|

|

|

|

|

|

|

Account Executives to work from our corp. office Aliso Viejo, CA. Exper. only, aggressive, 4 yr college degree required. Lucrative uncapped commission plan/environment conductive to success. To learn more, click here. |

Friday, June 17, 2005

Headlines---

Classified Ads—Collector/Controller/Contract Admin.

CIT Small Business Outlook Reaffirms Resiliency

Federal Reserve Beige Report on Economy-12 Dist.

Dash in Norfolk, Virginia

Classified Ads--Help Wanted

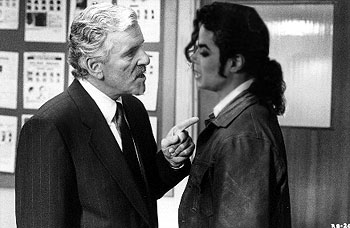

Sal Maglietta with Michael Jackson

August 3rd, Costa Mesa, Ca. Broker Workshop

Petropulos Joins Orix Equip. Fin. Group

Leaseurope Ranking of Top European Leasing Companies

Boullioun Aviation Services to Aviation Capital Group

Siemens Financial Services Study USA/Europe

Genesys/Finance Express Auto Finance Program

De Lage Landen adds Public Finance Capabilities

News Briefs---

Sports Brief--

"Gimme that Wine"

Top Event in Today's History

This Day in American History

Baseball Poem---Tim Peeler

######## surrounding the article denotes it is a “press release”

|

----------------------------------------------------------------

Classified Ads—Collector/Controller/Contract Admin.

Collector

Boston, MA.

Challenging position where my skills, professional experience, organization, leadership, strategic thinking, creativity, energy, passion, competitive nature will enable me to define opportunities and personal development.

Email: bernd.janet@verizon.net

Jacksonville, East Brunswick, FL.

13 years experience with collection, recovery, re-marketing and legal on commercial loans and leases. Expertise with distressed portfolios, Six Sigma trained. Willing to relocate.

Email: RichardB12364@aol.com

Controller

Seattle, WA

CPA w/ Sarbanes Oxley/ 15 years management exp. as CFO/ Controller/5 yrs w/ PWC Extensive exp providing accounting/ tax guidance for the equipment lease industry. Willing to relocate.

Email: bltushin@hotmail.com

Southeastern, MI.

Controller & Management experience w/ equip lessors &broker. MBA, CPA w/ extensive accounting, management, securitization experience with public and private companies. Willing to relocate.

Email: Leasebusiness@aol.com

Contract Administrator

New York, NY.

10+ years in equipment leasing/secured lending. Skilled in management & training, documentation, policy and procedure development & implementation, portfolio reporting. Strong work ethic.

Email: dln1031@nyc.rr.com

Portland, OR.

6+ years small ticket leasing/financing. Documentation/funding Policy development &implementation, management &training, process mapping, customer service, broker, vendor, portfolio experience.

Email: susanc777@hotmail.com

For all “job wanted” ads please go here:

http://64.125.68.91/AL/LeasingNews/JobPostings.htm

To place your free “job wanted” ad, please go here:

http://64.125.68.91/AL/LeasingNews/PostingFormWanted.asp

-----------------------------------------------------------------

#### Press Release #####################

CIT Small Business Outlook Reaffirms Resiliency in Small Business Sector

Small Businesses are Challenged by Rising Healthcare Costs

NEW YORK, -- Nearly 70 percent of small businesses have performed well over the past 12 months, in comparison with the U.S. economy, according to the third edition of the CIT Small Business

Outlook, a nationwide survey conducted jointly by CIT Group Inc. (NYSE: CIT) and BusinessWeek Research Services.

The survey also found that small business owners and executives continue to have an optimistic outlook for the future success of their own businesses for the second consecutive year.

"The positive responses expressed in the CIT Small Business Outlook confirm the resiliency of the U.S. small business market," said Tom Hallman, Vice Chairman of CIT's Specialty Finance group. "In fact, a significant number of decision makers at small businesses believe this is a good time to invest in their organizations. The level of confidence demonstrated by America's entrepreneurs is a strong signal that small businesses will continue to help fuel U.S. economic growth."

The semi-annual survey provides insightful information about the current state of small business in the United States. Highlights of this survey include:

* 85% of small businesses expect their 2005 gross annual sales to be higher than their 2004 revenue

* 75% believe that this is a good time for companies to invest in their organizations

* 64% expect that the reason for their increased revenue will be the addition of new accounts and customers

* 42% expect to increase revenue by expanding into new markets or customer bases

* 57% are confident about the future of the U.S. economy

Sales growth is a top priority for half of small businesses in 2005, but managing healthcare is also important. The results of CIT Small Business Outlook provide an in-depth look at current and future healthcare issues facing this business segment and the overall climate of small businesses.

Three out of four small businesses (75%) provide some type of health benefits to their employees and almost eight in ten believe that their benefits are as good, or better, than the benefits offered by larger companies. Although these benefits are costly, 44 percent of small businesses feel that their businesses are growing fast enough to support these costs. However, 82 percent of small businesses have difficulty dealing with insurance companies' administration and bureaucracy.

Additional significant findings include:

* Less than one-third of small businesses transfer the healthcare burden onto their employees by increasing deductibles (32%), increasing employee contributions (29%), reducing healthcare benefits (21%), reducing the number of employees (7%), or reducing other benefits (6%)

* 39% proactively manage healthcare costs by fostering a safe and healthy workplace

* 56% plan for the rising costs of healthcare

* 37% consider universal healthcare benefits is the best solution to long-term healthcare cost concerns

Many small businesses effectively manage their healthcare benefits, but small business leaders foresee major challenges on the horizon. Sixty percent of survey respondents believe that healthcare costs may damage the growth of the U.S. economy and more than half expect healthcare price increases to outpace their budgets within the next five years.

"As a leading provider of loans to small businesses, we understand the issues that small businesses face," stated John Canning, President of CIT Small Business Lending Corporation. "Notwithstanding the current healthcare issues, the small business sector continues to remain strong and plays a powerful role in the U.S. economy."

About the CIT Small Business Outlook

The third phase of the CIT Small Business Outlook continued to monitor issues that were explored in the first two phases of the CIT Small Business Outlook, such as current and future business conditions, spending and investment intentions and sales revenues. This study also focused on current and future healthcare issues for small businesses. The Outlook, conducted jointly by CIT and BusinessWeek Research Services, collected responses from a

sample of 453 companies nationwide with approximately 5 to 100 employees and revenues of $15 million or less. The study participants represent more than 40 types of businesses and industries, with a high concentration in consulting services, information technology, healthcare pharmaceuticals, publishing, financial services, real estate, manufacturing, and construction.

About CIT Small Business Lending

CIT Small Business Lending Corporation, a business unit of CIT Specialty Finance, offers Small Business Administration (SBA) loans to finance business acquisitions, owner-occupied real estate purchases and franchise and medical and professional practice start-ups through a network of field representatives. The nation's No. 1 SBA lender, CIT Small Business Lending Corporation has been designated a "Preferred Lender" by the SBA and can provide quick credit decisions and loan closings. The company's website and online SBA loan application are located at http://www.smallbizlending.com.

About CIT

CIT Group Inc. (NYSE: CIT), a leading commercial and consumer finance company, provides clients with financing and leasing products and advisory services. Founded in 1908, CIT has nearly $60 billion in assets under management and possesses the financial resources, industry expertise and product knowledge to serve the needs of clients across approximately 30 industries. CIT, a Fortune 500 company and a component of the S&P 500, holds leading positions in vendor financing, factoring, equipment and transportation financing, Small Business Administration loans, and asset-based lending. CIT,

with its principal offices in New York, New York, and Livingston, New Jersey, has approximately 6,000 employees in locations throughout North America, Europe, Latin and South America, and the Pacific Rim. For more information, visit http://www.cit.com.

About BusinessWeek Research Services

BusinessWeek Research Services (BWRS) is the custom marketing research division of BusinessWeek with more than 50 years of combined experience. This group of research experts regularly conducts primary research studies for established companies including technology and financial clients as well as leading agencies. For more information about BWRS, please contact Chris Rogers at Chris_Rogers@businessweek.com.

SOURCE CIT Group Inc.

#### Press Release #####################

Federal Reserve Beige Report---12 Districts

''Reports from all 12 Federal Reserve districts indicated that business activity continued to expand," according to the survey released yesterday in Washington. ''Labor market conditions continued to improve in most districts and several reports cited difficulty in finding specific types of workers."

The survey, called the beige book because of the color of its cover, suggests the economy is growing in most industries and in all regions without spurring faster inflation. Federal Reserve chairman Alan Greenspan told Congress on June 9 that the United States is on a ''firm footing and underlying inflation remains contained."

''There's very little inflationary pressure building," said Ross DeVol, an economist for the Milken Institute in Santa Monica, Calif., in an interview. ''There's nothing out there to cause the Fed alarm."

Most districts ''characterized the pace of expansion as moderate, solid or well-sustained," the report said.

The Boston Fed reported that economic growth continued in the region, although some sectors lagged behind the overall pace. Retailers cited healthy sales increases. Sales of lumber and hardware were especially strong as the housing boom continued. Many manufacturers, however, described business as merely OK, if not disappointing. Manufacturers remain concerned about high costs for raw materials.

Retail activity was mixed. Several Districts reported disappointing May retail sales results and cited unseasonable weather as the principal reason. A few reports mentioned that high gasoline prices were having a negative impact on sales.

Reports on residential real estate markets remained quite positive overall, although some slowing in activity was noted in a few markets.For most Districts reporting on financial services, the demand for loans either increased or remained solid.

Labor market conditions continued to improve in most Districts, and several reports cited difficulty finding specific types of workers.

Summary Report available here:

http://www.federalreserve.gov/FOMC/BeigeBook/2005/20050615/default.htm

Boston

www.federalreserve.gov/FOMC/BeigeBook/2005/20050615/1.htm

New York

www.federalreserve.gov/FOMC/BeigeBook/2005/20050615/2.htm

Philadelphia

www.federalreserve.gov/FOMC/BeigeBook/2005/20050615/3.htm

Cleveland

www.federalreserve.gov/FOMC/BeigeBook/2005/20050615/4.htm

Richmond

www.federalreserve.gov/FOMC/BeigeBook/2005/20050615/5.htm

Atlanta

www.federalreserve.gov/FOMC/BeigeBook/2005/20050615/6.htm

Chicago

www.federalreserve.gov/FOMC/BeigeBook/2005/20050615/7.htm

St. Louis

www.federalreserve.gov/FOMC/BeigeBook/2005/20050615/8.htm

Minneapolis

www.federalreserve.gov/FOMC/BeigeBook/2005/20050615/9.htm

Kansas City

www.federalreserve.gov/FOMC/BeigeBook/2005/20050615/10.htm

Dallas

www.federalreserve.gov/FOMC/BeigeBook/2005/20050615/11.htm

San Francisco

www.federalreserve.gov/FOMC/BeigeBook/2005/20050615/12.htm

Full Report:

www.federalreserve.gov/FOMC/BeigeBook/2005/20050615/FullReport.htm

----------------------------------------------------------------

Dash in Norfolk, Virginia

The above picture was taken when Dash graduated the Great Lakes Naval Training School. I like it because it shows him with his arm around me. To you who still have a father alive, let me tell you that is the best Father's Day present you can give: put you arm around him and let him know how much you love and appreciate him.

Dash is going back to the waters of Kuwait in a special unit, something he volunteered for. Here is part of a message he sent from Norfolk, Virginia:

“I've got a lot of training ahead...definitely in the military here(lol)!

“...currently I'm in charge of my new boat unit ... #42 that's my crew #42. we are under Coastal Warfare , Squadron 4.. we are soo new no one knows anything about it.

“It is funny. My crew is made of 8 crackerjack sailors...die hard guys...

“We will be "Brown Water Sailors" after all our extensive training. I now wear the jungle green basic issue battle dress uniform similar to our Marines... actually it is the same uniform, just US NAVY insignia.”

----------------------------------------------------------------

|

|

Classified Ads---Help Wanted

Account Executives

|

|

Account Executives to work from our corp. office Aliso Viejo, CA. Exper. only, aggressive, 4 yr college degree required. Lucrative uncapped commission plan/environment conductive to success. To learn more, click here. |

|

About the Company: At Dell Financial Services, we aspire to fuel your potential with the kind of challenging opportunities and hands-on support you need to grow. We're the exclusive provider of leasing and finance services for Dell technology systems worldwide. |

|

SALES: Seeking energetic, self motivated sales pro, nationwide opportunities, equipment/ transportation leasing and financing (buses, livery, limousines, ambulances, paratransit, funeral vehicles). Direct experience helpful/ not required. We are willing to train the right person. Moderate travel /extensive phone work required. Highest commissions paid in the industry. Fax or email resume to 718-392-5427 or dcoolbaugh@advantagefunding.us |

|

SFBI Recruiters |

|

Contact: Fred St Laurent, SFBI Professional Recruiting. Email: Fred@sfbirecruiter.com |

----------------------------------------------------------------

Sal Maglietta, USbancorp president and CEO of U.S. Bancorp Equipment Finance, gets a pledge from Michael Jackson for Father's Day this weekend. “No more sleeping with young boys as it doesn't look good to the public, even if nothing happens “ he told him. “ You are making pop singers like Madonna, P Diddy Daddy and Ice Cops look too good.”

Michael told him he won't do it any more. He just wants to sing and dance, again. Maglietta said his company would lease him a portable dance floor with lights that he could take on concerts, .038 for three years, first and last two, $150 doc fee.”

-----------------------------------------------------------------

#### Press Release #####################

Petropulos Joins Orix Financial Services Equip. Fin. Group

ORIX Financial Services, Inc. is pleased to announce that Peter A. Petropulos has joined the Equipment Finance Group as Vice President, Senior Account Executive. Peter will be responsible for EFG's growing direct customer penetration and initiative with respect to Middle Market Construction, Transportation and Mining segments in PA, WV, MD and Ohio. Pete brings 25 years of industry experience and expertise in these markets back to ORIX where he previously spent over 3 years. Prior to his recent return to ORIX he spent a year at GMAC, 7 years at CIT and 15 years at GE Capital.

John Crum, Senior Vice President and National Sales Manager of the Equipment Finance Group, states, “Pete brings a wealth of talent and proven experience to our CTS team and we are honored to have him back at ORIX. His years of business, calling directly into our core CTS markets will serve him well in becoming a material contributor to our team. He will be responsible for growing our direct sales originations in the Pennsylvania, West Virginia, Maryland and upstate New York territory.”

#### Press Release #####################

World Leasing Yearbook

To order call +44 (0) 20 7779 8999 or toll free in the US +1 800 437 9997 to receive your 10% discount. You can also order on line at |

Official release of the Leaseurope Ranking of Top

European Leasing Companies

Brussels, the 16th of June – a record 189 top European leasing companies in the 2004 Leaseurope ranking survey.

Leaseurope, the European Federation of Leasing Company Associations, is pleased to present its fourth consecutive ranking of Top European Leasing Companies. In the aim of improving the visibility of European leasing companies and promoting leasing as an accessible and favourable source of finance, the ranking is released to the public at large for the second year in a row.

In the Leaseurope Ranking, European leasing companies are ranked once a year according to the total value of their new contracts. Figures shown below represent the new production of parent companies on a consolidated basis for 2004.

This year, 189 organisations in total responded to the survey, out of which 72 are parent companies, located in 27 different countries (both EU and non-EU member states). The companies presented in the ranking are members of the 27 national leasing associations covered by Leaseurope, which in turn represent more than 1,200 European leasing companies. Grouped together within the Leaseurope Federation, these national associations represent more than 92% of the entire European leasing market.

With 130 Billion € worth of new contracts, the companies surveyed represent about 70% of the total 2004 Leaseurope market. The top ten companies of the 2004 ranking account for 49% of the value of new contracts included in the survey and for 28% of the total Leaseurope market.

It is important to note that the ranking is based on data provided on a voluntary basis by the companies themselves and that the released figures cover European activities only. All data provided has been submitted to the Leaseurope member associations for confirmation. As with the previous surveys, additional validation steps have been carried out to ensure the consistency and objectivity of the ranking.

The results of the ranking combined with the yearly European leasing statistics published by Leaseurope once again demonstrate the continued success of leasing as a means of finance. Mr Alain Vervaet, Chairman of Leaseurope, drew attention to the fact that “in spite of slowing investment rates and a generally sluggish economic climate, leasing has continued to grow in importance for a wider range of users”.

In 2004, Leaseurope members financed approximately 15% of gross fixed capital formation in Europe and Leaseurope estimates that the total new leasing production in Europe represents about 20% of all investment made during the course of last year.

First let me take this opportunity to thank you for publishing Leaseurope's ranking in Leasing News. We greatly appreciate this increased visibility among your readers. The contacts however should be as follows:

Alain Vervaet

Leaseurope Chairman

alain.vervaet@mail.ing.nl

Marc Baert

Leaseurope Secretary General

m.baert@leaseurope.org

Anne Valette

Head of Communications

+32-2-778 05 65

a.valette@leaseurope.org

Jacqueline Mills

Statistics and Economic Affairs

+32-2-778 05 71

j.mills@leaseurope.org

Margaret Waldren

Director

MW Links Ltd

T: +44 (0)1372 277772

E: margaret@mwlinks.com

www.mwlinks.com

### Press Release ######################

WestLB Has Completed the Sale of Boullioun Aviation Services

to Aviation Capital Group

DUSSELDORF, Germany----WestLB confirmed that it has completed the sale of Boullioun Aviation Services to Aviation Capital Group yesterday. The total consideration amounted to approximately U.S. $2.65 billion.

WestLB has owned the Seattle-based aircraft leasing company, which provides commercial airliners on operating leases to a variety of carriers worldwide, since 2001. Citigroup Global Markets acted as advisor to WestLB.

WestLB AG New York Connie J. Kain, 212-597-1439 Cell: 917-596-1904 connie_kain@westlb.com or WestLB AG London John Godfrey, 011-44-20-7020-2221 Cell: 011-44-77-4776-1071 john_godfrey@westlb.co.uk

#### Press Release #####################

Siemens Financial Services Study Points Towards Global Tech Spending Rebound; Spending Increasing, Replacement Cycles Decreasing Across U.S. and Europe

ISELIN, N.J.---American and European companies are once again making investments in new technology a priority, according to a study released today by Siemens Financial Services. The Siemens research project, completed in May, revealed that most companies on both sides of the Atlantic increased tech spending in 2004 and plan to continue doing so over the next year. Those companies spending more this year intend to invest at a higher rate than those who increased spending in 2004.

Among the key findings of the Siemens research are:

-- 67% of U.S. companies report an IT spending rebound, with half planning to increase current levels this year.

-- On most indicators studied, Germany tends to lag behind other countries, but shows strong signs of mirroring the technology investment growth path of its European neighbors.

-- IT replacement cycles are longest in the U.S. and France, shortest in the U.K. and Germany.

-- Server replacement cycles are longest in the U.S. and U.K.

-- Technology finance is strongly available in the U.S., U.K. and France, less so in Germany.

"It's clear that companies are viewing technology as a key enabler of future success," said Bill Zadrozny, president and CEO of Siemens Financial Services, Inc. "Our research shows that investment in IT equipment and software is rising, resulting in increased efficiency and productivity."

"The impetus for more regular IT upgrades in Europe's major industrial nations reflects the region's reputation for intelligently investing in technology to drive growth," said Kari Kupila, head of Equipment and Sales Financing for Siemens Financial Services. "We expect technology investment levels to continue to increase, an indicator that the health of European business is consistently improving."

Further information on the SFS study is available at www.siemens.com/sfs. In addition, Mr. Zadrozny and Mr. Kupila are available to discuss the research findings in greater detail, as well as provide insight into the current corporate spending landscape and factors driving IT investments and financing strategies. To arrange an interview, please contact Rory Mackin at

212-445-8414 or rmackin@webershandwick.com.

About Siemens Financial Services

With some 1,600 employees and an international network of financial companies coordinated by Siemens Financial Services GmbH, Munich, the Siemens Financial Services (SFS) Group offers a broad range of financial services. This covers activities from sales and investment financing to treasury services, fund management and insurance brokerage. SFS's key customers are above all internationally active industrial and services companies, as well as public-sector operators. SFS supervises 21 leasing companies worldwide. Further information: www.siemens.com/sfs

Siemens Financial Services, Inc. is one of Siemens' operating companies in the United States. The people of Siemens Financial Services, Inc. build relationships to deliver customized commercial financing solutions. SFS is led by industry veterans who work to ensure quick, quality financing. With expertise in Asset-Based Lending, Equipment Financing, Commercial Trade Finance and Vendor Financing, each transaction is tailored to fit the specific borrowing needs of the client.

About Siemens

Siemens AG (NYSE:SI) is one of the largest global electronics and engineering companies with reported worldwide sales of $91.5 billion in fiscal 2004. Founded more than 155 years ago, the company is a leader in the areas of Medical, Power, Automation and Control, Transportation, Information and Communications, Lighting, Building Technologies, Water Technologies and Services and Home Appliances. With its U.S. corporate headquarters in New York City, Siemens in the USA has sales of $16.6 billion and employs 70,000 people throughout all 50 states and Puerto Rico. Thirteen of Siemens' worldwide businesses are based in the United States. With its global headquarters in Munich, Siemens AG and its subsidiaries employ 440,000 people in 190 countries. For more information on Siemens in the United States: www.usa.siemens.com.

Siemens Financial Services, Inc. Brian Galloway, 732-476-3498 brian.galloway@siemens .

#### Press Release #####################

Genesys Systems, Inc. Joins the Finance Express Auto Finance Program

RANCHO SANTA MARGARITA, Calif., Finance Express, which operates the first online auto finance platform specifically designed for the independent dealer, today announced that it has signed an agreement with Genesys Systems, Inc. to join its online auto finance program. Genesys Systems, Inc. provides more than 1400 used car dealers around the country with finance and insurance systems and other technology products. Through its program integration with Finance Express, Genesys will be able to accelerate and automate the auto finance process for its independent dealers throughout the United States.

About Finance Express

Finance Express provides financing programs for all levels of credit through 31 national and regional lenders. It offers an integrated menu of services including credit application processing, credit bureau access, inventory management, electronic contracting, dealer management tools and licensed escrow services. It is a comprehensive solution that provides auto dealers with online access to lenders, credit bureaus and DMS tools and at the same time, through its fully licensed escrow company, provides auto lenders with a method of completing their transactions safely and securely.

About Genesys

Genesys was founded in 1986 to provide low-cost, professional, personal computer based systems and software to auto dealerships for F&I, customer tracking, leasing and more. Genesys has provided support to more than 1400 customers and supports dealers in 48 states. Additional information regarding the programs offered by Genesys is available at http://www.gensystem.com. Ted Cooper, the Founder of Genesys said, "In our 20 years we've been very careful who we partner with - reputation is everything. We're happy to be involved with Finance Express. The dealer that uses Genesys Lot Management software and Finance Express will be miles ahead of their competition, and they'll make more money."

The President of Finance Express, David Huber, said, "The addition of Genesys to the Finance Express program will be a significant benefit to all of our participating dealers. Genesys is a quality company, and we are pleased that they appreciate the value of the FEX technology and have selected us to be their partner." Additional information on Finance Express may be obtained by contacting David Huber at dhuber@financeexpress.com.

Contact: David L. Huber Finance Express (949) 635-5892 dhuber@financeexpress.com

http://www.financeexpress.com

This release was issued through eReleases(TM). For more information, visit http://www.ereleases.com

### Press Release ######################

De Lage Landen adds Public Finance Capabilities

WAYNE, Pa., – De Lage Landen Financial Services, a leading international provider of high-quality asset-based financing products to manufacturers and distributors of capital goods, announces the addition of a new business unit, named De Lage Landen Public Finance.

The new business unit will be managed by a seasoned team of Public Finance professionals, and will offer finance products to federal, state and local governments, and tax-exempt entities. Robert Neptune, President of De Lage Landen Public Finance: “The combination of De Lage Landen's vast experience in supporting Vendor financing and our experience with government financing will allow De Lage Landen to serve the market with one of the broadest product lines available for municipal and federal financing.”

De Lage Landen Public Finance will start offering various types of financing through vendor partnerships and directly to governmental entities within the next few months.

Bill Hall, Executive Vice President and Chief Commercial Officer of De Lage Landen Financial Services: “We are very excited about the opportunity to offer another value added product within the vendor's distribution channel. This product offering should turn into a win-win solution.”

De Lage Landen is a Netherlands based international provider of high-quality asset finance and vendor finance programs. The global offering also includes an array of commercial finance solutions. With a presence in more than 20 countries throughout Europe, the Americas and Asia Pacific the company focuses on the following industries: Food & Agriculture, Healthcare, Office Equipment, Telecommunications, Technology Finance, Materials Handling & Construction Equipment and Financial Institutions. In its domestic market the company offers Equipment Leasing, Car & Commercial Vehicle Leasing, ICT Leasing, Consumer Finance and Trade Finance through local Rabobanks but also direct to market.

De Lage Landen is a wholly owned subsidiary of the Dutch Rabobank Group that is AAA-rated by Moody's and Standard & Poors. Over 2004 De Lage Landen grew its net profit to $ 174 million and its balance sheet total to $ 20 billion.

For more information, please visit our website:

www.delagelanden.com.

#### Press Release #####################

----------------------------------------------------------------

News Briefs----

Earthquake shakes Southern California, but no damage reported

http://www.signonsandiego.com/news/state/20050616-1515-wst-californiaearthquake.html

Third Major Earthquake in Three Days/Near San Andreas Fault

http://reuters.myway.com/article/20050616/2005-06-16T234958Z_01

_N16187607_RTRIDST_0_NEWS-QUAKE-LOSANGELES-DC.html

Mortgage rates rise for first time in five weeks

http://www.usatoday.com/money/perfi/housing/

2005-06-16-mortgage-rates_x.htm

Housing Starts Rose in May; Pace Is Fastest Since February

http://www2.nytimes.com/2005/06/17/business/

17econ.html?pagewanted=all

More sell homes to lock in big gains

http://www.usatoday.com/money/perfi/housing/

2005-06-16-housing-1a-usat_x.htm

More homeowners cash out homes

http://www.usatoday.com/money/perfi/housing/

2005-06-16-housing-cash-out_x.htm

Prices dip; factory output rises

http://www.boston.com/business/articles/2005/06/16/

prices_dip_factory_output_rises/

Government's tax take hits an all-time high

http://www.signonsandiego.com/news/business/

20050616-1423-taxrecord.html

Fitch Report: U.S. Telecom Industry Regulatory Review

http://www.fitchratings.com/corporate/events/

press_releases_detail.cfm?pr_id=165367

----------------------------------------------------------------

Sports Brief---

Pistons' Defense Foils Spurs Once More

http://www.nytimes.com/2005/06/17/sports/basketball/17nba.html

----------------------------------------------------------------

“Gimme that Wine”

Wine Institute elects Eric Wente chairman

http://www.wineinstitute.org/communications/statistics/EricWente2005.dwt

Waiting for Washington Syrah

http://www.nytimes.com/2005/06/15/dining/15wine.html?pagewanted=all

Direct-shipping bill passes Connecticut legislature

http://www.sfgate.com/cgi-bin/article.cgi?f=/c/a/2005/06/16/

WIGFFD8JQB1.DTL&hw=wine&sn=006&sc=521

Sommeliers launch new qualification

http://www.wineint.com/story.asp?sectioncode=1&storyCode=1842

Ohio Wine Month: A Perfect Time to Tour Ohio Wine Country

http://biz.yahoo.com/prnews/050615/clw055.html?.v=15

Don't call Walla Walla ‘the next Napa'

http://www.thenewstribune.com/soundlife/story/4947368p-4526212c.html

New winery hopes to splash in on popularity

http://www.stltoday.com/stltoday/news/stories.nsf/metroeast/story/

B41857B48B58F149862570220015D584?OpenDocument

----------------------------------------------------------------

Today's Top Event in History

1954-Televised Senate Army McCarthy hearings ends; perhaps the finest hour of this medium which exposes McCarthy as a charlatan who many are afraid to oppose because they do not want to be labeled a communist ( ironically, McCarthy never exposed one unknown communist).

----------------------------------------------------------------

This Day in American History

1579- the expedition of Sir Francis Drake anchored in a harbor just north of present-day San Francisco Bay in California, during drake's celebrated circumnavigation of the globe. Drake named the land Nova Albion and claimed it for England. The members of the expedition spent a month repairing their ship. Then on July 26 Drake sailed from California, continuing north and then west across the Pacific Ocean. The precise spot that Drake and his men landed and stayed for a month is a controversy between historians and the actual spot bay is not known. All Drake's records were destroyed for political reasons and this event is also part of the controversy. ( Encyclopedia of American Facts, Gordon Carruth ).

http://legends.dm.net/pirates/drake.html

1742-birthday of William Hooper, signer of the Declaration of Independence, born at Boston, MA. Died Oct 14, 1790 at Hillsboro, NC. The British in retribution burned his house and farm during the war.

http://www.williamhooper.com/

1775-Suffolk County, MA, celebrates a county holiday to commemorate the Battle of Bunker Hill. According to the same source quoted above, the Battle of Bunker Hill was actually fought on Breed's Hill. British forces under General Howe assaulted the Continental position three times before the Americans, under Col. William Prescott, ran out of gunpowder and were forced to retreat. The British then occupied Bunker Hill after another skirmish. For this reason, it is referred to as the Battle of Bunker Hill in history books. Today when you visit Boston, and the guide takes you to Bunker Hill, it is really Breed's Hill, as historians decided to change the name rather than explain the story.

http://memory.loc.gov/ammem/today/jun17.html

1837- Strong Vincent is born in Waterford, Pennsylvania. After working as a lawyer, he went on to become a hero at the Battle of Gettysburg, where he was mortally wounded defending Little Round Top. When hostilities erupted in April 1861, Vincent left the law to become an officer in the Erie Regiment, Pennsylvania Volunteers. By early 1862, he rose to commander of the 83rd Pennsylvania. Vincent served in several campaigns with the Army of the Potomac, fighting at Yorktown, Fredericksburg, and Chancellorsville. He was promoted to colonel after Yorktown, and prior to Gettysburg, Vincent was given command of the Third Brigade, First Division, of the Fifth Corps. On the night of July 1, 1863, Vincent and his men were hurrying toward the battlefield under a bright moon. When the soldiers passed through a small town near Gettysburg, the regiment bands began to play and residents came to their doors to cheer the Yankee troops. Vincent remarked to an aide that there could be a worse fate than to die fighting in his home state with the flag overhead. The next day, as Vincent and his brigade were arriving behind the Union lines, General Governor K. Warren frantically summoned Vincent's force to the top of Little Round Top, a rocky hill at the end of the Federal line. Warren observed that the Confederates could turn the Union left flank by taking the summit, which was occupied by only a Yankee signal corps at the time. So Vincent and his men hurried up the hill, arriving just ahead of the Rebels. The brigade held the top, but just barely. Vincent was mortally wounded in the engagement and died on July 7. He was promoted posthumously to brigadier general.

http://members.aol.com/CWSurgeon0/indexV.html

http://www.oldgloryprints.com/What%20Are%20Your%20Orders.htm

http://www.hauntedfieldmusic.com/Vincent.html

1849-birthday of African-American Congressman Thomas Ezekiel Miller.

http://bioguide.congress.gov/scripts/biodisplay.pl?index=M000757

http://www.scsu.edu/News/lineage.htm

1863-Battle of Aldie, Confederates fail to drive back the Union Army in Virginia.

http://americancivilwar.com/statepic/va/va036.html

http://members.cox.net/johnahamill/aldie.html

1865- Dr. Susan LaFlesche Picotte birthday - Native American and U.S. physician. Under the sponsorship of the Women's National Indian Association that was founded in 1880 by Mary L. Bonney and Amelia S. Quinton, SLP graduated a 3-year medical course in 2 years. She finished at the head of her class not yet 24 years of age. She returned to practice medicine primarily with the Omaha tribe although her practice at times included almost as many whites as Indians. It has been estimated that this remarkable woman who braved blizzards and dust storms treated every member of the Omaha tribe in the 25 years of her practice.

http://www.americanwest.com/pages/picotte.htm

http://www.nde.state.ne.us/SS/notables/picotte.html

http://www.cfra.org/center/picotte.htm

1867-Birthday of Linda Anne Eastman - U.S. librarian. LE developed the children's rooms at the Cleveland Public Library, developed library extensions in hospitals, developed a Braille collection. In 1918 she became the first woman to head a metropolitan library system, that, under her tutelage became one of the largest and most complete library systems in the United States, its collection grew from 57,000 volumes to more than 2,000,000.

1871-birthday of James Weldon Johnson, African American poet, diplomat, songwriter and culturist of black history, born Jacksonville, FL.

( lower half of http://memory.loc.gov/ammem/today/jun17.html )

1882 - In Iowa, the town of Grinnel devastated by an F5 tornado. The tornado track was 200 miles long and 68 people were killed and damage was around 1 million dollars.

1894-A poliomyelitis epidemic occurred in Vermont. Between June 17 and September 1, 123 cases appeared in Rutland and Wallinigford. The first major urban polio epidemic took place in the summer of 1916 in New York City, where 9,000 children were stricken and 2,400 died.

1907-jazz reedman Gene Sedric born St. Louis, Mo.

http://www.rainerjazz.com/Interpreten/Sedric_G_001.htm

http://www.centrohd.com/biogra/s1/gene_sedric_b.htm

1910- country music star Red Foley was born in Bluelick, Kentucky. Foley, elected to the Country Music Hall of Fame in 1967, was the first country star to have a network radio show, "Avalon Time," in which he co-starred with Red Skelton, beginning in 1939. Foley's recordings for the Decca label were extremely popular, and in 1950 he had no less than three million-sellers - "Chattanoogie Shoe Shine Boy," "Steal Away" and "Just a Closer Walk With Thee." He continued his success with religious material in 1951, scoring another million-seller with "Peace in the Valley." Foley was a star on the Grand Ole Opry in the 1940's. In 1954, he moved to Springfield, Missouri, where he became the host of "Ozark Jubilee," one of the first successful country TV series. During the early '60s, he starred with Fess Parker in the TV series "Mr. Smith Goes to Washington." Red Foley died in 1968.

http://www.bellenet.com/foley.html

http://www.countrypolitan.com/bio-red-foley.php

1914-birthday of John Hersey, American novelist, born at Tientsin, China, who wrote “A bell for Adano”, which won the Pulitzer Prize in 1945. “The Wall” and “Hiroshima” are both based on fact and set in Poland and Japan respectively in World War II. Died at Key West, FL March 24,1993.

1917- singer and actor Dean Martin, whose real name was Dino Crocetti, was born in Steubenville, Ohio. He first gained fame as part of a comedy team with Jerry Lewis. When the duo broke up in 1956, Martin's career as both a singer and actor blossomed. His nonchalant, tongue-in- cheek approach proved very popular, as evidenced by his long-running TV show in the 1960's and '70s. Martin's record hits in the 1950's and '60s included "That's Amore," "Memories Are Made of This" and "Everybody Loves Somebody." He died on Christmas Day 1995.

http://www.deanmartinfancenter.com/

http://www.deanmartin.com/

http://www.monmouth.com/~rio1dude/

http://www.sinatra.clanpage.de/

1921-clarinest Tony Scott born Morristown, NJ.

http://www.tonyscott.it/

1933-birthday of Maurice “Mo” Stokes, basketball player born at Pittsburgh, PA. Stokes played at S. Francis College (PA and was drafted by the Rochester Royals of the NBA in 1955. He quickly became a top performer, winning the Rookie of the Year award in 1955-56 and making the All-Star team three years in a row. Following the 1957-58 season, Stokes collapsed and went into a coma. Encephalitis made him an invalid, but treammate Jack Twyman cared for him the rest of his life. Died at Cincinnati, OH, April 6, 1970.

1938-the first ski lift to operated in the United States was the Cannon Mountain Tramway at Franconia, NH, a 5,400-foot suspension ride. It was suspended by giant cables 40 feet above the trees and ran from the base of Cannon Mountain to one of it speaks. I had two cars, each accommodating 27 persons, which made the trip up or down in eight minutes at the speed of a thousand feet a minute.

1942 -- American author/poet Ron Padgett born, Tulsa, Oklahoma

http://www.ronpadgett.com/

http://jacketmagazine.com/03/padgett03.html

http://www.npr.org/programs/atc/features/2001/apr/010406.padgett.html

http://www.the-artists.org/ArtistView.cfm?id=319FB343-8B0A-40E0-B04F

DAAEE1E4095D

1944---Top Hits

Long Ago and Far Away - Helen Forrest & Dick Haymes

I'll Be Seeing You - The Tommy Dorsey Orchestra (vocal: Frank Sinatra)

I'll Get By - The Harry James Orchestra (vocal: Dick Haymes)

Straighten Up and Fly Right - King Cole Trio

1946-the first mobile telephone commercial service was inaugurated by the Southwester Bell Telephone Company, St. Louis, Mo. Installations were completed in the automobiles of two subscribers, the Monsanto Chemical Company and Henry L. Perkinson, a contractor. Conversation was possible with any Bell Telephone System or connecting company telephone.

1946-- Barry Manilow birthday (“This One's for You”)

http://www.manilow.com/

***My high school friend, Bruce Johnston, who played piano in my band, and I would sit in his as a "pick-up" bass player, wrote " I Write the Songs," which Barry Manilow made famous. Sue and I go to all Barry's concerts, even belong to his fan club, and suffice it to say, we have all his albums, some in duplicate and triplicate for the car, and for trips. We don't go anywhere with "Barry."

1947-The radio show The Adventures of Philip Marlowe debuts. Based on Raymond Chandler's groundbreaking series of hard-boiled detective novels, the producers hoped to reproduce the success of the hit radio drama The Adventures of Sam Spade, which ran from 1956 to 1941. Chandler's character Marlowe had already appeared on the silver screen four times, notably in The Big Sleep (1946), starring Humphrey Bogart. The character failed to translate well to the radio, though, and the series lasted only a few months.

1950-In a 45-minute operation witnessed by 40 visiting surgeons and doctors at Mary Hospital, Chicago, Il, Dr. James Ward West removed a healthy kidney from the body of a woman who had died. Dr. Richard Harold Lawler transplanted the kidney into the renal pedicle of a patient from who a polycystic left kidney had been removed, and the first kidney transplant was complete.

1952---Top Hits

Kiss of Fire - Georgia Gibbs

Be Anything - Eddy Howard

I'm Yours - Eddie Fisher

The Wild Side of Life - Hank Thompson

1954-The US organized the government of the US Virgin Island.

1954-Televised Senate Army McCarthy hearings ends; perhaps the finest hour of this medium which exposes McCarthy as a charlatan who many are afraid to oppose because they do not want to be labeled a communist ( ironically, McCarthy never exposed one unknown communist).

1960---Top Hits

Cathy's Clown - The Everly Brothers

Everybody's Somebody's Fool - Connie Francis

Burning Bridges - Jack Scott

Please Help Me, I'm Falling - Hank Locklin

1960 ---At Cleveland's Municipal Stadium, Ted Williams hits his 500th career home run off of Wayne Hawkins. 'Teddy Ballgame's two-run blast proves to be difference as the Red Sox beat the Indians, 3-2.

1968---Top Hits

Mrs. Robinson - Simon & Garfunkel

This Guy's in Love with You - Herb Alpert

Mony Mony - Tommy James & The Shondells

Honey - Bobby Goldsboro

1972-Five are arrested for the break-in at Democratic Party Headquarters ( in Watergate complex, Washington, DC). They had previously placed wire taps and searched the headquarters on a regular basis, but leaving a rear-door unlocked made a building security guard suspicious. The arrests led to revelations of political espionage, threats of imminent impeachment of the president, and, on August 9,1974, the resignation of President Richard M. Nixon. It is doubly ironic that Nixon was way ahead in the poll primarily because his opponent Senator George McGovern of South Dakota was not strongly supported by the Democratic Party, although he had sworn he would end the Viet Nam War 90 days after he was elected.

http://www.watergate.com/

http://sc94.ameslab.gov/TOUR/watergate.html

1976---Top Hits

Silly Love Songs - Wings

Get Up and Boogie (That's Right) - Silver Convention

Misty Blue - Dorthy Moore

I'll Get Over You - Crystal Gayle

1976-Four teams from the American Basketball Association joined the National Basketball association as the ABA went out of business after nine years. The four teams, the Denver Nugges, Indiana Pacers, New York Nets and San Antonio Spurs bought the total number of teams in the NBA to 22.

1978 ---Yankee southpaw Ron Guidry strikes out 15 Angels in six innings and finishes with 18 Ks establishing a new American League mark for left-handers. The performance, which will help coin a new nickname for the southpaw as the team's announcer, Phil Rizzuto begins to refer to him as 'Louisiana Lighntning', inspires a new baseball tradition as the fans begin to clap rhythmically each time there is two strikes on the batter.

1978 - "Shadow Dancing", by Andy Gibb, reached the number one spot on the pop music charts for the first of seven weeks. Gibb had two other number one hits: "I Just Want to Be Your Everything" and "(Love is) Thicker than Water". Gibb, the youngest of the Gibb brothers who made up the Bee Gees, hosted TV's "Solid Gold" in 1981-82. Andy scored nine hits on the pop music charts in the 1970s and 1980s. He died of an inflammatory heart virus in Oxford, England in 1988.

http://www.andygibb.net/

1988-Microsoft releases MS DOS 4.0

1984---Top Hits

Time After Time - Cyndi Lauper

The Reflex - Duran Duran

Self Control - Laura Branigan

I Got Mexico - Eddy Raven

1988-Bruce Springsteen separates from Juliette Phillips

1988-The Givens' Family reports heavyweight Mike Tyson beats his wife actress wife Robin Givens. They later divorce on the grounds of “extreme cruelty

1988—Top Hits

Foolish Beat- Debbie Gibson

Dirty Diana- Michael Jackson

Together Forever- Rick Astley

Make It Real- The Jets

1991-The body of Zachary Taylor, the 12th US President, was exhumed from a cemetery in Louisville, KY. Taylor died suddenly of acute gastrointestinal illness on July 9, 1850. Some historians suggested that he might have been poisoned. To test this theory, his remains were exhumed ( the first presidential body to be exhumed ). A coroner's report dated June 26 found no evidence of foul play.

1993-Top Hits

That s The Way Love Goes, Janet Jackson

Weak- SWV

Knockin Da Boots- H-Town

Freak Me- Silk

1994-the first World Cup soccer tournament was held at Soldier Field, Chicago, IL. Fourteen nations competed in the marathon tournament, with games held in nine American cities. Brazil won the cup after defeating Italy at the Rose Bowl in Pasadena,CA.

1994-Former football player and announcer O.J. Simpson was arrested in connection with the murder of his wife, Nicole Brown Simpson, and Ronald Goldman. Simpson had fled his home in the morning rather than be arrested. In the evening eh and his friend Al Cowlings were in Simpson's white Ford Bronco. They led a horde of police cars on a long but slow car chase on Los Angeles's freeways and eventually wound up back at Simpson's home where he was apprehended. Television stations around the country followed these vents live, and an estimated 90 million people watched. Simpson was later acquitted. The killer(s) have allegedly never been caught.

1994—The World Cup of soccer was played in the US for the first time. The international champisonhip is held every four years. The 1994 games began in Chicago on June 17 with a match between Germany and Boliva and eneded in Los Angeles with a final betweenBrazil and Italy on July 17 with Brazil taking the Cup. Soccer, generally known as football outside the US, is the most popular spectator sport in the world, though it has never achieved great status in the US above the amateur level. The games were watched on television by billionis of fans around the world. John Madden has suggested there is not room for television commercials and thus the networks do not broadcast these games.

2003--- The Phillies enter a 25-year agreement with Citizens Bank, one of the nation's largest commercial bank holding companies, which includes naming the Philadelphia's new baseball facility, Citizens Bank Park. At the new ball park, a gigantic Liberty Bell towering 100 feet above street level will come to life after every Phillies homer.

****by the way, Bruce Johnston's birthday is June 24---learn more about

him ( the girls used to fight over him)w.geocities.com/Hollywood/Lot/3813/

Extreme Is the Word

In sports today, the crazy zizz of skateboard wheels,

Of BMX bikes, of in-line skates,

Of rugged mountain cycles careening around boulders, Under feet and between the grips of your knees;

Human spiders suspended from cliffs

And bouncing at the end of Bungee threads.

All that angst and arrogance,

All that gas gone to pure adrenaline —

All that emptiness when compared

To the whole human feeling of pitching

Raised by dirt, rubber and cleats —

If the stadium is a temple,

Then the mound is its throne.

When the arm is loose, warm-muscled,

And the clay in front of the rubber just so,

And your mind nowhere else

But running to the fingers of your grip,

Aligning the catcher's target

With the perfect aim of memory,

And the batter is helpless as a fish,

Now that's extreme:

Ask Koufax,

Ask Maddux,

Ask crazy Bill Lee,

But don't even bother asking me.

Written by Tim Peeler

Published in “Touching All the Bases”

Printed by McFarland and Company

----------------------------------------------------------------

Happy Father's Day

|

www.leasingnews.org |