Connect with Leasing News

Connect with Leasing News ![]()

![]()

![]()

![]()

![]() Add me to mailing list |

Add me to mailing list | ![]() |

| ![]() Search |

Search | ![]() Stress Release

Stress Release

Advertising | All Lists | Archives | Classified Ads | This Day In American History

Independent, unbiased and fair news about the Leasing Industry

kitmenkin@leasingnews.org

![]()

Dallas-Fort Worth Please submit resume to ron.mitchell@bancleaseacceptance.com |

Friday, July 13, 2012

Today's Equipment Leasing Headlines

Take Charge of Google's Revised Privacy Controls

by Nick Medioti, www.pcworld.com

Classified Ads---Senior Management

30 Days---No Response!

---re: Marlin Bulletin Board Complaint

Companies Who Do Not Notify Lessee regarding termination

nor have such a standard for their discounters

New Hires---Promotions

Classified Ads---Help Wanted

"Pre-Funding of Leasing" ruling

By Scott D. Chait, Esq.

Cartoon---Baseball

Fall Leasing Conferences---Up-date

United Capital Refinances Multi-Unit Applebee’s® Operator

$2 Million Illegal Tax Refunds on Deceased Returns

Australian Shepherd Puppy

Rancho Santa Fe Adopt a Dog

Savages/Your Sister's Sister

Margaret/Friends w/Kids/the Turin Horse

Movies/DVD reviews by Fernando Croce

News Briefs---

Big United order allows Boeing to claim a successful Air Show week

Former Sonoma National Bank chief to lead First Community Bank

Bankruptcy in California Isn’t Seen as a Trend

How the Richest 400 People in America Got So Rich

Broker/Funder/Industry Lists |

Features (collection)

Top Ten Stories Chosen by Readers |

Top Stories last six months

You May have Missed---

SparkPeople--Live Healthier and Longer

Sports Briefs---

Baseball Poem

California Nuts Brief---

"Gimme that Wine"

This Day in American History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

######## surrounding the article denotes it is a “press release”

and was not written by Leasing News nor information verified, but from the source noted. When an article is signed by the writer, it is considered a “by line.” It reflects the opinion and research of the writer. It is considered “bias” as it is the writer’s viewpoint.

Please send Leasing News and ask them to subscribe.

We are free! Send email to kitmenkin@leasingnews.org

and put in subject line: subscribe

[headlines]

--------------------------------------------------------------

Take Charge of Google's Revised Privacy Controls

by Nick Medioti

www.pcworld.com

Google's privacy settings can be tricky to navigate, but these tips should help limit what Google can find out about you.

Google Dashboard

Go to www.google.com/dashboard

The Google Dashboard offers an overview of the information that Google has stored on your personal account across many of its services. You need to log in with your Google account (typically an email address). Click through the various services and review the data that Google is storing. Then clear out any data you no longer want associated with your account

Google Web History

Go to www.google.com/history

Google Web History keeps track of your Web browsing to help Google serve you customized search results (and ads). Even while you're logged out of your Google account, Google can track your search history via a browser cookie. To turn this off, visit www.google.com/history. When here, click "Remove all web history."

On the next screen, click "OK" to confirm.

Google will then stop tracking your Web history. While you have completed this, according to Electronic Frontier Foundation, Google may continue to log the data for internal purposes to improve its search accuracy.

Disable Ads

www.google.com/settings/ads

You can go here also by going to settings. To disable personalized ads, head to settings or use the address above. In the left column, under "Ads on Search and Gmail', click "Opt Out" button to the right. You can always "opt in,” if you change your mind.

To prevent personalized ads that appear on other sites via Google’s Web ad services (a growing feature that works by looking at an ad, not choosing the product, but it is brought up to you again in Google News or another site), visit the same page as above. In the left column, under "Ads on the Web", click "Opt out" and click the "Opt out" button to the right.

[headlines]

--------------------------------------------------------------

Classified Ads---Senior Management

(These ads are “free” to those seeking employment or looking

to improve their position)

| Philadelphia, PA 27 yrs. exp. sales, ops., credit, strategy, P&L mngmet. Most recently created & executed the biz plans for 2 highly successful Bank-owned small ticket leasing subsidiaries. email: mccarthy2020@comcast.net |

| Southern CA 20 years exp. as hands-on leasing CFO, managing accounting, treasury, FP&A, including securitizations, Great Plains/FRx, budgets, risk management. MBA. Also available as interim Controller/CFO, consultant. Email: leasecfo@gmail.com |

Free Posting for those seeking employment in Leasing:

http://www.leasingnews.org/Classified/Jwanted/Jwanted-post.htm

All “free” categories “job wanted” ads:http://www.leasingnews.org/Classified/Jwanted/Jwanted.htm

Please send Leasing News and ask them to subscribe. We are free! Send email to kitmenkin@leasingnews.org and put in subject line: subscribe

[headlines]

--------------------------------------------------------------

30 Days---No Response!

---re: Marlin Bulletin Board Complaint

Ed Dietz, General Counsel for Marlin Business Services Corp., Mount Laurel, New Jersey wrote a letter to the editor that appeared in "Letters? We get eMail" June 13, 2012 stating: "...add Marlin's name to the list on www.leasingnews.org of leasing companies that notify lessees in advance of lease expiration...

"Please allow this letter to serve as Marlin's formal demand that you immediately (1) post a correction on www.leasingnews.org stating that Marlin does, in fact, notify lessees in advance of lease expiration (and locate such correction in at least as prominent a position as you gave to the inaccurate information you previously posted), and (2) add Marlin's name to the list on www.leasingnews.org of leasing companies that notify lessees in advance of lease expiration. I expect the correction to appear today."

He had also included William G. Sutton, CAE, President & Chief Executive Officer, Equipment Leasing and Financial Association with an email regarding the "request."

Leasing News made this request in its response on June 13, 2012:

"Regarding Mr. Dietz request concerning notification of lessees regarding residuals, please start the dialogue by responding to this complaint posted April 4, 2012:

Marlin Business Services, Mount Laurel, New Jersey

Bulletin Board Complaint

Leasing News has attempted since March 22, 2012 to contact officers at Marlin Leasing, with over six emails to one officer, including four telephone calls, as well as two emails to four officers followed up with two telephone calls. The emails included the complaint as well as the documents, and the telephone calls were follow-up to the emails.

There has been no response.

From:

Ken J. Krebs

Beneficial Capital

(800) 886 - 8944

ken@bencap.com

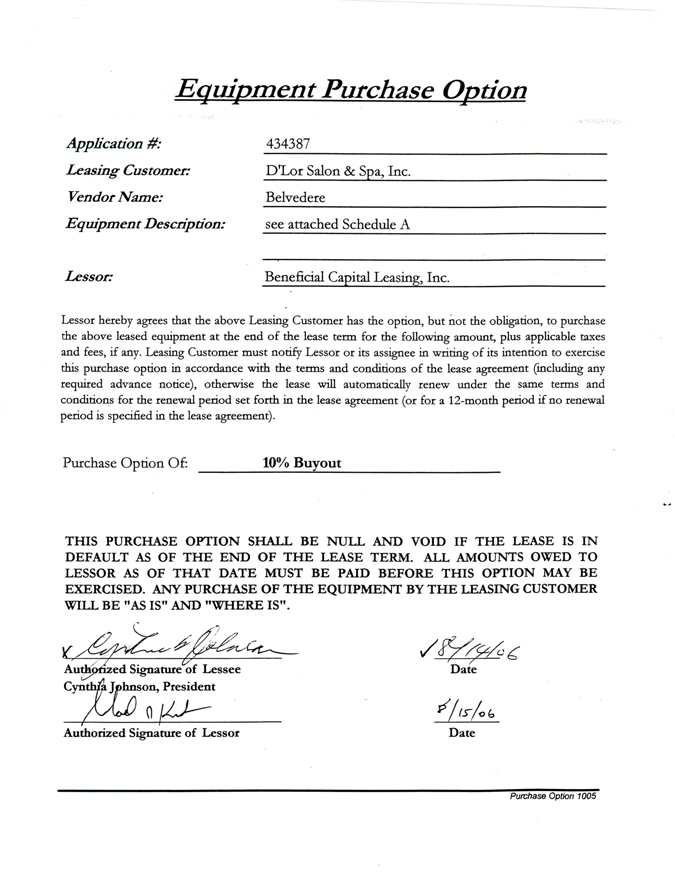

“I’ve been in this industry for about twenty years and although the past three have been rough, overall it has been a great experience. We have worked closely with so many quality people over the years, many who unfortunately are no longer around...I’m looking for some help, and hoping you may be able and willing. One of our Lessee’s contracts, that had been sold to Marlin, was put into auto renewal because the Lessee neglected (forgot) to exercise their purchase option. The contract was originally structured with two payments in advance as security deposit, followed by 60 monthly payments, and a 10% purchase option. They’ve recently realized they have now made 65 payments (five extra). In an effort to settle, they have offered to pay Marlin an additional $1,500 and to forfeit the return of their security deposit. This is a $25,000 contract with a $2,500 purchase option. The security deposit amount is $1,196.36. So, they are offering $1,500 plus $1,196.36 to settle the $2,500 purchase option. If accepted, this would give Marlin an additional 5 full payments plus $196.36. Marlin has declined the offer and in turn has requested an additional $3,000 payment as well as forfeiture of the security deposit. Can you help with this?"

From:

Patrick and Cynthia Tingling

D'Lor Salon & Spa

Atlanta, Georgia

“This is Patrick & Cynthia Tingling Owners of D’Lor Salon & Spa in Atlanta. We Regret that we have to take this course of action.

We feel that Marlin has received enough funds for the value of the equipment that was leased. We are willing to meet our obligations if they would meet us half way... the experience with marlin have left us a bad taste, hopefully you will be able to make sense to then that sometimes goodwill is far more valuable than driving customers away from the industry.

We must make a decision by tomorrow in order to prevent another monthly deduction from our bank account.

Thanks

Patrick and Cynthia..."

It appears the lease payments are ACH and the lessee was not aware that the original lease was up until they had made five extra payments on a 10% Purchase Option, which they are will to make:

There is no doubt this is not a "true lease" but a "capital lease" or "loan" in many states. This lease has a Pennsylvania choice of law and a Pennsylvania mandatory forum -- even though the lessee is in Georgia, the vendor is in Missouri, and there is absolutely no connection to Pennsylvania.

From:

Michael J. Witt, Esq.

MICHAEL J. WITT LAW OFFICES

4342 Oakwood Lane

West Des Moines, IA 50265

Tel: (515) 657-8706

Mobile: (515) 868-1067

Fax: (515) 223-2352

witt-law@live.com

“In my opinion Marlin stands on shaky grounds here. Most so-called ‘10% purchase option’ transactions in the small-ticket arena are not true leases under UCC 1-302 but are, instead, loans. It is preposterous to say that a loan can have an ‘automatic renewal’ provision. (How would anyone feel if, after paying off their mortgage over 30 years, the bank called and said the mortgage had "automatically renewed" for an additional 12-month period based on an auto-renewal clause hidden in the fine print?!)

“Marlin, we must all admit, was entitled to a particular return at the end of the 5-year term of this lease. However, it is now trying to illegitimately (in this one attorney's opinion) bloat its originally planned-for return by taking advantage of the fact that when this small-business lessee took out this lease in 2006, it did not purchase a un-purchasable 2011 calendar to mark the date it was required to notify Marlin not to renew the lease.

“Few people know that if Marlin did not have an auto-renewal program, it would be losing money (which only begs the question, how much longer do Marlin investors think that this flimsy business model can endure?). If this is not a true crime under our criminal codes, it is a crime against the industry that so many of us try to uphold every day we go to work.”

D’Lor Salon & Spa Lease Contracts:

http://www.leasingnews.org/PDF/DLor_Lease.pdf

June 13, 2012---Letters??---We get eMail

http://leasingnews.org/archives/Jun2012/6_13.htm#letters

[headlines]

--------------------------------------------------------------

Companies who utilize Evergreen Clauses for Extra Lease Payments

These companies use language in their purchase options to confuse, perhaps to deceive, with the result an automatic continuation for an additional twelve months of payments.

Several have contiuation of payments and the requirement of replacing the equipment for a new lease. Leasing News has had complaints involving companies who invoke the twelve months on a $1.00 purchase option, as well as on an Equipment Finance Agreements.

ACC Capital, Midvale, Utah

IFC Credit, Morton Grove, Illinois

Jules and Associates

LEAF Financial Group, Philadelphia, Pennsylvania

Marlin Business Leasing, Mount Laurel, New Jersey

Marquette Equipment Finance, Midvale, Utah

Mazuma Capital Corporation, Draper, Utah

Onset Financial, South Jordan, Utah

Republic Bank, Bountiful, Utah

Tetra Financial Group, Salt Lake City, Utah

ACC Capital, Midvale, Utah---This company is no longer in business, although its portfolio is being wound down, according to its owner Loni Lowder; the receivables are being collected by creditors. Lowder today is an employee, manager, Stalwart Contract Finance, Salt Lake City, Utah. To date, all Evergreen Clause complaints have been satisfied.

IFC Credit, Morton Grove, Illinois---This company is in bankruptcy, appeared many times in the Leasing News Bulletin Board prior to filing bankruptcy, but engaged in Evergreen Clauses, and unfortunately a recent example is a complaint to the trustee, stemming from M&T Bank lease assignment expiring and notify the lessee that they did not notify about the residual, which was a $1.00. This has happened many times with other banks who have taken over the IFC Credit Corporation portfolio. Calls and letters to the trustee and attorneys have gone unanswered.

Jules and Associates, Los Angeles, California--- Jules and Associates, Los Angeles, California---A repeat customer, who notified Jules and Associates on a lease, but was not before the 180 day expiration, so Jules and Associates instead of the 1% due for the residual ($2,308.79) charged six more payments or $40,463.94, and if 1% is not paid in this time, they will be subject to another three months.

http://leasingnews.org/archives/Aug2011/8_29.htm#jules

LEAF Financial Group, Philadelphia, Pennsylvania---It appears this company is in a more wind down phase, moving its operation of LEAF Commercial Credit with basically the same management. There have been complaints about the Evergreen Clause, including one this year for an Equipment Finance Agreement!

Marlin Business Leasing, Mount Laurel, New Jersey---The actual SEC filings state the profit earned from Evergreen Clause, primarily from copier leases. Bulletin Board Complaints have been received about this practice in addition to the SEC financial statement filings.

Marquette Equipment Finance, Midvale, Utah --- According to Dorran Sampson, Vice-President/Broker Relations: "Marquette Equipment Finance does not offer an Evergreen product. Our master lease provides for extensions but is negotiated at the schedule level. Notice periods are also negotiated at the schedule level and vary depending on the Lessee’s needs."

When the company was bought and became Pacific Western Equipment Finance (a division of Pacific Western Bank) he maintained the same position. It was noted his old company was still on the list, and a request of his "master lease" was made.

"Our docs are the same as when we were with Marquette. Because we’re public now, it is very difficult to get documents released."

I asked him if he could send to a broker wanting to do business with him, "Sorry, can’t forward to you or your brokerage."

A search of PACER, a national index for U.S. district, bankruptcy and appellate courts brought up a number of Marquette cases, and the first one hit pay dirt: Merchants & Farmers Bank, a Mississippi Corporation versus Marquette Equipment Finance and Applied Financial. It was a similar case and while "dismissed with prejudice" (6), it had the arguments regarding the purchase option and a copy of the complete contract with a similar PPR as with Mazuma Capital:

"(g) Lessee's Options at End of Initial Period. At the end of the Initial Period of any Lease, Lessee shall, provided at least one-hundred-eighty (180) days prior written notice is received by Lessor from Lessee via certified mail, do one of the following: (1) purchase the Property for a price to be determined by Lessor and Lessee, (2) extend the Lease for twelve (12) additional months at the rate specified on the respective Schedule, or (3) return the Property to Lessor at Lessee's expense to a destination within the continental United States specified by Lessor and terminate the Schedule; provided, however, that for option (3) to apply, all accrued but unpaid late charges, interest, taxes, penalties, and any and all other sums due and owing under the Schedule must first be paid in full, the provisions of Sections 6(c) and (d) and 7(c) hereof must be specifically complied with, and Lessee must enter into a new Schedule with Lessor to lease Property which replaces the Property listed on the old Schedule. With respect to options (1) and (3), each party shall have the right in its absolute and sole discretion to accept or reject any terms of purchase or of any new Schedule, as applicable. In the event Lessor and Lessee have not agreed to either option (1) or (3) by the end of the Initial Period or if Lessee fails to give written notice of its option via certified mail at least one-hundred-eighty (180) days prior to the termination of the Initial Period, then option (2) shall apply at the end of the Initial Period. At the end of the extension period provided for in option (2) above, the Lease shall continue in effect at the rate specified in the respective Schedule for successive periods of six (6) months each subject to termination at the end of any such successive six-month renewal period by either Lessor or Lessee giving to the other party at least ninety (90) days prior written notice of termination."

The first option is to purchase the equipment for a price to be determined by Lessor and Lessee and requires a certified letter 180 days prior. This sounds like a fair market purchase option, but the “price to be determined” language means that the Lessor can set any price it wants. This option is illusory in my opinion.

The second option is to continue the lease for an additional 12 months, the “Evergreen” period. No notice of this provision is given to the lessee either in advance of signing or prior to exercising this option. Republic Bank purchases these 12 month extensions in advance of their exercise. How would the bank know that the lessee is going to exercise this option, unless everyone knows it is the only practical option for the lessee to exercise? Republic Bank President Boyd Lindquist confirmed in a telephone call that he “buys” these extensions from Mazuma and has for quite some time.

The third option is to return the equipment, but the clause is draped with the condition that the lessee has to re-lease identical equipment for a similar term. It also has 180 day certified letter requirement, and applies to the second option of 12 months, but also has the clause of an automatic six month option. So what is the point of exercising this option? At the end of this re-lease, there would be the same three identical options, so the lessee would be required to re-lease and re-lease. It’s just like Groundhog Day.

Leasing News is working on obtaining information on other companies so named to add to the list, including follow-up on the master lease for Pacific Western Equipment Finance. If you have a copy, please send and will keep your name “off the record.”

((7) See for Copy of Filing, including contract.)

Mazuma Capital Corp, Draper, Utah Several routie "end of lease agreements, as alleged in Unified Container and Anderson Dairy (1) "8. The basic scheme involves the inclusion of a purchase, renewal, return (“PRR”) provision in the lease. The lessor assures the customer they will be able to purchase the equipment at the end of the initial term in the lease for a reasonable or nominal price. Often, the lessor promises the equipment can be purchased at a fixed percentage of the total amount financed. However, at the end of the initial lease term, the lessor refuses to honor the agreed upon purchase price or negotiate in good faith regarding a purchase price, but instead, insists the lease automatically renews for an additional term (usually twelve months).

9. The inclusion of the purchase and return options in the lease are entirely illusory and intended only to give the customer the false impression that it can exercise any of the three options at the end of the initial lease term, when in fact, the lessor will only allow an automatic renewal at the end of the initial lease term.) There are other exhibits. This case was settled "out of court."

(page 3)

H. Jared Belnap, President & CEO, Mazuma Capital Corp., takes exception on beingon the Evergreen list. His full letter and Leasing News Response is at (5).

Onset Financial, South Jordan, Utah --- Onset contract, which contained:

“Section 20

n. Lessee's Options at Maturity of Base Period. At the maturity of the Base Period of any Lease, Lessee shall, provided at least one hundred fifty (150) days prior written notice is received by Lessor from Lessee via certified mail, do one of the meowing: (1) purchase the Property for a price to be determined by Lessor end Lessee, (2) renew the Lease for twelve (12) additional months at the rate specified on the respective Schedule, or (3) terminate the Schedule and return the Properly to Lessor at Lessee's expense to a destination within the continental United States specified by Lessor; provided, however, that for option (3) to apply, all accrued but unpaid late charges, interest, taxes, penalties, and any and all other sums due end owing under the Schedule must first be paid in full, the provisions of Sections 8f, 8g and 7d hereof roust be specifically complied with, and Lessee must enter into a new Schedule with Lessor to lease Property which replaces the Property fisted on the old Schedule. With respect to options (1) and (3), each party shall have the right in its absolute and sole discretion to accept or reject any terms of purchase or of any new Schedule, as applicable. In the event Lessor end Lessee have not agreed to either option (1) or (3) by the maturity of the Base Period, or if Lessee fails to give written notice of Its option via certified marl at least one hundred fifty (150) days prior to Use maturity of the Base Period, or if an Event of Default has occurred under any Lease, then option (2) shall apply at the maturity of the Base Period. At the maturity of the renewal period provided for In option (2) above, the Lease shall continue in effect at the rate specified in the respective Schedule for successive periods of six (6) months each subject to termination at the maturity of any such successive six-month renewal period by either Lessor or Lessee giving to the other party at best thirty (30) days prior written notice of termination." (1)

((8) See for Copy of Onset Contract with PPR purchase option.

Republic Bank, Bountiful, Utah Purchases and participates in extended Evergreen clause agreements.

They are legal in all states, except four states require advance notification be given to the lessee regarding termination of the lease and its residual (Four states: New York Rhode Island, Texas, Illinois (In Illinois, Consumer law, but may affect commercial, especially a proprietorship, partnership or personal guarantee)"

Tetra Financial Group, Salt Lake City, Utah Several routine "end of lease agreements, as alleged in Unified Container and Anderson Dairy (1)

“22. Mazuma Capital is associated with Republic Bank and obtains financing for its leases containing PRR provisions from Republic Bank.

23. Like what took place at Amplicon, Inc., the PRR scheme utilized by Matrix, Applied Financial, LLC, Mazuma Capital, Tetra Financial Group, LLC and others has begun to be exposed through litigation and negative press. See Deseret News (2) articles attached hereto as Exhibits B (2) and C. (3)”

Here is a case where New York courts threw out the Evergreen Clause as not legal in New York, even though venue appears to be Utah. (4))

(1) 36 main pdf

http://leasingnews.org/PDF/36main.pdf

(2) Deseret News

http://leasingnews.org/PDF/DeseretNewsarticle.pdf

(3) Exhibit C

http://leasingnews.org/PDF/ExhibitCDeseret.pdf

(4) Salon Management case

http://leasingnews.org/PDF/SalonManagement.pdf

(5) Mazuma Takes Exception on Being on Evergreen List

http://leasingnews.org/archives/Jul2012/7_30.htm#mazuma

(6) Order to Dismiss with Prejudice

http://leasingnews.org/PDF/Marquette_order_dismiss.pdf

(7) Copy of filing, including contract

http://leasingnews.org/PDF/Maquette.pdf

(8) Copy of Onset Contract with PPR purchase option

http://leasingnews.org/PDF/OnsetContract.pdf

[headlines]

--------------------------------------------------------------

New Hires---Promotions

Steve Anderson has joined the Commercial and Specialty Finance Business as senior vice president and business development officer to support the Healthcare lending team, Capital One Bank. Previously he was senior director, Oxford Finance, joining the firm March, 2011. Previously he was director, Capital Source Finance (April, 2003-Feburary, 2011), vice-president, Kugman Associates, Capital Markets (October, 2001-April, 2003), vice-president, Finova Capital Corporation (May, 1996-October, 2001), Associate/Operations Manager, LINC (December, 1993-May, 1996). DePaul University MBA, Finance (January 1995 – June 1998) The University of Iowa BA, Broadcast Communications (August 1988 – August 1993) Activities and Societies: Tau Kappa Epsilon.

http://www.linkedin.com/pub/steve-anderson/0/aa0/978

Jim Coates promoted to regional vice president, client relations, Midwest, for LeasePlan, USA. He joined the company in February, 2008. Previously he was branch manager, Enterprise Rent-a-Car (January, 2033-February, 2008). Georgia Institute of Technology - Georgia Tech College of Management BS MGT, Finance, Chemical Engineering (1994 – 2000). Member: NAFA' Honors and Awards: CAFM (Certified Automotive Fleet Manager)

http://www.linkedin.com/pub/james-coates-iii/4/585/495

John Kosko joins TD Bank as vice-president, business development officer in SBA Lending for Northern New Jersey." He will be focused on providing SBA financing to qualified small businesses throughout Passaic and Hudson counties in Northern New Jersey. Previously he was director, credit and risk management, CIT Bank, small business Lending (May, 2010-June, 2012), regional sales manager, CIT Small Business Lending (2006-May, 2010), vice president, small business lending (2004-2006), vp-small business lending, TD Bank (2003-2004), commercial loan officer, Valley National Bank (1992-1998). Seton Hall University MBA, Finance (1994 – 1998) Penn State University BS, Quantitative Business Analysis (1988 – 1992).

http://www.linkedin.com/pub/john-kosko/9/227/992

Chuck Sell appointed senior vice president of sales and marketing, Northland Capital Financial Services, Minnetonka, Minnesota. Previously he was SVP Diversified Industries Sales Manager, TCF Equipment Finance (2009-July, 2012), National Sales Manager, TCF Equipment (February, 2001-September, 2008)Stonier Graduate School of Banking (2003 – 2006) Boston University M.S.B.A., Business Administration, Management and Operations (1984 – 1985), St. Cloud State University Bachelor of Science (B.S.), Business Administration and Management, General (1980). Activities and Societies: President - SCSU Aero Club.

http://www.linkedin.com/pub/chuck-sell/b/956/913

[headlines]

--------------------------------------------------------------

Leasing News Help Wanted

Dallas-Fort Worth Please submit resume to ron.mitchell@bancleaseacceptance.com |

Exp. only, 1 Southeast, 1 West Coast www.ifsc.com |

For information on placing a help wanted ad, please click here:

http://www.leasingnews.org/Classified/Hwanted/Hwanted-post.htm

Please see our Job Wanted section for possible new employees.

Leasing News Help Wanted Ad Pricing

25% Off regular rate below plus 30 day run

Help Wanted Web Ad New Programs Classified Ad Section 21 days in a row: All you need do is send us the copy or the position description you want to fulfill and we do the rest. We will design the ad with the idea to fit you budget best, as well as recommend a “click to a web page” or seprate full page job description. Lines and spaces determine the price of the “help wanted ad” as the Logo is free as well as company description at the bottom of the ad (not to exceed the number of lines of the ad.) Also free: click to a click to a web site or a full description of the position. Ads are placed in the "Help Wanted' section by category, alphabetical, with the ad with the most lines first in the group. They appear on the web site and in each news edition at the top, not in flash, but in separate news editions. (The “help wanted” top ad are changed in each news edition in sequence with other “help wanted” ads, mostly in a chronological basis.) The ad always appears in the classified help wanted section in each news edition, plus remains on the web site, even when it appears at the top of the headlines. Most readers scroll the newsletter, or those directly interested in classified, will click on the headline and go direct to the news edition classified help wanted section, or click on the web site, and go to it at this site. Leasing News reserves the right to refuse advertising, particularly to a company that has appeared in the complaint bulletin board |

[headlines]

--------------------------------------------------------------

“Pre-Funding of Leasing” ruling

By Scott D. Chait, Esq.

Peretore & Peretore, P.C.

An increasingly common issue in the equipment finance industry is vendors and customers demanding pre-funding before delivery of the equipment. As such, while courts generally look askance at waivers of rights and remedies under the UCC, equipment lessors should take note of a 2011 case out Iowa in which the court held that the parties could contractually waive acceptance of goods as a prerequisite for application of Article 2A’s “hell or high water” provision.

In GreatAmerica Leasing Corp. v. Wahoo Productions of Florida, Inc., 2011 U.S. Dist. LEXIS 43467 (N.D. Iowa Apr. 21, 2011), the defendant entered into a finance lease to acquire certain equipment for its three Floridian restaurants. While some of the equipment had been delivered and installed, the remainder was being held by the vendor until one of the restaurants was completed.

Despite delivery not being completed, at the request of the lessee the lessor paid the vendor in full. However, the lessor did so only after receipt of an additional guaranty and, most importantly, execution of a lease addendum which provided, in part, that the lessee acknowledged and agreed that the lessor had paid the vendor in full at the lessee’s request despite not all the equipment being delivered and the lessee nonetheless agrees that the lease commences immediately and is non-cancelable, including that the lessee will make all payments even if the remainder of the equipment is not delivered.

This point was critical because under Article 2A’s “hell or high water” provision (UCC §2A-407), a lessee’s obligations to make payment becomes irrevocable only upon acceptance of the goods. While there clearly had been no acceptance of the goods which had not yet been delivered (pending completion of one of the restaurants), the court held that acceptance of the goods was not a necessary predicate for the lessor to benefit from the “hell or high water” provision because the lessee had expressly waived that requirement in the lease addendum.

The Court’s reasoning turned on (i) the fact that the UCC provides that its provisions “may be varied by agreement” (Iowa Code § 554.1302) , (ii) the defendants cited no authority that its right to acceptance under the Code could not be varied, and (iii) especially in light of the lease addendum, “the actual delivery and receipt of equipment is not an absolute requirement to enforce an equipment lease as to the finance lessor.” GreatAmerica Leasing Corp., 2011 U.S. Dist. LEXIS 43467 at *27.

While it’s unclear if the reasoning of the Iowa court will apply in other jurisdictions, or whether it’s applicable in non “finance lease” scenarios (i.e., secured transactions under Article 9), the lesson of GreatAmerica is clear: while actual delivery still remains the ideal scenario to ensure benefit from the protections of “hell or high water” provisions, if circumstances (as they now often do) call for payment to the vendor prior to actual delivery, it’s wise to have the lessee sign a lease addendum acknowledging the non-delivery, but confirming that the lease has nonetheless commenced, is non-cancelable, and the lessee will perform all obligations, including make all payments even if the equipment is never delivered (the addendum at issue in GreatAmerica also contained a waiver of defenses against the lessor, but a lessor should go one step further and include a waiver of defenses against its assignees as well; while this waiver would likely already be included in the lease itself it should be re-iterated in the addendum since it’s such a potent weapon for an assignee (unlike a “hell or high water” provision, a waiver of defenses against assignees provision is not vulnerable to a defense of fraud in the inducement)).

In addition, the case is a good reminder to have well-drafted delivery and acceptance receipts, signed and dated by the lessee in which he acknowledges delivery, installation, the good working order of the equipment, and that the lease is non-cancelable and he waives all defenses.

Finally, lessors should also consider taking a separate promissory note or entering into a side agreement for the pre-funding amount (as well as requiring separate guarantees from the guarantors even if the guarantees of the lease are continuing; there is case law out there that if the lease never commences, neither do the guarantees). This way, if the lease never commences, the lender will have a direct and unconditional obligation from the lessee and guarantors for payment of the pre-funding amount, plus interest.

Scott Chait is an associate with Peretore & Peretore, P.C. and can be reached at scott.chait@peretore.com or (973) 729-8991.

(1) While the defendants disputed at trial that the lease contained a contractual “hell or high water” clause, since the parties agreed that the lease constituted a “finance lease” under Article 2A, the point was moot because the statutory “hell or high water” provision attached to the lease (and regardless, the Iowa Supreme Court and courts in other jurisdictions routinely uphold contractual “hell or high water” provisions; see e.g., C & J Vantage Leasing Co. v. Wolfe, 795 N.W.2d 65, 78 (Iowa 2011); Wells Fargo Bank Minn. v. Brooks America Mortg. Corp., 2004 U.S. Dist. LEXIS 18573, at *15-17 (S.D.N.Y. Sept. 13, 2004), aff’d 419 F.3d 107 (2d. Cir. 2005); Lyon Fin. Servs., Inc. v. Young Vending Servs., 2003 Minn. App. LEXIS 1180, *2-3, 11 (Minn. Ct. App. 2003).

(2) A provision also included in other states’ versions of the UCC, such as such as New York and New Jersey. See NY CLS UCC § 1-102(3); N.J. Stat. § 12A:1-102(3).

Gary DiLillo, President

440.871.0555 or gary@avptc.com |

[headlines]

--------------------------------------------------------------

Send Leasing News to a Colleague. We are free!!!

[headlines]

--------------------------------------------------------------

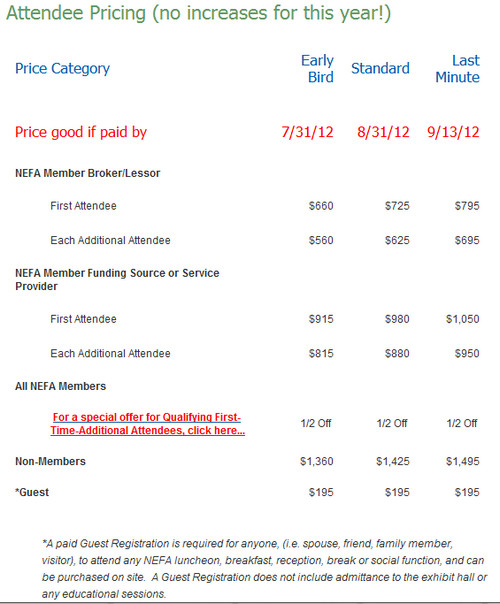

Leasing Association 2012 Conferences

Broker Member: 1st Attendee $125

Broker Member: 2nd Attendee $115

Assoc. Member: $260

Additional Mem: $200

Funder Member: $260

Add Attendee: $200

Broker Non-Mem: $200

Assoc. Non-Mem: $360

Please see below for more informaiton:

Registration:

https://www.paymyassociation.com/displayemailforms.cfm?SessionId=EBCE357E-C299-4734461C6EAFFE7153C4&emailformnbr=177958&event=381180

Hotel Reservations Available

https://www.starwoodmeeting.com/StarGroupsWeb/booking/reservation?id=1205167547&key=426B6

September 12-14, 2012

Canadian Finance & Leasing Association Conference

The Westin Calgary

Calgary, Canada

General Information

http://www.cfla-acfl.ca/wp-content/uploads/2011/12/Conference2012-General_Info.pdf

Exhibitor Information:

http://www.cfla-acfl.ca/2012/05/10/become-an-exhibitor-cfla-conference-21012/

Speakers

Andy Alper

Frandzel, Robins, Bloom & Csato

Barry Marks

Marks & Weinberg, P.C.

Dwight Galloway

RLC Funding a Division of Navitas Lease Corp

Eric Myers

TAB Bank

Frank Peretore

Peretore & Peretore, P.C.

Geoff Peters

Weltman, Weinberg & Reis Co., L.P.A.

Joe Leonard

Oakmont Capital Services

Roxana Safranek

LeaseTeam, Inc.

Skip Wehner

Pinnacle Capital

Terey Jennings

Financial Pacific Leasing, LLC

Registration:

https://m360.nefassociation.org/event/registration/login.aspx?eventID=41686

September 13—15

Funding Symposium

Rennaisance Washington, DC Dupont Circle Hotel

1143 New Hampshire Avenue, NW

Washington, DC 20037-1522

Chairperson for 2012 Funding Symposium

Lori A. Dean, CLP,

VP, Equipment Finance Operation Manager

Arvest Equipment Finance

October 21-23

ELFA 51st Annual Convention

JW Marriott Desert Springs

Palm Desert, California

Keynote Speakers

THE HONORABLE SHEILA C. BAIR

19th Chairman of the Federal Deposit Insurance Corporation

RUSSELL G. GOLDEN

Member, Financial Accounting Standards Board

SCOTT DEMING

Expert in Branding and Marketing

Convention Brochure, Register, Community Service Projects

http://www.elfaonline.org/Events/2012/AC/

November 4-5

2012 Expo NJ Super Regional Meeting

Teaneck Marriott at Glenpointe

November 7 - 9, 2012

32nd Annual Fall Conference

Hilton La Jolla Torrey Pines

La Jolla, California

November 14-16

67th Commercial Finance Conference

JW Marriott Hotel

Phoenix, Arizona

April 18-20, 2013

Annual Conference

Las Vegas, Nevada

-------------------------------------------------------------------

To view Leasing Association Events-Meetings Open to All, please click here.

[headlines]

--------------------------------------------------------------

#### Press Release #############################

United Capital Refinances Multi-Unit Applebee’s® Operator

HUNT VALLEY, MD – United Capital Business Lending, a national business lender specializing in franchise finance, announced today that it provided $6,330,000 in financing to Applebee’s® owner, Apple Two Associates, Inc. United Capital refinanced the franchisee’s 15 locations in Florida, Georgia and Alabama.

William Johnson

Sr. VP, Sales/business Development

“United Capital is pleased to partner with Applebee’s® operators during such a transformative time for the brand,” says William Johnson, senior vice president of sales and business development for United Capital. “Our lending programs for remodels, acquisitions, new store development and debt refinancing are helping Applebee’s® franchisees to capitalize on new growth initiatives.”

United Capital Business Lending is a subsidiary of BankUnited (NYSE: BKU), the largest bank headquartered in Florida with over $12 billion in assets.

In addition to Applebee’s®, the United Capital team has financed franchisees for Buffalo Wild Wings®, Denny’s®, Wendy’s®, Popeyes® and Sonic® among others.

For information about financing for franchise acquisition, new unit development, remodeling or debt refinancing, call United Capital at 866-218-4793 or visit the company’s website at www.unitedcapitalbusinesslending.com.

##### Press Release ############################

|

##### Press Release ############################

$2 Million Illegal Tax Refunds on Deceased Returns

Los Angeles- Masood Chotani, a Los Angeles county former CPA and tax return preparer that spent the last three years as a fugitive in Pakistan, was arraigned on charges that he conspired to defraud the United States and made false claims for income tax refunds, the Internal Revenue Service (IRS). A federal grand jury in Riverside returned an indictment against Chotani on June 23, 2010. The indictment was unsealed earlier this year.

The Indictment alleges that in 2002 and 2003, Masood Chotani, Ather Ali, of Diamond Bar, and Haroon Amin, of Upland, conspired to file at least 250 false income tax returns with the IRS using names and Social Security Numbers of deceased individuals, claiming more than $2,000,000 in tax refunds.

The indictment further alleges that many of the illegally obtained refund checks were deposited into bank accounts within the Islamic Republic of Pakistan and the Republic of Armenia.

According to court documents, most offenses occurred in SanBernardino, Los Angeles, Orange, Riverside, and Ventura counties. Chotani is also charged with personally preparing and filing two false claims for refund on federal income tax returns.

Trial is scheduled for September 4, 2012. If convicted, Chotani faces a maximum potential penalty of five years’ imprisonment and a $250,000 fine for each count of conspiracy and presenting false claims.

This case is being prosecuted by Assistant U.S. Attorney Charles E. Pell and Trial Attorney Joseph A. Rillotta of the Justice Department’s Tax Division. This case was investigated by special agents of the IRS Criminal Investigation office in Laguna Niguel. The apprehension of Chotani was made with assistance from the U.S. Marshals Service.

An indictment is merely a formal charge by the grand jury. The defendant is presumed innocent unless and until proven guilty beyond a reasonable doubt.

### Press Release ############################

(Leasing News provides this ad “gratis” as a means

to help support the growth of Lease Police)

Send Leasing News to a colleague.

Ask them to subscribe.

We are Free!!

[headlines]

--------------------------------------------------------------

Australian Shepherd Puppy

Rancho Santa Fe, California Adopt-a-Dog

Truffle

Australian Shepherd mix

Female-Spayed

12.5 lbs

Estimated DOB: 4/4/2012

“Hello! I am a very energetic pup that loves people but needs guidance and a lot of exercise to be the best I can be. Ideally I should go to a home that is active and has the time to take me on very long walks or even jogs or trail hikes. If you are looking for an active best friend who also loves the great outdoors, I could be the one for you. I am here waiting to meet you - so please stop by soon!”

“Please make a donation to help care for me until my new family finds me and takes me home.”

https://www.animalcenter.org/donate/donate_adoptions.aspx?name=Truffle

Helen Woodward Animal Center

Location: 6461 El Apajo Road Rancho Santa Fe, CA 92067

Adoption Center Hours: 12-6 M-F, 10-6 Sat, 11-6 Sun. (Holiday Hours)

Friday summer hours -12:00-7:00pm

Phone: (858) 756-4117, Option 1 Adoption

http://www.animalcenter.org/about_hwac/contact_us.aspx

Adopt-a-Pet by Leasing Co. State/City

http://www.leasingnews.org/Conscious-Top%20Stories/Adopt_Pet.htm

Adopt a Pet

http://www.adoptapet.com/

[headlines]

--------------------------------------------------------------