Information, news, and entertainment for the commercial

alternate financing,

bank, finance and leasing industries

Subscribe

| Search | All Lists | Site Map

Conferences/Forums |

Advertising | Archives | Columnists

Contact: kitmenkin@leasingnews.org

![]()

Wednesday, August 14, 2024

Today's Leasing News Headlines

Ameris Bancorp Names Phil Silva

to Lead Balboa Capital

From the Archive: Byrne is Back at the

Helm of Balboa Capital

New Hires/Promotions in the Leasing Business

and Related Industries

Funders Taking "New" Broker

Business List

Finance and Leasing Industry Recruiters

Recognized with Experience and Reputation

Leasing and Finance Industry Help Wanted

Positions Open with Attractive Income & Benefits

Structure Matters

By Scott Wheeler, CLFP

Police Diversify with EVs as

Combustion Engines Can’t Keep Up

Boeing & Airbus: Making Money or Losing Money?

Quarterly/Net Profit/Loss 2019

News Briefs ---

Pride EV Truck to wind down operations

As sale to founders rejected,

S.F. financial tech company valued at $855 million

shuts down, lays off entire staff

US Considers a Rare Antitrust Move:

Breaking Up Google

Layoffs at Dell and possibly Cisco raise concerns

about job market and AI: Trial Balance

Business Finance Companies on Inc 5000 List

in 2024

Loan broker Kris Roglieri denied

new detention hearing in wire fraud case

You May Have Missed ---

Bank of America no longer forecasts

a U.S. recession in 2024

Broker/Funder/Industry Lists | Features (wrilter's columns)

Top Ten Stories Chosen by Readers | Top Stories last six months

Sales Make It Happen

Sports Briefs

California News

"Gimme that Wine"

This Day in History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

Wordle

######## surrounding the article denotes it is a press release, it was not written by Leasing News nor has the information been verified, but from the source noted. When an article is signed by the writer, it is considered a byline. It reflects the opinion and research of the writer.

[headlines]

--------------------------------------------------------------

#### Press Release #######################

Ameris Bancorp Names Phil Silva

to Lead Balboa Capital

(Not a surprise, as many insiders knew Chief Executive Officer Patrick Byrne had retired but he waited until Ameris Bank had moved to the New York Stock Exchange July 23. In reality, the same senior staff remains and Phil Silva had been active in his role, growing with the company. - Editor)

Ameris Bancorp has named Phil Silva, President of Balboa Capital, to head this division of Ameris Bank. Balboa Capital is a leading vendor, broker and end user lender providing a range of financial and technology solutions to small and medium sized businesses nationwide.

Silva has more than 35 years of experience in the equipment finance industry. Starting in 2007, he led and navigated Balboa’s entry into the vendor and broker segments and meshed the existing and profitable small and medium end user segments.

Previously, Silva started and ran the National Accounts Group for American Express and served as general manager for its Healthcare, Franchise and Business Capital Loan divisions, as well as oversight of Marketing. Previously, he was responsible for Field Sales at Dana Commercial Credit. Silva holds a bachelor’s degree in business management from Whitworth University in Spokane, Washington.

Ameris Bank Chief Strategy Officer Jim LaHaise said, “Phil’s expertise in the equipment finance industry, combined with his outstanding leadership, positions Balboa Capital for future growth, industry-leading technology tools and customer service for all the businesses that count on us.

Balboa Capital President Phil Silva said, “It has been a privilege and honor to work alongside my Balboa team and customers, and I am excited about our collective future as part of Ameris Bank.”.

Balboa Capital is headquartered in Costa Mesa, California, and uses proprietary technology to deliver innovative financing solutions to a diverse group of business customers nationwide. It is known for its industry expertise, speed of processing and ease of documentation and funding.

About Ameris Bank

Ameris Bank, a subsidiary of Ameris Bancorp (NYSE: ABCB), is a state-chartered bank headquartered in Atlanta, Georgia. Ameris operates 164 financial centers across the Southeast and serves consumer and business customers nationwide through select lending channels. Ameris manages $26.5 billion in assets as of June 30, 2024, and provides a full range of traditional banking and lending products, treasury and cash management, insurance premium financing, and mortgage and refinancing services. Learn more about Ameris at www.amerisbank.com.

##### Press release#######################

|

[headlines]

--------------------------------------------------------------

From the Archives: Byrne is Back

at the Helm of Balboa Capital

Byrne originally started the company, joined the association that is now NEFA, became a CLP, then brought in a partner to expand.

https://leasingnews.org/Conscious-Top%20Stories/Byrne.htm

[headlines]

--------------------------------------------------------------

New Hires/Promotions in the Leasing Business

and Related Industries

Jim Noel was hired as Vice President, CAN Capital, Mt. Laurel, New Jersey. He is located in Swedesboro, New Jersey. Previously, he was National Sales Director, Marlin Capital Solutions (February, 2019 - August, 2022); Financial Specialist, Phillips Medical Capital (April, 2015 - February, 2019); Vice President of Sales, Navitas Lease Corp. (August, 2013 - April, 2015). Full Bio:

https://www.linkedin.com/in/jim-noel-1975594/details/experience/

https://www.linkedin.com/in/jim-noel-1975594/

Kyler Nunan was promoted at Dext Capital to Help Desk Technician II, Lake Oswego, Oregon. He is located in Portland, Oregon. He joined Dext as Help Desk Technician I, July, 2021.

https://www.linkedin.com/in/kyler-n-979249153/

Greg Stitt was hired as Senior Director, Capital Markets, Auxilior Capital, Plymouth Meeting, Pennsylvania. He is located in Rochester, New York. Previously, he was at Auxilor Capital Markets, starting November, 2017, Senior Credit Analyst, promoted January, 2018 AVP, Syndications, promoted to VP, Syndications (November, 2021 - July, 2024); Credit Intern, First American Equipment Finance (May, 2015 - September, 2015).

https://www.linkedin.com/in/greg-stitt-2599163a/

Evan Toth was hired as National Sales Director, Marshall Capital Group, Cureio, Texas. He is located in Cherry Hill, New Jersey. Previously, he was Account Manager, Fleetway Capital (July, 2021 - August, 2024); Account Specialist, Veritiv Corporation (May, 2019 - August, 2020).

https://www.linkedin.com/in/evan-toth/

[headlines]

--------------------------------------------------------------

Leasing and Finance Industry Help Wanted

Excellent Compensation/Marketing Support

Plus other openings for successful, growing funders

[headlines]

--------------------------------------------------------------

Funders Taking "New" Broker Business List

Four Do Not Require that Brokers Be Licensed

BSB Leasing, Inc.

Bankers Capital

C.H. Brown Company

Forum Financial Services

TimePayment Corp.

The following “funders” have informed Leasing News they will consider business from “new” third party originators. Many companies require a certain length of time in business and other requirements, such as a specific volume of business. These “funders” will consider submissions from those new in the leasing and finance business:

Name |

Employees

|

Geo

Area |

Dollar

Amount |

Business Reports

|

A

|

B

|

C

|

D

|

E

|

BSB Leasing, Inc. |

16 |

National |

$10,000 Minimum |

Y |

N |

N |

Y |

Y |

|

Bankers Capital 1990 James Aiksnoras Vice President Sales & Marketing 508-351-6000 Jamesa@bankers-capital.com www.bankers-capital.com AACFB, NEFA (footnote) |

6 |

National |

$40,000 + |

Y |

Y |

N |

N |

N |

|

C.H. Brown Company a Subsidiary of Platte Valley Bank Wheatland, Wyoming Kit West Business Development Director/Broker Relations (307) 241-7005 kwest@chbef.com www.chbef.com AACFB, NEFA, & NAFA (National Aircraft Financing Association) (click for more info) |

23 |

National

|

$15,000 minimum*

|

Y |

N |

Y* |

N |

N |

|

Forum Financial Services, Inc. 1996 Tim O'Connor 972.690.9444 ext. 225 tim@forumleasing.com 240 Lake Park Blvd. Suite 112 Richardson, TX 75080 www.forumleasing.com AACFB, ELFA, NEFA |

7 |

Nationwide |

$50,000 - $1.5 million (Our average size transaction is $250,000. Preferred range $100,000 - $500,000) |

NR |

N |

N/R |

N/R |

N/R |

|

Timepayment Corp Burlington, Massachusetts 1989 Mark Sheehan Vice President & General Manager, Capital Markets and Strategic Partnerships Mark.Sheehan@timepayment.com 781-994-4836 www.timepayment.com/lease-brokers AACFB, ELFA, NEFA (Footnote) |

175 |

National

|

$500 to

$1 million |

Y |

N |

N |

Y |

Y |

A -Accepts Broker Business | B -Requires Broker be Licensed | C -Sub-Broker Program

| D -"Private label Program" | E - Also "in house" salesmen

[headlines]

--------------------------------------------------------------

Finance and Leasing Industry Recruiters

Recognized with Great Experience and Reputation

Second Column: YCS - Year Company Started | YELB - Years in equipment Leasing Business

Name City, State Contact Website Leasing Association |

YCS

YELB (see above for meaning) |

Geographic Area |

Specialty

|

Executive Solutions for Leasing & Finance, Inc. |

1990 |

Nationwide |

Search firm specializing in leasing industry. Services include retained and contingent search, strategic consultation, compensation analysis, sales & management training, & customizable consulting products. |

Recruiters |

2000 |

North America |

Explanation: Boutique Executive Search Firm Specializing in the Finance & Equipment Leasing Industries. |

ZRG Partners |

1999 |

Global |

Senior Level retained Search firm doing C-Suite searches, board searches and VP level positions, We work on a client focused, project basis |

|

[headlines]

--------------------------------------------------------------

Structure Matters

By Scott Wheeler, CLFP

Successful originators in the commercial equipment finance and leasing industry understand the power of structuring a transaction and meeting the cash flow needs of every client.

I recently spoke with a relatively new originator who lost a transaction which she felt her company was highly aggressive with in pricing. However, a competitor had beaten her with a significantly lower monthly payment. She did not understand how her competitor could be so much lower in payment than what she had proposed. I asked her:

- How was her competitor's structure different?

- What was the competitor requiring upfront and in what form (advance payments, security deposits, down payment)?

- What was the competitor's term?

- Was the competitor asking for additional collateral?

- What were the competitor's end of term options?

Unfortunately, the originator had assumed that her competition was proposing the same structure as she had proposed. She assumed that her client was comparing similar structures (apples to apples).

Our discussion led the originator to follow up with the end-user (even though the transaction had already been funded through her competitor). The originator discovered that her competitor had won the transaction with more money upfront, a slightly longer term, and a purchase option at the end of the lease.

The competitor's structure realized a higher yield than what she had originally proposed by 150 basis points. She had lost the transaction because of structure.

The originator's lessons learned were:

- Structure matters.

- Even slightly different structures can significantly change monthly payments.

- Questions about a competitor's structure need to be asked upfront, not after a transaction has been lost.

- The lowest yield is not always a winning proposition.

- Understanding your customer's cash flow needs and structuring a transaction to meet those needs is a powerful tool in winning more transactions.

Scott A. Wheeler, CLFP

Wheeler Business Consulting

1314 Marquis Ct.

Fallston, Maryland 21047

Phone: 410 877 0428

Fax: 410 877 8161

Email: scott@wheelerbusinessconsulting.com

Web: www.wheelerbusinessconsulting.com

Wheeler Business Consulting is working with individual originators and sales teams throughout the industry to ensure that they are well positioned in the market, capturing their fair share of business, and outperforming the competition. To schedule a one-on-one meeting contact Scott Wheeler at: scott@wheelerbusinessconsulting.com

[headlines]

--------------------------------------------------------------

Police Diversify with EVs as

Combustion Engines Can’t Keep Up

By Matthew W. Daus, Esq.

Police departments around the country find themselves at a crossroads. They have decades of investment in traditional combustion engine police vehicles, of which the Dodge Charger Pursuit is one of the most popular and among the quickest with a 6-second 0-60 time. However, as electric vehicle ownership grows across the country, criminals are adapting. A suspect fleeing in a Tesla Model Y or Hyundai Ioniq 5 N can easily outrun a V6-powered Charger on city streets.

A recent report by WMTV 15 News in Madison, WI points to multiple examples of officers being eluded by criminals fleeing in electric cars and trucks.

During a recent police pursuit near Georgia Tech, a shooting suspect fled police in a Tesla Model Y. During the pursuit, officers lost sight of the vehicle which was able to weave in and out of traffic while maintaining a speed at or near 70 MPH on city streets.

In addition to the obvious improvements in performance, electric cruisers and pursuit vehicles are a more cost-effective option. Estimates out of New Hampshire say that every combustion engine vehicle replaced by an EV saves taxpayers $5,000 per year or more.

Georgia Tech is expecting $4,000 in fuel savings alone after adding three Mustang Mach-E GTs to their fleet.

Source: Inside Evs

https://insideevs.com/news/729764/ice-ev-gas-police-cruiser/?utm_source=Windels+Marx+-+Transportation+Practice+Group

[headlines]

--------------------------------------------------------------

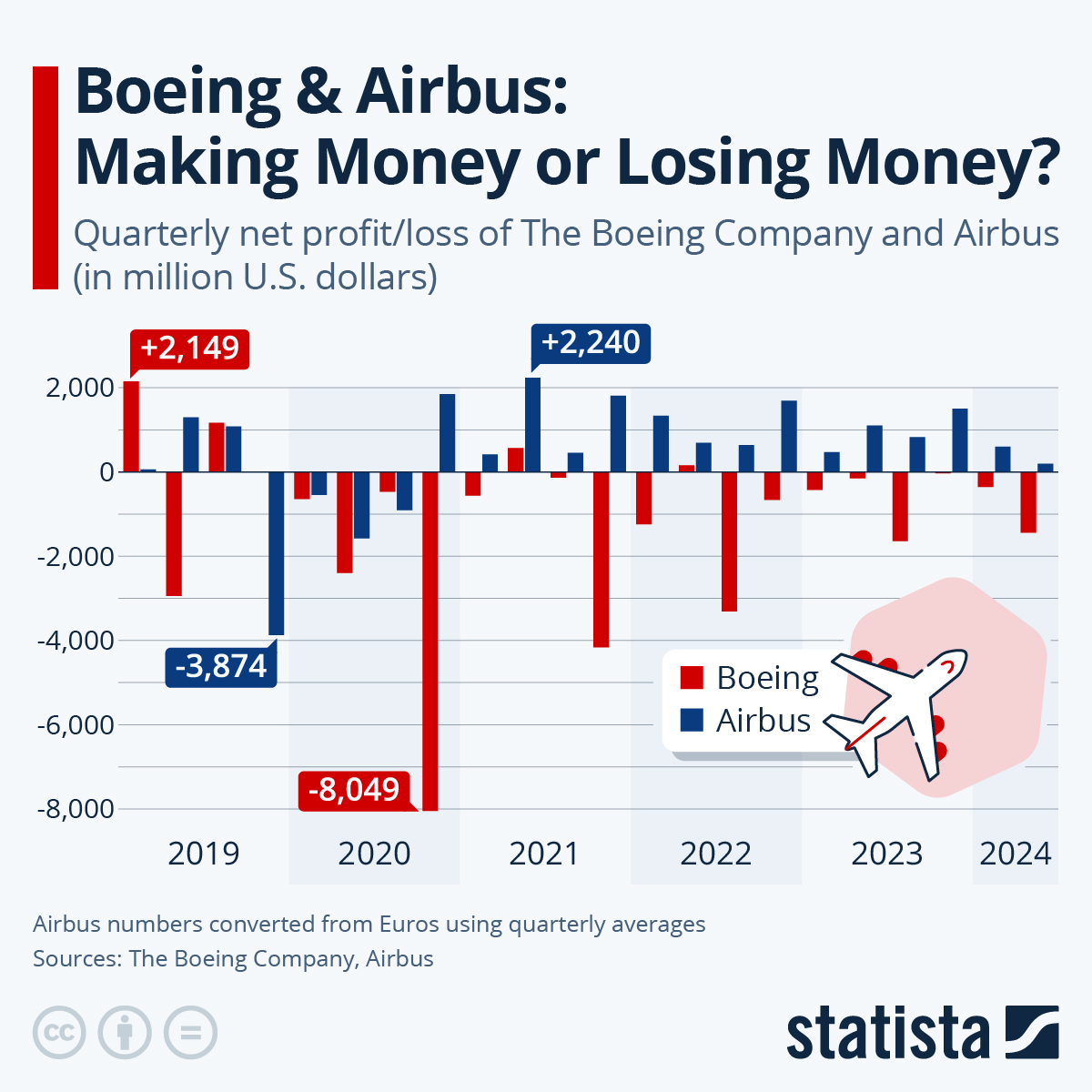

Boeing & Airbus: Making Money or Losing Money?

Quarterly/Net Profit/Loss 2019 - 2024

Comparing the net profit of rival airplane makers Boeing and Airbus over the past couple of years, one of the two has made money, while the other has lost money almost consistently. The company mostly in the red, Boeing, has been plagued by safety issues repeatedly, which had a very negative effect on its reputation and bottom line. From today, August 8, the company's new CEO Kelly Ortberg is taking over, trying to get the company back on track. He is making the switch from aviation technology company Rockwell Collins.

A wider critique of Boeing and attempt at an explanation for the continued safety issues is that cost-cutting and a lack of leadership consistency led to design and construction shortcuts that are now surfacing en masse. Airbus meanwhile has been back in the black since 2021. Its biggest loss quarter over the past 5.5 years was Q4 of 2019, when the company had to pay a huge fine in a corruption case.

Source: Statista

By Katharina Buchholz

[headlines]

--------------------------------------------------------------

News Briefs

Pride EV Truck to wind down operations

As sale to founders rejected,

https://www.trucknews.com/business-management/pride-sale-to-founders-rejected-company-to-wind-down-operations/1003187812/

S.F. financial tech company valued at $855 million

shuts down, lays off entire staff

https://www.sfchronicle.com/sf/article/fintech-tally-closes-19654132.php

US Considers a Rare Antitrust Move:

Breaking Up Google

https://www.bloomberg.com/news/articles/2024-08-13/doj-considers-seeking-google-goog-breakup-after-major-antitrust-win

Layoffs at Dell and possibly Cisco raise concerns

about job market and AI: Trial Balance

https://www.cfo.com/news/layoffs-at-dell-and-possibly-cisco-raise-concerns-about-job-market-and-ai/723839/

Business Finance Companies on Inc 5000 List

in 2024

https://debanked.com/2024/08/business-finance-companies-on-inc-5000-list-in-2024/

Loan broker Kris Roglieri denied

new detention hearing in wire fraud case

https://www.timesunion.com/business/article/roglieri-remain-county-jail-new-detention-hearing-19624841.php

[headlines]

--------------------------------------------------------------

Bank of America no longer forecasts

a U.S. recession in 2024

https://www.cbsnews.com/news/bank-of-america-ceo-brian-moynihan-predicts-no-us-recession-2024/

[headlines]

--------------------------------------------------------------

Sports Briefs---

Sports and music tourism will soon represent

a $1.5 trillion economy

https://www.mercurynews.com/2024/08/13/sports-and-music-tourism-will-soon-represent-a-1-5-trillion-economy/

[headlines]

--------------------------------------------------------------

![]()

California News Briefs---

California farmworkers say they were fired

for leaving jobs in heat. Could a bill prevent that?

https://www.sacbee.com/news/equity-lab/accountability/article290993250.html

[headlines]

--------------------------------------------------------------

Gimme that Wine

![]()

http://www.youtube.com/watch?v=EJnQoi8DSE8

Oregon boasts 3 of the top 4 wine tasting

rooms in the country

https://www.oregonlive.com/trending/2024/08/oregon-boasts-3-of-the-top-4-wine-tasting-rooms-in-the-country.html

French harvest 2024: Mildew and poor fruit

set to lower volumes

https://www.decanter.com/wine-news/french-harvest-2024-mildew-and-poor-fruit-set-to-lower-volumes-536196/

US imposes anti-dumping duties on

glass wine bottles

https://harpers.co.uk/news/fullstory.php/aid/33122/US_imposes_anti-dumping_duties_on_glass_wine_bottles.html

He fled Vietnam and created a world-famous condiment.

Now, he’s making Napa wine

https://www.sfchronicle.com/food/wine/article/red-boat-fish-sauce-napa-19569615.php

Napa winery opens 10,000-square-foot tasting facility,

launches wine series inspired by Japanese heritage

https://www.pressdemocrat.com/article/lifestyle/albarino-napa-valley-materra-cunat-family-vineyards/

[headlines]

----------------------------------------------------------------

![]()

This Day in History

https://leasingnews.org/archives/Aug2023/08_14.htm#history

-------------------------------------------------------------

SuDoku

The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler?

--------------------------------------------------------------

Daily Puzzle

How to play:

http://www.setgame.com/set/puzzle_frame.htm

Refresh for current date:

http://www.setgame.com/set/puzzle_frame.htm

--------------------------------------------------------------

http://www.gasbuddy.com/

http://www.gasbuddy.com/GB_Map_Gas_Prices.aspx

http://www.gasbuddy.com/GB_Mobile_Instructions.aspx

--------------------------------------------------------------

Weather

See USA map, click to specific area, no commercials

--------------------------------------------------------------

Traffic Live---

Real Time Traffic Information

You can save up to 20 different routes and check them out with one click,

or type in a new route to learn the traffic live

--------------------------------

Wordle

https://www.powerlanguage.co.uk/wordle/

How to Play

https://www.today.com/popculture/popculture/wordle-know-popular-online-word-game-rcna11056

![]()