Information, news, and entertainment for the commercial

alternate financing,

bank, finance and leasing industries

Subscribe

| Search | All Lists | Site Map

Conferences/Forums |

Advertising | Archives | Columnists

Don’t take the bait on phishing scams |Top Ten Stories Chosen by Readers

Contact: kitmenkin@leasingnews.org

![]()

Friday, June 27, 2025

Today's Leasing News Headlines

New Hires/Promotions in the Leasing Business

and Related Industries

Sales Based Financing: Louisiana

By Ken Greene, LN Chief Legal Editor

SFNet Releases Q1 2025 Asset-Based Lending

and Confidence Indexes

Leasing/Finance Help Wanted

Balboa Capital, Several Openings

Maxim Commercial Capital

Looking for Chief Operating Officer

Time Management

By Scott Wheeler, CLFP

The Salesperson Who Gets No Respect

By Dan Harkey

Boardroom vs. Battlefield

How Elite Leaders Lead in Crisis

By Ken Lubin, ZRG Partners, Managing Director

News Briefs---

Chainlink and Mastercard Partner to Enable Over 3 Billion

Cardholders to Purchase Crypto Directly Onchain

Ford’s First-Quarter Profit Drops 64%;

Suspends Outlook

Key Medicaid provision in Trump’s bill violates

Senate rules. The GOP is scrambling

The Trump administration wants crypto

to help you get a mortgage

Teamsters complain UPS slow to deploy

air-conditioned vehicles

Builders shrinking home sizes to keep prices

in check, experts say

Blackstone Buys Another $2 Billion in Discounted

Commercial Real-Estate Loans

You May Have Missed ---

New Yorkers Vote to Make Their

Housing Shortage Worse

Sports Briefs

California News

"Gimme that Wine"

This Day in History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

Wordle

######## surrounding the article denotes it is a press release, it was not written by Leasing News nor has the information been verified, but from the source noted. When an article is signed by the writer, it is considered a byline. It reflects the opinion and research of the writer.

[headlines]

--------------------------------------------------------------

New Hires/Promotions in the Leasing Business

and Related Industries

JP Camire, Vice President of Sales,

https://www.linkedin.com/in/jp-camire-65a953a/

David Palumbo, starting a new position as Vice President - Sales, Technology Market at Civista Bank. Previously at First Citizens Bank

https://www.linkedin.com/in/david-palumbo-0113442

[headlines]

--------------------------------------------------------------

Sales-Based Financing: Louisiana

By Ken Greene, Leasing News Chief Legal Editor

In my last article, I noted an unsettling national trend to treat sales-based finance transactions (aka merchant cash advances or revenue-based financing) as loans. With its House Bill 470 (text below), Louisiana has taken the bold step of pushing back on what I personally consider to be an improper characterization of this form of alternative financing. This bill, which was signed by the Louisiana governor on June 8, 2025, will become effective on August 1.

HB470 is largely a disclosure bill. However, the prefatory language should be comforting to the MCA providers throughout the country. It reflects a marked departure from new laws in Texas and North Dakota, and older laws in California, New York, Utah and Virginia, which seem to be leaning towards treating these purchase and sale transactions as if they are loans and requiring APR.

The prefatory language states:

(2) For the purposes of this Chapter, a "revenue-based financing transaction" is not a transaction for the use, forbearance, or detention of money.

This means that, at least in Louisiana, these transactions are not considered loans.

The new disclosure laws which are guided by that determination seem eminently reasonable given that underlying principle. The disclosures that will be required include:

1. The total amount of funds to be provided;

2. The total amount of funds to be disbursed (if less than #1);

3. The total amount to be repaid to the provider;

4. The manner, frequency and amount of each payment; and

5. Any prepayment costs or discounts.

The disclosures must be provided at or before the consummation of the transaction. No disclosure is required for a modification, forbearance or change to a consummated revenue-based transaction.

This should come as a welcome relief to MCA providers nationwide, although it is difficult to gauge the degree of influence that a law from Louisiana will have on the rest of the country, since Louisiana has long been known for marching to the beat of a different drummer in so many ways. Its laws and customs are quite different from other states. Only time will tell!

House Bill 470: https://www.counselorlibrary.com/library/alerts/alerts_06162025020624_611.pdf

Ken Greene

Law Office of Kenneth Charles Greene

5743 Corsa Avenue, Suite 208

Westlake Village, California 91362

Tel: 818.575.9095

Fax: 805.435.7464

ken@kengreenelaw.com

www.kengreenelaw.com

[headlines]

--------------------------------------------------------------

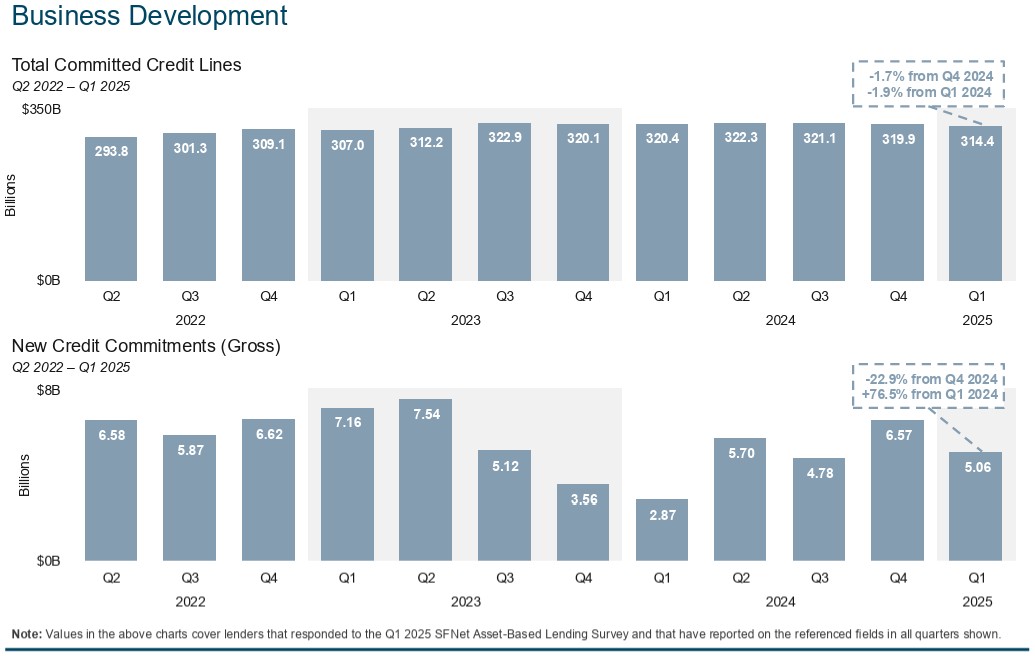

SFNet Releases Q1 2025 Asset-Based Lending

and Confidence Indexes

Quarterly Survey Finds Slipping Confidence Among Bank and Non-Bank Lenders

The Secured Finance Network (SFNet) recently released its Q1 2025 Asset-Based Lending Index and Lender Confidence Index, offering a snapshot of how the industry weathered recent trade policy volatility during the first quarter of this year.

According to the Q1 index, both bank and non-bank lenders saw lender confidence fall to neutral territory. The confidence of banks dropped 14.1 points to 49.1, while non-banks slid 12.5 points to 52.5, a sizable decline that is comparable to the drop in confidence in the first quarter of 2020.

SFNet CEO Rich Gumbrecht, said, "Substantial changes in trade policy have played a pivotal role in shaping U.S. economic activity in early 2025, and the resulting distortions have complicated efforts to clearly assess the economy’s true performance.“

The first quarter of 2025 was a relatively quiet one for banks and non-banks:

- Total commitments for banks fell 1.7%; total commitments for non-banks fell 2.2%

- New outstandings for banks rose 9.8%; new outstandings for non-banks plunged 57.4%

“New outstandings” refers to new amounts of money that a borrower has drawn or borrowed under the ABL facility during a specific period. The sharp difference between outstandings for banks and non-banks stems from the timing of when new deals will be available in the non-bank world, and many rely on deals from banks which didn’t materialize.

Bank portfolio performance was mixed in the first quarter. Non-accruals rose but remained within their historical range and write-offs were muted, but criticized loans – which have elevated credit risk – as a share of outstandings edged down 180 basis points. Credit performance within the ABL industry has typically been strong and is slowly returning to pre-pandemic levels.

Non-bank portfolio performance was mostly stable. Criticized loans and non-accruals climbed higher but write-offs improved, declining as a share of outstandings.

Gumbrecht observed, “Although signs point to a slowdown in economic activity and ABL lenders expect both business conditions and portfolio performance to decline, the industry’s strong historical performance during past downturns provides confidence that lenders are well-prepared to navigate potential challenges ahead.”

The Q1 2025 Asset-Based Lending Index and Lender Confidence Index are based on survey data from leading bank and non-bank lenders. Full quarterly and annual data reports are available at: SFNet Asset-Based Lending & Factoring Surveys.

About Secured Finance Network

Founded in 1944, the Secured Finance Network (formerly Commercial Finance Association) is an international trade association connecting the interests of companies and professionals who deliver and enable secured financing to businesses. With more than 1,000 member organizations throughout the US, Europe, Canada and around the world, SFNet brings together the people, data, knowledge, tools and insights that put capital to work. For more information, please visit: www.sfnet.com

[headlines]

--------------------------------------------------------------

Leasing and Finance Help Wanted

Balboa Capital

We Are Growing Our Senior Sales Team Now

Maxim Commercial Capital, LLC

Looking for Chief Operating Officer

[headlines]

--------------------------------------------------------------

Time Management

By Scott Wheeler, CLFP

Originators throughout the commercial equipment finance and leasing industry (newcomers and veterans) continue to ask the following questions:

- What equipment sector has the greatest potential?

- How do I find a strong prospect list?

- What activities are most productive?

- How many prospect calls should I make in a day?

- How can I increase my production numbers?

My answer remains the same. "It depends on you and how you are efficiently using your time to be most productive."

Much can be accomplished in a 40-hour week when originators are fully engaged with both vendors and end-users. I have often witnessed originators significantly improve their production trajectory in just thirty or sixty days, when they focus on success and give 100% effort every day.

- The best equipment sectors are those that an originator knows the most about based upon her own research, experiences, and passion.

- The best prospect lists are ones that an originator develops herself based upon her own research.

- Any activity that put an originator in direct contact with a decision maker is an activity worth pursuing.

- The number of calls made is not as important as the quality of calls made.

- Originators control their own destiny by using their time efficiently and wisely. Time is money.

Scott A. Wheeler, CLFP

Wheeler Business Consulting

1314 Marquis Ct.

Fallston, Maryland 21047

Phone: 410 877 0428

Fax: 410 877 8161

Email: scott@wheelerbusinessconsulting.com

Web: www.wheelerbusinessconsulting.com

[headlines]

--------------------------------------------------------------

The Salesperson Who Gets No Respect

By Dan Harkey

I am sure that most of you remember Rodney Dangerfield, the American stand-up comedian, actor, producer, screenwriter and author. He became known for his self-depreciating one liner humor. He became famous for his humor about “I don’t get no respect.” A couple of his lines were pretty good.

“My wife and I were happy for twenty years, then we met.” “I get no respect. The way my luck is running, if I was a politician, I would be honest,” “My psychiatrist told me I was crazy, and I said I want a second opinion. He said okay, you’re ugly too.”

How does this relate to a salesperson? When the salespeople are occasionally treated with disrespect and indignity, they should be thankful that they have the option of eliminating the lead or discontinuing active marketing. I call it the big “D” for delete. Yes, delete, de-link, de-friend, poof that they no longer exist in my world.

The salesperson has 3 kinds of lead interfaces:

- The salesperson works diligently over a period to develop many relationships where the person(s) becomes mutually familiar and appears pleased to hear from you. Familiarity, mutual trust, concern, and kindred values help grow the relationships. Periodic personal contact is a must. The business motive is to develop ongoing friendships and mutual respect where you have a high probability of referring business back and forth.

- The salesperson may follow up leads where the person on the receiving end will take the calls and be pleasant, willing to develop the familiar part and the friendship part, but somehow never find him or herself in a position to deliver business nor reciprocal referrals. The salesperson’s awareness of this type of lead will be proven out over time by multiple calls without result. But if you are soliciting or communicating with someone who may or may not have in interest or have other clients who can benefit from your services, the business motive should be understood. This type of lead should be marketed digitally, such as email, direct mail, online presence such as LinkedIn, Facebook and similar media but should be eliminated as a personal contact. The time spent following up personally is limited and should be coveted.

- The salesperson may follow up leads by direct contact which is short, disrespectful, or condescending. When his occurs, the salesperson should give them another chance in case they just bad a bad day. It is best to send them an email which says something like this. “Thank you for taking my call this morning. In our very short conversation, it appeared that you had little interest in hearing from me. Would it be appropriate that I do not contact you personally in the future?”

Based upon the response, you have the option of continuing to call them with a periodic direct call, keeping them in your marketing database for email, LinkedIn, Facebook and other media that do not require personal contact. Of course, the last option is the big “D”?

Dan Harkey

Business and Private Money Finance Consultant

949 533 8315

dan@danharkey.com

[headlines]

--------------------------------------------------------------

Boardroom vs. Battlefield: How Elite Leaders Lead in Crisis

By Ken Lubin, ZRG Partners

To all those in the trenches:

Markets shift. Teams fracture. Pressure builds. And in those moments, the difference between good leaders and great ones becomes blindingly clear.

Over the last 25 years in executive search, I’ve watched elite operators step into chaos with clarity, calm, and command—while others crumble under indecision and noise.

I put together this weekly playbook on what separates the top 1% in high-stakes moments:

Default to Decision – Why speed and clarity beat consensus

Own the Room Without Needing It – Presence over posturing

Operate From Reality – The end of wishful thinking

Make the First Cut – Lead through the pain, not around it

Protect Energy Like Capital – Build stamina like a system

This isn’t theory. It’s the real playbook used by top execs who build through the storm—not just after it.

The 5 Mindset Shifts Elite Leaders Make in a Crisis PDF

If you're navigating a pivot, a downturn, or just carrying more than most know—this one's for you.

Ken Lubin

Managing Director

ZRG Partners, LLC

Americas I EMEA I Asia Pacific

C: 508-733-4789

klubin@zrgpartners.com

https://www.linkedin.com/in/klubin/

klubin@zrgpartners.com

[headlines]

--------------------------------------------------------------

News Briefs

Chainlink and Mastercard Partner to Enable Over 3 Billion

Cardholders to Purchase Crypto Directly Onchain

https://www.prnewswire.com/news-releases/chainlink-and-mastercard-partner-to-enable-over-3-billion-cardholders-to-purchase-crypto-directly-onchain-302489729.html

Ford’s First-Quarter Profit Drops 64%;

Suspends Outlook

https://www.wsj.com/business/earnings/ford-motor-f-q1-earnings-report-2025-c2bc1c6c?mod=business_feat3_earnings_pos3

Key Medicaid provision in Trump’s bill is found to violate

Senate rules. The GOP is scrambling.

https://www.bostonglobe.com/2025/06/26/business/medicaid-provision-violate-senate/

The Trump administration wants crypto

to help you get a mortgage

https://www.washingtonpost.com/business/2025/06/26/crypto-mortgage-fannie-freddie/

Teamsters complain UPS slow to deploy

air-conditioned vehicles

https://www.freightwaves.com/news/teamsters-complain-ups-slow-to-deploy-air-conditioned-vehicles?oly_enc_id=7354E3969723H7B

Builders shrinking home sizes to keep prices

in check, experts say

https://www.mercurynews.com/2025/06/26/builders-shrinking-home-sizes-to-keep-prices-in-check-experts-say/

Blackstone Buys Another $2 Billion in Discounted

Commercial Real-Estate Loans

https://www.wsj.com/finance/banking/blackstone-buys-another-2-billion-in-discounted-commercial-real-estate-loans-d2c20b66?st=fp6xf7&reflink=desktopwebshare_permalink

[headlines]

--------------------------------------------------------------

New Yorkers Vote to Make Their Housing Shortage Worse

https://www.wsj.com/economy/housing/nyc-mayor-election-housing-costs-c1f88bcb?st=CX31EG&reflink=desktopwebshare_permalink

[headlines]

--------------------------------------------------------------

Sports Briefs---

Players, fans at Club World Cup coping with

high temperatures as heat wave hits US

https://www.pressdemocrat.com/article/sports/players-fans-at-club-world-cup-coping-with-high-temperatures-as-heat-wave/

[headlines]

--------------------------------------------------------------

![]()

California News Briefs---

Seniors are the fastest-growing age group in the San

Francisco Bay Area, and nationwide

https://www.mercurynews.com/2025/06/25/seniors-are-the-fastest-growing-age-group-in-the-bay-area-and-nationwide/

Looming sale of SF's biggest hotel could make

or break San Francisco city tourism

https://www.sfgate.com/travel/article/sf-hotels-starting-rebound-then-came-second-trump-20390534.php

'Heartbroken': Chz-TJ-Bay Area restaurant stripped of

Michelin star after 19 years

https://www.sfgate.com/food/article/bay-area-restaurant-chez-tj-loses-

[headlines]

--------------------------------------------------------------

Gimme that Wine

![]()

http://www.youtube.com/watch?v=EJnQoi8DSE8

Off-Premise Sales of $20-$24.99 Price Tier Most Resilient

https://www.winebusiness.com/news/article/304615

The 12th Annual WineaPAWlooza Raises $1,302,000

to Support Animal Welfare

https://www.winebusiness.com/news/article/304715

Oregon wine country hit by immigration raids

https://www.decanter.com/wine-news/oregon-wine-country-hit-by-immigration-raids-559706/

U.S. wine and spirits off the menu long-term for

majority of Canadian drinkers: report

https://www.theglobeandmail.com/life/food-and-wine/article-us-wine-and-spirits-off-the-menu-long-term-for-majority-of-canadian/

Petaluma’s Griffo Distillery wins ‘America’s

Greatest London Dry Gin’ award

https://www.pressdemocrat.com/article/lifestyle/london-dry-gin-griffo-distillery/

15 Sonoma Wineries With Gorgeous Gardens

https://www.sonomamag.com/15-sonoma-wineries-with-gorgeous-gardens/?utm_id=a2l0bWVua2luQGdtYWlsLmNvbQ==[headlines]

----------------------------------------------------------------

![]()

This Day in History

https://leasingnews.org/archives/Jun2017/06_23.htm#history

-------------------------------------------------------------

SuDoku

The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler?

--------------------------------------------------------------

Daily Puzzle

How to play:

http://www.setgame.com/set/puzzle_frame.htm

Refresh for current date:

http://www.setgame.com/set/puzzle_frame.htm

--------------------------------------------------------------

http://www.gasbuddy.com/

http://www.gasbuddy.com/GB_Map_Gas_Prices.aspx

http://www.gasbuddy.com/GB_Mobile_Instructions.aspx

--------------------------------------------------------------

Weather

See USA map, click to specific area, no commercials

--------------------------------------------------------------

Traffic Live---

Real Time Traffic Information

You can save up to 20 different routes and check them out with one click,

or type in a new route to learn the traffic live

--------------------------------

Wordle

https://www.powerlanguage.co.uk/wordle/

How to Play

https://www.today.com/popculture/popculture/wordle-know-popular-online-word-game-rcna11056

![]()