|

|

|

|

|

|

SALES: Seeking energetic, self motivated sales pro, nationwide opportunities, equipment/ transportation leasing and financing (buses, livery, limousines, ambulances, paratransit, funeral vehicles). Direct experience helpful/ not required. We are willing to train the right person. Moderate travel /extensive phone work required. Highest commissions paid in the industry. Fax or email resume to 718-392-5427 or dcoolbaugh@advantagefunding.us |

Tuesday, July 5,2005

Headlines---

######## surrounding the article denotes it is a “press release”

----------------------------------------------------------------

Classified News---

Classified Ads----Asset Management

NorVergence Up-Date

Story Credit List---Up Date

Leasing Association Conference—Up-date

Classified Ads—Help Want

NAMCM Mfg. Latest Statistics

Dash Sends me a July 4th Greeting

W. R. Johnnie Johnson, CLP in Kuwait

Streamline Sales Tax Changes 10/01/06

"Gimme that Wine"

Top Event Today's History

This Day in American History

Baseball Poem—Robert L. Harrison

----------------------------------------------------------------

Classified Ads----Asset Management

Austin, TX .

20+ years exper. lease/finance. P & L responsibility, strong credit & collection management, re-marketing& accounting. Computers, construction, auto & transportation. Both commercial/ consumer portfolios.

Email: kmalone@austin.rr.com

Bloomfield Township, MI.

15+ yrs experience asset management and credit analyst. Leadership and training skills. Audited returns, max residual, lease end and resale negotiator.

E-mail: cmcozzolino@msn.com

Chicago, IL .

MBA, 15+ years exp. Long history of success in maximizing residual position through outstanding negotiation skills & lease contract management. Third party re-marketing, forecasting etc...

email: jgambla@aol.com

Hartford, CT.

7yrs exp structuring US Leveraged & Single Investor leases w/ pre-paid deferred rents, 467 loans & early buyouts. Engineer rv guarantees, synthetic leases, economic capital models & securitizations.

E-mail: lease_structuring@yahoo.com

Princeton, NJ.

Asset management/credit/collection

20+ years experience in equipment financing.Last five years in Asset Management including remarketing, end of lease negotiations, equipment and market evaluations

E-mail: bgaffrey@earthlink.net

Wilton, CT.

18 years exp. in IT and High Tech leasing industry. Residual forecasting, workouts, off-lease sales, mid-term restructures, auctions, all aspects of remarketing and equipment management.

To view all 97 ‘Job Wanted” ads please go here:

http://64.125.68.91/AL/LeasingNews/JobPostings.htm

To post your free “job wanted” ad, please go here:

http://64.125.68.91/AL/LeasingNews/PostingForm.asp

----------------------------------------------------------------

|

NorVergence Up-Date

“I just got the word that WF has agreed to a settlement in California.

Basically, you have to bring your payments current thru 12/31/04. That means less than 10% for us and we are happy to end this ordeal.”

(Name With held)

Leasing News read several such e-mails, but we were unable to obtain from the California Attorney's General press department any information about the Wells Fargo settlement here. We had asked the person who wrote the last press release about the USbancorp settlement how many did the settlement effect.

In the release, Attorney General Bill Lockyer said there were over a 1,000 NorVergence lessees in the state. USbancorp did not have that many across the United States. His office has been very slow compared to the other 23 attorneys generals across the United States, including the District of Columbia Popular Leasing update for you.

“Many of the defendants have pending a motion to dismiss for lack of jurisdiction based on due process arguments. Only defendants with NorVergence V.P. Edward Lucas's signature (or stamped signature) on the Equipment Rental Agreements (ERAs) are eligible to file such a motion. Many of the ERAs were signed by E. Buchanan, a Popular Leasing employee. The court held a hearing and took the motion under consideration. About two weeks ago the court requested a list of those defendants who have submitted affidavits stating that they have had no contacts with the State of Missouri. Hopefully this means the court is inclined to grant the motions to dismiss.

“As to federal court Popular Leasing cases in St. Louis, a bad decision was issed a couple of days ago, largely ruling against the defendants. In a footnote, however, the court stated, "Defendants' arguments concerning the [FTC]'s claims against NorVergence can be revisited in the event injunctive relief is granted against the enforcement of its equipment rental agreements."

Ronald J. Eisenberg, Esq.

Schultz & Little L.L.P.

640 Cepi Drive, Suite A

Chesterfield, MO 63005

(636) 537-4645

----------------------------------------------------------------

|

|

Corrections have been made to the Story Credit list, in addition to new parties. We will continue to add those who want to be on the list and are qualified. We also will up-date or add information to the list as submitted.

To date, we have turned down one submission as the party turned out to be a “super broker.” The purpose of this list was not to list brokers, super brokers, of funding sources in general, but those who specialize in “story credits.” Those in the industry for a few years understand its meaning. You can also view the comments of the company's listed as several spell it out quite clearly. You can also see the differences in dollar ranges, geography, and as important, they have survived many years---so they must be doing something right. If your company qualifies, please contact kitmenkin@leasingnews.org with answers to the format of the list.Story Credit Lessors

These companies specialize in "C" and "D" credits, often news businesses, or businesses where the principal(s) have Beacon score around 600 or previous difficulties; meaning to become comfortable with the credit and financial situation you need to learn the "story" to make a positive decision, often requiring further security, shorter term, or additional guarantors. Many of these companies may also be a "B," but appear otherwise without the "story" to understand the full financial picture.

(To qualify for this list, the company must be a lessor and not a broker or superbroker, along with an acceptable Better Business Bureau Rating and no history of complaints at Leasing News. We reserve the right to not list a company who does not meet these qualifications.)

Rank |

Name In Business Since Contact Website Leasing Association |

Employees |

Geo Area |

Dollar Amount |

Broker Qualify |

1 |

Pawnee Leasing Corporation 1982 Scott Woodring, Vice President/Sales & Marketing scott@pawneeleasing.com www.pawneeleasing.com EAEL, NAELB & UAEL (A) |

45 |

Nationwide |

$1,000 - $30,000 |

One year time in business |

2 |

Pentech Financial Services, Inc. 1983 Peter C. Eaton Vice President-Intermediary Markets Group Phone - 608.661.9536 Fax - 608.661.9533 peter@pentechfinancial.com www.pentechfinancial.com ELA, NAELB, UAEL (H) |

32 |

Nationwide |

$250,000 - $3,000,000 |

Contact Peter Eaton |

3 |

Sunrise International Leasing Corporation 1975 Carrie Halvorson or Jim Teal, 800-950-3211 www.sunriseleasing.com ELA (I) |

20 |

U.S., Canada, Latin America |

$1,000 minimum no hard cap in place for maximums |

One year time in business |

4 |

Allegiant Partners Incorporated 1998 415.257.4200 Doug Houlahan ext. 205 Paul Foster ext. 206 www.allegiant-partners.com ELA, NAELB & UAEL (B) |

9 |

Nationwide, including Alaska & Hawaii |

$70,000 to $250,000 |

For Broker qualification please click here |

5 |

Black Rock Capital 1994 George Booth gkbooth@blackrockcapital.com 203.336-9200 www.blackrockcapital.com EAEL, ELA (E) |

7 |

US Canada (F) |

$50,000 to $3MM $250,000 average transaction |

Please Call |

7 |

6 |

Nationwide |

$50,000 to $1MM $250,000 average transaction |

Please call |

|

8 |

ABCO Leasing, Inc. 1974 Don Shipley VP and General Manager dons@abcoleasing.net Phone: 800.995.1897 www.abcoleasing.net ELA, NAELB, and UAEL (D) |

5 |

Western U.S. |

$25,000 - $350,000 |

Broker Qualification, contact: Rowan Clark, Credit Manager rowanc@abcoleasing.net Phone: 800.995.1897 |

9 |

Barrett Capital Corporation |

4 |

United States |

Vehicles Only $10,000 minimum |

Please Call |

(A) Pawnee Leasing Corporation; Some times we go higher than $30,000, but our marketplace is from $1,000 to $30,000.

(B) Allegiant.pdf

(D) ABCO Leasing, Inc. in Seattle area has been operating since 1974 serving the broker community. We required full financial disclosure on every transaction. We do story transaction, but do not like to refer to them as "C" of "D" credits. We think of therm as "A" type credits that have not been discovered yet. In actuallity, we do not really like to look at what most describes as "D" credits.

(E) Black Rock Capital comment: We book anywhere between $15 to 20 million per year. We do no "app only" business and require a full financial package for each transaction. Our average size transaction is approximately $250k and, although, we concentrate in printing, packaging (steel rule die industry) and road construction equipment we do not rule out anything that makes sense. More information can be found at www.blackrockcapital.com.

(F) Black Rock Capital (Ireland) Limited and Black Rock Capital (UK) Limited provide the same services for small to middle market corporations in the European Economic Community and the United Kingdom.

(G) Cobra Capital, LLC. Comments: Our registered trademark "Making impossible possible" is our central marketing tagline for both strong and weak credits. I have developed a 10 year history, (from Cobra and my prior company GALCO), with specialty, non-conforming transactions (story credits) and have a solid reputation for candidly responding to our originators and lessees and working diligently to mitigate deal risk rather than making excuses to turn deals down. Our originators prefer our underwriting approach to non-conforming transactions since unlike most non-conforming funders, we prefer to mitigate risk versus jacking our return. Both Originators and Lessee's prefer our candid approach as we are also frequently asked to advise lessee's and lessors on the best way to structure their bank loans and raise capital due to our 25+ year banking and accounting backgrounds as my partner and I are both former bankers and CPA's.

(H) Comment: Pentech is the lessor partner with Manifest Funding Services for their Navigator, Navigator Plus & Navigator Direct. This is through our sister company Pentech Funding Services, located in San Diego and headed up by Ron Wagner.

(I) Sunrise International Leasing Corporation Comment: The broker program is "...an informal program as our primary business is still vendor leasing."

----------------------------------------------------------------

Some of the above companies add to the “Story Credit” list we encouraged to attend a Leasing Association conference, particularly the join Eastern Association of Equipment Lessors along with the National Association of Equipment Brokers.

Here is the sponsorship application form for the joint conference meeting:

http://www.eael.org/doc/EAEL2005%20brochure.pdf

----------------------------------------------------------------

Leasing Association Conferences—Fall, 2005

![]()

Eastern Association of Equipment Lessors

September 19th, Teaneck, New Jersey

------------------------------------------

National Assocation of Equiment Leasing Brokers

joins with Eastern Association of Equipment

Lessors for Fall Expo 2005

September 19th, Teaneck, New Jersey

-----------------------------------------

![]()

United Association of Equipment Leasing

September 22-25, Lake Tahoe, California

for more information, please go here:

-----------------------------------------

![]()

Equipment Leasing Association

October 23-24

44th Annual Convention

Boca Raton Resort & Club

Boca Raton, Florida

A non-member who has not attended the conference before is invited

to attend.

Registration and all information about the Annual Convention are now available on-line at http://www.elaonline.com/events/2005/annconv/

---------------------------------------

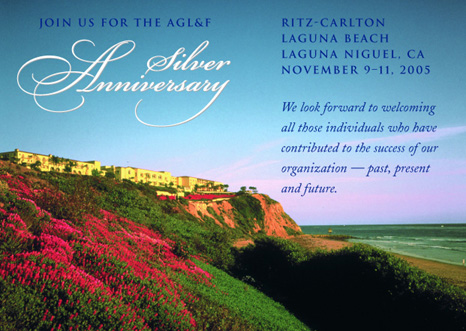

Association of Government Leasing & Finance

November 9, 2005

Dana Point, California

----------------------------------------------------------------

Help Wanted---Classified Ads

Account Executives

|

|

Account Executives to work from our corp. office Aliso Viejo, CA. Exper. only, aggressive, 4 yr college degree required. Lucrative uncapped commission plan/environment conductive to success. To learn more, click here. |

| Newport Beach, CA. Account Executives, Four year degree plus lease sales experience required. Learn more www.providentleasing.comor email: mdardis@providentleasing.com |

Account Representatives & Sales Coaches

|

About the Company: At Dell Financial Services, we aspire to fuel your potential with the kind of challenging opportunities and hands-on support you need to grow. We're the exclusive provider of leasing and finance services for Dell technology systems worldwide. |

Lease Administrator

|

|

|

San Francisco, CA. College Degree plus contract/ lease administration experience required. For a full description, click here. Email resume to |

Lease pricing division economic analysis / analytical support

| San Francisco Office

Two openings lease pricing division |

|

SALES: Seeking energetic, self motivated sales pro, nationwide opportunities, equipment/ transportation leasing and financing (buses, livery, limousines, ambulances, paratransit, funeral vehicles). Direct experience helpful/ not required. We are willing to train the right person. Moderate travel /extensive phone work required. Highest commissions paid in the industry. Fax or email resume to 718-392-5427 or dcoolbaugh@advantagefunding.us |

|

SFBI Recruiters |

|

Contact: Fred St Laurent, SFBI Professional Recruiting. Email: Fred@sfbirecruiter.com |

|

|

|

In business since 1958, DLC is an independent funding source servicing the $10K-250K market in 11 western states. |

Tax Manager

|

|

For complete description and application, click here. |

--------------------------------------------------------

Service Sector Rose 1.3% to Overcome Mfg Sector .02% Fall

"Continued rate hikes, a return to sharply rising energy prices, and weakness in Europe all represent significant headwinds, " concludes the June, 2005 National Association of Credit Manager's Index.

Manufacturing remains soft, as noted in other economic reports for the month. Compared with the previous year, the growth has been soft:

In the good news, service sector has brought the overall index up:

Compared to the last quarter of 2004, the manufacturer sector has been improving:

The CMI survey asks credit managers to rate favorable and unfavorable factors in their monthly business cycle. Favorable factors include sales, new credit applications, dollar collections and amount of credit extended. Unfavorable factors include rejections of credit applications, accounts placed for collections, dollar amounts of receivables beyond terms and filings for bankruptcies.

A complete index including results from the manufacturing and service sectors, along with the methodology, is attached. A complete view of the index can be viewed online at

http://leasingnews.org/PDF/CMI_June2005-1.pdf

The National Association of Credit Management (NACM), headquartered in Columbia, Maryland supports more than 25,000 business credit and financial professionals worldwide with premier industry services, tools and information. NACM and its network of Affiliated Associations are the leading resource for credit and financial management information and education, delivering products and services which improve the management of business credit and accounts receivable. NACM's collective voice has influenced legislative results concerning commercial business and trade credit to our nation's policy makers for more than 100 years, and continues to play an active part in legislative issues pertaining to business credit and corporate bankruptcy. www.nacm.org.

----------------------------------------------------------------

|

Dash Sends Me a July 4 th Greeting

The latest picture of my son Dash. He sent it in a Patriotic July 4th card. His US Navy uniform is now basically “brown,” as he is part of the “brown water unit,” as he explains it. He said he was playing around with his camera, which means he took the picture of himself, and attached it to the July 4 th greeting card to wish my the best of the holidays. He says the uniforms are really US Marine with the US Navy insignia on them. The units of nine operate light craft, also spending time on the land. What I write about is public knowledge, not “classified,” as the navy has made announcements to the changes they are making because of budget cuts in the ships they wanted for the near future.

I think it is like the Nay seals, except they have an actual craft and spend half the time on the water in other duties. I know he still swims five miles a day, runs, and works out besides other training in the morning and the evening. Most of his unit is younger than he is, so he thinks he has to work twice as hard to keep up.

He volunteered for duty in Kuwait in this special unit, designed primarily for the US Navy serving in the Middle East. He holds a “plank” for the first Arleigh Burke destroyer, served off the South American and the middle-east, often doing what I call US Coast guard duties in the ocean, inspecting ships, and other duties.

He had to move from his home base in San Diego, to Norfolk, Virginia.

He says that is his main base, although they train at many other locations, he tells me. He was going to ship his Dodge truck to Norfolk and ride his Harley Davidson across the country, but I somehow talked him out of it. The navy gave him a month to make the move, so I said why not drive your Dodge pick-up truck with the “bike” in the back, and at various cities, explore the area on your Harley---take your time.

He is a big Harley Davidson motorcycle fan. While he loves his large black Dodge truck, it is his “bike” he rode up from San Diego to visit us in Saratoga, California Santa Clara, California, and his sister Ashley, Lamoille, Nevada. Leave to him was a ride to Arizona on his bike.

He left about three girls in San Diego, one he says he was getting too serious about. He almost got married once, but that is another story.

When he lived in Elko, Nevada, he had a toy poodle called “Weezer.”

A girl friend abandoned him upon Dash. He would put goggles on the dog, put him in a nap sack on the side of his bike, and the dog would stick his face out into the wind. Dash says his dog would bark, go up to the bike, and tell him, he wanted to go for a ride. I have a picture of the two on my book shelf.

He said they went everywhere together.

When he joined the Navy, Weezer was given to his best friend.

It was like going off to college, as Dash continued his college education, plus continues to improve his military skills and knowledge.

Whether the war in Iraq is a “strategic catastrophe” or not, our airmen, coast guard, marines, national guard, sailors , Seabees, serve to protect our country. They don't choose the wars, the locations, the causes whether good or bad, right or wrong, but serve to protect our peace.

I know “Weezer” would go anywhere with my son, trusting him.

I trust my son to protect our country wherever he is sent.

----------------------------------------------------------------

W. R. Johnnie Johnson, CLP in Kuwait

W. R. Johnnie Johnson, CLP

Senior Advisor - Strategic Projects

The International Leasing & Investment Co.

P.O. Box 3716, Safat, 13038, Kuwait

Phone: +965 244 0368 (Direct)

Office: +965 246 9000

Mobile: +965 942-6529

E-Mail: johnson@ilic.net

Website: www.ilic.net

---= Middle-East Press-Business Section

The Inter-Arab Investment Guarantee Corporation (IAIGC), in cooperation with The International Leasing & Investment Company (ILIC), recently organized and held a comprehensive Lease training course at its premises in Kuwait. Participants representing institutions from throughout the Middle East and North Africa participated in the course.

The 5 day course was taught by international expert Mr. W. R. Johnnie Johnson, CLP, Senior Advisor to ILIC. Mr. Johnson has taught and lectured extensively worldwide on the subjects of leasing, finance, and Islamic finance

The Inter-Arab Investment Guarantee Corporation is a regional organization similar to the World Bank's MIGA, and comprises all Arab states. IAIGC provides export credit guarantees against both political and commercial risks, investment guarantees (political risk only), and insurance coverage for Arab investments and inter-Arab trade transactions. It also undertakes investment promotion activities among Arab countries.

IAIGC recently announced an extension of its guarantee program to include both the commercial and non-commercial risks associated with leasing transactions within the Arab world. The training course was organized to better familiarize the staff of IAIGC and other cooperating institutions as to the nature and characteristics of leasing and the leasing industry.

----------------------------------------------------------------

Streamline Sales Tax Changes as of October 1,2006

----courtesy of Dennis Brown, Equipment Leasing Assocation

The following summary of last week's Streamlined Sales Tax Petitioning States meeting is being distributed unedited by the Equipment Leasing Association (ELA) with the permission of CCH and it's author/editor Dan Schibley.

SST Agreement Comes into Effect Oct. 1 with 18 Member States

By Daniel Schibley © 2005, CCH Incorporated

The Streamlined Sales and Use Tax (SST) Agreement will come into effect on October 1, 2005, with an initial Governing Board of 18 states, as the result of a series of votes taken at a meeting in Chicago, June 30-July 1, 2005. The member states are Arkansas, Indiana, Iowa, Kansas, Kentucky, Michigan, Minnesota, Nebraska, New Jersey, North Carolina, North Dakota, Ohio, Oklahoma, South Dakota, Tennessee, Utah, West Virginia, and Wyoming. The Governing Board will hold its first meeting on October 1 in Washington.

The Chicago meeting of the SST Petitioning States was called to vote on the petitions for membership filed by 20 states. Wisconsin withdrew its petition because the necessary conformity legislation failed to pass the Legislature. Nevada's petition was not considered because it was judged to have been filed too late to allow for adequate public comment. However, with the announcement of last minute passage of the New Jersey conformity legislation, the states gathered in Chicago were able to vote to approve the anticipatory petition filed by New Jersey. As a result, by the end of the voting, 18 states had been accepted as either a full member or an associate member, and the thresholds to bring the Agreement into effect had been crossed.

Most of the law changes mandated by the Agreement are already in effect in these states or, in the case of some of the associate members, will be coming into effect over the next couple years. On October 1, certified service providers, a centralized online registration system, and an amnesty for qualifying sellers that volunteer to begin collecting should become available. However, the SST system will remain a voluntary one as far as remote sellers are concerned unless federal legislation is enacted giving the states mandatory collection authority. Such legislation is likely to be introduced in Congress shortly, but the prospects for passage this year are considered poor.

Background

The result of the voting represented “a significant milestone for this effort,” in the words of Charles Collins, one of the original co-chairs of the Streamlined Sales Tax Project (SSTP). The SSTP was organized in March 2000, largely in response to the states' perception that they were losing sales tax revenue from increasing online sales. Sellers without a physical presence in a state cannot be compelled to collect tax on sales destined for that state, according to the U.S. Supreme Court's decision in Quill Corp. v. North Dakota, 504 U.S. 298 (1992). The stated goal of the SSTP has been to simplify and modernize sales and use tax administration in member states in order to substantially reduced the burden of tax compliance. Simplification has been desired for its own sake, but also as a means to convince remote sellers to collect voluntarily. The ultimate goal is to persuade Congress that the member states have eliminated the burdens on interstate commerce identified in Quill and, therefore, should be given mandatory collection authority over remote sales.

State revenue department administrators and business representatives have worked together in the SSTP to draft numerous simplification proposals that are embodied in the Agreement. The original version of the Agreement was adopted on November 12, 2002, by the SST Implementing States, which consists of those states that have enacted enabling legislation authorizing representatives to participate in the negotiations. The Agreement has been amended by the Implementing States three times since then, most recently on April 16, 2005.

As originally drafted, the Agreement would have taken effect once at least 10 states comprising at least 20% of the total population of all states imposing a state sales tax had petitioned for membership and it had been found that the effect of each state's laws, rules, regulations, and policies (in place and in effect) was substantially compliant with each of the requirements in the Agreement. An affirmative vote of three-fourths of the other petitioning states was necessary for a state to be found in compliance.

By late 2004, it appeared that a sufficient number of states would have conformed their laws to the Agreement by July 1, 2005, for the thresholds to be crossed on that date. Therefore, this meeting was scheduled. However, developments in the interim called this timeline into question. Opposition from local governments and small retailers to the destination sourcing of sales required by the Agreement forced Ohio, Tennessee, and Utah to backtrack and delay the effective date of their conforming changes. Moreover, as businesses began looking closely at states' conformity legislation, they were of the opinion that some states had not achieved the requisite level of compliance.

In order to preserve the timeline, the Implementing States amended the Agreement on April 16, 2005, to create a new category of associate member (described below). States found to have satisfied the requirements for associate membership are counted along with full members for purposes of the 10-states/20%-population thresholds and, as a result, the July 1 vote was able to proceed with the desired result.

Disputes Deferred

Prior to voting, the Petitioning States received findings prepared by a committee of state representatives appointed to review each state's petition and its accompanying certificate of compliance. The purpose of the certificate is to document a state's compliance with the provisions of the Agreement and cite applicable statutes, rules, regulations, or other authorities evidencing that compliance. Representatives of the business community also provided comments. Disputes involving interpretations of the Agreement that could have derailed particular states' petitions were deferred at the Chicago meeting after businesses received assurances that the issues would receive prompt resolution.

The most hotly contested issue is the interplay between the product definitions in the Agreement and sections authorizing states to create entity- or use-based exemptions. The dispute arose after Kentucky adopted the Agreement's definition of “durable medical equipment” while exempting only hospital beds purchased for non-commercial private use. Businesses argued that carving out a subset of a defined product in this way undermines the purpose of uniform product definitions. Kentucky responded that the wording of the Agreement allows it to do this. The group of states at the Chicago meeting did not have the authority to resolve the matter, but it was generally agreed there is a conflict among the relevant sections of the Agreement that needs to be resolved by an amendment or interpretation of the Agreement as soon as possible.

Another dispute involved whether a state may refuse to allow delivery charges to be allocated to taxable and exempt items on the same invoice. Businesses argued refusing to allow this would be a step backward and would increase their burden, particularly in situations involving multiple shipments of goods and tax holiday orders. Ohio justified its interpretation on the basis that delivery charges are part of the Agreement's definition of “sales price.” However, the states involved, Kentucky and Ohio, agreed to apply their policy in a “flexible” way until the SSTP meets to resolve the dispute.

Categories of Members

The following states were voted in as full members on July 1 because they have enacted all of the necessary provisions to be substantially compliant with each of the Agreement's requirements, and these provisions were in effect as of that date: Indiana, Iowa, Kansas, Kentucky, Michigan, Minnesota, Nebraska, North Carolina, Oklahoma, South Dakota, and West Virginia.

The following states were voted in as associate members: New Jersey, North Dakota, Ohio, Tennessee, and Utah. These states have enacted all the necessary provisions to be substantially compliant with each of the Agreement's requirements; however, these provisions are not yet in effect. Absent any further intervening law changes, these states will automatically become full members upon the effective dates of their currently enacted conformity provisions, which are October 1, 2005 (New Jersey and North Dakota), July 1, 2006 (Utah), July 1, 2007 (Tennessee), and January 1, 2008 (Ohio).

Arkansas and Wyoming also were voted in as associate members. These states have achieved substantial compliance with the Agreement taken as a whole, but not with each provision in the Agreement as required, measured qualitatively. However, there is a reasonable expectation that these states will achieve complete compliance by January 1, 2008. These states must re-petition for full membership prior to that date, or forfeit their associate membership.

In addition to all of the states mentioned above, the following states, which either did not petition for membership or their petitions were not considered, continue to be members of the Implementing States: Alabama, Arizona, California, District of Columbia, Florida, Georgia, Hawaii, Illinois, Louisiana, Maine, Maryland, Massachusetts, Mississippi, Missouri, Nevada, New Mexico, New York, Rhode Island, South Carolina, Texas, Vermont, Virginia, Washington, and Wisconsin.

Governing Board

As a result of the votes, the Governing Board will come into existence on October 1, 2005, composed of representatives of each of the full and associate member states. Each state may appoint up to four representatives to sit on the Board; however, each state will have only one vote. The Board will administer the Agreement, elect officers and directors, and allocate the costs of administration among the member states.

Pursuant to the compromise crafted at the April 16 meeting, the Implementing States retain the exclusive power to amend the Agreement and issue interpretations of it until a sufficient number of states have become full members to cross the 10-states/20%-population thresholds without counting associate members. Once this occurs, the full members on the Governing Board take over responsibility for amending and interpreting the Agreement, while the Implementing States will continue to exist for a period of time as an advisory body.

On October 1, when New Jersey and North Dakota automatically shift from associate to full membership as their legislation takes effect, the Governing Board will cross the thresholds counting only full members. As a result, at its initial meeting the Board will assume full administration of the Agreement from the Implementing States (although the remaining associate members on the Board may not vote on amendments or interpretations). Nevada's late-filed petition also is likely to be considered on October 1, and it may well become a full member that day as well.

Other October 1 Events

A State and Local Advisory Council will formally come into existence on October 1. This will include one representative from each state involved in the SSTP (currently, every state with a general retail sales tax except for Colorado and Idaho). The Council will also have local government representation. It will advise the Governing Board and the Business Advisory Council on matters pertaining to the administration of the Agreement. The Business Advisory Council is an entity that will be “recognized” by the Governing Board for the purpose of providing private sector input. A prototype already exists in the form of the business representatives who have been participating in the SSTP almost since its inception.

Among the first tasks of the Governing Board will be the approval of certified service providers (CSPs) and the execution of contracts with them. Several companies seeking to be certified have responded to a Request For Proposal (RFP) and a review process is underway. The CSPs will offer taxpayers new technology models for the collection and remittance of tax. The contracts with the Board will provide CSPs with a monetary allowance funded from the money they collect under the SST system. The Board is unlikely to approve any certified automated systems (CASs) on October 1, as review of this “off-the-shelf” collection software is not as far advanced as the CSP review.

Once the Agreement is in effect, sellers will be able to use a centralized online registration system. By registering, a seller agrees to collect and remit tax for sales into all full member states. Associate members will not have access to the seller registration information. A seller that is not otherwise required to collect tax on sales into associate member states (i.e. a remote seller) may, however, volunteer to do so. A seller that volunteers to collect tax in an associate member state is not required to collect tax in any other associate member state. Associate members will not have access to the information from the planned joint audits, unless that state is a party to the audit.

A member state must provide an amnesty for uncollected or unpaid sales and use tax (together with penalty or interest) to a seller that registers under the Agreement, provided the seller was not registered in that state in the 12-month period preceding the state's participation in the Agreement. The seller must register within 12 months of the state's participation to benefit, and the amnesty does not apply to matters for which the seller has received notice of the commencement of an audit. Associate members must provide an amnesty from the date they become an associate member until 12 months after they have become full members. Recently, various sellers have been negotiating amnesties along these lines on a state-by-state basis with SSTP participants but, as of October 1, member states must make these amnesties available to all qualifying “volunteers.”

Outstanding Issues

The SSTP plans to meet, probably in August, to address several remaining issues, including the dispute over the allocation of delivery charges (discussed above), the definitions of “digital good” and “digital equivalent of tangible personal property,” purchaser use tax issues, and the completion of various issue papers to provide guidance on the interpretation of previously approved concepts.

Other matters that need to be resolved include the interplay among the Agreement's product definitions and sections governing entity- and use-based exemptions (discussed above); the completion of the online registration system and CSP testing; approval of the guidelines member states will be required to adopt in rules or regulations for the interpretation of the “food” definitions; audit procedures; the amount of compensation for the cost of collection; and the procedures for requesting and issuing interpretations of the Agreement. Work on all of these is expected to continue over the next three months in anticipation of the meetings of the Governing Board and the Implementing States on October 1, 2005, in Washington.

Streamlined Sales Tax Petitioning States Meeting, Chicago, June 30-July 1, 2005

----------------------------------------------------------------

|

![]()

“Gimme that Wine”

County says it's investigating V. Sattui Winery

http://www.sthelenastar.com/templates/index.cfm?template=story_

full&id=1D6A77BC-9246-48A0-9A9D-1B89F4CEB764

----------------------------------------------------------------

Today's Top Event in History

1938--- Herb Caen's 1st column in SF Chronicle

http://www.sfgate.com/columnists/caen/tribute/

http://www.gpaulbishop.com/GPB%20History/GPB%20Archive/

Section%20-%202/H.%20Caen/h__caen.htm

This Day in American History

1776-- “The Declaration of Independence” was printed by John Dunlop in a folio broadside and distributed the same day. On July 4, Congress, acting as a “Committee of the Whole,” approved the Declaration and ordered that it be printed and that copies be “sent to the several assemblies, conventions and committees or counsels of safety and to several commanding officers of the Continental troops that it be proclaimed in each of the United States and at the head of the army.” The draft document, although approved on July 4, was signed only by John Hancock and Charles Thomason, the president and secretary. The names of the signers were withheld from the public for more than six months because, if independence were not achieved, their treasonable act might result in their death. The actual Declaration of Independence signed by the members of the Continental Congress on August 2, 1776.

1810—Phineas Taylor “P.T.” Barnum, promoter of the bizarre and unusual. Barnum's American Museum opened in 1842, promoting unusual acts including the Feejee Mermaid, Chang and Eng (the original Siamese twins) and General Thom Thumb. IN 1850 he began his promotion of Jenny Lind, “The Swedish Nightingale,” and parlayed her signing talents into a major financial success. Barnum also cultivated a keen interest in politics. A founder of the newspaper, Herald of Freedom, he wrote outspoken editorials that resulted not only in lawsuits but also in at least one jail sentence. He 1852 he declined the Democratic nomination for governor of Connecticut but did serve two terms in the Connecticut legislature beginning in 1865. He was defeated in a bid for US Congress in 1966 but served as mayor of Bridgeport, CT from 1875 to 1876. In 1872 “The Greatest Show on Earth” opened at Brooklyn, NY; Barnum merged with his rival J. A. Bailey in 1881 to form the Barnum and Bailey Circus. P.T. Barnum was born at Bethel, CT, and died at Bridgeport, CT. April 7, 1891.

1862--The African-American troops were organized by Maj. Gen. David Hunter in the Union's First Carolina Regiment. Many of the soldiers were former slaves.

1864- Horace Greely, eager for Pres. Lincoln to open peace negotiations, advised him that Confederate emissaries from Jefferson Davis were in Canada. Lincoln authorized Greely to open negotiations with the men at Niagara Falls, N.Y. The negotiators were found to be without proper authority, and the peace attempt failed.

1865 - British preacher William Booth formed the Christian Mission, later renamed the Salvation Army, in London. Determined to assail poverty and religious indifference with the efficiency of a military organization, Booth modeled his group after the British army, labeling ministers "officers" and new members "recruits." The Salvation Army's officers are ordained ministers who have vowed to serve the Army for life. The Army has units in over 80 countries.

1882 -A trace of snow at Newton, NJ and other parts of the northeast.

1904 - $1 million damage from a powerful thunderstorm over Boston Harbor

1924—Trombonist Vern Friley born Marshall, MO.

1932--A massive F4 tornado struck Washington, KS destroying 50 homes and killing 5

1935—The National Labor Relations Act (the Wagner Act). This bill guaranteed workers the right to organize and bargain collectively with their employers. It also prohibited the formation of company unions. An enforcement agency, the National Labor Relations Board, was created by the act.

1936--- 120ø F (49ø C), Gannvalley, South Dakota (state record)

1937 ----117ø F (47ø C), Medicine Lake, Montana (state record)

1938--- Herb Caen's 1st column in SF Chronicle

http://www.sfgate.com/columnists/caen/tribute/

http://www.gpaulbishop.com/GPB%20History/GPB%20Archive/

Section%20-%202/H.%20Caen/h__caen.htm

1940—Birthday of alto sax player Arthur Blythe, Los Angeles.

http://www.vh1.com/artists/az/blythe_arthur/bio.jhtml

1943 - On the NBC Blue radio network, "The Adventures of Nero Wolfe" debuted. Nero Wolfe was "the detective genius who rates the knife and fork the greatest tools ever invented by man." The "gargantuan gourmet" as he was nicknamed stayed on the air until 1951.

1943 - Orchestra leader Harry James and screen actress Betty Grable were married on this date in Las Vegas. It was world wide news at the time as both were famous celebrities, including Betty Grable the pin-up girl of all US GI's.

1946—Bikini debuted: the skimpy two-piece bathing suit created by Louis Reard debuted at a fashion show in Paris. It was named after an atoll in the Pacific where the hydrogen bomb was first tested. It was his sense of humor that he was dropping the largest bomb on the fashion industry. It was an immediate success in France, followed by other resort countries, but slow to take hold in the United States until the 1960's.

1946-Wood Herman's First Herd completes 39 weeks on Wildroot radio show.

1946----Top Hits

They Say It's Wonderful - Frank Sinatra

The Gypsy - The Ink Spots

All Through the Day - Perry Como

New Spanish Two Step - Bob Wills

1947—Larry Doby became the first African-American to play n the American League when he appeared as a pinch-hitter for the Cleveland Indians in a game against the White Sox. The Indians lost, 6-5.

1948 - On CBS "My Favorite Husband," with Lucille Ball, became the redhead's first regular radio program. Lee Bowman, and later, Richard Denning would co-star with Lucy as "two people who live together and like it."

1950-Birthday of Hugh Anthony Cregg III, better known as singer Huey Lewis (Huey Lewis and the News), born New York, New York.

1951 - In Murray Hill, New Jersey, Dr. William Shockley announced that he had invented the junction transistor.

1952- the first vice-presidential candidate who was an African-American woman was Charlotta A. Bass, who was nominated by the Progressive Party at its convention in the International Amphitheatre, Chicago, IL.

1954----Top Hits

Little Things Mean a Lot - Kitty Kallen

Hernando's Hideaway - Archie Bleyer

Three Coins in the Fountain - The Four Aces

Even Tho - Webb Pierce

1954 - At his first session for Sam Phillips and Sun Records in Memphis, Elvis Presley recorded "That's All Right (Mama)" and "Blue Moon of Kentucky.".

1962----Top Hits

I Can't Stop Loving You - Ray Charles

The Stripper - David Rose

Palisades Park - Freddy Cannon

Wolverton Mountain - Claude King

1968-The Philadelphia 76ers traded cener Wilt Chamberlain to the Los Angeles Lakers for three players, Darrell Imhoff, Archie Clark and Jerry Chambers and an unannounced amount of cash.

1969-- Joseph Louis Searles II, a partner in the brokerage firm of Newburger, Loeb and Company, New York City, became the first African-American elected as a member of the New York Stock Exchange. The first African-American director of the New York Stock Exchange was Dr. Jerome Heartwell Holland, retired U.S. ambassador to Sweden and one of the 10 public nominees on the 21-member board, who was nominate don June 6, 1972, and elected on July 5.

1970----Top Hits

The Love You Save - The Jackson 5

Mama Told Me (Not to Come) - Three Dog Night

Ball of Confusion - The Temptations

He Loves Me All the Way - Tammy Wynette

1972—The first African-American director of the New York Stock Exchange was Dr. Jerome Heartwell Holland, retired U.S. ambassador to Sweden and one of the 10 public nominees on the 21-member board, who was nominated on June 6, 1972, and elected this day.

1973--- "Live and let Die," James Bond film premiers

http://movie-reviews.colossus.net/movies/l/live_let.html

1975--- Arthur Ashe wins men's single championship at Wimbeldon.

http://espn.go.com/tennis/s/2003/0205/1504540.html

1978----Top Hits

Shadow Dancing - Andy Gibb

Baker Street - Gerry Rafferty

It's a Heartache - Bonnie Tyler

It Only Hurts for a Little While - Margo Smith

1985-- 117ø F (47ø C), St George, Utah (state rec) (103ø spread, UT 1985)

1986 - Madonna's hit single, Papa Don't Preach, debuted on Billboard's Top 40, and eventually held onto the Number 1 spot for 2 weeks. It remained on the charts for a total of 13 weeks.

1986----Top Hits

There'll Be Sad Songs (To Make You Cry) - Billy Ocean

Holding Back the Years - Simply Red

Who's Johnny - El DeBarge

Everything that Glitters (Is Not Gold) - Dan Seals

1986 - Janet Jackson finally took "Control" and got all the way to the top of U.S. LP charts. She was the youngest (19 years old) to hit number one with an LP since Little Steve Wonder ("The 12 Year Old Genius") in 1963. Produced by Jimmy Jam & Terry Lewis, "Control" was her third album, but her first to hit number one. Tracks from the LP, "What Have You Done for Me Lately" became Jackson's first top-five single and "Nasty" made it to number three.

1986--Boise, ID drops to a crisp 35, the coldest ever for the month

1989 - The first episode of Seinfeld aired on NBC, starring Jerry Seinfeld, Michael Richards, and Jason Alexander.

http://www.seinfeld-fan.net/

http://www.movieprop.com/tvandmovie/Seinfeld/index.htm

http://www.sonypictures.com/tv/shows/seinfeld/tvindex.html

1989 - Remains of Tropical Storm Allison dumps heavy rains with 6.37 in 6 hours at Wilmington, DE.

1989--Denver, CO rises to 101, topping 100 for the second straight day, only happened once before in 1972

1993 - Arnold Schwarzenegger received a formal apology and an undisclosed, substantial amount in damages and legal costs from English journalist Wendy Leigh. Schwarzenegger sued Leigh after she had written a front-page article with the scorching headline "Hollywood Star's Nazi Secret," which appeared in the tabloid News of the World in February, 1988. The article claimed that the actor was an admirer of German leader Adolf Hitler.

1993-Big rains deluged the plains as the one of the greatest floods in U.S. history began to unfold. 24 hour totals included 5.90 inches at Columbia, IA and 5.15 at Centralia, KS

1994 - Hootie and the Blowfish released their first LP, "Cracked Rear View". But it didn't zoom to the top of the charts. The group had to get lots of help from a guy named David Letterman before their album made it big. Letterman heard one of the tracks, "Hold My Hand", on the radio and invited the band to appear on "The Late Show". "Cracked Rear View" finally hit number one on May 27, 1995. By mid-1996, the album had sold more than 13 million copies in the U.S.

1998-Roger Clemens of the Toronto Blue Jays became the 11 th pitcher in major league baseball history to reach the 3,000 mark in career strikeouts when he fanned Randy Winn of the Tampa Bay Devil Rays in the 3 rd inning. The Blue Jays won, 2-1.

STRIKEOUTS

Nolan Ryan 5,714

Roger Clemens + 4,309

Randy Johnson + 4,143

Steve Carlton 4,136

Bert Blyleven 3,701

Tom Seaver 3,640

Don Sutton 3,574

Gaylord Perry 3,534

Walter Johnson 3,509

Phil Niekro 3,342

Fergie Jenkins 3,192

Bob Gibson 3,117

Most Wines

Cy Young 511

Walter Johnson 417

Grover Alexander 373

Christy Mathewson 373

Warren Spahn 363

Pud Galvin 361

Kid Nichols 361

Tim Keefe 342

Steve Carlton 329

John Clarkson 328

Roger Clemens + 328

Eddie Plank 326

Nolan Ryan 324

Don Sutton 324

Phil Niekro 318

Gaylord Perry 314

Tom Seaver 311

Old Hoss Radbourn 309

Mickey Welch 307

Greg Maddox + 303

Lefty Grove 300

Early Wynn 300

Baseball Digest

----------------------------------------------------------------

![]()

Baseball Poem

Five O'Clock High

Bases loaded,

top of the ninth,

two out

and a run behind.

The windup,

the pitch,

the ball,

the swing,

the hit,

the cheers,

then the boss

waking you up.

Written by Robert L. Harrison

“Green Fields and White Lines”

Baseball Poems

Published by McFarland and Company

|

www.leasingnews.org |