![]() Add me to mailing list |

Add me to mailing list | ![]() Change email |

Change email | ![]() |

| ![]() Search

Search

Advertising | All Lists | Archives | Classified Ads | This Day In American History

Leasing News is a web site that posts information, news, and

entertainment for the commercial alternate financing,

bank, finance and leasing industries

kitmenkin@leasingnews.org

![]()

Monday, December 11, 2017

(Please click on Kettle)

Bruce Kropschot, Reid Raykovich, CLFP, Dean Rubin

Today's Equipment Leasing Headlines

Position Wanted – Asset Management

Work Remotely or Relocate for Right Opportunity

Top Stories -- December 4 - December 6

(Opened Most by Readers)

Finally! New York Attorney General’s Office Goes After

Northern Leasing

By Tom McCurnin, Leasing News Legal Editor

Leasing Industry Ads---Help Wanted

Harbour Capital/Maxim Commercial Capital

When a Debtor Tries to Pull Their Payment Out of a Hat

By Nancy Seiverd, President, CMI Credit Mediators Inc.

Leasing 102 by Mr. Terry Winders, CLFP

Bankruptcy

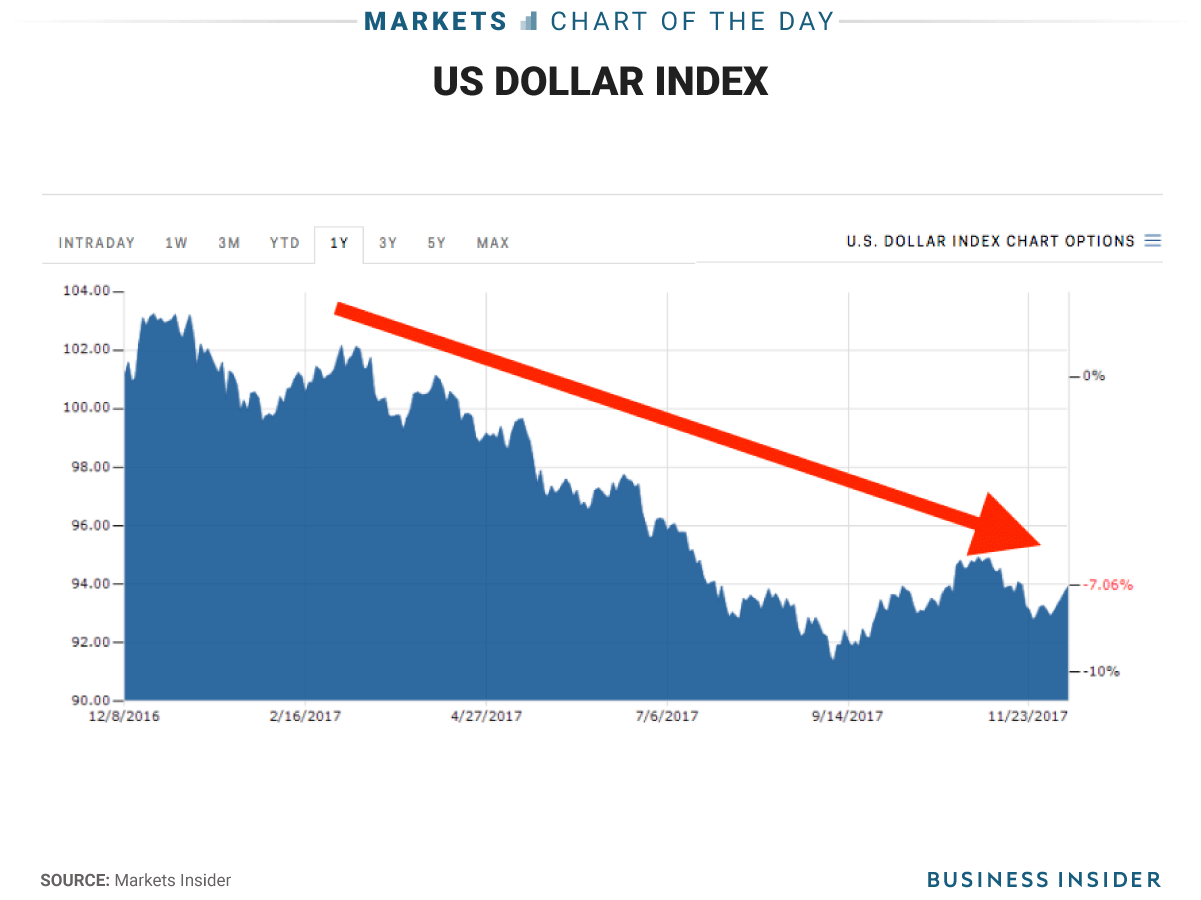

The dollar is set for a big rebound after a difficult year

By Akin Oyedele, Business Insider

The Most Valuable Companies of All-Time

Modern Juggernauts like Apple & Amazon Don't Even Come Close

Former President/CEO Farmer's Exchange Bank Sentenced

Over $500,000, but a large amount for a town 434

Small German Shepherd

New York City Greater Area Adopt-a-Dog

Attorneys Who Specialize in

Banking, Finance, and Leasing

News Briefs---

Banc of California Exec. turned Firm's Headquarters

into Sex Den: Suit -- More like Hotel California

$7M cab leasing scheme leads to prison

for ex-Hoboken council president

The FCC plans to repeal net neutrality this week

— and it could ruin the internet

Broker/Funder/Industry Lists | Features (writer's columns)

Top Ten Stories Chosen by Readers | Top Stories last six months

www.leasingcomplaints.com (Be Careful of Doing Business)

www.evergreenleasingnews.org

Leasing News Icon for Android Mobile Device

You May have Missed---

Poem

Sports Brief----

California Nuts Brief---

"Gimme that Wine"

This Day in History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

######## surrounding the article denotes it is a “press release”

and was not written by Leasing News nor information verified, but from the source noted. When an article is signed by the writer, it is considered a “by line.” It reflects the opinion and research of the writer.

Please send a colleague and ask them to subscribe. We are free.

Email kitmenkin@leasingnews.org and in subject line: subscribe

[headlines]

--------------------------------------------------------------

Position Wanted – Asset Management

Work Remotely or Relocate for Right Opportunity

Each Week Leasing News is pleased, as a service to its readership, to offer completely free ads placed by candidates for jobs in the industry. These ads also can be accessed directly on the website at:

http://www.leasingnews.org/Classified/Jwanted/Jwanted.htm

Each ad is limited to (100) words and ads repeat for up to 6 months unless the candidate tells us to stop. Your submissions should be received here by the end of each week.

Please encourage friends and colleagues to take advantage of this service, including recent graduates and others interested in leasing and related careers.

Asset Management

|

[headlines]

--------------------------------------------------------------

Top Stories -- December 4 - December 6

(Opened Most by Readers)

(1) Section 179 Depreciation Differs

in House and Senate Versions

http://leasingnews.org/archives/Dec2017/12_06.htm#179

(2) Looks Like No Changes to Section 179

But No Definitive News to Date

http://leasingnews.org/archives/Dec2017/12_04.htm#looks

(3) Marlin Wins Court of Appeal Reversal in Trial Court Which

Denied "Full Fair and Credit" to Default Judgement on Lease

By Tom McCurnin, Leasing News Legal Editor

http://leasingnews.org/archives/Dec2017/12_08.htm#marlin

(4) Brokers & Lenders: Are You Registered to Conduct Business

(doesn’t concern “license”) in your Key States?

By Tom McCurnin, Leasing News Legal Editor

http://leasingnews.org/archives/Dec2017/12_04.htm#bandl

(5) Sales Makes it Happen by Christopher Menkin

What can you learn from GreatAmerica Financial Services?

http://leasingnews.org/archives/Dec2017/12_04.htm#what

(6) New Hires/Promotions in the Leasing Business

and Related Industries

http://leasingnews.org/archives/Dec2017/12_08.htm#hires

(7) November, 2017 - The List

"The Good, the Bad and the Ugly"

http://leasingnews.org/archives/Dec2017/12_06.htm#nov_list

(8) State Licensing and Usury Laws:

An Updated Overview of a Few Troublesome States

By Barry Marks, CLFP

http://leasingnews.org/archives/Dec2017/12_06.htm#usury

(9) Guilt by Association

Recruiter Hal T. Horowitz Speaks Out

http://leasingnews.org/archives/Dec2017/12_06.htm#guilt

(10) All of America is doomed to repeat

a mistake Kansas made 5 years ago

http://www.businessinsider.com/republicans-are-repeating-kansas-tax-cut-disaster-2017-12

[headlines]

--------------------------------------------------------------

Leasing Industry Help Wanted

Asset Manager www.maximcc.com |

[headlines]

--------------------------------------------------------------

Finally! New York Attorney General’s Office Goes After

Northern Leasing

By Tom McCurnin

Leasing News Legal Editor

Civil Lawsuit Seeks to Put Northern Leasing Out of Business.

People v Northern Leasing Sys. Inc. 2017 NY Slip Op 32496 (NY Sup.Ct. 2017)

For lawyers who like to write columns on banking and leasing law, Northern Leasing is the gift that keeps on giving. I’ve been writing about these scofflaws for years now. Now, the activities of Northern Leasing have reached a critical mass—the State of New York has decided to take them on and put them out of business. Attorney General Eric Schneiderman may very well succeed. A New York Superior Court Judge ruled on the lawsuit and while striping some of it away, allowed most of the case to go forward, by passing the “hell or high water” clause and allowing claims against Northern Leasing, including claims against the collection manager. The facts follow.

The conduct of Northern Leasing is well known. It leases credit card processing machines and provides credit card processing services. In the process, their independent sales organizations (“ISOs”) used unconscionable tactics like having the merchant sign one page while concealing others, set exorbitant monthly lease fees and rewarded the ISOs with commissions based on those high fees. The ISOs charged the merchants “administrative fees” that were supposedly related to personal property taxes for leased equipment, even though the leases did not provide for such fees and the fees were not paid to taxing authorities. The ISOs allegedly engaged in abusive tactics in an attempt to collect money owed under these leases.

In addition, Northern Leasing ISOs misrepresented the lease provisions, gave lessees incomplete or unexecuted copies of leases, materially altered leases after their signature, and enforced leases with forged signatures. Their leases include automatic renewal provisions, without an agreement to renew and Northern Leasing did not advise lessees of the end of their lease term, while forcing ACH debits, effectively a never ending lease. Northern Leasing signed a Consent Order with the State of New York in 2013, but has apparently violated it.

In the present action, New York Attorney General Eric Schneiderman filed suit to enjoin the illegal activity and put Northern Leasing out of business permanently. Northern Leasing filed a motion to dismiss. The court, while dismissing some claims, allowed a significant portion of the claims to go forward, summarized below.

NY Deceptive Practices Act. Claims for deceptive practices are limited to consumers. Since the victims of Northern Leasing were merchants, the court threw out this claim.

NY Permanent Injunction. Because of the fraudulent allegations, the court allowed this claim to go forward.

Defense That the ISOs Were Responsible, Not Northern Leasing. In this defense, Northern Leasing essentially threw their ISOs under the bus, but the court allowed the claims to go forward based on the conduct of the ISOs as alleged.

Unconscionability. Again, based on the allegations, the claims that the contracts were unconscionable were to go forward to a trial.

Hell or High Water Provision. Since the leases were non-cancellable, Northern Leasing made the argument that all the claims were barred by the “hell or high water” clauses. The court correctly noted that such clauses only may be enforced if the equipment was accepted and there are valid signatures. The claims were allowed to proceed to trial.

Forum Selection Clause. Over 19,000 default judgments were issued in New York based on the forum selection clause. Because the lease was so permeated with fraud, the claim that such clauses are not enforceable was allowed to proceed to trial.

Waiver of Service. The lease document contains a provision whereby the lawsuit can be served by ordinary mail, but because the address was often incorrect, the service was not reasonably calculated to provide notice to the lessee.

Automatic Renewals. Based on the poor documentation of these evergreen clauses, the matter was allowed to proceed to trial.

Dissolution of Northern Leasing. Based on the violation of the Consent Order and other fraudulent conduct, the claims presented a significant, serious, and continuing abuse of a public right justifying dissolution. This claim was allowed to proceed to trial.

Claims Against Individual Defendants. Neil Hertzman is the Vice President of Customer Service and Collections. Claims against him personally were allowed to proceed to trial. Joseph Sussman is counsel for Northern Leasing. Because the lawsuit did not claim that he had advance knowledge of the fraud, the claims against him were dismissed.

In sum, Northern Leasing’s motion to dismiss was largely denied. It will be required to file an answer. State of New York wins, Northern Leasing loses, again.

What are the takeaways here?

• First, I Don’t Understand How This Conduct Could Continue After the Consent Decree. I get it that Northern Leasing are the bad boys of leasing and that they got caught in a class action and consent decree in 2013. I think if I were an owner, I’d stop this business model and go into copier leases.

• Second, The Court Issued Another Blow to the Hell or High Water Clause. Bad facts make bad law, so it is of no surprise to me that the court swept the “hell or high water” clause aside with little or no analysis. But this is a citable case and generally hurts the leasing industry.

• Third, Blowing Off the Government Has Consequences. Operating illegally after the consent decree has now landed the officers of Northern Leasing in legal hot water. For Neil Hertzman’s sake, I hope Northern Leasing doesn’t throw him under the bus.

The bottom line to this case is that bad behavior has consequences. This time, it may end up with a dissolution of Northern Leasing and judgments against its principals.

People v Northern Leasing Sys. Inc. (10 pages)

Tom McCurnin is a partner at Barton, Klugman & Oetting in Los Angeles, California.

Tom McCurnin

Barton, Klugman & Oetting

350 South Grand Ave.

Suite 2200

Los Angeles, CA 90071

Direct Phone: (213) 617-6129

Cell (213) 268-8291

Email: tmccurnin@bkolaw.com

Visit our web site at www.bkolaw.com

Previous Tom McCurnin Articles:

http://www.leasingnews.org

Previous Tom McCurnin Articles:

http://www.leasingnews.org/Conscious-Top%20Stories/leasing_cases.html

[headlines]

--------------------------------------------------------------

When a Debtor Tries to Pull Their Payment Out of a Hat

By Nancy Seiverd, President, CMI Credit Mediators Inc.

As a credit and collection professional for a few decades, I've seen my share of ploys by debtors who have attempted to show they have paid. At a minimum, this illusion is an effort to buy a little more time to eventually make a legitimate payment. At a maximum, it's an endeavor to completely maneuver out of the payment obligation.

Sometimes these impressions have been very creative. For example, at first glance of a copy of a cleared check, we've asked the creditor to verify if payment was posted in error to another account, which can easily happen from time to time. When speaking with a debtor who comes to the phone and demonstrates a proactive attitude to resolve the debt, it's natural to assume that the copy of the cleared check sent over is legitimate.

However, when a debtor's behavior towards the debt is passive, evasive, aggressive, or deceptive, the efforts to falsely demonstrate that a payment has been made can be far reaching.

Here are a few of the more elaborate illusions that I've come across below:

- Creating a check for the correct amount but sending it with a copy (by fax or email attachment) of the reverse side of another check from a previous payment to the creditor to show that the check had cleared the creditor's bank;

- Creating the reverse side of a check that included several unrelated processing numbers, giving the appearance the check cleared;

- Sending a copy of a check where the creditor's name was written slightly askew, giving the appearance the check might not have been properly processed on the creditor's side. For example, instead of sending the check made payable to ABC Tool Co., Inc., the check was made payable to AB Tools Limited.

- Sending a copy of a wire transfer application which showed elaborate but hard to read confirming bank seals and other details;

In addition, when the person in charge at the debtor company has left, sometimes the owner or other person in charge may take advantage of the situation by:

- Changing the dates and content on emails indicating that certain agreements and discounts favorable to the debtor were made;

- Forging signatures on documents by the people who left the creditor company indicating particular arrangements were concluded;

- Recreating purchase orders that have different terms and conditions;

- Forging documentation that indicated the goods were returned;

- Announcing an impeding bankruptcy where no intent of bankruptcy existed;

- Forging letters from a law firm indicating that the company was in receivership.

When customers have reached the last two points of deception, we can probably assume that payment will not be forthcoming. Instead, it's imperative to quickly search for and confirm potential assets that could be seized with a judgment in hand, as litigation will probably be your next best step. Your comments and experiences are most welcome.

Nancy Sieverd is President, CMI Credit Mediators Inc. She can be reached at nseiverd@cmiweb.com; www.cmiweb.com. This article was edited by Steven Gan.

The Editors at Credit Today

540-343-7500

Editor@CreditToday.net

PS. If you're hiring, use our job board - www.CreditJobsToday.com - to find the very best candidates in the profession!

[headlines]

--------------------------------------------------------------

Bankruptcy

While bankruptcy cases are always filed in United States Bankruptcy Court (an adjunct to the U.S. District Courts), bankruptcy cases, particularly with respect to the validity of claims and exemptions, are often dependent upon State law. State law therefore plays a major role in many bankruptcy cases, and it is often not possible to generalize bankruptcy law across state lines.

Generally, a debtor declares bankruptcy to obtain relief from debt, and this is accomplished either through a discharge of the debt or through a restructuring of the debt. Generally, when a debtor files a voluntary petition, his or her bankruptcy case commences.

The most common types of personal bankruptcy for individuals are Chapter 7 and Chapter 13. As much as 65% of all U.S. consumer bankruptcy filings are Chapter 7 cases. Corporations and other business forms file under Chapters 7 or 11.

In Chapter 7, a debtor surrenders his or her non-exempt property to a bankruptcy trustee who then liquidates the property and distributes the proceeds to the debtor's unsecured creditors. In exchange, the debtor is entitled to a discharge of some debt; however, the debtor will not be granted a discharge if he or she is guilty of certain types of inappropriate behavior (e.g. concealing records relating to financial condition) and certain debts (e.g. spousal and child support, student loans, some taxes) will not be discharged even though the debtor is generally discharged from his or her debt.

Many individuals in financial distress own only exempt property (e.g. clothes, household goods, an older car) and will not have to surrender any property to the trustee. The amount of property that a debtor may exempt varies from state to state. Chapter 7 relief is available only once in any eight year period. Generally, the rights of secured creditors to their collateral continue even though their debt is discharged.

For example, absent some arrangement by a debtor to surrender a car or "reaffirm" a debt, the creditor with a security interest in the debtor's car may repossess the car even if the debt to the creditor is discharged.

The 2005 amendments to the Bankruptcy Code introduced the "means test" for eligibility for chapter 7. An individual who fails the means test will have his or her chapter 7 case dismissed or may have to convert his or her case to a case under chapter 13.

Generally, a trustee will sell most of the debtor's assets to pay off creditors. However, certain assets of the debtor are protected to some extent. For example, Social Security payments, unemployment compensation, and limited values of your equity in a home, car, or truck, household goods and appliances, trade tools, and books are protected. However, these exemptions vary from state to state. Therefore, it is advisable to consult an experienced bankruptcy attorney.

In Chapter 13, the debtor retains ownership and possession of all of his or her assets, but must devote some portion of his or her future income to repaying creditors, generally over a period of three to five years. The amount of payment and the period of the repayment plan depend upon a variety of factors, including the value of the debtor's property and the amount of a debtor's income and expenses. Secured creditors may be entitled to greater payment than unsecured creditors.

Relief under Chapter 13 is available only to individuals with regular income whose debts do not exceed prescribed limits. If you're an individual or a sole proprietor, you are allowed to file for a Chapter 13 bankruptcy to repay all or part of your debts. Under this chapter, you can propose a repayment plan in which to pay your creditors over three to five years. If your monthly income is less than the state's median income, your plan will be for three years unless the court finds "just cause" to extend the plan for a longer period. If your monthly income is greater than your state's median income, the plan must generally be for five years. A plan cannot exceed the five-year limitation.

In contrast to Chapter 7, the debtor in Chapter 13 may keep all of his or her property, whether or not exempt. If the plan appears feasible and if the debtor complies with all the other requirements, the bankruptcy court will typically confirm the plan and the debtor and creditors will be bound by its terms. Creditors have no say in the formulation of the plan other than to object to the plan, if appropriate, on the grounds that it does not comply with one of the Code's statutory requirements.

Generally, the payments are made to a trustee who in turn disburses the funds in accordance with the terms of the confirmed plan.

When the debtor completes payments pursuant to the terms of the plan, the court will formally grant the debtor a discharge of the debts provided for in the plan. However, if the debtor fails to make the agreed upon payments or fails to seek or gain court approval of a modified plan, a bankruptcy court will often dismiss the case on the motion of the trustee. Pursuant to the dismissal, creditors will typically resume pursuit of state law remedies to the extent a debt remains unpaid.

In Chapter 11, the debtor retains ownership and control of its assets and is re-termed a debtor in possession ("DIP"). The debtor in possession runs the day to day operations of the business while creditors and the debtor work with the Bankruptcy Court in order to negotiate and complete a plan.

Upon meeting certain requirements (e.g. fairness among creditors, priority of certain creditors) creditors are permitted to vote on the proposed plan. If a plan is confirmed the debtor will continue to operate and pay its debts under the terms of the confirmed plan. If a specified majority of creditors do not vote to confirm a plan, additional requirements may be imposed by the court in order to confirm the plan.

Chapter 7 and Chapter 13 are the efficient bankruptcy chapters often used by most individuals. The chapters which almost always apply to consumer debtors are chapter 7, known as a "straight bankruptcy", and chapter 13, which involves an affordable plan of repayment. An important feature applicable to all types of bankruptcy filings is the automatic stay. The automatic stay means that the mere request for bankruptcy protection automatically stops and brings to a grinding halt most lawsuits, repossessions, foreclosures, evictions, garnishments, attachments, utility shut-offs, and debt collection harassment.

Chapters

There are six types of bankruptcy under the Bankruptcy Code, located at Title 11 of the United States Code:

" Chapter 7: basic liquidation for individuals and businesses; also known as straight bankruptcy; it is the simplest and quickest form of bankruptcy available

" Chapter 9: municipal bankruptcy; a federal mechanism for the resolution of municipal debts

" Chapter 11: rehabilitation or reorganization, used primarily by business debtors, but sometimes by individuals with substantial debts and assets; known as corporate bankruptcy, it is a form of corporate financial reorganization which typically allows companies to continue to function while they follow debt repayment plans

" Chapter 12: rehabilitation for family farmers and fishermen;

" Chapter 13: rehabilitation with a payment plan for individuals with a regular source of income; enables individuals with regular income to develop a plan to repay all or part of their debts; also known as Wage Earner Bankruptcy

" Chapter 15: ancillary and other international cases; provides a mechanism for dealing with bankruptcy debtors and helps foreign debtors to clear debts.

Terry is now retired. The above is updated from a prior column.

Previous #102 Columns:

http://www.leasingnews.org/Conscious-Top%20Stories/Leasing_102/Index.htm

[headlines]

--------------------------------------------------------------

The dollar is set for a big rebound after a difficult year

By Akin Oyedele, Business Insider

- The dollar has fallen 8% this year against a basket of other G10 currencies.

- But it's poised for a rebound in 2018 if the GOP tax plan passes, according to Bank of America Merrill Lynch. Right now, the market is pricing in "almost nothing" on taxes.

- Tax cuts would lift economic growth, prompting the Federal Reserve to raise rates faster than it expects, the firm's FX strategists said.

[headlines]

--------------------------------------------------------------

[headlines]

--------------------------------------------------------------

##### Press Release ############################

Former President/CEO Farmer's Exchange Bank Sentenced

Over $500,000, but a large amount for a town 434

Neshkoro, Wisconsin

"They say he spent most of the money on car racing -- shelling out $68,000 to Corvette Sports in Sheboygan Falls.

"A $50,000 Corvette he drove in various national auto sports association races...a $133,500 transaction for the purchase of a Renegade motor home and various other cars".

Gregory J. Haanstad, United States Attorney for the Eastern District of Wisconsin, announced that Judge J.P. Stadtmueller, sentenced former Neshkoro banker Geffrey Sawtelle, (age: 64), to two years in prison following his conviction on three counts of bank fraud, in violation of Title 18 United States Code section 1344; one count of false bank entry, in violation of Title 18 United States Code section 1005, and one count of false statement to federal bank examiners, in violation of Title 18 United States Code section 1001. The court also imposed a $20,000 fine, $500 in special assessments, and ordered Sawtelle to pay $338,000 in restitution. Following his prison sentence, Sawtelle will also serve two years of supervised release. Sawtelle pled guilty on July 19, 2017, to the five counts of conviction and acknowledged that the court would consider counts that were dismissed pursuant to the plea agreement as relevant conduct for sentencing purposes.

Geffrey Sawtelle

Sawtelle’s conduct was initially discovered during a routine bank examination by the Wisconsin Department of Financial Institutions, Division of Banking. He was removed from the bank in May 2014, after a more in depth investigation by regulators from the Federal Deposit Insurance Corporation.

In sentencing Sawtelle, Stadtmueller noted that the two-year prison sentence was fair, just, reasonable, and appropriate because the core facts of the defendant’s conduct were inconsistent with the level of trust that had been placed in him. Stadtmueller noted that it should also serve as a message to the community.

“Bank executives who intentionally falsify bank records to deceive regulators must be brought to justice for their actions,” said Mark Bialek, Inspector General of the Board of Governors of the Federal Reserve System and Consumer Financial Protection Bureau. “Such actions impact the safety and soundness of financial institutions. I commend our agents and their federal law enforcement partners for their hard work and persistence, which ultimately led to this conviction.”

The criminal case was investigated by agents from the Office of Inspector General of the Federal Deposit Insurance Corporation, the Office of Inspector General of the Board of Governors of the Federal Reserve System and Consumer Financial Protection Bureau, and the Federal Bureau of Investigation. The case was prosecuted by Assistant United States Attorneys Carol L. Kraft and Rebecca Taibleson.

### Press Release ############################

[headlines]

--------------------------------------------------------------

Small German Shepherd

New York City Greater Area Adopt-a-Dog

Lizzy

Female

10-11 months old

19 pounds

Black

Spayed

Up-to-date shots

"Hi, I’m Lizzy! I’m a sleek, all-black, mixed-breed pup from the Caribbean Islands, where we are known affectionately as “Coconut Retrievers.” I’m female, 19 lbs., and only about 10-11 months old, so I still have lots of puppy energy. I'm spayed, microchipped, heartworm negative, have all my shots, and am housebroken. I love everyone — kids, other dogs, and even cats! My foster mom says I’m a great girl — obedient; know “sit”, and eager to please. I could be your best friend! I’m best for an active family with a fenced yard (at least 5 feet tall, because I’m an expert jumper!)."

Contact:

http://nypeticare.com/contact-us/

Phone: 212-614-7194

Email: nypeticare@aol.com

Application:

http://nypeticare.com/wp-content/uploads/2016/04/Adoption.pdf

NY Pet-I Care

http://nypeticare.com/about-ny-pet-i-care/

Adopt a Pet

http://www.adoptapet.com/

[headlines]

--------------------------------------------------------------

Attorneys Who Specialize in

Banking, Finance, and Leasing

| Birmingham, Alabama The lawyers of Marks & Associates, P.C. have over 30 years experience in dealing with virtually every type of equipment financing and are recognized throughout the industry for prompt, practical solutions and exemplary service. They offer cost-conscious, effective lease enforcement and good counsel. Email: Barry@leaselawyer.com Website: www.leaselawyers.com |

|||

|

Connecticut, Southern New England: EVANS, FELDMAN & BOYER, LLC Collections, litigation, documentation, portfolio sales and financing, bankruptcy. We represent many of the national and local leasing companies doing business in this state. Past chairman EAEL legal committee. Competitive rates. email: rcfeldman@snet.net |

||

| Los Angeles/Santa Monica Hemar & Associates, Attorneys at Law Specialists in legal assistance, including debt collection, equipment recovery, litigation for 35 years. Fluent in Spanish. Tel: 310-829-1948 email: phemar@hemar.com |

|

||

| Los Angeles, Southern CA Seasoned attorney representing secured creditors in auto finance and truck/equipment lease industry. Bankruptcy and State Court litigation. Vincent V. Frounjian (818) 990-0605 or email: vvf@pacbell.net. |

Encino, California: Statewide “ELFA” |

||

Los Angeles, Statewide: CA. "ELFA" Aggressive creditors rights law firm specializing in equipment leasing handling collection matters on a contingency, fixed fee or hourly cbasis. email:RGarwacki@prodigy.net |

Los Angeles, Statewide: CA "ELFA" |

||

Los Angeles- Statewide, CA Lawyer specializing in banking and leasing issues statewide. Documents and litigation. Tom McCurnin, Barton, Klugman & Oetting. Voice: (213) 617-6129 Cell:(213) 268-8291 Email: tmccurnin@bkolaw.com |

California & National Paul Bent – More than 35 years experience in all forms of equipment leasing, secured lending, and asset based transactions. Financial analysis, deal structuring, contract negotiations, documentation, private dispute resolution, expert witness services. (562) 426-1000 www.paulbent.attorney pbent@paulbent.attorney |

||

Illinois |

Massachusetts |

||

| National: Coston & Rademacher: Business attorneys serving the lease-finance industry since 1980. Transactional, documentation, corporate/finance, workouts, litigation, bankruptcy, portfolio management. Chicago-based national practice. Jim Coston, CLP (Members: ELFA, NEFA). email: Jcoston@costonlaw.com Website:www.costonlaw.com |

Michael J. Witt, experienced bank, finance, and leasing attorney, also conducts Portfolio Audits. Previously he was Managing Counsel, Wells Fargo & Co. (May, 2003 – September, 2008); Senior Vice President & General Counsel, Advanta Business Services (May, 1988 – June, 1997) Tel: (515) 223-2352 Cell: (515) 868-1067 |

||

| St. Louis County , MO. - statewide: Schultz & Associates LLP., collections, negotiation, and litigation. Also register and pursue recovery on foreign judgments. Contingency and reasonable hourly rates. Ronald J. Eisenberg, Esq. (636) 537-4645 x108 reisenberg@sl-lawyers.com www.sl-lawyers.com |

NJ, De, Pa: Specializing in leased equipment/secured transactions. Collections, replevins/workouts reasonable rates. Sergio Scuteri/Capehart & Scratchard, PAsscuteri@capehart.com / www.capehart.com | ||

New York and New Jersey Frank Peretore Chiesa Shahinian & Giantomasi West Orange, New Jersey http://www.csglaw.com/ biographies/frank-peretore Phone 973-530-2058 fperetore@csglaw.com Documentation, portfolio purchase & sale, replevin, workouts, litigation, collection, bankruptcy. Aggressive. Over 30 years experience. |

Thousand Oaks, California: |

Receivables Management LLC • Third-Party Commercial Collections johnkenny2@verizon.net | ph 315-866-1167 |

[headlines]

--------------------------------------------------------------

![]()

News Briefs----

Banc of California Exec. turned Firm's Headquarters

into Sex Den: Suit -- More like Hotel California

https://nypost.com/2017/12/08/bank-exec-turned-firms-headquarters-into-sex-den-suit/

$7M cab leasing scheme leads to prison

for ex-Hoboken council president

http://www.nj.com/hudson/index.ssf/2017/12/7m_cab_leasing_

scheme_leads_to_prison_for_former_h.html

The FCC plans to repeal net neutrality this week

— and it could ruin the internet

https://finance.yahoo.com/news/fcc-plans-repeal-net-neutrality-133000962.html

Asset Manager www.maximcc.com |

[headlines]

--------------------------------------------------------------

You May Have Missed---

25 Cities Adding (and Losing) the Most Jobs in 2017

http://247wallst.com/special-report/2017/12/07/25-cities-adding-and-losing-the-most-jobs-in-2017/2/

[headlines]

--------------------------------------------------------------

Lines

by Martha Collins

Draw a line. Write a line. There.

Stay in line, hold the line, a glance

between the lines is fine but don't

turn corners, cross, cut in, go over

or out, between two points of no

return's a line of flight, between

two points of view's a line of vision.

But a line of thought is rarely

straight, an open line's no party

line, however fine your point.

A line of fire communicates, but drop

your weapons and drop your line,

consider the shortest distance from x

to y, let x be me, let y be you.

from Some Things Words Can Do, 1998

The Sheep Meadows Press, Riverdale-on-Hudson, N.Y.

[headlines]

--------------------------------------------------------------

Sports Briefs---

Eagles’ Win Over Rams Clouded by Injury to Carson Wentz

https://www.nytimes.com/2017/12/10/sports/carson-wentz-eagles-rams.html

Derek Carr’s regression puts the Raiders’ future in peril

http://www.eastbaytimes.com/2017/12/10/why-derek-carrs-regression-puts-the-raider

s-future-in-peril/

Garoppolo leads 49ers to back-to-back wins

Second-half comeback topples host Texans

http://www.mercurynews.com/2017/12/10/garoppolo-leads-49ers-to-back-to-back-wins/

Tom Savage returned to the field before being diagnosed

with a concussion. The NFL is looking into it.

https://www.sbnation.com/2017/12/10/16758748/tom-savage-injury-49ers-texans-t-j-yates

5 thoughts on Cowboys' 30-10 win over Giants:

Dak Prescott is looking like his old self

https://sportsday.dallasnews.com/dallas-cowboys/cowboys/2017/12/10/5-thoughts-cowboys-30-10-win-giants-dak-prescott-looking-like-old-self#_ga=2.143262453.1729526871.1512948872-1127871738.1512948872

Eli Manning is going to start again next week

-- and that makes no sense

http://www.nj.com/giants/index.ssf/2017/12/eli_manning_gets_his_giants_sendoff_--_can_they_pl.html

Panthers hang on for wild win over Vikings

https://www.yahoo.com/sports/panthers-hang-wild-win-over-211240391.html

Josh McCown leaves Jets' game against Broncos

http://www.theredzone.org/Blog-Description/EntryId/67125/Josh-McCown-leaves-Jets--game-against-Broncos

Colts fall short in 13-7 OT loss to the Bills

on a snowy day in Buffalo

https://www.foxsports.com/indiana/story/indianapolis-colts-fall-short-in-13-7-ot-loss-to-the-bills-on-a-snowy-day-in-buffalo-121017

Baker Mayfield Deserves the Heisman,

and His Antics Shouldn't Complicate That

http://bleacherreport.com/articles/2748165-baker-mayfield-deserves-the-heisman-and-his-antics-shouldnt-complicate-that?utm_source=cnn.com&utm_medium=referral&utm_campaign=editorial

Browns first began targeting new general manager

John Dorsey in October

https://www.cbssports.com/nfl/news/browns-first-began-targeting-new-general-manager-john-dorsey-in-october/

NFL Scoreboard

https://nytimes.stats.com/fb/scoreboard.asp

[headlines]

--------------------------------------------------------------

California Nuts Briefs---

At 230,000 acres, Thomas fire is now the fifth-largest wildfire in modern California history

http://beta.latimes.com/local/lanow/la-me-thomas-fire-santa-barbara-fire-20171210-story.html

Thousands of state workers face criminal background checks,

and some could lose their jobs

http://www.sacbee.com/news/politics-government/the-state-worker/article188828049.html#emlnl=Afternoon_Newsletter

[headlines]

--------------------------------------------------------------

![]()

“Gimme that Wine”

http://www.youtube.com/watch?v=EJnQoi8DSE8

10 Restaurants with Huge Wine Lists

https://restaurants.winespectator.com/article/55805/restaurants-with-huge-wine-lists?utm_campaign=PG2D120717&utm_source=Private-Guide-to-Dining-Consumer-12-07-17&utm_medium=email

Restaurant sales and traffic continue to recover in November

http://www.nrn.com/sales-trends/restaurant-sales-and-traffic-continue-recover-november

Fort Ross Winery's New Sea Slopes Brand

Captures the Essence of the Sonoma Coast

https://www.winebusiness.com/newReleases/?go=getArticle&dataid=193155

Wine Prices by vintage

http://www.winezap.com

http://www.wine-searcher.com/

US/International Wine Events

http://www.localwineevents.com/

Leasing News Wine & Spirits Page

http://two.leasingnews.org/Recommendations/wnensprts.htm

[headlines]

----------------------------------------------------------------

![]()

This Day in History

1620 - 103 Mayflower pilgrims landed at Plymouth Rock. Later that day, Myles Standish and a group of 18 settlers are attacked by 30 Native Americans, which became known as the "First Encounter".

1725 – George Mason (d. 1795) was born in Fairfax County, Virginia Colony. A planter, politician, and a delegate to the Constitutional Convention of 1787, he was one of three men who refused to sign. His writings, including substantial portions of “Virginia Declaration of Rights” of 1776, and his “Objections to this Constitution of Government” (1787) in opposition to ratification of the Constitution, have been a significant influence on political thought and events. The Virginia Declaration of Rights served as a basis for the Bill of Rights, of which he has been deemed the father.

1789 – The University of North Carolina was chartered by the NC General Assembly.

1815 - The Senate created a select committee on finance and a uniform national currency, predecessor of the Senate Committee on Finance.

1816 - Indiana became the 16th state of the Union.

1830 – Kamehaha V (d. 1872) was born Lot Kapuāiwa in Honolulu. He reigned as King of the Kingdom of Hawai’i from 1863 to 1872. He worked diligently for his people and kingdom and was described as the last great traditional chief. With no heir at his death, the next monarch would be elected by the legislature. Kamehameha V's cousin William C. Lunalillio, a Kamehameha by birth from his mother, demanded a general election and won. The legislature agreed and Lunalilo became the first elected King of the Hawaiian Kingdom.

1846 - In one of the most unusual battles in military history, US soldiers of the Mormon Battalion were attacked by a herd of wild longhorn bulls while camped on the San Pedro River in Arizona just 10 miles from present-day Tombstone. Men and mules were injured and wagons damaged. Several of the bulls were shot and killed. Lieutenant George Stoneman, one of the injured soldiers, later became Governor of California in 1883-87.

1844 - Dr. Horace Wells, a dentist of Hartford, CT, was the first to discover the anesthetic property of nitrous oxide (laughing gas). On this date, while under the influence of gas, he had one of his teeth extracted by Dr. John M. Riggs. The use of the gas was not successful, as he did not know that it had to be combined with oxygen, a discovery that was not made until 24 years later. Holy Cow.

1862 - Union General Burnside's engineers finally began to assemble the bridges around Fredericksburg, Virginia. He had replaced General George McClelland as head of the Army of the Potomac. Confederate snipers in Fredericksburg picked away at the builders, so Yankee artillery began a barrage that reduced to rubble many of the buildings along the river. Three regiments ran the sharpshooters out of the town, and the bridge was completed soon after. By evening on the 11th, the Union army was crossing the Rappahannock. By the next day, the entire army was on the other side and Burnside planned the actual attack. The Battle of Fredericksburg, which took place on December 13, was an enormous defeat for the Army of the Potomac. Ten percent of Burnside's soldiers were casualties. Lee lost less than 5,000 men while Burnside lost 12,600.

1863 - Birthday of Annie Jump Cannon (d. 1941), Dover, DE. American astronomer and discoverer of five stars. Author and winner of the National Academy of Science Draper Medal.

1872 - Already appearing as a well-known figure of the Wild West in popular dime novels, Buffalo Bill Cody makes his first stage appearance on this day, in a Chicago-based production of “The Scouts of the Prairie”. Cody's work as a scout in the western Indian wars laid the foundation for his later fame. From 1868 to 1872, he fought in 16 battles with Indians, participating in a celebrated victory over the Cheyenne in 1869. One impressed general praised Cody's "extraordinarily good services as trailer and fighter . . . his marksmanship being very conspicuous." Later, Cody again gained national attention by serving as a hunting guide for famous Europeans and Americans eager to experience a bit of the "Wild West" before it disappeared. As luck would have it, one of Cody's customers was Edward Judson, a successful writer who penned popular dime novels under the name Ned Buntline. Impressed by his young guide's calm competence and stories of dramatic fights with Indians, Buntline made Cody the hero of a highly imaginative Wild West novel published in 1869. When a stage version of the novel debuted in Chicago as “The Scouts of the Prairie”, Buntline convinced Cody to abandon his real-life western adventures to play a highly exaggerated version of himself in the play. Once he had a taste of the performing life, Cody never looked back. Though he continued to spend time scouting or guiding hunt trips in the West, Cody remained on the Chicago stage for the next 11 years. Buffalo Bill Cody was the hero of more than 1,700 variant issues of dime novels, and his star shone even more brightly when his world-famous “Buffalo Bill's Wild West Show” debuted in 1883. The show was still touring when Buffalo Bill Cody died in 1917.

1882 - The first theater lit by electric lights was illuminated in Boston, Massachusetts. Some 650 lamps were used to light the theater and stage for a performance of a Gilbert and Sullivan operetta. The light bulb had been invented by Thomas Edison in 1879 and had first been installed in a building in 1881.

1882 - Birthday of the great Fiorello La Guardia (d. 1947) at New York, NY. Popularly known as the “Little Flower,” La Guardia was not too busy as Mayor of New York City to read the “funnies” to radio listeners during the New York newspaper strike. He said of himself: “When make a mistake it’s a beaut!”

1884 - The American Association voted to keep its ban on overhand pitching and to continue to allow foul balls caught on one bounce to count as outs. It abolished the tradition of team captains flipping for the honor of batting first. Now the home team will automatically bat first.

1909 - Colored moving pictures were demonstrated at Madison Square Garden.

1913 - Birthday of Mary Virginia Martin (d. 1990) at Weatherford, TX. American stage star best known for her title role in the Broadway and television productions of “Peter Pan”. She won Tony awards for her starring roles in “South Pacific” and “Peter Pan”.

http://www.tsha.utexas.edu/handbook/online/articles/view/MM/fmacg.html

1914 – The Stockton Street Tunnel in San Francisco was completed.

1917 - 19 black soldiers hanged for alleged participation in Houston riot

http://www.houstonpress.com/issues/2001-08-30/news.html

http://polywog.navpoint.com/misc/history/civil/asgn1/node3.html

http://www.houstonhistory.com/decades/history5h.htm

1917 - The Philadelphia Phillies sold star pitcher, and future Hall of Famer, Grover Cleveland Alexander, twice a 30-game winner, and his personal catcher “Reindeer” Bill Killefer, to the Cubs for two players and $5000. Phil’s owner William Baker later admitted he made the trade because, "I needed the money." The 5th-place Cubs expected the addition of Alexander to greatly strengthen their staff, but Alex was drafted in the Army. Alexander went on to win 363 games in his career.

1919 - The citizens of Enterprise, Alabama erected a monument to the boll weevil.

http://memory.loc.gov/ammem/today/dec11.html

1922 - Perez Prado (d. 1989) birthday in Matanzas, Cuba. He is often referred to as the King of the Mambo. At the height of the mambo movement, in 1955, Pérez hit the American charts at number one with a cha-cha version of "Cherry Pink and Apple Blossom White". This arrangement held the spot for 10 consecutive weeks, sold over one million copies, and was awarded a gold disc. The song also went to number one in the UK and in Germany. In 1958 one of Perez's own compositions, "Patricia", became the last record to ascend to No. 1 on the Jockeys and Top 100 charts, both of which gave way the following week to the then newly introduced Billboard Hot 100 chart. The song also went to number one in Germany, and, in the UK, it reached number eight.

http://w1.523.telia.com/~u52304769/prado.html

http://hometown.aol.com/perezprado/index.htm

1923 - Marky Markowitz born, Washington, DC, great trumpet player.

1924 – “Mr. Inside”, Felix “Doc” Blanchard (d. 2009), was born in McColl, SC. He became the first ever junior to win the Heisman Trophy, Maxwell Award, and was the first ever football player to win the James E. Sullivan Award, all in 1945. He teamed with Glenn Davis on the 1944-45-46 Army teams (Davis won the Heisman in 1946, the year after Blanchard won it). They formed one of the most lethal rushing combinations in football history. In his three seasons at West Point, Blanchard scored 38 TDs, gained 1,908 yards and earned the nickname "Mr. Inside." Teammate Davis earned the nickname "Mr. Outside" because of his speed and in November 1945, they both shared the cover of Time magazine.

1926 – Big Mama Thornton was born (d. 1984) Willie Mae Thornton in Ariton, AL. She was the first to record Leiber and Stoller’s “Hound Dog” in 1952, which became her biggest hit. It spent seven weeks at number one on the Billboard Hot 100 in 1953 and sold almost two million copies.

1928 - At the National League meeting, President John Heydler proposed the designated hitter for pitchers to improve and speed up the game. He contended fans were tired of seeing weak-hitting pitchers come to bat. Heydler referred to his idea as "the tenth regular."

1930 - Another ominous sign that the nation was sliding towards a prolonged and difficult economic slump, as New York's branch of Bank of the United States announced that it had gone belly-up. Up until its downfall, the Bank held the savings of some 400,000 depositors, including a number of immigrants; its subsequent demise imperiled the finances of roughly one-third of New York and stood as the nation's single worst bank failure.

1931 - Birthday of Rita Moreno, Humacao, Puerto Rico. She is the first performer to win all four major entertainment awards: 1962 Academy Award for her work in the movie “West Side Story”; 1975 Tony for “Gomez in The Ritz”; Grammy for her recording work with “The Electric Company”; and Emmys for her work in “The Muppet Show” and “The Rockford Files”. On December 4, 2015 she was awarded the Kennedy Center Honor.

1932 - Very cold weather prevailed along the West Coast. San Francisco received 0.8 inch of snow, and at the airport the temperature dipped to 20 degrees. At Sacramento, CA, the mercury dipped to 17 degrees to establish an all-time record low for that location. Morning lows were below freezing from the 9th to the 15th at Sacramento, and the high on the 11th was just 34 degrees. The cold wave dealt severe damage to truck crops and orange groves in the Sacramento Valley.

1934 - The NL voted to permit night baseball, authorizing a maximum of seven games by any team installing lights. The AL did not grant permission for night games until 1937.

1939 - Actress Marlene Dietrich records her hit song "Falling in Love Again." Dietrich also became a U.S. citizen in 1939. Born in Berlin, Dietrich came to the United States in 1930 to make movies after considerable success on the German screen. She allegedly refused several offers to return to Germany to star in Nazi films. She became a U.S. citizen in 1939 and worked tirelessly during and after World War II to sell war bonds and entertain troops. She was awarded the Medal of Freedom and named Chevalier of the French Legion of Honor.

1940 – David Gates, of Bread, was born in Tulsa, OK.

1941 - Adolf Hitler declares war on the United States, bringing America, which had been neutral, into the European conflict. The bombing of Pearl Harbor surprised even Germany. Although Hitler had made an oral agreement with his Axis partner Japan that Germany would join a war against the United States, he was uncertain as to how the war would be engaged. Japan's attack on Pearl Harbor answered that question. The failure of the New Deal, argued Hitler, was the real cause of the war, as President Roosevelt, supported by plutocrats and Jews, attempted to cover up for the collapse of his economic agenda. "First he incites war, then falsifies the causes, then odiously wraps himself in a cloak of Christian hypocrisy and slowly but surely leads mankind to war," declared Hitler-and the Reichstag leaped to their feet in thunderous applause.

1941 - A Japanese invasion fleet attacked Wake Island, which was defended by 439 US marines, 75 sailors and 6 soldiers. The defenders sank 4 Japanese ships, damaged 8 and destroyed a submarine.

1942 - Japanese Admiral Tanaka's "Tokyo Express" again attempts the delivery of supplies to the Japanese forces on Guadalcanal. The cargo is dropped over board and only 1/4 of it reaches the troops on shore. Machine gun fire from US PT boats sinks much of it. One of the Japanese destroyers is sunk by the defenders as well.

1943 - Birthday of John Kerry, Aurora, CO. Former US Senator from Massachusetts and current Secretary of State.

1944 – Brenda Lee, “Little Miss Dynamite” was born Brenda Mae Tarpley in Atlanta. The top-charting solo female vocalist of the 1960s, she had 47 US chart hits during the 1960s, and is ranked fourth in that decade surpassed only by Elvis, the Beatles, and Ray Charles. She is perhaps best known in the United States for her 1960 hit "I’m Sorry", and 1958's "Rockin’ Around the Christmas Tree", a United States holiday standard for more than 50 years. At age six, she won a local singing contest sponsored by local elementary schools. The reward was a live appearance on an Atlanta radio show, “Starmakers Revue”, where she performed for the next year. Her father died in 1953, and by the time she turned ten, she was the primary breadwinner of her family through singing at events and on local radio and television shows. Lee achieved her biggest success on the pop charts in the late 1950s through the mid-1960s with her biggest hits including "Jambalaya", "Sweet Nothins" (#4), "I Want to Be Wanted" (#1), "All Alone Am I" (#3) and "Fool #1" (#3).

1946 – UNICEF, the United Nations Children’s Emergency Fund, was established.

1947 – The Pacific Coast League’s application to become a Major League was rejected.

1948 - Top Hits

“Buttons and Bows” - Dinah Shore

“On a Slow Boat to China” - The Kay Kaiser Orchestra (vocal: Harry Babbitt & Gloria Wood

“A Little Bird Told Me” - Evelyn Knight

“One Has My Name” (“The Other Has My Heart”) - Jimmy Wakely

1949 – Chicago Bears QB Johnny Lujack threw 6 TD passes as the Bears routed the Chicago Cardinals, 52-29. In the AAFC’s final game, the Cleveland Browns defeated the SF 49ers, 21-7 for the championship.

1950 - George “Gabby’ Hayes veteran of Western movies, hosted two series: the first was a 15 minute show; the second a half-hour Saturday morning show. On both shows, Hayes showed clips from old westerns.

1951 - Joe DiMaggio announced his retirement from baseball. Joltin’ Joe played only for the New York Yankees during his 13-year career. DiMaggio was a three-time MVP and an All-Star in each of his seasons. During his tenure with the Yankees, the club won ten American League pennants and nine World Series championships. His lifetime batting average was .325; and his hitting streak of 56 consecutive games still stands as one of MLB’s records least likely to be broken. Joe’s two brothers, Vince and Dom, were also Major Leaguer center fielders.

1952 - An audience of 70,000 people watched from 31 theatres as Richard Tucker starred in "Carmen". The event was the first pay-tv production of an opera. Ticket prices ranged from $1.20 to $7.20.

I went to summer camp with his son for several years in White Mountain, New Hampshire. Tucker was a famous Broadway/opera star in his day.

1956 - Top Hits

Singing the Blues - Guy Mitchell

A Rose and a Baby Ruth - George Hamilton IV

Rock-A-Bye Your Baby with a Dixie Melody - Jerry Lewis

Singing the Blues - Marty Robbins

1956 – A MLB Players Association was established with Bob Feller as president.

1957 - In one of the biggest scandals to ever hit rock music, Jerry Lee Lewis married his 14-year-old cousin, Myra Gale Brown, daughter of his cousin Jim. Lewis' first marriage was still valid; the divorce wouldn't be finalized for six months. When the story broke in England a few weeks later, Lewis' career was seriously damaged.

1959 - The Yankees trade Hank Bauer, Marv Throneberry, Don Larsen and Norm Siebern to the Kansas City A's for outfielder Roger Maris and two other players. He finished his MLB career playing for the St. Louis Cardinals in 1967 and 1968. Maris was an AL All-Star from 1959 through 1962, AL MVP in 1960 and 1961, and an AL Gold Glove winner in 1960. Maris appeared in seven World Series, five with the Yankees and two with the Cardinals. Perhaps most importantly, he teamed with the dangerous Mickey Mantle in a lineup that top to bottom could hit with power.

1960 - Baltimore quarterback Johnny Unitas failed to throw a touchdown pass in a 10-3 loss at Los Angeles, snapping his NFL record streak of 47 consecutive games with a scoring toss.

1960 - Aretha Franklin made her stage debut at New York's Village Vanguard.

1961 - Motown Records achieves their first number one song when The Marvelettes' "Please Mr. Postman" reaches the top. The session musicians on the track included 22 year old Marvin Gaye on drums.

1961 - Elvis Presley started a 20 week run at the top of the Billboard album chart with "Blue Hawaii", his seventh US #1 album.

1961 - The first American troops were sent to Vietnam. President John Fitzgerald Kennedy ordered 425 helicopter crewmen to Vietnam to provide support and training for South Vietnamese forces. Historians consider this the first day of the war in Vietnam. Politicians do not.

1964 - Top Hits

“Ringo” - Lorne Greene (“Bonanza”)

“Mr. Lonely” - Bobby Vinton

“She’s Not There” - The Zombies

“Once a Day” - Connie Smith

1964 – Rock ‘n’ roll pioneer Sam Cooke was slain at the Hacienda Motel in downtown LA. One of the most popular and influential R & B singers of his generation, Cooke died under violent and mysterious circumstances. According to court testimony, Cooke, who was married to Barbara Campbell, picked up a 22 year old woman named Elisa Boyer at a party. He promised her a ride home but they ended up at a motel. Boyer claims Cooke forced her into the motel room and began ripping her clothes off. She managed to escape with his clothes while he was in the bathroom. He pursued, wearing only a sports coat and shoes. While she called police from a phone booth, Cooke began pounding on the door of the office of the motel's manager, Bertha Franklin. He demanded to know where Campbell was and allegedly broke the door open. Cooke reportedly assaulted Franklin, who shot him three times, and kept coming at her, who then beat Cooke with a stick. http://www.history-of-rock.com/cooke.htm

http://www.angelfire.com/ms/musicstore/samcooke.html

1965 - The third Acid Test was held at the Big Beat night club in Palo Alto. It featured the Warlocks band (future Grateful Dead), a light show, and Stewart Brand's "America Needs Indians" slide show.

1965 - Ray Charles' "Crying Time" enters the Hot 100 where it stays for 39 weeks, making it to #6. It is his 44th chart entry.

1967 - Frank Sinatra records with the Duke Ellington Band, Hollywood, California (Reprise FS1024).

1968 - The Labor Department announced that the nation's unemployment rate had dwindled to 3.3%, the lowest mark in 15 years.

1971 - The Godfather of Soul, James Brown, has his 32nd album released this week, "Revolution of the Mind," subtitled "Live at the Apollo, Volume Three." It opens with a song whose title only James Brown could have come up with, "It's a Brand New Day So Open Up the Door and Let a Man Come In to Do The Popcorn."

1971 - Carly Simon's "Anticipation" is released.

1972 – Apollo 17, the sixth and last Apollo mission, landed on the Moon.

1972 - Top Hits

“I Am Woman” - Helen Reddy

“If You Don’t Know Me by Now” - Harold Melvin & The Bluenotes

“You Ought to Be with Me” - Al Green

“Got the All Overs for You” (“All Over Me”) - Freddie Hart & The Heartbeats

1972 - Genesis plays their first date in the U.S. at Brandeis University in Massachusetts. The group, which has yet to place an LP in the Top 200, consists of Peter Gabriel, Phil Collins, Steve Hackett, Mike Rutherford and Tony Banks.

1972 - After a show in Knoxville, TN, James Brown was arrested and charged with "disorderly conduct" when a conversation Brown had with fans was somehow mistaken for an attempt to incite a riot. Charges were dropped after Brown threatened to sue the city for a million dollars due to police brutality.

1973 - Ron Santo was traded to the Chicago White Sox from cross-town rivals, the Chicago Cubs. Santo became the first Major Leaguer to invoke the rule which permits 10-year veterans of a club to refuse to be traded. He turned down a trade to the California Angels.

1973 - Karen and Richard Carpenter received a gold record for their single, "Top of the World".

1976 - Al Stewart debuted on the Billboard Hot 100 with "Year of the Cat". It peaked at #8, but not until March 1977.

1978 - 6 masked men bound 10 employees at Lufthansa cargo area at NYC Kennedy Airport and made off with $5.8 M in cash and jewelry. The movie “Goodfellas” was loosely based on this heist.

1980 - Top Hits

“Lady” - Kenny Rogers

“More Than I Can Say” - Leo Sayer

“Another One Bites the Dust” - Queen

“Smoky Mountain Rain” - Ronnie Milsap

1980 - “Magnum, PI“ premiered on CBS starring Tom Selleck in the title role of Thomas Magnum, private investigator in Hawaii. Other cast regulars were John Hillerman as Jonathan Quayle Higgins, Roger E. Mosley as Theodore Calvin (“TV’) and Larry Maretti as Orville “Rick’ Wright. Final episode aired May 1, 1988. “Magnum” fans enjoy an open house at “Magnum Memorabilia’ (the nonprofit research/production foundation and full-service fan information clearinghouse) in celebration of this day every year. Episode viewings and costume/prop exhibits are featured. Contact ac2942@wayne.edu for more information.

1981 - It was Muhammad Ali’s 61st -- and last -- fight. He lost to future champ Trevor Berbick.

1982 - Toni Basil reached the #1 position on the pop music charts for the first time, with her single, "Mickey". The chorus: “Hey Mickey, you’re so fine, you’re so fine, you blow my mind, hey Mickey, hey Mickey.” Romantic, huh?

1983 - Thoroughbred John Henry became the first race horse to earn more than $4 million when he won the Hollywood Turf Cup under jockey Chris McCarron.

1985 - Hugh Scrutton is killed in his computer store in Sacramento, California, by a mail package that explodes in his hands. By the time he was finally apprehended, the "Unabomber", so named because his earliest attacks were directed at universities, had been responsible for the deaths of 3 people and the injuries of 23 others. After two months of surveillance, the FBI finally arrested Ted Kaczynski in 1996. Inside his cabin were bombs and writings that tied him to the crimes. In January 1998, while awaiting trial, Kaczynski tried to commit suicide in his cell. Still, he resisted his lawyer's attempts to plead insanity and instead pleaded guilty. Although prosecutors originally sought the death penalty, Kaczynski eventually accepted a life sentence with no right to appeal.

1985 - General Electric acquires RCA Corp and its subsidiary, NBC.

1985 - Dow Jones average closed above 1,500 for the first time, 1,511.70.

1985 - With the season still in progress, the Chicago Bears declared their intention to appear in and win the Super Bowl. Members of the team, known as Chicago Bears Shufflin’ Crew, released their "Superbowl Shuffle". The Bears went on to defeat the New England Patriots in the Super Bowl, 46-10. “You better start makin’ Your Superbowl plans. But don’t get ready or go to any trouble, Unless you practice The Superbowl Shuffle.”

1988 - Top Hits

“Look Away” - Chicago

“How Can I Fail?” - Breathe

“I Don’t Want Your Love” - Duranduran

“If You Ain’t Lovin’” (“You Ain’t Livin’”) - George Strait

1989 - The Recording Industry Association of America certifies four Led Zeppelin albums as multi-Platinum: "Presence" (2 million), "Led Zeppelin" (4 million), "Physical Graffiti" (4 million) and "In Through The Out Door" (5 million).

1989 - Strong Santa Ana winds developed across southern California and parts of central California. Winds in Kern County of central California gusted to 100 mph near Grapevine. The high winds reduced visibilities to near zero in the desert areas, closing major interstate highways east of Ontario CA

1992 – A violent nor’easter slammed the east coast, causing flooding and damage into the millions. For two days, it remained over the Mid-Atlantic before moving offshore. In Maryland, the snowfall unofficially reached 48 in; if verified, the total would have been the highest in the state's history. About 120,000 people were left without power in the state due to high winds. Along the Maryland coast, the storm was less severe than the Perfect Strom in the previous year, although the strongest portion of the storm remained over New Jersey for several days. In the state, winds reached 80 mph in Cape May, and tides peaked at 10.4 ft. in Perth Amboy. The combination of high tides and 25 ft. waves caused the most significant flooding in the state since the Ash Wednesday Storm of 1962. Several highways and portions of the NYC Subway and Port Authority Trans-Hudson systems systems were closed due to the storm. Throughout New Jersey, the nor'easter damaged about 3,200 homes and caused an estimated $750 million in damage.

1993 - Snoop Doggy Dogg’s "Doggy Style" was number one on U.S. album charts. The rest of the top five: 2-"Vs.", Pearl Jam; 3-"Music Box", Mariah Carey; 4-"The Spaghetti Incident?", Guns N' Roses; 5-"The Beavis & Butt-Head Experience", Various artists.

1995 - "Gangsta's Paradise" from the movie "Dangerous Minds" by Coolio, featuring L.V. tops the year-end Billboard Hot 100 singles chart followed by TLC's "Waterfalls" and Stone Temple Pilots' "Creep."

1995 - "Cracked Rear View" by Hootie and the Blowfish tops the year's album chart followed by Garth Brooks' "The Hits" and "II" by Boyz II Men.

1996 - Following the example of America Online, Prodigy announced it would provide unlimited use of its service for a flat fee of $19.95 per month. Prodigy, like other proprietary online services, was struggling to stay afloat in the face of competition from Internet service providers. Ultimately, Prodigy embraced the competition and transformed itself into an Internet access provider.

1997 - Negotiators from around the world (more than 150 countries) agreed on a package of measures that for the first time would legally obligate industrial countries to cut emissions of waste industrial (greenhouse) gases that scientists say are warming the Earth's atmosphere.

2000 - Alex Rodriguez signs the richest contract in sports history, a ten-year deal with the Rangers worth $252 million. The quarter billion dollars doubles the previous high of $126 million paid by the NBA's Timberwolves to Kevin Garnett in a six-year agreement signed in October, 1997.

2002 - Musicologist and author Rob Durkee compiled a list of The Top Ten Christmas Songs of All Time (according to sales and radio air play)

1. White Christmas - Bing Crosby - 1942

2. Silent Night - Bing Crosby - 1936

3. Rudolph the Red-Nosed Reindeer - Gene Autry - 1949

4. The Little Drummer Boy - Harry Simeone Chorale - 1958

5. Jingle Bell Rock - Bobby Helms - 1957

6. The Christmas Song - Nat King Cole - 1946

7. The Chipmunk Song - David Seville and the Chipmunks - 1958

8. Rockin' Around the Christmas Tree - Brenda Lee - 1958

9. Blue Christmas - Elvis Presley - 1957

10. Jingle Bells - Bing Crosby / The Andrews Sisters - 1943

2003 - Andy Pettitte inks a three-year, $31.5 million deal with his 'hometown' Astros. The thirty-one year old Texan, who compiled a 149-78 won-loss record with a 3.94 ERA during his nine-year stint in pinstripes turned down better offers to stay with the Yankees or go to the rival Red Sox.

2003 - MTV gives viewers a glimpse into the holiday season at the home of Ozzy Osbourne and his family with "The Osbourne Family Christmas Special." A wide range of celebrity guests join in on the festivities, including Jessica Simpson, who duets with Ozzy on "Winter Wonderland," and newlyweds Dave Navarro and Carmen Electra, who are shown baking holiday cookies.

2008 - The Red Sox unveil their new, but familiar “Hanging Sox” logo. Originally sown on uniforms in 1931, the pair of red socks will now appear on most of the club's letterhead and signs, diminishing the use of the circular trademark which contain the words "Boston Red Sox".

2008 – Bernie Madoff was arrested and charged with securities fraud in a $50 billion Ponzi scheme. They should rename it Madoff Scheme.

2013 – MLB owners voted to ban home plate collisions over concerns about serious injuries recently suffered by catchers such as Buster Posey and Alex Avila. Baserunners will now be called out if they deliberately run into the opposing catcher, and will face a fine or suspension for particularly grievous offenses. Catchers will also be banned from blocking access to the plate without the ball.

2014 – Detroit emerged from bankruptcy. The city filed for Chapter 9 bankruptcy on July 18, 2013, the largest municipal bankruptcy filing in U.S. history by debt, estimated at $18–20 billion. Debt was negotiated and liquidated, pensioners were reduced despite state law against it, and union contracts were renegotiated.

2014 - A 219-year-old time capsule was excavated from beneath the cornerstone of the Massachusetts State House in Boston; the capsule, first found in 1855 and reburied, is likely the oldest in the U.S. The capsule was buried in 1795 by Paul Revere and Samuel Adams. As Boston Museum of Fine Arts Conservator Pam Hatchfield chiseled away for hours to free the box, five silver coins spilled from the stone block.

-------------------------------------------------------------

SuDoku

The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler?

http://leasingnews.org/Soduku/soduko-main.htm

--------------------------------------------------------------

Daily Puzzle

How to play:

http://www.setgame.com/set/puzzle_frame.htm

Refresh for current date:

http://www.setgame.com/set/puzzle_frame.htm

--------------------------------------------------------------

http://www.gasbuddy.com/

http://www.gasbuddy.com/GB_Map_Gas_Prices.aspx

http://www.gasbuddy.com/GB_Mobile_Instructions.aspx

--------------------------------------------------------------

Weather

See USA map, click to specific area, no commercials

--------------------------------------------------------------

Traffic Live---

Real Time Traffic Information

You can save up to 20 different routes and check them out with one click,

or type in a new route to learn the traffic live

--------------------------------

![]()