Information, news, and entertainment for the commercial

alternate financing,

bank, finance and leasing industries

Subscribe

| Search | All Lists | Site Map

Conferences/Forums |

Advertising | Archives | Columnists

Contact: kitmenkin@leasingnews.org

![]()

Monday, August 5, 2024

Today's Leasing News Headlines

New Hires/Promotions in the Leasing Business

and Related Industries

North Mill Equipment Finance Sets Monthly

Origination Record in July; Adds New Employees

CLFP Foundation Adds 12 New CLFPs

with Photographs

Academy for Certified Lease & Finance Professionals

Five Scheduled August - November

Leasing and Finance Industry Help Wanted

Excellent Compensation/Marketing Support

Many Openings, Many Remote

Three Exceptional Leaders

By Scott Wheeler, CLFP

Commercial Finance/Leasing Finance

Conferences & Forums

Top Ten Most Read

July 29 to August 2

Shepherd Mix

Golden Valley, Minnesota Adopt-a-Dog

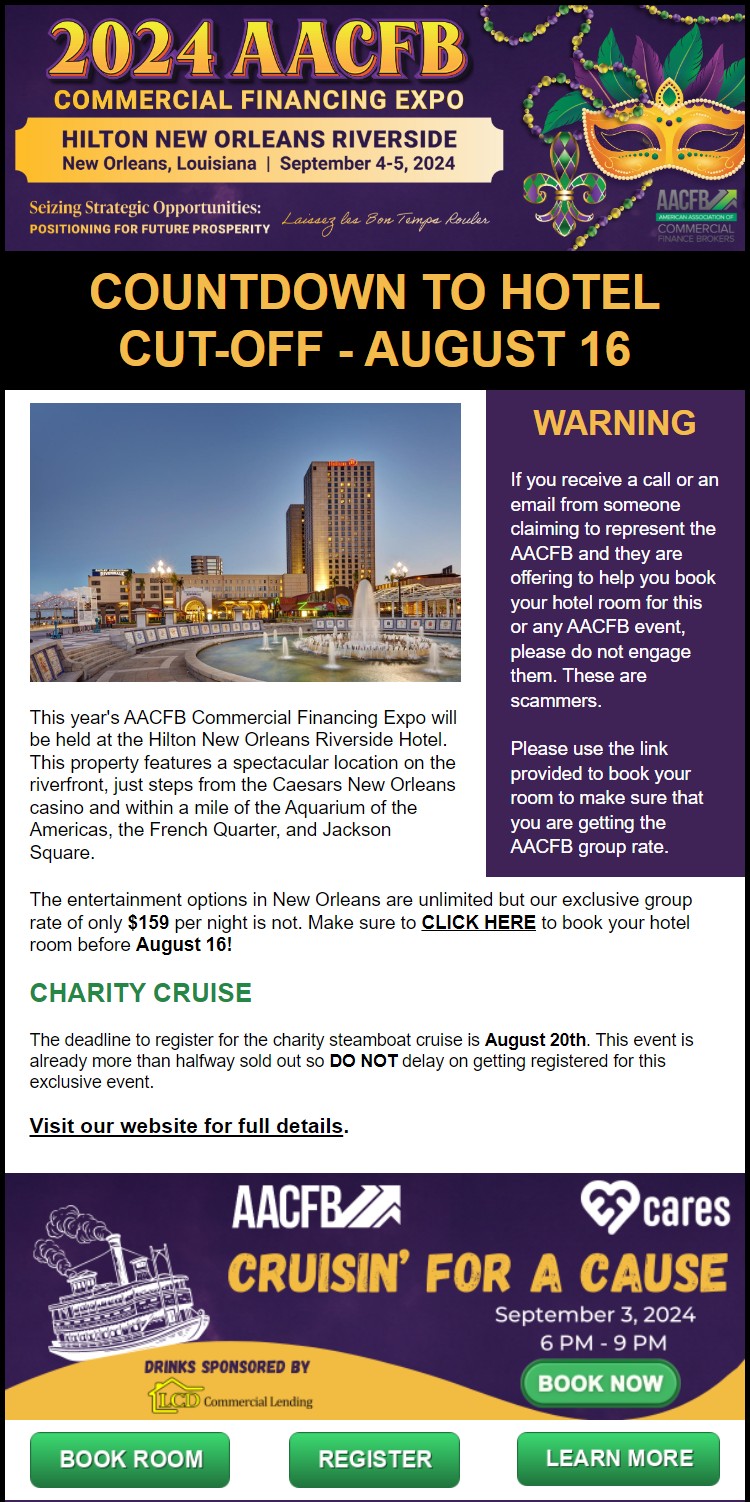

2024 AACFB Commercial Financing Expo

Countdown to Hotel Cut-Off August 16

News Briefs ---

FedEx’s Logistics Test

Getting Rid of Duplicate Trucks

As Hundreds of Churches Sit Empty, Some Become

Malls and Restaurants

Tech Bosses Preach Patience as They

Spend and Spend on A.I.

Hawaii announces $4 billion global settlement

over Maui wildfires

How One Man Lost $740,000 to Scammers

Targeting His Retirement Savings

Retailers Locked Up Their Products—and Broke Shopping

Chains have barricaded everything. It’s backfired

Tight Job Market Delivered Widespread Rewards

They Are at Risk

You May Have Missed ---

Who’s really at the wheel for Uber and Lyft?

In many ways, it’s AI

Broker/Funder/Industry Lists | Features (wrilter's columns)

Top Ten Stories Chosen by Readers | Top Stories last six months

Sales Make It Happen

Sports Briefs

California News

"Gimme that Wine"

This Day in History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

Wordle

######## surrounding the article denotes it is a press release, it was not written by Leasing News nor has the information been verified, but from the source noted. When an article is signed by the writer, it is considered a byline. It reflects the opinion and research of the writer.

[headlines]

--------------------------------------------------------------

New Hires/Promotions in the Leasing Business

and Related Industries

Liz Castillo was hired as Senior Vice President, Business Capital, Houston, Texas. She is located in Humble, Texas. Previously, she was Founder Greater Houston Trucking Association, September, 2019, President (October, 2022 - Present). Previously, she was Sales Manager, Transportation, Third Coast Commercial Capital, Inc. (May, 2019 - October, 2022); Vice President, Far West Capital (June, 2016 - May, 2018); Vice President, Regional Sales Manager, Bay View Funding (February, 2011 - September, 2014). Full Bio:

https://www.linkedin.com/in/lizcastillo/details/experience/

https://www.linkedin.com/in/lizcastillo/

Christy Phillips was hired as Senior Vice President, Commercial Funding Partners, Draper, Utah. She is located in Salt Lake City, Utah. Previously, she was Vice President, Global Banking & Markets, Goldman Sachs (April, 2023 - July, 2024); Vice President, Axos Bank (2018 - April, 2023); Vice President, Varilease Finance, Inc. (July, 2007 - March, 2018); Data Entry Specialist, Lexington Law (June, 2006 - January, 2007).

https://www.linkedin.com/in/kristy-phillips-72332147/

Jasmine Rognrud, CLFP Associate, was promoted to Syndications, Account Manager, Channel, Minnetonka, Minnesota. She joined Channel as Funding Coordinator (January, 2023 - August, 2024); Marketing Supervisor, Options Minnesota (January, 2021 - January, 2023).

Full Bio:

https://www.linkedin.com/in/jrognrud/details/experience/

https://www.linkedin.com/in/jrognrud/

Nick Storey was hired as Vice President of Sales, Dext Capital, Lake Oswego, Oregon. He us located in Alpine, Utah. Kyin Lok, Dext Capital CEO, said, “We are thrilled to welcome Nick to our team. His enthusiasm, wealth of exceptional experience, and dynamic personality are a perfect match for Dext Capital’s commitment to excellence and growth." Previously Nick Storey was Business Development Executive, Balboa Capital (December, 2021 - July, 2024); Vice President, Dedicated Funding (September, 2018 - March, 2022).

https://www.linkedin.com/in/nick-storey/

[headlines]

--------------------------------------------------------------

######## Press Release ###################

North Mill Equipment Finance Sets Monthly

Origination Record in July; Adds New Employees

North Mill Equipment Finance LLC (“NMEF”), a leading independent commercial equipment lessor headquartered in Norwalk, Connecticut, announced today that the company had a record-breaking month in July as funded volume surged to more than $56 million, an increase in loan and lease originations of 33% from the same period last year.

David C. Lee, Chairman and CEO, North Mill, declared,’ “We are firing on all cylinders and well poised to continue our growth trajectory.

“We have a strong capital base, a loyal and ever-expanding group of referral partners who consider NMEF their primary lender, and a diversified portfolio that helps us mitigate the economic woes that plague specific industries like the trucking sector.”

According to Lee, NMEF has been steadily rebalancing its book of business, providing its referral partners with more opportunities to finance a variety of equipment.

“Historically, trucking related collateral, both local and long-haul, represented an average of 40% of our originations whereas today it embodies just 15% of what we finance,” he said. “Medical, franchise, and construction collectively now represent almost 60% of our funding volume.”

In another pivotal move to diversify, NMEF has grown its vendor program in partnership with referral partners, including banks, captives and other funding sources. In addition to the high watermark in originations, the company’s weighted average FICO reached 735, weighted average yields are north of 13%, and submission approval rates are approaching 60%.

While many equipment lenders have reduced or even ceased funding operations over the past year, NMEF has been selectively adding to its team.

Mary E. Armstrong, CLFP, is Joining the company as an Assistant Vice President, Relationship Manager, is who brings over twenty years of referral partner relationships while holding similar roles at Financial Pacific, Marlin, and Canon.

Paul Cheslock, VP of Customer Relations, NMEF, said, “We are very excited to welcome Mary to the NMEF family of companies. “Her reputation is stellar. Brokers, customers, and colleagues alike have commented on her talent, innate sales ability, and professionalism.”

Ms. Armstrong reported “making the decision to join NMEF was not difficult. For quite some time, I’ve been aware of NMEF’s reputation as a progressive leader and trailblazer.”

Also joining NMEF is Zacchary Lee, Sr. Analyst, Corporate Development, who will assist the finance team with budgeting, portfolio analytics, and the execution of strategic initiatives. An honors graduate of The Wharton School at the University of Pennsylvania, Mr. Lee brings 5 years of experience in financial services.

About North Mill Equipment Finance

NMEF originates and services small to mid-ticket equipment leases and loans, ranging from $15,000 to $2,500,000 in value. A broker-centric private lender, the company accepts A – C credit qualities and finances transactions for many asset categories including construction, transportation, vocational, medical, manufacturing, technology, franchise, renovation, janitorial and material handling equipment. NMEF is majority owned by an affiliate of InterVest Capital Partners. The company’s headquarters are in Norwalk, CT, with regional offices in Irvine, CA, and Voorhees NJ.

For more information, visit https://nmef.com/. One of NMEF’s controlled affiliates, BriteCap Financial LLC, is a leading non-bank lender providing small businesses with fast, convenient financing alternatives such as working capital loans since 2003 from its main office in Las Vegas, NV. For more information, visit https://www.britecap.com/

##########Press Release #################

[headlines]

--------------------------------------------------------------

Leasing and Finance Industry Help Wanted

Excellent Compensation/Marketing Support

Plus other openings for successful, growing funders

[headlines]

--------------------------------------------------------------

CLFP Foundation Adds 12 New CLFPs

with Photographs

The Certified Lease & Finance Professional (CLFP) Foundation is pleased to announce that 12 individuals who recently sat through the online proctored CLFP exam, have passed. They are

Jennifer Bell, CLFP – Funding Team Lead

AP Equipment Financing

Justin Blumenstein, CLFP – Data Analyst,

AP Equipment Financing

- Headshot.jpg)

Erin Burruto, CLFP Associate – Assistant Vice President, Program Manager,

First American Equipment Finance

- Headshot.jpg)

Timothy Campbell, CLFP Associate – Account Executive

Ocean First Bank

Emmet Clarke, CLFP – Senior Operations

Manager, Tokyo Century (USA) Inc.

Danielle DeGraeve, CLFP – Vice President, Strategic Accounts and Marketing,

US Capital Corporation

Michael Lazarz, CLFP – End of Lease Specialist

CoreTech Leasing, Inc

- Headshot.jpg)

Tessa-Marie Menees, CLFP Associate – Project Manager

Dext Capital

- Headshot.jpeg)

Stephanie Mergen, CLFP – Financial & Project Analyst

Stearns Bank

Melanie Phillips, CLFP – Vice President

First American Equipment Finance

Molly Pulito, CLFP – Assistant Vice President, Project Manager

First American Equipment Finance

Sebastian Salgado Gonzalez, CLFP – Senior Operation Officer

Tokyo Century (USA) Inc.

Emmet Clarke of Tokyo Century USA, said, “I chose to pursue obtaining my CLFP because as a young person in leasing, I’m eager to learn as much as possible about the industry as a whole.

“Learning the different aspects of leasing has always drawn my attention. Seeing so many of the leaders at my company having this certification and talking so highly of it drove me to try and obtain it.”

Timonthy Campbell of Ocean First Bank said, “I chose to pursue the CLFP designation to build the foundational knowledge required for success in the equipment finance industry. I knew earning the designation would require commitment and extensive study, which would be a challenging yet rewarding experience.

“Learning to be comfortable being uncomfortable results in growth, so I knew this would be a great opportunity to advance my career.”

The CLFP designation identifies an individual as a knowledgeable professional to employers, clients, customers, and peers in the commercial equipment finance industry. There are Certified Lease & Finance Professionals and Associates located throughout the United States (including Puerto Rico), Canada, India, Pakistan, Africa, and Australia.

For more information, visit http://www.CLFPFoundation.org

[headlines]

--------------------------------------------------------------

Academy for Certified Lease & Finance Professionals

Five Scheduled August - November

The Academy for Lease and Finance Professionals (ALFP) is a three-day event designed to fully prepare an individual to sit for the CLFP exam assuming the attendee has already self-studied. A trend has begun in having virtual online sessions.

During the first two days, all of the required sections of the CLFP exam are covered in-depth. On the third day, the exam is offered but is not mandatory and may be taken on another day.

Students are strongly advised to have read and studied The Certified Lease & Finance Professionals' Handbook prior to attending the class in order to ensure success

Schedule

Great American Insurance Group Public,

in Person, ALFP

August 8 - 9

Financial Partners Group Private

Virtual ALFP

August 12 - 13

Wintrust Public, In-Person. ALFP

August 15 -16

DLL Online Private, ALFP

October 15 - 16

First Commonwealth EF Online, ALFP

November 6 -7

CLFP Handbook

For more information on the academy:

https://clfpfoundation.org/academy-for-lease-and-finance-professionals

[headlines]

--------------------------------------------------------------

Three Exceptional Leaders

By Scott Wheeler, CLFP

Now is a great time to acknowledge the exceptional leaders who exist throughout the commercial equipment finance and leasing industry. These professionals are critical in navigating the current transition and they are successfully helping the industry prepare for the future. Below are just a few examples:

A thirty-year veteran owner of an independent finance company, who recognized the struggles of his team over a year ago and has significantly increased his personal efforts to directly support the team. He has curtailed his travel schedule to industry events to spend more time with his team. He regularly meets one-on-one with managers, line personnel, and core clients to gather their suggestions of how the company can best serve the needs of all stakeholders.

This executive is leading by example; he is often the first to arrive in the morning and the last to leave at the end of the day. The company is doing well in 2024. Sales volume is up modestly, the company's profits are on par with previous years, and the company has increased its staff over the last six months in preparation for 2025 and 2026.

A seasoned credit manager has gone above and beyond over the past two years. She recognized that tighter credit requirements impacted everyone in the organization. She created regular, transparent, and internal communications that she has distributed to the entire staff of the company. The communications include weekly delinquency reports segmented by industries and equipment types.

She provides details of the reasoning behind new credit requirements and has facilitated regular meetings with the sales team to answer questions and suggest means to attract clients that align with the current credit requirements. She has a sales aptitude and is always willing to accompany originators to vendors and end-users to clarify the company's current credit position. Her leadership instills a team approach. The company's production and profitability has improved significantly in 2024.

A newer sales manager (only 2 years in his current position) has navigated a 100% pivot in his company's market focus. Prior to June of 2023, the company was 100% committed to the transportation industry. Today less than 25% of its production involves titled assets. Through the transition, the manager lost only two of his twelve originators because of his leadership skills.

He was exceptional in defining a new vision and strategy for the company. He captured 100% buy-in from his sales team. Each originator had a drop in personal incomes in 2023. However, 70% are expected to exceed their previous top incomes in 2024. The team is excited about their new position in the market and are committed to their success.

The industry has thousands of such leaders who are actively pursuing success. The industry should celebrate these professionals who work without public recognition to move the industry forward with confidence.

Scott A. Wheeler, CLFP

Wheeler Business Consulting

1314 Marquis Ct.

Fallston, Maryland 21047

Phone: 410 877 0428

Fax: 410 877 8161

Email: scott@wheelerbusinessconsulting.com

Web: www.wheelerbusinessconsulting.com

Wheeler Business Consulting is working with individual originators and sales teams throughout the industry to ensure that they are well positioned in the market, capturing their fair share of business, and outperforming the competition. To schedule a one-on-one meeting contact Scott Wheeler at: scott@wheelerbusinessconsulting.com

[headlines]

--------------------------------------------------------------

Commercial Finance/Leasing Finance

Conferences & Forums

(American Association of Commercial Finance Brokers Previous Expo Break)

Sept. 4-5: AACFB Commercial Financing Expo,

New Orleans, Louisiana

https://expo.aacfb.org/home

Registration Now Open - note: Women in Finance Breakfast Hottest to Attend!

NOTE: Hotel Exclusive Rate Cut-off August 15.

https://leasingnews.org/archives/Jul2024/07_22.htm#aacfb

Vicki Shimkus, CLFP, Balboa Capital, A Division of Ameris Bank| Broker Relationship Manager, will be covering the conference for Leasing News readers.

Sept. 10-12: CFLA Conference, St. John's, NL, Canada

https://cfla-acfl.ca/cfla-annual-national-conference-2024.html

Early Bird Rate Available:

https://cfla-acfl.ca/programs-services/event-calendar.html/event-info/details/id/48

Hugh Swandel, President, Meridian OneCap Commercial Credit, will be covering the conference for Leasing News

Sept. 23 - 24: B2B Finance Expo, Wynn, Las Vegas, NV

https://www.b2bfinexpo.com/

It also features Poker Game for 50, Sunday, Sept. 22, 2024

https://www.b2bfinexpo.com/page/3932469/poker-party

Accepting Reservations:

https://book.passkey.com/gt/220111918?gtid=3de05f54910c4c17c858cd28e9e1b9cf

Oct. 16-18: NVLA Conference, Clearwater Beach, Florida

https://www.nvla.org/page/2024conference

Early Bird Special:

https://leasingnews.org/archives/Jul2024/07_12.htm#nvla

Sloan Schickler, Esq., Schickler & Schickler, will be covering the conference for Leasing News. She is also presenting there.

Oct. 27-29: 63rd ELFA Annual Convention, Austin, TX

Convention details

Early Bird Registration Available, Plus Hotel

https://www.elfaonline.org/education-networking/2024/annual-convention

Bruce Kropschot, Senior Managing Director, The Alta Group, will be covering the ELFA Convention, as he has done for Leasing News for many years.

Nov. 6, 2024, Brokers Expo, New York City

https://brokerexponewyorkcity.com/

Super-Early-Bird-Pricing-Announced

https://reg.eventmobi.com/BENY24/register

Elevate Your Brand - Become a Sponsor

https://leasingnews.org/archives/Jul2024/07_26.htm#expo

Nov. 11-14: NEFA Fall Conference, Indianapolis, Indiana

https://www.nefassociation.org/events/upcoming

Don Cosenza, CLFP, Senior Vice President of North Mill Equipment Finance, will be covering the conference for Leasing News

To be listed or update: kitmenkin@leasingnews.org

[headlines]

--------------------------------------------------------------

Top Ten Most Read

Leasing News Stories

July 29 to August 2

(1) Major Bankruptcy Affects the Truck Industry

By James Menzies, Trucknews.com

https://leasingnews.org/archives/Jul2024/07_29.htm#major

(2) New Hires/Promotions in the Leasing Business

and Related Industries

https://leasingnews.org/archives/Jul2024/07_29.htm#hires

(3) Countries with the Most Olympic Medals

Nations with Most Summer Olympic Medals since 1896

https://leasingnews.org/archives/Jul2024/07_29.htm#oly2

(4) Commercial Finance/Leasing Finance

Conferences & Forums

https://leasingnews.org/archives/Jul2024/07_29.htm#conf

(5) The Olympics in France Remind Me

Why Athlete Are the Best to Hire

By Ken Lubin, ZRG Partners

https://leasingnews.org/archives/Jul2024/07_29.htm#oly

(6) New Hires/Promotions in the Leasing Business

and Related Industries

https://leasingnews.org/archives/Jul2024/07_31.htm#hires

(7) New Hires/Promotions in the Leasing Business

and Related Industries

https://leasingnews.org/archives/Jul2024/07_31.htm#hires

(8) Story Credit Financing - Updated

Business Loans, SBA Loans, Working Capital

https://leasingnews.org/archives/Jul2024/07_31.htm#sc

(9) Impossibly Unaffordable Housing Markets

Source: Visualcapitalist

https://leasingnews.org/archives/Jul2024/07_31.htm#housing

(10) Career Objectives

By Scott Wheeler, CLFP

https://leasingnews.org/archives/Jul2024/07_31.htm#career

[headlines]

--------------------------------------------------------------

Shepherd Mix

Golden Valley, Minnesota Adopt-a-Dog

Sadie

ID 56096382

Female

3 years, 1 month

49 Pounds

Adoption Fee $450

Location: Golden Valley

Affectionate dogs like me are cuddly and love snuggling and giving kisses. I might be a little shy or bashful as I adapt to a new environment but that should be easy in a home with moderate activity.

I love to be busy, both physically and mentally. I'll enjoy seeing and doing things with my new family and prefer an active household. Energetic dogs like me need a companion who can provide adequate mental stimulation and exercise, such as running, hiking, or playing Frisbee.

Visit Sadie

Location name

Golden Valley Adoption Center

Address

845 Meadow Ln N, Golden Valley, MN 55422

Directions

Adoption Hours

Open Tuesday-Friday 12-8 PM and Saturday-Sunday 10 AM–6 PM. Closed Mondays.

[headlines]

--------------------------------------------------------------

[headlines]

--------------------------------------------------------------

News Briefs

FedEx’s Logistics Test

Getting Rid of Duplicate Trucks

https://www.wsj.com/business/logistics/fedex-tackles-the-ultimate-logistics-challenge-getting-rid-of-duplicate-trucks-0103c0fc?st=onf3f0saft74ggm&reflink=desktopwebshare_permalink

As Hundreds of Churches Sit Empty, Some Become

Malls and Restaurants

https://www.nytimes.com/2024/08/04/business/church-development-reuse.html

Tech Bosses Preach Patience as They

Spend and Spend on A.I.

https://www.nytimes.com/2024/08/02/technology/tech-companies-ai-spending.html

Hawaii announces $4 billion global settlement

over Maui wildfires

https://www.courthousenews.com/hawaii-announces-4-billion-global-settlement-over-maui-wildfires/

How One Man Lost $740,000 to Scammers

Targeting His Retirement Savings

https://www.nytimes.com/2024/07/29/business/retirement-savings-scams.html?unlocked_article_code=1._k0.ronz.HmfAD0IwB63E&smid=url-share

Retailers Locked Up Their Products—and Broke Shopping in America

Chains have barricaded everything. It’s backfired

https://www.bloomberg.com/news/features/2024-08-01/why-cvs-and-target-locking-up-products-is-backfiring

Tight Job Market Delivered Widespread Rewards.

They Are at Risk.

https://www.wsj.com/economy/jobs/tight-job-market-delivered-widespread-rewards-they-are-at-risk-52255a2f?st=kj0to1l8zgnpxb4&reflink=desktopwebshare_permalink

[headlines]

--------------------------------------------------------------

Who’s really at the wheel for Uber and Lyft?

In many ways, it’s AI

https://www.bostonglobe.com/2024/08/04/business/uber-lyft-drivers-algorithm-ai/

[headlines]

--------------------------------------------------------------

Sports Briefs---

Noah Lyles wins gold for U.S.

in 100m by .005 seconds

https://www.espn.com/olympics/story/_/id/40726446/noah-lyles-wins-gold-us-100m-hair-breadth

Harvard grad Kristen Faulkner became a full-time

cyclist in 2021. She just won an unlikely gold in Paris

https://www.bostonglobe.com/2024/08/04/sports/kristen-faulkner-cycling-olympics/

Giants' Blake Snell throws 1st career no-hitter

in 3-0 win over the Reds

https://www.sfgate.com/sports/article/giants-blake-snell-throws-1st-career-no-hitter-19616991.php

A’s blown out 10-0 by Dodgers in

Jack Flaherty’s L.A. debut

https://www.sfchronicle.com/sports/athletics/article/a-s-blown-10-0-dodgers-jack-flaherty-s-debut-19618221.php

[headlines]

--------------------------------------------------------------

![]()

California News Briefs---

Park Fire still growing with containment at 30%

as temperatures expected to hit triple-digits

https://www.sacbee.com/news/politics-government/capitol-alert/article290739934.html

[headlines]

--------------------------------------------------------------

Gimme that Wine

![]()

http://www.youtube.com/watch?v=EJnQoi8DSE8

Paso Robles Wine Tour Company Ranks 5th Best in

USA Today's Readers' Choice for Best Wine Tour

https://www.winebusiness.com/news/article/290712

Inglenook is Distinguished by USA TODAY As One of the

10Best Winery Tours in the Country And Adds a New

Private Cave Tour & Tasting, Chef Demonstration

Series, And a Lifestyle-Focused "Visionary Membership"

https://www.winebusiness.com/news/article/290731

St. Francis Winery & Vineyards Teams Up with Professional

Dog Trainer Nicole Ellis to Show How Man's Best Friend

and Sonoma Wines are a Perfect Pairing this National

Dog Month

https://www.winebusiness.com/news/article/290735

Castle Rock Winery Brings Home the Gold

from the California State Fair

https://www.winebusiness.com/news/article/290708

Edna Valley Vineyard to be sold,

closing tasting room

https://www.ksby.com/san-luis-obispo/edna-valley-vineyard-to-be-sold-closing-tasting-room

[headlines]

----------------------------------------------------------------

![]()

This Day in History

https://leasingnews.org/archives/Aug2022/08_05.htm#history

-------------------------------------------------------------

SuDoku

The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler?

--------------------------------------------------------------

Daily Puzzle

How to play:

http://www.setgame.com/set/puzzle_frame.htm

Refresh for current date:

http://www.setgame.com/set/puzzle_frame.htm

--------------------------------------------------------------

http://www.gasbuddy.com/

http://www.gasbuddy.com/GB_Map_Gas_Prices.aspx

http://www.gasbuddy.com/GB_Mobile_Instructions.aspx

--------------------------------------------------------------

Weather

See USA map, click to specific area, no commercials

--------------------------------------------------------------

Traffic Live---

Real Time Traffic Information

You can save up to 20 different routes and check them out with one click,

or type in a new route to learn the traffic live

--------------------------------

Wordle

https://www.powerlanguage.co.uk/wordle/

How to Play

https://www.today.com/popculture/popculture/wordle-know-popular-online-word-game-rcna11056

![]()