Information, news, and entertainment for the commercial

alternate financing,

bank, finance and leasing industries

Subscribe

| Search | All Lists | Site Map

Conferences/Forums |

Advertising | Archives | Columnists

Don’t take the bait on phishing scams |Top Ten Stories Chosen by Readers

Contact: kitmenkin@leasingnews.org

![]()

Wednesday, June 25, 2025

Today's Leasing News Headlines

New Hires/Promotions in the Leasing Business

and Related Industries

CapEx Finance Index (CFI) May 2025: Demand Rose

Financial Conditions Remained Healthy

Sales-Based Financing: Danger Ahead?

By Ken Greene, Leasing News Chief Legal Editor

37% of Entrepreneurs Plan on Selling

in Next 12 Months

By Bob Coleman, Coleman Report

Leasing/Finance Help Wanted

Balboa Capital

Maxim Commercial Capital

Increasing Productivity

By Scott Wheeler, CLFP

AACFB Webinar Virtual Town Hall

Commercial Finance Professionals

Thursday, June 26 -3:00 P.M. (ET)

Report Examines the Healthcare Sector and

Opportunities for Equipment Finance

News Briefs---

Why Factories Are Having Trouble Filling

Nearly 400,000 Open Jobs

At Amazon’s Biggest Data Center, Everything

Is Supersized for A.I.

As countries race to power artificial intelligence,

a yawning gap is opening around the world

A Fight Between Cable and Wireless Providers

Means Cheaper Home Internet for You

Toys are getting pricier

as tariffs kick in

More Homeowners Find

Themselves Underwater

You May Have Missed ---

Sports Briefs

California News

"Gimme that Wine"

This Day in History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

Wordle

######## surrounding the article denotes it is a press release, it was not written by Leasing News nor has the information been verified, but from the source noted. When an article is signed by the writer, it is considered a byline. It reflects the opinion and research of the writer.

[headlines]

--------------------------------------------------------------

New Hires/Promotions in the Leasing Business

and Related Industries

Shane Butler was hired as Managing Director, Originations, Utica Equipment Finance, Wilton, Connecticut. He is located in the New York City Metropolitan Area. Previously, he was Founder & President, Greenwich Capital Advisory Services, LLC. (January, 2024 - June, 2025); Senior Vice President, Atalaya Capital Management (April, 2023 - December, 2023); Business Development, Northeast Region, Wintrust Commercial Finance (August, 2020 - April, 2023); Director, Originations, Northeast & Mid-Atlantic, Truist (July, 2018 - April, 2020. Full Bio:

https://www.linkedin.com/in/shane-butler-3730a69/details/experience/

https://www.linkedin.com/in/shane-butler-3730a69/

Christian Diaz was hired as Senior Vice President, Salesforce Architect, Navitas Credit Corporation. Previously, he was at Amur Financial, Grand Island, Nebraska, starting October, 2017, Salesforce Administrator, promoted October, 2019, Salesforce Solutions Architect, promoted Manager, Technology Development (March, 2022 - June, 2025); Salesforce/Pardot Administrator, United Bank (August, 2015 - October, 2017). Full Bio:

https://www.linkedin.com/in/cristiandiazmba/details/experience/

https://www.linkedin.com/in/cristiandiazmba

Jim Hines was hired as Vice President of Business Development, Univest Capital, Bensalem, Pennsylvania. He is located in Maynard, Massachusetts. Previously, he was Vice President of Business Development, Apex Commercial Capital (January, 2022 - June, 2025); Business Development Manager, Univest Capital, Inc. (March, 2018 - January, 2022). He joined Firestone Financial as Credit Supervisor, May, 2024, promoted Sales Executive, June, 2006, promoted Vice President Sales (August, 2001 - May, 2017); Credit Supervisor (May, 1994 - June, 1996).

https://www.linkedin.com/in/jim-hines

[headlines]

--------------------------------------------------------------

##### Press Release ######################

CapEx Finance Index (CFI) May 2025: Demand Rose

Financial Conditions Remained Healthy

- FORECAST: New business volumes suggest a 0.7% increase in new durable goods orders in May.

- Total new business volume (NBV) rose by $10.3 billion seasonally adjusted among surveyed ELFA member companies, an increase of 3.0% from the prior month.

- NBV year-to-date contracted by 1.2% relative to the same period in 2024.

- Year-over-year, NBV dropped by 3.7% on a non-seasonally adjusted basis.

Leigh Lytle, President and CEO at ELFA

“The May CFI survey confirmed that the equipment finance industry had a good start to 2025. Demand for new equipment picked up in the latest data, particularly at captive businesses, and industry-wide financial conditions remained healthy.

"The May delinquency data was largely unchanged after accounting for an outlier, and losses were stable, both good signs considering the restrictive stance of monetary policy. The slow bite of tariffs may still emerge this summer, and conflict abroad could impact energy prices and supply chains, but the string of solid CFI surveys is yet another clear indication that the equipment finance industry is going to be tough to slow down in 2025.”

New business volumes picked up. New business volumes rose by 3.0% in May from the previous month to $10.3 billion. The increase was nearly exactly in line with the recent two-year trend. New business volumes for small ticket deals were up 17.8%, the fifth consecutive month of double-digit volatility. It was also a nearly complete reversal from the 18.3% decline in the prior month. New volumes grew by 14% at captives and 5.0% at independents from April to May but declined by 3.0% at banks. That contrasts with the recent increase in bank volumes relative to captives and independents. The six-month rolling average of activity at banks as a share of total new volume activity jumped by 7.3 percentage points over the last year. That gain has come at the expense of new deals at captives, where the share of new activity has dropped by a nearly identical 7.3 percentage points.

Employment levels were lower than at the same time last year. The 12-month change in total employment was down 1.2% from May 2024. That’s an eight-tenths improvement from the 2.0% decline that was recorded in April. Employment was up at banks and independents and down at captives.

Credit approvals remained elevated. The overall credit approval rate edged down by four-tenths of a percentage point to 77%. The May rate is the second highest reading in the last two years; the highest was last month at 77.4%. The average approval rate on small ticket items declined by half of a percentage point but also remained near its two-year high.

Financial conditions were largely unchanged. Industry-wide delinquencies rose by more than percentage point, from 1.8% to 2.9%, from April to May. Adjusting for an outlier showed a more modest rise in 30-day aging receivables of around a tenth of a percentage point to 1.9%. Delinquencies for small ticket deals and at independent companies were also impacted. The loss rate was essentially unchanged from April.

David Drury, Senior Vice President and Head of Commercial Specialty Lending, Fifth Third Bank, National Association

"New business activity has been strong for our equipment finance business this year and up significantly from the first five months of 2024 as economic fundamentals that we favor—labor market strength, moderating inflation, easing monetary policy, strong corporate earnings—remain resilient.

“However, we suspect these fundamentals will deteriorate until a clear path forward for global trade is agreed upon by policymakers and businesses alike, and may present headwinds for equipment financing activity in the second half of the year.”

Industry Confidence

The Monthly Confidence Index from ELFA’s affiliate, the Equipment Leasing & Finance Foundation, increased to 58.2 in June, rebounding from tariff pressures after dramatic lows in April and May.

About ELFA’s CFI

The CapEx Finance Index (CFI) is the only real-time dataset that tracks nationwide conditions in the equipment financing industry. The information is compiled from a diversified set of businesses that respond to questions about demand for equipment financing, employment, and changes in financial conditions. The resulting data is organized by institution type, such as banks, captives, and independents, and is classified into overall activity and financing for small ticket equipment and software. The CFI is released monthly from Washington, D.C., generally one day before the U.S. Department of Commerce's durable goods report. More detail on the data and methodology can be found at www.elfaonline.org/CFI.

About ELFA

The Equipment Leasing & Finance Association (ELFA) represents financial services companies and manufacturers in the $1 trillion U.S. equipment finance sector. ELFA’s over 600 member companies provide essential financing that helps businesses acquire the equipment they need to operate and grow. Learn how equipment finance contributes to businesses’ success, U.S. economic growth, manufacturing and jobs at www.elfaonline.org

##### Press Release ######################

[headlines]

--------------------------------------------------------------

Sales Based Financing: Danger Ahead?

By Ken Greene, Leasing News Chief Legal Editor

As many of you know, sales-based financing, colloquially known as merchant cash advance (MCA) financing, is a commercial transaction in which a business is paid a lump sum of cash up front in exchange for a percentage of the business’s future sales or revenue. The MCA defies categorization in many ways. To some, it may seem like a creative form of loan. To others, it is a sale and purchase of assets. This distinction goes beyond splitting hairs. It has important ramifications in states that regulate lending. In particular, in a state like California, which requires licensure for lenders, the difference is critical.

The California Financing Law (CFL) does not contain language which requires that MCA providers be licensed. Some attorneys nonetheless recommend that those providers apply for licenses. Historically, I have not agreed with them. Being a licensee requires a substantial commitment of resources. The application is lengthy, time-consuming and can be expensive to pursue. Licensing comes with obligations, such as restrictions on the lenders and brokers with whom you are permitted to work. The annual reports are cumbersome, and the penalties for failure to file annual reports are severe.

Even without licensing requirements, many states are slowly but surely encroaching on the free hand MCA providers once enjoyed. Irrespective of whether an MCA provider is licensed in California, it must comply with the state’s disclosure rules. The same is true in New York. Utah and Virginia not only require that MCA providers comply with their disclosure laws but require that such providers be licensed.

The bottom line is that this form of alternative financing is receiving much closer scrutiny on the state as well as federal level, by the courts and the legislatures, than ever before. Two recent developments highlight this shift. On April 11, 2025, North Dakota passed House Bill 1127 (Money Brokers Act). The new law requires licensing and places a cap on fees. On June 21, 2025, Texas jumped on the bandwagon, passing a law which prohibits an MCA provider from automatically debiting any merchant in the state unless they have a first position MCA. The new Texas Law also requires disclosures and registration with the state, including disclosing the APR. That means a minimum of 12% of the states in this country are directly regulating MCA providers, including disclosing the APR. This number will almost certainly grow.

The most interesting aspect of the North Dakota law is that it allows the state to designate any financial product as a loan. If other states follow suit, the consequences, including licensing, registration, application of usury laws, greater oversight and other restrictions, will no doubt rock the boat of the MCA provider industry. I am reconsidering my position as to the wisdom of preemptive applying for a CFL license in California.

NORTH DAKOTA HOUSE BILL 1127: https://www.sos.nd.gov/sites/www/files/documents/services/leg-bills/2025-69/house-bills/1127.pdf

TEXAS HOUSE BILL 700: https://capitol.texas.gov/tlodocs/89R/billtext/pdf/HB00700F.pdf#navpanes=0

Ken Greene

Law Office of Kenneth Charles Greene

5743 Corsa Avenue, Suite 208

Westlake Village, California 91362

Tel: 818.575.9095

Fax: 805.435.7464

ken@kengreenelaw.com

www.kengreenelaw.com

[headlines]

--------------------------------------------------------------

37% of Entrepreneurs Plan on Selling

in Next 12 Months Says US Bank

By Bob Coleman, Founder & Publisher

Coleman Report

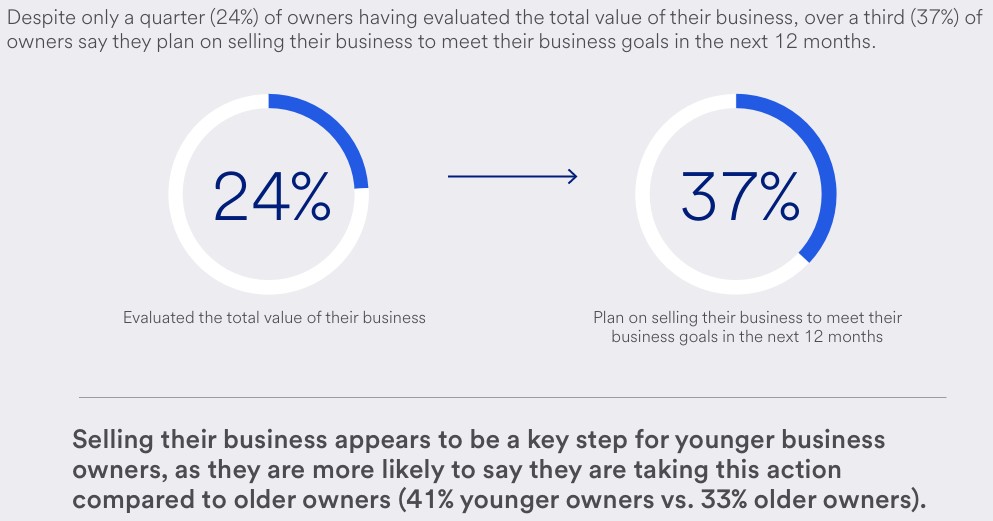

A recent US Bank small business survey offers valuable insights into the mindset of small business entrepreneurs. The survey reveals that developing a strategy for selling their businesses is a top priority for these owners. This focus on exit planning creates significant opportunities for SBA lenders.

Spoiler alert: Those with a succession plan report significant growth over the past year, compared to those without a plan.

US Bank says 37% plan to sell their business in the next 12 months, suggesting how quickly transitions of ownership may be approaching for some businesses. However, owners over 55 who own more than half of small businesses are not the only ones looking to sell. A high number of Gen Z and Millennial owners (41%) and Gen X (33%) say they are also planning to sell their businesses.

The report reveals a striking gap between intention and action. While 85% of surveyed participants say they originally became an owner to create something they could pass on, and 84% wanted to create generational wealth for their family, only 54% have a formal succession plan in place.

A growing number of owners (62%) have seen their retirement timelines accelerate in the past five years. But for many, navigating succession is a challenge:

- 62% find the process overwhelming

- 56% worry they won't get a reasonable price for their business when it's time to sell

- 53% lack the proper resources or guidance to plan for the future of their business

The need for small business owners to make long-term plans is reinforced by the day-to-day worries they are facing. Respondents reported their top macroeconomic stressors as:

- The economic environment (98%)

- Inflation or increased costs of materials / supplies (92%)

- Competition (92%)

- The ability of consumers to maintain their spending (86%)

- Fraud or cyber security threats (85%)

- Obtaining enough funding to support my business (84%)

Among other stressors, 4 out of 5 (81%) owners felt at least somewhat stressed about tariffs.

Despite these stressors, 96% of owners reported their business as currently successful and 88% saw growth in the past year. To manage pressures and position their businesses for the future, many owners are prioritizing key steps in the year ahead, including focusing on revenue (48%), ensuring enough staff (33%), improving company efficiency and cost-effectiveness (32%), and reacting to the general economic landscape such as inflation and recession risk (29%).

[headlines]

--------------------------------------------------------------

Leasing and Finance Help Wanted

Balboa Capital

We Are Growing Our Senior Sales Team Now

Maxim Commercial Capital, LLC

Looking for Chief Operating Officer

[headlines]

--------------------------------------------------------------

Increasing Productivity

By Scott Wheeler, CLFP

Top originators in the commercial equipment finance and leasing industry focus exclusively on activities that produce meaningful results. They eliminate busy work and concentrate on transactions, relationships, and initiatives that are likely to be approved and funded.

While most originators agree this is the objective, only top performers execute consistently—by identifying, soliciting, and cultivating relationships with vendors and end-users who have both the capability and willingness to submit high-quality transactions that align with the originator’s strengths.

Recently, I asked two originators a simple but revealing question: “What must be true for you to achieve a 90% approval ratio and a 90% funding-to-approval ratio?”

Originator #1 responded by suggesting that his credit department needed to “open the credit window” and that management should become “more aggressive in pricing.” This is the same answer underperformers have given for four decades. It's the answer of someone who doesn’t fully understand how our industry generates revenue or builds sustainable value. It reflects a prospecting strategy built on randomness rather than precision—a lack of alignment between their own capabilities and the attributes of quality opportunities in today’s market.

Originator #2, by contrast, answered with clarity and confidence. She explained that she identifies the characteristics of vendors and end-users that fit her criteria for success. She always conducts a comprehensive prequalification of prospects and spends her time only on transactions that align with her funding capabilities. She knows what deals are worth her time and effort. Using real-time data, she targets vendors and end-users who can truly benefit from her services—and then pursues their business with intention and urgency. She never apologizes for her pricing because she knows her market, understands her value, and believes that her services are the best available for the types of transactions she supports.

In 2025, data and efficiency are no longer optional—they are the driving forces behind successful sales and marketing efforts. Top originators are leveraging real-time insights, targeted outreach, and streamlined processes to significantly increase their results. By focusing on precision, they’re closing more transactions, faster, and with higher approval and funding ratios.

Scott A. Wheeler, CLFP

Wheeler Business Consulting

1314 Marquis Ct.

Fallston, Maryland 21047

Phone: 410 877 0428

Fax: 410 877 8161

Email: scott@wheelerbusinessconsulting.com

Web: www.wheelerbusinessconsulting.com

[headlines]

--------------------------------------------------------------

[headlines]

--------------------------------------------------------------

##### Press Release ######################

New Foundation Report Examines the Healthcare Sector

and Opportunities for the Equipment Finance Industry

Washington, DC, June 24, 2025 – The healthcare sector—a critical component of the U.S. economy that accounted for 17.6% of the country’s GDP in 2023—is the focus of a new study, “Vertical Market Outlook Series: Healthcare,” released today by the Equipment Leasing & Finance Foundation (Foundation). Among the wide-ranging data and analysis, the study reveals that about one-third of healthcare executives identify technology investments as a priority for 2025; however, 94% of healthcare administrators say they foresee buying less equipment or delaying upgrades to mitigate financial strain from tariffs.

The study provides an overview of the U.S. healthcare vertical with a focus on healthcare providers, and addresses topics including macroeconomic factors, technological innovations, and challenges that will impact the sector. It is the 12th release of the Foundation’s forward-looking Vertical Market Outlook Series designed to help readers recognize and understand opportunities and challenges that may affect their businesses.

“The new Foundation study reveals that the key themes running through every aspect of healthcare are cost and technology, which align with the focus of equipment finance providers,” said Will Tefft, Equipment Manager – EverBank Corporate Asset Finance and Foundation Trustee and Research Committee Member. “These findings can be a resource for our industry as we plan for strategic growth in this rapidly evolving sector.”

The report was commissioned by the Foundation and prepared by global advertising, technology, and data company Big Village, which also produced the previous studies in the Vertical Market Outlook Series. The new study presents data and research from a variety of sources, and examines a range of issues, including:

- Healthcare market size and future growth

- Macroeconomic environment:

- Demographics

- Labor

- Financing/funding/delivery models

- Market dynamics and trends:

- Factors impacting expenditures

- M&A/consolidation/private equity

- Equipment acquisition

- Productivity and profitability

- Supply chain

- Role of technology

Download the full report at https://www.leasefoundation.org/industry-resources/vertical-outlook

##### Press Release ######################

[headlines]

--------------------------------------------------------------

News Briefs

Why Factories Are Having Trouble Filling

Nearly 400,000 Open Jobs

https://www.nytimes.com/2025/06/23/business/factory-jobs-workers-trump.html

At Amazon’s Biggest Data Center, Everything

Is Supersized for A.I.

https://www.nytimes.com/2025/06/24/technology/amazon-ai-data-centers.html

As countries race to power artificial intelligence,

a yawning gap is opening around the world.

https://www.nytimes.com/interactive/2025/06/23/technology/ai-computing-global-divide.html

A Fight Between Cable and Wireless Providers

Means Cheaper Home Internet for You

https://www.wsj.com/business/telecom/a-fight-between-cable-and-wireless-providers-means-cheaper-home-internet-for-you-b36cc086?mod=business_lead_pos4

Toys are getting pricier as tariffs kick in

https://www.washingtonpost.com/business/2025/06/24/toy-prices-tariffs-inflation/

Themselves Underwater

https://www.wsj.com/economy/housing/underwater-mortgages-negative-equity-charts-4e5978a1?st=z1nkTw&reflink=desktopwebshare_permalink

[headlines]

--------------------------------------------------------------

Strike Set Back Iran’s Nuclear Program

by Only a Few Months, U.S. Report Says

https://www.nytimes.com/2025/06/24/us/politics/iran-nuclear-sites.html

[headlines]

--------------------------------------------------------------

Sports Briefs---

Players, fans at Club World Cup coping with

high temperatures as heat wave hits US

https://www.pressdemocrat.com/article/sports/players-fans-at-club-world-cup-coping-with-high-temperatures-as-heat-wave/

[headlines]

--------------------------------------------------------------

![]()

California News Briefs---

Intel, Walmart, other tech companies reveal

500-plus Bay Area job cuts

https://www.mercurynews.com/2025/06/24/economy-tech-jobs-layoff-intel-walmart-work-south-bay-chip-internet/

Developer buys Saratoga vineyard where it plans hundreds

of homes More than 200 homes are eyed on vineyard site

https://www.mercurynews.com/2025/06/23/saratoga-home-build-house-south-bay-economy-real-estate-develop/

Santa Clara County Assessor Larry Stone resigns

(Extremly Popular/Accomplish Quite a Lot)

https://sanjosespotlight.com/santa-clara-county-assessor-larry-stone-resigns/

[headlines]

--------------------------------------------------------------

Gimme that Wine

![]()

http://www.youtube.com/watch?v=EJnQoi8DSE8

2025 Wine Spectator Restaurant Award Winners Revealed

https://www.winespectator.com/articles/restaurant-awards-reveal-2025

Penfolds’ projected slowdown

https://winetitles.com.au/penfolds-projected-slowdown/

Francis Ford Coppola Winery hit by layoffs as its Rustic restaurant ends dinner service, employees say

https://www.pressdemocrat.com/article/lifestyle/coppola-winery-layoffs/

[headlines]

----------------------------------------------------------------

![]()

This Day in History

https://leasingnews.org/archives/Jun2017/06_23.htm#history

-------------------------------------------------------------

SuDoku

The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler?

--------------------------------------------------------------

Daily Puzzle

How to play:

http://www.setgame.com/set/puzzle_frame.htm

Refresh for current date:

http://www.setgame.com/set/puzzle_frame.htm

--------------------------------------------------------------

http://www.gasbuddy.com/

http://www.gasbuddy.com/GB_Map_Gas_Prices.aspx

http://www.gasbuddy.com/GB_Mobile_Instructions.aspx

--------------------------------------------------------------

Weather

See USA map, click to specific area, no commercials

--------------------------------------------------------------

Traffic Live---

Real Time Traffic Information

You can save up to 20 different routes and check them out with one click,

or type in a new route to learn the traffic live

--------------------------------

Wordle

https://www.powerlanguage.co.uk/wordle/

How to Play

https://www.today.com/popculture/popculture/wordle-know-popular-online-word-game-rcna11056

![]()