Information, news, and entertainment for the commercial

alternate financing,

bank, finance and leasing industries

Subscribe

| Search | All Lists | Site Map

Conferences/Forums |

Advertising | Archives | Columnists

Don’t take the bait on phishing scams |Top Ten Stories Chosen by Readers

Contact: kitmenkin@leasingnews.org

![]()

Friday, February 7, 2025

Today's Leasing News Headlines

Archie: First Web Search Engine

Released in 1990, 35 Years Ago

New Hires/Promotions in the Leasing Business

and Related Industries

Recruiter Hal T. Horowitz Speaks Out

Early Advice, Now Retired

Leasing and Finance Industry Help Wanted

Excellent Compensation/Marketing Support

Finance and Leasing Industry Recruiters

Experience in the finance and leasing industry

California Passes Law Extending

Debt Collection Rules by

Ken Greene, Law Offices of Kenneth Charles Greene

Leasing News Advisor

Bruce Kropschot

DFPI Takes Action Against Patelco Credit Union

for Cybersecurity Violations

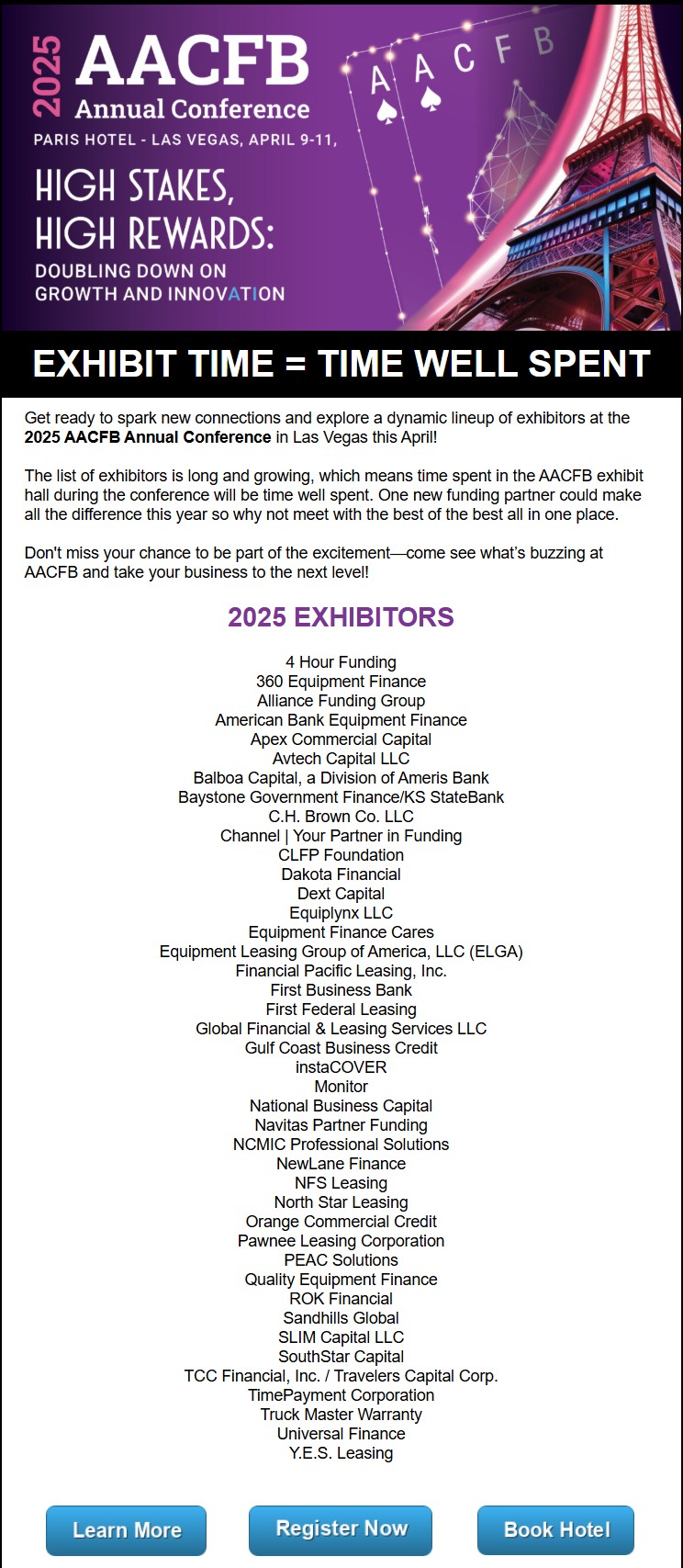

Get ready to spark new connections and explore

a dynamic lineup of exhibitors at the

2025 AACFB Annual Conference in Las Vegas

News Briefs---

A million cars have disappeared: What NYC

is like after one month of congestion pricing

Ford expects to rack up EV losses of up

to $5.5B in 2025, sending shares skidding

Layoffs hit contractors and small businesses

as Trump cuts take effect

Mass. must build 222,000 homes over the next

to rein in housing costs, state says

Here are all the new cruise ships

coming in 2025

Judge temporarily blocks Trump's

federal government employee buyout

You May Have Missed ---

Best States for Women’s Health

By Luke Power, smilehub

Sports Briefs

California News

"Gimme that Wine"

This Day in History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

Wordle

######## surrounding the article denotes it is a press release, it was not written by Leasing News nor has the information been verified, but from the source noted. When an article is signed by the writer, it is considered a byline. It reflects the opinion and research of the writer.

[headlines]

--------------------------------------------------------------

Archie: First Web Search Engine

Released in 1990: 35 Years Ago

Archie is a tool for indexing FTP archives, allowing users to more easily identify specific files. It is considered the first Internet search engine. The original implementation was written in 1990 by Alan Emtage, then a postgraduate student at McGill University in Montreal, Canada. Archie was superseded by other, more sophisticated search engines, including Jughead and Veronica, which were search engines for the Gopher protocol.

The name derives from the word "archive" without the 'v'. Emtage has said that contrary to popular belief, there was no association with the Archie Comics. Despite this, other early Internet search technologies such as Jughead and Veronica were named after characters from the comics.

These were in turn superseded by search engines like Yahoo! in 1995 and Google in 1998. Work on Archie ceased in the late 1990s. A legacy Archie server was maintained for historic purposes in Poland at Interdisciplinary Centre for Mathematical and Computational Modeling in the University of Warsaw until 2023.

https://en.wikipedia.org/wiki/Archie_(search_engine)

[headlines]

--------------------------------------------------------------

New Hires/Promotions in the Leasing Business

and Related Industries

Matthew Diehl was promoted to Head of Business Development and Program Management, LEAF Commercial Capital (a subsidiary of M&T Bank), Philadelphia, Pennsylvania, where he is also located. He joined LEAF April, 2016, Business Development Manager, SVP, March, 2021- February, 2025).

https://www.linkedin.com/in/matthew-diehl-23146066/

George Flomo was promoted to Senior Relationship Manager, LEAF Commercial Capital, Inc., Philadelphia, Pennsylvania. HE is also located there. He joined LEAF February, 2018, Relationship Specialist. Previously, he was President, The MacKenszie's Foundation, April, 2019.

Full Bio:

https://www.linkedin.com/in/george-flomo-357a2210a/details/experience/

https://www.linkedin.com/in/george-flomo-357a2210a/

Dee Nariz, CLFP, was hired as Senior Vice President, Client Experience, CoreTech, Chantilly, Virginia. He is located in Newport Beach, California. Previously, he was at First National Capital Corporation, starting January, 2014, Lease Administrative Group, Document Specialist, promoted Client

Service Representative (June, 2014 - January, 2025)

https://www.linkedin.com/in/dee-nariz-3ba95b113/

Curtis Powell was hired as Senior Vice President of Business Development, InFusion Capital, Knoxville, Tennessee, where he is also located. Previously, he was at CapitalPlus Financial Services, starting December, 2016, Senior Account Executive, promoted July, 2019, Director of Sales, promoted Vice President Sales, August, 2020, promoted Executive Vice-President (August, 2024 - January, 2025).

https://www.linkedin.com/in/curtis-powell-1604ab120/

Dennis Preston was hired as Senior Finance Specialist, Navitas Credit Corporation, at their Woodstock, Georgia office. He is also located ithere. Previously, he was Regional Financial Service Manager, Manufacturers Financing Services (November, 2008 - December, 2024); Relationship Manager, US Bank Equipment Finance (April, 2007 - September, 2008); District Sales Manager, Wells

Fargo Financial (May, 2002 - April, 2007); Program Manager, The Cit Group (January, 1992 - January, 2001).

https://www.linkedin.com/in/dennis-preston-2b94653/

Bree Shaut, CLFP, was promoted to Equipment Funding Coordinator with Channel Partners, Minnetonka, Minnesota. She is located in Fullerton, California. She joined Channel August, 2022, as Equipment Finance Funding Coordinator. Previously, she was Financing Project Manager, Blue Street Capital (October, 2020 - May, 2022); Project Coordinator.

https://www.linkedin.com/in/bree-shaut/

[headlines]

--------------------------------------------------------------

Recruiter Hal T. Horowitz Speaks Out

Early Advice, Now Retired

Don’t Bring Your Dog to an Interview

Many years ago, I sent a candidate on an interview who, without my prior knowledge, brought his dog with him. He got the job. That was a novel incident and I’d say that getting the job under that circumstance was an anomaly. When he was asked about the dog – almost immediately at the onset of the interview – he explained that since his territory was rural, he travelled everywhere with his border collie, and that the dog not only kept him company on long road trips, but often helped warm potential clients to him.

Although he got the job, I would never, EVER recommend bringing a dog (or any other animal) to an interview unless it’s a service animal whose presence is a necessity. And while perhaps not the best analogy, or segue into my subject, many candidates will bring an elephant with them.

The elephant in the room may be a period of long unemployment, a series of short term jobs or perhaps a conflict with a former supervisor. It could be something direr, such as a former bankruptcy, an addiction or even a criminal record. Each of these kinds of issues have, for each candidate, its own unique impact. Some, such as a spotty job record, may be apparent from the résumé; others may not so blatant. Some may have been the result of matters beyond the candidate’s control or be excused by a legitimate explanation. It perhaps may now just be a part of the candidate’s history. But, like the dog my applicant brought to his interview, each elephant will need to be addressed and should be addressed, like the dog, immediately.

Many subscribe to the practice of sharing only that which needs to be known. I agree. But I am also an advocate of honesty and transparency and, where it comes to information that may negatively impact how he feels about your ability to do your job, or hiring you, the elephant needs to be addressed.

Notwithstanding the animal itself, while there may be plenty of wrong ways to bring it into the conversation, there is no guaranteed right way. Depending on the circumstances, an interviewer might open the door by asking about what is apparent. “Why were your last two jobs less than a year each?” Or, “Why has it been so difficult for you find work in almost a year?” Alternatively, a candidate may have the opportunity to provide the narrative in his response to a typical opening such as, “Tell me about yourself,” or, “We’ll need to do a background check. Is there anything we need to be aware of?” Lacking these openings, it may be incumbent on the candidate to finesse an opening. However the elephant is brought into the interview, here are a few tips on how to help make sure it doesn’t sit down on the interviewer’s lap.

- Briefly explain the circumstances but don’t omit any relevant points that may come out later.

- Have a clear and plausible explanation for what occurred and how it came about. Be prepared to speak to the issue; don’t wing it.

- Maintain eye contact with the interviewer. Sit erect and treat the matter like the serious issue it is.

- Take accountability. Don’t blame exigent circumstances or others’ influence for your decisions. Avoid treating serious matters lightly or by being cliché.

- Don’t wallow in self-pity. Express any remorse you feel for any harm your actions may have caused others.

- Articulate how you’ve atoned and the lessons you’ve learned from your mistakes; how you’ve been able to turn a difficult time in your life into something positive, such as working with at-risk juveniles to help prevent them from making similar mistakes.

- Be confident in your having resolved any internal issues that might impact your job performance.

A word to employers and interviewers here. Since you’ve already invited the applicant for an interview, be considerate and show empathy when he must deal with personally sensitive matters. Good people do stupid things. A person’s actions may or may not be excusable but hear him out without prejudgment. He may be worth someone going to bat for.

And a final word to anyone going into an interview: don’t bring your dog, especially if you’re already bringing an elephant.

[headlines]

--------------------------------------------------------------

Balboa Capital Available Position

Program Manager II- Equipment Broker Sales

Full Job Details - Benefits

[headlines]

--------------------------------------------------------------

Finance and Leasing Industry Recruiters

These companies have experience in the finance

and leasing industry

Second Column: YCS - Year Company Started | YELB - Years in equipment Leasing Business

Name City, State Contact Website Leasing Association |

YCS

YELB (see above for meaning) |

Geographic Area |

Specialty

|

Executive Solutions for Leasing & Finance, Inc. |

1990 |

Nationwide |

Search firm specializing in leasing industry. Services include retained and contingent search, strategic consultation, compensation analysis, sales & management training, & customizable consulting products. |

Recruiters |

2000 |

North America |

Explanation: Boutique Executive Search Firm Specializing in the Finance & Equipment Leasing Industries. |

ZRG Partners |

1999 |

Global |

Senior Level retained Search firm doing C-Suite searches, board searches and VP level positions, We work on a client focused, project basis |

[headlines]

--------------------------------------------------------------

California Passes Law Extending Debt Collection Rules

By: Ken Greene, Law Offices of Kenneth Charles Greene

The new year brings yet more distressing news from the Golden State and you are in the commercial finance space, and you want to collect that gold in California, you will soon have to heed all the rules that, until now, only applied to consumer debt collectors.

Beginning July 1, 2025, commercial loans of $500,000 or less will be subject to the debt collection protections of the Rosenthal Fair Debt Collection Practices Act (“RFDCPA”). What is potentially more troublesome is that the statute will apply not only to debt collectors, but creditors! That means that your in-house collection department will have to heed all the prohibitions and restrictions of the RFDCPA.

The rules are fairly straightforward and apply to debt collectors and creditors attempting to collect on their own paper. There are many, including:

- It will be a crime for collection notices to simulate legal or judicial process or give the appearance of being authorized by a governmental agency or attorney (if it is not).

- If a borrower claims identity theft, collection efforts must cease once the borrower provides certain information which confirms the identity theft claim.

- The use, or threat of use, of physical force or violence is prohibited, as is telling a borrower that failure to pay a debt will result in an accusation that the borrower has committed a crime.

- Debt collectors/creditors can only initiate judicial proceedings in the county in which a non-natural person is located.

- There are many restrictions as to the timing of collection notices and calls.

There is a plethora of other rules, but you get the picture.

There are other important issues, i.e.:

- Are your attorneys bound by these rules? In my opinion, the answer is yes. At least I intend to comply.

- How liable is a creditor for its independent contractors who perform collection activities?

- Can you send emails at night? What if they are computer generated?

- Some of the terms of the law i.e. communicating with “such frequency as to be unreasonable” are vague, subjective and rich fodder for consumer plaintiff’s lawsuits. Lender beware!

- The new law will prohibit the “false representation that a legal proceeding has been or is about to be instituted” if payment is not made. Gone are the days of sending that threat to sue if you don’t really mean it. So, if you make that threat, are you compelled to sue? I am sure the consumer lawyers will claim foul!

One good thing about the expanded statute is that there is no licensing requirement for commercial debt collectors/creditors (yet!).

There is much more but it is, as they say, beyond the scope of this article. My best advice is to have an attorney prepare a best practices guide to help you navigate this minefield. That is exactly what I am doing for my clients.

I am publishing a best practice guide to help creditors through the new law. If you are interested in it, please contact me at ken@kengreenelaw.com.

The Law Offices of Kenneth Charles Greene present this article. All copyrightable text, the selection, arrangement, and presentation of all materials (including information in the public domain), and the overall design of this presentation are the property of the Law Offices of Kenneth Charles Greene. All rights reserved. Permission is granted to download and reprint materials from this article for the purpose of viewing, reading, and retaining for reference. Any other copying, distribution, retransmission, or modification of information or materials from this article, whether in electronic or hard copy form, without the express prior written permission of Kenneth C. Greene is prohibited. The materials available from this article are for informational purposes only and not for the purpose of providing legal advice. You should contact your attorney to obtain advice with respect to any issue or problem. Use of and access to these materials does not create an attorney-client relationship between the Law Office of Kenneth Charles Greene and the user or viewer. The opinions expressed herein are the opinions of the individual author.

[headlines]--------------------------------------------------------------

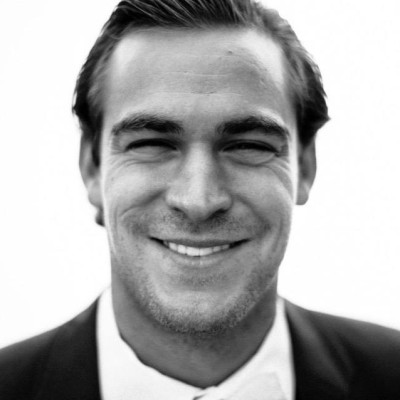

Leasing News Advisor

Bruce Kropschot

Bruce Kropschot

Senior Managing Director

4751 Bonita Bay Blvd., Unit 201

Bonita Springs, FL 34134

The Alta Group

(772) 321-2167

bkropschot@thealtagroup.com

www.thealtagroup.com

Bruce Kropschot is one of the first asked to join the advisory board and he has been active since September 6, 2000. He was named Leasing Person of the Year for 2015.

Bruce Kropschot has been active in the equipment leasing industry since 1972 and has been a senior executive of three large leasing companies. In 1986 he founded Kropschot Financial Services, a firm he developed into the leading provider of merger and acquisition advisory services for equipment leasing companies. In 2008 Kropschot Financial Services became a part of The Alta Group, the leading worldwide consulting firm for the leasing industry. Bruce formed Alta’s M&A advisory practice, which also arranges debt and equity capital and provides valuation services for leasing companies. He has played a major role representing sellers or buyers in the sale of over 200 equipment leasing and financing companies.

After 51 years in the equipment leasing industry, Bruce still is active, although he has been happy to turn over much of his workload to his successor at The Alta Group, Jim Jackson. Bruce says that his business is his favorite hobby, and he continues to keep his fingers in the business even while pursuing retirement. When asked what have been the keys to his success, he stated, “Obviously a thorough knowledge of many types of leasing companies is essential in the M&A advisory business. However, of utmost importance is maintaining the highest level of integrity. The Alta Group’s reputation depends upon always treating as confidential any information we receive in confidence from potential buyers and sellers of leasing companies.”

Bruce has served on the Board of Directors of the Equipment Leasing and Finance Association, the Equipment Leasing and Finance Foundation, Eastern Association of Equipment Lessors, United Association of Equipment Leasing and International Network of Merger & Acquisition Partners. At the 2024 annual ELFA convention, Bruce was inducted into the Equipment Finance Hall of Fame. He has served on the Leasing News Advisory Board since 2000, and he also served on the alumni advisory board of the Ross School of Business at the University of Michigan. He has BBA and MBA degrees (with honors) in Accounting and Finance from the University of Michigan and is a CPA.

Bruce’s favorite recreational activities have long been skiing and travel. Although knee problems have curtailed his ski trips, Bruce has continued to travel extensively throughout the world. He has visited all 7 continents and nearly 100 countries and is an active member of the Naples, FL chapter of the Circumnavigators Club. In his spare time, he enjoys watching NHL hockey games and following the University of Michigan athletic teams.

[headlines]

--------------------------------------------------------------

### Press Release ########################

DFPI Takes Action Against Patelco Credit Union for Cybersecurity Violations

SACRAMENTO – The California Department of Financial Protection and Innovation (DFPI) announced today a consent order with San Francisco-based, Patelco Credit Union (Patelco) for cybersecurity violations. The consent order, which includes a $100,000 penalty, follows an investigation prompted by a June 2024 ransomware attack affecting Patelco’s approximately 500,000 members.

The ransomware attack caused essential computer functions at Patelco to shut down from June 29, 2024, to July 15, 2024, and disrupted services to Patelco’s members, including the inability to conduct any online banking functions. At that time, ransomware attackers were also able to access a significant number of members’ personally identifiable information (PII).

Acting DFPI Commissioner KC Mohseni, commented “Last summer’s cybersecurity breach at Patelco adversely affected hundreds of thousands of credit union members. They were locked out of their accounts for weeks and their personal information was compromised.”

“This Department is committed to holding accountable companies that do not adequately protect their customers’ data.”

Today’s order directs Patelco to correct failures in their cybersecurity programs to comply with state and federal cybersecurity requirements. The company is also ordered to retain an independent compliance consultant to oversee remediation, report to the DFPI on the company’s cybersecurity programs, and pay a penalty of $100,000.

The DFPI encourages those with information on cybersecurity program violations, unsafe or unsound business practices, or other violations of law involving a California-regulated financial institution to come forward by submitting a complaint with the Department online: dfpi.ca.gov/submit-a-complaint.

About the DFPI

The California Department of Financial Protection and Innovation protects consumers, regulates financial services, and fosters responsible innovation. The DFPI protects consumers by establishing and enforcing financial regulations that promote transparency and accountability. We empower all Californians to access a fair and equitable financial marketplace through education and preventing potential risks, fraud, and abuse. Learn more at dfpi.ca.gov.

#### Press Release ########################

[headlines]

--------------------------------------------------------------

High Stakes, High Rewards

2025 AACFB Annual Conference in Las Vegas

[headlines]

--------------------------------------------------------------

News Briefs

A million cars have disappeared: What NYC

is like after one month of congestion pricing

https://www.fastcompany.com/91272434/a-million-cars-have-disappeared-what-nyc-is-like-after-one-month-of-congestion-pricing

Ford expects to rack up EV losses of up

to $5.5B in 2025, sending shares skidding

https://nypost.com/2025/02/05/business/ford-expects-to-rack-up-ev-losses-of-up-to-5-5b-in-2025-sending-shares-skidding/

Layoffs hit contractors and small businesses

as Trump cuts take effect

https://www.bostonglobe.com/2025/02/06/business/layoffs-contractors-small-businesses-trump-cuts/

Mass. must build 222,000 homes over the next

to rein in housing costs, state says

https://www.bostonglobe.com/2025/02/06/business/massachusetts-222000-new-homes/

Here are all the new cruise ships

coming in 2025

https://www.sacbee.com/news/business/article299841514.html

Judge temporarily blocks Trump's

federal government employee buyout

https://abcnews.go.com/US/judge-request-block-trumps-federal-government-employee-buyout/story?id=118535508

|

[headlines]

--------------------------------------------------------------

Best States for Women’s Health

By Luke Power, smi)ehub

https://smilehub.org/blog/best-states-for-womens-health/199

[headlines]

--------------------------------------------------------------

Sports Briefs---

Steve Young in awe of Andy Reid’s evolution

toward another Super Bowl

https://www.eastbaytimes.com/2025/02/02/andy-reid-super-bowl-chiefs-steve-young-49ers-byu/

Steve Young in awe of Andy Reid’s evolution

toward another Super Bowl

https://www.eastbaytimes.com/2025/02/02/andy-reid-super-bowl-chiefs-steve-young-49ers-byu/

Mexico has a 49ers-themed KFC

you have to see to believe

https://www.sfgate.com/sports/article/49ers-kfc-mexico-city-20063942.php

[headlines]

--------------------------------------------------------------

![]()

California News Briefs---

State Farm seeks 22% rate hike for California

homeowners to cover Los Angeles wildfire losses

https://www.mercurynews.com/2025/02/03/state-farm-seeks-22-rate-hike-for-california-homeowners-to-cover-los-angeles-wildfire-losses/

Ayesha Curry’s Oakland shop, Sweet July, closes

over safety concerns in crime-ridden Calif. city

https://nypost.com/2025/02/03/business/ayesha-currys-oakland-shop-sweet-july-closes-over-safety-concerns/

[headlines]

--------------------------------------------------------------

Gimme that Wine

![]()

http://www.youtube.com/watch?v=EJnQoi8DSE8

New Survey Sheds Light on

Use in the Wine Industry

https://www.winebusiness.com/wbm/article/297359

Revolutionizing Wine Product Photography

BottleShots.ai

https://www.winebusiness.com/news/article/298017

55% Increase in French Winery Bankruptcies

The largest number are in the south west.

https://www.meiningers-international.com/wine/news/55-increase-french-winery-bankruptcies

Two Historic and Iconic Napa Valley Wineries Join Forces to Champion Regenerative Organic Farming Through

their Re-Generation Cabernet Sauvignon

https://www.winebusiness.com/news/

St. Julian's Best-Selling Wine Is

Getting an Upgrade

https://www.winebusiness.com/news/article/298063

[headlines]

----------------------------------------------------------------

![]()

This Day in History

https://leasingnews.org/archives/Jan2021/01_07.htm#history

-------------------------------------------------------------

SuDoku

The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler?

--------------------------------------------------------------

Daily Puzzle

How to play:

http://www.setgame.com/set/puzzle_frame.htm

Refresh for current date:

http://www.setgame.com/set/puzzle_frame.htm

--------------------------------------------------------------

http://www.gasbuddy.com/

http://www.gasbuddy.com/GB_Map_Gas_Prices.aspx

http://www.gasbuddy.com/GB_Mobile_Instructions.aspx

--------------------------------------------------------------

Weather

See USA map, click to specific area, no commercials

--------------------------------------------------------------

Traffic Live---

Real Time Traffic Information

You can save up to 20 different routes and check them out with one click,

or type in a new route to learn the traffic live

--------------------------------

Wordle

https://www.powerlanguage.co.uk/wordle/

How to Play

https://www.today.com/popculture/popculture/wordle-know-popular-online-word-game-rcna11056

![]()