Information, news, and entertainment for the commercial

alternate financing,

bank, finance and leasing industries

Subscribe to Leasing News - Free

| Search | All Lists | Site Map

Advertising| Archives | Classified Ads | Columnists

Email the Editor

![]()

Monday, June 3, 2024

Today's Leasing News Headlines

Roglieri Arrested for Wire Fraud

By Ken Greene, Leasing New Emeritus

Official DOJ Release

Prime Capital Ventures Owner Arrested for Fraud

"if convicted...faces up to 20 years in prison..."

California Bill Would Deem Some Lenders As Licensed

Exemptions May be Confusing

By Keith Bishop, JD Supra

Leasing and Finance Industry Help Wanted

We Are Growing Our Senior Sales Team Now!

CLFP Foundation Adds 19 New CLFPs

With Photos

Academy for Certified Lease & Finance Professionals

8 Classes Scheduled June – November

Top Ten Leasing News Read by Readers

May 28 - May 30

QuickFi Wins Best of Show

at Finovate Spring 2024

Shepherd

Burlington, Massachusetts, Adopt-a-dog

News Briefs ---

Number of vehicles recalled in the US in

Q1 2024 continue to be high

City National Bank Faces Lawsuit Over Alleged Role in

Hollywood Ponzi Scheme ($770 Million Claim)

OPEC to Meet Amid Signs of Waning

Influence on Oil Prices

Chinese spacecraft lands on the moon’s

far side to collect rocks in growing

space rivalry with US

Mandalay Bay, Las Vegas, completes $100 million

remodel 2.1 Million Sq. foot convention Center

You May Have Missed ---

Google Rolls Back A.I. Search Feature

After Flubs and Flaws

Broker/Funder/Industry Lists | Features (wrilter's columns)

Top Ten Stories Chosen by Readers | Top Stories last six months

Sales Make It Happen

Sports Briefs

California News

"Gimme that Wine"

This Day in History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

Wordle

######## surrounding the article denotes it is a press release, it was not written by Leasing News nor has the information been verified, but from the source noted. When an article is signed by the writer, it is considered a byline. It reflects the opinion and research of the writer.

[headlines]

--------------------------------------------------------------

Roglieri Arrested for Wire Fraud

FBI agents took the loan broker into custody Friday morning

By Ken Greene, Esq., Leasing New Emeritus

As is so often the case, the cat catches the mouse when the mouse is no longer able to run. Like the feds who finally nailed Capone on tax evasion charges, as they were apparently unable to indict him on the more serious criminal charges, the feds have launched their first major salvo against Kris Roglieri by arresting him on serious and significant wire fraud charges. Roglieri is in a personal Chapter 7 bankruptcy and his companies have ceased operating. In perhaps a final act of desperation, he promised to lend $98.9 million to a company looking to build an egg farm in Minnesota. In exchange for the loan promise, the egg farm wired $5 million to Roglieri supposedly as interest on the loan, a classic Roglieri modus operandi with other creditors, though undoubtedly this will be his last.

The feds and the bankruptcy trustee have already seized all of Roglieri’s expensive toys, like his Lamborghini, Ferraris, Porsche, art, and a very expensive (but ugly) Richard Mille watch, part of a watch collection valued at more than $2 million. The hand that fed the greedy mouth, the National Association of Commercial Lease Brokers, is now part of the bankruptcy estate and technically defunct, a stark reminder of the repercussions of Roglieri's actions. However, this author believes another virtually identical company (which, for the moment, will remain unnamed) has “coincidentally” popped up to take its place.

It is also this author’s opinion that Roglieri is going to prison. This appears to be a blatant, multi-faceted Ponzi scheme that has wrought a multitude of lawsuits and, now, federal criminal charges. Roglieri lived the big life but his bad boy behavior has caught up with him and there is no lifeboat to whisk him off to the Cayman Islands for refuge. As I’ve said before, pigs get fat, but hogs get slaughtered. We will see what Judge Hummel has to say about this on Monday.

Official criminal complaint (PDF)

Ken Greene

Law Office of Kenneth Charles Greene

5743 Corsa Avenue, Suite 208

Westlake Village, California 91362

Tel: 818.575.9095

Fax: 805.435.7464

ken@kengreenelaw.com

www.kengreenelaw.com

[headlines]

--------------------------------------------------------------

#####Press Release######################

Prime Capital Ventures Owner Arrested for Fraud

"if convicted...faces up to 20 years in prison..."

ALBANY, NEW YORK – Kris Roglieri, age 44, of Queensbury, New York, was arrested today on a criminal complaint charging him with wire fraud.

Roglieri operated Prime Capital Ventures LLC (“Prime Capital”) and Prime Commercial Lending LLC (“Prime Commercial”), among other companies, that were based in Albany.

The criminal complaint alleges that Prime Capital held itself out as a commercial lending business. As part of contractual arrangements with its borrower clients situated across the country, Prime Capital obtained upfront interest payments from prospective borrowers while it sought to secure loans for those borrowers; these upfront interest payments were characterized by Prime Capital as the “Interest Credit Account Payment,” or “ICA” payment for short. ICA payments did not represent fees to Prime Capital. Instead, each borrower’s upfront ICA payment would be debited over time as the loan was funded and accrued more interest. An ICA payment would also be refundable if Prime Capital failed to secure a loan for the borrower client.

The complaint alleges that Roglieri defrauded a Minnesota company in December 2023, by committing to fund, through Prime Capital, a $100 million commercial project, even though, at the time, Prime Capital had failed to fund numerous loans promised to earlier clients; failed to return tens of millions of dollars in ICA payments to earlier clients once those loans did not materialize; and had been sued multiple times by clients alleging fraud and seeking the return of ICA payments.

On or about December 22, 2023, Roglieri, on behalf of Prime Commercial, signed a Deposit Agreement by which he agreed to keep the Minnesota company’s ICA payment in a “separate and distinct” bank account, and to hold it as a “trust fund.”

On December 22, the Minnesota company wire transferred a $5 million ICA payment to a Prime Capital account controlled by Roglieri. The complaint alleges that Roglieri then transferred and spent these funds, including by transferring $950,000 in order to meet a financial obligation to another Prime Capital client; paying $84,000 for his purchase of a Rolex day-date 36 mm yellow gold diamond bezel watch; and paying $101,000 to a private jet services company, for round-trip, private air travel between Albany International Airport and Anguilla, for a family vacation that Roglieri took from about December 29, 2023 to January 5, 2024.

The charges in the complaint are merely accusations. The defendant is presumed innocent unless and until proven guilty.

If convicted of the charge set forth in the complaint, Roglieri faces up to 20 years in prison, a maximum $250,000 fine, and up to 3 years of supervised release. A defendant’s sentence is imposed by a judge based on the particular statute the defendant is charged with violating, the U.S. Sentencing Guidelines and other factors.

Roglieri appeared today in Albany before United States Magistrate Judge Christian F. Hummel, and was ordered detained pending a detention hearing scheduled for Monday, June 3 at 3 p.m.

The FBI is conducting this ongoing investigation. Assistant U.S. Attorneys Joshua R. Rosenthal and Michael Barnett are prosecuting this case.

#####Press Release######################

[headlines]

--------------------------------------------------------------

California Bill Would Deem Some Lenders As Licensed

Exemptions May be Confusing

By Keith Bishop, JD Supra

California generally requires that persons engaged in the business of making loans be licensed. If not licensed under some other statute (such as the banking, credit union or residential mortgage lending laws), a lender will generally be subject to licensing under the California Financing Law (fka California Finance Lenders Law). Anyone who has applied for a CFL license from the Department of Financial Protection & Innovation can tell you that the process is a confusing, time consuming and frustrating experience.

The CFL currently includes two de minimis exemptions. The first exempts any person who makes no more than one loan in a 12-month period if that loan is commercial loan as defined in Section 22502 of the California Financial Code. Cal. Fin. Code § 22050.5 The second exempts any person who makes five or fewer loans in a 12-month period, provided these loans are commercial loans as defined Section 22502 and the loans are "incidental" to the business of the person relying upon the exemption.

This latter exemption does not work for special purpose lending entities that are formed to make more than one, but fewer than six , commercial loans in a 12-month period because their loans are not "incidental" to their business. Consequently, these lenders must complete the arduous licensing process, which typically takes months to complete. The California legislature is now considering a novel solution. Rather than exempt these lenders, the legislature is proposing to deem them to be licensed under the CFL. If enacted, AB 2981 would add a new subdivision (h) to Section 22100 to provide as follows:

A lender that does not make or broker residential mortgage loans or consumer loans shall be deemed a licensee under this article when the lender makes five or fewer commercial loans annually and the principal amount of all loans made by the lender in the preceding and current calendar year have each exceeded three hundred fifty thousand dollars ($350,000).

While interesting, this approach raises, but fails to answer, a number of important questions. For example, can a person simply be deemed "licensed" even without that person's knowledge or consent? How will the DFPI determine who is and who isn't licensed under the CFL?

[headlines]

--------------------------------------------------------------

Leasing and Finance Industry Help Wanted

[headlines]

--------------------------------------------------------------

CLFP Foundation Adds 19 New CLFPs

With Photos

The Certified Lease & Finance Professional (CLFP) Foundation is pleased to announce that 19 individuals who recently sat through the online proctored CLFP Exam, have passed.

The CLFP designation identifies an individual as a knowledgeable professional to employers, clients, customers, and peers in the commercial equipment finance industry.

They are:

Sandra Anderson, CLFP – Business Analyst

– Senior, The Huntington National Bank

Parker Bullard, CLFP – Sales Associate,

The Huntington National Bank

Paula Cole, CLFP – VP, Finance Segment/

Region Liaison, The Huntington National Bank

Jacob Crouch, CLFP – Vice President,

The Huntington National Bank

.jpg)

Alex Ducharme, CLFP – Equipment Finance

Sales Executive, The Huntington National Bank

Amy Henrikson, CLFP – Equipment Finance

Sales Executive, The Huntington National Bank

.jpg)

Ridge Johnson, CLFP – Portfolio Manager,

The Huntington National Bank

Matthew Kilarski, CLFP – Vice President –

Channel Sales, First Citizens Bank Equipment Finance

Todd Madson, CLFP – VP of Strategy,

The Huntington National Bank

Michelle McKie, CLFP – Senior Commercial

Portfolio Manager, The Huntington National Bank

Nathan Meyer, CLFP – Equipment Finance

Sales Executive, The Huntington National Bank

Jill Murphy, CLFP – Senior Vice President,

Managing Director, The Huntington National Bank

Sharon Pietras, CLFP – Vice President,

Associate General Counsel, The Huntington

National Bank

- Headshot.jpg)

Katie Riggs, CLFP Associate – Corporate

Counsel,Dext Capital

Jahnise Schneider, CLFP – Client Solutions

Operations Manager, The Huntington

National Bank

- Headshot.jpg)

Danielle Shields, CLFP – Human Resources

Director, Dext Capital

.jpg)

Katherine Sumner, CLFP – Equipment Finance

Sales Executive, The Huntington National Bank

Robert Tomlinson, CLFP – Vice President,

Portfolio Manager – Lender Finance,

The Huntington National Bank

Amber Wellhoefer, CLFP – Commercial

Portfolio Manager III – Equipment Finance,

The Huntington National Bank

Nathan Meyer of Huntington National Bank, said “I believe this certification to be extremely challenging and being able to call myself a CLFP is rewarding and humbling,” shares. “I’m eager to gain extensive knowledge in all areas of the leasing world I may not be exposed to on a day-to-day basis.

“The CLFP is a great way to network with other individuals in the leasing world, continue building relationships, and to bring on new opportunities of growth to my organization.”

Sharon Pletras, Huntington National Bank, Associate General Counsel, Vice President,(the 1,500th CLFP) shares her experience, said, “I pursued the CLFP designation because it is highly respected in the equipment and finance industry. Each CLFP professional is held to the highest standards of integrity, commitment, and excellence.

“As a new member of the CLFP Family, I am so excited to push my career to the next level, so that I can be that helping hand for the next generation of CLFPs.”

There are Certified Lease & Finance Professionals and Associates located throughout the United States (including Puerto Rico), Canada, India, Pakistan, Africa, and Australia. For more information, visit http://www.CLFPFoundation.org

[headlines]

--------------------------------------------------------------

Academy for Certified Lease & Finance Professionals

8 Classes Scheduled June – November

The Academy for Lease and Finance Professionals (ALFP) is a three-day event designed to fully prepare an individual to sit for the CLFP exam assuming the attendee has already self-studied. A trend has begun in having virtual online sessions.

During the first two days, all of the required sections of the CLFP exam are covered in-depth. On the third day, the exam is offered but is not mandatory and may be taken on another day.

Students are strongly advised to have read and studied The Certified Lease & Finance Professionals' Handbook prior to attending the class in order to ensure success

Schedule:

Financial Partners Group Private, Virtual ALFP

June 6 – 7

Online, Private, AP EF ALFP

June 12 – 14

Stearns Bank Public, In-Person (MN)

July 31 - August 2

Great American Insurance Group Public,

in Person,ALFP

August 8 - 9

Financial Partners Group Private

Virtual ALFP

August 12 - 13

Wintrust Public, In-Person. ALFP

August 15 -16

DLL Online Private, ALFP

October 15 - 16

First Commonwealth EF Online, ALFP

November 6 -7

The Certified Lease & Finance Professional Handbook

https://clfpfoundation.org/clfp-foundation-releases-updated-handbook/

About Academy

https://clfpfoundation.org/academy-for-lease-and-finance-professionals

Mel Vinson, CLFP, Director of Academies, VP of Marketing and Development

Mel@clfpfoundation.org

|

[headlines]

--------------------------------------------------------------

Top Ten Leasing News Read by Readers

May 28 - May 30

(1) Summation of News Reports of

Financial TechnologyCompanies Source

of Funding Shutting Down

https://leasingnews.org/archives/May2024/05_28.htm#sum

(2) New Hires/Promotions in the Leasing Business

and Related Industries

https://leasingnews.org/archives/May2024/05_30.htm#hires

(3) New Hires/Promotions in the Leasing Business

and Related Industries

https://leasingnews.org/archives/May2024/05_28.htm#hires

(4) Cash Flow is King

Placard

(5) Non-Competes Are Out the Window

By Sloan Schickler, Esq.

https://leasingnews.org/archives/May2024/05_28.htm#nc

(6) "Gold in Those Files"

By Scott Wheeler, CLFP

https://leasingnews.org/archives/May2024/05_30.htm#gold

(7) deBanked Broker Fair 2024 Recap

by deBanked Staff

https://leasingnews.org/archives/May2024/05_28.htm#bf

(8) Commercial Finance/Leasing Finance Conferences

https://leasingnews.org/archives/May2024/05_30.htm#conf

(9) The U.S. Now Has Over 183,000 Public EV Chargers

That’s almost double compared to three years

https://leasingnews.org/archives/May2024/05_30.htm#us

(10) FDIC-Insured Institutions Reported

Net Income of $64.2 Billion

https://leasingnews.org/archives/May2024/05_30.htm#fdic

--------------------------------------------------------------

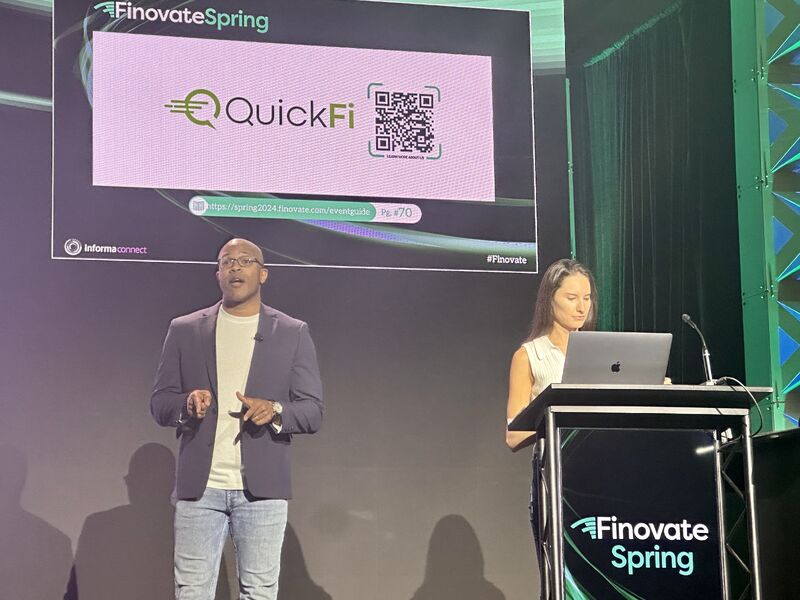

QuickFi Wins Best of Show

at Finovate Spring 2024

QuickFi® was recognized as Best of Show at Finovate Spring 2024. QuickFi participated with over 50 companies at Finovate Spring 2024, a leading fetch event series held annually in San Francisco, New York City, Asia, and Europe. QuickFi was honored to conduct a live demonstration of the embedded finance platform, making business equipment financing simple, fast, transparent and efficient for global OEMs and banks.

Nate Gibbons, CLFP and Jillian M. of QuickFi show something we haven’t seen in a while— an integrated platform for commercial lending with instant digital financing at the POS quickly.

QuickFi® enables global manufacturers to gain the advantages of a captive finance capability without the cost, complexity, or risk of establishing a traditional captive. With QuickFi’s revolutionary new embedded finance platform, creditworthy business equipment purchasers may obtain low, fixed-rate term equipment financing at the point of sale in minutes, not days or weeks, with transparent, borrower-friendly terms and conditions and 24/7 live support.

OEMs operate the QuickFi platform to facilitate 50-state and Canadian business equipment financing and leasing without big investments, high operating costs or the financial risks associated with operating a traditional captive finance company.

|

[headlines]

--------------------------------------------------------------

Shepherd

Burlington, Massachusetts

Aldo

Male

3 Months old

crate trained

house trained

good in home with

other dogs, children

Meet Aldo

Yes, Dogs, Yes Cats: unknown, but most likely Yes, Kids: Yes, Crate trained ,Working on leash and potty training. Everything else the same . He is a very crazy sweet lovable boy that was dumped alone with his siblings on a country road with mange but looking better now!

Would be good in house with another dog.

Alpha Paw

https://www.facebook.com/alphapawofficial

Monday — Friday, 9am — 5pm ET

Send Message:

https://www.alphapaw.com/pages/contact-us/

[headlines]

--------------------------------------------------------------

News Briefs

Number of vehicles recalled in the US in

Q1 2024 continue to be high

https://vayangroup.com/2024/04/17/number-of-vehicles-recalled-in-the-us-in-q1-2024-continue-to-be-high

City National Bank Faces Lawsuit Over Alleged Role in

Hollywood Ponzi Scheme ($770 Million Claim)

https://americanareport.com/city-national-bank-faces-lawsuit-in-ponzi/

OPEC to Meet Amid Signs of Waning

Influence on Oil Prices

https://www.nytimes.com/2024/05/31/business/opec-meeting-oil-prices.html

A Chinese spacecraft lands on the moon’s

far side to collect rocks in growing

space rivalry with US

https://www.bostonglobe.com/2024/06/02/business/china-space-moon-exploration/

Mandalay Bay, Las Vegas, completes $100 million

remodel 2.1 Million Sq. foot convention Center

https://www.prnewswire.com/news-releases/mandalay-bay-completes-100-million-remodel-of-2-1-million-square-foot-convention-center-302158918.html

[headlines]

--------------------------------------------------------------

Google Rolls Back A.I. Search Feature

After Flubs and Flaws

https://www.nytimes.com/2024/06/01/technology/google-ai-overviews-rollback.html

|

[headlines]

--------------------------------------------------------------

Sports Briefs---

Novak Djokovic keeps his French Open title defense

going getting past Lorenzo Musetti in 5 sets

https://www.pressdemocrat.com/article/sports/novak-djokovic-french-open-tennis/

[headlines]

--------------------------------------------------------------

![]()

California News Briefs---

Nearly half of California’s homeless people

are over 50. Their numbers and needs are growing

https://www.eastbaytimes.com/2024/06/02/nearly-half-of-californias-homeless-people-are-over-50-their-vulnerabilities-and-needs-are-growing/

California property owners paying more

as state works to keep insurers from leaving

https://www.northbaybusinessjournal.com/article/industrynews/california-insurance-rate-hikes-approvals/

20,000 people attended BottleRock this year.

Here’s what happens to all the leftover food

https://www.pressdemocrat.com/article/napa/bottlerock-napa-food/?gallery=79f80ab5-45e1-4d7a-9bf1-ca60edfae882

[headlines]

--------------------------------------------------------------

Gimme that Wine

![]()

http://www.youtube.com/watch?v=EJnQoi8DSE8

North Coast Wine & Food Festival will showcase

award-winning wines and gourmet bites

Saturday June 15, 2024/ 1-4pm, Santa Rosa

https://www.pressdemocrat.com/lifestyle/wine/?ref=nav

The Best Value Sonoma Wines for 2024

Wine Searcher

https://www.wine-searcher.com/m/2024/06/the-best-value-sonoma-wines-for-2024

Stag's Leap Winery Named an Official Partner

of Cirque du Soleil Big Top Shows in the United States

https://www.winebusiness.com/news/article/288062

Wildfire Mitigation is a Year-Round Task

for Napa and Sonoma Wineries

https://www.winebusiness.com/news/article/288077

[headlines]

----------------------------------------------------------------

![]()

This Day in History

https://leasingnews.org/archives/Jun2022/06_03.htm#history

-------------------------------------------------------------

SuDoku

The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler?

--------------------------------------------------------------

Daily Puzzle

How to play:

http://www.setgame.com/set/puzzle_frame.htm

Refresh for current date:

http://www.setgame.com/set/puzzle_frame.htm

--------------------------------------------------------------

http://www.gasbuddy.com/

http://www.gasbuddy.com/GB_Map_Gas_Prices.aspx

http://www.gasbuddy.com/GB_Mobile_Instructions.aspx

--------------------------------------------------------------

Weather

See USA map, click to specific area, no commercials

--------------------------------------------------------------

Traffic Live---

Real Time Traffic Information

You can save up to 20 different routes and check them out with one click,

or type in a new route to learn the traffic live

--------------------------------

Wordle

https://www.powerlanguage.co.uk/wordle/

How to Play

https://www.today.com/popculture/popculture/wordle-know-popular-online-word-game-rcna11056

![]()