Information, news, and entertainment for the commercial

alternate financing,

bank, finance and leasing industries

Subscribe

| Search | All Lists | Site Map

Conferences/Forums |

Advertising | Archives | Columnists

Don’t take the bait on phishing scams |Top Ten Stories Chosen by Readers

Contact: kitmenkin@leasingnews.org

![]()

Wednesday, February 26, 2025

Today's Leasing News Headlines

The Corporate Transparency Act is Back!

Contact Your Accountant or Attorney

By Ken Greene, Leasing News Editor, Emeritus

New Hires/Promotions in the Leasing Business

and Related Industries

CapEx Finance Index for January 2025

New Business

Balboa Capital Available Position

Program Manager II-Equipment Broker Sales

Full Job Details - Benefits

Employees at Leasing Companies Return to the Office

By Edward P. Kaye, Vice President, Putnam Leasing

NVLA Editorial Board Member

Leasing News Advisor

Phil Dushey

NFS Leasing, Inc. Achieves 34% Year-Over-Year

Growth of Originations in 2024

AP Equipment Financing Recognized in Best

Companies in Equipment Finance, Culture

Category by Monitor Magazine

News Briefs---

Mexico Transfers Dozens of Cartel Operatives

to U.S. Custody

Mexico First: How Mexico Plans To

Weather Trump’s Tariffs

U.S. Terminates Funding for Polio, H.I.V., Malaria

and Nutrition Programs Around the World

How to Keep Hackers From

Destroying Your Digital Life

FAA Aims to Boost Hiring of Air-Traffic Controllers

and Update Its Technology

You May Have Missed ---

Dirty Dozen tax scams for 2025: IRS warns taxpayers

to watch out for dangerous threats

Sports Briefs

California News

"Gimme that Wine"

This Day in History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

Wordle

######## surrounding the article denotes it is a press release, it was not written by Leasing News nor has the information been verified, but from the source noted. When an article is signed by the writer, it is considered a byline. It reflects the opinion and research of the writer.

[headlines]

--------------------------------------------------------------

The Corporate Transparency Act is Back!

Contact Your Accountant or Attorney

By Ken Greene, Leasing News Editor, Emeritus

The Corporate Transparency Act (CTA) was reinstated. In Smith v. United States Department of Treasury, the U.S. District Court for the Eastern District of Texas granted the government’s motion to vacate the preliminary injunction pending the disposition of an appeal to the U.S. Court of Appeals for the Fifth Circuit. What this means in plain English is that the nationwide injunction that had prohibited enforcement of the CTA’s beneficial ownership information (BOI) reporting rules is no longer in effect and the CTA is in full swing.

Leasing News has previously reported on the CTA. According to the Financial Crimes Enforcement Network (FinCEN), the purpose of the law is “to make it harder for bad actors to hide or benefit from their ill-gotten gains through shell companies or other opaque ownership structures.”

To recap the BOI reporting requirements, here is what it means to you:

• Your company may need to report if (1) you are a corporation or LLC; (2) your company was otherwise created in the U.S. by filing a document with the Secretary of State or a similar office; or (3) you are a foreign company registered to do business in the U.S.

• 23 types of entities are exempt from BOI reporting requirements, including publicly traded companies, nonprofits, and certain large operating companies. The exemption list is available in the BOI Information Guide (link below).

• Reporting is done through the FinCEN website at https://www.fincen.gov/boi.

• Companies that are covered by the CTA must report BOI, which generally refers to identifying information about the individuals who directly or indirectly own or control a company. For more details, see the BOI Information Guide below.

• When must BOI be reported? On Feb. 19, 2025, the FinCEN announced that for most reporting companies, the new deadline to file an initial, updated and/or corrected BOI report is now March 21, 2025. Further, FinCEN announced that it intends to initiate a process this year to revise BOI reporting rules to reduce the burden for lower-risk entities.

For further details, here is a link to a BOA informational brochure:

https://fincen.gov/sites/default/files/shared/BOI-Informational-Brochure-April-2024.pdf

Ken Greene

Law Offices of Kenneth Charles Greene

5743 Corsa Avenue, Suite 208

Westlake Village, CA 91362

T: 818.575.9095

F: 805.435.7464

E: ken@kengreenelaw.com

[headlines]

--------------------------------------------------------------

New Hires/Promotions in the Leasing Business

and Related Industries

Galina Beskurnikov was hired a Senior Underwriter, Cardiff, Washington, DC. Previously, she was at Kapitus, starting January, 2019, Contract Administrator, promoted Underwriter II (January, 2020 - February, 2025); Assistant, Intermark Relocation, Moscow, Assisted in home search for expats. Negotiated process for landlords (2012 - 2015)

https://www.linkedin.com/in/galinasokolovauw/

Brian Pollack was hired as Managing Director, Equipment Finance, Hilco Commercial & Industrial (HCI), Greater Chicago Area, where he is also located. Previously, he was Chief Executive Officer, North America, CIMC Capital LTD (October, 2021 - February, 2025); Credit Officer, Bank of America (July, 2016- October, 2021). Full Bio:

https://www.linkedin.com/in/bpollack/details/experience/

https://www.linkedin.com/in/bpollack/

Michael Villapian was promoted to Managing Director at Altmore Capital, He is located in Washington, District of Columbia, United States. He joined Altmore December, 2021, promoted Director,(February, 2024 - February, 2025). Full Bio: https://www.linkedin.com/in/michael-villapiano/details/experience/

https://www.linkedin.com/in/michael-villapiano

[headlines]

--------------------------------------------------------------

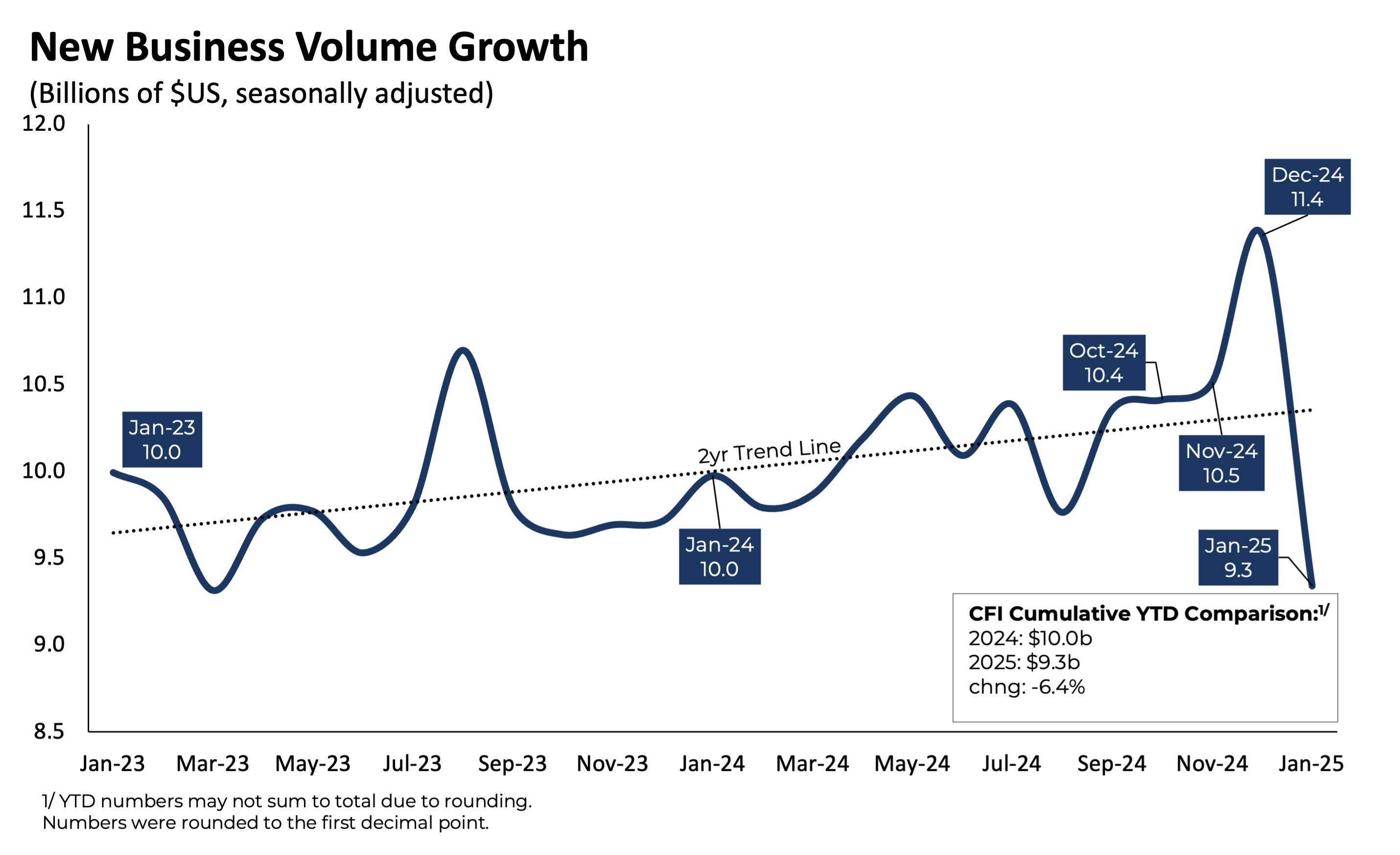

CapEx Finance Index for January 2025

New Business

ELFA has updated the name of the Monthly Leasing and Finance index (MLFI-24) to the CapEx Finance index (CFI) to better reflect what is measures and how it impacts the broader economy.

ELFA Capex Finance Index reports economic activity from 25 companies representing a cross section of the equipment finance sector. Data include New Business Volume Aging of Receivables, Average Losses, Credit Approval Ratios and Total Number of Employees.

Full Report:

https://www.elfaonline.org/knowledge-hub/capex-finance-index/elfa-capex-finance-index--january-2025

ELFA Monthly Reports from June, 2024

to September, 2006

https://leasingnews.org/Conscious-Top%20Stories/ELFA-Survey.htm

[headlines]

--------------------------------------------------------------

Balboa Capital Available Position

Program Manager II- Equipment Broker Sales

Full Job Details - Benefits

[headlines]

--------------------------------------------------------------

Employees at Leasing Companies Return to the Office

By Edward P. Kaye, Vice President, Putnam Leasing Company

NVLA Editorial Board Member

The post-pandemic era has brought significant changes to the workplace, including a return to the office for many employees, even in sectors like independent vehicle leasing. While major players like the federal government, JPMorgan, and Amazon are mandating a full five-day in-office work week, independent leasing companies are taking a variety of approaches.

Remote work offers undeniable flexibility and cost savings, but the leasing industry, with its emphasis on client interaction, relationship building, and access to physical resources, faces unique challenges. The return to the office presents both hurdles and opportunities. Readjusting to in-person work can be difficult after months or even years of working from home, but it also fosters mentorship, direct collaboration, and stronger team dynamics, potentially boosting productivity.

A common sentiment among lessors is the importance of in-office presence, particularly for less experienced salespeople. As one president of a large multinational independent lessor stated, “Only commissioned salespeople have the ability to work remote and with tha, they have to be experienced and accomplished enough to do so; not new salespeople. There is so much to learn by association in the office when you don’t have a formal training system.” This common sentiment amongst many lessors highlights the emphasis and value of learning through observation and interaction.

Complex deals often necessitate collaboration and many leasing executives believe face-to-face interaction leads to better outcomes for both clients and the company. Employees who resist returning to the office may face consequences as some employers are becoming less tolerant of work-from-home holdouts.

Dan Kaplan, a senior client partner at Korn Ferry, recently suggested to the Wall Street Journal a shift in CEO attitudes, “Behind closed doors there’s a view among CEOs that ‘I’m tired of this whining about coming back to work,’… ‘We’ve compromised enough and, if you’re not meeting the minimum, then we’re going to move on without you.’”

Many lessors initially prioritized the return of executives, followed by operations and administrative staff. Ken Sopp, president of Credit Union Leasing of America (CULA), shared his experience, “For a few months, we were all remote. In May/June 2020, we had the executives return to the office but many employees worked remotely for close to a year.”

Employee reactions are mixed. Some appreciate the return to in-person interaction and the separation between work and home life. Others express concerns about commuting, work-life balance, and stress. Leasing companies are addressing these concerns by offering flexible arrangements, including hybrid models. Currently, hybrid models are prevalent, with many employees working in the office Monday through Thursday and remotely on Fridays.

This aligns with the broader trend; data indicates that 43% of U.S. companies now have hybrid office policies, up from 29% a year ago, according to Flex Index which tracks workplace strategies.

One experienced banker who funds lessors noted, “We are a combination of hybrid and remote… We did not experience any drop off in performance during COVID when operating fully remote. Staff satisfaction increased dramatically with the hybrid model.” Despite his personal preference for full-time office work, he acknowledged the bank’s hiring of fully remote staff across departments.

However, many lessors align with JPMorgan’s mandate for a full five-day in-office work week, citing the benefits of mentorship and brainstorming. JPMorgan in a memo to employees stated, “We know that some of you prefer a hybrid schedule and respectfully understand that not everyone will agree with this decision. We feel that now is the right time to solidify our full time in-office approach.” If you work for Chase Auto Finance, prepare to return to the office full time starting in March.

The leasing industry, known for its entrepreneurial spirit and adaptability, will likely continue to refine its policies, seeking the optimal balance between remote and in-office work. With diverse opinions and no single guaranteed path to success, companies will need to carefully evaluate and adjust their strategies.

Edward P. Kaye

Direct: 203-340-7020

Phone: 203-961-8200

Cell: 646-294-6333

Fax: 203-961-8300

e.kaye@PutnamLeasing.com

www.putnamleasing.com

[headlines]

--------------------------------------------------------------

Leasing News Advisor

Phil Dushey

Philip Dushey

Global Financial Services

1 State Street

New York NY 10004

Email:phil@gbtsinc.com

Phone 212-480-4900

www.globalfinancialtrainingprogram.com

www.globaleasing.com

www.globalchurchfinancing.com

Phil is one of the original founding members of the Leasing News Advisory Board. Phil Dushey has been active in the finance and leasing industry for the over40 years. His first company was Global Financial Services, which is still active and successful today. Global specializes in all types of financing such as equipment leasing, accounts receivable financing, debt restructuring, and establishing lines of credit. Mr. Dushey feels that to be competitive in today's expanding financial climate a company must be able to service all of his clients’ needs not just equipment leasing.

In 1989, Mr. Dushey saw a need for a company that would serve the needs of churches, synagogues, mosques, and other places of worship throughout the country for equipment Leasing. At the time, most financing sources were reticent regarding religious institutions. He then formed Global Church Financing. It continues to be the leading company in providing financing to churches and other religious institutions today.

In 2001, Mr. Dushey fulfilled one of his lifelong dreams and formed Global Financial Training Program.

He believes it is the most comprehensive and successful training school in the country to train people who want to enter the finance and leasing business. The program includes everything they need to enter the business. He says he very much enjoys teaching how to make money in the finance industry based on over40 years of experience.

Mr. Dushey is a founding member of the National Association of Equipment Leasing Brokers, who changed their name to American Association of Commercial Finance Brokers.

He has been a member and speaker at many leasing organizations for several years.

He and his wife Laurie have been married for 51 years, with six grandchildren.

[headlines]

--------------------------------------------------------------

##### Press Release #######################

NFS Leasing, Inc. Achieves 34% Year-Over-Year

Growth of Originations in 2024

Beverly, Mass.— NFS Leasing, a privately-held leader in equipment finance serving the U.S. and Canada, announces that it achieved a 34% year-over-year growth of originations in 2024.This growth was driven by an increase in the volume of closed opportunities and an increase in the average deal size.

Ashley Whyman, President of NFS Leasing, said, “Our growth reflects the increasing demand for creative equipment financing solutions that better position growing small and mid-cap companies to strengthen their market position.

“At NFS Leasing, we strive to provide opportunities in the face of challenges, and our significant growth in 2024 is a testament to our team’s dedication and the trust our customers place in us. Our team’s expertise, creativity, and speed in completing transactions have been pivotal to building value for our customers.”

NFS Leasing’s innovative approach has transformed equipment financing across a wide-range of industries, including technology, healthcare, biotechnology, life sciences, construction, manufacturing and aviation. By taking a flexible, story-based approach to credit and providing innovative financing solutions, NFS Leasing has become a lifeline for businesses striving to scale, pivot, or recover.

Eric Renaud, Chief Credit Officer at NFS Leasing, said, “What truly sets NFS Leasing apart is our ability to say ‘yes’ when others say ‘no.’

“Our commitment to story credit lending - evaluating the unique narratives behind each client’s circumstances - has become a defining differentiator in an industry often constrained by rigid frameworks. We take pride in delivering equipment financing solutions that empower businesses to grow, innovate and succeed.”

As demand for tailored equipment financing continues to grow, NFS Leasing remains committed to providing businesses with flexible financing solutions to support their evolving financing needs.

ABOUT NFS LEASING, INC.

NFS Leasing is a privately held independent equipment finance leader with more than 17 years of experience. NFS Leasing is a story lender and provides flexible equipment financing and secured loans to small and middle market non-investment grade companies in the U.S. and Canada. NFS uses its own balance sheet capital and provides customized solutions supporting emerging, turnaround, and established businesses. NFS Leasing is proud to have created thousands of jobs and infused over $1,500,000,000 of capital.

[headlines]

--------------------------------------------------------------

#### Press Release ########################

AP Equipment Financing Recognized in Best

Companies in Equipment Finance, Culture Category

BEND, OR. – AP Equipment Financing proudly announces its feature in the Best Companies in Equipment Finance, Culture Category by Monitor magazine. This recognition highlights the exceptional company culture fostered at AP Equipment Financing that has been instrumental in driving its success.

Founded in 1998, AP Equipment Financing remains committed to its motto, “The Power of Personal,” channeling this ethos into every client and partner interaction. The company has grown into a trusted leader by providing not only financing solutions but also innovative business growth programs, including inventory floor plan financing, fleet management services, and customized rental plans.

A pivotal moment in AP’s cultural evolution was the creation of its House Rules, designed to define and sustain the core values of the organization. Inspired by CEO Chris Enbom, CLFP, after attending a seminar stressing the central role of culture in business success, the House Rules were built collaboratively across all levels of the company. These 11 principles, from “Attitude is Everything” to “We Stand Behind Our Word - We Do What We Say,” are cornerstones of AP’s thriving workplace environment.

Chris Enbom, CLFP, CEO of AP Equipment Financing, said “I am very proud of this recognition for our company. Our leadership team recognized very early in AP's development as a company that creating a professional, positive culture was a vital part of our success. The creation of our specific culture has been intentional, and a cornerstone of our culture revolves around rules we developed which are strictly enforced. The rules were written by employees of all levels of the company and agreed by all.

“Tony Golobic of Great American Leasing spoke at a conference where he laid out the argument that culture is more important than any other aspect of a company... more than strategy, tactics, or capital. He was right, and I thank him for explaining how to cement a great culture in a company,”

To ensure these values thrive, AP created a Culture Committee to foster enthusiasm, collaboration, and inclusivity through initiatives like virtual gatherings and team-building events, connecting its predominantly remote workforce. Transparency and employee well-being are emphasized through quarterly Town Halls, anonymous Q&A sessions, and flexible work options. AP also supports growth with programs like educational reimbursements, Women’s Leadership Programs, and CLFP certifications.

Recognition remains vital, with highlights such as Employee of the Quarter awards and the year-end 'Rock Star Award,’ ensuring team members feel valued for their contributions.

This recognition by Monitor magazine underscores AP Equipment Financing’s unwavering dedication to a thriving workplace culture, enabling sustained growth while meeting the needs of diverse customers.

For more information about AP Equipment Financing visit http://www.apfinancing.com.

### Press Release #######################

[headlines]

--------------------------------------------------------------

News Briefs

Mexico Transfers Dozens of Cartel Operatives

to U.S. Custody

https://www.nytimes.com/2025/02/27/us/politics/mexico-cartel-sheinbaum-trump.html

Mexico First: How Mexico Plans To

Weather Trump’s Tariffs

https://www.truthdig.com/articles/mexico-first-how-mexico-plans-to-weather-trumps-tariffs/

U.S. Terminates Funding for Polio, H.I.V., Malaria

and Nutrition Programs Around the World

https://www.nytimes.com/2025/02/27/health/usaid-contract-terminations.html

How to Keep Hackers From

Destroying Your Digital Life

https://www.wsj.com/tech/personal-tech/how-to-keep-hackers-from-destroying-your-digital-life-f632ac16?st=Cs3YGr&reflink=desktopwebshare_permalink

FAA Aims to Boost Hiring of Air-Traffic Controllers

and Update Its Technology

https://www.wsj.com/business/airlines/faa-aims-to-boost-hiring-of-air-traffic-controllers-update-technology-318f9397?st=kuCmva&reflink=desktopwebshare_permalink

[headlines]

--------------------------------------------------------------

Dirty Dozen tax scams for 2025: IRS warns taxpayers

to watch out for dangerous threats

https://www.irs.gov/newsroom/dirty-dozen-tax-scams-for-2025-irs-warns-taxpayers-to-watch-out-for-dangerous-threats

[headlines]

--------------------------------------------------------------

Sports Briefs---

Buffalo Bills and team-leading receiver agree

to 4-year contract extension

https://www.syracuse.com/buffalo-bills/2025/02/buffalo-bills-team-leading-receiver-agree-to-4-year-contract-extension.html

[headlines]

--------------------------------------------------------------

![]()

California News Briefs---

Elon Musk’s DOGE layoffs hit California National

Weather Service employees

https://www.sfchronicle.com/weather/article/noaa-layoffs-california-national-weather-service-20192595.php

Forest Service chief, a former Bay Area resident,

retires after thousands of layoffs

https://www.sfgate.com/politics/article/forest-service-chief-retires-criticizes-firings-20192715.php

[headlines]

--------------------------------------------------------------

Gimme that Wine

![]()

http://www.youtube.com/watch?v=EJnQoi8DSE8

Winery Jobs Index Sales & Marketing

https://www.winebusiness.com/news/article/298766

The Livermore Valley Wine Community Announces the

Formation of The Global Artisan Vintners Alliance

https://www.winebusiness.com/news/article/298903

[headlines]

----------------------------------------------------------------

![]()

This Day in History

https://leasingnews.org/archives/Feb2021/02_26.htm#history

-------------------------------------------------------------

SuDoku

The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler?

--------------------------------------------------------------

Daily Puzzle

How to play:

http://www.setgame.com/set/puzzle_frame.htm

Refresh for current date:

http://www.setgame.com/set/puzzle_frame.htm

--------------------------------------------------------------

http://www.gasbuddy.com/

http://www.gasbuddy.com/GB_Map_Gas_Prices.aspx

http://www.gasbuddy.com/GB_Mobile_Instructions.aspx

--------------------------------------------------------------

Weather

See USA map, click to specific area, no commercials

--------------------------------------------------------------

Traffic Live---

Real Time Traffic Information

You can save up to 20 different routes and check them out with one click,

or type in a new route to learn the traffic live

--------------------------------

Wordle

https://www.powerlanguage.co.uk/wordle/

How to Play

https://www.today.com/popculture/popculture/wordle-know-popular-online-word-game-rcna11056

![]()