Information, news, and entertainment for the commercial

alternate financing,

bank, finance and leasing industries

Subscribe

| Search | All Lists | Site Map

Conferences/Forums |

Advertising | Archives | Columnists

Contact: kitmenkin@leasingnews.org

![]()

Wednesday, August 21, 2024

Today's Leasing News Headlines

New Hires/Promotions in the Leasing Business

and Related Industries

Latest News on Chesswood Group in Canada:

CB Leaseco Holdings

Leasing and Finance Industry Help Wanted

Sales, Accounting/Credit, Funding, IT

Follow the Fundamentals to Make More Sales

Scott Wheeler, CLFP

New CEO at Starbucks

Great Impact on Company Stock

Channel Successfully Closes

$125MM ABS Transaction

Most Influential Lawyers

in Equipment Finance and Leasing

China is the World's Biggest Producer of Beer

By Ana Fleck, Statista

Clear the Shelters

Dogs and Cats from Overcrowded

Countries Potentionally Most Exposed

to Trump's U.S. Trade Policy

News Briefs ---

Wells Fargo is selling off billions of dollars

in commercial mortgages

Alaska Air, Hawaiian Airlines Clear

Key Antitrust Hurdle

Boeing Finds Cracks in Structure

of 777X Test Jets

A new setback hits a Boeing jet: US will require

inspection of pilot seats on 787s

The power keeps going out at the Port of Los Angeles

raising worries about its green future

Global Trade Needs a China Alternative.

India Needs Better Ports

Column: Trump’s Truth Social stock

is circling the drain

KeyCorp Deal Could Be a Model for Regional Banks

Upbeat reaction, eyebrow-raising indicator

You May Have Missed ---

US judge strikes down Biden administration

ban on worker 'noncompete' agreements

Broker/Funder/Industry Lists | Features (wrilter's columns)

Top Ten Stories Chosen by Readers | Top Stories last six months

Sales Make It Happen

Sports Briefs

California News

"Gimme that Wine"

This Day in History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

Wordle

######## surrounding the article denotes it is a press release, it was not written by Leasing News nor has the information been verified, but from the source noted. When an article is signed by the writer, it is considered a byline. It reflects the opinion and research of the writer.

[headlines]

--------------------------------------------------------------

New Hires/Promotions in the Leasing Business

and Related Industries

Jackie Johnson was hired was hired as Intermediary Relations Manager, Orange Funding, Salt Lake City Metropolitan Area. Previously, she was Enterprise Business Development, Inbox Health (January, 2024 - August, 2024). She joined Solution Reach, Inc., October, 2021, as Account Development Manager, promoted Sales Team Lead (February, 2022 - October, 2022). Full Bio:

https://www.linkedin.com/in/jackie-johnson-15609a106/details/experience/

https://www.linkedin.com/in/jackie-johnson-15609a106/

Dan Karas was hired as Executive Vice President, nFusion Capital, Austin, Texas. He is located in Plano, Texas. Previously he was Chief Credit Officer, C2FO (November, 2022 - August, 2024); Executive Vice President, Allied Affiliated Funding, a division of Axiom Bank, N.A. (October 2020 - August, 2022). Full Bio:

https://www.linkedin.com/in/dan-karas-5ba4b24/details/experience/

https://www.linkedin.com/in/dan-karas-5ba4b24/

Samia Maisha was promoted to Marketing Specialist, Verve, New York, New York. She joined Verve as Marketing Coordinator (August, 2022 - August, 2024). Previously,

she was Customer Strategy Coordinator, Sidecar (June, 2021 - March, 2022). Full Bio:

https://www.linkedin.com/in/samia-maisha-abbb50178/details/experience/

https://www.linkedin.com/in/samia-maisha-abbb50178

Jim Plummer, CLFP, was hired as Equipment Finance Specialist, Jupiter Equipment Finance, Riviera Beach, Florida. He is located in Shelbyville, Indiana. Previously, he was Senior Leasing Consultant, Quality Leasing Co., Inc. (March, 2013 - August, 2024); UCM, PCNA (February, 2012 - March, 2013); General Manager, IMC Credit Services (September, 1998 - August, 2010).

Full Bio: https://www.linkedin.com/in/jim-plummer-clfp-77282519/details/experience/

https://www.linkedin.com/in/jim-plummer-clfp-77282519

[headlines]

--------------------------------------------------------------

Latest News on Chesswood Group in Canada:

CB Leaseco Holdings

The estimated net worth of CB Leaseco Holdings Inc. is at least $3 Million as of 2024-08-20. CB Leaseco Holdings Inc. is the 10% Security Holder of Chesswood Group Ltd and owns about 3,079,489 shares of Chesswood Group Ltd (TSX:CHW) stock worth over $3 Million. Details can be seen in CB Leaseco Holdings Inc.'s Latest Holdings Summary section.

Chesswood stopped originations by Pawnee Leasing located in Fort Collins, Colorado. In a previous press release stated, "...the sales of interests in, or assets of, Pawnee Leasing, as contemplated in the Waiver, will be completed during the current waiver period, or ever."

"Rifco.net" (in Canada) reported sold, which leaves www.tandemFinance, www.waypointinvestmentpartners.com, and www.EasyLegal.ca.

Each Press Release often explains Chesswood Group intentions. noting "A material change report will be filed as soon as practicable under the Company's SEDAR+ profile in connection with the Transaction. The Company did not file a material change report at least 21 days prior to closing of the Transaction as required under section 5.2(2) of MI 61-101 as the Company desired to complete the Transaction at the earliest possible opportunity in light of the Company's financial condition."

https://www.gurufocus.com/insider/245725/cb-leaseco-holdings-inc.

|

[headlines]

--------------------------------------------------------------

Leasing and Finance Industry Help Wanted

Excellent Compensation/Marketing Support

Plus other openings for successful, growing funders

[headlines]

--------------------------------------------------------------

Follow the Fundamentals to Make More Sales

Scott Wheeler, CLFP

Originators in the commercial equipment finance and leasing industry are constantly learning the fundamentals of the business. Leaders are often vindicated during transitional periods for their previous decisions and their focus on the fundamentals.

An originator explained how a few years ago he was frustrated that the management team had pivoted away from transportation transactions (especially OTR transactions). Competitors were growing their transportation volume. Other originators were doubling their production in transportation while his volume remained flat as the company pivoted away from transportation in 2021.

At the time, his management team explained that equipment valuations were unrealistic, pricing was too low for the risk, and that, once again, the transportation industry was building an unsustainable bubble.

Today, his company is thriving while other competitors are trying to survive and are in the beginning stages of pivoting away from transportation. His company has a very small legacy transportation portfolio and is well positioned in its current markets. Lesson learned: the fundamentals prevail.

An originator explained how her company was aggressive in raising its yields early and often when rates started to increase in March of 2022. (The company started raising its yields in the fourth quarter of 2021).

The company also sold portfolios in 2022 at a reasonable profit to eliminate the lowest yields in its existing portfolio, before rates rose even further. In 2022, the originator felt as if she were no longer competitive in the market and could point to multiple transactions lost in the early days of the rate increases. However, her management team emphasized new structures and promoted value over price with "cash flow" alternatives which helped her to win more transactions over time.

Her company maintained their profitability goals and is currently positioned well with plenty of liquidity and line availability while many of her competitors are struggling. Lesson learned: bottom-line profits ensure long-term security.

The commercial equipment finance and leasing industry is not a difficult business when we follow the fundamentals.

Scott A. Wheeler, CLFP

Wheeler Business Consulting

1314 Marquis Ct.

Fallston, Maryland 21047

Phone: 410 877 0428

Fax: 410 877 8161

Email: scott@wheelerbusinessconsulting.com

Web: www.wheelerbusinessconsulting.com

Wheeler Business Consulting is working with individual originators and sales teams throughout the industry to ensure that they are well positioned in the market, capturing their fair share of business, and outperforming the competition. To schedule a one-on-one meeting contact Scott Wheeler at: scott@wheelerbusinessconsulting.com

[headlines]

--------------------------------------------------------------

New CEO at Starbucks

Great Impact on Company Stock

CEOs have a significant impact on organizations. As highlighted in the reshared post, great CEOs are constantly thinking about challenges and solutions for their organization, regardless of the time of day. Leadership involves different kinds of work and greater responsibility, as noted by Seth Bader. Effective CEOs drive organizational success through their vision, decision-making, and ability to inspire and lead their teams.

Source: Linkedin

[headlines]

--------------------------------------------------------------

##### Press Release #######################

Channel Successfully Closes

$125MM ABS Transaction

Minnetonka, MN – Channel, a leading provider of equipment financing and working capital solutions, is proud to announce the closing of its sixth securitization and fourth Working Capital securitization; a $125 million issuance of asset-backed notes, secured by a diverse portfolio of small business loans and advances spanning multiple industries. roll Bond Rating Agency (KBRA) rated all four classes of not

Mike McConnell, Vice President of Treasury & Capital Markets, said, ”Channel is a clear leader in small business lending, committed to both Partners and borrowers.

“The market acceptance and efficient pricing reflects the strong support and confidence our investors have in us.”

Eli Sethre, Chief Financial Officer at Channel, said, “We are immensely proud of our team’s continued success in identifying and originating high-quality working capital assets at attractive pricing.

“This accomplishment reflects not only our collective expertise but also showcases our track record of consistent and predictable balance sheet credit performance.”

This securitization highlights Channel’s strong investor sponsorship amid the market challenges of 2024. Despite

the high volume of ABS year-to-date, Channel accessed a favorable window to complete this transaction, simultaneously redeeming two existing working capital ABS transactions ahead of the conclusion of their revolving period.

CFO Eli Sethre, explained,” This achievement represents a pivotal moment for Channel, further solidifying its leadership in the industry. Moving forward, Channel remains determined to provide outstanding value to its investors and Partners while driving continued growth and market presence

“It should be noted this accomplishment marks Channel’s fourth consecutive year of successfully accessing the ABS market, highlighting Channel’s continued sustained dedication to the marketplace. Notably, Channel achieved a 100% advance rate through Class D notes, distinguishing this as the only working capital ABS transaction this year to

accomplish such a feat.

Truist Securities served as the structuring agent and joint book-running manager, and Guggenheim Securities served as a joint book-running manager. The completion of the transaction has strengthened existing investor connections and attracted seven new investors. The success of this securitization reaffirms investor confidence in Channel, solidifying its position as a trusted and reliable market investment.

About Channel | Established in 2009, Channel is a leading full-service independent lender offering a single source solution for both equipment finance and working capital to small businesses exclusively through equipment finance companies. To date, Channel has funded over $2.2 billion across more than 24,000 transactions throughout the U.S., from its main office in Minnetonka, MN, along with additional locations in Atlanta, GA, Des Moines, IA, and Marshall, Minnesota.

https://www.channelpartnerscapital.com

### Press Release #########################

[headlines]

--------------------------------------------------------------

Most Influential Lawyers

in Equipment Finance and Leasing

Andrew Alper

Julie Babcock

Bill Carey

Richard Contino

Jonathan Fleisher

Marshall Goldberg

David G. Mayer

Allan J. Mogol

Frank Peretore

John G. Sinodis

Mark Stout

Kevin Trabaris

Allan Umans

Mark Wada

Irwin Wittlin

Full List

https://leasingnews.org/Pages/top_lawyers.html

|

[headlines]

--------------------------------------------------------------

China is the World's Biggest Producer of Beer

The BarthHaas report the United States is the second biggest producer of beer with an output of 193m hectoliters in 2023. China's outpu stood at 360 million of beer. A hectoliter is equivalent to one hundred liters.

[headlines]--------------------------------------------------------------

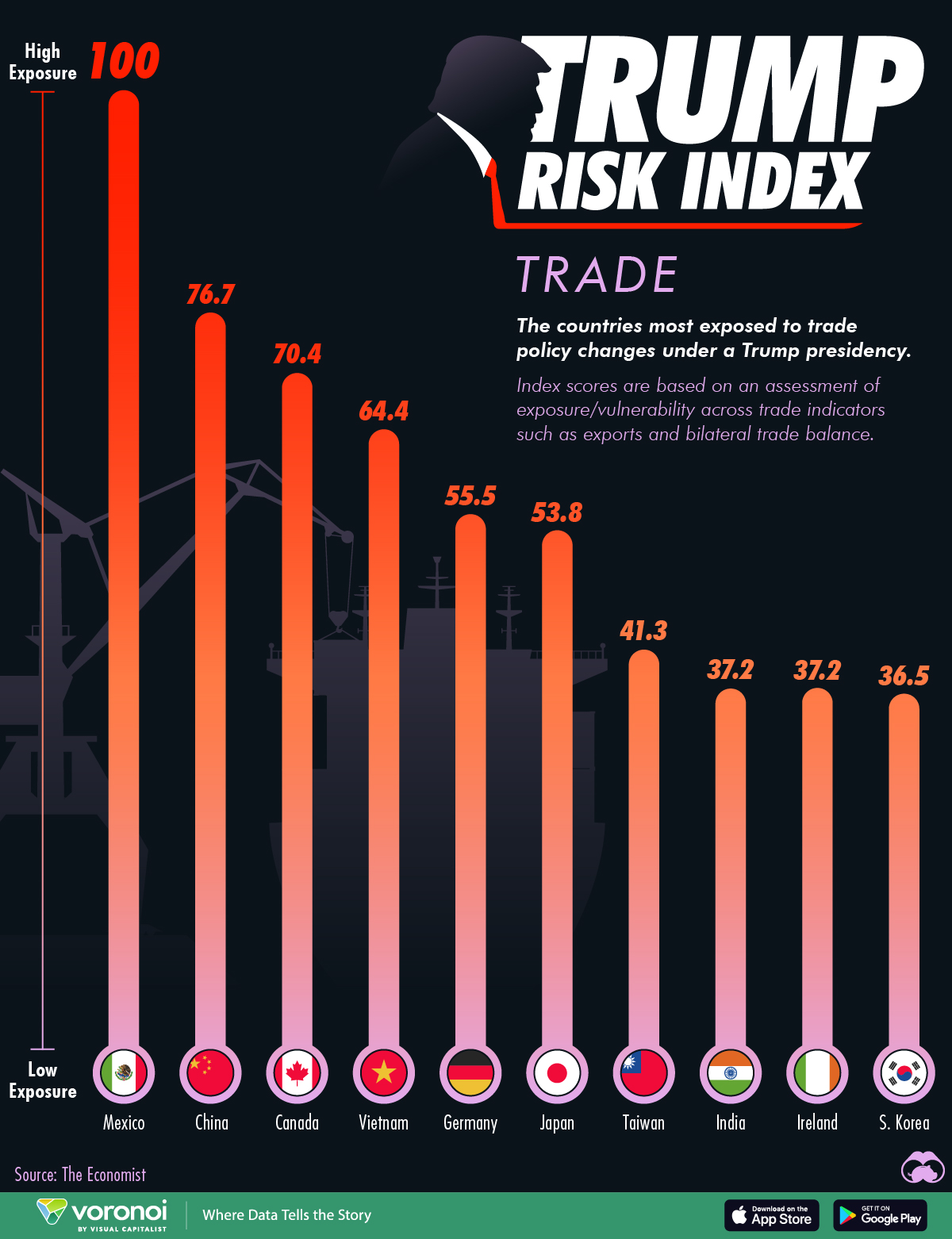

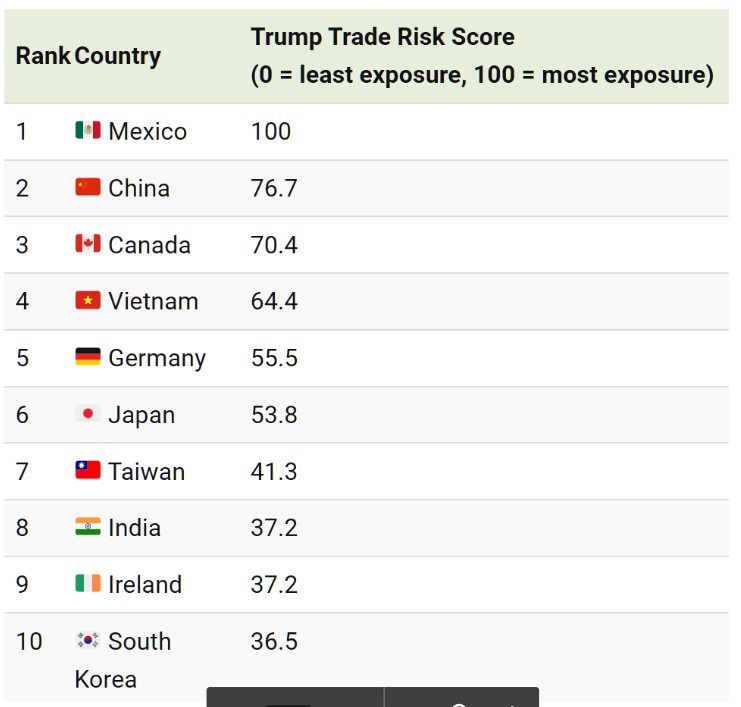

The Countries Potentially Most Exposed to

Trump's Proposed U.S. Trade Policy

By Dorothy Neufeld, Visualcapitalist

If Donald Trump wins the presidential election this November, U.S. trade policy could become more protectionist with a focus on policies aimed at protecting jobs and industries at home.

Under the proposed trade agenda, domestic manufacturing and reducing trade imbalances could be prioritized. This might include imposing a blanket 10% tariff on all imports and deprioritizing trade pacts, as the 16-page Republican Party platform outlines. As a result, many of the country’s largest trade partners could face potential economic risk, given their dependence on U.S. trade.

Methodology

The Economist created the Trump Risk Index, which assesses the exposure and vulnerability of America’s 70 largest trading partners to potential policy changes. It was broken down into three sub-categories: trade, immigration, and security.

For the trade sub-index, each country was given a score based on six trade indicators: bilateral trade balance, trend in bilateral trade, current-account balance, sensitive exports to the U.S., reliance on the U.S. in goods and trade, and free-trade agreements with America.

Question Marks for Key Trading Partners

Below, we show the top 10 countries with the highest trade exposure if Trump returns to office:

Mexico, the largest exporter to America, ranks first, driven by its $152 billion trade surplus.

As supply chains came closer to home, Mexico’s trade surplus has jumped nearly 40% since 2020. Moreover, significant volumes of exports are automotives and other sensitive exports like aluminum and steel.

Today, Mexico, Canada and the U.S. operate under the USMCA trade agreement, which eliminates tariffs for goods meeting the treaty’s provisions.

With the biggest trade surplus across all U.S. trading partners, China also faces significant risk. If re-elected, Trump plans to impose a 60% tariff or more on goods imported from China.

While President Biden has taken a more selective approach to Chinese exports, including a 100% tariff on electric vehicles and a 50% levy on semiconductor chips by 2025, Trump’s policies would be more wide-ranging. For instance, Biden’s policies affect about $18 billion in Chinese goods, but Trump’s would impact roughly $427 billion in imports.

[headlines]

--------------------------------------------------------------

News Briefs

Wells Fargo is selling off billions of dollars

in commercial mortgages

https://www.cnn.com/2024/08/20/economy/wells-fargo-sells-off-commercial-mortgages/index.html

Alaska Air, Hawaiian Airlines Clear

Key Antitrust Hurdle

https://www.wsj.com/business/airlines/alaska-air-hawaiian-airlines-clear-key-antitrust-hurdle-96c334d8?mod=business_lead_story

Boeing Finds Cracks in Structure

of 777X Test Jets

https://www.wsj.com/business/airlines/boeing-finds-cracks-in-structure-of-777x-test-jets-8c94087d?mod=business_lead_pos3

A new setback hits a Boeing jet: US will require

inspection of pilot seats on 787s

https://finance.yahoo.com/news/setback-hits-boeing-jet-us-193808070.html

The power keeps going out at the Port of Los Angeles

raising worries about its green future

https://www.latimes.com/business/story/2024-08-16/power-outages-a-growing-concern-for-port-of-los-angeles-now-and-down-the-road

Global Trade Needs a China Alternative.

India Needs Better Ports

https://www.nytimes.com/2024/08/20/business/india-jawaharlal-nehru-port.html

Column: Trump’s Truth Social stock

is circling the drain

https://www.latimes.com/business/story/2024-08-20/trumps-truth-social-stock-is-circling-the-drain

KeyCorp Deal Could Be a Model for Regional Banks

Upbeat reaction to purchase of a stake in Cleveland-based lender eyebrow-raising indicator

https://www.wsj.com/finance/keycorp-deal-could-be-a-model-for-regional-banks-05ef70db?st=gk6n4ke6dyuehcy&reflink=desktopwebshare_permalink

[headlines]

--------------------------------------------------------------

US judge strikes down Biden administration

ban on worker 'noncompete' agreements

https://www.reuters.com/legal/us-judge-strikes-down-biden-administration-ban-worker-noncompete-agreements-2024-08-20/

[headlines]

--------------------------------------------------------------

Sports Briefs---

Warriors coach Steve Kerr borrows Steph Curry’s

‘night night’ move in DNC speech

https://www.sfchronicle.com/politics/article/stevenc-19665594.php

[headlines]

--------------------------------------------------------------

![]()

California News Briefs---

Still blazing galore': Wildfire torches 95%

of historic Northern California wilderness

https://www.sfgate.com/california-parks/article/park-fire-torches-ishi-wilderness-19659584.php

Popular California beach closes after

crowd of sea lions invade

https://www.sfchronicle.com/california/article/sea-lions-monterey-beach-19665244.php

California's new $20 million train is

unlike anything else in the US

https://www.sfgate.com/travel/article/california-train-zemu-debut-san-bernardino-19664920.php

One of California’s oldest nudist resorts,

located in the Bay Area, listed for $32.8 million

https://www.sfchronicle.com/realestate/article/south-bay-nudist-resort-for-sale-lupin-lodge-19664552.php

[headlines]

--------------------------------------------------------------

Gimme that Wine

![]()

http://www.youtube.com/watch?v=EJnQoi8DSE8

Healdsburg winemaker reveals secret behind

top-notch Sauvignon Blanc

https://www.pressdemocrat.com/lifestyle/wine/?ref=nav

23 years later, this hip affordable wine brand

in Santa Rosa continues to thrive

https://www.pressdemocrat.com/article/lifestyle/hobo-wine-company-santa-rosa-affordable-wines/

Now That TikTok Wine Ads Are Legal, Marketers Are

Bullish on the Platform's Potential to Reach New Audiences

https://www.winebusiness.com/news/article/291428

Drink to that! NY Gov. Hochul signs law allowing

distilleries to ship direct to consumers

[headlines]

----------------------------------------------------------------

![]()

This Day in History

https://leasingnews.org/archives/Aug2022/08_19.htm#history

-------------------------------------------------------------

SuDoku

The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler?

--------------------------------------------------------------

Daily Puzzle

How to play:

http://www.setgame.com/set/puzzle_frame.htm

Refresh for current date:

http://www.setgame.com/set/puzzle_frame.htm

--------------------------------------------------------------

http://www.gasbuddy.com/

http://www.gasbuddy.com/GB_Map_Gas_Prices.aspx

http://www.gasbuddy.com/GB_Mobile_Instructions.aspx

--------------------------------------------------------------

Weather

See USA map, click to specific area, no commercials

--------------------------------------------------------------

Traffic Live---

Real Time Traffic Information

You can save up to 20 different routes and check them out with one click,

or type in a new route to learn the traffic live

--------------------------------

Wordle

https://www.powerlanguage.co.uk/wordle/

How to Play

https://www.today.com/popculture/popculture/wordle-know-popular-online-word-game-rcna11056

![]()