Information, news, and entertainment for the commercial

alternate financing,

bank, finance and leasing industries

Subscribe to Leasing News - Free

| Search | All Lists | Site Map

Advertising| Archives | Classified Ads | Columnists

Email the Editor

![]()

Wednesday, January 31, 2024

Today's Leasing News Headlines

Great Tine to be a True Independent or an

Equipment Finance company that Acts Independent

By Randy Haug, LTi

80% of Small Business Borrowers Point to Interest

Rates as Their Top Problem when Accessing Credit

Leasing and Finance Industry Help Wanted

Excellent Compensation/Marketing Support

Helping an Originator to Break the Status Quo

By Scott Wheeler, CLFP

Leasing News Advisory Board Chair

Shari L. Lipski, CLFP

Commercial Finance/Leasing Finance Conferences

2024 - Linked Updated

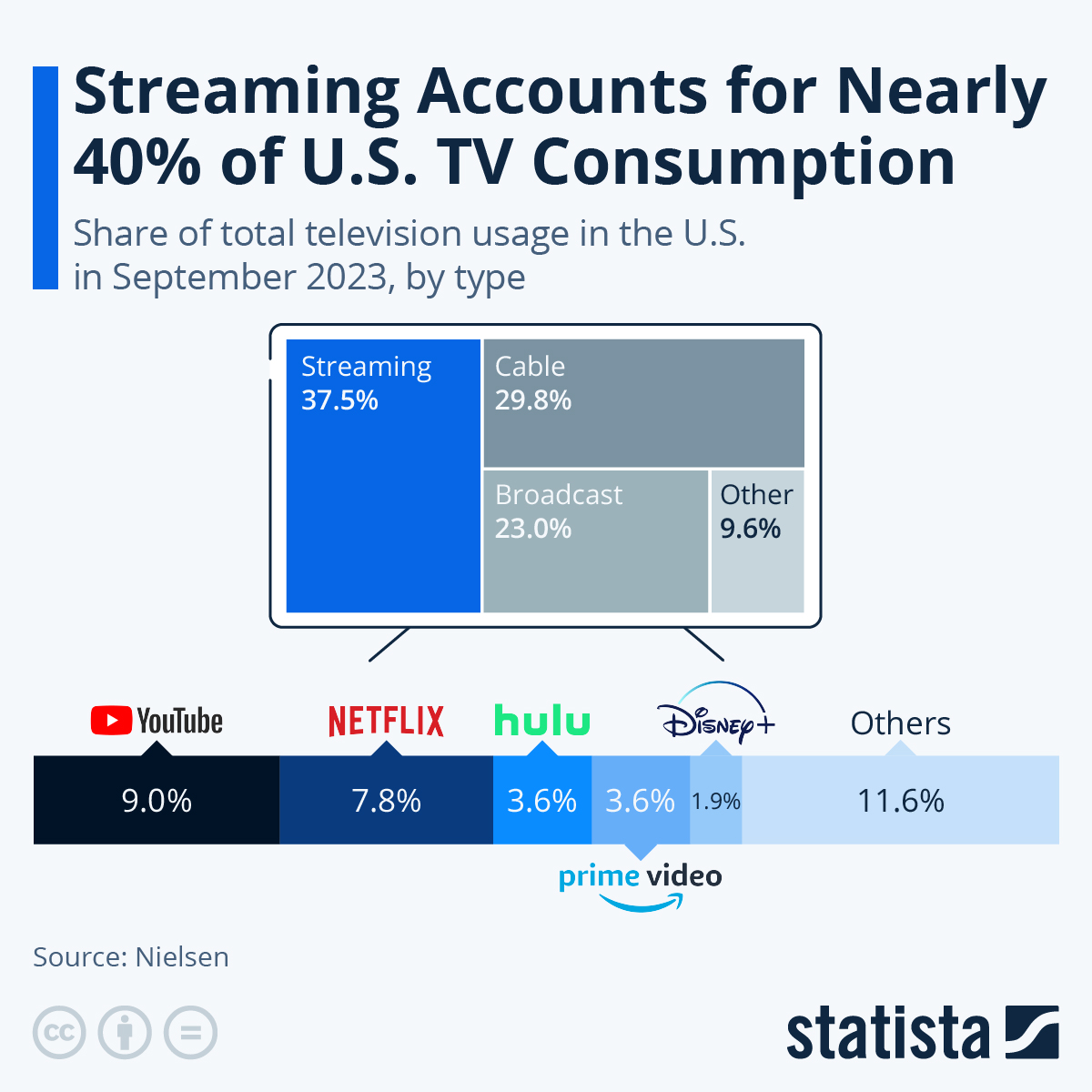

Streaming Accounts Chart for Nearly

40% if U.S. TV Consumption

AP Embarks on the Strategic Expansion

of Several Key Programs

Cattle Dog Mix

Roseville, California Adopt-a-Dog

News Briefs ---

GM Profits Hurt by Electric car Business and Strike

But Made $10. billion, 2$ Increase from 2023 earnings

Truck Makers Team Up to Push for

Electric Vehicle Chargers

UPS stock down before market open as company

says it's eliminating about 12,000 jobs

83% of Finance Leaders Dealt

With Cyber Fraud in 2023

You May Have Missed ---

Elon Musk cannot keep Tesla pay package

worth more than $55 billion, judge rules

Broker/Funder/Industry Lists | Features (wrilter's columns)

Top Ten Stories Chosen by Readers | Top Stories last six months

Sales Make It Happen

Sports Briefs

California News

"Gimme that Wine"

This Day in History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

Wordle

######## surrounding the article denotes it is a press release, it was not written by Leasing News nor has the information been verified, but from the source noted. When an article is signed by the writer, it is considered a byline. It reflects the opinion and research of the writer.

[headlines]

--------------------------------------------------------------

Great Tine to be a True Independent or an

Equipment Finance company that Acts Independent!

By Randy Haug, LTi

The current market place and liquidity issues that prevail within many traditional banks today makes this an ideal time to be an independent, both on the Origination and Funding side, as long as you have anticipated and worked toward securing additional funding lines and dry capital needed to take advantage of the current market conditions.

Let’s take a look at how this is having an effect on the market. Small ticket independents are finding more direct and vendor business opportunities than they ever have in the past. And in market segments they like to work in from a credit perspective (sometimes all credit stacks) that give them the margins and the types of risk-based returns/margins they seek.

Many are very smart and have top tier credit policies, teams and savvy sales teams that allow them to sell efficiently at all levels of pricing required to be successful today. Not just at the very low bottom rates, which really are not prevalent and available in today’s market. Which is turn allowing them to expand and do well in these markets.

If you pay attention to the Independent market and new hires over the last year and particularly over the last 6 months, quality talent is migrating quickly from many regional and money center banks to smaller, yet significant small to middle market independents and other equipment finance companies who very much act like Independents in the marketplace.

The leaders that operate these companies are many times veterans and some have come from and through the bank equipment finance arenas in the recent past. They are experienced, are thought leaders, and are doing a great job positioning their businesses for significant growth. I look for that to continue beyond 2024-2025.

Randy Haug | EVP/ Co-Founder

LTi Technology Solutions

w: 402.493.3445 ext. 1014

Mobile: 402-981-3155

rhaug@ltisolutions.com

www.ltisolutions.com

https://leasingnews.org/Advisory%20Board/Haug_Randy.htm

[headlines]

--------------------------------------------------------------

80% of Small Business Borrowers Point to Interest

Rates as Their Top Problem when Accessing Credit

“Small business owners have been navigating higher interest rates since the Federal Reserve started hiking rates in March 2022, but have been increasingly affected by higher rates over the last six months. NFIB again asked about business owners’ financing activities and their experience in accessing credit.

The health of the financial system is essential to small business operations and this report offers insight into how well it is serving their small business clients,” reads the NFIB Financing Sales Survey published in December.

These are the key takeaways:

- 69% of small business owners use a small, regional, or local bank; 17% use a large bank; and 14% use a medium bank.

- In December, 74% of small business owners did not try to borrow money for their business within the prior three months.

- For the 26% that did borrow money, the small business owners were evenly split about their satisfaction: 32% mostly satisfied, 30% moderately satisfied, and 30% unsatisfied.

- The number one reason small business owners were not satisfied when borrowing was the high interest rates.

- When small businesses applied for financing, the top reasons were to expand business (29%), meet operating and inventory expenses (26%), and replace capital assets or make repairs (24%).

- 56% of the owners received a term loan, and, 28% of owners received a line of credit.

Source:

NFIB Financing Sales Survey

Coleman Report

28081 Marguerite Pkwy.

#4525, Mission Viejo, CA 92690

bob@colemanreport.com

[headlines]

--------------------------------------------------------------

Leasing and Finance Industry Help Wanted

[headlines]

--------------------------------------------------------------

Helping an Originator to Break the Status Quo

By Scott Wheeler, CLFP

I recently coached a veteran originator. His production level was slightly below the $25.0M level and his goal is to be in the top third of industry originations.

Close inspection of his daily activities confirmed that most of his activities and relationships are the same as they were prior to 2019. He is confined by the status quo.

The originator quickly defined several new relationships, opportunities, and programs that he was aware of but had not pursued, because of what he considered time restraints.

In a matter of weeks (not months) the originator was capturing new business. He was re-energized and he was seeing greater potential.

The originator's energy also allowed him to serve his existing vendors and end-users with additional vigor and purpose. The originator is focusing on maximizing his results, prioritizing his activities, working more efficiently, and having fun again.

I basically pursued the “Wheeler Business Consultant's recent survey; a third of all originators produce more than $25.0M of equipment funding annually. These top producers are:

- Focusing on efficient relationships

- Developing programs that ensure a consist flow of business

- Using technology to leverage their activities

- Constantly prospecting for new opportunities

- Moving forward with confidence.

Scott A. Wheeler, CLFP

Wheeler Business Consulting

1314 Marquis Ct.

Fallston, Maryland 21047

Phone: 410 877 0428

Fax: 410 877 8161

Email: scott@wheelerbusinessconsulting.com

Web: www.wheelerbusinessconsulting.com

Wheeler Business Consulting is working with individual originators and sales teams throughout the industry to ensure that they are well positioned in the market, capturing their fair share of business, and outperforming the competition. To schedule a one-on-one meeting contact Scott Wheeler at: scott@wheelerbusinessconsulting.com

[headlines]--------------------------------------------------------------

Leasing News Advisory Board Chair

Shari L. Lipski, CLFP

Shari L. Lipski, CLFP

Principal

ECS Financial Services

3400 Dundee Road, Suite 180

Northbrook, Illinois 60062

847.897.1711

SLipski@ecsfinancial.com

www.ecsfinancial.com

December 31, 2020, she was named Chair of the Leasing News Advisory Board when Bob Teichman, CLFP, retired. January 1, 2019 Shari was named Vice-Chair of Board. She is both intelligent and diplomatic, and well respected in the industry.

Shari previously served on the Leasing News Advisory Board from March, 2003 to January, 2005, and rejoined in February, 2016. Her resume includes over 30 years of experience in equipment lease portfolio management, lease originations, and corporate business development.

From 1989 through 1997, Shari worked for Public Funding Corporation, a financer of small-ticket governmental equipment leases. During her time with Public Funding, she held various positions including Lease Administrator, Corporate Secretary, and garnered equity ownership when she took the position of Vice President. In 1997, Public Funding was sold to First Sierra Financial, Inc. It was at that time Shari assumed responsibilities for managing operations in the Chicago branch office, as well as a portfolio of vendor relationships.

In 1999, Shari joined ECS Financial Services, Inc., CPAs, and is responsible for corporate business development with a direct focus on the Equipment Lease and Loan Portfolio Management Division as well as the Tax, Accounting, and Audit Divisions. She also serves the firm’s clients by offering an expertise in many areas including marketing and managing a lease/loan portfolio, back-office leasing company operations, business process outsourcing, sales and personal property tax compliance, and consulting.

Shari has written for several trade publications, served as an educational instructor for several associations, as well as the Certified Leasing and Finance Professional Foundation. She was featured in the 2019 Monitor Magazine “Women in Leasing.”

OFFICES/POSITIONS HELD:

2021-present: Equipment Leasing and Finance Foundation, Trustee

2017-2020: SFN-Midwest Leadership Committee Member and Membership Committee, Co-Chair, and Women in Commercial Finance Committee Member (formerly CFA)

2017-2020: ELFA, Service Providers Business Council Steering Committee

2019 Named one of the Top 50 Women in Equipment Finance, Monitor Magazine (accolade)

2019 NEFA Funding Symposium Conference Co-Chairperson

2017-2019: ELFA, Women’s Council Founding Member

2016-present: Advisory Board Member

2012-present: Women In Leasing, LinkedIn Discussion Group, Owner

2013: Advisory Committee Member, Rockford Career College

2012: NEFA, Funding Symposium-Conference Committee

2011: NEFA, Finance Summit-Conference Chairperson

2010-2012: NEFA, Conference Committee Member

2008-2012: ELFA, Service Providers Business Council Committee Member, State Government Relations Committee Member, and Annual Convention Review Committee Member

2009 Named of the 20 Most Influential Women in Leasing, Leasing News (accolade)

2005-2008: EAEL, Director

2006-2008: CLP Foundation, Director

2007 EAEL, Fall Expo-Conference Chairperson

2003-2005: Leasing News Advisory Board

2004-present: ECS Financial Services, Inc., Principal

2003: NAELB, Conference Chairperson

2002-2003: CLP Foundation, Marketing Committee Chairperson

2001-2004: Mid-America Association of Equipment Lessors (MAEL), Director

1998: UAEL, Illinois Regional Chairperson

1999-2004: ECS Financial Services, Inc., Lease Portfolio Manager

1993-1997: Public Funding Corporation, Vice President

1989-1993: Public Funding Corporation, head envelope and stamp licker

[headlines]

--------------------------------------------------------------

Commercial Finance/Leasing Finance Conferences

2024

March 5-7: Funder's Forum, Miami, Florida

https://thefundersforumbrokerexpo.com

March 25–28: NEFA Finance Summit, Huntington Beach, CA

April 16–18: AACFB Conference, Glendale, Arizona

https://annualconference.aacfb.org/home

Book Your Room, Special Rate until March 25, 2024

https://myemail.constantcontact.com/Book-Your-Room-for-2024-AACFB-Annual-Conference-in-Arizona.html

April 16-18: ELFA National Funding Conference, Chicago, IL

https://thefundersforumbrokerexpo.com

April 30-May 1: AGLF Conference, Austin, Texas

May 5–7: Equipment Finance Connect, Nashville, Tenn.

https://equipmentfinanceconnect.com

Sept. 4-5: AACFB Commercial Financing Expo New Orleans, LA

Sept. 10-12: Auto Finance CEOs, San Antonio, Texas

Sept. 10-12, CFLA Conference, St. John's, NL, Canada

Oct. 16-18: NVLA Conference, Clearwater Beach, Florida

Oct. 27-29: 63rd ELFA Annual Convention, Austin, TX

Nov. 3- Nov. 5: NACLB Conference, Las Vegas, NV

https://naclb.getregistered.net/2024-conference-expo/agenda

Nov. 11-14: NEFA Funding Symposium, Indianapolis, Indiana

To be listed, email: kitmenkin@leasingnews.org

[headlines]

--------------------------------------------------------------

Streaming Accounts Chart for Nearly

40% if U.S. TV Consumption

Beginning with the success of Netflix‘s all-you-can stream model, there has been a dramatic shift in TV consumption over the past decade. Consumers quickly came to appreciate the flexibility, ease-of-use and affordability of Netflix and other streaming services that inevitably followed, making life increasingly hard for broadcast TV networks, cable TV providers and traditional pay-TV channels such as HBO.

Felix Richter, Statista

[headlines]

--------------------------------------------------------------

########### Press Release #####################

AP Embarks on the Strategic Expansion

of Several Key Programs

Bend, OR – AP Equipment Financing, a leading name in equipment financing, is proud to announce a new expansion initiative designed to diversify and nurture their growing portfolio. In 2024, AP is placing a focus on expanding its towing and construction verticals with a concentrated effort on strengthening vendor, dealer, and manufacturer relationships.

As part of this expansion, AP brought onboard four industry experts spearheading these initiatives. Ryan Whitehead, with over 18 years of experience in equipment finance, brings an extensive background in the towing sector. Leading AP's initiative in the construction industry, Seth Davis is supported by seasoned professionals Andrew McBride and Adam Domke.

Ryan Whitehead: VP of Business Development – Towing

Ryan Whitehead leverages over 18 years of expertise in building relationships with end-users and dealers in various markets. Coming from Huntington National Bank (formally TCF Equipment Finance), Ryan’s wealth of experience makes him a recognized expert in the towing industry, known for providing excellent service and crafting tailored programs across the United States.

Seth Davis: VP of Business Development – Construction

Seth Davis, a seasoned professional, collaborates with construction dealers, manufacturers, and end-users to optimize profitability through tailored finance solutions. With prior roles as Territory Manager, Dealer Development, and Branch Manager, Seth brings expertise that spans vendor finance, sales team oversight, and dealer growth. His focus on client and vendor relationships positions him well for spearheading AP’s construction verticals.

Andrew McBride: VP of Business Development – Construction

Andrew McBride is an experienced sales professional in the finance industry with numerous years managing vendor programs at Marlin Capital Solutions. His expertise involves engaging new and existing equipment manufacturers and dealer networks through compelling offers, including subsidized promotions, floor planning, and retail solutions. With a focus on creating unique vendor programs, his extensive experience and networking skills make him an asset in AP’s new initiatives.

Adam Domke, CLFP: Business Development Officer – Construction

Adam Domke brings over 6 years of experience in the finance sector from Stearns Bank & Oakmont Capital, providing valuable business development expertise within the industry. His background includes extensive involvement in dealer programs and vendor management, with a strong focus on growth and sales.

Chris Lerma, CLFP, President of AP, states, “This expansion underscores our commitment to providing innovative solutions, fostering client success, and reinforcing our position as a leader in equipment financing. With a focus on towing and construction verticals, we're poised for significant growth, and our dedicated team of industry experts ensures a bright future ahead.”

About AP Equipment Financing:

Founded in 1998 and based in Bend, Oregon, AP Equipment Financing is a subsidiary of Tokyo Century (USA) Inc., the U.S. subsidiary of Tokyo Century Corporation. Tokyo Century Corporation, headquartered in Tokyo, has 7,800 employees, and offers specialty leasing and other high value-added financial services in more than 30 countries.

AP Equipment Financing is renowned for its reliability, consistently delivering innovative financial services and comprehensive expertise to ensure customer satisfaction. The affiliation with Tokyo Century Corporation grants AP the financial strength and resources of a large organization, while enabling them to uphold the swift and personalized service characteristic of an agile independent enterprise.

Learn more at https://apfinancing.com/

########### Press Release #####################

--------------------------------------------------------------

Cattle Dog Mix

Roseville, California Adopt-a-Dog

Pokey

Male

7 Months old

Neutered

House-Trained

Vaccinations up to date

Good in a Home with other dogs

introducing Pokey Puppy!!!

Pokey's estimated is May 2023. He came to us in poor condition from one of the Central Valley shelters so he had little hope of making it out. Pokey has had good care and good groceries and has flourished. He appears to be a short stack Cattle Dog mix given his coloration and some of his behaviors.

Pokey is still shy with new people and to some extent, other dogs so patience will be needed for his transition. Once he is comfortable, he is happy and playful. Pokey has been learning about the wide world and walks the neighborhood every day. He will continue to need exposure and reassurance for outings as he matures, along with solid training. Pokey is currently 23-24 lbs and will most like be between 30-40 lbs at maturity. He is a strong and active player so another sturdy playful pup would be good. Pokey sleeps in his crate at night. He has also mastered the dog door. And he is pretty much potty trained.

Pokey's wish list:

1. Fenced yard

2. Daily walks and activity

3. No young children. Older respectful children

4. Continued training

5. Patience and leadership

6. A compatible playmate

Sacramento Independent Animal Rescuers

Roseville, California

http://www.siarescuers.org/

Email: star.1@comcast.net

[headlines]

--------------------------------------------------------------

News Briefs

GM Profits Hurt by Electric car Business and Strike

But Made $10. billion, 2$ Increase from 2023 earnings

https://www.bostonglobe.com/2024/01/30/business/gm-profits-hurt-by-electric-car-business-strike/

Truck Makers Team Up to Push for

Electric Vehicle Chargers

https://www.nytimes.com/2024/01/30/business/electric-vehicles-trucks.html

UPS stock down before market open as company

says it's eliminating about 12,000 jobs

https://abcnews.go.com/Business/wireStory/ups-stock-market-open-company-softer-expected-full-106791152

83% of Finance Leaders Dealt

With Cyber Fraud in 2023

https://www.cfo.com/news/cyber-fraud-2023-survey-trustpair/705928/

|

[headlines]

--------------------------------------------------------------

Elon Musk cannot keep Tesla pay package

worth more than $55 billion, judge rules

https://www.bostonglobe.com/2024/01/30/business/elon-musk-tesla-compensation-package/

[headlines]

--------------------------------------------------------------

Sports Briefs---

How Brock Purdy QB’d 49ers to the Super Bowl

by shredding his ‘game manager’ rep - The Full Story

https://www.sfchronicle.com/sports/michaelsilver/article/brock-purdy-super-bowl-qb-18634404.php

The 10 Super Bowl storylines you’ll hear

(over and over) before 49ers play Chiefs

https://www.eastbaytimes.com/2024/01/30/ten-super-bowl-storylines-that-will-go-bust-before-49ers-play-chiefs/

Pebble Beach Pro-Am’s new vibe: More top golfers,

more money, fewer celebs

https://www.sfchronicle.com/sports/article/pebble-beach-pro-am-new-vibe-top-golfers-fewer-18631552.php

[headlines]

--------------------------------------------------------------

![]()

California News Briefs---

S.F.’s largest downtown project is now a gaping hole.

Here’s how the legal mess could get resolved

https://www.sfchronicle.com/realestate/article/sf-downtown-oceanwide-18635503.php

[headlines]

--------------------------------------------------------------

Gimme that Wine

![]()

http://www.youtube.com/watch?v=EJnQoi8DSE8

Crystal Geyser Water Company to shut down

Calistoga operations

https://www.northbaybusinessjournal.com/article/article/crystal-geyser-water-company-to-shut-down-end-of-january/?ref=mosthome

Axe Falls Again at Vintage Wine Estates

At least 92 potential VWE layoffs were reported

https://www.wine-searcher.com/m/2024/01/axe-falls-again-at-vintage-wine-estates

Pink Won't Save California Wine

California has too many grapevines

https://www.wine-searcher.com/m/2024/01/pink-wont-save-california-wine

This company controls much of the alcohol industry.

Can a lawsuit and the feds break its grip?

https://www.sfchronicle.com/food/wine/article/southern-glazers-alcohol-18611711.php

[headlines]

----------------------------------------------------------------

![]()

This Day in History

https://leasingnews.org/archives/Jan2022/01_31.htm#history

-------------------------------------------------------------

SuDoku

The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler?

--------------------------------------------------------------

Daily Puzzle

How to play:

http://www.setgame.com/set/puzzle_frame.htm

Refresh for current date:

http://www.setgame.com/set/puzzle_frame.htm

--------------------------------------------------------------

http://www.gasbuddy.com/

http://www.gasbuddy.com/GB_Map_Gas_Prices.aspx

http://www.gasbuddy.com/GB_Mobile_Instructions.aspx

--------------------------------------------------------------

Weather

See USA map, click to specific area, no commercials

--------------------------------------------------------------

Traffic Live---

Real Time Traffic Information

You can save up to 20 different routes and check them out with one click,

or type in a new route to learn the traffic live

--------------------------------

Wordle

https://www.powerlanguage.co.uk/wordle/

How to Play

https://www.today.com/popculture/popculture/wordle-know-popular-online-word-game-rcna11056

![]()