Information, news, and entertainment for the commercial

alternate financing,

bank, finance and leasing industries

Subscribe

| Search | All Lists | Site Map

Conferences/Forums |

Advertising | Archives | Columnists

Don’t take the bait on phishing scams |Top Ten Stories Chosen by Readers

Contact: kitmenkin@leasingnews.org

![]()

Friday, December 13, 2024

Today's Leasing News Headlines

New Hires/Promotions in the Leasing Business

and Related Industries

AP Equipment Financing Secures $200 Million

Credit Facility from Wells Fargo

AP Equipment Financing

Goes 100% Remote

Leasing and Finance Industry Personnel Wanted

Top Compensation/Benefits/Local & Remote

Why You Will Fail to Have a Great Career

By Ken Lubin, ZRG Partners, Managing Director

Visualizing the Major Holders

of America's Debt

2024 ELFA Membership Milestones

Companies celebrating anniversaries

Kudos to the ELFA Membership Committee

For 2024 New Members (ELFA Magazine)

Here is a sample of some of the new members

From ELFA Cover Story: Meet the New Members

######## surrounding the article denotes it is a press release, it was not written by Leasing News nor has the information been verified, but from the source noted. When an article is signed by the writer, it is considered a byline. It reflects the opinion and research of the writer.

[headlines]

--------------------------------------------------------------

New Hires/Promotions in the Leasing Business

and Related Industries

Mark Johnson, a seasoned executive and current member of Orion’s Advisory Board, has assumed the role of CEO. After 23 years as Founder and CEO, Dave Schaefer has decided to transition into the role of Chairman of Orion First, where he will focus on providing strategic guidance to the company.

(As a side note, from Curtis Costner, Marketing, VP: "Dave and Mark both live in Scottsdale and we have an office in Tempe. We still have our Gig Harbor office, too, recently downsized since most of the staff is remote throughout the US.")

Mr. Johnson's bio shows he is CEO/President, COO, Operations Lead. Previously, he was Consultant, Coach, and Business Solutions Advisor, Mejay Advisors, a Trusted Advisor Affiliate (Remote); CEO, Consultant, Keystone Law Firm (November, 2022 - July, 2023); Chief Executive Officer (2019 - July, 2022); Chief Executive Officer, Concord Servicing Corporation (2019 - July, 2022); Chief Hospitality Officer, CVP, Wyndham Destinations (2015 - 2018). Full Bio:

https://www.linkedin.com/in/markjohnson719/details/experience/

https://www.linkedin.com/in/markjohnson719/

Collin Mackie was hired as Vice President, Regional Market Manager, Amerisource Business Capital, Greenville, South Carolina, where he is located. Previously, he was Partner and National Sales Director, Capital Business Funding (November, 2017 - December, 2024); Senior Vice President,

A/R Funding, Inc., Greenvile, South Carolina Area; Senior Vice President, Southern First Bank (2000 - 2008); Vice President, The Palmetto Bank (1997 - 2000). Full Bio:

https://www.linkedin.com/in/collinmackie/details/experience/

https://www.linkedin.com/in/collinmackie/

Olivia Schroll was hired as Transaction Coordinator, Regents Capital Corporation, Costa Mesa, California. She is located in Newport Beach, California. Previously, she was Account Manager, Dealer Development, Equify Financial, LLC (January, 2023 - October, 2024). She joined Pacific Rim Capital Inc., Funding Specialist, July, 2019, promoted Funding Supervisor, April, 2020, promoted Funding Manager (April, 2022 - January, 2023). Full Bio:

https://www.linkedin.com/in/olivia-schroll-aa01a38b/details/experience/

https://www.linkedin.com/in/olivia-schroll-aa01a38b/

Jenny Wood , CLFP, is being promoted to the role of Chief Client Experience Officer (CXO). Having been with Orion for over 22 years, Wood has been a cornerstone of its team, helping to shape the way it serves and supports its clients. She joined Orion November, 2002, AVP, Customer Service and Collections, promoted November, 2013, VP Client Services, promoted SVP Client Services (April, 2017 - December, 2024). Previously, she was Lead Collection Specialist, Financial Pacific Leasing (November, 1999 - October, 2022).

https://www.linkedin.com/in/jennifer-wood-8899a982/

[headlines]

--------------------------------------------------------------

##### Press Release ######################

AP Equipment Financing Secures $200 Million

Credit Facility from Wells Fargo

BEND, OR. – AP Equipment Financing is proud to announce the finalization of a $200 million credit facility from Wells Fargo. This strategic financial move comes as AP Equipment Financing is set to capitalize on increasing demand from customers and dealer partners alike.

Zack Marsh, CLFP, SVP of Accounting at AP Equipment Financing, said, "We are thrilled to continue our relationship with Wells Fargo with this $200 million credit facility. This increase in our lending capacity underscores our confidence in the resilience of the industries we serve and reaffirms our commitment to being a reliable financial resource, even in the current economic environment."

As the U.S. economy continues to adjust to a changing rate environment, this expansion of credit capacity serves as a testament to AP Equipment Financing's commitment to fueling growth and innovation. This facility enables the company to meet the escalating requirements of its diverse clientele and offers a boost to industries that are pivotal to everyday operations and commerce.

AP Equipment Financing has consistently demonstrated its agility and adaptability in the face of economic fluctuations. The expanded credit facility from Wells Fargo further strengthens the company's position as a forward-looking independent finance firm and further progresses Tokyo Century’s commitment to a growth strategy within the United States.

About AP Equipment Financing

AP Equipment Financing is a wholly owned subsidiary of Tokyo Century, a publicly traded company on the Tokyo Stock Exchange. AP was founded in 1998 to provide a fast, easy, and more personalized way for companies across the US to lease and finance their specialized equipment.

### Press Release #########################

[headlines]

--------------------------------------------------------------

### Press Release #########################

AP Equipment Financing

Goes 100% Remote

In an era where adaptability defines success, AP Equipment Financing is making the move to fully embracing remote work. Starting December 5, 2024, the company will operate as a 100% remote organization. This milestone reflects AP’s commitment to evolving alongside the modern work landscape while prioritizing its employees and customers alike.

Along with this transition, AP is relocating its physical office to a new address:

360 SW Bond St, Ste 340, Bend, OR 97702

This move supports the company’s strategic shift by centralizing essential operations while providing employees with the flexibility of remote work.

Over the years, AP Equipment Financing has been steadily transitioning to remote work, testing the waters with hybrid models and decentralized teams. This shift wasn’t made overnight; it was the result of strategic planning, employee feedback, and an understanding of how flexibility enhances productivity and employee satisfaction.

By adopting a fully remote model, AP is furthering its mission to provide exceptional service across the U.S., unbound by traditional office limitations. Whether it’s helping businesses finance critical equipment or delivering industry-leading customer support, AP is proving that a distributed team can excel in today’s fast-paced business world.

Why Fully Remote?

AP’s move to a remote-first model is a testament to its forward-thinking culture. Here are a few reasons behind the transition:

• Increased Flexibility for Employees: Remote work allows team members to create work-life balance that best suits their needs, whether that’s avoiding long commutes or working from a location of their choice.

• Access to Top Talent Nationwide: Without geographic constraints, AP can recruit the best professionals across the U.S., fostering a diverse and skilled workforce.

https://apfinancing.com

##### Press Release ######################

(If you missed Mark Johnson in New Hires above, please review to learn about Orion First. Editor).

[headlines]

--------------------------------------------------------------

Leasing and Finance Industry Help Wanted

Excellent Compensation/Marketing Support

[headlines]

--------------------------------------------------------------

Why You Will Fail to Have a Great Career

By Ken Lubin, ZRG Partners, Managing Director

Recently,I watched one of the most provocative TED talks that I have ever seen. It was done by Larry Smith, Economist, and it hits the nail on the head of why many don't have the careers that they want. It all comes down to fear!

In listening to this, it got my mind spinning and I started to question every career decision that I have ever made. Most of us are looking for the comfort of good pay, health benefits and a level of security in our careers.

Is that who we really are? A robot that just goes to the office and does the same thing day in and day out? We are taught at a young age to go from box to box to then being buried in a box, I don't like boxes. They are confining, brown, and overall, not very pleasant. When I die, I don't want to be in a box but that is for another post.

Each and every day, I ask myself. “What can I do to be better than I was yesterday?” Hopefully when all those little changes add up, I will have created my own box or my own great career!

Don't get me wrong, I love my job and my career. I get to meet and speak with the most amazing people each and every day. I get to help people change their lives and I get to make many new friends, but I want to do be able to do it better!

I don't want to fail to have a great career and you shouldn't either.

Don't settle for the mediocrity of the daily grind. Overcome your fears and make your career better. If you don't like your job, change your attitude. I am not saying that you need to pack up and quit and be left on the street with no money, benefits, and a spouse that wants to kill you. What I am saying is that in one second, one minute, or one hour in your current role, you can change it for the better. Change your attitude and overcome your fear and you will not fail to have a great career!

Watch the video here when you have time: http://www.ted.com/talks/larry_smith_why_you_will_fail_to_have_a_great_career?language=en

Ken Lubin, Managing Director

ZRG Partners, LLC

Americas I EMEA I A

klubin@zrgpartners.com

https://www.linkedin.com/in/klubin/

[headlines]

--------------------------------------------------------------

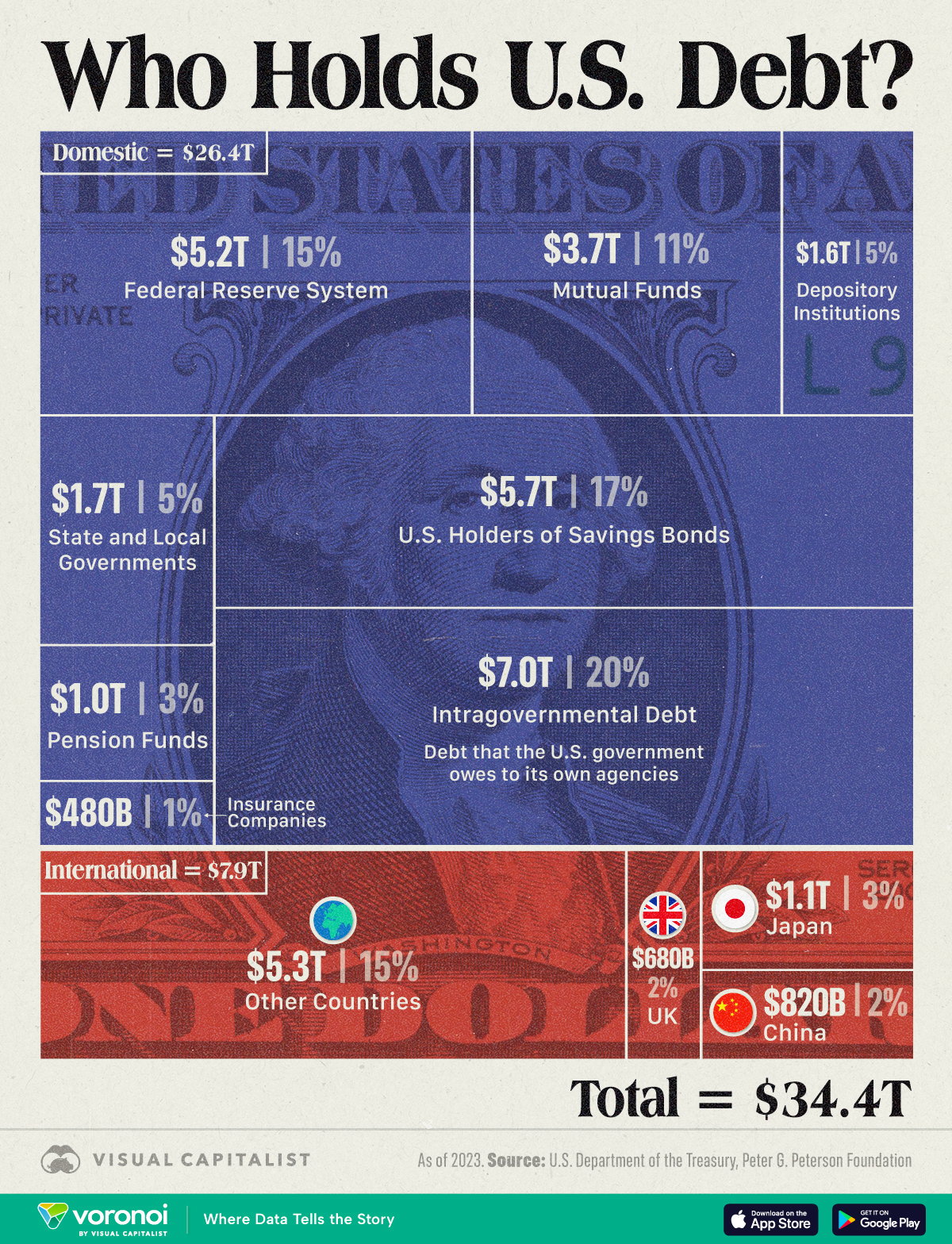

U.S. gross debt increased from $34.4 trillion at the end of 2023 to $36.1 trillion as of December 2024, with some experts calling it unsustainable.

In this graphic, we bring a break down the U.S. debt composition, categorized by domestic and foreign investors as well as intragovernmental holdings. The data is sourced from the U.S. Department of the Treasury by the Peter G. Peterson Foundation, as of year-end for 2023.

Key Data on U.S. Debt

The U.S. national debt increases when the federal government spends more than it collects through taxes and other revenue streams.

When government spending exceeds tax revenue, a budget deficit occurs. To cover the shortfall, the U.S. Treasury issues Treasury bills, notes, and bonds. The national debt is the cumulative total of the federal government’s budget deficits, adjusted for any surpluses.

Of the $34.4 trillion in gross debt in 2023, $27.3 trillion (79%) was public debt borrowed from domestic and foreign investors, while $7.0 trillion (21%) was intragovernmental debt, reflecting internal government transactions.

The Federal Reserve System was the largest domestic holder of U.S. public debt, with holdings of $5.24 trillion.

Debt held by the public represents the amount borrowed by the U.S. Treasury from external lenders via financial markets to fund government operations. It is considered a critical measure of debt because it directly impacts the government’s ability to manage economic crises and can influence economic stability.

As of December 2023, debt held by the public equaled 97% of the U.S. GDP.

Source: Visual Capitalist

[headlines]

--------------------------------------------------------------

2024 ELFA Membership Milestones

Since Inception

ELFA is pleased to recognize the following companies celebrating milestone membership anniversaries in 2024. We thank all companies for your membership, and we are pleased to recognize those that have been members of the association for 20, 25, 30, 35, 40, 45, 50, 55 and 60 years!

Celebrating 60 Years

- BMO

Celebrating 55 Years

- DLL

Celebrating 50 Years

- PNC Equipment Finance

Celebrating 45 Years

- Bank of America Global Leasing

- John Deere Financial

Celebrating 40 Years

- Commonwealth Capital Corp.

- Great American Insurance Group, Specialty Equipment

- NETSOL Technologies Inc.

- Presidio Technology Capital, LLC

- Sirius Computer Solutions Financial Services, LLC a CDW Company

- Wells Fargo Equipment Finance

Celebrating 35 Years

- Americorp Financial, LLC

- Glass & Goldberg, A Law Corporation

- Tetra Corporate Services, LLC

Celebrating 30 Years

- Constellation Financial Software

- Ferns, Adams & Associates, A Professional Corporation

- Milestone Bank

- Parker, Milliken, Clark, O'Hara, Samuelian

- Platzer, Swergold, Goldberg, Katz & Jaslow, LLP

- PricewaterhouseCoopers LLP

- RVI Group

- Steelcase Financial Services Inc.

Celebrating 25 Years

- Altec Capital Services, LLC

- Deloitte

- Jules and Associates, Inc.

- Madison-Davis, LLC

- Merrimak Capital Company

- PEAC Solutions

- Ritchie Bros.

- Smith Debnam Narron Drake Saintsing & Myers, LLP

- Thompson Coburn LLP

- Transamerican Equipment North Carolina Corporation

Celebrating 20 Years

- Ascentium Capital, A Division of Regions Bank

- Byline Financial Group

- Caine & Weiner

- CHG-MERIDIAN USA Corp.

- Colliers Funding LLC

- Dominion Leasing Software LLC

- Geneva Capital, LLC

- Lane Powell

- MassMutual Asset Finance

- McGlinchey Stafford, PLLC

- Ray Quinney & Nebeker P.C.

- Ross International

- Taylor and Martin Auctioneers and Appraisals

- Vertex Inc.

- Vista Consulting Group, Inc.

[headlines]

--------------------------------------------------------------

Kudos to the ELFA

2024Membership Committee

In 2024, the Membership Committee worked closely with the ELFA Membership Department to assist in the association’s recruitment and retention initiatives. With the committee’s assistance, ELFA met and exceeded its membership goals for the year. Many thanks to the 2024 committee for their dedication and participation:

- Randy Haug, Chair

- Julie Benson, Staff Liaison, ELFA

- Susan Carol, Foresight Marketing Agency

- Mark Farlin, LEAF Commercial Capital Inc.

- Jon Gerson, Executive Solutions for Leasing and Finance, LLC

- Brent Hall, Alliance Funding Group

- Stephanie Hall, Apex Commercial Capital Corp.

- Dominic Janney, Canon Financial Services, Inc.

- Xiang Ji, Toyota Industries Commercial Finance, Inc.

- Kayla Perlinger, Oakmont Capital Services

- Mark Scardigli, Trio Capital Solutions

- Marci Slagle, CLFP, BankFinancial, NA

- Harrison Smith, Stonebriar Commercial Finance

- Justin Tabone, EverBank

- Andrea Tzamaras, Staff Liaison, ELFA

[headlines]

--------------------------------------------------------------

Here is a sample of some of the new members

From ELFA Cover Story: Meet the New Members

![]()