Information, news, and entertainment for the commercial

alternate financing,

bank, finance and leasing industries

Subscribe

| Search | All Lists | Site Map

Conferences/Forums |

Advertising | Archives | Columnists

Don’t take the bait on phishing scams |Top Ten Stories Chosen by Readers

Contact: kitmenkin@leasingnews.org

![]()

Wednesday, June 18, 2025

Today's Leasing News Headlines

Equipment Finance Industry Confidence Rebounds

from Tariff Pressures; June Shows 58.2 Confidence

New Hires/Promotions in the Leasing Business

and Related Industries

The Roglieri Dominoes Continue To Fall

By Ken Greene, LN Chief Legal Editor, Emeritus

Small Business Optimism on the Rise Says NFIB

By Bob Coleman, Coleman Report

Leasing and Finance Help Wanted

Balboa Capital

We Are Growing Our Senior Sales Team Now

Maxim Commercial Capital, LLC

Looking for Chief Operating Officer

Built for Pressure

By Ken Lubin, ZRG Partners, Managing Director

Breaking the Cycle of Complacency

By Scott Wheeler, CLFP

How Many New Businesses

Survive 10 Years in the US?

News Briefs---

Eli Lilly to buy gene-editing biotech Verve

for $1.3 Billion

China Is Unleashing a New Export

Shock on the World

Chobani CEO Says Food System Needs

Immigration to Function

Senate Passes Crypto currency Bill, Handing

Industry a Victory

Kraft Heinz to remove dyes from US products

amid ‘Make America Healthy Again’ pressure

You May Have Missed ---

It’s Official: Streaming

Is Now the King of TV

Sports Briefs

California News

"Gimme that Wine"

This Day in History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

Wordle

######## surrounding the article denotes it is a press release, it was not written by Leasing News nor has the information been verified, but from the source noted. When an article is signed by the writer, it is considered a byline. It reflects the opinion and research of the writer.

[headlines]

--------------------------------------------------------------

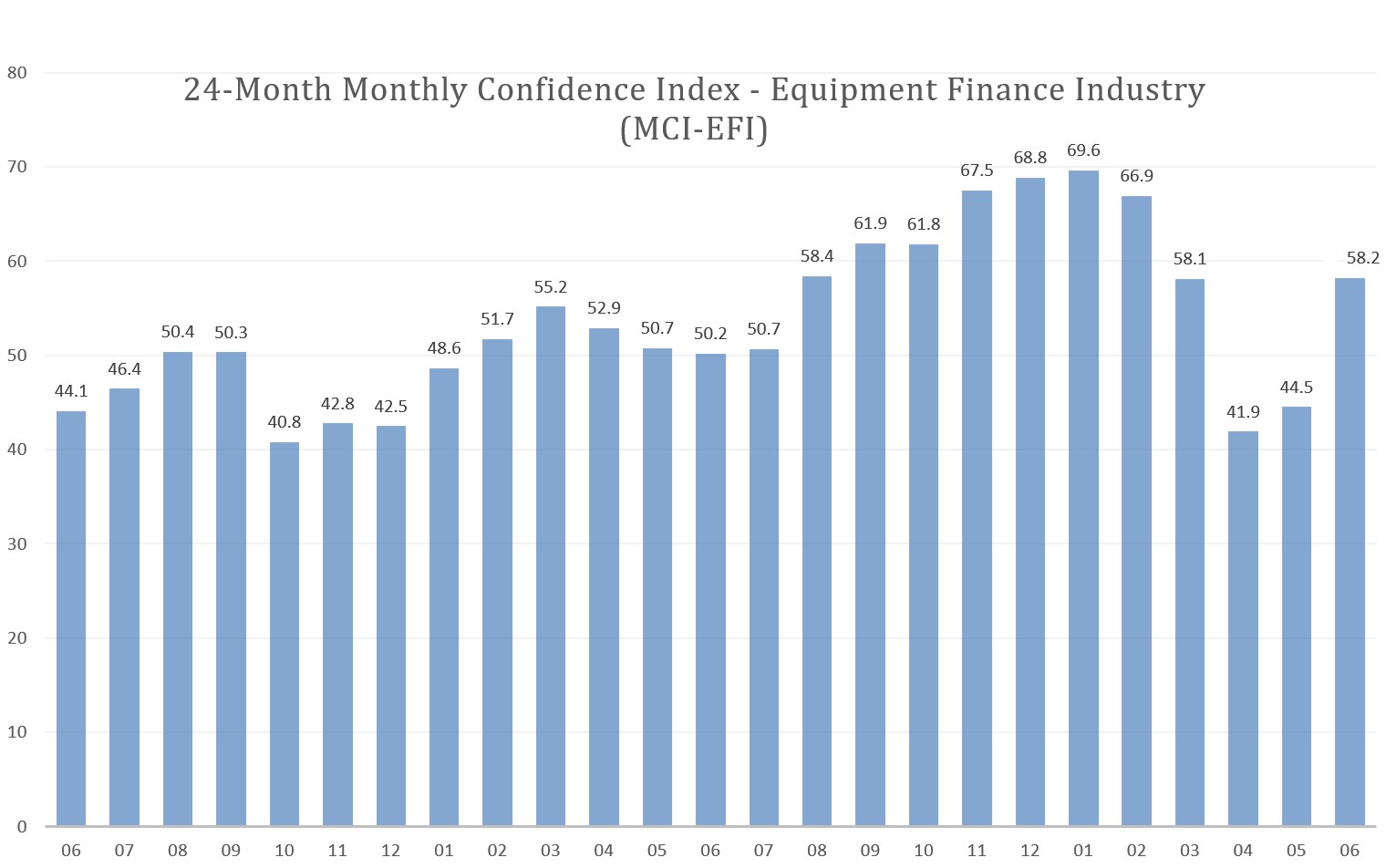

Equipment Finance Industry Confidence Rebounds

from Tariff Pressures; June ELFF Release Shows 58.2 Confidence

Overall, confidence in the equipment finance market is 58.2, a return to historically more positive levels after dramatic lows in April and May. The index reports a qualitative assessment of both the prevailing business conditions and future expectations as reported by key executives from the $1.3 trillion equipment finance sector.

Jim DeFrank, EVP and Chief Operating Officer, Isuzu Finance of America, Inc., said, “As companies are getting a better feel for where tariffs will land, it’s very plausible we’ll see pent-up demand begin to release, backlogged or postponed purchases resurface, and a shift in financing behavior. Leasing in particular could spike, as companies look to preserve cash while still upgrading assets.”

Jeffry Elliott, CLFP, CEO, Elevex Capital, stated, “Tariffs and subsequent economic pressures related to supply chain issues and inflation will slow down equipment purchases. However, a slowdown may limit competitive capital in the equipment finance space and allow for more opportunities at higher margins for independent lessors.”

Charles Jones, Senior Vice President,1st Equipment Finance, Inc..commented, “As tariff talks continue to ping pong back and forth, one thing is clear: businesses continue to grow and demand financing. Tired of the "wait and see" approach, many are pulling the trigger and looking forward.”

David Normandin, CLFP, President and Chief Executive Officer, Wintrust Specialty Finance, said, “Fundamentals in the market remain positive. 2025 has been a good year for many equipment finance companies and the possibility for incremental improvement is visible. I expect to realize a solid growth year in 2025.”

Full Press Release with results in percentage of reporting:

https://www.leasefoundation.org/industry-research/monthly-confidence-index/

[headlines]

--------------------------------------------------------------

New Hires/Promotions in the Leasing Business

and Related Industries

Tom Grady, CLFP, was hired as President & CEO, Banleaco, Urbandale, Iowa. He is located in Minneapolis, Minnesota. Previously, he was Senior Relationship Manager, Syndications, KLC Financial (February, 2025 - June, 2025); Senior Vice President, Equipment Finance, Old National Equipment Finance, a division of Old National Bank (January, 2023 - December, 2025); Vice President, Commercial Relationship Manager, K2 Popular Equipment Finance, LLC.,(January, 2011- January, 2023).

Full Bio:

https://www.linkedin.com/in/gradytom/details/experience/

https://www.linkedin.com/in/gradytom/

Terry Jennings is retiring from Financial Pacific Leasing, Federal Way, Washington where he worked for 39 years, six months, helping to build the operation. He is located in Auburn, Washington. He was named President, January 2019, formerly Executive Vice President since 1986. He was very active in several leasing associations and perhaps knew all those in the broker industry, where Kit Menkin sent his first business when he started as an independent. “Remember he and his wife as avid rose growers. He was key to the success of the company.” Kit Menkin.

https://www.linkedin.com/in/terey-jennings-80b50222/

Matt Mueller was announced retiring from GreatAmerica Financial Services as Executive Vice President & Chief Operating Officer, Cedar Rapids, Iowa, “who has been with the company for 14 years, has played a meaningful role leading corporate operations and working with leadership to prioritize and build the business capabilities necessary to meet the needs of GreatAmerica customers."

"Matt has made a significant impact on our organization over the years, contributing to corporate finance, operations, strategy, and technology," said Martin Golobic, CEO of GreatAmerica Financial Services. "I admire his commitment to prioritizing time with his family during these formative years. He will always remain an integral part of the foundation we have built for the bright future of GreatAmerica."

Full Bio:

https://www.linkedin.com/in/matthewsmueller/details/experience

https://www.linkedin.com/in/matthewsmueller/

Falencia Prime was hired as Chief Operating Office, Eastern Funding, LLC, New York, New York. She is located in the New York City Operating Area. "In her role, she will oversee the Company’s operations, technology and compliance functions." Previously, she was Director of Loan Operations, Pitney Bowes (May, 2023 - June, 2024); SVP, Loan Documentation and Group Manager, Citi (February, 2023 - May, 2023); VP of Loan Originations, FirstBank, (September, 2018 - January, 2021); VP, Division Loan Production Manager, Western Alliance Bancorporation (July, 2017 - August, 2018). Full Bio:

https://www.linkedin.com/in/falencia-prime-60876ab/

https://www.linkedin.com/in/falencia-prime-60876ab/details/experience/

Peter Sinapi, Jr. was hired as Commercial Validations Manager, Wells Fargo Equipment finance Company. He is located in Brookfield, Connecticut. Previously, he was Collateral Manager, Wells Fargo Capital Finance, Danbury, Connecticut (March, 2016 - June, 2025);Portfolio Analyst, GE Capital (August, 2013 - March, 2015).

https://www.linkedin.com/in/peter-sinapi-jr-66b3b231/

Allen Snelling was appointed President of Financial Pacific Leasing, Federal Way, Washington, owned by Umpqua Bank. He is located in Sherwood, Oregon. Previously, he was Vice President Business Development, Financial Pacific, January, 2022. He joined Umpua Bank as Senior Vice President, Umpqua Vendor Finance (June, 2015 – November, 2024); Vice President, strategic National Accounts, Marlin Leasing (April, 2010 – May, 2015); He joined Key Equipment Finance, Product Development Manager, April, 2003, promoted National Sales Manager, October, 2003, Promoted Vice President, Office Products (June, 2006 – August, 2009); Regional Sales Manager, Northwest, GE Capital, Express

Financial Solutions (July, 2002 – April, 2003). Full Bio:

https://www.linkedin.com/in/allen-snelling-811b637/details/experience/

https://www.linkedin.com/in/allen-snelling-811b637/

[headlines]

--------------------------------------------------------------

The Roglieri Dominoes Continue To Fall

By Ken Greene, Leasing News Chief Legal Editor, Emeritus

Kimberly Humphrey 2020 YouTube video

Another shoe has dropped in the footpath of Mr. Kris Roglieri, the embattled loan broker accused of stealing millions of dollars from clients. One month after COO Christopher Snyder pleaded guilty to wire fraud charges, Ms. Kimberly Humphrey, who is Snyder’s sister and the alleged girlfriend of Roglieri, has also pleaded guilty to wire fraud as well as health care fraud.

Humphrey apparently admitted that Roglieri’s company, Prime Capital, collected borrower funds for multi-million dollars loan applications it no intention or ability to fund. Humphrey allegedly claims she warned Roglieri not to do the deal.

“You have no way to get them funded in 60 days,” she wrote in an email submitted into evidence. “Do not sign the docs.”

Roglieri signed the documents anyway.

Roglieri is facing five wire fraud charges and has been accused of running a Ponzi scheme by misappropriating client’s money to pay other clients. He is presently in federal custody and has been since May 2024. He has been deemed a danger to the community after alleged threats against an FBI agent. Several requests for bail have been denied. United States District Judge Mae D’Agostino has set a “firm” trial date for January 5, 2026, warning the parties and their counsel that there will be no further delays.

People in the industry know Roglieri as a flamboyant but at least superficially successful loan broker and educator whose lifestyle and persona seemed to mimic that of the fictitious character Tony Soprano. It would appear that Mr. Roglieri’s bravado and apparent hubris will not be great assets in his new role.

Ken Greene

Law Office of Kenneth Charles Greene

5743 Corsa Avenue, Suite 208

Westlake Village, California 91362

Tel: 818.575.9095

Fax: 805.435.7464

ken@kengreenelaw.com

www.kengreenelaw.com

[headlines]

--------------------------------------------------------------

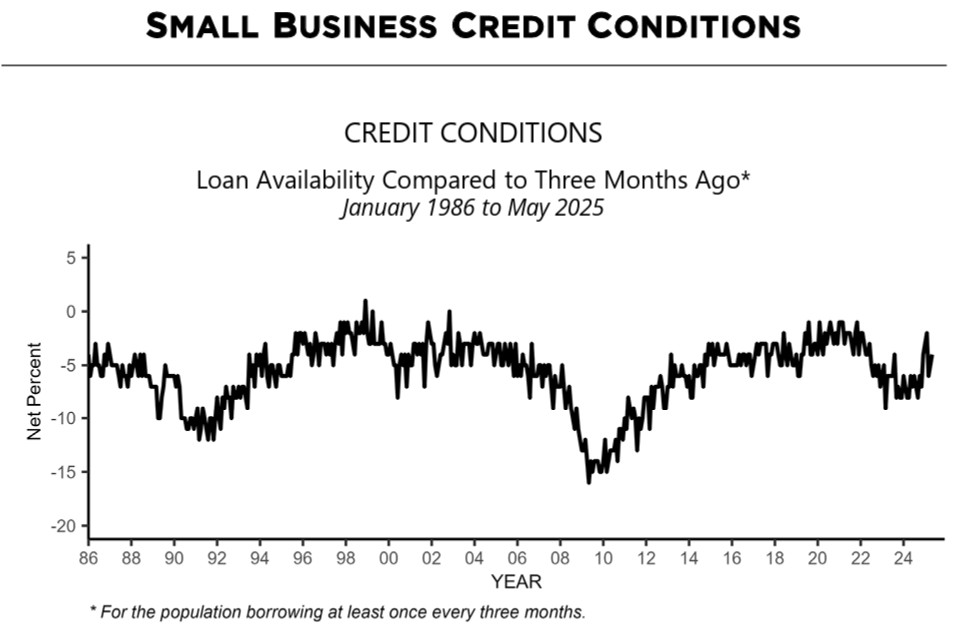

Small Business Optimism on the Rise Says NFIB

By Bob Coleman, Founder & Publisher, Coleman Report

Small business owners have reasons to feel positive heading into the summer, as optimism levels improved in May, according to the NFIB Small Business Economic Trends Report. The Small Business Optimism Index climbed three points to 98.8, slightly surpassing the 51-year average. This boost was driven primarily by improved expectations for business conditions and sales growth. However, uncertainty remains a challenge, with the Uncertainty Index increasing by two points from April to 94.

Navigating Credit Markets and Financing Challenges

Credit conditions showed a mixed bag in May. While fewer small business owners reported difficulty obtaining loans compared to April, financing costs continue to rise. A net 7 percent of owners reported paying higher rates on recent loans, with the average rate for short-term loans at 8.7 percent. Despite a slight dip in borrowing activity, 25 percent of owners still reported funding their businesses regularly. While credit remains accessible, high mortgage rates are cooling housing activity, impacting broader economic growth.

Shifts in Capital Spending Priorities

Capital investments saw some declines, with only 56 percent of small business owners making expenditures in the past six months—the lowest figure of 2025 so far. Spending on fixtures, furniture, and new buildings all fell compared to April. However, plans for future capital outlays rose by four points, signaling cautious optimism and the highest planning levels this year.

Key Challenges for Small Businesses

Taxes emerged as the dominant concern for 18 percent of owners—the highest level since December 2020. Labor quality concerns dropped to 16 percent, marking a significant shift, while inflation and government regulations remained steady at 14 and 9 percent, respectively. As owners navigate these challenges, adapting to evolving credit markets and tax burdens will be critical.

Small businesses are resilient, but vigilance in addressing rising costs and tax concerns is vital for sustained growth through 2025!

[headlines]

--------------------------------------------------------------

Leasing and Finance Help Wanted

Balboa Capital

We Are Growing Our Senior Sales Team Now

Maxim Commercial Capital, LLC

Looking for Chief Operating Officer

[headlines]

--------------------------------------------------------------

Built for Pressure

By Ken Lubin, ZRG Partners, Managing Director

High performance isn’t a mystery. It’s a system.

The best leaders don’t wait for clarity, energy, or opportunity. They build it—week after week.

That’s why I created: The Weekly Performance Brief: Built for Pressure

It’s a tactical, no-fluff framework designed for professionals who need to perform under pressure—on the job, in the boardroom, or in the field.

The framework covers:

Situational Awareness — See what others miss

Stress as a Catalyst — Use pressure to sharpen your edge

Strength as a Leadership Asset — Energy is your presence

Clarity for Velocity — Eliminate noise, move fast

Reputation as Currency — Build a brand of consistent execution

If you're managing people, driving growth, or simply pushing your own limits—this weekly cadence is a game-changer.

Ken Lubin, Managing Director

ZRG Partners, LLC

Americas I EMEA I Asia Pacific

C: 508-733-4789

https://www.linkedin.com/in/klubin

klubin@zrgpartners.com

[headlines]

--------------------------------------------------------------

Breaking the Cycle of Complacency

By Scott Wheeler, CLFP

In the commercial equipment finance and leasing industry, one of the most significant threats to productivity and income is complacency. When complacency—and its close cousin, negativity—begins to creep into an originator's daily routine, it quietly erodes motivation and erects invisible walls between the originator and potential prospects. Left unchecked, it can derail even the most experienced professionals.

The cycle must be broken to reignite performance, both individual originators and sales teams need a positive shock of optimism. They need change—not necessarily external change, but the kind that reinvigorates from within. As someone who regularly coaches veteran originators, I’m frequently asked:

What steps should I take to re-energize my daily activities? How do I bring back the “fun” I used to feel in this career?

The answer lies in creating. The most effective way to re-energize is by launching a meaningful, self-directed project—something that excites you and pushes you to grow. A venture like this can shift your trajectory and revive the passion that first brought you into the commercial equipment finance and leasing industry.

Too often, change is mistaken for switching jobs or companies. But that move, while sometimes necessary, is rarely the most transformative.

The deepest change begins with a shift in mindset, daily focus, and personal goals—right where you are.

This isn’t about chasing novelty. It’s about rekindling purpose.

Begin with reflection. What sparked your energy when you first started? What still gives you a jolt of enthusiasm today? Let those insights shape a new initiative—whether it’s building a niche offering, creating value-added content, or mentoring the next generation.

Inspiration doesn’t come from waiting. It comes from building. The spark never left. Now it’s your turn to ignite it.

Scott A. Wheeler, CLFP

Wheeler Business Consulting

1314 Marquis Ct.

Fallston, Maryland 21047

Phone: 410 877 0428

Fax: 410 877 8161

Email: scott@wheelerbusinessconsulting.com

Web: www.wheelerbusinessconsulting.com

Wheeler Business Consulting is working with individual originators and sales teams throughout the industry to ensure that they are well positioned in the market, capturing their fair share of business, and outperforming the competition. To schedule a one-on-one meeting contact Scott Wheeler at: scott@wheelerbusinessconsulting.com

[headlines]

--------------------------------------------------------------

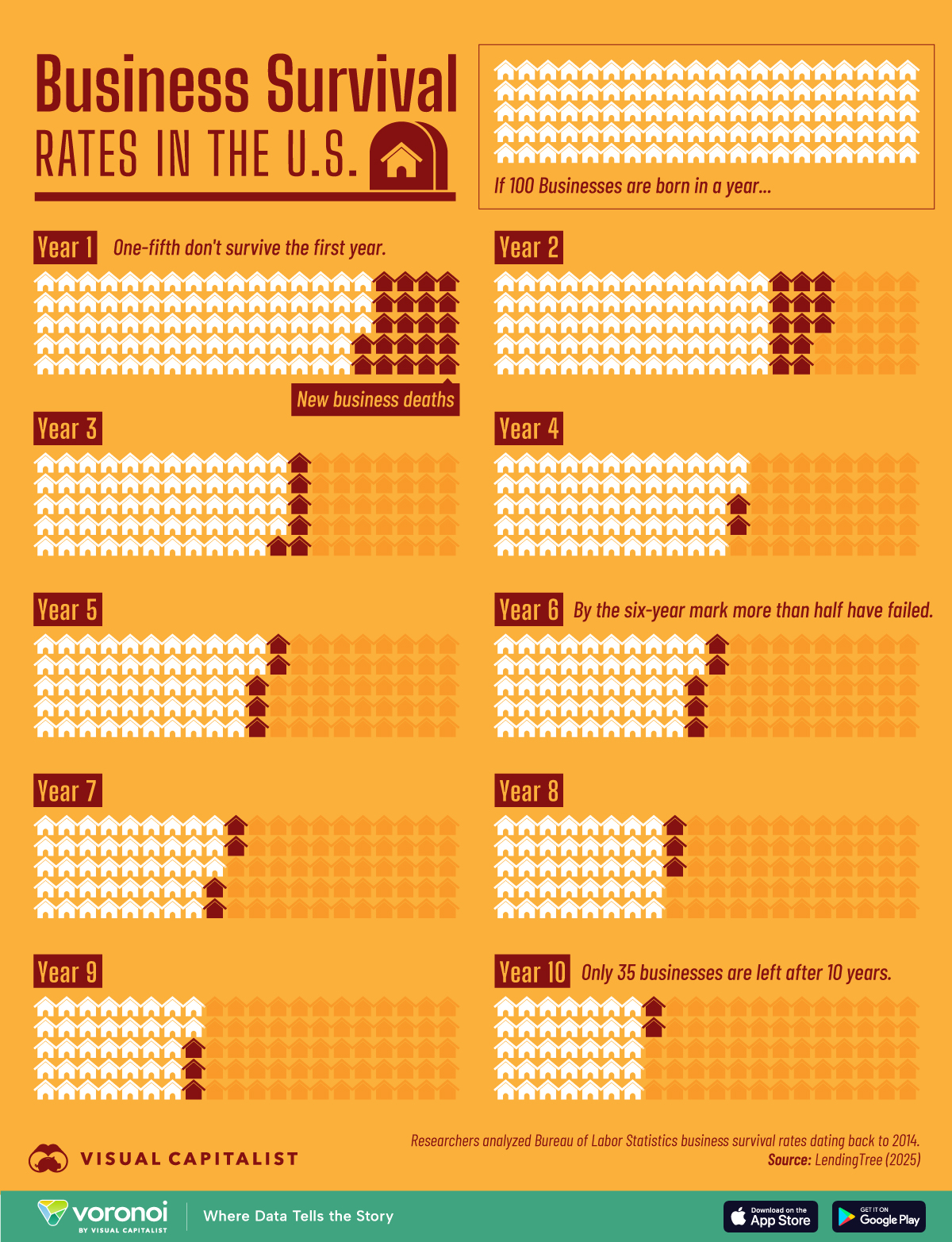

How Many New Businesses

Survive 10 Years in the US?

Key Takeaways

- If 100 new U.S. businesses are born in a year, 20% will not survive till the second year.

- By the 10-year mark, only about one-third (35%) will survive.

AI is making it easier than ever to start a business, acting as idea generator, sales rep, and marketing director all in one.

But if you’re thinking of getting into the game, have a look at the data before making decisions.

Why is that first year so brutal?

In short, because it’s new for most of the people setting up a business. And a new business will not generate revenue (let alone profit) immediately.

Which means a new owner needs to retain emotional resilience while still maintaining long hours to grow sales, under the crushing pressure of financial insecurity.

This is a deadly cocktail: it can lead to self-doubt, and short-sighted decision making, creating more opportunities to fail.

And of course, the demands of running a business far outpace the demands of a regular 9–5 job. A skilled worker still needs to learn new roles for running a business (sales, marketing, leadership) all the while anticipating market needs and innovating as disruptions occur.

Interestingly, experience does pay. The rate of failure falls steadily as the years progress.

However, even then, only about one-third (35%) will survive to celebrate their first decade.

[headlines]

--------------------------------------------------------------

News Briefs

Eli Lilly to buy gene-editing biotech Verve

for $1.3 Billion

https://www.bostonglobe.com/2025/06/17/business/eli-lilly-gene-editing-biotech-verve/

China Is Unleashing a New Export Shock on the World

https://www.nytimes.com/2025/06/17/business/tariffs-china-exports.html

Chobani CEO Says Food System Needs Immigration

to Function

https://www.wsj.com/business/chobani-ceo-says-food-system-needs-immigration-to-function-c985861f?mod=business_lead_story

Senate Passes Crypto currency Bill, Handing

Industry a Victory

https://www.nytimes.com/2025/06/17/us/politics/senate-cryptocurrency-bill.htm

Kraft Heinz to remove synthetic dyes from US products

amid ‘Make America Healthy Again’ pressure

https://nypost.com/2025/06/17/business/kraft-heinz-to-remove-synthetic-dyes-amid-make-america-healthy-again-pressure/

[headlines]

--------------------------------------------------------------

It’s Official: Streaming Is Now the King of TV

https://www.nytimes.com/2025/06/17/business/media/streaming-beats-cable-broadcast.html

[headlines]

--------------------------------------------------------------

Sports Briefs---

Former Santa Clara star Williams overcomes shooting

woes help Thunder regain footing in NBA Finals

https://www.eastbaytimes.com/2025/06/15/jalen-williams-resilience-helps-thunder-gain-solid-position-heading-into-game-5-vs-pacers/

Bobrovsky shines for Panthers in Stanley Cup Final

as Oilers have goalie debate

https://www.eastbaytimes.com/2025/06/15/oilers-dealing-with-stanley-cup-final-goalie-debate-panthers-1-win-from-repeating-have-bobrovsky/

Like father, like son — 49ers coaches Shanahan,

Lombardi, Kubiak got started at an early age

https://www.eastbaytimes.com/2025/06/15/like-father-like-son-49ers-coaches-shanahan-lombardi-kubiak-got-started-at-an-early-age/

Dodgers tried to stop Spanish version of

US national anthem before SF Giants game

https://www.sfgate.com/giants/article/dodgers-tried-to-stop-spanish-us-anthem-sf-giants-20378533.php

[headlines]

--------------------------------------------------------------

![]()

California News Briefs---

California’s Wildfires Could Be Brutal This Summer

https://www.nytimes.com/2025/06/16/weather/california-fire-season-forecast.html

Waymo expands into several more SF Bay Area cities

https://www.sfgate.com/tech/article/waymo-expands-bay-area-cities-20381647.php

California’s Wildfires Could Be Brutal This Summer

https://www.nytimes.com/2025/06/16/weather/california-fire-season-forecast.html

Photos: Bing Crosby’s Hillsborough mansion

sells for $25 million

https://www.mercurynews.com/2025/06/13/photos-bing-crosbys-hillsborough-mansion-sells-for-25-million/

[headlines]

--------------------------------------------------------------

Gimme that Wine

![]()

http://www.youtube.com/watch?v=EJnQoi8DSE8

"Taste the Difference" Marks a Successful Second

Year of Campaign with Impactful Activities Across

the U.S. Wine Trade

https://www.prnewswire.com/news-releases/taste-the-difference-marks-a-successful-second-year-of-campaign-with-impactful-activities-across-the-us-wine-trade

After early reprieve from immigration enforcement,

farming industry reckons with raids

https://www.npr.org/2025/06/16/nx-s1-5430846/farming-industry-immigration-ice-worksite-enforcement-trump

[headlines]

----------------------------------------------------------------

![]()

This Day in History

https://leasingnews.org/archives/Jun2023/06_16.htm#history

-------------------------------------------------------------

SuDoku

The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler?

--------------------------------------------------------------

Daily Puzzle

How to play:

http://www.setgame.com/set/puzzle_frame.htm

Refresh for current date:

http://www.setgame.com/set/puzzle_frame.htm

--------------------------------------------------------------

http://www.gasbuddy.com/

http://www.gasbuddy.com/GB_Map_Gas_Prices.aspx

http://www.gasbuddy.com/GB_Mobile_Instructions.aspx

--------------------------------------------------------------

Weather

See USA map, click to specific area, no commercials

--------------------------------------------------------------

Traffic Live---

Real Time Traffic Information

You can save up to 20 different routes and check them out with one click,

or type in a new route to learn the traffic live

--------------------------------

Wordle

https://www.powerlanguage.co.uk/wordle/

How to Play

https://www.today.com/popculture/popculture/wordle-know-popular-online-word-game-rcna11056

![]()