Information, news, and entertainment for the commercial

alternate financing,

bank, finance and leasing industries

Subscribe

| Search | All Lists | Site Map

Conferences/Forums |

Advertising | Archives | Columnists

Don’t take the bait on phishing scams |Top Ten Stories Chosen by Readers

Contact: kitmenkin@leasingnews.org

![]()

Wednesday, January 29, 2025

Today's Leasing News Headlines

Top Ten List Correction

Number Ten was originally omitted

New Hires/Promotions in the Leasing Business

and Related Industries

Veteran Barry Shafran Hired as Chairman

of Alliance Funding Group

Balboa Capital Available Position

Program Manager II - Equipment Broker Sales

Full Job Details - Benefits

2025 Opportunity is Growing to Larger Numbers

By Scott Wheeler, CLFP

Newly Launched Alliance Equipment Finance

Brings Decades of Experience to Equipment Financing

Jupiter Equipment Finance Celebrates 10 Years of

Success with Significant Growth and Bold Future Plans

News Briefs---

The Fed Is About to Hit Pause on

Rate Cuts. Here’s Why

Judge Blocks Trump’s Federal-Assistance Freeze

After Chaos Over Medicaid, Other Funding

Banking regulator rescinds more than 200 job

offers for examiners it needs

Trump offering buyouts to all federal workers,

source says

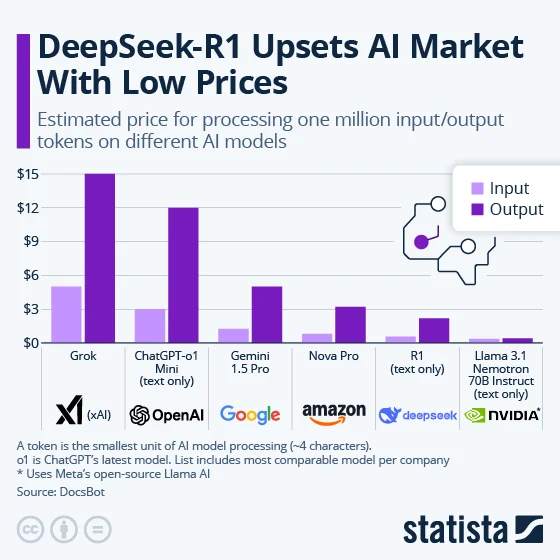

DeepSeek just blew up the AI industry’s narrative

that it needs more money and power

G.M. Has Plans Ready for Trump’s

Canada and Mexico Tariffs

Got milk? At Starbucks the answer is yes,

and it’s back on the condiment bar

You May Have Missed ---

DeepSeek-R1 Upsets A1 Market

With Low Prices

Sports Briefs

California News

"Gimme that Wine"

This Day in History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

Wordle

######## surrounding the article denotes it is a press release, it was not written by Leasing News nor has the information been verified, but from the source noted. When an article is signed by the writer, it is considered a byline. It reflects the opinion and research of the writer.

[headlines]

--------------------------------------------------------------

Top Ten Correction

Number Ten Originally Omitted

(7) Balboa Capital Job Board

https://recruiting.ultipro.com/AME1062AMERI/JobBoard/eb04fcfa-9141-457f-ac1c-41b41f2682ad/?q=&o=postedDateDesc

(10) Leasing and Finance Industry Help Wanted

Balboa Excellent Compensation/Marketing Support

https://leasingnews.org/archives/Jan2025/01_24.htm#ads_help

https://leasingnews.org/archives/Jan2025/01_27.htm#122

[headlines]

--------------------------------------------------------------

New Hires/Promotions in the Leasing Business

and Related Industries

Ananya (Das) Menon was hired as Vice President, Quality Control Manager, Port 51 Lending, New York, New York. She is located in New Providence, New Jersey. Previously, she was at Ready Capital, starting February, 2022, Quality Control Associate, promoted June, 2023, Quality Control & Loan Processing Manager, promoted Vice President, Quality Control & Loan Processing Manager (February, 2024 - April, 2024). Full Bio:

https://www.linkedin.com/in/ananya-menon-75100513/details/experience/

https://www.linkedin.com/in/ananya-menon-75100513/

Frederick “Fred” Van Etten retiring after 47 years. He is located in Scottsdale, Arizona. He is leaving Midland States Bank as President * CEO of Midland Equipment Finance, also in Scottsdale, Arizona. ( ‘I remember when you used to write articles for Leasing News and life then changed after you successfully sold First Sierra Financial to American Express Business Capital. He wrote, “I went to work for the private equity firm (Redstone Companies) which first had given us the seed capital to start First Sierra. I co-managed their bank interests and other entities." Editor.) He remains as Owner and Partners Van Etten Farms LLC (2003 - Present); He was President & Founder, Scottrade Bank Equipment Finance (December, 2012 - November, 2017). Full Bio:

https://www.linkedin.com/in/fredvanetten/details/experience/

Past Articles on Mr. Etten:

https://leasingnews.org/Conscious-Top%20Stories/van_etten.htm

https://leasingnews.org/Conscious-Top%20Stories/whateverFred.htm

[headlines]

--------------------------------------------------------------

###################################

Veteran Barry Shafran hired as Chairman

of Alliance Funding Group

TUSTIN, CA - Alliance Funding Group (“AFG”) is pleased to announce the appointment of Barry Shafran as Chairman. Mr. Shafran was the Founder, CEO, and Director of Chesswood Group Limited, as well as the CEO of Pawnee Leasing Corporation, until 2020. During his tenure, he oversaw almost twenty years of consistent growth in earnings and portfolio.

Mr. Shafran brings a diverse background that includes managing all aspects of a public equipment finance business. His expertise spans driving growth and profitability, developing and executing strategic initiatives, risk management, treasury operations, fundraising in both private and public markets, investor relations, strategic mergers and acquisitions, and the oversight and guidance of management teams.

Brij Patel, CEO of AFG, commented, “AFG has grown significantly over the past five years, including the emergence of our on-balance sheet portfolio across both small ticket and middle market segments, with $750MM+ in AUM. As we continue that growth, Barry will bring to AFG his considerable experience in risk management, portfolio growth, strategic planning, and team building.

“I look forward to working with Barry in building a formidable specialty finance company while maintaining the culture of AFG. This culture has been instrumental to our success in attracting best in class talent.”

AFG has funded over $3B in equipment leases, loans and working capital to more than 25,000 customers since 1998 and is ranked as one of the fastest-growing independent leasing companies in the US.

afg.com

#####################################

[headlines]

--------------------------------------------------------------

Balboa Capital Available Position

Program Manager II- Equipment Broker Sales

Full Job Details - Benefits

[headlines]

--------------------------------------------------------------

2025 Opportunity

By Scott Wheeler, CLFP

Top originators in the commercial equipment finance and leasing industry are capitalizing on a unique opportunity. A void is developing in the industry to fund transactions that require extra expertise and financial analysis; transactions that may have qualified for an application-only process just a few years ago.

There are strong applicants seeking between $250.0K and $750.0K of equipment funding which, rightfully, require full financial packages in order to render a proper credit decision. Top originators are embracing these transactions and building credit files for not only their immediate needs, but for future transactions. Top originators are building long-term relationships rather than pursuing a single transaction.

Recently, an originator solicited a larger end-user that was seeking $150.0K for manufacturing equipment. The originator was confident that he could secure an application-only approval. However, he was convinced that this end-user had ongoing needs. The originator asked the right questions, requested three years of financial statements, and submitted a complete credit package to his credit department.

His package outlined the financial strengths of the company, the upcoming equipment acquisitions being considered, and how those acquisitions would strengthen the company's ability to win additional business and improve profitability. The credit department approved an initial request for $750.0K; and subsequently increased the approval to $1.2MM.

Many average originators would have been satisfied with the original request for $150.0K and subsequently moved on to the next end-user. This top originator correctly assessed the situation, moved beyond an application-only mentality, and secured a relationship which produced $1.2MM of new business.

The market is filled with similar opportunities for savvy originators who have credit attributes, are willing to have meaningful financial conversations with decision makers, and are seeking larger relationships with financially strong end-users.

Scott A. Wheeler, CLFP

Wheeler Business Consulting

1314 Marquis Ct.

Fallston, Maryland 21047

Phone: 410 877 0428

Fax: 410 877 8161

Email: scott@wheelerbusinessconsulting.com

Web: www.wheelerbusinessconsulting.com

Wheeler Business Consulting is working with individual originators and sales teams throughout the industry to ensure that they are well positioned in the market, capturing their fair share of business, and outperforming the competition. To schedule a one-on-one meeting contact Scott Wheeler

[headlines]

--------------------------------------------------------------

##### Press Release #######################

Newly Launched Alliance Equipment Finance Brings

Decades of Experience to Equipment Financing

AFG and Lightbrook announce the launch of Alliance Equipment Finance (AEF) , a new standard of efficiency and expertise to equipment financing. Specializing in transactions ranging from $5 million to $50 million, AEF offers businesses streamlined financial solutions to support critical capital investments.

Randy Hicks, President and CEO, Todd Greenberg, Chief Risk Officer and Ryan Elsass, Chief Revenue Officer will lead AEF. Randy and Todd have worked together for over a decade at Nations Equipment Finance, while most recently he was with Post Road Equipment Finance. “Todd brings a terrific balance of risk assessment with the ability to deliver thoughtful solutions to our clients”.

Randy Hicks, brings over 30 years of experience in equipment leasing, corporate finance, and business development. His extensive career includes co-founding Nations Equipment Finance, where he led origination efforts across the U.S. and Canada, as well as holding senior leadership roles at GE Capital. Hicks’s proven expertise in structuring complex financial solutions establishes AEF as a trusted partner for businesses managing sophisticated capital needs. “I hope to impart my experience while empowering my colleagues to take on leadership roles and build a business that delivers for our clients and a portfolio that produces for our partnership.

Todd Greenberg

Ryan Elsass joins AEF from 36th Street Capital where he developed and fostered deep relationships with large privately held companies as well as many private equity sponsors. “Ryan has enjoyed many years of success originating large ticket transactions across many industries and collateral types. I couldn’t be more excited for him to lead our origination effort.”

https://www.linkedin.com/in/ryanelsass/

Alliance Equipment Finance leverages the strategic support of Alliance Funding Group (AFG), founded in 1998 by Brij Patel. As a seasoned leader in the equipment financing industry, Patel has built AFG into a powerhouse, originating over $3B in leased assets across a wide range of industries.

AEF will be supported by Lightbrook, founded by former Truist Bank investment banking veterans Andrew Carroll and Prashant Upadhyay.

Randy Hicks, said, “Andrew and Prashant, I refer to them as our secret weapon, bring unparalleled experience in sourcing and delivering external capital and ABS directly into our business. They know exactly how our portfolio can be constructed to provide us access to the most cost effective capital available in the market. I do not believe this level of in-house experience exists with any other independent equipment finance platform today.”

AEF’s mission is to empower businesses with reliable large scale financing solutions rooted in decades of industry knowledge. By prioritizing precision and execution, AEF ensures transactions are handled efficiently and accurately, delivering dependable results for every project.

### Press Release #######################

--------------------------------------------------------------

### Press Release #######################

Jupiter Equipment Finance Celebrates 10 Years of

Success with Significant Growth and Bold Future Plans

JUPITER, FL – Jupiter Equipment Finance proudly marks its 10th anniversary, celebrating a decade of helping businesses nationwide secure the equipment financing they need to grow and succeed. By partnering with equipment dealers to provide their customers with seamless, competitive financing options at the point of sale, Jupiter has become a trusted resource in the industry. Jupiter Equipment Finance has established itself as a leader in the industry with over $1 billion in application dollars, an impressive 93% approval rate, and a loyal customer base.

Serving businesses in over 74 industries across all 50 states, Jupiter has earned a reputation for delivering personalized service tailored to the unique needs of its customers. The company's ability to support a wide range of customers - from start-ups to well-established enterprises with

diverse credit profiles - ensures that vendor partners and customers alike receive the assistance they need to thrive.

In December 2023, the company rebranded Jupiter Financial to Jupiter Equipment Finance, reinforcing its commitment to the equipment finance industry. The new name highlights its

dedication to supporting equipment sellers and buyers with an easy, competitive financing process that drives success for all parties.

Sean Coburn, CEO of Jupiter Equipment Finance, said, "As we celebrate this milestone, we are setting our sights on the future. Over the next 3-5 years, we plan to double or even triple our sales team, creating specialized industry-focused teams to deepen our expertise and deliver even

greater value to our vendor partners and customers."

A Testament to Customer Loyalty:

62% Repeat Business Jupiter's 62% repeat business rate reflects the trust and satisfaction it has cultivated among its customers. This impressive figure demonstrates the company's ability to consistently deliver reliable, tailored service year after year, with some single businesses financing 30 to 40 schedules, resulting in millions of dollars in transactions. Customers view Jupiter as a financing provider and committed partner invested in their long-term success.

"Our approach goes beyond traditional financing," Coburn added. "Our equipment finance specialists take the time to understand each customer's business and how their equipment investments will drive revenue. This allows us to deliver customized financing solutions with the most favorable terms."

A "Boots on the Ground" Approach

Jupiter Equipment Finance's unique "boots on the ground" approach sets it apart in the industry. By developing deep relationships with vendor partners and customers, Jupiter creates meaningful connections that extend beyond financing. The company often facilitates cross-selling

opportunities, matching customers with vendor partners specializing in the equipment needed. This relationship-driven model has become a significant value-add for both vendors and customers, fostering success across the board.

Committed to staying ahead of industry trends, Jupiter empowers its sales team with tools and data-driven insights to deliver personalized, one-to-one service. Its ability to understand the nuances of specific industries has earned widespread trust, positioning Jupiter as more than just a

finance provider - it is a partner invested in its customers' success.

Looking Ahead

"We are dedicated to continuously innovating and improving the experience for both our vendor partners and customers," Coburn said. "Our focus is on forging lasting relationships, and we see ourselves as partners invested in the success of the businesses we serve. As we expand, we'll continue to bring that commitment to every industry and every customer for years to come."

About Jupiter Equipment Finance

Based in Jupiter, FL, Jupiter Equipment Finance is a leading independent commercial equipment finance company dedicated to providing businesses with the financing solutions they need to achieve their goals. Jupiter Equipment Finance partners with equipment manufacturers, dealers,

and distributors to build industry-specific financing programs and supports businesses needing to finance their equipment with a straightforward and easy process. Driven by a team of seasoned equipment finance specialists, Jupiter Equipment Finance places a premium on gaining a

comprehensive understanding of each transaction to create customized financing solutions.

########### Press Release ###############

[headlines]

--------------------------------------------------------------

News Briefs

The Fed Is About to Hit Pause on

Rate Cuts. Here’s Why

https://www.nytimes.com/2025/01/28/business/fed-rate-cute-pause-why.html

Judge Blocks Trump’s Federal-Assistance Freeze

After Chaos Over Medicaid, Other Funding

https://www.wsj.com/politics/policy/white-house-orders-pause-of-federal-financial-assistance-programs-8362a8e0?st=FbQhYh&reflink=desktopwebshare_permalink

Banking regulator rescinds more than 200 job

offers for examiners it needs

https://www.washingtonpost.com/business/2025/01/27/fdic-bank-examiners-job-offers-rescinded/

Trump offering buyouts to all federal workers,

source says

https://www.axios.com/2025/01/28/trump-federal-workers-quit-severance

DeepSeek just blew up the AI industry’s narrative

that it needs more money and power

https://www.mercurynews.com/2025/01/28/deepseek-just-blew-up-the-ai-industrys-narrative-that-it-needs-more-money-and-power/

G.M. Has Plans Ready for Trump’s

Canada and Mexico Tariffs

https://www.nytimes.com/2025/01/28/business/general-motors-trump-mexico-canada-tariffs.html

Got milk? At Starbucks the answer is yes,

and it’s back on the condiment bar

https://www.pressdemocrat.com/article/industrynews/starbucks-policy-update

[headlines]

--------------------------------------------------------------

[headlines]

--------------------------------------------------------------

Sports Briefs---

Warriors to retire four-time champion

Andre Iguodala’s jersey

https://www.eastbaytimes.com/2025/01/28/warriors-to-retire-four-time-champion-andre-iguodalas-jersey/

[headlines]

--------------------------------------------------------------

![]()

California News Briefs---

As California burns, Trump freezes federal

spending to investigate it for ‘wokeness’

https://www.sacbee.com/news/politics-government/capitol-alert/article299314974.html

AF South Bay office building flops into default

as market woes widen

https://www.mercurynews.com/2025/01/28/santa-clara-office-property-build-economy-loan-develop-real-estate-tech/

6th-generation San Franciscan from billionaire

family takes over city's oldest coffee roastery

https://www.sfgate.com/food/article/walter-haas-acquires-sf-roastery-graffeo-coffee-20047694.php

[headlines]

--------------------------------------------------------------

Gimme that Wine

![]()

http://www.youtube.com/watch?v=EJnQoi8DSE8

Sonoma, Napa county vineyard owners fear deportation

of workers amid Trump’s immigration crackdown

https://www.pressdemocrat.com/article/lifestyle/immigration-vineyard-workers/

Trump’s plans could devastate California wine.

Here’s how some in Napa are ‘preparing for a war’

https://www.sfchronicle.com/food/wine/article/napa-immigration-coalition-trump-20047562.php

Winery Hiring Slows Through End of 2024

https://www.winebusiness.com/news/article/297668

New Bill Allowing Wine Shipments to New Yorkers

Supported by White Paper

https://nawr.org/press-releases/ny-shipping-bill/

[headlines]

----------------------------------------------------------------

![]()

This Day in History

https://leasingnews.org/archives/Jan2020/01_29.htm#history

-------------------------------------------------------------

SuDoku

The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler?

--------------------------------------------------------------

Daily Puzzle

How to play:

http://www.setgame.com/set/puzzle_frame.htm

Refresh for current date:

http://www.setgame.com/set/puzzle_frame.htm

--------------------------------------------------------------

http://www.gasbuddy.com/

http://www.gasbuddy.com/GB_Map_Gas_Prices.aspx

http://www.gasbuddy.com/GB_Mobile_Instructions.aspx

--------------------------------------------------------------

Weather

See USA map, click to specific area, no commercials

--------------------------------------------------------------

Traffic Live---

Real Time Traffic Information

You can save up to 20 different routes and check them out with one click,

or type in a new route to learn the traffic live

--------------------------------

Wordle

https://www.powerlanguage.co.uk/wordle/

How to Play

https://www.today.com/popculture/popculture/wordle-know-popular-online-word-game-rcna11056

![]()