|

|

|

|

|

|

Learn more www.providentleasing.com |

Wednesday, July 3,2005

Headlines---

Classified Ads --- Sales Manager

Super Brokers' List

Leasing Association Meeting Open to Non-Members

Classified Ads --- Help Wanted

CLEARLINK Reports Details of Settlement

GATX Board Elects Lead Director

U.S. Bancorp Equip. Fin. Names Executive VP/GM

Universal Express Receives Competitive Price From Ford Motors

Vehicle Leasing Back to New York

Xerox Capital Services Chooses Avolent's Online Invoicing

Today's Top Event in History

This Day in American History

Baseball Poem --- Life

Maria C. Martinez-Wong Editor

######## surrounding the article denotes it is a “press release”

|

Classified Ads --- Sales Manager

Atlanta, GA

30 years in transportation Finance with strong management/ sales background. Represented company on national & region markets. Started two successful operations- produce profits and growth.

Email: pml@mindspring.com

Chicago, IL.

Successful sales manager has 15 years experience with captives and independents. Expertise in re-energizing existing sales teams and territories, also building teams from scratch. True Team Leader looking for new challenge. email: Murph5553@aol.com

Chicago, IL

Senior sales manager seeks Chicago based sales management role with growing, creative, customer focused lessor. Extensive experience/documented results in all aspects of information technology leasing.

Email: belanger@dataflo.net

Dallas/Fort Worth, TX.

Domestic-int'l exp. Small to middle ticket. 24 yrs with Fortune 500 firms(2). Consistently achieves margin/ volume goals.

Email: dptr7300@sbcglobal.net

New York, NY

I have over 25 years owning an independent leasing company that specialized in truck leasing. Tow trucks, Limos, ambulances, tractors, etc..

Email: rfleisher@rsrcapital.com

Pennsauken, NJ.

17 Years Leasing in all capacities from CSR and Collections to National Sales Management and Vice President Vendor Development. Exceptional People Skills. Many industry references.

email: cherfurth1@aol.com

Portland, OR.

18+ yrs w/bank leasing company. Supervised 14- 20 sales people. Willing to relocate for the proper position.

Email: pthygeson@netscape.net

Scottsdale, AZ

Have successfully built or rebuilt 3 national sales forces in 3 different industry niches. Strong credit and operations background compliment overall experience. Strong industry references.

Email: azlessor@cox.net

For a full listing of all “job wanted” ads, please go to:

http://64.125.68.91/AL/LeasingNews/JobPostings.htm

To place a free “job wanted” ad, please go to:

http://64.125.68.91/AL/LeasingNews/PostingForm.asp

----------------------------------------------------------------

|

Super Brokers' List

A -Requires Broker be Licensed | B -Sub-Broker Program | C -Warehouse Line | D -Also a Lessor

Rank |

Name In Business Since Contact Website Leasing Association |

Employees |

Geo Area |

Dollar Amount |

Broker Qualify |

A |

B |

C |

D |

1 |

BSB Leasing, Inc. 1982 Skip Wehner, VP 303-329-0227 ext 334 swehner@bsbleasing.com Rick Wehner, Manager Broker Services 303-329-0227 ext 273 rwehner@bsbleasing.com www.bsbleasing.com NAELB (Gold Sponsor), UAEL (Skip Wehner is a Board Member of UAEL) (A) |

15 |

National |

Application Only $5,000 - $100,000, Commercial $50,000 - $500,000 |

Please Call or see application on-line at bsbleasing.com |

N |

N |

Y |

Y |

(A) BSB Leasing, Inc has been providing syndication services for brokers nationwide since 1982 and have been funding business directly since 2002 through BSB Direct Finance, LLC. We offer Brokers a complete internet solution for credit submission and tracking and document preparation.

---------------------------------------------

These companies basically function as a "broker," meaning most of their transactions are sent to other leasing companies or funders.They are not “lessors” or “funders.” An additional description: the majority of their business comes from others, who are acting as a broker. These “deals” may come from an independent, a “company,” or even a “lessor” or “funder.”

Brokers come to them because they may not have the "volume" for the source the "super broker" may have; they may be "too new" in business to qualify for many sources: they may be looking for a better rate than their regular sources, or the transaction was originated by another broker and they need to acknowledge that the transaction comes from another broker, called "sub broker," in the trade (most funders will not accept business from that has been “re-brokered.” .” As important, the sender may not have a regular source for the specific transaction they want to place, such as a young privately held company wanted the lease as “corporate only.”

The transactions may come from a lessor that wants to satisfy their client, and they have a "minimum" that the transaction does not meet; or perhaps their client is to the maximum amount of exposure for them.

For whatever reason, they come to a "super broker" to place the deal on their behalf.

In the question of sub-broker business, we take for granted that the “super broker” not only has a written agreement with the sub-broker but informs the lessor when submitting an application it has come from a sub-broker. A violation of this will have the company removed from the list.

This list is not does not include leasing companies who "fund" the majority of the transactions they receive.

In addition to the above qualifications, the "Super Broker" must have a "clean" Better Business Bureau rating, no Leasing News Bulletin Board complaints or a poor record, and must belong to a national leasing association, as we view this that they are professional and abide by their association standards and code of ethics.

We also will be verifying warehouse lines or "lessor" lines with their bankers (as done with those on the Story Credit List.)

Leasing News reserves the right not to list any company it believes does not meet the qualifications as stated above.

----------------------------------------------------------------

-------------------------------------------------------------

August 3rd, Costa Mesa, Ca. Broker Workshop

-this is an association of companies who have

gotten together to not only present their programs

but to provide a forum to instruct and education

those who submit leases to funding sources---

"It's being held the same day as the 4th Annual Angel Game Night - Take me out to the Ball Game! Brokers can attend the workshop during the day, attend the ball game at night. Initial response has been excellent. In the past we have had anywhere from 15 to 35 brokers attend our "free lunch" but we're expecting over 100 brokers to attend this workshop. Space is limited and that's why we're encouraging reservations."

Norm Malkowiski

Structured Leasing - That’s Where The Money Is!

An Equipment Leasing Broker Workshop - August 3, 2005

Location: Experian Building, Costa Mesa, California

Mesa Leasing has been sponsoring lunch meeting for all equipment leasing brokers in southern California for over 2 years. The meetings have helped to educate each of us about what is going on in our industry locally. It has also opened eyes to new opportunities through the sharing of knowledge. This workshop continues that effort to educate and offer new opportunities to brokers within the industry.

The enclosed flyer provides a brief overview of the “workshop” Mesa Leasing is producing. The workshop is designed to offer brokers insight into a market niche we and other Funding sources target – C & D Credits. Several funding Sources have committed to attend the workshop and share with the brokers what is necessary to put more money in their pocket.

The workshop consists of 2 specific areas of interest. First, each Funding Source is helping to sponsor this workshop. They will have a designated area where several brokers can meet and discuss the niche served by a specific lender. Brokers will learn what special areas of interest each source might have. Brokers will share in the knowledge gained by the questions asked by other brokers at the table. Brokers will come prepared with questions and a willingness to share.

The second part of the workshop involves a 20 to 30 minute presentation by each funding source to those of interest. In a classroom environment, each Funding Source will present their program and educate the Brokers as to how to generate more business with them.

Brokers are encouraged to come prepared to discuss specific applications they may have had turned down by other funding sources. Perhaps they may walk out with an approval turning that “turn-down” into income.

This workshop will be of special interest to brokers “on the street”. They will learn what questions to ask – the first time you meet with the customer!

Space is limited! Brokers are encouraged to reserve their spot- NOW! There is a small cost of $10 to the Broker. But when one considers the information obtained, and that lunch is included, this is an excellent workshop. Brokers don’t want to miss an opportunity never before available in southern California.

http://leasingnews.org/PDF/CCreditFlyer1.pdf

For information or reservations contact: Lauren@mesaleasing.com or

858-541-1002

Norm Malkowski

Mesa Leasing, Inc.

"Funding Sub-Prime Credits in California"

4180 Ruffin Road, #205

San Diego, CA 92123

858-541-1002 Phone

858-541-1006 Fax

619-743-7111 Mobil

------------------------------------------------------------

August 10, 2005

UAEL PRESENTS AN EVENING OUT WITH:

Colorado Rockies

VS.

Pittsburgh Pirates

IN THE OWNER'S BOX!

WHEN: Wednesday August 10, 2005 at 7:05 PM|

WHERE: Coors Field at the Owner's Box

HOW MUCH: $35.00 Per person

Please remit payments to Kim at UAEL

78120 Calle Estado, Ste 201

La Quinta, CA 92253

760-564-2227

INCLUDES: Ticket to owners box, food and beverages.

For more information please contact:

Scott Woodring at Pawnee Leasing # 970-482-2556 ext 255

or

Skep Wehner at BSB Leasing # 800-945-3372 ext 334

COMPANY EMPLOYEES ARE INVITED AS WELL AS FAMILY AND FRIENDS!!

AVAILABILITY IS LIMITED – GET YOUR TICKETS NOW!!

-------------------------------------------------------------

![]()

September 19-21 ELA Lease Accountants Conference

"If you are planning to attend the ELA Lease Accountants Conference, scheduled for September 19-21, 2005 at the JW Marriott Hotel, New Orleans, Louisiana, complete conference details including hotel and conference registration, are now available online: http://www.elaonline.com/events/2005/leaseaccts/

This premier event includes programming for both new and seasoned accounting professionals. Special bonus: Two pre-conference workshops on accounting for commercial vehicle fleet leasing and leases involving real estate have been added to the program. These workshops are scheduled on Monday, September 19, 2005 from 9:00 am – Noon and are free to all fully-registered conference attendees. If you wish to attend one of the workshops, simply check the appropriate box on the conference registration form.

The full conference agenda includes sessions that address:

Doing business in a changing corporate environment: understanding the regulatory, tax and accounting impact Current & emerging developments at the FASB and how they impact lease accounting The impact of the SEC report on off-balance sheet arrangements on leasing Current status and outlook of proposed FASB standards related to off-balance sheet accounting and financial reporting for securitization implementation and interpretive questions Update on the latest developments in accounting for cross-border transactions Changes in the accounting treatment of tax benefits in leverage leases."

For complete details, including registration information, please go here: http://www.elaonline.com/events/2005/leaseaccts

--------------------------------------------------------------

Oct. 21-22, 2005

Western Regional Meeting

National Association of Equipment Brokers

Hilton Irvine Irvine, California

For more information: mwilson@hqtrs.com

---------------------------------------------------------------------

November 4-5

Eastern Regional Meeting

National Association of Equipment Brokers Atlanta, Georgia

For more information: mwilson@hqtrs.com

----------------------------------------------------------------

Classified Ads --- Help Wanted

Account Executives

|

|

Account Executives to work from our corp. office Aliso Viejo, CA. Exper. only, aggressive, 4 yr college degree required. Lucrative uncapped commission plan/environment conductive to success. To learn more, click here. |

|

Learn more www.providentleasing.com |

Lease Administrator

|

|

|

San Francisco, CA. College Degree plus contract/ lease administration experience required. For a full description, click here. Email resume to |

Lease pricing division economic analysis / analytical support

| San Francisco Office

Two openings lease pricing division |

|

|

|

In business since 1958, DLC is an independent funding source servicing the $10K-250K market in 11 western states. |

Tax Manager

|

|

For complete description and application, click here. |

###Press Release######################

CLEARLINK Reports Details of Settlement

Mississauga, Ontario, CLEARLINK Capital Corporation announced that, it settled unconditionally its litigation with the City of Windsor and The County of Essex regarding the regional landfill. Under the settlement, the Corporation contributed approximately $14 million in cash and extinguished certain contractual claims it had for approximately $5 million.

In addition, the majority of the dollar exposure on the equipment leasing disputes with the City of Windsor has been settled unconditionally with CLEARLINK making a $7 million payment to the City. The parties have also agreed to a further mediation and arbitration process to settle the relatively smaller claims in the remaining leases.

The Corporation believes it has now achieved substantial resolution of this $300 million litigation matter, (other than the remaining leases) that had significantly impaired its business conduct over the past several years. Of further importance, this matter has been settled within the financial reserves established by the Corporation in its Fiscal 2005 financial statements.

CLEARLINK Capital Corporation is a provider of innovative financial solutions in technology and equipment leasing, and equipment trading. Based in Mississauga, Ontario, CLEARLINK operates throughout North America and Europe.

CLEARLINKTM is a trademark of CLEARLINK Capital Corporation.

###Press Release#######################

![]()

GATX Board Elects Deborah Fretz Lead Director

CHICAGO--The board of directors of GATX Corporation (NYSE:GMT) announced they have elected Deborah M. Fretz to the new position of lead director.

Among her responsibilities as lead director, Ms. Fretz will serve as a formal liaison between the independent directors and senior management of the Company, chair the executive sessions of the board's independent directors, act as ex officio member of each board committee, and assist with establishing the agenda for each board meeting. Currently, eight of GATX's ten directors satisfy the independence standards of the New York Stock Exchange and the Company's standards of independence.

Ms. Fretz was first elected to the board of directors of GATX in December 1993 and served as chair of the audit committee from 1999 until her election as lead director. Ms. Fretz was named President and Chief Executive Officer of Sunoco Logistics Partners, L.P., an owner and operator of refined product and crude oil pipelines and terminal facilities, in October 2001.

Mr. Michael E. Murphy, director of GATX since 1990 and retired former Vice Chairman and Chief Administrative Officer of Sara Lee Corporation, was elected to succeed Ms. Fretz as chair of the audit committee.

Further information on GATX's corporate governance is available on the Company's website at www.gatx.com in the investor relations section.

COMPANY DESCRIPTION

GATX Corporation (NYSE:GMT) provides lease financing and related services to customers operating rail, air, marine and other targeted assets. GATX is a leader in leasing transportation assets and controls one of the largest railcar fleets in the world. Applying over a century of operating experience and strong market and asset expertise, GATX provides quality assets and services to customers worldwide. GATX has been headquartered in Chicago, IL since its founding in 1898 and has traded on the New York Stock Exchange since 1916. For more information, visit the Company's website at www.gatx.com.

Investor, corporate, financial, historical financial, photographic and news release information may be found at www.gatx.com.

CONTACT: GATX Corporation

Rhonda S. Johnson (Investor Relations), 312-621-6262

SOURCE: GATX Corporation

###Press Release#######################

U.S. Bancorp Equipment Finance Names McBeth

Executive VP/GM of Capital Equipment Group.

PORTLAND, Ore. — U.S. Bancorp Equipment Finance, Inc. has named R. Blair McBeth, Jr. executive vice president and general manager of its Capital Equipment Group. McBeth replaces Greg Mamula, who will be retiring after 14 years with U.S. Bancorp. McBeth will be based in Portland and report to Sal Maglietta, president and chief executive officer of U.S. Bancorp Equipment Finance, Inc.

In his new role, McBeth will manage and lead the largest of four lines of business that comprise U.S. Bancorp Equipment Finance, which provides flexible and competitive equipment financing for middle-market and investment-grade companies across the United States.

“We welcome Blair's breadth of industry knowledge and seasoned management skills, and are pleased to have attracted someone with his notable background,” said Maglietta. “At the same time I'm saddened to be losing Greg's leadership, expertise and insight. He's been a valued member of our senior management team.”

McBeth has worked in the equipment leasing and finance industry for more than 26 years, most recently with ORIX Financial Services in Atlanta, where he was senior vice president and sales manager of the structured finance division. Prior to that post, he worked for ICX Corporation based in Cleveland, and as national sales manager for Citicapital Bankers Leasing in Harrison, N.Y. His experience also includes senior sales management positions with GE Capital–Phoenixcor in Norwalk, Conn. and the CIT Group, Capital Equipment Financing, Inc. in New York.

A graduate of Dickinson College in Carlisle, Pa., McBeth earned his bachelor's degree in political science and went on to earn a master's degree from the American Graduate School of International Management in Phoenix.

U.S. Bancorp Equipment Finance, Inc., one of the largest bank-affiliated equipment finance companies in the nation, has been providing quality equipment finance solutions for more than 30 years. It is a major funding source for companies in virtually every industry sector nationwide.

U.S. Bancorp Equipment Finance, Inc. is part of U.S. Bancorp (NYSE: USB). With $204 billion in assets, U.S. Bancorp is the 6th largest financial holding company in the United States. The company operates 2,383 banking offices and 4,877 ATMs in 24 states, and provides a comprehensive line of banking, brokerage, insurance, investment, mortgage, trust and payment services products to consumers, businesses and institutions. U.S. Bancorp is home of the Five Star Service Guarantee in which the company pays customers if certain key banking benefits and services are not met. U.S. Bancorp is the parent company of U.S. Bank. Visit U.S. Bancorp on the web at usbank.com.

Sites of Reference:

CONTACT:

Patty Wampler

U.S. Bancorp Equipment Finance Inc.

Phone Number: 503-797-0846

Fax Number: 503-797-0490

E-mail: patricia.wampler@usbank.com

###Press Release#######################

Universal Express Receives Special Competitive

Price Allowance From Ford Motors

NEW YORK--Universal Express Inc. (OTCBB: USXP), announced that it has received a special competitive price allowance (CPA) from Ford Motors to offer van leasing incentives to private postal stores and couriers through it's subsidiary, Universal Express Logistics.

Ford Motors has offered Universal Express Logistics an aggressive leasing incentive that will be passed along to private postal stores and couriers throughout the United States. This offer gives Universal Express Logistics the opportunity to promote and sell fleet services of select 2006 Ford vehicles at very competitive prices.

"Ford's aggressive competitive price allowance will put Universal Express Logistics and UniversalPost in the forefront of the van and fleet leasing industry. We're looking forward to our upcoming incentive programs to promote this special pricing to approximately 13,000 private postal stores and courier's national wide. Our persistence and patience in finding the best leasing options for all private postal stores has finally paid off with Ford bringing us the best offer available", said Mr. Richard Altomare, CEO and Chairman of Universal Express, Inc.

Ford has also provided Universal Express Logistics with a competitive assistance offer that will provide the fleet of leased vehicles with significant acquisition economics and purchasing flexibility throughout the 2006 model year which includes Roadside Assistance, and access to the Ford Fleet Customer Information Center.

About Universal Express

Universal Express, Inc. is a 22 year old logistics and transportation conglomerate with multiple developing subsidiaries and services. For additional information please visit www.usxp.com

Safe Harbor Statement under the Private securities Litigation Reform Act of 1995: The statements contained herein, which are not historical, are forward-looking statements that are subject to risks and uncertainties that could cause actual results to differ materially from those expressed in the forward-looking statements including, but not limited to, certain delays beyond the Company's control with respect to market acceptance of new technologies, products and services, delays in testing and evaluation of products and services, and other risks detailed from time to time in the Company's filings with the Securities and Exchange Commission.

###Press Release#######################

Vehicle Leasing Back to New York, Says Greater

New York Automobile Dealers Association

NEW YORK, - When President Bush signs the federal highway bill New Yorkers will likely get a special bonus -- the return of vehicle leasing. The Bill includes a ban on vicarious liability – the antiquated law that holds a leasing company liable for a driver's negligence which has forced 20 automakers and every major retail bank in New York out of leasing. The elimination of vicarious liability has long been an initiative of the Greater New York Automobile Dealers Association (GNYADA), and is expected to bring automakers back into the business of leasing vehicles in New York.

GNYADA president, Mark Schienberg, welcomed the federal action.

"I am pleased with this bill, which results in repealing lessor vicarious liability in New York," said Schienberg. "The anticipated signing of this Bill means that all New Yorkers will be able to again lease vehicles. This antiquated law has hurt the retail auto industry, and we are pleased that Congress has put an end to it."

Vicarious liability is a legal concept that holds a leasing company liable for the actions of the driver of a leased vehicle. According to information released by GNYADA and the Alliance of Automobile Manufacturers earlier this year, it has cost consumers in New York more than $280 million in extra costs since 2003, and has eroded choice from the market place. The passage of this bill ends a long-running battle with the trial lawyers who supported vicarious liability and brings New York in line with the other 49 states which have already eliminated it.

Vicarious liability has forced 20 manufacturers, including all of the GM, Ford, and Chrysler brands and every major retail bank and credit union in New York out of leasing. The repeal is expected to bring the automakers and banks back into the New York leasing market.

"Historically, automobile leasing programs have allowed thousands of New Yorkers to drive new vehicles at more affordable monthly payments. Leasing is an important alternative financing option for families looking for newer, safer vehicles and for small and large businesses looking to expand their fleets. It is an option that all consumers deserve, and we are pleased that New Yorkers will again have the ability to lease vehicles," Schienberg concluded.

The Greater New York Dealers Association, a not-for-profit organization represents 650 franchised automobile dealerships in the metro are of New York, which sells more than 700,000 cars each year. Its members generate more than $1.2 billion for state and local governments and employ (directly and indirectly) approximately 54,000 individuals in metro New York.

###Press Release#######################

|

Your One stop solution for training and reference material for the Leasing Professional

|

Xerox Capital Services Chooses Avolent's Online Invoicing

Avolent Inc., the leading provider of Interactive eBilling software, announced that Xerox Capital Services, LLC (a joint venture of GE Commercial Financial Services and Xerox Corporation), has selected Avolent's BizCast™ web-based invoicing solution. Xerox Capital Services will be the first in the industry to offer customers online self-service to review, parse, dispute, approve and pay invoices. Using BizCast, Xerox Capital Services anticipates significantly reducing invoice process costs, streamlining IT operations, and lowering Day Sales Outstanding (DSO), while setting new industry standards in customer service.

The Leasing Industry Today – more than the “Art of the Deal”

Equipment leasing is a $200 billion industry in the U.S. with over 35% of all business capital being leased. With “commoditized” products and aggressive competitors, leasing firms can no longer depend on winning deals based on price or products, but must focus on operational efficiency and customer service to maintain a competitive edge. Xerox Capital Services realized that one area of high operational costs and immense frustration for both leasing firms and their customers was the manual and complex invoicing process, where the invoices vary significantly each month based on usage of the equipment (i.e. number of copies) and how companies charge back equipment within their organization.

“With millions of invoices sent every year, billing represents a critical interaction with our diverse group of customers and their specific product and service needs”, stated Kevin Divine, eBusiness Leader at Xerox Capital Services. “We believe that Avolent's online solution can help XCS reduce the cost and administrative workload for invoice processing.” Xerox Capital Services successfully deployed the application in April of 2005.

"Xerox Capital Services understands that you don't have to sacrifice raising the bar on customer service to achieve operational effectiveness," stated Doug Roberts, chief executive officer of Avolent. "We are pleased to support Xerox Capital Services in leading the industry in this effort – minimizing the back-office financial cost and resource commitment of invoice processing and payment.”

About Xerox Capital Services

Xerox Capital Services, LLC (XCS) is a joint venture owned 81% by GE Capital and 19% by Xerox Corporation. With over 1,800 employees in four major locations, XCS is a world-class provider of specialized administration, financing and servicing programs for Xerox, its vendors, distributors, dealers and resellers in the United States.

About Avolent

Avolent provides application software for Interactive eBilling for large organizations that want to connect with customers online. Avolent's award winning BizCast software product suite streamlines all processes in the invoice-to-cash cycle through real-time electronic invoicing and payment, customer self-service, cash management, forecasting, and a unique patent-pending ability to dynamically adjust trade terms to meet corporate financial goals. Avolent's BizCast processes over $44 billion in invoices annually for customers such as AT&T, MasterCard, Highmark, Do It Best, Office Depot, PacifiCare, Xerox Capital Services, Unisys, Wells Fargo, and two of the three largest PC suppliers. For more information call (800) 553-5505 or visit www.avolent.com.

Sites of Reference:

CONTACT:

Rich Koch

Avolent

Phone Number: (415) 553-6974

Fax Number: (415) 553-6499

E-mail: rkoch@avolent.com

###Press Release#######################

----------------------------------------------------------------

Today's Top Event in History

1492--- Christopher Columbus ( Christophe Colombo ) set sail half a hour before sunrise from the harbor of Palos, Spain. With three ships, Nina, Pinta and Santa Maria, and a crew of 90, he sailed “for Cathay” but found instead a New World of the Americas, first landing at Guanahani ( San Salvador Island in the Bahamas ) October 12. He returned 224 days later, on March 14, 1493, to Lisbon, where he dispatched two letters of identical content, one to Raphael Sanchez and the other to Luis de Santangel, to describe the new world he had discovered. While he never set foot on the mainland of the United States or even called it America, he described what he thought were islands of China. He was to return to the area three more times. During his fourth and final expedition (1502-1504) Columbus (who's Italian name was Cristo Columbo---history changed it to Columbus on a map written in Latin ) discovered Martinique, and explored the coasts of present-day Honduras, Nicaragua, Costa Rica, and Panama.

(lower part of http://memory.loc.gov/ammem/today/aug03.html )

----------------------------------------------------------------

|

This Day in American History

1492--- Christopher Columbus ( Christophe Colombo ) set sail half a hour before sunrise from the harbor of Palos, Spain. With three ships, Nina, Pinta and Santa Maria, and a crew of 90, he sailed “for Cathay” but found instead a New World of the Americas, first landing at Guanahani ( San Salvador Island in the Bahamas ) October 12. He returned 224 days later, on March 14, 1493, to Lisbon, where he dispatched two letters of identical content, one to Raphael Sanchez and the other to Luis de Santangel, to describe the new world he had discovered. While he never set foot on the mainland of the United States or even called it America, he described what he thought were islands of China. He was to return to the area three more times. During his fourth and final expedition (1502-1504) Columbus (who's Italian name was Cristo Columbo---history changed it to Columbus on a map written in Latin ) discovered Martinique, and explored the coasts of present-day Honduras, Nicaragua, Costa Rica, and Panama.

(lower part of http://memory.loc.gov/ammem/today/aug03.html )

1492-The first letter containing a description of America was probably written by the explorer Christopher Columbus. He dispatched two letters of identical content, one to Raphael Sanchez and the other to Luis De Santangel. The first use of the word “America” came from German mapmaker Martin H. Waldessmuller, who named the new land in a map in the honor of Italian explorer Amerigo Verspucci of his discoveries in South America. Other map makers took copies his maps and names, including “America.”

1900- Ernie Pyle was born at Dana, [N, and began his career in journalism in 1923. After serving as managing editor of the Washington Daily News, he returned to his first journalistic love of working as a roving reporter in 1935. His column was syndicated by nearly 200 newspapers and often focused on figures behind the news. His reports of the bombing of London in 1940 and subsequent reports from Africa, Sicily, Italy and France earned him a Pulitzer Prize in 1944. He was killed by machine-gun fire at the Pacific island of le Shima, Apr 18, 1945.

1900- Central figure in a cause célèbre (the “Scopes Trial” or the “Monkey Trial”), John Thomas Scopes was born today at Paducah, KY. An obscure 24-year-old schoolteacher at the Dayton, TN, high school in 1925, he became the focus of world attention. Scopes never uttered a word at his trial, which was a contest between two of America's best-known lawyers, William Jennings Bryan and Clarence Darrow. The trial, July 10—21,1925, resulted in Scopes's conviction. He was fined $100 “for teaching evolution” in Tennessee. The verdict was upset on a technicality and the statute he was accused of breaching was repealed in 1967. Scopes died at Shreveport, LA, Oct 21, 1970.

1904—Use of “American” as an adjective instead of “United States” was officially recommended by John Hay, secretary of state, who instructed American diplomatic and consular officers to adopt it.

1911--Danish woodcarver Charles Looff delivered the classic carousel to the Santa Cruz Beach Boardwalk, California.. A furniture-maker by trade, Looff began carving carousel animals as a hobby after immigrating to America. His first carousel was installed at Coney Island in New York in 1875. The Boardwalk carousel features jeweled horses and a 342-pipe Ruth band organ built in 1894. The carousel and the park's Giant Dipper roller coaster were designated National Historic Landmarks by the US National Par

1923 - Calvin Coolidge was sworn in as the 30th president of the United States, following the death of Warren G. Harding. k Service in June of 1987.

http://memory.loc.gov/ammem/today/aug03.html

1926 --Tony Bennett Birthday, born Tony Benedetto.

http://www.jazzdiscography.com/Artists/Bennett/

http://www.tony-bennett.com/newsFr.html

http://www.tonybennettart.com/index2.html

1946---Top Hits

The Gypsy - The Ink Spots

Doin' What Comes Naturally - Dinah Shore

They Say It's Wonderful - Frank Sinatra

New Spanish Two Step - Bob Wills

1948 --Negro League legend Satchel Paige makes his major league debut hurling seven innings to lead the Indians over the Senators, 5-3.

1954 - For that time, a record divorce settlement was awarded to Mrs. Barbara (Bobo) Rockefeller when her ex, Winthrop Rockefeller, was ordered to pay $5,500,000 to his ex-wife.

1954---Top Hits

Sh-Boom - The Crewcuts

The Little Shoemaker - The Gaylords

Hey There - Rosemary Clooney

One by One - Kitty Wells & Red Foley

1958 - The submarine USS Nautilus began the first crossing of the Arctic Ocean under ice cap. With a crew of 116 men, the Nautilus was commanded by William R. Anderson. The Nautilus was the world's first nuclear powered submarine.

1962---Top Hits

Roses are Red - Bobby Vinton

The Wah Watusi - The Orlons

Sealed with a Kiss - Brian Hyland

Wolverton Mountain - Claude King

1963 - The college football all-stars beat the Green Bay Packers 20-17. It was a huge upset as the college team had been underdogs with odds of 50-1.

1963 - It was the final appearance at the Cavern Club in Liverpool, England for The Beatles as they weres about to leave their hometown for world fame and fortune.

1963 - Capitol Records released The Beach Boys' song, "Surfer Girl". It became one of their biggest hits, making it to number seven on the hit music charts on September 14, 1963.

1963 - Warner Brothers Records released comedian Allan Sherman's summer camp parody, "Hello Mudduh, Hello Fadduh! (A Letter from Camp)". The song would go to number two on the pop charts on August 14, 1963.

1968—Birthday of Rodney Roy “Rod” Beck, baseball player, born Burbank, Ca.

1968 - "Hello, I Love You," recorded by The Doors, jumped into the top spot on Billboard's hit record charts, and stayed there for 2 weeks.

1970 - Hurricane Celia struck the coast of Texas producing wind gusts to 161 mph at Corpus Christi, and estimated wind gusts of 180 mph at Arkansas Pass. The hurricane was the most destructive of record along the Texas coast causing 454 million dollars damage, and also claimed eleven lives

1970---Top Hits

(They Long to Be) Close to You - Carpenters

Make It with You - Bread

Signed, Sealed, Delivered I'm Yours - Stevie Wonder

Wonder Could I Live There Anymore - Charley Pride

1978---Top Hits

Shadow Dancing - Andy Gibb

Baker Street - Gerry Rafferty

Miss You - The Rolling Stones

Only One Love in My Life - Ronnie Milsap

1979 - "Tonight Show" host Johnny Carson, appeared on the cover of the Burbank, California telephone directory.

1979 - Jai-alai player Jose Ramon Areitio threw the fastest ball ever recorded at a speed of 188 mph (301 kph). Jai-alai is a sport that originated in the Basque region of Spain and France, and it consists of throwing a ball with a long, curved basket against a wall.

1979-The Knack hit the top of both the album and singles charts, with their LP, "Get The Knack" and the single, "My Sharona.

1981 - United States air traffic controllers went on strike, despite a warning from President Ronald Reagan that they would be fired.

1984 - At the 1984 Olympics held in Los Angeles, American Mary Lou Retton won gold in all-around gymnastics.

1985 - Mail service was reinstated to Paradise Lake, Florida, a nudist colony, after residents promised they would wear clothes or at least stay out of sight when the mailperson came to deliver.

1985-Bruce Springsteen's "Glory Days" peaks at #5 on the chart, while Sting's "If You Love Somebody Set Them Free" peaks at #3

1986---Top Hits

Glory of Love - Peter Cetera

Papa Don't Preach - Madonna

Mad About You - Belinda Carlisle

Nobody in His Right Mind Would've Left Her - George Strait

1987 - Joe Niekro got a 10 day suspension for throwing scuffed baseballs. At first he denied the charge made by the home plate umpire, but changed his tune when an emery board fell out of his pocket during an inspection.

1987 - The Iran-Contra congressional hearings ended, with none of the 29 witnesses tying President Ronald Reagan directly to the diversion of arms-sales profits to Nicaraguan rebels.

1988-Steve Winwood's "Roll With It" hits #1 on the chart.

1989 - Thunderstorms representing what remained of Hurricane Chantal drenched Wichita, KS, with 2.20 inches of rain in four hours during the early morning. Thunderstorms developing in Minnesota produced wind gusts to 85 mph at Baudette during the afternoon, and softball size hail at Lake Kabetogama, during the evening. Jamestown, ND, reported a record hot afternoon high of 103 degrees

2002 --In just the first four innings, Edgar Martinez ties a the major league record for sacrifice flies in a game with three. The Mariners' designated hitter becomes the 11th player in history to accomplish the feat doing it in his first three at-bats in Seattle's 12-4 victory over the Indians.

----------------------------------------------------------------

http://leasingnews.org/images/baseball.jpg

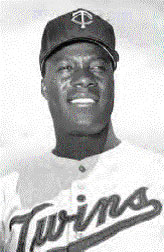

Baseball Poem

Life

by Jim "Mudcat" Grant

Life is like a game of baseball

And you play it every day.

It isn't just the breaks you get,

But the kind of game you play.

Stop and look the whole team over,

You've got dedication there.

You're bound to be a winner,

With men who really care.

Your pitcher's name is courage,

You need him in this game.

For trust and faith your keystone men,

The grounders they will tame.

Your centerfielder is very fast,

Though small and hard to see.

So watch him when he gets the ball,

He's opportunity.

At first base there's religion,

He's stood the test of time.

At third base there is brotherhood,

A stalwart of the nine.

Your leftfielder is ambition,

Don't ever let him shirk.

Rightfielder is a husky man,

You'll find his name is work.

Your catcher's name is humor,

He's important to the scheme.

While honor is pitching from the bull pen,

Your game is always clean.

With love on your bench,

You've perfection, no less.

And a winning team,

With joy and happiness.

The other team is strong,

Greed, envy, hatred, and defeat

Are four strong infielders you'll have to buck,

To make your game complete.

Discouragement and falsehood,

Are the big boys in the pen.

You'll have to swing hard,

When you meet up with them.

Carelessness and a man called waste,

You'll find them playing hard.

And selfishness and jealousy,

None can you disregard.

There's one more man you'll have to watch,

He's always very near.

He's the pitcher for this team,

I'm told his name is fear.

The game will not be easy,

There'll be struggle, there'll be strife.

To make the winning runs,

For it's played on the field of life.

So stand behind your team,

There'll be many who'll applaud.

Just remember you are the player,

And the umpire there is God.

|

www.leasingnews.org |