Information, news, and entertainment for the commercial

alternate financing,

bank, finance and leasing industries

Subscribe

| Search | All Lists | Site Map

Conferences/Forums |

Advertising | Archives | Columnists

Don’t take the bait on phishing scams |Top Ten Stories Chosen by Readers

Contact: kitmenkin@leasingnews.org

![]()

Friday, August 22, 2025

Today's Leasing News Headlines

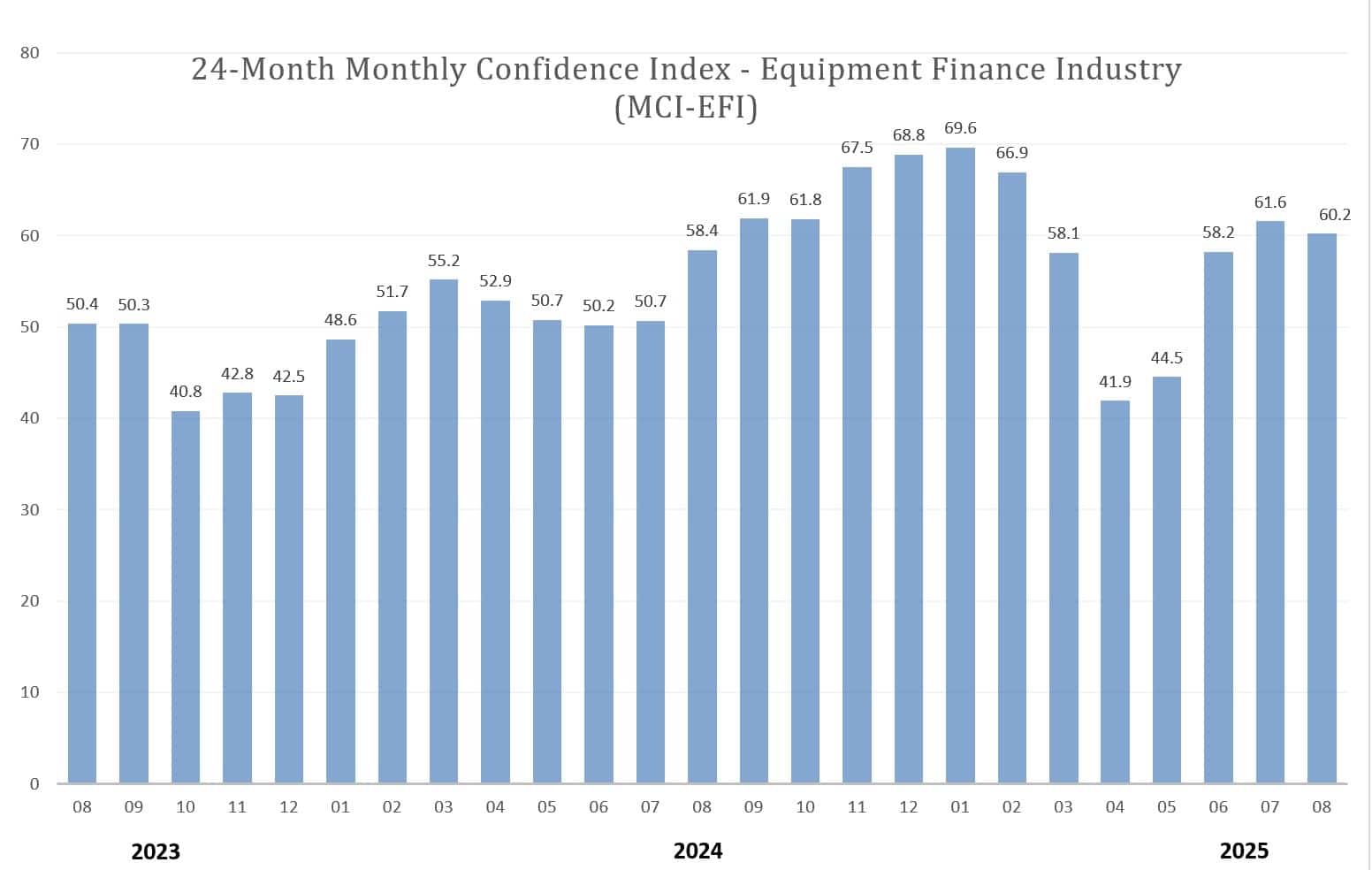

ELFF Reports August Drops from 60.2 in August

From 61.6 in July Monthly Confidence Index

New Hires/Promotions in the Leasing Business

and Related Industries

Funder List "A"

Email to update

Sudhir Amembal, CLFP, Schedules Second Webinar

on Recent Tax Law Changes

Free September 24

Leasing and Finance Industry Help Wanted

Balboa Capital – Several Positions Available

I Want to Move

Career Crossroads By Emily Fitzpatrick/RII

Entegra Capital Notifies Brokers

Ceasing Operations

[headlines]

--------------------------------------------------------------

ELFF Reports August Drops 60.2 in August

From 61.6 in July Monthly Confidence Index

The Equipment Leasing & Finance Foundation shows a loss of confidence in the Equipment Finance Market following three consecutive months of increases.

The press release reports the August 2025 Survey Reports:

- Business Conditions - When assessing the next four months, 26.9% of responding executives believe business conditions will improve (down from 37.5% in July). The majority (69.2%) believe business conditions will remain the same (up from 58.3% in July) and 3.9% believe business conditions will worsen (down slightly from 4.2% in July).

- Capex Demand – For the next four months, 26.9% of the survey respondents believe demand for leases and loans to fund capital expenditures (capex) will increase (down from 37.5% in July). 61.5% expect demand to remain the same (up from 58.3%), and 11.5% believe demand will decline (up from 4.2% in July).

- Access to Capital – Over the next four months, 11.5% of respondents expect greater access to capital to fund equipment acquisitions, a decrease from 16.7% in July. The majority (88.5%) anticipate the same access to capital to fund business, up from 70.8% the previous month. None expect “less access to capital, down from 8.3% in July.

- Employment – Regarding employment over the next four months, 42.3% of executives expect to hire more employees, a sharp increase from 20.8 % in July. 57.7% foresee no change in headcount (down from 70.8% last month), and none expect to hire fewer employees, down from 8.3% in July.

- U.S. Economy – None of the respondents evaluate the current U.S. economy as “excellent,” down from 8.3% in July. 100% assess it as “fair,” up from 91.7% last month, while none evaluate it as “poor” (unchanged from July).

- Economic Outlook – Over the next six months, 23.1% of respondents believe that U.S. economic conditions will “get better,” a notable decline from 41.7% in July. More favorably, 65.4% expect the U.S. economy to “stay the same” (up from 41.7%), and 11.5% believe economic conditions will worsen, a decrease from 16.7% last month.

- Business Development Spending – Over the next six months, 30.8% of respondents believe their company will increase spending on business development activities, up from 25% in July. 69.2% believe there will be “no change” in business development spending (down from 75%), and none believe there will be a decrease in spending (unchanged from last month).

August 2025 MCI-EFI Survey Comments from Industry Executive Leadership:

Bank, Small Ticket

“The impact of tariffs, real or perceived, is still a risk. As costs increase for everyday items and proposed tax cuts aren't yet realized, we are in a state of ‘wait and see.’" Charles Jones, Senior Vice President, 1st Equipment Finance, Inc.

Independent, Small Ticket

“Slowly, we are seeing that tariffs are not moving inflation higher as critics projected. Any relief on the fed funds rate will certainly open up the economy.” James D. Jenks, CEO, Global Finance and Leasing Services, LLC

Independent, Middle Ticket

“At some point in the next two quarters, we should get some consistent policy from the federal government and businesses should be able to plan.” Jeffry Elliott, CLFP, CEO, Elevex Capital and Equipment Leasing & Finance Association Treasurer

Equipment Finance Industry Confidence Steady in August

www.leasefoundation.org/news_item/equipment-finance-industry-confidence-steady-in-august/

[headlines]

--------------------------------------------------------------

New Hires/Promotions in the Leasing Business

and Related Industries

Cory Damm was hired as Chief Marketing Officer, Elevex, Capital, West Lake, Ohio. He is located in Portsmouth, New Hampshire. Previously, he was Managing Director, Velocity Finance (May, 2023 - August, 2025); CEO & Managing Director, Flexing Capital (May, 2022 - April, 2023). He joined Time Payment October, 2019, VP & GM Restaurant and Franchise Group, promoted August, 2020, GM, Marketing and F&B, promoted VP & GM, Capital Markets and Strategic Partnerships (August, 2021 - January, 2022). Full Bio:

https://www.linkedin.com/in/cory-damm-b92baa4/details/experience/

https://www.linkedin.com/in/cory-damm-b92baa4/

Jaimie Haver, CLFP, SHRM, SCP, was hired as Chief Operating Officer of Blue Street Capital, Huntington Beach, California. She is located in Tustin, California. Previously, she was Chief Enthusiasm Officer, Happy Manufacturing, Inc. (June, 2021 - August, 2025); SVP Operations, Commercial Finance Group, Harris Bank (October, 2016 - June, 2021).

https://www.linkedin.com/in/jaimie-haver-clfp-shrm-scp-a0405b1b/

Leslie Roberts was hired as Senior Managing Director at Peapack Capital, a subsidiary of Peapack Private Bank & Trust, Winter Park, Florida. She is located in Smithtown, New York. Previously, she was Vice President, Portfolio Manager, Flagstar Financial & Leasing, LLC. (February, 2016 - August, 2025); Vice President, Credit Manager Macrolease Corporation (April, 2006 - February, 2016); Relationship Manager, North Forth Bank (April, 2000 - October, 2005)).

https://www.linkedin.com/in/leslie-roberts13/

Bret Sorensen was promoted to Chief Revenue Officer, KLC Financial, Minnetonka, Minnesota. He is located in the Greater Minneapolis-St. Paul Area. He joined KLC as Vice President of Sales & Marketing (December, 2022 - July 2025). He was Founder & Convener, Minnesota Bitcoin & Digital Asset Network (October, 2021 - Present); Founder, 295 Strategies (August, 2021 - Present). He joined Compute North as Vice President of Business Development, March, 2022, promoted Vice President/General Manager-Asset Optimization (August, 2022 - December, 2022); Senior Vice President, Bell Bank (August, 2019 - August, 2021). Full Bio:

https://www.linkedin.com/in/brettsorensen1/details/experience/

https://www.linkedin.com/in/brettsorensen1/

[headlines]

--------------------------------------------------------------

Funder List "A"

Page 1 of 2

Click here for full list: leasingnews.org/Funders_Only/Funders.htm

Leasing News as explained when started this list, those listed are responsible to update the information, not Leasing News. Please send update to Kit Menkin (kitmenkin@leasingnews.org)

There is no advertising fee or charge for a listing. They are “free.” Leasing News makes no endorsement of any of the companies listed, except they have qualified to be on this specific list.

To qualify for this list, the company must be a "funder" and not a "Broker/Lessor" or "Super Broker/Lessor." The company may sell off its portfolio from time to time, but the definition is for a company or financial institution where 50% or more of its business is from actually "funding" transactions themselves, where they are on "recourse." Every non-public company's banker and/or investor(s) are contacted to verify this.

Leasing News reserves the right to not list a company who does not meet these qualifications.

We encourage companies who are listed to contact us for any change or addition they would like to make. Adding further information as an "attachment" or clarification of what they have to offer would be helpful to readers are very much encouraged.

[headlines]

--------------------------------------------------------------

Leasing and Finance Help Wanted

Balboa Capital

We Are Growing Our Senior Sales Team Now

[headlines]

--------------------------------------------------------------

Sudhir Amembal, CLFP, Schedules Second

Free Webinar on Recent Tax Law Changes September 24

The webinar, entitled "Recent Tax Legislation and its Impact", conducted by Sudhir Amembal, CEO of Amembal & Halladay, held on August 12, was attended by over 250 industry professionals. Beyond communicating the obvious changes brought about in the “One Big Beautiful Bill,” Mr. Amembal presented the impact of these changes on customers, financiers, and the equipment finance products offered in our industry. He opined that the upcoming CAPEX uptick would benefit both non-tax lease products such as EFAs and Capital Leases as well as the true lease -- the FMV Lease. In doing so, he concluded that the recent changes create a tax puzzle for a large number of customers who have to juggle a host of quantitative variables such as taxable income, NOL complexities, and the limitation on business interest expense along with a host of non-tax considerations in deciding which equipment finance product best suits them’ The puzzle presents an opportunity for financiers to add value by assisting their customers in providing the most appropriate solution.

Mr. Amembal stated "I was delighted that this webinar, the first-ever offered in our industry on this topic, attracted a large number of industry professionals. Tax ramifications are important but the equipment product of choice must take into account a host of other non-tax factors, primarily the unique benefits inherent in the FMV Lease."

Given the significance and the impact of recent tax legislation and given the robust attendance at the webinar, Mr. Amembal will host the free webinar again on September 24.

For further information regarding our seminars, please contact Sudhir Amembal at sudhir@amembalandhalladay.com or General Manager Kelly Farnham at kelly@amembalandhalladay.com.

Amembal, who created the first-ever leasing seminar in the U.S., has been honored by our industry in a multiplicity of ways for having led his firm in training over 80,000 equipment finance professionals worldwide, publishing 18 industry books, and providing consultancy services to a host of equipment finance companies. He is an inductee in ELFA's Hall of Fame, Monitor Converge 2023 and 2024 Nominee for MVP Behind the Scene and The Legend, Monitor 2024 Industry Pioneer Icon, and the first- ever honorary CLFP.

[headlines]

--------------------------------------------------------------

I Want to Move

Career Crossroads By Emily Fitzpatrick/RII

Whether it is a spouse moving, a lifestyle change, wanting to buy a house in an area where you can afford to live, moving closer to your grown-up children, or to help an adult reaching an older age, you first should discuss with your current employer the possibility of working from a remote location. This is typically not an issue if you are in a Business Development role.

However, if you are in a Management or Operations role, your company's computer system or method of operation may not make this feasible. I see "Cloud Computing" growing, meaning anyone from anywhere can access the company computer system without dialing up as all the information is located elsewhere to be downloaded by digital device, tablet, laptop or home computer. I see more and more employees now working from their home.

VOIP or Digital phone as well as a fast internet connection are making it more and more feasible to work away from the main headquarters.

If the only reason for making a move is predicated on location, FIRST discuss with your employer. They may even "lend" you a computer or surprise you by paying for your relocation cost and, if they do, they may request reimbursement should you leave the company within a specified time frame.

You might be surprised to find your employer finding you more valuable than you realize and wanting to keep you working for the firm.

I always recommend talking with your employer to explore all opportunities.

Please call me if you would like to discuss this in person.

Emily Fitzpatrick

Sr. Recruiter

Recruiters International, Inc.

Phone: 954-885-9241

Cell: 954-612-0567

emily@riirecruit.com

Invite me to connect on LinkedIn

www.linkedin.com/pub/emily-fitzpatrick/4/671/76

Also follow us on Twitter #RIIINFO

[headlines]

--------------------------------------------------------------

Entegra Capital Notifies Brokers

Ceasing Operations

As a finance broker that has partnered with Entegra Capital over the past few years, I wanted to make you aware that Entegra Capital has officially ceased operations and the office will be closing permanently on August 22, 2025.

Effective immediately, should you or your customers have questions regarding active contracts, you will now need to reach out to Orion First, the new servicer of our portfolio. These questions (including payoff requests, payment inquiries, etc) should be directed to:

Email Address: customersupport@contractcare.net

Phone Number: 866-851-8804

We sincerely value all of the relationships we have developed over the years and thank you for entrusting your business to us. We will miss you and wish you continued success in the coming years.

Sincerely,

Vickie Rocco and the Entire Entegra Capital Team

Our mailing address is:

Entegra Capital LLC

8900 Indian Creek Parkway, Suite 400

Overland Park, KS 66210-1681

![]()