Information, news, and entertainment for the commercial

alternate financing,

bank, finance and leasing industries

Subscribe

| Search | All Lists | Site Map

Conferences/Forums |

Advertising | Archives | Columnists

Don’t take the bait on phishing scams |Top Ten Stories Chosen by Readers

Contact: kitmenkin@leasingnews.org

![]()

Wednesday, April 16, 2025

Today's Leasing News Headlines

California Passes Law Extending

Debt Collection Rules: Update

Ken Greene, Leasing News Editor, Emeritus

New Hires/Promotions in the Leasing Business

and Related Industries

70% of Small Businesses to Move in Next 2 Yrs

Coleman Report

Leasing and Finance Industry Help Wanted

Excellent Compensation/Marketing Support

The True Value of Originators in a Recession

By Scott Wheeler, CLFP

How Reliant Are Foreign Automakers on U.S. Buye

by Visual Capitalist

The U.S. Relies Heavily on Rare Earth

Imports from China

CLFP Foundation 2025 1st Qtr Circular

Released this Week

News Briefs---

China halts

Boeing jet orders

Can Trump strip

Harvard

of its tax-exempt status?

United Airlines to slash flights by 4% this summer due

to softer demand, recession fears: ‘Impossible to predict’

Elliott Investment Management targets

Hewlett Packard by reportedly building $1.5B stake

Trump signs executive action

to lower drug prices

You May Have Missed ---

Manufacturers struggle with uncertainty,

chaos in Trump tariffs

Sports Briefs

California News

"Gimme that Wine"

This Day in History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

Wordle

######## surrounding the article denotes it is a press release, it was not written by Leasing News nor has the information been verified, but from the source noted. When an article is signed by the writer, it is considered a byline. It reflects the opinion and research of the writer.

[headlines]

--------------------------------------------------------------

California Passes Law Extending

Debt Collection Rules: Update

Ken Greene, Leasing News Editor, Emeritus

The new year brought more distressing news from the Golden State. If you are in the commercial finance space, and you want to collect that gold in California, you will soon have to heed all the rules that, until now, only applied to consumer debt collectors.

The good news is that California Financing Law (“CFL”) licensees will be exempt from the amended law.

Beginning July 1, 2025, commercial loans of $500,000 or less will be subject to the debt collection protections of the Rosenthal Fair Debt Collection Practices Act (“RFDCPA”), unless the creditor is licensed under the CFL. What is potentially more troublesome is that the statute will apply not only to debt collectors, but creditors! That means that your in-house collection department will have to heed all the prohibitions and restrictions of the RFDCPA.

The rules are fairly straightforward and apply to debt collectors and unlicensed creditors attempting to collect on their own paper. There are many, including:

- It will be a crime for collection notices to simulate legal or judicial process or give the appearance of being authorized by a governmental agency or attorney (if it is not).

- If a borrower claims identity theft, collection efforts must cease once the borrower provides certain information which confirms the identity theft claim.

- The use, or threat of use, of physical force or violence is prohibited, as is telling a borrower that failure to pay a debt will result in an accusation that the borrower has committed a crime.

- Debt collectors/creditors can only initiate judicial proceedings in the county in which a non-natural person is located.

- There are many restrictions as to the timing of collection notices and calls.

There is a plethora of other rules, but you get the picture.

There are other important issues, i.e.:

- Are your attorneys bound by these rules? In my opinion, the answer is yes. At least I intend to comply.

- How liable is a creditor for its independent contractors who perform collection activities?

- Can you send emails at night? What if they are computer generated?

- Some of the terms of the law i.e. communicating with “such frequency as to be unreasonable” are vague, subjective and rich fodder for consumer plaintiff’s lawsuits. Lender beware!

- The new law will prohibit the “false representation that a legal proceeding has been or is about to be instituted” if payment is not made. Gone are the days of sending that threat to sue if you don’t really mean it. So, if you make that threat, are you compelled to sue? I am sure the consumer lawyers will claim foul!

One good thing about the expanded statute is that there is no licensing requirement for commercial debt collectors/creditors (yet!).

There is much more, but it is, as they say, beyond the scope of this article. My best advice is to have an attorney prepare a best practices guide to help you navigate this minefield. That is exactly what I am doing for my clients. To reiterate, CFL licensees will be exempt from the RFDCPA.

I am publishing a best practice guide to help creditors through the new law. If you are interested in it, please contact me at ken@kengreenelaw.com.

Ken Greene

Law Office of Kenneth Charles Greene

5743 Corsa Avenue, Suite 208

Westlake Village, California 91362

Tel: 818.575.9095

Fax: 805.435.7464

ken@kengreenelaw.com

www.kengreenelaw.com

[headlines]

--------------------------------------------------------------

New Hires/Promotions in the Leasing Business

and Related Industries

Joyce Almazan was promoted to Junior Underwriter, BriteCap, Las Vegas, Nevada. She is located in Los Angeles, working remote. She joined BriteCap, October, 2014, Underwriting, promoted Loan Servicing, Merchant Card Processing, Merchant Services.

https://www.linkedin.com/in/joyce-almazan-8b7200264

Jose Baylon was promoted to Junior Underwriter at BriteCap Financial, Las Vegas, Nevada, where he is located. He joined BriteCap July, 2022, Loan Processor, promoted Senior Loan Processor (June, 2024 - March, 2025).

https://www.linkedin.com/in/jose-baylon-91963b221/

Amy Crowe was hired as Funding Specialist, AP Equipment Financing, Bend, Oregon, where she is located. Previously, she was Administrative Assistant, FMI Equipment (September, 2024 - April, 2025); Collections Representative, AP Equipment Financing (October, 2020 - September, 2024).

https://www.linkedin.com/in/amy-crowe-890821168/

Susan Kalinay was hired as EFG Senior Sales Support Representative, First Commonwealth Bank, Indiana, Pennsylvania. She is located in Luzerne, Pennsylvania. Previously, she was at 1st Equipment Finance, Inc., starting September, 2021, Equipment Sales Coordinator, promoted November, 2022, Finance Operations Coordinator, promoted Equipment Finance Inside Sales Associate (January, 2024 - April, 2025). Sales Assistant, F.N.B. Corporation, November, 2016 - September, 2021).

https://www.linkedin.com/in/susan-kalinay-mba-200470164/

Jenaleigh (Jen) Lathrop, CLFP, was hired as Salesforce Center of Excellence Strategist, Arvest Bank, Nixa, Missouri, where she is located. She joined Arvest Equipment Finance, working remote, starting April, 2021 - December, 2022), Credit Analyst for Arvest Equipment Finance. Full Bio:

https://www.linkedin.com/in/jenaleigh-lathrop-clfp/details/experience/

https://www.linkedin.com/in/jenaleigh-lathrop-clfp/

Devan Phillips was hired as Account Executive, Direct Credit Funding, Ogden, Utah. He works remote from Mapleton, Utah. Previously, he was Sales Development Representative, Voze (August, 2024 - April, 2025); Business Development Officer, VFI Corporate Finance (July, 2023 - August, 2024); Senior Sales Agent, Basic Research. (June, 2012 - July, 2023), Sales (June, 2012 - July, 2023). Full Bio:

https://www.linkedin.com/in/devan-phillips-7565b7a3/details/experience

https://www.linkedin.com/in/devan-phillips-7565b7a3

[headlines]

--------------------------------------------------------------

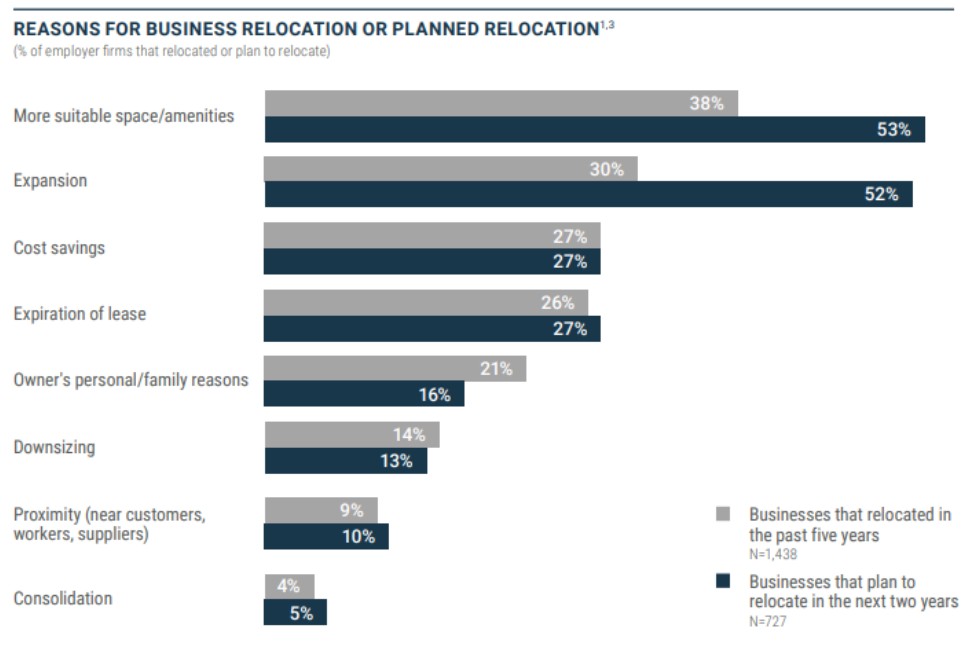

70% of Small Businesses to Move in the Next 2 Years

by Bob Coleman, Coleman Report

The statistics of not moving in the next 2 years comes from the Federal Reserve Bank’s 2025 small business credit survey.

Compared to firms that relocated in the past 5 years, small businesses planning to move within the next 2 years were more likely to cite expansion or the need for more amenities as the reason for their planned moves.

The top survey results are:

1. More suitable space / amenities (53%)

(Notably, that is up from 38% that moved in the last five years.)

2. Expansion (52%)

3. Cost savings (27%)

4. Expiration of lease (27%)

Some other fascinating statistics for SBA lenders:

– 59% of small businesses rent their facility, while only 17% own their facility.

– 17% of all small businesses are home-based.

– In the last 5 years, 75% of all businesses moved.

– 3% are virtual.

– 1% are based out of vehicles.

[headlines]

--------------------------------------------------------------

Balboa Capital Available Position

Program Manager II- Equipment Broker Sales

[headlines]

--------------------------------------------------------------

The True Value of Originators in a Recession

By Scott Wheeler, CLFP

The top performers aren’t retreating. They’re leaning in, moving forward with clarity and confidence, offering stability and solutions when others are pulling back.

Now is the time to emphasize the true value an originator brings to the table. Vendors, end-users, credit departments, and funders are all watching closely, testing whether originators can truly deliver on what they promise.

Less experienced originators are tempted to treat every transaction the same, often forcing deals that don’t align with their strengths or market realities. In contrast, top originators are highly selective. They don’t chase transactions that come with unmitigated risk. Instead, they seek out deals that fit their expertise and value proposition. Top originators focus on sectors, equipment types, and niches they know best. They don’t try to be all things to all people—they go deep, not wide.

Top originators go deep to:

- Understand the markets they serve inside and out.

- Assess each transaction’s unique needs and nuances.

- Identify emerging trends that could shape future demand.

- Confirm funding capabilities in real time with current market dynamics.

- Position themselves as trusted financial advisors—not commodity-driven salespeople.

- Outperform their competition and gain ground while others fall behind.

In 2025, success won’t be about waiting for the market to improve—it will be about creating and shaping an originator's own success.

Scott A. Wheeler, CLFP

Wheeler Business Consulting

1314 Marquis Ct.

Fallston, Maryland 21047

Phone: 410 877 0428

Fax: 410 877 8161

Email: scott@wheelerbusinessconsulting.com

Web: www.wheelerbusinessconsulting.com

Wheeler Business Consulting is working with individual originators and sales teams throughout the industry to ensure that they are well positioned in the market, capturing their fair share of business, and outperforming the competition. To schedule a one-on-one meeting contact Scott Wheeler at: scott@wheelerbusinessconsulting.com

[headlines]

--------------------------------------------------------------

How Reliant Are Foreign Automakers on U.S. Buyers?

VisualCapitalist

[headlines]

--------------------------------------------------------------

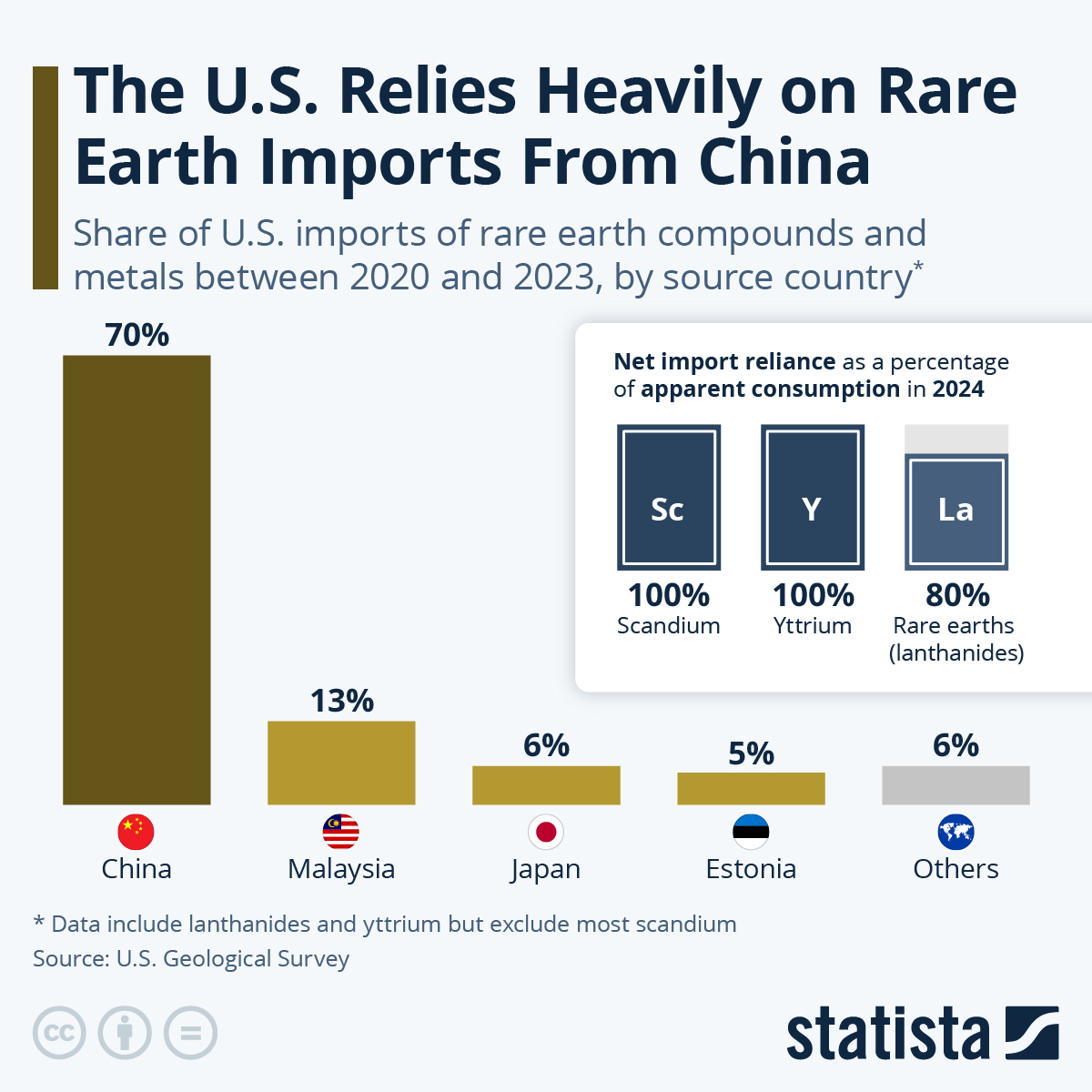

The U.S. Relies Heavily on Rare Earth

Imports from China

Beijing has introduced new controls on the export of several critical minerals and magnets amid an escalating trade war with Washington. These materials are vital for the production of a range of technologies, from cars to missiles.

According to the New York Times, exporters must apply to the Ministry of Commerce for special export licenses, with the process anticipated to be lengthy, risking stockpiles running low.

Data from the United States Geological Survey (USGS) shows that China is the world leader for rare earth reserves. With 44 Mt of known reserves of rare earth oxides (REO) in 2024, it is home to nearly half of the world’s total known reserves (90+ Mt). By contrast, the U.S. has just 1.9 million tons of rare earths and is highly dependent on China for imports of these elements. These figures reflect the reserves that could be economically extracted or recovered as of 2024.

Global mine production increased from 376,000 tons of REO equivalent in 2023 to 390,000 tons of REO equivalent in 2024, largely due to increased mining and processing in China, Nigeria and Thailand. This data includes lanthanides and yttrium but excludes most scandium.

Source: Statista

[headlines]

--------------------------------------------------------------

CLFP Foundation First Quarter 2025 Circular

Released this Week

02 | A Message From the CLFP President

03 | Spotlight: Matthew Kleberger, CLFP

Trans Lease, Inc.

05 | Get to know the First CLFP in 2025

07 | Why I Became a CLFP

08 | New CLFPS & Associates

10 | Industry News

12 | Thank You to Our Supporting Associations

13 | Thank You to Our Corporate Partners

14 | Thank You to Our Personal Partners

[headlines]

--------------------------------------------------------------

News Briefs

China halts

Boeing jet orders

https://www.foxbusiness.com/markets/china-halts-boeing-jet-orders

Can Trump strip

Harvard

of its tax-exempt status?

https://www.bostonglobe.com/2025/04/15/business/trump-harvard-tax-exemption/

United Airlines to slash flights by 4% this summer due

to softer demand, recession fears: ‘Impossible to predict’

https://nypost.com/2025/04/15/business/united-airlines-to-slash-flights-by-4-this-summer-due-to-less-demand/

Elliott Investment Management targets

Hewlett Packard by reportedly building $1.5B stake

https://nypost.com/2025/04/15/business/activist-investor-targets-hewlett-packard-by-reportedly-building-1-5b-stake/

Trump signs executive action

to lower drug prices

https://www.npr.org/sections/shots-health-news/2025/04/15/nx-s1-5366067/trump-medicare-lower-drug-prices

[headlines]

--------------------------------------------------------------

Manufacturers struggle with uncertainty,

chaos in Trump tariffs

https://www.washingtonpost.com/business/2025/04/13/trump-tariffs-us-manufacturing-impacts/

[headlines]

--------------------------------------------------------------

Sports Briefs

Reports: Derek Carr has shoulder injury,

2025 status iffy

https://www.linkedin.com/in/jenny-dubinsky-cpa-6146423b/details/experience/

[headlines]

--------------------------------------------------------------

![]()

California News Briefs

California’s demographic earthquake: Asian

immigrants rise, Latinos decline, state transformed

https://www.reddit.com/r/LosAngeles/comments/1jz7dde/californias_demographic_shift_asian_immigrants/?rdt=45888

Santa Clara approves another 1,000+ housing project

https://sanjosespotlight.com/santa-clara-approves-another-1000-housing-project

[headlines]

--------------------------------------------------------------

Gimme that Wine

![]()

http://www.youtube.com/watch?v=EJnQoi8DSE8

It’s like winning the lottery.’ Tiny Napa Valley winery

wins big at North Coast Wine Challenge

https://www.pressdemocrat.com/article/lifestyle/its-like-winning-the-lottery-tiny-napa-valley-winery-wins-big-at-north/

Napa Valley College Nears Completion of Wine Spectator

Wine Education Center

https://www.winespectator.com/articles/wine-spectator-wine-education-center-at-napa-valley-college-nears-completion

Francis Ford Coppola Winery Expands

"Diamond Collection" Portfolio

https://www.winebusiness.com/news/article/300843

A Taste of Napa's Best: Winery and Chef Lineup for the

2025 Napa Valley Barrel Auction Announced

https://www.winebusiness.com/news/article/300847

Trade & Tariffs | The US has stopped orders

for Portuguese wines -- Portugal

https://portuguese-american-journal.com/trade-tariffs-the-us-has-stopped-orders-for-portuguese-wines-portugal/

Sonoma-Cutrer Releases First

Sonoma County Sauvignon Blanc

https://www.winebusiness.com/news/article/300800

[headlines]

----------------------------------------------------------------

![]()

This Day in History

https://leasingnews.org/archives/Apr2021/04_16.htm#history

-------------------------------------------------------------

SuDoku

The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler?

--------------------------------------------------------------

Daily Puzzle

How to play:

http://www.setgame.com/set/puzzle_frame.htm

Refresh for current date:

http://www.setgame.com/set/puzzle_frame.htm

--------------------------------------------------------------

http://www.gasbuddy.com/

http://www.gasbuddy.com/GB_Map_Gas_Prices.aspx

http://www.gasbuddy.com/GB_Mobile_Instructions.aspx

--------------------------------------------------------------

Weather

See USA map, click to specific area, no commercials

--------------------------------------------------------------

Traffic Live---

Real Time Traffic Information

You can save up to 20 different routes and check them out with one click,

or type in a new route to learn the traffic live

--------------------------------

Wordle

https://www.powerlanguage.co.uk/wordle/

How to Play

https://www.today.com/popculture/popculture/wordle-know-popular-online-word-game-rcna11056

![]()