before he was hanged he said, “I only regret that I have but one life to lose for my country.”

http://memory.loc.gov/ammem/today/sep22.html

1777 - Tacy Richardson's Ride: Courageous 23-year-old Tacy Richardson (Jan 1, 1754-June 18, 1807) rode her favorite horse, "Fearnaught," several perilous miles from the family farm at Montgomery County, PA to the James Vaux mansion to warn General George Washington of the approach of British troops led by General William Howe. As it turned out, the British crossing of the Schuylkill at Gordon's Ford was a feint to deceive Washington who indeed hastily withdrew to Pottstown, clearing the way for General Howe to spend that night in the quarters Washington had occupied only a few hours earlier.

1789 - The U.S. Created the Office of Postmaster General under the Treasury Department, following the Departments of State, War and Treasury.

1823 – Mormon leader Joseph Smith states he found the Golden plates after being directed by God through the Angel Moroni to the place where they were buried.

1862 – Abraham Lincoln delivers the Emancipation Proclamation, one of the most important presidential proclamations of American history. President Lincoln, by executive proclamation, freed the slaves in the rebelling states: "That on . . . [Jan 1, 1863] . . . all persons held as slaves within any state or designated part of a state, the people whereof shall then be in rebellion against the United States, shall be then, thenceforward, and forever, free. . . ." The 13th Amendment to the US Constitution officially declared the abolition of slavery in all states.

(Lower half of: http://memory.loc.gov/ammem/today/sep22.html )

1888 – The first issue of National Geographic Magazine is published.

1893 – The first automobile in U.S. (by Duryea brothers) runs in Springfield, MA. The Duryea's "motor wagon" was a used horse drawn buggy that the brothers had purchased for $70 and into which they had installed a 4 HP, single cylinder gasoline engine.

1903 - Italy Marchiony applied for his patent for his new mold which was filled with Ice Cream and is credited with inventing the Ice Cream Cone. He emigrated from Italy in the late 1800's and went into business in New York City with a pushcart dispensing lemon ice. Success soon led to a small fleet of pushcarts, and the inventive Marchiony was inspired to develop a cone, first made of paper, later of pastry, to hold the ices and then vanilla and chocolate ice cream.

1902 –American actor and producer John Houseman was born Jacques Haussmann at Bucharest. He is best known for his collaboration with Orson Wells on the 1938 radio production of “War of the Worlds” and his role as Professor Kingsfield in the film and television version of “The Paper Chase.” He won an Oscar for that film role in 1974 and helped establish the Julliard drama school and the Acting Company repertory group. He died Oct. 30, 1988, at Malibu, Ca.

1911 - Cy Young beats Pittsburgh 1-0 for his 511th and final career victory. With Joe DiMaggio’s 56-game hitting streak, many believe this to be baseball’s most unbreakable record. The annual award for the top pitchers in each league is named the Cy Young award.

1915 – Xavier University, the first Black Catholic college in the US, opens in New Orleans. This is not to be confused with Xavier University in Ohio.

1919 – A strike led by the Amalgamated Association of Iron and Steel Workers, begins in Pennsylvania before spreading across the United States.

1920 – A Chicago grand jury convenes to investigate charges that 8 White Sox players conspired to fix the 1919 World Series. They would find all eight to be not guilty, a verdict that did not deter new Major League Baseball Commissioner Kennesaw Mountain Landis from banning them for life for conduct detrimental to the game.

1922 - With the passage of the Cable Act, women who married foreign citizens kept their US citizenship. Up to that point, American-born women automatically lost their US citizenship if they married a foreign man. At no time in the history of the United State could men have lost their citizenship.

1925 - New York Yankee Ben Paschal hits two inside-the-park HRs.

1927 - Still talked about today as the “long count”, the world championship boxing match between Jack Dempsey and Gene Tunney at Soldier Field, Chicago, IL was fought. It was the largest fight purse in the history of boxing at the time, nearly $1 million dollars. Nearly half the population of the US is believed to have listened to the radio broadcast of this fight. In the seventh round of the 10-round fight, Tunney was knocked down. Following the rules, Referee Dave Barry interrupted the count when Dempsey failed to go to the farthest corner. The count was resumed and Tunney got to his feet at the count of nine. Stopwatch records of those present claimed the total elapsed time from the beginning of the count until Tunney got to his feet at 12-15 seconds. Tunney, awarded seven of the 10 rounds, won the fifth and claimed the world championship. Dempsey's appeal was denied and he never fought again. Tunney retired the following year after one more (successful) fight.

1927 – Birthday of “I bleed Dodger blue”, Tommy LaSorda in Norristown, PA. Originally signed by the nearby Phillies in 1945, the Dodgers drafted him off their minor league roster in 1948 and he has been a Dodger since. His career MLB record is 0-4, and other than his fame as a Dodger manager, he contributed mightily to the Dodgers in 1954. LaSorda had to be sent to the minors to make room for rookie Sandy Koufax. LaSorda’s managerial record is 1,599–1,439 and it includes World Series championships in 1981 and 1988. He was elected to Baseball’s Hall of Fame in 1997.

1937 - On the Brunswick label, Red Norvo and his orchestra recorded the "Russian Lullaby". Later Norvo would do a more famous work with a recording including singer Dinah Shore.

1938 - A great hurricane smashed into Long Island and bisected New England, causing a massive forest blowdown and widespread flooding. Winds gusted to 186 mph at Blue Hill, MA, and a storm surge of nearly thirty feet caused extensive flooding along the coast of Rhode Island. The hurricane killed 600 persons and caused 500 million dollars damage. The hurricane, which lasted twelve days, destroyed 275 million trees. Hardest hit were Massachusetts, Connecticut, Rhode Island and Long Island, NY. The "Long Island Express" produced gargantuan waves with its 150 mph winds, waves which smashed against the New England shore with such force that earthquake recording machines on the Pacific coast clearly showed the shock of each wave.

1941 – Birthday of Pastor Jeremiah Wright in Philadelphia. Pastor Emeritus and former Pastor of the Trinity United Church of Christ in Chicago. He is the former pastor and ‘spiritual advisor’ of President Obama, known for his politically charged, controversial comments denouncing the United States.

1945 - Stan Musial of the St. Louis cardinals gets 5 hits off 5 pitchers on 5 consecutive pitches.

1946 – Birthday of longtime California Congressman Dan Lungren.

1950 - Omar N. Bradley promoted to rank of 5-star general

1954 - The temperature at Deeth, NV, soared from a morning low of 12 degrees to a high of 87 degrees, a record daily warm-up for the state.

1954 – Brooklyn Dodger Karl Spooner, in his Major League debut, strikes out 15 New York Giants. Consistent arm injuries forced him out of the game, his last being in the 1955 World Series.

1955 - The film, “To Hell and Back,” starring World War II hero Audie Murphy, premiered in New York on this date.

http://www.rottentomatoes.com/m/to_hell_and_back/cast_crew.php

1955 – Champ Rocky Marciano knocks out Archie Moore in nine rounds. Marciano retired undefeated.

1956 - Top Hits

“Canadian Sunset” - Hugo Winterhalter & Eddie Heywood

“Whatever Will Be Will Be” (Que Sera Sera) - Doris Day

“Be-Bop-a-Lula” - Gene Vincent & His Blue Caps

“Don't Be Cruel/Hound Dog” - Elvis Presley

1957 – Brooklyn Dodger Duke Snider, in his final season in Brooklyn before the Dodgers’ move to LA, hits his 40th home run, tying him with Ralph Kiner for having five consecutive 40+ homer seasons in the National League.

http://www.baseballhalloffame.org/hofers_and_honorees/hofer_bios/snider_duke.htm

http://www.thebaseballpage.com/past/pp/sniderduke/

1957 - “Maverick” premiered on television. (Yes, my father Lawrence Menkin, wrote several of these episodes as well as other Western television shows). This popular western, which has since been remade into a popular movie, starred James Garner as Bret Maverick, a clever man who preferred card playing to fighting. A second Maverick was introduced when production was behind schedule--Jack Kelly played his brother Bart. Garner and Kelly played most episodes separately, and when Garner left in 1961, Kelly was in almost all the episodes. Other performers included Roger Moore, Robert Colbert and Diane Brewster. This western distinguished itself by its light touch and parody of other westerns and was must-see TV on Sunday nights if you weren’t watching The Ed Sullivan Show.

http://www.tvtome.com/tvtome/servlet/ShowMainServlet/showid-1020

http://www.amazon.com/exec/obidos/tg/browse/-/871682/103-0205572-2897419

1958 – TV financial host Neil Cavuto was born.

1960 - Joan Jett is born in Philadelphia. Her first solo hit, "I Love Rock 'N Roll" sells more than one million records and stays at No. 1 on Billboard's Hot 100 singles chart for seven weeks.

1961 - The first African-American judge of a federal district court was Judge James Benton Parsons, who was sworn in at Chicago, IL, as U. S. district judge for the Northern District of Illinois.

1961 - Hurricane Esther performed a 350 mile complete circle south of Cape Cod, MA from the 21st to the 25th, then passed over Cape Cod and Maine. Its energy was spent mainly over the cool Atlantic but heavy rains resulted in widespread local flooding in Maine.

1961 - In response to the ever-expanding "twist" craze, Chubby Checker performs his original hit from a year ago, "The Twist," along with the follow-up smash "Let's Twist Again," in a medley on CBS-TV's Ed

Sullivan Show. The resultant attention boosted both singles back into the Hot 100, and shot "The Twist" back to #1 in early 1962, marking the only time the same single has hit the top spot in two separate years

1962 – Bob Dylan plays Carnegie Hall in NYC.

1964 - Robert Vaughn starred as Napoleon Solo when "The Man from U.N.C.L.E." debuted on NBC-TV this night. Solo's trusty side-kick in this James Bond spoof was Illya Kuryakin, played by David McCallum. The show was a hit for 3½ seasons.

http://www.manfromuncle.org/

http://www.tvtome.com/tvtome/servlet/ShowMainServlet/

showid-3323/The_Man_From_UNCLE/

1964 - Top Hits

“The House of the Rising Sun” - The Animals

“Bread and Butter” - The Newbeats

“Oh, Pretty Woman” - Roy Orbison

“I Guess I'm Crazy” - Jim Reeves

1964 - "Fiddler on the Roof" opened on Broadway at the Imperial Theater. The lights lowered, the curtain rose and Zero Mostel stepped into the spotlight as the fiddler played. “Tra-a--a-dition,” he sang, as he began the first of 3,242 performances. It became the first musical to run for more than 3,000 performances and is based on stories by the Yiddish writer Sholem Aleichem (pen name of Sholem Yakov Rabinowitz). Zero Mostel took the part of Tevye. It was presented by Harold Prince, with choreography of Jerome Robbins, music by Jerry Bock, lyrics by Sheldon Hamick and book by Joseph Stein.

1965 - San Francisco rock group, “The Great Society” with singer Grace Slick, makes its stage debut at the Coffee Gallery in North Beach, California.

1965 - The Supremes make studio recording of "I Hear a Symphony." The song tops Billboard's Hot 100 for two weeks in November.

1966 - Surveyor 2 crashes on Moon

1966 – The Baltimore Orioles beat the Kansas City A's 6-1 to clinch their first AL pennant since moving from St. Louis to start the 1954 season.

1966 – Paid attendance at Yankee Stadium – 413.

1967 - The Beatles appear on the cover of Time Magazine.

1967 - No. 1 Billboard Pop Hit: "The Letter," The Box Tops. The Arbors took the song to No. 20 in 1969 and Joe Cocker hit No. 7 with it in 1970.

1968 - The Twins' Cesar Tovar is the second major leaguer to play one inning at each position. In 1965, A's Bert Campaneris became the first.

1969 – The ‘Say Hey Kid’, Willie Mays hits the 600th HR of his career.

1971 - Captain Ernest Medina is acquitted of all charges relating to the My Lai massacre of March 1968. His unit, Charlie Company, 1st Battalion, 20th Infantry, 11th Infantry Brigade (Light) of the 23rd (Americal) Division, was charged with the murder of over 200 Vietnamese civilians, including women and children, at My Lai 4, a cluster of hamlets that made up Son My village in Son Tinh District in Quang Ngai Province in the coastal lowlands of I Corps Tactical Zone. Medina had been charged with murder, manslaughter, and assault. All charges were dropped when the military judge at the Medina's court martial made an error in instructing the jury. After the charges were dropped, Medina subsequently resigned from the service. There were 13 others charged with various crimes in conjunction with the My Lai massacre, but only one, Lt. William Calley, was found guilty. Calley was sentenced to life imprisonment for the murder of 22 civilians, but his sentence was reduced first to 20 years, then 10 years, and he was ultimately paroled by President Nixon in November 1974, after having served about one-third of his sentence.

1972 - Top Hits

“Black & White” - Three Dog Night

“Baby Don't Get Hooked on Me” - Mac Davis

“Saturday in the Park” - Chicago

“When the Snow is on the Roses” - Sonny James