Information, news, and entertainment for the commercial

alternate financing,

bank, finance and leasing industries

Subscribe

| Search | All Lists | Site Map

Conferences/Forums |

Advertising | Archives | Columnists

Don’t take the bait on phishing scams |Top Ten Stories Chosen by Readers

Contact: kitmenkin@leasingnews.org

![]()

Friday, April 18, 2025

Today's Leasing News Headlines

ELFF Reports Monthly Confidence Continues

Downward Trend: April is 41.9 from March 58.1

New Hires/Promotions in the Leasing Business

and Related Industries

One-Half of All Small Businesses Apply for

Financing, One-Half of Requests Get Fully Funded

By Bob Coleman, Coleman Report

Balboa Capital Available Position

Program Manager II - Equipment Broker Sales

Answering the Question "Tell Me About Yourself?"

By Ken Lubin, Managing Director, ZRG Partners

How To Be Successful in Truck Financing

Webinar Wednesday, April 23, 3:00pm (ET)

Free: AACFB - Register Now

Sloan Schickler

Leasing News Advisor

NVLA Annual Meeting 2025

Soars To New Heights

By Sloan Schickler, Schickler & Schickler

News Briefs---

Google is an online advertising monopoly

judge rules

Burger King franchisee with 57 locations files for

bankruptcy after owing $37M to creditors

Nearly 90% of Consumer Financial Protection Bureau

Cut as Trump's government downsizing continues

Massive cuts at National Weather Service spark

fears about forecast quality, public safety

Fed Chair Lays Out Game Plan in Case of High Inflation

and Slower Growth

From Italy to Japan, tariffs disrupt Boeing supplies

that support U.S. jobs

You May Have Missed ---

Trump administration asks IRS to revoke Harvard’s

tax-exempt status

Sports Briefs

California News

"Gimme that Wine"

This Day in History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

Wordle

######## surrounding the article denotes it is a press release, it was not written by Leasing News nor has the information been verified, but from the source noted. When an article is signed by the writer, it is considered a byline. It reflects the opinion and research of the writer.

[headlines]

--------------------------------------------------------------

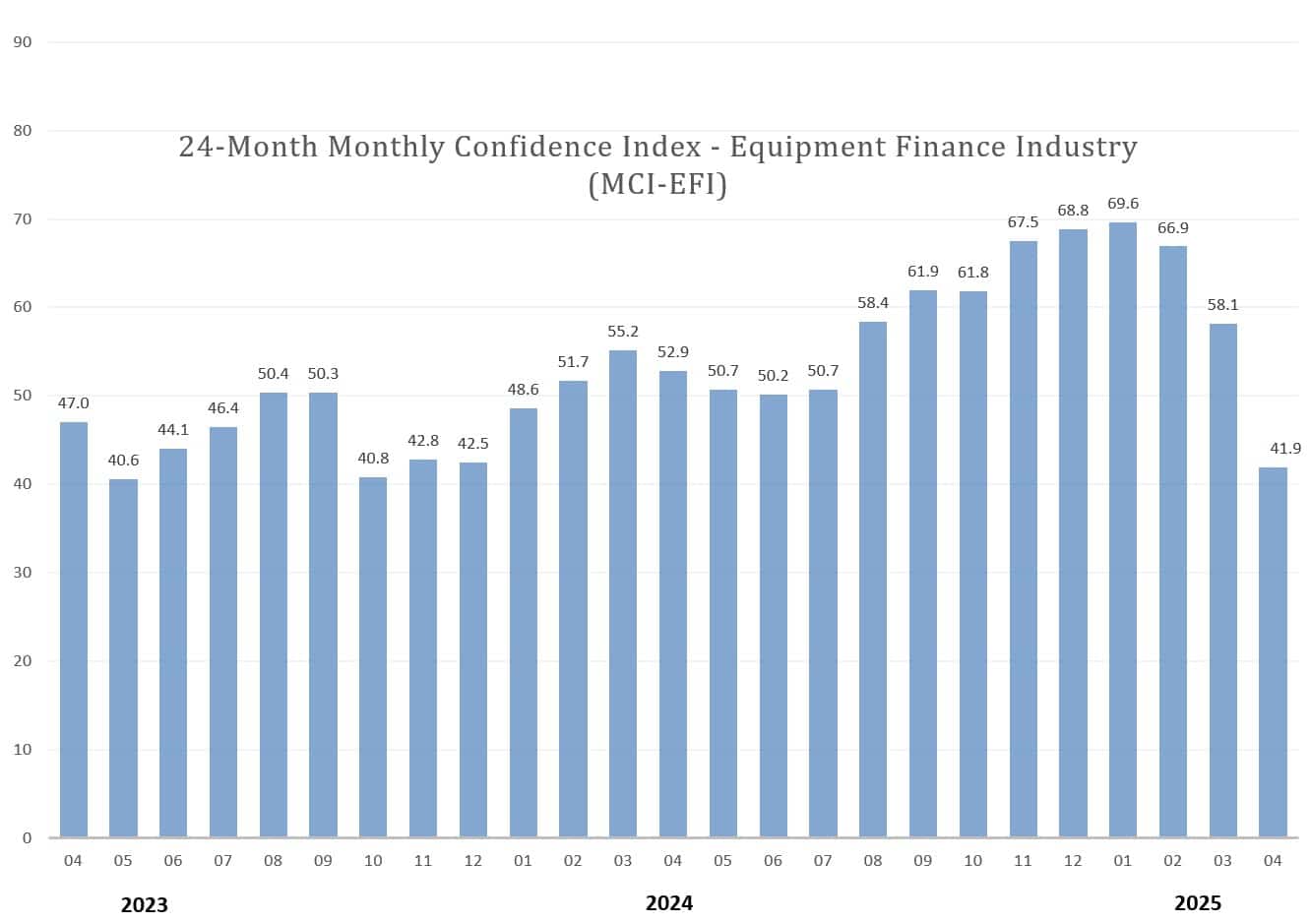

ELFF Reports Monthly Confidence Continues

Downward Trend: April 41.9 from March 58.1

(Chart: ELFF)

Survey Demographics:

Market Segment

Bank 54.2%

Captive 16.6%

Independent 29.2%

Other 0%

The Equipment Leasing & Finance Foundation reports "Overall, confidence in the equipment finance market is 41.9, down from the March index of 58.1, and the lowest index since October 2023. The index reports a qualitative assessment of both the prevailing business conditions and future expectations as reported by key executives from the $1.3 trillion equipment finance sector. Approximately half of the survey responses were submitted prior to the tariff announcement on April 2."

Jonathan Albin, Chief Operating Officer, Nexseer Capital, briefly commented, "“I'm optimistic because demand remains steady to strong at the moment, but I have concerns that at some point the various headwinds will have an impact.”

Charles Jones, Senior Vice President,1st Equipment Finance, Inc., said, “Turbulent times...doom and gloom mixed with increased opportunities. Tariffs could lead to higher prices for parts and equipment. They also will result in "creative" financing opportunities to help borrowers protect cash flow and offset higher prices for goods. Once you get past the fear, it's an exciting time to be in equipment finance.”

David Normandin, CLFP, President and Chief Executive Officer, Wintrust Specialty Finance, reports "“New business volume was strong for Q1, and the pipeline continues to trend upward. Although there are many aspects of the market that are uncertain, our customers’ confidence levels remain high and that equates to further investments into their business that, in turn, is good for our industry. We are paying close attention to portfolio performance and while the metrics are still good, they are elevated from previous years. We expect that to remain throughout 2025.”

Full ELFF Press Release

https://www.leasefoundation.org/industry-research/monthly-confidence-index/

[headlines]

--------------------------------------------------------------

New Hires/Promotions in the Leasing Business

and Related Industries

Ian Fine was promoted to Vice President, Relationship Management, U.S. Bank Equipment Finance. He joined U.S. Bank September, 2023, as Account Manager. Previously, he was Regional Sales Manager, Balboa Capital (September, 2022 - September, 2023); Account Manager, U.S. Bank (October, 2018 - September, 2022); Sales Representative, Finance, Olympus Corporation of Americas (October, 2017 - May, 2018); Relationship Manager, CIT (April, 2013 -

October, 2017). Full Bio:

https://www.linkedin.com/in/ian-fine-5268209/details/experience/

https://www.linkedin.com/in/ian-fine-5268209/

Daren Solomon was hired as Senior Account Manager, Navitas Credit Corporation. He works remote from Colchester, Vermont. Previously, he was Business Development Specialist, North Star Leasing, a Division of Peoples Bank (2017 - April, 2025).

https://www.linkedin.com/in/daren-solomon-58b9a344

[headlines]

--------------------------------------------------------------

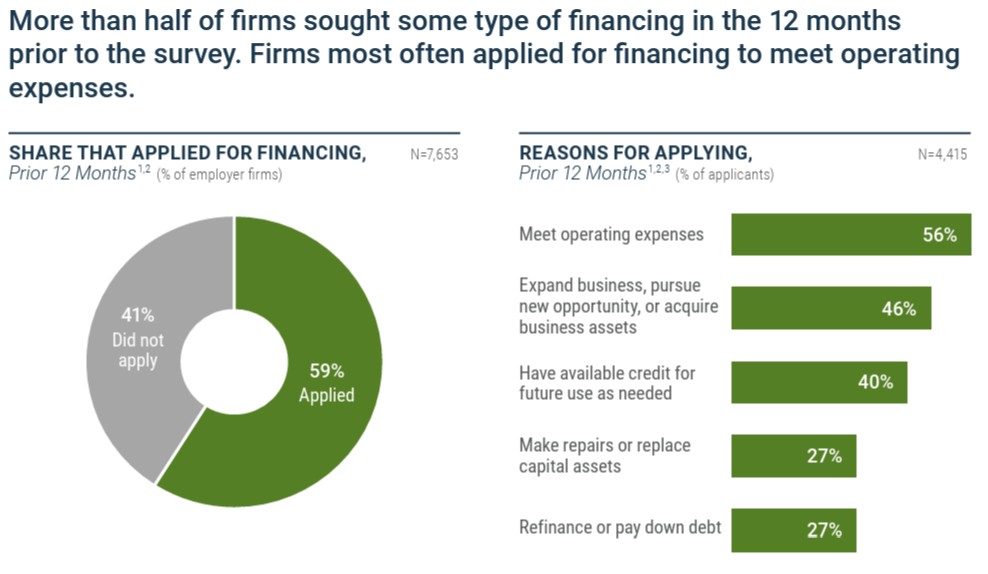

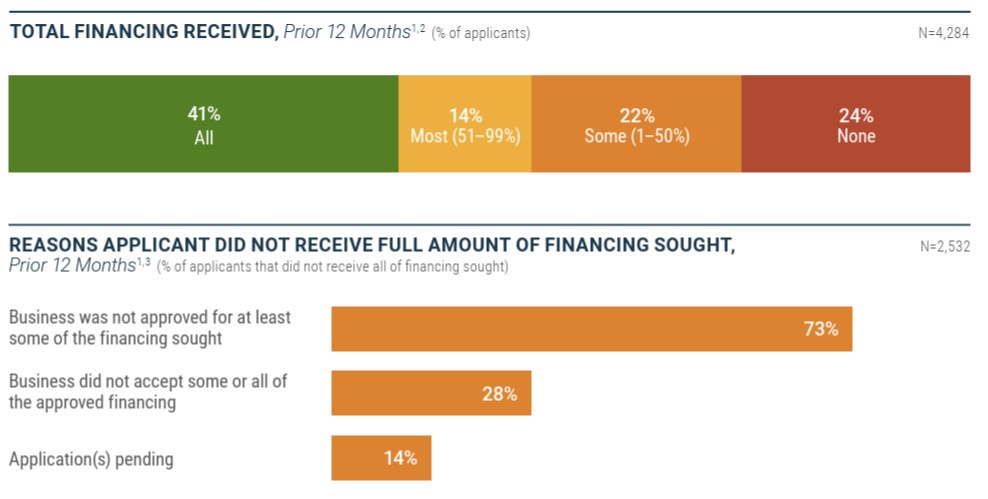

One-Half of All Small Businesses Apply for Financing,

One-Half of Requests Get Fully Funded

By Bob Coleman

Coleman Report

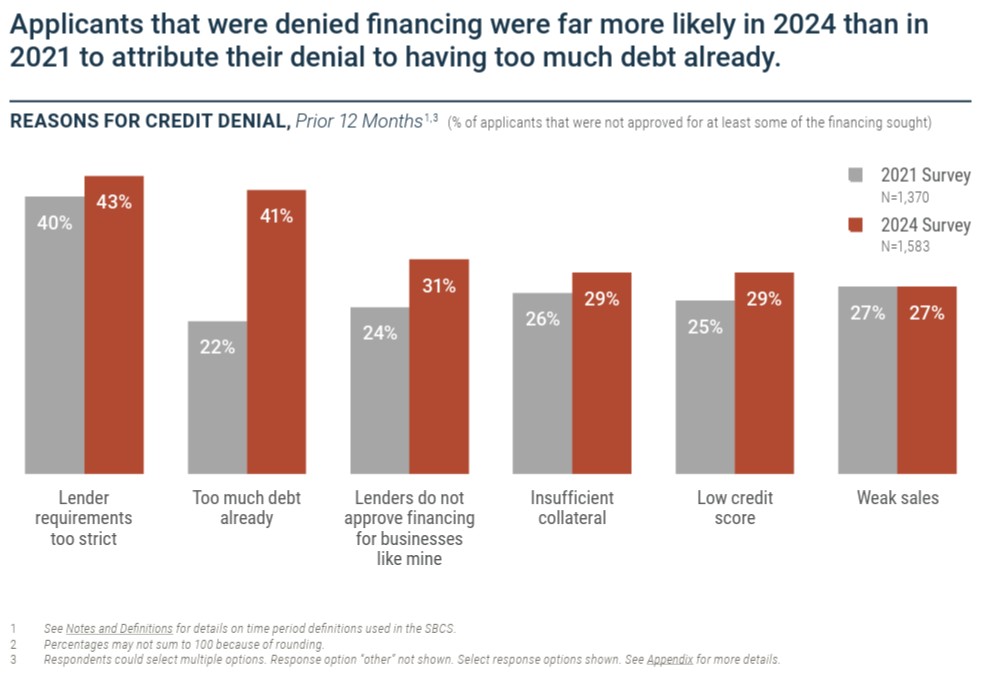

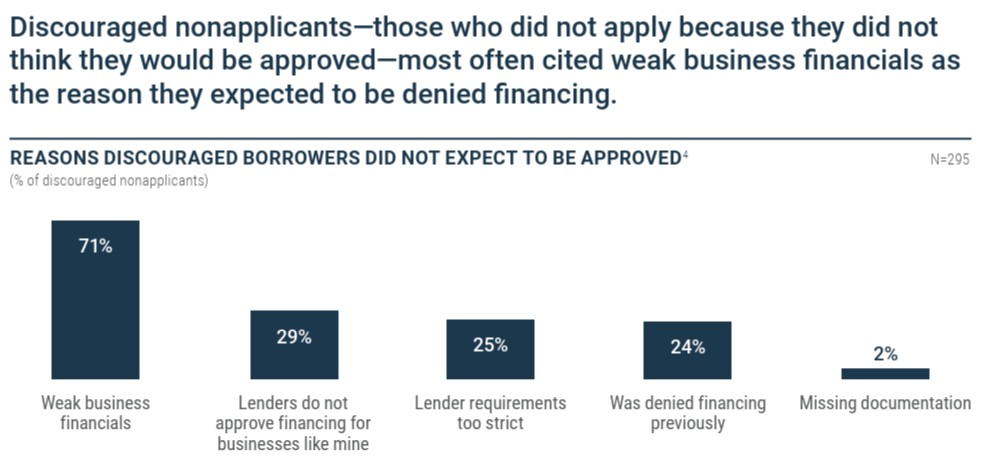

Continuing our reporting from the 2025 Federal Reserve Banks' Small Business Credit Survey on employer firms, today we focus on small business financing needs and application outcomes.

More than half of firms sought some type of financing in the 12 months prior to the survey. Firms most often applied for financing to meet operating expenses.

Reasons for applying:

• 56% to meet operating expenses

• 46% to expand business, purchase new opportunity, or acquire business assets

• 40% to have available credit for future use as needed

• 27% to make repairs or replace capital assets

• 27% to refinance or pay down debt

[headlines]

--------------------------------------------------------------

Balboa Capital Available Position

Program Manager II- Equipment Broker Sales

[headlines]

--------------------------------------------------------------

Answering the Question "Tell Me About Yourself?"

By Ken Lubin, Managing Editor, ZRG Partners

First, for this approach to work, to ensure you deliver a confident response, you need to practice your answer before the interview. Rehearse with a friend or record yourself to review your delivery. This will help you feel more comfortable and articulate during the actual interview.

Start with a Brief Personal Introduction:

Begin your response with a concise personal introduction. Mention your name and a brief statement about your background. For example, "I'm [Your Name], and I have a background in [your field or relevant experience]."

Highlight Relevant Professional Experience: Next, focus on your professional journey. Highlight key experiences, achievements, and skills that are relevant to the job you're applying for. Emphasize how your past roles have prepared you for this specific opportunity.

Showcase Your Passion: Express your enthusiasm and passion for the industry or field. Explain why you're drawn to this line of work and what motivates you. Employers appreciate candidates who are genuinely excited about the role.

Connect with the Company: Demonstrate your knowledge of the company and its values. Explain why you're interested in working for this organization specifically. Mention any research you've done about the company and how it aligns with your career goals.

Highlight Soft Skills: In addition to technical skills, emphasize your soft skills. Mention qualities like teamwork, communication, problem-solving, and adaptability. Provide brief examples of situations where you've demonstrated these skills.

Keep it Concise: While it's essential to provide enough information to give the interviewer a sense of who you are, avoid making your response too lengthy. Aim to keep your answer under two minutes. You can always expand on specific points later in the interview.

Tailor Your Response: Customize your answer for each job interview. Highlight experiences and skills that are most relevant to the specific position you're applying for. This demonstrates that you've done your homework and are genuinely interested in the role.

Be Positive and Professional: Maintain a positive and professional tone throughout your response. Avoid discussing personal matters, negative experiences, or irrelevant details. Focus on what makes you a strong candidate.

End with an Open Invitation: Conclude your response by inviting the interviewer to ask any follow-up questions or for additional information. This keeps the conversation open and engaging.

Ken Lubin

Managing Director

ZRG Partners, LLC

Americas I EMEA I Asia Pacific

klubin@zrgpartners.com

C: 508-733-4789

https://www.linkedin.com/in/klubin

[headlines]

--------------------------------------------------------------

[headlines]

--------------------------------------------------------------

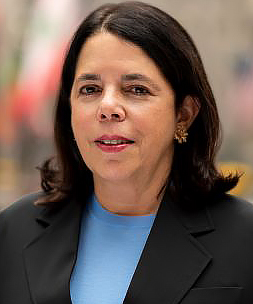

Sloan Schickler

Leasing News Advisor

Sloan Schickler

Schickler & Schickler PLLC

One Rockefeller Plaza, FL11

New York, NY 10020

Direct Dial: 212-262-5297

sloan.schickler@schicklerlaw.com

https://schicklerlaw.com

Sloan Schickler has contributed articles to Leasing News for several years. She was appointed to serve on the Leasing News advisory board in February of 2023.

Sloan is a highly experienced commercial attorney. Her firm and its predecessors have been a leader in the financial services area of vehicle and equipment finance for decades. Sloan’s practice includes secured lending, commercial and consumer leasing, retail installment sales and dealer floor plan finance, regulatory licensing and compliance, syndicated revolving credit facilities, asset securitization, corporate structuring and governance, and real estate finance. Clients have included major commercial banks, captive finance companies, financial institutions, investment banks, leasing companies, auto manufacturers, auto dealerships, real estate investors, hedge funds, and public and closely held corporations.

Over the years, Sloan has served as outside general counsel to auto finance companies; advocated for her clients before the New York legislature; designed documentation and compliance procedures for financing recourse loans collateralized by vehicles leases and loans; documented and conducted numerous sales and financings of vehicle lease and loan portfolios including at foreclosure; and served as special counsel in bankruptcy, work out and loan modification matters.

Sloan is currently the Legal and Legislative Counsel for the National Vehicle Leasing Association (NVLA) and a director on its Board. She is the founder of the NVLA’s Women in Leasing initiative.

A loyal alumna of Vanderbilt University Law School, Sloan has served as Class Agent for her class for decades. She also acted as an alumna interviewer for the school. Sloan has also served on the board of directors of a not-for-profit organization that developed a residential model for autistic individuals.

Her career began at Holland & Knight (Haight Gardner Poor & Havens) as a commercial litigation associate. Sloan is currently a partner of Schickler & Schickler PLLC. Her bar admissions are the State of New York, Southern and Eastern Districts of New York, the U.S. Tax Court and the U.S. Supreme Court.

Sloan is also the proud mother of two daughters who have attended Vanderbilt University as undergraduates. She resides with her husband, a physician specializing in infectious diseases, and her Maltipoo dog, Lulu.

[headlines]

--------------------------------------------------------------

NVLA Annual Meeting 2025

Soars To New Heights

By Sloan Schickler

Women In Leasing Roundtable

The National Vehicle Leasing Association held its 2025 Annual Meeting in Clearwater Beach, FL on April 9-10. It was a high energy meeting after the fall meeting was postponed due to Hurricane Milton.

The meeting kicked off on April 9th with the usual golf outing and a buzzing poolside social hosted by Women in Leasing. That evening, NVLA held a Welcome Reception and the President, Tarry Shebesta, gave awards to: Doug Moore - Clemons-Pender Lessor of the Year Award; Gary Mott - Samuel J. Lee Memorial Award; Tom Kontos – Lifetime Achievement Award; Mark Van Ness and Suzanne Fedie – President’s Award.

As always, Charlie Vogelheim was the emcee for the festivities. Charlie has had an amazing 40-year career in the automotive industry and he brings incredible insights and a huge amount of levity to an action packed meeting.

One of the highlights of the morning of April 10th, was the keynote speaker Michelle “MACE” Curran. Ms. Curran had an impressive career as a fighter pilot in the U.S. Air Force. From 2019-2021 she was the only female pilot that flew with the Air Force Thunderbirds. Her address: “Flying Through Fear: How Vulnerability Fuels Success” was inspirational. Ms. Curran talked about her fears during her flights and a job search. She overcame her self-doubts to become a confident fighter pilot and instructor by summoning the courage to start something even when she did not feel ready. The key is knowing that you will figure it out along the way. She said most people like to play it safe, but she encouraged everyone to be bold and take action. Courage comes from overcoming fear and doing something anyway.

Next, Charlie Vogelheim spoke about AI, the Risks, Rewards and the Road Ahead. He described various autonomous vehicles from Aptera, Hyundai, Waymo and more. AI is moving so rapidly that 92% of all Fortune 500 companies are using it and it greatly increases the intelligence of the user of a system. Sam Altman predicted in the summer of 2024 we would have Artificial General Intelligence (“AGI”) meaning a system of artificial intelligence that can perform any task that a human being can perform in 1000 days. We are not quite there, but it is coming fast. There are still many issues to work out including hallucinations, i.e., AI giving the wrong answer, bias by default and many answers that are America forward as the development is U.S. driven.

Jessica Gonzalez a V.P. from Informed, spoke enthusiastically about AI Innovations in Auto Leasing. Informed’s AI facilitates retail credit decisions, streamlining the process of collecting documentation for credit review. The AI process designed by Informed provides feedback to the lender as to documents that are missing or irregular based on parameters preset by the lender such as contracts, gap insurance, checking VIN numbers, driver’s licenses, pay stubs and bank stubs. This can greatly speed up credit decision making. The process is geared towards consumer credit and sole proprietorships but not commercial credits.

The last item of the morning was the Legal and Legislative Update provided by yours truly. The first topic up was Commercial Finance Disclosures. I reminded the crowd that each state has different legal requirements, and the disclosures vary by state. These disclosures are currently required in CA, CT, FL, GA, KS, NY, UT and VA (sales-based financing only). States that are currently considering new law or amending that on the books are: CA, IL, KA, MD, NJ, NY, NC, MI, MO and TX. Next, I advised that the Financial Crimes Enforcement Network (“FINCEN”) issued an interim final rule in March of 2025 that required filing with FINCEN only for entities formed under foreign law (not U.S. domestic entities). On the non-compete front, I explained that in April 2024 the Federal Trade Commission (“FTC”) had issued a rule banning non-compete clauses with a few exceptions. As a result of litigation pending in the 5th Circuit Court of Appeals, enforcement of the rule has been stayed—this could change and may mean that non-compete agreements may become unenforceable. Compliance with the Dodd-Frank Section 1071 Small Business Collection Rule also has been stayed by the 5th Circuit for the litigants and intervenors in a case challenging the rule. Congress likely will repeal the rule. The Consumer Financial Protection Board has indicated they may issue a new Section 1071 rule. In another legal battle the FTC CARS Rule—requiring significant increased disclosure to consumers on the premise of eradicating unfair and deceptive practices by dealers—has been vacated by the 5th Circuit Court of Appeals.

Among the activities prohibited by the rule are “bait and switch” advertising. While the rule is no longer in play, I warned that there were 19 state attorneys general (“AGs”) that had joined the lawsuit in favor of the FTC CARS rule. With so much federal law in a state of flux, it is likely that the AGs will become vigilant in upholding laws that protect consumers, especially as federal agencies have been diminished in this new presidential administration. Substantial state AG enforcement actions joined by the FTC have occurred in the last few years against dealers and several states have also added or are entertaining legislation aimed at lessor and dealer disclosure and advertising. Moreover, state AGs have the ability to enforce federal laws including the Truth in Lending Act, Regulations M and Z, the Equal Opportunity Credit Act and Regulation B and the Electronic Funds Transfer Act. All of which means that lessors and their lenders need to be vigilant about regulatory compliance.

During the lunch break, Women in Leasing (“WIL”) held its third annual roundtable during which we planned our sessions and course for the next year. We meet the second Tuesday of every other month on Zoom. I serve as chairperson of WIL and we have a dynamic group of women from all facets of NVLA membership including, banks, independent lessors, manufacturers’ fleet teams, and computer software vendors, among others. We discussed our focus for the next year including adding sessions covering succession planning and retention in business, mentoring, developing a social media presence for NVLA and more. We are also completing a series of five sessions on wellness for women in the workplace including topics such as career development and pay parity.

The afternoon session started with To EV or Not EV the Great Debate with Charlie Vogelheim as moderator and Elena Cicottelli and Jimmy Douglas for EVs and Nick DiPrima and John Possummato against EVs. Issues raised about EVs are possible ending of the $7,500 federal tax credit for EV purchases, the challenge of setting the residual value and battery life and disposal. Other issues are range of vehicles and rate of charging. Of course, low maintenance other than tires makes EVs attractive. Aside from environmental issues, the EVs are at the beginning of their evolution and there is much more to come!

FBI Cyber: Imposing Risks and Consequences addressed the problems of protecting the business environment in the face of state sponsored actors that attack networks and adjacent accessories such as routers. Currently, there is an increased threat of phishing attacks and other methods of infiltrating systems. As a result, businesses must be careful to develop strong password methodology and to build systems and employee awareness to be careful with online activities. Cyber attacks, ransomware and AI cloning are real threats. Businesses must be vigilant and update all systems and software as recommended including anti-virus programs.

Navigating the Future of Vehicle Leasing – Market Insights and Emerging Trends was next up and the participants delved into the pending tariffs and providing insights. Eric Lyman spoke of the potential tariff impact and projections that BlackBook just put together. Notably, he said used cars will keep elevated values above pre-2020 levels, residual forecasts will be in the mid-50% range and total sales will be 16.4M with the seasonably adjusted annual rate dropping to 12.9M. Melinda Zabriski of Experian indicated that new vehicle leasing continues to rise and lease return volumes are projected to increase for 2026. She stated that EV vehicle sales were approaching 10% of new vehicles in Q1 of 2025 with leasing surging to almost 58% of all new vehicles. And EVs reached over 23% of all new leasing in Q1 2025. Overall retention for both EV and ICE vehicles is expected to increase.

Finally, Gail Rubenstein of Retail Resilient provided an engaging session on Automotive Social Media and made the case for the importance of using this in the leasing business. The organic pillars of social media advertising are: sales posts (why lease with us? keep your fleet up to date), customer posts (testimonials, success stories), relationship posts (meet the team, your specialty in the market), store promotions (limited time offers, company news, contests) and fun posts (holiday posts, shoutout local business, memes). She also talked about paid social media advertising and how this may enhance a business’ advertising activities.

Overall, the meeting was highly engaging, and the sessions were topical and on point.

Sloan Schickler is a partner in the commercial finance law firm, Schickler & Schickler PLLC (www.schicklerlaw.com). Schickler, a veteran vehicle leasing, finance and bank attorney and the attorneys in her firm have decades of experience representing and protecting lessors, banks, captive and independent finance companies in all facets of the vehicle leasing and financing business. She has served as the NVLA Legal and Legislative counsel since 2017, is currently the only woman on the NVLA board of directors, is the founder of NVLA’s Women in Leasing and is a supporter of Leasing News and sits on its Advisory Board. Sloan can be reached at sloan.schickler@schicklerlaw.com or 212-262-5297.

[headlines]

--------------------------------------------------------------

News Briefs

Google is an online advertising monopoly

judge rules

https://www.cnn.com/2025/04/17/tech/google-adtech-trial-decision/index.html

Burger King franchisee with 57 locations files for

bankruptcy after owing $37M to creditors

https://nypost.com/2025/04/17/business/burger-king-franchisee-files-for-bankruptcy-after-owing-37m-to-creditors/

Nearly 90% of Consumer Financial Protection Bureau

Cut as Trump's government downsizing continues

https://www.sfgate.com/news/politics/article/layoffs-hit-consumer-financial-protection-bureau-20281755.php

Massive cuts at National Weather Service spark

fears about forecast quality, public safety

https://www.nbcnews.com/science/science-news/noaa-workers-fired-weather-forecasts-programs-safety-rcna194568

Fed Chair Lays Out Game Plan in Case of High Inflation

and Slower Growth

https://www.nytimes.com/2025/04/16/business/economy/jerome-powell-federal-reserve-inflation-interest-rates.html

From Italy to Japan, tariffs disrupt Boeing supplies

that support U.S. jobs

https://www.washingtonpost.com/transportation/2025/04/16/tariffs-boeing-airbus-impact-trump-china/

[headlines]

--------------------------------------------------------------

Trump administration asks IRS to revoke Harvard’s

tax-exempt status

https://www.washingtonpost.com/business/2025/04/16/trump-harvard-tax-exempt-irs/

[headlines]

--------------------------------------------------------------

Sports Briefs

Reports: Derek Carr has shoulder injury,

2025 status iffy

https://www.linkedin.com/in/jenny-dubinsky-cpa-6146423b/details/experience/

[headlines]

--------------------------------------------------------------

![]()

California News Briefs

California’s demographic earthquake: Asian

immigrants rise, Latinos decline, state transformed

https://www.reddit.com/r/LosAngeles/comments/1jz7dde/californias_demographic_shift_asian_immigrants/?rdt=45888

Santa Clara approves another 1,000+ housing project

https://sanjosespotlight.com/santa-clara-approves-another-1000-housing-project

[headlines]

--------------------------------------------------------------

Gimme that Wine

![]()

http://www.youtube.com/watch?v=EJnQoi8DSE8

CrossHatch Winery Ventures into York Mountain:

Michelle Vautier Acquires Templeton Farm

to Cultivate Estate Vineyards

https://www.winebusiness.com/news/article/300942

Jackson Family Wines Trims Headcount

https://www.winebusiness.com/news/article/300944

Wine in history: The world’s oldest wine

https://worldoffinewine.com/news-features/carmona-worlds-oldest-surviving-wine

[headlines]

----------------------------------------------------------------

![]()

This Day in History

https://leasingnews.org/archives/Apr2021/04_16.htm#history

-------------------------------------------------------------

SuDoku

The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler?

--------------------------------------------------------------

Daily Puzzle

How to play:

http://www.setgame.com/set/puzzle_frame.htm

Refresh for current date:

http://www.setgame.com/set/puzzle_frame.htm

--------------------------------------------------------------

http://www.gasbuddy.com/

http://www.gasbuddy.com/GB_Map_Gas_Prices.aspx

http://www.gasbuddy.com/GB_Mobile_Instructions.aspx

--------------------------------------------------------------

Weather

See USA map, click to specific area, no commercials

--------------------------------------------------------------

Traffic Live---

Real Time Traffic Information

You can save up to 20 different routes and check them out with one click,

or type in a new route to learn the traffic live

--------------------------------

Wordle

https://www.powerlanguage.co.uk/wordle/

How to Play

https://www.today.com/popculture/popculture/wordle-know-popular-online-word-game-rcna11056

![]()