Information, news, and entertainment for the commercial

alternate financing,

bank, finance and leasing industries

Subscribe

| Search | All Lists | Site Map

Conferences/Forums |

Advertising | Archives | Columnists

Don’t take the bait on phishing scams |Top Ten Stories Chosen by Readers

Contact: kitmenkin@leasingnews.org

![]()

Wednesday, April 9, 2025

Today's Leasing News Headlines

Onset Financial Acquires Channel, Forming One

of the Largest Independent Equipment Finance Lenders

New Hires/Promotions in the Leasing Business

and Related Industries

Yes, Cash Flow is King

By Dale Kluga, CPA

Now is the Time for New Business

Before Tariffs Take Place

By Scott Wheeler, CLFP

Leasing and Finance Industry Help Wanted

Excellent Compensation/Marketing Support

Selling in a Recession

By Steve Chriest

20% of Main Street Applied for SBA Loans in 2024

Small Business Credit Survey

Leasing Software Companies

Updated

News Briefs---

Jamie Dimon sounds

the alarm bell on tariffs

Warren Buffett’s decision to sit on $300B cash pile pays off

— as 500 richest moguls lose half a trillion dollars

US, Panama ‘taking back’ canal from ‘China's influence,’

says Secretary of Defense Hegseth

How Apple Flew 5 Flights Full of iPhones from

India and China in 3 Days to Beat Trump Tariffs

Trump’s Tariffs Are Already Reducing Car Imports

and Idling Factories

Why I.R.S. Audits, Already at Their Lowest Levels,

May Fall Further

You May Have Missed ---

Big Bank CEOs Reckon With

Their Lack of Influence on Trump

Sports Briefs

California News

"Gimme that Wine"

This Day in History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

Wordle

######## surrounding the article denotes it is a press release, it was not written by Leasing News nor has the information been verified, but from the source noted. When an article is signed by the writer, it is considered a byline. It reflects the opinion and research of the writer.

[headlines]

--------------------------------------------------------------

Onset Financial Acquires Channel, Forming One

of the Largest Independent Equipment Finance Lenders

Onset Financial, today announced it has acquired Channel and its subsidiaries, "a premier provider of equipment finance and working capital solutions for small business". It should be noted in Leasing News New Hires/Promotions section that the president of Onset, Melinda Haynes, has now retired.

Reportedly, Channel has ties to Trio Capital, based out of Mount Laurel, NJ, and run by former Marlin financial people. It is small ticket, vendor driven, and is majority owned by Elliott Management, the majority owner of Channel Partners.

There is more to the story as Brad Peterson brought Bob Ceribelli in December 2023 from DLL. He was named Channel president in March 2024. Peterson's son, Adam, currently serves as Managing Director for Channel. It appears Brad is about to retire as he and his wife own a second house, this one in Florida, where they enjoy the warm weather and friendship with neighbors and people they have met on their vacations.

Kit remembers Brad's visits to his American Leasing office in Santa Clara, California, as his company did a lot of business with Manifest. In the early days, Leasing News published a weekly chart of Channel Business, not as advertisement but news as it explained the unique business conducted that week. It perhaps has been a reason for Channel's longtime advertising at Leasing News. The company has been very successful with its special operation and growth in hiring the best to work at Channel.

- Kit Menkin, Editor/Publisher

Press Release #################################

Onset Financial Acquires Channel Forming Large Independent Lender

Draper, UT, and Minnetonka, MN (April 8, 2025) – Onset Financial, one of the nation’s fastest-growing independent equipment leasing companies, today announced it has acquired Channel and its subsidiaries, a premier provider of equipment finance and working capital solutions for small business. This strategic acquisition brings together two of the industry’s most innovative and financially strong independent finance companies, creating an unmatched platform with the scale, expertise, and resources to meet the evolving needs of businesses across all segments.

For more than 16 years, Onset has been a driving force in equipment finance, facilitating over $5 billion in funding, with more than $1 billion in the past year alone. With a proven track record across industries including manufacturing, healthcare, energy, aviation, and technology, Onset has built a reputation for exceptional deal structuring, capital strength, and a relentless focus on customer and team member success. Recognized as a Monitor Magazine Top 100 and Independent Finance Company, Inc. Magazine Best Workplace, and Salt Lake Tribune Top Workplace, Onset’s growth

trajectory and industry leadership continue to set it apart.

Since its founding in 2009, Channel has provided over $3 billion in financing to more than 30,000 businesses, earning widespread recognition for its data and technology-driven approach, deep industry relationships, and commitment to its partners. Its accolades include listing on Inc. Magazine’s Fastest Growing Companies list for 12 consecutive years. The company has also been recognized as a Top Workplace by Inc. Magazine, Minnesota Star Tribune, and on Monitor Magazine’s Top Companies list for both Culture and Leadership, all of which reflect a reputation built on trust, service, and innovation. Channel has developed industry-superior systems and processes that enable it to deliver a best-in-class financial product to its partners, enhancing efficiency and service.

By joining forces, Onset and Channel are setting a new standard for what a fiercely independent finance company can achieve. This partnership amplifies their collective ability to be nimble, creative, and hyper-focused on innovation, culture, and lasting partnerships. Importantly, the Channel brand and subsidiaries will continue, and the full leadership team and employees will remain in place, ensuring continuity without any disruption for its partners and customers. Onset gains expanded capabilities in small-ticket financing and exclusive partner-based funding models, while Channel benefits from increased capital access and accelerated growth. Together, they create a dynamic, best-in-class lending platform that combines flexibility, scale, and operational strength to deliver groundbreaking financial solutions with a partner-centric focus.

“This acquisition positions us to lead the independent equipment finance space with unmatched resources, expertise, and combined financial strength,” said Justin Nielsen, Founder & CEO of Onset Financial. “The exceptional leadership, industry experience, and culture that the Channel team brings to the table are a perfect match with Onset. Their deep partner network and technology-driven approach, combined with our large-scale leasing capabilities, create a powerhouse of innovation and service. We are excited for the near-term growth opportunities this creates, as we combine forces to build an even stronger future. Together, we’re not just expanding our reach, we’re setting a new standard for excellence, agility, and partnership in the industry.”

“This is a defining moment for Channel,” said Brad Peterson, Co-Founder and CEO of Channel. “From my first conversation with Justin, it was clear that Onset operates with a bold, forward-thinking approach that sets them apart. Their vision, leadership, and ability to execute at scale are truly impressive. Our united strength in both financial foundation and proven expertise, positions us extremely well for projected expansion. What excites me most, however, is not just the financial strength they bring, but their entrepreneurial spirit, like-minded culture, and commitment to collaboration. With Onset, we’re ready to build and transform what is possible in our industry for our partners and customers.”

Established in financial strength, industry expertise, and progressive culture, the newly combined organization will offer a powerful alternative to traditional lending institutions, providing businesses with the agility, service, and tailored financing solutions they need to thrive.

Onset’s legal counsel was Ray Quinney & Nebeker. Keefe, Bruyette & Woods, a Stifel Company, served as financial advisor to Channel Partners, and Simpson Thacher & Bartlett LLP served as its legal advisor.

###

About Onset Financial, Inc.

Founded in 2008, Onset Financial, Inc. is an industry leader in equipment leasing and financing. Onset’s seasoned Management Team has decades of equipment leasing experience and key industry relationships that enable Onset to offer additional flexibility in lease structuring. For more information, please call 801-878-0600 or visit www.onsetfinancial.com.

About Channel

Established in 2009, Channel is a leading full-service independent lender offering a single source solution for both equipment finance and working capital to small businesses. To date, Channel and its subsidiaries have funded over $3 billion to more than 30,000 businesses across the U.S. The organization is comprised of three business divisions that operate from its main office in Minnetonka, MN, along with additional locations in Kennesaw, GA, Mount Laurel, NJ, Des Moines, IA, and Marshall, MN. For more information about Channel, please visit www.channelpartnersllc.com.

Press Release #################################

[headlines]--------------------------------------------------------------

New Hires/Promotions in the Leasing Business

and Related Industries

Melinda Haynes retires as President of Onset Financial, South Jordan, Utah. She is located in the Salt Lake City, Utah Metropolitan Area. She joined Onset January, 2018, Senior Vice President of Product Management, promoted President (January, 2019 - April, 2025). Previously, she was Senior Vice President, Director of Bank Operations, Zions Bancorporation (May, 2016 - December, 2017). Prior, she was at Zions Bank for 27 years, 9 months, joining Zions September, 1988 as Assistant Vice President, Project Manager, promoted Vice President, Assistant Director of Bank Operations, promoted Senior Vice President, Director of Bank Operations (April, 2013 - May, 2016).

https://www.linkedin.com/in/melinda-haynes-169960152/

Karen Neathery promoted to Assistant Vice President, Account Manager, Baystone Government Finance, Manhattan, Kansas. She is located in the Kansas City Metropolitan Area. She joined Baystone September, 2021, Account Manager. Previously, she was District General Manager, H&R Block (April, 2017 - September, 2021); Business Banking Center Manager, Vice President, Bank

Midwest (March, 2015 - April, 2017); Vice President, Market Manager, Bank of America (November, 2005 - April, 2015); Manager, Best Buy (1999 - 2005).

https://www.linkedin.com/in/karen-neathery-a6308213/

Derek Warner was hired as Business Development Manager, Office Equipment, DLL, Wayne, Pennsylvania. He is located in Woodbine, New Jersey. Previously, he was Inside Sales Program Manager, First Citizens Bank (January, 2022 - April, 2025); Senior Strategic Account Manager, CIT (July, 2020 - January, 2022); Senior Business Development Manager, Marlin Capital Solutions (June, 2005 - June, 2020),

https://www.linkedin.com/in/derek-warner-a389557

[headlines]

--------------------------------------------------------------

Yes, Cash Flow is King

By Dale Kluga, CPA

Earlier this morning, I posted on my LinkedIn page my view of the macro economic impact from Trump’s proposed tariffs. What I did not cover, as was so astutely pointed out by Kit Menkin is that the cash flow impact on both our industry and on our clients can tighten up. Indeed, the commercial finance and leasing industries can be affected when their sources tighten up on having funds available to cover transactions.

At first blush, it seems logically apparent that increased costs from tariffs on our imports will increase prices, assuming that those costs are directly passed along to consumers. This is not an automatic assumption with the possibility of any looming recession, particularly since Trump’s strategy to onshore jobs will take years if not an entire decade. The consumer simply cannot sustain any more long term pain. However, our economy is structurally the opposite today.

Government spending dwarfs private lending and investment and our economy has thrived on this counterintuitive debt-addicted strategy. Higher interest rates certainly could occur if our deficits continue to increase as they have over the past 20 years. But our GDP growth has been bastardized over the last four plus years and is dependent upon federal spending growth like a drug addicted soul.

Therefore, any intended reduction in rates may not, by a wide margin, offset the needed reduction in fiscal deficits. Make no mistake, the fundamental concept of higher leverage will always be more damaging in the long run than if debt is reduced. It is during this interim short-sighted period of time to get to that goal of reducing deficits that has a highly complex outcome and could actually damage the global economy, irrespective of the media hype and mis-directed tariff increase topics.

As for the impact on rates and on our industry, reducing government spending will initially cause dramatic financial pain until the counter balancing effect of self-sufficient production has become an equalizing factor. This will take years, not months. The markets’ volatile reactions reflect this condition.

As with everything in our industry as taught to me over the last 44 years by my mentors, everything in our lives is judged by the time value of money. How much time will it take to justify onshoring and negotiating equitable tariffs charged to our country? Right now, it does not appear hopeful. Only time will tell.

Dale R. Kluga

Equipment Finance Founder & CPA

Member AICPA & ICPA

Cell: 630-675-0828

Email: dalekluga@gmail.com

[headlines]

--------------------------------------------------------------

Now is the Time for New Business

Before Tariffs Take Place

By Scott Wheeler, CLFP

Top originators understand that opportunities in the commercial equipment finance and leasing industry are vast. With a $1.3 trillion market, securing $10MM, $20MM, or even $50MM in funding is a small but achievable fraction for those originators who take the right approach. Funds are

available to back up transactions today.

A conversation with a veteran originator—who has navigated decades of industry shifts—offered key insights into what it takes to succeed in 2025. His perspective is clear:

- Opportunities Abound – Despite uncertainty in the market, he sees an abundance of business available to exceed his goals.

- The Market is Changing – Vendors, end-users, and competitors face new challenges, requiring originators to work harder and smarter. The keys to success? Selling expertise, value, and professionalism. Clients want trusted advisors, not just salespeople.

- Competitors are Hesitant—He is aggressive! While others act as if the glass is half empty, he sees it as full of new and different opportunities. He is actively expanding his network of vendors and end-users, ensuring his database in 2026 looks vastly different from 2023. New relationships are critical.

- Resilience Wins – Having thrived through the 2008 financial crisis, the 2020 pandemic, and multiple economic disruptions, he knows that businesses need equipment in every economic environment. Those who adapt will succeed.

- Blocking Out the Noise – Instead of getting distracted by headlines on tariffs, inflation, and volatile markets, he stays focused on his clients’ needs, helping them navigate today’s economic realities.

- Investing in the Future – 2025 is about laying the foundation for long-term success. He is embracing new technology, streamlining efficiencies, and ensuring that both he and his clients are positioned for growth.

Success in 2025 isn’t about waiting for the market to improve—it’s about shaping your ability to get fundings. Originators who build strong relationships, leverage technology, and take an advisory role will not only survive but thrive.

Scott A. Wheeler, CLFP

Wheeler Business Consulting

1314 Marquis Ct.

Fallston, Maryland 21047

Phone: 410 877 0428

Fax: 410 877 8161

Email: scott@wheelerbusinessconsulting.com

Web: www.wheelerbusinessconsulting.com

Wheeler Business Consulting is working with individual originators and sales teams throughout the industry to ensure that they are well positioned in the market, capturing their fair share of business, and outperforming the competition. To schedule a one-on-one meeting contact Scott Wheeler at: scott@wheelerbusinessconsulting.com

[headlines]

--------------------------------------------------------------

Balboa Capital Available Position

Program Manager II- Equipment Broker Sales

[headlines]

--------------------------------------------------------------

Selling in a Recession

By Steve Chriest

Sooner or later, tariffs and economic cutbacks may cause a recession.

Selling in a down economy is problematic for most salespeople in almost all industries. What can you do, as a professional salesperson, to prepare for selling during uncertain economic times?

There are at least four things you can prepare to do if you expect to sell in a down economy:

- Stay in front of your customers

- Get to the senior levels in buying organizations

- Share success stories to which your customers can relate

- Manage your time as a guardian of your company's resources.

In tough economic times, it's vital that you stay in front of your customers, especially your best customers. One major caveat applies to this advice: Only contact your customers when you have something of value to offer them, such as advice, an unusual perspective, or special knowledge. Never, I repeat, NEVER, contact a customer during tough times and ask, “Do you have any deals for me today?” That inane question will drive customers to the nearest exit!

Unfortunately, middle managers are often a primary layoff target when times get tough. This reality, however, presents an opportunity for you to meet with senior managers who otherwise might be inaccessible to you. Forget about “pitching” special programs and offers to senior executives. Meeting with senior executives gives you an opportunity to listen carefully to them and to learn about and understand their concerns and the real challenges facing their business.

Senior managers are usually eager to hear about what other companies are doing to address tough issues and circumstances. Without divulging anything held by you in confidence, sharing success stories with executives is a powerful way to build your credibility and build your business with company leaders. You might, for example, share the experiences of a vendor who used a particular marketing approach to expand their universe of potential customers.

Finally, while it's always important to effectively manage your time and your territory, it's critical to optimize your selling time and guard your company's resources during an economic slowdown. By pursuing only realistic, profitable sales opportunities, you can help ensure the best use of your time and of company resources that are usually strained during a down economy.

In the interest of fair disclosure, I should tell you that it isn't absolutely necessary to prepare yourself for selling in a down economy. Keep in mind, however, the words of a college professor who offered this observation of those salespeople who prefer to “wing it” during good and bad times: “Failure comes as a complete surprise, and is not preceded by a period of worry and depression.”

[headlines]

--------------------------------------------------------------

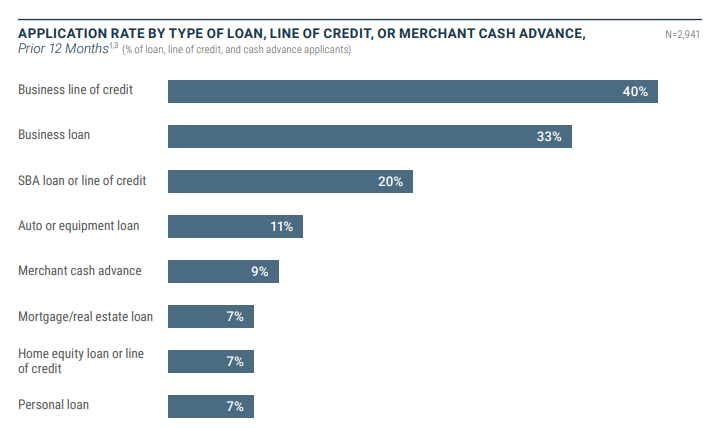

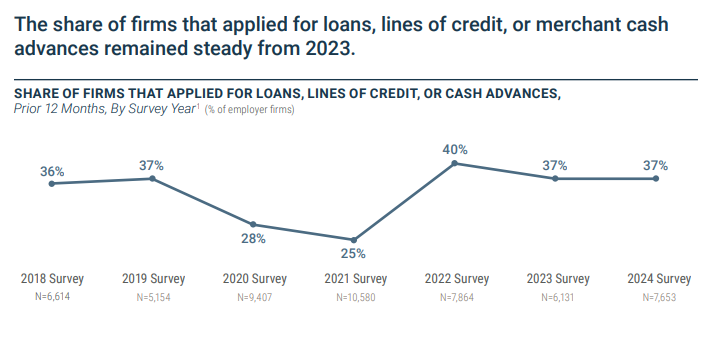

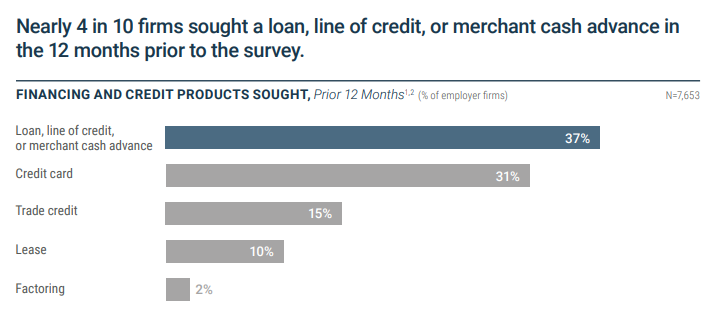

20% of Main Street Applied for SBA Loans in 2024

Bob Coleman

Founder & Publisher Coleman Report

From the 2025 Federal Reserve Bank Small Business Credit Survey.

Some Interesting Survey Results:

- 37% of Main Street applied for credit

- Of those, 33% applied for a business loan

- 20% applied for an SBA loan or line of credit

Check out our earlier reporting: Cash Reserves are the Number One Solution for Main Street Financial Challenges (April 2, 2025)

[headlines]

--------------------------------------------------------------

Leasing Software Companies

[headlines]

--------------------------------------------------------------

News Briefs

Jamie Dimon sounds

the alarm bell on tariffs

https://www.cnn.com/2025/04/07/business/jamie-dimon-tariff-warning/index.html

Warren Buffett’s decision to sit on $300B cash pile pays off

— as 500 richest moguls lose half a trillion dollars

https://nypost.com/2025/04/07/business/warren-buffetts-move-to-sell-stocks-pays-off-amid-tariffs-turmoil/

US, Panama ‘taking back’ canal from ‘China's influence,’

says Secretary of Defense Hegseth

https://www.foxnews.com/world/us-panama-taking-back-canal-from-chinas-influence-says-hegseth

How Apple Flew 5 Flights Full of iPhones from

India and China in 3 Days to Beat Trump Tariffs

https://timesofindia.indiatimes.com/technology/mobiles-tabs/how-apple-flew-5-flights-full-of-iphones-from-india-and-china-in-3-days-to-beat-trump-tariffs/articleshow/120044321.cms

Trump’s Tariffs Are Already Reducing Car Imports

and Idling Factories

https://www.nytimes.com/2025/04/08/business/trump-tariffs-cars-auto-industry.html

Why I.R.S. Audits, Already at Their Lowest Levels,

May Fall Further

https://www.nytimes.com/2025/04/08/upshot/irs-tax-audits-cuts.html

[headlines]

--------------------------------------------------------------

Big Bank CEOs Reckon With

Their Lack of Influence on Trump

https://www.wsj.com/finance/banking/trump-big-bank-influence-tariffs-c3897775?st=MsXjbr&reflink=desktopwebshare_permalink

[headlines]

--------------------------------------------------------------

Sports Briefs

The A's opener in Sacramento was an absolute disaster

https://www.sfgate.com/athletics/article/as-opener-sacramento-complete-utter-disaster-20252911.php

[headlines]

--------------------------------------------------------------

![]()

California News Briefs

The most expensive house in America just

hit the market again

https://www.sfgate.com/la/article/most-expensive-house-listing-hits-market-again-20253245.php

[headlines]

--------------------------------------------------------------

Gimme that Wine

![]()

http://www.youtube.com/watch?v=EJnQoi8DSE8

Résonance Winery Introduces Willamette Valley

Pinot Noir Rosé 2024

https://www.winebusiness.com/news/article/300390

For Wine, Tariffs Mean Fear, Uncertainty and Higher Prices

Eric Asimov, New York Times, Paywall

https://www.nytimes.com/2025/04/03/dining/drinks/wine-tariffs-prices.html

Far Niente Steps Up to the Plate as Proud Partner

of the San Francisco Giants

https://www.winebusiness.com/news/article/300436

Places of Sustainability

https://www.jlohr.com/facesofsustainability

[headlines]

----------------------------------------------------------------

![]()

This Day in History

https://leasingnews.org/archives/Apr2010/4_07.htm#day

-------------------------------------------------------------

SuDoku

The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler?

--------------------------------------------------------------

Daily Puzzle

How to play:

http://www.setgame.com/set/puzzle_frame.htm

Refresh for current date:

http://www.setgame.com/set/puzzle_frame.htm

--------------------------------------------------------------

http://www.gasbuddy.com/

http://www.gasbuddy.com/GB_Map_Gas_Prices.aspx

http://www.gasbuddy.com/GB_Mobile_Instructions.aspx

--------------------------------------------------------------

Weather

See USA map, click to specific area, no commercials

--------------------------------------------------------------

Traffic Live---

Real Time Traffic Information

You can save up to 20 different routes and check them out with one click,

or type in a new route to learn the traffic live

--------------------------------

Wordle

https://www.powerlanguage.co.uk/wordle/

How to Play

https://www.today.com/popculture/popculture/wordle-know-popular-online-word-game-rcna11056

![]()