![]() Add me to mailing list |

Add me to mailing list | ![]() Change email |

Change email | ![]() |

| ![]() Search

Search

Advertising | All Lists | Archives | Classified Ads | This Day In American History

Leasing News is a web site that posts information, news, and

entertainment for the commercial alternate financing,

bank, finance and leasing industries

kitmenkin@leasingnews.org

![]()

Inside Sales Manager We are currently seeking qualified talent to be primarily responsible for overseeing the Inside Sales Department within the Vendor business group of the Equipment Finance Division, while developing and improving policies and procedures to properly support high production volume. For more information |

Wednesday, July 13, 2016

Today's Equipment Leasing Headlines

George Davis II Needs Your Prayers

Former UAEL President/CLF Co-Founder

Archives: July 13, 2012 30 Days---No Response!

re: Marlin Bulletin Board Complaint

Regions Bank Failure to Give Notice to Guarantors

Dooms Secured Creditor’s Deficiency

By Tom McCurnin, Leasing News Legal Editor

New Hires---Promotions in the Leasing Business

and Related Industries

Leasing Industry Ads---Help Wanted

Please Also Refer a Position Available to a Colleague

Sales Make it Happen by Steve Chriest

All Sales Are Complex

DealSafe---Control of Contractual Rights

Cloud Based Control of Lease Payments/Auto-Renew

Embracing Google’s Mobile-Friendly Ranking Algorithm

FinTech #102 by Brittney Holcomb

Leasing News Web App

Download to your Mobile Device

California Mortgage Lending by Non-Banks Increased

at Fast Pace in 2015, DBO Report Shows

The BFG/Hunt for the Wilderpeople

Knights of Cups/Cemetery of Splendor/Dr. Strangelove

Movie/DVD Reviews by Fernando Croce

German Shepherd

San Clemente-Dana Point, California Animal Shelter

Leasing News Classified Ads

Asset Management

News Briefs---

Former Regions Bank VPs Indicted in Bribery,

Wire Fraud Scheme, $5.1 Million

LendingClub’s Newest Problem: Its Borrowers

Charge-off rates have risen as much as 38% since 2013

Slump Might Turn Anti-Bank SoFi Into a Bank

CEO who called banks a ‘waste of human capital’

CG Commercial Fin. Acquired by Atalaya Capital Management

$1MM to $300MM Projects

New Lease Account Standard Impact

on the Lease vs. Buy Decision

New York Times Lets $27 Million Jamie Dimon Brag About

What He's Doing for Income Inequality

Google to Ban Search All Consumer Lenders Charge 36% APR

Google wrote that commercial loans are exempt from the ban

Google to train 2m Android developers in India for free

May, rival Apple announced 4,000 new jobs in Hyderabad

Microsoft leasing Surface Tablet/Software Bundles

"But do both small companies and corporations want them?"

Seagate will eliminate 6,500 jobs/computer hard drives

$21 million loss for the quarter ended April 1

Broker/Funder/Industry Lists | Features (writer's columns)

Top Ten Stories Chosen by Readers | Top Stories last six months

www.leasingcomplaints.com (Be Careful of Doing Business)

www.evergreenleasingnews.org

Leasing News Icon for Android Mobile Device

You May have Missed---

SparkPeople--Live Healthier and Longer

Winter Poem

Sports Briefs---

California Nuts Brief---

"Gimme that Wine"

This Day in American History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

######## surrounding the article denotes it is a “press release”

and was not written by Leasing News nor information verified, but from the source noted. When an article is signed by the writer, it is considered a “by line.” It reflects the opinion and research of the writer.

[headlines]

--------------------------------------------------------------

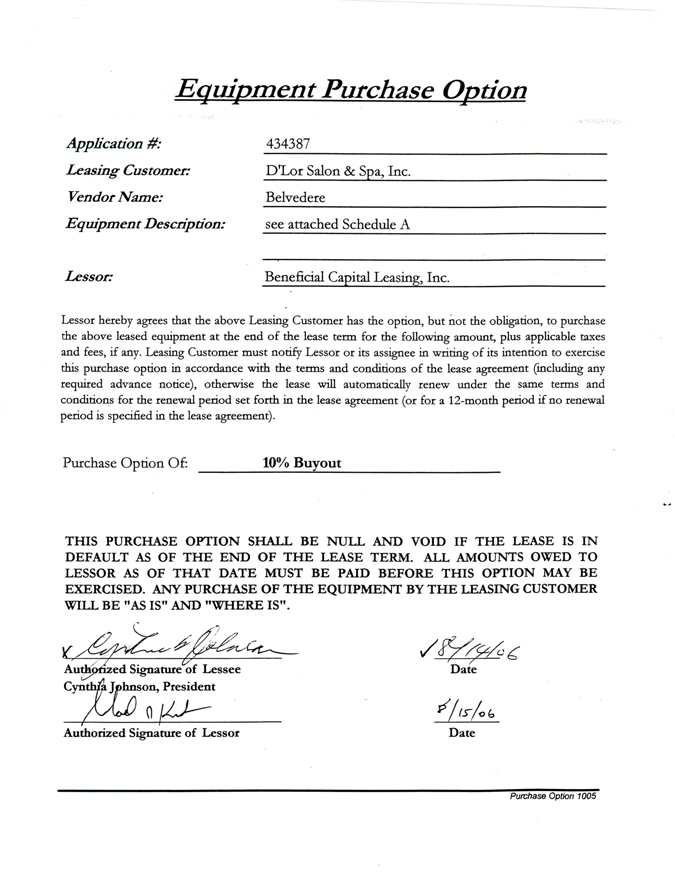

Archives—July 13, 2012

30 Days---No Response!

---re: Marlin Bulletin Board Complaint

Ed Dietz, General Counsel for Marlin Business Services Corp., Mount Laurel, New Jersey wrote a letter to the editor that appeared in "Letters? We get eMail" June 13, 2012 stating: "...add Marlin's name to the list on www.leasingnews.org of leasing companies that notify lessees in advance of lease expiration...

"Please allow this letter to serve as Marlin's formal demand that you immediately (1) post a correction on www.leasingnews.org stating that Marlin does, in fact, notify lessees in advance of lease expiration (and locate such correction in at least as prominent a position as you gave to the inaccurate information you previously posted), and (2) add Marlin's name to the list on www.leasingnews.org of leasing companies that notify lessees in advance of lease expiration. I expect the correction to appear today."

He had also included William G. Sutton, CAE, President & Chief Executive Officer, Equipment Leasing and Financial Association with an email regarding the "request."

Leasing News made this request in its response on June 13, 2012:

"Regarding Mr. Dietz request concerning notification of lessees regarding residuals, please start the dialogue by responding to this complaint posted April 4, 2012:

Marlin Business Services, Mount Laurel, New Jersey

Bulletin Board Complaint

Leasing News has attempted since March 22, 2012 to contact officers at Marlin Leasing, with over six emails to one officer, including four telephone calls, as well as two emails to four officers followed up with two telephone calls. The emails included the complaint as well as the documents, and the telephone calls were follow-up to the emails.

There has been no response.

From:

Ken J. Krebs

Beneficial Capital

(800) 886 - 8944

ken@bencap.com

“I’ve been in this industry for about twenty years and although the past three have been rough, overall it has been a great experience. We have worked closely with so many quality people over the years, many who unfortunately are no longer around...I’m looking for some help, and hoping you may be able and willing. One of our Lessee’s contracts, that had been sold to Marlin, was put into auto renewal because the Lessee neglected (forgot) to exercise their purchase option. The contract was originally structured with two payments in advance as security deposit, followed by 60 monthly payments, and a 10% purchase option. They’ve recently realized they have now made 65 payments (five extra). In an effort to settle, they have offered to pay Marlin an additional $1,500 and to forfeit the return of their security deposit. This is a $25,000 contract with a $2,500 purchase option. The security deposit amount is $1,196.36. So, they are offering $1,500 plus $1,196.36 to settle the $2,500 purchase option. If accepted, this would give Marlin an additional 5 full payments plus $196.36. Marlin has declined the offer and in turn has requested an additional $3,000 payment as well as forfeiture of the security deposit. Can you help with this?"

From:

Patrick and Cynthia Tingling

D'Lor Salon & Spa

Atlanta, Georgia

“This is Patrick & Cynthia Tingling Owners of D’Lor Salon & Spa in Atlanta. We Regret that we have to take this course of action.

We feel that Marlin has received enough funds for the value of the equipment that was leased. We are willing to meet our obligations if they would meet us half way... the experience with marlin have left us a bad taste, hopefully you will be able to make sense to then that sometimes goodwill is far more valuable than driving customers away from the industry.

We must make a decision by tomorrow in order to prevent another monthly deduction from our bank account.

Thanks

Patrick and Cynthia..."

It appears the lease payments are ACH and the lessee was not aware that the original lease was up until they had made five extra payments on a 10% Purchase Option, which they are will to make:

There is no doubt this is not a "true lease" but a "capital lease" or "loan" in many states. This lease has a Pennsylvania choice of law and a Pennsylvania mandatory forum -- even though the lessee is in Georgia, the vendor is in Missouri, and there is absolutely no connection to Pennsylvania.

From:

Michael J. Witt, Esq.

MICHAEL J. WITT LAW OFFICES

4342 Oakwood Lane

West Des Moines, IA 50265

Tel: (515) 657-8706

Mobile: (515) 868-1067

Fax: (515) 223-2352

witt-law@live.com

“In my opinion Marlin stands on shaky grounds here. Most so-called ‘10% purchase option’ transactions in the small-ticket arena are not true leases under UCC 1-302 but are, instead, loans. It is preposterous to say that a loan can have an ‘automatic renewal’ provision. (How would anyone feel if, after paying off their mortgage over 30 years, the bank called and said the mortgage had "automatically renewed" for an additional 12-month period based on an auto-renewal clause hidden in the fine print?!)

“Marlin, we must all admit, was entitled to a particular return at the end of the 5-year term of this lease. However, it is now trying to illegitimately (in this one attorney's opinion) bloat its originally planned-for return by taking advantage of the fact that when this small-business lessee took out this lease in 2006, it did not purchase a un-purchasable 2011 calendar to mark the date it was required to notify Marlin not to renew the lease.

“Few people know that if Marlin did not have an auto-renewal program, it would be losing money (which only begs the question, how much longer do Marlin investors think that this flimsy business model can endure?). If this is not a true crime under our criminal codes, it is a crime against the industry that so many of us try to uphold every day we go to work.”

D’Lor Salon & Spa Lease Contracts:

http://www.leasingnews.org/PDF/DLor_Lease.pdf

June 13, 2012---Letters??---We get eMail

http://leasingnews.org/archives/Jun2012/6_13.htm#letters

[headlines]

--------------------------------------------------------------

George Davis II Needs Your Prayers

Former UAEL President/CLF Co-Founder

1987 “Order of the WAEL was awarded to (left to right: Ruth Paddock, Steven Gilyeart, Joe DeNunzio, and George Davis at Spring Conference.”

"George is very ill, suffering from an as yet unidentified form of Autoimmune Encephalitis. Right now his prognosis is very guarded and his doctors are waiting for an exact diagnosis to come back from the Mayo Clinic. As you may recall, George was the President of the United Association of Equipment Leasing in 1999 and served on the board and as an officer for many years. He was also active in founding the Certified Leasing Professional Foundation.

"Fortune Financial was founded by George in 1980 as I recall. George has a lot of friends throughout the leasing and specialty finance industry and Leasing News is the best way to let them know that George needs their best wishes and prayers at this time. He is in the St. Charles Medical Center, 2500 NE Neff Road, Bend, OR 97701 Tel: 541-382-4321, Rm. 437."

Bob Rodi,

VP, Credit and Risk Management

FranFund, Inc.

[headlines]

--------------------------------------------------------------

Regions Bank Failure to Give Notice to Guarantors

Dooms Secured Creditor’s Deficiency

By Tom McCurnin

Leasing News Legal Editor

Court, Facing Botched Foreclosure Sale, Focuses On What Might Have

Happened, Had Proper Notice Been Given. Sadly for Creditor, Counsel

Put On No Evidence of What Might Have Happened.

Regions Bank v. Thomas, 2016 WL 1719325 (Tenn. Ct. App. Apr. 27, 2016).

“If you see a defense with dirt and mud on their backs they've had a bad day.” --John Madden.

As long as I have been a lawyer, I was taught that the secured creditor must give notice of a foreclosure sale to guarantors. In today’s case, the secured creditor failed to give notice to the guarantors and got a little too creative in the trial court. The Court of Appeals corrected matters—twice, denying the deficiency judgment, and entering judgment for the guarantors. A $1.4mm turnaround, and a bad day indeed for the bank. The facts follow.

Regions Bank, as secured creditor, loaned $2.3mm to LGT Aviation, secured by the aircraft and further collateralized by the personal guaranties of LGT’s principals. The loan went into non-monetary default (failure of insurance) and Regions sued the borrower and guarantors. While the suit was pending, Regions Bank repossessed and sold the aircraft, at a private sale in 2008 for a purchase price of $875,000, leaving a deficiency of $1.4 million dollars. The trial court entered judgment.

But Regions failed to give notice to the guarantors of the private sale. Regions Bank argued that a letter sent to the guarantors suggesting that the bank might take possession of the aircraft and there might be a deficiency was good enough notice. The trial court thought so. On appeal, the Tennessee Court of Appeal reversed, holding that the equivocal “notice” did not suffice, and sent it back.

The trial court heard the case a second time, and this time focused on a key issue—did the failure to give notice result in a diminished recovery that would affect the deficiency. Specifically, most states have enacted UCC § 9-626 which, when the secured creditor fails to give notice, the botched sale places the burden on the secured creditor that it was “no harm, no foul.” In short, did the failure to give notice diminish the proceeds of the private sale?

The Bank assumed that it could establish the market value of the aircraft and meet this burden. But the Code’s exact language is more daunting. The Code states that the secured creditor must present evidence that it would not have been satisfied had it given notice. That’s a tough burden. When the guarantors attempted to introduce evidence as to what they might have done had they received notice, counsel for the bank objected. Therefore other than some market value numbers, there was nothing in evidence to satisfy the Code.

That didn’t matter much to the trial court, which reduced the deficiency from $1.4mm to about $500,000. Both parties appealed.

The Tennessee Court of Appeal reversed again, throwing out the deficiency. Their rationale was based on the rule that once the secured creditor botches the sale, the burden is placed on that secured creditor to prove that it would not have been satisfied had it given notice, a hypothetical fact. Although Regions Bank argued that this is a simple analysis of the market value of the collateral at the time of the sale, the Court of Appeals refused this simplistic analysis.

The Court held that it was Regions Bank’s burden to produce evidence that had it given proper notice to the guarantors, their note would not have been satisfied. The Court further held that the hypothetical intentions of the guarantors, had they received possible notice, was relevant to the issue. Since Regions Bank did not produce that evidence (and indeed objected to it, when offered), the Bank did not carry their burden and there could be no deficiency.

The Court of Appeals reversed the trial court a second time and this time entered judgment for the guarantors, including costs and attorney fees. Guarantors win, secured creditor loses.

What are the lessons here?

• First, What Banker Doesn’t Know To Give Notice to Guarantors? Were these guys living in a cave for the last 20 years? Assuming I expect too much from the bankers, on a $2.4mm deal, do you think it might be a good idea to retain counsel for advice?

• Second, The Ruling Places a Difficult Burden on Secured Creditors. The Court’s ruling that the secured creditor has the burden of proving that had it given proper notice, the note would not have been satisfied does appear to be a difficult, if not near impossible burden to achieve, especially when the guarantors can’t testify to the issue. Yes, the statute reads like that.

• Third, The Secured Creditor’s Counsel Was Partly At Fault. The Court noted that the guarantors’ possible actions had they received notice was relevant, and bank counsel objected to the testimony. I get that trial counsel wants to exclude all of the defendant’s evidence. But this was an issue that would have helped the bank.

• Fourth, Where is the Settlement? I find it hard to believe that a botched foreclosure sale case could go through two trials and two appeals and not get resolved. Counsel for the Bank should have cut the best deal available after the first appeal. To me it was obvious that the appellate courts were not very sympathetic to the bank. The guarantors will likely tag the bank for $300,000 in attorney fees now. So to go from a $1.4mm judgment to owing the customer $300,000 is indeed a bad day.

The bottom line to this case is that Guarantors need to get notice of disposition of collateral, and if the Bank is remiss in that respect, then it’s going to be a bad day in Memphis.

Regions Bank v. Thomas D. Thomas (10 pages)

http://www.leasingnews.org/PDF/Regions_Bank_v_Thomas2016.pdf

Tom McCurnin is a partner at Barton, Klugman & Oetting

in Los Angeles, California.

Tom McCurnin

Barton, Klugman & Oetting

350 South Grand Ave.

Suite 2200

Los Angeles, CA 90071

Direct Phone: (213) 617-6129

Cell (213) 268-8291

Email: tmccurnin@bkolaw.com

Visit our web site at www.bkolaw.com

Previous Tom McCurnin Articles:

http://www.leasingnews.org

Previous Tom McCurnin Articles:

http://www.leasingnews.org/Conscious-Top%20Stories/leasing_cases.html

[headlines]

--------------------------------------------------------------

New Hires---Promotions in the Leasing Business

and Related Industries

Mac Braun was hired as Senior Vice President, Agriculture and Golf and Turf Markets at Wells Fargo Equipment Finance, Des Moines, Iowa. Previously, he was Associate General Counsel, DLL, March, 2007; promoted September, 2013, Vice President, New Business Development, Americas. Associate General Counsel, DLL (March, 2007 – September, 2013); Associate General Counsel, Wells Fargo Financial (May, 2002 – March, 2007); Legal Counsel, Learjet Inc. (May, 1999 – May, 2002); Volunteer: President – 2015, Johnston Chamber of Commerce, January 2015, Economic Empowerment. President of the School Board (2014-2015 School Year), Saint Pius X School.

https://www.linkedin.com/in/mac-braun-35360536

Douglas Ducray was hired as Senior Vice President, MB Financial Bank, based out of Eatonton, Georgia. "Ducray is primarily responsible for structuring, pricing and syndicating equipment finance transactions originated by MB Equipment Finance’s direct sales force." Previously, he was Senior Vice President, Syndication, Citizens Bank (February, 2004 – July, 2016); Vice President, GMAC Commercial Finance (March, 2002 – January, 2004); Vice President, Syndication, PureMarkets Corporation (2000 – 2002); Vice President Syndication, Bank of America (1992 – 2000); Regional Sales Manager, CheckFree (1991 – 1992 ); Vice President, Syndication, Barclays (1986 – 1991); Portfolio Manager, StorageTek (1982 – 1986). Education: University of Northern Colorado, MBA, Business Administration (1984 – 1985). Colorado State University, BS, Finance (1978 – 1982).

https://www.linkedin.com/in/douglas-ducray-27b5174

Loren J. Hill was hired as Senior Vice president, Commercial Manufacturer and Vendor Sales, Key Equipment Finance, Superior, Colorado. "In this role, Hill will be responsible for the ongoing strategic leadership of Key Equipment Finance’s U.S. commercial vendor organization, including all business development and manufacturer program management for the energy, health care, industrial and technology verticals. He will be based out of the company’s headquarters in Superior, CO." Previously, he was Vice President, Capital Markets, IBM Global Finance (2000 – July, 2016); VP Capital Markets, Heller Financial (1998 – 2000); VP Syndications, Heller Financial (1997 – 1998). Education: University of Denver, Daniels College of Business (1982 – 1984); The University of North Dakota BS, Business (1975 – 1980).

https://www.linkedin.com/in/loren-hill-63185b2

Sang-hun Lee was hired as Head of CDF Korea at Wells Fargo Capital Finance, Korean. Previously, he was Country Leader of Commercial Distribution Finance Korea, GE Capital, Seoul, Korea (July, 2012 – June, 2016); Finance Account Sales Manager, Hewlett-Packard Financial Services (March, 2012 – July, 2012); Director, Kyochon F&B November (2009 – January, 2011); Country Manager, CIT (February, 2001 – October, 2009); Operations/Sales Mgr. of Technology Finance, Agilent Technologies (1999 – 2001); Sales Manager, Sanup Yokogawa Rental Co. (November, 1992 – September, 1999); Education: Yonsei University, MBA, Corporate Finance & Accounting (2002 – 2004); Seoul National University, Bachelor, Electrical Engineering (1987 – 1990).

https://kr.linkedin.com/in/sang-hun-lee-b32b133

Kevin Nguyen was hired as Senior Financial Analyst, Arrow Electronics, Greater Denver Area. He had joined Key Equipment Finance, Superior, Colorado, December, 2007, as Account Manager; promoted April, 2012 to Credit Analyst; promoted August, 2014, Senior Finance Analyst. Prior, he was Staff Accountant, University of Colorado Boulder (May, 2004 – December, 2007). Languages: English, Mandarin, Vietnamese. Education: University of Colorado Boulder - Leeds School of Business, Bachelor’s Degree, Business Administration (with an emphasis in Finance and Accounting)

• Additional coursework in International Business, Computer Science, and Mathematics. (1998 – 2004). Sciences Po, International Relations and Affairs

(2002). City University of Hong Kong, International Business

(2001) • Selected by the University of Colorado at Boulder as one of two students to participate in this exchange program • Two-week internship at the Hong Kong and Shanghai Banking Corporation (HSBC) learning about international finance and banking practices.

https://www.linkedin.com/in/kevinnguyendenver

John Scheid was hired as Corporate Compliance Consultant at CT Corporation, A Wolters Kluwer Company. Previously, he was Account Executive, LEAF Commercial Capital, Inc. (January, 2015 – June, 2016); Sales Supervisor, Direct Satellite TV (August, 2011 – January, 2015); Security Guard, Boyd and Associates (January, 2011 – October, 2011); Loss Prevention, Macy's (June, 2008 – May, 2009); Busser, Brunos Restaurant (January, 2007 – January, 2008); Cashier, PetSmart (January, 2007 – January, 2008). Education: University of Phoenix, Bachelor of Business Administration (BBA), Business Administration and Management, General (2013 – 2016). Hope International University (2012 – 2014). Online studies 2013-present: Sociology of Families, Christian Worldview & Contemporary Living, Composition and Literature. Rancho Buena Vista High School, Graduate.

https://www.linkedin.com/in/john-scheid-1bbb3677

[headlines]

--------------------------------------------------------------

Leasing Industry Ads---Help Wanted

Positions Available for the Right Person

|

Senior Credit Analyst - Minimum 5 years of small ticket/high volume equipment finance underwriting experience preferred

Senior Credit Analyst - Transportation - Minimum 5 years of small ticket/high volume equipment finance underwriting experience preferred

www.pawneeleasing.com |

Inside Sales Manager We are currently seeking qualified talent to be primarily responsible for overseeing the Inside Sales Department within the Vendor business group of the Equipment Finance Division, while developing and improving policies and procedures to properly support high production volume. For more information |

[headlines]

--------------------------------------------------------------

Sales Make it Happen by Steve Chriest

All Sales Are Complex

More than a few leasing salespeople and their managers think of the leasing sale as transactional. I want to suggest that the leasing sale, at all levels, is a complex sale. As is true in any complex selling situation, it's what and who you don't know that usually spells disaster for your selling efforts.

The complex sale characteristics of vendor sales are easy to see. Selling to vendors usually involves more than one buying influencer on the vendor side.

Not only must the senior managers in a vendor organization approve doing business with you, but the vendor's salespeople and support staff must also stand behind doing business with you and your company. Reluctance on the part of any of these influencers and players can spell big trouble for your sale. In addition, the decision-making process, especially for large vendor accounts, can be involved and can take a good deal of time.

What about a leasing sale to an individual lessee who runs a small business? You're dealing directly with the decision-maker. He or she can make a quick decision and does not need to consult with anyone regarding the decision, right? This sale is simple and transactional, right? Wrong!

What most salespeople and managers miss about these transactional sales is the fact that in many cases, in fact in almost all cases, unseen decision influencers lurk in the background. A sole proprietor who operates a one-man machine shop, for example, may have a spouse who works in the business, but behind the scenes, exerts strong influence over capital expenditures. That same entrepreneur may belong to local trade group that offers free advice on financing alternatives for its members. This small business owner may have a CPA, and perhaps an attorney with whom he consults on all major business decisions.

So, what appears to be a simple, transactional sale is actually a complex sale that may involve multiple decision influencers. The fact that the machine shop owner may also engage outside experts to evaluate financing options also adds to the complexity of the decision-making process. It is best to find out if he will discuss it with his bookkeeper or his certified public accountant, or even his son-in-law, who is an attorney.

Don't be fooled into thinking any sale is as simple as it appears. If you don't know everything there is to know about your customer's buying decision process, or you haven't identified, or aren't aware of all the key decision influencers, both seen and unseen, you may lose your sale without ever knowing why.

Steve Chriest is the CEO of Open Advance and author of Selling to the E-Suite, The Proven System for Reaching and Selling Senior Executives and Business Acumen 101. He recently re-named his company from Selling-Up. He produces video and radio blogs, as well as continues as a columnist for Leasing News.

www.openadvance.com/contact/

925-263-2702

www.openadvance.com/

Sales Makes It Happen Articles:

http://www.leasingnews.org/Legacy/index.htm

(Leasing News provides this ad as a trade for appraisals

and equipment valuations provided by Ed Castagna)

[headlines]

--------------------------------------------------------------

DealSafe---Control of Contractual Rights

Cloud Based Control of Lease Payments/Auto-Renew

Jason Dauderman, based in Phoenix, Arizona, has developed a software program that provides solutions to the end user, the Lessee, to take back control of their contractual rights. The cloud based platform "allow companies to easily upload, parse, and set notifications to any key contractual data such as end of term notification windows, early buyout options or upgrade opportunities. Access can be granted to multiple users and even outside professionals such as attorneys and accountants. In addition to equipment leases, customers use it for sales, procurement, employment and NDA contracts as well."

A demonstration is available with prices based on services

provided: http://dealsafe.co

|

[headlines]

--------------------------------------------------------------

Embracing Google’s Mobile-Friendly Ranking Algorithm

FinTech #102 by Brittney Holcomb

Having your business optimized for mobile devices has rapidly gone from being an ‘add on’ feature to be a ‘must have’ feature for all financial businesses. Ever since Google released its “Mobilegeddon,” the mobile usage for business has grown tremendously. Mobilegeddon is the word they adopted for Google’s significant new mobile-friendly ranking algorithm. It is designed to give a boost to mobile-friendly pages in Google’s mobile search results, and has been in use since April 21, 2015.

The trend has been away from the website to attract mobile friendly users, as well as to consider adopting a mobile app.

With mobile friendliness now a Google ranking factor, financial businesses cannot afford to not embrace the shift towards being mobile. Google will simply rule out a website among legitimate search results if it does not have a mobile friendly version. Seem unfair? Not exactly. Google’s main goal is to provide their searchers with the top- most quality content on the internet for any given search keyword or phrase. When a majority of their users have now switched to using mobile devices for search, they in turn need to adjust their search results to reflect the best websites suited for mobile devices.

All internet users, from small to large business users, are no longer spending a major of their time in front of desktop computers. They are researching businesses on the go and making decisions via their mobile device.

When smartphone usage first started increasing almost a decade ago, financial companies and banks were afraid to adopt the new channel. Back then everything about mobile devices just seemed unsecure, especially for financial companies handling personal information. As a result of that fear, a lot of financial businesses chose to avoid the mobile channel as long as they could.

While both consumers and businesses may have been hesitant performing financial transactions on mobile devices before, that has certainly changed over the last few years. Users now expect everything to be accessible at their fingertips at any given time, even financing for their business.

If your business does not have a mobile friendly website then those on line looking for services similar to yours will not be able to find you, and if they cannot find you online, they obviously will go someplace else, possibly to your competitor.

Some reading this may say “my website shows up on my mobile device, no problem!” Just because your website shows up on a mobile device, does not necessarily mean it is also “mobile friendly.” Proper mobile websites look much different than the website does on a desktop computer. Since a smartphone screen is much smaller than a desktop screen, all the features on a website have to be reformatted so they are visible and easy to navigate on a mobile screen.

The shift towards mobile is not meant to spark anxiety in financial business owners. It’s more or less an awakening to help the financial industry realize the days of avoiding mobile marketing are over. Financial businesses need to be where their target audience is spending the most time: on the mobile devices.

According to Forbes, nearly 75% of Americans look at their mobile device at least once every hour. Think about all the missed opportunities financial companies have been missing out on by not taking advantage of marketing to their target audience anytime they turn their phone on to search online or even to use an app.

Mobile devices have made interest users researching and service acquisition much more convenient than having to jump on a computer every time you want to look up a local business. It has actually allowed financial business owners to be able to reach an even bigger client base.

The times of having to periodically check your email on your computer at home are long gone. Email comes directly to mobile devices and even can be set up to alert you when anything new comes in. An increased efficiency in communication between a borrower and a lender or broker allows deals to be done much quicker, lessening the chance of a drop off from the borrower.

Since most financial companies have been slow to adapt to the new mobile-first world, that leaves a large opportunity for other financial businesses to take advantage of right now. Be proactive about the movement towards mobile and take advantage of the consumers you have not reached yet through mobile marketing efforts before the market becomes saturated.

Brittney Holcomb is the Director of Paid Search at The Finance Marketing Group. She works exclusively with finance companies and banks to help better develop their business online through digital marketing strategies. Brittney has been trained by some of the top leaders in the industry giving her a vast knowledge she is able to pass along to her client base.

eMail: brittney@financemarketing.com

https://www.linkedin.com/in/brittney-holcomb-02101834

Previous Financial Technology Articles

http://www.leasingnews.org/Conscious-Top%20Stories/fintech.html

[headlines]

--------------------------------------------------------------

Leasing News Web App

Download to your Mobile Device

![]()

Readers can access the latest edition of Leasing News on their mobile device by going to their browser and typing in www.leasingnews.org. A web app is available for Android smartphones that opens the news edition in Portrait style, versus a landscape (but can be read either way; however, designed for Portrait viewing).

To add the Android Web App, open www.leasingnews in your mobile device, go to this article, and click on the link below:

http://leasingnews.org/items/LeasingNews.apk

Your mobile device has a download section, just as your computer has a download section. Find the .apk file and open it. It will automatically be placed with your other Web Aps. Adjust the size to fit your screen.

You can also ask us to email you the .apk to your mobile device and then follow the directions in the paragraph above.

(Please send to a colleague and ask them to subscribe. We are free. Write “subscribe” in subject line to kitmenkin@leasingnews.org)

[headlines]

--------------------------------------------------------------

##### Press Release ############################

California Mortgage Lending by Non-Banks Increased

at Fast Pace in 2015, DBO Report Shows

Number of Loans up 47%; Principal Grew 57%

Mortgage lending by non-banks in California increased substantially in 2015, measured both in volume and principal amount, according to a report released today by the Department of Business Oversight (DBO).

Jan Lynn Owen

Dept. Business Oversight Commissioner

“It’s only one indicator, but this data points to the continued good health of California’s housing market,” said DBO Commissioner Jan Lynn Owen. “The numbers are cause for encouragement, but not giddiness. DBO will remain on guard against the bad underwriting and unfair business practices that crashed our economy and inflicted financial hardship on millions of Californians.”

Today’s report presents consolidated data from unaudited annual reports filed with the DBO by mortgage lenders and servicers licensed under the California Residential Mortgage Lending Act. It’s the first such report ever issued by the DBO.

“Non-banks’ share of the mortgage market has grown substantially in recent years, and California is no exception” said Owen. “That’s why we thought it was important to start sharing this data with the public and policymakers. And, fortunately, technology upgrades have made it easier for us to do that job.”

Licensed lenders originated 537,757 mortgages in 2015, up 47.3 percent from 2014’s total of 365,045, according to the data. The aggregate principal for mortgages originated in 2015 grew 56.7 percent from 2014, to $179.3 billion from $114.4 billion. The 2015 principal amount represented a 364.5 percent increase from 2008’s low point of $38.6 billion, according to the report. Still, last year’s total was 29.6 percent below the $254.8 billion recorded in 2006.

On the servicing side, the aggregate average principal amount of loans serviced by licensees each month increased 7.4 percent in 2015, to $766.2 billion from $713.1 billion in 2014, the data showed. This number hit a low of $234.7 billion in 2009.

Licensees reported completing 16,246 foreclosures in 2015, down 3.6 percent from the 2014 total of 16,853. In 2012, the first year the DBO started collecting such data, licensees reported completing 18,468 foreclosures.

Prominent lenders and servicers licensed under the Residential Mortgage Lending Act include: Quicken Loans; Prospect Mortgage, LLC; Caliber Home Loans, Inc.; Finance of American Mortgage, LLC; Guaranteed Rate, Inc.; LoanDepot, LLC; Nationstar Mortgage, LLC; Ocwen Loan Servicing, LLC; Pennymac Loan Services, LLC; Stearns Lending, Inc.; and Suntrust Mortgage, Inc.

A report released by the DBO June 30 showed mortgage lending by non-banks licensed under a different law also increased significantly in 2015 from the prior year. Lenders licensed under the California Finance Lenders Law reported a 61.7 percent jump in the number of residential mortgage loans they made (to 78,073), and a 55.3 percent rise in the aggregate principal (to $24.6 billion).

Combined in 2015, non-bank mortgage lenders licensed under both laws reported a 49 percent increase in the number of loans (to 615,830), and a 56.6 percent increase in aggregate principal (to $203.9 billion).

The DBO licenses and regulates more than 360,000 individuals and entities that provide financial services in California. DBO’s regulatory jurisdiction extends over state-chartered banks and credit unions, money transmitters, securities broker-dealers, investment advisers, non-bank installment lenders and payday lenders, mortgage lenders, escrow companies, franchisors and more.

2015 California Residential Mortgage Loan Report (16 pages)

http://www.leasingnews.org/PDF/2015CRMLAReport.pdf

### Press Release ############################

(Leasing News provides this ad “gratis” as a means

to help support the growth of Lease Police)

[headlines]

--------------------------------------------------------------

Fernando's View

By Fernando F. Croce

A gentle charmer (“The BFG”) and a poignant comedy (“Hunt for the Wilderpeople”) arrive in theaters, while DVD releases offer an impressionistic meditation ("Knight of Cups"), a ravishing modern fable (“Cemetery of Splendor”), and a brilliantly sardonic classic ("Dr. Strangelove").

In Theaters:

The BFG (Walt Disney Motion Pictures): Two masters of wondrous whimsy, director Steven Spielberg and author Roald Dahl, team up for this special effects-laden yet hearteningly gentle tale of friendship. The Big Friendly Giant of the title (played, in a marvel of motion-capture technique, by Mark Rylance) is a benevolent behemoth who meets Sophie (Ruby Barnhill), a 10-year-old orphan who accompanies him to the mythical land of the giants. There, she learns of their capacity to capture dreams, and, while at first determined to escape, gradually develops a bond with the Giant. Together, can they stand up to the sinister, man-eating other giants? With a knack for depicting radiant fantasy that goes back decades, Spielberg works his magic and crafts a children’s tale that should charm audiences of all ages.

Hunt for the Wilderpeople (The Orchard): New Zealander director Taika Waititi switches gears from his previous movie, the horror mockumentary “What We Do in the Shadows,” with this warmhearted comedy-adventure, which gives Sam Neill one of his richest roles. Neill stars as Hec, a cantankerous farmer who, along with his wife (Rima Te Wiata), takes in young Ricky (Julian Dennison), a kid with a history of trouble. Though reluctant at first, Hec grows fond of the boy. When a tenacious social worker (Rachel House) comes along to take the young man to another foster home, however, Ricky runs away into the jungle with Herc—a flight that turns into a nationwide manhunt. Maintaining an offbeat sense of humor even as the story veers into serious territory, Waititi’s film is a consistently winning mix.

Netflix Tip: An artist of enormous ambition and visual scope, director Michael Cimino (1939-2016) was infamous for his successes as well as his failures. So check out this controversial filmmaker’s bold works, which include “The Deer Hunter” (1978), “Heaven’s Gate” (1980), and “Year of the Dragon” (1985). |

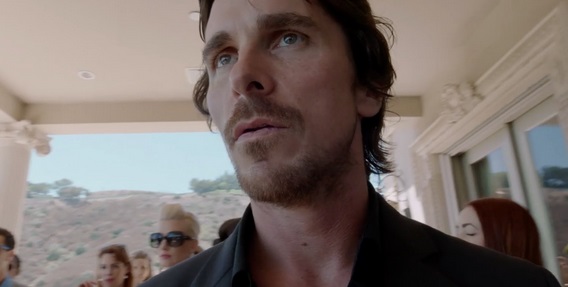

On DVD:

Knight of Cups (Broad Green): One of the most acclaimed (and divisive) American filmmakers, Terrence Malick (“The New World”) continues to blend narrative storytelling with experimental exploration in this intoxicating look at human loneliness and discovery. Christian Bale stars as Rick, a young Los Angeles screenwriter whose flashy lifestyle is a façade for an aching need for connection. As he ventures into fancy studios, lavish parties and lurid nightclubs, his complicated relationships with his father (Brian Dennehy), brother (Wes Bentley), and many women (including Cate Blanchett, Natalie Portman, and Imogen Poots). With the help of ace cinematographer Emmanuel Lubezki, Malick paints a remarkably immersive and impressionistic portrait of spiritual turmoil and rebirth, bending time and space with dizzying mastery. Not an easy journey, but one serious cinema lovers certainly will want to take.

Cemetery of Splendor (Strand Releasing): Thai auteur Apichatpong Weerasethakul (“Uncle Boonmee Who Can Recall His Past Lives”) serves up another one-of-a-kind trip in this leisurely, magical blend of political history and lyrical surrealism. Set in a rural hospital built on the ruins of a palace, the story centers on Jenjira (Jenjira Pongpas Widner), a bored housewife who works as a volunteer in the midst of an outbreak of a strange sleeping disease. When a young soldier (Banlop Lomnoi) awakens under her care, a tentative romance blossoms between the strangers. But in a place as spiritually fluid as the hospital, who can draw the line between reality and fantasy, past and present? With a sure and serene touch, Weerasethakul creates a patient, visually gorgeous and often humorous modern fable that lingers in the mind. With subtitles.

Dr. Strangelove or: How I Learned to Stop Worrying and Love the Bomb (Criterion): In a time when worldwide fears and tensions were high, legendary director Stanley Kubrick (“2001: A Space Odyssey”) seized the moment for a blast of astonishingly sardonic humor with this very dark 1964 comedy. Unfolding at the height of the Cold War, the story follows the catastrophic events that take place when an insane U.S. Air Force commander (Sterling Hayden) launches an atomic attack on the Soviet Union. While the air bomber heads toward its target, the Pentagon is shaken up with clashes between authorities, including a gung-ho general (George C. Scott) and the President himself (Peter Sellers). Playing a harrowing scenario for madcap laughs, Kubrick brilliantly exposes the madness behind warfare and humanity’s yen for self-destruction.

[headlines]

--------------------------------------------------------------

German Shepherd

San Clemente-Dana Point, California Animal Shelter

Sydney

ID#A035147

Female

Six Years Old

Primary Color: Black

Secondary Color: Yellow, Tan, Blond or Fawn

Current on Vaccinations

Spayed

"Hi! My name is SYDNEY. I am a female, black and tan German Shepherd Dog. The shelter staff thinks I am about 6 years old. I have been at the shelter since Mar 30, 2016. I am a Rescue Mission dog which means I was rescued from a high-kill shelter in the area. I am a big, strong, healthy girl. I love the ball. I could play fetch for hours. I also love taking walks and am learning to walk on a loose leash. I am quite sweet when you get to know me. I would prefer an experienced owner."

(German Shepherds are great dogs, loyal, family “pets,” protective,

smart, and very friendly to their family. A great bred! Editor).

Applications are only accepted by FAX (949-366-4765), mail or in person. Sorry, no applications through the Internet. The adoption fee for dogs is $125, which covers the following: spay or neuter, microchip, current shots, flea treatment if required, New Owner folder packed with helpful information, and one free basic health examination within 5 days of adoption from a veterinarian on our list.

Please call 949-492-1617 to check if your desired pet is still available or the status of your application.

Shelter Hours: Tuesday, Thursday, Friday, & Saturday: 10:00 AM - 4:00 PM. Wednesday: 10:00 AM - 7:00 PM. Sunday: Noon - 3:00 PM. We are CLOSED Mondays.

Adoption Process

http://www.petprojectfoundation.org/Adoptions/AdoptADog

Adopt a Pet

http://www.adoptapet.com/

[headlines]

--------------------------------------------------------------

Asset Management

Asset Management: Minneapolis, MN |

Asset Management: Boston, MA Nationwide appraisals, remarketing, audits, inspections and more! Over 15-years industry experience and dedicated to deliver personal, prompt, professional services. Call Chris @ 508-785-1277 Email: |

| Asset Management: Monroe, NC Recover a greater return on your investment. We specialize in the woodworking, pallet, sawmill and forestry industries. Carolinamachinerysales.com Melinda Meier (704)288-1904 x103 |

Nationwide |

| Asset Storage/Re-Marketing: Ohio & surrounding states. Providing no cost warehousing, condition reports, digital photos and remarketing of off-lease forklifts & industrial equipment. NAFTA wide dealer network. Email to GCochran@OhioLift.com |  Asset Management Asset ManagementMelville, New York Auctions, Appraisals, National Repossessions. ALL asset classes. 20+ year team works for you. Spend less, Net More… Fast! Ed Castagna 516-229-1968ecastagna@inplaceauction.com |

| Bulldog Asset Management provides recovery and remarketing services with a difference. Contingent repos, free storage and industry experts to remarket. http://bulldogasset.com/contact www.bulldogasset.com |

Asset Management: Global Specializing in Semiconductor and Electronic Test Equipment collateral. Lender services include Consignment Sales, Remarketing, Portfolio Purchases, Inspections, De-installation, Repairs and Warehousing. testequipmentconnection.com |

|

[headlines]

--------------------------------------------------------------

![]()

News Briefs---

Former Regions Bank VPs Indicted in Bribery,

Wire Fraud Scheme, $5.1 Million

http://www.al.com/news/index.ssf/2016/07/

former_regions_bank_vps_indict.html

LendingClub’s Newest Problem: Its Borrowers

Charge-off rates have risen as much as 38% since 2013

http://www.wsj.com/articles/lendingclubs-newest-problem-its-borrowers-1468265212

Slump Might Turn Anti-Bank SoFi Into a Bank

CEO who called banks a ‘waste of human capital’

http://www.wsj.com/articles/slump-might-turn-anti-bank-sofi-into-a-bank-1468339004

CG Commercial Fin. Acquired by Atalaya Capital Management

$1MM to $300MM Projects

(The Alta Group provided advisory and due diligence services to Atalaya Capital Management in support of Atalaya’s acquisition of CG Commercial Finance.)

https://cgcommercialfinance.com/cg-commercial-finance-acquired-atalaya-capital-management/

New Lease Account Standard Impact

on the Lease vs. Buy Decision

http://www.elfaonline.org/News/IndNews/news_report.cfm?id=23596

New York Times Lets $27 Million Jamie Dimon Brag About

What He's Doing for Income Inequality

http://us10.campaign-archive1.com/?u=

Google to Ban Search All Consumer Lenders Charge 36% APR

Google wrote that commercial loans are exempt from the ban

http://debanked.com/2016/07/google-adwords-interruption-may-be-coming-for-business-lending-and-mca-this-week/

Google to train 2m Android developers in India for free

May, rival Apple announced 4,000 new jobs in Hyderabad

https://www.siliconrepublic.com/portfolio/google-india-android-developers

Microsoft leasing Surface Tablet/Software Bundles

"But do both small companies and corporations want them?"

https://www.engadget.com/2016/07/12/microsoft-is-leasing-surface-tablet-and-software-bundles-to-busi/

Seagate will eliminate 6,500 jobs/computer hard drives

$21 million loss for the quarter ended April 1

http://www.mercurynews.com/business/ci_30116238/seagate-cut-6-500-jobs

Senior Credit Analyst - Minimum 5 years of small ticket/high volume equipment finance underwriting experience preferred

Senior Credit Analyst - Transportation - Minimum 5 years of small ticket/high volume equipment finance underwriting experience preferred

www.pawneeleasing.com |

[headlines]

--------------------------------------------------------------

--You May Have Missed It

2016 Best Franchise Deals

10 Brands Offer Best Bang for Your Buck

https://www.qsrmagazine.com/reports/2016-best-franchise-deals

[headlines]

--------------------------------------------------------------

SparkPeople--Live Healthier and Longer

![]()

How to Keep Fruits and Veggies Fresh

Proper Storage Prevents Spoilage, Saving You Hundreds

http://www.sparkpeople.com/resource/nutrition_articles.asp?id=1103

[headlines]

--------------------------------------------------------------

Baseball Poen

Love of the Game

by David Michael Chambers

Crack of the bat

Love of the game

This is a picture

That needs no frame

From the pitcher’s stance

High atop of the mound

To the cheer of the crowd

What a terrific sound

The ball flies high

Up into the air

When it comes down

Will it be fowl or fair?

The outfielder runs hard

Attempting to catch the ball

But into fowl territory

Alas does it fall

Once again

The pitcher comes set

Letting go with a fastball

His fastest yet

The batter then swings

With all his mustered might

Hoping to hit the ball

Clean out of sight

Clearing that outfield fence

Is what he longs to see!

Trotting around the bags

Crossing that plate with glee

A pop the batter does hear

As the ball shoots into the glove like a spike

Followed by the umpire’s ringing up

The batter’s third and final strike

On his way to the dugout

Smiling without shame

With a heart that’s full of love

For this Baseball game

[headlines]

--------------------------------------------------------------

Sports Briefs----

Magic Johnson, Charles Barkley support Warriors’ Draymond Green

http://www.sfgate.com/warriors/article/Magic-Barkley-rally-behind-Warriors-Green-8355458.php

Colts offseason report: Indy hopes healthy,

wealthy Andrew Luck means playoff return

http://www.usatoday.com/story/sports/nfl/colts/2016/07/11/offseason-report-andrew-luck-chuck-pagano-indianapolis/86938560/

Nevada panel eyes 9 sites for Raiders stadium

http://www.theredzone.org/BlogDescription/tabid/61/EntryId/57352/Nevada-panel-eyes-9-sites-for-Raiders-stadium/Default.aspx

U.F.C. Sells Itself for $4 Billion

http://www.nytimes.com/2016/07/11/business/dealbook/ufc-sells-itself-for-4-billion.html?src=me&_r=0

49ers QB situation ranked second to worst in NFL

http://sfo.247sports.com/Bolt/49ers-QB-situation-ranked-second-to-worst-in-NFL--46195053

[headlines]

--------------------------------------------------------------

California Nuts Briefs---

Panel Focuses Ire on SFPD Officers' Union

http://www.courthousenews.com/2016/07/12/panel-focuses-ire-on-sfpd-officers-union.htm

[headlines]

--------------------------------------------------------------

![]()

“Gimme that Wine”

http://www.youtube.com/watch?v=EJnQoi8DSE8

2015 California Wine Sales in U.S. Hit $31.9 Billion Retail Value

http://www.wineinstitute.org/resources/pressroom/07082016

California wine industry asks feds to tighten labeling standards

http://www.pressdemocrat.com/business/5828537-181/california-wine-industry-asks-feds?artslide=1

Justin Vineyards has a history of clearing thousands

of oak trees in SLO County (photos)

http://kcbx.org/post/justin-vineyards-has-history-clearing-thousands-oak-trees-slo-county

Impact Napa conference to include Warren Winiarski interview, discussion on Napa Valley growth

http://www.northbaybusinessjournal.com/events/5829434-181/napa-valley-growth-wine-business-conference

NW wine industry mourns Walla Walla’s Duane Wollmuth

http://www.greatnorthwestwine.com/2016/07/11/duane-wollmuth/

Sonoma County winery development at issue in debate about events

http://www.pressdemocrat.com/news/5815321-181/sonoma-county-winery-development-at?artslide=0Free Mobile Wine Program

http://leasingnews.org/archives/Feb2010/2_26.htm#mobile

Wine Prices by vintage

http://www.winezap.com

http://www.wine-searcher.com/

US/International Wine Events

http://www.localwineevents.com/

Leasing News Wine & Spirits Page

http://two.leasingnews.org/Recommendations/wnensprts.htm

[headlines]

----------------------------------------------------------------

![]()

This Day in American History

1585 - A group of 108 English colonists, led by Sir Richard Grenville, reached Roanoke Island, North Carolina and became England's first foothold in the New World. Sir Walter Raleigh sent a detachment of 108 men to build a fort on the island. The detachment included two scientists, Thomas Hariot, a surveyor, mathematician, astronomer and oceanographer, and Joachim Gans, a metallurgist.

1729 - Birthday of Minuteman John Parker (d. 1775), Lexington, Massachusetts Bay Colony. “Stand your ground. Don't fire unless fired upon, but if they mean to have a war, let it begin here,” Captain John Parker to the Lexington patriot militia assembled on Lexington Green, preparing to fight the British at the Battle of Lexington. http://memory.loc.gov/ammem/today/jul13.html

1787 - The Continental Congress enacted a slavery ban for a territory of the United States. The law prohibited slavery forever within the borders of the Northwest Territory. The Northwest Ordinance, also known as the Freedom Ordinance or The Ordinance of 1787, was approved by the Congress of the Confederation of the United States (the Confederation Congress). The ordinance created the Northwest Territory, the first organized territory of the United States as the lands beyond the Appalachian Mountains, between British North America and the Great Lakes to the north and the Ohio River to the south. The upper Mississippi River formed the Territory's western boundary. It was the response to multiple pressures: the westward expansion of American settlers, tense diplomatic relations with Great Britain and Spain, violent confrontations with Indians, the weaknesses of the Articles of Confederation, and the empty treasury of the American government. Considered one of the most important legislative acts of the Confederation Congress, it established the precedent by which the Federal government would be sovereign and expand westward with the admission of new states, rather than with the expansion of existing states and their established sovereignty under the Articles of Confederation. It was also precedent setting legislation with regard to American public domain lands.

1821 - Nathan Bedford Forrest (d. 1877) was born in Chapel Hill, TN. This is an official holiday in the State of Tennessee. A lieutenant general in the Confederate Army, he is remembered as a self-educated, brutal, and innovative cavalry leader during the Civil War and as a leading Southern advocate in the postwar years. He was a pledged delegate from Tennessee to the Democratic National Convention in New York in 1868. He served as the first Grand Wizard of the KKK, composed of many ex-Southern Civil War soldiers, but he later distanced himself from the organization.

1832 - Ethnologist Henry R. Schoolcraft was the first white person to arrive at the source of the Mississippi River at Lake Itasca, Minnesota. A pioneer in Native American studies, Schoolcraft conducted ethnological research among the Ojibwa in the Great Lakes region.

1861 – At the Battle of Corrick's Ford, Virginia, the Union Army took total control of western Virginia (what is now West Virginia on the Cheat River) and it stayed that way for the rest of the war. The campaign propelled Maj. Gen. George B. McClellan to command of the Army of the Potomac.

1862 - The First Battle of Murfreesboro, an important Union supply center on the Nashville & Chattanooga Railroad, was fought in Tennessee. Troops under Confederate Brig. Gen. Nathan Bedford Forrest surprised and quickly overran a Federal hospital, the camps of several small Union units, and the jail and courthouse in Murfreesboro. All of the Union units surrendered to Forrest, and the Confederates destroyed much of the Union's supplies and destroyed railroad track in the area. The primary consequence of the raid was the diversion of Union forces from a drive on Chattanooga and the deprivation of supplies.

1863 - Starting today and lasting until July 16, antidraft riots broke out in New York City. Modern history's bloodiest riot began when a mob of 50,000 Civil War draft protesters burn buildings (including an orphan asylum), stores and draft offices, attack police. Some club, lynch and shoot large numbers of blacks, who they blamed for the war. Rioters were protesting the provision allowing true red-blooded flag-waving Americans to make cash payment in place of serving in the army. When troops returning from Gettysburg finally restored order, 1,200 were dead.

1863 - Mary Emma Woolley (d. 1947) birthday, S. Norwalk, CT. President of Mt. Holyoke College (1900- 1937) whose strong leadership expanded it to a major learning institution. She was voted one of the 12 most influential women in America.

1865 - Horace Greeley advises his readers to "Go west young man.” Greeley was editor of the New-York Tribune, among the great newspapers of its time. It was first stated by John Babsone Lane Soule in an 1851 editorial in the Terre Haute Express, "Go west young man, and grow up with the country." Greeley later used the quote in his own editorial in 1865, favoring westward expansion. He saw the fertile farmland of the west as an ideal place for people willing to work hard for the opportunity to succeed. The phrase came to symbolize the idea that agriculture could solve many of the nation's problems of poverty and unemployment characteristic of the big cities of the East. It is one of the most commonly quoted sayings from the nineteenth century and may have had some influence on the course of American history. Some sources have claimed the phrase is derived from the following advice in Greeley's July 13, 1865 editorial in the New York Tribune, but this text does not appear in that issue of the newspaper. The actual editorial instead encourages Civil War veterans to take advantage of the Homestead Act and colonize the public lands: “Washington is not a place to live in. The rents are high, the food is bad, the dust is disgusting and the morals are deplorable. Go West, young man, go West and grow up with the country.”

1868 - Oscar J Dunn, former slave, installed as lieutenant governor of Louisiana. He became the first elected black lieutenant governor of a U.S. state, running on the ticket headed by Henry C. Warmoth, formerly of Illinois. After Dunn died in office, then-state Senator P.B.S. Pinchback, another black Republican, became lieutenant governor and thereafter governor for a 34-day interim period.

http://www.famousamericans.net/oscarjamesdunn/

1869 - Street riots against Chinese laborers begin in San Francisco. The first significant Chinese immigration to North America began with the Gold Rush of 1848–1855 and continued with subsequent large labor projects, such as the building of the transcontinental railroad. During the early stages of the gold rush, when surface gold was plentiful, the Chinese were tolerated, if not well received. As gold became harder to find and competition increased, animosity toward the Chinese and other foreigners increased. After being forcibly driven from the mines, most Chinese settled in enclaves in cities, mainly San Francisco, and took up low-wage labor. The Chinese immigrant workers provided cheap labor and did not use any of the government infrastructure (schools, hospitals, etc.) because the Chinese migrant population was predominantly made up of healthy male adults. As time passed and more and more Chinese migrants arrived in California, violence would often break out until Congress passed legislation excluding the Chinese, but this was vetoed by President Hayes. www.chiamonline.org/Chronology/1850.htm

1886 - Birth of Father Edward Flanagan (d. 1948), Leabeg, Ireland. American Catholic parish priest. Believing there was 'no such thing as a bad boy,' in 1922, he organized Boys Town near Omaha, Nebraska.

1898 – The Ferry Building, at the foot of Market Street on the Bay in San Francisco, opened to the public. Designed in 1892 by American architect A. Page Brown in the Beaux Arts style, it was the largest project undertaken in the city up to that time. Brown designed the clock tower after the 12th-century Giralda bell tower in Seville, Spain, and the entire length of the building on both frontages is based on an arched arcade. The well-built reinforced building with its arched arcades survived both the 1906 and 1989 earthquakes with little damage. It served as the destination for commuters to San Francisco from the East Bay, who rode the ferry fleets of the Southern Pacific and the Key System.

1898 – Guillermo Marconi patented the radio. US Patent 997,308 for "Transmitting apparatus for wireless telegraphy". Marconi made his first demonstration of his wireless transmission system for the British government in July, 1896. Numerous additional demonstrations followed, and Marconi began to receive international attention. In July 1897, he carried out a series of tests in his home country, for the Italian government. A test for Lloyds in Ireland was conducted on July 6, 1898. autumn of 1899, the first demonstrations in the United States took place, with the reporting of the America’s Cup international yacht races at New York. Marconi sailed to the United States at the invitation of the New York Herald newspaper to cover the races off Sandy Hook, NJ. The transmission was done aboard the SS Ponce, a passenger ship. Marconi left for England on November 8, 1899 on the SS St. Paul, and he and his assistants installed wireless equipment aboard during the voyage. On 15 November, Saint Paul became the first ocean liner to report her imminent return to Great Britain by wireless when Marconi's Royal Needles Hotel radio station contacted her sixty-six nautical miles off the English coast. The role played by Marconi Co. wireless in maritime rescues raised public awareness of the value of radio and brought fame to Marconi, particularly the sinkings of the RMS Titanic on April 15, 1912 and the RMS Lusitania on May 7, 1915. Titanic radio operators Jack Phillips and Harold Bride were employed the Marconi International Marine Communications Company, not the ship line. After the sinking of the ocean liner, survivors were rescued by the RMS Carpathia. Also employed by the Marconi Company was David Sarnoff, who later headed RCA. Wireless communications were reportedly maintained for 72 hours between Carpathia and Sarnoff. When Carpathia docked in New York, Marconi went aboard with a reporter from The New York Times to talk with Bride, the surviving operator.

1913 – Dave Garroway (d. 1982), the first host of “Today” (1952-61), was born, Schenectady, NY.

1915 - Baltimore, MD, became the first city to support a City orchestra ( $6,000).

1923 - A sign consisting of 50-foot-tall letters spelling out "HOLLYWOODLAND" was dedicated in the Hollywood Hills to promote a subdivision (the last four letters were removed in 1949). Real estate developers Woodruff and Shoults called their development "Hollywoodland" and advertised it as a "superb environment without excessive cost on the Hollywood side of the hills."

1930 – David Sarnoff reported in The New York Times, "TV would be a theater in every home."

1934 – Babe Ruth hit his 700th career HR, in Detroit. He finished his career with 714, the record until Hank Aaron passed him in 1974.

1936 - 112ø F (44ø C), Mio, Michigan (state record)

1936 - 114ø F (46ø C), Wisconsin Dells, Wisc. (state record)

1938 - When the first television theatre opened in Boston, Massachusetts, spectators paid 25 cents to witness the event. Attended by 200 people, the variety show included dancing and singing, and lasted 45 minutes. The acts were transmitted to the room, by television, while they were being performed on the floor above the theatre.

1939 - Making his recording debut with the Harry James band was Frank Sinatra, who sang "Melancholy Mood" and "From the Bottom of My Heart."

( lower half of: http://memory.loc.gov/ammem/today/jul13.html )

1940 - Captain Jean-Luc Picard Birthday. Actually this is the birthday of the man who played Capt. Picard, Patrick Stewart, who was born in Mirfield, Yorkshire, England.

1946 - Top Hits

“They Say It's Wonderful” - Frank Sinatra

“The Gypsy” - The Ink Spots

“I Don't Know Enough About You” - The Mills Brothers

“New Spanish Two Step” - Bob Wills

1954 - Top Hits

“Little Things Mean a Lot” - Kitty Kallen

“Hernando's Hideaway” - Archie Bleyer

“The Little Shoemaker” - The Gaylords

“Even Tho” - Webb Pierce

1959 - The Shirelles song, "Dedicated To The One I Love", was released. The song only hit number 83 on "Billboard" magazine's Top 100 chart. When the song was re- released in 1961, it went to number three on the charts.

1960 - Democratic National convention nominates Senator John F Kennedy for President.

1962 - Top Hits

“The Stripper” - David Rose

“Roses are Red” - Bobby Vinton

“Al Di La'” - Emilio Pericoli

“Wolverton Mountain” - Claude King

1963 - At the age of 43, Early Wynn pitches the first five innings to register his 300th win as the Indians down the Kansas City A's, 7-4. It will be his last Major League win.

1968 - Paul Simon and Art Garfunkel's album, "Bookends" is #1 for the third week in a row. That album along with the "Mrs. Robinson" soundtrack will give the duo 16 straight weeks at #1 on the L.P. charts.

1968 - Steppenwolf's "Born To Be Wild" is released.

1970 - Top Hits

“Mama Told Me (Not to Come)” - Three Dog Night

“Ball of Confusion” - The Temptations

“Ride Captain Ride” - Blues Image

“He Loves Me All the Way” - Tammy Wynette

1971 - At the All-Star Game at Tiger Stadium at Detroit, Michigan, Reggie Jackson hit a home run off Doc Ellis. The ball bounced off a light tower deep in right field. With a score of 6-4, the American League won the game.

1972 - Baltimore Colts owner Carroll Rosenbloom and Los Angeles Rams owner Robert Irsay proposed a unique trade to the NFL, when the wealthy businessmen traded teams. Chicago industrialist Irsay purchased the Rams for $19 million from original Rams owner Dan Reeves, then traded the franchise to Rosenbloom for the Colts and cash. Rosenbloom holds the highest winning percentage in NFL history among owners, .660, and was dissatisfied with the stadium in Baltimore and the city’s unwillingness to upgrade it, thus prompting the trade of the teams. Coincidentally, it was this same issue that prompted Irsay to move the Colts to Indianapolis, and why the Rams eventually left LA for Anaheim before moving to St. Louis. Follow the bouncing ball…the Rams are back in LA for the 2016-17 season.

1973 - During a concert at the John Wayne Theatre in Buena Park, California, the Everly Brothers broke up. Right in the middle of the concert Phil Everly walked off the stage, brother Don said, “The Everly Brothers died ten years ago.” They joined together 1983 to sing with the “Simon and Garfunkle” Tour, as both Paul Simon and Art Garfunkle have acknowledged they started singing together to become just like their idols, the Everly Brothers. With Phil’s passing in 2014, the end of the Everly Brothers as an entertainment act was complete. One of Rock and Roll’s early successful and influential (particularly the Beatles) acts, the Everly Brothers were elected to the Rock and Roll Hall of Fame in 1986 and the Country Music Hall of Fame in 2001.

http://www.everly.net/

1973 - Alexander Butterfield reveals the existence of the Nixon tapes to the special Senate committee investigating the Watergate break in.

1974 - George McCrae's "Rock Your Baby" begins the first of two straight weeks at #1.

1974 - Eric Clapton's "I Shot The Sheriff" is released.

1977 - A vast power failure plunged New York City and Westchester County into darkness last night, disrupting the lives of nearly nine million people. Thousands of subway riders were trapped in trains that stopped between stations. Homes and apartments went black. Thousands of people were trapped in elevators. Others stumbled and streamed from theaters, restaurants, and late-closing shops and office buildings. The power failed at 9:34 P.M., apparently when lightning struck a Consolidated Edison electrical transmission line in northern Westchester.

http://sloan.stanford.edu/Blackout/archive/curvin_porter/curvin_porter_toc.html

1978 - Top Hits

“Shadow Dancing” - Andy Gibb

“Baker Street” - Gerry Rafferty

“Take a Chance on Me” - Abba

“I Believe in You” - Mel Tillis

1980 - Afternoon highs of 108 degrees at Memphis, TN, 108 degrees at Macon, GA, and 105 degrees at Atlanta, GA, established all-time records for those three cities. The high of 110 degrees at Newington, GA, was just two degrees shy of the state record

1982 - In Montreal, Canada, the first All-Star Game to be played outside the United States took place. For the eleventh consecutive year, the National League won when it defeated the American League 4-1.

1984 - The Yankees retire Roger Maris (#9) and Elston Howard (#32) uniform numbers. The team also erect plaques in their honor to pay tribute to their achievements as Bronx Bombers. Maris is best remembered as the man who first broke Babe Ruth’s single season home run record when hit 61 in 1961, and although others have hit more, they have been identified as having used illegal PEDs. Many, many consider Maris to still hold the legitimate record. Maris appeared in seven World Series, five as a member of the Yankees and two with the Cardinals, winning three. Elston Howard was the first African-American to play for the Yankees and he succeeded the legendary Yogi Berra as the Yankee catcher. Howard was named AL MVP in 1963, becoming the first black player in AL history to win the honor. He appeared in ten World Series, winning four, and ranks among Series career leaders in several categories. He also won another two World Series as a coach. His lifetime slugging average of .427 ranked fourth among AL catchers at the time of his retirement.

1984 - When sportscaster Howard Cosell asked to leave "Monday Night Football," saying he was “tired of being tied to the football mentality." Roone Arledge gave him what he wanted, and a year later, Cosell was removed from television altogether.

1985 - Simultaneously, the "Live Aid" concert, for African famine relief, occurred in Philadelphia, Pennsylvania and London, England. Performances from JFK Stadium in Philadelphia, London's Wembley Stadium and other venues were broadcast world-wide and raising over $70 million. The all-day and most-of-the-night concert showcased some of rock 'n' roll's biggest names including Mick Jagger, Tina Turner, Madonna, Bob Dylan and Paul McCartney. The concert was attended by 162,000 people, while 1.5 billion people watched the show from their televisions. Bob Geldorf, singer for Boomtown Rats organized the "Live Aid" concert and was responsible for gathering the big name stars, all of agreed to perform without pay.

1985 - "A View to a Kill," from the James Bond movie of the same name, performed by Duran Duran, went to the top of the record charts, staying on top for two weeks. Both themes from James Bond movies, "Live and Let Die" by Wings and "Nobody Does It Better" by Carly Simon only reached number two on the record charts.

1986 - Top Hits

“Holding Back the Years” - Simply Red

“Invisible Touch” - Genesis

“Nasty” - Janet Jackson

“Hearts Aren't Made to Break (They're Made to Love)” - Lee Greenwood

1986 - Philadelphia Phillie Kent Tekulve broke the National League record for relief appearances for his 820th performance. He helped his team win in the 11-inning over the Houston Astros 5-4. The old record holder was Elroy Face of Pittsburgh.

1987 - Representatives of fifty of America's largest record retailers are guests at Michael Jackson's home in Encino, California to preview his new album, "Bad". The LP, which includes the singles, "I Just Can't Stop Loving You", "Bad", "The Way You Make Me Feel", "Man in the Mirror" and "Dirty Diana", would go on to reach number one on the Billboard Hot 200 chart and sell over 30 million copies worldwide.

1989 - A thunderstorm at Albany, GA, produced 1.40 inches of rain in forty minutes, along with wind gusts to 82 mph. Afternoon highs of 98 degrees at Corpus Christi, TX, 110 degrees at Tucson, AZ, and 114 degrees at Phoenix, AZ, equaled records for the date. Greenwood, MS, reported 55.65 inches of precipitation for the year, twice the amount normally received by mid-July.

1994 – Jeff Gillooly, former husband of skater Tonya Harding, was sentenced to 2 years for attacking rival Nancy Kerrigan.

1995 - Rush vocalist Geddy Lee sings "Oh Canada" before the All-Star Game at Baltimore's Camden Yards.

1995 - The temperature in Chicago, Illinois reached its all-time high -- 106 degrees (Fahrenheit) -- recorded at Midway Airport.

http://www.press.uchicago.edu/Misc/Chicago/443213in.html

1999 - Boston Red Sox pitcher Pedro Martinez became the first pitcher to open an All-Star Game with four strikeouts and fanned five in two dazzling innings to lead the American League to a 4-1 victory over the National League at Fenway Park.

2011 - Researchers revealed two studies showing the antiretroviral drugs prescribed to treat AIDS can also prevent HIV infections.

2013 - George Zimmerman was found not guilty in the case regarding the fatal shooting of Treyvon Martin.

-------------------------------------------------------------

SuDoku

The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler?

http://leasingnews.org/Soduku/soduko-main.htm

--------------------------------------------------------------

Daily Puzzle

How to play:

http://www.setgame.com/set/puzzle_frame.htm

Refresh for current date:

http://www.setgame.com/set/puzzle_frame.htm

--------------------------------------------------------------

http://www.gasbuddy.com/

http://www.gasbuddy.com/GB_Map_Gas_Prices.aspx

http://www.gasbuddy.com/GB_Mobile_Instructions.aspx

--------------------------------------------------------------

Weather

See USA map, click to specific area, no commercials

--------------------------------------------------------------

Traffic Live---

Real Time Traffic Information

You can save up to 20 different routes and check them out with one click,

or type in a new route to learn the traffic live

--------------------------------

![]()